Easy to Use Acting Invoice Template for Actors and Performers

When working as a freelancer in the entertainment industry, keeping track of payments and ensuring proper documentation is essential. A clear and professional financial record can prevent misunderstandings with clients and help maintain smooth business relationships. For those offering their talents in front of the camera or on stage, a well-structured financial statement is an indispensable tool for managing earnings.

Whether you’re just starting out or are already an experienced performer, having a reliable document that outlines your services, rates, and payment terms is key. This document not only helps you stay organized but also shows clients that you take your work seriously. With the right format, creating such a document becomes easy and efficient.

In this guide, we’ll explore the most important elements of a payment request form tailored for actors and other creatives. From customizing the layout to ensuring all critical details are included, we’ll cover everything you need to know for generating a professional and legally sound record of your transactions.

What is a Billing Document for Performers

A payment request document for artists is a structured file that details the terms and specifics of a financial transaction between the performer and their client. It serves as an official record of the services provided, the agreed-upon compensation, and the payment expectations. This type of document helps to ensure that both parties are clear on the financial terms and can avoid potential misunderstandings.

Why It’s Essential for Freelancers

For freelancers in the entertainment industry, a well-organized financial record is a crucial part of maintaining professionalism. This document acts as a formal request for payment, outlining all the necessary details to facilitate smooth transactions. It ensures that both the artist and the client are on the same page regarding the services rendered and the agreed-upon amount.

Basic Elements of the Document

While the format may vary, most such records contain several key components: the name and contact details of both the performer and the client, a description of the work completed, the payment amount, and the payment due date. A clear breakdown of these elements provides transparency and helps prevent disputes.

Why You Need a Payment Request Document

For any freelancer, especially those working in creative fields, having a formal document to request payment is crucial for both professionalism and financial organization. This type of document ensures that both the performer and the client are clear about the terms of the agreement, the work completed, and the compensation to be received. It protects both parties by providing a clear record of the transaction and helps avoid confusion or disputes over payments.

Professionalism and Trust

Using a well-structured financial record adds a layer of professionalism to your freelance business. It shows that you take your work seriously and understand the importance of clear communication in business dealings. By providing a detailed and accurate document, you build trust with your clients, making it more likely they will continue to work with you in the future.

Helps with Financial Organization

Keeping track of your payments and income is essential for managing your finances effectively. A well-prepared request form helps you stay organized, track your earnings, and ensure that you are paid on time. It also simplifies the process of filing taxes by keeping

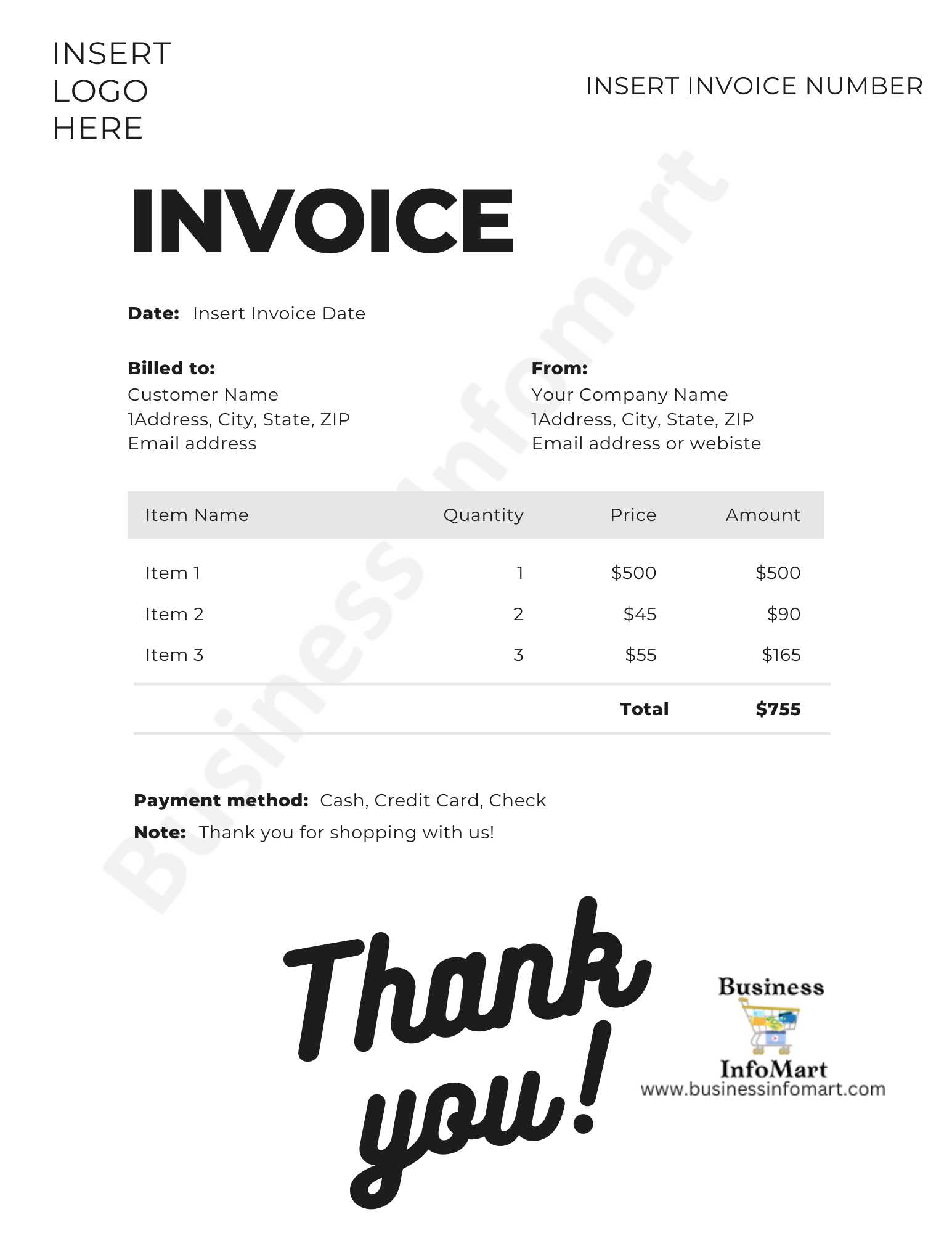

Key Features of a Performer Payment Document

A well-designed payment request form is more than just a bill; it serves as a clear, professional record of the transaction between the performer and the client. To ensure the document is both effective and legally sound, it should include several important elements. These features help streamline the payment process, reduce the risk of errors, and provide both parties with the necessary details for a smooth transaction.

