Employee Salary Invoice Template for Easy Payroll Management

Managing financial records for staff can be time-consuming, but having the right structure in place can make the process significantly smoother. Businesses of all sizes need an efficient way to document payments made to workers, ensuring clarity, compliance, and transparency. A well-designed method for recording compensation is not only essential for keeping accurate accounts but also for avoiding disputes and potential legal issues.

One of the most effective ways to handle this task is by using a standardized form that captures all necessary details. These forms provide consistency across payments, making it easier to track earnings, deductions, and overall compensation. With a pre-set structure, employers can save time, reduce errors, and ensure that each payment is properly documented.

By implementing a reliable method for financial reporting, businesses can maintain better oversight of their expenses, provide clear statements to workers, and stay compliant with relevant regulations. Whether manually creating these records or utilizing software, an organized approach is key to maintaining smooth operations.

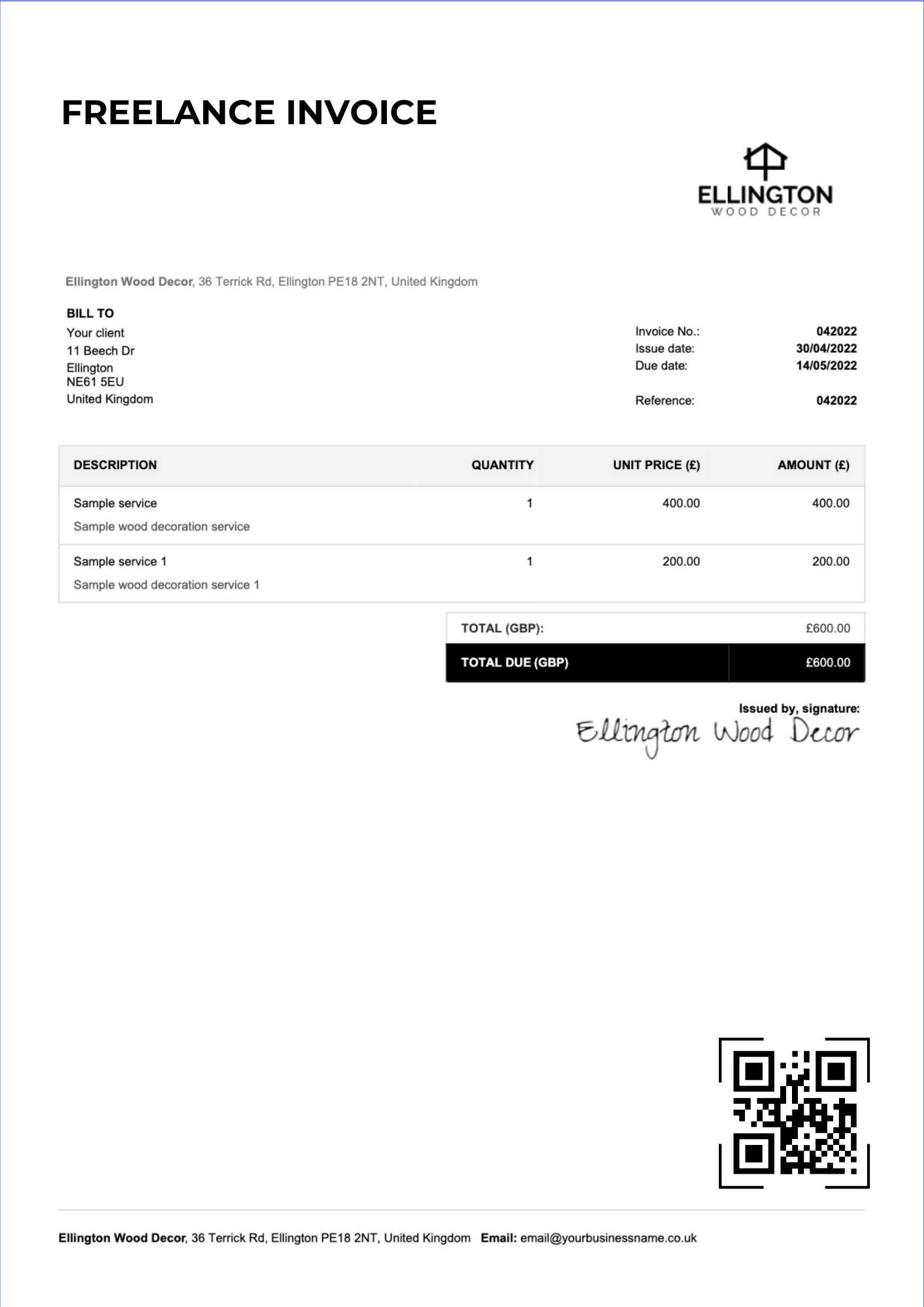

Employee Salary Invoice Template Overview

Managing financial records for staff compensation is a crucial aspect of any business operation. It involves ensuring that all payments are documented accurately and efficiently, which helps to maintain clarity for both the employer and the recipient. An organized document that captures all payment details not only serves as a record for future reference but also helps with regulatory compliance and transparency in business dealings.

Importance of Structured Payment Records

When workers are compensated, it’s vital to have a structured way to record their earnings, deductions, and benefits. A well-organized document allows employers to track payments easily, making it simple to address questions, resolve discrepancies, or generate reports when needed. Using a standardized document also minimizes the risk of mistakes and ensures that all required information is consistently included.

Key Elements to Include in the Document

These records typically include essential details such as the recipient’s name, the payment period, the total amount earned, any deductions or withholdings, and the net amount paid. Additionally, it may feature company details, payment methods, and specific notes about benefits or bonuses. The structure is designed to provide clear information for both the employer and the recipient, ensuring all necessary data is easily accessible.

Why You Need a Salary Invoice

Properly documenting financial transactions related to worker compensation is essential for maintaining transparency and accuracy in business operations. Without clear and consistent records, it becomes difficult to track payments, address any discrepancies, or meet legal requirements. An organized form to capture these details ensures both the employer and the worker are on the same page regarding compensation, reducing the risk of misunderstandings.

