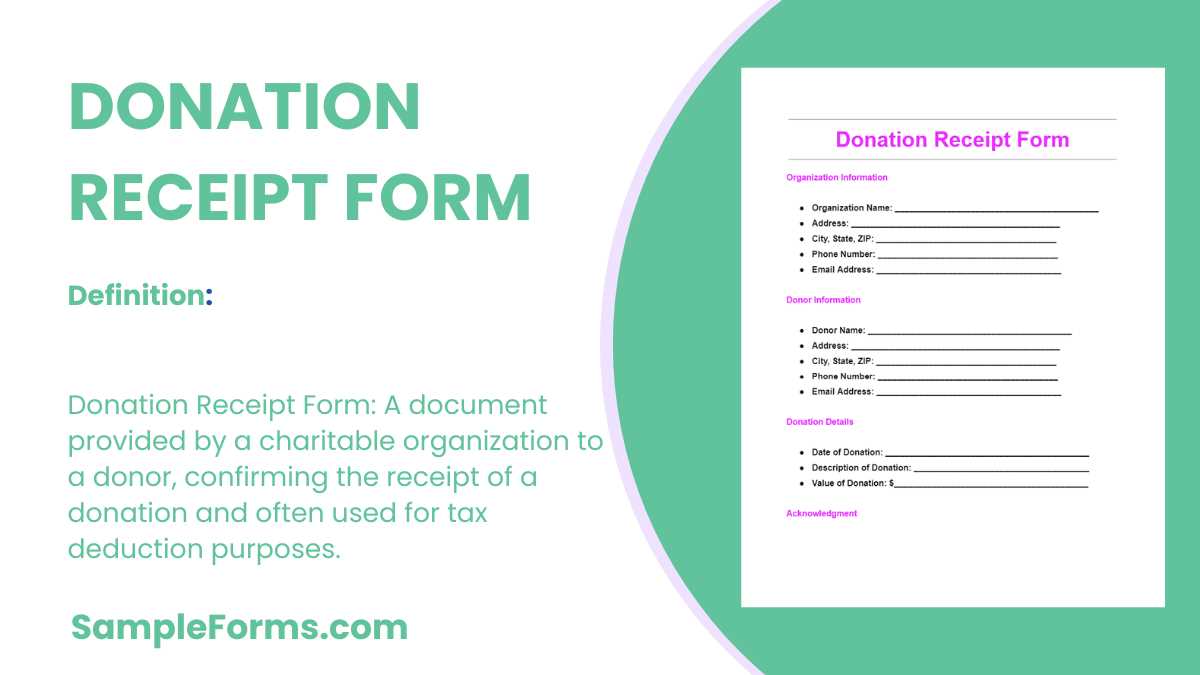

Invoice Template for Donation Made Simple

Managing financial contributions efficiently is essential for both individuals and organizations. Whether you’re running a charity, organizing a fundraiser, or tracking gifts, it’s important to have a clear and professional record of every transaction. This helps in maintaining transparency and building trust with supporters. An organized approach to tracking contributions also simplifies the process for both the giver and the receiver.

Having a structured document that acknowledges received funds can streamline communication and ensure all legal requirements are met. A well-designed record serves not only as a confirmation but also as a tool for tracking totals over time. By using an organized layout, you can provide donors with all necessary details in a simple, easy-to-understand format.

Consistency and accuracy are key when designing such documents. This ensures that both the giver and the recipient have a reliable reference for tax purposes and future transactions. It’s crucial to make sure that all the relevant details are clearly presented without overwhelming the reader. In this guide, we will explore the best practices for creating these essential documents, offering practical advice on how to create clear and effective records for every contribution received.

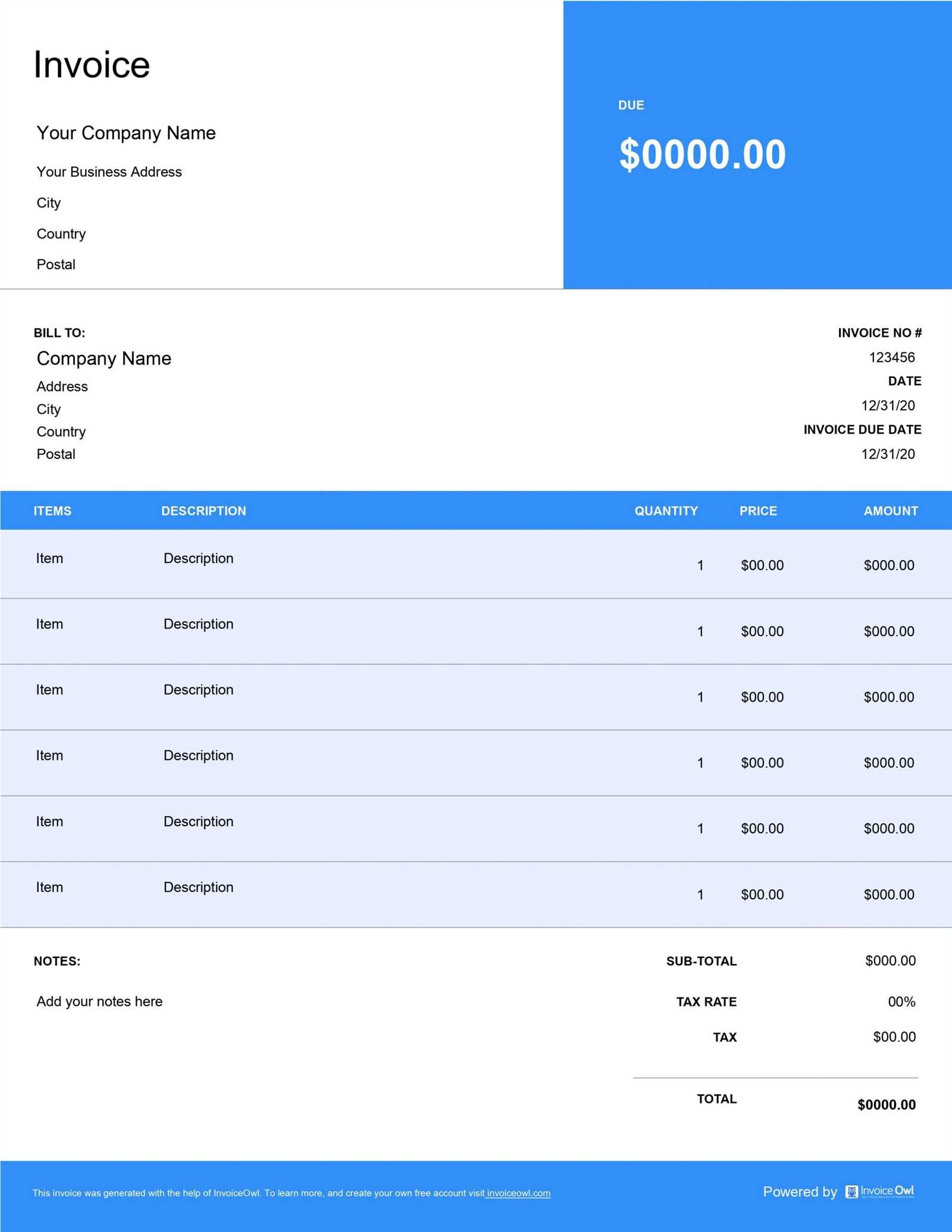

Invoice Template for Donation

When managing financial contributions, it is important to have a structured document that helps track and confirm the funds received. This document acts as a professional acknowledgment of the amount given, including the details required for both the giver and the recipient. A well-organized record is vital not only for transparency but also for proper documentation for future reference or legal purposes.

