Download and Customize Your Ticket Invoice Template

When organizing events or services, it’s essential to have a structured way to manage financial transactions. Whether you’re hosting a concert, seminar, or any other type of gathering, clear documentation ensures smooth operations and builds trust with your clients. This section will guide you through creating well-organized financial records that can be customized to meet your needs.

By utilizing a pre-designed document format, you can save time and focus on what matters most – running your event. Customizing these records allows for personalized details, such as attendee names, payment amounts, and specific terms. Accuracy and clarity are key when generating these documents, ensuring both you and your clients understand the financial transactions involved.

Ticket Invoice Template Overview

In any event or service-oriented business, maintaining clear records of financial transactions is crucial. These documents serve as formal receipts that detail the costs and services provided, ensuring both parties have a mutual understanding of the agreement. A well-structured document helps avoid confusion and offers a professional approach to managing payments.

Importance of Clear Financial Records

Having a well-organized document for each transaction helps streamline communication with clients. It also plays a vital role in keeping track of payments received and outstanding amounts. With the right format, you can include all necessary information, such as service descriptions, payment terms, and dates, ensuring transparency and reducing errors.

Customizing for Different Events

Every event or service may have unique needs, which is why customization of these records is key. Whether you are organizing a concert, workshop, or seminar, tailoring the document to reflect event-specific details like venue, date, or pricing structure will enhance clarity. Personalization also strengthens your brand identity, making it instantly recognizable to clients.

How to Create a Ticket Invoice

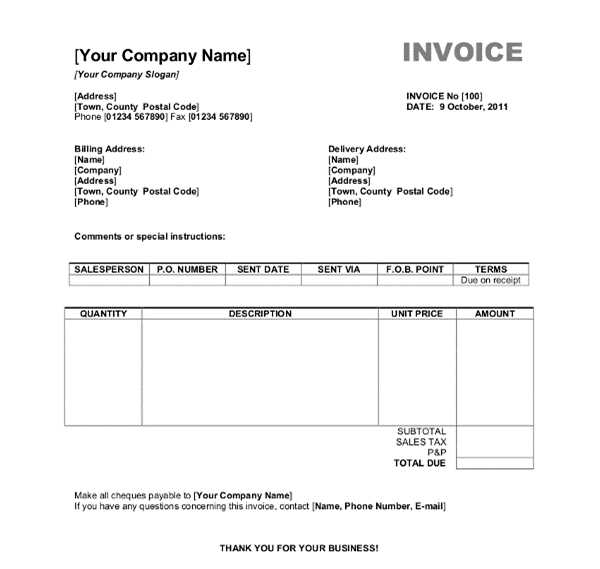

Creating a clear and professional financial record for events or services requires a methodical approach. By following a structured process, you ensure that all necessary details are included, providing both you and your clients with a transparent document that reflects the transaction. This not only simplifies payment processing but also helps maintain accurate financial records.