Legal and Tax Compliance

One of the primary reasons for having a structured document is to stay compliant with tax and labor laws. Governments often require businesses to provide detailed records of compensation paid, and having a well-maintained document helps meet these requirements. It also serves as proof of payment, which can be crucial during audits or legal disputes.

Improved Financial Management

Accurate records not only protect businesses legally but also help with internal financial management. By documenting each transaction, business owners and managers can easily track how much they’ve spent on labor costs, make budget adjustments, and generate reports. This level of organization enhances decision-making and helps avoid errors that could affect cash flow.

Key Features of an Invoice Template

For any business, having a well-organized document for recording compensation details is vital for both clarity and accuracy. The right structure ensures that all essential information is captured, reducing the likelihood of errors and making it easier to track payments over time. Below are the key elements that should be included to create an efficient and comprehensive document.

Essential Components

- Recipient Information: Full name, job title, and contact details to clearly identify the individual receiving the payment.

- Payment Period: Dates specifying the time frame for which compensation is being provided, such as weekly, bi-weekly, or monthly.

- Payment Amount: Clear breakdown of total earnings, including base pay, overtime, bonuses, and any other applicable compensation.

- Deductions: A detailed list of any deductions, such as taxes, insurance, or retirement contributions, to ensure transparency.

- Net Payment: The final amount to be paid after deductions, giving the worker a clear understanding of their take-home pay.

Additional Features

- Company Information: Name, address, and contact details of the business issuing the payment, establishing legitimacy.

- Payment Method: The method used to transfer the funds, such as direct deposit, check, or cash, providing clear documentation for both parties.

- Notes or Comments: A section for any additional information or clarifications, such as special bonuses, reimbursements, or adjustments.

Including these essential features in each document helps create a clear, reliable, and legally sound record of payments, benefiting both employers and workers. A consistent format will ensure that each transaction is documented accurately and professionally.

How to Customize Salary Invoices

Tailoring financial documentation for workers’ compensation allows businesses to meet specific needs while ensuring clarity and accuracy. Customizing these records ensures that all relevant details are included, while also maintaining a professional and consistent format. Here’s how to personalize your documents to better fit your company’s requirements.

