Open Office Billing Invoice Template for Streamlined Invoicing

Managing financial transactions efficiently is key to running a successful business, whether you’re a freelancer, small business owner, or a large corporation. One of the most crucial tasks in this process is generating accurate and professional billing documents. These documents not only reflect your business standards but also ensure that clients are invoiced correctly, helping to maintain smooth cash flow.

Using a flexible tool allows you to create customized statements tailored to your needs, offering essential features like automatic calculations, detailed line items, and adaptable design options. Such a solution can save valuable time and reduce errors, providing you with a polished document ready for distribution.

Efficient invoicing doesn’t require advanced software or complicated systems. With the right approach, you can quickly generate detailed and clear records that communicate all necessary information to clients in a professional manner. This section will guide you through the process, highlighting tips and key elements for creating effective financial documents that will impress every time.

Open Office Billing Invoice Template Guide

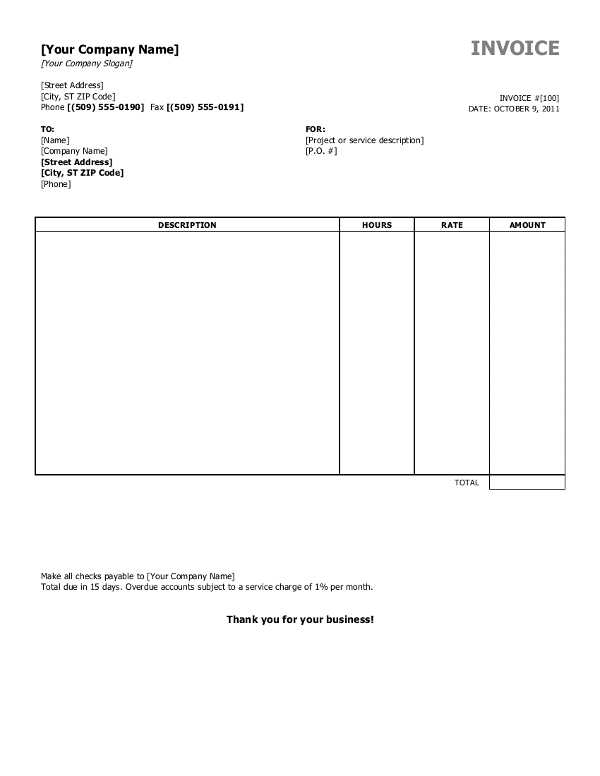

Creating professional payment documents doesn’t have to be complicated. By using an easy-to-edit digital document, you can customize all necessary sections to suit your specific needs, ensuring clarity and accuracy every time you need to send a statement. This guide will walk you through how to get started with a fully adaptable tool for generating structured and reliable billing records.

Steps to Access and Set Up Your Document

- Download the document file from a reliable source.

- Open the file in your preferred software.

- Review the pre-filled sections and identify the areas you need to adjust.

- Save the document with a unique name to avoid overwriting the original template.

Key Elements to Include in Your Document

- Client Information: Ensure you have all the client details such as name, address, and contact number.

- Service/Product Description: Clearly outline the services or products provided, including quantity, price, and any applicable discounts.

- Payment Terms: Include payment due date, late fees, and preferred payment methods.

- Itemized Costs: Provide a detailed breakdown of costs to ensure transparency and avoid confusion.

By carefully customizing each section of your document, you can create professional and accurate records that meet all business needs. Adjust the layout and design according to your brand’s aesthetic, and include any additional fields that may be necessary for specific transactions.

Why Choose Open Office for Invoices

When it comes to managing financial records, choosing the right tool is essential. A reliable solution should not only provide flexibility but also ensure that documents are created with precision and professionalism. Using a widely recognized program gives you the ability to tailor documents to your exact specifications while also simplifying your workflow. The ease of use and adaptability make it a top choice for individuals and businesses looking to streamline their financial documentation process.

Cost-Effective Solution

One of the biggest advantages of using this software is its cost-effectiveness. Unlike other paid programs, it’s available for free, making it an ideal option for startups, freelancers, and small businesses with limited budgets. This enables you to access essential features without the financial burden, allowing you to focus on what truly matters–growing your business.

Customizable and Easy to Use

Another compelling reason to choose this software is its flexibility. It allows you to modify documents as needed, whether you’re adjusting layout, adding specific fields, or inserting logos. The interface is intuitive, so even those with minimal experience can create professional and accurate records without difficulty. Whether you’re handling one-time transactions or recurring payments, it provides the necessary tools to meet all your documentation needs.

