Free Timesheet Invoice Template for Simple and Fast Billing

Managing client payments and tracking work hours can become a tedious task without the right tools. Whether you are a freelancer or a small business owner, organizing and presenting your work details in a structured format can save you time and prevent errors. By using the right kind of document, you can streamline your administrative work and focus on what truly matters–delivering quality service to your clients.

There are various ways to document your time and charges, but having a clear and professional format can make a significant difference. By choosing the right tool, you ensure that both you and your clients have a mutual understanding of the work performed and the agreed-upon costs. Customizing such documents to suit your needs allows for flexibility and professionalism in every transaction.

With the right structure, you can easily manage your payments, maintain a record of completed tasks, and ensure timely compensation for your efforts. These simple yet powerful tools provide all the necessary components to enhance your billing workflow, making it easier than ever to stay organized and on top of your financial dealings.

Free Timesheet Invoice Template for Efficient Billing

Managing billing and time tracking effectively is key to maintaining smooth operations, especially for independent contractors and small business owners. Having a structured approach to documenting work completed and the corresponding charges can streamline the entire process, ensuring accuracy and timeliness in payments. By using a well-organized document, you can reduce the chances of errors and improve the efficiency of your financial dealings.

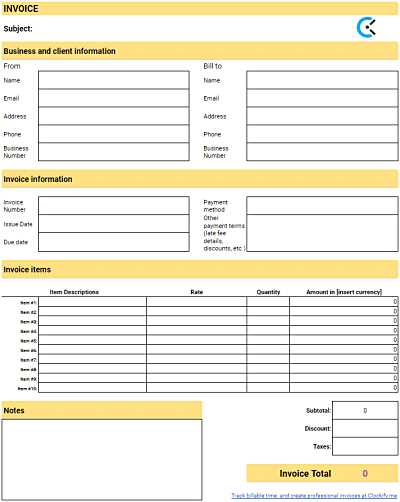

The right structure can simplify the process of recording hours worked, adding rates, and providing clients with a clear breakdown of costs. A customizable document can be tailored to fit various needs, from simple hourly charges to more complex project-based billing. By standardizing this process, you ensure consistency in all your financial transactions, which not only saves time but also helps build trust with clients.

Incorporating essential fields like work description, time spent, and payment terms ensures that the information is clear and transparent. A user-friendly layout enhances the presentation, making it easier for both you and your clients to review and understand the details. By using this tool regularly, you can significantly improve your billing workflow, reduce administrative overhead, and ensure that you are compensated properly for your efforts.

Why Use a Timesheet Invoice Template

Efficiently managing client payments and keeping track of hours worked can be a challenging task, especially when relying on manual calculations or inconsistent methods. Using a standardized document to record and present work details can eliminate confusion and ensure that both parties are on the same page. By adopting an organized approach, you make your billing process faster and more reliable, benefiting both you and your clients.

Here are several reasons why adopting such a document is a smart choice:

- Accuracy: A consistent structure helps minimize errors in calculations, ensuring your clients are billed correctly for the work you’ve completed.

- Time-Saving: By using a pre-set format, you avoid having to create a new document from scratch every time. This helps you save valuable time for more important tasks.

- Professionalism: A clear, well-organized record of work done projects an image of professionalism, which can help strengthen client relationships.

- Transparency: Providing a detailed breakdown of hours worked and the corresponding charges fosters trust and avoids misunderstandings between you and your clients.

- Consistency: Using a standardized method ensures that all your financial documents follow the same format, making it easier to track and review payments over time.

By implementing this approach into your workflow, you can streamline your billing process, improve organization, and ensure prompt payments, all while maintaining a professional image.

Benefits of Customizable Invoice Templates

Using a document that can be easily modified to suit your specific needs provides significant advantages in managing your billing process. Customization allows you to tailor each record to reflect the unique details of a particular project, client, or task. This flexibility enhances the accuracy and relevance of the information, making it more useful for both you and your clients.

Personalization is one of the most significant benefits. You can adjust the layout, design, and content to match your brand or business requirements. This makes the document feel more professional and aligned with your overall business identity. Additionally, the ability to customize allows you to highlight important sections, such as payment terms or specific job details, ensuring that key points are never overlooked.

Another advantage is efficiency. When working on multiple projects or clients, having a flexible document means you don’t have to create a new format every time. Instead, you can reuse the same structure and simply update the relevant fields. This saves you time and ensures consistency across all your billing communications.