Essential Components

- Performer and Client Information: The document should include the names, contact details, and addresses of both parties involved in the transaction.

- Detailed Description of Services: A brief but clear description of the work provided, including the duration or nature of the project, will help avoid confusion.

- Total Payment Amount: Clearly state the total amount due for the services rendered, including any taxes or additional fees.

- Payment Due Date: Specify when payment is expected, helping to set clear expectations for both parties.

- Payment Instructions: Provide detailed instructions on how the client can make the payment (e.g., bank transfer, online platform, check).

- Terms and Conditions: Include any relevant payment terms, such as late fees or discounts for early payment, to ensure both parties understand their obligations.

Formatting and Professionalism

- Clear and Readable Layout: Use a professional layout that makes all information easy to find and read. Clean, well-organized documents give a positive impression.

- Consistent Branding: If applicable, include your logo or brand colors to make the document feel official and consistent with your personal or business identity.

How to Customize Your Payment Request Form

Customizing your payment request document allows you to tailor it to your specific needs and ensure it reflects your professional style. By personalizing the layout, including relevant details, and ensuring clarity, you can make your form more effective and aligned with your branding. Customization not only improves the appearance but also enhances functionality, making the process of billing easier and more efficient.

Personalizing the Layout

The layout of your payment request form should be simple and easy to follow. It’s important to arrange the key elements in a way that makes sense for both you and your client. Below is a basic structure to follow when customizing the layout:

| Section | Description |

|---|---|

| Header | Include your name, logo, and contact information at the top for easy identification. |

| Client Details | Clearly display the client’s name and contact info to ensure correct billing. |

| Service Description | Provide a concise summary of the services performed, including dates and any relevant details. |

| Amount Due | List the total amount owed, with any applicable taxes or additional charges. |

| Payment Instructions | Provide clear directions on how to make the payment, including payment methods and deadlines. |

Adding Your Personal Touch

Including your branding, whether it’s a logo, color scheme, or font choice, can give your document a professional appearance. Additionally, consider adding a brief note or thank you message at the end of the document to express your appreciation to the client. A personal touch goes a long way in building strong working relationships.

Common Mistakes When Creating Payment Requests

When preparing a payment request document, even small errors can lead to delays, confusion, or disputes with clients. It’s important to pay attention to the details and ensure all information is accurate and clear. Below are some of the most common mistakes people make when generating these documents, which can negatively affect both your professionalism and cash flow.

Missing or Incorrect Information

- Omitting Client Details: Failing to include the client’s full name and contact information can lead to confusion and payment delays.

- Incorrect Payment Amount: Double-check the total amount to ensure you’ve added all relevant charges, such as taxes or additional fees.

- Missing Dates: Not including the service date or the payment due date can cause misunderstandings about when payment is expected.

Poorly Structured Documents

- Unclear Service Descriptions: Vague descriptions of the work completed can make it harder for the client to understand exactly what they are being charged for.

- Lack of Clear Payment Instructions: Not providing detailed instructions on how the client can pay may lead to delays in payment or confusion on both sides.

- Inconsistent Formatting: A cluttered or inconsistent layout can make your document difficult to read, causing potential mistakes in payment processing.

Not Addressing Payment Terms

- Neglecting Late Fees: Failing to mention late payment penalties can result in clients taking longer to settle their bills.

- Unclear Refund Policies: If you offer refunds or discounts, not specifying these terms may lead to disputes later on.

Benefits of Using a Payment Request Form

Using a pre-designed document for billing offers numerous advantages, especially for freelancers and creatives who need to maintain professionalism while managing their finances. These forms streamline the process of requesting payment, ensuring all essential details are included and making it easier to track earnings over time. By utilizing such a document, you can save time, reduce errors, and present yourself as organized and reliable.

Time-Saving and Efficiency

One of the key benefits of using a pre-designed billing form is the amount of time saved. Instead of creating a new document from scratch each time, you can simply fill in the necessary details. This allows you to focus more on your work and less on administrative tasks. With a well-structured format, the process becomes quicker and more efficient.

Consistency and Professionalism

Using a consistent format for all your billing documents projects professionalism. Clients are more likely to take you seriously when they see you provide clear, well-organized requests for payment. It helps build trust and strengthens your reputation as someone who is detail-oriented and responsible.

Minimizing Errors

A standardized payment request form reduces the risk of making mistakes, such as forgetting to include important information or miscalculating amounts. By using a template with all the necessary fields, you ensure accuracy and avoid confusion that could lead to delays in payment.

Choosing the Right Format for Your Payment Request

When creating a document to request payment, it’s important to choose the format that best suits both your needs and those of your clients. The format you select can impact how easily the information is processed and whether it looks professional. Whether you prefer digital or printed records, the key is ensuring the format is clear, organized, and accessible for both parties involved.

Digital vs. Printed Formats

There are two main types of formats to consider: digital and printed. Each has its own advantages, and your choice will depend on the nature of your business and the preferences of your clients.

- Digital Formats: These are fast, convenient, and environmentally friendly. Digital documents can be easily shared via email or through online platforms, reducing the time it takes for clients to receive and process them.

