Simple Invoice Template in Word for Easy Invoice Creation

Efficient management of financial transactions is a vital part of running a business. Having a well-organized document to request payment ensures clarity and professionalism. A customizable format allows you to streamline the process and adapt it to various needs and industries.

Using a ready-made format can save time while ensuring all necessary details are included. Whether you’re handling large corporate accounts or small freelance projects, a standardized approach can make your records more consistent and easier to manage. With the right tools, crafting clear and accurate statements becomes a straightforward task.

Customization is key when creating these documents. From adjusting fonts to incorporating company logos, the flexibility to modify the structure means that each document can align with your unique business requirements. This approach not only enhances your image but also ensures that the final result is both professional and functional.

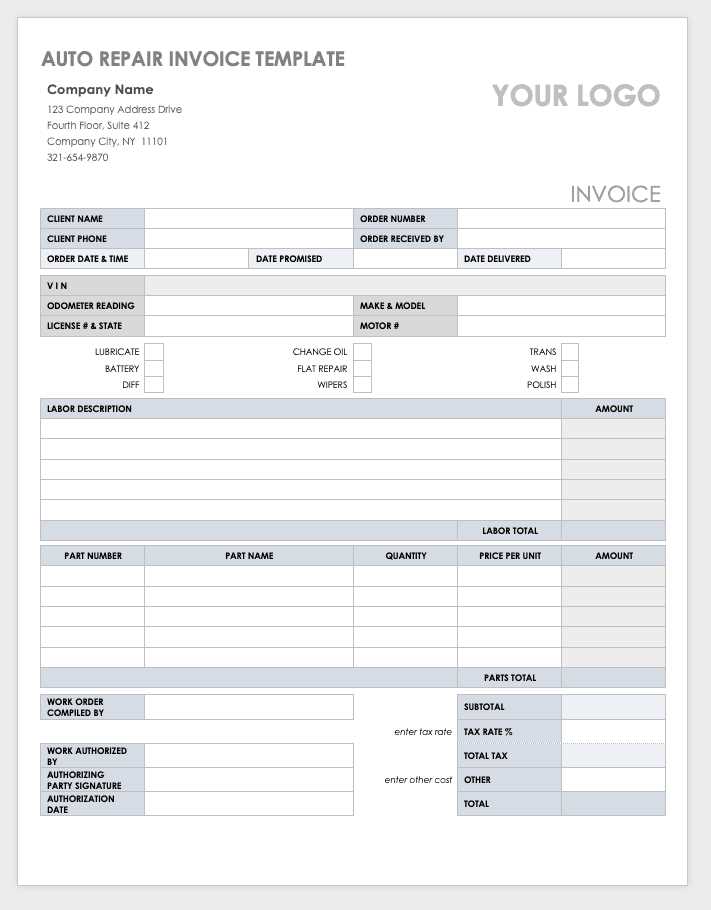

Simple Invoice Template in Word

When it comes to requesting payment for goods or services, having a consistent and easy-to-use document can make all the difference. A straightforward layout that can be quickly customized saves valuable time while ensuring that all essential details are clearly presented. Whether you’re a freelancer, small business owner, or running a larger enterprise, having an efficient method for generating payment requests is crucial.

Many individuals and companies prefer using ready-made formats that offer flexibility in design. This approach allows for customization, whether it’s adding logos, adjusting text styles, or changing the document’s layout to fit your needs. The key advantage of using a predefined structure is its simplicity, allowing users to quickly input necessary information without starting from scratch.

Customization plays an important role in ensuring that your document looks professional. From personalizing contact details to modifying payment terms, having the ability to easily adjust these elements ensures that the final output matches your business identity and style. A well-organized format not only enhances your professionalism but also helps clients quickly understand the necessary steps for completing a transaction.

Why Use Word for Invoices

Choosing the right software to create billing documents is essential for both efficiency and professionalism. The popular word processing tool provides an easy-to-use platform that allows users to create, modify, and format these documents quickly. It offers a range of features that simplify the process of generating clear and customizable payment requests, whether for a small business or a freelance operation.