Additionally, adaptability is crucial for businesses with varying rates, services, or billing cycles. A customizable approach allows you to adjust pricing, payment schedules, and terms for each client, ensuring that the document always aligns with the specific agreement in place. This is particularly useful for freelancers and small business owners who need to adjust their charges based on the type or length of work completed.

How to Download a Free Template

Getting started with a ready-made document is simple and can save you considerable time. Whether you need a general structure for your billing or a specialized form for your business needs, the process to obtain a customizable file is straightforward. There are many online platforms where you can access these tools and download them directly to your device.

Step 1: Choose a Reliable Source

Begin by selecting a trustworthy website that offers the document you’re looking for. Ensure that the platform provides high-quality, secure downloads to avoid any issues with corrupted files. Reputable sites often offer a range of options that cater to different business types, allowing you to choose a format that best suits your needs.

Step 2: Download the Document

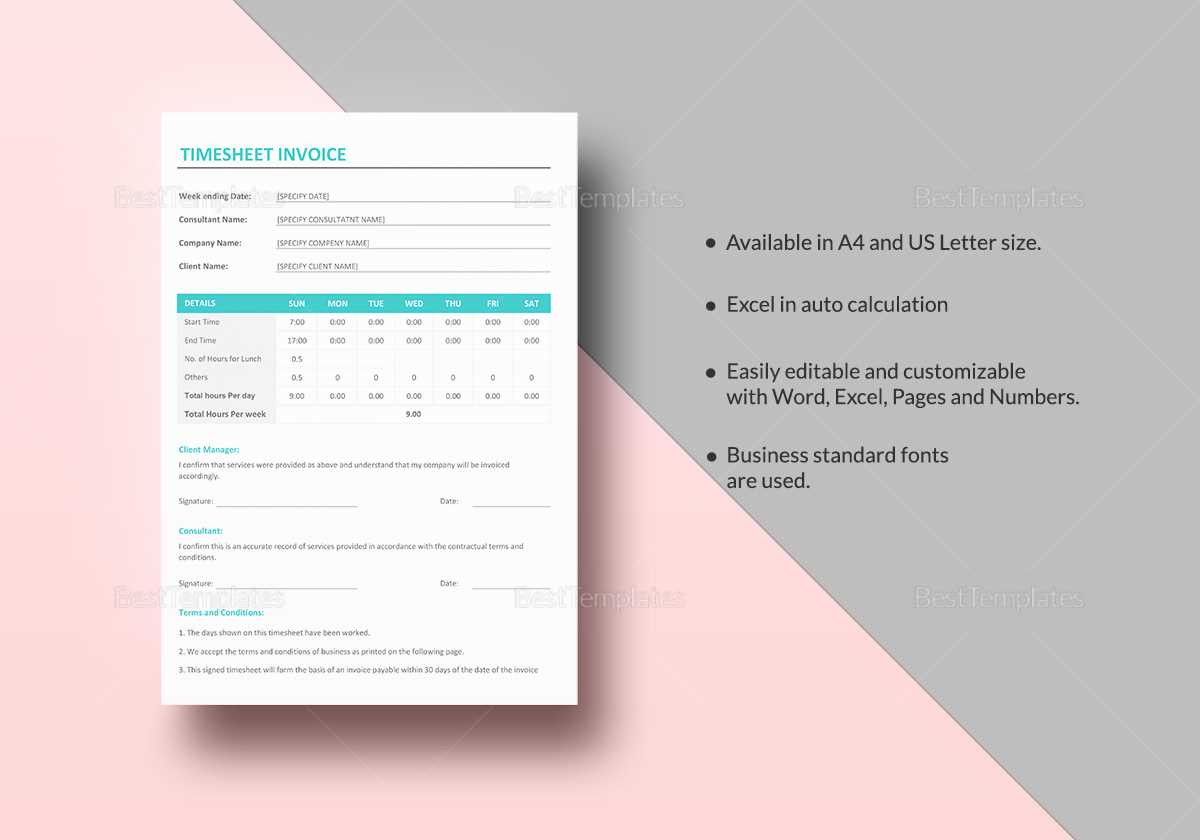

