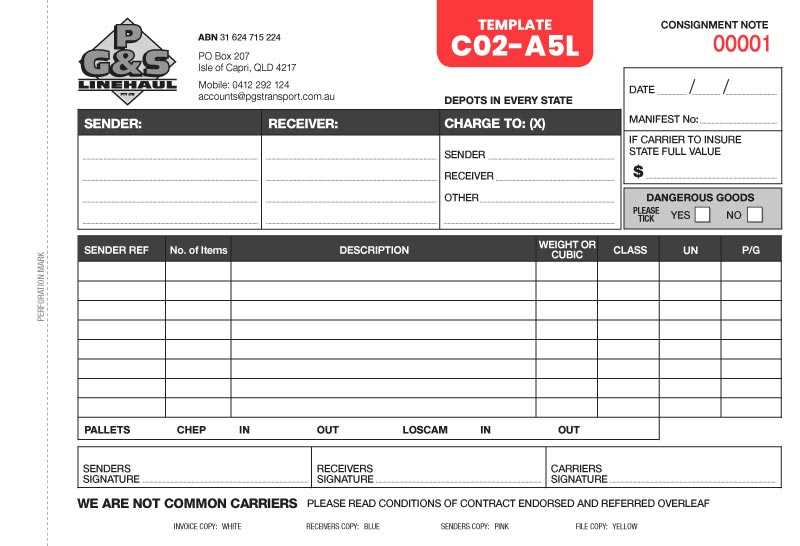

Free Consignment Invoice Template for Easy Use

Managing sales and payments can be a challenging task for any business, especially when dealing with goods sold on behalf of others. Having a reliable and structured document to track these transactions is essential for both clarity and accountability. Using a well-designed document helps ensure that all parties involved are on the same page, minimizing the risk of confusion and errors.

With the right tool, businesses can quickly generate professional documents that not only save time but also maintain a high level of organization. Whether you’re handling a small retail operation or working with a larger inventory, the importance of accurate records cannot be overstated. A simple yet efficient system can streamline the process, allowing you to focus more on growing your business and less on administrative tasks.

Utilizing a pre-designed form can provide immediate relief, offering an easy-to-use format that fits your needs without the complexity of creating one from scratch. This approach saves time and effort while maintaining professionalism in your transactions. By customizing the document to reflect your business requirements, you can ensure each deal is processed smoothly and securely.

What is a Consignment Invoice?

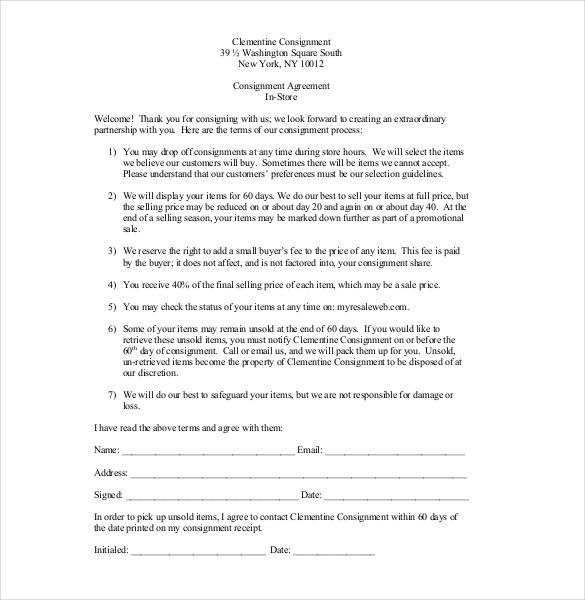

A document used to track transactions between two parties, where one sells goods on behalf of the other, is an essential tool in various business models. This record outlines the terms of the sale, including the amount due, the goods involved, and the agreed-upon payment conditions. It serves as a proof of the sale, ensuring that all parties are clear on the terms and preventing any potential misunderstandings.

In simple terms, this document functions as a formal receipt that not only details the transaction but also establishes the responsibilities of each party. It helps in managing the financial aspects of the agreement and is crucial for bookkeeping, especially when products are sold through third-party arrangements.

| Item Description | Quantity | Price | Total |

|---|---|---|---|

| Product A | 10 | $15 | $150 |

| Product B | 5 | $25 | $125 |

| Total | $275 |

This document also helps in resolving disputes by providing a clear record of what was agreed upon, helping both parties ensure that payments are made according to the terms outlined. By using a structured format, businesses can keep their financial records organized and transparent, making it easier to track and manage outstanding amounts.

Benefits of Using Consignment Invoices

Utilizing a structured document to record transactions between sellers and third parties brings numerous advantages to businesses. By having a clear and standardized format, companies can ensure that all financial details are accurately tracked and that both parties involved are held accountable. This not only helps to minimize misunderstandings but also promotes smooth business operations.

Improved accuracy is one of the primary benefits of using such documents. These forms allow businesses to easily track the quantities, prices, and terms of the agreement, reducing the chances of errors that could arise from manual entry or unclear communication. With a consistent format, it becomes easier to compare and reference past transactions, helping to maintain financial integrity.