Familiarity and Accessibility

One of the main reasons many people prefer using this tool is its widespread availability and ease of use. Most users are already familiar with the basic functions of the software, which means there’s little to no learning curve. Additionally, the program is commonly included with many operating systems and office suites, making it an accessible option for anyone with a computer.

Customizable Features

The flexibility to modify the layout, fonts, and design elements gives users the freedom to tailor their documents according to specific business needs. Users can adjust details such as contact information, payment terms, and itemized lists without difficulty, which ensures that each document aligns with their branding and personal preferences.

| Advantages | Considerations |

|---|---|

| Easy to use and widely accessible | Basic functions may not offer advanced features |

| Customizable formatting and design | Limited in automation compared to specialized software |

| Familiar interface for most users | May require manual adjustments for recurring tasks |

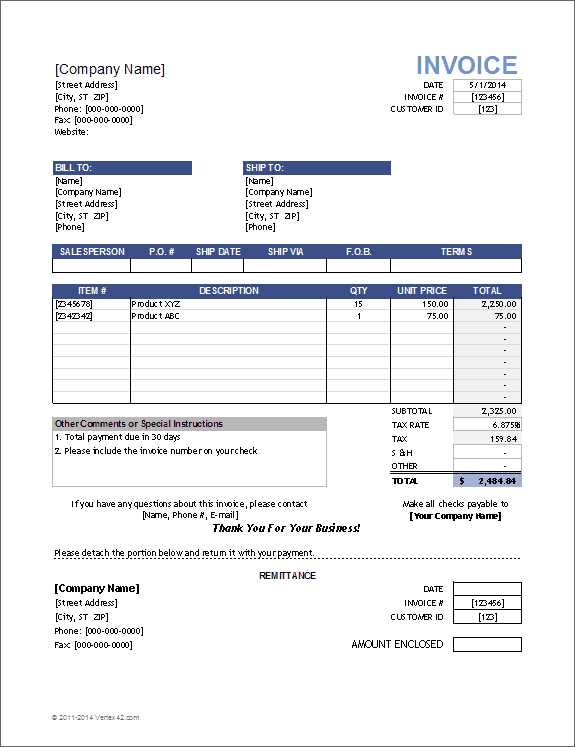

Key Features of an Invoice Template

When creating a document to request payment, having specific elements in place ensures clarity and professionalism. A well-structured format helps convey all necessary details in an organized manner, reducing the chances of confusion. Essential features such as company details, payment instructions, and itemized lists allow for smooth communication between businesses and clients.

Essential Information Fields

The primary function of any payment request document is to clearly communicate the required payment details. Key fields include the payer’s and recipient’s contact information, a unique reference number, and the due date. Additionally, it’s crucial to provide a clear breakdown of the services or goods provided, along with their respective costs. These details not only help the recipient understand what they are paying for but also make the document more official and easy to process.

Customizable Layout and Design

Flexibility in design is another important feature. A clean and professional layout ensures that the document is easy to read and aesthetically pleasing. The ability to adjust fonts, logos, and overall presentation helps personalize the document and align it with the business’s branding. This customization gives businesses the opportunity to create a cohesive and professional image in every transaction.

Key elements like itemized lists and payment instructions ensure transparency, while customization options help reflect your business identity in each document.

How to Download a Template

Obtaining a ready-to-use document for creating payment requests is a simple process that can save time and effort. By downloading a pre-designed file, you gain access to a structured format that can be easily filled in with your business details and transaction information. Many online sources offer free or paid options that can be tailored to meet your specific needs.

Finding a Reliable Source

To start, search for trusted websites that offer customizable formats for creating payment requests. Many of these platforms provide various styles and layouts that cater to different industries. Look for providers that offer clear instructions on how to access and use the file. Be cautious when selecting a source, ensuring that it is reputable and that the file is free from any unnecessary software or hidden costs.

Downloading and Saving the File

Once you’ve found the right document, the next step is to download it. Most providers will have a prominent download button or link that directs you to the file. After clicking the link, ensure that the document is saved to a location on your computer where you can easily access it. Depending on the file format, you may need compatible software to open and edit it.

Customizing Your Invoice Template

Tailoring a document for requesting payment allows you to reflect your business’s identity while maintaining a professional appearance. Adjusting key elements such as layout, font styles, and adding specific details ensures that your document serves both functional and branding purposes. Customization is essential for creating consistency in all your financial transactions.