Benefits of Customizing Your Invoice

Personalizing your financial documents offers numerous advantages that go beyond simply filling in the required details. Customization allows you to tailor each document to your specific needs, ensuring that it not only meets your business requirements but also reflects your brand identity. This flexibility can make a significant difference in how professional and organized your communications appear to clients and partners.

Brand Identity and Recognition are two major benefits when customizing your documents. By adding logos, custom fonts, and specific color schemes, you create a consistent visual style that reinforces your brand. This not only helps in building recognition but also adds a level of professionalism that can set you apart from competitors.

Accuracy and Clarity are enhanced when you adjust the document layout and content according to your preferences. Customizing enables you to include only the most relevant information for your business, making it easier for clients to understand the payment structure and terms. A clean, well-organized document reduces the risk of errors or misunderstandings and ensures that the financial process is as transparent as possible.

Overall, customizing your financial records adds a personal touch that makes interactions with clients more professional and efficient, helping to build trust and credibility.

Steps to Download the Template

Accessing the right document format is a simple process that can help you get started quickly. By following a few easy steps, you can download a customizable file that fits your needs, ensuring you have all the necessary tools for creating accurate and professional records. Below are the steps to guide you through the downloading process.

| Step | Description |

|---|---|

| 1. Visit a Trusted Source | Navigate to a reliable website offering free or paid downloads of financial record templates. |

| 2. Select the Desired Format | Choose the file format that suits your software preferences, such as .ods or .xls. |

| 3. Download the File | Click the download button and wait for the file to be saved to your device. |

| 4. Open the Document | Once the download is complete, open the file with your preferred spreadsheet software. |

| 5. Save for Future Use | Rename the file and save it in a location where it can be easily accessed for future use. |

By following these steps, you can quickly access a file that is ready for customization, ensuring you have a professional document on hand whenever you need it.

