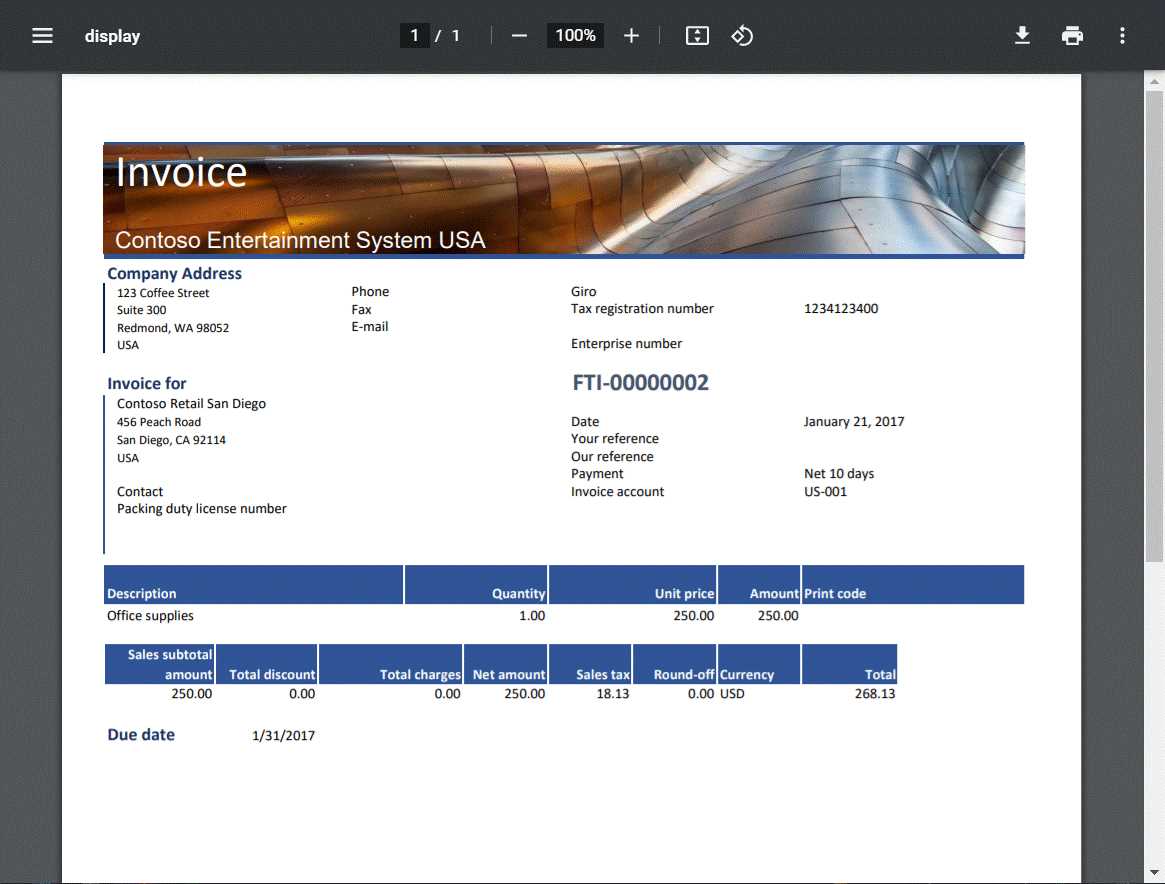

Free Text Invoice Template for D365

In today’s fast-paced business environment, having an efficient and customizable system to manage transactions is essential. Whether you’re a small business owner or a large enterprise, simplifying the creation of documents that outline client charges can save time and reduce errors. This becomes particularly important when you need a system that adapts to your unique requirements without unnecessary complexity.

Many organizations opt for software that allows for greater flexibility in generating payment statements. By using an adaptable document structure, companies can quickly generate professional and consistent records. These systems offer tools to personalize the format, ensuring that all necessary details are included and the output aligns with branding or regulatory needs.

Incorporating a tool that automates and customizes these documents can significantly enhance your workflow. With the right features, users can easily adjust the structure, ensuring that everything from the client name to the amount due is presented accurately and clearly. By integrating such a tool into your workflow, you can improve overall efficiency and communication with clients.

Free Text Invoice Template for D365

When managing business transactions, having a versatile and user-friendly system for generating billing documents is crucial. Customizing the format of these records allows companies to streamline their accounting process while ensuring consistency and accuracy. With the right tools, it’s possible to create detailed statements that meet the specific needs of any organization, without being restricted to rigid templates.

Customization Options for Billing Documents

One of the main advantages of using a flexible document generation system is the ability to tailor each record to reflect your company’s specific requirements. Users can modify the layout, adjust fields for particular data points, and include unique identifiers such as client numbers or order references. This customization makes it easier to create professional-looking statements that align with your business’s style and standards.