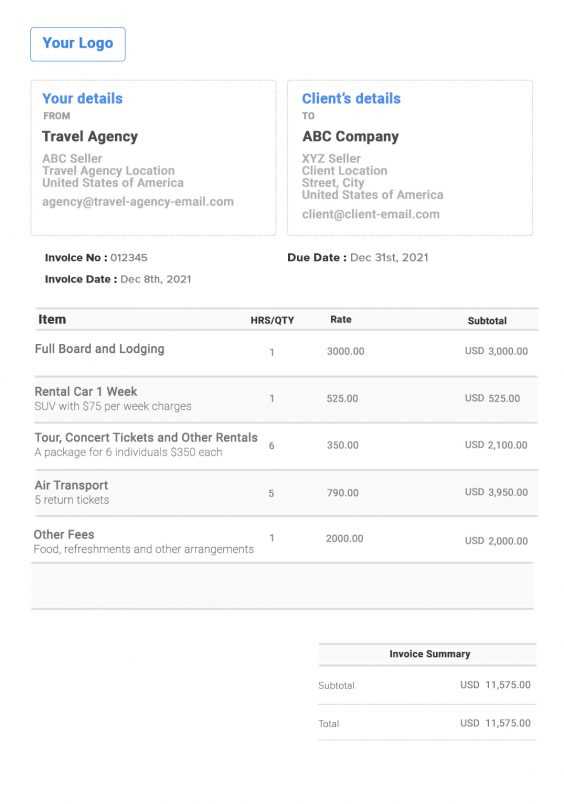

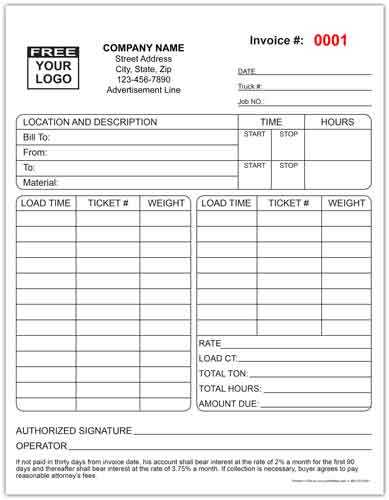

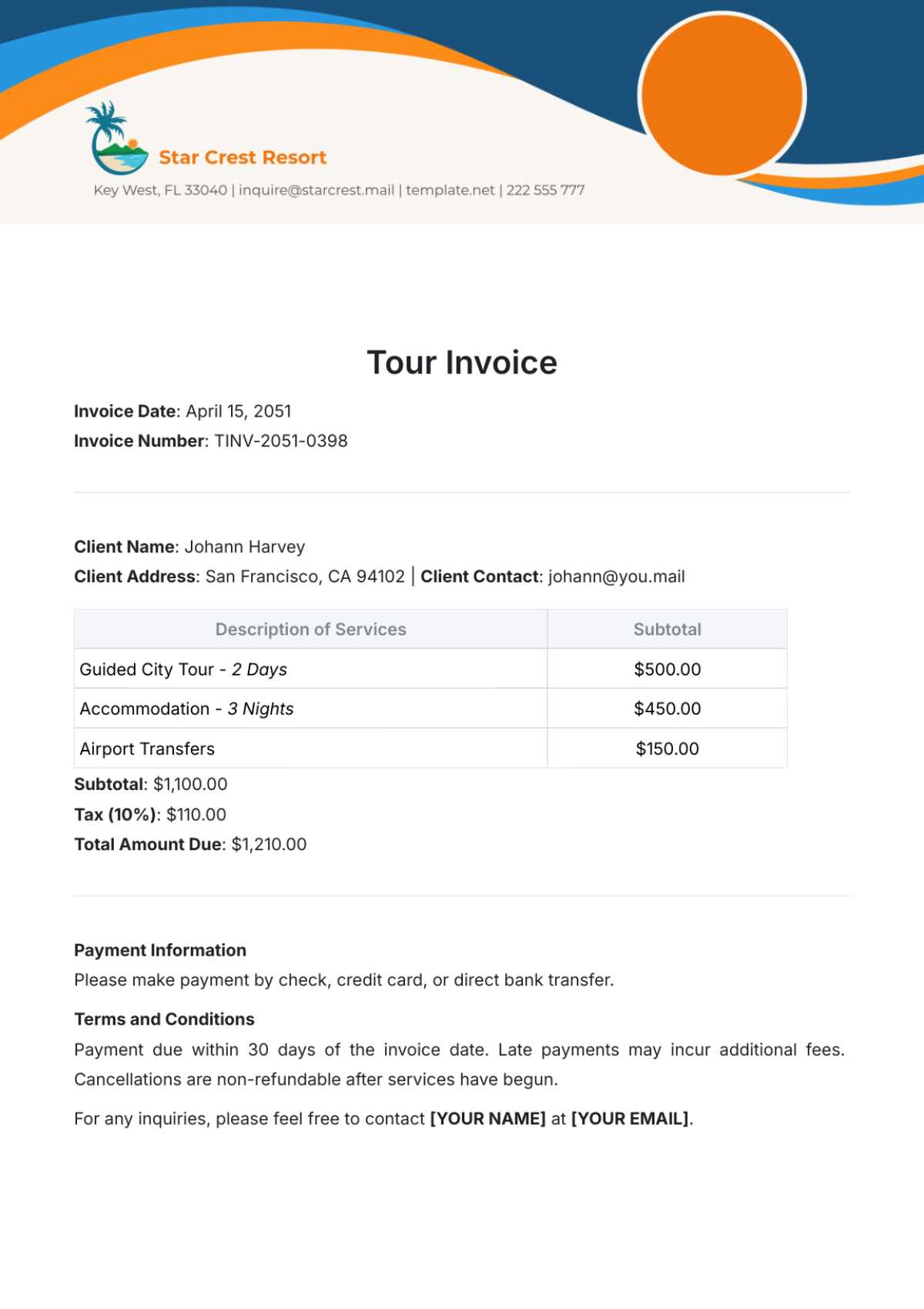

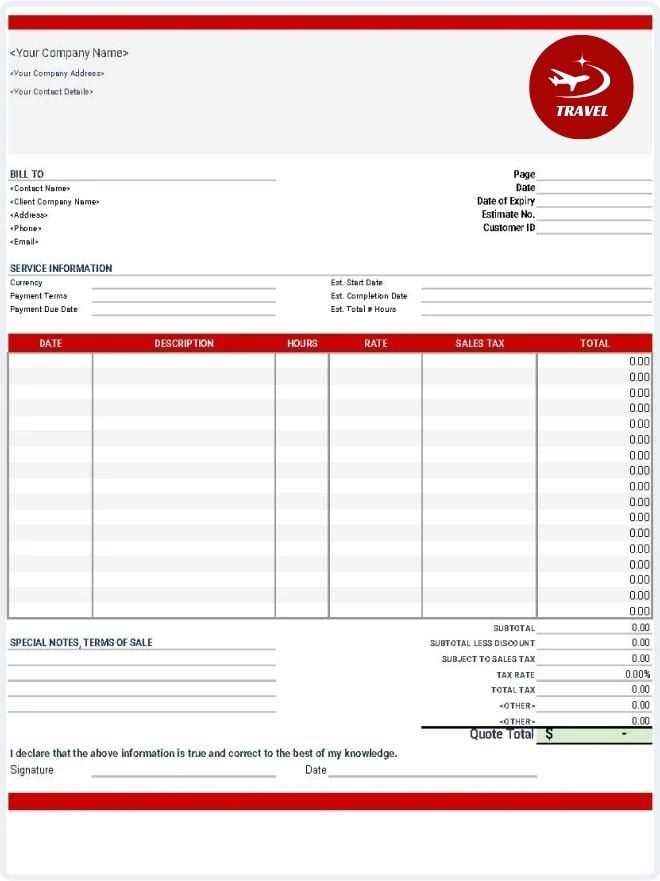

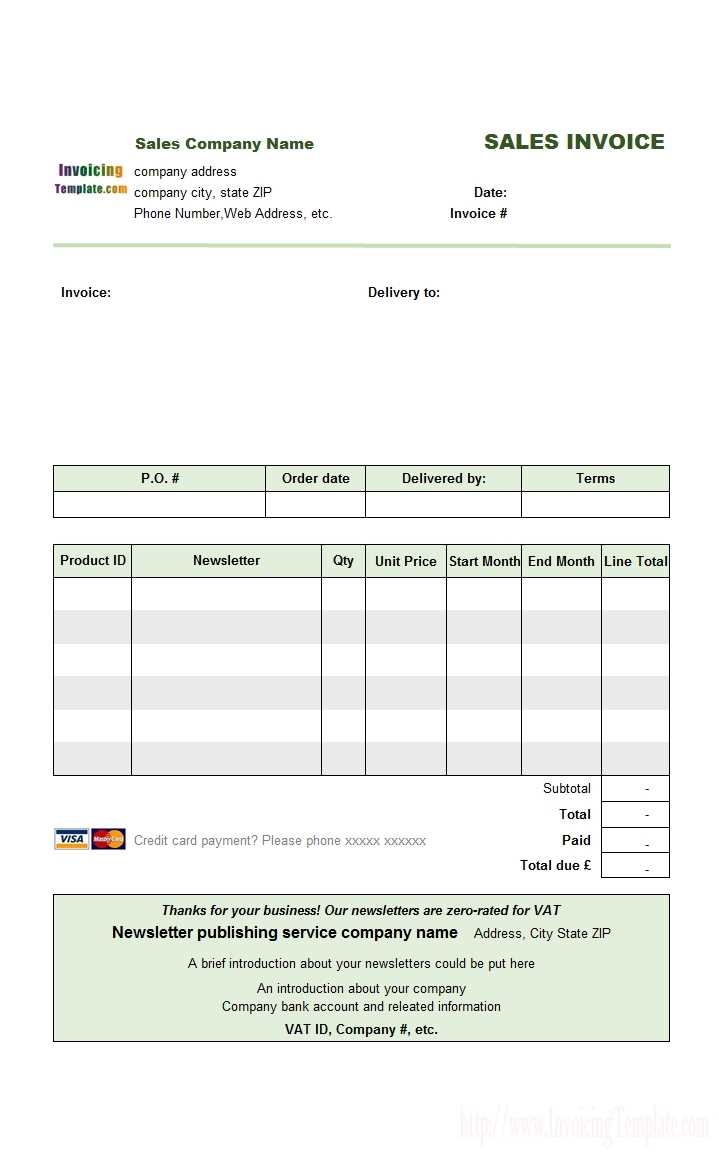

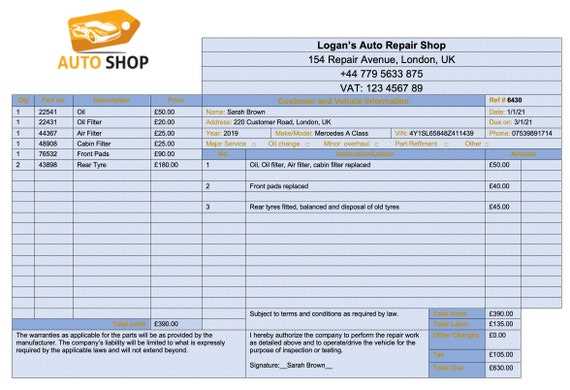

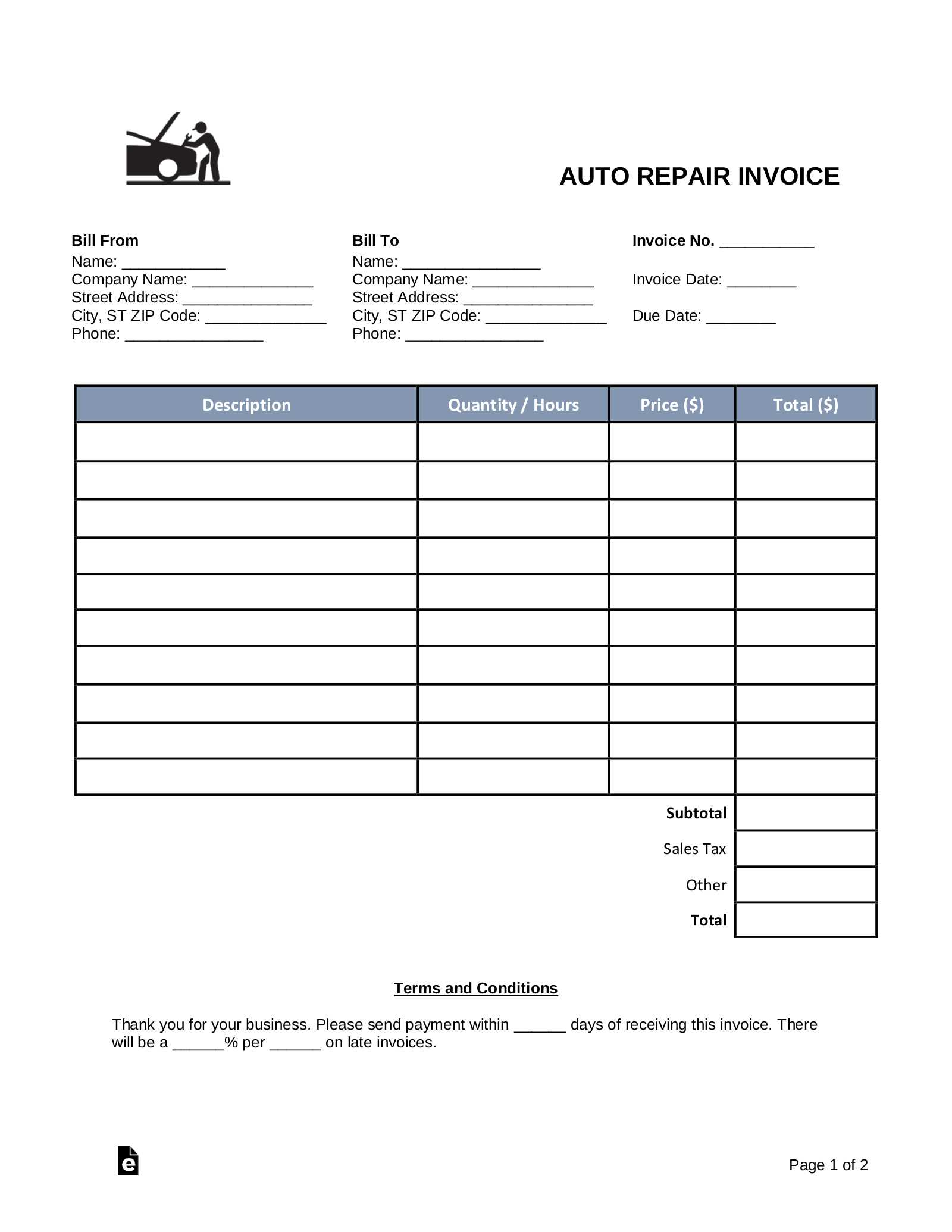

Start by including the essential elements such as the event name, client information, and a breakdown of charges. Be sure to specify the date of the transaction, the total amount due, and the payment terms. It’s also important to mention any applicable taxes or additional fees to avoid confusion. Including payment instructions or methods can further simplify the process for your clients.

Finally, customize the layout to align with your branding. A well-designed document reflects professionalism and helps ensure that your clients