Adjusting Layout and Design

One of the first steps in customization is adjusting the layout to match your business branding. This may include adding your company logo, choosing specific fonts and colors, and adjusting the overall structure of the document. The layout should be clean and easy to navigate, with sections clearly defined for each type of information.

Including Custom Fields

To meet the unique needs of your business, you can add custom fields to capture specific information. For example, if your company provides additional benefits or allowances, you can create dedicated spaces to list these details. Some businesses may also require fields for project codes, department names, or cost centers, which can help with internal accounting and reporting.

- Custom Notes Section: Add a space for any additional remarks, such as one-time payments or adjustments.

- Additional Deduction Categories: Customize the document to reflect any specific deductions, such as equipment fees or union contributions.

- Payment References: If payments are linked to specific projects or contracts, adding reference numbers can help with tracking.

By customizing these key elements, you can ensure that each document fully meets the needs of your business while keeping it professional and organized.

Common Mistakes in Salary Invoices

Even with the best intentions, errors can occur when documenting payments for workers. These mistakes can lead to confusion, disputes, or even legal issues. Identifying and avoiding common pitfalls can help ensure that all records are accurate, clear, and professional. Below are some of the most frequent mistakes to watch out for.

Common Errors to Avoid

| Error | Impact | Solution |

|---|---|---|

| Missing Payment Period | Unclear time frame may lead to confusion about the work period. | Always specify exact start and end dates for each payment period. |

| Incorrect Deductions | Improper deductions can lead to overpayment or underpayment. | Double-check all tax and other deduction amounts before finalizing the document. |

| Omitting Company Details | Lack of company information can make the document look unprofessional or unclear. | Ensure your company’s name, address, and contact details are included in every document. |

| Failure to Account for Bonuses or Overtime | Missing extra payments may result in incorrect totals. | List all additional earnings, such as bonuses or overtime, clearly. |

| Incorrect Net Payment Calculation | Errors in math may cause significant issues in payments. | Always verify that the final net amount is correct after deductions. |

Ensuring Accuracy and Consistency

By paying attention to these common mistakes, businesses can reduce the likelihood of errors in financial records. Regularly reviewing your documentation process and using a checklist can ensure consistency, minimize risks, and enhance transparency for all parties involved.