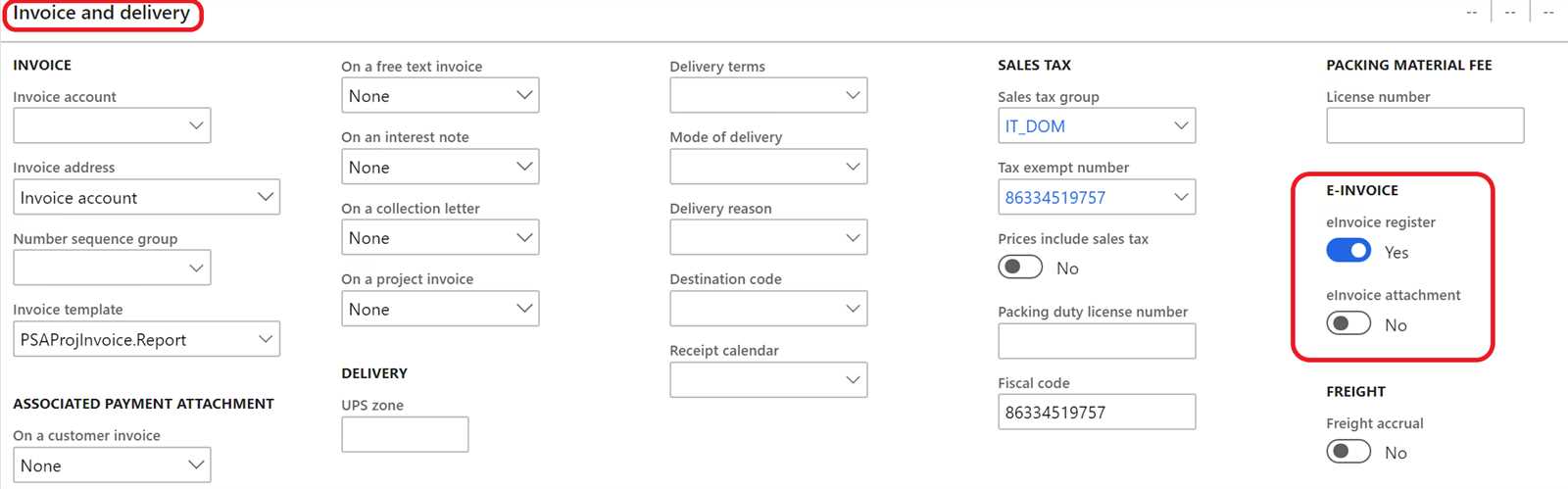

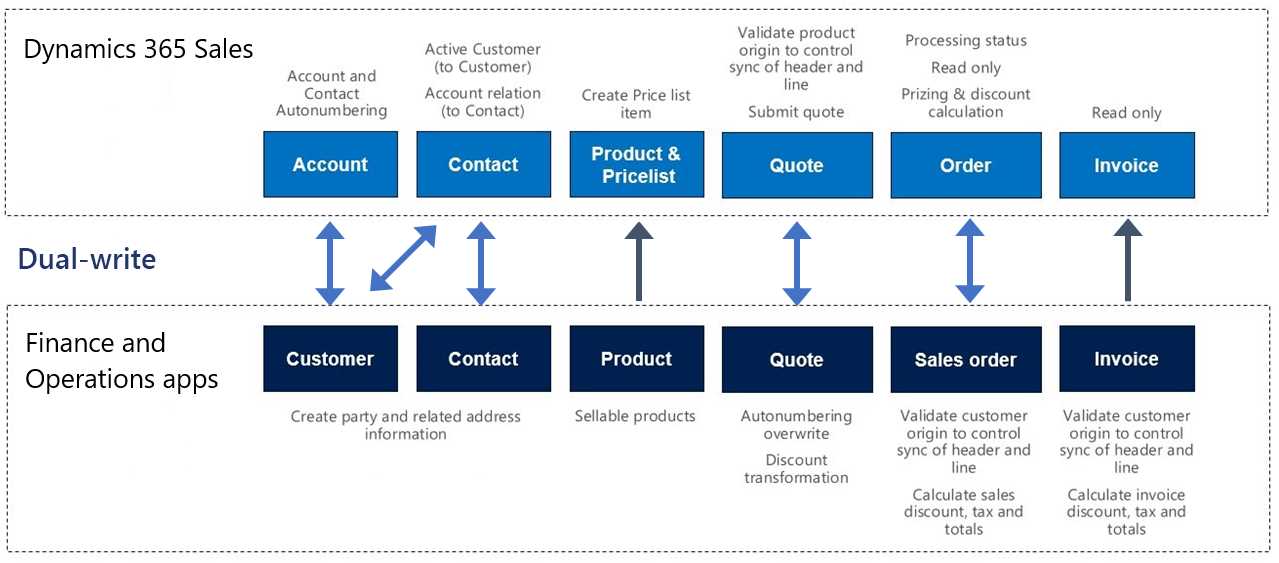

Integration with Business Software

Modern accounting solutions integrate seamlessly with such document generation systems, enabling the automatic transfer of relevant client information. By linking your financial data to the document creation process, you ensure that each record is automatically populated with the correct details, minimizing human error. These integrations also allow for quicker processing and better synchronization across different business functions.

What is a Free Text Invoice Template

In any business, creating accurate and detailed payment records is a key part of the transaction process. This document, which outlines the charges, quantities, and terms of payment, can be highly flexible, allowing companies to adjust it based on specific needs. A customizable structure provides the flexibility to include various types of information, whether it be about products, services, or additional terms that might apply to a particular client or order.

Key Features of Customizable Billing Documents

A flexible document structure allows for several important features that can streamline and enhance the billing process:

- Dynamic Content Fields: The ability to modify fields like dates, amounts, and descriptions based on the transaction details.

- Personalization: Customizable layouts and branding options to align the document with company identity.

- Integration Capabilities: Integration with accounting or ERP systems to automatically populate details and reduce errors.

- Additional Information: Ability to include terms and conditions, discount information, or any special notes relevant to the client.

