Download QuickBooks Invoice Templates for Streamlined Billing

Efficient billing is essential for any business looking to maintain smooth operations and ensure timely payments. Having the right tools can greatly simplify the process, reduce errors, and save time. One of the easiest ways to enhance your invoicing system is by using pre-designed billing formats that can be easily customized to fit your specific needs.

These ready-to-use documents provide a quick and professional way to request payments from clients, track transactions, and maintain organized records. With just a few modifications, you can personalize the layout, add necessary details, and even adjust the structure to suit various business types.

By adopting these resources, businesses can eliminate the hassle of creating invoices from scratch, ensuring consistency and accuracy every time. Whether you are a freelancer, a small business owner, or part of a larger organization, these solutions can be a game-changer in managing financial workflows more effectively.

QuickBooks Invoice Templates for Small Businesses

For small businesses, managing financial transactions efficiently is crucial to maintaining smooth operations and ensuring timely payments. Using pre-designed billing structures can save valuable time and reduce the chance of mistakes. These professional tools help small business owners stay organized and present themselves as credible, reliable partners in the eyes of clients.

Benefits of Using Pre-Designed Billing Formats

By adopting ready-to-use billing documents, small business owners can streamline their accounting processes. Some key benefits include:

- Time savings: No need to create billing documents from scratch.

- Professionalism: Clean, well-organized formats enhance your brand image.

- Accuracy: Pre-set fields reduce the likelihood of missing important information.

- Flexibility: Easily customizable to fit specific business needs.

Choosing the Right Billing Format for Your Business

Selecting the most suitable layout is essential to ensure your billing system works efficiently. Small businesses should consider the following factors when choosing a layout:

- Industry-specific needs: Certain fields may be more relevant depending on the nature of your business.

- Customizability: Choose a design that allows you to make adjustments for each client.

- Ease of use: The format should be intuitive and easy to work with, even for those with limited technical knowledge.

- Integration: Ensure the billing structure can be seamlessly integrated with your existing accounting software or tools.

By carefully selecting and utilizing these resources, small businesses can ensure their billing is not only efficient but also professional, helping to foster positive relationships with clients and improve cash flow management.

How to Download QuickBooks Invoice Templates

Obtaining pre-designed billing forms is a simple process that can greatly enhance your ability to manage financial transactions efficiently. These ready-to-use documents are easily accessible and can be customized to meet the specific needs of your business. By following a few straightforward steps, you can quickly find and access these resources to streamline your workflow.

Finding Reliable Sources

The first step in obtaining suitable billing formats is knowing where to look. There are several trustworthy sources available, including:

- Official Platforms: Many accounting software providers offer a range of free templates directly on their websites.

- Third-party Websites: Several reputable online platforms provide a variety of formats tailored to different business types.

- Community Resources: Online forums and user groups may also share custom-designed documents that have been optimized for specific industries.

Steps to Access and Customize the Files

Once you have identified a trusted source, follow these steps to get started:

- Visit the website: Navigate to the provider’s website or platform where the files are offered.

- Select your preferred format: Browse through the available options and choose the one that best suits your business needs.

- Download and save: Click the download link, and save the document to your device.

- Customize the fields: Open the file in your preferred software and adjust it to reflect your company details and branding.

After following these simple steps, you will be ready to use the customized billing document for your transactions, ensuring both professionalism and efficiency in your financial processes.

Benefits of Using QuickBooks Invoice Templates

Utilizing pre-designed billing structures can significantly improve the efficiency of your financial operations. These resources not only save time but also help maintain a consistent, professional image for your business. By integrating these ready-to-use formats into your workflow, you can streamline the invoicing process, minimize errors, and ensure timely payments.

Time Efficiency and Consistency

One of the key advantages of using pre-built billing documents is the amount of time saved. Instead of manually creating each billing form from scratch, you can simply fill in the necessary details, ensuring consistency in every transaction. This efficiency translates into faster payments and more time to focus on other essential aspects of your business.

- Quick setup: No need to design from the ground up; just input client-specific details.

- Uniformity: Ensures that every document follows the same structure and design.

- Reduced errors: With set fields and formats, the chances of missing critical details are minimized.

Improved Professionalism

Presenting well-organized and polished billing documents can enhance your business’s credibility. Clients are more likely to trust and value your services when they see that your financial paperwork is clear, professional, and easy to understand. Pre-designed layouts offer a clean and structured approach, reflecting your commitment to quality and organization.

