Complete Guide to Sage Invoice Templates for Streamlined Billing

Creating and managing professional payment requests is essential for any business. Efficient billing not only helps in maintaining financial records but also ensures smooth transactions with clients. Having the right tools to generate and customize these documents can save valuable time and reduce errors.

With customizable solutions, businesses can easily generate clear, concise, and professional documents tailored to their specific needs. These tools allow for quick adjustments, ensuring that each request is aligned with branding and legal requirements. Whether you are a freelancer, a small business owner, or part of a larger organization, using a reliable system can make a significant difference in the way payments are processed.

In this article, we will explore various features of digital solutions that facilitate the creation of financial requests. By understanding how to leverage these tools, you can streamline your operations and enhance your professionalism in the eyes of clients and partners.

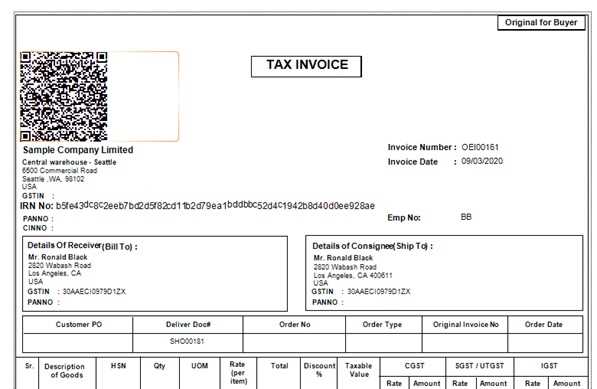

Overview of Sage Invoice Templates

Managing billing documents efficiently is a crucial part of running any business. The ability to create and modify payment requests quickly can drastically improve workflow and reduce the risk of errors. A streamlined system for generating these documents can help ensure consistency, professionalism, and ease of use, no matter the size of the business.

These customizable solutions are designed to simplify the process of creating accurate and professional financial documents. They allow users to adjust fields, incorporate branding elements, and meet local legal requirements with minimal effort. Whether you’re a freelancer, a small business owner, or part of a larger organization, having access to an efficient billing tool can save both time and resources.

