Free Online Service Invoice Template for Easy Customization

Managing billing tasks efficiently is a crucial aspect of running any business. Having the right tools to produce well-structured documents can streamline your workflow and help ensure that you receive payments on time. By using the right tools, you can create clear and concise records that leave a positive impression on your clients.

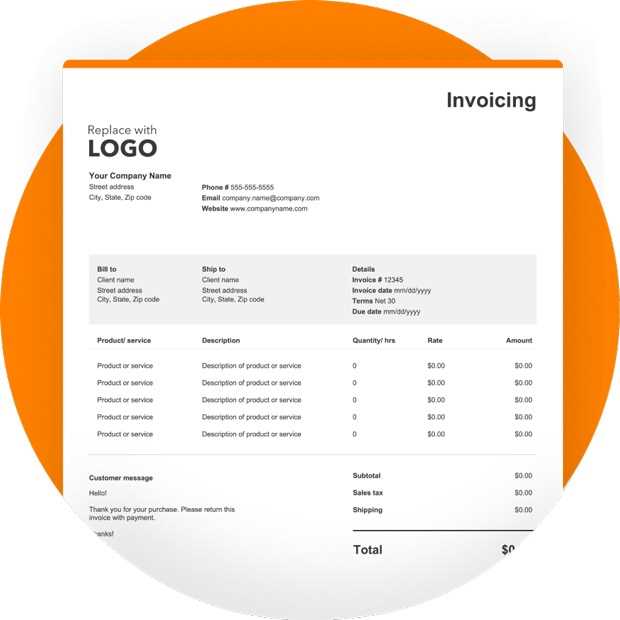

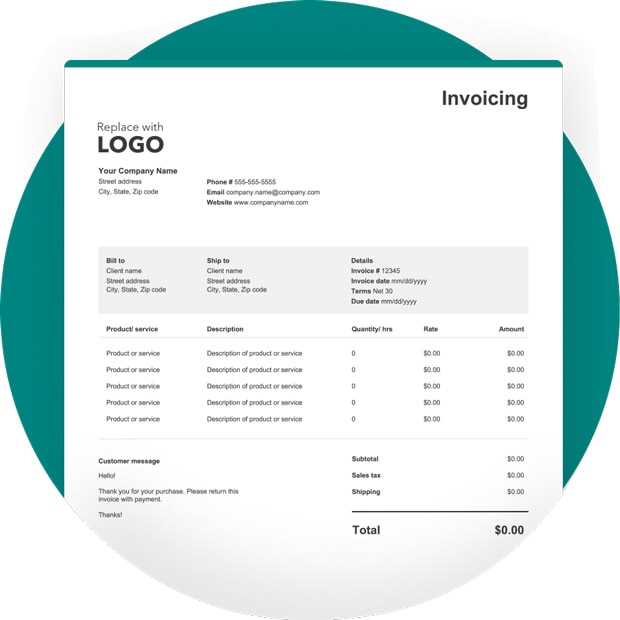

With the right resources, customizing your payment requests to fit your brand and business needs is simpler than ever. These customizable formats allow you to focus on what matters most–providing top-quality work–while leaving the administrative side to intuitive, easy-to-use solutions. Whether you are a freelancer, small business owner, or large enterprise, creating effective billing records has never been more accessible.

Efficient design plays a significant role in making sure that your customers understand the charges and the details associated with the transaction. With modern tools, anyone can quickly generate documents that are not only functional but also professional in appearance. These platforms offer a variety of customizable fields and layouts, giving you complete control over your business’s documentation needs.

Free Online Invoice Templates for Services

For businesses that rely on providing expertise or specialized work to clients, having an efficient way to request payment is essential. A well-structured billing document helps convey professionalism and ensures clarity in financial transactions. The availability of customizable document formats enables entrepreneurs to easily produce professional-looking payment requests without investing in expensive software or tools.

Easy Customization for Different Needs

With these ready-to-use formats, tailoring each document to reflect the specific nature of the service provided is simple. Whether you’re offering consulting, design, or maintenance services, these solutions allow you to adjust the layout, wording, and fields according to your preferences. Key information such as payment terms, contact details, and line items can be modified to fit the unique requirements of any project or client.

Streamlined Process for Fast Billing

By using these customizable resources, the billing process becomes much faster. No need to manually create each document from scratch; simply input the necessary details, adjust the format, and send it off. This efficiency reduces time spent on administrative tasks, allowing business owners and freelancers to focus more on what they do best–serving their clients and growing their business.

Why Choose an Online Invoice Generator

Generating professional payment requests can be time-consuming, especially for small business owners and freelancers. However, using automated tools to create these documents streamlines the process and ensures accuracy. By utilizing an intuitive generator, users can produce polished records in just a few clicks, saving valuable time and reducing errors.

Key Benefits of Using a Generator

Automated tools offer several advantages that make them a preferred choice for creating billing records:

- Time-Saving: No need to manually design or format documents. Pre-designed fields and layouts simplify the process.