Modifying Layout and Design

One of the first steps in personalizing your payment request is adjusting the layout. You can move sections around, resize fields, or add new areas to suit your needs. Customizing the layout allows you to highlight important information, such as due dates or payment terms, ensuring that clients can easily navigate the document. Incorporating your company logo or brand colors also adds a personal touch that strengthens your business identity.

Adjusting Content for Specific Needs

Customization goes beyond the design–it also includes modifying the content to fit specific transactions. This might involve updating the item descriptions, adding quantities, or altering pricing structures. For recurring clients, you can save versions of the document with pre-filled details to speed up the process in the future. The flexibility to edit text fields and numbers gives you control over every aspect of the payment request.

By a

Steps to Create an Invoice

Creating a payment request document requires attention to detail and organization. The process involves several key steps, from gathering necessary information to formatting the document correctly. By following a systematic approach, you can ensure that each request is clear, professional, and accurate, which helps in streamlining your financial transactions.

Step 1: Collect Necessary Information

The first step in crafting a payment request is to gather all the required details. This includes the names and addresses of both the buyer and seller, as well as contact information and payment terms. You will also need a unique reference number for tracking purposes, the date of the transaction, and a list of products or services provided, including their individual prices and quantities.

Step 2: Organize the Content and Design

Once you have all the information, the next step is to organize it in a clear and logical manner. Arrange the content in sections such as company details, client information, itemized descriptions, and the total amount due. Ensure that the layout is clean and professional, making it easy for the recipient to understand all the relevant details. You can also adjust fonts and formatting to highlight important information, such as payment terms and due dates.

Formatting Your Invoice in Word

Proper formatting is crucial to ensure that your payment request document is both professional and easy to read. By structuring the information in an organized way, you make it easier for your clients to quickly find important details, such as the total amount due or payment terms. A well-formatted document also enhances your brand’s image and helps in building trust with your clients.

Choosing the Right Layout

When formatting your document, start by selecting an appropriate layout that suits your needs. A common structure includes sections for the sender’s and recipient’s details, an itemized list of services or products, and a summary of the total amount owed. By keeping the layout simple and clear, you avoid clutter and allow important information to stand out. Make sure the most critical data, like payment terms and due dates, are easily visible.

Adjusting Fonts and Styles

Font selection plays an important role in the readability of your document. Choose clear, professional fonts like Arial or Times New Roman and avoid using too many different styles. You can use bold or italics to highlight key sections, such as the total amount or the due date, but avoid excessive use of these styles to maintain a clean look. Consistency in font style and size ensures that the document appears polished and well-organized.

By paying attention to layout and font choices, you create a document that is not only functional but also conveys professionalism and attention to detail.