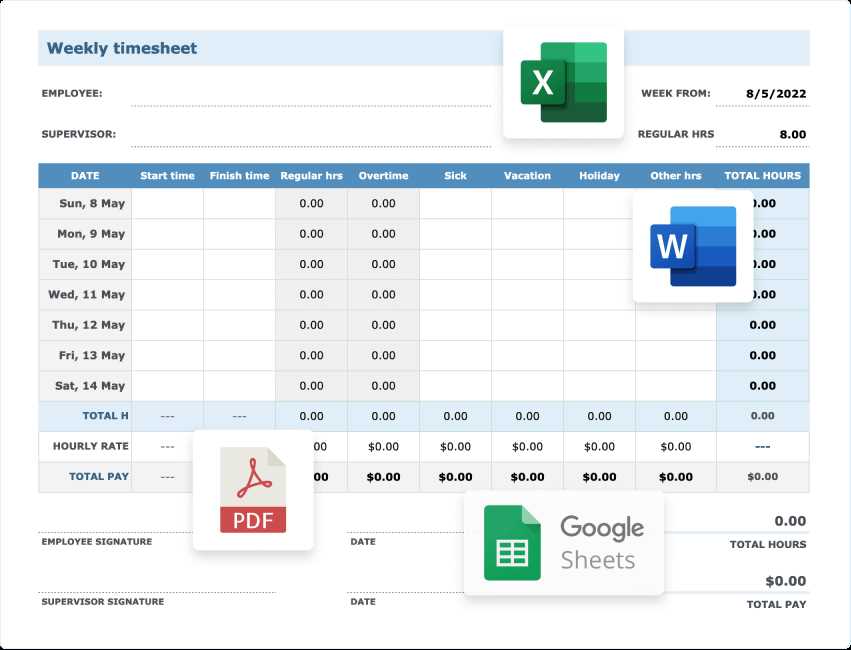

Once you’ve chosen your desired format, click on the download link. The document will typically be available in a format compatible with popular office software, such as Word, Excel, or PDF. Depending on the platform, you may need to provide some basic information, like your email address, before you can access the download link.

Tip: Always verify that the file is from a reliable source and scan it for viruses or malware before opening it on your device.

After downloading, you can edit the document as needed, inputting your specific details and adjusting it to your preferences. With this approach, you’ll have a fully functional tool in no time, ready to streamline your billing and record-keeping process.

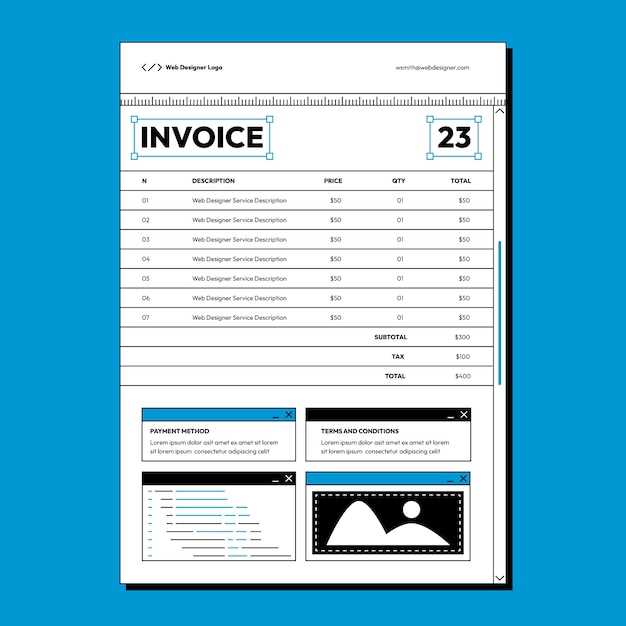

Key Features of an Effective Timesheet Invoice

For any business or independent contractor, having a well-structured document to track work completed and payments due is crucial. A comprehensive and clear document ensures that both the service provider and the client are fully informed of the details of the work and the payment terms. An effective record should include several essential components that make it both practical and professional.