Advantages of Using a Customizable Document Format

With this type of approach, businesses can easily adapt the document format to fit various situations. Whether it’s adjusting to client preferences or ensuring that all required legal or business details are included, a versatile document structure provides greater control and efficiency in the billing process. Some of the main advantages include:

- Improved accuracy in records

- Faster document generation and processing

- Clear and professional appearance

- Enhanced client communication and satisfaction

Benefits of Using D365 Invoice Templates

Using a customizable document generation system for creating billing records offers significant advantages to businesses of all sizes. By automating the creation of client statements, companies can save valuable time, reduce errors, and ensure consistent presentation across all transactions. These tools not only streamline the billing process but also provide the flexibility needed to adapt to specific business needs or client preferences.

One of the primary benefits is the integration with existing business systems. When the billing solution is connected to other platforms like financial software or customer management tools, it ensures that all necessary data–such as client details, order quantities, and amounts–are populated automatically. This minimizes the risk of mistakes and eliminates the need for manual data entry.

Enhanced Efficiency and Accuracy

Automation significantly improves the speed of document creation. Instead of manually preparing each statement, the system can generate them in a fraction of the time, allowing staff to focus on more strategic tasks. Moreover, automated population of fields ensures that all details are correct, reducing the risk of human error.

Customization and Flexibility

Another benefit is the flexibility to tailor each record according to specific requirements. Whether it’s adjusting the layout, adding custom fields, or inserting personalized terms, businesses can create a billing document that reflects their brand and meets unique client needs. This customization ensures a professional presentation, helping to build trust and strengthen client relationships.

How to Customize a Free Text Template

Customizing billing records to meet your company’s specific requirements can enhance both efficiency and professionalism. By adjusting the layout, content, and data fields, you ensure that the generated documents reflect your business’s identity and meet client expectations. This process allows for greater flexibility, enabling you to adapt the document according to the type of transaction or client needs.

Steps to Customize Your Billing Document

Follow these steps to personalize the layout and structure of your billing record:

| Step | Description |

|---|---|

| 1. Access the Document Settings | Start by navigating to the section where you can manage and edit document settings within your accounting or ERP system. |

| 2. Choose the Layout | Select a layout that suits your business style. Most systems offer several pre-designed formats for easy customization. |

| 3. Modify Fields | Edit the fields to include relevant information, such as client details, products, services, and payment terms. |

| 4. Add Custom Data | If necessary, insert additional fields to reflect special discounts, terms, or unique client identifiers. |

| 5. Save and Test | Once the changes are made, save the settings and test by generating a document to ensure all modifications appear correctly. |

Advanced Customization Options

For businesses that require further adjustments, advanced features such as adding custom logos, adjusting fonts, or creating templates for specific clients are available. These options ensure that each generated document not only contains accurate data but also aligns with your brand’s visual identity, helping maintain consistency across all communication.

Steps to Download a Template in D365

Downloading a pre-configured document format within your accounting or ERP system is a straightforward process that allows you to quickly generate professional and consistent records. By following a few simple steps, you can access and download the necessary file, making it ready for customization according to your business needs.

Accessing the Document Management Section

The first step is to navigate to the document management or settings area within your business software. Most systems have a dedicated section for managing and downloading different document structures. Look for an option labeled something like “Document Templates,” “Billings,” or “Statements.”

Downloading and Setting Up the Document Format

Once you have located the right section, select the appropriate option to download the format. This typically involves choosing from a list of available designs or structures that align with your business needs. After downloading, you may need to assign specific data fields, such as client information or pricing, to be auto-populated in the final document. Make sure to save the downloaded file for future use and testing.

Why Choose Free Text Invoices in D365

Opting for a flexible document generation system within your financial software can significantly improve the billing process. The ability to easily modify and adapt the format of records based on specific needs offers numerous advantages to businesses. Instead of relying on rigid templates, this approach allows you to create a personalized statement that meets both client requirements and business standards.

Advantages of Using Flexible Document Formats

Choosing a customizable structure within your accounting software provides the following key benefits:

- Flexibility in Content: Easily add or remove sections based on the type of transaction or client, ensuring relevant information is always included.

- Efficient Data Entry: Automatically populate client and transaction details from integrated systems, reducing the chance for manual errors and speeding up the process.

- Professional Appearance: Maintain consistent, branded documents that reflect your company’s identity, boosting professionalism in client communications.

- Adaptability: Modify the document’s layout and content to meet unique business requirements, such as adding specific payment terms or legal disclaimers.

How This Approach Enhances Your Workflow

By adopting this more flexible solution, businesses benefit from faster document creation, reduced administrative overhead, and improved communication with clients. The ability to easily adjust documents ensures that your team can respond quickly to changes, whether it be new client needs or updated regulatory requirements. Ultimately, this method helps streamline your accounting operations while ensuring accuracy and compliance across the board.

Integrating Free Text Templates with D365

Integrating a customizable document generation system with your business management platform ensures seamless data transfer and simplifies the overall billing process. By linking document formats with other operational tools, such as accounting or customer management software, you create a unified workflow that reduces manual data entry and improves accuracy. This integration streamlines the process of generating payment records and eliminates the need for redundant tasks, saving both time and resources.

Connecting Document Creation Tools with Accounting Software

When integrated with your financial system, the document generator can automatically pull key information from your records, such as customer names, addresses, itemized charges, and payment terms. This real-time data transfer minimizes the risk of errors and ensures that each document is created with the most up-to-date information. Additionally, these integrations enable faster processing of client accounts, making the overall financial management process more efficient.

Improving Workflow and Reducing Redundancy

Once the connection is established, the need for manual entry of repetitive data is eliminated. With integrated systems, your team can generate accurate, up-to-date documents in just a few clicks, making the billing cycle much faster. Furthermore, integration improves coordination between departments, as the data needed for accounting, reporting, and customer service is all available in one central location.

