Free Blank Invoice Template for Excel Download

Managing financial transactions efficiently is crucial for any business. Whether you’re a freelancer or a small business owner, having the right tools to create accurate and professional billing documents can save time and reduce errors. Using customizable documents designed to suit your specific needs can streamline the entire process and ensure consistency in every transaction.

With the right tools, generating well-organized billing sheets becomes a quick and easy task. By choosing editable formats, you gain flexibility, allowing you to make adjustments as needed. This approach not only saves you time but also ensures that you’re presenting a polished image to clients.

There are a variety of options available for those looking to simplify their accounting procedures. Accessing customizable formats online can help you stay organized while minimizing the effort needed to generate each document. This approach allows you to focus more on growing your business while handling financial tasks efficiently.

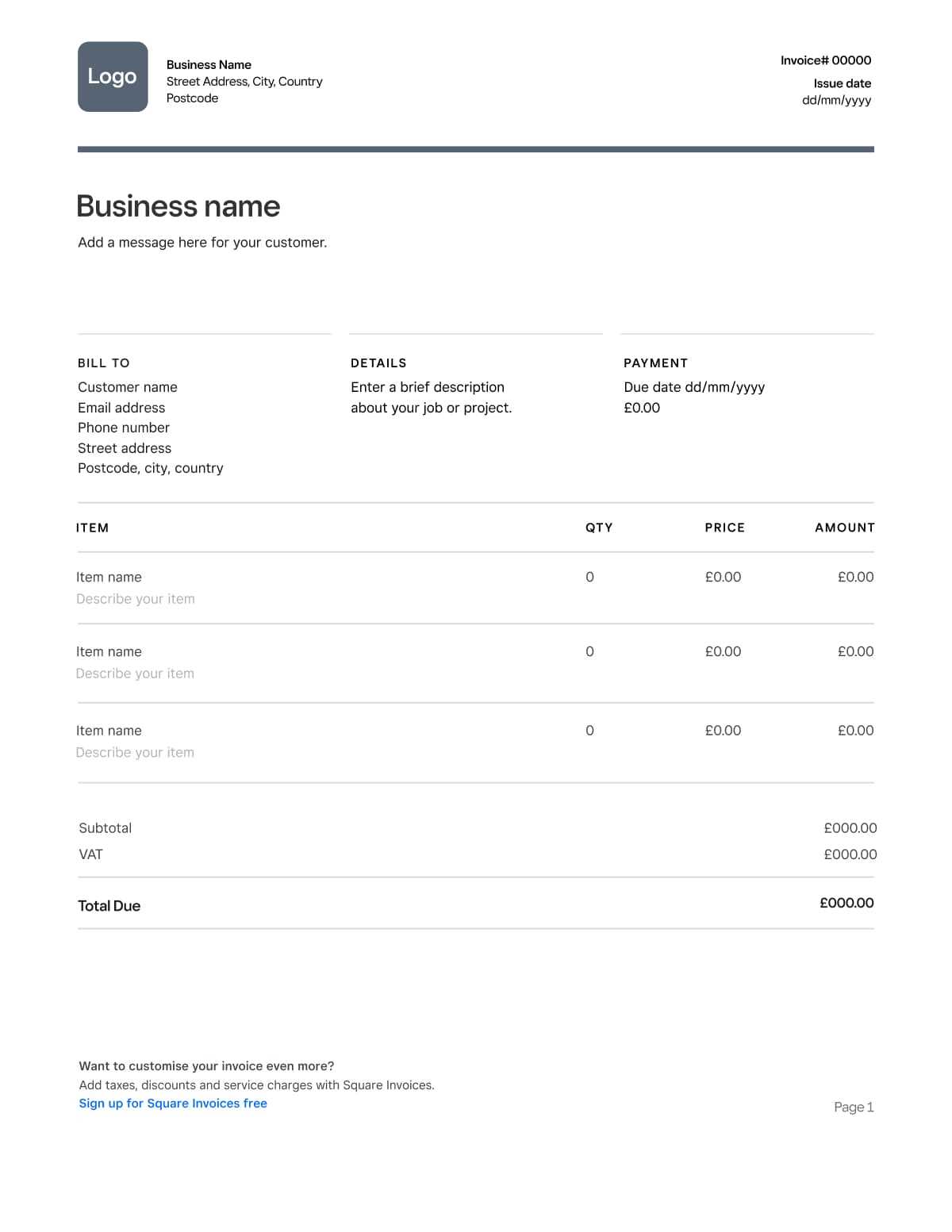

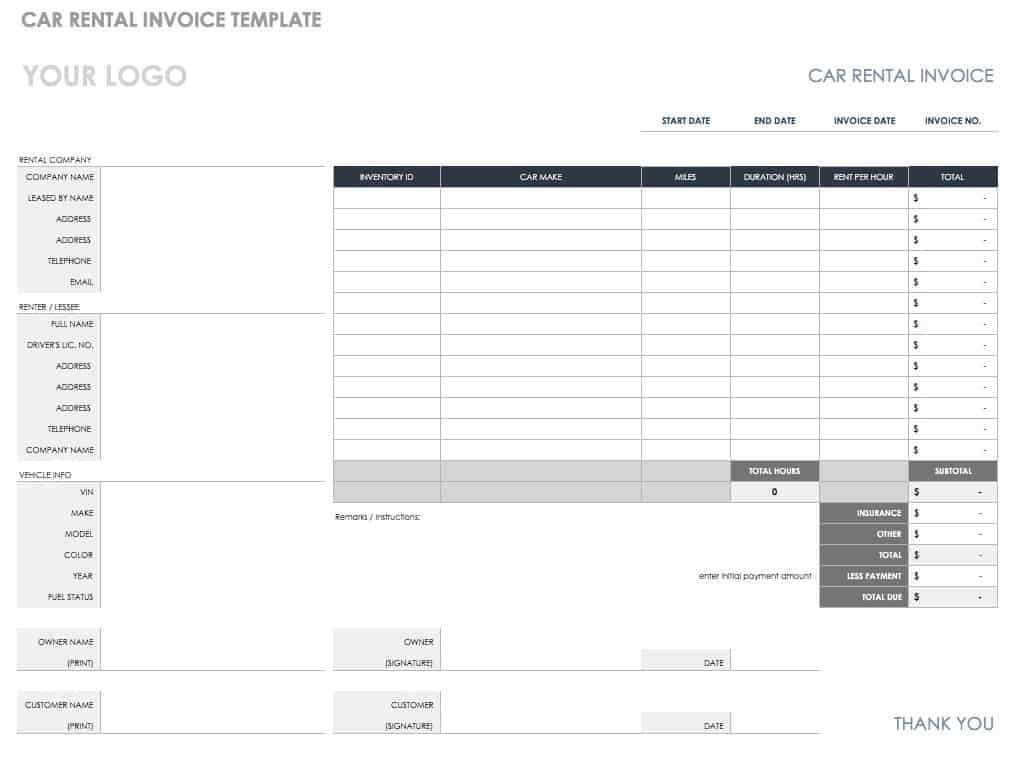

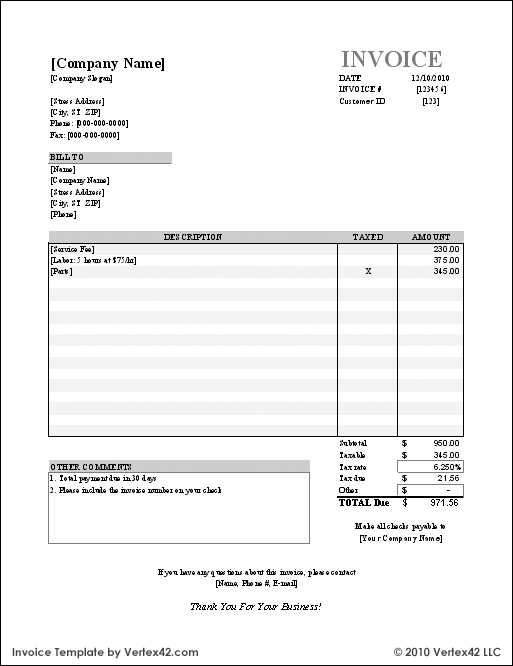

Free Excel Invoice Templates for Download

For businesses looking to streamline their billing processes, accessing ready-made documents can make a significant difference. These ready-to-use files allow for quick customization and efficient completion of essential tasks. By downloading these resources, you save both time and effort while ensuring accuracy and professionalism in your financial dealings.

Many platforms offer downloadable resources that are both simple to use and customizable to fit various business needs. These resources help to standardize the process, making it easier for you to manage multiple clients and transactions. The key is to find the right format that suits your business requirements and integrates seamlessly with your accounting workflow.

Here are some of the benefits of downloading these editable files:

- Time-saving: With a pre-structured document, you can quickly fill in necessary details without starting from scratch.

- Customization: Modify the layout, design, and fields to match your business style and client requirements.

- Professional appearance: A well-organized layout improves the way you present your financial documents to clients.

- Easy tracking: Track payments and outstandin

Why Use an Invoice Template in Excel

Using a pre-designed format for creating financial documents offers numerous advantages, particularly for those who manage multiple transactions. A structured document simplifies the process of recording and tracking payments, saving time while reducing the risk of errors. Whether you’re managing a single client or handling numerous accounts, such tools ensure consistency and accuracy throughout your billing process.

Excel is one of the most widely used programs for creating such documents due to its flexibility and ease of use. The platform’s built-in features, such as formulas and data organization options, make it an ideal choice for creating structured records. By using a pre-set layout, you can quickly customize fields and calculations to suit your needs.

Here are some key reasons to use a well-organized financial sheet in Excel:

- Efficiency: With a pre-structured format, it only takes a few minutes to fill in client details, payment amounts, and other relevant data.

- Accuracy: Excel’s automatic calculations help reduce human errors when tallying totals or adding taxes, ensuring your figures are correct.