Enhanced professionalism is another key advantage. When you present a well-organized document to customers or partners, it signals that your business is reliable and professional. This can foster trust and improve relationships with suppliers, retailers, or other stakeholders involved in the sale process.

Better financial management is achieved through consistent record-keeping. A formal record ensures that payments, commissions, and balances are clearly documented, allowing businesses to stay on top of their finances. It can also help with planning and forecasting, making it easier to manage cash flow and expenses.

Legal protection is another crucial benefit. A clear written agreement outlining the terms of the sale serves as legal evidence in case of disputes. Having a documented record ensures that both parties are aware of their rights and obligations, providing peace of mind in the event of any disagreements.

Overall, incorporating such a document into business practices simplifies the transaction process, improves organization, and helps maintain smooth operations, contributing to long-term success and efficiency.

How to Create a Consignment Invoice

Creating a structured document to record sales made on behalf of another party is a straightforward process that helps businesses maintain clear financial records. The key is to include all relevant details to ensure both parties understand the terms of the sale and payment. A well-organized document can prevent confusion and reduce the risk of errors, providing a reliable way to track sales transactions.

Step 1: Gather Necessary Information

Before creating the document, collect all the details you will need, including product descriptions, quantities, agreed prices, and the commission or fee structure. Ensure you have the correct contact information for both the seller and the third party. This information will serve as the foundation for the entire record.