- Clear presentation: Structured layouts make important information easy to locate.

- Customizable branding: You can easily add your logo and company details for a personalized touch.

- Trust-building: Well-formatted documents foster confidence in your business operations.

Incorporating these pre-designed documents into your financial practices not only simplifies the invoicing process but also contributes to smoother business transactions and stronger client relationships.

Customizing QuickBooks Invoice Templates for Your Needs

One of the main advantages of using pre-designed billing structures is the ability to easily customize them to suit your business’s specific requirements. Whether you need to add your logo, adjust the layout, or include custom fields, these resources offer a flexible approach that can be tailored to any industry or business type. By making these adjustments, you ensure that each document accurately reflects your brand and provides all the necessary information for your clients.

Modifying Key Elements

When adapting a billing document for your business, it’s important to focus on several key elements. These include:

- Logo and branding: Personalize the form by adding your company logo, colors, and contact details.

- Payment terms: Customize the payment due date, late fees, and accepted payment methods based on your preferences.

- Itemized lists: Include or remove specific product or service categories, and adjust quantities or prices as needed.

Ensuring Flexibility and Clarity

Customizing these documents also allows you to make them more user-friendly and relevant to your client base. It’s crucial that the layout remains clear and easy to understand while still being comprehensive. You may want to:

- Adjust layout: Organize sections in a way that best suits your business style and makes it easier for clients to process.

- Include special instructions: Add space for terms and conditions, or specific notes relevant to your business transactions.

- Use multiple formats: Tailor different documents for specific industries or clients, ensuring that each one addresses their unique needs.

Customizing billing documents ensures not only professionalism but also a tailored experience for your clients. These personalized forms enhance your business’s credibility and can lead to smoother transactions and better relationships with customers.

Where to Find QuickBooks Invoice Templates

If you’re looking for an easy way to create professional billing documents for your business, there are several places you can explore to find pre-designed options. These customizable forms can help you save time and maintain consistency in your financial processes. Whether you’re looking for basic or specialized designs, there are numerous platforms and resources available to meet your needs.

- Official Software Provider – One of the most reliable sources for finding high-quality billing sheets is directly through the software provider. Their platform often offers built-in resources that are seamlessly integrated with their features, ensuring compatibility and ease of use.

- Online Marketplaces – Several online marketplaces, such as Etsy and TemplateMonster, offer a wide variety of pre-designed forms for all business types. These can often be easily customized with your business information and branding.

- Third-Party Websites – Numerous third-party websites provide free and paid options for creating professional documents. Sites like Vertex42 and Template.net offer an extensive selection of customizable templates tailored to different industries and business needs.

- Cloud Services – Popular cloud-based platforms like Google Docs or Microsoft Office 365 often have templates that can be used for invoicing and billing purposes. These can be modified to fit your specific requirements, and they’re usually easily accessible and shareable.

- Specialized Design Tools – If you’re looking for more creative or customized options, design tools like Canva or Adobe Spark provide templates for generating your own documents. These tools offer flexibility in design and are ideal if you want a more branded look.

With these options, you’ll be able to find the perfect form that suits your business’s billing needs. Choose the one that aligns best with your workflow and industry requirements for efficient and accurate documentation.

QuickBooks Invoice Templates for Freelancers

Freelancers often juggle multiple projects and clients, and keeping track of payments is crucial for maintaining cash flow. Having a reliable and professional document for requesting payments ensures that clients understand the services rendered and the agreed-upon terms. Customizable billing formats specifically designed for freelancers can help streamline the process and avoid confusion, allowing for a smoother workflow.

Key Features for Freelancers

When choosing the right billing format for freelance work, there are several important features to consider. A good document should include all the necessary details, such as client information, payment terms, and a clear breakdown of services provided. Below is a summary of the key elements that are essential for freelancers:

| Feature | Description |

|---|---|

| Client Details | Name, address, and contact information of the client receiving the bill. |

| Service Description | A detailed list of services provided, including hourly rates or fixed prices for each item. |

| Payment Terms | Due dates, late fees, or any special conditions agreed upon for payment. |

| Total Amount | The total charge for services rendered, including taxes or discounts if applicable. |

Where to Find Freelance-Specific Formats

Freelancers can find suitable documents from several sources, tailored to their specific needs. These options offer simple and customizable designs that can fit the varying demands of different freelance industries:

- Software Tools – Many software providers offer user-friendly systems that include predefined billing forms, optimized for freelancers working in different sectors.