- Customization: Adjust the layout and fields to match your specific requirements, such as adding a company logo, payment terms, or specific client information.

- Trackability: Excel’s features allow you to easily track outstanding amounts, due dates, and payments, which helps maintain a clear record of all transactions.

- Professionalism: A well-organized document gives a polished, consistent look to your financial records, enhancing your business’s reputation with clients.

Ultimately, using such a system not only improves your workflow but also helps build a reliable and professional approach to handling your business’s financial dealings.

How to Customize an Excel Invoice

Personalizing your billing document allows you to tailor it to your business needs and branding. Customization helps ensure that each document accurately reflects your company’s identity while also meeting the specific requirements of your clients. The ability to modify certain fields, design elements, and calculations can improve both the appearance and functionality of your financial records.

Steps for Customizing Your Document

Follow these simple steps to adjust your layout and content:

- Change the Header: Replace the default title with your business name, logo, and contact details to make the document instantly recognizable to your clients.

- Edit the Client Information: Adjust fields to include specific customer data such as company name, address, email, and payment terms.

- Update the Itemized List: Modify the table to list the goods or services provided, including quantities, unit prices, and any additional charges.

- Customize Payment Details: Add your payment methods, bank information, and due dates to make it easy for clients to complete transactions.

- Modify Colors and Fonts: Personalize the document’s appearance to match your brand’s colors and font styles, ensuring a professional look.

Advanced Customization Tips

If you’re comfortable with more advanced functions, here are some ways to make your document even more efficient:

- Use Formulas: Automatically calculate totals, taxes, or discounts using built-in functions, saving time and minimizing errors.

- Insert Date and Number Fields: Use dynamic fields to automatically insert the current date or generate unique reference numbers for each transaction.

- Add Conditional Formatting: Set up rules to highlight overdue payments or emphasize certain amounts for better visibility.

By customizing these elements, you ensure that each document you send is both functional and professional, and tailored specifically to your business’s needs.

Top Features of Free Invoice Templates

When looking for a ready-made solution for managing billing and payments, it’s important to consider the features that make these documents both efficient and user-friendly. The best tools offer a balance of simplicity and functionality, allowing for easy customization while ensuring accuracy in every calculation. These features help businesses streamline their financial processes while maintaining a professional appearance.

Key Elements to Look for

Here are some of the essential features you should expect when downloading an editable financial document format:

Feature Description Customizable Layout The ability to adjust fields, design elements, and data placement ensures the document suits your specific needs. Pre-built Calculations Automatic formulas for totals, taxes, and discounts help eliminate errors and speed up the process. Client and Company Details Fields for both your business and customer information are pre-structured, saving time on data entry. Itemized Listing A clear breakdown of goods or services with prices and quantities makes it easy for clients to review charges. Payment Terms Predefined areas to include payment methods, due dates, and bank details ensure clarity for both parties. Professional Design Well-organized and visually appealing layouts enhance your business’s image when dealing with clients. Additional Functionalities

In addition to the basic features, some advanced functionalities make these tools even more powerful:

- Tracking: Some formats come with built-in features for tracking payments, due dates, and outstanding balances.

- Multi-currency Support: International businesses can benefit from options that allow for different currencies and exchange rates.

- Recurring Billing: For businesses offering subscription-based services, certain layouts allow for easy duplication and recurring invoicing.

These features combine to create an all-in-one solution that simplifies your billing process and helps maintain consistent, professional communication with your clients.

Benefits of Using Excel for Invoices

Utilizing spreadsheet software to manage billing documents offers several advantages for businesses of all sizes. The flexibility and powerful features of these programs enable you to create, organize, and track your financial records with ease. Whether you’re managing a few transactions or hundreds, this approach simplifies the process while maintaining accuracy and professionalism.

Efficiency and Accuracy

One of the main reasons businesses choose spreadsheet software for their financial documents is the ability to automate many tasks. By using built-in formulas, you can quickly calculate totals, taxes, discounts, and other important figures. This reduces the potential for human error and ensures that each document is accurate and consistent.

- Automatic Calculations: Complex math, such as summing up totals or applying discounts, is done automatically, saving you time and effort.

- Error Reduction: With preset formulas and data validation features, the risk of mistakes in numbers or calculations is minimized.

Customization and Flexibility

Another key benefit is the ability to customize your documents to fit the specific needs of your business. Whether it’s adjusting the layout, adding your company’s branding, or modifying the fields to reflect different services, spreadsheet tools offer great flexibility. You can easily modify existing layouts or create new ones from scratch to match your exact requirements.

- Tailored Design: Personalize your records by adjusting the structure, font style, color scheme, and logo placement.

- Adaptability: Easily modify or expand fields to include new information, such as additional items or payment instructions.

In addition, spreadsheets allow you to store and organize your financial data in a way that is easy to manage. You can track payments, generate reports, and maintain a clear record of all transactions for future reference, improving the overall efficiency of your financial processes.