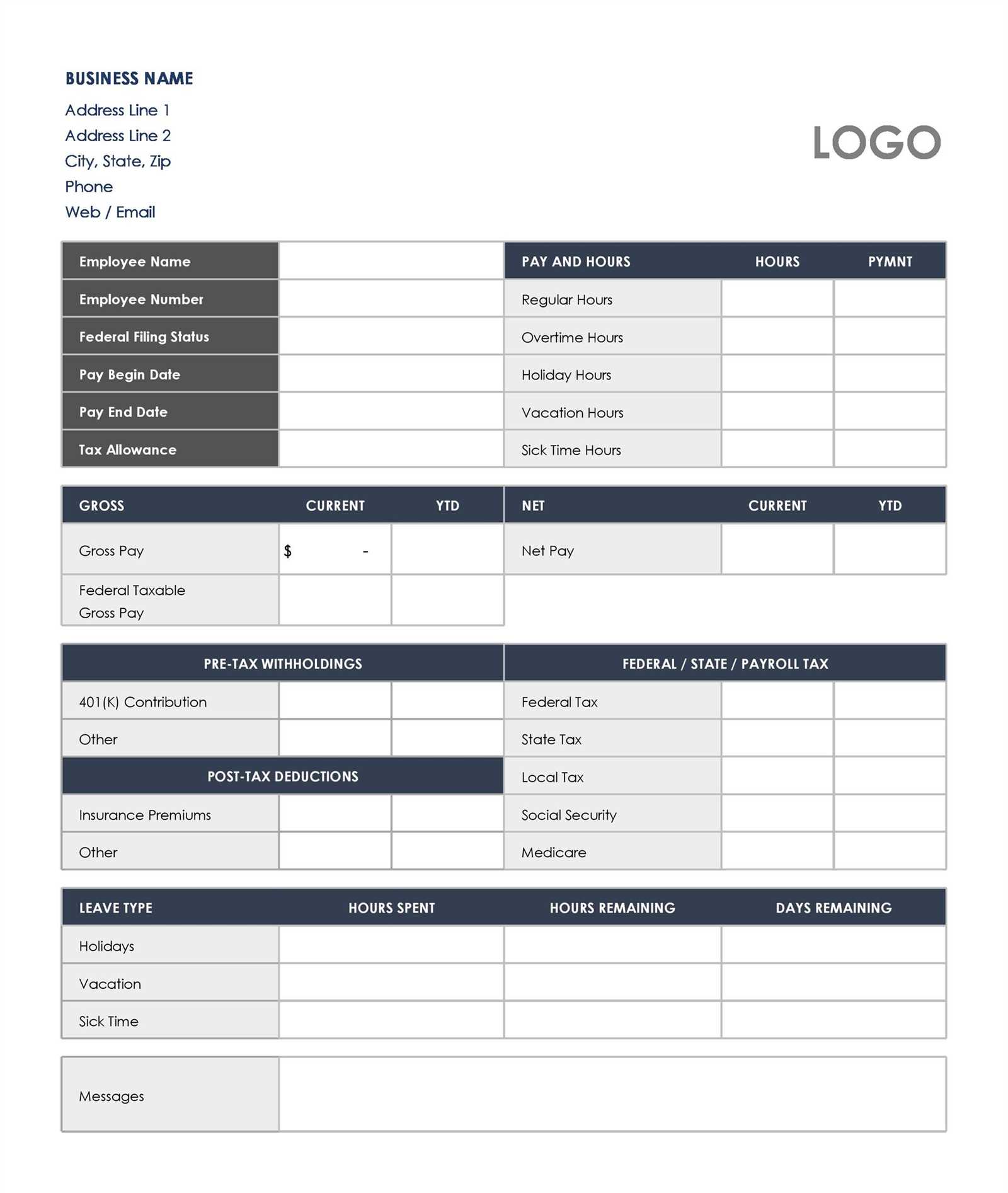

How to Calculate Employee Salary

Accurate calculations of compensation are crucial to ensure workers are paid correctly for their work. The process involves considering base pay, additional earnings, and required deductions. Understanding how to calculate the total payment amount is essential for both employers and workers, as it directly impacts financial records and legal compliance. Below is a breakdown of the key steps involved in determining the correct payment amount.

Step-by-Step Calculation Process

- Determine Base Pay: Identify the agreed-upon hourly wage or fixed monthly/weekly pay rate. For hourly workers, multiply the hourly rate by the total hours worked.

- Include Overtime or Bonuses: If applicable, calculate any overtime pay or bonuses. Overtime is typically paid at a higher rate, such as 1.5 times the regular hourly rate.

- Account for Deductions: Subtract any mandatory deductions, such as taxes, insurance premiums, or retirement contributions. These should be calculated according to local laws or company policies.

- Calculate Net Pay: Subtract total deductions from the gross earnings (the amount before deductions) to find the net payment. This is the final amount the worker will receive.

Additional Considerations

- Bonuses or Commissions: If applicable, ensure that any performance-related bonuses or sales commissions are included in the total payment calculation.

- Allowances: Some companies provide allowances for travel, meals, or other expenses. Be sure to account for these in the final payment amount.

- Reimbursements: If the worker is owed for any out-of-pocket expenses, these should be included in the compensation calculation.

By foll

Choosing the Right Format for Invoices

Selecting the appropriate structure for documenting compensation is essential for ensuring accuracy and consistency. The right format can streamline the process, making it easier to track payments, generate reports, and stay compliant with legal requirements. A well-chosen format provides clarity for both the employer and the recipient, minimizing confusion and reducing errors. Below are key considerations when deciding on the best format for your payment records.

Factors to Consider When Selecting a Format

- Simplicity and Clarity: Choose a format that is straightforward and easy to read. A clean layout helps ensure that all necessary details are visible and accessible at a glance.