Common Issues with Text Invoice Templates

While flexible billing document structures offer many benefits, they can also present challenges if not properly configured or maintained. From formatting errors to data synchronization issues, problems can arise that disrupt the smooth generation of payment records. Identifying and addressing these common issues early on can help ensure that the document creation process remains efficient and accurate.

One common problem is the misalignment of data fields, which occurs when certain information fails to display correctly in the generated document. This can happen if the system’s data integration isn’t set up properly, leading to missing or incorrectly populated fields. Additionally, issues with formatting, such as inconsistent font sizes or layout mismatches, can cause documents to appear unprofessional, undermining their effectiveness.

Another frequent issue is the lack of customization options, especially when specific business requirements need to be reflected in the document. Without adequate flexibility in the document structure, it may be difficult to include unique client terms, special pricing, or additional notes that are important for certain transactions. These limitations can hinder the customization of billing records and complicate the process of aligning documents with client expectations or legal requirements.

How Free Text Templates Improve Efficiency

Using a customizable document creation system significantly enhances operational efficiency by automating routine tasks, reducing manual effort, and ensuring accuracy across all records. When billing or transaction documents can be quickly generated with relevant data automatically populated, businesses can save valuable time that would otherwise be spent on manual entries. This efficiency improves the speed of the overall process, from document creation to client communication, and leads to better resource allocation.

Key Ways to Boost Productivity

Here are several ways customizable document formats contribute to operational efficiency:

- Reduced Manual Data Entry: Automatic population of client and transaction details eliminates the need for repetitive data input, speeding up the process.

- Faster Document Generation: Once the structure is set, creating new records becomes a one-click process, saving time compared to creating them manually.

- Improved Consistency: Automated systems ensure that all records follow the same format, reducing errors caused by human oversight.

- Streamlined Approval Process: With pre-configured documents, approvals and reviews become faster as the content is standardized and error-free.

Enhancing Workflow and Collaboration

By integrating these tools with existing business systems, teams can easily share and access documents across departments. Whether it’s finance, sales, or customer service, everyone has access to accurate, up-to-date information. This collaboration minimizes delays, improves decision-making, and strengthens client relationships by ensuring timely and professional communication at every step.

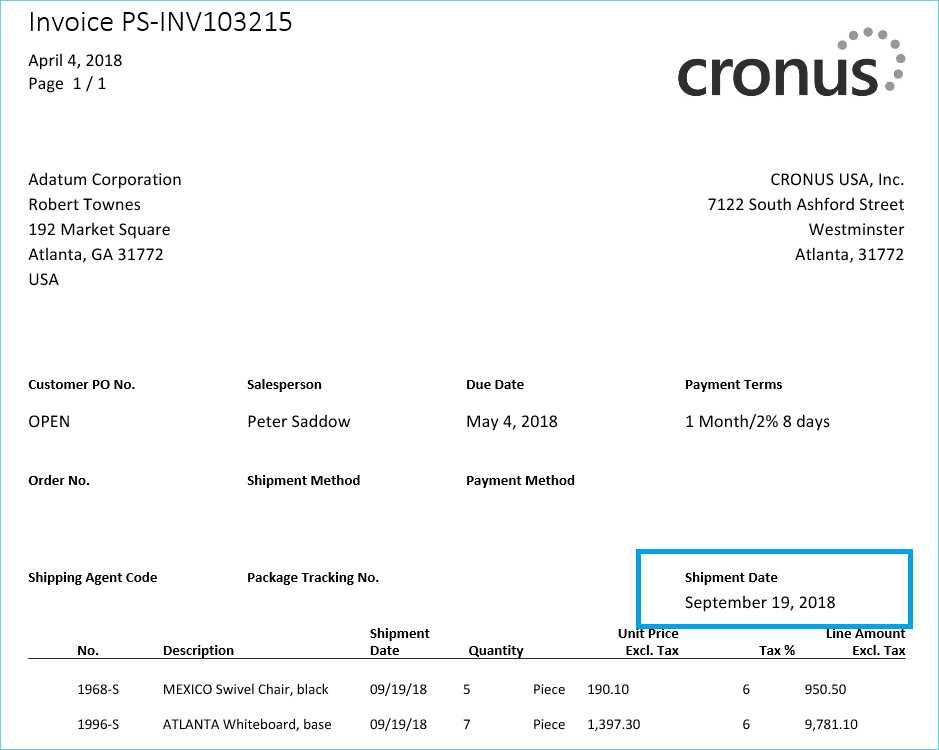

Template Formatting Options in D365

When it comes to generating business documents, having the ability to adjust formatting ensures that the final output aligns with both brand identity and operational needs. Customizable formatting options allow businesses to design documents that are both professional and clear, while also accommodating specific requirements such as client preferences or legal regulations. In many accounting and business management systems, these formatting capabilities offer flexibility in terms of structure, design, and content presentation.

With robust formatting options, users can modify various elements of the document, including font types, sizes, and colors, as well as how information is arranged on the page. This not only enhances the visual appeal but also ensures the document is easy to read and understand. Whether it’s for internal records or client-facing communication, the right formatting helps maintain consistency and clarity across all documents.

Customizable Layouts

The system typically provides several layout options, allowing users to choose or design formats that best suit their needs. Whether it’s a simple document or a more detailed statement, different layouts can be selected to organize information logically and aesthetically. Some common layout options include:

- Header and Footer Customization: Add company logos, contact details, and other branding elements to personalize the document.

- Field Placement: Choose where different sections of data (such as billing information, product descriptions, and amounts) are positioned on the page for clarity and ease of reading.

- Column and Row Adjustments: Modify the alignment, width, and spacing of columns and rows to improve document readability and accommodate various data sets.