Key Features

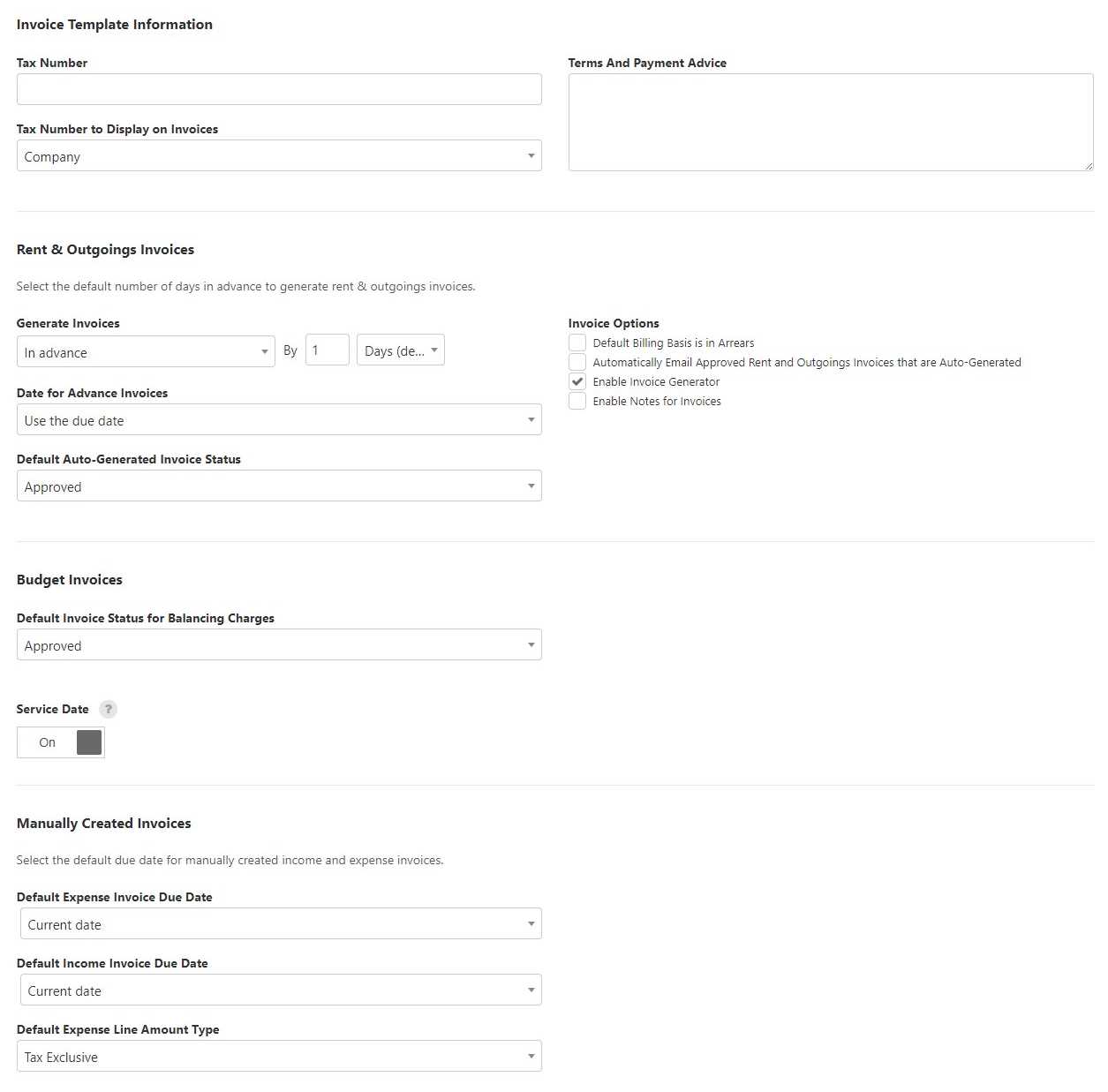

These systems typically offer a wide range of functionalities. Users can easily select from various pre-built designs, modify them to fit their needs, and add essential details such as payment terms, itemized lists, and tax information. Additionally, many tools offer integration with other software, such as accounting and project management platforms, providing a unified solution for all financial operations.

Benefits for Businesses

Utilizing such tools can significantly enhance business operations. Not only do they reduce manual work and the chances of human error, but they also contribute to maintaining a professional image. Customization features ensure that every request sent to clients is aligned with the company’s branding and is tailored to its specific needs. With all necessary data prefilled and readily accessible, businesses can spend less time managing administrative tasks and more time focusing on growth.

Why Choose Sage for Invoicing

When it comes to managing financial documents, having a reliable, efficient tool is key. A system that provides ease of use, flexibility, and integration with other business processes can save time and reduce the chances of errors. For businesses looking to streamline their billing procedures, there are several reasons why certain software stands out as a top choice.

The platform in question offers a comprehensive solution for creating and managing payment requests. It not only allows for quick customization but also ensures that all essential details are included in each document. Moreover, it integrates smoothly with other tools, enhancing its versatility and overall efficiency for businesses of all sizes.

Advantages of Using This Tool

| Feature | Benefit |

|---|---|

| Easy Customization | Tailor documents to your specific needs and branding. |

| Integration with Accounting Systems | Simplify financial record-keeping by syncing with existing software. |

| Predefined Layouts | Save time by using ready-made formats that require minimal adjustments. |

| Automatic Calculations | Reduce errors by automating tax, discount, and total amount calculations. |

| Client Management | Store and retrieve client details for faster processing. |

With these features and more, businesses can significantly improve their billing workflows, ensuring greater accuracy and professionalism in every document they send. Whether you’re managing a small business or handling a large volume of transactions, the software offers the tools you need to work more efficiently.

Key Features of Sage Templates

Modern software solutions for generating financial documents offer a variety of features designed to simplify the process and ensure accuracy. These tools are equipped with multiple functionalities that allow users to create polished, professional documents with minimal effort. With the right features, businesses can automate many aspects of document creation, freeing up valuable time for more important tasks.