- Online Marketplaces – Platforms such as Etsy or TemplateMonster offer a wide range of ready-to-use designs, often customizable for specific freelance industries, from graphic design to writing services.

- Freelance Platforms – Websites like Upwork or Fiverr provide resources for creating billing documents directly through their platform, ensuring easy submission and payment tracking.

By utilizing these resources, freelancers can ensure that their payment requests are professional, detailed, and easy for clients to understand. Customizable forms help maintain consistency and can be tailored to suit the unique requirements of a

Step-by-Step Guide to QuickBooks Invoices

Creating accurate and professional billing documents is essential for managing your business finances efficiently. The process of crafting a payment request involves several important steps that ensure all necessary information is included and organized. This guide will walk you through the process of setting up a payment request document, from initial setup to sending it to clients, so that you can maintain a smooth cash flow and clear communication with your customers.

Step 1: Set Up Your Business Information

Before creating your billing document, you need to configure your business details. This includes adding your business name, contact information, and logo, which will appear on every document you generate. Setting up this information ensures that your clients can easily recognize your branding and contact you with any questions regarding the payment request.

- Enter your business name, address, phone number, and email.

- Upload your company logo (optional but recommended for a professional look).

- Set your preferred currency and tax rates if applicable.

Step 2: Create a Payment Request Document

Once your business information is set up, you can proceed to create a payment request. This document should include details about the services or products provided, the amount due, and any payment terms agreed upon with the client. Here’s how to add the necessary elements:

- Client Information: Add the client’s name, company name (if applicable), and contact details.

- Description of Services: List the services or products you provided, along with their corresponding rates and quantities.

- Payment Terms: Specify the payment due date and any late fees if applicable.

- Total Amount Due: Calculate the total amount, including taxes or discounts, and ensure the client can easily see the amount due.

After filling in the necessary information, you can preview the document to ensure everything is correct before sending it out to your client.

Step 3: Send the Document to Your Client

Once the payment request is ready, it’s time to send it to the client. Many platforms allow you to send the document directly via email, or you can export it as a PDF and share it manually. Here’s how to proceed:

- Review the document for accuracy before sending.

- Email the document to your client or use an integrated system that tracks when the document is viewed or paid.

- Set up reminders f

How to Use Templates in QuickBooks

Setting up professional documents for your business can be time-consuming, but with the right tools, it becomes much more efficient. By using pre-designed forms within your financial management software, you can quickly create accurate and well-organized payment requests or other business documents. These pre-built designs help ensure consistency across all your financial communications, saving you time and effort while maintaining a polished appearance for your clients.

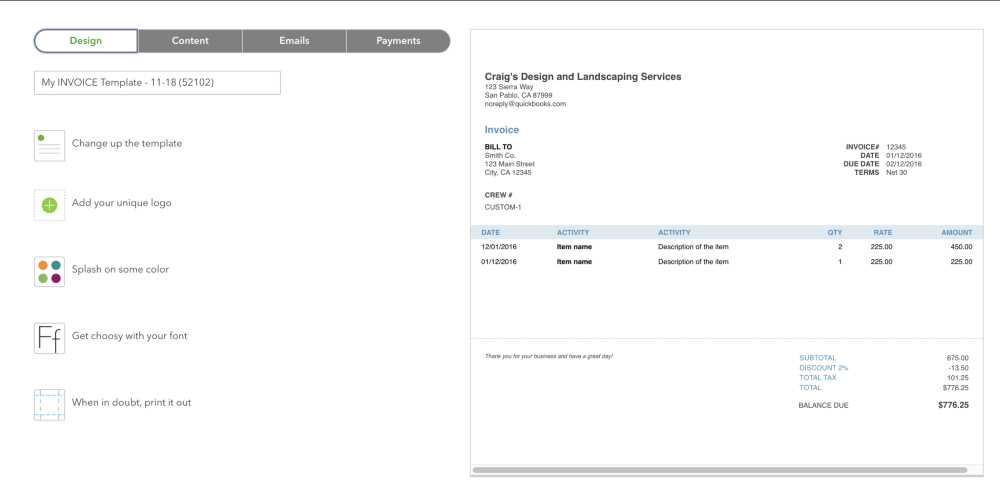

Step 1: Accessing the Available Forms

First, you need to locate the collection of pre-configured documents within the software. These ready-made designs are typically available in the settings or documents section, where you can browse through different styles and layouts. Each form can be customized to fit the specific needs of your business.