- Printed Formats: Some clients may prefer a hard copy for their records. In this case, it’s important to ensure your document is properly formatted for printing and is free of any unnecessary elements that could waste paper or cause confusion.

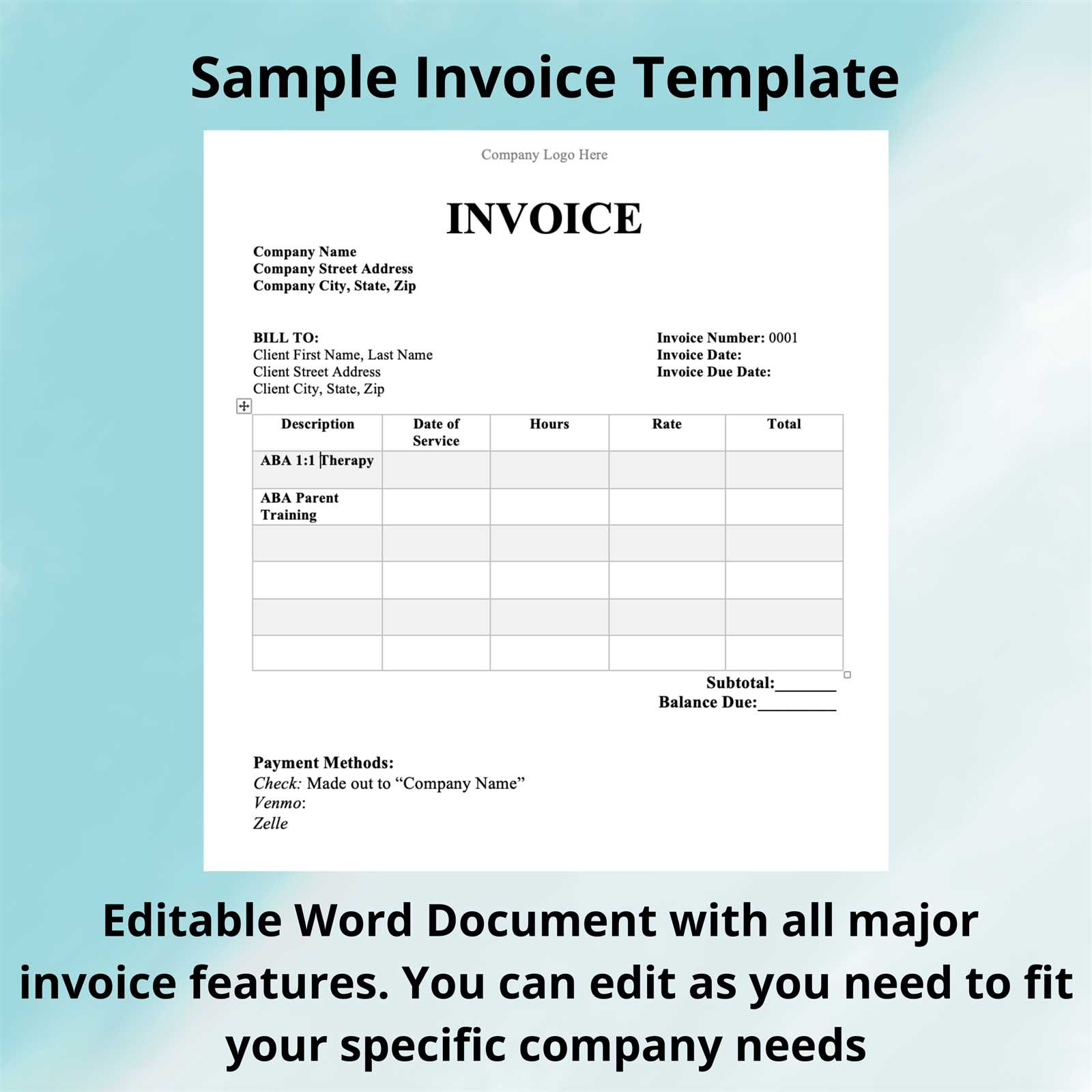

Choosing the Right Software or Tool

The next step is selecting the right tool for creating your document. There are many options available, ranging from basic word processors to specialized software designed for generating financial documents.

- Word Processors: Programs like Microsoft Word or Google Docs can be used to create simple payment requests with basic formatting options.

- Spreadsheet Software: If you need to include detailed breakdowns or calculations, spreadsheet tools like Excel or Google Sheets offer the ability to create customized templates with built-in formulas.

- Accounting Software: Platforms like QuickBooks or FreshBooks offer pre-built templates specifically designed for billing and invoicing, saving time while ensuring professionalism.

How to Calculate Performance Fees Accurately

Calculating the correct fee for your services is crucial to ensuring fair compensation for your time and effort. While it may seem straightforward, there are several factors to consider that can impact the final amount. By understanding how to assess these factors properly, you can avoid undercharging or overcharging and maintain professionalism in your business transactions.

Consider All the Relevant Factors

To calculate your fee accurately, you need to account for several variables, including:

- Time Spent: Factor in the amount of time dedicated to rehearsals, performances, and any other work related to the project. Be sure to track your hours carefully, including breaks and preparation time.

- Experience and Expertise: Your level of experience and the type of work you’re being hired for should influence your rate. More experienced professionals can generally charge higher fees.

- Location and Travel: If the project requires you to travel, consider transportation and accommodation costs. You may want to add a surcharge for travel time or expenses.

- Type of Project: The complexity and scale of the project will also affect your fee. Larger or more high-profile jobs typically warrant higher compensation than smaller, local gigs.

Adding Additional Charges

In some cases, you may need to include extra charges for things like overtime, rush jobs, or additional services. For example, if a performance requires extra rehearsals or a longer performance time than initially agreed upon, these should be reflected in your final fee. Be sure to clarify these terms in advance and add them to the final calculation to avoid confusion.