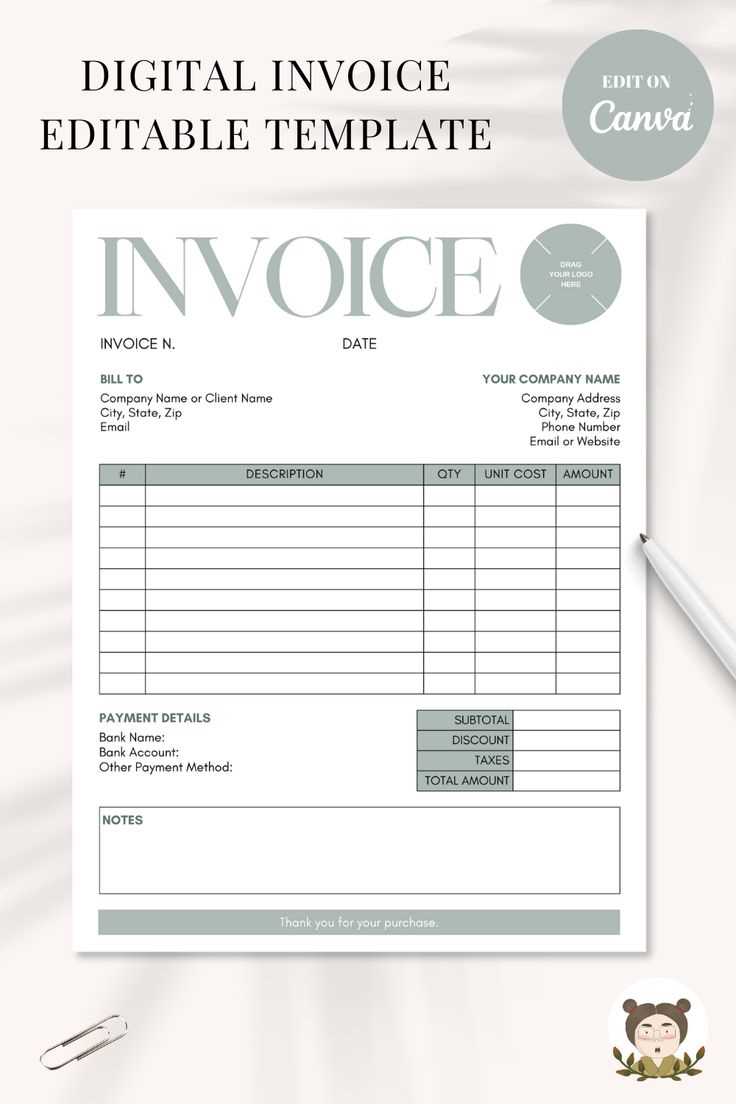

The main strength of such systems lies in their flexibility and ease of use. They provide a range of options for customization, enabling users to tailor documents to their specific needs. From adjusting layouts to adding business logos, every aspect can be modified for a personalized touch.

Customization and Flexibility

One of the standout features of these solutions is the ability to fully customize each document. Users can easily alter the design, fonts, and layout, ensuring the document aligns with the company’s branding. Whether it’s a simple request for payment or a detailed report, the platform allows for adjustments that make the document look professional and cohesive.

Automation and Accuracy

Another key benefit is the automation of calculations and data input. The system automatically computes totals, taxes, discounts, and other important values, reducing the risk of human error. Pre-filled client details and recurring billing options further streamline the process, saving users time on repetitive tasks. This level of accuracy helps prevent costly mistakes and ensures that every document is consistent and correct.

In addition, these solutions offer seamless integration with other business tools. This makes it easier to synchronize financial records, track payments, and manage client information in one place. With the combination of customization, automation, and integration, businesses can achieve greater efficiency and professionalism in managing their financial documentation.

