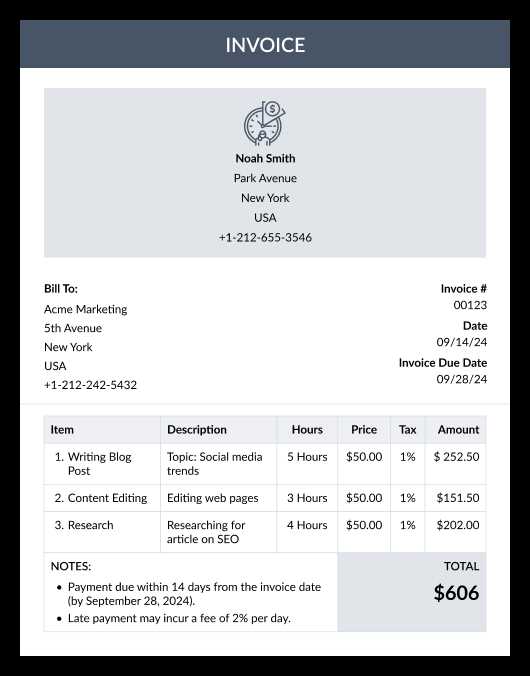

Invoice Template for Tracking Hours Worked

Managing compensation for services provided on an hourly basis requires an organized approach. A well-structured document can ensure that both parties understand the terms and maintain clarity throughout the payment process. Having a professional format can save time, reduce errors, and promote transparency in every transaction.

Creating a clear record for the time spent on specific tasks can help businesses and freelancers avoid misunderstandings. This ensures that every minute of effort is appropriately accounted for, leading to accurate and timely payments. The right approach simplifies the entire procedure, from recording to submission.

Using a practical solution can make the process smooth and reliable, whether you are working with clients or managing a team. Customizing the structure to your specific needs helps avoid confusion and ensures efficiency, benefiting both parties in the long run.

How to Create an Invoice Template

Designing a clear and effective document for billing services can streamline the payment process and ensure accurate records. A well-constructed form should be both simple and comprehensive, providing essential details that help both the provider and client stay on the same page.

To get started, consider these basic components:

- Contact Information: Include your name, business name, phone number, email, and address, as well as the client’s details.

- Task Description: Clearly list the tasks or services provided, with concise descriptions.

- Rates and Amounts: Specify the agreed-upon rate and total cost for the work done.

- Dates: Ensure you include both the start and end date for the services rendered.

- Payment Terms: Mention the due date, any applicable late fees, and accepted payment methods.

Once the basics are in place, customize the layout to suit your needs. Here are a few tips to enhance the document:

- Keep it professional: Use a clean, easy-to-read design that reflects your brand’s identity.

- Include a unique identifier: Assign an invoice number for easier reference and tracking.

- Be clear about payment instructions: Make sure clients understand how to make payments promptly.

By following these steps, you can create a customized document that facilitates accurate and timely payments, keeping the entire process organized and professional.

Essential Elements of an Invoice

When creating a document to request payment, certain key details are crucial to ensure that the process runs smoothly. These components help both parties understand the terms of the transaction and ensure that everything is accounted for accurately.

Basic Information

The first step is to include the necessary contact details for both parties involved. This ensures there is no confusion about who is issuing the payment request and who is responsible for settling it.

| Details | Description |

|---|---|

| Sender’s Information | Name, business name, address, phone number, email. |

| Recipient’s Information | Client’s name, address, contact information. |

Financial Details

Next, be sure to clearly outline the specific charges. This includes the tasks or services rendered, their associated rates, and the total amount due. Providing this breakdown ensures clarity and prevents disputes later on.

| Details | Description |

|---|---|

| Service Description | Brief, clear explanation of each service provided. |

| Amount Due | Cost for each service, total cost, and any applicable taxes. |

By including these essential elements, you can ensure that your billing documents are both professional and functional, making it easier for both you and your clients to manage payments effectively.

Tips for Accurate Time Tracking

Maintaining precise records of the time spent on various tasks is essential for both efficiency and accurate compensation. By keeping track of your work hours effectively, you can avoid discrepancies and ensure that every task is appropriately accounted for.

Organizing Your Schedule

Clear organization of your work schedule helps in avoiding errors and ensures that all activities are documented correctly. Whether using digital tools or manual logs, consistency is key to accuracy.

| Method | Benefits |

|---|---|

| Time Tracking Software | Automates the process and provides real-time updates. |

| Manual Logs | Helps maintain a personal record, ensuring no task is overlooked. |

Staying Consistent

Consistency is crucial when tracking your time. Regularly logging your activities ensures that no details are forgotten and that all tasks are documented accurately from start to finish.

| Consistency Tip | How to Implement |

|---|---|

| Track in Real-Time | Log your time immediately after completing each task to avoid forgetting details. |

| Review Regularly | Take a few minutes daily or weekly to review and correct any inconsistencies. |

By following these tips, you can ensure a more accurate and reliable method for recording time, which helps to maintain fairness and clarity in your professional agreements.