- Customization: Easily adjust each document to reflect your business’s branding, terms, and specific details of the transaction.

- Consistency: Maintain a professional and uniform appearance for all your payment requests, helping to strengthen your brand identity.

- Error Reduction: Automated systems reduce human error, ensuring that critical details like amounts, dates, and contact information are correctly entered.

- Accessibility: These tools can be used from virtually anywhere, making it easy to create and send documents while on the go.

How It Works

Using a generator typically involves a few simple steps:

- Enter your company and client details into the fields provided.

- Specify the services rendered and payment terms.

- Customize the layout and add any necessary logos or branding elements.

- Preview the document to ensure all information is accurate.

- Download or send the document directly to your client.

By following these straightforward steps, you can create a polished, professional document that accurately reflects your business’s services and payment expectations.

How to Use a Service Invoice Template

Creating a clear and accurate payment request is essential for any business that works with clients. Using pre-designed documents can simplify the process significantly. By following a few straightforward steps, you can quickly generate a professional record, ensuring all necessary details are included and formatted properly.

Steps to Create a Payment Request

Using a customizable document format is simple and efficient. Here’s how to get started:

- Choose a Format: Select a layout that suits your needs. Most tools offer different styles, ranging from basic to more detailed formats.

- Input Client and Business Information: Fill in fields such as your business name, address, and contact details, along with your client’s information.

- Describe the Services Provided: Clearly list the work performed, including the time spent, rates, and any additional charges or discounts.

- Set Payment Terms: Specify due dates, late fees, and any other payment-related terms.

- Review and Customize: Double-check all entries for accuracy. Customize the layout, fonts, and branding elements as needed.

- Save and Send: Once satisfied, save the document and send it to your client via email or your preferred method of delivery.

Tips for Accurate and Professional Results

- Double-check calculations: Ensure that all amounts and totals are correct before sending the document.

- Use clear language: Avoid jargon or ambiguity. Make sure your client understands the charges and payment expectations.

- Personalize the document: Adding your company’s logo or adjusting the design elements can make the request feel more tailored and professional.

By following these steps, you can produce well-organized and professional payment requests with ease, ensuring a smooth transaction process for both you and your clients.

Benefits of Customizable Invoice Formats

Having the ability to modify your billing documents offers several key advantages. Customizable formats give you the flexibility to design payment requests that align with your brand and client needs. This adaptability ensures that each document is not only functional but also professional and visually appealing, which can help leave a lasting impression on your clients.

Personalization is one of the greatest benefits of using adjustable document layouts. Whether you need to include your business logo, adjust fonts, or change color schemes, these formats give you complete control over how the final document appears. This means you can create a consistent and cohesive brand image across all client communications.

Another significant advantage is efficiency. When you can easily tweak a layout to fit your needs, you can create accurate payment records quickly. Customizable formats save you the hassle of starting from scratch for each project or transaction, ensuring faster turnaround times for billing tasks.

Moreover, these flexible tools allow you to adapt the content based on the specific nature of the work completed. Whether you’re charging for hours worked, a fixed fee, or a combination of both, you can easily adjust the sections of the document to reflect the right terms, reducing the chance of errors or misunderstandings.

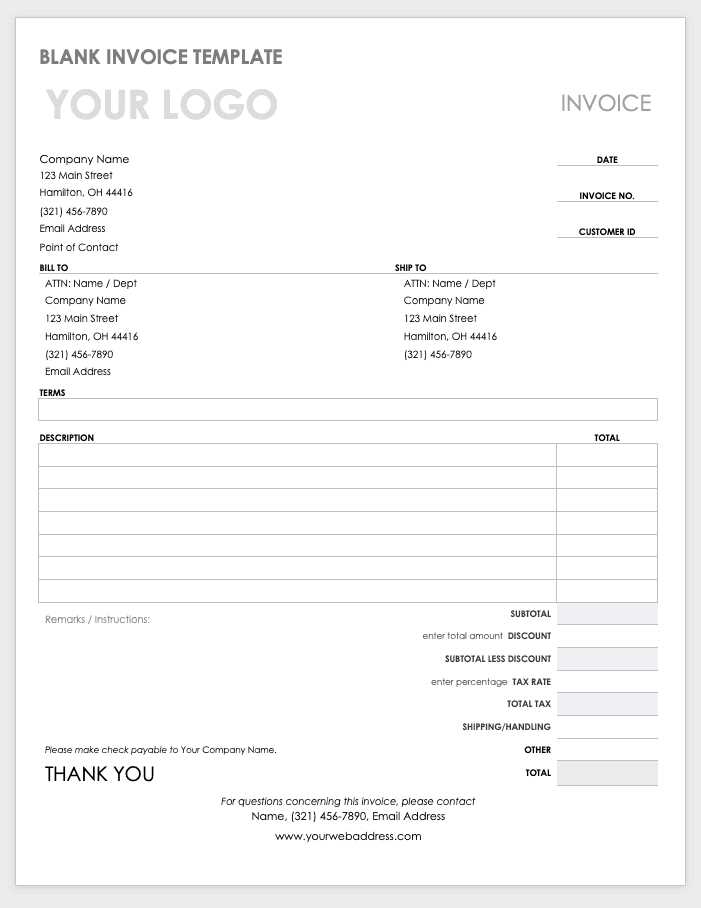

Key Features of Free Invoice Templates

Effective billing documents include specific features that make them both functional and professional. A well-designed layout ensures clarity and accuracy in communication with clients, while built-in features can save time and reduce errors. Understanding the key characteristics of these tools helps you take full advantage of their capabilities.