- Navigate to the document section within the software.

- Choose from a variety of designs, including basic, detailed, or specialized formats.

- Preview each option to see which one fits your business style and needs.

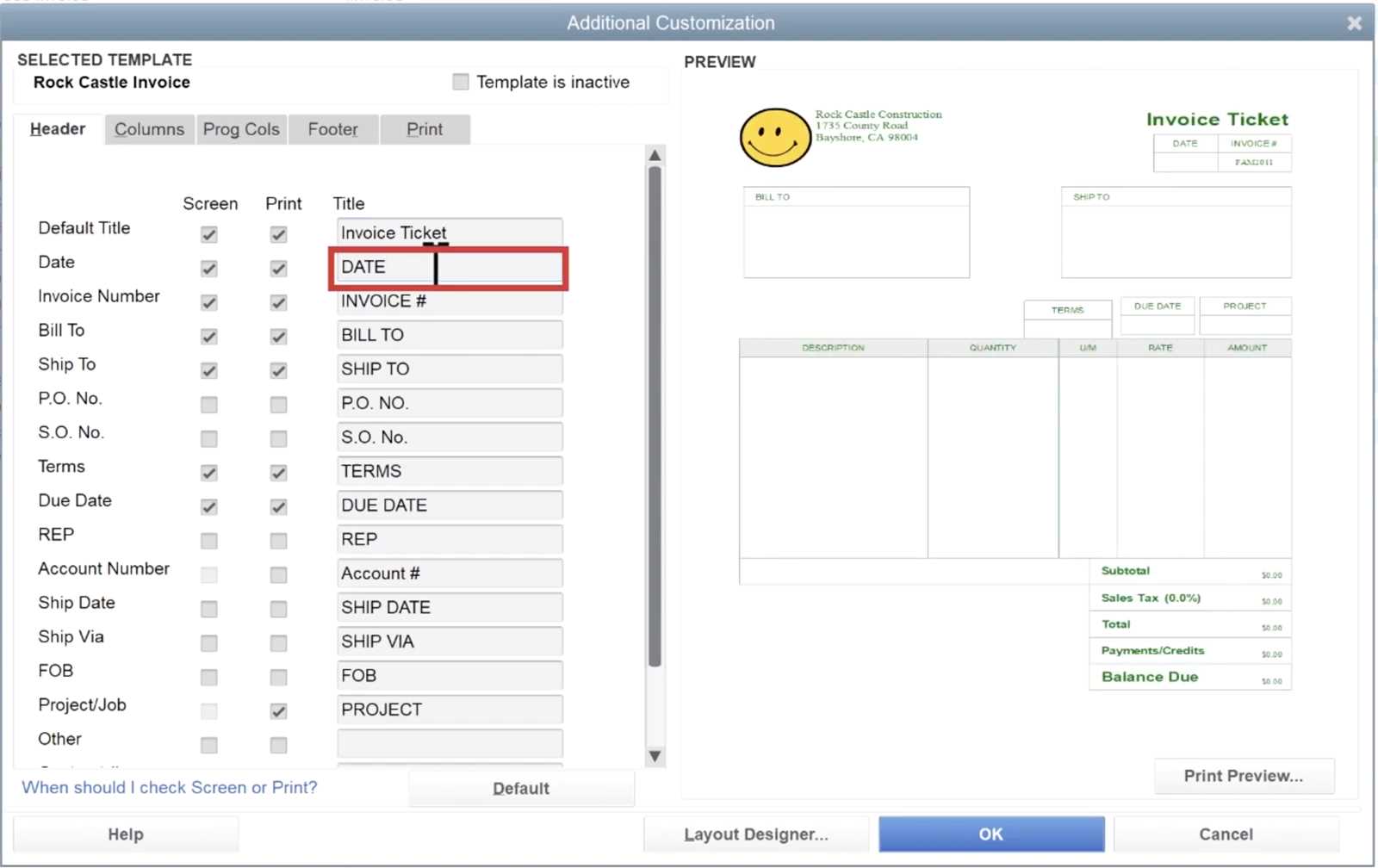

Step 2: Customizing the Document

Once you’ve selected your desired format, you can start customizing it to include your company details, client information, and specific terms of the agreement. Customization options often include adding your logo, adjusting the layout, and setting default fields such as payment terms, tax rates, and item descriptions.