Data Integration and Visual Appeal

In addition to layout options, users can enhance the visual appeal by integrating specific data points directly into the document. For instance, automatic population of client names, addresses, or transaction details ensures that the document is up-to-date and accurate. Furthermore, incorporating elements such as borders, shading, and color coding can help highlight key sections, improving the overall user experience and readability of the document.

Managing Client Information in Templates

Effectively managing client details in billing documents is essential for ensuring accurate and timely communication. By integrating client information directly into the document creation process, businesses can eliminate the risk of errors, reduce manual entry, and improve efficiency. With the right system in place, client data such as contact details, transaction history, and payment terms can be automatically included, ensuring each document is personalized and up-to-date.

Most business management systems allow you to map client-specific fields to automatically populate the relevant sections of a document. This ensures that all required information is included without requiring manual input, saving time and improving the accuracy of each record. Furthermore, the ability to store and update client details in a central database allows for quick access to up-to-date information whenever needed.

| Client Information | Example Data |

|---|---|

| Client Name | John Doe |

| Company Name | ABC Corporation |

| Billing Address | 123 Business Rd, City, Country |

| Contact Email | [email protected] |

| Payment Terms | Net 30 Days |

By automating the inclusion of client information, businesses can ensure that every document is not only accurate but also reflects the most current details. This level of integration makes it easier to maintain client relationships, handle billing inquiries, and deliver a consistent client experience with each transaction.

Optimizing Invoice Design for D365

Designing effective billing documents that are both functional and visually appealing is crucial for maintaining professionalism and ensuring clarity. Optimizing the structure of these documents involves making sure the content is organized, easy to read, and aligned with your company’s branding. A well-designed document helps improve client satisfaction, reduces confusion, and supports smoother payment processes.

When working with a system like business management software, optimizing document design goes beyond simple aesthetic choices. It’s about structuring the content to make essential information–such as charges, terms, and contact details–immediately clear and easy to find. The right layout and formatting can streamline internal workflows and improve client interactions.

Key Elements of Effective Document Design

To achieve a well-optimized billing document, focus on the following key elements:

- Clear Hierarchy: Use headings, subheadings, and bold text to differentiate key sections like client information, transaction details, and payment terms.

- Consistent Branding: Ensure that the document reflects your company’s branding by incorporating logos, color schemes, and font choices that align with your brand’s identity.

- Logical Layout: Arrange content in a way that flows naturally. Group related information together, and prioritize the most important details (e.g., amounts due) to stand out.

Enhancing Readability and Usability

Aside from structure, optimizing readability is another essential factor. Choosing legible fonts, adequate spacing, and properly aligned text ensures that clients can quickly and easily understand the information presented. Additionally, ensuring that key details are highlighted (such as payment due dates and amounts) can help prevent misunderstandings and improve the likelihood of on-time payments.

