Overdue Invoice Letter Template for Effective Payment Collection

Chasing unpaid bills is a challenge many businesses face. When clients fail to meet their payment obligations on time, it’s essential to maintain a professional approach that encourages prompt settlement. One of the most effective ways to address this issue is through written communication that reminds clients of their outstanding debts in a clear and respectful manner.

In this guide, we’ll explore how to craft messages that encourage timely payments while preserving good business relationships. A well-crafted reminder can convey the urgency of the situation without damaging client trust or satisfaction. By understanding the key components of an effective reminder and knowing when and how to send it, you can significantly improve your chances of getting paid on time.

Clear and concise communication is crucial when addressing overdue payments. A strategically written message not only informs the recipient of the pending balance but also serves as a subtle nudge to take action. Whether you’re reaching out for the first time or following up on previous reminders, the tone, wording, and timing of your message can make all the difference.

As you move forward, consider the best practices for creating these notices that can be tailored to your business needs, helping you maintain a professional image and a steady cash flow.

Overdue Invoice Letter Template Essentials

When a payment is not received by the agreed-upon date, it’s crucial to follow up with a professional reminder. This communication should serve as both a prompt to settle the balance and a reminder of the terms of the original agreement. The key to an effective message is clarity, politeness, and professionalism, which can help you avoid misunderstandings while ensuring prompt payment.

Core Elements of an Effective Reminder

An efficient payment reminder should contain several important details to make the situation clear without sounding aggressive. First, include the original amount owed, the due date, and any relevant payment instructions. Ensure that the tone remains respectful, highlighting the importance of settling the balance while acknowledging the possibility of an oversight. A brief mention of any late fees or penalties for delayed payment can also be included, but it should be done delicately to avoid alienating the client.

Maintaining a Professional Tone

Even if the payment is overdue, your reminder should be courteous and professional. The goal is not only to recover the funds but also to maintain a positive business relationship. Use polite language and remain neutral in tone, avoiding any words that may come across as confrontational. A friendly yet firm approach is often the best way to ensure that clients understand the seriousness of the matter while feeling respected.

Why You Need an Overdue Invoice Letter

When payments are not received within the expected time frame, it can significantly affect cash flow and disrupt the financial stability of your business. Sending a formal reminder is essential for ensuring that your clients understand their responsibility to pay on time. Not only does this improve the likelihood of timely payment, but it also helps you maintain a professional relationship with your clients while reminding them of their obligations.

Importance of Payment Reminders

A well-crafted payment reminder serves multiple purposes. It serves as a gentle nudge to the client, reminding them of the outstanding balance without damaging your relationship. Additionally, it can help prevent future delays by reinforcing the importance of timely payments. Sending a formal reminder also provides a documented record of your communication, which may be useful in case of further disputes or legal actions.

Benefits of Sending a Professional Reminder

| Benefit | Description |

|---|---|

| Improves Cash Flow | By prompting timely payments, you can maintain a healthy cash flow and avoid disruptions to your operations. |

| Maintains Professionalism | Sending a clear and courteous reminder shows that you take business matters seriously, reflecting well on your brand. |

| Reduces Payment Delays | Sending reminders can prevent clients from forgetting or neglecting payments, ensuring a smoother transaction process. |

How to Write an Effective Reminder

Crafting a successful reminder is all about striking the right balance between professionalism and clarity. The aim is to prompt the recipient to take action, while also preserving the business relationship. An effective message should be polite, direct, and include all the necessary details to avoid confusion. By following a few key guidelines, you can ensure that your reminder serves its purpose without causing unnecessary friction.

Key Elements to Include in Your Reminder

To make sure your communication is effective, your reminder should be clear and concise, providing the recipient with all the relevant details. The following are the essential elements to include:

| Element | Explanation |

|---|---|

| Clear Subject Line | A subject line that immediately conveys the purpose of the message helps the recipient recognize its importance. |

| Polite Opening | Begin with a friendly greeting and a gentle reminder, acknowledging the possibility of an oversight. |

| Details of the Outstanding Amount | Clearly state the amount due, the original due date, and any payment instructions to avoid confusion. |

| Consequences for Non-Payment | If applicable, mention any penalties or interest that may apply if the payment is not made promptly. |

| Call to Action | Encourage the recipient to take immediate action, providing any necessary instructions or contact information. |

By ensuring your reminder includes these key details, you increase the chances of receiving the payment promptly while maintaining a professional rapport with your client.