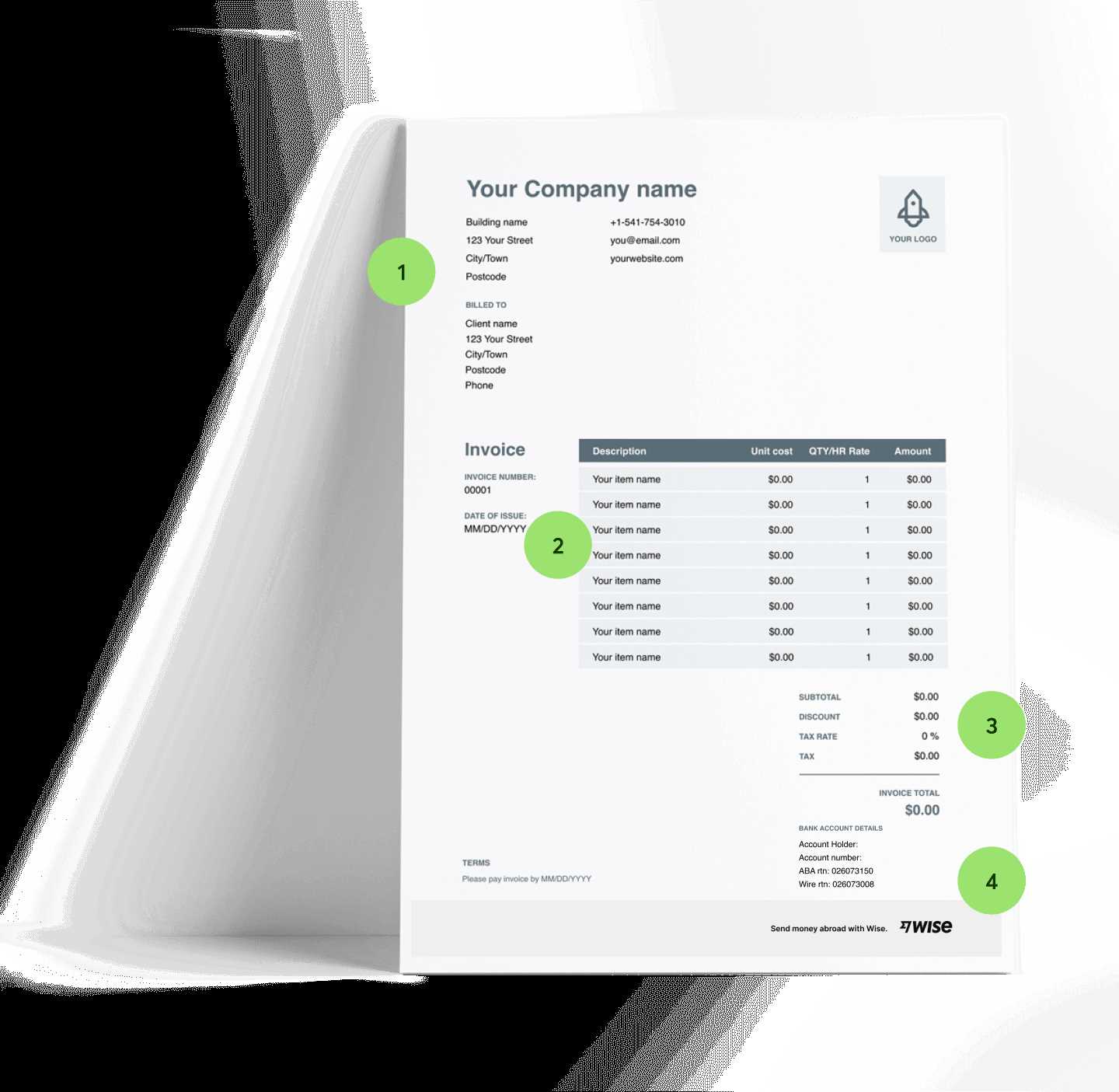

How to Edit Your Open Office Invoice

Once you have downloaded your document, the next step is customizing it to meet your specific needs. Editing financial documents allows you to adjust details such as client information, services provided, payment terms, and other essential elements. By following a few simple steps, you can create a fully personalized record that aligns with your business practices.

Steps to Modify the Document

- Open the Document: Launch your preferred spreadsheet software and open the file you have downloaded.

- Edit Client Information: Replace the default name, address, and contact details with your client’s information.

- Adjust the Line Items: Modify or add rows to include the specific products or services provided, adjusting the quantities and prices as needed.

- Update Payment Terms: Customize the payment due date, fees, and available payment methods to suit your agreement with the client.

- Modify Branding: Insert your company logo, change the fonts, or adjust colors to align with your brand’s visual identity.

Finalizing the Document

- Check for Accuracy: Review all the details to ensure the document is error-free, including the client’s information, pricing, and payment terms.

- Save the Document: After making all changes, save the file under a new name for easy identification, and keep it stored securely for future reference.

Customizing the document is straightforward, and with just a few edits, you can generate a professional and accurate financial record that is perfectly tailored to your needs.

