Complete Invoice Checklist Template for Accurate Billing

Managing financial transactions with precision is essential for any business. To ensure smooth operations, it’s crucial to have a reliable system that helps track every detail. This section explores how organizing the necessary components can greatly improve the accuracy and efficiency of your billing procedures.

By following a well-structured approach, you can avoid common errors that lead to delays and confusion. The right tools will help you maintain consistency and ensure all necessary elements are included in each document, thus promoting timely payments and smooth business operations.

Whether you’re handling payments manually or with digital solutions, having a framework that can be easily customized to fit various needs can save valuable time and reduce the risk of mistakes. Proper preparation of your financial documents is a key step toward better financial management.

Invoice Checklist Template Guide

Organizing financial documents efficiently is essential for maintaining smooth business operations. A systematic approach helps ensure that every necessary component is included, avoiding errors and delays in the payment process. This section will guide you through how to structure a useful framework that simplifies this task, making it easier to keep track of all essential details.

Essential Elements for Proper Organization

Key components are crucial for ensuring completeness and accuracy. These include clear payment terms, correct contact information, and accurate billing details. A solid structure makes it easier to manage these elements and reduces the chances of overlooking important data.

Benefits of a Well-Structured Approach

Streamlining the documentation process can save significant time, improve financial record-keeping, and prevent unnecessary confusion. A clear outline of all required items ensures that each document is accurate and consistent, which is essential for maintaining a positive relationship with clients and partners.

Why Use an Invoice Checklist

Having a clear, organized system for managing billing details is essential to ensuring accuracy and efficiency in any business. A well-structured guide for creating these documents helps to streamline the entire process and minimize the chances of missing important information. This practice ensures that every step is followed, reducing errors and improving the overall flow of financial transactions.

By using a structured framework, businesses can benefit in several key ways:

| Benefit | Description |

|---|---|

| Consistency | A uniform process reduces the risk of missing critical details or making mistakes. |

| Time-Saving | Having a standard approach speeds up the process, allowing for quicker document preparation. |

| Accuracy | Ensures all necessary elements are included, reducing the likelihood of disputes or delays. |

| Professionalism | Maintaining a structured approach reflects well on the business, helping to build trust with clients. |