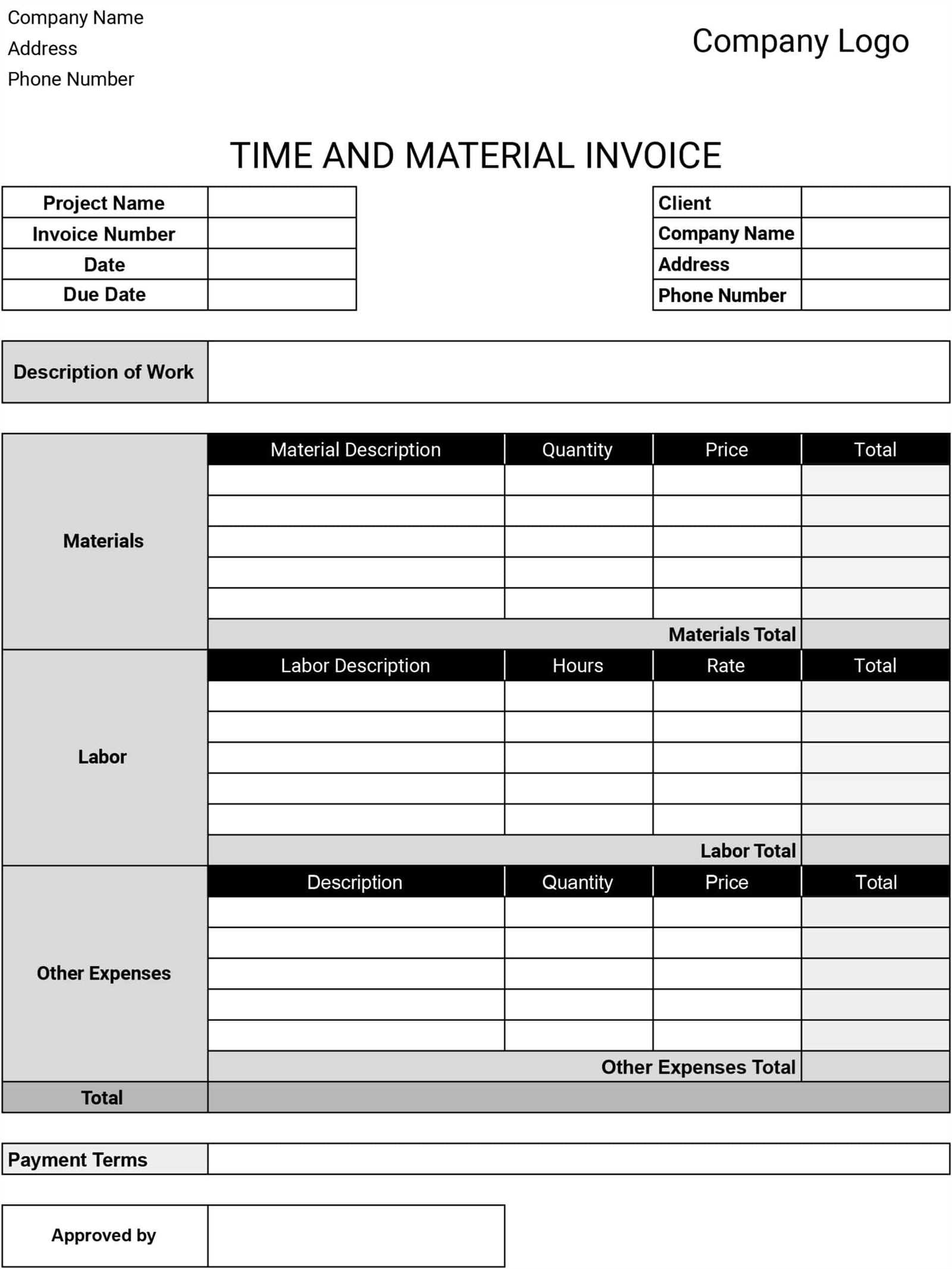

Customizing Your Invoice Template

Personalizing your billing document allows you to create a format that best reflects your style and business needs. Tailoring the design and content ensures that the details are clear, professional, and aligned with the services you offer.