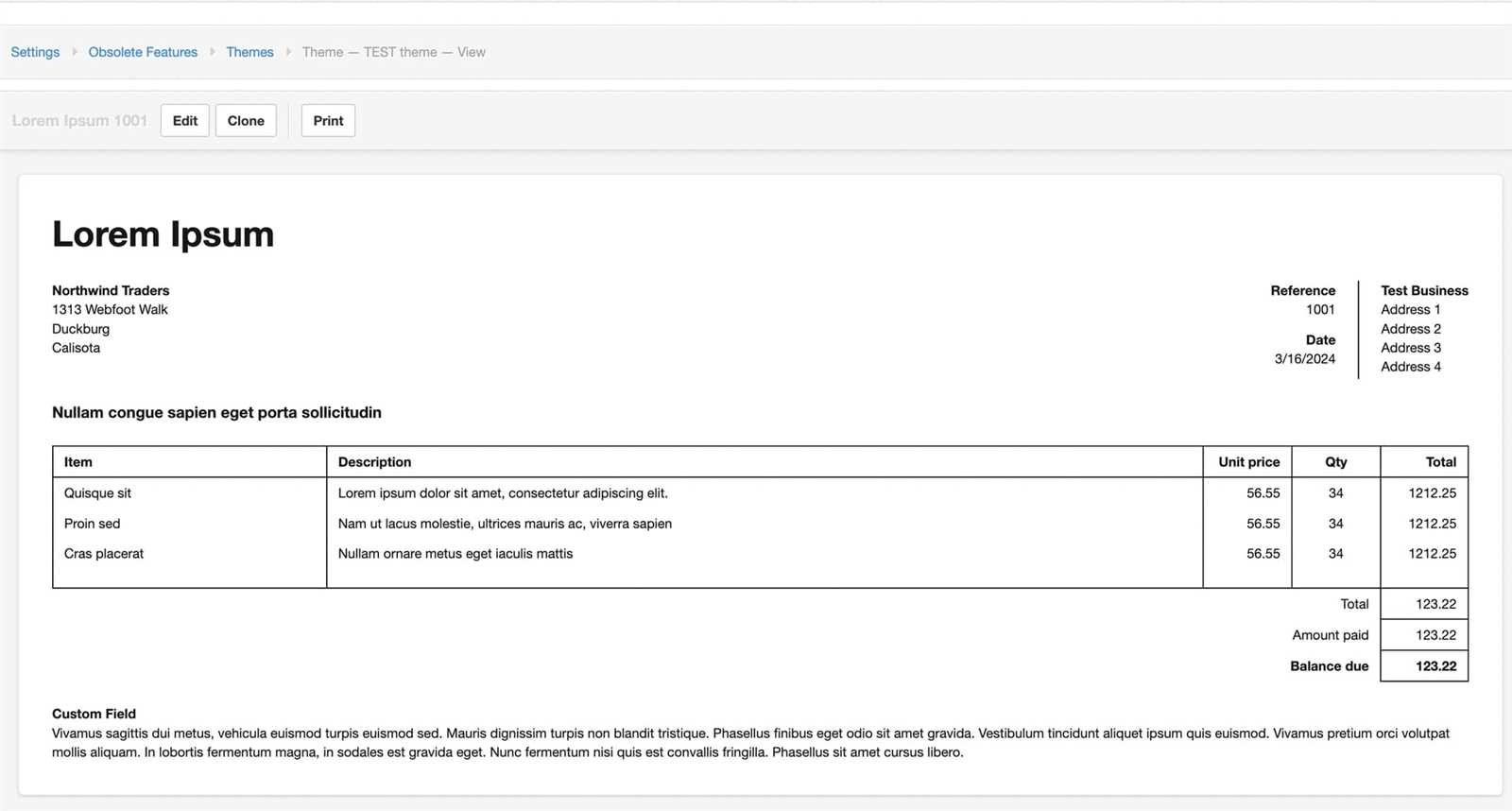

How to Customize Sage Invoices

Personalizing financial documents is essential for businesses that want to maintain a consistent brand identity and ensure clarity in communication. A well-customized document not only looks professional but also ensures that all necessary information is clearly presented. Customizing these documents allows businesses to align them with their unique needs, whether it’s adjusting layout, adding logos, or modifying specific sections.

Most software solutions for document creation offer intuitive features for easy customization. These systems allow you to modify almost every aspect of the document, from the general design to the fine details, ensuring that it reflects the business’s style and meets specific requirements.

Adjusting Layout and Design

One of the first steps in customization is adjusting the layout. Users can choose from a variety of pre-set structures, or create their own by modifying columns, rows, and text fields. Adding logos, changing font styles, or selecting specific colors are simple tasks that help ensure the document matches your company’s branding guidelines.

Personalizing Content and Fields

In addition to the design, it’s essential to tailor the content of each document. Many systems allow users to add custom fields, such as unique client references, project codes, or payment terms. This makes it easier to generate personalized documents for different clients or projects. You can also adjust the placement of key details, such as item descriptions, pricing, and tax rates, ensuring everything is easy to read and well-organized.

By utilizing these customization features, businesses can create professional-looking documents that not only meet their specific needs but also reflect their brand’s personality and improve client relationships. This level of personalization ensures that every communication is tailored to both the company’s standards and its client expectations.

Benefits of Using Sage Invoice Templates

Utilizing ready-made solutions for creating financial documents offers businesses numerous advantages. These systems not only simplify the document creation process but also enhance accuracy and professionalism. The ability to quickly generate precise and polished records can significantly improve efficiency and reduce administrative burdens.

By leveraging these tools, businesses can automate several tasks, ensuring that every document is consistent and meets the required standards. The ease of customization also means that businesses can adapt the documents to suit their needs, whether it’s for different clients, regions, or specific types of transactions.

Advantages for Business Efficiency

| Benefit | Explanation |

|---|---|

| Time Savings | Pre-designed formats and automated features reduce the time spent on document creation. |

| Consistency | Standardized layouts ensure that every document maintains a professional look. |

| Accuracy | Automated calculations minimize the risk of human error, ensuring precise totals and taxes. |

| Customization | Adapt fields, colors, and layout to reflect your branding and unique business requirements. |

| Professional Appearance | Create polished, branded documents that leave a lasting impression on clients. |

With these advantages, businesses can streamline their workflow, reduce administrative overhead, and improve client relationships. Whether you’re sending a routine request for payment or a detailed breakdown of services, the benefits of using such solutions are clear and impactful.

