Free Trucker Invoice Template for Easy and Professional Billing

Managing payments and financial records is crucial for professionals in the transportation industry. Ensuring clear, precise, and efficient billing not only streamlines business operations but also helps maintain a professional image. By using structured documents, drivers and logistics companies can easily outline their services, charges, and payment terms.

Creating a reliable billing system involves selecting the right format that suits your business needs. A well-organized form allows you to communicate important details to clients, such as the cost of services rendered, delivery dates, and payment deadlines. Moreover, using a customizable layout enables you to adapt to specific customer requirements, making the invoicing process smooth and straightforward.

Whether you are an independent contractor or managing a larger fleet, having a consistent and professional method for billing is essential. With the right tools, handling finances becomes less time-consuming and more accurate, helping you focus on what truly matters–delivering quality service and maintaining strong client relationships.

Trucker Invoice Template Overview

When managing financial transactions in the transportation industry, it’s essential to have a clear and organized method of documenting services provided. A structured form not only ensures accurate calculations but also maintains professionalism in client communications. This document serves as a formal request for payment, detailing all aspects of the service provided, such as distances traveled, hours worked, or additional fees.

Importance of a Well-Designed Billing Document

Having a well-crafted billing form helps avoid confusion between service providers and clients. It ensures that all relevant information is easily accessible, reducing errors and disputes. By including necessary details such as service descriptions, payment deadlines, and contact information, businesses can create a smooth and efficient payment process that benefits both parties.

Customizing for Your Business Needs

One of the key advantages of using a customizable billing format is flexibility. Depending on the type of services offered, you can adapt the document to include specific terms or categories. Whether it’s adding fuel surcharges, equipment rental costs, or additional service fees, customizing your format helps address the unique needs of your business and customers.

Why Use a Billing Form for Transport Services

Managing financial transactions efficiently is vital for success in the transportation business. A standardized form for documenting completed jobs helps ensure that all relevant details are captured accurately, making the payment process clear and transparent for both parties. By using a structured document, service providers can avoid errors and reduce time spent on administrative tasks.

Improved Organization and Clarity

A properly designed form eliminates confusion by providing a consistent structure for each transaction. It allows service providers to clearly communicate essential details such as service dates, charges, and payment instructions. This clarity benefits both the service provider and the client, reducing the chances of misunderstandings and delays.

Time-Saving and Efficiency

By using a pre-made layout, you can save valuable time that would otherwise be spent creating documents from scratch. These forms streamline the billing process, allowing you to quickly input necessary information without reinventing the wheel each time. Automating this process with ready-to-use formats reduces administrative workload and speeds up the overall payment cycle.