Step 2: Structure the Document Properly

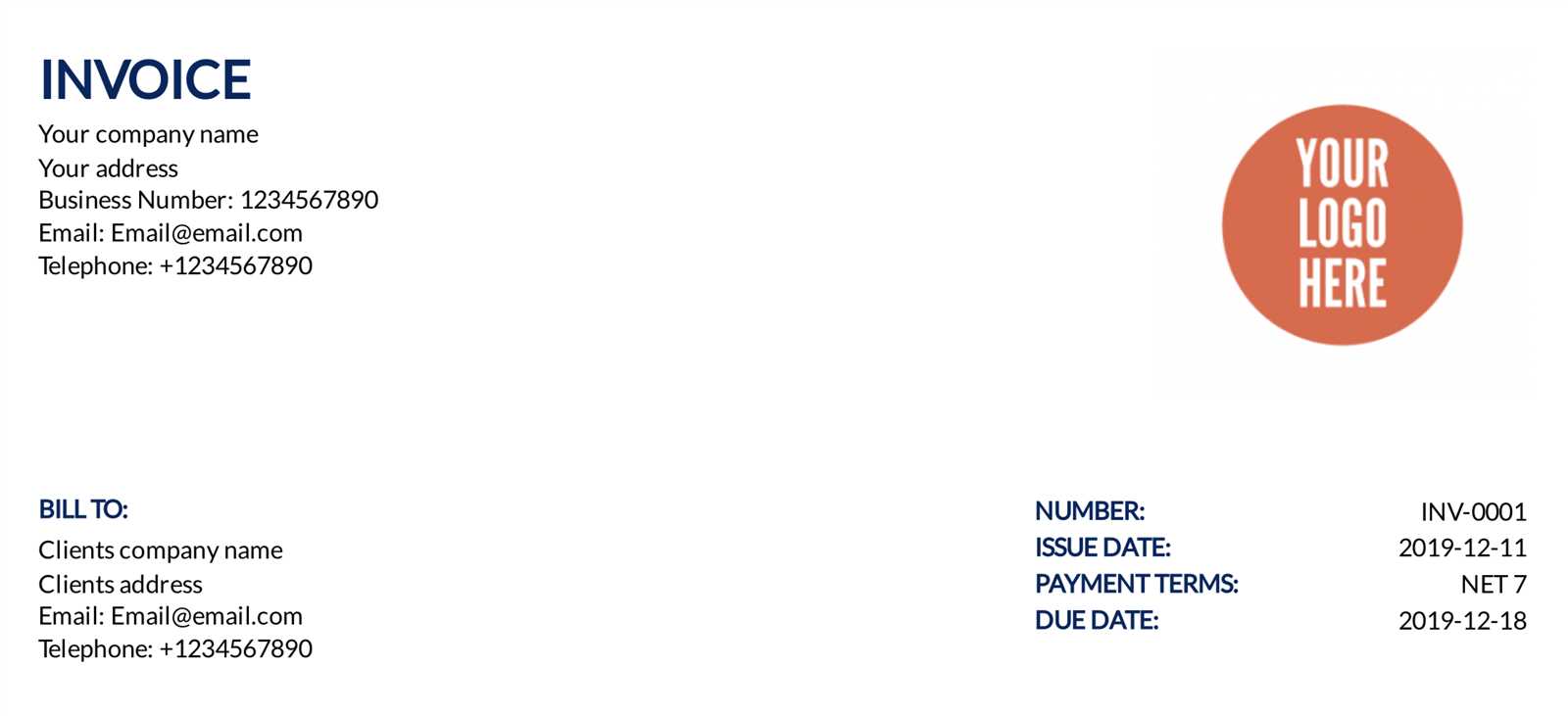

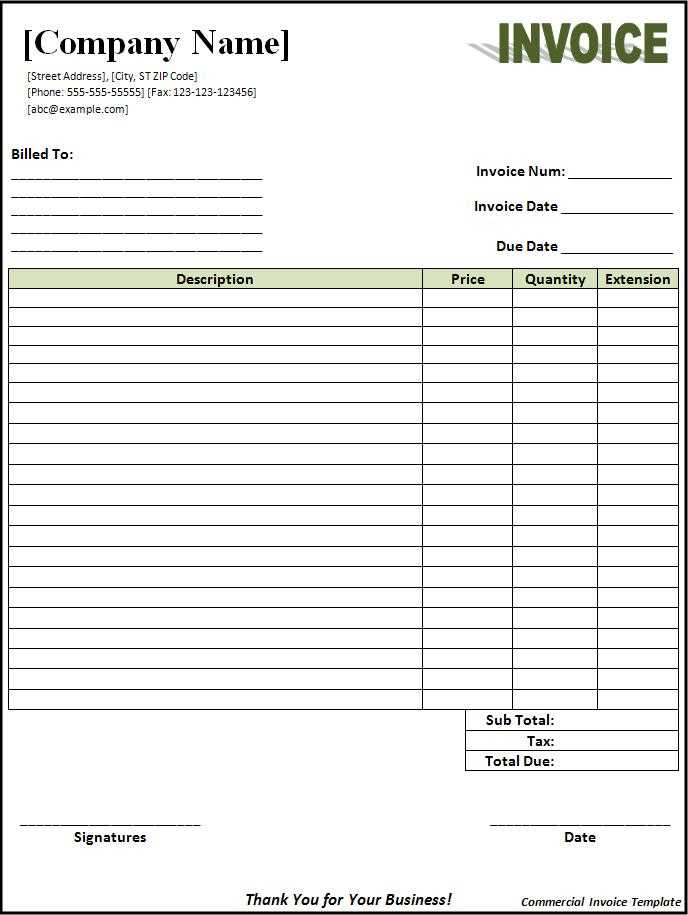

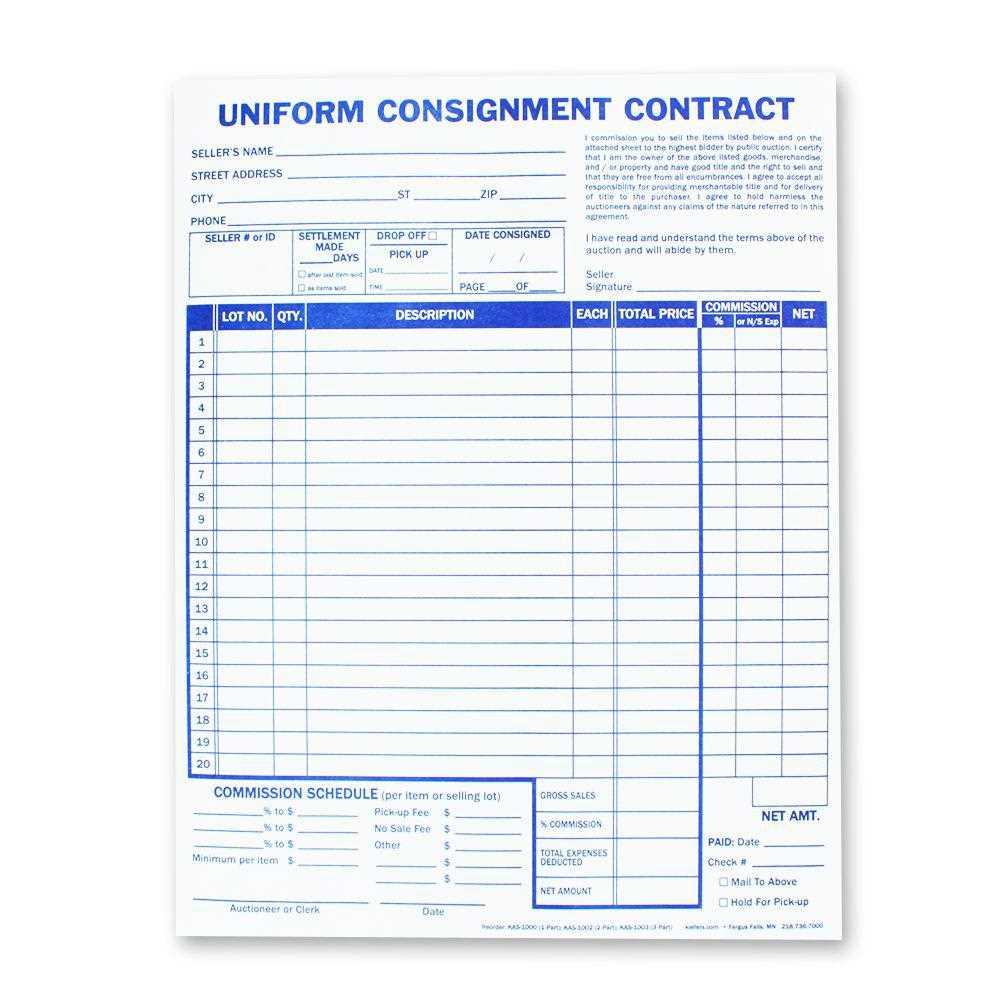

Start by clearly labeling the document with a title and include both parties’ contact details at the top. Next, provide a detailed list of the items involved, along with quantities, unit prices, and total amounts. Ensure the terms of payment are outlined, specifying due dates, any commissions, and applicable taxes. Additionally, include a unique reference number for easy tracking and reference in the future.

Ensure accuracy when entering all details to avoid mistakes. Use consistent formatting to make the document easy to read and professional in appearance. Once the document is complete, both parties should review and sign it, confirming their agreement to the terms.

With the right information and structure, generating a clear and reliable document can become a quick and simple process, enhancing business efficiency and protecting the interests of all involved.

Key Elements of a Consignment Invoice

A well-structured document that tracks sales made on behalf of another party must include several key components to ensure clarity and accuracy. These elements not only help keep transactions organized but also serve as a clear reference for both the seller and the third party involved in the sale. Including the right details minimizes confusion and ensures that payments are processed correctly.

Header Information: The top of the document should feature essential details such as the names and contact information of both the business selling the goods and the party they are working with. This section ensures that both parties can easily be identified and reached if needed.

Itemized List of Products: Clearly list each product or service involved in the transaction, including descriptions, quantities, unit prices, and the total cost for each item. This breakdown allows both parties to verify that all items are accounted for and priced correctly.

Transaction Total: The document should clearly display the overall amount due, including any applicable taxes, shipping fees, or additional charges. This gives both parties an accurate view of the final sum that must be paid.