take the payment request seriously. Clear fonts, consistent spacing, and proper organization are key to making the document easy to read and understand.

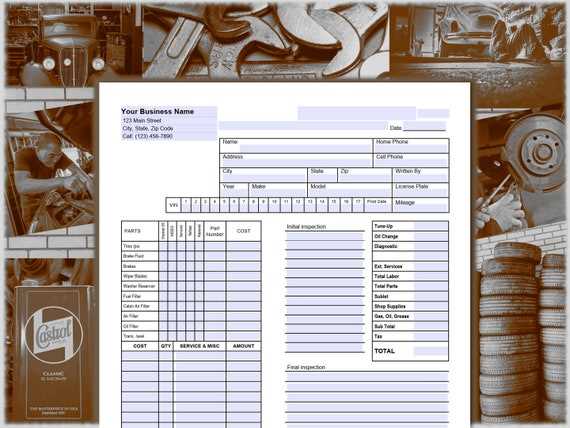

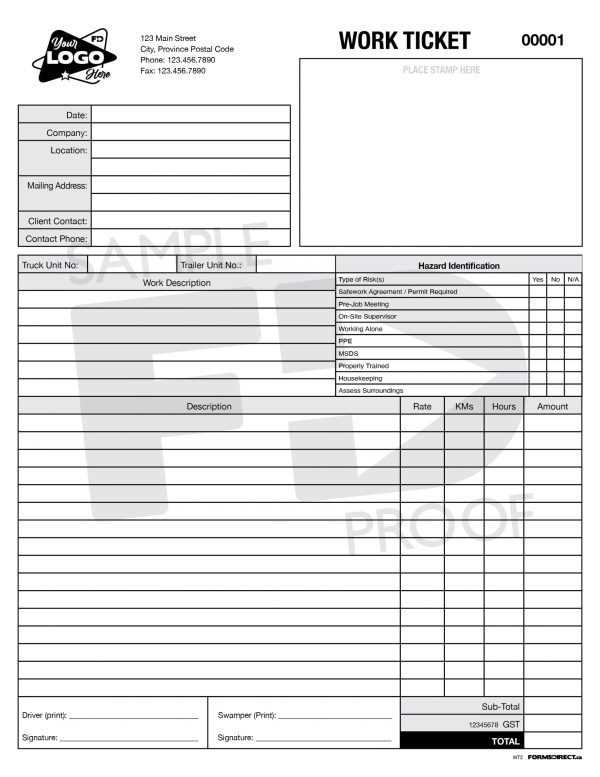

Key Elements of a Ticket Invoice

To create a complete and accurate financial document for events or services, it is essential to include several critical components. These elements ensure that both the service provider and the client understand the details of the transaction, promoting transparency and clarity. Below are the key parts that should always be present in such a document.

| Element | Description |

|---|---|

| Header | Include your business name, logo, and contact information for easy identification. |

| Client Information | Ensure to add the client’s name, address, and contact details for accurate record-keeping. |

| Event or Service Details | Provide a clear description of the event or service rendered, including the date and location. |

| Amount Due | Clearly list the amount payable, including any additional fees or taxes, if applicable. |

| Payment Terms | Specify the payment methods accepted and the due date for payment. |

| Unique Identifier | Assign a reference number for easier tracking of the document. |

Benefits of Using a Template

Using a pre-designed structure for generating financial documents can save significant time and effort. By relying on a consistent format, businesses can streamline their operations and ensure that each document contains all necessary details. This approach not only enhances efficiency but also ensures a professional presentation every time.