Benefits of Customizing Your Billing Document

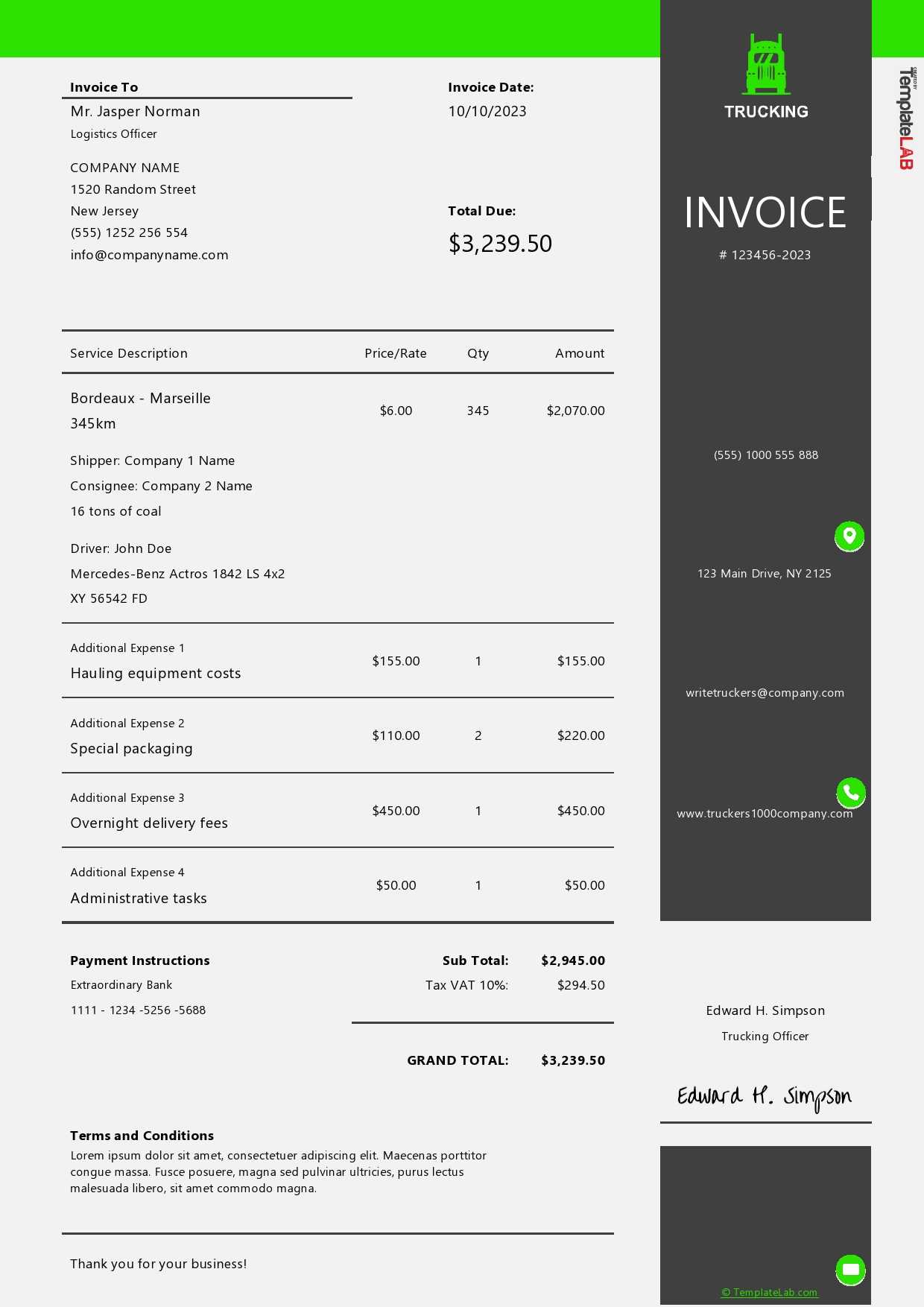

Customizing your billing document provides a significant advantage in the way you present your services and manage financial transactions. Tailoring the structure and content allows you to reflect your unique business needs, client preferences, and industry-specific requirements. This level of personalization ensures that every detail is relevant and clear, enhancing the overall professionalism of your communications.

By adjusting the layout, you can include essential information such as payment terms, service descriptions, and applicable taxes in a way that suits your business model. Customization also allows you to reinforce branding by incorporating your company’s logo, contact details, and specific formatting, creating a consistent experience for clients.

Moreover, adapting the document to reflect specific job details or pricing structures helps improve accuracy. When every element of the billing process is tailored to the service provided, the risk of errors or disputes decreases, leading to faster payments and stronger customer relationships.

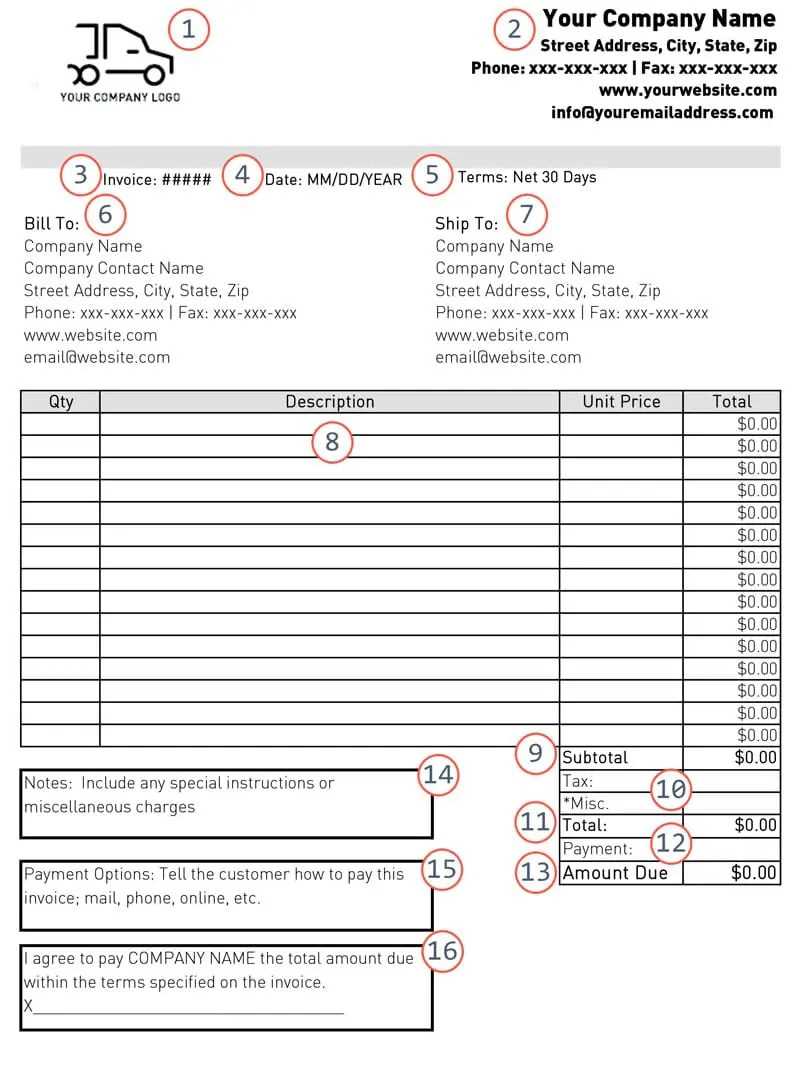

Key Elements of a Billing Document

A well-structured billing document is essential for ensuring accurate communication between service providers and clients. It should include all necessary details to facilitate smooth transactions and prevent misunderstandings. By incorporating the right elements, you can ensure that both parties are on the same page regarding the scope of work and payment expectations.