Common Mistakes with Invoice Templates

Even with automated solutions for generating payment requests, errors can still occur if the setup is not done correctly. Small mistakes can lead to misunderstandings with clients, delayed payments, and unnecessary administrative work. Understanding common issues can help businesses avoid these pitfalls and ensure that every document sent is clear, accurate, and professional.

From incorrect data entry to failing to properly customize essential fields, there are several areas where mistakes tend to happen. These errors may seem minor at first, but they can create significant problems down the line. By being mindful of the most frequent mistakes, businesses can ensure smoother operations and better client relationships.

Overlooking Key Details

One common mistake is failing to include or update essential details, such as client names, payment terms, or the correct billing address. Missing or incorrect information can confuse clients and lead to payment delays. It’s crucial to double-check that all required fields are correctly filled before sending any documents.

Using Outdated Information

Another frequent error is using outdated or incorrect pricing, tax rates, or service descriptions. Businesses that frequently update their offerings or adjust their pricing may forget to update these fields in their templates. This can result in sending inaccurate documents, potentially damaging the business’s reputation and client trust.

Ignoring Branding Consistency

Failing to properly customize the layout and design of the document is another mistake that can affect the professional appearance. Not including the company logo, using inconsistent fonts, or neglecting to match color schemes can make the document look unprofessional. A well-branded document helps reinforce your business identity and makes a better impression on clients.

By avoiding these common mistakes and taking the time to review every document carefully, businesses can improve their efficiency, enhance their professionalism, and maintain good relationships with their clients. Proper attention to detail is key to ensuring that each document is clear, accurate, and aligned with business goals.

