Comprehensive Invoice Contract Template for Your Business Needs

When working with clients or customers, having clear and precise agreements is essential to ensure smooth transactions and avoid misunderstandings. A well-structured document outlining the terms of services and payments provides both parties with a sense of security and transparency. These written agreements serve as a valuable reference in case of disputes, delays, or other issues that may arise during the course of the business relationship.

For any business, it’s crucial to define the specific terms regarding payment expectations, deadlines, and responsibilities. A professional approach to drafting such agreements helps establish trust, professionalism, and ensures that both sides understand their commitments. Whether you are a freelancer, a small business owner, or a large corporation, having a solid, standardized document to guide your transactions is a must.

Clear documentation of expectations not only reduces the risk of confusion but also protects your interests. In this article, we’ll explore how to create a comprehensive agreement, the key components that should be included, and best practices for customization to suit various business needs.

Invoice Contract Template Overview

Having a structured document to formalize agreements between businesses and clients is a critical component of maintaining professionalism and clarity. Such a document outlines the responsibilities of both parties, ensuring that each understands the expectations regarding services, payments, and timelines. This approach minimizes the risk of misunderstandings and potential conflicts, fostering a transparent relationship.

Why a Structured Agreement is Essential

Without a standardized document, businesses may face challenges in clearly communicating the terms of the agreement. A well-organized document serves as a reference point throughout the transaction process, making it easier to track progress and resolve any issues. By setting clear parameters for the services to be provided and the payments to be made, both parties are assured that their interests are protected.

Key Benefits of a Standardized Document

One of the main advantages of using a detailed agreement is the reduction of ambiguity. A clear outline of the terms ensures that both parties are aligned on expectations from the start. Additionally, it provides a framework for resolving any disputes that might arise. It also acts as a record that can be referred to in the future, should any questions about the arrangement emerge.

Why Use an Invoice Contract

Having a formalized document to outline the terms of an agreement between a service provider and a client is essential for maintaining clarity and professionalism. This type of agreement sets clear expectations from both sides, helping to avoid misunderstandings and potential disputes. When the terms are documented in writing, both parties are more likely to fulfill their obligations in a timely and efficient manner.

One of the key reasons for using such a formalized agreement is to establish a legal framework for the exchange of goods or services. It acts as a safeguard, protecting both the provider and the client by ensuring that each party understands the specific conditions of the agreement, including payment amounts, deadlines, and deliverables. Without this documentation, the process can become ambiguous and open to interpretation.

Clear terms also contribute to a smoother workflow. When both sides agree to the details of the arrangement upfront, the likelihood of delays, missed payments, or unmet expectations decreases significantly. In addition, having everything in writing gives businesses and clients peace of mind, knowing that there is a clear plan in place for the completion of services and the settlement of payments.

