Free Excel Invoice Templates for Easy and Professional Billing

Managing financial transactions and keeping track of payments can be time-consuming, especially for small businesses or freelancers. Simplifying the process of generating professional documents for clients is crucial to maintaining efficiency. By utilizing customizable tools, you can save time and reduce the potential for errors while keeping your records organized and clear.

Ready-made solutions are an excellent choice for anyone looking to speed up the billing process. These tools provide pre-designed formats that allow users to quickly fill in relevant details without the need for creating new documents from scratch. Whether you are handling recurring tasks or one-time payments, these resources can cater to various business needs.

With the right options at your disposal, managing finances becomes much easier. By choosing suitable formats, businesses can ensure a professional appearance, maintain accuracy, and stay on top of financial responsibilities. This approach not only improves productivity but also enhances the credibility of your brand.

Why Use Excel for Invoicing

When it comes to creating billing documents, many business owners seek a solution that is both simple and flexible. Using a familiar software application offers a range of benefits, from customization to efficient data management. For small businesses or freelancers who want a reliable and accessible method, this tool stands out as a cost-effective and easy-to-use choice.

One key advantage is the ability to customize your financial documents based on your unique requirements. With just a few adjustments, you can create different formats, modify sections, or even add special features such as automatic calculations. The ability to tweak the design and layout ensures that your documents always reflect your branding while remaining professional.

Another benefit is the versatility and integration with other functions, such as tracking payments, calculating totals, or managing client information. This integration makes it easy to create documents and keep everything organized in one place, reducing the chances of errors and improving workflow efficiency.

| Feature | Benefit |

|---|---|

| Customizable Layout | Ability to adjust the format according to specific needs |

| Automated Calculations | Saves time by automatically computing totals and taxes |

| Data Integration | Seamless integration with payment tracking and record keeping |

| Cost-Effective | Free or low-cost solutions for businesses of all sizes |

Benefits of Free Invoice Templates

Using ready-made document formats offers numerous advantages, especially for businesses looking to streamline their billing processes without additional costs. These pre-designed options allow for quick document creation, reducing the time spent on manual entry and ensuring consistency across all client transactions.

One of the most significant advantages is the cost-effectiveness. There are many no-cost solutions available, which makes them an ideal choice for startups or freelancers operating on a tight budget. This eliminates the need for expensive software while still providing professional-looking results.

Time Efficiency

Ready-made documents can be customized in minutes, allowing users to quickly generate a professional-looking record with minimal effort. The built-in structure helps users avoid unnecessary steps, letting them focus on other important tasks.

Customization Flexibility

Another benefit is the ability to adjust the layout and fields according to your specific needs. Whether it’s adding your business logo, modifying the content, or including additional details, you can tailor these documents to match your brand and business requirements.

Overall, using accessible and pre-designed solutions can enhance your productivity, reduce manual work, and help maintain a professional appearance at no extra cost.

