Freelance Developer Invoice Template for Efficient Billing

For anyone offering services on a contract basis, maintaining clear and accurate records of payments is essential. A well-structured billing document serves as a vital tool to ensure timely compensation and establish trust with clients. These documents are not just about requesting payment–they reflect professionalism and help manage business transactions smoothly.

When crafting a billing document, certain key details need to be included, such as the breakdown of services, payment terms, and total amount due. By providing a clear and organized format, you not only simplify the process for clients but also protect yourself from misunderstandings. Whether you’re working on a one-time project or a long-term partnership, a professional payment request is essential for maintaining healthy business relationships.

In this guide, we’ll explore how to design an efficient and comprehensive document that meets both your needs and your client’s expectations. With the right structure and approach, you can ensure that payments are processed quickly and disputes are minimized.

Freelance Billing Document Guide

When working independently, organizing payment requests is crucial for both tracking compensation and fostering professionalism. A well-constructed document can help you clearly communicate the services rendered and ensure prompt payment. It serves as an official record that both parties can refer to, preventing misunderstandings and protecting your rights as a service provider.

In this guide, we will walk you through the essential components of a billing request. From providing accurate details about the work completed to including payment terms and deadlines, each part plays a vital role in simplifying the payment process. By following a structured approach, you can create a streamlined and efficient request that enhances your business operations.

In the following sections, we will discuss how to customize this essential tool for your specific needs, ensuring it meets both your requirements and those of your clients. A well-designed billing document not only helps with timely payments but also promotes trust and transparency in your business relationships.

Understanding the Importance of Invoices

When providing services or products, it’s essential to clearly outline the terms of payment to ensure both parties are on the same page. A well-prepared document that requests compensation serves not only as a formal agreement but also as a tool for tracking transactions. This kind of record is crucial for keeping your finances organized and managing your client relationships effectively.

Here are some key reasons why such documents are necessary for business transactions:

- Clarity and Transparency: A detailed payment request provides transparency, outlining exactly what services were provided and what amount is due. This helps avoid misunderstandings and sets clear expectations.

- Legal Protection: A properly structured request serves as a legal record of the services rendered and the agreed-upon terms. It can help resolve disputes or clarify any issues in the future.

- Financial Tracking: These documents play an important role in accounting, helping you track payments, monitor due dates, and manage cash flow effectively.

Why Professionalism Matters

In addition to practical benefits, using well-crafted requests can enhance your professional image. By providing clients with clear, organized, and timely documents, you demonstrate a commitment to professionalism that can lead to repeat business and positive referrals.

Key Benefits of Structured Payment Requests

- Efficient Payment Processing: A well-organized document speeds up the payment process, making it easier for clients to understand and approve payments.

- Trust and Confidence: Clear documentation helps establish trust, ensuring clients feel confident that they are dealing with someone who takes their financial transactions seriously.