| Benefit | Description |

|---|---|

| Time Efficiency | By using a ready-made structure, you can quickly generate documents without starting from scratch. |

| Consistency | Maintaining the same format across all records ensures uniformity and reduces the risk of errors. |

| Professionalism | A well-organized and polished document reflects a high level of professionalism, leaving a positive impression on clients. |

| Customization | Many pre-designed structures are easily customizable to suit your specific needs, whether for different events or services. |

| Error Reduction | Templates include all essential fields, reducing the likelihood of missing important information or making mistakes. |

Common Mistakes in Ticket Invoices

When creating financial documents for events or services, it’s easy to make simple mistakes that could lead to confusion or disputes. These errors can affect your business’s credibility and delay payments. Avoiding common pitfalls is essential for maintaining professionalism and ensuring smooth transactions.

One frequent mistake is failing to include all necessary details, such as the event date, client information, or payment terms. Another issue is inconsistent formatting, which can make the document difficult to read and understand. Miscalculations in the total amount or forgetting to add taxes and additional charges are also common problems that can lead to discrepancies.

Lastly, neglecting to provide clear instructions for payment or missing a reference number can cause confusion for your clients. Ensuring that all the necessary information is included and clearly presented helps avoid misunderstandings and ensures prompt payment.

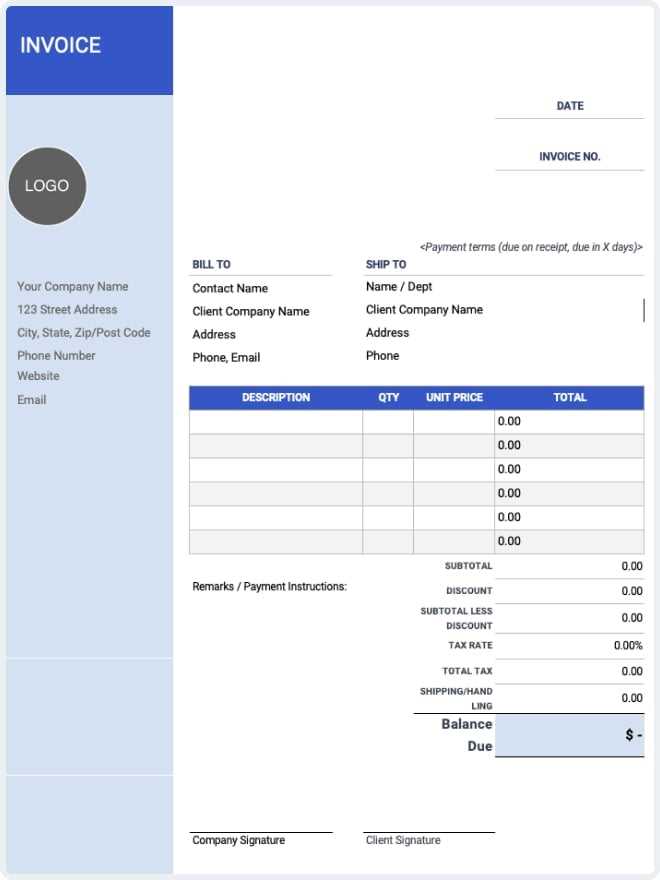

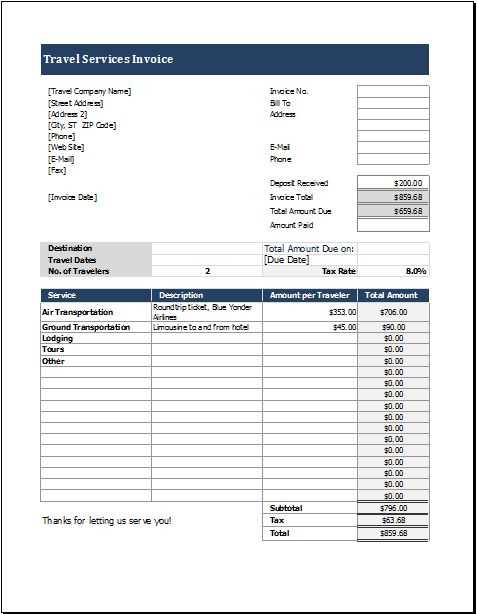

Choosing the Right Format for Invoices

Selecting the appropriate layout for financial documents is crucial for ensuring clarity and ease of use. The right format can make a significant difference in how easily the information is understood by both the provider and the client. There are several factors to consider when deciding on the best layout for your needs, including the type of business, the level of detail required, and the client’s preferences.

| Factor | Consideration |

|---|---|

| Business Type | Consider whether a simple or detailed structure is needed depending on the services you offer or the events you organize. |

| Client Preferences | Some clients may prefer a digital or paper format, so it’s important to understand what works best for them. |

| Level of Detail | Determine if a basic document or one with itemized charges is necessary to reflect the complexity of the transaction. |

| Customization | Choose a format that allows easy customization to fit your brand’s identity, such as logos and color schemes. |

| Compatibility | Ensure that the format is compatible with your accounting or management software to streamline the workflow. |