Essential Information to Include

The most crucial components of any billing document include the service provider’s contact details, the client’s information, a description of the work completed, and the associated charges. Each of these elements plays a role in ensuring that the document is both clear and comprehensive. Including payment terms, such as deadlines or late fees, helps set clear expectations and avoid future disputes.

Additional Features for Clarity

Beyond the basic information, adding extra sections like itemized charges, applicable taxes, and discounts can make the document even more transparent. Itemizing each service allows clients to easily see the breakdown of costs, making it more likely they will process payments promptly. Additionally, specifying payment methods and any special instructions can further reduce confusion and help maintain a smooth financial workflow.

How to Create a Simple Billing Document

Creating an easy-to-understand billing document is crucial for clear communication and efficient payment collection. A straightforward form ensures that all the necessary details are presented without confusion, allowing clients to quickly process payments. By focusing on the essential elements, you can craft a simple but effective document that serves its purpose without unnecessary complexity.

Steps to Create a Basic Billing Document

Follow these steps to create a clean and simple billing document:

- Include Your Contact Information: Start with your name or business name, address, and phone number or email for easy contact.

- Client Details: Add your client’s name, address, and any other relevant contact information to ensure the document is directed to the correct person or company.

- List of Services: Provide a clear description of the services rendered, including dates and any important details that clarify the scope of work.

- Charges and Costs: Break down the costs for each service or product, along with the total amount due. This could include labor, mileage, or materials used.

- Payment Terms: Specify the payment method, due date, and any penalties for late payments.

Additional Tips for Simplicity

- Keep the design clean and easy to read with clear headings.

- Ensure all amounts are clearly stated, including any taxes or discounts.

- If possible, use a digital format to speed up delivery and tracking of payments.

By following these steps, you can create a straightforward billing document that reduces errors and promotes prompt payments.

Free Billing Forms for Transportation Professionals

Using a pre-designed billing form can save valuable time and effort, especially when handling multiple clients and jobs. Free downloadable options allow transportation service providers to easily create professional, error-free documents without starting from scratch. These forms typically come with essential fields and structures already in place, allowing you to focus on customizing details for each job.

Where to Find Free Billing Forms

There are many online resources offering free forms specifically designed for those in the logistics and transport industry. These resources provide templates in various formats, such as Word, Excel, and PDF, allowing you to choose the one that best fits your needs. Some platforms even offer customizable options, enabling you to adjust the layout, add your branding, and modify the fields according to your specific services.

Benefits of Using Free Forms

- Cost-Effective: Free forms save money on expensive software or professional services.

- Time-Saving: Ready-to-use documents reduce the time spent on creating paperwork from scratch.

- Customization: Many free resources allow for easy edits, so you can tailor the form to your exact needs.

- Professional Appearance: Well-designed forms enhance your business’s credibility and foster trust with clients.

By utilizing these free forms, you can streamline your billing process, maintain consistency, and ensure all necessary details are included in every transaction.