- Flexibility: The format should allow for customization to accommodate various payment structures, such as hourly, weekly, or project-based compensation.

- Legality and Compliance: Ensure the format includes all legally required elements, such as tax information and deduction categories, to meet local or industry-specific regulations.

- Compatibility: The chosen format should be compatible with your record-keeping or accounting software, enabling seamless integration and data management.

Popular Formats to Consider

- Digital Formats: Electronic documents (such as PDFs or Excel sheets) allow for easy customization, sharing, and storage. They are often preferred for businesses that require quick access and secure digital records.

- Printed Formats: For businesses that prefer physical documentation, printed records provide a tangible paper trail. Ensure the format remains clear and legible when printed.

- Online Platforms: Many businesses opt for specialized online tools or software that generate structured payment records automatically. These platforms often offer additional features like automated calculations, compliance tracking, and secure cloud storage.

By carefully selecting a format that suits your business needs, you ensure that all payments are documented accurately and professionally, enhancing efficiency and maintaining clear communication with workers.

Steps to Create a Salary Invoice

Creating a payment record for workers involves several key steps to ensure that all necessary details are accurately captured. From calculating the total amount owed to ensuring compliance with tax regulations, each element must be carefully considered to produce a professional and error-free document. Below are the essential steps to follow when preparing such a document.

Step 1: Gather Essential Information

Before you start, make sure you have all the necessary details at hand. This includes the worker’s name, payment period, job title, and any additional payments such as overtime or bonuses. You’ll also need to know the deductions to be made, such as taxes or insurance premiums, in order to calculate the final amount correctly.

Step 2: Choose the Right Format

Decide on the format for the document. You can use a word processor, spreadsheet software, or specialized accounting software to create the record. Choose a format that is easy to customize and clear for both you and the worker to review. The format should have designated areas for all key details, such as the payment amount, deductions, and net total.

Step 3: List Compensation and Deductions

Clearly outline the total compensation amount, breaking it down into components like base pay, bonuses, and overtime. Subtract any required deductions, such as taxes, retirement contributions, or insurance premiums, to arrive at the net amount. Be transparent with all deductions so that the worker can easily understand the breakdown.

Step 4: Double-Check Calculations

Verify all calculations to ensure accuracy. This includes confirming the hours worked, the pay rate, and any deductions. Even a small mistake in the math could result in over- or underpayment, which could lead to confusion or disputes.

Step 5: Add Payment Details

Include information about the method of payment (e.g., bank transfer, check, or cash) and the date the payment was made or will be made. This helps keep clear records for both parties and ensures that the transaction is well-documented.

Step 6: Review and Finalize

Review the document for any errors or missing information. Ensure that all fields are filled out and that the final amount is clearly stated. Once you’re confident that everything is accurate, finalize the document by either sending it digitally or printing it out for the worker.

By following these steps, you can create a comprehensive and accurate payment record that will help keep both you and your workers

Understanding Payroll Deductions on Invoices

When documenting payments made to workers, it’s essential to accurately reflect all required deductions. These reductions from gross earnings are a standard part of compensation records and help ensure compliance with tax laws, benefits programs, and other financial obligations. Understanding how to properly calculate and display these deductions is crucial for both employers and workers to ensure transparency and avoid confusion.

Types of Common Deductions

There are several types of deductions that are commonly applied to compensation. These can vary depending on local laws, company policies, and specific worker agreements. Below are some of the most frequent deductions you might encounter:

| Deductions | Description |

|---|---|

| Taxes | Federal, state, and local income taxes are typically deducted from gross earnings based on applicable tax rates and the worker’s tax status. |

| Social Security and Medicare | Contributions to social security and healthcare programs are mandatory in many countries. These deductions are usually a percentage of the total pay. |

| Insurance Premiums | Health, dental, or life insurance premiums may be deducted from earnings if the worker is enrolled in a company-sponsored benefits plan. |

| Retirement Contributions | Contributions to pension or retirement funds (such as a 401(k) in the U.S.) may be deducted, either as part of a company-sponsored program or through employee elections. |

| Union Dues | For workers who are members of a union, dues may be deducted directly from their pay to maintain membership in the union. |

How to Calculate Deductions

To ensure that the deductions are accurate, each one must be calculated based on the relevant percentage or amount set by law or company policy. For example, tax rates are often dependent on the worker’s income bracket, while contributions to social security or insurance premiums may be fixed percentages. It’s important to stay updated with any changes in regulations to prevent errors in the calculations.

