Free Invoice Receipt Template for Your Business

When running a business, keeping track of transactions and maintaining accurate records is essential. Having a structured method for documenting payments and services ensures smooth operations and helps with financial management. Whether you’re managing a small business or freelance work, an organized approach can save valuable time and prevent errors in your records.

Utilizing well-designed forms is a practical way to manage these important details. By adopting simple yet effective formats, you can streamline the process and focus on what matters most–growing your business. These documents not only facilitate better communication with clients but also help maintain a professional image.

Accessing ready-made solutions allows you to avoid the hassle of designing documents from scratch. Many platforms offer templates that can be easily customized to suit your business needs. Whether you need a quick solution for a one-time use or a long-term system for consistent record-keeping, these ready-to-use formats offer significant convenience.

Free Invoice Receipt Template Guide

Organizing financial records efficiently is key to maintaining a smooth business flow. Using well-structured documents for tracking transactions and payments simplifies this process, providing a reliable and professional approach. By relying on easy-to-adapt solutions, business owners can save time and focus on core operations.

Benefits of Ready-to-Use Documents

Ready-made formats offer a range of advantages, especially for small business owners and freelancers. These pre-designed documents help eliminate the need for manual creation, ensuring consistency and saving time. With customizable fields, users can adapt the structure to meet their specific needs without compromising on professionalism.