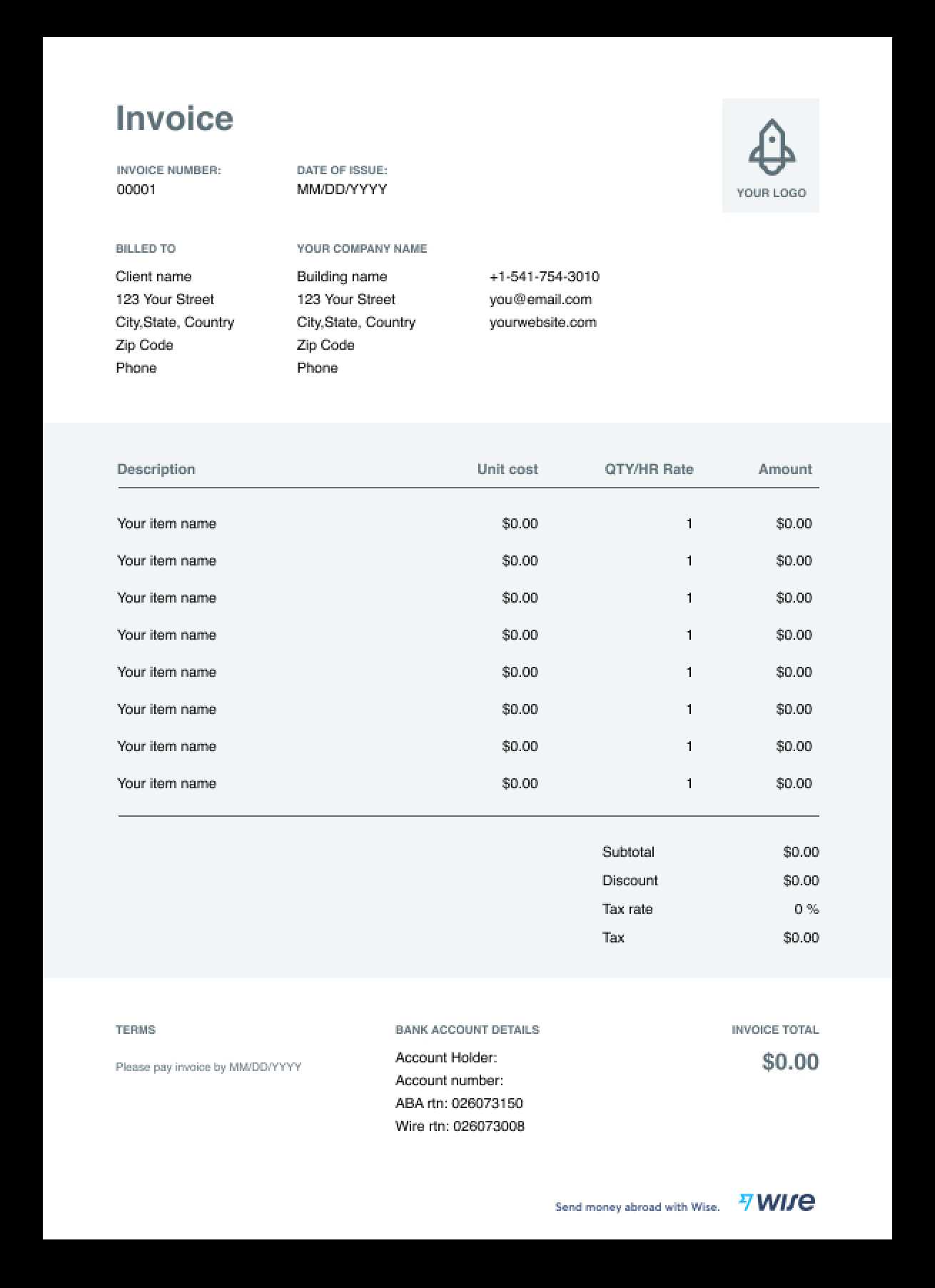

Adding Your Company Details

Incorporating your business information into a payment request document is a crucial step to ensure that the recipient knows exactly who the transaction is from. Including your company’s name, address, and contact information helps to establish credibility and makes it easier for clients to reach out if they have questions or need clarification.

Key Information to Include

When adding your company’s details, it’s important to make sure all relevant information is included in a clear and organized manner. Here’s what should be listed:

- Business Name: Clearly display your company’s name at the top of the document.

- Contact Information: Include your phone number, email address, and website, if applicable.

- Business Address: Provide your full business address to ensure there are no issues with correspondence.

- Tax Identification Number: If relevant, include your business’s tax ID or VAT number to make the document official.

Formatting Company Information

Make sure your company’s details are easy to find and read. Typically, this information is placed at the top of the page, often in the header section. Use a slightly larger font or bold formatting to ensure your business name stands out. Keep the contact information concise but complete, and align everything neatly to avoid clutter.

By including this essential information, you make your document look professional and ensure that the recipient can easily identify the source of the request, which can improve communication and payment processing.

Including Client Information Properly

Accurate and clear client information is essential when creating a document to request payment. Properly including the client’s details ensures that there are no mistakes regarding who the request is intended for, helping to avoid delays in processing. It also provides the recipient with necessary contact information in case any issues arise with the transaction.

Essential Client Details

To make sure the payment request is correctly directed, the following client information should be included:

| Client Name | Address | Email/Phone Number |

|---|---|---|

| Full Name or Company Name | Complete billing address | Email address or phone number |

Formatting Client Information

Make sure that the client’s details are clearly presented, typically placed near the top of the document, below your company information. It’s important to double-check that the contact information is up-to-date and correct, as this will ensure smooth communication throughout the payment process. Always align the data properly, using appropriate spacing between fields for better readability.