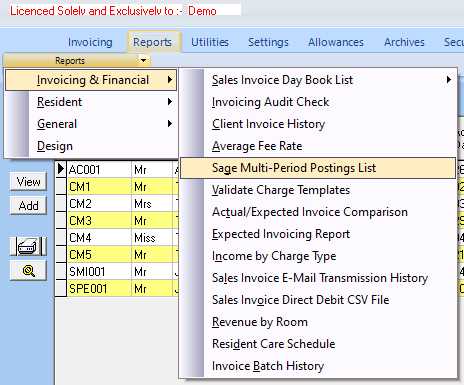

Integrating Sage with Accounting Software

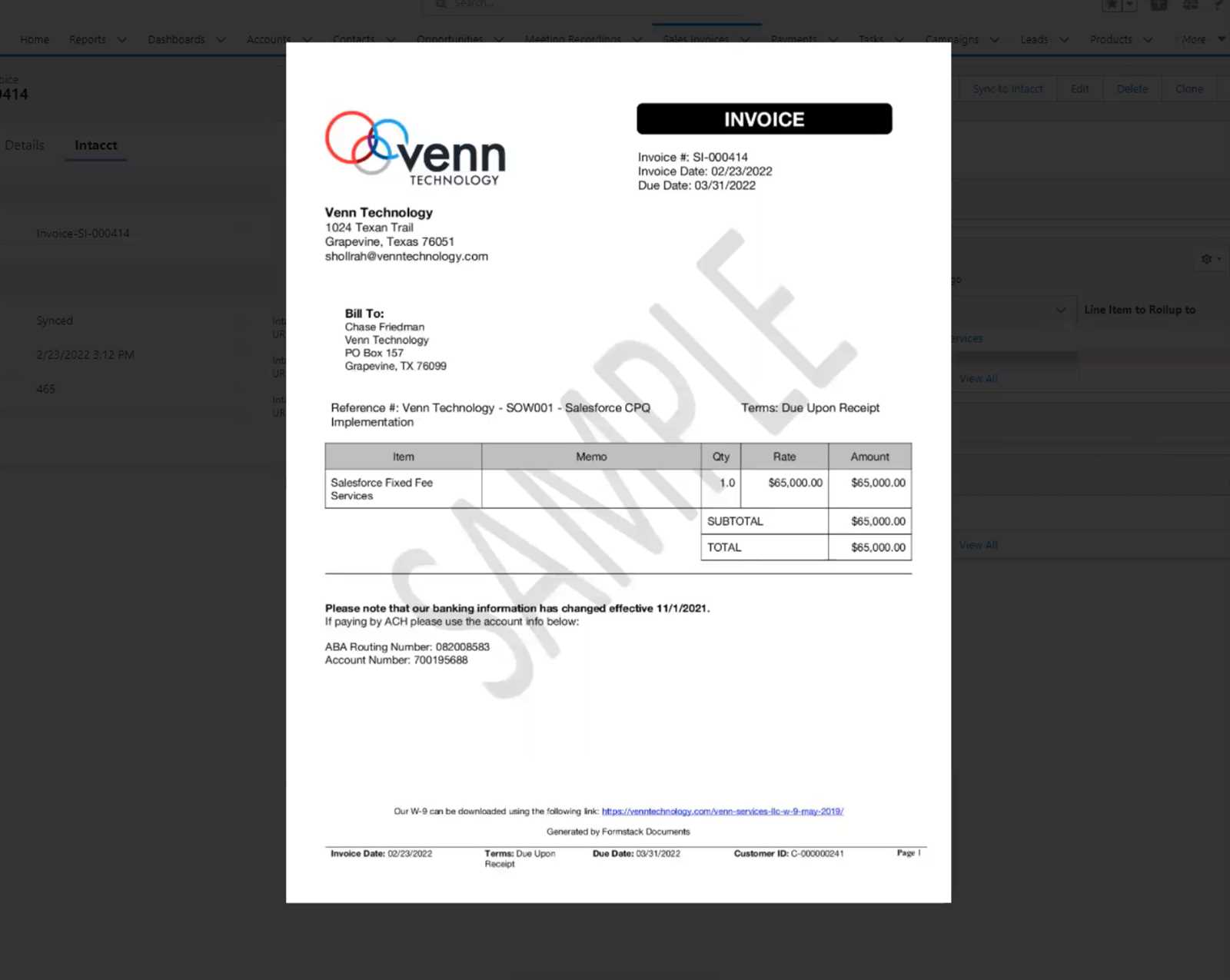

Seamlessly connecting document creation tools with accounting software can significantly enhance business operations. By integrating these systems, businesses can automate data transfer, minimize errors, and ensure that financial records are consistently updated. This integration eliminates the need for manual entry, making it easier to track expenses, payments, and overall financial health.

Connecting your document generation system with accounting platforms offers a unified solution for managing all aspects of your finances. From automatic updates of payment statuses to real-time financial reporting, integration can streamline processes and improve the accuracy of records. It also ensures that all data from payment requests is aligned with the company’s accounting system, reducing the risk of discrepancies.

Benefits of Integration

Integrating financial management tools offers several advantages. One of the main benefits is the elimination of manual data entry. When a payment request is created, the data can be automatically transferred to the accounting system, ensuring that the financial records are immediately updated without the need for redundant work. This minimizes the risk of errors that may occur during manual data entry, improving accuracy and efficiency.

Key Features of Integration

Some key features of integration include real-time synchronization, automatic updates, and consolidated reporting. Real-time synchronization ensures that any changes made in one system are instantly reflected in the other, allowing for up-to-date records. Automatic updates help keep payment statuses current and prevent delays in financial reporting. Consolidated reporting provides a comprehensive view of the business’s financial position by combining data from both systems.

By integrating document generation tools with accounting platforms, businesses can streamline operations, enhance accuracy, and save valuable time. This integration not only reduces the administrative burden but also ensures that financial records are consistently accurate and aligned with the business’s overall strategy.

