Email Template for Overdue Invoice Reminder

When payments are delayed, sending a polite yet clear reminder is essential for maintaining professional relationships while encouraging timely settlements. Crafting the right message ensures that clients understand the importance of fulfilling their financial obligations without feeling pressured. An effective approach involves balancing professionalism and assertiveness.

In this guide, we will explore how to communicate such reminders effectively, covering key elements that enhance the chances of prompt payment. From setting the right tone to personalizing your message, these strategies can help reduce misunderstandings and strengthen your financial management practices.

Why Send Overdue Invoice Emails

When payments are delayed, it’s crucial to remind clients of their outstanding balances in a professional manner. Such reminders not only help recover owed amounts but also reinforce the importance of meeting financial obligations. Promptly addressing late payments can prevent further delays and minimize disruptions to cash flow.

Sending these reminders shows a commitment to maintaining clear communication and a strong business relationship. A well-crafted reminder encourages clients to prioritize payment, while also highlighting the consequences of continued delays. By establishing a consistent follow-up process, you foster a sense of responsibility and accountability in your clients.

Key Elements of an Effective Email

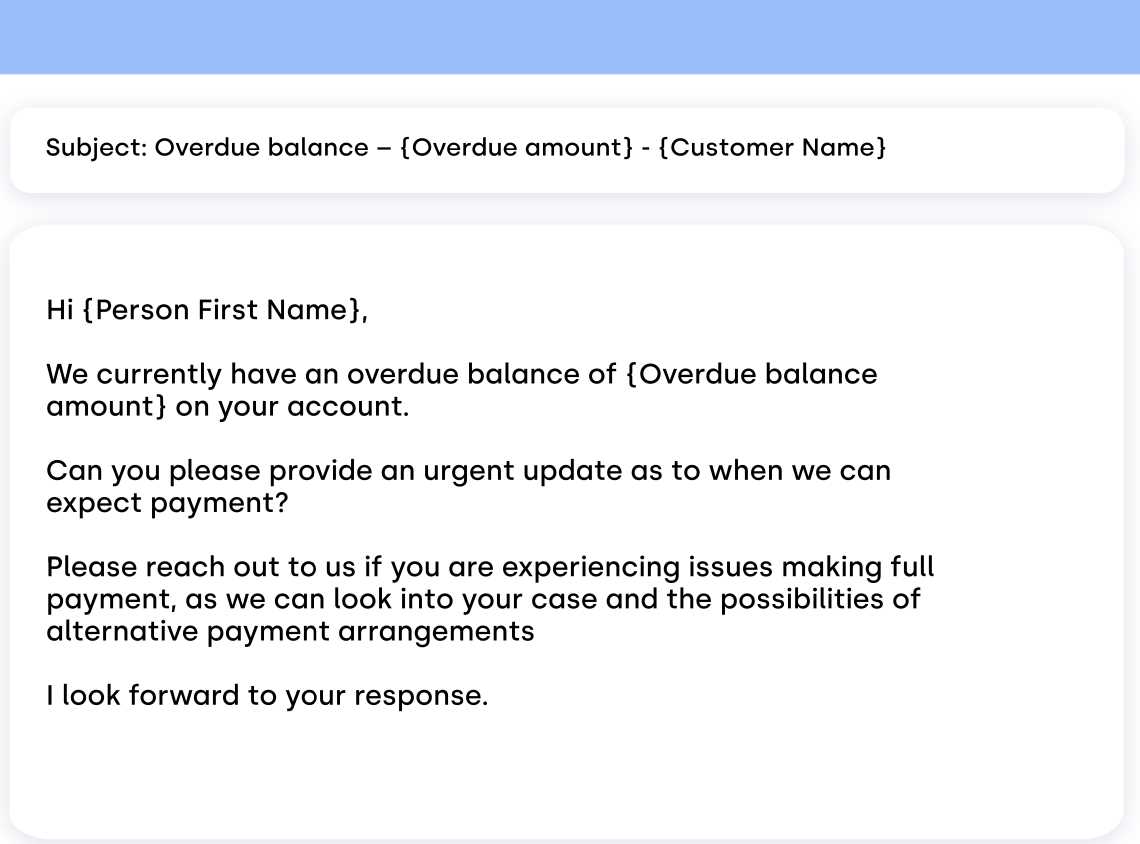

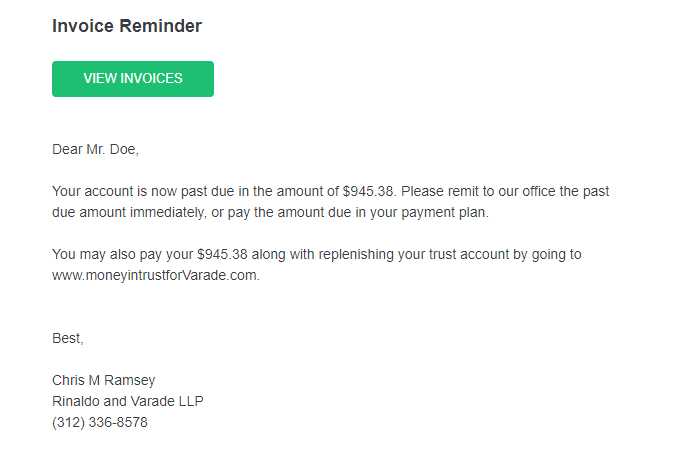

To ensure that reminders about unpaid amounts are received well, it’s essential to focus on clarity, tone, and structure. A clear and concise message helps convey the necessary information without overwhelming the recipient. It’s important to balance professionalism with a sense of urgency, while also maintaining a polite and respectful tone.

Effective reminders typically include key details such as the amount owed, the due date, and any relevant payment instructions. Personalizing the message can also help strengthen the connection with the recipient, making them more likely to respond positively. A well-structured reminder ensures the recipient can quickly understand their responsibility and take appropriate action without confusion.