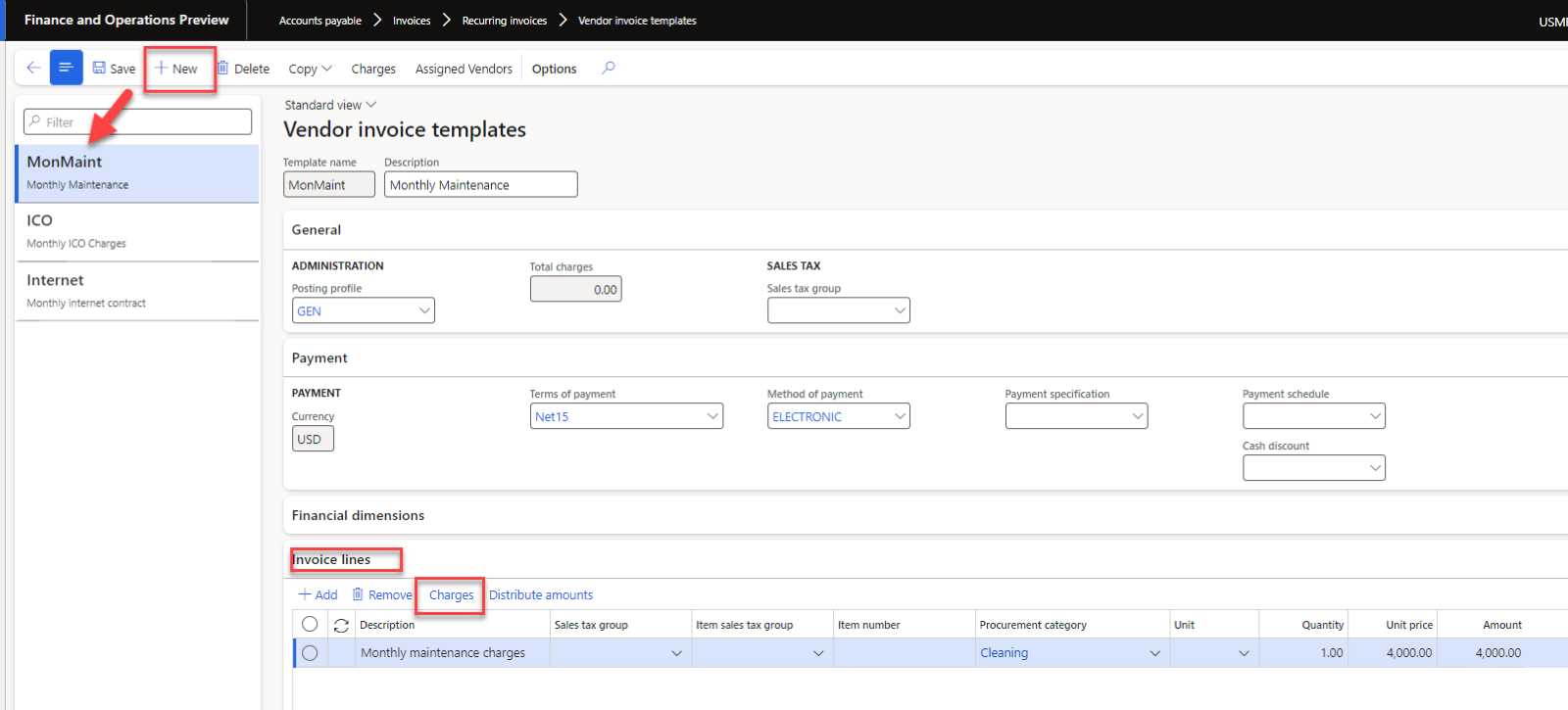

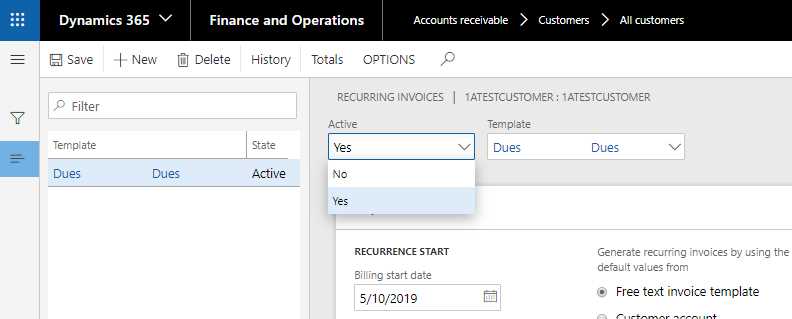

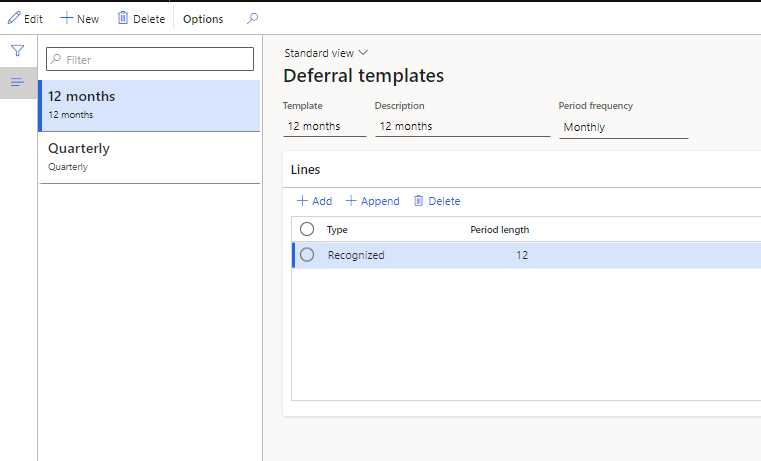

How to Automate Invoice Generation in D365

Automating the creation of billing records can significantly streamline your financial processes and reduce manual work. By setting up automated workflows within your enterprise system, you can ensure that documents are generated quickly, accurately, and without the need for manual intervention. This process improves efficiency, reduces errors, and speeds up your billing cycle, allowing your team to focus on more strategic tasks.

Automation works by linking data sources–such as customer orders, payment terms, and transaction details–directly to the document creation process. When these elements are predefined and connected to the system, generating accurate records becomes a seamless task that can be triggered automatically at scheduled times or when specific conditions are met.

Setting Up Automated Workflows

To automate the document generation process, follow these key steps:

- Define Data Sources: Ensure that all necessary data, such as client details, transaction history, and pricing, are accurately captured and stored in your system.

- Create Trigger Conditions: Set up rules that automatically trigger document creation based on specific events, like the completion of a transaction or the arrival of a payment deadline.

- Configure Document Settings: Tailor document formatting and structure to align with your business needs, including adding relevant fields and ensuring proper alignment.

Scheduling and Testing Automation

Once workflows are set up, schedule regular document generation times, or set up event-based triggers to automate the process when required. It’s essential to test the automation setup to ensure that all data is populated correctly and that documents are generated without errors. Automated systems should be monitored regularly to confirm that they are working as expected and making necessary adjustments as your business needs evolve.

Best Practices for Using D365 Templates

To maximize the efficiency and effectiveness of your document generation processes, it’s essential to follow best practices when working with custom document structures. By adhering to proven methods, businesses can ensure that their documents are both accurate and professional, while also optimizing workflow and minimizing errors. Proper setup and usage can lead to smoother transactions, better client relationships, and improved internal operations.

Standardize Document Formats

One of the first best practices is to standardize document formats across your organization. Consistency ensures that all generated documents follow the same structure and design, which helps maintain professionalism and clarity. Key elements like fonts, headers, footers, and field placements should be uniform, providing a cohesive experience for clients and internal users alike.

- Maintain Consistent Branding: Ensure all documents reflect your company’s branding guidelines, including logos, color schemes, and fonts, to reinforce brand identity.

- Ensure Accurate Information: Double-check that all data fields, such as client names, addresses, and amounts due, are automatically populated and error-free.

- Use a Clear Layout: Organize information in a logical, easy-to-read format, prioritizing key details like due dates and payment amounts.

Customize Documents for Specific Needs

While standardization is important, flexibility is key to tailoring documents for various business scenarios. Customize document structures to suit different types of transactions or client relationships, ensuring that each document includes only the most relevant and necessary information.

- Adapt for Different Transaction Types: Whether it’s a service contract, a product sale, or a recurring payment, tailor the content and layout accordingly.