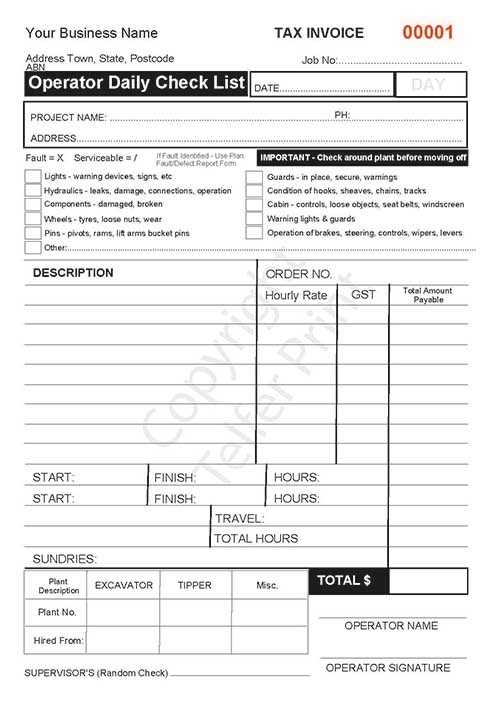

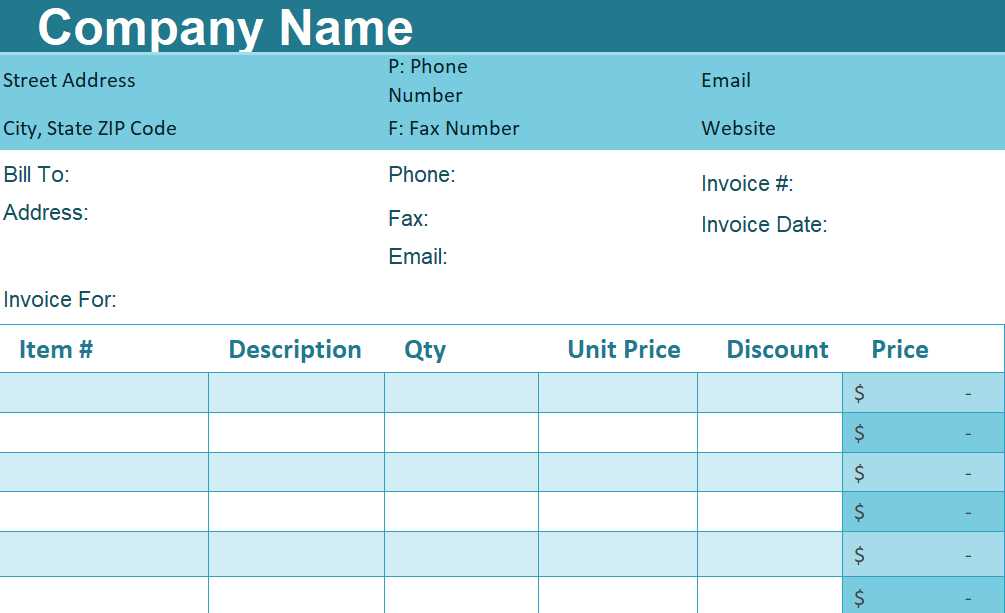

Key Elements of an Invoice

When preparing a financial document, it’s important to include all necessary components to ensure clarity and completeness. These elements serve as the foundation for a successful transaction, ensuring both parties have a clear understanding of the terms and expectations. A well-detailed document facilitates smooth communication and reduces the chances of confusion or disputes.

Essential Information for Accurate Documentation

To avoid errors and ensure that everything is accounted for, certain details must be included in every document. Each of these elements plays a critical role in maintaining the professionalism and efficiency of the billing process.

| Component | Description |

|---|---|

| Contact Information | Ensure both parties’ details are clearly listed, including names, addresses, and phone numbers. |

| Service or Product Description | Provide a detailed list of services or products provided, including quantities and prices. |

| Payment Terms | Specify the agreed-upon payment conditions, such as due dates, late fees, or discounts. |

| Unique Identifier | A reference number or code for easy tracking and management of the transaction. |

How to Organize Your Checklist

Having a structured approach to managing billing documents can significantly improve efficiency and reduce errors. By organizing each step and detail in a systematic way, you ensure that nothing is overlooked and that every necessary component is addressed in a timely manner. Proper organization helps streamline the entire process, making it quicker and more reliable.

To effectively manage your process, follow these steps:

- Prioritize Key Components: Begin by listing the most important details, such as payment terms and service descriptions. This ensures the core aspects are addressed first.

- Use a Consistent Format: Maintain a uniform format for every document. This will help reduce confusion and make it easier to compare and track information over time.

- Break Down the Process: Organize tasks into smaller steps. For example, first gather all client details, then review the items or services provided, and lastly finalize payment terms.

- Review and Update Regularly: Keep your organization method flexible by reviewing it periodically. This ensures that any changes to your business operations or regulations are incorporated.

Creating Custom Invoice Templates

Designing personalized financial documents allows you to tailor them to your specific business needs and client preferences. A custom approach helps ensure that all necessary elements are included and that the final document aligns with your brand’s style and requirements. By creating documents from scratch or adapting existing models, you gain greater control over the content and presentation.

Follow these steps to create your own customized documents:

- Determine the Essential Components: Identify which elements must always be present, such as client information, payment terms, and descriptions of goods or services.

- Choose a Layout That Works for You: Decide whether you prefer a minimalist design, one with more detailed sections, or something with a bold and professional appearance.

- Incorporate Your Branding: Add your logo, color scheme, and other brand elements to create a professional and recognizable appearance.

- Consider Client Preferences: Think about how your clients receive and process documents. Some may prefer clear and simple layouts, while others might need more detailed sections.

Once the structure and design are finalized, regularly update your custom documents to reflect any changes in your business practices, industry regulations, or client requests.

Essential Steps for Accurate Invoices

Ensuring that every document is correct and complete is vital for maintaining smooth financial transactions. By following a structured approach and paying attention to each detail, you can avoid errors that lead to delays or misunderstandings. This process ensures that both parties are on the same page and that payments are processed without complications.

Follow these essential steps to guarantee accuracy:

- Verify Client Information: Double-check the recipient’s name, address, and contact details to ensure they are up to date and correct.

- Include Clear Descriptions: Provide a detailed and accurate description of the goods or services provided, including quantities, unit prices, and any applicable taxes.

- Specify Payment Terms: Clearly state the payment due date, methods of payment accepted, and any late fees or discounts for early payment.

- Assign Unique Identifiers: Include a reference number or code to make tracking and managing documents easier.

- Check for Accuracy: Before finalizing, carefully review all details to make sure there are no typos, miscalculations, or omissions.