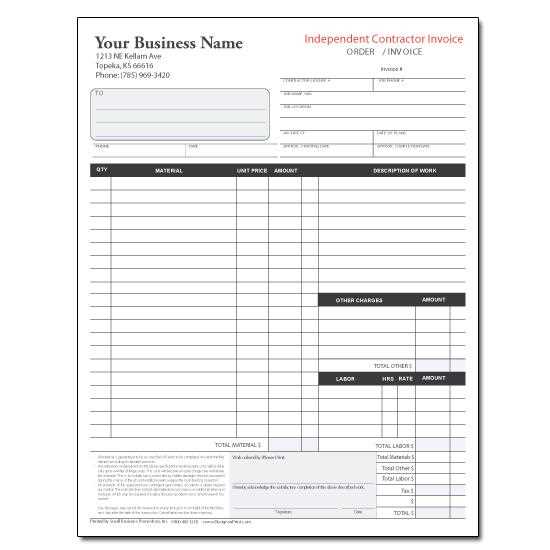

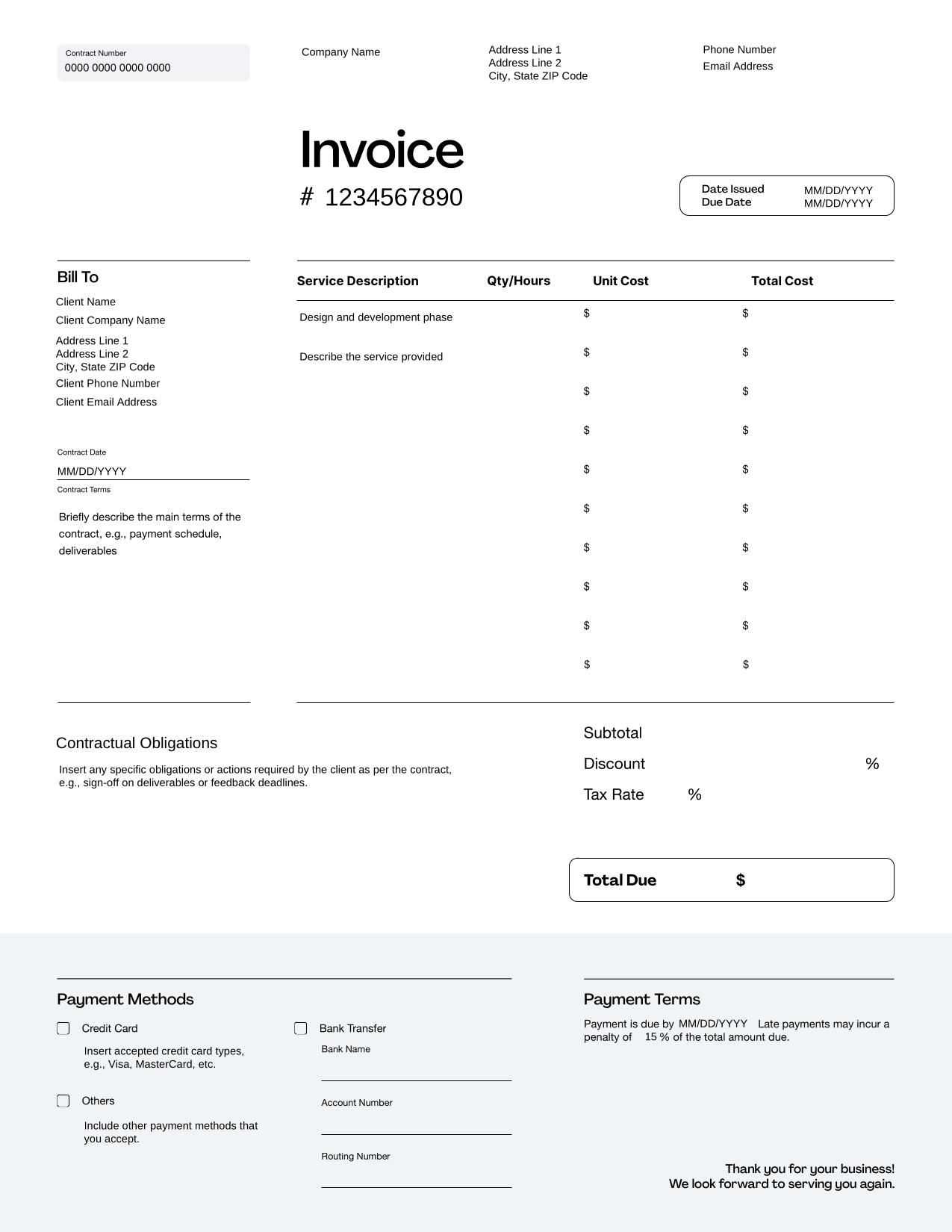

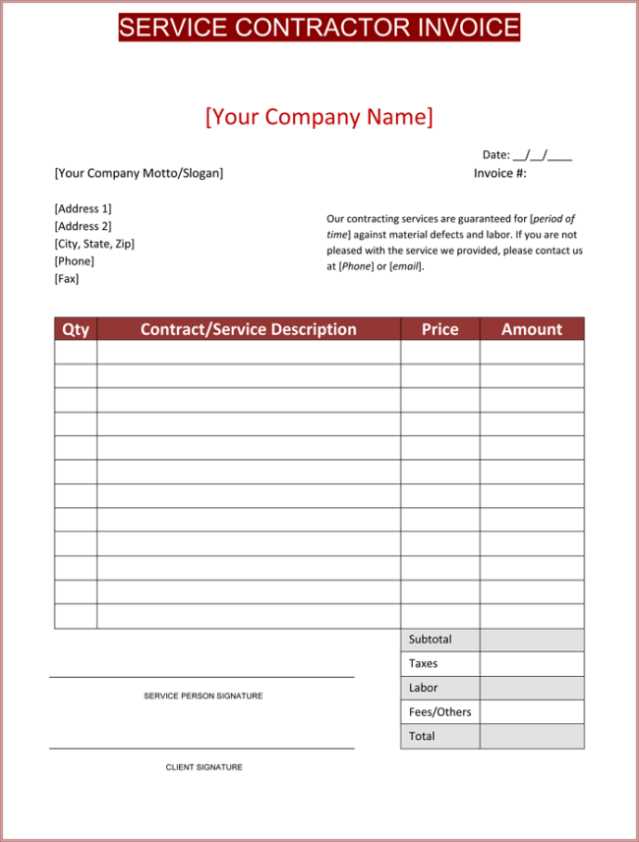

Key Elements of an Invoice Agreement

When drafting a formal agreement between a service provider and a client, it is crucial to include all the necessary components that define the scope of the relationship. A well-structured document should cover key details that ensure both parties are aligned on expectations and responsibilities. These elements create a clear roadmap for how the arrangement will proceed and help avoid confusion during the course of the transaction.

The first and foremost element is the description of services or goods provided. Clearly stating what is being offered prevents misunderstandings about deliverables. This section should outline the specific services, products, or tasks to be completed, along with any relevant specifications or quality standards. Additionally, a timeline is essential–this outlines deadlines for deliverables and expected completion dates to set clear expectations for both parties.

Another critical aspect is the payment terms. This section should specify the agreed-upon amount, payment methods, and the due dates for payments. It is also important to outline any late payment penalties or interest rates in case the payment is not made on time. Finally, both parties should agree on confidentiality clauses, if necessary, to protect any sensitive information exchanged throughout the engagement.