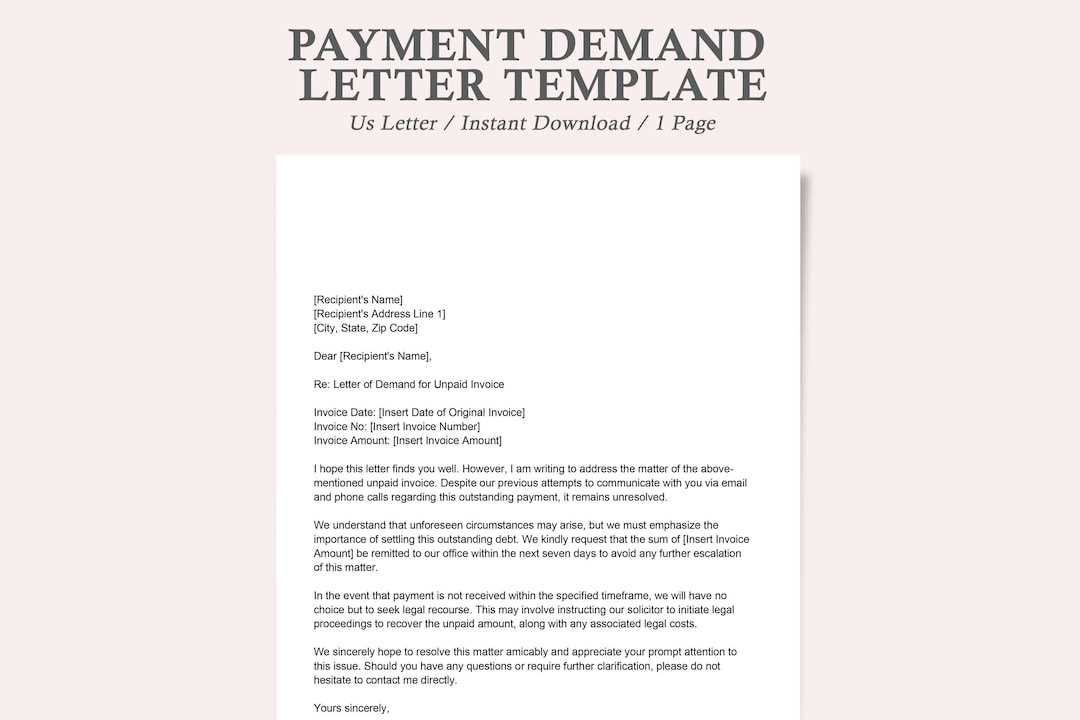

Key Components of an Overdue Invoice Letter

When following up on a missed payment, it’s important to ensure that your communication is both professional and clear. A well-structured message will not only convey the necessary information but also encourage the recipient to act quickly. There are several key elements that should be included in your message to ensure it serves its purpose effectively, while maintaining a positive relationship with your client.

Essential Elements to Include

Each payment reminder should include specific details that are crucial for the recipient to understand the situation and respond appropriately. The following are the key components:

- Subject Line: A clear and concise subject that reflects the purpose of the message, such as “Payment Reminder for Invoice #12345”.

- Polite Introduction: Begin with a courteous greeting, acknowledging the possibility of a simple oversight or delay on the client’s part.

- Details of the Payment: Specify the outstanding amount, the original due date, and any payment terms, ensuring that the recipient can easily identify what is owed.

- Late Payment Consequences: If applicable, mention any late fees or penalties that may be incurred if the payment is not made within a certain time frame. This should be done tactfully, without sounding confrontational.

- Call to Action: End with a polite yet firm request for immediate payment. Provide clear instructions for how to settle the balance and any necessary contact information.

- Closing Statement: Finish with a courteous closing, expressing appreciation for their prompt attention to the matter and offering assistance if they have any questions.

By including these elements in your communication, you ensure that the message is clear, professional, and more likely to lead to a prompt resolution.

Professional Tone in Payment Requests

Maintaining a professional tone in payment reminders is crucial for both preserving business relationships and ensuring that payments are made promptly. The way you communicate can greatly influence the outcome of your request. A message that is too harsh may damage relationships, while one that is too casual could fail to convey the seriousness of the situation. Striking the right balance between being firm and respectful is key to achieving a positive result.

How to Maintain a Professional Tone

Here are some best practices for keeping a professional tone in your payment reminders:

- Be Courteous: Always begin with a polite greeting. Address the recipient by their name and use formal language where appropriate.