Payment Terms: Specify the payment due date, any discounts or penalties for early or late payments, and the method of payment. This section is critical for ensuring that both parties understand the timing and conditions for payment.

Commission or Fees: If applicable, include a section that outlines any agreed-upon commissions or fees for the party handling the goods. This ensures that all financial obligations are clearly defined from the start.

Signatures and Acknowledgments: Both parties should sign the document to confirm that they agree to the terms and conditions listed. This serves as an official agreement and adds a layer of legal protection in case of disputes.

By including these key elements, the document becomes an effective tool for managing transactions and preventing errors or misunderstandings in the sales process.

Why You Need a Template

Having a pre-designed document for recording sales made on behalf of another party can significantly streamline business operations. Instead of starting from scratch each time, using a structured format ensures consistency, reduces errors, and saves valuable time. A ready-made form allows you to quickly input relevant details without worrying about layout, structure, or missing key information.

Here are a few reasons why a structured format is essential:

- Efficiency: A ready-made design reduces the amount of time spent organizing information. You can quickly enter transaction details without worrying about formatting or layout issues.

- Accuracy: By following a standard layout, you minimize the chances of forgetting important information or making mistakes when recording data. This ensures that all key details are included.

- Professionalism: Using a consistent format conveys a professional image to customers and partners. It shows that your business is organized and reliable, which helps build trust.

- Consistency: A standard document helps maintain uniformity across all transactions, making it easier to track and compare records over time.

- Legal Protection: A well-structured document ensures that all terms and conditions are clearly defined, offering legal protection in case of disputes.

By using a structured document, businesses can streamline their processes, improve accuracy, and maintain a high level of professionalism. This approach not only saves time but also enhances the overall efficiency of financial record-keeping and management.