Here are the key elements that make a record of work effective:

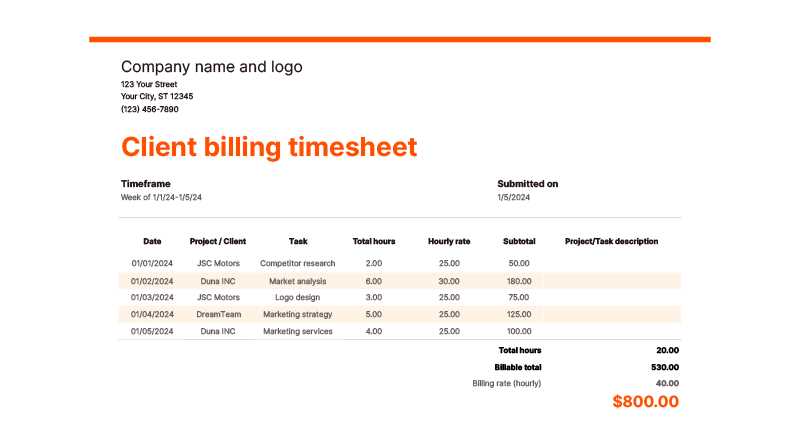

- Clear Description of Work: Each task or project should be clearly listed with enough detail for the client to understand exactly what was done.

- Accurate Time Tracking: Ensure that all hours worked are recorded with precise start and end times, avoiding any confusion over billed hours.

- Hourly or Flat Rate Breakdown: The document should specify the agreed-upon hourly rate or flat fee for each task, allowing the client to easily verify the costs.

- Total Amount Due: Clearly present the final amount due for payment, including any applicable taxes or fees.

- Payment Terms: Clearly outline when payment is due, any penalties for late payments, and acceptable payment methods.

- Client Information: Include the client’s name, contact details, and any other relevant information to ensure that the document is easily traceable to a specific customer.

- Professional Design: The layout should be clean, easy to read, and free from unnecessary clutter, projecting a professional image.

- Customization: Ensure that the format allows for personalization so that each document can be tailored to different clients or projects.

By incorporating these features, you can ensure that your records are clear, accurate, and professional, helping to maintain good client relationships and smooth financial operations.

Formatting Your Invoice for Maximum Clarity

The format of your billing document plays a significant role in ensuring that both you and your clients clearly understand the work completed and the corresponding payment. A well-organized and visually appealing layout can enhance readability, making it easier for the client to verify details and for you to avoid disputes. When your document is clear, you establish trust and professionalism with every transaction.

Organizing Information Logically

To achieve maximum clarity, start by structuring the content in a logical order. Begin with basic client details and contact information at the top, followed by a clear breakdown of services provided. Then, list the time worked or tasks completed along with the rates charged. Finally, conclude with the total amount due, including any applicable taxes or discounts.

Using Clear Headers and Sections

Another key aspect of formatting is using headers and sections to separate different parts of the document. This makes it easy for anyone reviewing the document to quickly locate the information they need. For example, group sections like “Client Information,” “Work Details,” and “Payment Terms” in distinct areas to avoid confusion.

Tip: Use bold text or different font sizes to highlight the most important details, such as the total due or payment terms, so they stand out and are easy to find.

By carefully organizing the information and using a clear layout, you ensure that your document is not only functional but also professional. This attention to detail will help create a smooth and efficient billing process for both you and your clients.

Including Relevant Information in Your Invoice

For a billing document to be both effective and professional, it is crucial to include all necessary details that provide clarity for both parties. Omitting important information can lead to confusion, disputes, or delayed payments. Including the right elements ensures that the document is complete, accurate, and easy to understand, promoting smoother transactions.

Here are the key pieces of information you should include in every document:

- Client’s Details: Always include the client’s full name, address, and contact information to ensure proper identification.

- Service Description: Provide a detailed list of the tasks or services rendered. This will help the client clearly understand what they are being charged for.

- Dates of Service: Include the start and end dates for the work performed. This adds clarity regarding the time period being billed.

- Hourly Rate or Project Fee: Clearly state your rate or the agreed-upon fee for the work, ensuring both parties are aware of the charges.

- Payment Terms: Specify when the payment is due and the accepted methods of payment. If applicable, include any late fees or discounts for early payments.

- Unique Reference Number: A unique number helps keep track of the document for both you and your client, especially if you issue multiple bills over time.

- Tax Information: Include any relevant tax details or applicable taxes if required by your region or industry.

By providing this essential information, you ensure that the document is comprehensive and easy for your client to understand. Clear communication is key to maintaining strong professional relationships and ensuring prompt payment.