- Stay Neutral and Non-confrontational: Avoid using language that might come across as accusing or blaming. Phrasing such as “I hope this is simply an oversight” or “If there has been any issue with the payment, please let us know” helps maintain a neutral tone.

- Be Direct but Respectful: Clearly state the amount owed, the due date, and the payment terms, but do so with respect. Instead of saying, “You missed your payment,” say “As of [date], we have not yet received payment for [service/product].”

- Use Polite Requests: Instead of demanding payment, politely request it. For example, “We kindly ask that you settle the amount by [date]” or “Please arrange for payment at your earliest convenience.”

- Express Understanding: If there are reasons for a delay, acknowledge them. Use phrases like “We understand that unforeseen circumstances can occur” or “If there has been any issue, please do not hesitate to contact us for clarification.”

Examples of Professional Phrasing

Here are some examples of how to phrase your payment requests in a professional manner:

- Firm but Polite Request: “This is a friendly reminder that your payment of [amount] is due. Please arrange for payment as soon as possible.”

- Neutral Tone for Unpaid Amount: “We have not yet received payment for [product/service]. We would appreciate your prompt attention to this matter.”

- Graceful Closing: “Thank you for your immediate attention to this matter. If you have already made payment, kindly disregard this reminder.”

Common Mistakes to Avoid in Letters

When crafting payment reminders, it’s important to be mindful of the tone and content. Small mistakes in your communication can lead to confusion, delays, or even strained relationships with clients. To ensure your message is effective, there are several common pitfalls to avoid when drafting your follow-up correspondence.

Key Mistakes to Avoid

- Using Aggressive Language: Even if a payment is overdue, being confrontational or aggressive can harm your professional relationship. Always use a polite and respectful tone, even when the message is urgent.

- Leaving Out Important Details: Failing to include key information such as the amount due, the original due date, and payment instructions can confuse the recipient and delay the process.

- Being Too Vague: Avoid using unclear or non-specific language. Phrases like “please send money soon” are not as effective as “please arrange for payment by [date].” Be precise and direct.

- Making Assumptions: Never assume the reason for non-payment. It’s better to phrase things like, “If there has been any issue or delay, please let us know” rather than accusing the client of neglecting the payment.

- Using Threats: Mentioning legal action or penalties too early can make clients defensive. Instead, first ask politely and only mention consequences if the situation does not improve after multiple reminders.

- Neglecting to Proofread: A reminder that contains grammatical errors or unclear statements can reduce your credibility and professionalism. Always double-check your communication for clarity and accuracy.

How to Avoid These Mistakes

- Be Courteous and Professional: Use respectful, neutral language to keep the tone friendly yet firm.

- Include All Relevant Information: Clearly outline the outstanding amount, original due date, and payment methods to avoid confusion.

- Stick to the Facts: Keep your message direct and focused on the payment, without making assumptions or judgments about the situation.

- Proofread Before Sending: Ensure that the letter is error-free and professional in both appearance and content.

By avoiding these common mistakes, you ensure that your communication is clear, respectful, and more likely to result in timely payments while maintaining strong client relationships.

When to Send an Overdue Invoice Letter

Timing plays a crucial role in the effectiveness of payment reminders. Sending a follow-up at the right time can significantly increase the chances of receiving payment promptly. However, sending it too early may be premature, while sending it too late may cause further delays. Understanding when to send a reminder ensures that your communication is both respectful and effective in prompting timely action.

Key Timing Considerations

Here are some important factors to consider when deciding the right time to send a reminder:

- Immediately After the Due Date: It’s advisable to send the first reminder shortly after the payment due date has passed. A gentle nudge can help prevent the payment from slipping further out of the client’s mind.

- Grace Period: If you typically offer a grace period (e.g., 7–10 days), wait until that period has passed before sending a follow-up. This shows flexibility while still maintaining a sense of urgency.

- After a Week of Non-Payment: If no payment is received after the first reminder, send a more assertive message after a week. Be firm, but remain courteous and professional in your tone.

- Before Applying Late Fees: If your payment terms include penalties for late payment, it’s good practice to send a reminder a few days before the fees are applied. This can act as a final reminder and encourage prompt action.

- In Case of Repeated Delays: If the payment is repeatedly delayed, consider escalating the tone of your reminders. You may want to introduce more formal language or reference any consequences for continued non-payment.

Suggested Timeline for Sending Reminders

Here’s a general timeline for sending reminders and follow-ups:

- First Reminder: 1–2 days after the payment due date. Keep it polite and professional.

