FedEx Commercial Invoice Template PDF for Easy Shipping

When sending goods across borders, proper documentation is crucial to ensure smooth customs processing and timely delivery. Shipping forms play a key role in providing the necessary details for customs authorities to assess the value, origin, and nature of the goods being shipped. These documents are essential for businesses and individuals to facilitate international transactions and avoid delays or complications.

The right forms can make the difference between a hassle-free experience and unnecessary delays. By using standardized forms designed specifically for global shipping, you can reduce the likelihood of mistakes and ensure your shipment meets all legal requirements. This guide will introduce you to a widely used shipping form, explaining its importance, how to fill it out correctly, and how to save and submit it efficiently.

Whether you are shipping for personal or business reasons, understanding how to properly prepare the necessary paperwork is an essential skill. Accurate documentation ensures compliance with import/export regulations and minimizes the risk of fines or returned shipments. In this article, we will walk you through the essential aspects of creating, using, and managing shipping forms for international deliveries.

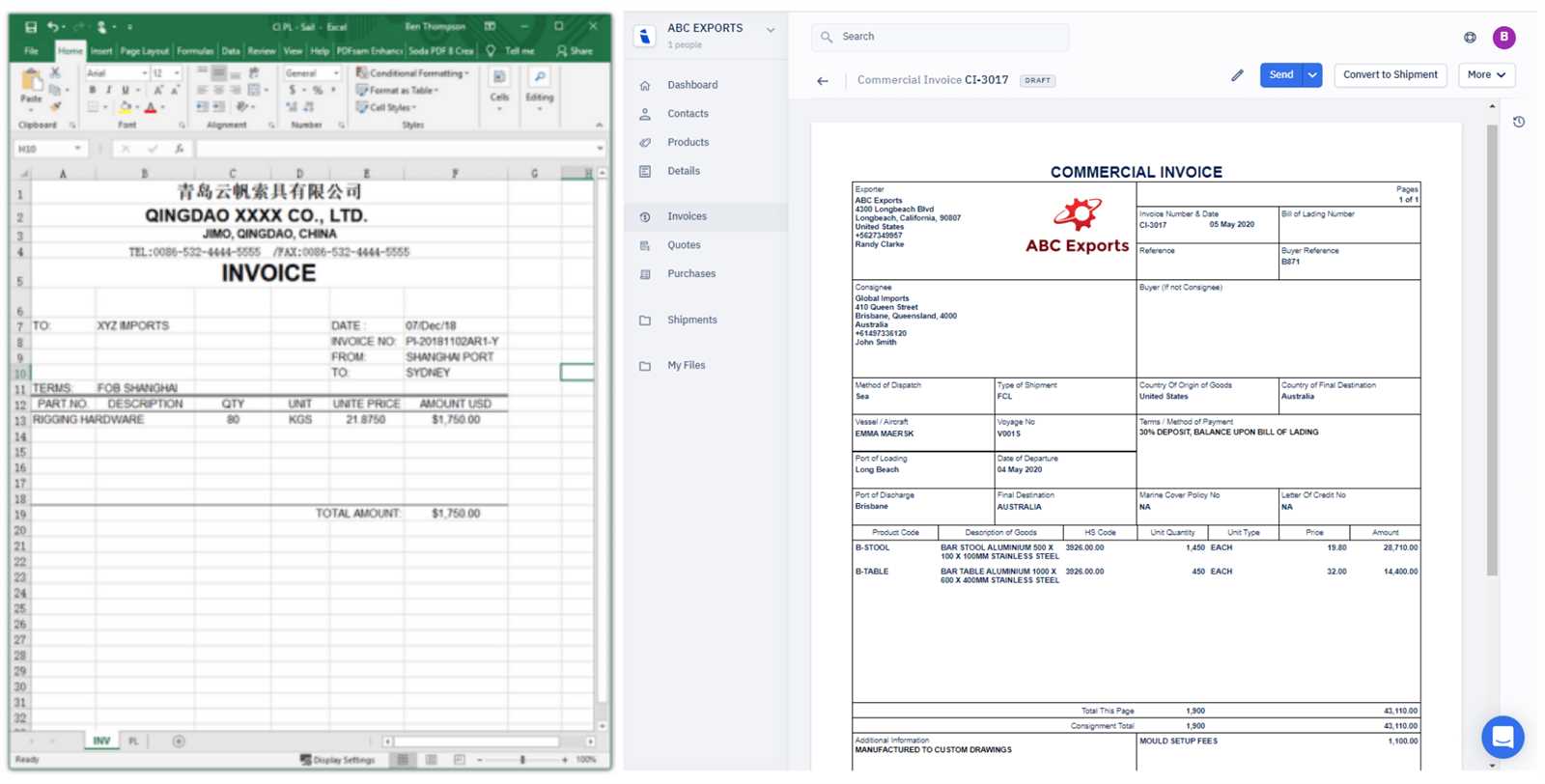

Shipping Document Overview for International Shipments

When shipping goods internationally, a key document is often required to accompany the shipment, providing detailed information about the contents, value, and sender. This specific form is designed to ensure that customs authorities can quickly process and assess the shipment for taxes, duties, and regulatory compliance. The document serves as both a record and a declaration, offering transparency about the goods being transported.

One of the most commonly used documents in global shipping is available as a pre-formatted form, making it easier for senders to input the necessary information. This standardized document simplifies the process and reduces the risk of errors. Understanding how to properly use and fill out this form is critical for anyone engaged in international trade or shipping goods overseas.

- Includes necessary details about the sender and recipient

- Lists the items being shipped along with their value and origin

- Helps to avoid delays in customs clearance by ensuring accuracy

- Prevents potential issues with authorities by complying with regulations

By using the correct form, you ensure that all relevant details are captured accurately, helping the shipment move smoothly through customs and avoid any unnecessary disruptions. This overview will explore the structure of this document, its key components, and how to effectively use it for your international shipments.

What is a Shipping Declaration Document?

A shipping declaration document is a key form used in international trade that outlines the specifics of a transaction between the seller and the buyer. This document provides detailed information about the goods being shipped, including their value, origin, and intended destination. It is crucial for ensuring that the shipment complies with customs regulations and helps to determine any applicable duties or taxes. Without this document, shipments can face delays, fines, or even be held at customs.