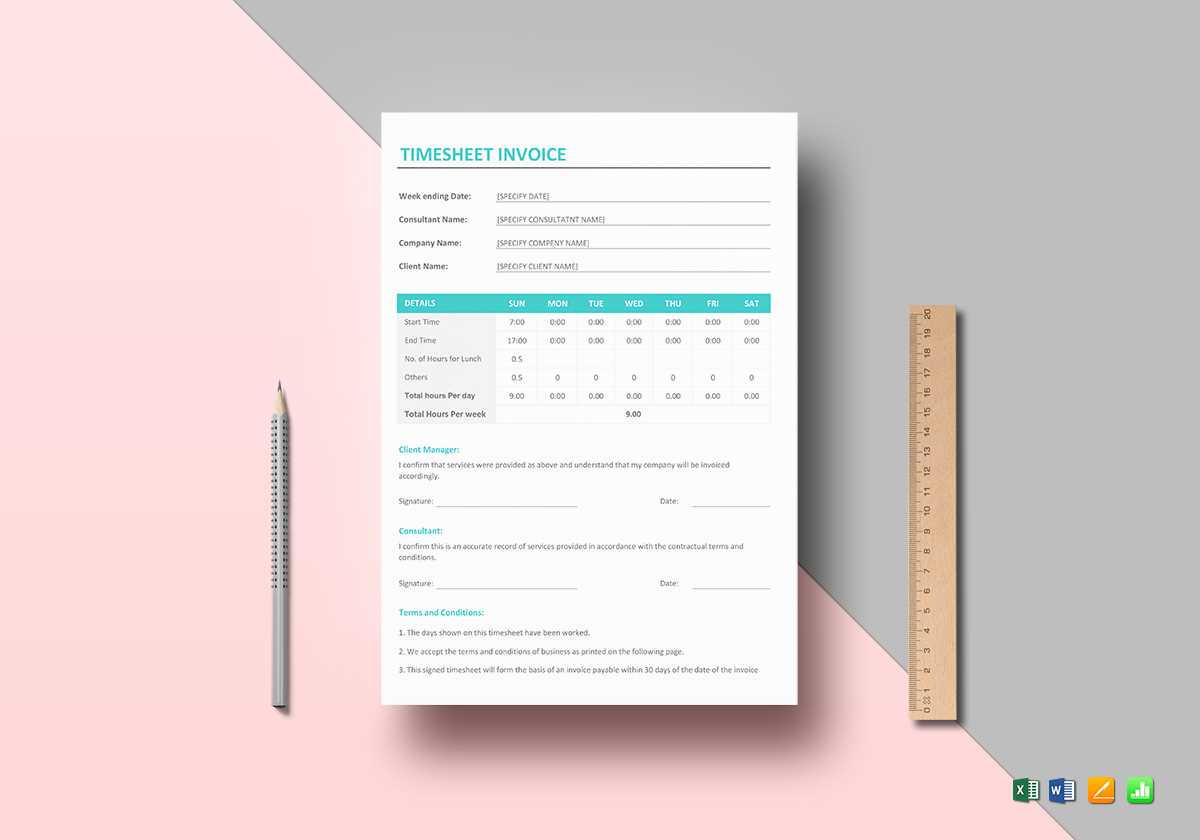

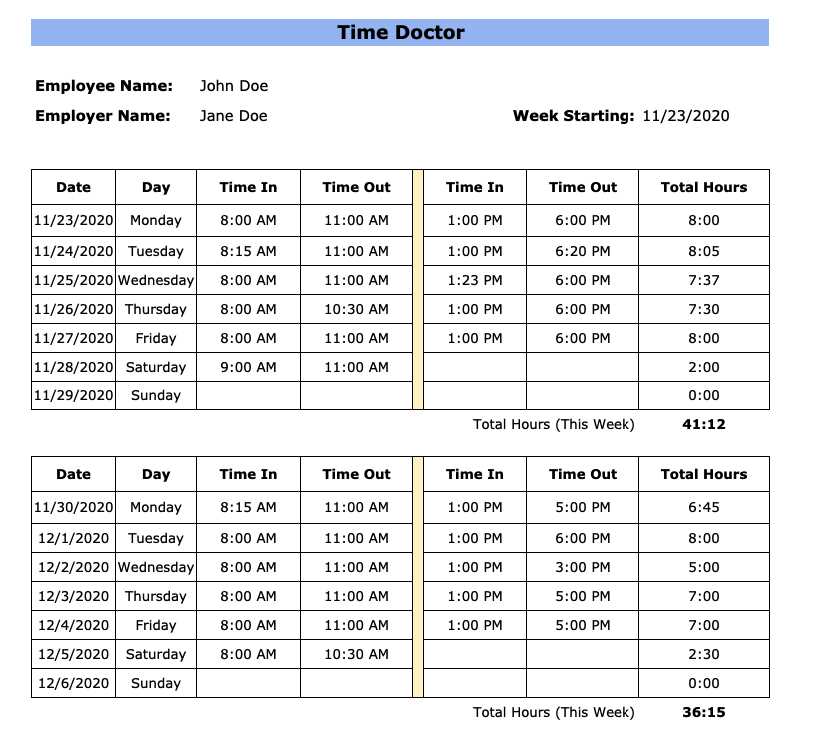

How to Track Work Hours with a Template

Keeping an accurate record of the time spent on various tasks is essential for both freelancers and businesses alike. Having a structured system in place makes it easy to track billable hours, monitor project progress, and ensure clients are charged correctly. With the right structure, you can stay organized and avoid errors in time tracking.

Step 1: Set Up Time Fields

The first step in creating an effective system is to ensure that your document includes proper fields for tracking work hours. These fields should include:

- Date: Record the specific day or range of days when work was performed.

- Start and End Time: Log the exact hours worked for each session, including breaks if necessary.

- Total Hours Worked: Calculate the total hours for each work period.

- Description of Tasks: Add a brief note describing the task or project worked on during the specified hours.

Step 2: Maintain Consistency

Consistency is key when tracking work hours. To ensure accuracy, stick to the same format for each entry. Regularly update the document at the end of each workday or shift, rather than leaving it to the last minute. This will help you avoid missing any hours and ensure that you are logging the correct details.

Tip: If your work varies in complexity or time spent on each task, use categories or sub-totals to further clarify the time allocations.

By regularly tracking hours in an organized manner, you can easily assess productivity, ensure accurate billing, and maintain a professional approach to client relations. Whether you’re managing multiple projects or handling one large task, staying on top of your time records is crucial for smooth operations and timely payments.

Automating Your Billing Process

Streamlining the process of creating and sending payment requests can save valuable time and reduce the risk of errors. Automation not only improves efficiency but also ensures consistency in how you handle billing tasks. By integrating tools that automate key aspects of your payment process, you can focus more on your work while minimizing administrative overhead.

Key Steps to Automate Billing

To get started with automating your billing process, consider the following steps:

- Choose the Right Software: Find an automation tool or software that fits your needs, whether it’s an invoicing app, accounting software, or a custom solution that integrates with your existing system.