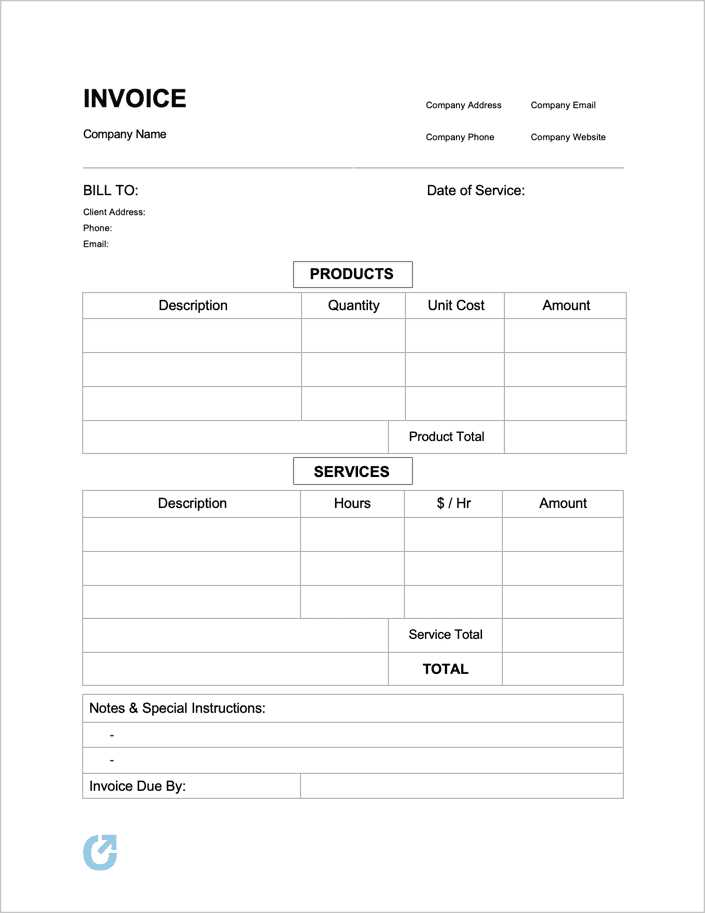

How to Create a Professional Invoice

Creating a polished and professional billing document is essential for building trust with clients and ensuring smooth business transactions. A well-organized financial record not only reflects positively on your business but also ensures that all relevant details are clearly communicated. Whether you’re invoicing for services rendered or products sold, there are key elements that should always be included to maintain professionalism.

Follow these steps to craft a well-organized, professional billing document:

- Include Your Business Information: Start by clearly displaying your company name, logo, and contact details, such as address, phone number, and email. This makes it easy for clients to reach out or verify your identity.

- Client Information: Add the recipient’s name, address, and contact details. It’s important to ensure this information is accurate to avoid confusion or delayed payments.

- Unique Reference Number: Assign a unique number or code to each document to help both you and your client track payments. This is particularly useful for keeping your records organized.

- Detailed Breakdown of Services or Goods: List all products or services provided, along with quantities, unit prices, and a brief description. This section should be clear and easy to read, so clients understand exactly what they are being charged for.

- Payment Terms: Specify the payment methods you accept, due date, and any late fees or discounts for early payment. Clear terms prevent misunderstandings and encourage timely payments.

- Total Amount Due: Ensure that the total is prominently displayed, along with any taxes, shipping fees, or discounts applied. Double-check that your calculations are correct before sending.

Additionally, consider adding personalized elements such as a thank-you note or a reminder of future services. This adds a touch of professionalism and helps maintain a positive relationship with your clients.

By following these guidelines, you’ll create billing documents that reflect your business’s credibility and foster trust with your clients.

Simple Steps to Download an Invoice Template

Downloading a ready-made billing document layout is a quick and easy way to streamline your financial tasks. By choosing a pre-designed format, you can avoid the hassle of creating one from scratch, while ensuring that your records are both organized and professional. Follow these straightforward steps to download and start using your customizable financial document.

Here’s how to get started:

- Step 1: Choose a Trusted Source: Begin by selecting a reliable website that offers downloadable financial document layouts. Make sure the site is reputable to avoid issues with files or security.

- Step 2: Select the Desired Format: Many platforms offer multiple options. Look for one that suits your business needs, such as simple layouts for freelancers or more complex ones for businesses with multiple items or services.

- Step 3: Download the Document: Once you’ve found the right format, click the download button. The file will typically be available in formats like .xlsx or .ods, ready to open in your preferred spreadsheet program.

- Step 4: Open and Customize: Open the downloaded file in your spreadsheet software. Customize the fields such as company name, client details, services, and payment terms to match your specific needs.

- Step 5: Save and Use: After making the necessary adjustments, save the file with a new name for easy access. You can now use this document for your billing tasks, and update it as needed for future transactions.

By following these simple steps, you can quickly gain access to a professional and customizable document format that saves you time and ensures consistency in your financial dealings.