Creating a Fair and Transparent Fee Structure

Once you’ve considered all the relevant factors, it’s important to communicate your fee structure clearly to clients. Use a consistent format when presenting your fees, and ensure that both you and your client understand the terms before any work begins. This not only helps build trust but also sets clear expectations, which can prevent misunderstandings later on.

Including Payment Terms on Your Payment Request

Clear payment terms are essential for ensuring smooth transactions and avoiding misunderstandings with clients. These terms outline when and how payment is expected, providing both you and the client with a clear understanding of the financial agreement. Including these details in your payment request helps set professional expectations and encourages timely payments.

Key Payment Terms to Include

When drafting your document, make sure to include the following terms to avoid confusion:

- Due Date: Specify the exact date by which payment is expected. Common terms are “Net 30” or “Due on receipt,” but you can customize this based on your agreement with the client.

- Late Payment Fees: Indicate any fees that will be applied if payment is not made by the due date. This helps encourage timely payment and provides an incentive for the client to settle the amount promptly.

- Accepted Payment Methods: Clearly state the methods through which payment can be made, whether it’s bank transfer, PayPal, credit card, or check. Providing multiple options can make the process easier for your clients.

- Deposits or Upfront Payments: If applicable, mention any upfront payments or deposits required before beginning the work. This ensures that you are compensated for your time and effort, even if the project is delayed or canceled.

Clarifying Terms for International Clients

If you’re working with clients from other countries, it’s important to specify how currency conversion, taxes, or any additional fees will be handled. Being upfront about these elements can help prevent confusion or disputes down the line.

How to Handle Late Payments

Late payments are a common challenge for freelancers and professionals across many industries. It’s important to address this issue in a professional and proactive manner to ensure you are compensated for your work on time. Establishing clear payment terms from the start and knowing how to manage delays can help protect your cash flow and maintain good relationships with clients.

Steps to Take When Payment is Late

If a client misses the agreed-upon due date, follow these steps to address the issue politely and effectively:

- Send a Reminder: Politely remind the client about the payment due. A simple email or message stating that the payment is overdue and requesting it as soon as possible can often resolve the situation quickly.

- Follow Up With a Formal Notice: If the payment is still not made, send a more formal reminder. This can include a clear statement of the overdue amount, the original due date, and any late fees that may apply.

- Offer a Payment Plan: If the client is facing financial difficulties, consider offering a payment plan or extended deadline. This can maintain goodwill while still ensuring you receive your compensation.

- Use Late Payment Fees: To deter future delays, ensure your payment terms include a late fee clause. This should clearly outline the penalty for late payments and when it will be applied. Be consistent in enforcing this policy.

When to Take Further Action

If payments continue to be delayed despite reminders, it may be necessary to escalate the situation. Some steps to consider include:

- Engage a Collection Agency: If the client refuses to pay or is consistently late, hiring a collection agency can help recover the funds, though this should be a last resort due to the associated costs.

- Consider Legal Action: If the amount is significant and you’ve exhausted other options, legal action may be required. Consult with a lawyer to determine if pursuing a claim is worthwhile.

By handling late payments promptly and professionally, you can minimize disruptions to your income and protect your business interests.

How to Organize Your Payment Requests for Tax Purposes

Properly organizing your financial records is essential for managing your business, especially when it comes time to file taxes. Keeping detailed and organized records of all the payments you’ve received throughout the year can help ensure that you pay the correct amount of tax and avoid penalties. By following a systematic approach, you can easily track your income, deductions, and any relevant expenses.

Key Steps for Organizing Financial Records

Here are some effective methods to help you keep your payment records in order for tax season:

- Track Payments Regularly: Keep a log of all transactions as they happen. This will prevent you from scrambling at the end of the year and ensure that you don’t miss any income.

- Label and Categorize: Label each record with the corresponding project or client, and categorize them by month or quarter. This makes it easier to spot trends and identify any missing payments when reviewing your finances.

- Store Digital and Physical Copies: Maintain both digital and physical copies of your records. Use cloud storage or accounting software to store electronic copies, and keep hard copies filed in a secure place. Having multiple backups ensures that you won’t lose important documentation.

- Use Accounting Software: Using accounting software can help you track and organize your payment records automatically. These platforms often allow you to categorize payments, generate reports, and calculate taxes owed based on your entries.

How to Manage Deductions and Expenses

In addition to tracking payments, it’s equally important to monitor any business-related expenses or deductions you may be eligible for. Expenses such as travel costs, materials, or home office supplies can reduce your taxable income.

- Keep Receipts: Save receipts for any purchases or expenses related to your business. This is crucial for claiming deductions.

- Separate Business and Personal Expenses: Keep your business finances separate from personal ones. Having a dedicated business account or credit card will simplify this process.

- Consult a Tax Professional: If you’re unsure about which expenses are deductible, consult a tax professional to help you navigate the rules and maximize your deductions.

By following these steps, you can ensure that your financial records are well-organized and ready for tax season, making the entire process smoother and less stressful.

Digital vs Printed Payment Requests: Pros and Cons

When it comes to requesting payment, one of the key decisions is whether to send a digital or printed document. Each option comes with its own set of benefits and challenges, and the best choice often depends on your specific business needs and the preferences of your clients. Below, we’ll explore the advantages and disadvantages of both digital and printed formats to help you make an informed decision.

Advantages of Digital Payment Requests

- Convenience: Sending digital documents is quick and easy. You can email the request or share it via online platforms, making it accessible to clients anywhere in the world without the need for postal services.

- Cost-Effective: Digital formats eliminate printing, paper, and postage costs, making them more affordable for both you and your client.

- Environmental Impact: By going paperless, you contribute to sustainability efforts by reducing paper waste and energy consumption associated with printing and mailing.

- Automation Features: Digital payment requests can be integrated with accounting software, enabling automatic tracking of payments and faster processing.

Disadvantages of Digital Payment Requests

- Technical Issues: Digital documents rely on technology, which means there could be issues with email delivery or compatibility, leading to delays or confusion.