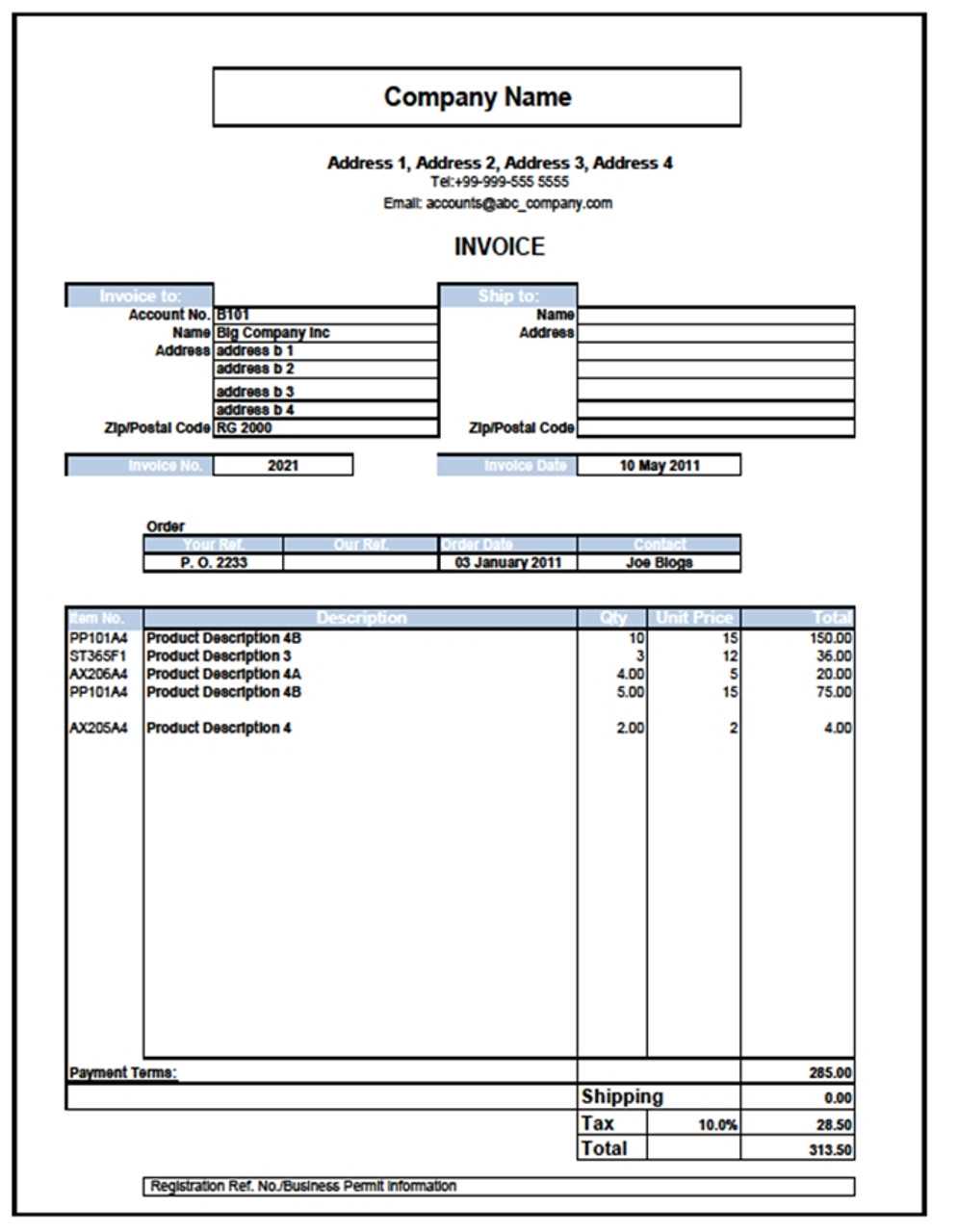

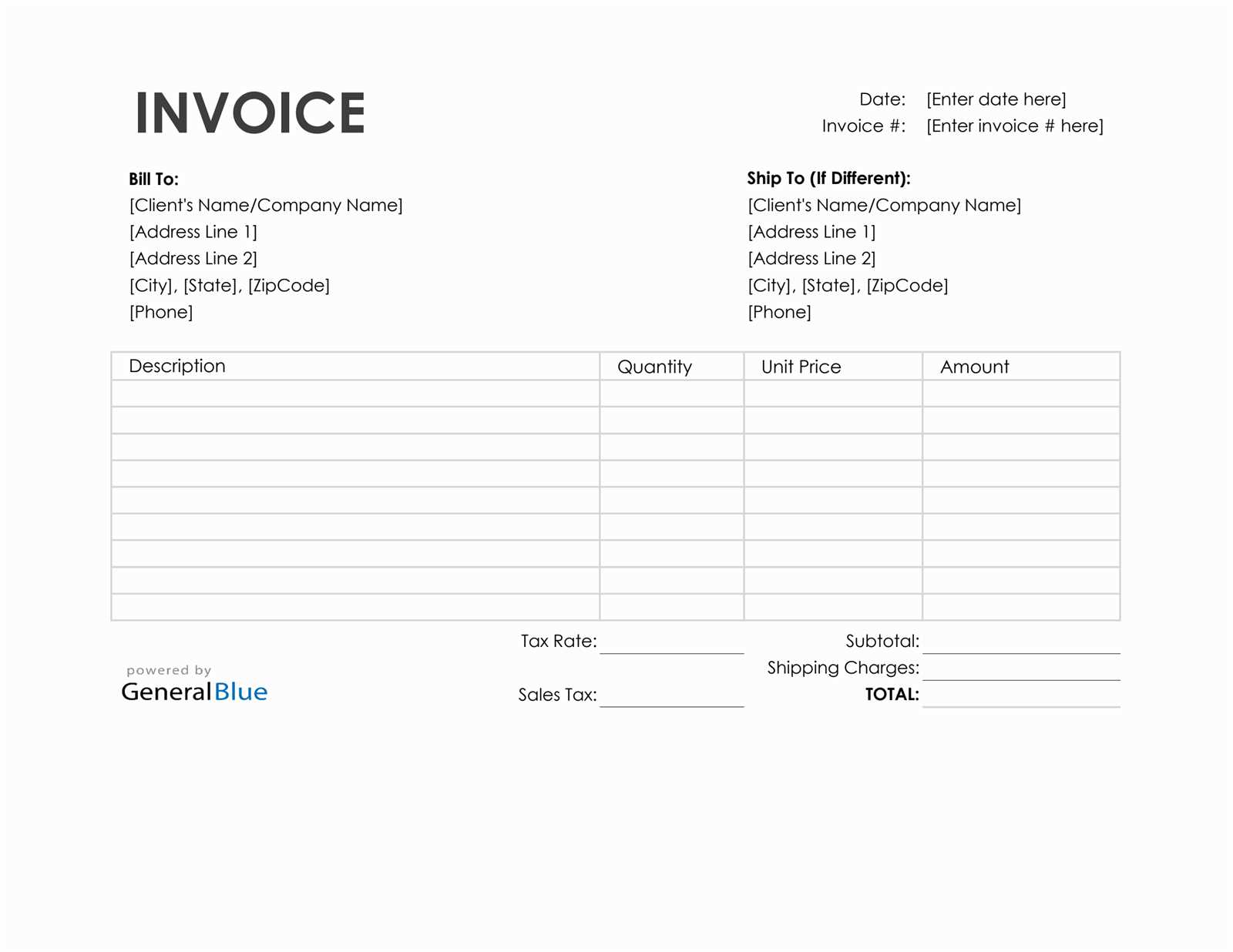

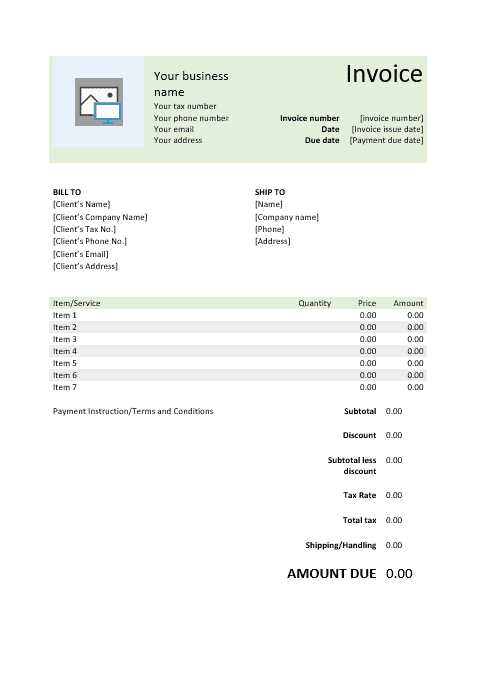

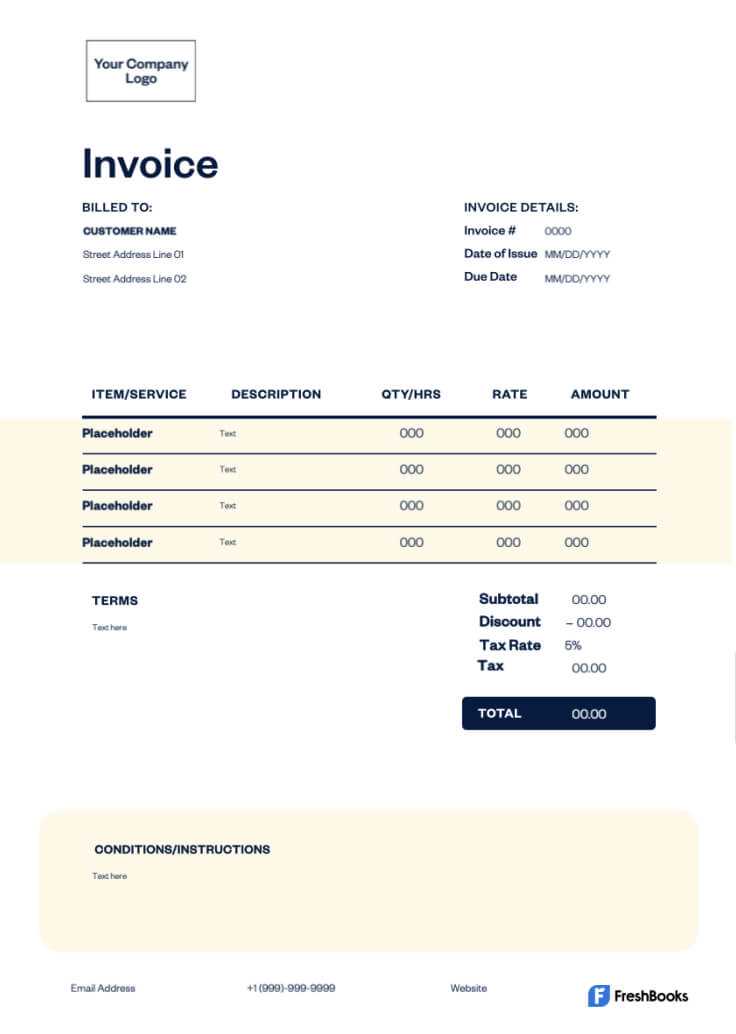

How to Customize Excel Invoice Templates

Customizing pre-designed billing documents allows you to create professional and personalized records that meet your specific business needs. Whether you want to add your company logo, adjust the layout, or include specific terms, the process of personalizing these files can be simple and quick. With a few changes, you can ensure your documents reflect your brand and professionalism while maintaining functionality.

The first step in customization is identifying the fields that need modification. Common areas to adjust include business details, payment terms, item descriptions, and totals. By updating these sections, you ensure the document meets your specific requirements.

| Step | Action |

|---|---|

| 1 | Update company details (name, address, contact info) |

| 2 | Modify client information and billing addresses |

| 3 | Add or remove fields based on business needs (e.g., tax, discounts) |

| 4 | Insert your business logo or branding elements |

| 5 | Adjust column sizes and formatting for clarity |

Once these key elements are adjusted, you can save the updated document for future use, ensuring that all generated files maintain consistency and a polished appearance. Customizing these files empowers you to create professional-looking records that are suited to your specific business operations and client needs.

Top Features in Free Invoice Templates

When choosing a pre-designed document for billing purposes, it’s essential to look for key features that can enhance functionality and ensure that your records are accurate and professional. Many no-cost solutions come with built-in tools and options that make it easier to manage client information, calculate totals, and track payments with minimal effort. These features help streamline the process and reduce the risk of errors.