- Set Recurring Billing: If you work on a subscription or retainer basis, set up recurring billing schedules to automatically generate payment requests at specified intervals.

- Customize Payment Reminders: Automate follow-up reminders for unpaid balances, ensuring timely payments without manual intervention.

- Integrate Payment Gateways: Allow your clients to pay directly through the automated system by integrating payment processors like PayPal or Stripe for seamless transactions.

Automating Time and Cost Calculations

Many automated billing systems allow you to track and calculate work hours, project milestones, and corresponding costs. This can be especially helpful if your work is time-based or involves various billing rates. The system will automatically calculate the total due based on the data entered, ensuring accuracy every time.

| Task Description | Hours Worked | Rate | Total |

|---|---|---|---|

| Project A Development | 5 | $50/hour | $250 |

| Consultation Call | 2 | $75/hour | $150 |

| Total | $400 |

By automating the process of generating detailed records, you eliminate the need for manual calculations and reduce the chances of mistakes. This not only saves time but also builds trust with clients, knowing they

Common Mistakes to Avoid in Invoices

When generating a document for payment, even small errors can lead to misunderstandings, delayed payments, or disputes. Ensuring accuracy and clarity in every detail is essential for maintaining a professional image and a smooth transaction process. Below are some common mistakes people often make when preparing these documents and how to avoid them.

Key Mistakes to Watch Out For

It’s important to be mindful of the following pitfalls when creating a billing document:

- Missing or Incorrect Contact Information: Always ensure that both your and the client’s details are up to date and accurately listed. Missing or incorrect addresses can cause delays in processing.

- Omitting Payment Terms: Failing to specify the due date or acceptable payment methods can lead to confusion. Always state when payment is due and how clients should make the payment.

- Inaccurate or Unclear Descriptions: If the work or services provided are not clearly described, it may lead to misunderstandings about the charges. Be as specific as possible when detailing tasks, hours worked, and rates.

- Forgetting Taxes or Fees: If applicable, ensure that taxes, handling fees, or any other additional charges are included and clearly indicated. Failure to do so can result in discrepancies when clients make payments.