Essential Elements to Look For

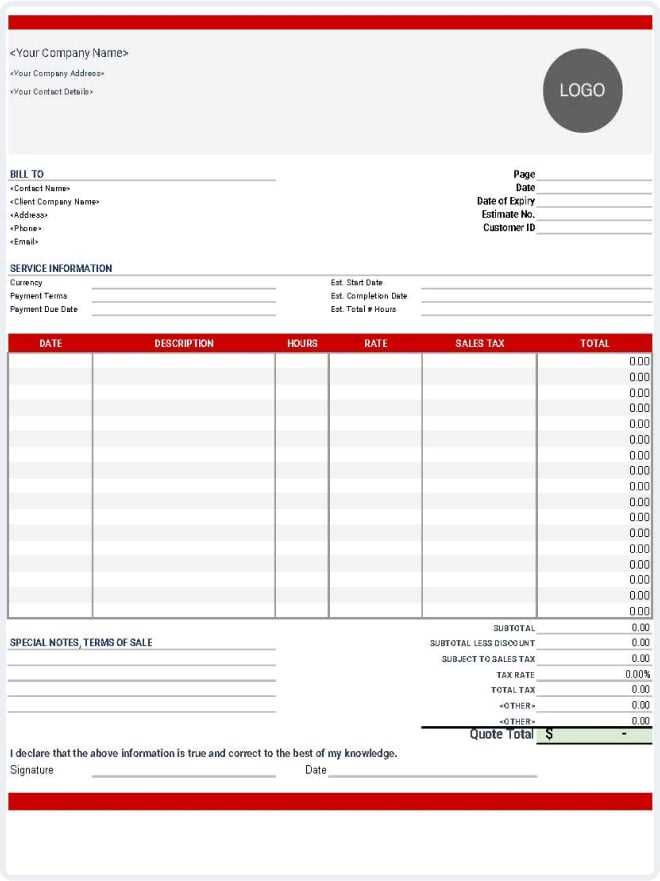

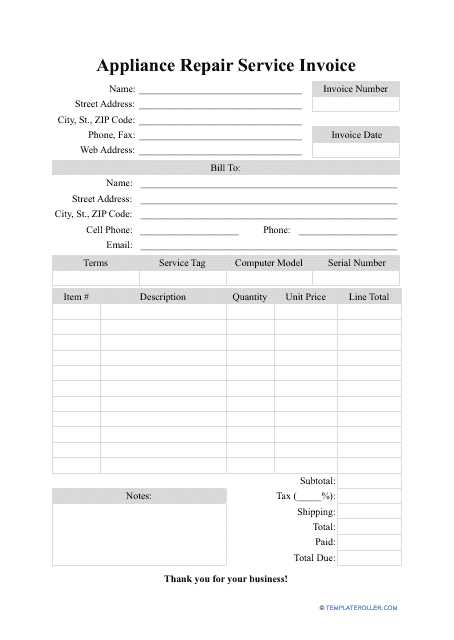

- Pre-Formatted Fields: Automatically organized sections for dates, client details, item descriptions, and totals streamline the document creation process.

- Customizable Layout: Flexible designs that can be easily adapted to your business branding, allowing for logo insertion and color adjustments.

- Clear Payment Terms: Built-in options for including payment deadlines, late fees, and any applicable taxes to avoid misunderstandings.

- Tax Calculations: Automatic calculation of taxes based on the specified rate, reducing the likelihood of manual calculation errors.

- Itemized List: Detailed descriptions of each service or product provided, including quantities, rates, and subtotals.

- Professional Design: Clean, structured layouts that give your documents a polished and business-like appearance.

Additional Time-Saving Features

- Multiple Currency Support: Ability to select different currencies for international clients, ensuring accuracy in global transactions.

- Quick Export and Delivery: Options for easy exporting to PDF or other formats, as well as direct email delivery to clients.

- Automated Numbering: Sequential numbering for invoices, helping to maintain a clear record of transactions and reducing the risk of duplication.

These features help simplify the billing process, ensuring that businesses can create accurate, professional documents with ease, saving time and minimizing errors in the financial workflow.

How to Create a Professional Invoice

Creating a polished payment request involves more than just listing charges. A professional document clearly communicates all necessary details, ensuring that clients understand the terms and conditions of the transaction. By following a few simple steps, you can ensure your documents reflect the quality of your work and help establish trust with your clients.

