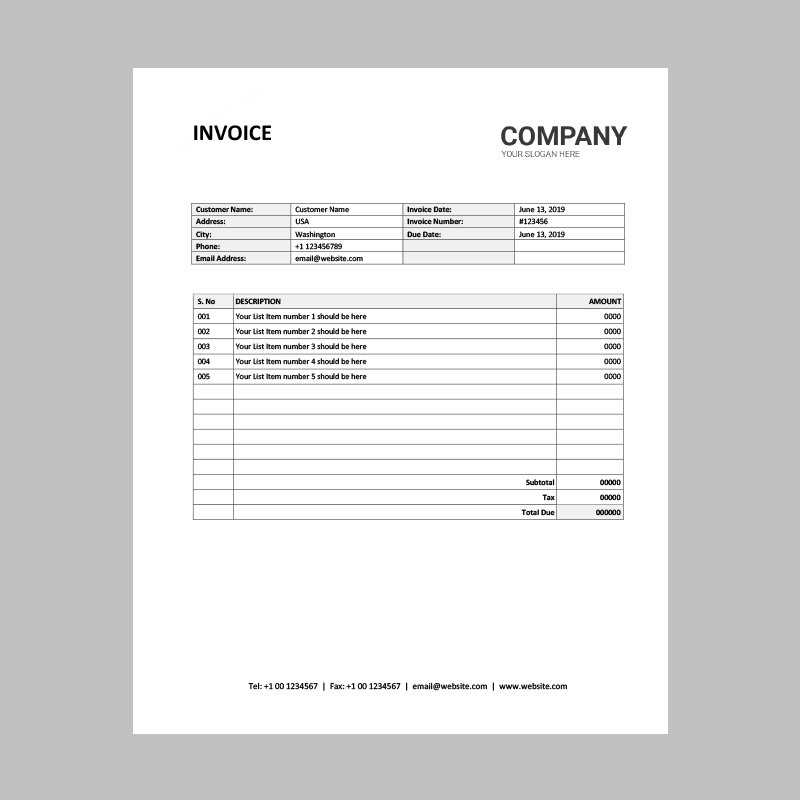

Free Download of Professional Invoice Template for Easy Invoicing

Managing finances can be simplified with ready-to-use forms designed for efficient billing. These resources help organize transactions, ensuring that each detail is accurately recorded and easy to understand. Accessible and adaptable, they are perfect for various business needs.

Utilizing a pre-made form saves time and reduces errors, letting businesses focus more on their core operations. By choosing a structured layout, professionals can quickly create clean, organized statements that communicate clearly with clients.

Effective billing builds trust and improves cash flow by making it easy to track payments. This resource can be tailored to fit individual branding, ensuring a polished and professional appearance every time. With just a few adjustments, these forms can fit any style and need, enhancing business efficiency.

Free Invoice Template for Professionals

For businesses seeking a reliable way to organize financial exchanges, ready-made forms offer an ideal solution. They provide a straightforward structure, helping to keep financial records precise and consistent without unnecessary complexity. Designed to save time and improve accuracy, these forms are suitable for both small ventures and large enterprises.

Professionals can benefit from structured formats in several ways:

- Enhanced Organization: Ready-made forms simplify tracking of payment details and dates, ensuring nothing is overlooked.

- Customizable Layouts: These forms often come with adaptable sections, making it easy to include necessary information for each transaction.

- Professional Appearance: Using a clean, well-designed format reflects positively on a business, enhancing credibility.

Below are some key features that make these forms useful for professionals:

- Sections for client information, dates, and amounts, keeping everything in one place.

- Options for brand

Simple Steps to Download Templates

Accessing structured forms for financial documentation is straightforward and can greatly improve efficiency. These forms are easily available online, designed to streamline the record-keeping process, and adaptable to various professional needs. With just a few steps, anyone can begin organizing their transactions more effectively.

Step-by-Step Guide

- Find a Reliable Source: Start by choosing a reputable platform offering various forms suitable for your business needs.