Accurate client information not only prevents errors but also helps in maintaining a professional appearance, contributing to efficient business practices and stronger client relationships.

Setting Up Payment Terms

Establishing clear and precise payment conditions is vital to ensure both parties understand when and how the payment should be made. By clearly stating the payment terms, you help prevent misunderstandings and delays. Defining these details upfront also helps in managing cash flow and maintaining a professional relationship with your clients.

Common Payment Terms to Include

There are several essential payment conditions that should be outlined in your document:

- Due Date: Clearly state the date by which payment must be made, such as “Net 30” (meaning payment is due 30 days after the transaction date).

- Late Fees: Specify if any penalties will be applied if the payment is not received by the due date.

- Accepted Payment Methods: Mention the types of payment methods you accept, whether it’s bank transfer, credit card, PayPal, etc.

- Discounts: If you offer any early payment discounts, list the percentage and applicable terms.

Formatting Payment Terms

Ensure that the payment terms are highlighted in a prominent place on your document, typically at the bottom or in a section clearly labeled for terms and conditions. Using bold text or a larger font size for the due date or late fees helps these details stand out. Being transparent and explicit about payment expectations reduces the likelihood of late payments and fosters trust between you and the client.

By setting up clear and detailed payment terms, you protect both your business and your client’s interests, making financial transactions more straightforward and efficient.

Adding Itemized Lists to Invoices

Including a detailed breakdown of goods or services provided is essential for clarity and transparency in any payment request document. An itemized list ensures that your client understands exactly what they are being charged for and how the total amount is calculated. This not only helps in preventing disputes but also aids in maintaining professionalism and trust with your clients.

Essential Elements of an Itemized List

When creating a detailed breakdown, make sure to include the following elements for each item or service:

- Description: Provide a clear description of each item or service offered.

- Quantity: Specify the number of units or hours for each product or service.

- Unit Price: Indicate the price per unit or hour for each item or service.

- Total Cost: Calculate the total amount for each line by multiplying quantity by unit price.

Formatting the Itemized List

Use tables or bulleted lists to organize the details of the items or services. This helps in keeping the document clean and easy to read. Each row should contain the information about one item, and columns should align correctly to make the breakdown visually clear. For example, using a table allows for precise alignment of descriptions, quantities, and prices, making it easier for the client to review and understand the charges.

By adding an itemized list, you make your payment request document transparent and detailed, ensuring both parties are on the same page regarding the charges.

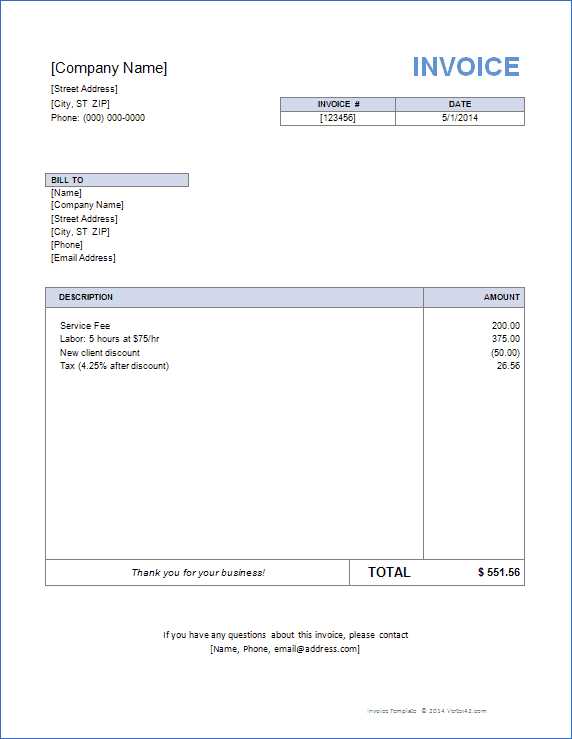

Calculating Totals and Taxes

Accurately calculating the total amount due is crucial to ensure the payment request is clear and error-free. This process involves adding up the costs of each item or service and applying any relevant taxes. Providing an accurate summary of the amounts due, including taxes, helps avoid confusion and ensures both parties are aligned on the payment amount.