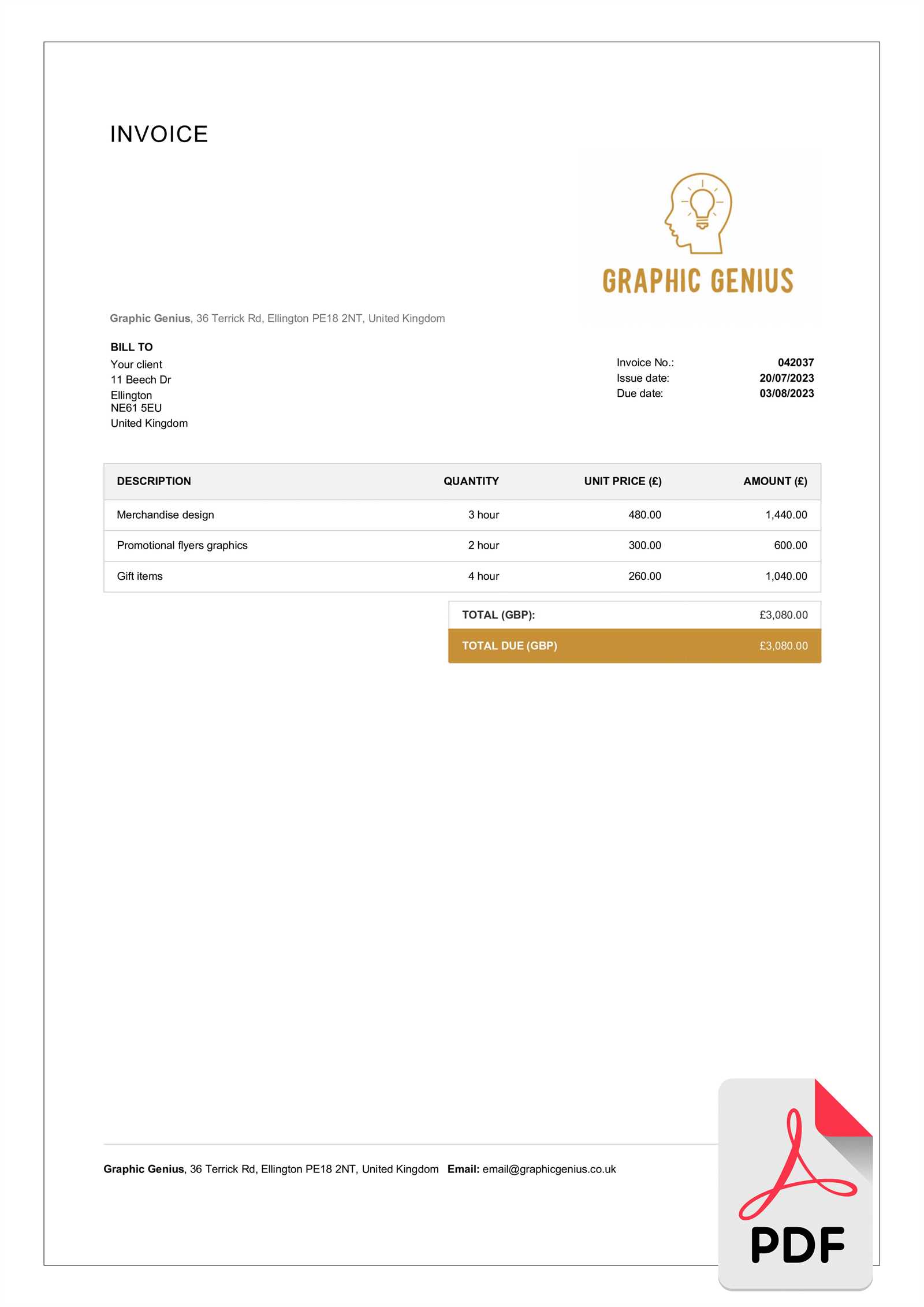

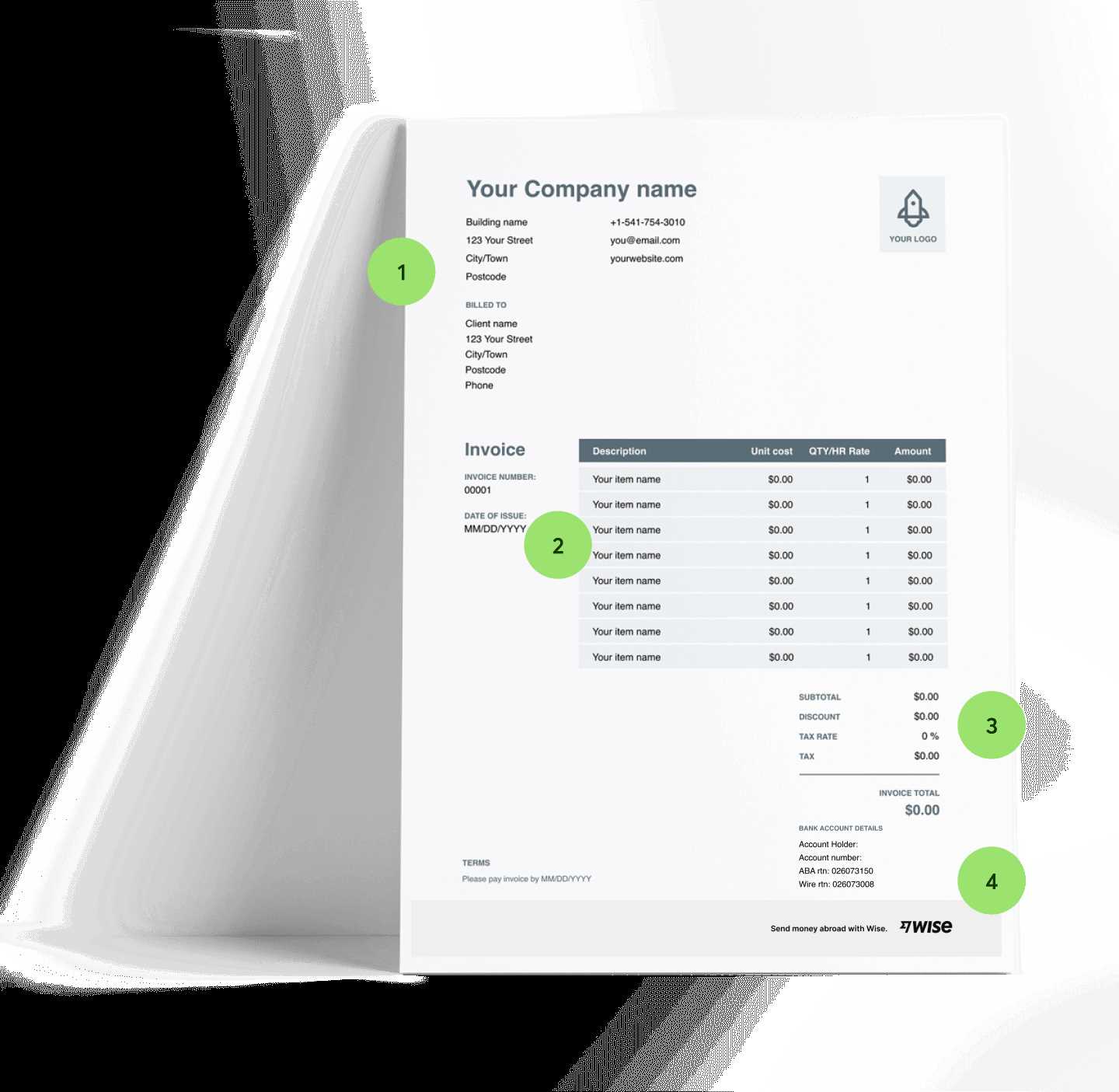

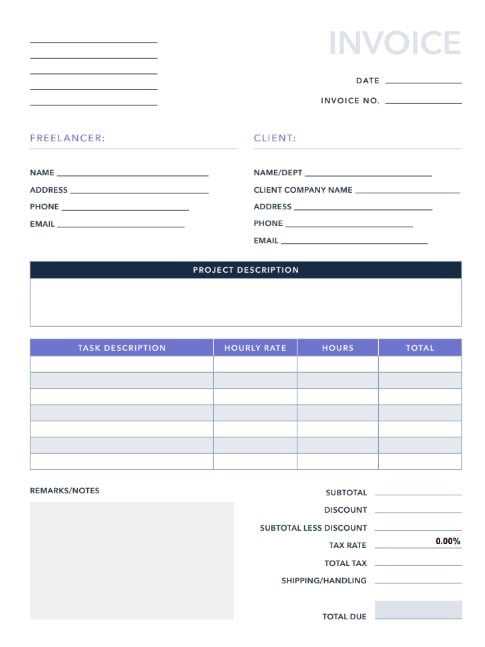

Essential Elements of an Invoice

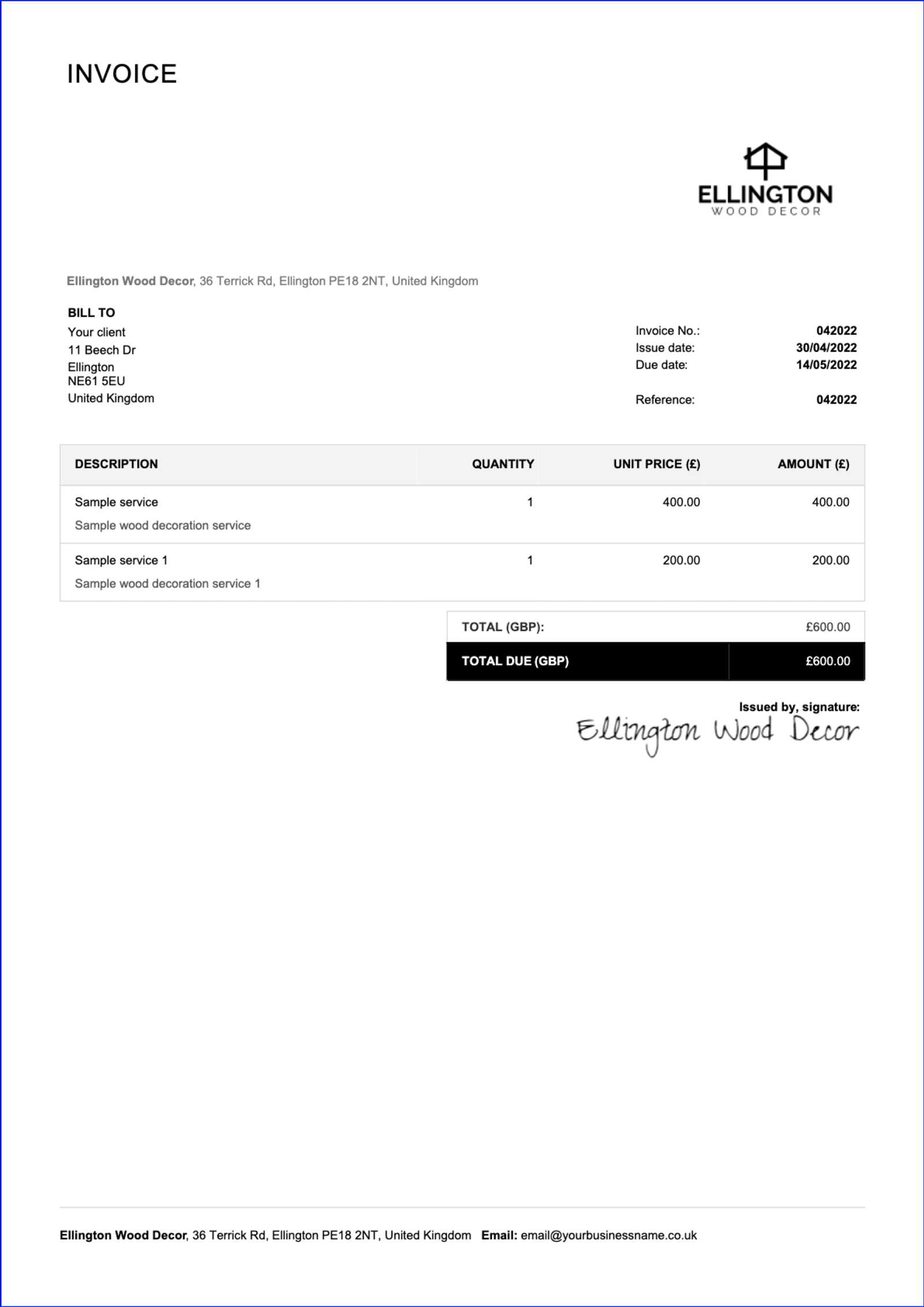

Creating a well-structured payment request requires including key components that ensure clarity and accuracy. Each part serves a specific function, from identifying the service provider and client to specifying payment terms. Without these essential elements, a payment request may lack the necessary details to process the transaction efficiently and professionally.

Here are the crucial components that should be included in every billing document:

| Element | Description | ||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Contact Information | Include your name or business name, address, phone number, and email, as well as the client’s contact details. | ||||||||||||||||||||||||||||||||||||||||||||

| Element | Description |

|---|---|

| Project Overview | Provide a brief description of the work completed, outlining key deliverables and milestones achieved. |

| Agreed Price | Clearly state the total agreed price for the project or specific milestones, ensuring it matches the initial contract. |

| Payment Schedule | If applicable, list payment installments or due dates as per the terms agreed with the client. |

| Completion Date | Indicate the date when the project or milestone was completed to provide a reference point for the payment. |

| Additional Notes | Include any relevant information such as additional tasks, adjustments, or agreed-upon discounts. |

By including these elements, you ensure that the payment request is comprehensive and provides all the necessary information to the client, making the payment process smooth and efficient. A detailed payment document also helps maintain a professional relationship with clients and ensures you are compensated according to the terms of the contract.