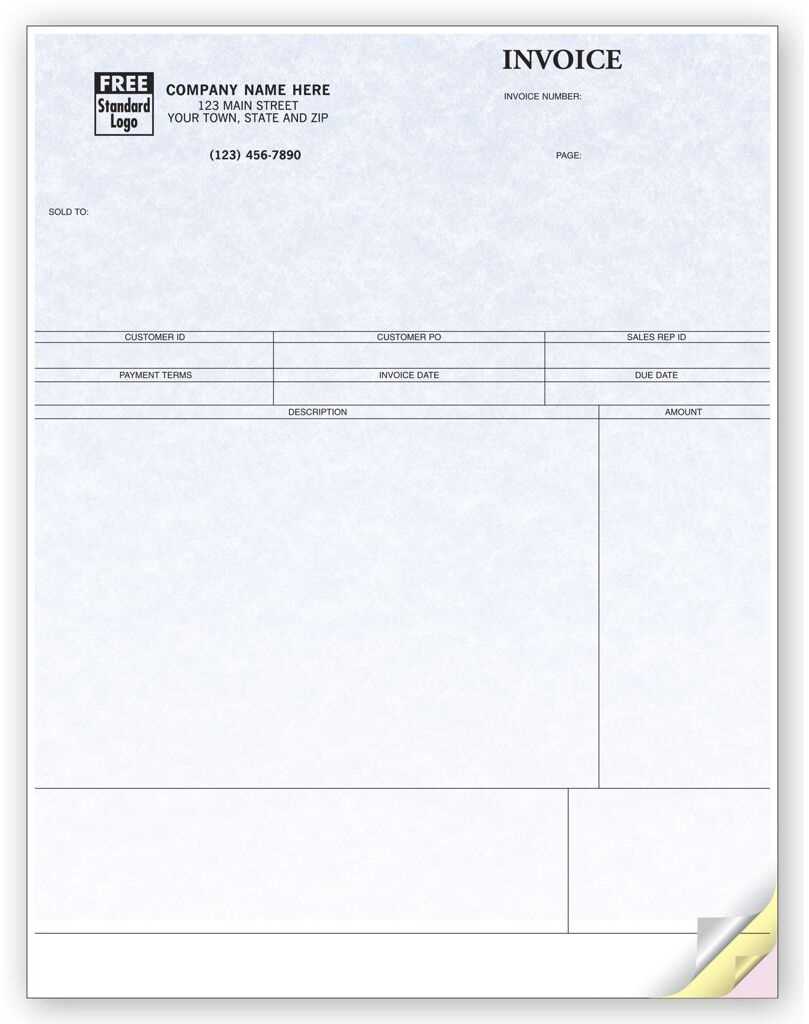

Design Tips for Professional Invoices

Creating clear and visually appealing financial documents is essential for making a strong, professional impression. A well-designed document not only looks more polished but also ensures that all important information is easy to find and understand. A thoughtful layout can help clients quickly process the details and make timely payments.

When designing your payment requests, it’s important to strike a balance between functionality and aesthetics. The following design tips can help create documents that are both professional and effective in conveying the necessary information.

Keep It Simple and Clean

- Use clear, legible fonts that are easy to read.

- Avoid overcrowding the document with too much text or too many images.

- Leave sufficient white space between sections to make the content easy to digest.

Ensure Proper Branding

- Incorporate your company logo and brand colors to create a cohesive and recognizable look.

- Maintain consistency in fonts and design elements to reflect your brand identity.

- Use professional color schemes, avoiding overly bright or distracting shades.

Highlight Key Information

- Ensure that important details such as payment amounts, due dates, and client information are prominently displayed.

- Use bold text or larger font sizes for essential data points, making them stand out.

- Group related information together, such as line items, totals, and payment instructions, to improve clarity.

Choose a Consistent Layout

- Use a consistent format for each document to maintain professionalism.

- Ensure the layout is logical, with clear sections for item descriptions, totals, and payment instructions.

- Consider including a footer with your business contact information for easy reference.

By following these design principles, businesses can create documents that not only look p

How to Save Time with Sage Templates

Efficiency is key when it comes to managing financial documents. By using pre-designed systems for generating payment requests, businesses can save significant time and reduce manual work. These systems streamline the process of creating accurate and professional records, allowing users to focus on more important tasks while ensuring consistency in every document sent out.

Automating common tasks such as data entry, calculations, and formatting can dramatically speed up the document creation process. With just a few clicks, businesses can generate, customize, and send financial records, eliminating the need to start from scratch each time. Below are some of the key ways that time can be saved using these solutions.

Automating Repetitive Tasks

By setting up automated features for recurring tasks, such as filling in client information, calculating totals, or applying discounts, the system can handle the repetitive aspects of document creation. This automation ensures accuracy and reduces the time spent on each request.

Reducing Data Entry Errors

Manual data entry can lead to mistakes that take time to correct. By using pre-configured fields, businesses can minimize the risk of input errors and ensure that all essential details are included automatically, such as client names, billing addresses, and product descriptions.

Time-Saving Features

| Feature | Time-Saving Benefit |

|---|---|

| Pre-Filled Client Information | Automatically populate client details from your database, reducing the need for manual input. |

| Standardized Layouts | Use consistent, ready-to-go designs that only require minimal adjustments. |

| Automatic Calculations | Eliminate manual calculations for taxes, discounts, and totals, speeding up the process. |

| Integration with Other Tools | Sync data with accounting software to avoid duplicate work and ensure accurate financial reco