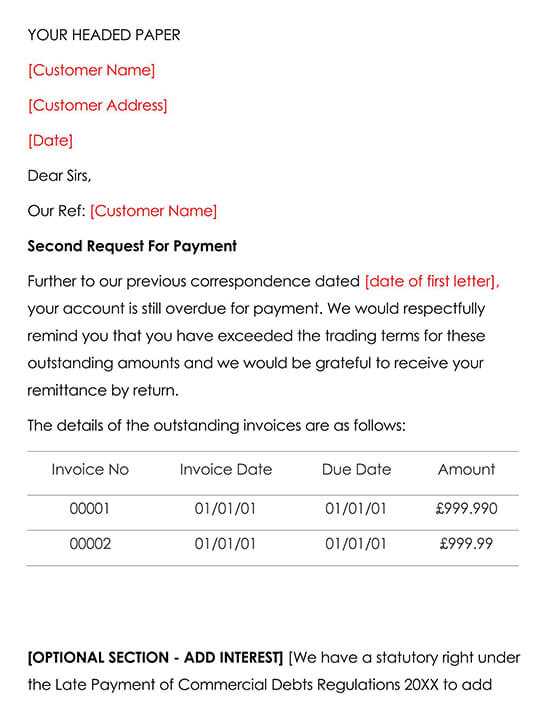

- Second Reminder: 7 days after the first reminder. Be firm but respectful, and mention any late fees or penalties if applicable.

- Third Reminder: 14–30 days after the second reminder, depending on the agreed-upon terms. At this point, you may want to introduce a more serious tone.How to Customize Your Template

Personalizing your payment reminder ensures that it aligns with your business tone and the specific relationship you have with the client. While it’s important to have a general structure in place, customizing each reminder can make it more effective. Tailoring the message to suit the particular circumstances, client preferences, and payment terms increases the likelihood of a prompt response.

Key Customization Elements

To create a more personalized message, consider the following key components:

- Client Name and Contact Information: Always address the recipient by their name to establish a personal connection. This small detail can make the reminder feel less like a generic message and more like a tailored request.

- Specific Details of the Transaction: Reference the specific product or service provided, along with the agreed-upon amount. This shows attention to detail and helps the client immediately recall the transaction.

- Customized Payment Terms: Include any special agreements, payment methods, or previous discussions that may have been part of your original agreement. For instance, if you offered a discount for early payment, remind them of that incentive.

- Appropriate Tone: Adjust the tone of your message based on your relationship with the client. For long-term, loyal clients, a softer tone might be suitable, while newer clients or those with a history of delays might require a firmer approach.

- Personalized Closing: End the communication with a closing that fits your business relationship. For example, a “Thank you for your continued partnership” can reinforce a positive working relationship, while “We look forward to resolving this promptly” is more neutral but still polite.

Tips for Customizing Your Communication

To ensure your reminder is both effective and professional, keep the following tips in mind:

- Maintain Professionalism: While personalizing, never lose sight of the professional nature of the communication. Even if your tone is friendly, it should remain respectful.

- Avoid Over-Explaining: Keep the message concise and to the point. Too much information can confuse the recipient or make the reminder seem less urgent.

- Use a Clear Call to Action: Be clear about what you expect from the recipient–whether it’s immediate payment,

Legal Considerations for Late Payments

When payments are delayed, businesses must understand the legal aspects of handling such situations. While it is essential to maintain professionalism in communication, there are also legal rights and obligations that must be taken into account when pursuing overdue amounts. Knowing these legal considerations ensures that you take appropriate action without overstepping boundaries, and helps protect your business from potential legal complications.

Key Legal Aspects to Keep in Mind

Before sending reminders or pursuing further action, it is important to be aware of the legal framework that governs late payments. Here are some key legal aspects to consider:

- Payment Terms: Always have clear, written terms agreed upon at the outset of any transaction. These terms should outline when payment is due, any applicable late fees, and the consequences of non-payment. These terms protect both parties and set expectations.

- Late Payment Fees: Depending on the jurisdiction, you may be legally allowed to charge interest or fees for late payments. However, ensure that the rates and conditions are specified in your original agreement and comply with local laws.

- Consumer Protection Laws: Be aware of consumer protection laws in your area, which may limit how you can pursue late payments, especially when dealing with individuals or small businesses. For example, some regions may restrict excessive interest rates or aggressive collection practices.

- Debt Collection Agencies: If payments remain unpaid for a prolonged period, you may consider involving a collection agency. However, make sure to follow proper legal procedures when transferring the debt to a third party to avoid any potential liability for harassment or unethical practices.