Customization Area What to Include Header Your company name, logo, and contact information. Client Information Client’s name, address, and contact details. Details of Service Description of products or services, including pricing and quantity. Payment Terms Due date, late fees, and other relevant payment conditions. After filling in all the necessary fields, review the document for accuracy before saving or sending it to your client.

Step 3: Saving and Using the Customized Form

Once you’ve customized the form to your liking, you can save it for future use. This allows you to create consistent

Choosing the Right QuickBooks Invoice Format

When it comes to creating payment request documents for your business, selecting the right format is key to ensuring clarity and professionalism. The right design not only helps maintain consistency across your communications but also makes it easier for clients to understand the terms and amounts due. With various options available, it’s important to choose a layout that aligns with your business type, the complexity of your services, and your clients’ preferences.

Consider Your Business Type: The first step in choosing the ideal document format is to think about the nature of your business. A straightforward service-based business may require a simple format, while a product-based business or one with more complex billing needs might benefit from a more detailed layout. Freelancers, for instance, may prefer clean, minimalistic formats, while larger companies might need more comprehensive forms with multiple line items, taxes, and discounts.

- Service-Based Businesses: Choose a basic design with clear descriptions of work performed and rates charged.

- Product-Based Businesses: Opt for a format that includes itemized lists, quantities, and unit prices.

- Subscription-Based Services: Select a format that highlights recurring charges and payment intervals.

Account for Client Preferences: Some clients may have specific preferences or expectations regarding billing formats. Large corporations, for example, might require detailed documents with purchase order numbers or specific terms, while smaller clients may prefer a simple and direct approach. Understanding your clients’ needs can help you choose a layout that makes the payment process easier for both parties.

Evaluate Your Layout Options: Some formats are more flexible than others, allowing for easy customization. Consider whether you need a basic template for one-time use or a more customizable option for frequent use. Think about features such as:

- Customization: Does the format allow you to easily edit client details, services, and pricing?

- Automation: Does the format include options to automate recurring charges or send follow-up reminders?

- Design: Does the layout reflect your branding and maintain a professional appearance?

By carefully considering your business model, client preferences, and the specific features offered by different designs, you can choose the right layout that not only meets your needs but also enhances your client relationships and improves the efficiency of your billing process.

Improving Billing Efficiency with QuickBooks Templates

Streamlining the process of creating and sending payment requests is crucial for businesses looking to improve cash flow and reduce administrative time. Using pre-configured forms allows for faster, more accurate document generation, minimizing errors and ensuring consistency. By implementing these tools into your daily operations, you can boost productivity, save valuable time, and provide a smoother experience for both your business and your clients.

Benefits of Using Pre-Designed Forms

Pre-designed formats offer several advantages that can enhance your billing process. These benefits include time savings, consistency in presentation, and reduced risk of mistakes. With customizable fields, you can quickly tailor each document to the specifics of the service or product provided while ensuring that all necessary information is included.

Benefit Description Time Efficiency Pre-configured designs allow you to quickly create new documents without starting from scratch. Consistency Ensure that all your documents follow the same layout and professional standard, which enhances your brand’s credibility. Customization Easily adapt the document to include specific details, such as pricing, terms, and client information, without manual adjustments. Fewer Errors Automated fields and pre-set sections reduce the chance of mistakes and omissions in your documents. How to Maximize Efficiency

To fully take advantage of pre-designed formats, it’s important to integrate them into your regular workflow. Automating as much as possible–such as setting up recurring charges or saving client details for future use–can further streamline your operations. Additionally, integrating these forms with your financial software allows for seamless tracking and management of payments, making the overall process more efficient.

- Set up recurring charges: Automate regular payment requests for subscription-based services.

- Save client information: Store details for repeat clients to minimize data entry.

- Track payments: Easily monitor the status of documents, from creation to payment receipt, within your software.

By leveraging these tools and strategies, you can significantly improve your billing efficiency, ensuring timely payments and a smoother financial process overall.

Best Practices for QuickBooks Invoicing

Creating and managing accurate payment requests is essential for maintaining a healthy cash flow in any business. By following best practices, you ensure that each document you send is professional, clear, and complete, reducing the risk of confusion or delays in payment. These practices help streamline your billing process and improve client relationships, contributing to the overall success of your business.

1. Ensure Clarity and Completeness

One of the most important aspects of creating effective payment requests is ensuring they are clear and comprehensive. Every document should include the following key elements:

- Client Information: Include the full name, address, and contact details of the client receiving the request.