Best Websites for Free Invoice Templates

Finding reliable online resources for downloadable financial document layouts can help businesses save valuable time and effort. Many websites offer a variety of well-structured, customizable documents that cater to different business needs. Whether you need a simple layout or something more comprehensive, these platforms provide excellent options for generating professional records without starting from scratch.

Here are some of the best websites where you can find high-quality, downloadable layouts for your business:

- Microsoft Office Templates: This is one of the most popular sources for a wide range of customizable layouts. Microsoft offers both basic and detailed designs that can be easily adapted for your needs, all downloadable in various formats.

- Zoho Invoice: Zoho provides an intuitive platform with various professional styles, making it easy to create and manage billing documents. The site also offers additional tools for invoicing and payment tracking.

- Invoice Simple: Known for its user-friendly design, Invoice Simple offers templates that you can download and modify. The site also includes features for creating and sending documents directly online, simplifying the entire billing process.

- Canva: If you’re looking for visually appealing layouts with creative customization options, Canva is a great choice. It allows users to design everything from basic to highly detailed documents, with the option to download them in multiple formats.

- Invoiced: Invoiced provides an assortment of layouts that suit various industries, from freelancers to large enterprises. Their platform is particularly useful for businesses that require recurring billing systems, as well as custom branding options.

These websites offer a mix of simple and advanced options, making it easy to find a solution that fits your specific business needs. By choosing the right resource, you can quickly generate professional records that enhance your company’s financial management processes.

Common Mistakes to Avoid When Using Templates

While pre-designed billing documents can be a great time-saver, it’s important to use them correctly to ensure that your records are both accurate and professional. Many users make simple mistakes when customizing or filling out these formats, which can lead to confusion, delayed payments, or even damage to your business’s reputation. Avoiding these errors will help ensure that your financial records are clear, precise, and effective in communicating with clients.

Here are some common mistakes to watch out for when using ready-made formats:

Mistake Why It Matters How to Avoid It Leaving Fields Incomplete Missing client or product details can lead to confusion and delay payments. Ensure all relevant sections, including client contact details, payment terms, and service descriptions, are filled in completely. Incorrect Calculations Errors in totals, taxes, or discounts can create discrepancies and cause frustration for clients. Double-check any auto-calculation fields and ensure that all prices and quantities are correct before sending. Using Outdated Information Outdated contact details or terms can confuse clients and lead to missed payments. Regularly update your business and client information, such as addresses, phone numbers, and payment methods. Not Customizing the Design A generic layout may not reflect your company’s brand and professionalism. Customize the design with your business logo, colors, and fonts to maintain a consistent look across all documents. Ignoring Payment Terms Failure to specify payment deadlines or methods can lead to late payments and misunderstandings. Clearly state your payment terms, including due dates, accepted methods, and any late fees. By being mindful of these common mistakes and taking the time to review and customize your financial documents, you can avoid unnecessary complications and maintain a professional image in your client communications.

How Excel Invoices Help Small Businesses

Managing financial transactions efficiently is essential for the success of any small business. Using digital billing systems allows entrepreneurs to streamline their processes, reduce errors, and ensure that payments are processed quickly. For many small businesses, using a digital record-keeping system in a spreadsheet format offers a simple, yet powerful solution for managing customer transactions.

Cost-Effective Solution for Small Businesses

One of the biggest advantages of using spreadsheets for managing billing documents is the minimal cost. Unlike expensive accounting software, most businesses already have access to spreadsheet programs, making them an affordable option for managing business finances. This saves money that would otherwise be spent on subscriptions to paid software services.

- Low upfront cost: Most spreadsheet programs are either already available or free to use, making it easy for small business owners to get started.

- No need for training: Many people are already familiar with basic spreadsheet functions, so there is little learning curve involved in using them for billing purposes.

Streamlining the Billing Process

Another key benefit of using spreadsheet software for financial documents is the ability to automate calculations and organize information efficiently. From calculating totals and taxes to tracking payments and due dates, spreadsheets make it easier to stay on top of outstanding invoices. The ability to customize layouts for specific business needs also helps businesses reduce the time spent creating and managing records.

- Efficiency: Automatically generate totals, taxes, and discounts, reducing the manual effort required to process payments.

- Organization: Use built-in sorting and filtering options to keep track of payments, clients, and billing histories.

For small businesses that need to handle multiple clients and transactions, a digital solution like a spreadsheet helps to keep everything organized, improving both cash flow management and customer relationships.

In summary, spreadsheets offer a simple and effective way for small businesses to maintain professional billing systems, save on costs, and streamline day-to-day financial tasks. By leveraging the power of spreadsheet tools, small business owners can focus more on growth and less on administrative tasks.

Formatting Tips for an Effective Invoice

Creating a well-organized and easy-to-read billing document is crucial for maintaining a professional image and ensuring timely payments. Proper formatting not only helps clients understand the charges clearly but also reflects positively on your business. By following a few simple formatting tips, you can create a document that is both visually appealing and functional.

- Keep It Simple and Clean: Avoid cluttering the document with unnecessary details or graphics. Use clear headings, sections, and ample white space to make the content easy to read.