- Legal Action and Court Proceedings: As a last resort, you may need to take legal action to recover funds. Before proceeding with court action, check the statute of limitations in your jurisdiction, as the ability to collect debts may expire after a certain period.

Steps to Take Before Legal Action

Before escalating the matter legally, follow these steps to ensure you’ve taken the proper steps and documented everything:

- Send Multiple Reminders: Ensure that you’ve sent at least one or two payment reminders and allowed reasonable time for the client to respond or settle the debt.

- Document Communication: Keep a record of all communications with the client, including emails, phone calls, and formal letters. This documentation can be crucial if you decide to take legal action.

- Offer Payment Plans: If the client is having financial difficulties, consider offering a payment plan or alternative arrangements. This

Follow-up Strategies After Sending the Letter

After sending a payment reminder, it’s essential to have a clear plan for following up. If the recipient hasn’t responded or made the payment, further action may be required to encourage prompt resolution. Having a set of strategies for follow-up ensures that you address the situation without being overly aggressive, while still maintaining the pressure necessary to achieve a favorable outcome.

Effective Follow-up Techniques

Here are several strategies to consider when following up on a payment request:

- Wait for the Appropriate Time: Before sending another reminder, give the recipient enough time to process the payment or respond. A gap of 7 to 10 days after the first reminder is usually sufficient. If no action is taken, follow up promptly after this period.

- Use Multiple Communication Channels: If the first reminder was sent by email, consider following up with a phone call or a physical letter. Different communication methods may have varying levels of impact depending on the recipient.

- Be Persistent, but Professional: Consistent follow-ups are important, but they should always remain polite and professional. Avoid being confrontational or making demands. Instead, keep the tone friendly and helpful, while clearly reiterating the outstanding amount and payment terms.

- Offer Alternative Payment Solutions: If the client is facing difficulties making the full payment, offer a payment plan or an extension. This can be a more flexible approach that encourages the client to act without feeling pressured.

- Provide Clear Consequences: If previous reminders have failed, it may be necessary to mention any potential consequences, such as late fees or transferring the debt to a collection agency. However, this should be done tactfully and as a last resort.

When to Escalate the Follow-up Process

While most late payments can be resolved through standard follow-up methods, there are instances where escalation is necessary. Consider the following signs that indicate it’s time to take stronger action:

- Repeated Delays: If the client has failed to make payments or respond to multiple reminders, it may be time to escalate the issue by offering more formal terms or involving a third party.

- No Communication: If the recipient is unresponsive to your follow-up attempts, it may be helpful to send a final notice or contact them by phone to ensure they rec

How to Handle Non-Payment after the Letter

When a payment remains unsettled despite sending a formal reminder, it’s important to approach the situation carefully to protect your business interests while maintaining a professional stance. Non-payment can result from various reasons, including financial difficulties or simple oversight. Regardless of the cause, it’s essential to follow a structured approach to resolve the issue effectively without damaging your relationship with the client.

Assess the Situation

Before taking further steps, it’s crucial to understand why the payment has not been made. Consider the following actions:

- Reach Out Personally: Sometimes, a simple phone call can clear up misunderstandings or reveal issues that prevented payment. Engaging directly with the client can help clarify their position and open the door for negotiation.

- Check Payment History: If this is a first-time delay, the situation might be more easily resolved. However, if the client has a history of late payments, you may need to adjust your approach accordingly.

- Offer Payment Alternatives: If the client is facing financial challenges, offering a payment plan or an extension can show flexibility and help maintain a positive business relationship.

Escalating the Process

If initial follow-up attempts have not resulted in payment, it’s time to consider escalating the situation. Here are some options:

- Send a Final Notice: If the payment is still not made, send a final reminder outlining the consequences of continued non-payment, such as applying late fees, suspending services, or involving a debt collection agency.

- Involve a Third Party: If you have tried all other avenues and the payment remains outstanding, consider working with a collection agency. They specialize in recovering unpaid debts and can often secure payment faster than direct communication.

- Legal Action: As a last resort, you may need to take legal action to recover the amount owed. Before pursuing this route, consult with a legal professional to understand your rights and the potential costs involved.

Handling non-payment after sending a reminder requires a balance of patience, persistence, and professionalism. By assessing the situation carefully and taking measured actions, you can maximize your chances of receiving payment while preserving your client relationships.