By following these steps with attention to detail, you ensure that your financial documents are professional, clear, and free of errors, leading to smoother transactions and faster payments.

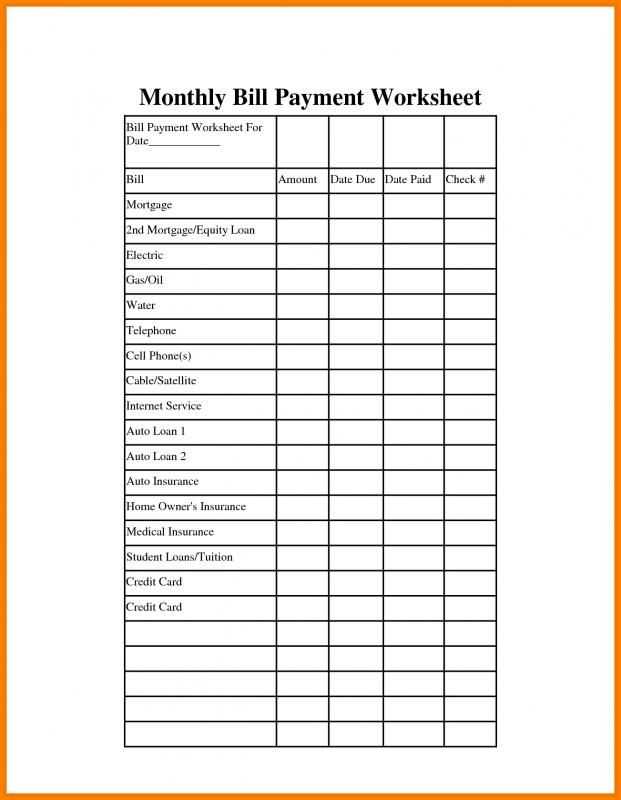

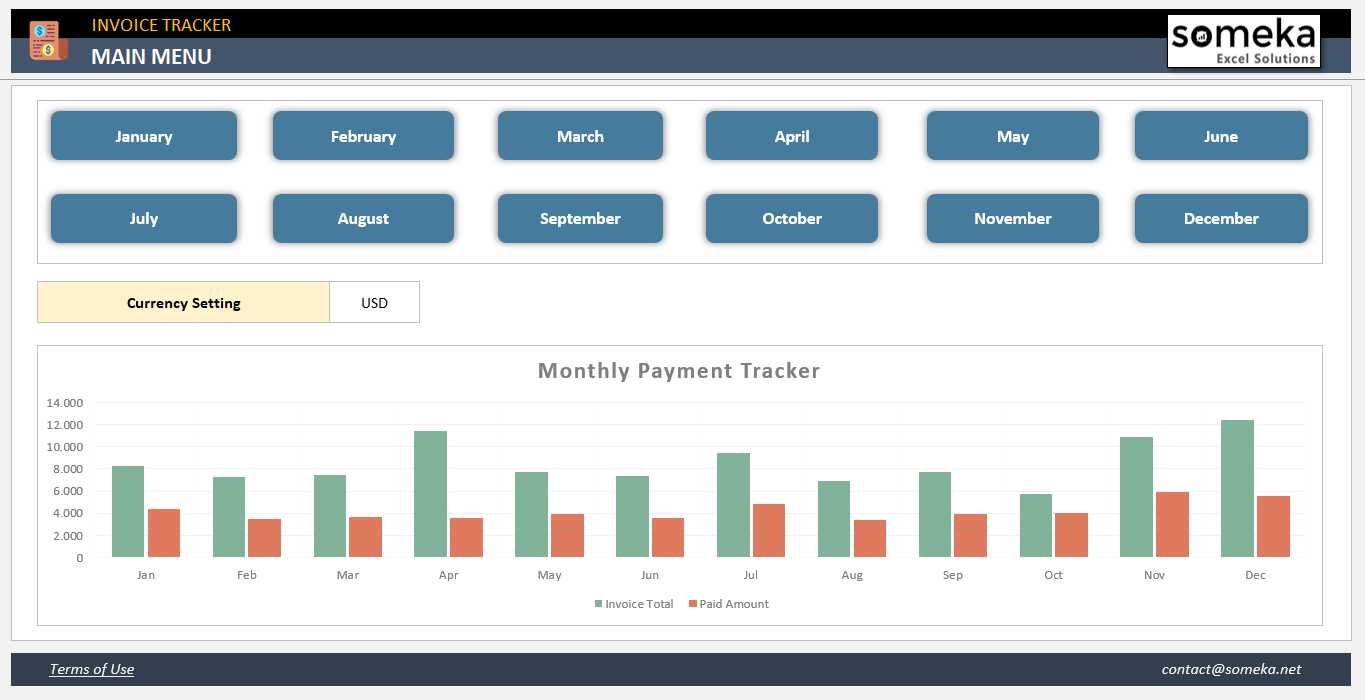

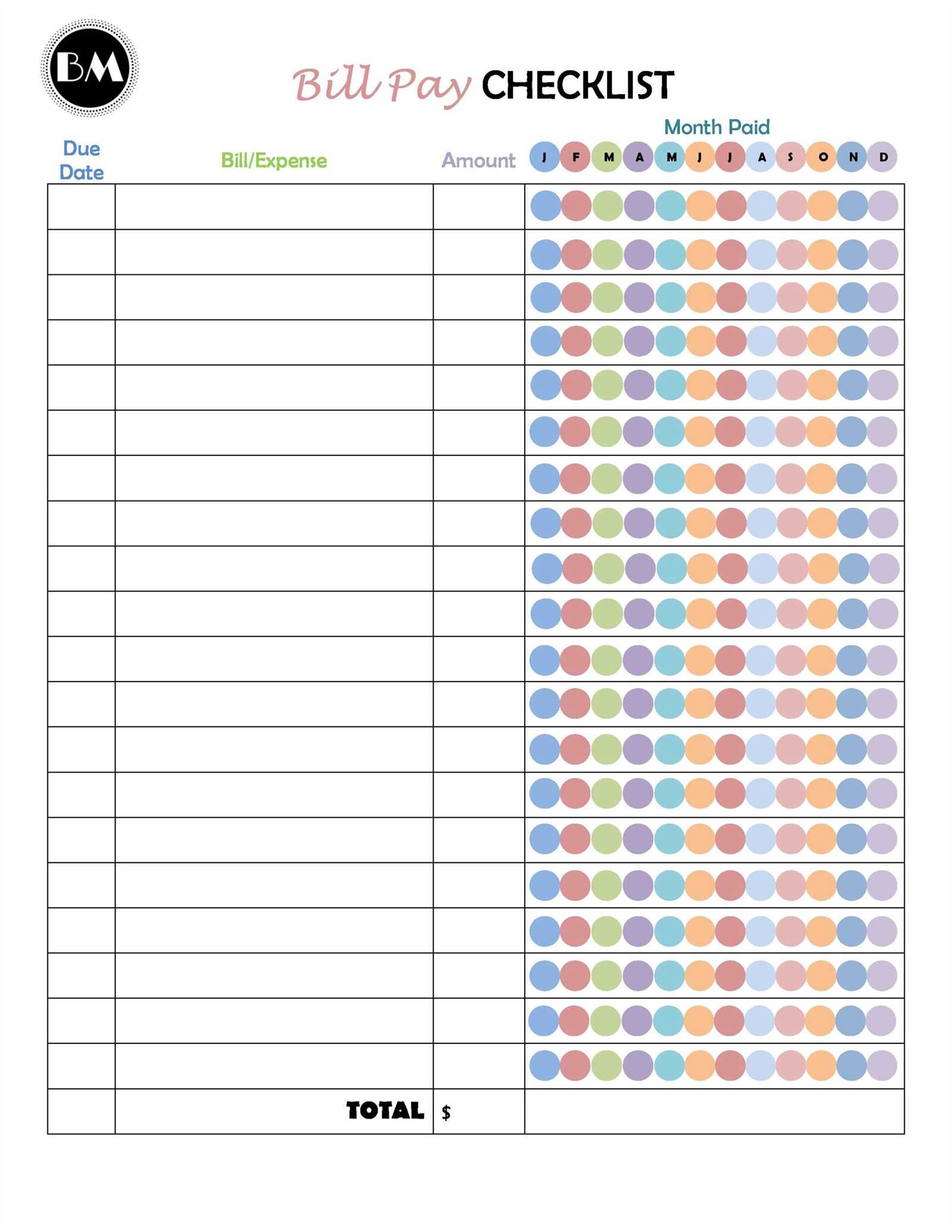

Tracking Payments with Checklists

Monitoring and recording payments effectively is a crucial part of managing finances. Having a system to track transactions ensures that no payment is overlooked, and helps to maintain clear financial records. A well-organized method allows businesses to stay on top of outstanding balances, identify overdue payments, and keep the cash flow steady.