Steps to Craft a Professional Document

- Include Business Information: Start by adding your company’s name, contact details, and logo (if applicable) at the top of the document. Make sure your contact information is easily accessible to the client.

- Add Client Details: Clearly state the client’s name and contact information. This helps personalize the document and ensures accuracy when processing payments.

- Provide a Detailed Description: List all services or products provided, including quantities, rates, and specific details. Be precise to avoid misunderstandings about what is being billed.

- Specify Payment Terms: Clearly state payment deadlines, late fees, or discounts if applicable. Providing this information upfront ensures there is no confusion regarding the payment expectations.

- Include Totals and Taxes: Make sure the document includes a subtotal for each service, any applicable taxes, and a final total. This should be easy for the client to understand and verify.

- Number the Document: Give each document a unique reference number to keep track of billing and maintain an organized record of all transactions.

- Choose a Clean, Professional Layout: Use clear fonts, simple formatting, and adequate white space to ensure the document is easy to read and looks professional.

Finalizing the Document

- Review for Accuracy: Double-check all information, especially numerical details such as totals and tax rates, to ensure there are no mistakes.

- Export and Save: Once you’re satisfied with the document, save it in an easily accessible format, such as PDF, to ensure it can be viewed without issues across different devices.

- Send Promptly: Deliver the document to your client quickly to ensure timely payment. You can send it via email or your preferred delivery method.

By following these steps, you can easily create a professional payment request that reflects well on your business and encourages smooth transactions with your clients.

Save Time with Invoice Automation Tools

Managing financial records and client payments can be time-consuming, especially when done manually. However, automating the billing process offers a powerful solution to save time and reduce the workload. Automation tools simplify the creation, sending, and tracking of payment requests, allowing you to focus more on your business and less on administrative tasks.

How Automation Tools Help

Automation tools help streamline the billing process in several ways:

- Quick Generation: Automatically generate payment requests with pre-filled details, saving time compared to creating each document from scratch.

- Customizable Settings: Set default payment terms, rates, and templates, so you don’t need to adjust these every time you create a new document.

- Automatic Calculations: Tools can automatically calculate totals, taxes, and discounts, reducing the risk of errors and speeding up the process.

- Recurring Invoices: For clients with ongoing work, you can set up recurring payment requests that are generated and sent automatically on a scheduled basis.

- Client Management: Save client information for easy access, making it faster to create documents for returning clients.

Other Time-Saving Features

Many automation tools also include additional features that make the process even more efficient:

- Integrated Payment Options: Automatically link to payment gateways so clients can pay directly through the document, speeding up the payment process.

- Reminder Notifications: Send automated reminders to clients when payment is due or overdue, reducing the need for manual follow-ups.

- Analytics and Reporting: Track payment status, outstanding balances, and client payment histories all in one place, providing valuable insights with minimal effort.

By incorporating automation tools into your business workflow, you can significantly reduce the time spent on administrative tasks, allowing you to focus on delivering quality work and growing your business.

Downloadable Invoice Templates for Freelancers

Freelancers often juggle multiple clients and projects, making it essential to have a streamlined system for managing payments. Using downloadable formats to create billing documents can save time and ensure that each client receives clear and accurate payment requests. These formats allow freelancers to quickly customize and send documents, reducing administrative burdens and allowing more focus on the work itself.