Customizable Fields

The ability to personalize fields is a significant advantage. From client names and addresses to product descriptions and payment terms, editable sections allow you to tailor the document to your specific needs. This customization makes it easy to maintain consistency across all documents while ensuring the content is relevant to each transaction.

Automatic Calculations

One of the standout features is the ability to automatically calculate totals, taxes, and discounts. This feature saves time and ensures accuracy, especially when dealing with multiple items or varying rates. It also eliminates the need for manual calculations, reducing the chances of mistakes.

| Feature | Benefit |

|---|---|

| Customizable Fields | Allows for personalized content based on business requirements |

| Automatic Calculations | Reduces errors and saves time on complex math |

| Pre-set Layouts | Ensures professional and consistent formatting |

| Payment Tracking | Helps monitor client payments and outstanding balances |

By leveraging these features, businesses can create professional-looking records that are easy to manage and customize as needed. Whether you’re a freelancer or a small business, these tools enhance productivity and provide a reliable method for keeping financial documents organized.

Step-by-Step Guide to Creating Invoices

Creating clear and professional billing documents doesn’t have to be a complicated task. By following a straightforward process, you can ensure your records are accurate, complete, and tailored to your business needs. With simple tools and a clear structure, generating a proper document becomes a quick and efficient task, allowing you to focus on other important aspects of your business.

Step 1: Set Up Document Details

The first step is to enter your business information, including your name, address, contact details, and logo. This makes the document recognizable and ensures the client knows exactly who the bill is from. Next, include the recipient’s information, including their name and address, to ensure the document is correctly addressed.

Step 2: Itemize Products or Services

Once the basic details are entered, move on to listing the goods or services provided. Include a description of each item, the quantity, unit price, and total cost for each. Be sure to account for any applicable discounts or adjustments to provide an accurate breakdown.

Important Tip: Always double-check the math and ensure the total is accurate, especially if your business involves multiple items or rates.

Once all the details are in place, review the document for accuracy and completeness before sending it off to your client. Having a clean, professional, and accurate document reflects positively on your business and builds trust with your clients.

Save Time with Automated Templates

One of the biggest advantages of using pre-designed documents is the ability to automate many aspects of the billing process. Automation eliminates the need to manually calculate totals, taxes, and discounts for each transaction, reducing time spent on repetitive tasks. With built-in formulas and pre-set layouts, you can generate accurate, professional documents in a fraction of the time.

Efficient Data Entry

Automated solutions can quickly fill in client details and itemized lists, saving you the trouble of entering the same information repeatedly. Once set up, you only need to adjust key details, such as quantities and prices, and the rest is handled automatically. This helps reduce human error and speeds up document creation.

Automatic Calculations and Totals

Another time-saving feature is the automatic calculation of totals, taxes, and other financial elements. When using an automated system, you no longer need to manually sum each line or compute complex formulas. The system does the work for you, ensuring precision and consistency across all documents.

Key Benefit: Automation allows you to focus on running your business rather than spending valuable time on administrative tasks.

Choosing the Right Template for Your Business

Selecting the right document format for your billing needs is crucial for ensuring that your records are professional, clear, and tailored to your business model. With numerous options available, it’s important to choose a layout and structure that align with your specific requirements, helping you maintain consistency and accuracy in all client transactions.

Consider Your Business Type

The first step in choosing a suitable document is to consider the nature of your business. Different industries have different needs when it comes to financial documentation, and selecting a format that fits your operations can make a significant difference in workflow efficiency.

- If you are a freelancer, opt for a simpler format with essential details like payment terms, services provided, and rates.

- For product-based businesses, choose a template that allows easy itemization and tax calculation.

- If you run a consulting business, a template with space for detailed descriptions and hourly rates may be more suitable.