To track payments effectively, consider the following steps:

- Record Payment Dates: Keep a detailed record of when payments are received and when they are due. This helps in managing deadlines and avoiding missed payments.

- Monitor Outstanding Balances: Create a system that allows you to track which payments are pending and follow up accordingly.

- Use Clear Payment Status Indicators: Mark whether payments are completed, pending, or overdue. This provides a clear visual representation of your financial status.

- Track Partial Payments: If a payment is made in installments, make sure to update records regularly to reflect the remaining balance.

- Review and Reconcile Regularly: Ensure that all records are updated and accurate by reconciling your tracking system with your bank or payment processor’s records.

By organizing payment tracking in this way, you can ensure that your financial operations run smoothly and payments are processed on time, reducing the risk of disputes or delays.

Common Mistakes to Avoid in Invoices

Errors in financial documents can lead to confusion, delayed payments, and even damaged client relationships. It’s crucial to avoid common mistakes that can compromise the clarity and accuracy of your documents. By being mindful of these errors, you ensure that your business maintains a professional image and avoids unnecessary complications.

Here are some common mistakes to watch out for:

| Mistake | Impact |

|---|---|

| Incorrect or Missing Contact Information | Leads to confusion and delays in communication or payments. |

| Unclear Descriptions of Products or Services | Can cause misunderstandings or disputes over what was provided. |

| Wrong Payment Terms | Leads to confusion about due dates, payment methods, and penalties. |

| Failure to Include a Unique Identifier | Makes it difficult to track and reference specific transactions. |

| Omitting Taxes or Fees | Can result in undercharging or legal issues with tax authorities. |

By being aware of these common mistakes and addressing them proactively, you can maintain smooth financial operations and ensure that your documents reflect professionalism and accuracy.

How to Handle Late Payments

Late payments can disrupt cash flow and create unnecessary tension between businesses and clients. Handling these situations effectively is crucial to maintaining good relationships while ensuring timely compensation for services or products provided. By having a clear strategy in place, you can address overdue payments diplomatically and efficiently.

Here are key strategies for managing late payments:

| Action | Outcome |

|---|---|

| Send a Polite Reminder | Gentle follow-ups help remind clients of the outstanding balance without escalating the situation. |

| Offer Flexible Payment Options | Provide clients with different payment methods or installment plans to make the process easier. |

| Implement Late Fees | A clear fee for overdue payments encourages clients to pay on time and ensures you’re compensated for the delay. |

| Review Terms and Agreements | Ensure that payment terms are clearly defined upfront and revisit them if necessary for future transactions. |

| Seek Legal Action if Necessary | If payments remain unpaid despite multiple attempts, consider legal action to recover the owed funds. |

By taking proactive steps to manage late payments, you can mitigate the impact on your business and maintain positive, professional relationships with your clients.

Choosing the Right Format for Your Checklist

When organizing tasks or information related to financial documents, selecting an appropriate structure is essential for clarity and ease of use. The format you choose should be aligned with the complexity of the items you are managing and should ensure that important details are not overlooked. Whether you prefer a simple list or a more detailed approach, the format can greatly influence the efficiency of your workflow.

Consider the following factors when selecting the right structure for your needs:

- Simplicity: If the task list is short and straightforward, a basic linear format may be sufficient for easy reference.

- Level of Detail: For more complex documents, a segmented format with clear categories can help separate different sections and make information easier to find.

- Ease of Access: Think about how you plan to access the list–whether it’s through a digital tool, spreadsheet, or a printed document–and ensure the format supports quick retrieval.

- Flexibility: Choose a layout that allows room for adjustments as tasks or details change over time.

Digital or Physical Format

- Digital Tools: Using software like spreadsheets or specialized apps can offer advanced features such as sorting, reminders, and easy sharing.

- Physical Documents: Printed lists might be more accessible for some users, especially when working offline or in a non-digital environment.

Customizable Features

- Interactive Fields: Consider using a format with checkboxes or editable fields to make marking completed items more efficient.

- Predefined Sections: If certain categories are always required, using a format that includes predefined sections for each task can save time and ensure consistency.

Choosing the right structure not only enhances efficiency but also ensures that your system remains flexible and easy to use, allowing for smoother financial operations.