This document typically serves as both a receipt for the transaction and a declaration of the goods being shipped. It contains a range of important details that customs authorities need to assess the shipment for clearance. From describing the products to listing their value and country of origin, it ensures that the shipment is processed efficiently and in accordance with international trade rules.

| Information Included | Description |

|---|---|

| Sender and Recipient Details | Names, addresses, and contact information of both parties involved. |

| Item Descriptions | Detailed descriptions of the items being shipped, including quantity and unit value. |

| Country of Origin | Indicates where the goods were produced or manufactured. |

| Item Value | The declared monetary value of each item for customs assessment purposes. |

| Harmonized Code | A classification code used to categorize goods for customs duties and taxes. |

| Payment Terms | Details on how payment will be made for the transaction, such as “prepaid” or “collect.” |

In essence, this form ensures transparency and compliance with international regulations, helping both the seller and buyer avoid any complications or delays. It is an essential document for international shipping and should be completed accurately to facilitate smooth transactions across borders.

Importance of Shipping Declaration Document

A shipping declaration form is crucial for ensuring that international shipments are processed efficiently and comply with customs regulations. Without this form, goods may be delayed, held, or even rejected at customs, leading to frustration for both the sender and recipient. This document acts as a declaration of the goods’ value, origin, and nature, providing customs authorities with the information they need to assess the shipment for any applicable duties or taxes. It helps streamline the process, ensuring that the goods arrive on time and without complications.

Accurate and timely completion of this document is essential for smooth international transactions. It serves not only as a legal requirement but also as a safeguard for businesses, allowing them to avoid fines or penalties that may arise from incomplete or incorrect paperwork. By providing all the necessary details about the shipment, this form minimizes the risk of delays and ensures that the transaction is completed in compliance with international laws.

How to Use the Shipping Declaration Form

Using a standardized shipping declaration form can significantly simplify the process of sending goods internationally. This form provides a clear structure for entering all required details about the shipment, ensuring accuracy and consistency in your documentation. By following the step-by-step instructions, you can easily complete the necessary information, reducing the chances of mistakes and delays during customs clearance.