Customization Options

Look for formats that allow customization based on your unique needs. A flexible layout will enable you to add or remove sections, ensuring that your document reflects the full scope of your services or products. Consider templates that offer:

- Adjustable fields for client information

- Editable sections for project details or item descriptions

- Space for discount or promotional offers

Choosing the right format can help you streamline your billing process, improve professionalism, and enhance client trust.

Common Mistakes When Using Excel Templates

While pre-designed document formats can save a lot of time and effort, there are several common mistakes that can occur when using them. These errors often stem from overlooking key details or failing to customize the format properly. Understanding these pitfalls can help you avoid issues and create more accurate and professional documents for your business.

1. Failing to Update Client Information

One of the most frequent mistakes is not properly updating the client’s contact details before generating the document. Leaving outdated or incorrect information can lead to confusion or delays in payment. Always ensure that the recipient’s name, address, and contact information are accurate before sending any document.

2. Ignoring Automatic Calculations

Many users forget to check that the automatic calculations are working correctly. Whether it’s tax rates, discounts, or total amounts, it’s crucial to verify that the calculations reflect the correct values. A small error in the math can result in significant financial discrepancies.

Tip: Double-check the formulas and review totals before finalizing any document. This can prevent potential mistakes from affecting your client relationships.

3. Overcomplicating the Layout

Another common mistake is overloading the document with excessive details or cluttered information. While it’s important to include all necessary data, it’s also crucial to keep the format clean and easy to read. Too many sections or overly complicated designs can confuse clients and make the document less professional.

Keeping your format simple, with clear and concise sections, will make your documents easier to understand and improve their effectiveness.

How to Track Payments Using Excel

Tracking payments is a crucial aspect of managing finances, especially for small businesses or freelancers. By using a structured format, you can easily monitor which payments have been received, which are pending, and any outstanding balances. This process helps ensure timely follow-ups and provides a clear overview of your financial status.

To efficiently track payments, you can create a simple system that includes essential information such as client names, amounts due, payment dates, and payment status. By organizing these details in a clear and consistent way, you can quickly access important data and avoid missing payments.

| Client Name | Amount Due | Payment Date | Status | Amount Paid |

|---|---|---|---|---|

| John Doe | $500 | 10/01/2024 | Paid | $500 |

| Jane Smith | $300 | 10/05/2024 | Pending | $0 |

| Mike Johnson | $450 | 10/08/2024 | Paid | $450 |

Tip: Use simple formulas to calculate outstanding balances and ensure your records are always up to date. A well-organized tracking system allows for easy reference and efficient follow-ups with clients.

Excel vs Other Invoicing Tools

When it comes to managing billing documents, many businesses turn to different tools to streamline the process. Some rely on spreadsheet software, while others opt for specialized software designed specifically for creating financial documents. Each option has its own advantages and limitations, depending on your business needs and workflow.

Spreadsheets offer flexibility and customizability, allowing you to create unique document formats that fit your specific requirements. They also give you full control over the data and formulas used. However, this flexibility can sometimes come with a learning curve, especially for those unfamiliar with creating complex formulas or maintaining organized records.

Specialized invoicing software, on the other hand, often provides pre-designed structures, automation features, and cloud-based storage for easy access and management. These tools are built specifically for financial tasks, which can reduce the risk of errors and save time. However, they may come with subscription costs or limit customization options compared to spreadsheets.

Advantages of Spreadsheets

- Highly customizable to suit unique business needs

- Cost-effective for small businesses or freelancers

- Simple to use and implement

Advantages of Specialized Tools

- Automated calculations and templates

- Cloud storage for easy access and sharing

- Time-saving with integrated payment tracking and reporting

Choosing between these tools ultimately depends on your business’s size, needs, and budget. If you require simple billing solutions with flexibility, spreadsheets might be the best choice. However, if you prefer a streamlined, automated approach with additional features, specialized software could provide more convenience and efficiency.