- Select the Appropriate Format: Choose a form style that matches your preferred file type, such as PDF, Word, or Excel, for easy customization.

- Preview and Customize: Many resources allow a quick preview. This option helps you assess whether the layout suits your requirements before accessing it.

- Save to Your Device: Once selected, save the form to a secure location on your computer or cloud storage for easy access and use.

Why Use an Invoice Template

Structured forms designed for billing simplify the entire financial process, providing a reliable framework that saves time and reduces errors. These tools are tailored to help professionals present transaction details in a clear, organized way, which enhances the efficiency and professionalism of their interactions with clients.

One major advantage is the consistency these forms bring to business documentation. With standardized fields, all necessary details are included, ensuring that each record is complete and easy to understand. This level of organization is essential for tracking payments and maintaining accurate financial records.

Another benefit is the professional appearance they lend to every document. A well-designed form reflects positively on a business, giving clients confidence in its reliability and attention to detail. Customizable options also allow businesses to incorporate branding elements, making each document unique and aligned with their identity.

Using these forms not only promotes accuracy but also streamlines the billing workflow, enabling professionals to focus on their core tasks without getting bogged down by administrative work. This resource is a practical solution for any business

Top Features of a Quality Template

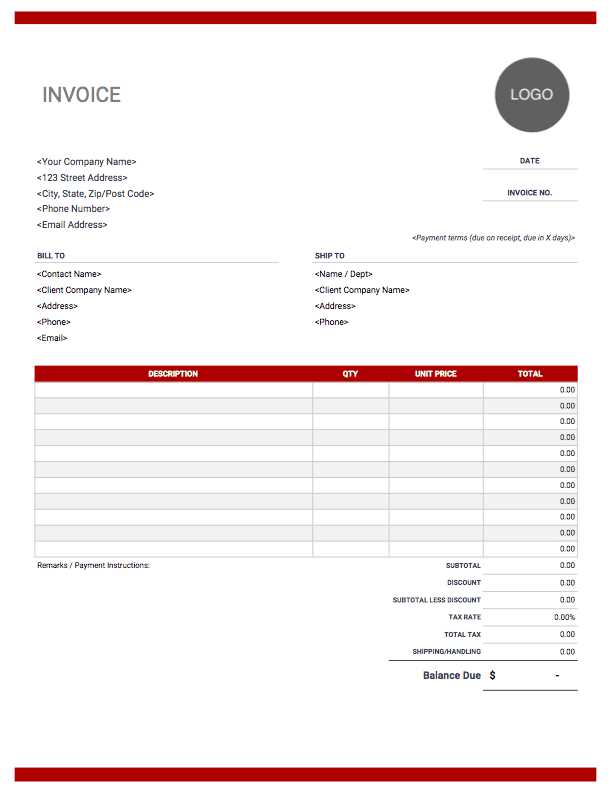

Effective billing forms offer key elements that enhance both functionality and professionalism, making them indispensable for businesses. A well-designed format allows users to organize transaction details accurately while providing a polished appearance that reflects positively on the business.

Key Characteristics to Look For

- Clear Layout: A clean, straightforward structure helps users find essential fields quickly, making the process of filling in details smooth and efficient.

- Editable Fields: Customizable sections allow businesses to add unique details such as client information, service descriptions, and payment terms without hassle.

- Automated Calculations: Built-in formulas for totals, taxes, and discounts save time and ensure accuracy by reducing manual calculations.

- Professional Design: A quality form includes a professional design with options for branding, giving a polished look that enhances credibility.

Additional Useful Elements

- Customizing Your Downloaded Template

- Include Company Details: Adding your business name, address, and contact information makes the form look official and helps clients reach you easily if needed.

- Edit Section Headings: Customizing section titles can clarify each part of the document, ensuring clients understand the information provided.

- Best Formats for Invoice Templates

Selecting the right file format for your billing documents is crucial for ease of use, sharing, and long-term storage. Different formats offer varying levels of compatibility with devices and software, making it important to choose one that best suits your needs.