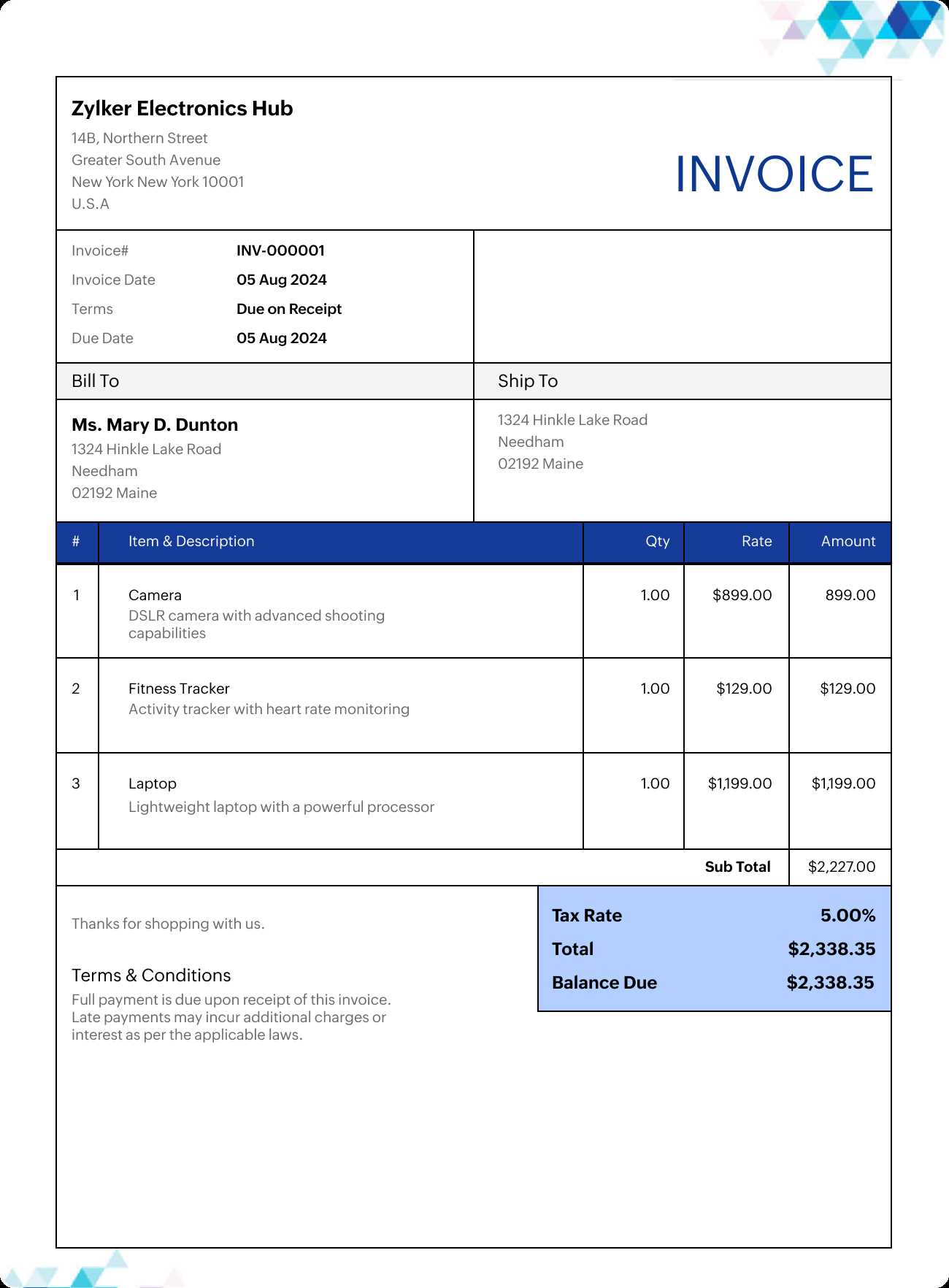

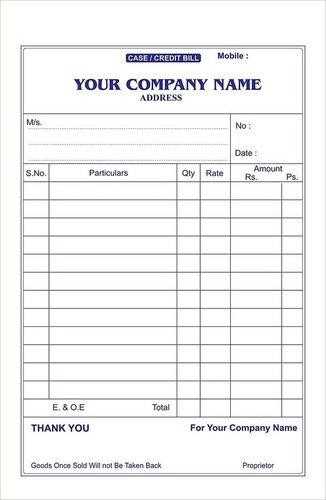

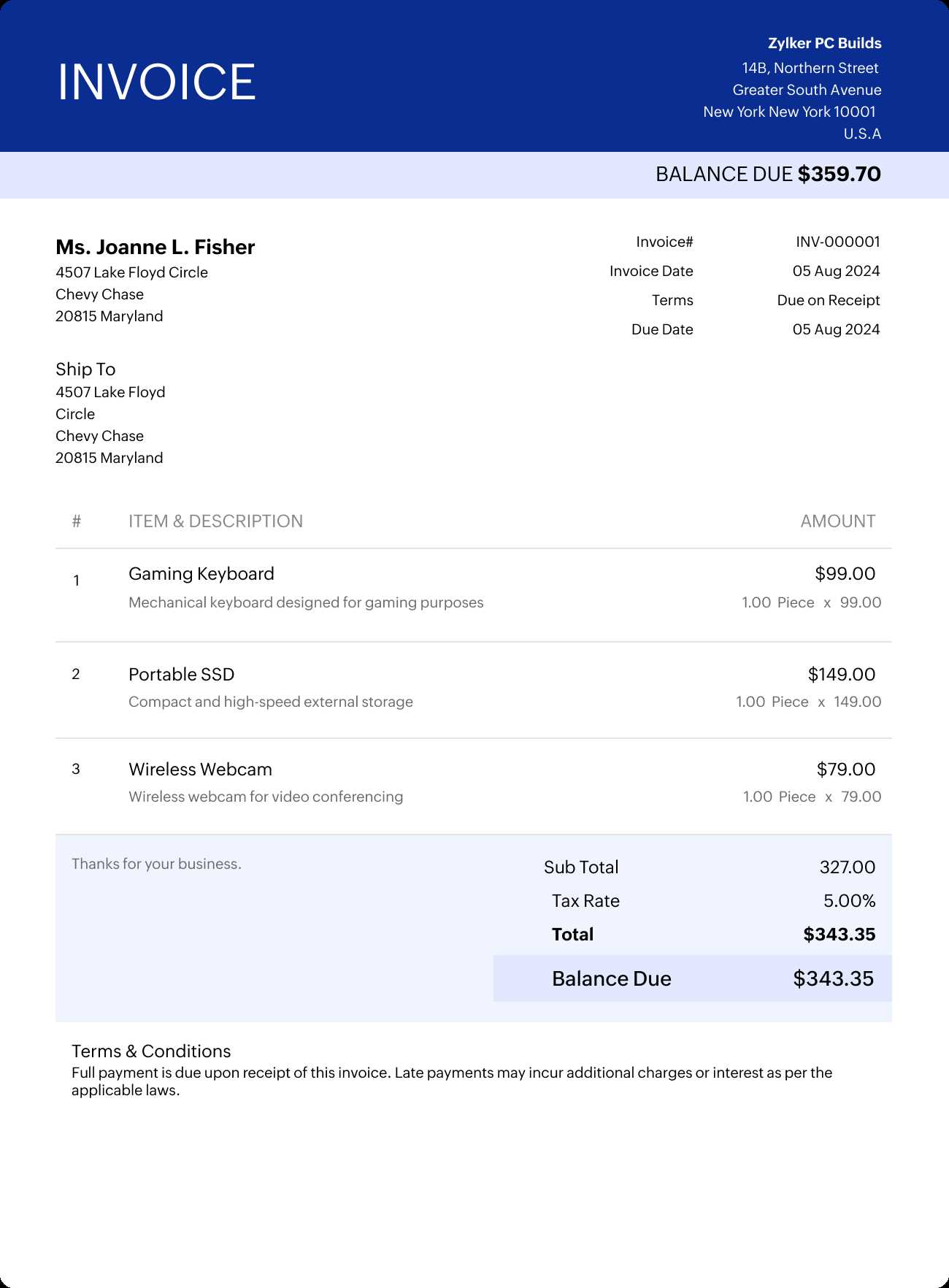

Key Features of an Invoice Template

A well-designed document for financial records should contain certain essential features to ensure clarity, professionalism, and accuracy. These features not only help in structuring the document effectively but also make the information easy to understand for both you and your clients. Below are the key elements that should be present in any effective financial record template.

| Feature | Description |

|---|---|

| Header with Business Information | Includes your company name, logo, and contact details such as address, phone number, and email, providing immediate recognition of your brand. |

| Client Information | Clearly displays the client’s name, address, and contact information to ensure the document is directed to the right person. |

| Itemized List of Services or Products | Breaks down each product or service provided with details like quantity, rate, and total cost, offering transparency. |

| Terms and Payment Details | Outlines payment due dates, accepted methods, and any additional fees or discounts, ensuring both parties are clear on the terms. |

| Unique Reference Number | Assigns a distinct number to each document for easy tracking and future reference, making it easier to manage records. |

| Total Amount Due | Clearly states the final amount due after all services and discounts, eliminating any confusion about the payment required. |

Having these key elements in place ensures that your financial documents are not only organized but also provide all the necessary information for quick processing and client satisfaction.

Best Practices for Invoice Formatting

Creating a well-structured financial document is essential for both clarity and professionalism. Proper formatting ensures that all information is easy to locate and interpret, reducing confusion and enhancing the overall user experience. By following a few key formatting practices, you can make your document more effective and client-friendly.

Clear and Organized Layout

- Consistent Font Usage: Use clear and legible fonts for readability. Avoid using too many different fonts, as it can make the document look cluttered.