To begin, download the appropriate form and open it on your device. Most versions of this form come with pre-set fields that make it easy to fill in your details. Each section corresponds to specific information that customs authorities need, such as the sender and recipient’s details, a description of the items, their value, and the country of origin. Here’s how to proceed:

- Step 1: Fill in the sender’s and recipient’s contact details, including name, address, and phone number. Make sure these are accurate to avoid delivery issues.

- Step 2: List the items being shipped. Provide a detailed description of each product, including the quantity and individual value. Be clear and concise.

- Step 3: Declare the total value of the goods. This is essential for calculating customs duties and taxes.

- Step 4: Include the country of origin for each item. This helps customs determine the appropriate tariffs.

- Step 5: Specify the payment terms, such as whether the shipping costs are prepaid or collect.

Once you have completed the form, review all the entries to ensure everything is accurate. Any errors in the documentation can cause delays or lead to the shipment being held at customs. After reviewing, save the form and print it out if necessary. This document should be included with the shipment, either in the package or attached externally, depending on the carrier’s instructions.

By following these steps, you can streamline the shipping process and ensure that your goods move smoothly through customs without unnecessary complications.

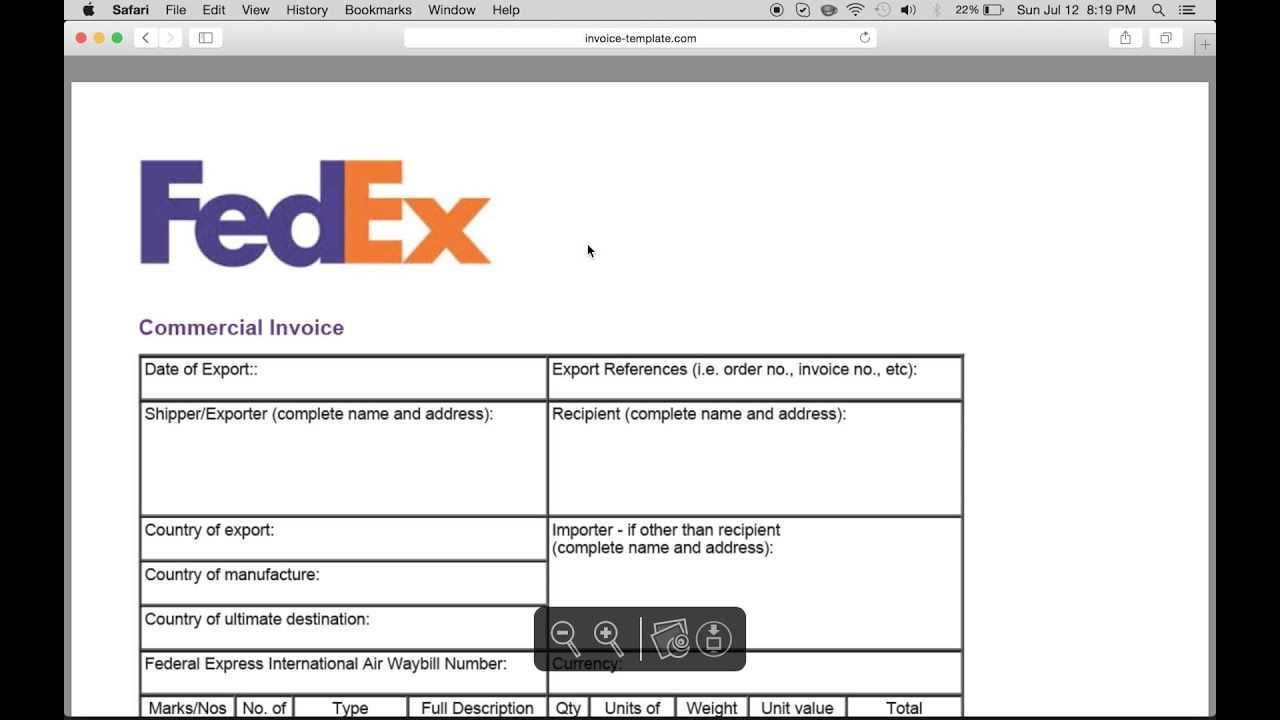

Download FedEx Invoice Template in PDF

When it comes to international or domestic shipping, having the right documentation is essential for smooth transactions. A well-structured document is crucial for both the sender and the recipient to ensure clarity and compliance. This form helps provide necessary details, including item descriptions, quantities, and pricing, making it easier to process goods for customs and other official purposes. Many shipping carriers offer customizable versions of this document, making it easier to adapt for various needs.