Choosing the Right Sage Invoice FormatSelecting the appropriate document format for billing is crucial to ensure clear communication, accuracy, and professionalism. The format you choose will impact how easily your clients can understand the details of the payment request, and whether they can quickly process and act on it. It’s important to pick a layout that suits your business needs and provides all necessary information in a clean and organized manner. The right format should make it easy to include essential data, such as item descriptions, payment terms, and totals. It should also allow for customization to align with your business branding and client preferences. Different situations, such as recurring billing or one-time services, may require different formats, so understanding the options available can help you make an informed decision. How to Track Payments Using SageEfficiently monitoring and managing payments is a critical aspect of any business’s financial operations. By leveraging the right tools, businesses can easily track when payments are made, monitor outstanding amounts, and ensure accurate records. Using automated systems to track transactions not only saves time but also reduces errors and improves overall cash flow management. With the right system, businesses can quickly view the status of payments, match them to corresponding financial records, and send reminders for overdue amounts. It helps ensure that you’re always up to date with your financial situation and enables proactive management of accounts receivable. Tips for Reducing Errors in InvoicesErrors in financial documents can cause confusion, delays in payments, and damage to business relationships. By implementing best practices and using the right tools, you can significantly reduce the chances of mistakes. Ensuring accuracy from the start saves time, avoids unnecessary follow-ups, and helps maintain professionalism. There are several strategies that businesses can adopt to minimize errors when creating and sending payment requests. Below are key tips to enhance accuracy and avoid common pitfalls. Automate and Streamline Processes

Double-Check Information

By following these tips, businesses can reduce errors in payment requests and improve their overall efficiency. Accuracy not only leads to timely payments but also strengthens client trust and professionalism. How to Export Sage Invoices to PDF

Exporting financial documents to PDF format allows businesses to share, store, and print payment requests in a standardized and professional way. PDFs are universally accessible, ensuring that clients and colleagues can view documents without formatting issues, regardless of their device or software. The process of converting documents into this format is simple and can be done quickly with just a few steps. By exporting your financial records to PDF, you also preserve the integrity of the layout and content, ensuring that nothing gets altered during transmission. Below is a guide on how to efficiently convert and save documents in PDF format for easy sharing and archiving. Steps to Export Your Documents

Benefits of Exporting to PDF

By exporting your financial documents to PDF, you can ensure that they are easily accessible, safe to share, and retain their intended formatting, making it an ideal solution for businesse Understanding Sage Invoice Template PricingWhen selecting a system for creating and managing payment requests, understanding the pricing structure is essential for making an informed decision. Different solutions offer various pricing plans depending on features, customization options, and additional services provided. It’s important to evaluate the costs involved and determine which option best aligns with your business’s needs and budget. Pricing can vary widely based on the complexity of the solution, the number of users, and the level of customization available. Some systems offer free basic plans, while others may charge a monthly or annual fee for premium features. Below, we’ll break down the key factors that influence the cost and help you navigate pricing when choosing a solution for generating financial documents. Factors Affecting Pricing

Evaluating Your NeedsWhen choosing the right plan, it’s important to carefully assess the features you require. If your business only needs basic templates for generating simple payment requests, a lower-cost or even free solution might be sufficient. However, if you require more advanced features such as automation, integration with other business tools, or extensive customization, investing in a more comprehensive plan may offer better value in the long run. Ultimately, understanding the pricing model and aligning it with your business’s requirements ensures that you select the most cost-effective solution for managing your financial documentation. Improving Cash Flow with Sage TemplatesManaging cash flow efficiently is essential for the growth and stability of any business. Streamlining the process of creating and sending financial documents plays a key role in accelerating payments and reducing delays. By using organized, professional templates, businesses can ensure that payment requests are accurate, clear, and sent promptly, which directly impacts the speed at which funds are received. When payment requests are well-designed and automated, it reduces the time spent on administrative tasks and minimizes errors that could lead to delays. Clear and consistent documentation helps clients process payments faster, improving overall cash flow. Below are some ways to improve financial management and liquidity by using these efficient tools. Accelerating Payment Processing

Enhancing Professionalism and Client Trust

By adopting automated, standardized systems for financial documentation, businesses can significantly reduce administrative overhead, eliminate delays, and foster positive relationships with clients, ultimately improving cash flow and supporting sustainable business growth. Best Practices for Invoice ManagementEffective management of financial documents is essential for maintaining smooth operations and ensuring timely payments. By adopting the right strategies, businesses can streamline the process, reduce errors, and maintain strong client relationships. Proper organization and consistent practices are key to managing payment requests efficiently and avoiding common pitfalls. Below are some of the best practices that can help businesses improve their management of financial documents, from creation to follow-up and payment collection. 1. Keep Your Records Organized

2. Ensure Accuracy and Consistency

3. Set Clear Payment Terms

4. Stay On Top of Follow-Ups

|