Key Elements of a Contribution Record

Each record should contain specific details to ensure that all necessary information is included. The document should clearly state the donor’s name, the amount given, the date of the transaction, and any other relevant identifiers, such as transaction IDs or receipt numbers. It is also important to include a short description of the purpose of the funds or the program they support, ensuring clarity for both parties involved.

Customizing Your Contribution Record

Customizing the document to suit your specific needs is an essential part of the process. Different organizations or individuals may have varying requirements depending on their sector or the type of financial exchange taking place. Including branding, such as a logo or specific design elements, can add a personal touch and further enhance professionalism. Additionally, it is important to make sure the format is simple and easy to read, avoiding unnecessary complexity.

Why Use an Invoice for Donations

Providing a formal record of financial gifts offers both practical and legal benefits. Whether supporting a cause or contributing to a personal project, having a well-documented acknowledgment ensures that all parties involved have a clear understanding of the transaction. Such a record serves not only as proof of the amount given but also as a reference point for future purposes, including tax deductions and financial audits.

One of the main reasons for using a structured document is legal compliance. Many jurisdictions require specific documentation for charitable gifts, ensuring that funds are tracked and properly reported. Without such records, it can be challenging to verify the legitimacy of contributions, potentially leading to misunderstandings or complications. Additionally, donors benefit from clear documentation that can be used to claim tax deductions, making it an essential tool for both parties.

Key Features of a Donation Invoice

To ensure that financial gifts are properly acknowledged and documented, certain key elements must be included in a formal record. These features help make the document clear, accurate, and useful for both the giver and the recipient. Including all relevant information is essential to avoid confusion and provide a reliable reference for future purposes.

- Donor Information: Clearly display the name and contact details of the person or entity making the contribution.

- Amount Contributed: Specify the exact amount given, making it easy to understand and verify.

- Transaction Date: The date when the contribution was made should be included to track the timing of the gift.

- Purpose of Contribution: A brief description of the intended use or cause the funds are supporting provides context for the giver.

- Receipt Number or ID: This unique identifier helps track the contribution and provides a reference point for any future inquiries.

- Legal Disclaimer: A note about tax benefits or legal considerations may be necessary depending on the jurisdiction.

Including these details ensures that the document is both professional and effective in tracking contributions. It helps prevent misunderstandings and provides both the giver and the recipient with a clear, accurate record of the transaction.

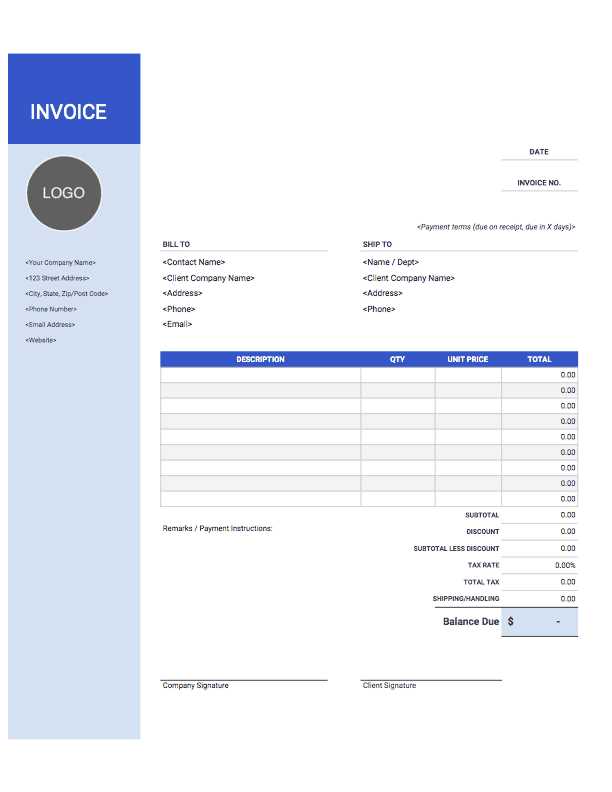

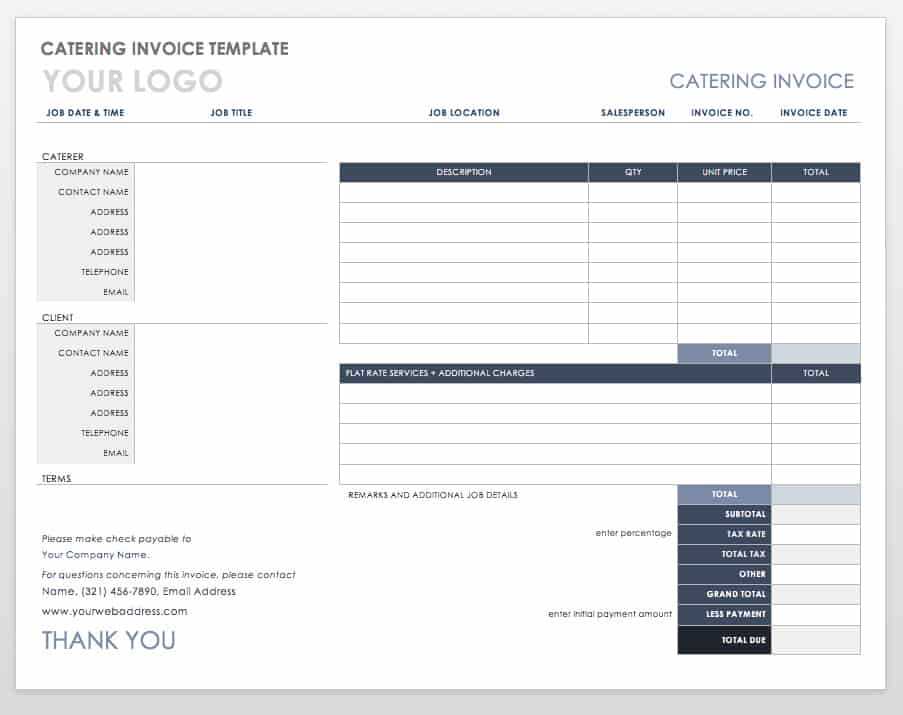

How to Customize Your Invoice Template

Creating a personalized record for financial contributions allows you to tailor the document to your specific needs while maintaining professionalism. Customization ensures that your acknowledgment aligns with your brand or organization’s identity, making it both functional and visually appealing. By adjusting the layout, design, and content, you can create a clear and effective document that suits various situations.

Adjusting Layout and Design

The first step in customizing your document is determining the overall layout and structure. Consider the following key elements to ensure clarity:

- Header: Include your logo, organization name, and contact details for easy recognition.

- Sections: Divide the document into clear sections, such as contribution details, donor information, and purpose.

- Font and Color: Choose a simple, readable font and color scheme that aligns with your branding.