- Logical Arrangement: Place important information at the top, such as business and client details, followed by an itemized list of services or products. This helps readers locate key details quickly.

- Whitespace: Make sure there is enough space between sections to avoid overcrowding. Proper spacing makes the document easier to read and gives it a clean, professional appearance.

Essential Information Formatting

- Bold Key Details: Use bold text for headers, total amounts, and payment terms to make them stand out and easy to find.

- Use Tables for Itemization: Organize product or service details in a table with columns for descriptions, quantities, rates, and totals to ensure clarity.

- Highlight Payment Terms: Make payment deadlines and methods visually prominent so there is no confusion about when and how payments should be made.

By incorporating these formatting practices, you can create a polished and easy-to-read financial document that promotes professionalism and clarity, ensuring that your clients have all the information they need to complete the transaction smoothly.

Adding Company Branding to Your Invoice

Incorporating your company’s brand into your financial documents enhances its professional appearance and helps reinforce your identity with clients. Personalizing your documents with consistent brand elements like logos, colors, and fonts not only makes them recognizable but also fosters trust and credibility. This section outlines how to effectively integrate your branding into financial records.

Using Logo and Colors

- Logo Placement: Position your logo at the top of the document, where it’s most visible. This reinforces your company’s identity right from the start.

- Color Scheme: Use your brand’s primary colors for headings, lines, and accents to create a cohesive look. Ensure the colors don’t overwhelm the document’s readability.

Fonts and Text Style

- Consistent Font Choice: Choose fonts that align with your branding. Use simple, professional fonts for easy readability while maintaining consistency with your company’s style guide.

- Emphasize Key Details: Apply bold or italics to important information like payment terms or totals to make them stand out without cluttering the document.