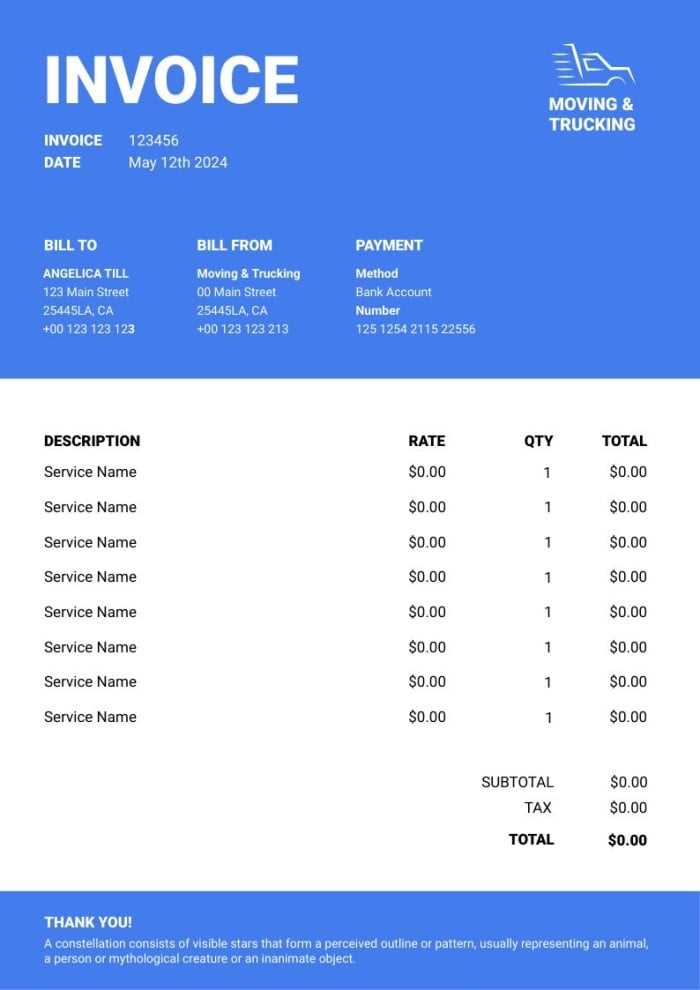

Free Ticket Invoice Templates Online

Finding free, ready-to-use structures for creating financial documents can be an excellent way to save time and effort. Many websites offer a variety of customizable formats that are suitable for different business needs. These free resources are often easy to access and can be tailored to match your specific requirements, whether you are running an event, offering services, or selling products.

Benefits of Using Free Templates

Utilizing free resources for generating financial documents can provide several benefits. These include saving money, accessing ready-made formats, and eliminating the need for extensive design skills. Additionally, they often come with pre-filled fields, ensuring that you don’t miss essential details.

Where to Find Free Resources

Various websites offer free downloadable or editable options for creating financial records. Some websites even allow you to create and send the document directly from their platform. Be sure to explore multiple options to find the one that best fits your needs and preferences.

Legal Considerations for Ticket Invoices

When creating financial documents for events or services, it’s essential to ensure that they meet legal requirements. These documents not only serve as proof of transactions but also help in case of disputes or audits. Understanding the legal aspects of these documents ensures that you protect your business and maintain compliance with regulations.

One of the key elements is ensuring that all required information is included, such as dates, client details, and payment terms. Additionally, tax compliance is crucial, as some jurisdictions require specific tax information to be listed. Depending on the region, failure to include required details could result in penalties or loss of business credibility.

It’s also important to check the format’s adherence to local and international laws, especially if you’re working across borders. Some countries may require certain clauses or terms to be present, such as cancellation policies or refund terms, to protect both the service provider and the client.