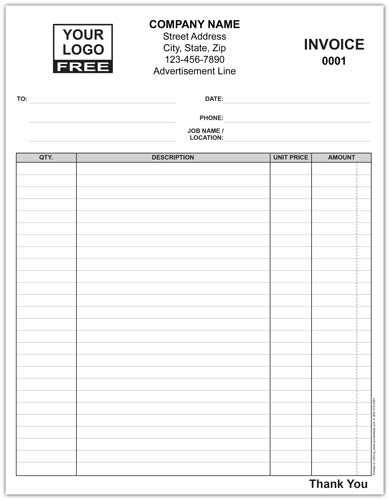

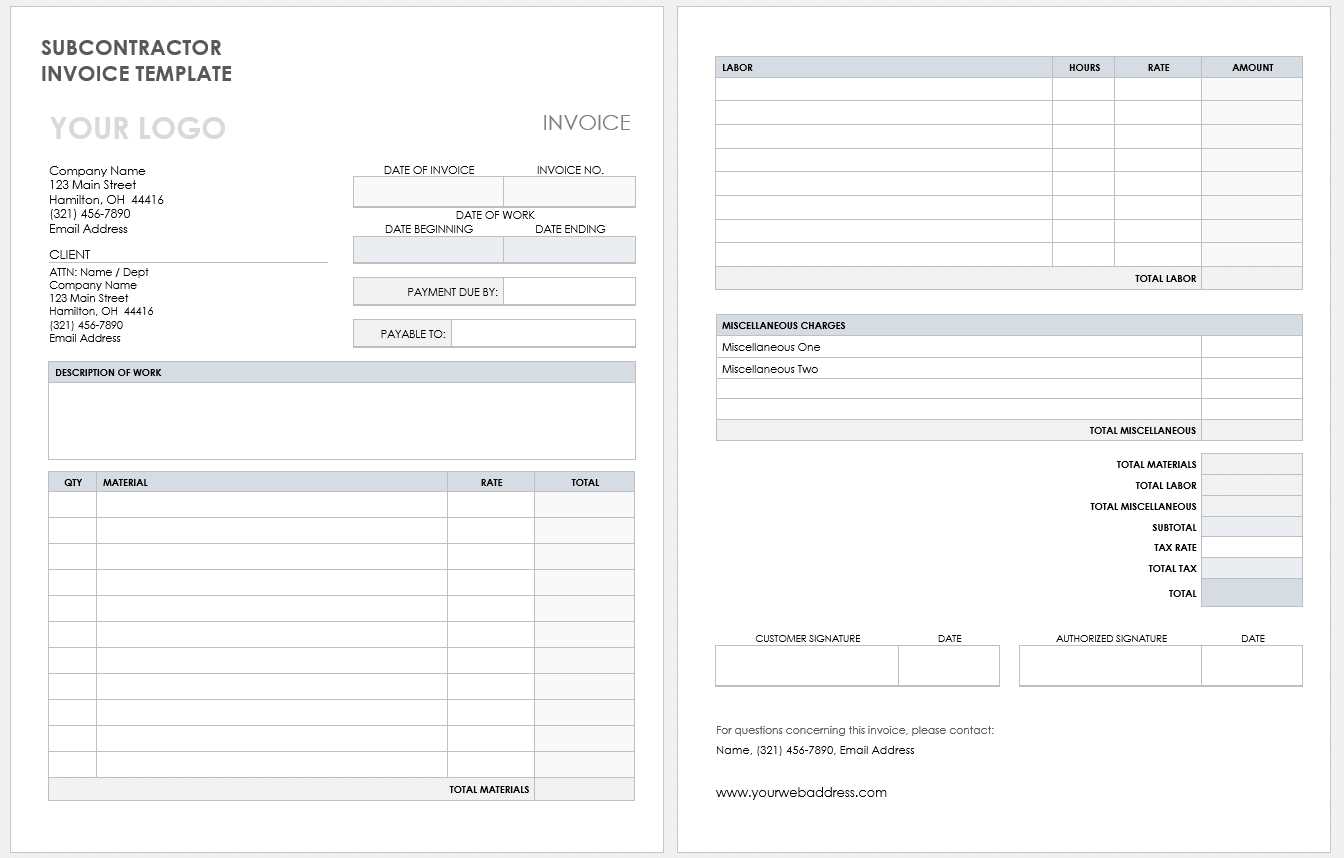

How to Customize Your Invoice Template

Customizing a formal agreement document is a key step to ensure it meets the specific needs of your business and clients. Tailoring the layout, content, and structure of your document not only enhances professionalism but also allows you to better represent your brand and streamline the process. By adjusting details like payment terms, services, and deadlines, you can create a personalized agreement that aligns with the nature of each project or transaction.

Steps to Personalize Your Agreement Document

To effectively modify your document, follow these essential steps:

- Define the Structure: Choose a clean and organized layout that clearly divides sections like services, payment terms, and deadlines. A well-structured document improves readability and ensures that key information stands out.

- Adjust Service Descriptions: Customize the description of the goods or services provided to accurately reflect the specific project or task. Include details such as quantities, specifications, and delivery methods if applicable.

- Set Payment Terms: Include payment deadlines, methods, and any additional conditions like deposits, late fees, or installment plans. Tailor these to fit the financial arrangements you agree on with the client.

- Add Branding Elements: Incorporate your business logo, colors, and contact details to make the document feel cohesive with your brand’s identity. This also helps clients easily recognize the document as official.

- Include Legal Considerations: Adjust legal language based on your region or industry standards. For example, you may want to add clauses for intellectual property, confidentiality, or warranties if they apply to the project.

Tools to Streamline the Customization Process

There are various tools available to help you personalize your agreement documents efficiently. Online platforms offer easy-to-use interfaces that let you drag and drop sections, modify text, and apply pre-designed styles. These tools also ensure that your document complies with legal standards and industry best practices.

Benefits of Clear Payment Terms

Establishing transparent and well-defined payment expectations is a fundamental aspect of any business arrangement. Clear payment terms help both parties understand their financial obligations and minimize potential conflicts or delays. By outlining the details upfront, you can ensure smoother transactions, promote trust, and maintain a healthy cash flow for your business.

When payment terms are clearly outlined, businesses benefit from:

- Reduced Risk of Late Payments: When both parties know exactly when payments are due and the consequences of missing deadlines, it’s more likely that payments will be made on time.

- Enhanced Cash Flow Management: Clear terms make it easier to predict when payments will be received, which is essential for managing cash flow and planning for future expenses.

- Stronger Client Relationships: Transparency about payment schedules fosters trust between businesses and clients, leading to better long-term relationships.

- Avoidance of Disputes: Having the terms set in writing minimizes misunderstandings and provides a reference point if any disagreements arise regarding payments.

- Improved Professionalism: Outlining payment expectations in detail demonstrates professionalism and shows that you take your business agreements seriously.

Additionally, clear payment terms allow for the inclusion of specific clauses, such as penalties for late payments or discounts for early settlement. These terms create a fair environment for both sides, ensuring that there are no surprises and that both parties understand their rights and responsibilities throughout the engagement.

Common Mistakes in Invoice Contracts

Even with the best intentions, mistakes can easily occur when drafting formal agreements for business transactions. These errors often lead to confusion, delays, or even legal issues. It’s important to be aware of the most common pitfalls so that you can avoid them and ensure smooth, professional interactions with clients and vendors.

Some of the most frequent mistakes include:

- Unclear Payment Terms: One of the biggest mistakes is failing to specify exact payment terms, including due dates, payment methods, and any potential penalties for late payments. Vague terms can lead to misunderstandings and delayed payments.

- Omitting Detailed Descriptions of Services: Failing to clearly outline the services or goods being provided can cause confusion and disputes. It’s essential to describe all deliverables in detail, including quantities, specifications, and deadlines.

- Not Including Milestones or Deadlines: Without clear timelines for deliverables or payment, both parties may have different expectations, leading to frustration. Deadlines should be precise to avoid misunderstandings.

- Missing Legal Protections: Important clauses such as intellectual property rights, confidentiality, or dispute resolution are often left out. These protections are essential to ensure both parties are safeguarded if any issues arise during the engagement.

- Incorrect Contact Information: An often-overlooked mistake is incorrect or missing contact details, which can delay communication and lead to problems with the execution of the agreement.

By carefully reviewing your documents and addressing these common errors, you can ensure that your agreements are both clear and legally binding, which will contribute to smoother business operations and stronger professional relationships.

Understanding Invoice Payment Schedules

Establishing a clear payment schedule is essential to ensure that both the service provider and the client are aligned on when payments are due and how they will be made. A payment schedule outlines the timeline and conditions for financial transactions, helping both parties manage expectations and avoid confusion. Clear payment terms not only facilitate smooth cash flow management but also ensure that both sides are aware of their obligations from the outset.

Types of Payment Schedules

There are several common types of payment schedules, depending on the nature of the work or services being provided. Each type allows businesses to structure payments according to their preferences or cash flow needs:

| Payment Type | Description |

|---|---|

| One-Time Payment | A single payment made in full upon completion or delivery of services/products. Common in fixed-price projects. |

| Installment Payments | Payments made in multiple installments, often with a deposit upfront and the balance paid in stages. |

| Milestone Payments | Payments tied to specific project milestones, such as the completion of certain phases or deliverables. |

| Recurring Payments | Scheduled payments that occur on a regular basis, such as monthly or quarterly, common for subscription-based services. |

Why Payment Schedules Matter

Having a well-defined schedule allows both parties to plan their finances effectively. For the service provider, it ensures that payments are made on time and can help with cash flow management. For the client, it clarifies the costs over time, avoiding any sudden financial burdens. Additionally, payment schedules can help manage expectations, especially for long-term projects or ongoing services, ensuring that both sides remain accountable and committed throughout the engagement.

How to Handle Late Payments in Contracts

Dealing with late payments is a common challenge in business relationships. While most clients intend to pay on time, delays can happen for various reasons. It’s important to have a clear plan in place to handle such situations effectively, ensuring that both parties understand the consequences of missing deadlines. Properly addressing late payments helps maintain professionalism while protecting your business interests.