Why You Need a Professional Shipping Document

Having an official, easy-to-read form for each shipment is more than just a formality–it ensures that shipments are correctly classified and valued for customs. A clear, organized document reduces the likelihood of errors, potential delays, or unexpected costs. It also serves as a helpful record for accounting and future reference, especially when dealing with returns or exchanges. By downloading this document, you streamline the shipping process, ensuring everything is in place for a smooth transaction.

How to Download and Use the Shipping Form

The process of obtaining the necessary form is straightforward. Simply select the version that best suits your needs, download it to your device, and fill in the relevant information. The downloadable form is ready for use, and its structure allows easy customization to match the details of each shipment. With a digital format, you can easily save and print the document whenever required. Make sure to double-check all the fields to ensure accurate and complete information is provided before submitting it for shipment processing.

Required Information for a FedEx Invoice

To ensure a shipment is processed correctly, it is important to provide all the necessary details on the accompanying documents. These key pieces of information allow for accurate tracking, proper valuation, and seamless customs clearance. Omitting any required data can result in delays, additional fees, or complications with delivery. Below is a list of essential elements to include when preparing the shipping paperwork.

Essential Details for Accurate Processing

- Sender’s Information: Include the full name, address, and contact details of the individual or company sending the items.

- Recipient’s Information: Provide the name, delivery address, and contact information for the person or company receiving the goods.

- Item Descriptions: Clearly describe each product being shipped, including its purpose, material, or function.

- Quantity: Specify the number of units for each item being sent, along with their individual values.

- Declared Value: Declare the total value of the shipment, which is used for customs and insurance purposes.

- Weight and Dimensions: Include the weight and size of each package, as these factors affect shipping costs and delivery times.

- HS Code (if applicable): Provide the harmonized system code for each item to ensure proper classification during customs clearance.

- Payment Method: Indicate who will be responsible for shipping charges (sender, recipient, or third party).

Steps to Fill Out FedEx Invoice Form

Filling out the required shipping documentation is a critical step in ensuring your goods are processed correctly for delivery. By following a few simple steps, you can provide all the necessary information in an organized manner, minimizing the chances of errors or delays. Below, we outline the essential steps for completing the form, making the process quick and easy.

Step-by-Step Guide

Start by gathering all the relevant details about the shipment, including sender and recipient information, item descriptions, and the total value of the goods. Once you have everything ready, follow the steps below to complete the form accurately:

- Fill in Sender’s Details: Enter the name, address, and contact information of the person or business sending the items.

- Enter Recipient’s Information: Provide the name, address, and contact details of the person or company receiving the shipment.

- List Items Being Shipped: For each item, include a description, quantity, unit price, and total value.

- Specify Shipping Costs: Indicate whether the sender, recipient, or a third party is responsible for paying shipping charges.

- Provide Additional Details: Include any other information required, such as harmonized system (HS) codes for international shipments.

- Review and Verify: Double-check all information for accuracy before

Common Mistakes in Commercial Invoices

When preparing the necessary documentation for shipments, many people overlook important details or make errors that can cause delays or complications. Even small mistakes on these forms can lead to customs issues, incorrect billing, or unnecessary expenses. Understanding the most common errors can help prevent these problems and ensure that the process goes smoothly from start to finish.

Frequent Errors in Shipping Documents

Several common mistakes can occur when filling out shipping documents. These errors often lead to confusion, delays, or additional charges. Some of the most frequent issues include:

- Incorrect or Missing Contact Information: Ensure both the sender’s and recipient’s contact details are accurate and complete, including phone numbers and email addresses.

- Omitting Required Item Descriptions: Failing to provide a clear description of the items being shipped, such as material, usage, or function, can result in customs delays or reclassification.

- Inaccurate Value Declaration: Underestimating or overestimating the total value of the shipment can lead to complications with customs clearance and might affect taxes or duties.

- Incorrect Harmonized System (HS) Code: Using the wrong HS code for your goods can result in delays at the border, fines, or even confiscation of the shipment.

- Missing Signatures or Dates: Forgetting to sign the document or provide the correct date may cause the paperwork to be deemed incomplete or invalid.