- Client Preferences: Some clients may not be comfortable with digital transactions or may prefer a physical document for their records.

Advantages of Printed Payment Requests

- Professional Appearance: A printed document can feel more formal and tangible, which may help reinforce your professionalism with certain clients.

- Client Preference: Some clients, particularly those in more traditional industries, may prefer receiving a physical document for record-keeping purposes.

- No Technology Barriers: Printed documents don’t rely on email systems or digital platforms, which means there’s less risk of delivery errors or technical incompatibility.

Disadvantages of Printed Payment Requests

- Higher Costs: Printing and mailing physical documents can add up, especially when sending to clients in different locations.

- Time-Consuming: Printing and posting a document takes more time compared to simply sending a digital file.

- Environmental Impact: Printing and shipping paper documents contribute to environmental waste, which can be a concern for businesses looking to reduce their carbon footprint.

In summary, digital documents are more efficient, cost-effective, and eco-friendly, while printed documents may appeal to clients who prefer a more formal or traditional approach. Depending on your client base and business model, you can choose the option that best suits your needs.

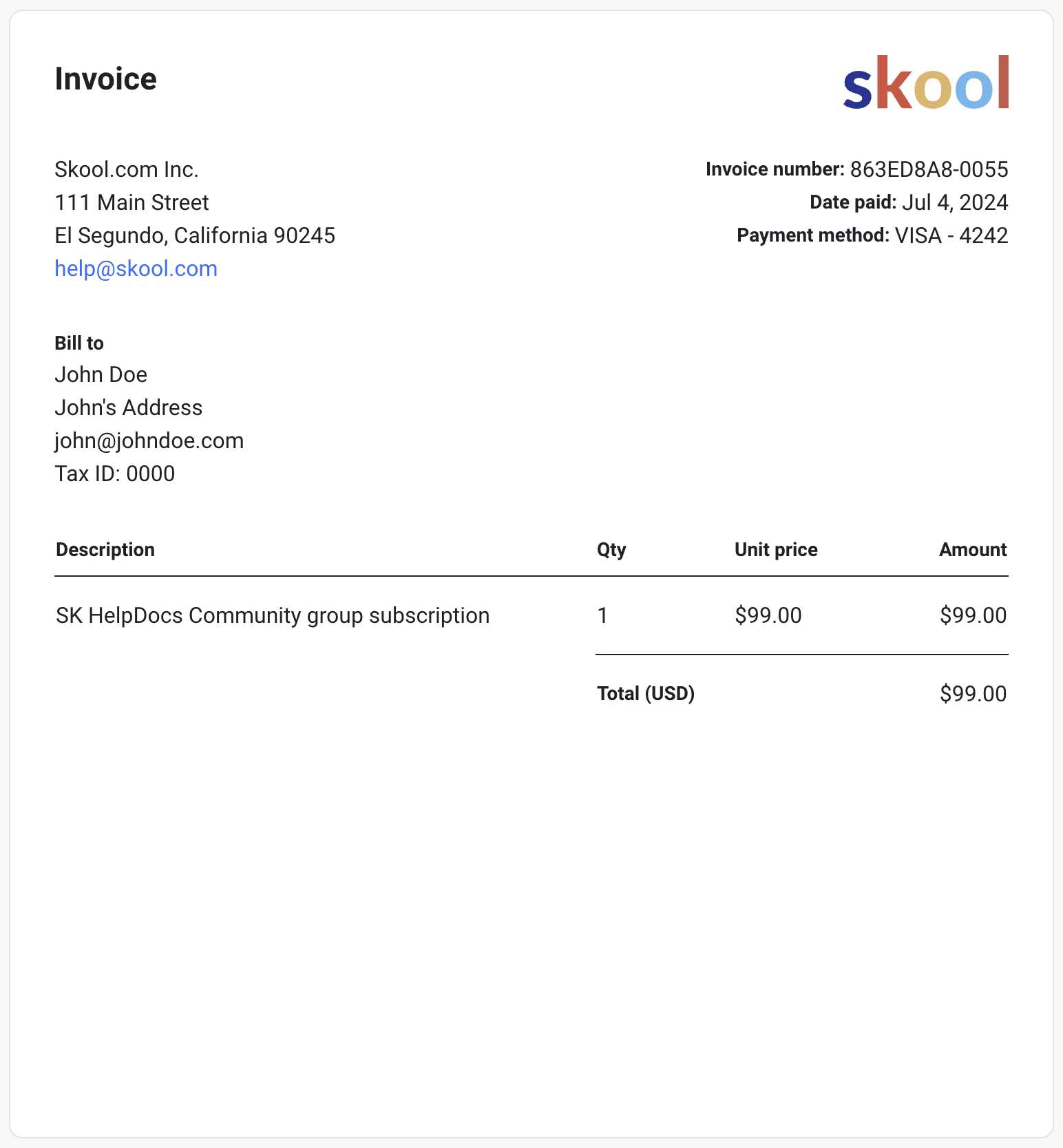

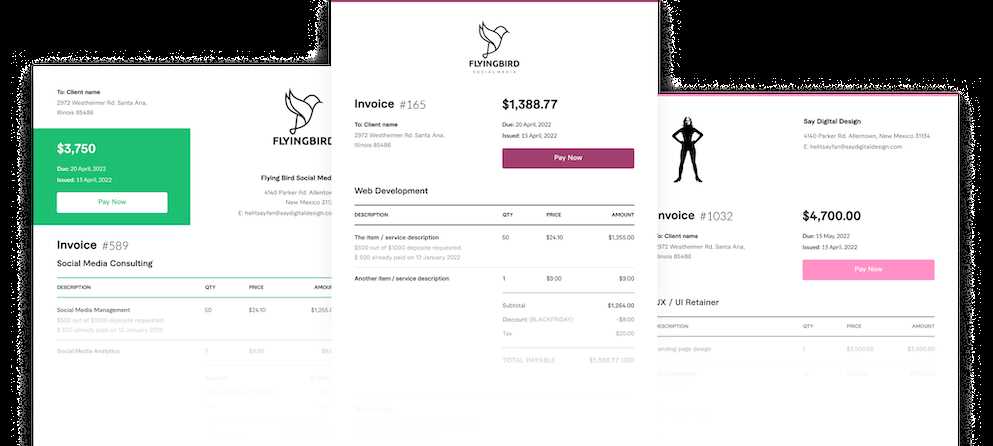

Best Software for Creating Payment Requests

Using the right software to create payment documents can save time, ensure accuracy, and improve the overall professionalism of your billing process. There are many tools available that allow you to create custom payment requests with ease. Depending on your needs–whether you’re a freelancer, a small business owner, or someone working on larger projects–certain software may offer better features, integration, and user experience. Below are some of the best options to consider when looking to streamline your payment management process.

1. QuickBooks

QuickBooks is a comprehensive accounting software that offers invoicing features along with full financial management tools. It’s ideal for those who want to handle both their billing and overall business finances in one place. QuickBooks allows you to create customized payment requests, track expenses, and even send automated reminders for overdue payments. It’s a great choice for freelancers and small businesses who need more than just a basic invoicing tool.

2. FreshBooks

FreshBooks is another popular option for creating professional payment requests. Known for its user-friendly interface, FreshBooks makes it easy to generate bills, track time, and manage clients. The software also integrates with various payment processors, making it simple for clients to pay online. FreshBooks is particularly beneficial for service-based professionals who need to track hours worked and create detailed reports.