Design flexibility plays an important role in making your document stand out. Whether you prefer a simple layout or something more detailed, adjusting colors, fonts, and sections can enhance readability and branding. You can add your logo or choose colors that represent your business, making the document feel more personalized.

Content customization is equally important. You may choose to include specific terms or notes based on your client relationships or the nature of the service provided. Adding additional fields like payment instructions or a discount section can make the billing process smoother and clearer.

With these adjustments, you create a document that not only communicates the essential details but also promotes a professional image to your clients.

Best Practices for Hourly Billing

When charging clients based on the time spent on tasks, it is important to maintain transparency and consistency to ensure fair compensation and avoid misunderstandings. Implementing effective strategies not only improves your billing process but also strengthens your professional reputation.

Clearly define your rates: Be upfront about your rate structure, including any variations for different types of work or project complexities. Clear communication helps clients understand exactly what they are paying for.

Track time accurately: Record each task as it is completed to avoid errors and ensure accurate billing. Using digital tools or time tracking apps can help maintain precise records and prevent forgotten tasks from affecting the final total.

Establish payment terms: Set clear expectations for payment deadlines and methods. This includes specifying when payments are due and whether any late fees will be applied. Having this information upfront reduces confusion later in the process.

By following these best practices, you ensure that your billing system is both efficient and transparent, fostering trust and satisfaction with your clients.

Why Use an Invoice Template

Using a pre-designed structure for your billing documents can save time, ensure consistency, and reduce the risk of errors. It provides a professional format that simplifies the entire payment process for both the issuer and the recipient.

Instead of manually creating each document from scratch, a ready-made format allows you to quickly add necessary details and generate a clean, organized request for payment. This approach helps maintain clarity and ensures that all required information is included without missing key elements.

| Benefits | Description |

|---|---|

| Efficiency | Reduces the time spent on document creation, allowing you to focus on other tasks. |

| Consistency | Ensures that each document follows the same structure, promoting professionalism. |

| Accuracy | Reduces human error by having pre-set fields to fill out, ensuring all necessary details are included. |

By using such a structure, you can ensure that your payment requests are timely, organized, and meet the expectations of your clients, making the entire transaction smoother for both parties.

Understanding Hourly Rate Calculations

Calculating a fair and accurate rate for your time is essential for ensuring you are compensated appropriately for your services. It involves determining an amount that reflects both your expertise and the market standards while taking into account factors such as operating costs and the nature of the work.

Factor in costs: Begin by considering any overhead expenses, such as tools, software, and utilities, that are necessary to perform your tasks. These costs should be factored into your rate to ensure that you’re covering all your business expenses.

Account for experience and skill: Your experience and expertise play a significant role in determining your rate. The more specialized your skill set, the higher your hourly price can be, as clients often value experience in their professionals.

By combining these elements, you create a rate that is fair to both you and your clients, helping to establish a sustainable pricing structure for your business.

Automating Your Invoicing Process

Streamlining your payment requests through automation can save significant time and reduce manual errors. By setting up automated systems, you can ensure timely and consistent billing, improving efficiency and freeing up time for other important tasks.

Benefits of Automation

Efficiency: Automation allows you to generate and send requests instantly without manually entering the same information each time.

Consistency: With automated systems, you can ensure that every document follows the same format and structure, leading to more reliable communication with clients.

Implementing Automation Tools

Use software solutions: There are various tools available that can integrate with your business processes, such as time tracking or project management software. These can automatically generate documents based on predefined criteria, reducing the need for manual intervention.

By incorporating automation into your billing system, you not only improve accuracy but also build trust with clients through timely and professional payment requests.

Common Mistakes in Hourly Invoices

When generating payment requests, it’s easy to overlook certain details that can lead to misunderstandings or delayed payments. Common errors in calculating or presenting charges can affect both the payer and the recipient, causing confusion or frustration. Identifying and addressing these mistakes is crucial for maintaining professionalism and smooth transactions.

| Common Mistake | Description |

|---|---|

| Missing details | Omitting important information like client details, service description, or the date can delay payments and cause confusion. |

| Incorrect calculation | Errors in computing rates or quantities can lead to disputes, often requiring adjustments and delaying payment processing. |

| Lack of clear payment terms | Not specifying payment terms or deadlines can lead to delays and misunderstandings, making it unclear when funds are due. |

Being mindful of these common errors will help ensure that your documents are accurate, clear, and professionally presented, leading to smoother transactions with clients.

Free Invoice Templates Online

Many online platforms offer cost-free solutions to create professional payment requests quickly and easily. These resources allow individuals and businesses to generate properly structured documents, saving time while ensuring that all necessary information is included for smooth transactions.