Steps to Calculate Totals

To calculate the total cost, follow these basic steps:

- List All Items: Ensure every item or service is accounted for in the document, with its quantity and price.

- Multiply Quantity by Unit Price: For each item or service, multiply the quantity by the unit price to get the cost for that line.

- Sum Up the Line Totals: Add the costs of all items or services to find the subtotal before taxes.

Adding Taxes

Once you have the subtotal, it’s time to calculate taxes. Depending on your location or the type of service, different tax rates may apply. To calculate taxes, multiply the subtotal by the applicable tax rate.

- Tax Rate: Specify the percentage of tax applicable (e.g., 10%, 15%).

- Tax Amount: Multiply the subtotal by the tax rate to calculate the tax amount.

- Total Due: Add the tax amount to the subtotal to find the total amount due.

By carefully calculating the totals and including the correct tax rate, you ensure your payment request is accurate, preventing misunderstandings and streamlining the payment process.

Saving and Printing Your Invoice

Once your payment request document is ready, it’s important to save and print it correctly for record-keeping and distribution. By ensuring your file is saved in a widely accessible format, you can easily share or store the document. Printing the document ensures you have a physical copy if needed for business records or to provide a client with a hard copy.

Saving the Document

Saving your document in an appropriate format is essential to maintain its integrity and make sharing easier. Most commonly, you should save the file as a PDF to preserve the layout and formatting.

- Choose the Right Format: Saving as a PDF ensures that your formatting and design will remain intact, no matter the device used to open it.

- File Name: Use a clear and recognizable file name, such as “Payment Request for [Client Name] – [Date].”

- Location: Store the file in an easily accessible folder on your device or cloud storage for future reference.

Printing the Document

To print your document, ensure that all details are clear and legible, and that the layout fits well on the page. Before printing, it’s a good idea to preview the document to confirm that everything is properly aligned.

- Print Preview: Check the document layout to ensure that no content is cut off or misplaced.

- Printer Settings: Choose the appropriate printer and paper size. Standard letter or A4 sizes are typically used for business documents.

- Quantity: Select how many copies you need, whether it’s for personal records, your client, or both.

By saving and printing your payment request in the proper format and settings, you ensure that the document is professional and ready for distribution or filing.