How to Politely Request Payment

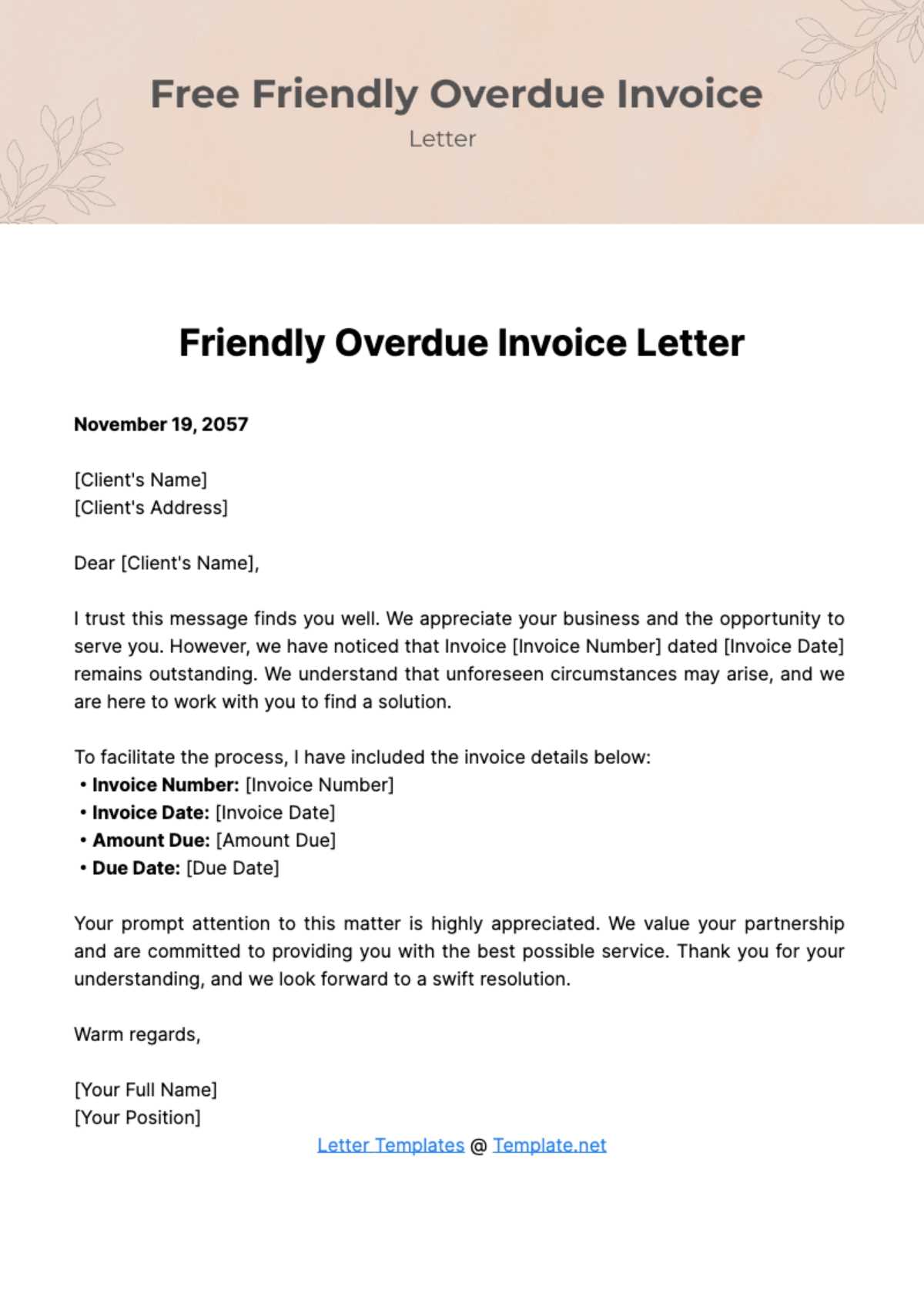

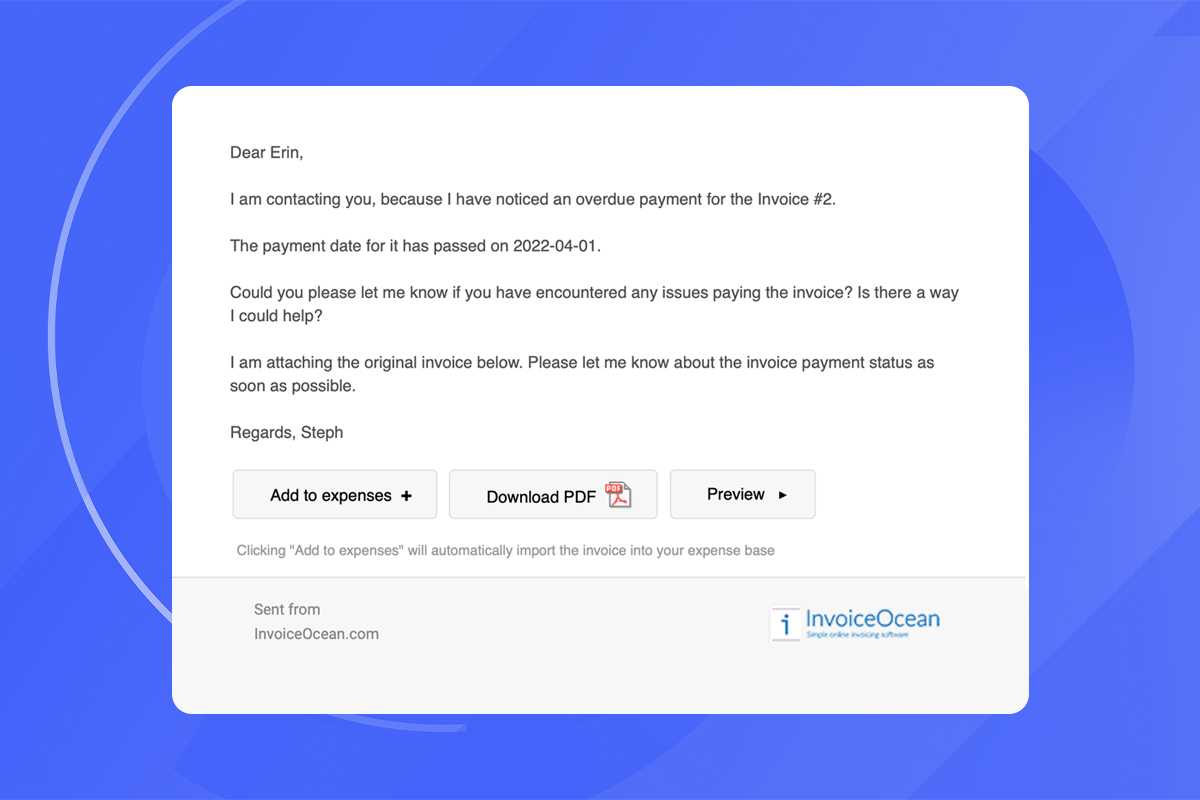

When requesting payment from a client, it’s important to strike the right balance between being firm and respectful. A polite tone encourages cooperation, while clear communication ensures there’s no misunderstanding about the outstanding balance. By approaching the situation with professionalism and empathy, you can effectively prompt the necessary action without damaging your relationship with the client.

Maintain a Respectful Tone

Begin by acknowledging any potential oversight or misunderstandings, as this can set a cooperative tone. Phrasing your request in a way that assumes the client simply forgot can avoid making them feel defensive. Use positive language that shows you’re simply reminding them of their commitment rather than accusing them of neglect.