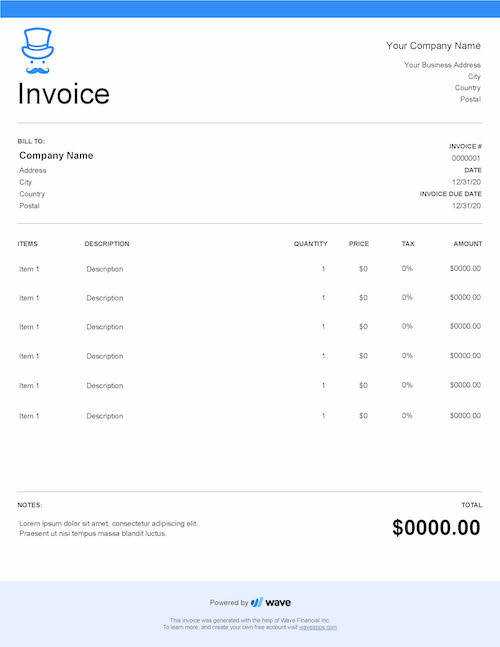

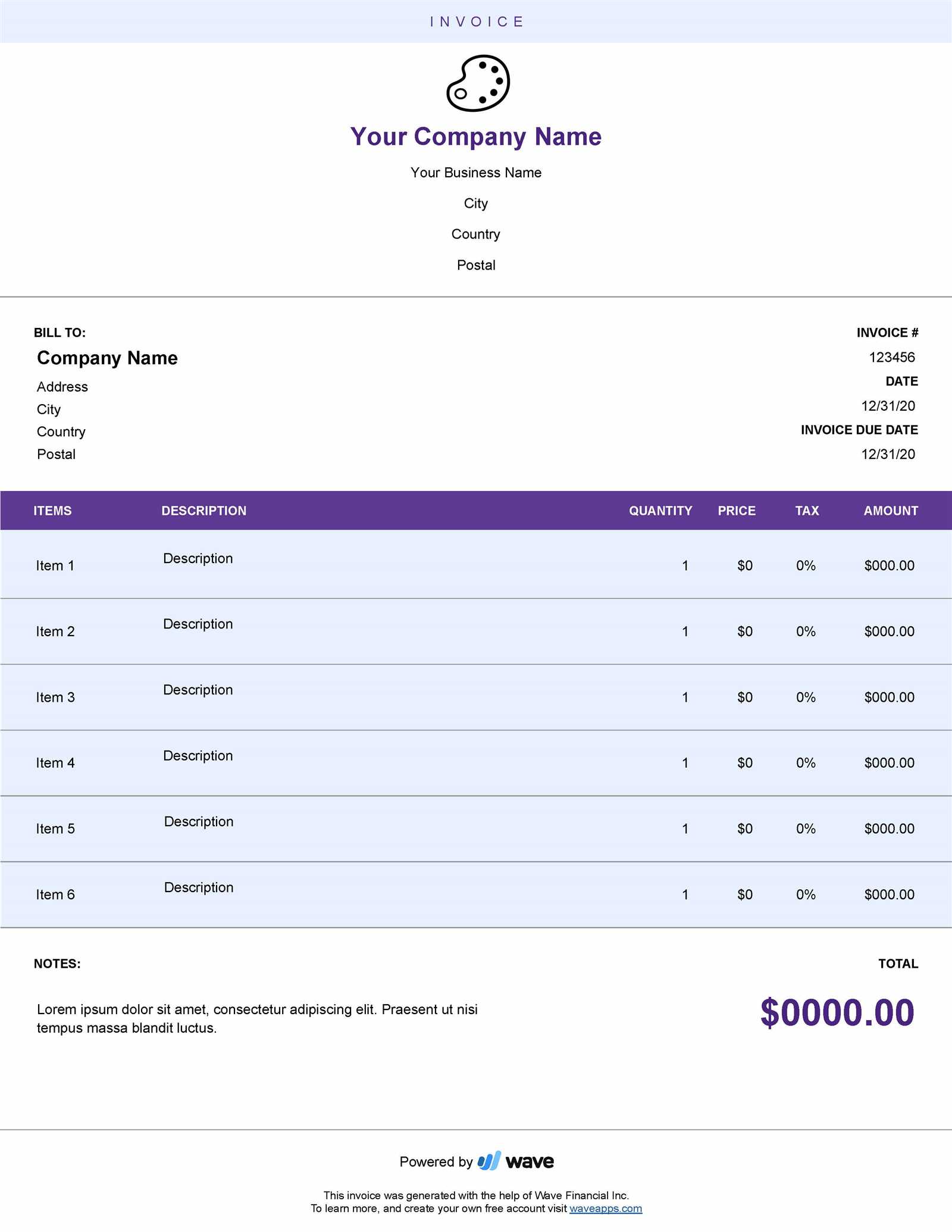

3. Wave

Wave is a free accounting software with invoicing capabilities, perfect for small businesses or solo entrepreneurs. With Wave, you can create fully customizable payment documents, track payments, and even set up recurring billing. While the software is free to use, it does offer paid services for payments processing and payroll if needed. It’s a great option for those just starting out or who want a straightforward tool without the added cost.

4. Zoho Invoice

Zoho Invoice offers a range of customization options, allowing you to design personalized payment requests to match your business branding. It also includes automated features like reminders for overdue payments, and it integrates with other Zoho tools, such as accounting and project management software. Zoho Invoice is great for freelancers and businesses of all sizes looking for a powerful, affordable solution.

5. PayPal Invoicing

For those who frequently use PayPal for transactions, PayPal’s invoicing tool is an easy and convenient option. The software allows you to create and send professional-looking payment requests directly from your PayPal account. It’s ideal for small businesses or freelancers who already have a PayPal account and want a quick, straightforward invoicing solution. While it’s less customizable than other options, it’s great for ease of use and fast payments.

Each of these software solutions offers unique features that cater to different types of businesses and individual needs. Choosing the right one depends on the scale of your operations, the level of customization required, and your budget. Consider trying out a few options to see which one works best for your specific requirements.

Legal Considerations for Actor Payment Requests

When requesting payment for services rendered, it’s important to be aware of the legal aspects that govern such transactions. Ensuring that your financial documents are legally sound can help protect both you and your client, preventing disputes and ensuring timely compensation. From contracts to tax implications, understanding the legal considerations involved in creating and sending payment requests is crucial for maintaining professionalism and complying with applicable laws.

1. Contractual Agreements

Before sending a payment request, it’s important to have a written agreement or contract in place. This document should clearly outline the terms of your services, including payment rates, deadlines, and any other relevant details. Having a signed contract not only ensures that both parties are on the same page but also provides legal protection in case of disputes. A well-drafted contract serves as a reference point for the payment request, making sure the amounts invoiced are consistent with what was agreed upon.