Steps to Address Late Payments

If a payment is overdue, consider these steps to address the issue professionally:

- Send a Reminder: Politely remind the client of the due payment. Sometimes, a gentle reminder is all that’s needed to prompt action.

- Review the Agreement: Check the original terms and ensure both parties understand the agreed-upon payment timeline and penalties for delays.

- Request Immediate Payment: If a payment is significantly overdue, reach out with a more formal request for payment, outlining the amount owed, the original due date, and any late fees incurred.

- Offer Payment Plans: For clients facing financial difficulty, offer a payment plan or installment option to make it easier for them to pay off the balance.

- Consider Legal Action: If the payment remains unpaid after multiple reminders, you may need to consult legal resources to explore the next steps for recovery, such as involving a collections agency or pursuing small claims court.

Preventing Late Payments in the Future

To reduce the likelihood of late payments, implement clear payment terms in your agreements and consider adding:

- Late Payment Fees: Clearly state the penalties for late payments, such as interest charges or fixed late fees, to encourage timely payment.

- Incentives for Early Payments: Offer discounts or other incentives for clients who pay before the due date.

- Regular Follow-Ups: Maintain open communication with clients and send periodic reminders as the payment date approaches.

By taking proactive steps and having a clear plan for handling overdue payments, you can maintain positive relationships while ensuring that your business stays financially secure.

Legal Requirements for Invoice Agreements

When formalizing a business transaction, it is essential to understand the legal requirements that govern the agreement between parties. A well-constructed document does more than outline services and payments–it ensures that both parties are protected by law and that the agreement is enforceable in case of disputes. Understanding the legal aspects helps ensure compliance with local and international regulations, minimizing risks for both businesses and clients.

Key Legal Considerations

To ensure your document is legally sound, there are several key elements that must be included:

- Clear Identification of Parties: The document should clearly identify all involved parties, including their legal business names, addresses, and contact information. This ensures that there is no ambiguity about who is entering the agreement.

- Payment Terms and Conditions: Specify the payment amount, payment methods, deadlines, and any late fees or interest charges. This is essential to protect both parties and ensure timely payments.

- Tax Compliance: Be sure to include applicable tax information, such as VAT or sales tax, and ensure that the document complies with local tax laws. This helps avoid any future tax-related issues.

- Dispute Resolution Clause: Include a clause that outlines the steps to be taken in case of a dispute, such as mediation or arbitration, and the governing law for the agreement.

- Signature and Date: For the document to be legally binding, both parties must sign and date it. This confirms their acceptance of the terms and serves as proof of the agreement.

Industry-Specific Requirements

In certain industries, additional legal requirements may apply. For example, businesses in the healthcare, finance, or technology sectors may need to include specific clauses related to confidentiality, intellectual property, or data protection. Always consult with a legal expert to ensure that your agreements meet the unique requirements of your industry.

By understanding and incorporating these legal elements, businesses can create agreements that are not only fair and clear but also legally enforceable, providing a solid foundation for professional relationships.

Setting Clear Service Descriptions

One of the most important aspects of any formal business agreement is providing a clear and detailed description of the services or products being offered. Ambiguity in this area can lead to misunderstandings, disputes, and dissatisfaction on both sides. A well-defined service description not only helps manage expectations but also serves as a reference in case any issues arise during the course of the agreement.

Why Clarity is Crucial

Clearly outlining the scope of work ensures that both the service provider and the client are on the same page regarding deliverables, timelines, and quality expectations. Without precise details, there may be confusion about what is expected, which can lead to disagreements over performance, quality, or payment. Furthermore, clear descriptions can help protect both parties legally in case the terms of the agreement are not met.

Key Elements to Include in Service Descriptions

When drafting service descriptions, make sure to include the following essential details:

- Specific Deliverables: List exactly what is being provided, whether it’s a product, service, or outcome. The more specific you are, the fewer opportunities there are for confusion.

- Timeline and Deadlines: Define the expected timeline for the completion of services, including start dates, milestones, and final delivery dates.

- Quality Standards: Outline any quality standards or performance metrics that must be met. This ensures both parties understand the expected level of service.

- Additional Terms: If there are any special conditions, such as warranty terms, support services, or revisions, be sure to include them to avoid future disputes.

By being thorough and precise in your service descriptions, you ensure that both parties understand the full scope of work, which helps avoid unnecessary conflicts and sets the stage for a successful business relationship.

Including Tax Information in Contracts

When formalizing a business agreement, it is essential to address tax information to ensure compliance with local and international laws. Tax details not only affect the financial aspects of the transaction but also help prevent legal complications. Including the correct tax rates, identifying who is responsible for taxes, and specifying the tax-exempt status can all contribute to a clearer and more legally sound arrangement.

Key Tax Information to Include

To make sure the tax aspects of an agreement are properly covered, include the following details:

| Tax Element | Description |

|---|---|

| Applicable Tax Rates | Specify the relevant tax rates, such as VAT, sales tax, or any other taxes that apply to the transaction. Ensure that these rates align with local or international tax laws. |

| Tax Responsibilities | Clarify who is responsible for paying the tax–whether it is the buyer or the seller. This helps avoid confusion and ensures both parties understand their obligations. |

| Tax Exemptions | If the transaction is tax-exempt or if there are any special tax considerations (e.g., nonprofit status), be sure to explicitly mention these in the agreement. |

| Tax Invoices | State whether a tax invoice will be issued, and outline the requirements for issuing it, such as the inclusion of tax identification numbers or other relevant details. |

Why Tax Information Matters

Including tax information is not only a legal requirement in many jurisdictions, but it also protects both parties by setting clear financial expectations. Without proper tax details, businesses may face unexpected liabilities, audits, or disputes. By specifying tax obligations upfront, businesses can avoid these risks and ensure that both parties are compliant with all relevant tax regulations.

How to Track Invoice Payments Effectively

Keeping track of payments is crucial for maintaining healthy cash flow and ensuring that all financial transactions are processed on time. An organized payment tracking system allows businesses to quickly identify outstanding balances, prevent late payments, and maintain accurate financial records. Implementing the right tools and processes can help you stay on top of payments and reduce the risk of errors or missed deadlines.

Key Steps to Track Payments

To track payments effectively, consider the following steps and best practices:

| Step | Description |

|---|---|

| 1. Create a Payment Record | Maintain a comprehensive record of all transactions, including the payment amount, date, method, and the party making the payment. This ensures a clear history of payments and helps in future references. |

| 2. Use Accounting Software | Utilize accounting software to automate payment tracking, set reminders for due payments, and generate reports that provide insights into your business’s financial health. |

| 3. Monitor Payment Status | Regularly check the status of payments to ensure that they have been processed. Make it a habit to review both received and pending payments at regular intervals. |

| 4. Send Payment Reminders | If a payment is overdue, send a polite reminder to the client, and follow up periodically until the balance is settled. This encourages prompt payments and reduces delays. |

| 5. Reconcile with Bank Statements | Regularly reconcile your payment records with bank statements to ensure all transactions are accounted for and there are no discrepancies between your records and the actual payments received. |

Tools for Effective Payment Tracking

There are several tools available to help streamline the payment tracking process:

- Accounting Software: Programs like QuickBooks, Xero, or FreshBooks offer built-in features for tracking payments and automating reminders.