Provide Clear Payment Details

Make sure to include all relevant details, such as the amount due, the original due date, and any payment methods available. Offering clarity will help the recipient feel more confident in fulfilling the request without further questions. If needed, you can also offer assistance in case there are issues with processing the payment.

Customizing Your Message for Clients

Tailoring your reminder to each individual client can increase the likelihood of prompt payment. A personalized approach demonstrates your attention to detail and shows that you value the client relationship. By adjusting the tone, structure, and content to suit each situation, you can enhance communication and avoid coming across as impersonal or robotic.

Understanding Client Preferences

Different clients may respond better to various communication styles. Some might appreciate a formal tone, while others may prefer a more casual approach. It’s important to consider the nature of your business relationship and the history of payments when deciding how to customize your message. Being mindful of these preferences can help maintain a positive connection while encouraging timely settlements.

Adjusting Content Based on Client Type

For instance, large corporate clients may require a more formal structure, with clear references to contracts or previous correspondence. On the other hand, small business owners or frequent clients may respond better to a friendly, conversational reminder. Below is an example of how the same message can be adjusted for different client types:

| Client Type | Message Style | Example Phrase |

|---|---|---|

| Corporate Client | Formal, Direct | “We kindly remind you that payment is now due as per our agreement.” |

| Small Business | Friendly, Personal | “Just a friendly reminder that the payment is now due. We’d appreciate your prompt attention to this matter.” |

| Frequent Client | Casual, Appreciative | “We value your business and would love to receive the payment for your recent purchase at your earliest convenience.” |

Common Mistakes to Avoid in Emails

When sending reminders regarding unpaid balances, it’s easy to make mistakes that could affect your professional image or delay the payment process. These errors can undermine your efforts and make the situation more challenging. By understanding common pitfalls, you can ensure that your message is clear, polite, and effective in encouraging timely payments.

- Being Too Aggressive: A harsh tone or demands can alienate clients and create unnecessary tension. Always maintain a professional and respectful approach.

- Vague Information: Failing to provide clear details such as the amount owed, the original due date, and payment instructions can confuse the recipient and delay the response.

- Ignoring the Client’s Situation: Sometimes clients may have legitimate reasons for delayed payments. Acknowledging their possible circumstances can help maintain goodwill and encourage quicker resolutions.

- Sending Without Proof of Transaction: Not including any documentation or references to past agreements can make it difficult for the client to verify their outstanding balance.

- Not Following Up: Failing to send a follow-up reminder can lead to further delays. Setting a clear timeline for follow-up communication is essential for maintaining payment schedules.

Avoiding these mistakes can significantly improve your chances of receiving timely payments and maintaining strong client relationships.

Best Practices for Clear Communication

Effective communication is essential when addressing unpaid balances. A well-structured and straightforward message helps the recipient quickly understand their obligations without confusion or misinterpretation. By focusing on clarity and simplicity, you can increase the likelihood of a prompt response while maintaining professionalism.

Be Direct and Concise

One of the most important aspects of clear communication is brevity. Avoid lengthy explanations or unnecessary details that might overwhelm the recipient. Stick to the key points–amount owed, due date, and any necessary payment instructions. This ensures that the recipient doesn’t miss the main message and can act quickly.

Use Polite and Respectful Language

While being clear is important, it’s equally vital to remain respectful. Polite language shows that you value your relationship with the client and are simply addressing a business matter. Phrases like “We would appreciate your prompt attention” or “Kindly let us know if there are any issues” can help soften the tone while maintaining a professional demeanor.

Timing Your Payment Reminder Email

When it comes to collecting payments, timing is crucial. Sending reminders too soon may seem unnecessary, while waiting too long can lead to delayed settlements. Finding the right moment to reach out can improve the chances of receiving payment promptly without frustrating the recipient.

Consider Your Client’s Payment Cycle

Understanding your client’s payment habits and schedule can help you time your reminder effectively. Some clients may have specific payment cycles or protocols, so it’s important to tailor your reminders accordingly. Here are some general guidelines for determining the best time to send your message:

- 1-3 Days After the Due Date: Sending a gentle reminder soon after the due date can be an effective way to prompt clients who may have simply forgotten.

- 1 Week After the Due Date: If no payment has been made, sending a more direct reminder after a week can signal urgency without being overly aggressive.