Adding these branding elements helps create a more polished and professional document, reflecting your company’s standards and making it easier for clients to recognize and trust your business.

How to Include Payment Terms

Clearly defining payment terms in your financial documents is essential for ensuring both parties are on the same page regarding deadlines, amounts due, and accepted methods of payment. This section explains how to properly incorporate payment terms into your document to avoid misunderstandings and promote timely transactions.

To include payment terms, start by specifying the due date for payment. Make it clear whether the payment is due upon receipt, within a certain number of days (e.g., 30, 60 days), or at the end of the month. Additionally, it is important to outline the payment methods you accept, such as bank transfer, credit card, or online payment platforms. If applicable, include any late fees or interest charges for overdue payments to encourage timely settlement.

By providing clear and concise payment terms, you create transparency and set expectations, reducing the likelihood of payment delays or disputes.

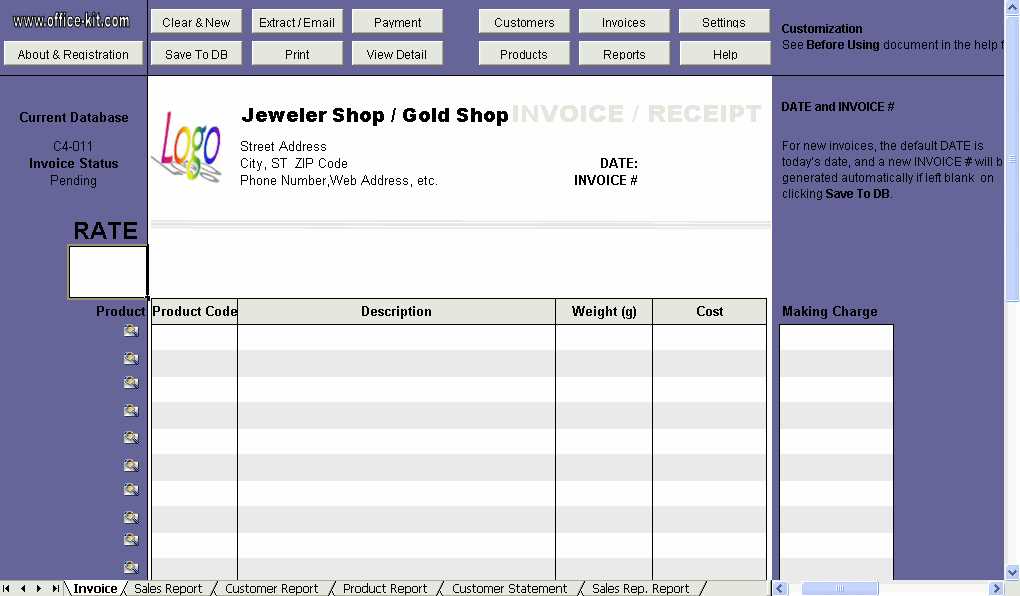

Automating Invoice Calculations in Open Office

Automating calculations in financial documents can save time and reduce errors, making the process more efficient and accurate. By using built-in features like formulas and functions, you can easily perform tasks such as calculating totals, taxes, discounts, and other variables without manual input.

To automate calculations, start by using basic arithmetic functions like SUM to add up amounts, or PRODUCT for multiplication when calculating prices and quantities. You can also incorporate conditional functions such as IF to apply specific rules, for instance, to automatically add a discount if the total exceeds a certain amount. Additionally, formulas for tax calculation can be integrated by multiplying the subtotal by a fixed tax rate.

Automating these calculations reduces the chance of human error and ensures that your financial documents are always accurate and up-to-date. It also allows you to focus on other important aspects of the document creation process, while the system handles the numbers.

Saving and Exporting Your Invoice

Once you’ve completed your financial document, it’s crucial to save it in a format that is both accessible and secure. Additionally, exporting the document allows you to share it with clients or colleagues in a convenient way. This section explains how to save and export your file for various uses.

Saving Your Document

- Save Regularly: Always save your work frequently to avoid losing any progress. Use the “Save” or “Save As” option to create backups.

- Choose the Right Format: Save your document in the native format of your software, usually .odt, for easy editing in the future.

- File Naming: Name the file in a clear and organized way (e.g., “ClientName_Invoice_2024”) to make it easy to locate later.

Exporting for Sharing

- Export as PDF: Export your document as a PDF for easy sharing with clients. PDFs preserve formatting and are universally accessible.

- Export to Other Formats: If needed, you can also export the document to Excel (.xlsx) or CSV format for easy integration with accounting systems or databases.

- Check Export Settings: Ensure that any sensitive information (like payment details) is properly formatted or omitted before exporting.