- Use a Clear, Readable Font: Stick to professional fonts like Arial, Times New Roman, or Calibri. Ensure that the text is large enough for easy reading–typically, a font size between 10pt and 12pt works well.

- Organize Information Hierarchically: The most important details should be placed at the top, such as your business name and the client’s information. Follow this with the details of the services or products provided, payment terms, and total amount due.

- Make Key Information Stand Out: Use bold text for important sections like the total amount due, due date, and payment methods. This ensures that these details are not overlooked by the client.

- Use Consistent Alignment: Align your text consistently, particularly for items like amounts and descriptions. Ensure that numbers are right-aligned, and descriptions are left-aligned to maintain a neat and professional appearance.

Additional Formatting Considerations

- Highlight Payment Terms: Clearly state payment deadlines, accepted methods (bank transfer, PayPal, etc.), and any late fees. This section should be easy to find so there’s no ambiguity about when payment is expected.

- Include Clear Item Descriptions: Break down your products or services with a brief but informative description. This prevents confusion and shows transparency in your pricing.

- Use a Professional Color Scheme: Stick to neutral or your company’s brand colors. Avoid using too many bright or distracting colors, as this can make the document look unprofessional.

By following these formatting tips, you can create clear, professional-looking documents that ensure your clients understand exactly what they are being charged for and what is expected of them. Effective formatting helps reinforce your business’s professionalism and increases the likelihood of timely payments.

How to Include Payment Terms on Invoices

Clear payment terms are essential for ensuring that clients understand when and how to settle their accounts. Including well-defined terms on your billing documents helps avoid confusion and encourages timely payments. By clearly communicating your expectations for payment deadlines, methods, and any applicable fees, you can prevent misunderstandings and protect your cash flow.

Here’s how to properly include payment terms on your billing documents:

- Specify the Due Date: Clearly indicate when the payment is expected. Use phrases such as “Due upon receipt,” “Net 30,” or specify an exact date (e.g., “Due by December 15th”). This sets a clear expectation for your client.

- State Accepted Payment Methods: List the ways clients can pay, such as bank transfer, credit card, or online payment platforms (PayPal, Stripe, etc.). This ensures clients know exactly how to send their payment.

- Include Late Fees (if applicable): If you charge a late fee for overdue payments, specify the amount or percentage. For example, “A 5% late fee will be applied after 30 days.” This creates an incentive for clients to pay on time.

- Discount for Early Payment: Offering discounts for early payments can encourage clients to settle their bills sooner. For example, “2% discount if paid within 10 days.” Be sure to include the terms clearly so clients know they have this option.

- Clarify Currency and Amount: Ensure that the total amount due is clearly stated, and if your business operates internationally, indicate the currency (e.g., USD, EUR). This prevents confusion, especially when dealing with clients from different countries.

When drafting payment terms, remember to keep the language simple and direct. Clients should easily understand their obligations without having to ask for clarification. By making payment terms clear and transparent, you can avoid disputes and ensure a smoother transaction process.

Using Excel to Track Invoice Payments

Tracking payments is a critical task for any business to ensure that revenue is being collected on time. Using a digital tool like a spreadsheet provides an efficient way to monitor the status of each payment, track overdue amounts, and maintain accurate financial records. A well-organized spreadsheet allows business owners to keep a clear overview of outstanding balances and easily manage their cash flow.

By using a spreadsheet, you can create a simple yet effective system to track payments and stay on top of your finances. Here are some key components to include when using a spreadsheet for payment tracking:

Column Title Description Why It’s Important Invoice Number Unique identifier for each document issued. Helps keep track of individual transactions and avoids confusion with similar entries. Client Name The name of the customer who received the services or products. Allows you to quickly find the customer associated with a particular payment. Amount Due The total amount of money the client is expected to pay. Ensures you have a record of how much each client owes at any given time. Payment Date The date when the payment was received. Helps track when payments are made and ensures timely follow-ups for overdue accounts. Payment Status A field indicating whether the payment has been completed or is still outstanding. Allows you to monitor which payments are received and which are still pending, making it easier to manage follow-ups. Notes Any additional information related to the payment, such as discounts, partial payments, or payment issues. Provides a space for documenting special conditions or any issues that may arise. By setting up a simple system with these key fields, you can easily track payments, identify overdue balances, and ensure your business stays financially healthy. Additionally, the flexibility of spreadsheet tools a