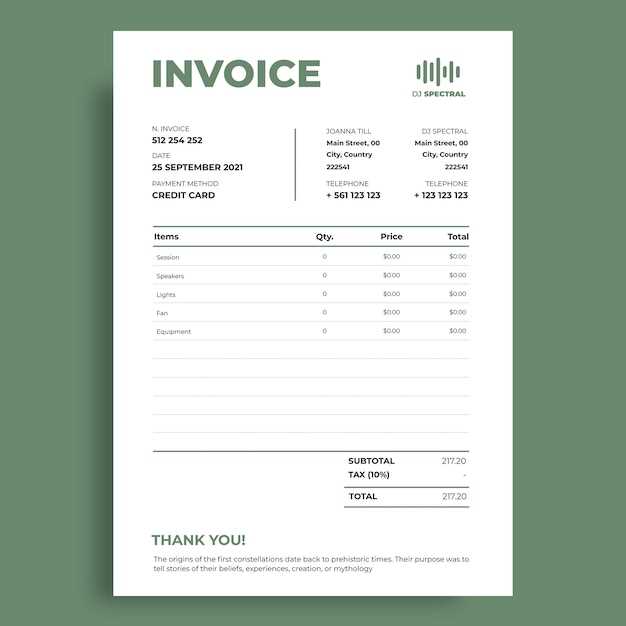

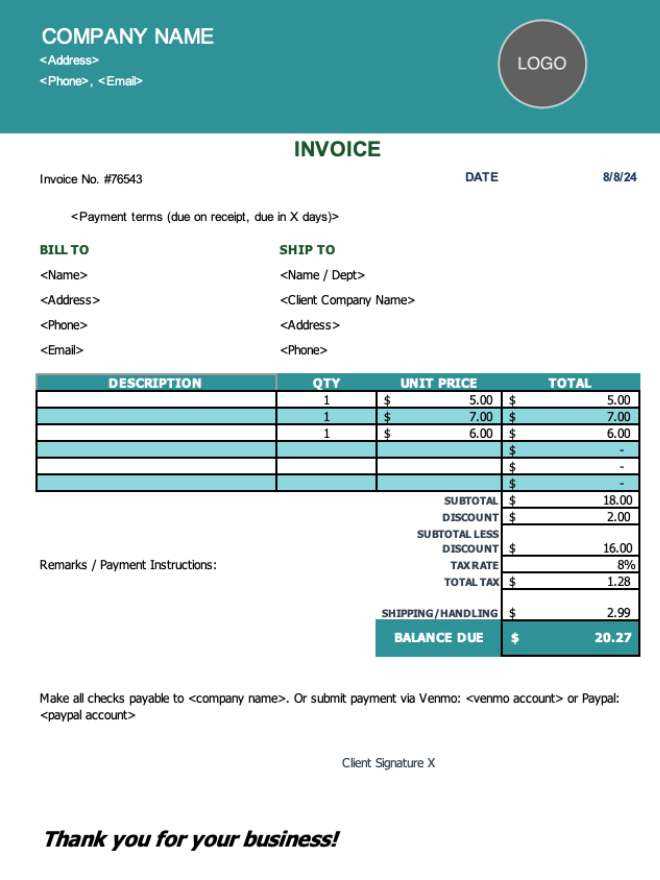

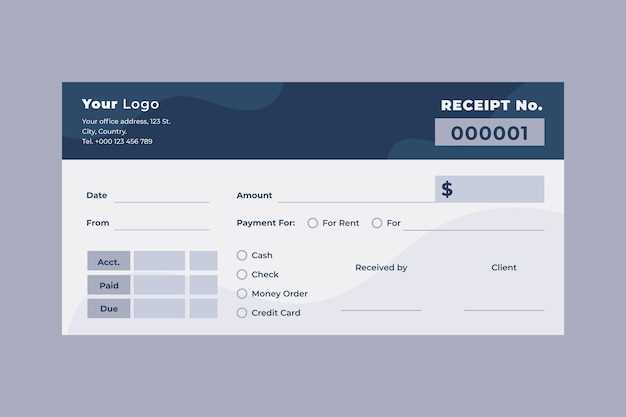

How to Customize Your Document

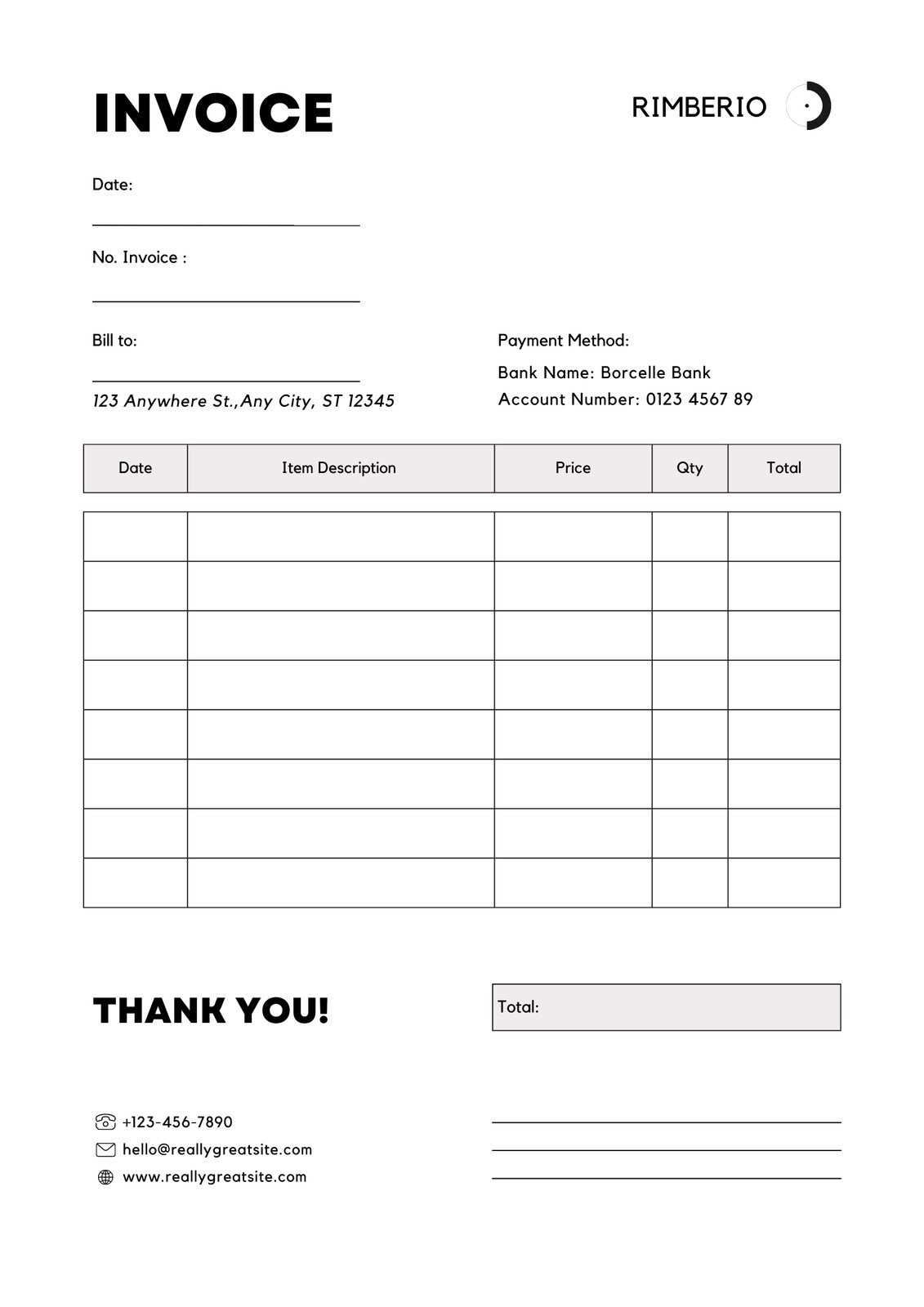

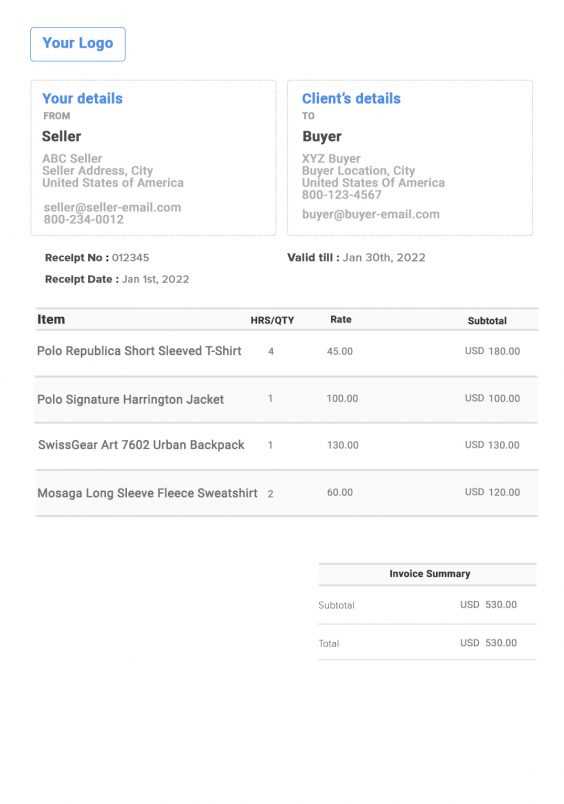

Most online services provide editable options for these files, allowing you to tailor them to your business. Customization can include adjusting the layout, adding business logos, or modifying the fields to reflect the exact nature of your transactions. This flexibility ensures that your records are always accurate and aligned with your business practices.

| Feature | Description |

|---|---|

| Customizable Fields | Edit fields for specific details such as client names, dates, or amounts. |

| Professional Design | Pre-designed layout that gives your documents a polished and official appearance. |

| Easy Sharing | Download and send your documents digitally or print them for physical records. |

Why You Need an Invoice Receipt

Having a clear and organized way to document financial exchanges is essential for any business. Properly recording the details of transactions ensures transparency, reduces confusion, and maintains a professional image. These documents serve as proof of payment and help in tracking business expenses and income effectively.

Establishing Trust with Clients

Providing well-organized documents after each transaction fosters trust and strengthens the relationship with clients. It shows that your business is professional and committed to keeping accurate records. This transparency can make clients feel more confident in doing business with you repeatedly.

Tax and Legal Compliance

Having a consistent method for documenting payments is also crucial for tax purposes. These records are often required during audits or for filing taxes, ensuring that your business complies with local regulations. Well-maintained documents help avoid legal issues and provide clarity in case of disputes.

How to Create Your Own Template

Building a personalized document for tracking transactions can greatly benefit your business. Designing a customized format allows you to include the specific details you need while keeping the layout simple and effective. This approach not only ensures clarity but also adds a professional touch to every transaction record you issue.

Start by outlining essential information such as client names, dates, descriptions of goods or services, and payment details. Including these core elements ensures that eac

Advantages of Using a Free Template

Opting for ready-made documents to manage transaction records can streamline your business processes. These pre-designed formats provide a quick and practical solution, especially for small businesses and freelancers, allowing you to maintain organized and professional documentation without starting from scratch.

Time-Saving Solution

Using a prepared document format significantly reduces the time needed to create each record manually. By simply filling in relevant