By saving and exporting your document in the appropriate format, you can ensure its security, accuracy, and ease of sharing. This process ensures that both you and your clients can access the document as needed without issues.

Customizing Invoice Colors and Fonts

Personalizing the colors and fonts in your financial documents can greatly enhance their visual appeal and make them more aligned with your brand identity. By adjusting these elements, you can create a cohesive and professional look that reflects your company’s style, while also making the document easier to read and navigate.

When choosing colors, it’s essential to strike a balance between aesthetics and readability. Opt for contrasting colors for text and backgrounds to ensure that the information stands out clearly. Additionally, select fonts that are clean and easy to read. Avoid overly decorative styles that may confuse the reader, and instead use simple, professional fonts for clarity and consistency.

These customizations allow you to create documents that not only look professional but also make a strong, recognizable impression on your clients.

How to Handle Multiple Currency Types

When dealing with clients or suppliers from different countries, it is often necessary to manage multiple types of currency in your financial documents. Properly displaying various currencies ensures that both parties understand the amount being paid or received and avoids confusion. This section covers how to manage and display different currencies effectively.

Setting Up Multiple Currencies

To handle multiple currencies, you must first define the exchange rate and ensure that the correct symbol for each currency is used. In most document-editing software, you can set up different currency symbols and amounts in the appropriate columns or fields.

Calculating and Converting Currencies

For accurate calculations, it is important to set up formulas that automatically convert amounts based on real-time exchange rates. This can be done manually or by using available online tools or plugins that fetch the latest exchange rates.

| Currency | Amount | Exchange Rate | Converted Amount |

|---|---|---|---|

| USD | $100 | 1.25 | €125 |

| EUR | €100 | 0.80 | $125 |

By carefully managing currency types and exchange rates, you ensure that all financial transactions are accurately reflected in your documents and are easily understood by both parties.

Invoice Numbering Systems in Open Office

Using a consistent numbering system for your financial documents helps maintain order and makes it easier to track transactions. Implementing an effective numbering strategy ensures that each document is unique and identifiable, and it helps with both organization and compliance. This section covers different ways to set up and manage numbering systems for your financial documents.

Benefits of a Numbering System

- Organization: A structured numbering system keeps your records organized and makes it easier to find specific documents.

- Uniqueness: Each document gets a unique number, preventing duplicates and confusion.

- Professionalism: A clear numbering system reflects professionalism and efficiency in your business practices.

Setting Up Numbering Systems

When configuring your numbering system, consider the following options:

- Sequential Numbering: The most common approach is to start with a number (e.g., 001) and increase it by one for each new document. This ensures continuous and easily traceable numbering.

- Date-Based Numbering: Another method is to include the date in the number (e.g., 2024-001). This can be helpful for tracking when the document was created.

- Custom Formats: You can create custom formats that combine various elements such as client IDs, project numbers, or department codes to make the numbering even more personalized.

Once you’ve chosen a system, it’s important to set it up correctly in your document software to ensure that the numbers are generated automatically with each new entry. This saves time and reduces errors.

Using Office Templates for Freelancers

Freelancers often need to create professional documents quickly and efficiently. With the right tools, they can streamline their workflow and ensure that their financial documentation meets industry standards. Pre-designed document formats help freelancers save time, maintain consistency, and focus on their core work while ensuring they present a polished image to clients.

Advantages for Freelancers

Utilizing pre-built document formats offers several key benefits for freelancers:

- Time-saving: Ready-to-use formats eliminate the need to design documents from scratch, allowing freelancers to focus on their projects.

- Consistency: A uniform document structure ensures that all communications and financial records remain professional and consistent.

- Customization: Templates can be easily modified to reflect personal branding or specific project details, making them versatile for different needs.

How to Use These Documents Effectively

When using pre-designed formats, freelancers should keep the following tips in mind to maximize their effectiveness:

- Personalize: Make sure to include your business information, such as logo, contact details, and payment terms, to give the document a personalized touch.

- Update Regularly: Customize your format as your business grows. Add new sections or modify fields to suit new services or pricing models.

- Double-check Accuracy: Always review the document for accuracy before sending it to clients. Ensure that all amounts, dates, and details are correct.

By leveraging these tools, freelancers can create documents that reflect their professionalism while saving valuable time for their core activities.

Sharing and Sending Your Document

Once your financial document is ready, it’s crucial to send it to your client in a secure and professional manner. Whether you’re sharing a final report, request for payment, or other business-related documentation, choosing the right method ensures smooth communication and a timely response. By using effective sharing techniques, you can maintain professionalism and avoid delays in payment processing.