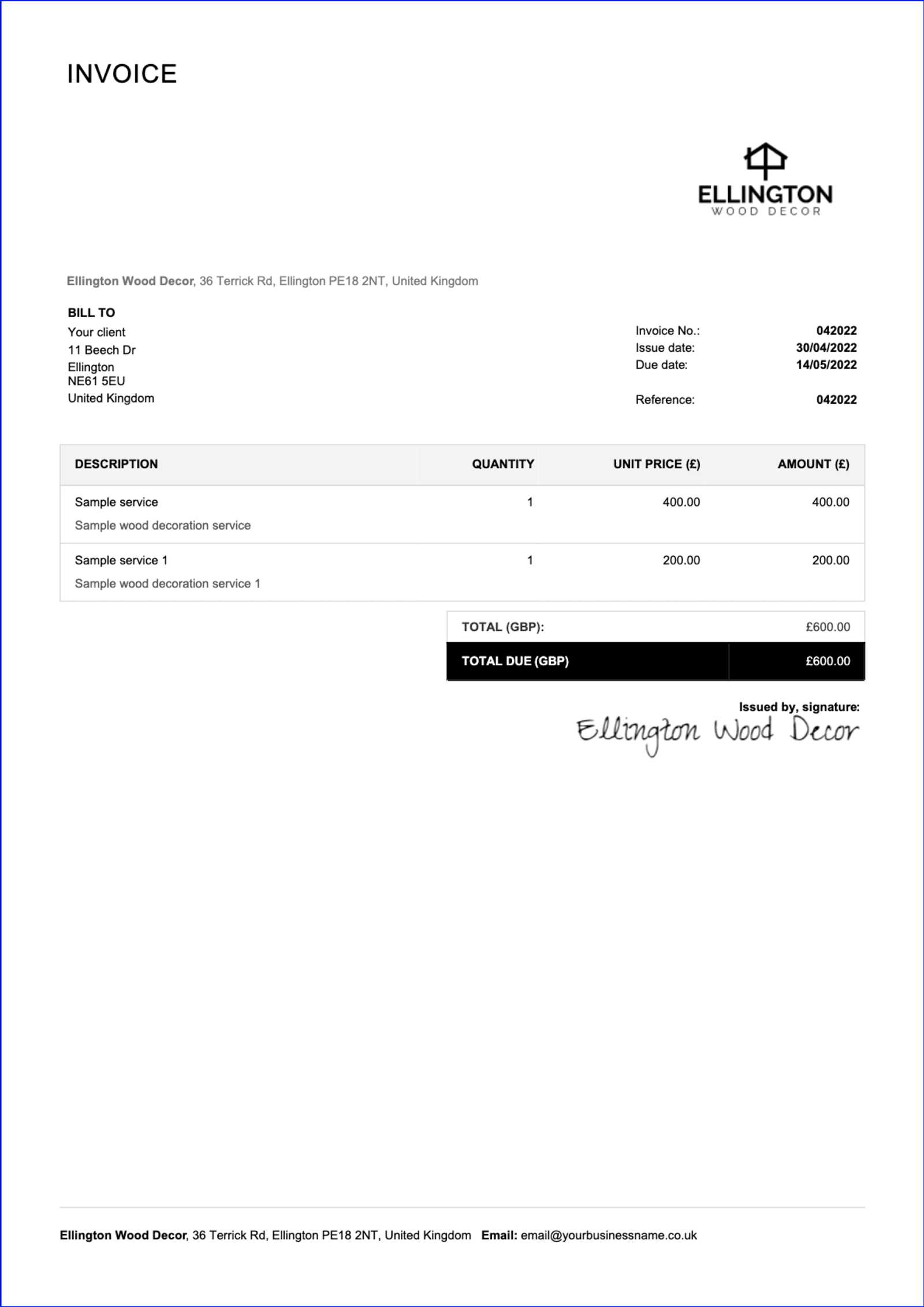

Having a set of customizable and downloadable options can be particularly useful for freelancers who require flexibility in their payment records. These tools make it easy to adjust for different services, rates, and client details, all while maintaining a professional appearance. Below is an example of how a freelancer might organize their billing details using such a document format:

| Item Description | Hours Worked | Rate | Total |

|---|---|---|---|

| Graphic Design | 10 | $50 | $500 |

| Consulting | 5 | $75 | $375 |

| Total | $875 |

With a downloadable format like this, freelancers can input hours worked, rates, and a brief description of services, generating an organized and professional document in just a few steps. This format is flexible enough to handle varying project types while ensuring clients receive a clear and accurate breakdown of the work performed.

Top Free Online Invoice Platforms

For businesses and freelancers looking to simplify their billing process, using a reliable platform can significantly ease the task of creating and managing payment requests. These platforms provide customizable options that allow users to quickly generate documents that meet their specific needs. Many tools offer additional features, such as automatic calculations, client management, and built-in reminders, which make handling finances more efficient and professional.

Popular Platforms for Generating Payment Requests

Here are some of the top platforms that provide excellent tools for crafting professional payment documents:

- Wave: A user-friendly platform known for its intuitive interface, offering customizable templates and the ability to track payments and expenses.

- Zoho Invoice: A comprehensive tool that allows for easy creation of personalized billing documents, integrates with various payment gateways, and helps track time and expenses.

- Invoice Ninja: Ideal for freelancers and small businesses, this platform offers both free and paid versions, allowing users to generate professional documents and manage clients efficiently.

- PayPal Invoicing: A widely-used platform that integrates directly with PayPal, allowing users to create and send invoices, and also track payments within the system.

- FreshBooks: While primarily an accounting tool, FreshBooks also offers simple invoice generation features, making it easy for businesses to manage both billing and financial reporting in one place.

Features to Look For in a Platform

When choosing a platform, it’s essential to look for key features that will save you time and ensure professionalism in your payment requests:

- Customization: Look for tools that allow you to easily adjust the design and content of your documents to reflect your brand.

- Automation: Choose platforms that can automate recurring invoices and send reminders for overdue payments.

- Reporting: Access to detailed reports can help you track payment statuses and manage finances more effectively.

- Payment Integration: The ability to integrate with payment gateways ensures that clients can pay directly from the billing document, speeding up the payment process.

These platforms provide everything you need to create, send, and manage your payment requests with ease, whether you’re a freelancer just starting out or a small business owner managing multiple clients.

Creating a Clear and Simple Invoice

When it comes to requesting payment, clarity and simplicity are key. A well-structured document not only makes it easier for clients to understand the charges but also helps establish professionalism. By focusing on essential details and presenting them in an organized way, you can create an effective document that reduces confusion and facilitates smooth transactions.