Properly listing these deduc

Benefits of Using a Template for Salaries

Using a standardized structure for documenting compensation brings several advantages to both employers and workers. By utilizing a pre-designed format, businesses can streamline their processes, reduce errors, and ensure consistency in financial documentation. These benefits extend beyond just convenience, as a well-organized format improves communication and legal compliance, leading to a smoother payment process overall.

Improved Accuracy and Consistency

One of the main advantages of using a structured format is the reduction in human error. With predefined fields and sections, there is less room for mistakes, such as forgetting key details or miscalculating payment amounts. This consistency not only ensures that the information is accurate but also builds trust with workers who can easily verify that their compensation has been calculated correctly.

Time-Saving and Efficiency

Having a ready-to-use format can significantly reduce the time spent on creating records for each payment cycle. Instead of starting from scratch each time, businesses can simply fill in the necessary details and generate the document quickly. This is especially beneficial for businesses with multiple workers or large teams, where processing payments manually can be time-consuming and tedious.

Using a standardized format also reduces the administrative burden, allowing HR or payroll departments to focus on other critical tasks while ensuring all payments are documented properly and on time. Whether it’s a simple template in a word processor or an advanced tool integrated with accounting software, having a consistent structure makes managing compensation much easier.

How to Track Employee Payments with Templates

Keeping accurate records of worker compensation is crucial for both businesses and workers, ensuring transparency, legal compliance, and financial accountability. A well-organized system helps track payments, monitor any discrepancies, and maintain a clear record for tax and reporting purposes. Using a structured format can simplify this process and make tracking payments more efficient.

Steps to Track Payments Effectively

- Use a Consistent Structure: Having a standardized format for all records ensures that every document contains the same essential information, making it easier to compare, reference, and track payments over time.

- Include Key Payment Details: Always document important details such as the worker’s name, the payment period, the total amount paid, and any deductions made. These details are essential for accurate tracking and future reference.

- Track Payment Dates: Record the exact dates when payments are issued. This helps you stay organized and ensures you can easily track whether payments are being made on time or need to be addressed.

- Record Deductions and Bonuses: It’s important to track both deductions and any additional payments like bonuses or overtime. By including these, you can ensure all adjustments are accounted for in the overall payment history.

Benefits of Using a Structured Format for Tracking

- Enhanced Accuracy: With a consistent format, the chances of errors are significantly reduced, ensuring that the correct amount is tracked for each individual.

- Easy Retrieval of Information: A well-organized system makes it easy to access previous payment records when needed, whether for audits, tax filings, or resolving any disputes.

- Streamlined Financial Management: When payments are tracked in an organized and efficient manner, it simplifies financial planning, budgeting, and reporting.

By using a structured format to track compensation records, businesses can ensure that payments are properly documented, errors are minimized, and financial operations run smoothly. Whether using manual systems or digital tools, consistency in tracking is key to maintaining order and compliance.

Automating Salary Invoices with Software

Automating the creation of compensation records using software can drastically improve efficiency, reduce human error, and streamline the overall payroll process. By integrating automation tools into your business, you can eliminate the time-consuming task of manually generating payment documentation. Automation ensures that all necessary details are included, calculations are accurate, and compliance with regulations is maintained, all while saving valuable time and resources.

Key Benefits of Automation

- Time Efficiency: Automation reduces the time spent on generating and distributing payment records, allowing businesses to focus on other essential tasks.

- Accuracy: Automated systems perform calculations without the risk of human error, ensuring that all amounts are correct, including deductions, bonuses, and overtime.

- Consistency: Using software ensures that every record follows the same structure and format, eliminating inconsistencies that could lead to confusion or errors.