Tips for Clear and Concise Communication

Effective communication is key when requesting payment from clients. A clear and concise message not only helps ensure your request is understood but also increases the likelihood of a prompt response. By keeping your language direct and straightforward, you reduce the chances of confusion and foster better business relationships. The following tips can guide you in crafting messages that are both polite and efficient, increasing the chances of a positive outcome.

Key Elements of Effective Communication

To communicate clearly and avoid unnecessary misunderstandings, consider these essential points:

- Use Simple Language: Avoid jargon or overly complex language. Your goal is for the recipient to quickly understand the purpose of your message without confusion. Keep sentences short and to the point.

- State the Purpose Early: Be upfront about the reason for the communication. Start with a clear statement of what you are asking or reminding the recipient about. This ensures that even if the reader only scans the message, they grasp the key point.

- Include All Relevant Details: Ensure that all necessary information, such as the amount due, the original due date, and any applicable terms, are included. This eliminates the need for the recipient to look up additional details, speeding up the process.

- Avoid Ambiguity: Be as specific as possible. Vague requests or unclear terms can lead to misunderstandings and delays. For example, instead of saying “Please pay soon,” specify a due date or mention the late fees if applicable.

How to Maintain a Professional Yet Friendly Tone

While clarity is important, tone also plays a significant role in how your message is received. Here are some ways to ensure your message remains both professional and friendly:

- Be Polite: Even though you are requesting payment, it’s important to remain courteous. Phrases like “Thank you for your attention to this matter” or “We appreciate your prompt response” can help maintain a positive tone.

- Avoid Confrontation: Rather than using harsh or aggressive language, approach the situation with a problem-solving attitude. You might say, “We understand that circumstances can cause delays, and we’re happy to assist in resolving this promptly.”

- Use Positive Language: Words that suggest cooperation and a willingness to help can make a big difference. For example, “We look forward to yo

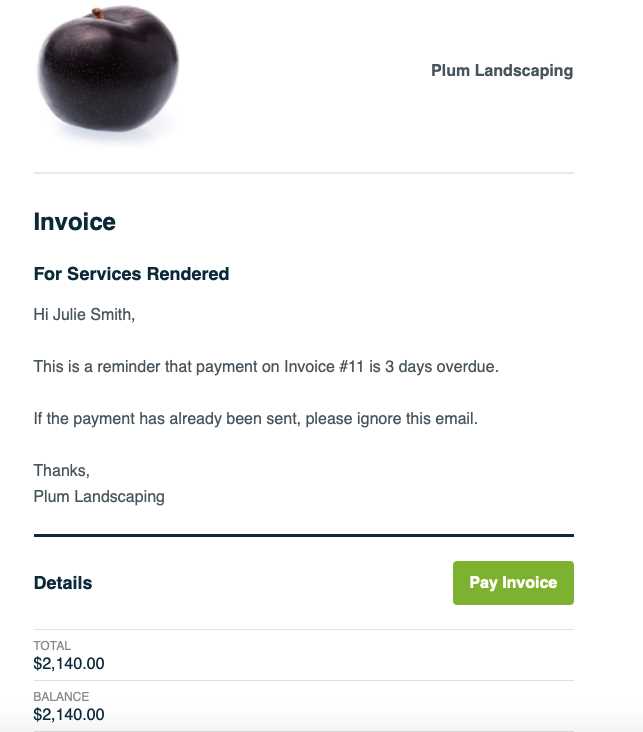

Automation Tools for Payment Reminders

Managing payment requests can be time-consuming, especially for businesses with multiple clients or ongoing transactions. Automation tools can significantly simplify the process by streamlining the creation and delivery of reminders, saving time, and ensuring consistency. By leveraging these tools, businesses can reduce the administrative burden and focus on other aspects of their operations while still ensuring timely payments.

Benefits of Using Automation for Payment Requests

Implementing automation in your payment reminders can offer several advantages:

- Time Efficiency: Automating the reminder process allows you to send multiple reminders without manual input, saving time and effort. Once set up, the system works on autopilot.

- Consistency: Automation ensures that all clients receive the same professional, clear, and timely communication, reducing the risk of errors or missed reminders.

- Reduced Human Error: Since the process is automated, there’s less risk of forgetting to send a reminder or making mistakes in the details of the message.

- Follow-Up Scheduling: Most automation tools allow you to schedule follow-ups based on your preferred timing, so reminders can be sent at regular intervals without manual intervention.

Popular Tools for Automating Payment Reminders

Several tools are available to help automate payment reminder processes. Here are a few popular options:

- FreshBooks: This accounting software offers automated payment reminders, allowing businesses to set up recurring invoices and follow-up emails for late payments.