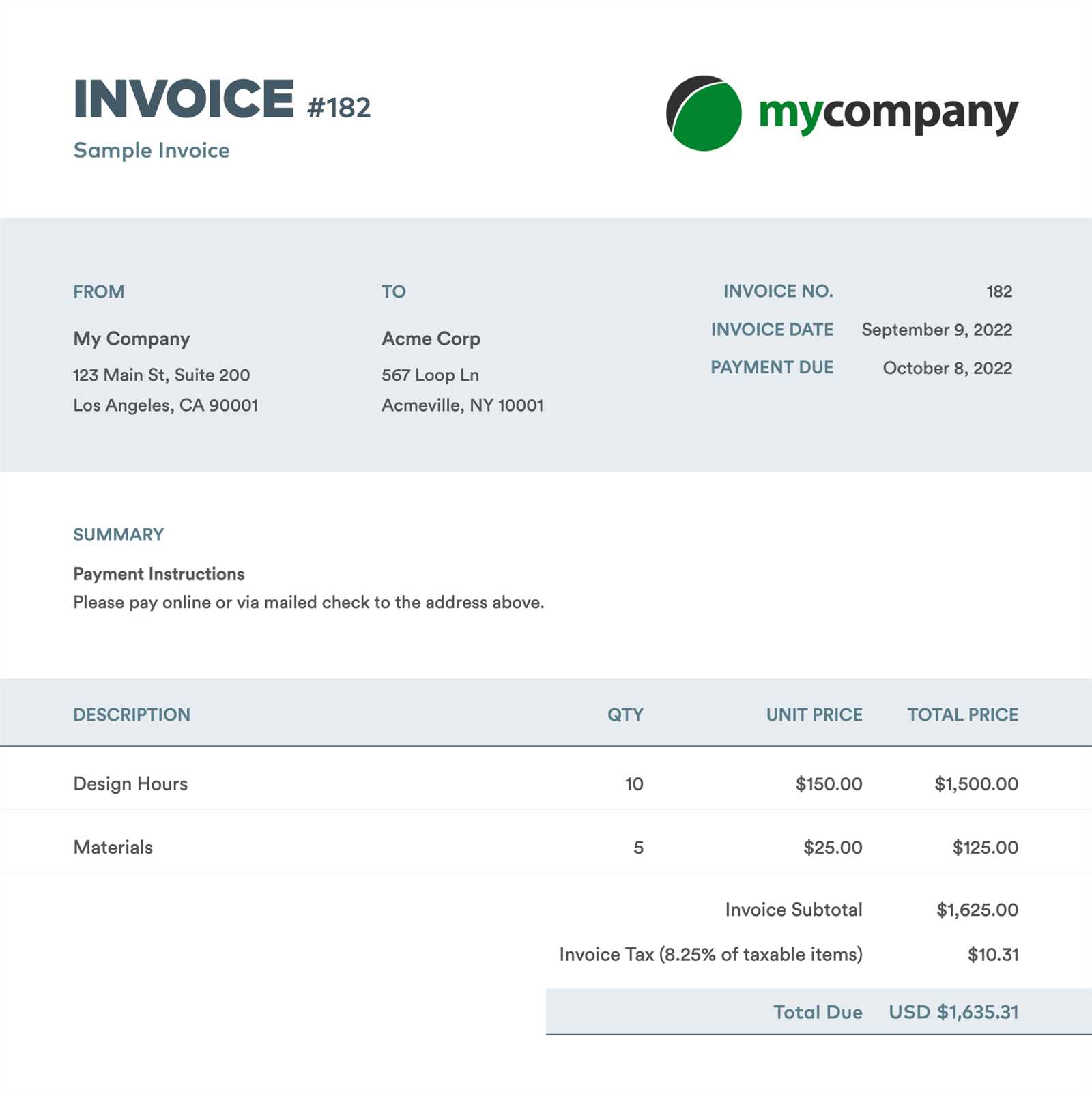

Including Taxes and Additional Fees

When preparing a payment request, it’s essential to account for any taxes and extra charges that might apply. Including these details ensures that the total amount reflects all costs associated with the project. Being transparent about additional fees not only helps avoid misunderstandings but also ensures that you are compensated fully for the services provided. Whether it’s sales tax, service charges, or other fees, these should be clearly outlined for both parties to review and agree upon.

Here is a breakdown of how to properly include taxes and additional fees in a payment request:

| Element | Description |

|---|---|

| Sales Tax | Specify the applicable tax rate based on the client’s location and the nature of the service. Ensure that you are complying with local tax laws. |

| Service Fees | If there are any service fees for processing the payment or handling the project, include these charges separately to keep things transparent. |

| Shipping or Delivery Costs | If physical goods or materials are part of the project, list shipping or delivery costs as separate items to ensure the client knows exactly what they are paying for. |

| Additional Costs | Include any other costs that have been agreed upon during the project, such as expenses for third-party tools or software used. |

| Discounts | If you have offered any discounts as part of the agreement, list them clearly and ensure the reduced amount is reflected in the total. |

By including all taxes and extra charges clearly in your payment document, you ensure that both you and your client have a complete understanding of the final amount due, avoiding any potential disputes later. It also demonstrates professionalism and transparency in your business dealings.