- Include Client-Specific Terms: Customize payment terms, discounts, and other conditions based on the specific agreements with each client.

By following these best practices, businesses can optimize their document generation processes, improve operational efficiency, and enhance client satisfaction.

Document Template Compatibility with D365 Versions

Ensuring that your billing documents work seamlessly across different versions of business management software is essential for maintaining consistency and minimizing disruptions in your workflow. Compatibility between document structures and software versions ensures that the system can handle all required fields and formatting without issues, regardless of the version being used. Proper configuration and testing are key to ensuring smooth operation, especially when upgrading to newer software releases.

As new versions of business management solutions are released, certain features and capabilities may be updated or modified, which can impact how custom document formats function. To avoid potential problems, it’s important to verify that your document structures are compatible with the latest software updates and configurations. This includes checking data field mappings, layout adjustments, and integration with other business processes that rely on the document system.

Testing Compatibility Across Versions

Before implementing any updates or new versions, it’s essential to thoroughly test how your documents perform. This involves checking the following:

- Field Population: Ensure that client details, pricing information, and transaction data are correctly pulled from the system and displayed in the document as expected.

- Layout and Formatting: Verify that the document’s structure remains consistent, with no disruptions in the arrangement of content or visual design.

- Integration with Other Features: Check that the document system continues to work well with other features like payment tracking, reporting, and customer management systems.

Updating Documents for New Software Versions

When upgrading to a new version of your business software, it may be necessary to make adjustments to your document designs and configurations to ensure full compatibility. Some common updates include adjusting field types, modifying layout templates, and ensuring that any new features or fields introduced in the software are correctly integrated into your document generation process.

By regularly testing and updating your document formats to match the latest system versions, you can ensure ongoing efficiency and accuracy in your billing and reporting workflows.

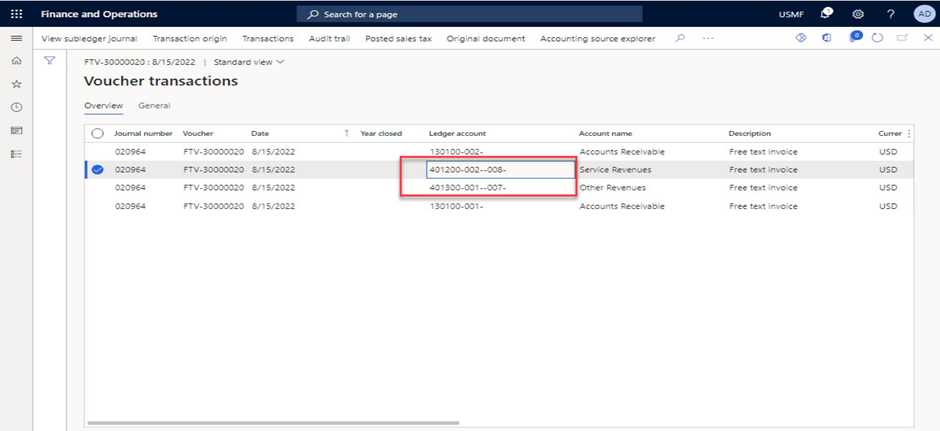

Tracking Payments with D365 Invoice Templates

Effective payment tracking is a vital part of maintaining a healthy cash flow and ensuring financial stability for any business. By integrating payment tracking directly into the document generation process, companies can easily monitor outstanding balances, payment statuses, and historical payment data. This integration minimizes errors, streamlines financial reporting, and provides clear insights into the status of transactions without the need for manual tracking.

By linking transaction records to the system’s document creation process, businesses can automatically update and track the status of payments, ensuring that all information remains current. This not only saves time but also helps avoid missed payments or accounting errors, ensuring that the finance team always has accurate and up-to-date information at their fingertips.

Integrating Payment Data into Documents

One of the key benefits of integrating payment tracking into your document generation process is that it enables you to include real-time payment data in your business documents. The system can automatically update the payment status, showing whether a payment has been received, is pending, or overdue. These details can be displayed clearly on the document itself, providing both the business and the client with a transparent view of the current financial status.

- Payment Status Indicators: Include visual indicators such as “Paid,” “Pending,” or “Overdue” to easily highlight the status of each transaction.

- Payment History: Display a detailed payment history showing past payments made against the invoice, including amounts and dates.

- Balance Due: Clearly show the remaining balance to be paid, along with payment terms and due dates, to facilitate timely payments.

Automatic Notifications and Reminders

To further streamline payment tracking, many systems allow automatic reminders and notifications to be sent to clients when payments are due or overdue. These can be set up to trigger based on pre-defined conditions, ensuring that clients are always reminded in a timely manner. Additional