Tips for Creating Professional Invoices

Creating a well-designed financial document not only reflects professionalism but also ensures smooth transactions with clients. A clear, organized document helps avoid misunderstandings and can speed up the payment process. To maintain a professional image and streamline billing, consider the following tips when designing your financial statements.

1. Keep it Simple and Clean

A cluttered document can confuse clients and slow down the payment process. Keep your layout simple and easy to read, with clearly labeled sections and adequate spacing. Stick to the essentials–don’t overcomplicate the design.

- Use a clear, legible font such as Arial or Times New Roman.

- Ensure all text is aligned and evenly spaced.

- Avoid excessive colors or graphics that could distract from the main content.

2. Include All Necessary Information

To avoid delays or confusion, include all relevant details in your document. Ensure your clients can easily find the information they need, such as payment terms, contact details, and the description of services provided.

- Client’s name and contact details

- Your business details and logo (if applicable)

- Detailed description of services or products

- Payment terms and due date

- Payment methods accepted

3. Number Your Documents

Assigning a unique reference number to each document helps keep your records organized. This also makes it easier for clients to refer to specific documents if any issues arise.

- Use a sequential numbering system (e.g., INV-001, INV-002).

- Include the issue date along with the reference number to avoid confusion.

4. Double-Check Calculations

Ensure that all amounts, taxes, and totals are correctly calculated. Errors in the math can lead to delays in payment and damage your credibility. If possible, use automated features to minimize human error.

Tip: If using a spreadsheet, make sure all formulas are working correctly before sending the document.

How to Calculate Taxes in Excel Templates

When preparing financial documents, correctly calculating taxes is crucial to ensure accurate billing and compliance with local regulations. In many cases, you can automate this process within a spreadsheet by using basic formulas. This makes the task faster and less prone to errors, which is particularly helpful for businesses that frequently issue financial statements.

To calculate taxes, you first need to know the tax rate applicable to the transaction. Once you have this, it’s a matter of multiplying the total amount by the tax percentage. Let’s break down how this can be done using a simple calculation method in your document.

| Item Description | Price | Tax Rate (%) | Tax Amount | Total Amount |

|---|---|---|---|---|

| Service 1 | $200 | 10% | $20 | $220 |

| Service 2 | $150 | 10% | $15 | $165 |

Formula Explanation: In the above example, the tax amount for each item is calculated by multiplying the price by the tax rate (e.g., $200 * 10% = $20). The total amount is then the sum of the price and the tax amount (e.g., $200 + $20 = $220).

Tip: You can use a simple formula to calculate the tax automatically. For instance, in your document, use the formula =PriceCell*TaxRateCell to calculate the tax for each line item. This way, you only need to input the tax rate once and let the formula handle the rest.

Tracking Expenses with Excel Templates

Managing business expenses is essential to maintaining a healthy financial flow. By organizing costs and keeping detailed records, businesses can easily monitor their spending and identify areas for improvement. Using a structured approach to track expenses not only simplifies budgeting but also helps in making informed financial decisions.

To effectively track your business expenses, create a clear system that categorizes each cost. You can group them into different categories such as office supplies, utilities, services, and travel expenses. Regularly updating this system will give you a real-time view of your financial standing and allow you to quickly identify discrepancies or unexpected charges.

Steps to Track Expenses

Follow these steps to ensure a comprehensive and accurate expense tracking system:

- Identify Categories: Break down your expenses into relevant categories such as operational, administrative, and marketing costs.

- Enter Data Regularly: Make it a habit to update the system after each purchase or expenditure.

- Use Formulas for Accuracy: Apply simple mathematical functions to calculate totals for each category and overall costs.

- Review Monthly: Regularly review your expenses to identify areas where savings can be made.

Essential Columns to Include

Ensure your tracking document includes the following columns for better organization:

- Date: Record the date of each expense.

- Description: Briefly describe the expense incurred.

- Category: Assign each expense to a relevant category (e.g., supplies, marketing).