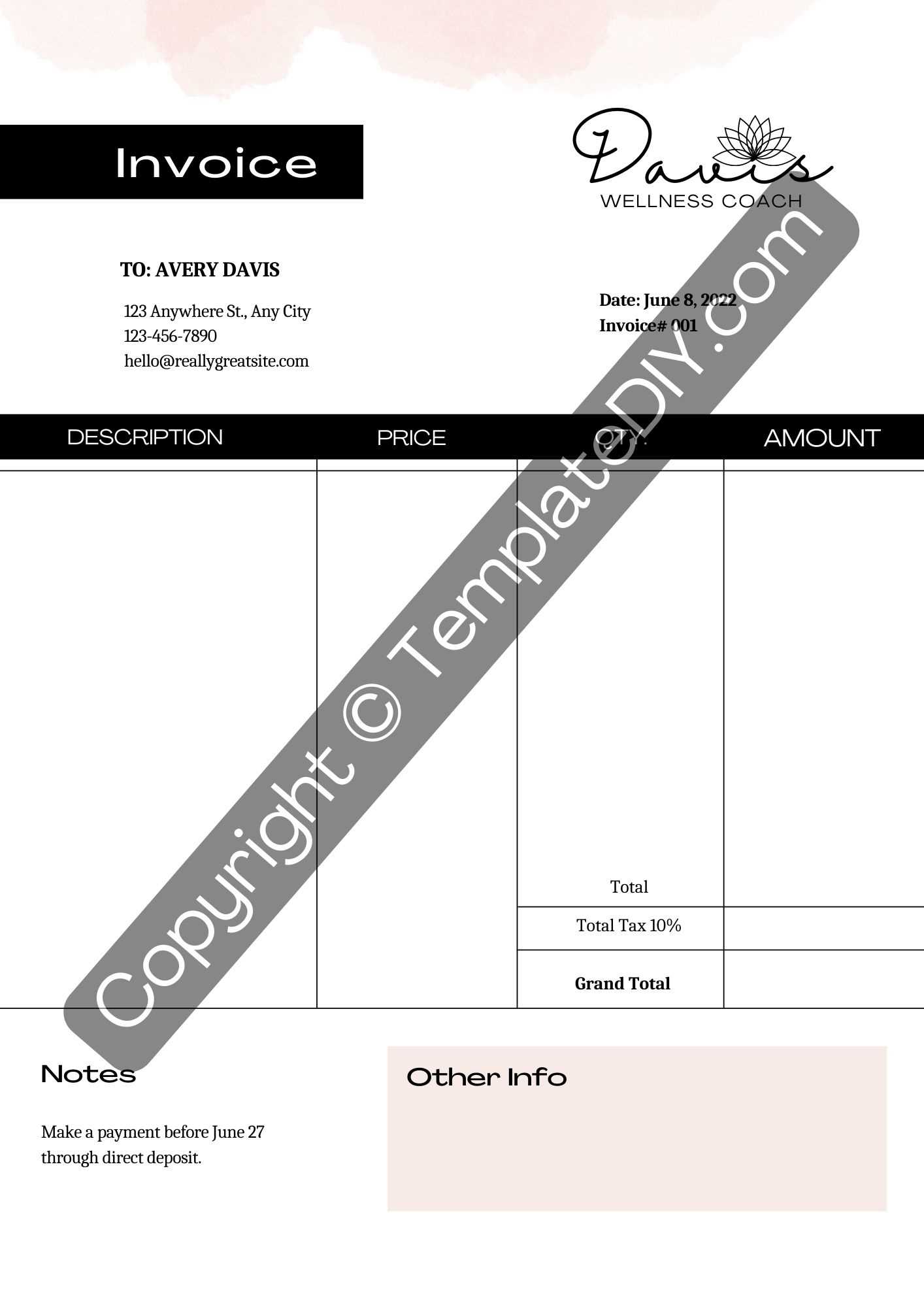

Designing Invoices for Different Industries

Different businesses require distinct approaches when it comes to designing their billing documents. Depending on the industry, certain details and formats will need to be emphasized to ensure clarity and accuracy. A professional and industry-specific layout helps not only in maintaining a clear transaction record but also in communicating with clients in a manner that aligns with industry standards.

Here are some considerations and tips for creating effective billing documents tailored to different industries:

Industry Key Elements to Include Why It’s Important Freelancers & Consultants Service descriptions, hourly rates, project milestones Clear breakdowns help clients understand the value of services provided and avoid disputes over rates. Retail Product codes, quantities, tax rates Ensures the client can match each item with their purchase and clearly see any taxes or discounts applied. Construction & Contractors Labor charges, material costs, work progress details These documents should itemize each charge for transparency, including specific project milestones and payment schedules. Healthcare Insurance details, service dates, patient ID For compliance and clarity, it’s important to include necessary details for insurance claims and payment processing. Real Estate Commission rates, property details, transaction fees Real estate transactions are often complex; a well-organized document ensures that all fees and commissions are transparent. Education & Training Course or class descriptions, enrollment dates, tuition fees It’s important to clearly specify the services provided (like courses or training sessions) to avoid confusion regarding payments. Tailoring your billing documents to meet industry-specific needs is essential for professionalism and smooth communication with your clients. By including the right details and formatting, you can build trust and reduce the chances of misunderstandings or delays in payments. Whether you’re a freelancer, retailer, or part of a large industry, customizing your records to reflect your business’s nature is a smart way to stay organized and efficient.