Popular File Formats

- PDF: Portable Document Format is widely used for its universal compatibility and fixed layout. PDFs maintain their appearance across all devices, ensuring that clients always see the document as intended.

- Excel: Spreadsheet files are ideal for those who need to perform calculations or want to keep a record that’s easily editable and sortable. They are highly customizable and can include formulas to automate totals and taxes.

- Word: Word documents provide more flexibility in editing text and formatting, making them a good choice for those who need to create more complex documents with detailed descriptions and notes.

Other Formats to Consider

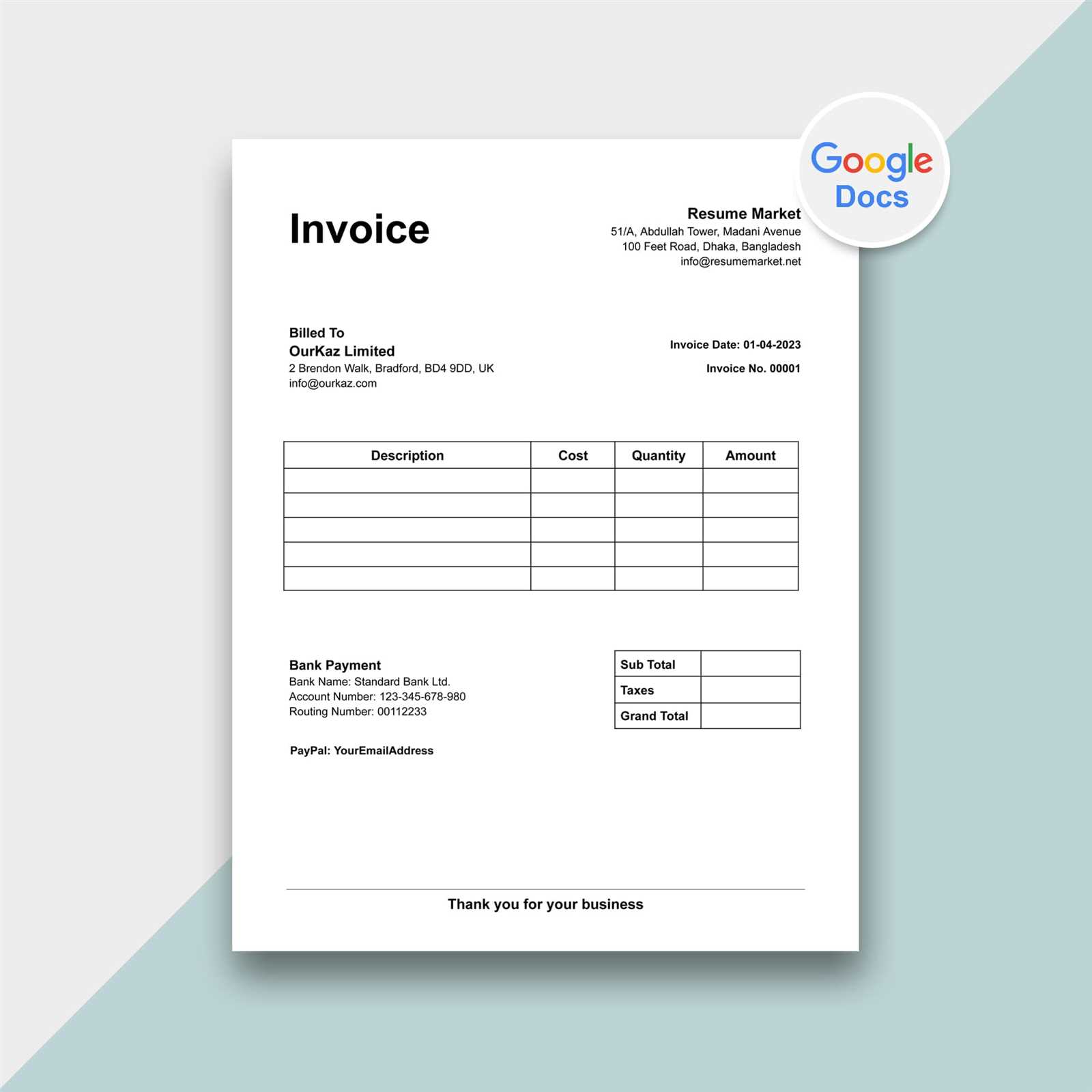

- Google Docs: Cloud-based documents are easy to access and share, offering real-time collaboration. They are especially useful for teams or businesses that need to update forms frequently.

- CSV: Comma-Separated Values files are suitable for businesses that need to import data into accounting software. While not as visually polished, CSV files are excellent for data processing.

- Plain Text: Simple text files are lightweight and universally compatible, making them useful for quick notes or when minimal formatting is required.

Choosing the right format ensures that your billing documents are accessible, easy to update, and ready to be sent in the most convenient way possible for both you and your clients.

Benefits of Free Invoice Options

Choosing no-cost solutions for creating billing documents can bring significant advantages for businesses looking to save on operational expenses. These options allow you to manage transactions efficiently without additional costs, while still maintaining a professional appearance.

Cost Efficiency

- Zero Upfront Costs: Using available resources without incurring any expenses allows you to allocate your budget toward other important business areas, such as marketing or growth initiatives.

- No Subscription Fees: Many paid tools require ongoing subscription payments. Opting for free solutions means you can avoid these recurring fees while still getting the features you need.

Convenience and Accessibility

- Easy Access: Free options are often easily accessible, allowing you to create and manage documents from any location, often without the need for specialized software.

- User-Friendly: These solutions typically offer simple interfaces, making them accessible even for those with little to no experience in document creation.

Customization and Flexibility

- Adaptable Designs: Many no-cost tools provide customizable formats that can be tailored to suit the specific needs of your business, helping you maintain a consistent and professional look across all documents.

- Variety of Features: Free resources often include features like automatic calculations, customizable fields, and easy export options, offering enough flexibility to meet your needs without the extra cost.

By utilizing these no-cost solutions, businesses can benefit from the efficiency, ease of use, and flexibility they offer, all while maintaining control over their budget.

How to Choose the Right Template

Selecting the best design for your billing documents is key to maintaining professionalism and ensuring that all essential details are included. With many options available, it’s important to identify the one that best fits your business needs and personal preferences.