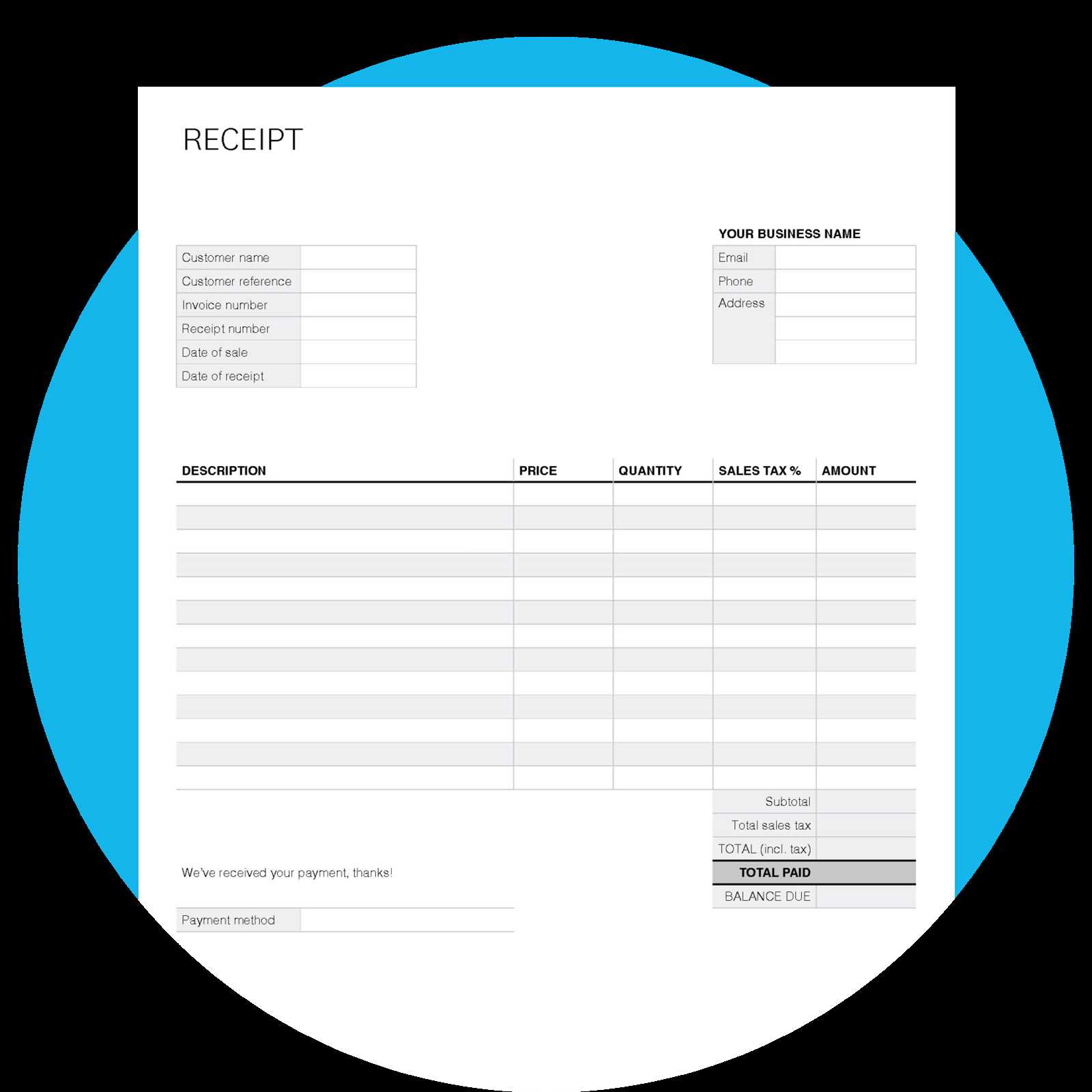

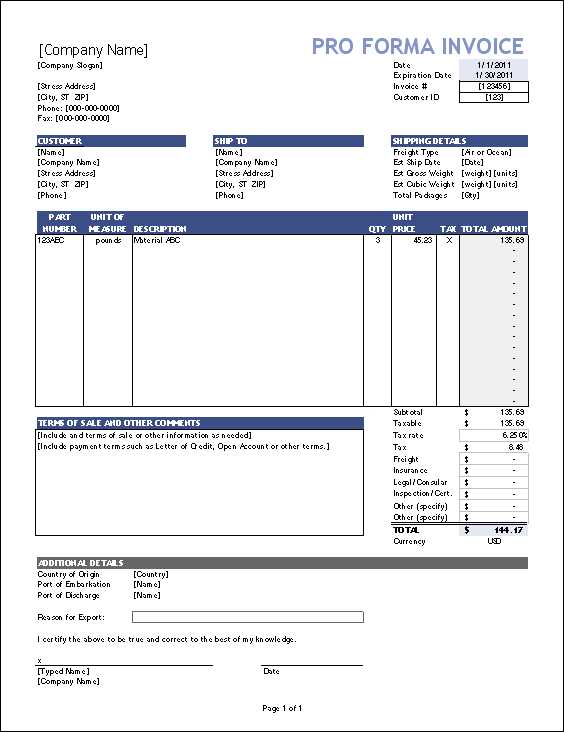

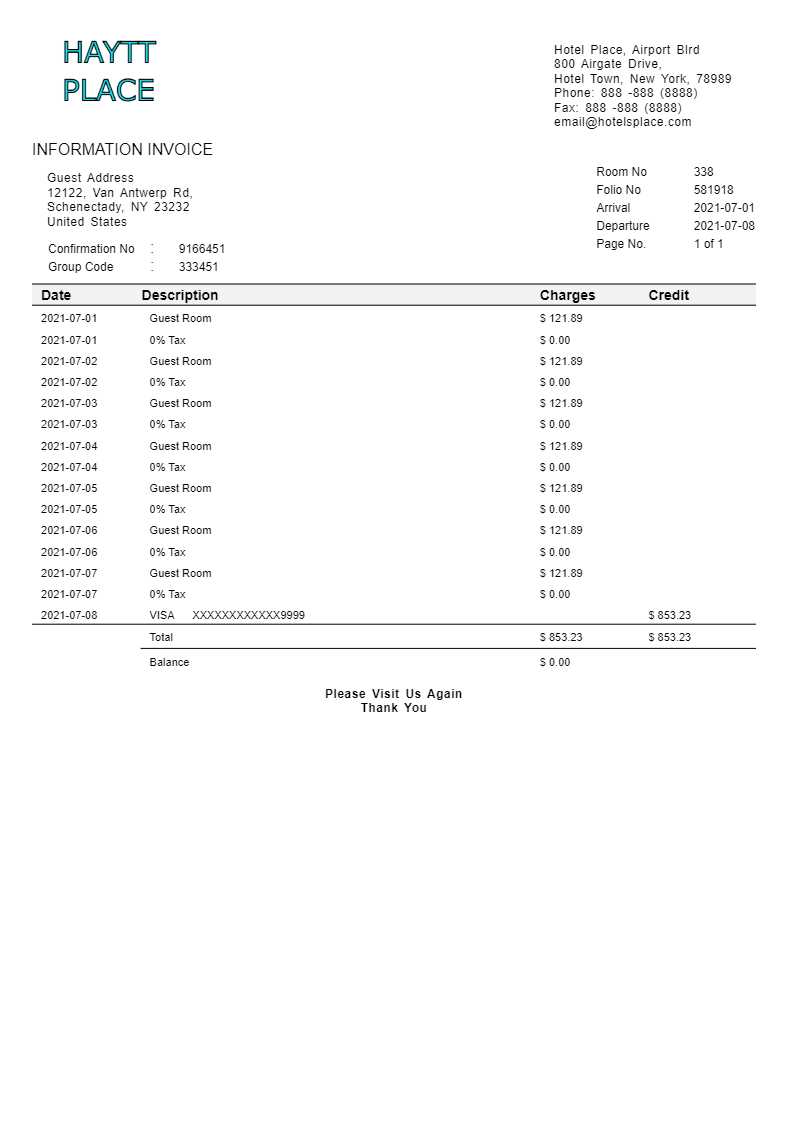

Key Elements of an Invoice Receipt

To create an effective document for tracking transactions, certain essential details should be included. These key components provide clarity and ensure that both parties have a clear record of the financial exchange. A well-structured document reduces misunderstandings and helps maintain a professional approach in business dealings.

Basic Information and Contact Details

Include essential identification information such as business names, addresses, and contact information for both you and the client. These details make it easy to trace the transaction and en

Customizing a Free Invoice Receipt

Personalizing a standard document can help align it with your business’s unique style and needs. Making adjustments allows you to add details that reflect your brand, making the document more recognizable and ensuring it includes all essential information specific to your operations. This customization can enhance both professionalism and functionality.

Steps for Personalization

Follow these steps to create a document that fits your business requirements while maintaining a professional layout:

- Add Branding Elements: Include your business logo, colors, and fonts to

Customizing a Free Invoice Receipt

Personalizing a standard document can help align it with your business’s unique style and needs. Making adjustments allows you to add details that reflect your brand, making the document more recognizable and ensuring it includes all essential information specific to your operations. This customization can enhance both professionalism and functionality.

Steps for Personalization

Follow these steps to create a document that fits your business requirements while maintaining a professional layout:

- Add Branding Elements: Include your business logo, colors, and fonts to reinforce brand identity. This small touch makes your records stand out and appear more official.

- Customize Fields: Tailor specific sections, such as client details, service descriptions, and payment terms, to suit your transaction details.

- Adjust Layout: Modify the structure of the document to highlight important information, such as due dates or contact information, for easier reference.

Essential Components to Consider

Ensure your customized document covers all necessary sections. Here are some important elements to include:

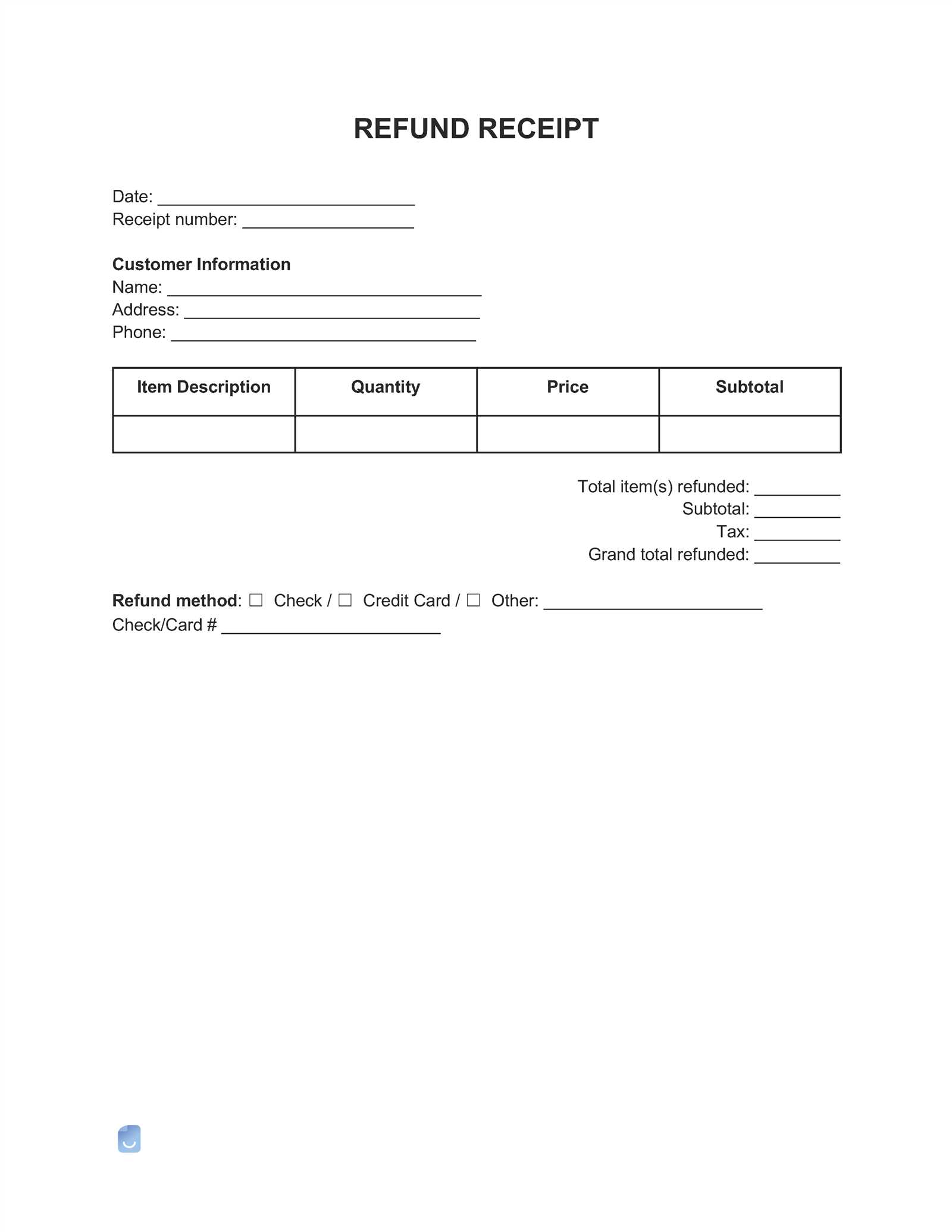

- Client Information: Names, addresses, and contact details.

- Service or Product Details: Detailed descriptions and associated costs.

- Payment Terms: Clear information on due dates and accepted payment methods.

By making these adjustments, you create a professional, tailored document that effectively meets your business’s needs and communicates essential information to clients.

Printable vs. Digital Invoice Receipts

Choosing between physical copies and digital formats for transaction records depends on various factors, including business needs, customer preferences, and storage considerations. Both options offer unique advantages that can suit different business environments and client expectations.

Advantages of Printable Formats

- Tangible Record: Physical copies provide a tangible document that clients can file and access without digital devices, useful for those who prefer traditional record-keeping.

- Professional Presentation: High-quality printed formats can leave a positive impression, especially when handed directly to clients, reinforcing professionalism.

- Reliable Storage: Physical documents do not rely on electronic storage and are safe from data loss associated with digital storage failures.

Common Mistakes to Avoid in Invoices

Creating clear and accurate transaction documents is essential for smooth business operations and effective communication with clients. Avoiding common errors can save time, prevent misunderstandings, and ensure timely payments. Here are some frequent mistakes to watch out for and tips on how to avoid them.

Missing or Incorrect Information

- Incomplete Contact Details: Ensure both business and client names, addresses, and contact numbers are fully listed. Missing these can lead to confusion or delays.

- Incorrect Dates:

Common Mistakes to Avoid in Invoices

Creating clear and accurate transaction documents is essential for smooth business operations and effective communication with clients. Avoiding common errors can save time, prevent misunderstandings, and ensure timely payments. Here are some frequent mistakes to watch out for and tips on how to avoid them.

Missing or Incorrect Information

- Incomplete Contact Details: Ensure both business and client names, addresses, and contact numbers are fully listed. Missing these can lead to confusion or delays.

- Incorrect Dates: Dates are crucial for due payment terms and record-keeping. Double-check that the issue and due dates are accurate to avoid miscommunication.

- Omitted Item Descriptions: Include clear descriptions of products or services to prevent any uncertainty regarding charges.

Errors in Calculations and Payment Terms

- Miscalculations: Simple errors in adding up amounts or applying taxes can cause payment delays. Verify all calculations to ensure the final amount is correct.

- Unclear Payment Terms: Specify due dates and acceptable payment methods clearly. Lack of clarity here can lead to delays or missed payments.

- Missing Discounts or Fees: If discounts or additional fees apply, make sure they are itemized. Leaving these out can create unexpected confusion at payment time.

Being mindful of these common issues and double-checking for accuracy can help build trust with clients and streamline your billing process. Clear, correct documents contribute to smoother transactions and better professional relationships.