Methods of Sending

There are several methods to send your document, each offering different advantages:

- Email: One of the most common ways to send business documents, email allows you to attach your file securely and add any necessary comments. Ensure the subject line is clear and concise for easier reference.

- Cloud Storage: For large files or documents that require ongoing collaboration, using cloud platforms like Google Drive or Dropbox allows both you and the client to access and manage the document.

- Online Payment Systems: Many freelancers use platforms like PayPal or Stripe, which allow easy integration of documents directly within the payment request, ensuring both the transaction and the document are connected.

Best Practices for Sharing Documents

To ensure that your document is received and processed effectively, consider the following tips:

- Double-check the file format: Ensure that your document is in a commonly accepted format such as PDF to avoid compatibility issues.

- Include all necessary details: If you’re sending a request for payment, make sure to include relevant details such as due dates, payment methods, and any reference numbers that may help the client process the payment easily.

- Set up follow-ups: If you don’t receive a response within a reasonable timeframe, send a polite reminder to ensure your document has been received and is being processed.

By taking these steps, you can ensure your document is received promptly and professionally, which can contribute to smooth transactions and improved client relationships.

Ensuring Accuracy in Document Details

When preparing any document that involves financial transactions, it’s essential to ensure that every detail is accurate. Mistakes, no matter how small, can lead to confusion, delayed payments, or even disputes. By taking the time to carefully review and verify all information, you can avoid unnecessary issues and maintain a professional reputation.

Key Areas to Check for Accuracy

Here are the most important details to verify before finalizing your document:

- Client Information: Double-check the recipient’s name, address, and contact details. Mistakes in this section can lead to delays in processing or delivery.

- Dates: Verify the issue date, payment due date, and any other relevant timeframes. Missing or incorrect dates can confuse both you and the client.

- Amounts: Ensure that all amounts are correctly calculated, including any applicable taxes, discounts, or adjustments. Double-checking your math can prevent misunderstandings.

- Descriptions of Goods or Services: Be specific about what was provided. Vague descriptions can cause confusion or disagreements over the scope of work or products delivered.

- Payment Terms: Review the terms of payment, including methods, deadlines, and any late fees. Clear terms prevent disputes later on.

Tools and Methods to Verify Accuracy

There are several strategies you can use to ensure accuracy in your document:

- Automated Calculations: Use built-in features in your document creation software to automatically calculate totals, taxes, and discounts. This reduces the risk of human error.

- Proofreading: Always take the time to review the document for any spelling or grammatical errors. Small mistakes can undermine your professionalism.

- Double-Check References: If you reference a purchase order or contract number, make sure it’s correct and matches the client’s records.

By paying attention to these details, you can ensure that your document is clear, accurate, and professional, helping to facilitate smooth transactions and maintain positive client relationships.

Advanced Features for Managing Financial Documents

When it comes to creating and managing financial records, advanced tools can help streamline the process and add a level of customization and efficiency. These features are designed to simplify tasks such as automatic calculations, personalized designs, and easy integration with other business systems. By exploring and utilizing these tools, you can save time and enhance the accuracy of your documentation.

Key Advanced Features

Here are some of the powerful features that can be used to optimize your financial documentation:

- Automated Calculations: Many software solutions allow you to set up formulas that automatically calculate totals, taxes, discounts, and subtotals. This feature saves time and reduces the likelihood of errors in your calculations.

- Customizable Fields: You can tailor the document to meet your specific needs by adding custom fields. These can be used for additional notes, payment instructions, or custom item descriptions, ensuring each document reflects your business requirements.

- Recurring Entries: If you offer subscription-based services, automated recurring entries allow you to automatically generate documents with the same amounts, terms, and due dates, saving you from manually entering data for each cycle.

- Client Data Integration: Linking the software with your customer database allows for quick population of client details. This ensures the correct information is added to every document and minimizes the risk of errors when inputting client names and addresses.

- Multi-Currency Support: For businesses that operate internationally, the ability to manage and display multiple currencies in your documents is essential. You can set up exchange rates and ensure accurate conversions, so clients are always billed correctly.

- Personalized Branding: You can easily incorporate your brand’s logo, color scheme, and font choices, ensuring that each document reflects a consistent professional image and strengthens brand recognition.

Leveraging These Features for Better Efficiency

To make the most of these advanced tools, it’s important to invest time in learning how to configure them properly. Here are a few ways to get the most out of these features:

- Explore built-in templates: Many programs come with pre-configured templates that already include advanced features, so you can start using them right away without extensive customization.

- Use automation for repetitive tasks: Setting up automated processes like recurring entries and calculation formulas helps save time and reduces manual errors.

- Test and optimize: Always test your documents before se