Including Relevant Information

Once the layout is set, ensure that all the necessary details are included for proper documentation. Some key elements to personalize include:

- Contribution Amount: Make sure the amount is easy to locate and stands out on the page.

- Personal Message: Adding a personalized thank-you note or message from your organization can enhance the recipient’s experience.

- Legal Information: If required, include any legal disclaimers or tax-related details that apply to the contribution.

By adjusting these components, you can create a document that is not only professional but also tailored to reflect the unique nature of your contributions and supporters.

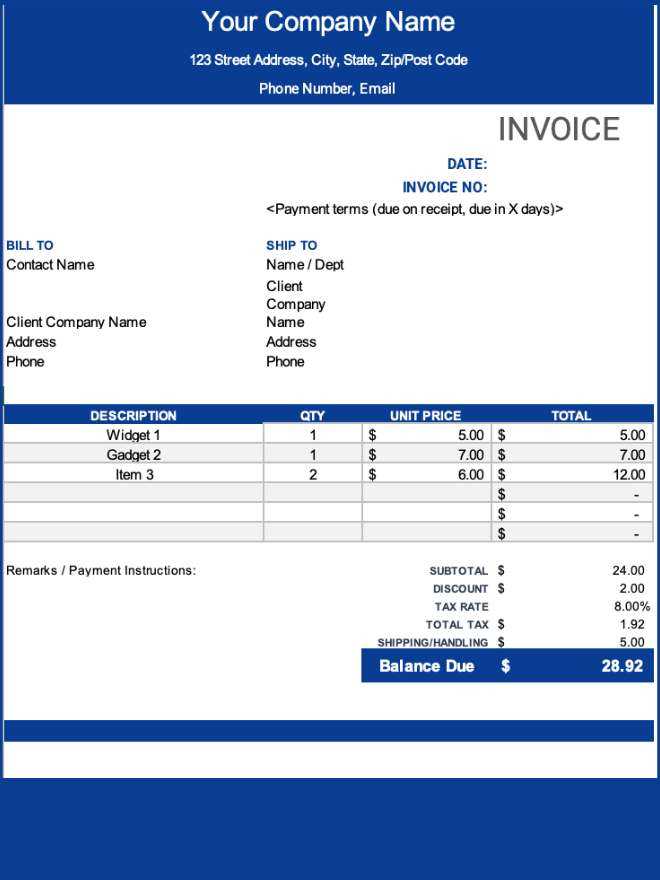

Best Formats for Donation Invoices

Choosing the right structure for acknowledging financial contributions is essential to ensure clarity and professionalism. The format you select affects how easy it is to understand the key details and makes it easier for both the giver and the recipient to manage their records. Different formats suit different needs, whether it’s a simple donation receipt or a more complex acknowledgment for larger contributions.

Digital Formats

Digital formats are becoming increasingly popular due to their convenience and ease of sharing. Common digital formats include:

- PDF: Portable and easy to share, PDF files are ideal for maintaining a professional appearance and ensuring that the document’s format remains consistent across devices.

- Excel/CSV: These formats are useful for those who need to track multiple transactions or manage large volumes of contributions. They allow for quick updates and easy sorting of data.

Printed Formats

Printed records are still widely used for those who prefer tangible documents or need to provide physical copies for legal purposes. Consider these options for printed acknowledgment:

- Pre-printed Forms: These are ready-to-use, customizable forms that can be printed with your organization’s details. Ideal for large-scale fundraisers.

- Custom Printed Pages: For a more personalized touch, create a custom layout that includes your organization’s logo, a message of thanks, and all necessary information.

Choosing the right format depends on your specific needs and how you intend to distribute the record. Whether digital or printed, the key is to ensure the document is clear, professional, and easy to reference.

Common Mistakes to Avoid in Donation Invoices

When creating a formal document for financial contributions, it’s important to avoid common errors that could lead to confusion or mismanagement of records. These mistakes can range from missing details to incorrect formatting, which can undermine the professionalism and clarity of the document. By being aware of these pitfalls, you can ensure that the record serves its intended purpose effectively and meets all necessary legal and organizational requirements.

Missing or Incorrect Information

One of the most significant mistakes is failing to include essential details or providing inaccurate information. Missing data can create confusion and make it harder to track contributions accurately. The most common errors include:

| Missing Information | Potential Consequences |

|---|---|

| Donor Name or Contact Info | Difficulty in identifying the giver, making follow-up or legal processing impossible. |

| Contribution Amount | Inaccurate records, leading to problems with financial reporting or tax deductions. |

| Transaction Date | Uncertainty about when the contribution took place, complicating reporting and verification. |

Poor Formatting and Readability

Another common mistake is poor layout or unclear formatting. A cluttered document can make it difficult for the reader to quickly identify key details. To avoid this, ensure the layout is clean, simple, and easy to follow. Key details like the amount and transaction date should be prominent, while other supporting information should be easy to locate.

By avoiding these common mistakes, you can ensure that the formal acknowledgment of contributions remains clear, professional, and legally compliant, helping both the recipient and the giver maintain accurate records.

Legal Considerations for Donation Invoices

When issuing a document that acknowledges a financial contribution, it’s important to understand the legal requirements surrounding such records. This includes ensuring that all necessary information is provided, and that the document complies with tax laws and regulations. Not having the proper documentation can cause issues for both the donor and the recipient, especially when it comes to tax deductions or audits.

Essential Legal Information

In order to meet legal requirements, several key elements should be included in the acknowledgment. Failure to provide these details may result in the document not being valid for tax purposes. Below are the critical elements to ensure compliance:

| Legal Requirement | Explanation |

|---|---|

| Donor Information | Including the donor’s name and contact details is essential for record-keeping and verification. |

| Contribution Amount | Documenting the exact amount donated is necessary for both the donor’s and the recipient’s financial records. |

| Tax Identification Number (TIN) | If applicable, including the organization’s TIN or EIN is critical for compliance with tax laws. |

| Purpose of Contribution | Clearly stating the purpose or the program the funds will support helps demonstrate that the funds are used correctly. |

| Disclaimer or Tax Information | A brief legal note on whether the contribution is tax-deductible or not ensures transparency and clarity. |

Tax Deductions and Compliance

In many regions, individuals or organizations can claim tax deductions for financial gifts made to qualified recipients. To facilitate this, it is essential that the acknowledgment document contains all the required information, as missing or incomplete records could prevent the donor from claiming deductions. Additionally, ensure that the organization receiving the contribution complies with relevant tax-exempt status or other legal requirements.

By addressing these legal considerations, you can ensure that the document serves its intended purpose without causing future complications for either party involved.