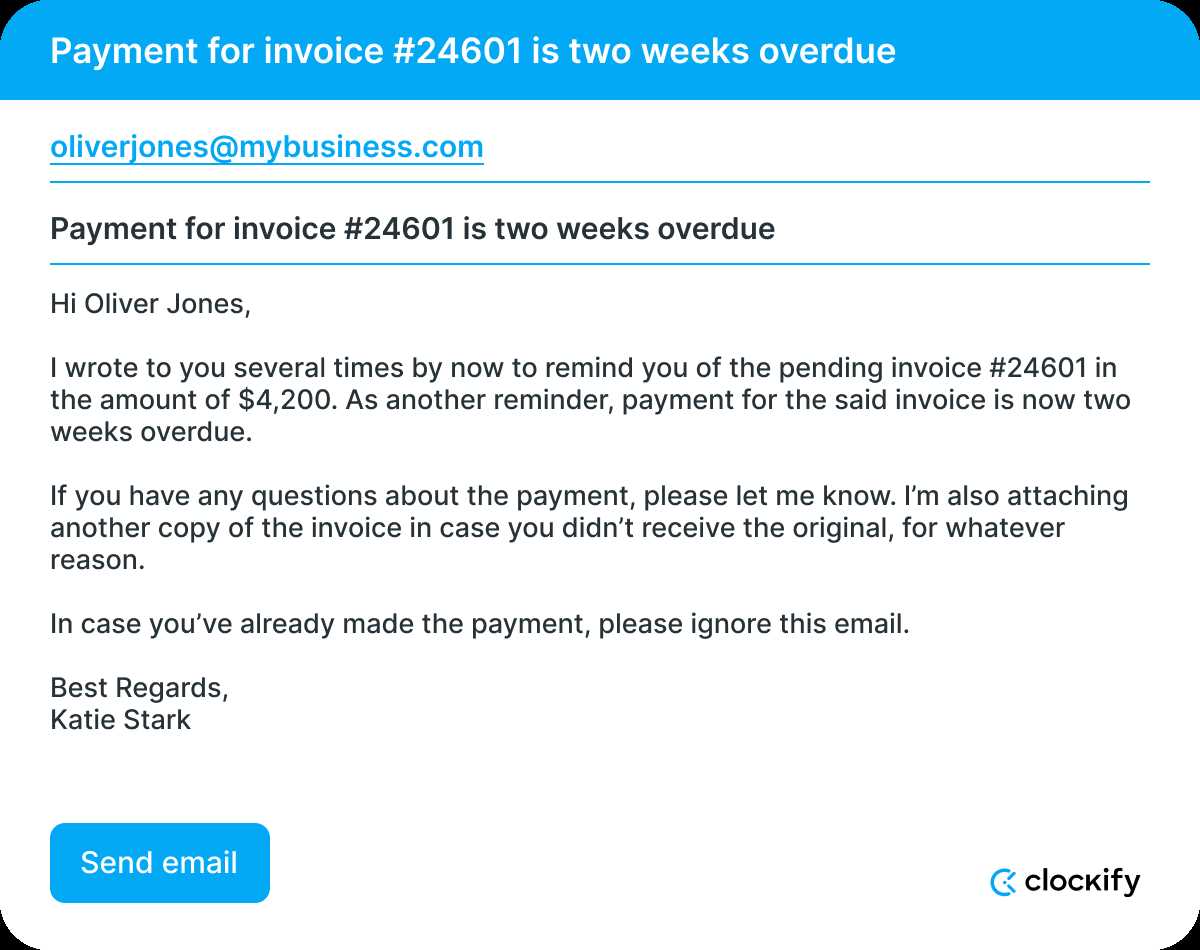

- Two Weeks After the Due Date: At this stage, it may be appropriate to reinforce the importance of paying promptly to avoid further complications, especially if previous reminders went unheeded.

Factor in Business Days and Holidays

When determining the timing, consider weekends and holidays. Messages sent during non-business hours may be overlooked or forgotten. It’s better to send reminders during the workweek when your client is more likely to be active and responsive.

Building a Professional Tone in Emails

Maintaining a professional tone when requesting payment is essential to fostering positive business relationships. A well-crafted message balances assertiveness with courtesy, ensuring that your communication is respectful while still conveying the urgency of the matter. By using polite and considerate language, you can effectively encourage prompt action without alienating the recipient.

Start by addressing the recipient respectfully and using formal language when appropriate. While it’s important to be firm, avoid sounding accusatory or demanding. Instead, focus on the facts and frame your message in a way that emphasizes your desire for a smooth transaction. For example, use phrases such as “We would greatly appreciate your prompt attention” or “Kindly ensure payment is made at your earliest convenience” to express both professionalism and respect.