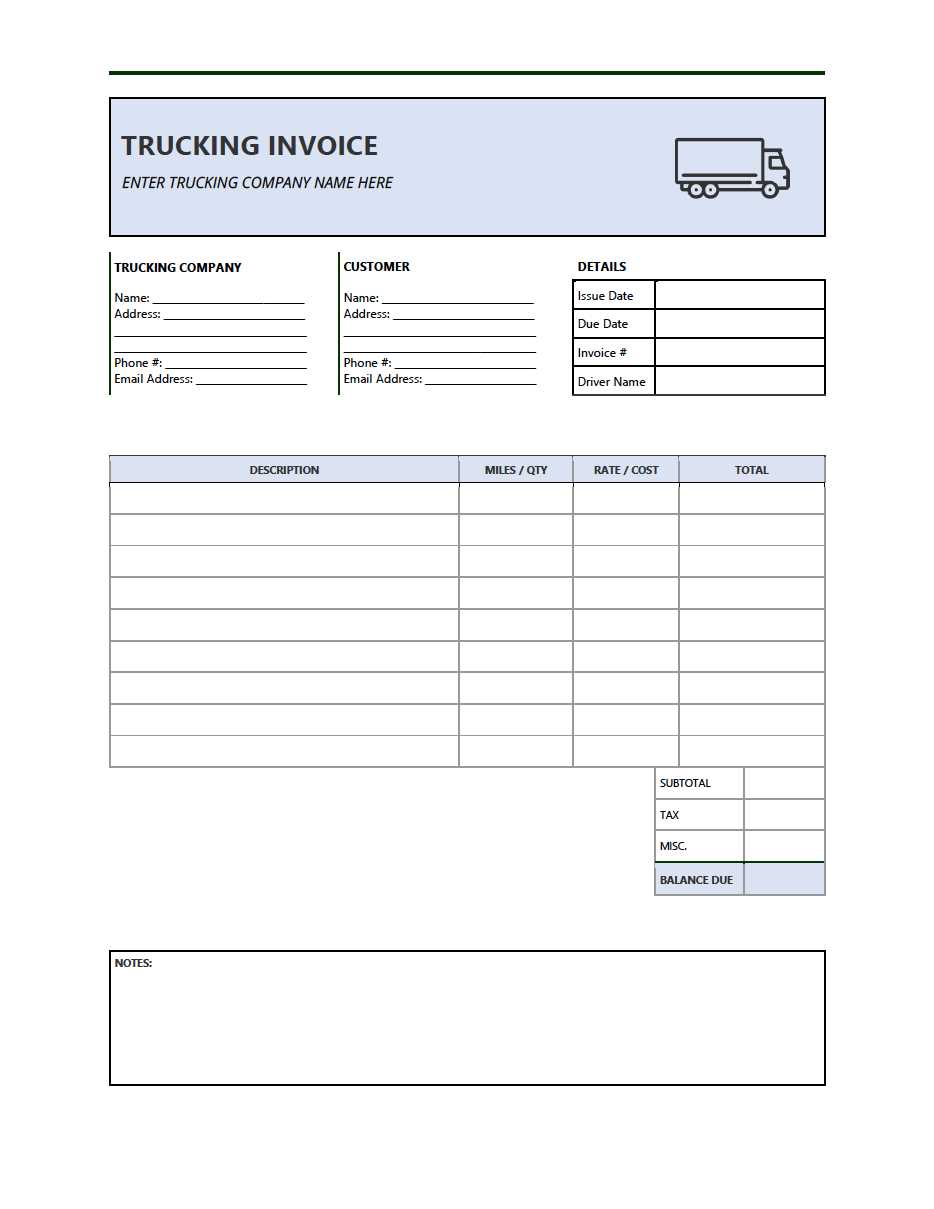

Choosing the Right Billing Form for Your Business

Selecting the right billing document for your business is a crucial decision that affects your workflow, client interactions, and payment efficiency. A well-suited form should align with the scale and nature of your services, ensuring that all necessary details are easily captured and communicated. The right format helps maintain consistency, professionalism, and clarity, ultimately leading to faster payments and stronger client relationships.

Factors to Consider When Choosing a Form

Before deciding on a billing document, consider the following factors to ensure you select the best option for your business:

- Business Size and Structure: For small operations, a simple, straightforward layout may suffice, while larger businesses may require more detailed forms that accommodate complex pricing structures or multiple services.

- Service Types: If your business offers a variety of services, choose a format that allows for easy customization. You may need sections for hourly rates, materials, or fuel surcharges, depending on the services you provide.

- Client Preferences: Some clients may prefer more detailed documents, while others might appreciate a quick, simple summary. Understanding your clients’ needs can help you choose the best format for them.

- Legal and Tax Requirements: Ensure the chosen form complies with local tax laws and includes necessary fields for taxes, discounts, or other regulatory information.

Types of Billing Forms to Consider

There are several types of forms available, each serving different business needs:

- Basic Forms: Ideal for businesses that offer simple, fixed-price services. These forms typically include essential fields like service description, total amount, and due date.

- Detailed Forms: Suitable for businesses with variable pricing, multiple service categories, or complex projects. These forms may include itemized charges, taxes, and additional costs like fuel or mileage.

- Customizable Forms: A great option if your business requires flexibility. These forms allow for easy adjustments to suit unique needs and special client requests.

Choosing the right form for your business ensures efficiency, accuracy, and a seamless client experience, helping you build a professional reputation and expedite payments.

Common Mistakes in Billing Documents

Creating accurate and clear billing documents is essential for maintaining good relationships with clients and ensuring timely payments. However, there are several common mistakes that can lead to confusion, delays, or even disputes. These errors often stem from missing information, miscalculations, or unclear terms. Avoiding these pitfalls can help streamline your billing process and ensure smooth transactions.

Common Errors to Watch Out For

- Missing Contact Information: Failing to include complete details for both the service provider and client can cause delays in communication and payment processing.

- Unclear Service Descriptions: Not clearly describing the services rendered can lead to confusion. It’s important to be specific about what was delivered, including dates, hours, and any special conditions.

- Incorrect Pricing or Calculations: Errors in pricing, tax calculations, or discounts can result in incorrect payment amounts and lead to disputes. Double-check all figures before sending the document.

- Omitting Payment Terms: Not specifying payment deadlines, penalties for late payments, or acceptable payment methods can create confusion about when and how payment is expected.

- Not Itemizing Charges: Failing to break down costs into specific line items can make the document less transparent, causing clients to question charges or delay payments.

How to Avoid These Mistakes

To ensure your billing process runs smoothly, follow these best practices:

- Double-Check All Information: Verify that all contact information, service descriptions, and pricing are accurate.

- Be Clear and Detailed: Include as much detail as possible, such as the specific services provided, time frames, and costs.

- Use a Consistent Format: Stick to a structured, easy-to-follow format to ensure all necessary details are included every time.

- Specify Terms Clearly: Always mention payment due dates, accepted payment methods, and any late fees or penalties.