Consider Your Business Needs

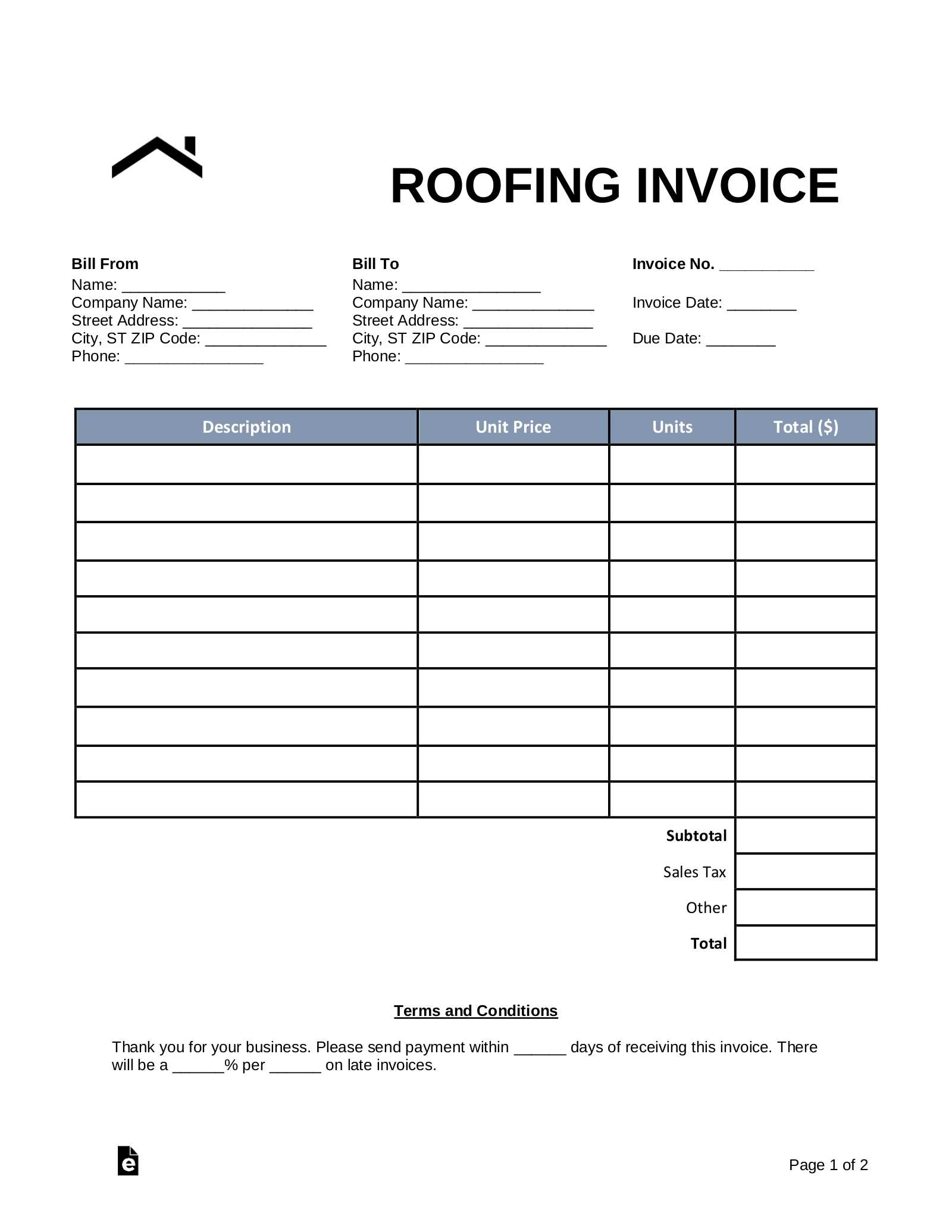

- Industry Requirements: Some sectors may require specific information on the form, such as project codes or detailed descriptions of services.

- Customization Needs: If you require frequent adjustments to your forms, choose a format that allows easy modifications, like one that can be edited in a text editor or spreadsheet software.

Look for Essential Features

- Clear Layout: Ensure the design offers space for all necessary fields such as recipient details, payment terms, and amounts due.

- Compatibility: Choose a design that works with the software you currently use, ensuring smooth integration into your existing workflow.

Table of Common Features

Feature Importance Examples Custom Fields Allows the inclusion of specific data like project names, client numbers, or service descriptions. Editable fields for notes, product codes, or service descriptions. Clear Payment Terms Ensures clients understand when payments are due and any applicable fees for late payments. Section for “Due Date” and “Late Fee” information. Branding Options Helps maintain a consistent visual identity by incorporating company logos and color schemes. Logo upload area, color scheme selection. By focusing on these key factors, you can select the most suitable document design that will serve your business effectively, ensuring both functionality and professionalism.

Save Time with Ready-Made Invoices

Using pre-designed forms can significantly reduce the time spent on administrative tasks. By adopting ready-to-use layouts, you eliminate the need to start from scratch, allowing you to focus on what matters most–your business operations. These formats streamline the billing process, ensuring accuracy while saving valuable time.

Key Benefits of Pre-Made Forms

- Quick Setup: Pre-designed forms are ready to be used immediately, saving time on creating new documents for each transaction.

- Accuracy: With pre-set fields, there is less chance of overlooking essential details, ensuring your records are complete and error-free.

- Consistency: Using the same format for all records ensures uniformity, which is important for maintaining a professional image.