- QuickBooks: Known for its robust invoicing features, QuickBooks also provides automatic reminder notifications to clients based on due dates or overdue periods.

- Zoho Invoice: Zoho allows businesses to automate payment reminders and follow-ups through customizable templates that can be sent automatically based on predefined criteria.

- PayPal: PayPal offers features to automate reminders and overdue notices for businesses accepting payments online. It can send reminders directly through the platform to encourage prompt payment.

- Xero:

Improving Cash Flow with Timely Letters

Maintaining a healthy cash flow is crucial for the stability and growth of any business. One of the most effective ways to ensure regular cash inflows is through timely communication with clients regarding their outstanding payments. Sending well-timed reminders or requests for payment can help prevent delays, reduce the risk of non-payment, and improve overall financial stability. A proactive approach can lead to faster collections, better financial forecasting, and less reliance on credit or loans to cover operational costs.

Impact of Timely Payment Requests on Cash Flow

By sending payment reminders at appropriate intervals, businesses can reduce the gap between service delivery and payment receipt, which directly impacts cash flow. Below are some key advantages:

- Reduces Delays: When clients are reminded about their obligations in a timely manner, it reduces the likelihood of forgotten or ignored payments, speeding up the process of receiving funds.

- Strengthens Client Relationships: Regular, polite reminders maintain professional communication and show that the business is organized and attentive to detail, which can help build trust with clients.

- Improves Forecasting: Timely payment reminders help businesses predict cash flow more accurately, allowing for better financial planning and resource allocation.

- Minimizes Credit Dependence: With a consistent stream of payments, businesses can avoid taking on unnecessary debt or using credit to cover gaps in cash flow.

Best Practices for Timely Payment Reminders

To ensure your payment reminders are effective in improving cash flow, follow these best practices:

Best Practice Description Send Reminders Early Don’t wait until payments are significantly late. Sending an initial reminder shortly after the due date can encourage early resolution. Be Consistent Establish a routine for follow-ups, such as sending reminders at specific intervals (e.g., 7, 14, and 30 days after the due date). Keep Communication Professional Ensure that all reminders maintain a polite and professional tone, Examples of Professional Payment Requests

When requesting payment from clients, it’s important to maintain a professional tone while being clear and direct. A well-crafted message can foster a positive relationship with the client, encouraging prompt settlement of balances. The following examples illustrate how to approach payment requests with professionalism, ensuring the message is polite, clear, and effective.

Example 1: Initial Reminder

This is a polite reminder that gently informs the client about a pending payment, typically sent shortly after the payment due date has passed.

Subject Message Payment Reminder – [Company Name] Dear [Client Name],

We hope this message finds you well. This is a friendly reminder regarding your outstanding balance of [Amount Due] for [Product/Service]. The payment was due on [Due Date]. We kindly request that you process this payment at your earliest convenience.

If you have already made this payment, please disregard this message. If you have any questions or concerns, feel free to contact us. We appreciate your prompt attention to this matter.

Best regards,

[Your Name]

[Company Name]

Example 2: Second Reminder

If the payment has not been received after the first reminder, the second reminder should be a bit firmer but still polite. It may also include additional information on late fees if applicable.

Subject Message Second Payment Reminder – [Company Name] Dear [Client Name],

We are following up on our previous message regarding your outstanding payment of [Amount Due], which was due on [Due Date]. As of today, we have not yet received your payment.

We understand that issues may arise, and we are here to assist if necessary. However, please note that a late fee of [Late Fee Amount] will be applied if payment is not received by [New Due Date].

Kindly process the payment by the updated deadline to avoid any disruption of service. If you have already sent the payment, please let us know so we can update our records.

Thank you for your attention to this matter.

Best regards,

[Your Name]

[Company Name]