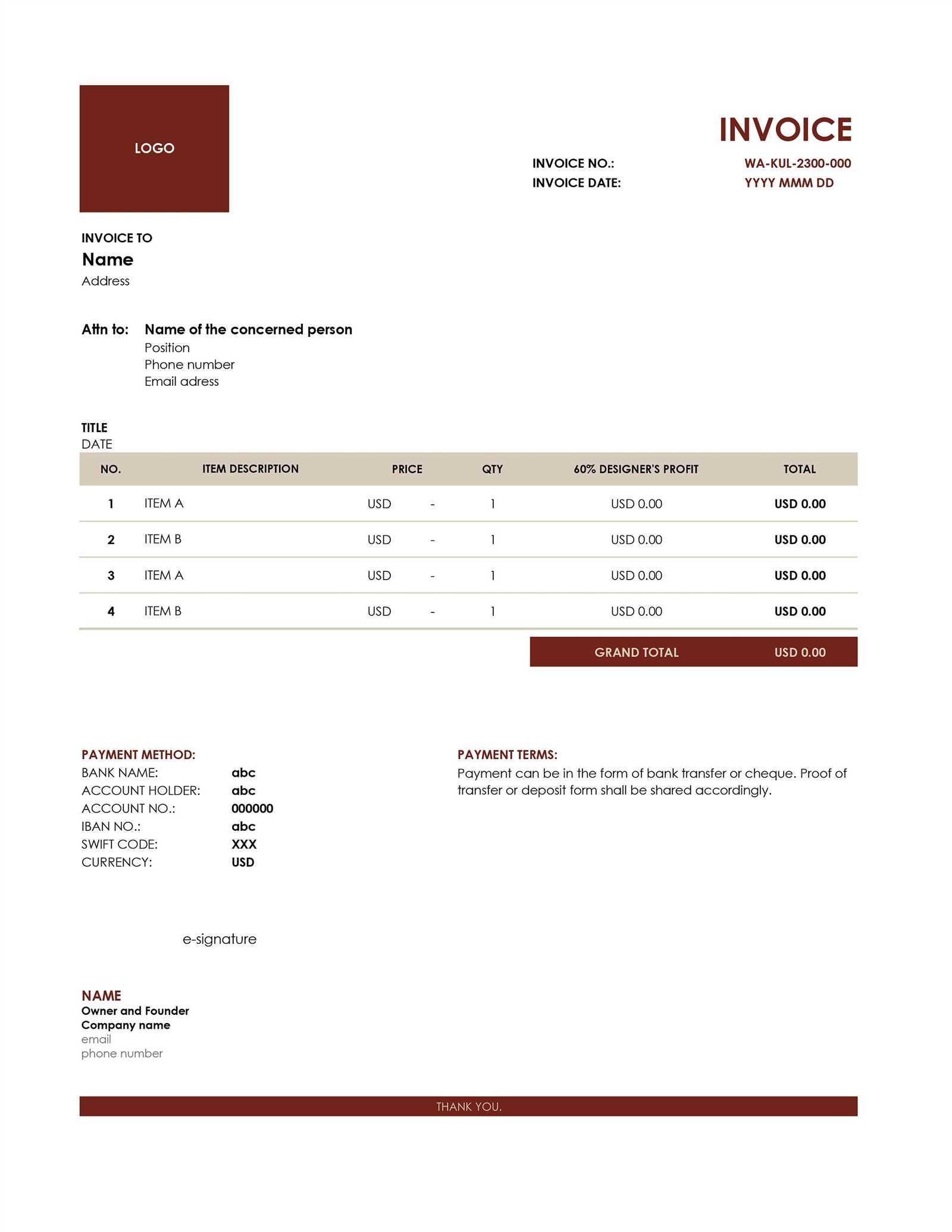

Features of a Free Template

A ready-to-use form for documenting transactions brings several useful features that can greatly benefit businesses. These pre-designed documents offer a range of customizable options, enabling you to quickly adapt them to your needs. With the right format, you can ensure that all necessary information is captured in an organized and professional manner.

Easy Customization

One of the main advantages of using such a document is the ability to personalize it to match your business’s unique requirements. You can modify sections like payment terms, product descriptions, and contact information to align with your specific transactions. Customization ensures that you can adapt the document to any situation, making it a versatile tool for ongoing business needs.

Clear and Organized Structure

These documents are designed with simplicity and clarity in mind. The layout is user-friendly, guiding you through the key elements of the transaction without unnecessary complexity. Sections for pricing, quantities, and payment details are clearly laid out, allowing both parties to review the terms quickly and easily. This helps avoid misunderstandings and ensures smooth communication.

Compatibility is another benefit. Most free options are compatible with various software programs like Microsoft Excel or Google Sheets, allowing for easy editing and sharing. You can choose between digital and printed formats, depending on how you want to manage the transaction records.

Cost-effective solutions like these are particularly beneficial for small businesses or startups, as they reduce the need for expensive software or services. The ability to access and use these forms without any upfront costs makes them an attractive choice for anyone looking to keep their operations cost-efficient.

By using a pre-designed document, you can simplify your transaction management, reduce errors, and maintain professionalism without a significant financial investment.

Where to Find Free Templates

If you’re looking for an easy and cost-effective way to manage transactions, there are several places online where you can find pre-designed documents that suit your needs. These resources offer a wide variety of options that are easy to customize and implement into your business operations, helping you save time and ensure accuracy in your records.

- Online Document Libraries: Many websites provide a range of templates that can be downloaded and customized. These platforms often have templates for various industries and transaction types, making it easy to find one that fits your needs.

- Business Software Platforms: Some business management software offers pre-built forms that can be accessed directly from their tools. These platforms typically offer free plans or trials, allowing you to use the forms without additional costs.

- Google Docs and Microsoft Office: Both Google Docs and Microsoft Office have a selection of business-related documents available in their templates section. These can be easily modified to fit your specific transaction requirements.

- Specialized Websites for Small Businesses: Many websites that cater to small businesses offer free resources, including ready-made forms. These websites may also include useful guides to help you customize and make the most of the document.

- Open-Source Platforms: Certain open-source communities provide a range of business documents that are available for free. These platforms often allow for greater customization and flexibility in terms of format and content.