How to Handle Ignored Invoices

When payment requests are ignored, it can be frustrating and challenging to maintain a positive business relationship. However, it’s important to handle the situation with patience and professionalism. Addressing ignored balances in a thoughtful way can often lead to resolution without escalating the issue unnecessarily.

Stay Calm and Professional

It’s essential to approach the situation without anger or frustration, as this can harm your business reputation. Instead, remain calm and professional in all follow-up communications. A polite reminder that references previous correspondence is often enough to prompt action. If a client hasn’t responded, avoid making assumptions about their intentions–there may be an issue with payment methods or internal processing delays.

Escalate Carefully If Necessary

If your initial reminders continue to go unanswered, it may be time to escalate the situation. Start by reaching out to a higher contact within the organization or requesting a conversation to discuss the issue. Always express your willingness to work with them to resolve any issues, but make it clear that continued inaction will lead to further consequences, such as late fees or legal action. Keeping the tone polite yet firm is key to navigating this delicate situation.

Legal Considerations for Payment Requests

When requesting payment from clients, it’s essential to be mindful of the legal implications of your communications. While it’s important to remain polite and professional, there are specific legal considerations that ensure you stay compliant with regulations and avoid potential disputes. Understanding these considerations will help you navigate the collection process in a way that is both effective and legally sound.

Understanding Contractual Obligations

Before taking any action, ensure that the terms of your agreement with the client are clearly outlined in a contract. The payment schedule, due dates, and any penalties for late payments should be clearly defined. This makes it easier to prove your case in the event of a dispute and reinforces your position when requesting payment. If your contract includes specific clauses regarding late payments or interest fees, reference these terms in your communication.

Complying with Debt Collection Laws

Debt collection is governed by laws designed to protect both creditors and consumers. Ensure that your payment reminders comply with these regulations. For example, in many jurisdictions, you cannot use aggressive or threatening language, and you must respect the privacy of the individual or business. It is also crucial to avoid making false claims or misrepresenting the nature of the debt. Below is a table of general guidelines that can help you navigate legal considerations when requesting payment:

| Consideration | Best Practice |

|---|---|

| Clear Terms in Contract | Ensure all payment terms are explicitly stated in the agreement. |

| Respect Privacy | Do not disclose any payment issues to third parties without permission. |

| Avoid Aggressive Language | Maintain a professional, respectful tone in all communication. |

| Follow Legal Procedures | If escalation is necessary, ensure all actions are within legal bounds, including potential use of a collection agency or legal action. |

By adhering to these guidelines and understanding your rights and responsibilities, you can ensure that your payment requests remain within legal boundaries while protecting your business interests.

How to Create a Payment Plan

When a client is unable to pay the full amount at once, offering a structured payment plan can be a helpful solution. A payment plan allows the client to settle the amount in manageable installments, while you can still maintain cash flow and preserve the business relationship. Crafting a clear and fair payment plan ensures both parties are aligned on expectations and timelines.

Determine the Total Amount and Installments

Start by confirming the total outstanding balance and agreeing on a reasonable timeline for payment. The number of installments should be based on the client’s financial capacity, keeping in mind the need to collect the full amount within a reasonable period. Be clear about the amount due for each installment and set specific due dates to avoid confusion. For example, you might suggest monthly payments or bi-weekly options, depending on the client’s preferences.

Outline Terms and Consequences

It’s essential to define the terms of the plan clearly. Specify the consequences of missing a payment, such as late fees or a possible revision of the payment plan. Ensure that these terms are documented in writing and agreed upon by both parties. This will help prevent misunderstandings down the line and provide a clear framework for both sides to follow.

Follow-Up Strategies for Unpaid Invoices

When payments are not received on time, following up promptly and professionally is essential to ensure that your business remains financially healthy. Effective follow-up strategies help you maintain positive client relationships while addressing the financial obligations that need to be met. By taking a methodical and respectful approach, you can increase the chances of receiving payment without damaging your business reputation.

Start by reviewing the terms outlined in the original agreement to ensure there was no misunderstanding regarding payment expectations. A polite reminder that includes all relevant details, such as the amount due and the original due date, is a helpful first step. If this initial communication does not resolve the issue, a more direct follow-up may be required. A well-timed phone call or additional written reminder can prompt action without seeming overly aggressive.

It’s also important to offer flexible solutions if the client is facing difficulties in making the full payment. Proposing a payment arrangement or installment plan can often help resolve the issue quickly while keeping the client satisfied. By providing these options, you show your willingness to work with them, which can strengthen the relationship and increase the likelihood of timely payments in the future.