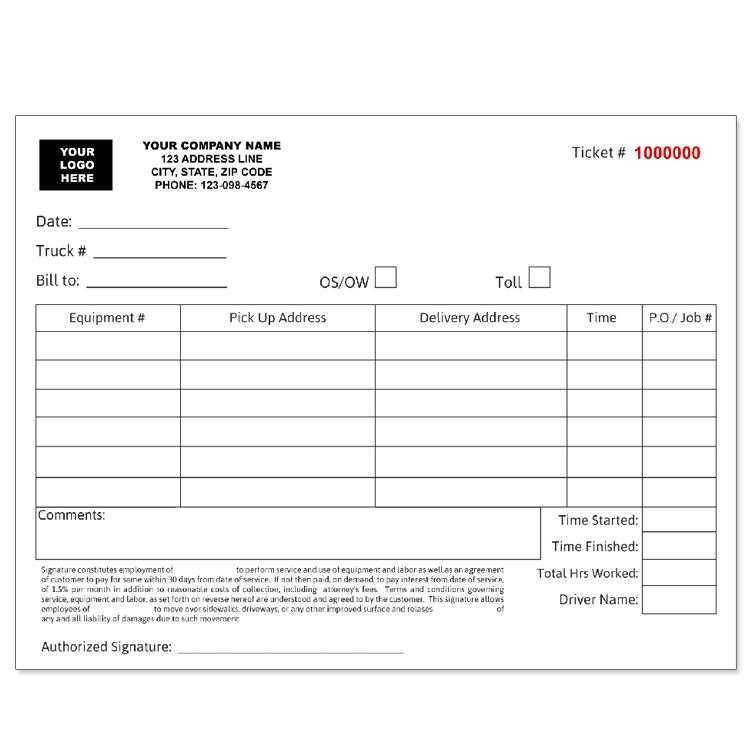

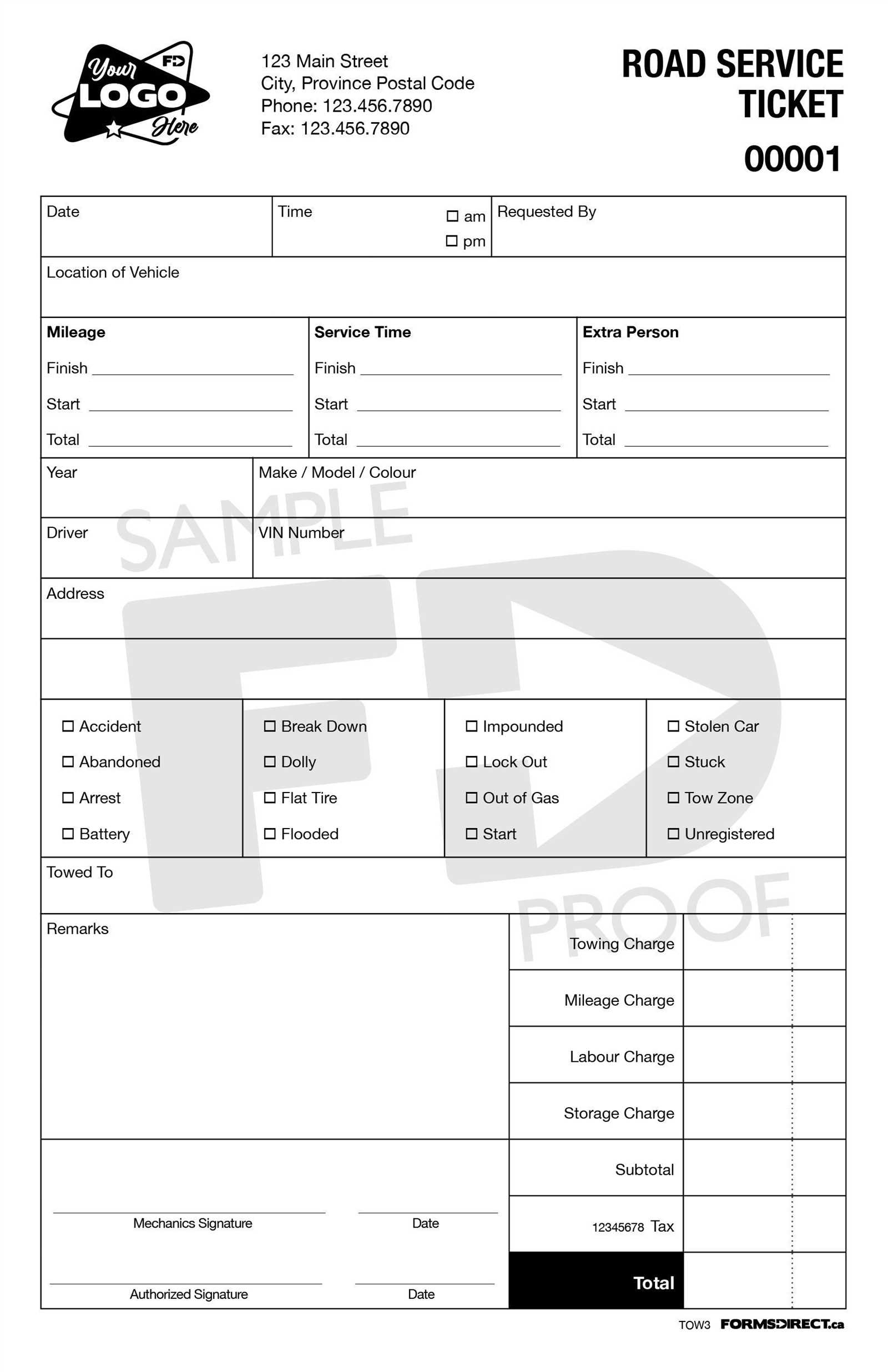

How to Add Event Details

When preparing financial documents related to an event or service, including comprehensive and accurate event details is crucial. These details not only provide clarity but also help the recipient understand the context of the transaction. Whether it’s for a concert, conference, or another occasion, clear event information ensures transparency and smooth communication.

Essential Event Information

Ensure you include the event name, date, time, and location of the event. These basic elements help define the service being provided and set the expectations for both the provider and the client. Additionally, if the event has specific terms, such as age restrictions or special requirements, be sure to mention those as well.

Optional Details to Include

Some events might have additional details that can be useful, such as seating arrangements, performers, or schedule highlights. If applicable, you may also want to include instructions on parking, accessibility, or entry procedures to ensure that the attendees have a seamless experience.

Managing Multiple Ticket Invoices

Handling numerous financial documents for various events or services can be challenging, especially when dealing with high volumes. Proper management ensures that each document is tracked, processed, and stored correctly, preventing any confusion or errors. It’s essential to have a system in place to organize and monitor all related transactions efficiently.

One effective approach is to categorize these documents based on event type, date, or client group. This method allows you to quickly locate any specific record and ensures that you can handle requests or disputes efficiently. Additionally, using digital tools or accounting software can automate many of these processes, providing an easy way to track payments, due dates, and overall financial status.

Another strategy is to assign unique identifiers or numbers to each document. This helps keep a structured record and reduces the risk of losing important details. You can also integrate bulk email systems to send reminders or updates, streamlining communication and keeping your clients informed.

Incorporating Branding into Templates

Incorporating your brand’s identity into financial documents is an effective way to maintain a professional appearance and reinforce your business identity. By ensuring that these documents reflect your unique style, you not only make them more recognizable but also create a cohesive experience for your clients. Branding helps establish trust and consistency across all communication channels.