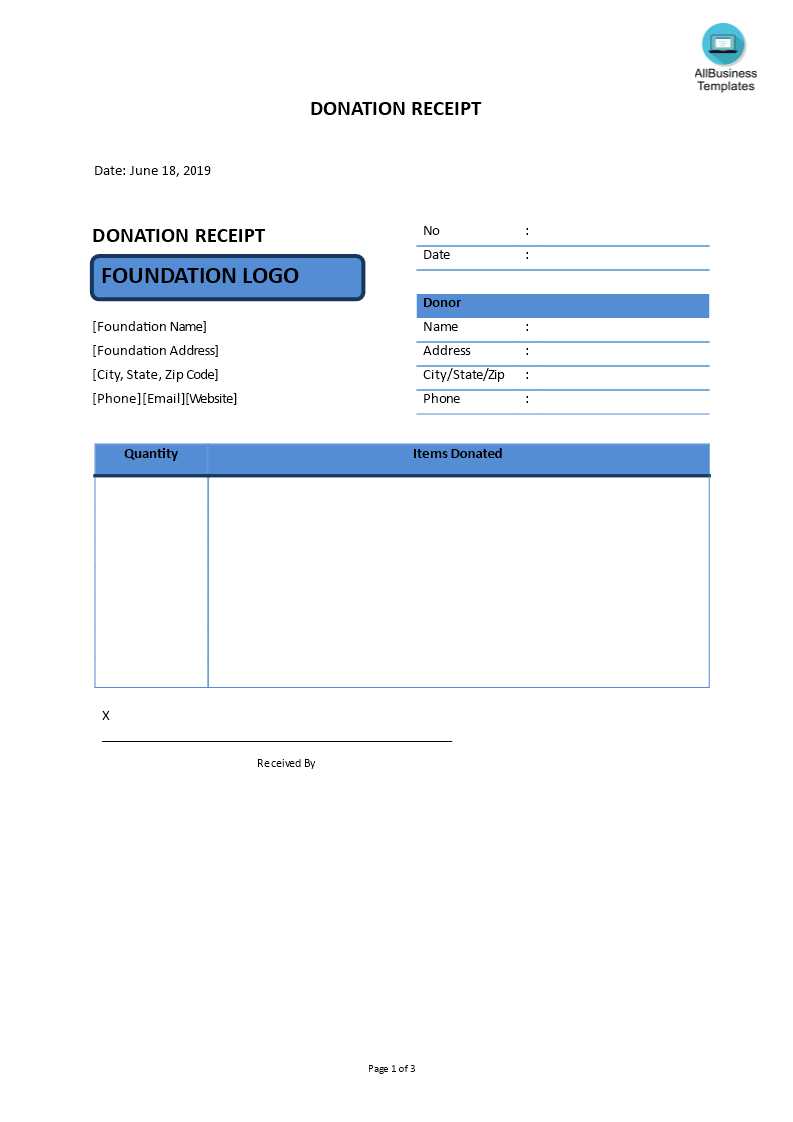

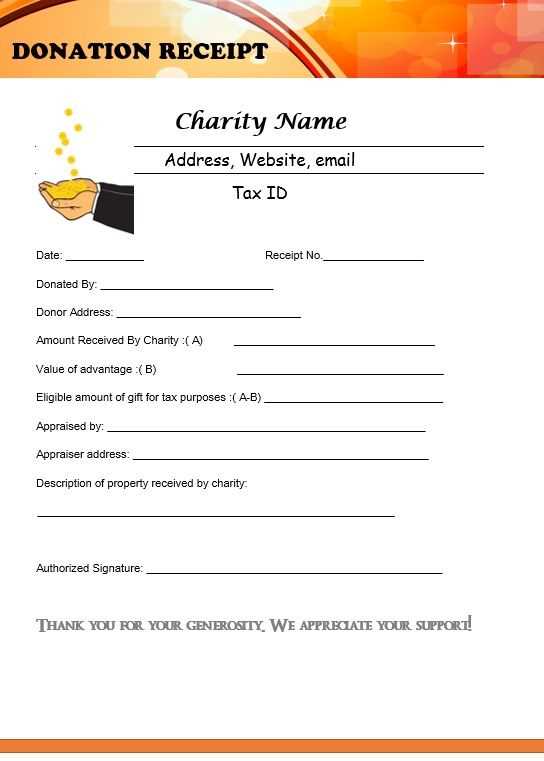

Creating Professional Invoices for Charities

When preparing a formal acknowledgment for contributions made to charitable organizations, it is crucial to ensure the document reflects the professionalism and trustworthiness of the charity. A well-crafted acknowledgment not only serves as a legal and financial record but also helps foster stronger relationships with supporters. By including key details and adhering to certain standards, charities can provide donors with a professional, clear, and informative record of their contributions.

Key Components of a Professional Acknowledgment

To maintain professionalism, certain elements must be included to ensure the document meets both legal and organizational standards. Below are the key components that should be featured in an acknowledgment document for a charity:

| Component | Importance |

|---|---|

| Organization Name and Logo | Helps establish the authenticity and identity of the charity. |

| Donor Information | Essential for both the donor’s and the charity’s record-keeping and tax purposes. |

| Contribution Amount | Precise documentation of the amount is crucial for transparency and for tax deduction purposes. |

| Date of Contribution | Provides clarity on when the funds were received, which is important for both financial reporting and donor acknowledgment. |

| Purpose of the Contribution | Clearly explaining where the funds are directed helps build trust and ensures transparency. |

Best Practices for Charities

To ensure that the acknowledgment not only meets legal requirements but also strengthens the relationship with donors, charities should adhere to best practices in terms of presentation and content. Some key best practices include:

- Clarity: Ensure the document is easy to read, with a clear breakdown of all relevant details.

- Personalization: Add a personal thank-you note or a message expressing gratitude for the donor’s contribution.

- Legal Compliance: Include any necessary tax information or disclaimers related to the contribution’s status for deductions.

- Consistent Branding: Use the charity’s official branding, colors, and fonts to maintain a professional appearance.

By following these guidelines, charities can create professional, effective acknowledgments that help donors feel valued and ensure prop