By avoiding these common mistakes, you can create more efficient billing processes, reduce the chance of disputes, and ensure timely payments from clients.

How to Calculate Shipping Charges Correctly

Accurately calculating shipping charges is a crucial part of the billing process for transportation services. Incorrect charges can lead to confusion, disputes, and delays in payment. To avoid these issues, it’s important to consider several factors that affect shipping costs and ensure each charge is justified and clearly explained to the client.

Key Factors to Consider in Shipping Costs

Several elements contribute to the overall cost of shipping. The main factors to consider when calculating charges include:

- Distance: The farther the shipment needs to travel, the higher the cost. Make sure to calculate the total mileage or travel time accurately.

- Weight and Dimensions: Heavier or larger shipments require more resources to transport, which increases the charge. Always weigh and measure goods accurately.

- Fuel Surcharges: Fuel prices can fluctuate, so it’s important to include a fuel surcharge based on the current rates if applicable.

- Time Sensitivity: If the shipment is urgent or requires expedited delivery, the cost should reflect the priority level and additional resources needed.

- Additional Services: If you offer extra services such as packing, unloading, or special handling, these should be factored into the charge.

How to Calculate and Communicate Charges

Once you’ve gathered all the relevant information, follow these steps to ensure you’re calculating charges correctly:

- Assess the Distance and Time: Determine the route and calculate the mileage or travel time, factoring in any tolls or detours.

- Weigh the Shipment: Accurately weigh and measure the shipment to ensure you’re applying the correct rate for size and weight.

- Factor in Additional Fees: If there are extra services or surcharges (e.g., fuel, handling), calculate these and include them in the total cost.

- Review and Confirm: Double-check all calculations to ensure there are no errors, and clearly list the charges on the document for transparency.

By considering all the relevant factors and calculating charges carefully, you can provide a fair and accurate breakdown of shipping costs, leading to smoother transactions and improved client satisfaction.

Setting Payment Terms for Transportation Services

Establishing clear and mutually agreed-upon payment terms is essential for ensuring timely compensation and preventing misunderstandings. Setting proper payment expectations at the start of a contract or agreement helps both the service provider and the client understand their financial obligations. It also sets the tone for a professional relationship and helps avoid unnecessary disputes over payment amounts or deadlines.

Essential Elements to Include in Payment Terms

When defining payment terms for transportation services, consider the following critical elements:

- Payment Due Date: Clearly specify the date by which payment is expected. Common terms include “net 30,” meaning payment is due within 30 days, or “due on receipt,” where payment is expected immediately after service completion.

- Late Payment Penalties: To encourage prompt payments, outline any late fees or interest charges that will be applied to overdue amounts. This will incentivize clients to meet the specified deadline.

- Accepted Payment Methods: List the payment options available (e.g., bank transfer, credit card, check) to ensure that clients know how to submit payments easily and efficiently.

- Advance Payments or Deposits: For larger or long-term projects, consider requiring a deposit or advance payment before services begin. This helps secure cash flow and reduces the risk of non-payment.

Best Practices for Setting Clear Terms

To ensure your payment terms are fair and transparent, follow these best practices:

- Be Specific: Avoid vague language and be as precise as possible regarding payment amounts, due dates, and penalties. This will leave little room for confusion.

- Communicate Early: Make sure to discuss payment terms with clients before starting work, ideally in the initial stages of the contract negotiation.

- Use Written Agreements: Document the agreed-upon payment terms in writing, either in a contract or a formal service agreement, to protect both parties legally.

- Offer Flexible Payment Options: If possible, provide multiple ways for clients to pay, making it easier for them to settle their accounts on time.

By setting clear, fair, and well-communicated payment terms, you can foster a professional and trustworthy business relationship while ensuring that your transportation services are compensated in a timely manner.

How to Include Taxes in Your Billing Document

Including taxes in your billing document is an essential aspect of ensuring that all legal and financial obligations are met. Taxes can vary depending on your location, the type of service, and the client’s status, so it’s crucial to calculate them correctly and present them clearly on the document. Properly itemizing taxes helps maintain transparency, ensuring that clients understand the charges they are paying for.

Steps to Include Taxes in Your Billing Document

Follow these steps to ensure taxes are correctly calculated and displayed:

- Identify Applicable Taxes: Determine which taxes apply to your services based on your location and the nature of the work. Common taxes include sales tax, VAT, or local service taxes.

- Calculate Taxable Amount: Identify which parts of your service are taxable. If you have a combination of taxable and non-taxable services, ensure only the taxable portions are included in the tax calculation.

- Apply the Correct Tax Rate: Once you’ve determined the taxable amount, apply the correct tax rate. This rate can vary depending on jurisdiction, so ensure you’re using the accurate rate for the client’s location or your business’s tax rules.

- List Taxes Separately: It’s a good practice to clearly separate the tax amount from the total cost. This makes it easier for clients to see exactly how much tax they are being charged and ensures transparency.

Example of How to Itemize Taxes

Here’s how taxes can be presented in your document:

- Subtotal: List the total cost of the service or goods before tax.

- Tax Amount: Specify the tax rate and the amount calculated based on the subtotal.