By exploring these resources, you can find a wide variety of documents tailored to your business needs without spending a penny. Whether you prefer digital or printable formats, these tools make it easy to stay organized and maintain clear financial records.

Customizing Your Consignment Invoice

Personalizing your business transaction document ensures it meets your specific needs and accurately reflects the terms of the agreement. Customization allows you to include relevant information such as payment terms, product descriptions, and discounts, while also adapting the layout to your brand’s style. Tailoring the document ensures clarity and professionalism, while also simplifying the record-keeping process.

Here are some key areas you can customize:

- Business Branding: Include your company logo, name, and contact information at the top of the document to reinforce your brand’s identity.

- Product Details: Add specific descriptions for each item involved in the transaction, including serial numbers, sizes, or color options, depending on the nature of the goods.

- Payment Terms: Define the payment due date, applicable late fees, and accepted payment methods. This ensures both parties are clear about financial obligations.

- Additional Charges: If there are any shipping costs, handling fees, or taxes, these should be clearly outlined, helping to prevent misunderstandings.

- Discounts or Adjustments: Include any agreed-upon discounts or special pricing arrangements, specifying the amount or percentage and the reason for the reduction.

Once you have all the necessary information, you can format the document to enhance readability. For example, adding a table for itemized charges can help break down complex information into easily digestible sections. Below is an example of a simple layout:

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Product A | 10 | $15 | $150 |

| Product B | 5 | $25 | $125 |

| Total | $275 |

By adjusting these elements, you create a personalized document that perfectly aligns with your business model and customer expectations. Customization ensures accuracy, improves communication, and presents your company as organized and professional.

Common Mistakes in Consignment Invoices

When preparing transaction documents, errors can often occur that lead to confusion, financial discrepancies, or delays in payment. It’s important to be aware of common mistakes so you can avoid them and ensure smooth business operations. Even small mistakes can lead to serious consequences, such as missed payments, disputes, or damage to client relationships. Below are some of the most frequent errors businesses make when creating transaction records.

- Incorrect Item Descriptions: Providing unclear or incomplete descriptions of goods can lead to misunderstandings. It’s essential to list products in detail, including their specifications, quantities, and any identifying features like model numbers or serial codes.

- Omitting Payment Terms: Failing to specify clear payment terms, such as the due date, late fees, or accepted payment methods, can cause confusion and delay payments. Always ensure this section is included and well-defined.

- Math Errors: Simple calculation mistakes can result in incorrect totals or taxes, leading to overcharges or undercharges. Double-checking calculations is crucial to maintain trust and avoid financial discrepancies.

- Not Including Contact Information: Missing or incomplete contact details can make it difficult for parties to resolve any issues. Always ensure that both the seller’s and third-party’s contact information are included and up to date.

- Failure to Include a Unique Reference Number: Not including a unique identifier for each transaction can lead to confusion when referencing past transactions. A reference number allows you to track and locate specific transactions quickly.

Below is an example of how even a simple document can go wrong due to calculation errors or missing details:

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Product A | 10 | $15 | $150 |

| Product B | 5 | $20 | $100 |

| Total | $240 |

In this example, the total is incorrect because the calculation for

How to Avoid Invoice Errors

Ensuring accuracy when creating transaction documents is crucial for maintaining smooth business operations. Errors can lead to misunderstandings, delayed payments, and damage to your professional reputation. By following a few simple guidelines and adopting best practices, you can minimize the risk of mistakes and keep your records error-free.

- Double-Check Calculations: One of the most common errors is incorrect math. Always verify the calculations for item prices, quantities, taxes, and totals. Use automated tools or spreadsheets to reduce the risk of human error.

- Review Product Information: Ensure that each item listed is described clearly and accurately. Provide sufficient details such as product numbers, sizes, or colors to prevent confusion about the products being sold.

- Standardize Payment Terms: Always specify payment due dates, accepted payment methods, and any applicable late fees. This reduces ambiguity and ensures both parties are clear on financial expectations.

- Use a Consistent Format: Maintaining a uniform layout for all transaction records helps prevent missing information or forgotten details. Consistent formatting also improves readability and professionalism.

- Include All Contact Information: Make sure to include full contact details for both the seller and the recipient, including names, phone numbers, and email addresses. This will ensure that any issues can be easily addressed.

Below is an example of a well-structured document that avoids common errors:

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Product A (Model X) | 10 | $15 | $150 |

| Product B (Model Y) | 5 | $20 | $100 |

| Total | $250 |

By following these simple steps and using a structured approach, you can reduce the chances of errors and ensure that your records are accurate, transparent, and professional.

Tracking Consignment Sales with Invoices

Keeping track of sales made on behalf of another party is crucial for maintaining accurate financial records and ensuring transparency in business transactions. Using detailed documents that record the terms of each sale allows both the seller and the third-party owner of the goods to monitor performance, track payments, and maintain a clear record of transactions. These documents provide a straightforward way to ensure that everything is accounted for and that both parties meet their financial obligations.