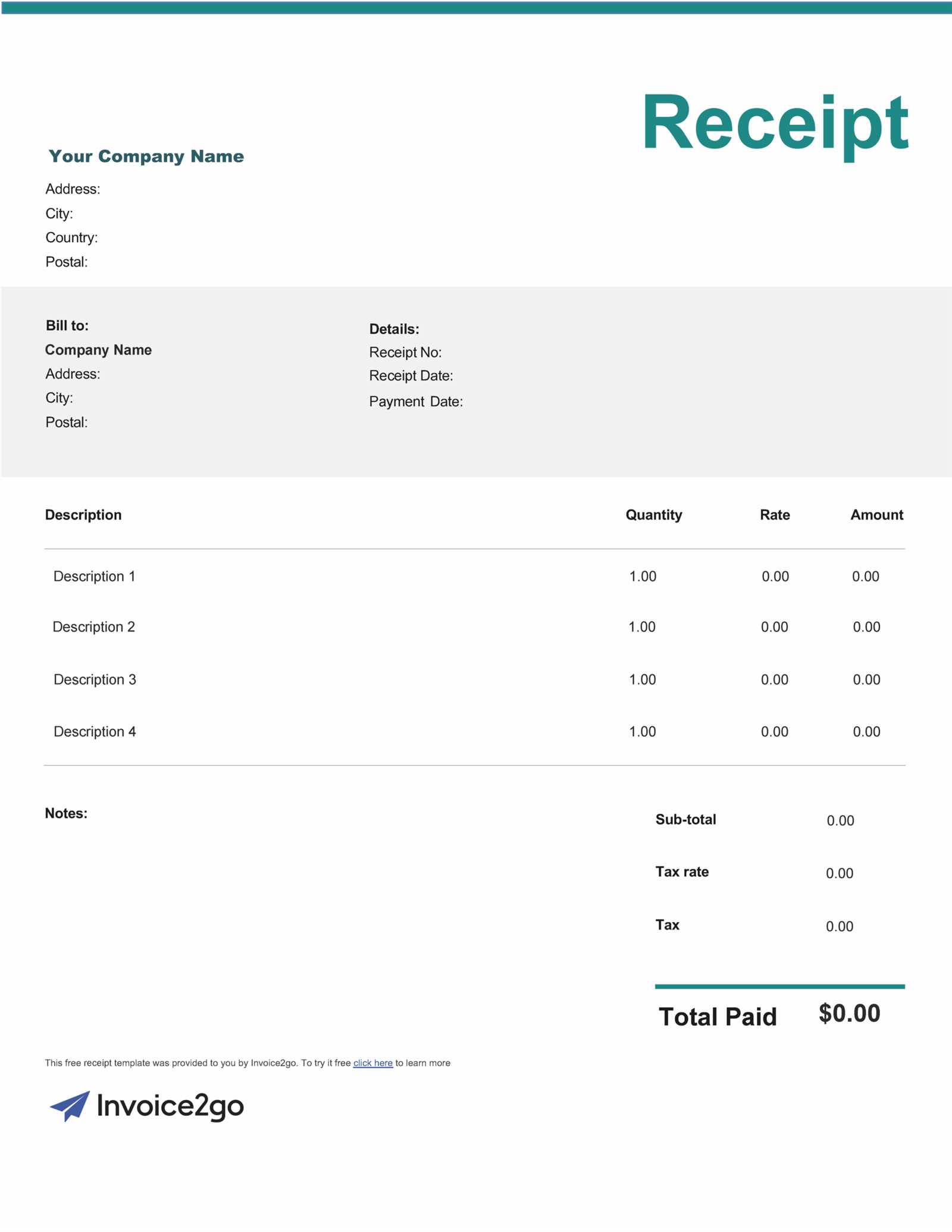

Choosing the Right Format for Receipts

Selecting an appropriate format for transaction records is essential for efficient record-keeping and ease of use. Different formats suit various needs, depending on the type of business, frequency of transactions, and client preferences. The following guide outlines popular formats and their advantages to help you determine the most effective choice for your needs.

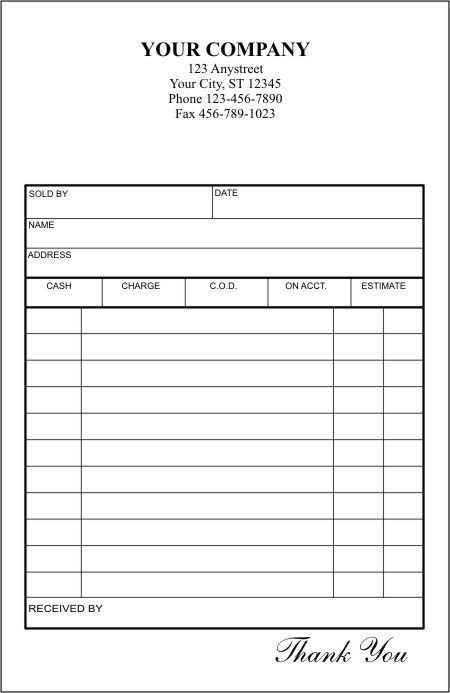

Format Type Advantages Choosing the Right Format for Receipts

Selecting an appropriate format for transaction records is essential for efficient record-keeping and ease of use. Different formats suit various needs, depending on the type of business, frequency of transactions, and client preferences. The following guide outlines popular formats and their advantages to help you determine the most effective choice for your needs.

Format Type Advantages Best For PDF Easy to share and print, maintains consistent formatting across devices Businesses needing a professional, secure format Excel or Spreadsheet Customizable, allows for easy adjustments and calculations Frequent transactions with varied item or service listings Word Document Simple to edit, suitable for straightforward records Small businesses with basic transaction needs Online or Cloud-Based Accessible from anywhere, can integrate with other tools Businesses with remote or mobile transactions Each format has unique benefits, so selecting the best one depends on balancing usability, accessibility, and professionalism. A well-suited format can streamline the record-keeping process and enhance client interactions.

Legal Aspects of Invoice Receipts

Ensuring that transaction records meet legal standards is vital for maintaining transparency and compliance in business dealings. Properly structured records protect both parties, providing a clear account of the transaction details and supporting evidence for tax and audit purposes.