- Total Amount Due: Add the tax amount to the subtotal to calculate the final amount due for payment.

By following these steps and clearly listing taxes on your billing document, you ensure compliance with tax regulations while providing clients with a transparent and professional service experience.

Tracking Payments with Your Billing Document

Effectively tracking payments is essential for maintaining a smooth cash flow and ensuring that your business remains financially stable. By including the right details in your billing documents, you can easily monitor when payments are made, identify overdue accounts, and maintain organized records. This not only helps with cash flow management but also prevents misunderstandings with clients about outstanding balances.

Key Information to Include for Tracking Payments

To make payment tracking more efficient, ensure that your billing document contains the following essential information:

- Invoice Number: A unique reference number for each billing document will help you track individual transactions and quickly locate details when needed.

- Payment Due Date: Clearly state the due date to avoid confusion about when the payment is expected. This will also help you determine when to follow up on overdue payments.

- Amount Due: List the total amount due, along with a breakdown of the charges. This makes it clear what is being paid for and the exact amount required.

- Payment Status: Include a section for marking the payment status (e.g., “Paid,” “Pending,” or “Overdue”). This can be updated once a payment is received.

- Payment Method: Specify the payment method used (e.g., bank transfer, credit card, check), so that you have a clear record of how payments were made.

How to Use Payment Tracking Effectively

To make the most of your payment tracking system, consider these best practices:

- Update Payment Status Regularly: After receiving a payment, promptly update the payment status on your document. This helps you stay organized and reduces the risk of errors.

- Keep Detailed Records: Maintain a record of all payments made, including dates, amounts, and payment methods. This can be helpful for financial reporting and resolving any disputes.

- Follow Up on Overdue Payments: If a payment is overdue, send a reminder or contact the client to resolve the issue. Being proactive ensures that payments are received on time.

By tracking payments effectively through your billing documents, you can streamline your financial processes, reduce the chance of missed payments, and ensure that your business stays on top of its financial health.

Making Your Billing Document Professionally Designed

Having a well-designed billing document reflects professionalism and builds trust with your clients. A clean, organized, and visually appealing design not only helps ensure clarity but also strengthens your brand’s image. A professional layout can make a significant difference in how your business is perceived, and it encourages prompt payments while providing clients with easy-to-understand details.

Key Design Elements for a Professional Look

To create a polished billing document, consider the following design elements:

- Branding: Include your company logo, business name, and contact information at the top of the document. This helps reinforce your brand identity and makes the document look official.

- Consistent Layout: Use a consistent layout with clear headings, columns, and sections. Group similar information together, such as the services provided, total costs, and payment details, to make the document easy to read.

- Legible Fonts: Choose professional, easy-to-read fonts for text. Avoid overly decorative fonts, as they can be hard to read, especially on mobile devices or printed copies.

- Whitespace: Use adequate spacing between sections and items. A cluttered document can be overwhelming and difficult to read, so leave enough space for a clean and organized appearance.