- Spreadsheets: Simple tools like Microsoft Excel or Google Sheets can be customized to track payments manually if you prefer a more hands-on approach.

- Payment Platforms: Platforms like PayPal, Stripe, or Square allow for easy tracking of payments made through their systems and provide reporting features that help monitor payment statuses.

By implementing a reliable tracking system and using the right tools, you can stay on top of all payments, ensure that no balances are missed, and maintain smooth financial operations for your business.

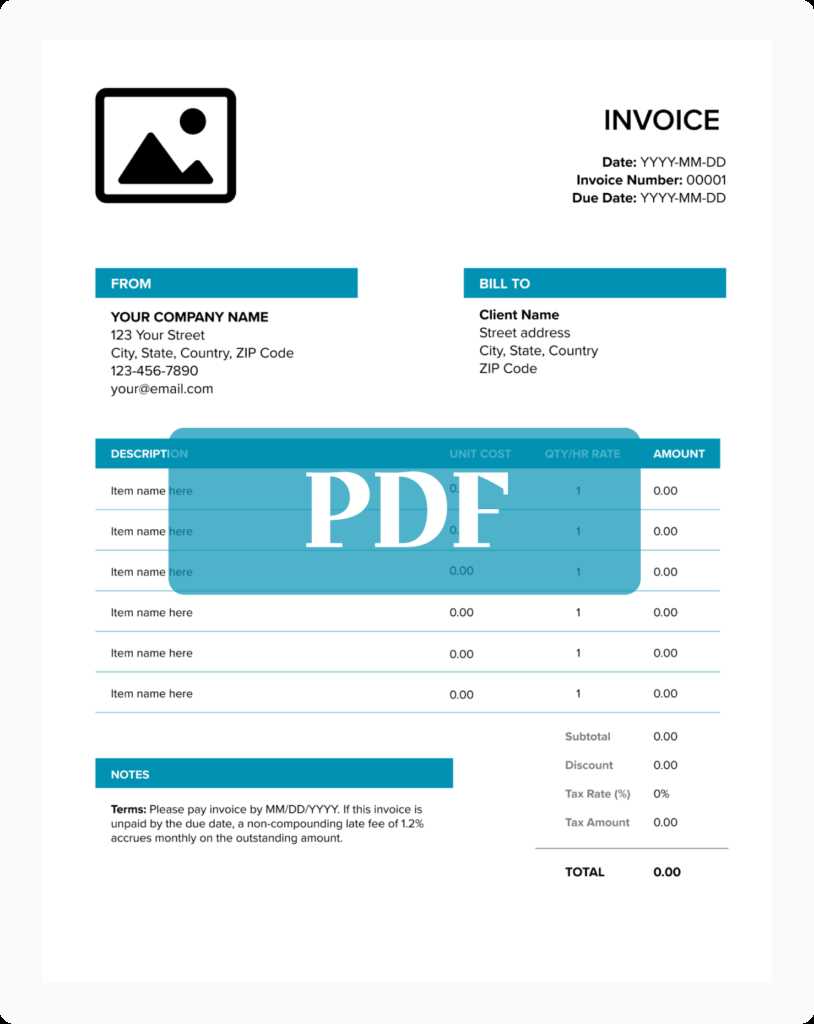

Digital vs Printed Invoice Contracts

In today’s business landscape, organizations have the option to choose between digital or printed versions of formal agreements and payment documents. Each format comes with its own set of benefits and challenges, and selecting the right one depends on factors like convenience, cost, security, and environmental considerations. Understanding the differences between digital and printed options can help businesses make more informed decisions based on their needs and the preferences of their clients.

Comparing Digital and Printed Formats

Both digital and printed documents have their strengths, but they differ in various aspects. Here’s

Digital vs Printed Invoice Contracts

In today’s business landscape, organizations have the option to choose between digital or printed versions of formal agreements and payment documents. Each format comes with its own set of benefits and challenges, and selecting the right one depends on factors like convenience, cost, security, and environmental considerations. Understanding the differences between digital and printed options can help businesses make more informed decisions based on their needs and the preferences of their clients.

Comparing Digital and Printed Formats

Both digital and printed documents have their strengths, but they differ in various aspects. Here’s a comparison of the two:

| Feature | Digital | Printed |

|---|---|---|

| Speed of Delivery | Instant delivery via email or cloud-based platforms, reducing waiting time. | Requires physical mailing, which can take several days depending on the location. |

| Cost | No printing or postage costs, making it a cost-effective option. | Requires printing, paper, and postage, adding to the overall expense. |

| Environmental Impact | More eco-friendly as it eliminates the need for paper and reduces waste. | Less eco-friendly due to paper use, printing, and waste generation. |

| Security | Can be secured with encryption and password protection, making it less prone to tampering. | Physical documents can be lost or damaged, and require additional security measures, such as storage in a safe. |

| Ease of Access | Accessible from anywhere with an internet connection, allowing for easier tracking and record-keeping. | Limited to physical storage, which can be cumbersome to manage and locate. |

When to Use Each Format

The decision to use a digital or printed document depends largely on the nature of the transaction, the preference of the parties involved, and the level of formality required. Digital formats are ideal for fast, efficient communication and transactions, especially when dealing with international clients or time-sensitive situations. Printed versions may still be necessary in certain legal contexts or for clients who prefer physical copies for their records.

Ultimately, businesses should weigh the benefits of both formats and choose the one that aligns with their operational needs and environmental goals.

How to Deal with Disputes in Contracts

Disputes can arise in any professional agreement, whether due to misunderstandings, unmet expectations, or differences in interpretation. Handling these disputes effectively is essential to maintaining positive relationships and ensuring that business operations continue smoothly. Addressing conflicts early and professionally can prevent them from escalating and protect both parties’ interests.

Steps to Resolve Disputes

When a dispute arises, following a structured approach can help facilitate resolution. Here are the key steps to take when addressing conflicts:

- Review the Terms: Start by revisiting the original agreement to ensure both parties understand the terms clearly. This helps identify any potential misunderstandings and clarify obligations.

- Open Communication: Reach out to the other party to discuss the issue in a calm and professional manner. Often, simply talking through the situation can lead to a resolution.

- Identify the Root Cause: Determine the underlying cause of the dispute–whether it’s about the scope of work, payment terms, or expectations. Understanding the core issue helps in finding an effective solution.

- Negotiate a Compromise: Both parties may need to make concessions to reach a satisfactory solution. Focus on finding common ground and offering reasonable compromises that benefit both sides.