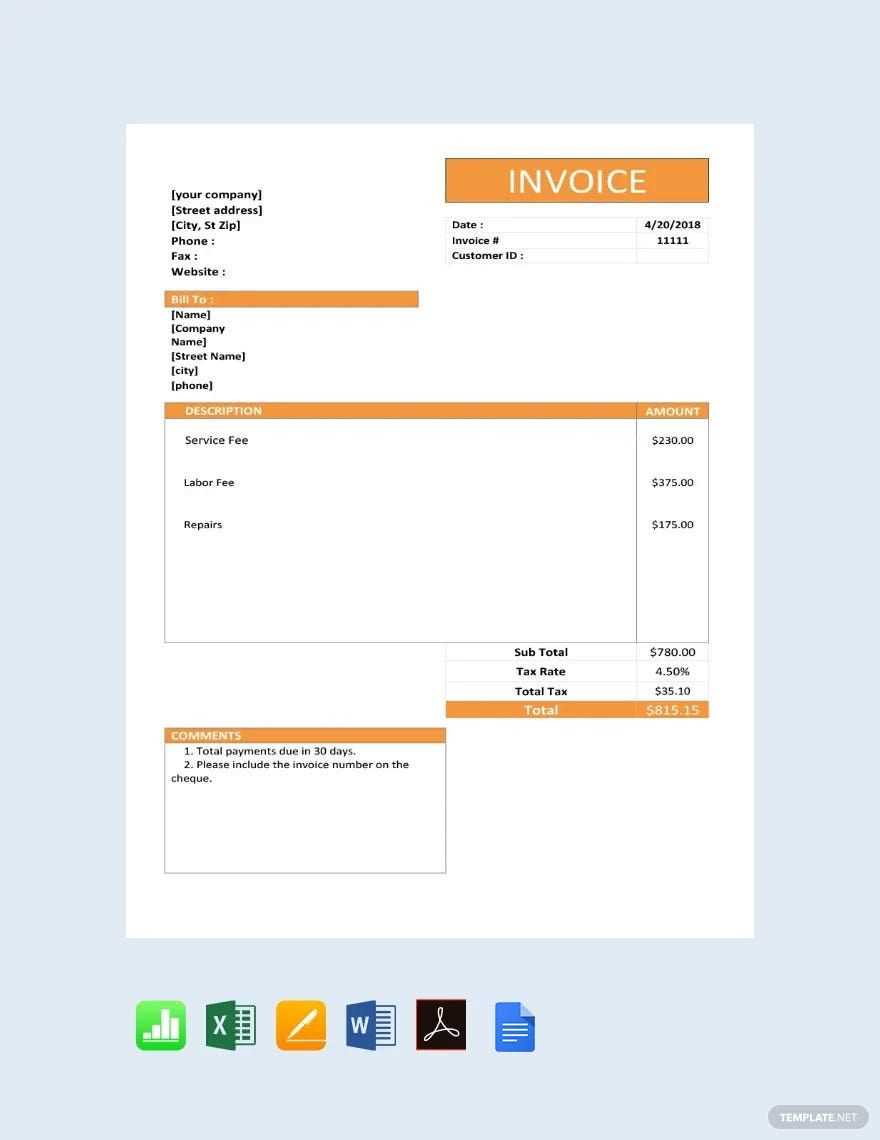

Invoice Template for Different Businesses

Different types of businesses have unique requirements when it comes to creating payment requests. Tailoring the structure and details of your document to fit your specific industry helps ensure that all necessary information is included and presented in the most appropriate way. Whether you are running a small retail shop, a service-based business, or a large corporation, customizing your document format is essential for clarity and professionalism.

Retail Businesses

For retail businesses, the focus is often on product details, quantities, and unit prices. It’s essential to list each item clearly along with its corresponding price, ensuring that customers understand exactly what they are being charged for. Additionally, including taxes and any potential discounts can provide a comprehensive breakdown.

- Clear Product Descriptions: Each product or service should be listed with a brief but clear description.

- Quantities and Prices: Include the quantity purchased and the unit price to help customers understand the cost structure.

- Discounts and Promotions: If applicable, clearly show any discounts or special offers applied to the total amount.

Service-Based Businesses

Service-based businesses often deal with hourly rates or project-based billing. In these cases, the document should clearly state the time spent on each task or the milestones achieved. It’s also important to specify the agreed-upon rates and any additional fees for specialized services.

- Hourly or Project Rate: Break down the cost based on the hours worked or milestones completed.

- Details of Services Provided: Include a description of each service provided, so the client understands what they are being billed for.

- Additional Charges: If applicable, list any extra fees for materials or special services.

By adjusting the format and content of your document to suit the needs of your business, you create a more effective and professional billing process that supports transparency and helps build trust with your clients.

Tips for Professional Invoice Design

Creating a well-designed payment request document is essential for presenting a professional image to your clients. A clean, organized layout not only makes the document easier to understand but also reflects positively on your business. The design should be simple yet functional, ensuring that all essential information is easy to find and read.

Keep It Clear and Organized

Clarity is key when designing a payment request document. Ensure that the layout is structured and that all sections are easy to differentiate. A cluttered document can confuse clients, while a clear and neat design will encourage prompt payments.

- Headings and Subheadings: Use distinct headings to separate different sections, such as “Client Information,” “Itemized Charges,” and “Payment Terms.”

- Consistent Font Styles: Choose one or two fonts that are professional and easy to read, using different sizes to highlight important information.

- Whitespace: Avoid overcrowding your document by leaving enough space between sections and text blocks for better readability.

Incorporate Your Branding

Incorporating your company’s branding elements, such as your logo, colors, and fonts, can help reinforce your brand identity and make your documents stand out. Consistency in your design across all documents builds recognition and trust with your clients.

- Logo Placement: Place your logo in a prominent position, such as at the top of the document, to ensure it’s easily visible.