Table Comparing Time-Saving Features

Feature Benefit Example Pre-filled Details Saves time by automatically including common information like company name, address, and contact details. Business name, address, and logo already added to the document. Standardized Layout Eliminates the need for formatting, allowing faster document creation. Consistent sections for dates, amounts, and services provided. Easy Customization Allows quick adjustments to the document for specific clients or transactions. Editable sections for itemizing services or changing prices. By choosing ready-to-use formats, you can avoid the hassle of manual entry and focus on other aspects of your business. The result is not only a quicker workflow but also a more professional and efficient process overall.

Ensuring Professionalism in Invoicing

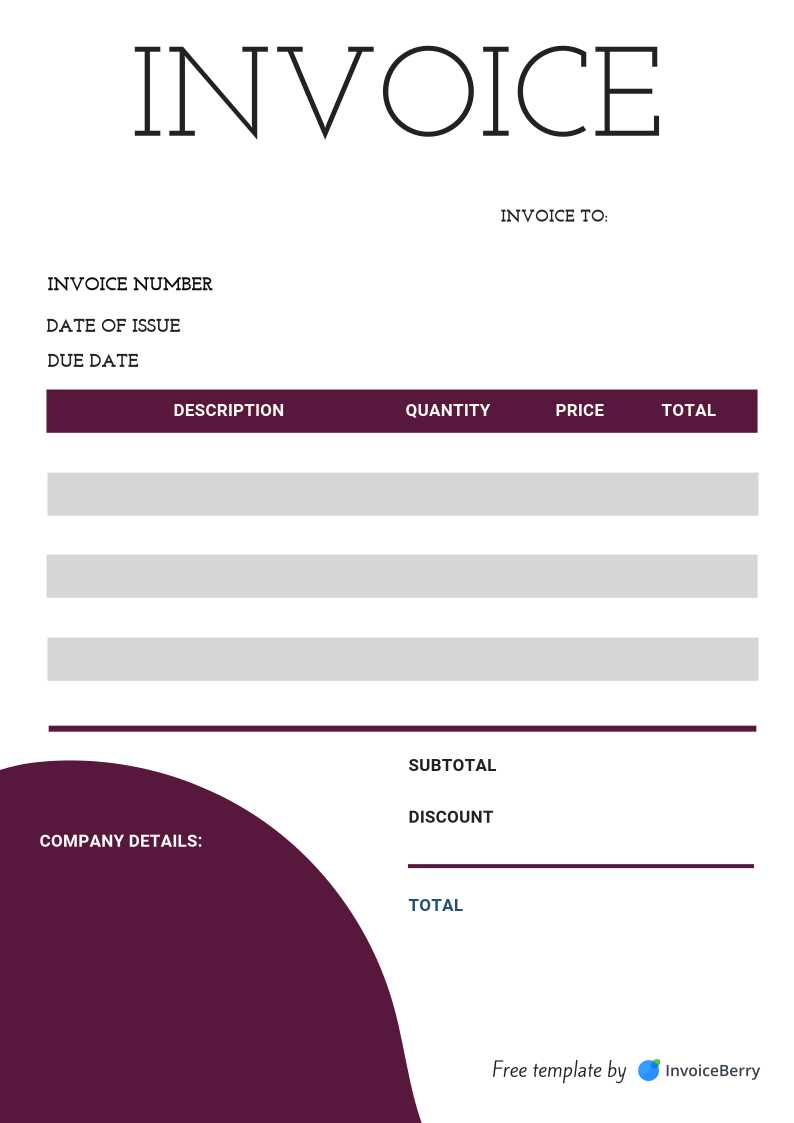

Maintaining a high level of professionalism in all business interactions is essential, and this extends to how financial documents are presented. By using structured and polished layouts, you can ensure that your transactions appear organized, clear, and credible. A well-designed document not only enhances your business image but also fosters trust with clients.

Key Elements for Professional Documents

- Clear Formatting: Consistent use of fonts, headers, and spacing helps make the document easy to read and visually appealing.