To effectively track sales, it’s important to include all relevant details in the document. This includes the list of items sold, the agreed-upon pricing, the quantity of products sold, and the total value of each transaction. By maintaining organized records, you can easily identify which products are performing well and which are not, making it easier to make informed business decisions.

Additionally, tracking these transactions through a detailed document helps with reconciliation when it comes time for payment. You can easily calculate how much is owed, track any commissions or fees, and ensure that the correct amount is paid to the rightful party. This also helps to reduce discrepancies or misunderstandings between the seller and the third party involved.

Using this method not only ensures that all sales are accounted for but also provides a valuable reference for future business decisions, helping to optimize inventory, pricing strategies, and sales tactics.

Best Software for Invoice Creation

When it comes to creating accurate and professional transaction records, having the right software can make all the difference. The right tools not only streamline the process but also help ensure that all necessary details are included, reducing the risk of errors. Choosing software that suits your business needs can significantly improve the efficiency of managing sales, payments, and client interactions.

There are several options available for businesses of all sizes, offering a range of features from basic document generation to advanced reporting and financial management. These platforms typically allow you to create and customize transaction records, track payments, and even automate follow-up reminders for overdue payments. Below are some of the best software solutions for creating and managing these documents:

- QuickBooks: Known for its comprehensive accounting capabilities, QuickBooks offers an easy-to-use interface for creating detailed records, tracking payments, and managing client relationships. It’s perfect for small to medium-sized businesses looking for an all-in-one solution.

- FreshBooks: FreshBooks provides an intuitive platform with excellent invoicing features, including customizable templates, time tracking, and expense management. It’s ideal for freelancers and service-based businesses.

- Zoho Invoice: Zoho offers a versatile platform for creating detailed transaction documents and tracking payments. It integrates well with other Zoho tools, making it a great choice for businesses already using the Zoho ecosystem.

- Wave: A free accounting software, Wave offers an easy-to-use invoicing tool that can be used by small businesses to create professional transaction records. It’s ideal for startups looking for a no-cost solution.

- Invoice Ninja: With both free and paid plans, Invoice Ninja offers customizable forms, time tracking, and even integration with payment processors. It’s great for freelancers and small businesses looking for flexibility and functionality.

By using any of these software tools, businesses can simplify the process of creating and managing transaction records, ensuring that all sales and payments are tracked accurately, and reducing the likelihood of errors. This not only improves efficiency but also helps maintain a professional and organized approach to financial management.

Printable vs. Digital Consignment Invoices

When it comes to managing business transactions, one key decision is whether to use paper-based or electronic documents. Both options have their advantages and drawbacks, and the choice often depends on the nature of your business, client preferences, and organizational needs. Understanding the benefits and limitations of both methods can help you choose the best approach for your operations.

Printable documents are physical copies that can be handed over to clients or filed for reference. These are often preferred by businesses that have in-person interactions with customers or those that deal with clients who require paper documentation for their records. However, using printed records can lead to higher operational costs for paper, ink, and storage space. Moreover, managing paper-based documents can become cumbersome, especially when it comes to keeping track of large volumes of paperwork.

Digital documents, on the other hand, are stored electronically and can be easily shared via email or cloud storage. They are ideal for businesses aiming to streamline their operations and reduce costs associated with physical documentation. Digital formats also provide better accessibility, allowing business owners and clients to access records from anywhere. The ability to automate and integrate these documents with other financial tools is another major advantage, providing better organization and quicker transaction processing. However, digital records require a secure system to ensure confidentiality and protect against data loss or unauthorized access.

Both options are effective in their own right, but choosing the right one depends on the specific needs of your business and the preferences of your clients. Whether you prioritize convenience, cost-saving, or environmental considerations, both printable and digital documents can serve as reliable tools for managing your sales and transactions.

Legal Considerations for Consignment Invoices

When managing transactions between parties, especially in cases where goods are sold on behalf of another, it is important to understand the legal aspects of the documentation involved. These records not only serve as proof of the transaction but also establish the rights and obligations of each party. Ensuring that your documents comply with legal requirements helps to protect your business from disputes and liabilities, and ensures smooth transactions.

Key Legal Elements to Include

- Clear Payment Terms: It’s crucial to specify the payment schedule, including the amount owed, when payment is due, and any penalties for late payments. This helps avoid misunderstandings and legal disputes.

- Ownership Clauses: Clearly outline the ownership of the goods. In many cases, the goods may remain the property of the original owner until they are sold, and this should be explicitly mentioned in the document.

- Taxes and Fees: Properly accounting for taxes, such as sales tax or VAT, and any additional charges or fees is essential to avoid legal issues with tax authorities.

- Dispute Resolution: Include terms for resolving potential disputes. This may involve specifying jurisdiction or the method of resolution, such as arbitration or mediation, to streamline conflict resolution.

- Confidentiality and Data Protection: With electronic transactions, businesses must adhere to laws regarding data protection, ensuring that sensitive client and transaction data is securely stored and handled.

Compliance with Local Laws

- Consumer Protection Laws: Different jurisdictions may have specific consumer protection regulations that govern sales agreements, even for goods sold on behalf of another party. Understanding these laws ensures that your documentation complies with local legal standards.