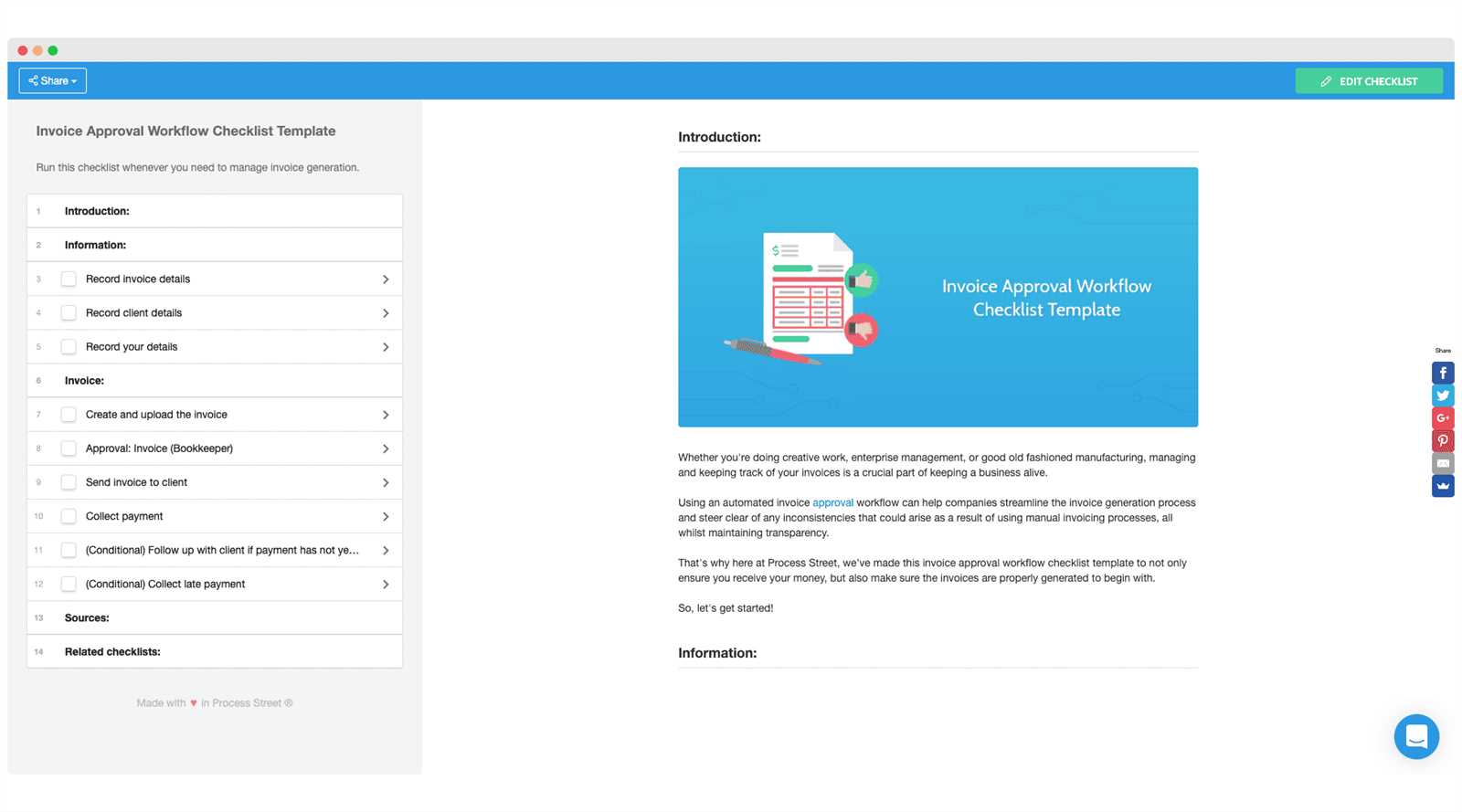

Integrating Digital Tools with Invoices

Incorporating digital solutions into financial management can streamline operations and reduce manual errors. Modern tools and software allow businesses to automate key processes, improving accuracy and efficiency when handling transactions. Integrating these tools can help simplify record-keeping, track payments, and ensure compliance, all while saving time.

Here are some ways digital tools can enhance your financial workflows:

Automating Document Creation

By utilizing specialized software, businesses can automatically generate accurate financial records based on predefined templates and customer data. This eliminates the need for manual entry, reducing the likelihood of mistakes.

Tracking Payments and Status

Digital tools can help you monitor when payments are received, overdue, or pending. With real-time tracking, you can easily follow up on outstanding balances and keep an updated record without manually searching through files.

- Cloud-Based Storage: Keep all documents accessible in one centralized, secure location that can be shared across teams and accessed remotely.

- Integrated Payment Systems: Enable clients to pay directly through integrated digital platforms, simplifying the payment process for both parties.