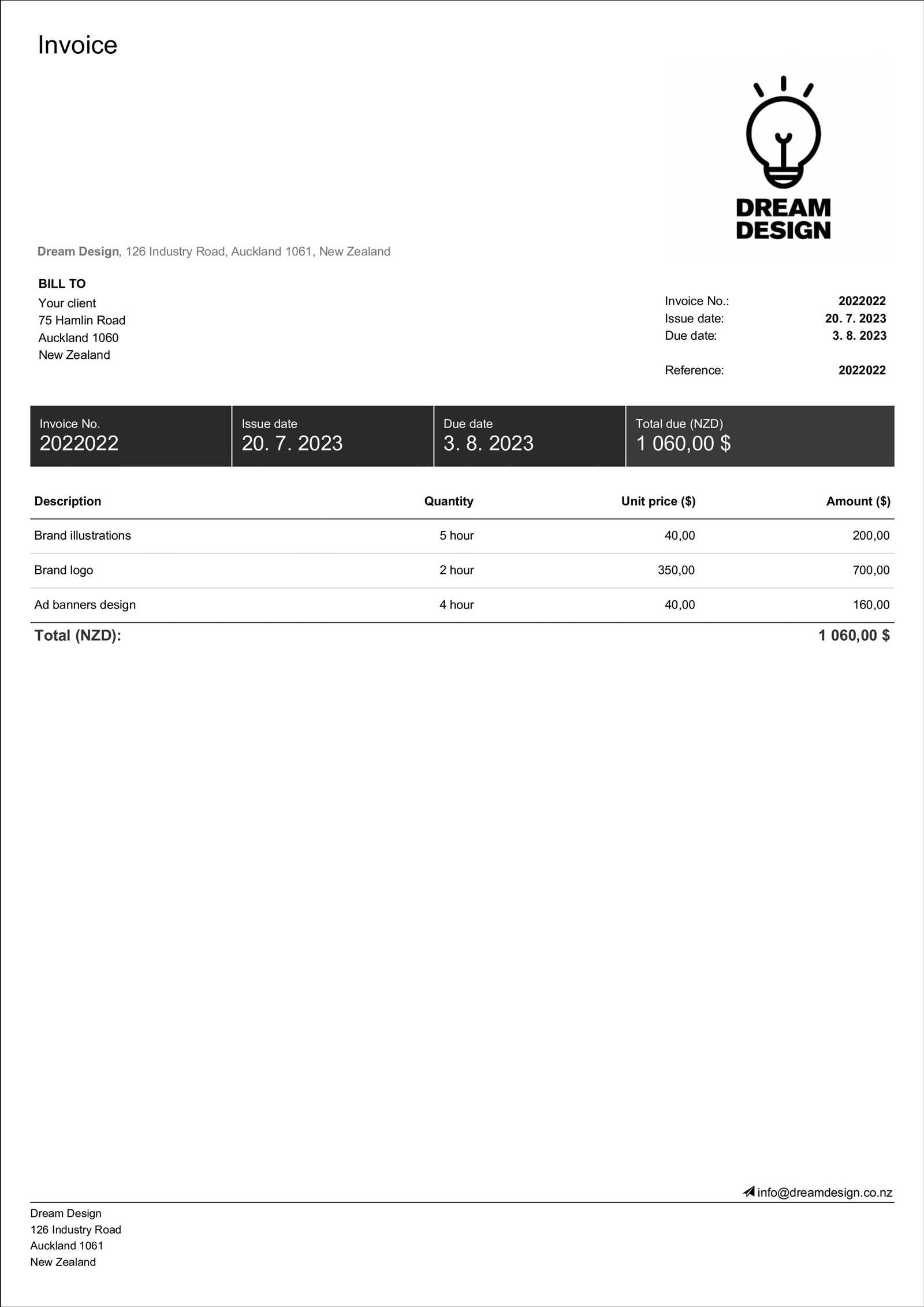

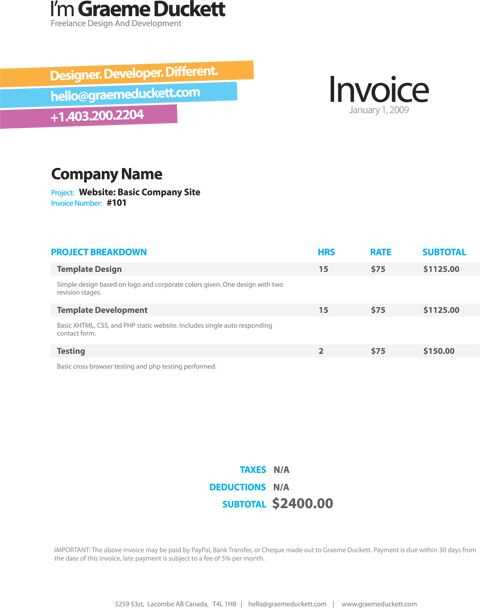

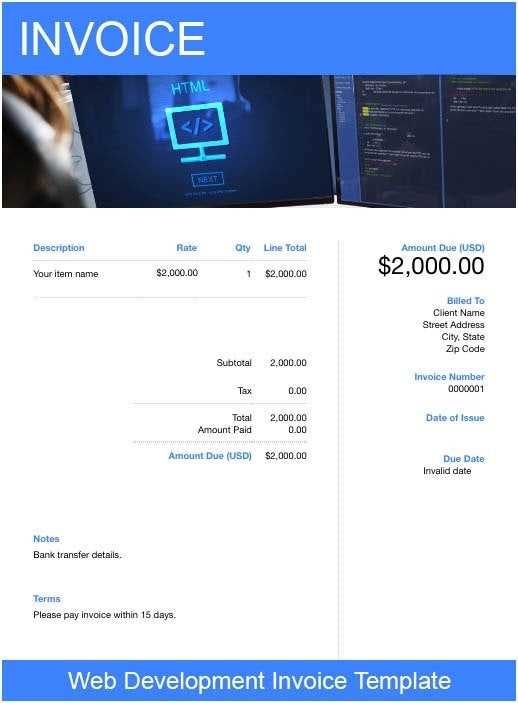

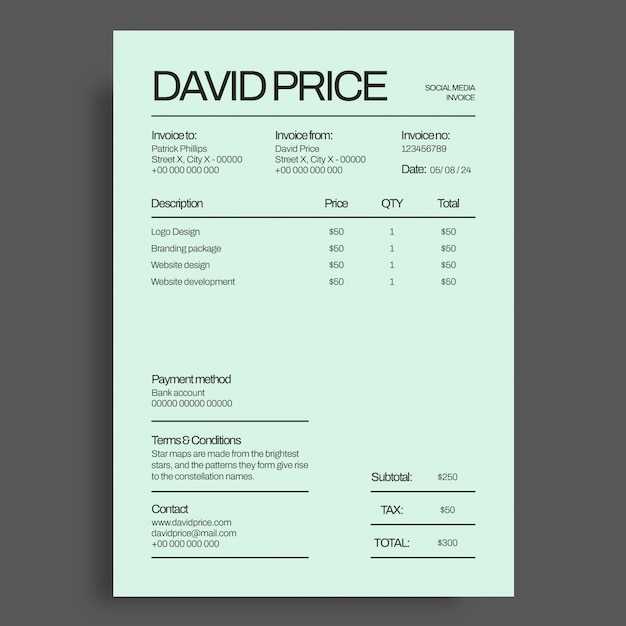

Choosing the Right Format for Your Payment Request

Selecting the right structure for your payment request is crucial to ensure clarity and professionalism. The format should make it easy for the client to understand the details of the transaction, the services provided, and the amount due. Whether you choose a simple document or a more detailed, itemized layout depends on the nature of the work and the preferences of both parties.

Factors to Consider When Choosing a Format

- Project Type: For straightforward tasks, a basic format may suffice. However, for more complex projects, a detailed breakdown may be necessary.

- Client Expectations: Some clients may prefer a simple overview, while others might expect a more formal, detailed structure. It’s important to align with their preferences when possible.

- Legal Requirements: Ensure that the format complies with any local or industry-specific regulations regarding billing and payment documentation.

Popular Formats for Payment Requests

- Simple Format: A concise document that includes key details such as services rendered, total amount, and payment due date. Ideal for short-term or less complicated projects.

- Itemized Breakdown: A more detailed format that lists each service or task performed, the rate for each, and the corresponding amount. This is useful for longer or more intricate projects.

- Online Tools: Digital platforms allow for easy generation of payment requests with customizable fields, automated calculations, and secure delivery options.

Ultimately, choosing the right format for your payment request ensures that both you and your client have a clear understanding of the terms and prevents any delays or confusion in the payment process.

Setting Payment Terms and Due Dates

Establishing clear payment terms and specifying due dates are essential steps in ensuring timely compensation for the work completed. By outlining the expectations upfront, both parties can avoid misunderstandings and delays. Setting clear terms also helps in managing cash flow and maintaining a professional relationship with clients. These details should be explicitly stated in the payment documentation to ensure everyone is on the same page.

Key Elements to Include in Payment Terms

- Payment Method: Specify the preferred payment methods, such as bank transfers, credit cards, or online payment platforms, to ensure smooth transactions.

- Due Date: Clearly state when the payment is expected, whether it’s within a set number of days after receipt (e.g., “Net 30”) or on a specific date.