- Compliance: Payroll software is often updated to reflect the latest tax laws and regulations, helping businesses stay compliant with local and national requirements.

How Automation Streamlines the Process

- Centralized Data Management: Software solutions allow you to store all relevant compensation data in one place, making it easier to track, update, and retrieve information as needed.

- Customizable Templates: Many software tools come with pre-built templates that can be customized to suit the unique needs of your business. You can adjust payment structures, tax calculations, and deductions according to company policies.

- Automated Reports: Automated systems can generate and send reports on a scheduled basis, ensuring that you always have up-to-date financial information without needing to create new records manually.

- Integration with Accounting Software: Many payroll automation tools integrate seamlessly with accounting and financial software, streamlining the entire workflow from payment calculation to record keeping and tax filing.

By automating the process of creating compensation records, businesses can save time, increase accuracy, and ensure they remain compliant with all financial and legal regulations. Software solutions provide an efficient and reliable way to manage payments, improving the overall payroll experience for both

Legal Considerations for Salary Invoices

When creating documentation for worker compensation, it’s essential to be mindful of the legal requirements that ensure accuracy and compliance with relevant laws. These records are not only financial documents but also legal instruments that may be used in audits, disputes, or regulatory inspections. Understanding the legal aspects of compensation records helps businesses avoid penalties, maintain good relations with workers, and stay in line with labor regulations.

Key Legal Aspects to Consider

- Accurate Representation: Compensation records must clearly reflect the actual payments made, including base pay, bonuses, overtime, and any deductions. Falsifying information can lead to legal consequences, including fines and potential lawsuits.

- Compliance with Local Tax Laws: Ensure that all applicable taxes are deducted and properly reported. Depending on the jurisdiction, tax laws may differ, so it’s important to stay informed about the latest rates and compliance rules.

- Worker Rights: In many countries, labor laws require employers to provide workers with detailed records of their compensation. These documents serve as proof of payment and help workers understand how their earnings were calculated, including deductions for taxes, benefits, and other contributions.

- Timely Distribution: Payment records must be distributed in a timely manner, typically at the same time as the payment. Delays in providing these documents can lead to misunderstandings and may be seen as a violation of workers’ rights in some jurisdictions.

- Retention of Records: Employers are typically required to keep compensation records for a certain number of years for tax and legal purposes. Failure to retain these records can result in penalties if the business is audited or if a dispute arises.

How to Ensure Legal Compliance

- Familiarize Yourself with Local Laws: Research and understand the specific legal requirements for compensation records in your region. Laws can vary widely, so it’s crucial to stay up-to-date with local, state, and federal regulations.

- Include Required Information: Ensure that all legally required details are included in the record, such as the worker’s full name, total amount earned, deductions made, and the date of payment.

- Consult with Legal Professionals: For larger businesses or complex compensation structures, it’s wise to consult with legal or financial experts who can help you navigate the specific requirements and ensure full compliance with the law.

By understanding and adhering to these legal considerations, businesses can ensure that their compensation records are not only accurate but also legally compliant, reducing the risk of legal challenges or disputes in the future.

Best Practices for Salary Invoice Design

Creating well-structured and easy-to-read compensation records is essential for clarity and professionalism. A clean and organized design not only helps workers understand their payments but also reflects positively on the business. By following best practices in the design of these documents, you ensure that the information is presented clearly and in a way that meets legal and business standards.

Key Design Considerations

- Clarity and Simplicity: The design should be simple and intuitive, with clearly labeled sections for essential details like the total amount paid, deductions, and payment period. Avoid clutter and ensure that every piece of information has its place.

- Readable Font and Layout: Use easy-to-read fonts and an organized layout. Avoid overly complex fonts that may be hard to decipher. Consistent spacing and alignment improve readability, making it easier for both you and the recipient to review the document.

- Consistent Branding: If you’re using the record for business purposes, include your company logo, contact details, and other relevant branding elements. This creates a professional appearance and reinforces your company’s identity.