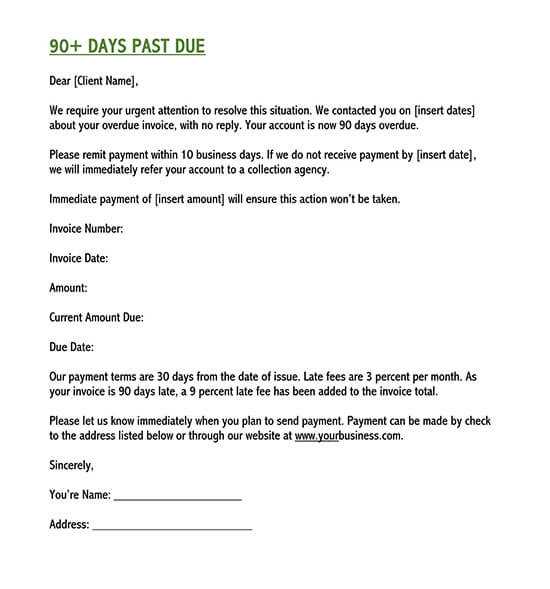

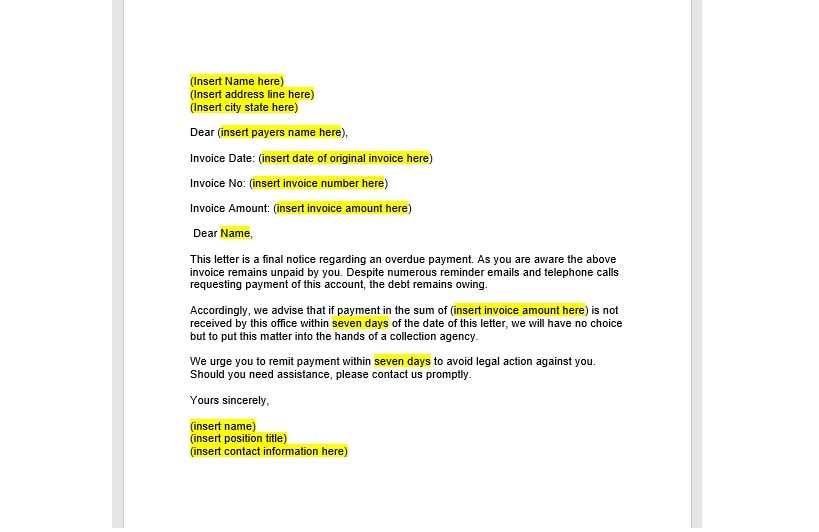

Example 3: Final Notice

A final notice should be clear and assertive, stating the potential consequences of non-payment, such as suspension of services or legal action, while maintaining professionalism.

Subject Message Final Payment Notice – [Company Name] Dear [Client Name],

This is a final notice regarding your outstanding balance of [Amount Due], which has been overdue since [Due Date]. Despite our previous reminders, we have not yet received payment.

Please note that if payment is not received by [Final Due Date], we will have no choice but to suspend services or take further action to recover the debt, which may include engaging a collection agency or pursuing legal remedies.

To avoid any disruption, please arrange payment immediately. If you have already made payment, kindly disregard this notice.

We apprec

How to Stay Professional in Difficult Situations

Dealing with payment delays or disputes can be challenging, but maintaining professionalism is essential for preserving client relationships and protecting your business reputation. It’s important to approach these situations calmly, clearly, and with a focus on resolution. By handling difficult circumstances with professionalism, you not only increase the likelihood of timely payments but also strengthen trust and cooperation with clients. Below are some strategies that can help you stay professional in even the most stressful situations.

Key Strategies for Professionalism

In challenging situations, it’s crucial to approach the issue with tact and composure. Here are some strategies to maintain professionalism:

Strategy Description Stay Calm and Objective Emotions can run high when payments are delayed, but it’s important to keep your communication neutral and factual. Avoid sounding accusatory or frustrated, as this can escalate the situation. Use Clear and Respectful Language Even if the situation is frustrating, always use polite and respectful language. Address the issue directly, but without placing blame. Aim for a solution-oriented tone. Offer Flexible Solutions If a client is unable to pay on time, offer alternative solutions such as payment plans or partial payments. This shows you’re willing to work with them while still aiming to resolve the issue. Document All Communications Keep a record of all interactions regarding the situation. This helps avoid misunderstandings and provides a clear paper trail should you need to take further action. Set Clear Expectations Be clear about what you expect from the client and set firm but fair deadlines. This helps prevent confusion and reinforces the importance of timely resolution. Examples of Professional Communication in Difficult Situations

Here are some examples of how you can communicate effectively and professionally in challenging circumstances:

Scenario Professional Response Client is Late on Payment Dear [Client Name],

We wanted to kindly remind you of the outstanding balance of [Amount Due] that was due on [Due Date]. We understand that things may sometimes get busy, and we would appreciate it if you could let us know when we can expect payment.

If you’re facing any issues, please don’t hesitate to reach out so we can work together on finding a solution.

Best regards,

[Your Name]

Client Requests More Time Dear [Client Name],

Thank you for informing us about the situation