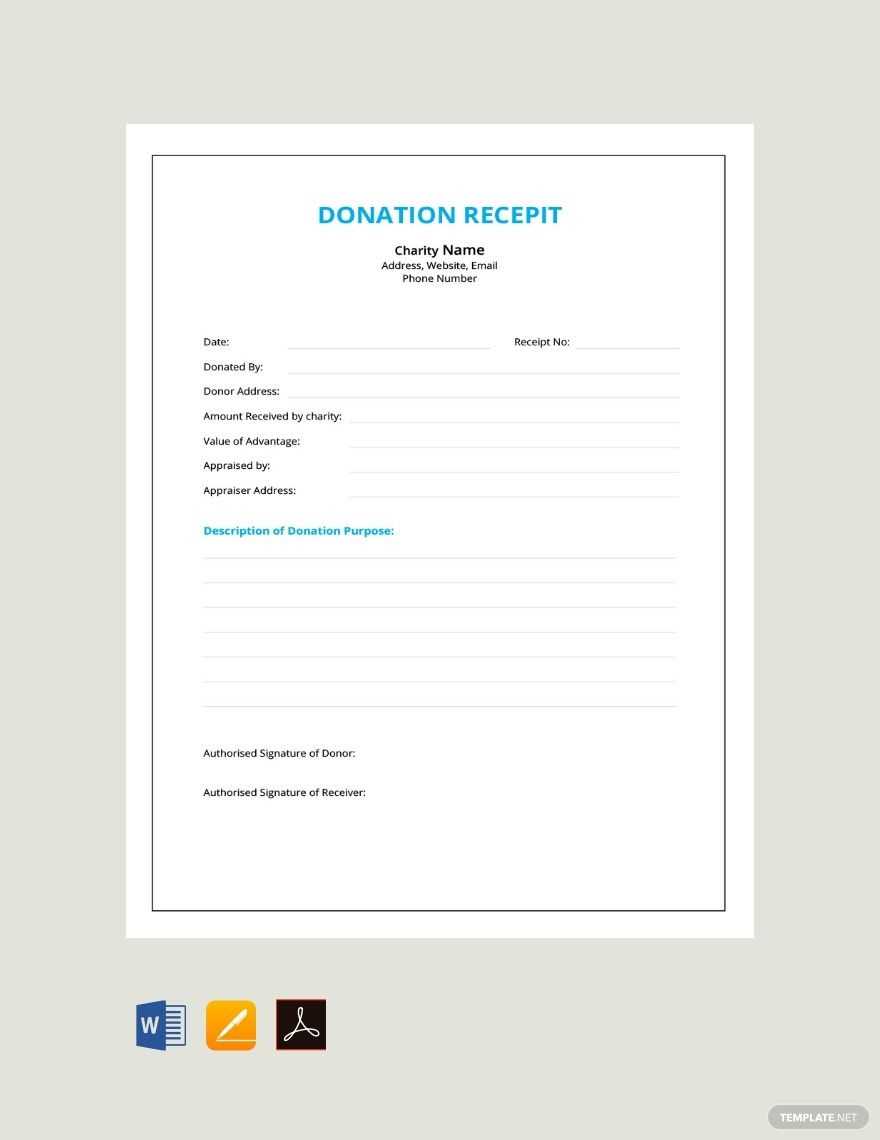

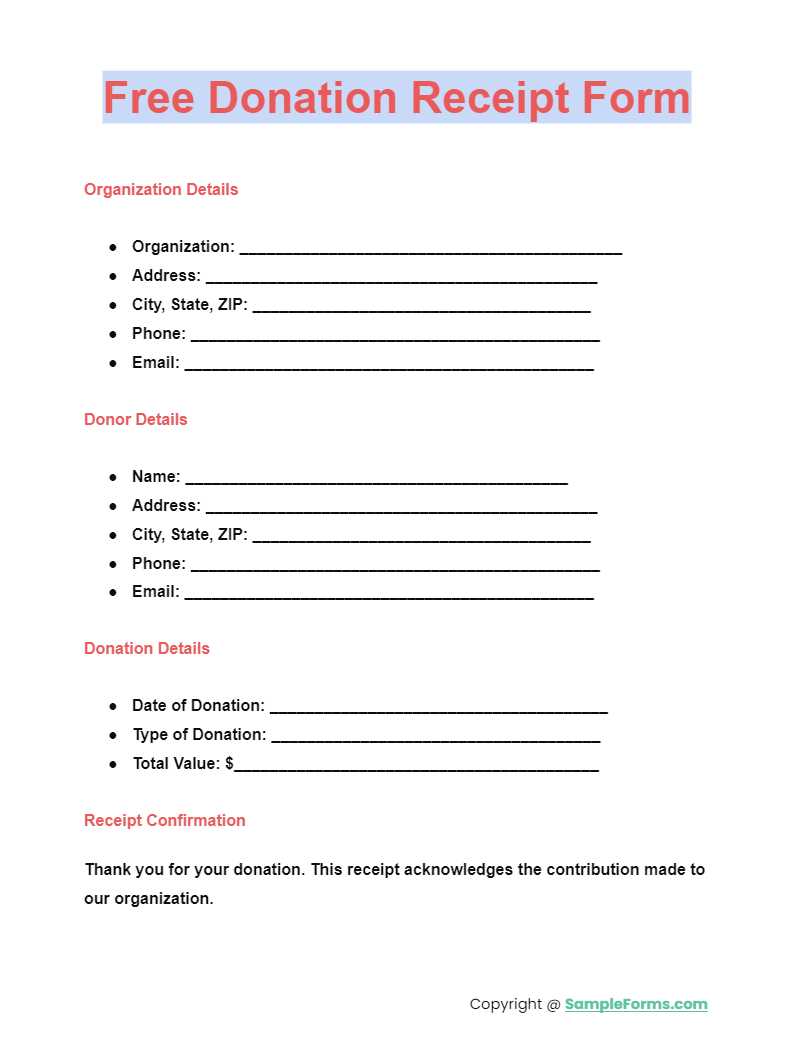

Free Invoice Templates for Donations

When creating formal records for charitable contributions, having access to no-cost resources can be highly beneficial, especially for smaller organizations or individuals handling occasional transactions. Free tools provide a cost-effective way to generate the necessary documents without compromising on quality or functionality. These resources help ensure that all the necessary details are included and properly formatted, making it easier to manage financial records and comply with legal requirements.

Many platforms offer customizable options, allowing users to personalize the documents to suit their needs. Whether you require a simple acknowledgment or a more detailed report, these free solutions ensure that the process is streamlined and accessible. Using such resources can save time, improve accuracy, and provide professional-looking records without additional expenses.

Key benefits of using free resources include:

- Cost-effectiveness: No need to spend money on specialized software or professional services.

- Ease of use: Many free options are designed with simplicity in mind, ensuring that even beginners can create accurate records quickly.

- Customization: Free resources often allow for customization, enabling you to adjust the content and format to match the needs of your organization.

- Accessibility: Many platforms are web-based, meaning they are easy to access from any device with an internet connection.

By taking advantage of these free tools, individuals and organizations can easily create the necessary documents, ensuring proper record-keeping without unnecessary costs.