- Detailed Descriptions: Clearly explain the services provided or products sold, including quantities, rates, and any applicable taxes.

- Due Date: Clearly state the date by which payment is expected, and include any late fees if applicable.

By providing all relevant information upfront, you eliminate the need for follow-up questions and make it easier for your clients to understand what they’re paying for and when.

2. Maintain Professional Formatting

The appearance of your payment request can make a significant impact on your business’s professionalism. A well-structured and visually appealing document not only reflects positively on your brand but also makes it easier for clients to read and process the information. To achieve this, consider:

- Consistent Layout: Use a clear and easy-to-follow structure that includes distinct sections for client details, services, and payment terms.

- Branding: Incorporate your logo and business colors to reinforce your brand identity and make your documents instantly recognizable.

- Readable Fonts: Choose fonts that are simple, legible, and professional to ensure your content is easy to read, even on mobile devices.

By using a clean, professional design, you increase the likelihood that your clients will take your requests seriously and pay on time.

3. Automate Where Possible

Automation can save you significant time and effort, especially if you handle a high volume of payment requests. By setting up automated processes, you can eliminate the need to manually enter client details and payment terms each time. Here are a few ways to automate your workflow:

- Recurring Billing: If you have clients with regular billing cycles, set up recurring payment requests to be

Integrating QuickBooks Invoice Templates with Other Tools

For businesses looking to streamline their billing and financial processes, integrating pre-designed document formats with other tools can significantly improve efficiency. By connecting your billing system to project management, payment processing, and accounting software, you can automate data entry, reduce errors, and ensure seamless communication across different platforms. This integration allows for better synchronization between various business functions and can help save time while providing greater accuracy in managing finances.

One of the most effective ways to integrate your billing forms with other business tools is by using cloud-based solutions that allow for data sharing between applications. Many software platforms offer built-in integrations with popular accounting tools, customer relationship management (CRM) systems, and payment gateways. This enables you to automate workflows, such as generating and sending documents, tracking payments, and updating client records, all in one seamless system.

- Project Management Tools: Integrating with tools like Trello, Asana, or Basecamp allows you to automatically create payment requests based on project milestones, ensuring that you never miss a billing cycle.

- Payment Processors: Connecting your payment processor (like PayPal or Stripe) with your financial software allows you to automatically update the status of payments, reducing manual tracking.

- CRM Software: By linking your customer relationship management system with your billing platform, you can easily pull client information and billing history, eliminating the need for repetitive data entry.

With these integrations in place, you can generate and send documents with minimal effort, all while ensuring that your financial data is up-to-date across multiple platforms. This not only helps improve your workflow but also ensures greater accuracy and faster processing times.

By leveraging the power of these integrations, businesses can achieve a higher level of automation, reducing the time spent on administrative tasks and freeing up resources for more important work.

How QuickBooks Invoice Templates Save Time

In any business, streamlining administrative tasks can have a significant impact on productivity. By using pre-designed document formats, you can reduce the amount of time spent creating and managing billing paperwork. These ready-to-use designs automate much of the data entry and formatting, allowing you to focus on other critical aspects of your operations. Whether you’re dealing with one-time or recurring transactions, using pre-configured formats can save you hours of manual work each month.

1. Reducing Manual Data Entry

One of the most time-consuming parts of creating payment requests is entering client and transaction details manually. Pre-designed formats automatically populate certain fields, such as client contact information, item descriptions, and payment terms. Once this data is saved within your system, you can easily select it for each new document, eliminating the need to re-enter information every time you send a request.

- Client Profiles: Store customer details to automatically fill in forms for future transactions.

- Recurring Services: Set up recurring entries to save time on regular billing.

- Automated Calculations: Let the system calculate totals, taxes, and discounts without manual intervention.

2. Streamlining Communication and Delivery

Another way pre-designed formats save time is by simplifying how you send and track payment requests. Many tools offer the option to automatically email documents to clients or save them in a cloud-based storage system for easy access. By reducing the number of steps required to send out documents, you can significantly cut down on the time it takes to complete the entire billing cycle.

- Email Integration: Send completed documents directly to clients via email with just a few clicks.

- Cloud Storage: Automatically store and organize your documents for easy retrieval and tracking.

- Status Tracking: Keep track of whether a document has been opened or paid without manually following up.

By incorporating pre-configured designs into your workflow, you can reduce the time spent on administrative tasks, improve accuracy, and keep your billing process smooth and efficient.