Benefits of Automating Invoice Reminders

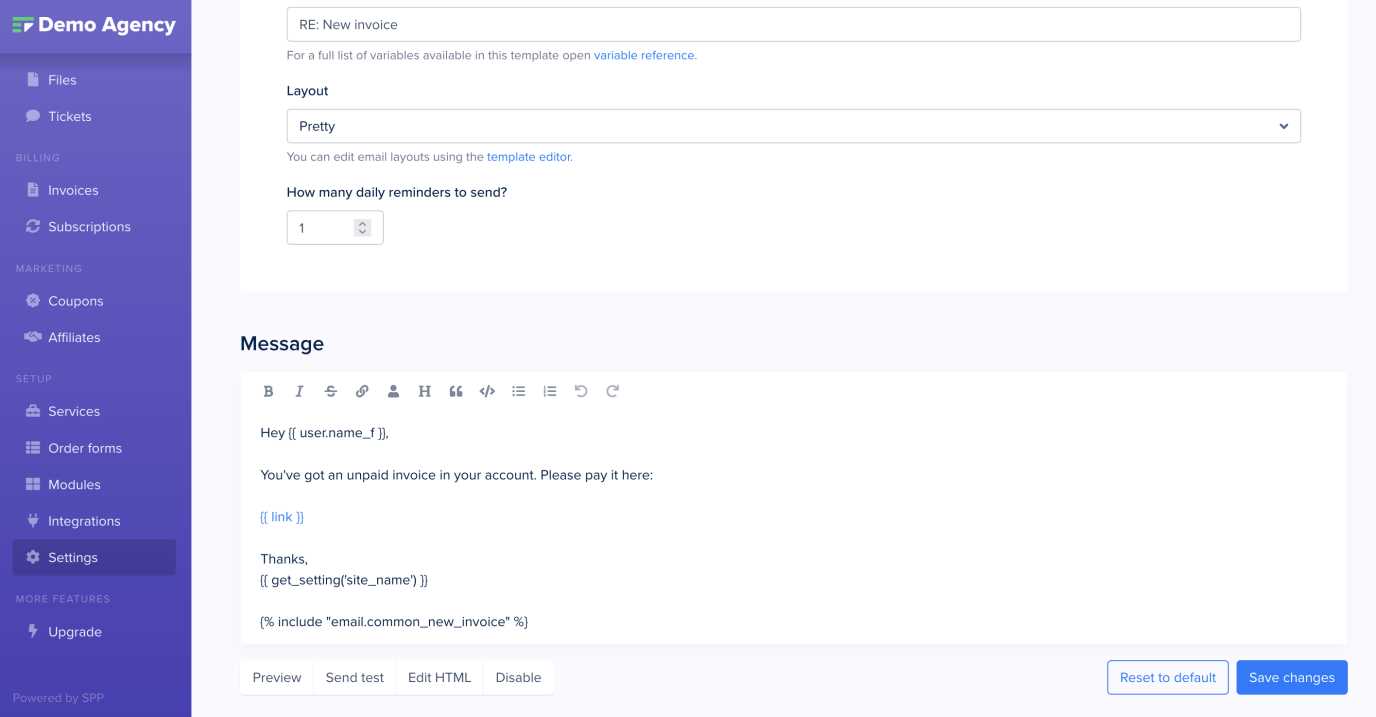

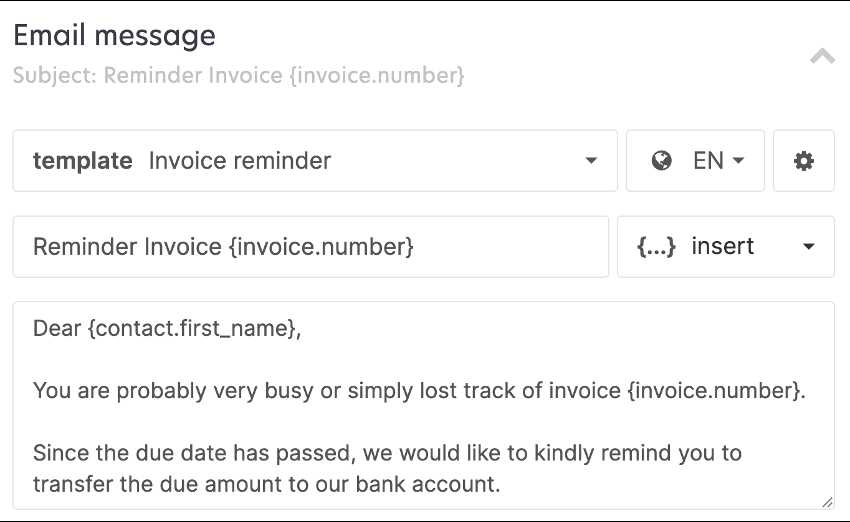

Automating payment reminders offers significant advantages for businesses seeking to streamline their collections process. By setting up automated systems to handle reminders, companies can ensure that no payment is overlooked, while saving valuable time and reducing the stress of manually managing collections. Automation not only improves efficiency but also enhances consistency in communication with clients.