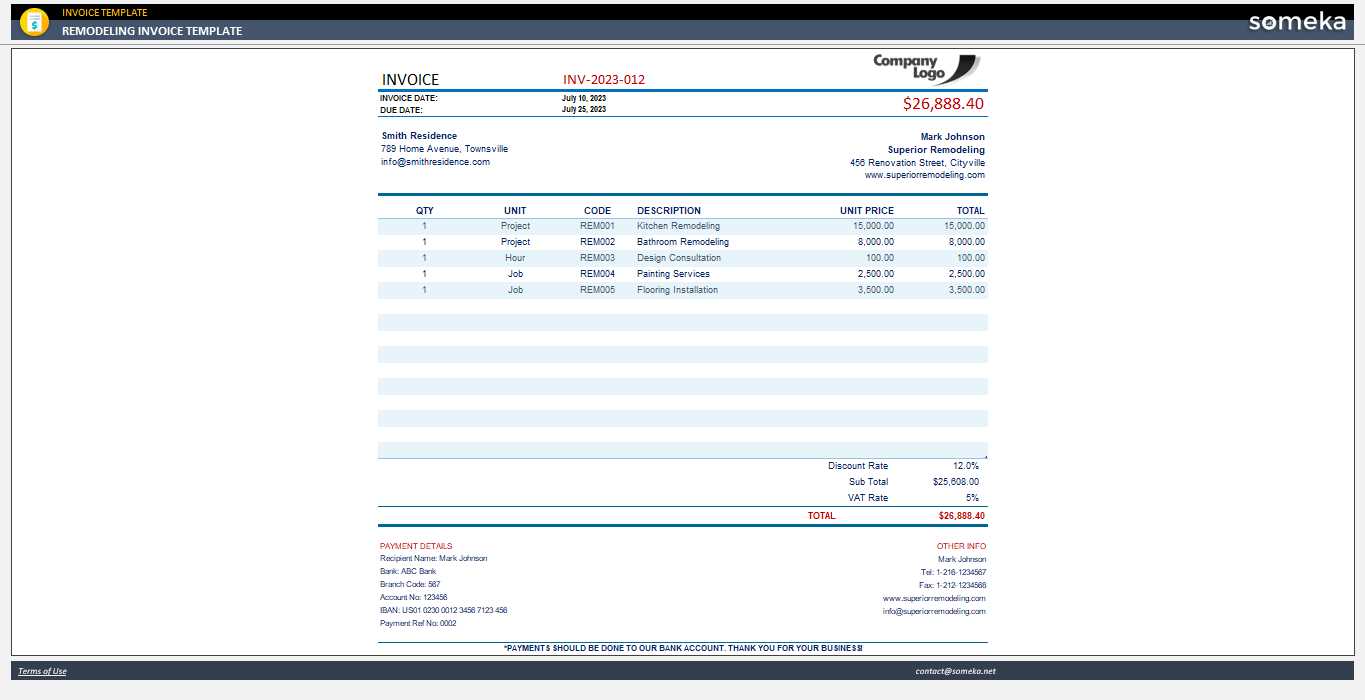

How to Include Tax Information in Invoices

When preparing formal records of financial contributions, including the correct tax information is essential for both legal compliance and transparency. Accurate tax details not only help the donor claim deductions but also ensure that the recipient organization adheres to regulatory requirements. Proper documentation of taxes is vital for both parties, as it simplifies the process for audits and tax filings.

Key Tax Details to Include

To ensure compliance and avoid confusion, it is necessary to include specific tax-related information in each document. Below is a list of the critical tax components to incorporate:

| Tax Detail | Importance |

|---|---|

| Tax Identification Number (TIN) | Include the organization’s TIN or EIN to verify its legal status and to ensure proper tax treatment. |

| Contribution Amount | Clearly state the exact amount contributed, which is necessary for tax purposes and deduction claims. |

| Tax Deductibility Statement | Provide a statement indicating whether the contribution is tax-deductible, including the relevant tax law if applicable. |

| VAT or Sales Tax | If applicable, include information about sales tax or VAT, especially for goods or services exchanged alongside the contribution. |

Formatting and Clarity

To make sure the tax information is easy to understand, format the tax-related details clearly and prominently. Donors should be able to quickly see the tax-deductible amount and understand the implications for their tax filings. Always ensure the details are correctly presented and do not cause confusion during tax reporting or audits.

Including the proper tax information ensures compliance with both tax laws and organizational best practices, benefiting both the donor and the recipient by simplifying future financial processes.