- Logical Information Flow: Present details in a logical order, starting with worker information at the top, followed by the payment breakdown, and concluding with the total amount due. This helps guide the reader through the document seamlessly.

Visual Elements to Include

- Bold Headers: Make key sections, such as the total amount and deductions, stand out by using bold headers. This helps important information catch the eye quickly.

- Tables for Payment Breakdown: Use tables to break down compensation details. Tables help organize information, such as regular pay, overtime, bonuses, and deductions, in an easy-to-read format.

- Color for Emphasis: Use color sparingly to highlight important elements, such as totals or due dates. However, avoid overwhelming the document with excessive color, as it may distract from the content.

- Footer for Legal and Contact Information: Include a footer with your company’s legal information, payment terms, and contact details. This provides the recipient with easy access to any necessary contact information in case of inquiries.

Maintaining Consistency Across Docum

How to Store Employee Salary Records

Proper storage of compensation documents is essential for businesses to ensure compliance with legal requirements, facilitate audits, and maintain organized financial records. Whether using physical or digital systems, it’s important to establish a clear, secure method for storing payment records. This ensures that the necessary information is easily accessible, protected from unauthorized access, and preserved for future reference when needed.

Digital Storage Solutions

Storing compensation records digitally offers several advantages, such as quick access, space-saving, and improved security. Here’s how to effectively manage digital records:

- Use Secure Cloud Storage: Cloud-based storage solutions offer secure, scalable options for keeping records organized. They provide easy access from multiple devices and ensure that data is backed up regularly.

- Implement Encryption: To protect sensitive financial information, encrypt the records before storing them online. This adds an extra layer of security against unauthorized access.

- Organize by Categories: Create folders for different payment periods, tax years, or employee groups to make it easier to find specific records when needed. Keep the structure simple and consistent.

- Regular Backups: Perform regular backups of your digital records to safeguard against data loss. Cloud services often provide automatic backups, but it’s good practice to manually back up critical data periodically.

Physical Storage Methods

While digital records are more common, some businesses may still choose to store physical copies of compensation documentation. Here’s how to manage physical records effectively:

- Use Filing Cabinets: Store documents in well-organized filing cabinets, with clearly labeled folders for each individual or payment period. Ensure the system is simple to navigate for easy retrieval of records.

- Updating and Maintaining Invoice Templates

As your business evolves, it’s important to regularly review and update the documents used for payment records to ensure they remain accurate and reflect current company policies, tax laws, and industry standards. Keeping these documents up-to-date helps avoid errors, ensures compliance with legal requirements, and improves efficiency in generating compensation statements. A well-maintained record structure also contributes to a consistent and professional image for your business.

Reasons to Regularly Update Payment Records

- Legal Compliance: Tax laws, deductions, and reporting requirements can change over time. Regular updates ensure that your documents reflect these changes and stay compliant with local, state, and national regulations.

- Reflecting Business Changes: As your company grows or alters its compensation structure (e.g., adding new benefits, bonuses, or adjusting pay rates), it’s crucial to update documents to accurately reflect these modifications.

- Consistency Across Records: Periodically updating your documents helps maintain consistency, making sure that all compensation records across your company look uniform and follow the same format.

- Improved Clarity: Changes in formatting, layout, or additional information can improve the clarity and professionalism of your records, making them easier for recipients to understand.

Best Practices for Maintaining Payment Records

- Review Regularly: Set a schedule to review and update your payment documents, ideally quarterly or at least once a year. Ensure all details, such as tax rates, benefits, and deductions, are current and accurate.

- Version Control: When making changes to your records, create version-controlled files or documents. This allows you to keep track of the changes made and revert to previous versions if necessary.

- Customize for Specific Needs: Tailor your payment documents based on the specific needs of your business. You may need different formats for full-time, part-time, or contract workers, or custom fields for specific deductions or bonuses.

- Integrate with Software: Consider using payroll or accounting software that automatically updates your record formats in line with changing regulations, helping reduce manual updates and potential errors.

By regularly updating and maintaining your payment records, you ensure your business remains compliant, organized, and efficient. This proactive approach helps avoid costly mistakes, improves communication, and strengthens your company’s overa