- Record-Keeping Requirements: Depending on your location, you may be legally required to keep transaction records for a specified number of years. Familiarize yourself with the record retention laws in your jurisdiction.

- Contractual Obligations: Always ensure that the terms agreed upon by both parties are clearly stated and legally enforceable. This protects both parties and ensures there are no misunderstandings about the terms of the agreement.

By adhering to these legal guidelines, you can create well-structured and legally compliant documents that safeguard your business interests and maintain strong relationships with your partners and clients. Understanding and addressing legal considerations can also reduce the risk of costly disputes and enhance the credibility of your business.

Tips for Managing Consignment Records

Efficiently managing records for transactions involving goods on behalf of another party is crucial for maintaining smooth business operations. Accurate record-keeping ensures that all sales, payments, and product movements are tracked properly, helping to prevent disputes and financial discrepancies. Here are some practical tips for managing these records effectively, from organization to tracking and reporting.

1. Organize Your Records

Proper organization is key to managing transactions efficiently. Make sure to separate records based on their status (e.g., sold, unsold, returned, or in-transit). Using a consistent naming convention and categorizing transactions into clear groups can help keep track of each product and its status in real time.

2. Track Sales and Payments Regularly

Regularly updating your records after each sale ensures accuracy and minimizes the chances of errors. When a sale is made, immediately record the details, such as the item sold, quantity, sale price, and payment status. This practice will help keep financial reports up-to-date and make the payment process smoother.

3. Use Software for Better Tracking

Using dedicated software for managing records is an excellent way to streamline the process. Many software tools are designed to track product sales, commissions, and payments in real-time. These tools often include features for automated reports, payment reminders, and even integration with accounting software, making the process faster and more efficient.

4. Regularly Reconcile Your Records

Performing regular reconciliations between sales records and payment reports will help ensure that everything is aligned. This is especially important when dealing with multiple third-party agreements, as it ensures that payments are properly accounted for, and discrepancies can be addressed quickly.

5. Keep Detailed Descriptions

Each record should include clear and detailed descriptions of the goods or services involved. This includes the product’s name, model, quantity, and sale price. It’s essential for tracking purposes, and will also help resolve any issues that may arise regarding specific items sold on behalf of another party.

6. Prepare for Audits

Proper record-keeping is not only essential for daily operations but also for legal and financial audits. Maintain clear, accurate, and organized records that can be easily accessed for review when necessary. A good system can save time and reduce stress during audit periods.

Example of a Well-Managed Record

| Product Name | Quantity | Sale Price | Payment Status | Commission |

|---|---|---|---|---|

| Item A | 10 | $200 | Paid | $20 |

| Item B | 5 | $150 | Pending | $15 |

| Item C | 3 | $120 | Paid | $12 |

By implementing these tips and maintaining a solid record-keeping system, you can ensure transparency, reduce errors, and improve the efficiency of your business operations. Whether you are working with a few items or managing a large inventory, proper record management is essential for long-term success.

How Consignment Invoices Improve Cash Flow

Managing cash flow is one of the most important aspects of running a successful business. Effective financial management ensures that you have the liquidity to cover operational costs, pay vendors, and invest in growth. Properly tracking transactions, especially in cases where goods are sold on behalf of another party, plays a key role in maintaining a healthy cash flow. By clearly documenting each transaction and the agreed-upon terms, you can avoid delays and improve the efficiency of payment collection.

One of the main ways detailed documents help improve cash flow is by providing clarity on payment terms and expectations. When all transaction details are outlined–from the sale price to the commission structure–both the seller and the third party can more easily understand when and how payments are to be made. This transparency reduces the risk of delayed or missed payments, ensuring that cash flow remains steady and predictable.

Furthermore, these records allow businesses to track outstanding payments and identify issues early on. Automated reminders and clear payment terms make it easier to manage outstanding balances, which can lead to quicker payment collection. The ability to track these transactions in real-time helps prevent bottlenecks and ensures that any cash flow issues are addressed immediately.

Benefits of Using Detailed Transaction Records for Cash Flow Management

- Improved Payment Tracking: Clear documentation allows businesses to monitor payments, reducing the chance of forgetting or overlooking a transaction.

- Faster Collections: Well-defined terms make it easier for both parties to understand when and how payments should be made, leading to quicker collections and improved liquidity.

- Reduced Disputes: Clear records help prevent misunderstandings between businesses and their partners, reducing the chances of payment delays caused by disputes.

- Better Financial Planning: When transactions are properly documented, businesses can predict cash flow more accurately, making it easier to plan for upcoming expenses.

Example of Payment Tracking in Action

| Transaction Date | Product Sold | Sale Amount | Payment Due Date | Payment Status |

|---|---|---|---|---|

| 01/05/2024 | Item X | $300 | 01/20/2024 | Paid |

| 01/10/2024 | Item Y | $150 | 01/25/2024 | Pending |

| 01/15/2024 | Item |