By integrating digital tools, you not only increase efficiency but also gain valuable insights into your financial data, making it easier to manage your business’s finances effectively.

How to Review Your Checklist

Regularly reviewing your task list ensures that nothing is overlooked and that all required actions are completed. A thorough review process helps identify any missing details or discrepancies, allowing you to correct them before moving forward. It’s essential to approach the review methodically, checking each item against the set criteria to maintain consistency and accuracy.

Step-by-Step Verification

Start by verifying each entry against the relevant documentation or guidelines. Make sure every task is properly addressed and no essential components are skipped. This ensures that all necessary details are included and that the process is on track.

Cross-Check for Accuracy

After the initial verification, cross-check all numbers, dates, and other data points for accuracy. A simple mistake can lead to delays or confusion, so this step is critical. Also, review for clarity in any descriptions or instructions to make sure everything is easy to understand.

By following a structured review process, you can avoid errors and ensure that your tasks are completed efficiently and correctly.

Legal Requirements for Invoices

In any financial transaction, it’s essential to ensure that all necessary documentation complies with legal standards. Certain details must be included to guarantee that the record meets regulatory requirements and can be used for audits or legal purposes. Adhering to these requirements not only ensures transparency but also protects both parties involved in the transaction.

Common legal requirements for financial documents include the following:

- Clear Identification: The document must contain identifiable information about both the business and the customer, including names, addresses, and contact details.

- Transaction Date: The date when the transaction was made must be clearly stated to comply with tax regulations and deadlines.

- Description of Goods or Services: A detailed breakdown of what was provided, including quantities, unit prices, and total amounts, is required for full transparency.

- Unique Identification Number: A sequential number helps identify the record uniquely, making it easier to track and reference.

- Tax Information: The applicable tax rates and amounts must be included, along with the overall tax amount due.

- Payment Terms: Clearly stating the payment deadline and any applicable late fees ensures that both parties understand the terms of the transaction.

By ensuring compliance with these legal requirements, businesses can avoid penalties and facilitate smoother financial operations.

Best Practices for Invoice Templates

Creating well-structured and professional documents is key to ensuring smooth financial transactions. A clear, organized layout not only facilitates timely payments but also helps to prevent confusion or disputes. By following best practices, businesses can ensure that their records are both effective and compliant with standards.

Key Elements for a Professional Layout

A good document should include all essential details in a clear and concise manner. The layout should be visually appealing, easy to read, and logically structured. Here are some best practices to follow:

- Consistent Formatting: Use consistent fonts, spacing, and headings for better readability. This helps create a clean and organized appearance.

- Use of Clear Headings: Organize the document with bold and clear headings for different sections, such as “Description of Goods”, “Payment Terms”, and “Total Due”.

- Simple and Professional Design: Avoid clutter. Use minimal colors and graphics, focusing on a clean, professional design that emphasizes important details.

- Proper Alignment: Ensure all columns are aligned properly, especially for numerical data like amounts, tax rates, and totals. This makes the document easier to follow.

Organizing Essential Information

It’s important to include all required elements in an easily accessible format. Essential details should be prominently placed to ensure they are not overlooked. Here’s a checklist of key sections to consider:

- Contact Details: Both your business and the customer’s contact information should be clear and visible.

- Unique Reference Number: Assign a unique identifier to each document for easy tracking.

- Payment Instructions: Provide clear payment instructions, including the methods of payment accepted, and relevant payment deadlines.

- Tax Information: Include accurate tax rates, if applicable, along with a breakdown of the total cost, including taxes.

By following these best practices, you can create documents that enhance professionalism and streamline your business operations, ensuring a smooth process for both you and your clients.

Customizing Templates for Different Clients

Adapting documentation to suit the specific needs of each client helps build stronger business relationships and enhances clarity. Customizing these records ensures that the details are relevant and aligned with the preferences and requirements of the client, creating a more personalized and professional experience. Whether it’s a small business or a large corporation, tailoring each document adds value and helps in maintaining smooth financial interactions.

Key Benefits of Personalizing Financial Documents

- Clear Communication: By aligning the format with the client’s preferences, you reduce the risk of confusion and misunderstandings, ensuring that all terms are clearly presented.

- Professional Appearance: Customization shows that you’re attentive to detail and committed to providing a professional service, which can enhance your credibility and strengthen client trust.

- Client-Specific Details: Including relevant information like project names, reference numbers, or agreed terms tailored to the client’s business helps improve the relevance and clarity of the document.