QuickBooks Invoice Templates for Different Industries

Each industry has its own unique billing needs, and having the right document format can significantly improve the efficiency and professionalism of your financial communications. Whether you’re running a service-based business, managing product sales, or working in a specialized field, choosing a format that fits the specific demands of your industry ensures that your documents are both comprehensive and easy to understand. Tailoring these formats to your business requirements can help streamline your workflow and foster better relationships with clients.

1. Service-Based Businesses

For businesses that provide services rather than physical products, the format of your payment requests should focus on clarity and detailed descriptions of work completed. Service providers often need to break down their charges based on hours worked or specific tasks performed. A clean, simple format that outlines the services rendered, time spent, and associated fees works best.

- Time-Based Services: Include hourly rates and a detailed list of services performed with the corresponding hours worked.

- Project-Based Services: List tasks or milestones completed during the project, along with a clear breakdown of the agreed fees.

- Payment Terms: Clearly outline payment due dates and late fees to avoid confusion.

2. Product-Based Businesses

For companies that sell physical products, your document format should accommodate an itemized list of goods, including quantities, unit prices, and totals. A more detailed format that allows for a clear breakdown of products is essential to avoid any misunderstandings regarding the charges. This format also helps clients verify their purchases quickly.

- Product Descriptions: Provide clear descriptions of the products being sold, including size, model, or any distinguishing features.

- Quantity and Pricing: Ensure that each item has its corresponding quantity, unit price, and extended total.

- Taxes and Discounts: Include any applicable sales tax or discounts in a transparent manner.

3. Subscription-Based and Recurring Services

If your business offers subscription-based services or recurring payments, your format should clearly highlight payment cycles, renewal dates, and any recurring charges. This helps set clear expectations with clients and minimizes the risk of late or missed payments.

- Recurring Payments: Specify the payment interval (monthly, quarterly, annually) and renewal terms.

- Service Duration: Clearly define the period covered by each payment and any terms for cancellation or changes.

- Automatic Billing: If applicable, include information on automatic billing and payment methods.

By adapting your document formats to the specific needs of your industry, you can ensure smoother transactions, improved client satisfaction, and more efficient management of your financial communications.

Common Issues with QuickBooks Invoice Templates

Despite the convenience of using pre-designed formats for creating payment requests, there are common challenges that businesses may encounter. These issues can range from technical glitches to misunderstandings in document structure. Identifying and addressing these problems early on is essential to maintaining smooth operations and ensuring that financial documents are clear, professional, and accurate.

1. Formatting Errors

One of the most frequent issues faced when using pre-designed formats is incorrect or inconsistent formatting. Sometimes, the layout may not display properly, especially if the document is opened on different devices or software. This can result in misaligned text, missing elements, or incorrect calculations, which can lead to confusion or delays in payment.

- Text Misalignment: Ensure that fields such as client names, dates, and payment amounts align correctly across devices.

- Missing Fields: Some fields may not display properly, especially when custom fields are used. Regularly review documents to check for omissions.

- Incorrect Calculations: Double-check the automated totals, taxes, and discounts to avoid discrepancies.

2. Client Information Errors

Another common issue is errors related to client details. If the stored information is outdated or incorrect, it can lead to mistakes on documents, which may affect client relationships and payment processing. Incorrect billing addresses, contact details, or payment terms can result in confusion and delays.

- Outdated Information: Regularly update client profiles to ensure that details such as billing addresses and contact information are accurate.

- Data Entry Mistakes: When inputting new client information, be sure to double-check for typos or incomplete entries.

- Inconsistent Terms: Ensure that payment terms and service descriptions are consistent with previously agreed-upon terms.

3. Compatibility Issues with Other Software

In some cases, integration issues can arise when using billing formats with other business software. Whether it’s a CRM system, accounting tool, or payment processor, compatibility problems can prevent smooth data exchange, which may delay the billing process or result in errors.

- Software Updates: Keep all systems up-to-date to prevent compatibility issues between different tools.

- Integration Conflicts: Test integrations regularly to ensure that data flows seamlessly between platforms.

- File Format Issues: Ensure that the formats are compatible with both your system and your client’s preferences, such as PDFs or Word documents.

By being aware of these common issues and taking proactive steps to address them, businesses can ensure that their payment requests remain accurate, professional, and efficient, reducing the risk of errors that could affect cash flow and client trust.