Essential Components of a Clear Payment Request

A simple, easy-to-read document should include the following elements:

- Your Business Information: Include your company’s name, address, and contact details at the top, so clients can easily reach out if needed.

- Client Information: Clearly list your client’s name and contact details. This ensures there are no mix-ups when processing payments.

- Itemized List: Break down the work or products provided, including descriptions, quantities, and individual rates. This allows your client to easily verify each charge.

- Total Amount: Clearly state the total amount due, including any taxes or additional fees. Make this figure stand out so it’s easy to find.

- Payment Terms: Specify when payment is due and any late fees, discounts, or payment methods accepted. This helps set expectations and avoid confusion.

Best Practices for Simplicity and Clarity

To ensure your document is straightforward and easy to understand, follow these best practices:

- Use Clear Language: Avoid technical jargon or overly complicated terms. Make sure the client can quickly understand what they are being billed for.

- Keep the Layout Clean: Use clear headings, bullet points, and enough white space to make the document visually appealing and easy to follow.

- Highlight Key Information: Use bold or larger fonts to emphasize important details like the total amount due and payment due date.

- Double-Check for Accuracy: Before sending, review the document for any mistakes, such as incorrect amounts, dates, or client details.

By following these simple steps, you can create a clear and professional payment request that not only saves time but also helps build trust with your clients.

Common Mistakes in Invoice Creation

When preparing a payment request, even small errors can lead to misunderstandings, delays, or frustration with clients. While the process may seem straightforward, there are several common mistakes that many people make, often without realizing it. Recognizing these mistakes and knowing how to avoid them can help ensure that your documents are professional, accurate, and easily understood.

Frequent Errors in Billing Documents

- Missing Client Information: One of the most common mistakes is forgetting to include key client details such as their full name, address, or contact information. This can lead to confusion and delays in processing the payment.

- Unclear Descriptions: Vague or incomplete descriptions of the work provided can cause clients to question the charges. Be sure to provide detailed explanations of services or products so there is no ambiguity.

- Incorrect Calculations: Errors in adding up totals or applying the wrong tax rate are common. Always double-check your numbers and use automatic calculation features when available to avoid mistakes.

- Failure to Set Payment Terms: Not specifying the payment due date, payment method, or late fees can lead to delayed payments. Make these terms clear from the outset to avoid misunderstandings.

- Lack of Unique Identification Number: Forgetting to assign a unique reference number to your document can make it harder to track payments and create a professional impression. Ensure each request is numbered sequentially for better organization.

How to Avoid These Mistakes

To prevent these errors and ensure that your payment requests are accurate and professional, consider the following tips:

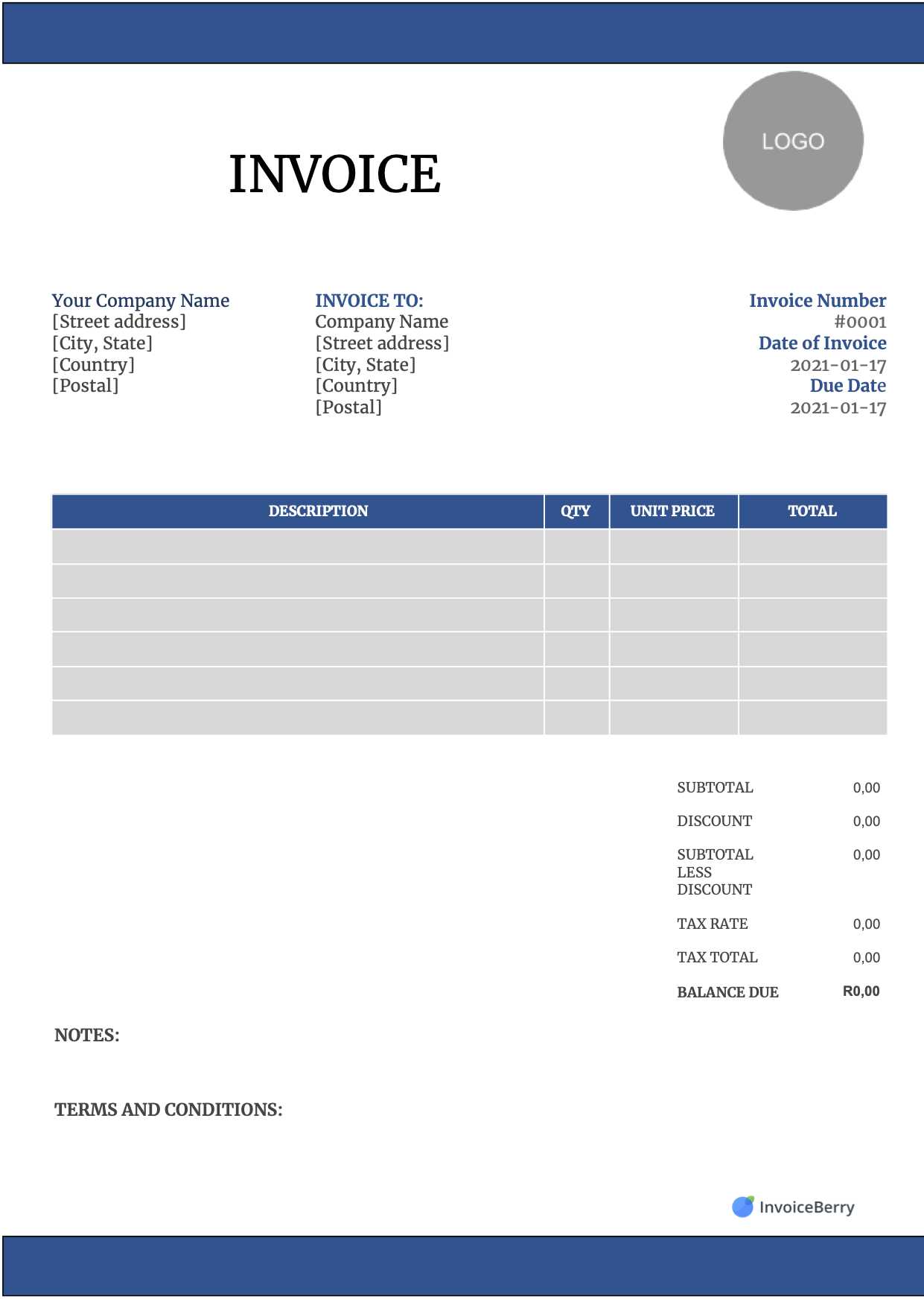

Essential Elements in a Service Invoice

When creating a request for payment, it’s important to include the right details to ensure clarity and avoid confusion. A well-structured document serves as both a record of the transaction and a professional communication tool. Including all necessary elements not only makes the document more effective but also fosters trust with clients by showing attention to detail.

Key Information to Include

A comprehensive billing document should contain the following components to ensure that the client has all the information they need:

- Your Business Details: At the top of the document, include your name or company name, address, contact information, and business registration number (if applicable). This establishes the legitimacy of your business.

- Client Information: Clearly state the client’s full name, address, and any other relevant contact information to ensure that the request is directed to the right person.

- Document Number and Date: Assign a unique reference number to each request and include the issue date. This helps in tracking and managing your financial records.

- Detailed Breakdown of Charges: List each service or product provided with a description, quantity, rate, and total amount. This gives your client a clear understanding of what they’re paying for.

- Payment Terms: Specify the due date for payment, any late fees, and accepted payment methods. Providing clear terms helps prevent misunderstandings and delays.

Additional Helpful Information

In addition to the essential elements, there are some optional but helpful details that can improve communication and clarity:

- Discounts or Special Offers: If you’re offering a discount or a promotional price, make sure it’s clearly stated and applied in the total.

- Taxes and Fees: If applicable, include a breakdown of any sales tax, handling charges, or other fees to ensure transparency.

- Payment Instructions: Clearly mention the payment options, including bank account details or links to payment platforms to make the payment process as seamless as possible.

Including these key elements in your billing documents will not only make the process smoother for both you and your client but will also help maintain a professional relationship built on transparency and clear communication.

Invoice Templates for Small Business Owners

For small business owners, maintaining a steady cash flow is essential, and one of the key aspects of this is creating clear, professional payment requests. Having a reliable and easy-to-use method for generating these documents can help streamline administrative tasks and ensure timely payments. By using customizable formats, business owners can quickly generate billing records tailored to their unique needs, reducing the time spent on paperwork and allowing them to focus on growing their business.

Why Small Business Owners Need Customizable Payment Request Formats

Having the ability to adjust and personalize billing documents is crucial for small business owners, as they often deal with a wide range of clients and services. Customizable formats allow for:

- Brand Consistency: By personalizing the document with your logo, business colors, and font styles, you maintain a consistent brand image in all communications with clients.

- Accurate Record-Keeping: A template can help you track payments, manage due dates, and organize financial records more efficiently.

- Flexibility: Small businesses often provide various services at different price points. Customizable options allow you to adjust for each unique transaction.

- Professional Appearance: Well-designed payment requests with clear itemized charges reflect professionalism and can help build trust with your clients.

Key Features to Look for in a Payment Request Format

When selecting a format for generating your payment requests, keep an eye out for features that will make the process more efficient and comprehensive:

- Client Information Fields: Include space for client names, addresses, and contact details for clear identification.

- Itemized Billing: The ability to list individual items, hours worked, or services provided, with corresponding rates and totals, makes it easier for clients to understand the charges.

- Customizable Payment Terms: Clearly define payment deadlines, accepted payment methods, and late fees to set expectations.

- Tax and Discount Calculations: Easily apply sales tax or any discounts, ensuring everything is automatically calculated and accurate.

By using customizable billing formats, small business owners can ensure that their financial transactions are smooth, professional, and efficiently managed. This approach helps them stay organized while also fostering positive relationships with their clients.