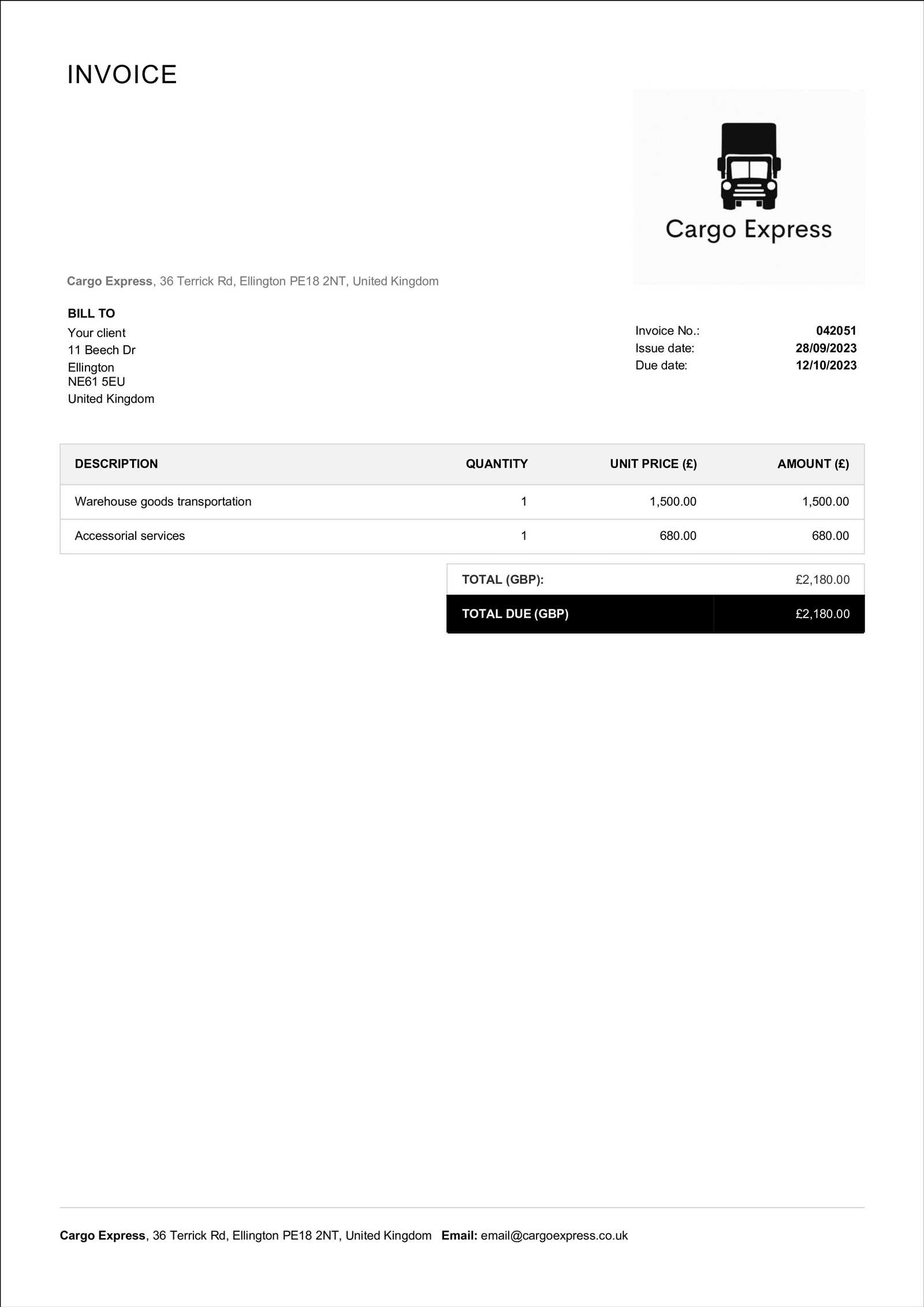

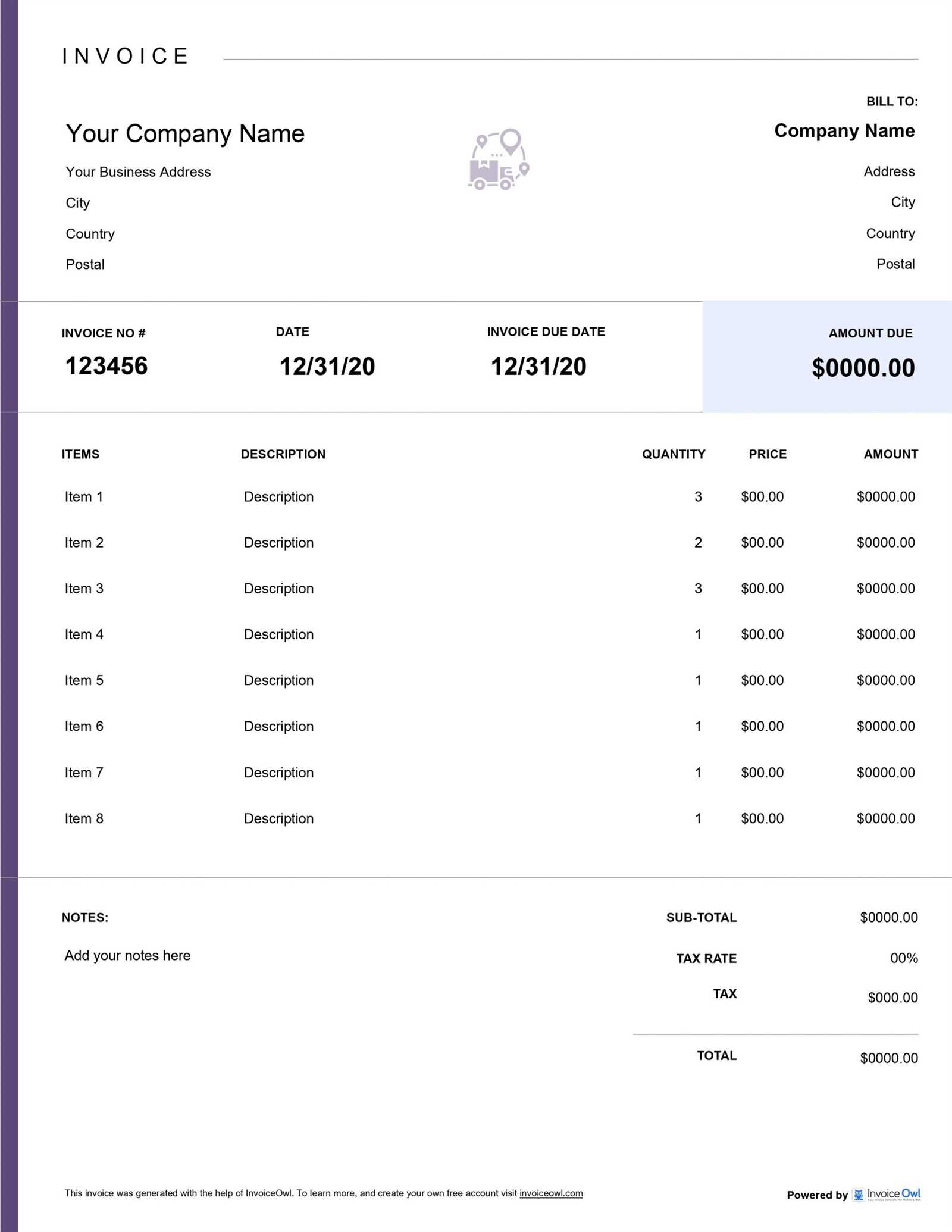

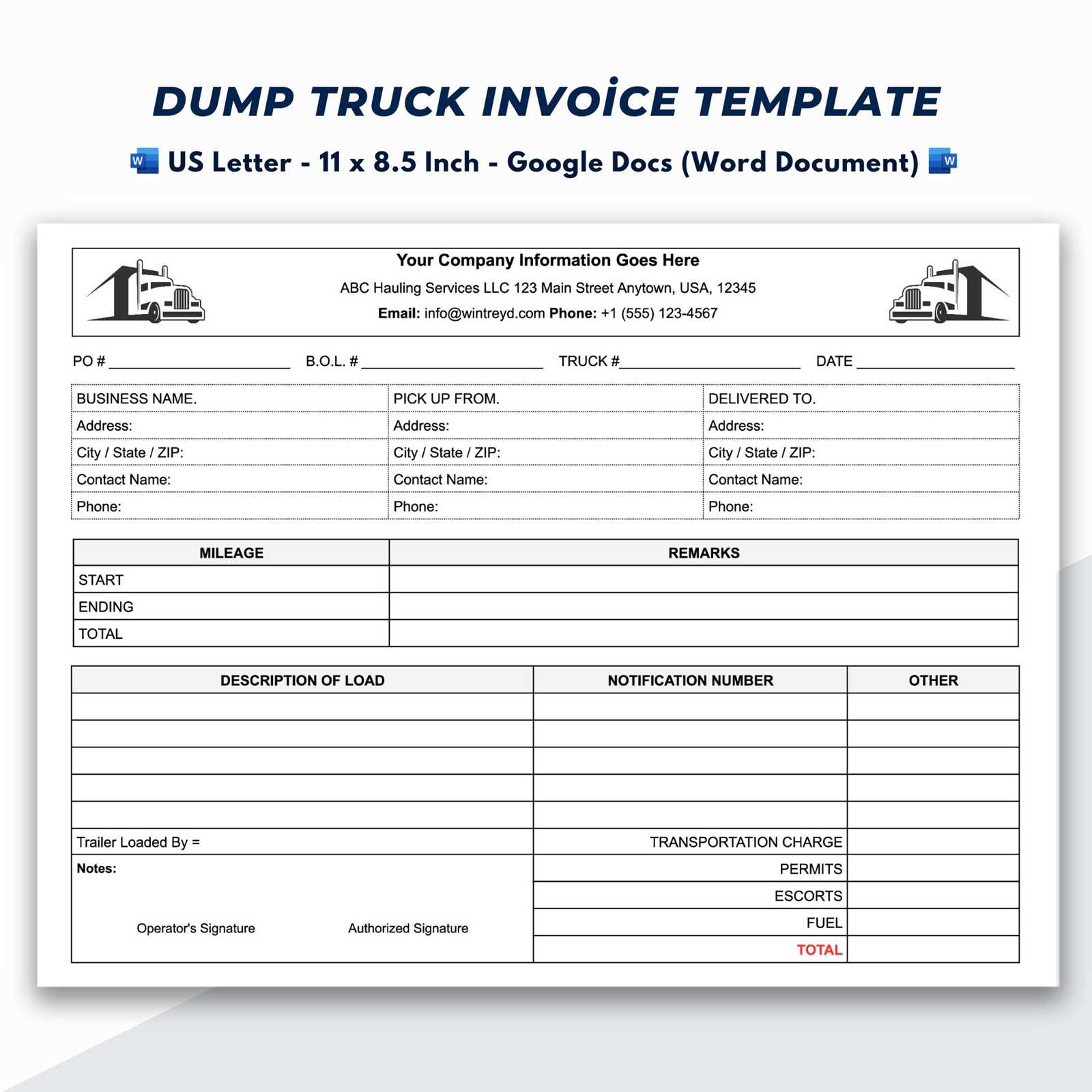

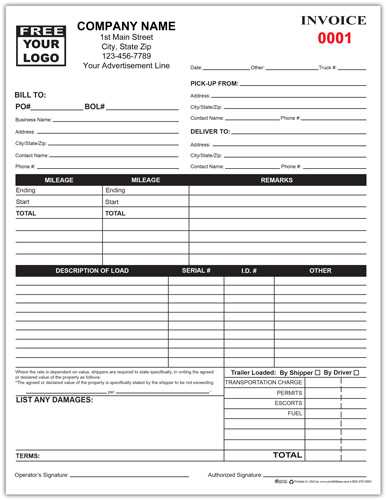

Example Layout for a Professionally Designed Billing Document

Here’s an example layout you can follow for a streamlined, professional design:

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Delivery of Goods | 2 | $150 | $300 |

| Fuel Surcharge | 1 | $25 | $25 |

| Total Amount |