A well-drafted document should include all required information, such as identification details of both parties, description of goods or services exchanged, and the agreed amount. These elements not only support business integrity but also help avoid potential disputes by creating a comprehensive account of each transaction.

Managing Invoice Receipts for Tax Purposes

Keeping accurate transaction records is essential for organized financial management, especially when preparing for tax obligations. Properly maintained records help ensure smooth tax filing, allowing businesses and individuals to avoid unnecessary complications and meet compliance requirements.

Best Practices for Record-Keeping

To streamline financial tracking, consider adopting a few key practices for managing transaction documents effectively:

- Organize by Date: Sort documents chronologically to simplify retrieval during tax season.

- Categorize by Expense Type

Managing Invoice Receipts for Tax Purposes

Keeping accurate transaction records is essential for organized financial management, especially when preparing for tax obligations. Properly maintained records help ensure smooth tax filing, allowing businesses and individuals to avoid unnecessary complications and meet compliance requirements.

Best Practices for Record-Keeping

To streamline financial tracking, consider adopting a few key practices for managing transaction documents effectively:

- Organize by Date: Sort documents chronologically to simplify retrieval during tax season.

- Categorize by Expense Type: Separate records by types, such as supplies, services, and travel, to provide clear insights into deductible expenses.

- Digitize Records: Keep digital backups of all documents to protect against physical loss or damage.

Preparing for Tax Filing

When it’s time to file taxes, having an organized system pays off. Structured records provide a clear view of deductible expenses and streamline the process of calculating owed taxes:

- Review records for completeness and accuracy.

- Ensure that each document includes essential details like dates and descriptions.

- Verify that all eligible expenses are documented to maximize tax benefits.

By implementing these practices, individuals and businesses can maintain clean financial records that facilitate easier tax reporting and support compliance with tax regulations.

Making Your Invoice Receipts More Secure

Ensuring the security of transaction records is essential in today’s digital world, where data privacy and financial integrity are top priorities. Implementing key practices to safeguard these documents can protect sensitive information and build trust with clients.

Tips for Enhancing Document Security

There are several steps you can take to make sure your transaction records are well-protected:

- Use Encryption: Protect digital documents by encrypting files, adding an extra layer of security to prevent unauthorized access.

- Secure Storage: Keep physical documents in a locked and secure location, and store digital files in trusted cloud services or password-protected folders.

- Access Control: Limit access to these documents only to necessary personnel to reduce risks associated with data leaks.

Establishing a Backup System

To prevent data loss, it’s important

Benefits of Using a Template for Record Keeping

Utilizing a structured format for maintaining financial documents can greatly enhance organization and efficiency. By adopting a consistent approach, businesses can streamline their record-keeping processes, reduce errors, and ensure compliance with financial regulations.

Advantages of a Structured System

A well-organized record-keeping system brings numerous benefits, including:

- Improved Accuracy: With predefined fields and a consistent layout, it’s easier to avoid mistakes and ensure data is correctly entered.

- Time Efficiency: Templates save time by eliminating the need to start from scratch for each document, allowing for quicker processing.

- Professional Appearance: Using a uniform system ensures that all financial documents appear consistent and professional, which is crucial for business reputation.

- Enhanced Compliance: A well-structured system helps ensure that all necessary information is captured, meeting legal and regulatory requirements.

Streamlining Your Workflow

By leveraging a standardized framework for financial documentation, businesses can easily track transactions, maintain accurate records, and reduce the chances of missing important details. This approach supports better management of finances and simplifies audits or reviews.

Example of a Standardized Format

Field Description Date The date the transaction occurred. Amount The total sum of the transaction. Client Information Details about the client involved in the transaction. Description A brief explanation of the goods or services provided. Adopting a reliable structure for managing financial documents not only increases efficiency but also ensures that important information is easily accessible when needed.

How to Share Invoice Receipts with Clients

Effectively sharing financial documents with clients is crucial for smooth business transactions. Choosing the right method to send such documents ensures prompt payment and reduces confusion. There are various ways to share these records securely and professionally, depending on the preferences of both the business and the client.

Email Communication

One of the most common methods to send financial records is via email. By attaching the document as a PDF or other widely accessible format, businesses can quickly deliver the necessary information. When using this method, ensure the file is appropriately named for easy identification, such as including the client’s name or transaction number.

- Advantages: Fast, convenient, and widely accepted by clients.

- Best Practice: Use a clear subject line and a polite message that summarizes the attached file.

Using Online Payment Platforms

Many businesses utilize online payment systems that allow clients to view and download financial records directly from the platform. This method ensures that both the payment and documentation are linked, providing a seamless transaction experience.

- Advantages: Clients can access the document anytime, from any device.

- Best Practice: Include clear instructions on how to access the document, and ensure the system is user-friendly.

Choosing the right sharing method depends on the preferences of your clients, the nature of your business, and the level of security required. Whether by email or an online platform, the goal is to ensure clear communication and smooth financial record management.