- Late Fees: Outline any penalties for delayed payments. This could include a percentage fee added to the total amount after the due date has passed.

- Partial Payments: If applicable, define if partial payments are allowed and the conditions under which they are accepted.

Common Payment Terms to Consider

- Net 30: Payment is due 30 days after the completion of the project or receipt of the payment request.

- Net 15: Payment is due within 15 days, often used for shorter projects or ongoing services.

- Due on Receipt: Payment is expected immediately upon delivery of the payment request, commonly used for one-time projects.

- 50/50 Payment Plan: A split payment structure where 50% is paid upfront, and the remaining 50% is due upon completion.

By setting clear payment terms and due dates, you ensure that both you and your client are aware of the expectations, reducing the risk of disputes and delays in compensation. This approach helps in managing finances more effectively and promotes trust between both parties.

Adding Discounts or Promotions to Payment Requests

In some cases, offering discounts or running promotions can help incentivize timely payments or encourage new clients to engage with your services. Including discounts on your payment requests not only provides an added value to the client but also fosters goodwill and long-term business relationships. It’s essential to clearly communicate any discounts or promotional offers in the payment details to ensure both transparency and proper calculation of the final amount due.

Types of Discounts to Include

- Early Payment Discount: Offer a reduction in the total amount if the client settles the payment before the due date. For example, a 5% discount for payments made within 10 days.

- Volume Discount: Offer a discount based on the size of the project or the amount of work completed. This can be useful for large or ongoing projects.

- Referral Discount: Provide a discount for clients who refer new customers to your business. This incentivizes clients to bring in more business.

- Seasonal or Promotional Discount: Offer discounts during certain periods, such as holidays or special events, to encourage more business during slower seasons.

How to Clearly Present Discounts

- Include a Line for the Discount: Clearly indicate the discount applied as a separate line item, showing both the original price and the discounted amount.

- Specify the Terms: Be specific about the terms of the discount, including expiration dates, eligibility criteria, or any conditions that must be met.

- Highlight the Final Price: Ensure that the final amount after the discount is clearly visible so the client can easily understand the total they need to pay.