How to Save and Organize Excel Invoices

Properly saving and organizing your financial records is crucial for maintaining an efficient and professional system. When it comes to billing documents, a well-structured approach helps ensure that you can quickly access past transactions, track payments, and keep your records in order for tax purposes or future reference. By using effective naming conventions and organizing your files systematically, you can streamline the entire process.

Here are some practical tips for saving and organizing your billing records in a spreadsheet format:

- Create a Dedicated Folder: Set up a folder specifically for your financial documents. Within this folder, create subfolders for each client, project, or month. This will make it easier to locate specific records when needed.

- Use Consistent File Naming: Develop a consistent naming system for your files. For example, use a format like “ClientName_InvoiceNumber_Date” (e.g., “JohnDoe_001_2024-11-05”). This ensures that you can quickly identify the document based on the client, invoice number, and date.

- Leverage Cloud Storage: Storing your records in cloud storage services such as Google Drive, Dropbox, or OneDrive allows you to access them from anywhere and ensures that they are backed up in case of computer failure. Additionally, cloud storage allows for easy sharing with clients or team members.

- Maintain a Digital Log: Use a separate spreadsheet to track all issued billing documents. Include columns for client name, invoice number, due date, amount, and payment status. This allows you to have an overview of your financial status and ensures nothing falls through the cracks.

- Set Up Automatic Backups: Ensure that your spreadsheet software or cloud storage automatically backs up your files. This reduces the risk of losing important records due to hardware issues or accidental deletions.

By following these organizational strategies, you can create a streamlined and efficient system for managing your financial documents. A clear and well-structured approach not only helps you stay on top of outstanding payments but also simplifies your administrative tasks and ensures that your business remains organized in the long term.

Advantages of Editable Invoice Templates

Having the ability to modify your billing documents offers significant flexibility and control over your business operations. Editable documents allow you to tailor each record to your specific needs, ensuring accuracy and consistency across all your financial communications. Whether you’re dealing with custom charges, varying payment terms, or specific client preferences, the ability to adjust details on the fly can save time and reduce errors.

Here are some key benefits of using customizable billing documents:

- Flexibility: Editable records can be easily adjusted to fit the unique requirements of each client or project. You can modify quantities, prices, and descriptions without the need to recreate a new document from scratch.

- Consistency: Once you’ve set up your standard structure, you can use the same design and layout across all your documents. This ensures that your financial communications maintain a consistent and professional appearance, reinforcing your brand’s identity.

- Time-Saving: Customizable records eliminate the need to manually input repetitive information. Fields like client details, payment terms, and services rendered can be pre-filled, significantly reducing the time spent on each new transaction.

- Error Reduction: By using an editable document with predefined fields, you reduce the chance of missing important information or making typographical errors. Additionally, templates can help automate calculations, ensuring accuracy in totals and taxes.

- Cost-Effective: Customizable billing documents do not require purchasing specialized software. You can create, edit, and store them with basic software or cloud tools, minimizing additional expenses while providing a professional service to your clients.

Editable billing records are not just about convenience–they also provide a level of professionalism that can set your business apart. By ensuring each document is tailored to reflect your unique services and terms, you maintain control over your invoicing process while optimizing efficiency and accuracy.

How to Protect Your Invoice Files

Protecting your financial documents is essential for maintaining the privacy and integrity of your business transactions. Since these files contain sensitive information, including client details, payment amounts, and due dates, it is crucial to ensure that they are secure from unauthorized access, loss, or theft. Implementing proper security measures will safeguard your business and prevent potential financial disputes or fraud.

Here are some important strategies to protect your financial files:

1. Use Strong Passwords

Ensure that all documents are password-protected, especially if they contain sensitive information. Strong passwords should include a mix of letters, numbers, and special characters, and be changed regularly to prevent unauthorized access.

2. Backup Your Files

Regularly back up your financial records to a secure location. Whether it’s an external hard drive or a cloud-based service, having copies of your files ensures that you won’t lose valuable information in the event of hardware failure or data corruption.

- Cloud Storage: Use reliable cloud storage platforms like Google Drive, Dropbox, or OneDrive that offer encryption and automatic backups to prevent data loss.

- External Backup: If you prefer offline storage, regularly save copies of your files to encrypted external drives or USB sticks.

3. Encrypt Sensitive Information

When sending or storing files that contain sensitive client data or payment details, consider encrypting them. Encryption scrambles the contents of your files, making them unreadable without the correct decryption key. This adds an extra layer of protection for your financial records.

4. Limit Access to Files

Only authorized personnel should have access to your financial documents. Restrict access to certain users based on their role in your organization. Use file permission settings to control who can view, edit, or delete these documents.

- Role-Based Access: Implement role-based access controls (RBAC) to ensure that only specific team members can make changes or view sensitive documents.

- Read-Only Mode: For those who only need to review records, set files to “read-only” mode to prevent any accidental edits.

5. Regularly Update Software and Security Systems

Ensure that your software, antivirus programs, and security systems are always up-to-date. This helps protect your files from malware, ransomware, and other potential threats. Regular updates can patch vulnerabilities and protect against new security risks.

By following these steps, you can significantly reduce the risks associat