- Branding: Including your logo and company colors reinforces your business identity and adds a personalized touch.

- Complete Information: Ensuring that all necessary details such as services provided, dates, and contact information are included minimizes confusion and prevents delays.

Table of Professional Features in Financial Documents

Feature Benefit Example Consistent Layout Enhances readability and makes your document look well-organized. Uniform headings and sections for each item or service listed. Contact Information Builds transparency and makes it easy for clients to reach you. Clearly displayed phone number, email, and business address. Itemized Billing Provides clarity for both parties, reducing the risk of misunderstandings. Detailed breakdown of services with prices and quantities listed. By incorporating these elements, you can ensure that your business documents convey a sense of professionalism. This attention to detail not only helps in securing client trust but also enhances the overall efficiency of your operations.

Popular Software for Invoice Creation

In today’s business world, utilizing the right software for generating financial documents is crucial for efficiency and professionalism. Various tools are available that streamline the process of creating, managing, and sending these documents. Choosing the right one depends on your business needs, whether you require basic functionality or advanced features like automated calculations and integration with accounting systems.

Top Software Options for Creating Financial Documents

- QuickBooks: A well-known accounting tool that also offers robust features for generating professional-looking documents, including customizable layouts and integration with bank accounts.

- FreshBooks: Ideal for small businesses, this software offers easy-to-use invoice creation features, tracking, and expense management tools.

- Zoho Invoice: A versatile software that allows you to create, manage, and automate your financial transactions with ease, and offers free plans for small businesses.

- Wave: This software provides excellent tools for freelancers and small businesses, offering an intuitive interface for creating professional-looking documents without the need for a subscription.

- Invoicely: A cloud-based option that provides customizable options for business owners, including multi-currency support and the ability to track payment statuses in real time.

Factors to Consider When Choosing Software

- Customization: Consider the ability to personalize documents with your company’s branding elements like logos, colors, and fonts.

- Integration: Look for software that integrates with your accounting system or other business tools to streamline workflows.

- Automation: Automated features such as recurring billing, reminders, and payment tracking can save time and reduce the risk of errors.

- Cost: Evaluate the pricing structure to ensure it fits your business needs and budget, especially if you’re just starting out.

By selecting the right software, you can save time, reduce errors, and ensure that your financial documents always look polished and professional.

Common Mistakes to Avoid in Invoices

Creating financial documents that are clear, accurate, and professional is essential for maintaining strong relationships with clients and ensuring timely payments. While generating these documents may seem straightforward, there are common errors that many businesses make. Avoiding these mistakes can help you maintain professionalism and prevent confusion or delays in receiving payment.

1. Missing Essential Information

Omitting key details such as the recipient’s contact information, the services or products provided, and the payment terms can lead to misunderstandings. Ensure that all critical information, including dates and payment instructions, is clearly stated.

2. Incorrect or Unclear Amounts

One of the most important aspects of these documents is accuracy. Incorrect totals, missing taxes, or unclear breakdowns of charges can cause confusion and delays. Always double-check the calculations and ensure that the charges are listed clearly.

3. Failure to Set Clear Payment Terms

Be sure to specify the due date, preferred payment methods, and any late fees that may apply. Ambiguous terms can cause confusion and lead to delayed payments.

4. Not Including a Professional Layout

Even if the content is accurate, an unorganized or unprofessional-looking document can create a negative impression. Use a clean, easy-to-read format that reflects your business’s brand and style.

5. Not Tracking Previous Payments

For businesses that issue multiple financial documents, it’s essential to track payments accurately. Failing to do so can lead to confusion about what has been paid and what remains outstanding. Ensure that all previous payments are clearly recorded and noted.

6. Using Inconsistent Numbering or Referencing

Keep your records organized by using a consistent system for numbering and referencing these documents. This will help both you and your clients track payments more efficiently and avoid confusion.

By avoiding these common mistakes, you can ensure that your financial documents are professional, clear, and free from errors, helping to foster better relationships with clients and maintain a smooth workflow.