2. Payment Terms and Deadlines

Clear payment terms are essential for any professional transaction. Specify when payment is due, whether it’s on delivery, within a certain number of days, or upon completion of a project. Additionally, outline any late fees or penalties that will apply if the payment is not made by the agreed-upon deadline. These terms should be part of the initial agreement and reflected in your payment request, helping you enforce timely payments and avoid financial disputes.

3. Tax Obligations

As a professional, it’s important to understand your tax obligations when it comes to payment requests. Depending on your location and the nature of your work, you may need to charge sales tax or report your income to tax authorities. In some cases, you might need to provide tax identification numbers or include specific tax language on your payment documents. Consulting with a tax professional or accountant can ensure you meet all legal requirements and avoid penalties related to unpaid taxes.

4. Record-Keeping and Documentation

Maintaining accurate records of all financial transactions is crucial, especially when it comes to legal compliance. Keep copies of every payment request you send, as well as any correspondence related to payments. This documentation serves as evidence of the work completed and the payments owed. In the event of a legal dispute or audit, having a comprehensive record can protect you and help resolve any issues quickly.

5. International Considerations

If you are working with clients from other countries, it’s important to be aware of international laws and regulations that may affect payment terms. For example, you may need to consider currency differences, tax implications, or specific laws regarding payment timelines and methods. Consulting with a legal expert in international business can help ensure your payment requests comply with the legal requirements in both your country and your client’s location.

By taking these legal factors into account when drafting payment requests, you ensure not only that you are compensated properly but also that you are operating within the boundaries of the law. Clear agreements, proper record-keeping, and understanding your tax obligations will help safeguard your professional reputation and financial stability.

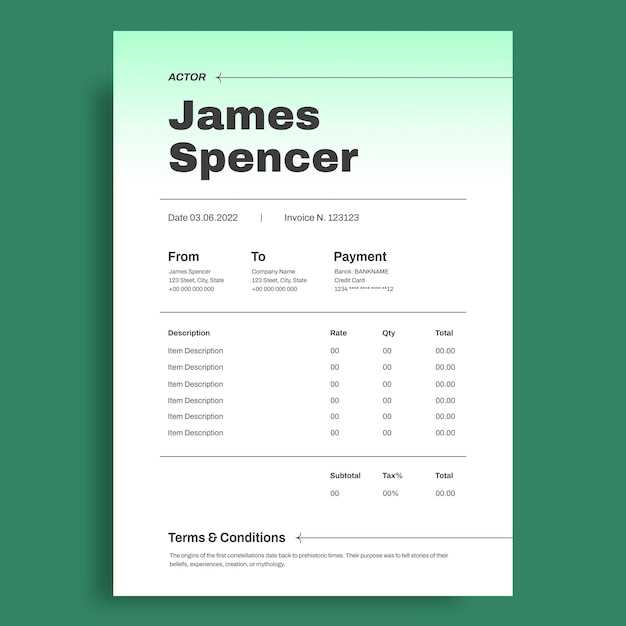

How to Add Client Details on Your Payment Request

Including accurate client information on your payment documents is crucial for ensuring clear communication and proper record-keeping. This information not only helps identify the recipient but also ensures that the payment is processed smoothly. By including all necessary client details, you avoid confusion and ensure that your request is complete and professional. Below are some key steps to follow when adding client details to your payment request.