How to Customize Your Invoice for Branding

For any business, creating a cohesive brand image is crucial, and this extends to all forms of client communication, including payment requests. Customizing your billing documents to align with your brand identity not only reinforces professionalism but also builds recognition and trust with clients. By incorporating brand elements into your payment documents, you ensure that your business stands out and presents a polished, consistent image.

Key Elements to Brand Your Payment Requests

To effectively incorporate branding into your payment documents, consider these essential elements:

- Logo Placement: Your company logo should be placed prominently at the top of the document, making it instantly recognizable to your clients.

- Color Scheme: Use your brand’s colors for headings, borders, and backgrounds to create a visually cohesive look that reflects your brand’s personality.

- Font Style: Select fonts that match your brand guidelines for a professional and consistent appearance. Choose easy-to-read fonts for the body text and consider using bolder styles for section headings.

- Brand Tagline or Slogan: If you have a catchy slogan or tagline, including it in the document adds a personal touch and reinforces your brand message.

Additional Customization Tips

In addition to the visual elements, you can further align your billing documents with your brand by considering the following:

- Personalized Language: The tone of your document should reflect your brand’s voice–whether it’s formal, casual, or friendly–so your communication feels aligned with the rest of your customer interactions.

- Consistent Layout: A clean, organized layout helps convey professionalism. Ensure that the structure of your document is easy to follow, with sections clearly labeled, and totals prominently displayed.

- Custom Footer: Use the footer to include additional brand elements, such as your website, social media links, or a brief note of appreciation for your clients’ business.

By customizing your payment request documents to reflect your brand, you not only create a more professional impression but also build consistency across all your business communications. This thoughtful approach can help strengthen client relationships and enhance your business’s identity.

What to Include in an Invoice Header

The header of a payment request is one of the first things your client will see, so it’s important to ensure it’s clear, professional, and contains all the essential information. A well-organized header helps set the tone for the rest of the document and allows your client to quickly identify the key details of the transaction. Here’s a breakdown of what should be included in the header of any billing document.

Key Elements for a Complete Header

- Business Information: At the very top, include your company or personal name, address, phone number, and email. This ensures the recipient knows exactly who the document is from and how to contact you if needed.

- Client Details: Include the full name, address, and contact details of the client being billed. This avoids any confusion, especially when dealing with multiple clients.

- Document Title: Clearly label the document as a “Payment Request” or “Billing Statement” to immediately clarify its purpose.

- Unique Reference Number: Assign a specific reference number for each document to make tracking and organizing payments easier. This is especially important for accounting and client management purposes.

- Issue Date: Always include the date when the document was created. This helps both parties understand when the charges were generated and establishes the timeframe for payment.

Additional Details to Include in the Header

While the key elements above are essential, there are a few additional pieces of information that can further enhance the clarity and professionalism of your document:

- Logo: If you have a company logo, include it in the header. This adds to the branding and helps your document appear more professional.

- Payment Terms Summary: A brief mention of your payment terms (e.g., “Due within 30 days”) in the header can help set expectations right from the start.

- Tagline or Slogan: If your business uses a tagline or slogan, consider adding it under the logo or business name. This reinforces your brand identity.

By including these key elements in the header, you can create a clear, professional first impression and ensure that your payment requests are both organized and easy to understand. A well-structured header helps prevent confusion, streaml

Tips for Accurate Billing with Templates

Accurate billing is essential for maintaining smooth financial operations and positive client relationships. Using pre-designed formats can significantly simplify the process, but it’s important to ensure the information entered is correct. Following a few key guidelines can help you avoid common errors and create well-structured, error-free documents every time.

Best Practices for Accurate Billing

- Double-Check Client Details: Always verify the client’s name, address, and contact information before finalizing any document. Incorrect client details can lead to confusion or delays in payments.

- Be Clear About Services Rendered: Clearly list each service provided, along with the dates and specific details of the work completed. This reduces the chances of disputes and ensures transparency.

- Use Correct Pricing: Ensure that all pricing is accurate, including rates, quantities, and discounts. Small mistakes in numbers can lead to miscommunications and issues down the line.

- Confirm the Payment Terms: Specify payment terms such as due dates, late fees, and accepted methods of payment. This avoids misunderstandings and sets clear expectations with clients.

- Track Your Documents: Assign a unique reference number to each document. This allows you to track the payment process more easily and provides a way to quickly refer back to previous transactions.

Additional Tips for Ensuring Accuracy

- Review Calculations: Before sending out a document, carefully review all calculations for any mathematical errors, such as totals or tax percentages. Automated fields in templates can assist with this, but a final check is always necessary.

- Ensure Consistency: Keep your formatting consistent across all documents. This includes using the same fonts, styles, and layout for easier readability and a professional appearance.

- Keep Templates Updated: Regularly update your formats to reflect any changes in pricing, terms, or branding. This ensures that all your documents remain accurate and aligned with your business practices.

By following these best practices, you can ensure that your billing process is accurate, organized, and professional. With the help of a well-structured format, you can avoid common billing mistakes and maintain strong relationships with your clients.