The process starts with the logo, which should be prominently displayed, usually at the top of the document. Incorporating your brand’s color scheme and typography further aligns the document with your business’s visual identity. Fonts and color palettes that match your marketing materials can make a significant difference in how professional and polished your documents appear.

Additionally, consider adding your contact information and website in a consistent location to ensure it’s easy for clients to reach you. This not only promotes brand recognition but also makes it simple for clients to take action when necessary.

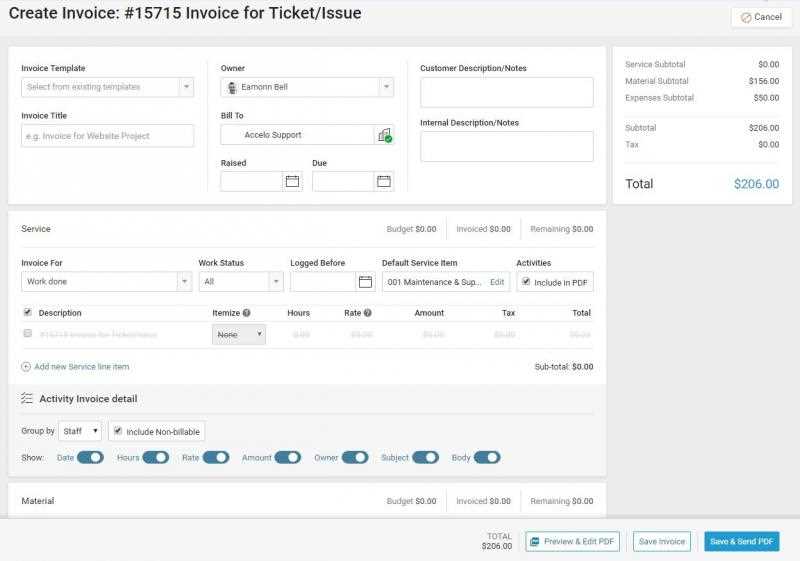

Automating Your Invoice Generation

Automating the creation of financial documents can save time, reduce errors, and streamline your overall workflow. By leveraging software and tools designed for this purpose, you can efficiently generate consistent and accurate records with minimal manual input. This not only boosts productivity but also enhances the professionalism of your business operations.

Here are some steps to help you automate the process:

- Select the right software: Choose a platform or tool that integrates well with your existing business processes, such as accounting software or CRM systems.

- Set up templates: Pre-design your documents with all necessary fields, such as client information, dates, and pricing details. This allows the system to fill in data automatically.

- Automate data entry: Connect your system with databases or spreadsheets where client and transaction details are stored. This will allow automatic population of fields without requiring manual input.

- Configure recurring generation: For repeat clients or regular transactions, set up automatic document generation to be sent out at specific intervals.

- Review and track: Monitor the automated process to ensure that everything is being generated correctly and make adjustments as necessary.

By automating this process, your business will enjoy faster and more accurate document creation, freeing up valuable time for other important tasks.

Best Software for Managing Financial Documents

Choosing the right software for generating and managing financial records can significantly improve the efficiency and accuracy of your business processes. With the right tools, you can automate the creation, tracking, and storage of payment-related documentation, ensuring a smooth operation. Many solutions on the market offer specialized features to cater to different business needs, from small startups to large enterprises.

1. QuickBooks

QuickBooks is a popular solution for managing all aspects of business finances. It allows you to easily create professional-looking financial documents and track transactions in real-time. With its user-friendly interface and robust features, QuickBooks is ideal for businesses looking for an all-in-one solution that integrates well with other financial systems.

2. Zoho Books

Zoho Books is another strong contender for small to medium-sized businesses. Known for its ease of use and affordable pricing, Zoho Books offers comprehensive features for generating customized financial records, tracking expenses, and managing recurring payments. It also integrates seamlessly with various third-party apps for added functionality.

These software options provide excellent support for businesses aiming to streamline their financial processes, reducing the time spent on administrative tasks while maintaining a high level of accuracy and professionalism.

Tracking Payments on Financial Documents

Monitoring payments for services or goods provided is a critical part of maintaining healthy cash flow and ensuring that all transactions are properly recorded. By tracking payments, businesses can quickly identify outstanding balances and follow up on overdue amounts. Efficient payment tracking also helps to avoid errors and ensures that customers receive the correct documentation for their records.

To successfully manage payments, it’s important to regularly update your financial records with payment status. This can include marking whether payments are pending, completed, or overdue. Additionally, using tools that automate the process can help reduce manual effort and increase accuracy in tracking transactions.

Implementing a structured system for tracking payments not only improves financial management but also provides a clear overview of your business’s financial health at any given time.

Frequently Asked Questions About Financial Documents

When managing the documentation for services provided or goods sold, many individuals and businesses often have common inquiries about best practices, formatting, and specific details to include. Understanding these questions can ensure that all necessary components are properly addressed and help streamline the process. Below are some frequently asked questions related to managing such records.

| Question | Answer |

|---|---|

| What information should be included in a financial record? | The essential details to include are the provider’s name, recipient’s name, service description, payment terms, total amount, and due date. |

| How can I ensure accurate records? | Regular updates, automation tools, and careful review of each entry will ensure accuracy in financial documentation. |

| Can I create custom records for my business? | Yes, many tools allow customization to fit your business needs, ensuring that all relevant details are captured for your specific industry. |

| How do I track payments on these documents? | By regularly updating payment status, you can mark whether payments are pending, completed, or overdue for better tracking. |