- Using Complex Formats: If the document is difficult to read or contains overly complex language, clients may struggle to understand it. Use a simple, clean layout with easy-to-read fonts and a straightforward design.

- Incorrect Calculations: Double-check all calculations for accuracy. Small errors in totaling hours or rates can lead to billing mistakes that may cause frustration and delay payments.

- Neglecting to Include a Unique Reference Number: Each billing document should have a unique number for record-keeping and to track payments efficiently. Without this, managing payments can become difficult.

How to Avoid These Mistakes

To avoid these common mistakes, take your time when filling out each section of the billing document. Double-check your calculations, ensure all required fields are completed, and review the final document before sending it to the client. If possible, use a digital tool that helps automate some of these steps, reducing the chances of error.

By being mindful of these details, you can create clear, professional documents that are easy to understand and ensure timely payment without any unnecessary back-and-forth.

How to Personalize Your Billing Document

Personalizing your payment request documents is a great way to make them feel more professional and aligned with your brand. Customizing various elements can create a more memorable experience for your clients, and it can also help build trust. Whether you’re working with a new client or a long-term partner, ensuring that your document reflects your unique style and approach can set you apart from others.

Essential Customization Tips

Here are some simple ways to personalize your payment request documents and enhance their overall appearance:

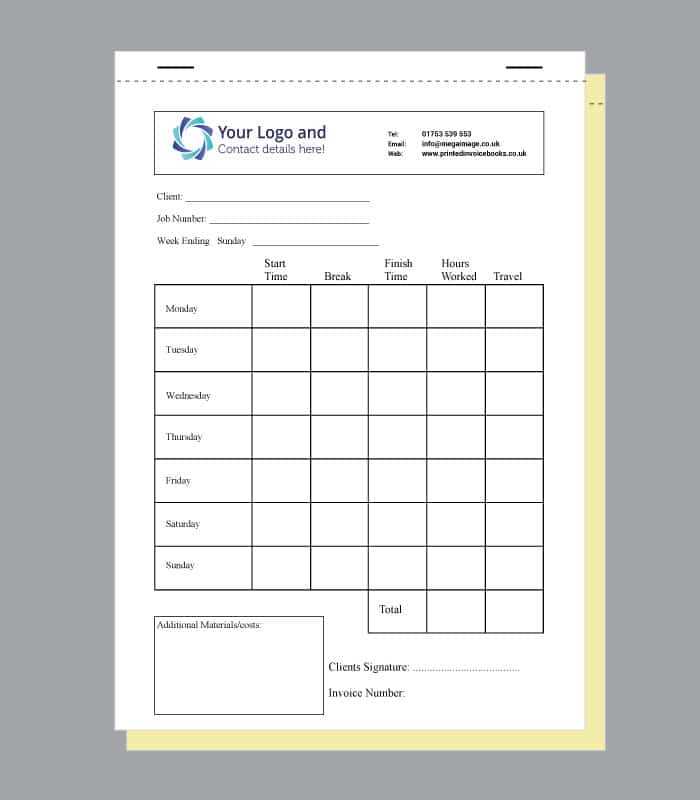

- Branding with Your Logo: Adding your logo at the top of the document immediately gives it a professional touch. It also helps clients quickly identify the document as coming from your business.

- Customizing the Design: Choose fonts, colors, and layouts that reflect your company’s brand. Use professional but attractive fonts, and stick to a color palette that matches your corporate identity.

- Adding a Personal Touch: Include a personalized greeting or message at the beginning of the document. A simple “Thank you for your business” can help foster stronger relationships with clients.

- Including Your Business Information: Make sure to prominently display your business name, address, and contact information. This makes it easy for clients to reach you if they have any questions or issues regarding the payment.

- Including Specific Client Information: Personalize the document by including the client’s full name, their address, and project details to show attention to detail and ensure accuracy.

- Using Custom Payment Terms: If your business offers special terms or discounts, highlight these within the document to reinforce your unique offers or agreements with the client.

Integrating Payment Details in Invoices

Clearly specifying payment information within your billing document is essential for ensuring that clients understand how to settle their balances efficiently. Proper integration of payment instructions helps avoid confusion and accelerates the payment process, which in turn improves your cash flow and reduces the chances of delays.