- Overlooking Shipping Charges: Be clear about who will cover the shipping fees,

How to Customize the FedEx Template

When preparing the necessary shipping documentation, it’s often essential to tailor the standard form to suit your specific needs. Customizing the document ensures that all relevant details are included, helping to streamline the shipping process. Below are some key steps for adjusting the form to meet your requirements while maintaining accuracy and compliance.

Steps for Customization

To modify the standard form, follow these steps:

- Download the Standard Version: Start by obtaining the official form in an editable format. Many carriers offer downloadable versions that allow for easy customization.

- Update Sender and Recipient Information: Replace the default contact details with your own, making sure to include full addresses, phone numbers, and email addresses for both the sender and recipient.

- Adjust Item Descriptions: Modify the fields related to the products you are shipping. Provide a clear and accurate description of each item, including quantity and unit value.

- Modify Payment Information: Specify who will be responsible for shipping charges–whether it’s the sender, recipient, or a third party–and update any other payment-related fields as necessary.

- Add Specific Shipping Instructions: If needed, include additional information such as handling instructions or special delivery requests. These details can be added to designated sections on the form.

- Double-Check for Accuracy: Before finalizing the form, carefully review each field for accuracy, ensuring that all details match the shipment and comply with regulations.

Benefits of Customization

Shipping Documentation and International Shipments

When sending goods across borders, accurate and complete shipping paperwork is essential to ensure smooth delivery and customs processing. Proper documentation helps clarify the value, contents, and destination of the shipment, making it easier for customs officials to evaluate and clear the goods. International shipments require additional details compared to domestic shipments, as they must comply with both the laws of the sender’s and recipient’s countries.

Key Elements for International Shipments

For shipments crossing international borders, certain information must be included in the shipping documents to avoid delays and ensure proper customs clearance. The required fields typically include:

- Complete Sender and Recipient Information: Full names, addresses, and contact details are necessary for both parties to facilitate delivery and communication.

- Detailed Description of Goods: A clear description of each item being shipped, including its nature, use, and purpose, is vital for customs processing.

- Declared Value and Currency: The total value of the shipment must be clearly stated, including the currency used for the transaction. This helps determine taxes, duties, and insurance requirements.

- Customs Classification: The appropriate harmonized system (HS) code for each product is crucial for accurate customs classification and duty assessment.

- Shipping Charges and Payment Terms: Clearly indicate whether the sender, recipient, or a third party will cover the shipping costs and any additional fees.

Importance of Accurate Documentation for Smooth Delivery

Accurate documentation is critical for preventing delays, fines, or returns. Incomplete or incorrect forms can result in goods being held up at customs, leading to longer delivery times and additional charges. Ensuring that all required fields are filled out correctly, especially when dealing with international shipments, can help avoid complications and expedite the delivery process. Properly completed documents also provide a clear record of the transaction, which can be useful for accounting, insurance, or future reference.

Differences Between Commercial and Proforma Invoice

When preparing shipping paperwork, it is important to understand the difference between various types of forms used for different purposes. Two common documents are the proforma and commercial versions, each serving a distinct function in the process of international trade. While they may appear similar, their purposes, contents, and legal implications vary significantly. Understanding these differences can help ensure you use the right form for your transaction.

Key Differences

The main distinction between these two documents lies in their intended use and the information they contain. Below is a comparison of the two:

| Key Benefits | Explanation |

|---|---|

| Customs Compliance | Ensures that the shipment meets all regulatory requirements, avoiding delays or fines. |

| Accurate Tax and Duty Calculation | Provides information necessary for correct calculation of import/export taxes and duties. |

| Faster Clearance | Helps expedite customs processing by providing all required information upfront. |

| Aspect | Proforma Document | Commercial Document | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Purpose | Preliminary document used for customs purposes or to provide an estimate of costs | Official document used for final transactions and customs clearance | ||||||||

| Legal Binding | Non-binding; does not require payment | Legally binding; reflects the actual transaction | ||||||||

| Content | Includes an estimated value of goods and basic shipment details | Contains final price, payment terms, and complete shipping details | ||||||||

| When Used | Used for quotes, cost estimation, or customs valuation before shipment | Used after the sale has been finalized, for actual shipping and customs cl