- Amount: Enter the amount spent for each entry.

- Payment Method: Track whether the payment was made via credit card, cash, or another method.

By consistently applying these techniques, you can stay on top of your financial management, make more accurate forecasts, and improve overall business efficiency.

How to Protect Your Invoice Data

Protecting sensitive financial data is essential for any business. Whether you’re managing customer transactions or tracking expenses, safeguarding this information ensures compliance with regulations and prevents unauthorized access. Implementing proper security measures helps maintain the confidentiality and integrity of your records.

There are several steps you can take to ensure that your financial data remains secure, from using strong passwords to applying encryption methods. The goal is to protect your documents from being accessed or tampered with by unauthorized individuals, whether they are stored locally or in the cloud.

Key Strategies for Protecting Data

Here are some effective methods to secure your financial records:

- Use Strong Passwords: Always create strong, unique passwords for any documents or software used to manage your financial records. Avoid using easily guessable information.

- Encrypt Documents: Encryption is a powerful tool to make your files unreadable to anyone who doesn’t have the decryption key. This adds a layer of protection in case of theft or unauthorized access.

- Regular Backups: Regularly back up your documents to secure storage solutions. This ensures that if data is lost or corrupted, you can easily restore it.

- Use Cloud Storage with Security Features: If you use cloud-based services, choose providers that offer strong security features, such as two-factor authentication and end-to-end encryption.

- Limit Access: Only share sensitive documents with authorized personnel. Set permissions and access controls to ensure that only those who need the information can access it.

Additional Precautions

For enhanced security, consider these additional precautions:

- Monitor Activity: Regularly monitor access logs to ensure no unauthorized individuals are accessing your files.

- Update Software: Always keep your software, including document management tools, up to date to protect against known security vulnerabilities.

- Secure Physical Access: If you’re storing documents physically, ensure they are in a locked and secure location, accessible only to authorized individuals.

By taking these steps, you can protect your financial information and maintain the confidentiality of your business records, providing peace of mind to both you and your clients.

Integrating Excel Templates with Accounting Software

Seamlessly connecting your financial records with accounting software can simplify your workflow, improve accuracy, and save time. By integrating your spreadsheets with specialized software, you ensure that your data is processed efficiently and with minimal manual entry. This integration allows you to synchronize transactions, automatically update financial statements, and generate reports with ease.

Many businesses use spreadsheet files for managing financial data but may face challenges when it comes to syncing this data with accounting platforms. Fortunately, most accounting systems offer ways to import and export data, enabling businesses to bridge the gap between their records and more advanced financial tools.

How Integration Improves Efficiency

Integrating your records with accounting software offers several benefits:

- Streamlined Data Entry: Automatically importing data from spreadsheets reduces the need for manual data entry, lowering the risk of errors.

- Real-Time Updates: By linking your financial records directly with accounting software, you ensure that any updates are instantly reflected across your system, providing up-to-date information.

- Consistent Data Formatting: With integration, the software ensures that data follows consistent formats, preventing issues that may arise from incompatible formats.

- Quick Report Generation: You can generate comprehensive financial reports without needing to manually consolidate data from multiple sources.

Steps to Integrate Your Records with Accounting Software

Here are some practical steps to integrate your financial records with accounting platforms:

- Step 1: Export Data: Ensure your records are well-organized and properly formatted before exporting them to your accounting software.

- Step 2: Use Import Functions: Most accounting platforms offer import tools that allow you to upload spreadsheet data directly. Use these functions to transfer your information.

- Step 3: Match Fields: When importing, match the fields from your spreadsheet with those in your accounting software. This ensures the data is mapped correctly.

- Step 4: Review and Sync: After the import, review the data to confirm that everything has been correctly transferred and synced with your system.

By integrating your financial records with accounting software, you streamline processes, improve data accuracy, and reduce the amount of manual work required, making financial management more efficient and reliable for your business.