By incorporating discounts or promotional offers thoughtfully into your payment requests, you can incentivize prompt payments and encourage repeat business, while also maintaining transparency and fairness in the transaction process.

Tips for Clear and Professional Payment Requests

Ensuring that your payment requests are both clear and professional is crucial for maintaining a positive relationship with clients. A well-structured document not only ensures that both parties understand the terms of the transaction but also reflects your professionalism and attention to detail. Clear and concise information can help avoid misunderstandings and delays in payment.

Key Tips for Crafting Effective Payment Requests

- Use a Clean and Organized Layout: Keep the document visually simple and easy to read. Use clear headings, bullet points, and sections to help clients find information quickly.

- Include All Necessary Information: Always provide essential details, such as the scope of work, the total amount, payment due date, and any applicable taxes or fees.

- Be Transparent with Payment Terms: Clearly define when and how payment is due, along with any penalties for late payments. This helps set expectations and reduces confusion.

- Personalize the Document: Use your business name and logo to give the payment request a professional touch. Personalizing the document can also make it more memorable for the client.

- Proofread for Accuracy: Before sending, double-check for errors in the calculations, client details, and service descriptions. Accurate documents prevent delays and disputes.

- Use Professional Language: Ensure that the language used is polite, clear, and professional. Avoid slang or overly casual terms to maintain a business-like tone.

Additional Considerations for a Professional Touch

- Include a Thank You Note: A brief thank you for the client’s business can go a long way in building rapport and leaving a positive impression.

- Provide Contact Information: Ensure your contact details are easy to find in case the client needs to discuss the payment or has any questions.

- Digital Format Options: Sending the request in a PDF format ensures that the document remains professional and intact, regardless of the recipient’s software.

By following these guidelines, you can create payment requests that not only look professional but also help foster a trusting and efficient client relationship, ensuring timely and hassle-free payments.

Common Mistakes in Payment Requests

When creating payment requests, there are several common errors that can lead to confusion, delayed payments, or disputes with clients. These mistakes can make the payment process more difficult and less professional. By being aware of the typical pitfalls, you can ensure that your requests are accurate, clear, and effective.

Frequent Mistakes to Avoid

- Missing or Incorrect Client Information: Always double-check client details such as name, address, and contact information. Errors here can cause confusion and delay the payment process.

- Vague Descriptions of Work Done: Failing to provide a detailed breakdown of the services or work provided can lead to misunderstandings. Ensure that each task or project milestone is clearly described.

- Not Including Payment Terms: Clearly stating the payment terms is crucial. Omitting the payment due date, late fees, or accepted payment methods can lead to delays and confusion.

- Failure to Calculate Correctly: Simple math errors in calculating totals, taxes, or discounts can cause issues. Always double-check your calculations to avoid discrepancies.

- Unclear or Missing Due Date: Not specifying a clear due date can lead to delayed payments. Always include a specific date when payment is expected.

- Not Accounting for Taxes and Fees: Depending on your location and the client’s, certain taxes or fees may apply. Failing to include these can lead to confusion and create issues with both the client and the tax authorities.

How to Avoid These Mistakes

- Use a Standardized Format: A consistent format reduces the chance of omitting important information or making errors. Using a reliable structure for each request will streamline the process.

- Include Detailed Descriptions: Break down the services or deliverables to avoid ambiguity. This provides clarity and shows professionalism in your work.

- Double-Check All Details: Always proofread the payment request before sending it to ensure all the details are correct, from client information to the final amount due.

- Set Clear Expectations: Establish clear terms, due dates, and payment methods upfront, so the client understands the payment schedule and what is expected from them.

By taking the time to avoid these common mistakes, you can ensure that your payment requests are professional, accurate, and lead to smooth, timely payments.

Tools to Create and Send Payment Requests

When managing payments for your services, utilizing the right tools can save you time and reduce errors. There are various platforms and software available that allow you to easily generate, customize, and send professional payment requests. These tools can help streamline the entire process, making it faster and more efficient, while ensuring accuracy in your transactions.

Popular Tools to Consider

- Accounting Software: Many accounting software platforms offer built-in features for creating payment requests, tracking payments, and managing finances. Examples include QuickBooks, FreshBooks, and Xero.

- Online Payment Platforms: Platforms like PayPal, Stripe, and Square not only let you accept payments but also provide tools to create and send digital requests. These services often allow you to add payment terms, discounts, and taxes easily.

- Dedicated Payment Request Tools: There are specialized tools for creating and sending payment requests, such as Invoice Ninja, Zoho Invoice, and Wave. These tools offer easy-to-use templates and customizable features.

- Spreadsheets: While more manual, spreadsheets like Google Sheets or Microsoft Excel can also be used to create and send detailed payment requests. They offer flexibility and customization but require careful attention to avoid errors.

- Document Management Systems: Tools like Google Docs and Microsoft Word can be used to create simple, custom payment requests. These are great for individuals who prefer to design requests from scratch but may not offer the same features as specialized software.

Choosing the Right Tool for Your Needs

- Consider Your Workflow: If you are managing a large volume of transactions, an accounting or invoicing software might be the best choice. For simpler needs, spreadsheets or document systems may suffice.

- Customization Options: Look for a tool that allows you to tailor the payment request to your needs, from including detailed line items to adjusting tax rates and payment terms.

- Integration with Payment Systems: Choose a platform that integrates with your payment system, allowing clients to pay directly through the request and ensuring quicker, seamless transactions.

By selecting the appropriate tool, you can streamline the process of creating and sending payment requests, ultimately saving time and ensuring smooth financial management.