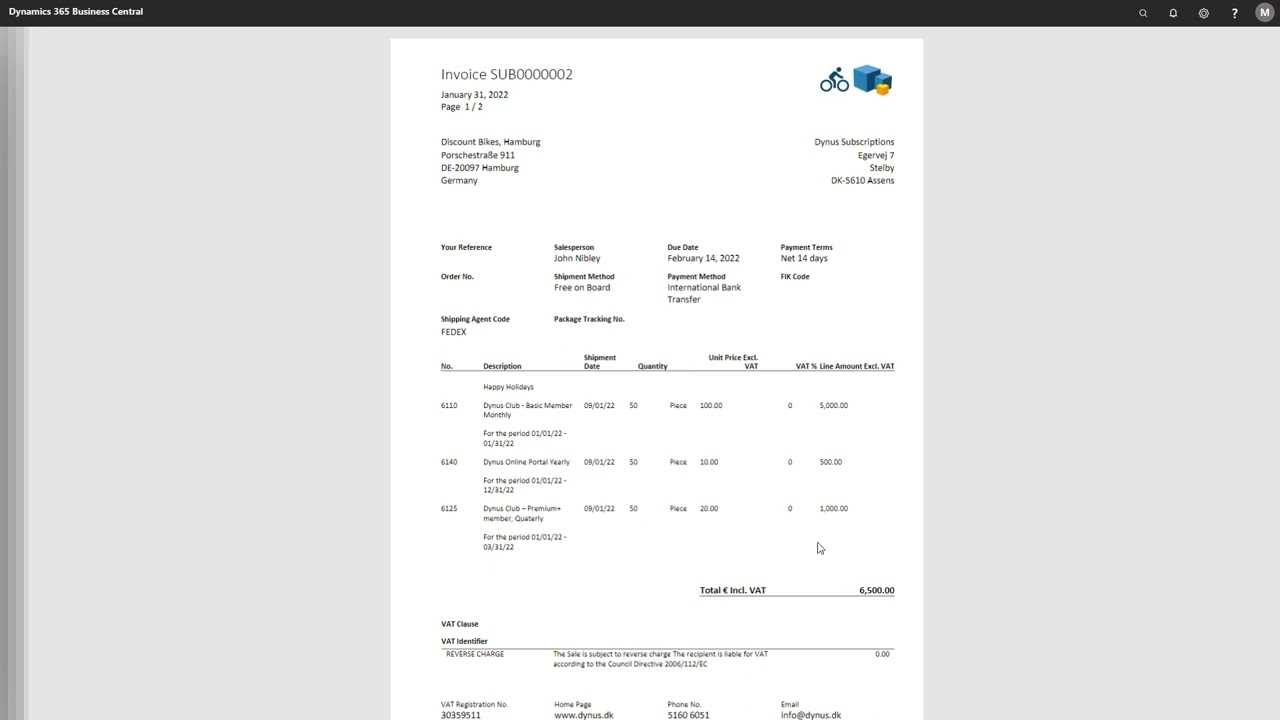

Enhancing Customer Communication through Templates

Effective communication with customers is essential for building strong relationships and ensuring smooth business transactions. Customizing documents allows businesses to present important information in a clear, professional, and personalized manner. By utilizing tailored formats for billing and related documents, companies can provide clients with an experience that feels both efficient and engaging, enhancing overall customer satisfaction.

Integrating automated, customized documents into your workflow streamlines communication while ensuring that clients always receive the most accurate and up-to-date information. Whether it’s a summary of charges, payment instructions, or special terms, well-designed documents communicate professionalism and attention to detail, helping to build trust and credibility with clients.

Personalizing Client Interactions

One of the key benefits of using customized document structures is the ability to personalize each interaction. By incorporating client-specific details into the document–such as names, preferred payment methods, or special agreements–you create a more tailored and engaging experience for the customer.

- Client-Specific Information: Include personalized greetings, contract terms, and custom messages that show attentiveness to each client’s needs.

- Branded Communication: Incorporate your company’s logo, colors, and fonts to ensure that every document feels aligned with your brand’s identity.

- Clear, Concise Language: Use simple, professional language that makes it easy for clients to understand key details and take necessary actions, such as making payments or requesting further information.

Improving Transparency and Trust

Clear communication is key to building transparency, which in turn fosters trust between your business and its clients. By ensuring that your documents include relevant payment information, terms, and expectations, clients are more likely to feel confident and informed. For instance, including a breakdown of services or products, due dates, and payment terms reduces ambiguity and prevents misunderstandings.

By using customized document structures, you can strengthen customer relationships, reduce confusion, and enhance overall customer experience, ultimately leading to better retention and satisfaction.

Protecting Data in D365 Invoice Templates

Protecting sensitive information is critical in today’s digital landscape. When handling financial transactions, personal client details, and other confidential data, businesses must take steps to ensure that documents remain secure and protected from unauthorized access. By implementing proper security measures, organizations can safeguard client privacy, maintain compliance with data protection laws, and minimize the risk of data breaches.

Documents that contain sensitive information, such as payment records, client contact details, and service descriptions, should be carefully controlled throughout their lifecycle–from creation and storage to transmission. Utilizing secure systems and protocols within your document generation processes helps to ensure that all data is encrypted, protected, and only accessible by authorized personnel.

Best Practices for Securing Documents

There are several strategies that can be implemented to enhance the security of documents and protect customer data:

- Encryption: Use encryption techniques to protect sensitive data both at rest and in transit, ensuring that unauthorized individuals cannot access or modify documents.

- User Access Controls: Limit document access to authorized employees only by implementing role-based permissions and access restrictions, preventing unauthorized users from viewing or altering sensitive information.

- Audit Trails: Maintain logs of document access and edits, allowing you to track who has interacted with the documents and when, to identify any potential security risks.

Compliance with Data Protection Regulations

Adhering to legal and regulatory standards is crucial for ensuring that data is handled correctly. Many regions have strict laws, such as the GDPR in Europe or the CCPA in California, that dictate how personal and financial data should be stored, processed, and transmitted. When working with documents that include client or payment data, businesses must ensure they are compliant with these regulations.

- Data Minimization: Only collect and store the minimum amount of personal information necessary for processing transactions, reducing the risk of storing unnecessary sensitive data.

- Regular Security Audits: Conduct regular security audits to assess the strength of your data protection practices and make necessary improvements to safeguard documents.

By taking these steps and incorporating robust security protocols into your document management processes, you can protect sensitive information, maintain customer trust, and ensure compliance with data protection regulations.