- Document the Outcome: Once a resolution is reached, ensure the terms are documented and agreed upon. This protects both parties and provides a record of the settlement in case further issues arise.

Additional Tips for Preventing Disputes

To minimize the likelihood of disputes in the future, consider implementing these best practices:

- Clear Terms and Conditions: Always ensure that the terms of the agreement are clear, detailed, and mutually understood from the beginning. Ambiguities can lead to misunderstandings later.

- Set Realistic Expectations: Be transparent about what can realistically be delivered within the agreed-upon timeframes and scope. Setting unrealistic expectations can lead to frustration and disputes.

- Regular Communication: Maintain open lines of communication throughout the project or engagement. Regular updates help ensure both parties are on the same page and can address issues before they escalate.

- Use Mediation if Necessary: If direct communication doesn’t resolve the issue, consider involving a neutral third party for mediation. Mediation can help facilitate a fair resolution without resorting to legal action.

By approaching disputes with a clear plan and maintaining professionalism, businesses can resolve conflicts effectively and preserve valuable relationships.

Protecting Your Business with Contracts

Having formal agreements in place is essential for safeguarding your business interests. These written documents serve as a foundation for clear communication, outlining the rights and responsibilities of all parties involved. Whether you are providing services, selling goods, or entering into partnerships, a well-crafted agreement helps minimize risks, prevents misunderstandings, and offers legal protection in case of disputes.

Why Formal Agreements Are Essential

Formal agreements are a critical tool for ensuring that both parties are aligned in their expectations. They clearly define the terms of the arrangement, such as deliverables, timelines, and payment schedules, which helps avoid confusion down the line. More importantly, these documents act as a safeguard if one party fails to meet their obligations, offering a legal recourse to resolve the issue fairly.

Key Protections for Your Business

When creating a formal agreement, there are several important protections you can include to help secure your business:

- Clear Payment Terms: Specify how and when payments will be made to avoid delays or disputes regarding financial matters.

- Confidentiality Clauses: If sensitive information is being exchanged, include provisions to protect trade secrets, intellectual property, and any proprietary knowledge.

- Dispute Resolution: Outline the steps to be taken in case of a disagreement, including mediation or arbitration procedures, to avoid costly legal battles.

- Limitation of Liability: Protect your business from excessive liability by clearly stating the limits of your responsibility under the agreement.

- Termination Conditions: Define the conditions under which the agreement can be terminated by either party, including any notice requirements and penalties for early termination.

By implementing these protections, you not only ensure that your business is legally protected but also set clear boundaries and expectations that can help build trust and professionalism with your partners, clients, and suppliers.