Key Advantages of Automation

- Consistency and Reliability: Automated reminders ensure that clients are contacted at the right intervals without fail, leading to fewer missed or forgotten payments.

- Time Savings: Automating the process eliminates the need for manual follow-ups, freeing up time for other business-critical tasks.

- Improved Cash Flow: Timely reminders encourage prompt payment, leading to better cash flow and fewer instances of delayed payments.

- Professional Communication: Automated reminders can be programmed with professional and courteous language, ensuring a consistent tone in all communications.

- Reduced Human Error: Automation eliminates the risk of forgetting to send reminders or making mistakes in the process, ensuring a smoother operation.

Setting Up Effective Automated Reminders

To make the most out of automated reminders, it’s essential to set clear rules regarding when and how reminders are sent. Customize the timing to ensure that reminders are sent early enough to give clients time to settle payments, but not so soon that it feels pushy. Additionally, consider integrating automated payment systems with your accounting software to streamline both communication and payment processing.

Understanding Payment Terms in Communications

Clear and precise payment terms are essential in any communication related to financial transactions. These terms outline the expectations between a business and its clients regarding when and how payments should be made. By understanding and clearly defining these terms, businesses can reduce confusion and ensure smoother transactions. Properly conveying payment expectations helps to prevent misunderstandings and builds trust with clients.

Key Elements of Payment Terms

When outlining payment terms, it’s important to include the following details:

- Due Date: The specific date by which the payment is expected.

- Late Fees: Information on any additional charges that will apply if payment is not received by the due date.

- Payment Methods: A clear outline of the acceptable methods for making the payment, such as bank transfers, credit card payments, or checks.

- Discounts: If applicable, specifying any early payment discounts offered to clients who pay ahead of schedule.

Why Clear Terms Matter

Setting clear payment expectations helps avoid unnecessary delays and disputes. It ensures both parties are aligned on the timeline and conditions of the transaction. Well-defined terms also protect businesses by providing a framework for addressing late payments, thus maintaining a professional relationship with clients. Additionally, it can simplify the collections process if payments are not made on time, providing a basis for follow-up actions or penalties.

When to Involve Collection Agencies

At times, despite your best efforts, clients may fail to settle their financial obligations even after repeated reminders. When this happens, involving a third party to recover the debt might become necessary. Collection agencies specialize in recovering unpaid amounts, and they can take actions that businesses may not be able to, such as initiating legal proceedings or leveraging more aggressive collection techniques. However, it’s important to know when to take this step, as premature involvement can strain client relationships or lead to unnecessary expenses.

Signs It’s Time to Consider a Collection Agency

Several factors can indicate it’s time to bring in a collection agency:

- Extended Delays: When payments remain outstanding for an unusually long period, despite multiple reminders, it may be time to escalate the matter.

- Lack of Communication: If clients are unresponsive to your follow-up attempts or refuse to communicate regarding their debt, a collection agency might be the next logical step.

- Large Amounts: When the outstanding amount becomes significant, the cost of continuing to pursue the debt internally may outweigh the fees involved in hiring a collection agency.

- Client Insolvency: If there are signs that a client is facing financial difficulty, engaging a professional recovery service might help recover some of the debt before it’s too late.

When to Hold Off on Collection Agencies

While collection agencies can be helpful, there are times when it’s best to continue handling the situation yourself:

- Ongoing Relationships: If you value the business relationship and believe there’s a chance of resolution through direct communication, it’s worth exploring further options.

- Small Balances: For smaller amounts, pursuing external help may not justify the expense, especially if the debt is likely to be paid soon.

- Disputes: If there’s a legitimate dispute over the payment, it’s better to resolve the issue directly with the client rather than involving a third party.

Cost Considerations

Before engaging a collection agency, it’s important to weigh the costs involved. Most agencies charge a percentage of the amount recovered, so ensure that the amount owed justifies the fee. Additionally, consider whether the co