Updating Your Template for Accuracy

To maintain a smooth workflow and ensure that your financial documents reflect your business accurately, it’s essential to regularly update your documents. As business practices evolve and regulations change, staying current with the necessary details is critical to avoid errors and miscommunication.

Why Regular Updates Are Important

Keeping your documents up to date ensures that all information is accurate, consistent, and in line with your current business practices. It also helps to prevent issues such as outdated terms, incorrect calculations, or missing data.

Steps to Update Your Document

Follow these steps to ensure that your financial documents are always accurate:

Step Description 1. Review Business Details Ensure that your company name, address, and contact information are current. Outdated details can lead to confusion and a lack of professionalism. 2. Update Payment Terms Check that the payment methods, due dates, and any applicable late fees are accurate and relevant to your current business policy. 3. Include Correct Tax Information Make sure that tax rates and applicable charges are up to date, as tax laws can change over time. 4. Double-Check Calculation Formulas If your documents include automated calculations, verify that the formulas are functioning properly and accurately reflect your pricing structure. 5. Maintain Consistent Formatting Ensure that the layout and design remain clear, professional, and easy to navigate, with all sections properly labeled and organized. Regularly updating your financial documents not only helps you stay organized but also ensures that you can manage client relationships smoothly and avoid potential issues.

Invoicing Tips for Small Businesses

Managing financial transactions efficiently is key to keeping a small business running smoothly. Establishing a streamlined process for creating and sending billing documents can save time and reduce errors, ensuring that clients are satisfied and payments are received on time.

Best Practices for Small Business Billing

To ensure smooth operations and positive client relations, consider these essential practices:

- Be Clear and Concise: Include all necessary details such as services rendered, payment terms, and due dates. Avoid ambiguity that might confuse clients.

- Automate When Possible: Use software to automate the process, which can save time and reduce human error. Automation can handle recurring charges and generate accurate totals.

- Set Clear Payment Terms: Specify your payment terms up front, including due dates and any late fees, to avoid misunderstandings.

- Use Professional Formatting: A clean, professional layout reflects well on your business and makes it easier for clients to understand the charges.

- Keep Track of Sent Documents: Maintain a record of all billing documents sent, including dates and amounts, to prevent missed payments.

- Follow Up on Late Payments: Send polite reminders or follow-up notices for overdue payments, helping maintain positive client relationships while ensuring you receive the funds owed.

Tools and Resources

There are various tools available to simplify the process of creating and managing your billing documents. Explore software options or online resources to find what works best for your business needs.

Boosting Cash Flow with Faster Payments

Improving the speed at which you receive payments is crucial to maintaining healthy cash flow. The quicker you can process transactions and receive funds, the more efficiently your business can operate and grow. Optimizing your billing process can make a significant impact on your financial stability.

Effective Strategies to Speed Up Payments

Consider the following strategies to encourage faster payments from your clients:

- Offer Multiple Payment Options: Make it easier for customers to pay by offering a variety of payment methods, including credit cards, bank transfers, and online payment platforms.

- Set Clear Terms and Deadlines: Be transparent about your payment expectations and due dates. This helps prevent delays and ensures customers know when to make payments.

- Automate Reminders: Use automated systems to send reminders as the due date approaches, and follow up promptly on overdue payments.

- Offer Early Payment Discounts: Encourage customers to pay sooner by offering a small discount for early settlement of their accounts.

Tools to Help Speed Up Payment Collection

Implementing the right tools can streamline the billing process and help you track payments more effectively. Consider using software or services that automate and simplify these tasks to reduce delays and improve your cash flow.

Adjusting a pre-made billing form to suit your business style can add a unique touch and help you create a consistent brand image. With a few simple modifications, you can ensure that each document reflects your business identity while also meeting specific requirements for your transactions.

Steps for Personalization

One of the easiest ways to make a form your own is by adding a business logo or custom color scheme. This adds a recognizable element, making your documents look more professional and tailored.