- Color Scheme: Use your brand’s color scheme to create a cohesive look, but keep it subtle and professional to avoid overwhelming the client.

- Contact Information: Make sure your contact details are easily accessible and clearly visible, preferably at the top or bottom of the page.

Example Layout

Here’s a simple layout for a well-organized payment request document:

| Section | Details | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Header | Company name, logo, and contact details | ||||||||||

| Client Information | Client’s name, address, and contact details | ||||||||||

| Itemized Charges | List of products or services, including quantities and prices | ||||||||||

| Subtotal | Total amount before taxes | ||||||||||

| Taxes | Applicable taxes (if any) | ||||||||||

| Total Due | Grand total after taxes |

| Section | Potential Mistakes |

|---|---|

| Itemized List | Incorrect quantities or pricing, missing items |

| Subtotal | Not adding up itemized amounts correctly |

| Taxes | Missing tax rate or incorrect calculation |

| Total | Not including taxes or rounding errors |

Lack of Clear Payment Terms

Another frequent mistake is not providing clear payment terms. Your client should be fully aware of when the payment is due, how to pay, and any penalties for late payment. A lack of clarity can lead to confusion or delayed payments.

- Set a Clear Due Date: Always specify when the payment is expected.

- Include Payment Methods: Make sure to list accepted payment options, such as bank transfers or online payments.

- Late Fees: Clearly state if there are any penalties for delayed payments.

By avoiding these common mistakes, you can ensure that your documents are accurate, professional, and effective in encouraging prompt payments. Double-checking every detail and maintaining a cle

Benefits of Using Invoice Templates

Utilizing pre-designed documents for billing purposes offers significant advantages to businesses of all sizes. These structured formats save time, reduce errors, and provide a professional appearance that fosters trust with clients. By using ready-made layouts, users can streamline their processes and focus on what truly matters: providing excellent service and managing finances.

One of the primary benefits is efficiency. With a pre-made document, you don’t need to design each bill from scratch. All the necessary fields are already in place, allowing you to quickly enter data and issue the bill without delays. This improves productivity, especially for businesses that regularly issue payments for products or services.

Additionally, using standardized layouts helps ensure accuracy. Mistakes such as missing information or calculation errors can be minimized with built-in formulas and predefined fields. This eliminates the need to manually format every single document and ensures a consistent, error-free result.

Another key advantage is professionalism. Consistent and well-organized invoices present a polished image to your clients, which can enhance credibility and encourage timely payments. Clients are more likely to trust businesses that provide clear, professional billing documents that are easy to read and understand.

In summary, using pre-made billing documents can significantly improve operational efficiency, reduce human error, and create a more professional and trustworthy business image.

How to Track Sent Invoices

Monitoring the status of sent payment requests is a vital task for businesses to ensure timely payments and smooth cash flow. Keeping track of each document sent to clients helps prevent missed payments and allows for efficient follow-ups. There are various methods to stay organized and keep track of all issued documents, whether you’re managing a handful or hundreds of transactions.

Here are several effective strategies for tracking sent payment requests:

- Use a Dedicated Tracking System: Implementing a simple software or tool designed for managing payment requests can help streamline this process. Many tools allow you to store and track all details about each document, including the date sent, payment due date, and whether the payment has been received.

- Maintain a Record Log: Keeping a physical or digital log of each document sent is a simple but effective method. You can use a spreadsheet or a dedicated document to track essential details like the client name, date sent, due date, and status of payment. This provides a quick overview of pending or completed payments.

- Automated Reminders: Setting up automated reminders for both you and your clients ensures nothing is overlooked. Many management tools or even email platforms offer scheduling options that can automatically notify clients of an upcoming due date or overdue payment.

- Establish Clear Communication: Maintain open communication with clients by regularly checking in regarding outstanding balances. By proactively reaching out, you can avoid confusion and establish a positive relationship with your clients while ensuring timely payments.

- Use Status Indicators: Many invoice management systems allow you to mark documents as “sent,” “paid,” or “overdue.” This gives you a visual representation of where each document stands and allows for easy tracking of unpaid items.

By implementing these strategies, businesses can effectively track sent documents and stay on top of their financial obligations, ensuring timely payments and minimizing the risk of overdue accounts.