Advantages of Using Free Resources

Cost-effective: These online tools are typically free to use, making them accessible for freelancers and small businesses who need a simple and affordable solution.

Easy to use: Most platforms provide user-friendly interfaces, allowing users to customize their documents without needing advanced design skills.

Where to Find Free Resources

Websites: Numerous websites provide free templates that can be easily customized to fit your needs. Popular options often include various designs and layouts for different types of services.

By taking advantage of these free resources, you can create well-organized and professional payment requests without any added cost or complexity.

How to Add Taxes to Your Invoice

Including taxes in your payment requests is an essential part of ensuring that both you and your clients meet legal requirements. It’s important to clearly indicate any applicable taxes in your billing documentation to avoid confusion and ensure transparency in financial transactions.

Understanding Tax Rates

Know your local tax laws: Depending on your location and the nature of your services, the tax rate may vary. It’s crucial to familiarize yourself with the tax laws that apply to your business to ensure you’re charging the correct amount.

Types of taxes: Common taxes that may need to be added include sales tax, VAT, or service tax. The exact tax you need to include will depend on your country or region’s regulations.

Steps to Add Taxes

Calculate the tax: Determine the tax amount by applying the relevant rate to the total sum of your service or product. Make sure to calculate it separately to show the breakdown of charges clearly.

Display the tax clearly: Include a line item for the tax on your payment request document. This ensures the recipient can easily see the amount being charged and understand how it’s being calculated.

By adding taxes in an organized manner, you ensure compliance and maintain a transparent relationship with your clients, helping to avoid misunderstandings regarding payment amounts.

Legal Considerations for Invoices

When preparing payment requests, it’s crucial to be aware of the legal aspects involved. Properly documenting the details of transactions ensures that both parties are protected and that your business remains compliant with local regulations. Understanding these legal requirements is essential to avoid potential disputes and penalties.

Important Information to Include

Clearly state terms and conditions: Always specify the payment terms, including the due date and penalties for late payments. This helps set expectations and protects your business from delays.

Tax identification numbers: Depending on your location, including your tax identification number (TIN) or VAT number may be necessary for tax reporting purposes.

Compliance with Local Laws

Know your jurisdiction: Different regions have varying legal requirements regarding what needs to be included in a payment request. Be sure to research the specific regulations in your area or industry.

Adhere to tax regulations: Ensure that you’re following the correct procedures for tax reporting and that any required taxes are included appropriately. Failure to comply with tax regulations can lead to serious consequences.

By following these legal considerations, you can avoid complications and ensure your financial transactions are conducted professionally and in accordance with the law.

Tracking Payments for Hourly Work

Keeping a close eye on payments is essential for managing projects based on time-based billing. Accurate records not only help maintain financial transparency but also ensure that all work is compensated correctly and promptly. Proper tracking allows both clients and contractors to monitor outstanding balances and resolve discrepancies quickly.

Recording Payment Details

Document payments promptly: As soon as a payment is made, it’s important to record it in your system. This ensures that you have up-to-date financial records and prevents any confusion later on.

Track payment methods: Always note the payment method used, whether it’s bank transfer, check, or digital payment. This helps in case of future inquiries or disputes regarding the transaction.

Setting Up Reminders

Automate reminders: Set up automatic reminders for both clients and yourself regarding pending payments. This reduces the need for manual follow-up and helps keep everything on track.

Clear due dates: Always include clear due dates in your payment records, so both parties are aware of when payments are expected. This helps avoid delays and ensures timely compensation.

By following these steps and staying organized, tracking payments becomes a smoother process, leading to fewer issues and more efficient management of time-based compensation.