How to Track Payments and Outstanding Invoices

Keeping track of payments and outstanding amounts is crucial for maintaining healthy cash flow and ensuring that all financial obligations are met. Efficient tracking allows you to easily monitor what has been paid, what remains outstanding, and when payments are due. This not only helps you stay organized but also prevents misunderstandings with clients regarding payment statuses.

Methods for Tracking Payments

- Use Accounting Software: Many accounting platforms, like QuickBooks or FreshBooks, have built-in features to track payments automatically. These systems can link directly to your bank account or payment processor to show real-time updates on received payments.

- Manual Tracking with Spreadsheets: For those who prefer a more hands-on approach, using Google Sheets or Excel allows for easy customization. You can create columns for due dates, amounts, payment dates, and outstanding balances.

- Online Payment Platforms: Services such as PayPal, Stripe, and Square provide payment tracking as part of their service. They often include a dashboard where you can see the status of each transaction, whether it’s pending, completed, or overdue.

Keeping Track of Outstanding Amounts

- Set Clear Payment Terms: When establishing payment terms, make sure the due dates are clear and mutually agreed upon. This sets a foundation for tracking whether payments are made on time.

- Create Follow-Up Reminders: Automate reminders to be sent to clients when payments are nearing their due date or have already passed. Most accounting tools and online payment platforms offer this feature.

- Maintain a Separate Ledger: If you are handling multiple clients, it might be helpful to maintain a separate record for each client’s payments and outstanding amounts. This can be done through accounting software or in a physical ledger.

What to Do with Unpaid Balances

- Send Polite Payment Reminders: Always start with a friendly reminder to your client. Often, delays happen because of oversight, and a simple reminder can resolve the issue.

- Offer Payment Plans: For larger amounts or long-term clients, consider offering payment installments to make it easier for them to pay off the balance.

- Escalate if Necessary: If payment is still not received after reminders, consider escalating the situation. This may include applying late fees or seeking legal advice in extreme cases.

By implementing clear tracking systems, maintaining records, and communicating effectively with clients, you can manage payments and outstanding amounts with ease and confidence.

Legal Considerations for Freelance Invoicing

When creating and sending billing documents, it’s important to understand the legal implications involved. Ensuring that your financial communications are compliant with local and international regulations can prevent disputes and help avoid legal issues down the road. Knowing the required components of these documents, the proper way to issue them, and any necessary tax considerations will safeguard both you and your clients.

Key Legal Components of a Billing Document

There are certain elements that must be included to make your payment requests legally binding and clear. Including the right information not only protects you but also ensures your clients understand the terms of your arrangement. Below is a table outlining the essential legal elements of a billing document:

| Element | Description |

|---|---|

| Client Information | Ensure you have the full legal name, company name (if applicable), and address of your client to avoid any confusion. |

| Legal Terms | Specify the agreed-upon terms, including payment due date, late fees, and methods of payment. |

| Tax Identification Numbers | If applicable, include your tax identification number and your client’s tax details for proper record-keeping. |

| Payment Amounts | Be clear about the payment for services provided, any applicable taxes, and any other additional fees. |

| Signatures | Though not always required, having both parties sign the payment request document may be helpful for formal agreements. |

Tax and Compliance Considerations

Tax laws vary depending on your location and the nature of your business. It’s important to be aware of local, state, or national tax regulations to ensure that you’re charging the appropriate taxes and submitting required documentation. Here’s what you should keep in mind:

- Sales Tax: Depending on the jurisdiction, certain services may be subject to sales tax. Verify whether your services are taxable and apply the correct tax rate.

- Self-Employment Taxes: Many individuals offering services as independent contractors are responsible for self-employment taxes. Be sure you’re reporting your income correctly to avoid penalties.

- Invoice Re

How Invoices Impact Your Reputation

The way you handle financial documentation can significantly influence your professional image. Clear, accurate, and timely billing reflects your professionalism, organization, and commitment to client relationships. On the other hand, confusion, errors, or delays in your financial communications can negatively affect how others perceive you, potentially harming your reputation and future business prospects.

Clients expect transparency and reliability when it comes to financial matters. Failing to meet these expectations can lead to misunderstandings, disputes, or delays in payment. This, in turn, may affect your ability to secure future contracts or maintain long-term business relationships.

How Proper Billing Affects Your Image

When creating financial documents, accuracy and professionalism are key. Here’s a breakdown of how it can positively influence your reputation:

Aspect Impact on Reputation Clarity A well-organized, easy-to-understand financial document ensures your client understands exactly what they are being charged for, reducing the chance for confusion or disputes. Accuracy Accurate billing documents show attention to detail and reflect reliability. Mistakes in the charges or calculations can make you appear unprofessional and careless. Timeliness Issuing timely billing documents demonstrates your respect for your client’s time and ensures the payment process proceeds without unnecessary delays. Professionalism A polished, well-structured financial document demonstrates that you value professionalism in all aspects of your work, which enhances your image and credibility. Consequences of Poor Billing Practices

Failing to properly manage financial documentation can result in various negative consequences. These include:

- Loss of Trust: Mistakes in billing can make clients question your reliability, damaging trust in your services.

- Delayed Payments: Confusing or incorrect billing can lead to delayed payments, which may affect your cash flow.

- Negative Reviews: Dissatisfied clients may share their experiences online or with others, damaging your professional reputation.

- Missed Opportunities: A poor reputation in managing financial matters could cause potential clients to hesitate or look elsewhere for services.

Ultimately, clear, accurate, and professional financial documentation not only ensures timely payments but also enhances your overall reputation, buildin