Including accurate and detailed payment information not only demonstrates professionalism but also streamlines the financial transactions between you and your clients. Here are some key points to keep in mind when adding payment details to your billing documents:

- Payment Methods: Always specify the acceptable methods of payment, such as credit card, bank transfer, or checks. Be clear about any preferences or restrictions to avoid misunderstandings.

- Banking Information: If you are accepting wire transfers, include your bank’s name, account number, and routing number. Make sure this information is up to date and clearly visible to the client.

- Online Payment Links: If you use online payment platforms, include the relevant links or payment portals where clients can easily complete transactions. This provides a convenient and quick way for clients to pay.

- Currency and Amount: Clearly indicate the currency in which payment is expected and ensure the total amount is accurate and matches the details of the work provided. Double-check this for accuracy before sending the document.

- Due Date: Always specify the payment due date to avoid delays. Clients need to know exactly when they are expected to pay and any penalties for late payments, if applicable.

- Late Payment Fees: If you charge late fees, clearly state the penalty terms in the billing document. This acts as a reminder and encourages clients to adhere to the payment schedule.

By integrating these payment details effectively, you help ensure that clients can easily understand and follow your payment process, reducing the likelihood of errors or missed payments. A transparent and organized billing document can lead to smoother financial interactions and a better overall client experience.

How to Edit and Save Your Document

Customizing and saving your billing document is a key step in maintaining consistency and professionalism in your business dealings. Whether you’re adjusting the design, adding specific details, or updating client information, knowing how to effectively edit and save your document will ensure it’s always ready for use. Below are some essential steps for editing and saving your document for future use.

Editing Your Document

When it comes to editing your document, it’s important to focus on both the design and the content. Follow these simple steps to make the necessary adjustments:

- Update Client Information: Make sure to enter the correct client name, address, and other contact details for each billing cycle. This ensures accurate communication.

- Modify Work Details: Review and update the list of services provided, including dates, hours worked, and rates. Clear, up-to-date descriptions are essential for transparency.

- Adjust Payment Terms: If any payment terms or rates have changed, update these in the document to reflect the current agreement. This keeps your clients informed.

- Personalize the Design: Consider adjusting the color scheme, fonts, or adding your business logo. A customized design can improve your branding and give the document a professional feel.

Saving Your Document for Future Use

Once you’ve made the necessary edits, it’s time to save your document for future use. Proper file management ensures that your documents are easy to access and update when needed. Here are the steps to follow:

- Choose the Right File Format: Save your document in an editable format (like Word or Google Docs) for easy future modifications. You may also save a copy in PDF format to share with clients securely.

- Organize by Client or Date: Create a system for naming and organizing your saved files. For instance, use the client’s name and the date of the billing period to make it easy to locate specific documents later.

- Backup Your Documents: Consider storing your documents in the cloud or an external drive. This ensures you won’t lose important files and can access them from anywhere.

- Regular Updates: If you have recurring updates, set a reminder to check and update your document regularly to stay current with rates, terms, and client information.

By following these steps, you can ensure that your document is always ready, accurate, and customized for each client. Efficient editing and saving practices will save you time and help keep your billing proc

Using a Template for Multiple Projects

Managing multiple projects simultaneously can become overwhelming, especially when it comes to organizing and tracking work-related details. Using a standardized document can streamline the process, making it easier to handle various tasks, deadlines, and client requirements. By reusing a consistent layout, you can ensure all important information is captured while saving time and effort on repetitive tasks.

Adapting a Standard Layout for Multiple Projects

One of the key benefits of using a consistent document structure for various projects is the ability to maintain uniformity across all your work. This makes tracking progress, reviewing time spent, and managing payments much easier. Below are some tips for adapting your layout for multiple projects:

- Separate Sections for Each Project: Divide the document into clear sections, each dedicated to a specific project. This helps in managing each project’s details individually without confusion.

- Use Consistent Formatting: Ensure that each project’s details, such as tasks, hours worked, and deadlines, follow the same format. This promotes clarity and makes the document easier to read.

- Track Different Billing Rates: For projects with varying payment structures, include separate rates for each. This ensures accurate calculations for all work completed.

How to Organize Project Information

Properly organizing the details for multiple projects is crucial for clarity and efficiency. Here’s a suggested layout to keep everything structured:

| Project Name | Task Description | Hours Worked | Rate | Total |

|---|---|---|---|---|

| Project A | Web Development | 40 | $50 | $2000 |

| Project B | SEO Optimization | 25 | $45 | $1125 |

| Project C | Consulting | 15 | $60 |