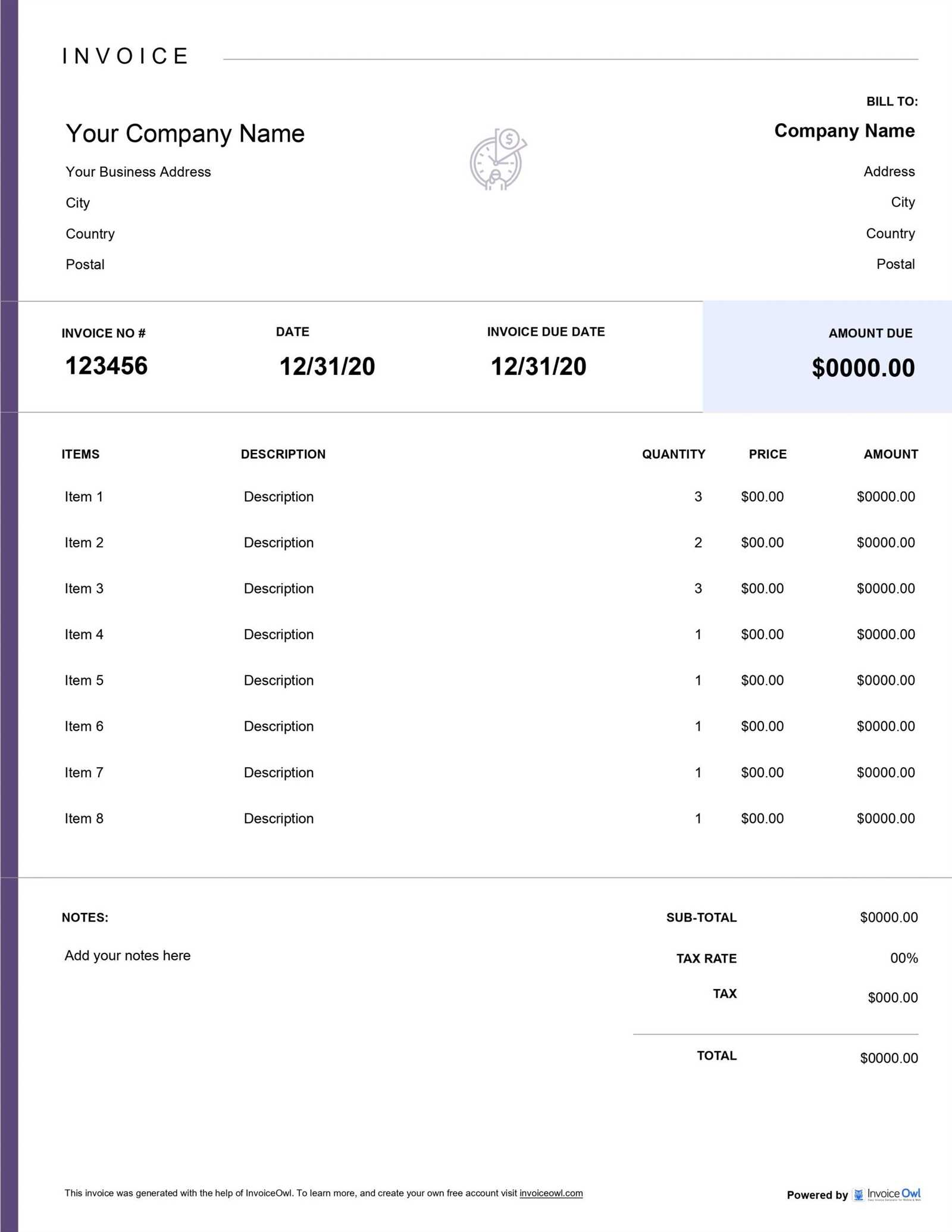

How to Design a Professional Invoice

Creating a well-structured document that clearly outlines the services rendered and the amount due is essential for maintaining professionalism. The layout, details, and formatting of such a document can have a significant impact on how clients perceive your business. A clean, easy-to-read format enhances your credibility and makes it easier for clients to process payments without confusion.

Organize the Layout

Header: Include your business name, logo, and contact details at the top of the document. This ensures your client can easily identify who the document is from and how to reach you if needed.

Client Information: Make sure to include the client’s name, address, and contact details. This helps avoid any mix-up and ensures that the document reaches the right person.

Include Key Details

Itemized Breakdown: Provide a detailed list of the services or products provided. Clearly state the quantity, description, and price for each item to ensure full transparency.

Total and Payment Terms: Summarize the total amount due, including taxes and any discounts. Clearly specify payment terms such as due dates and accepted payment methods.

By following these guidelines, you can create a professional document that reflects your business’s values while simplifying the payment process for your clients.

Benefits of Using an Invoice Template

Utilizing a pre-designed structure for billing can streamline the process and reduce the chance of errors. It provides consistency and saves time by eliminating the need to create documents from scratch for each transaction. By following a set format, businesses can focus on other aspects of their work while ensuring accuracy and professionalism in their financial communications.

Time Efficiency

Faster Creation: With a ready-to-use format, you can generate billing documents quickly, reducing the time spent on administrative tasks. This efficiency helps businesses stay on top of finances without unnecessary delays.

Consistency and Accuracy

Uniform Layout: A standardized structure ensures that all necessary information is included and organized in the same way every time. This consistency minimizes the risk of missing important details or making mistakes, which can lead to confusion or delayed payments.

By leveraging a pre-arranged format, businesses not only enhance operational efficiency but also present a polished, professional image to their clients, fostering trust and clarity in every transaction.