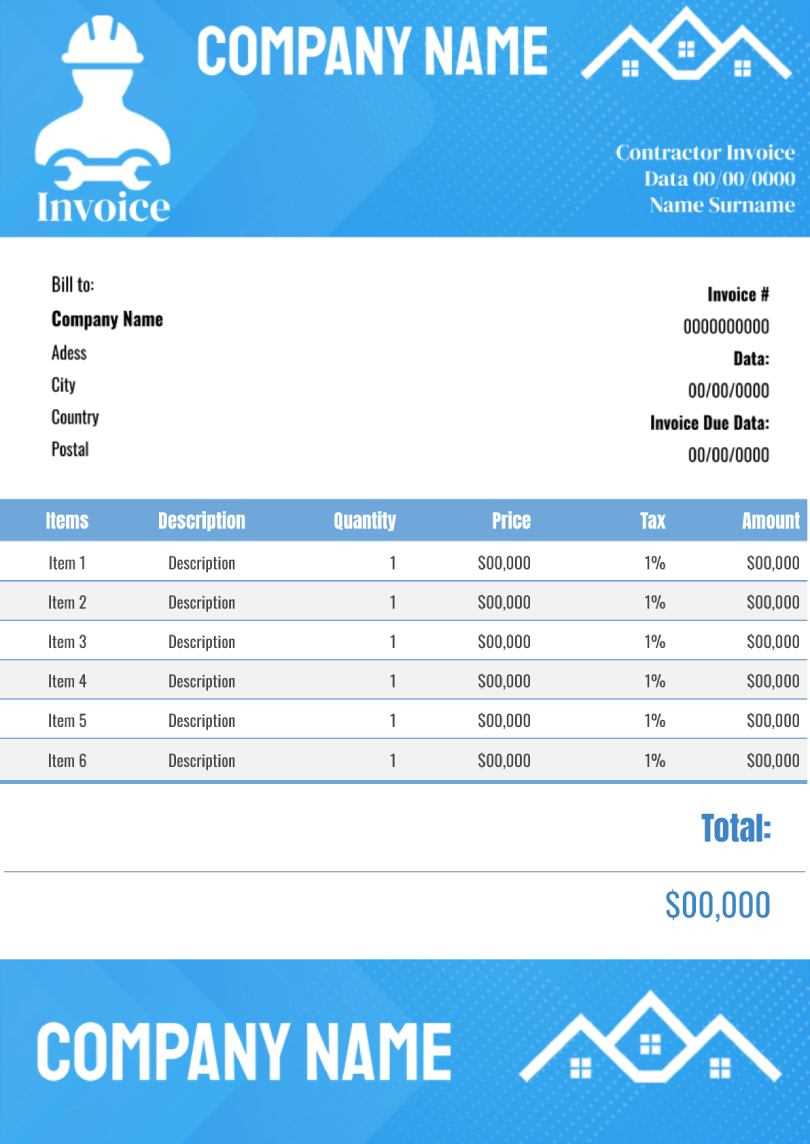

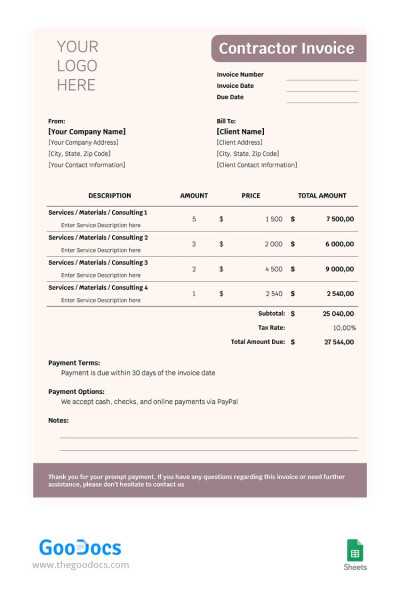

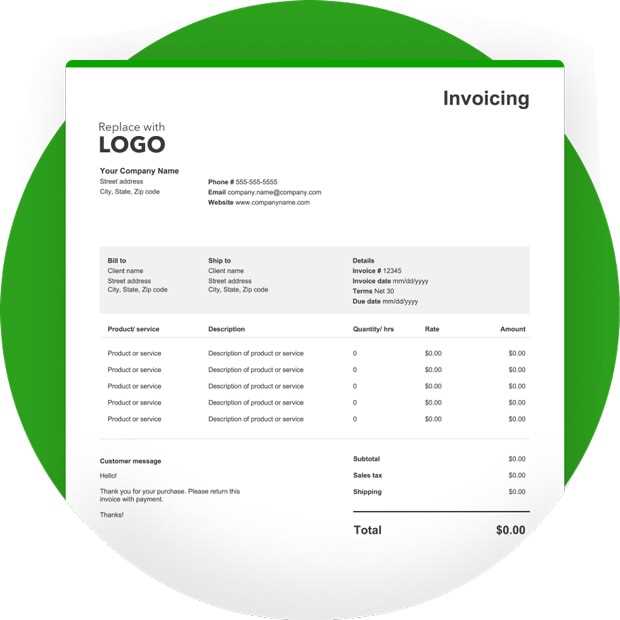

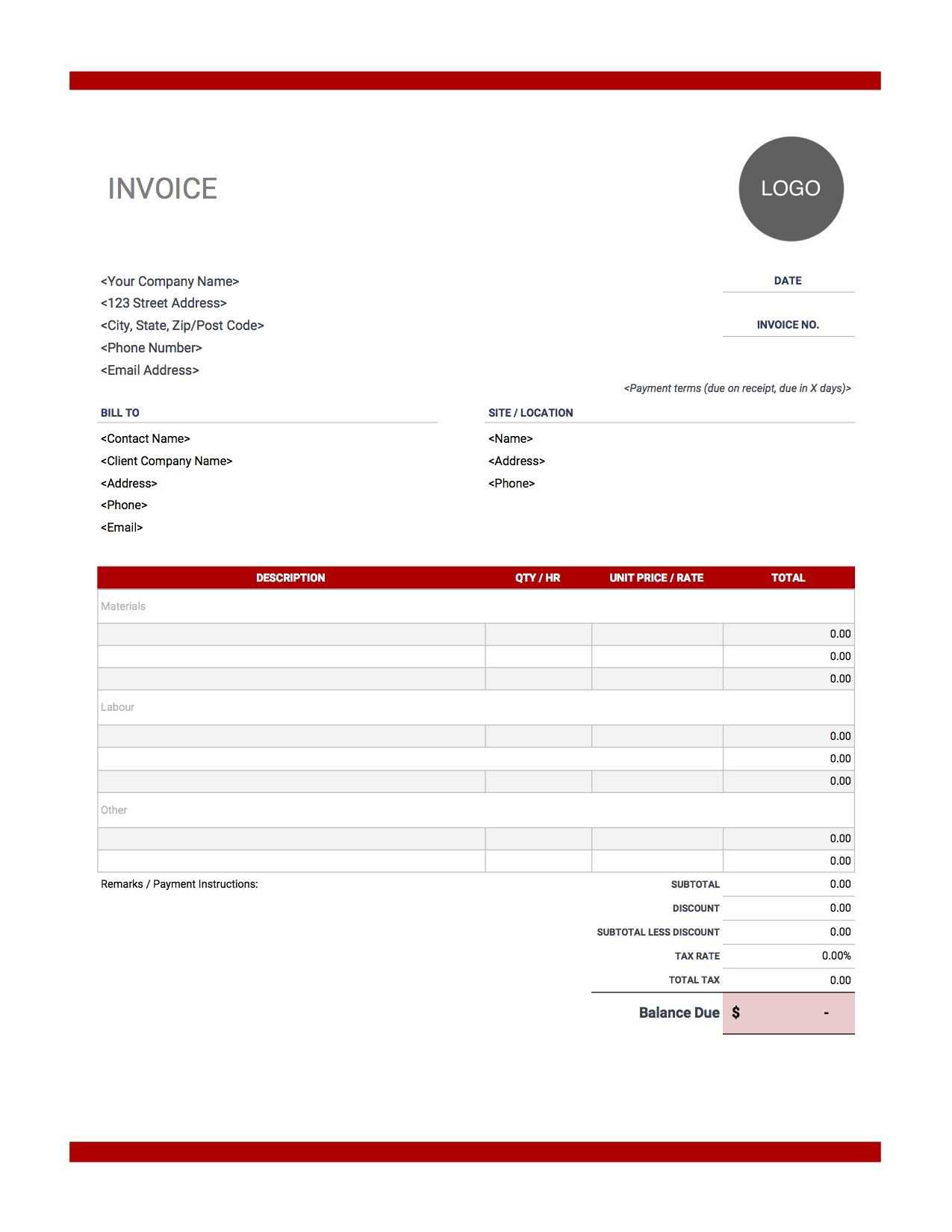

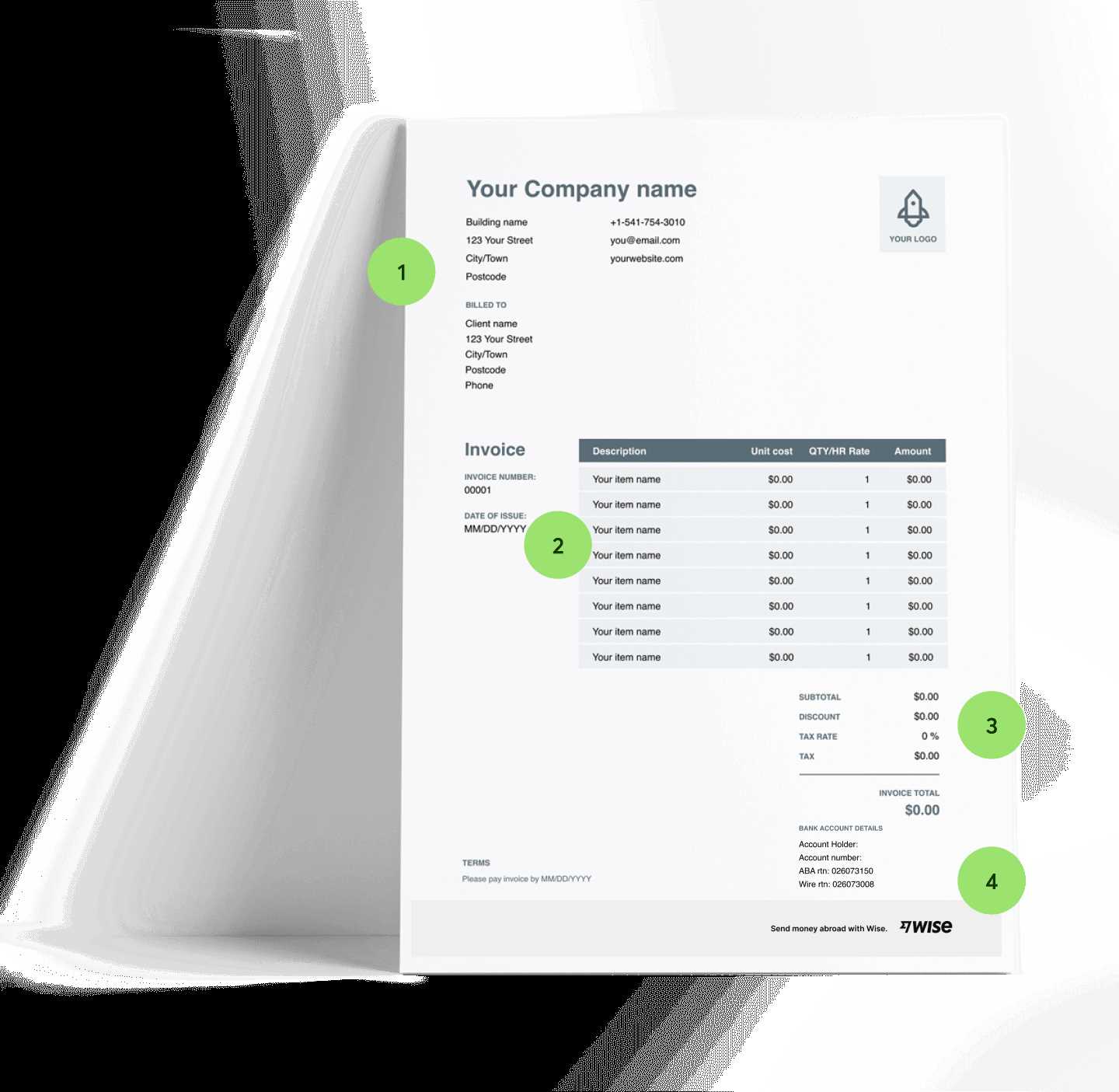

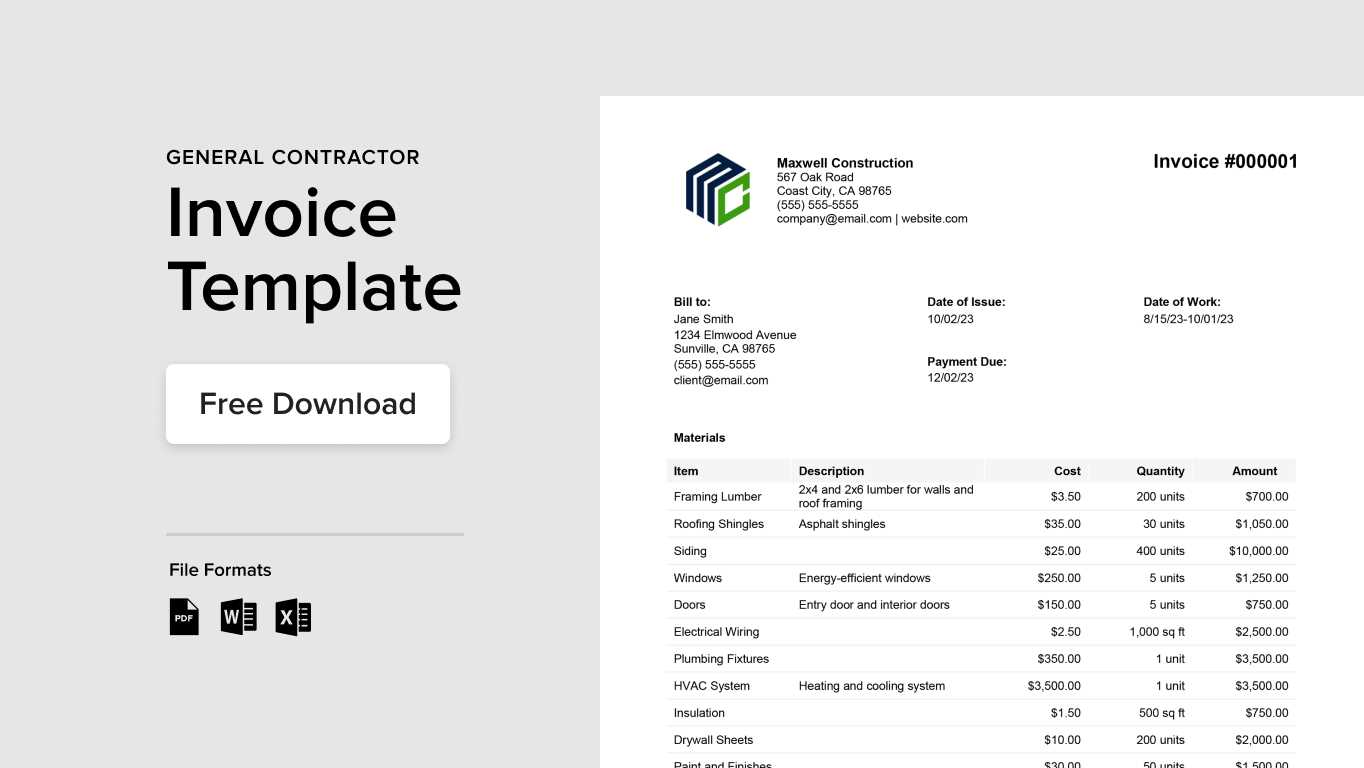

Free Resources for Invoice Templates

Creating accurate and professional-looking documents for business transactions doesn’t have to be expensive. There are numerous free resources available online that offer customizable formats, allowing businesses of all sizes to create customized payment documents easily. Whether you’re just starting out or need a quick solution, these tools can save you time and money while ensuring that your documents meet all necessary standards.

Top Free Resources for Document Templates

Here are some popular resources where you can find free templates to suit your business needs:

- Google Docs: Offers a variety of free templates that are easily customizable. You can create, edit, and store documents in the cloud, allowing for seamless access from anywhere.

- Microsoft Office Online: Microsoft provides a collection of free templates for various types of business documents, including payment forms, with easy editing options.

- Zoho Invoice: A free invoicing tool that offers customizable formats and features for small businesses, allowing you to create professional documents quickly.

- Canva: Known for its design capabilities, Canva provides beautifully designed document templates, including options for billing forms and transaction records that are visually appealing and easy to edit.

- Template.net: This website offers a large selection of free business document templates, including payment-related documents, in various formats like Word, Excel, and PDF.

- Invoice Generator: A straightforward, no-cost tool for creating custom documents with essential fields like pricing, taxes, and payment methods. It’s great for those who need a fast solution without the need for design work.

Benefits of Using Free Resources

Utilizing free resources for creating business documents provides several key advantages:

- Cost-Effective: Free templates eliminate the need for paid software or hiring professionals to create documents from scratch.

- Customization: Most resources allow you to tailor documents to suit your business style and requirements.

- Ease of Use: Many of these tools are user-friendly, making it easy for even those without design or technical skills to create professional documents.

- Time-Saving: Pre-designed formats save time on formatting, allowing you to focus on the content and get your documents ready faster.

With these free t