1. Client Name and Business Information

The first piece of information you should include is the client’s full name or the name of their business. This ensures that there’s no ambiguity about who the payment is being requested from. If you are working with a company, make sure to include the official business name as well as the name of the person who is responsible for handling payments.

2. Client Address

Include the client’s full billing address, which typically includes their street address, city, state, and zip code. This is important for a few reasons: it ensures that any paper documents or physical payments are directed to the right location, and it also serves as a record for tax purposes. In some cases, you may need to include an international address if the client is located abroad.

3. Contact Information

Adding the client’s contact information, such as their phone number and email address, is essential. This allows you to reach out if there are any issues with the payment request or if follow-up is required. It’s also useful if you need to send reminders or invoices for future services.

4. Client Account or Reference Number

If applicable, include any client-specific account number, order number, or reference number that is relevant to the work completed. This can help both you and the client easily track the transaction and ensure it’s linked to the correct project or service. It’s especially helpful if you manage multiple clients or projects simultaneously.

5. Payment Terms and Method

Along with client details, it’s also helpful to specify the payment terms on the request. This includes the payment due date, accepted payment methods (such as bank transfer, credit card, or online payment systems), and any late fees or penalties that may apply if the payment is delayed. This ensures that the client is fully aware of how to make the payment and what to expect in terms of timing and fees.

By clearly adding all relevant client details to your payment request, you streamline the process and reduce the likelihood of errors. It also ensures that both you and your client are on the same page regarding expectations and deadlines. Always double-check the client information to avoid any potential delay

How to Make Your Payment Request Stand Out

When sending a payment document, it’s important that it captures your client’s attention and reflects your professionalism. A well-crafted document can enhance your business image, foster positive relationships, and even speed up the payment process. By focusing on design, clarity, and personalization, you can ensure that your request stands out and leaves a lasting impression. Here are some key strategies to make your payment request more effective and memorable.

1. Use a Professional Design

The design of your payment request plays a significant role in how it is perceived. A clean, well-organized layout not only makes the document easier to read but also reflects your attention to detail. Consider using templates that align with your brand’s colors and style, or customize one to ensure consistency with your other business materials. A professional look conveys trustworthiness and competence.

2. Add Your Branding

Incorporating your logo, business name, and contact details prominently in your document is a great way to establish brand identity. Customizing the document with your unique style ensures that clients immediately recognize the source of the request. Including a tagline or a personalized message can also add a touch of individuality, making the document feel less generic and more tailored to the client.

3. Be Clear and Concise

A well-organized document should have all the necessary details but remain simple and easy to read. Use clear headings, bullet points, and proper spacing to ensure the information is digestible. Avoid cluttering the document with too much text or irrelevant details. The clearer and more straightforward the request, the more likely it is to be processed quickly and without confusion.

4. Offer Multiple Payment Options

To make it easier for your client to fulfill the payment, provide various methods they can use. Include bank transfer details, online payment links, or credit card options. Offering flexibility not only helps ensure timely payment but also demonstrates your willingness to accommodate the client’s preferred method of transaction.

5. Personalize the Document

Rather than using a one-size-fits-all approach, take the time to personalize each payment request. Address the client by name and reference specific details about the work you completed. Personalization adds a human touch, fostering stronger relationships and making the request feel more like a conversation than a transaction.

6. Use a Professional Tone

While you want your request to stand out, it’s equally important to maintain a professional and respectful tone. Be polite, positive, and clear when stating the amount due and any relevant payment terms. Using professional language shows that you take the process seriously and expect the same from your client.

By following these strategies, you can make your payment requests more effective, increasing the chances of timely payment and fostering long-term, positive rel

How to Send Your Payment Request Professionally

Sending a payment request in a professional manner is essential for ensuring timely payment and maintaining strong business relationships. The way you present and deliver your billing documents reflects on your overall professionalism. By following a few simple steps, you can ensure that your request is clear, respectful, and received with the same level of professionalism you expect in return.

1. Use a Professional Email or Platform

When sending your payment document, always choose a formal and reliable method of communication. While emails are the most common, ensure that your subject line is clear and to the point (e.g., “Payment Request for [Project Name]”). If you’re using an online payment platform, make sure your account is professional, with a well-branded profile and a personal touch where appropriate. Avoid using casual language or unprofessional email addresses that could detract from the document’s seriousness.

2. Attach the Document as a PDF

For easy accessibility and professionalism, always send your payment request as a PDF file. PDFs preserve your formatting, ensuring that your document appears exactly as you intended, no matter what device or software your client uses. Sending a document in a universally accepted format helps avoid technical issues and ensures the recipient can open it without difficulty.

In addition, make sure that the file name is clear and professional, such as “Payment_Request_[ClientName]_[Date].pdf.” This allows the client to easily identify the document and reduces the risk of it being overlooked or lost in their inbox.

3. Include a Professional Message

Along with the payment request, include a polite and professional message in the email body. Briefly explain the reason for the payment, reference any previous agreements, and express your appreciation for the client’s business. A well-crafted message shows respect and reinforces your professionalism. You can also gently remind them of the payment due date or any late fees that apply, if necessary, but always keep the tone courteous and understanding.

For example, a simple message might read: “Dear [Client Name], I hope you are doing well. Attached is the payment request for the recent work completed on [Project Name]. Kindly refer to the details in the attached document. Please feel free to reach out if you have any questions. I look forward to your timely payment. Best regards, [Your Name].”

4. Send at the Right Time

Timing plays a crucial role in sending a payment request. Try to send your document at a time when your client is likely to read and respond promptly, such as at the beginning of the workweek. Avoid sending payment requests late at night or during weekends, unless absolutely necessary. Sending your request at a reasonable time shows respect for your client’s schedule while also increasing the likelihood of a timely response.

By using a professional method of communication, attaching your document in a universally accepted format, and crafting a courteous message, you ensure that your payment request is well-received and that your relationship with your client rem