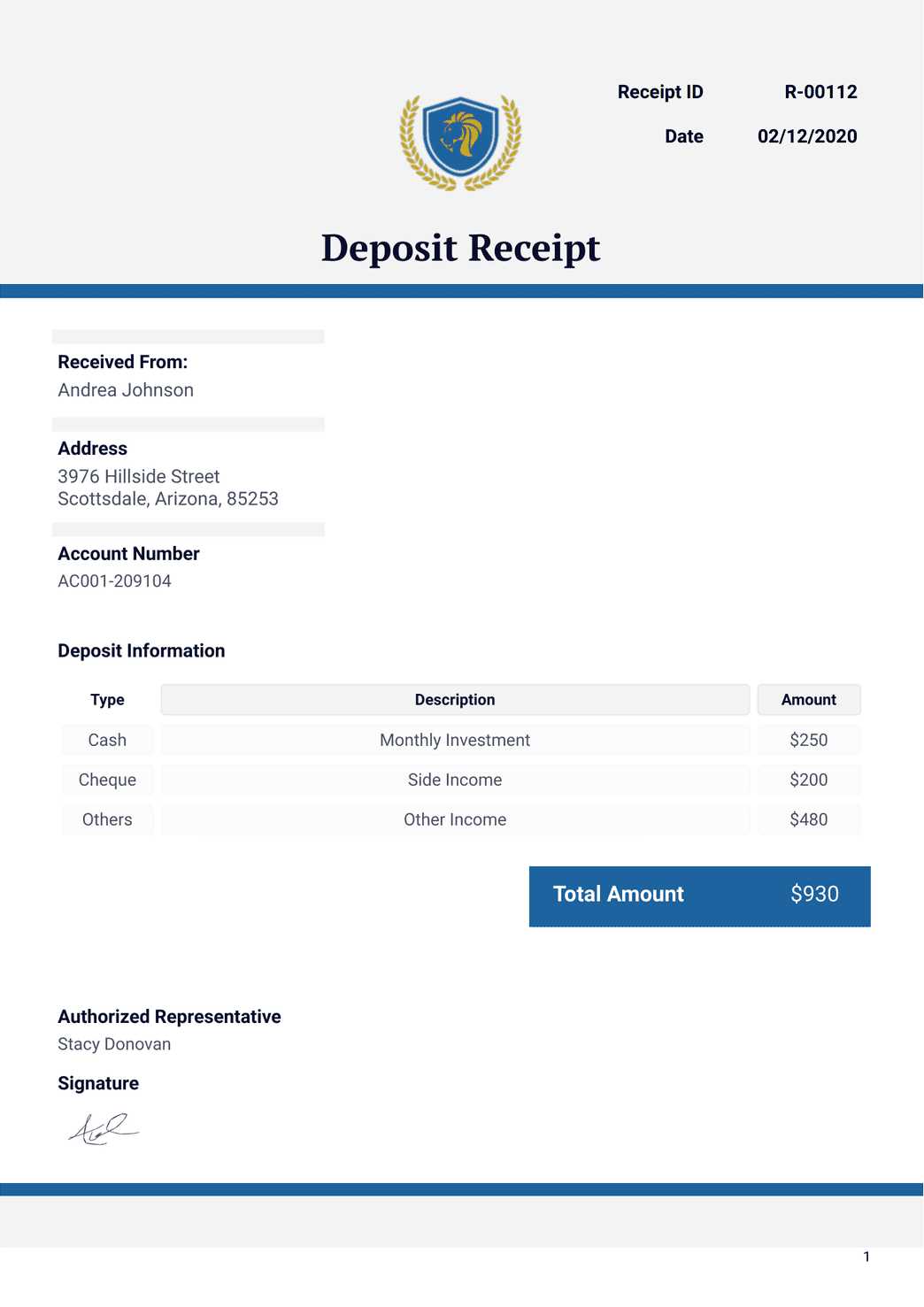

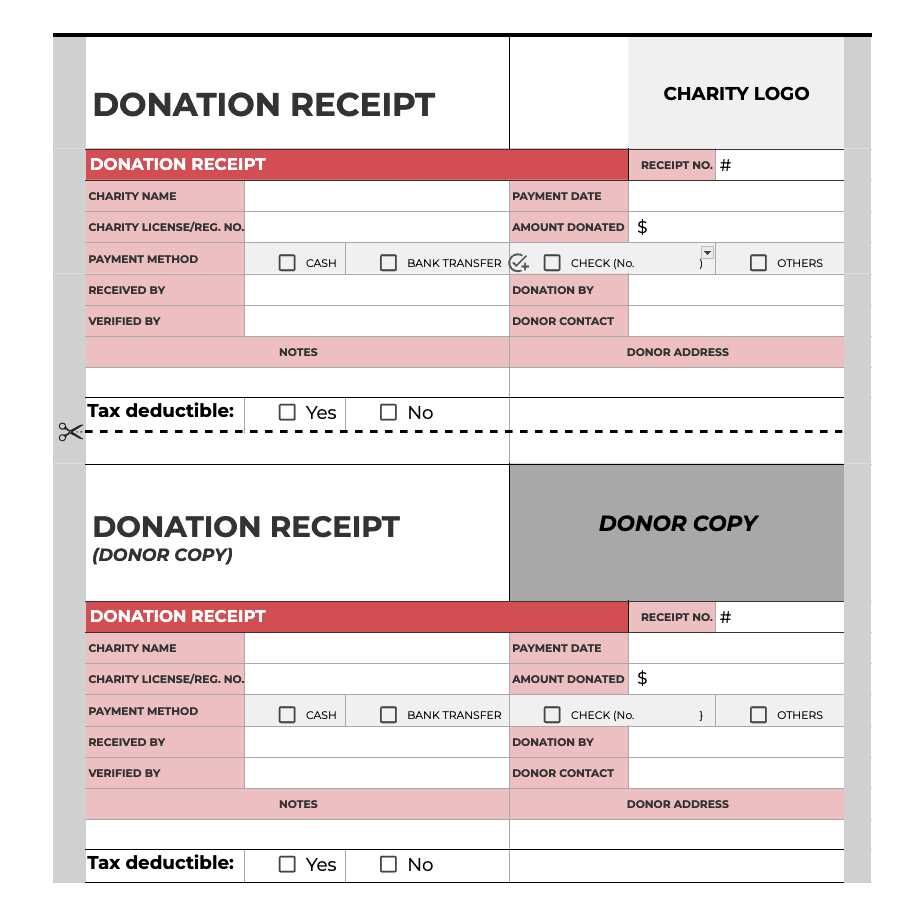

Donor Acknowledgement and Receipt Information

Properly acknowledging the generosity of supporters is a key component of fostering long-term relationships between donors and organizations. When individuals contribute financially, it is essential to provide them with a clear, formal record that both acknowledges their support and serves as proof of the contribution. This acknowledgment not only expresses gratitude but also provides donors with the necessary information for tax purposes and future reference.

Essential Information to Include

To ensure the document serves its purpose both for the donor’s records and the organization’s compliance, certain pieces of information should always be included. The following elements are crucial:

- Organization’s Name and Contact Information: Make sure the charity or organization’s full name, address, and contact information are clearly stated.

- Donor’s Information: Include the donor’s name and contact details to properly identify the contributor.

- Contribution Amount: Clearly indicate the exact value of the contribution made by the donor.

- Date of Contribution: The date when the contribution was made should be accurately recorded.

- Purpose of Contribution: If applicable, note the specific program or cause the contribution is supporting, helping the donor understand where their funds are directed.

- Tax-Deductibility Statement: Include a statement confirming the tax-deductible status of the contribution, if relevant, with a reminder that no goods or services were provided in exchange for the donation.

Importance for Record Keeping

Clear acknowledgment and accurate record-keeping are vital for ensuring that donors can claim their contributions for tax deductions. A receipt that is correctly formatted with all necessary details also serves as a key part of an organization’s financial documentation, making it easier to manage audits and comply with regulations. Providing this information helps build trust, transparency, and long-term relationships with contributors.

Understanding Donation Invoice Guidelines

When preparing formal records for charitable contributions, it is essential to adhere to certain standards and guidelines that ensure accuracy, legality, and transparency. These guidelines not only help organizations maintain compliance with tax regulations but also provide clarity to donors regarding their financial support. By following proper practices, organizations can foster trust and ensure that all necessary information is clearly communicated to contributors.

Key Considerations When Creating Contribution Records

There are several crucial elements to keep in mind when preparing these documents. Following these guidelines ensures that the records are legally sound and provide the donor with all necessary details for their tax filings. Some of the most important considerations include:

- Clear Identification: Both the donor and the organization should be clearly identified with complete contact information. This helps validate the contribution and ensures proper crediting for the donor.

- Accurate Date and Amount: The exact date of the contribution and the total amount donated should be recorded without any ambiguity.

- Tax-Deductibility Confirmation: Include a statement confirming whether the contribution is tax-deductible, in line with the relevant tax laws.

- Purpose of Contribution: If the donation is designated for a specific project or cause, this should be clearly indicated to provide context for the donor.

Compliance with Legal Requirements

In many jurisdictions, there are specific laws regarding how contributions should be documented, especially when they are intended for tax deductions. Organizations must ensure that their records comply with these legal requirements to avoid potential issues. Ensuring proper documentation helps both the donor and the organization remain compliant with government regulations, facilitating smoother tax processing and audits.

By following these basic guidelines, organizations can create accurate and professional records that serve the needs of both the donor and the recipient, while fostering transparency and trust in the contribution process.

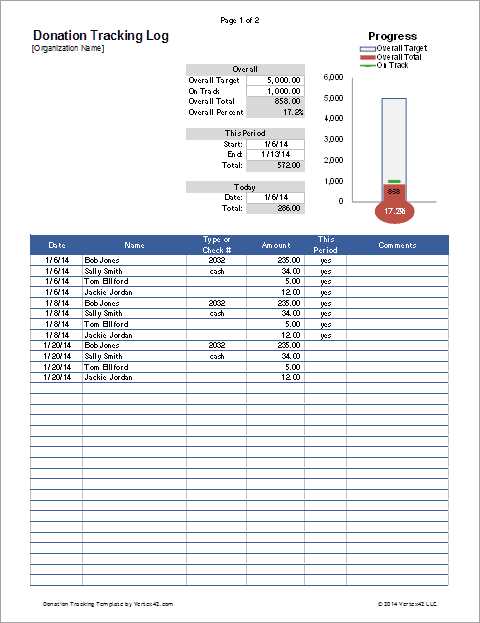

How to Track Donations with Invoices

Tracking financial contributions is a crucial aspect of managing charitable funds. It ensures that donations are properly documented, provides transparency for donors, and supports accurate financial reporting for the organization. One effective way to achieve this is by creating detailed records that track each contribution, making it easier to manage and report on funds received.

Steps to Effectively Track Contributions

By following a structured approach, organizations can ensure that they are capturing all the necessary information for every contribution. Here are some important steps to consider when managing donation records:

- Record Each Contribution: Make sure that every donation is logged separately, including the date, amount, and donor’s contact information.

- Assign Unique Identifiers: Assigning a unique reference number or code to each donation helps in easily locating and tracking specific records, especially in the case of large volumes of contributions.

- Include Purpose of Donation: If the contribution is directed to a specific program or cause, note this clearly. This helps in ensuring the donor’s intent is respected.