How to Tailor Financial Documents for Each Client

- Adjust the Layout: Depending on the client’s preferences, you may opt for a more formal or simplified design. Some clients may prefer detailed breakdowns, while others may require concise summaries.

- Include Client-Specific Terms: Customize payment terms, discounts, or additional charges based on the specific agreement made with the client.

- Branding Considerations: Incorporate your client’s branding guidelines, such as logo, color scheme, and fonts, if necessary. This creates a more personalized connection and aligns with their branding.

By customizing your financial documents, you not only improve your service but also foster positive long-term relationships with your clients, showing that you value their unique needs.

How to Update Your Checklist Regularly

Maintaining an up-to-date system for managing documentation is crucial for staying organized and ensuring accuracy. Regular updates to your tracking system help to ensure that all necessary details are captured and reflect the latest agreements or changes in the process. By revising your records frequently, you avoid overlooking essential information, which can improve overall efficiency and minimize errors.

Why Regular Updates Are Essential

- Stay Current: Changes in pricing, terms, or services may occur, and keeping your documentation updated helps you remain aligned with any modifications.

- Improve Accuracy: Outdated records can lead to mistakes or confusion, especially when working with new projects or clients. Regular updates reduce this risk.

- Adapt to Client Preferences: Over time, clients may request adjustments or changes in how documentation is structured or presented. Updating your system ensures that these requests are consistently met.

How to Effectively Update Your System

- Review at Regular Intervals: Set a schedule to review and update your system. This could be monthly, quarterly, or based on the frequency of changes in your operations.

- Incorporate Feedback: After each use, collect feedback from clients or team members on what worked well and what could be improved. This allows for continuous improvement.

- Adjust for New Legal or Financial Changes: Make sure that your documents reflect any updates in legal or financial regulations that may impact the way you do business.

Regular updates ensure that your tracking system remains relevant, efficient, and aligned with current practices, which leads to better management and smoother operations.

Tips for Streamlining Billing Procedures

Efficient management of payment processes is essential for any business. Streamlining these procedures not only saves time but also reduces the risk of errors and enhances overall cash flow. By implementing clear systems and making use of the right tools, you can simplify the process and ensure that all parties involved are on the same page.

Key Strategies to Improve Billing Efficiency

- Automate Where Possible: Automating repetitive tasks, such as payment reminders or document creation, can save valuable time and reduce manual errors.

- Centralize Billing Information: Keeping all client information in one place ensures that data is easily accessible and reduces the chances of mistakes or missing details.

- Standardize Payment Terms: Clear, standardized payment terms set expectations for both you and your clients, helping to avoid confusion or delays.

- Offer Multiple Payment Options: Providing customers with different ways to pay–such as online payments, credit cards, or bank transfers–makes the process more convenient and faster.

Setting Up a Streamlined Billing System

To ensure that your billing procedures are efficient, consider the following steps:

| Step | Action | Benefit |

|---|---|---|

| Step 1 | Digitize Your Records | Easy access and reduced paperwork. |

| Step 2 | Implement an Automated Reminder System | Ensures timely payments and reduces follow-up efforts. |

| Step 3 | Maintain Clear Communication | Reduces misunderstandings and payment delays. |

By focusing on these strategies, you can create a streamlined billing process that reduces administrative burdens and improves your overall business efficiency.

How to Ensure Timely Payments

Receiving payments promptly is crucial for maintaining healthy cash flow and ensuring the smooth operation of your business. To achieve this, it is essential to establish a reliable and effective payment process that encourages clients to settle their dues without delays. By setting clear expectations and maintaining open communication, you can minimize payment delays and improve your financial management.

Effective Strategies for Timely Payments

1. Set Clear Payment Terms: Clearly communicate your payment terms to clients upfront. Specify due dates, acceptable payment methods, and any late fees associated with overdue payments. This reduces confusion and sets expectations from the beginning.

2. Offer Multiple Payment Options: Providing clients with various payment methods–such as bank transfers, credit cards, or online payment platforms–makes it easier for them to pay on time. The more convenient the process, the more likely they are to comply.

Communication and Follow-Up Techniques

3. Send Timely Reminders: Use automated systems or manual reminders to notify clients of upcoming payment deadlines. This ensures they are aware of their obligations and helps prevent missed payments.

4. Offer Discounts for Early Payments: Providing small incentives, such as discounts for early payments, can encourage clients to pay sooner, improving your cash flow and reducing the likelihood of delays.

By incorporating these strategies, you can improve your chances of receiving payments on time and build stronger relationships with your clients based on mutual trust and clarity.