How to Save Shipping Document as PDF

Saving your shipping paperwork in a portable and universally accessible format is essential for easy sharing, record-keeping, and future reference. One of the most common ways to save important documents is in the form of a PDF, which ensures the file remains consistent across different devices and platforms. Below are simple steps to save your completed shipping document as a PDF, making it easy to store or send electronically. Steps to Save the Shipping Form

What to Include in Item DescriptionsWhen preparing documentation for a shipment, accurately describing the items being sent is crucial for both the sender and recipient. Clear and detailed item descriptions help ensure that goods are processed smoothly during shipping and customs procedures. A well-crafted description reduces the likelihood of misunderstandings, delays, and potential additional charges. Below are the key components to include when describing items for shipment. Essential Elements for Clear DescriptionsEach item in your shipment should be described in a manner that provides both clarity and completeness. Here’s what should be included:

Why Detailed Descriptions MatterIncluding detailed descriptions not only ensures compliance with legal and customs requirements but also prevents delays or issues with delivery. Customs officers rely on these descriptions to classify goods, determine taxes, and evaluate whether the items are allowed to enter the country. Accurate descripti How to Calculate Customs ValueWhen sending goods internationally, determining the correct value for customs purposes is crucial. This value is used by customs authorities to assess duties and taxes on shipments. Understanding how to calculate this value ensures compliance with international trade regulations and helps avoid delays or extra costs during the shipping process. Key Elements in Determining Customs ValueThe customs value is typically based on the cost of the goods being shipped, along with other relevant expenses. These elements may include:

Adjustments to ConsiderIn some cases, additional adjustments must be made to the value. These may include:

By carefully adding and subtracting these components, a total customs value is established, which is then used to calculate applicable duties and taxes. This process helps ensure that the shipment is processed smoothly through customs and complies with all necessary regulations. Tips for Accurate Invoice PreparationEnsuring the accuracy of a document outlining the transaction details is essential for smooth international shipping and customs clearance. A precise document helps avoid delays, errors in duty calculations, and potential disputes with authorities or customers. Proper preparation is key to meeting all regulatory requirements and preventing unnecessary complications during the shipping process. Essential Information to IncludeAccurate preparation starts with including all necessary details in the document. Make sure the following items are clearly stated:

Double-Check for AccuracyBefore finalizing the document, review all details for correctness. A minor mistake in numbers, names, or product descriptions can lead to significant delays or additional fees. Pay special attention to:

By following these steps, you can prepare an accurate document that meets all necessary standards and avoids costly errors during shipping and customs clearance. FedEx Invoice Template for Business UseFor businesses involved in international shipping, having a standardized document to track transactions, ensure proper duty assessments, and streamline customs processes is essential. A well-organized document can help maintain consistency, prevent mistakes, and ensure that all required information is accurately recorded for each shipment. Key Features of a Business Shipping DocumentWhen creating a document for shipping goods, it’s important to include specific details that allow customs authorities and shipping providers to process the goods efficiently. A robust shipping document should contain the following key elements:

Advantages of Using a Standardized FormatUsing a predefined structure for shipping documents offers several benefits, particularly for businesses engaged in frequent cross-border transactions:

Having a reliable and well-organized document format in place is an essential tool for businesses to ensure smooth operations and meet international trade standards. Benefits of Using a Template for ShippingFor businesses involved in global trade, having a pre-designed framework for creating shipment documentation can save significant time and reduce errors. By using a standardized structure, companies can streamline their processes, ensuring accuracy and compliance with customs regulations. This approach is especially beneficial when dealing with multiple shipments or maintaining consistent practices across different teams. Improved Accuracy and Reduced ErrorsOne of the most significant advantages of using a predefined structure is the reduction in mistakes. By providing a consistent layout, the risk of forgetting crucial information or making typographical errors is minimized. Key details such as product descriptions, values, and shipping methods are clearly defined and easy to input. This reduces the chances of delays caused by incorrect or incomplete documentation.

Enhanced Efficiency and Time-SavingUsing a standardized structure for creating shipping records helps businesses speed up their workflow. When there is a clear format to follow, employees can quickly prepare the necessary paperwork without having to start from scratch each time. This efficiency is particularly beneficial when managing high volumes of shipments, allowing businesses to maintain smooth operations without unnecessary delays.

|