- Track Donation Status: Include a status indicator such as “received,” “confirmed,” or “completed” to track the progress of each donation.

Best Practices for Managing Contributions

In addition to capturing the essential details, it is important to maintain a well-organized system for managing these records. Consider using a digital system or database to store records securely, ensuring easy access when needed. Regularly updating your donation logs and creating periodic reports can help identify trends and patterns in contributions.

- Consistency: Make sure that all records are filled out consistently to avoid discrepancies and

Automating the Donation Invoice Process

Streamlining the process of managing charitable contributions can significantly reduce the time spent on administrative tasks and minimize errors. By automating the creation and management of donation records, organizations can ensure efficiency, accuracy, and consistency in their documentation efforts. Automated systems can also provide donors with instant confirmation of their contributions, enhancing the overall donor experience.

Benefits of Automating the Process

Automation offers numerous advantages that can help improve both organizational efficiency and donor satisfaction. Some key benefits include:

- Increased Efficiency: Automating the process reduces manual data entry, allowing organizations to process donations faster and more accurately.

- Accuracy and Consistency: Automated systems ensure that all details are recorded correctly and consistently, reducing the risk of human error.

- Instant Acknowledgment: Donors receive immediate confirmation of their contributions, which improves communication and trust.

- Time Savings: With automation, staff can focus on more strategic tasks, such as building donor relationships and improving fundraising efforts.

How to Implement Automation

Implementing automation in managing contribution records doesn’t need to be complicated. Here are some simple steps to get started:

- Choose the Right Software: There are various tools and platforms designed to manage charitable contributions and automate the creation of records. Research and select the one that best fits the needs of your organization.

- Set Up Custom Fields: Most systems allow you to customize fields to capture the necessary details, such as donor information, amount, and purpose of the contribution.

- Integrate Payment Systems: Many payment processors offer integration options that allow automated creation of records once a contribution is made, eliminating the need for manual input.

- Enable Automated Acknowledgments: Set up the system to automatically send thank-you messages or receipts to donors as soon as their contributions are recorded.

By integrating automation into the donation tracking process, organizations can save time, reduce errors, and improve the overall experience for both staff and donors. This streamlined approach enhances efficiency while ensuring all contributions are properly documented and acknowledged.

Importance of Accurate Donation Records

Maintaining precise records of financial contributions is essential for both organizations and their supporters. When every transaction is accurately documented, it ensures that both parties have clear, verifiable evidence of the exchanges. This clarity not only builds trust but also helps in the smooth management of funds, whether for tax purposes, financial audits, or transparency in how funds are used.

Legal and Tax Compliance: Properly recording all contributions is crucial to meet legal and tax obligations. Accurate data helps ensure that all donations are appropriately acknowledged for tax deductions, and that organizations comply with tax regulations. Mistakes in records can lead to legal issues or missed opportunities for donors to claim tax benefits.

Transparency and Trust: For charities and other non-profit organizations, transparency is key to maintaining the trust of their supporters. Donors are more likely to continue contributing when they see that their support is being accurately tracked and used effectively. Detailed records allow for clear communication about how donations are allocated and spent.

Financial Reporting: Accurate records are also essential for effective financial management and reporting. With precise documentation, organizations can easily generate reports on the total amount raised, the source of each contribution, and how funds are being spent. This information is critical for evaluating the success of fundraising efforts and ensuring that all financial activities align with the organization’s mission.

Donor Recognition: Timely and accurate tracking allows for proper acknowledgment of donor contributions. When supporters receive the correct recognition for their generosity, it enhances their satisfaction and encourages future donations. This acknowledgment can take the form of personalized thank-you messages or public recognition in reports or on the organization’s website.

In conclusion, accurate record-keeping is more than just a practical necessity; it is a foundational element of good stewardship and relationship-building. By ensuring that every contribution is meticulously documented, organizations can maintain legal compliance, enhance transparency, and foster greater trust with their supporters.

Designing an Easy-to-Read Invoice

Creating clear and well-structured records for contributions is essential for ensuring that both donors and recipients can easily understand the details of the transaction. A well-designed document ensures that all necessary information is presented in a way that is intuitive, concise, and visually appealing. This helps eliminate confusion and minimizes the risk of errors, making it easier for both parties to review and process the information.

Organized Layout: The layout of the document plays a critical role in how easily information can be digested. Clear headings, logical groupings, and sufficient spacing between sections make the document easier to navigate. Grouping similar details, such as donor information and contribution specifics, in distinct sections enhances readability.

Readable Fonts and Size: Font selection is another key factor in legibility. Choose fonts that are easy to read on both digital and printed formats. Sans-serif fonts like Arial or Helvetica are often recommended for their clean and modern appearance. Additionally, appropriate font sizes should be used, with larger fonts for headings and smaller sizes for details, ensuring a hierarchy of information.

Use of Color and Contrast: While too much color can make the document look cluttered, using a subtle color scheme can help draw attention to key elements. A balance of dark text on a light background increases contrast and readability. Avoid overly bright or distracting colors that could reduce clarity.

Clear Sectioning and Labels: Properly sectioned content with clear labels helps guide the reader’s attention to the most relevant information. For example, clear labels for the contribution amount, the date, and the donor’s name ensure that the document’s important sections stand out. Visual cues, like bold text for totals, also help highlight critical details.

Inclusion of Essential Details: Every document should clearly present essential details, such as the donor’s name, contact information, the amount of the contribution, and any related tax or legal information. These details should be presented in an organized and easily readable manner, allowing the recipient to quickly verify the information.

In conclusion, designing an easy-to-read document is essential for maintaining clarity and professionalism in all transactions. By considering factors like layout, font, color, and clear labeling, organizations can ensure that recipients have a positive experience when reviewing their contributions, leading to greater satisfaction and trust.

Ensuring Compliance with Donation Regulations

When handling contributions, it’s essential to adhere to the applicable legal and regulatory standards. Organizations must ensure that all documentation, including acknowledgment forms and receipts, comply with relevant tax laws, charity guidelines, and financial reporting requirements. Non-compliance can result in legal consequences and may negatively impact the trust between the donor and the organization.

One of the primary concerns in this area is the need to accurately record the donation amount, date, and any goods or services provided in return. Donors may require this information for tax purposes, and it is critical that such details are presented clearly and truthfully. Misrepresentation can lead to penalties, and in some cases, it may invalidate the donor’s ability to claim tax deductions.

Furthermore, organizations must be aware of the specific rules surrounding charitable donations. For instance, certain contributions may be subject to different tax rates, or they may require a specific format for acknowledgment. In some regions, the organization must provide a formal receipt or letter to donors for amounts exceeding a certain threshold, ensuring that donors are properly informed for their personal records and tax filings.

Another important consideration is ensuring the proper categorization of contributions. Depending on the nature of the gift, whether monetary or in-kind, different regulations may apply. For example, non-cash donations may require additional details regarding the fair market value, and the donor’s acknowledgment must reflect this correctly.

By implementing these compliance measures, organizations can safeguard themselves against potential legal challenges, maintain transparency, and build long-term trust with their supporters. It is also advisable to periodically review the latest regulatory changes to stay informed about evolving legal requirements that affect contributions and related documentation.