Free Blank Invoice Template Printable for Quick and Easy Invoicing

Creating clear and professional billing documents is essential for maintaining smooth financial operations in any business. Whether you’re a freelancer, small business owner, or contractor, having a reliable format to request payment can save time and ensure accuracy. The right format can help you stay organized and reduce the chance of errors, making the invoicing process easier for both you and your clients.

With various options available online, you can access simple, customizable formats that suit your specific needs. These documents can be easily adjusted to reflect your business’s branding and include all necessary payment details. By using well-structured layouts, you can enhance your professionalism and make the payment process clearer for your clients.

In this guide, we’ll explore how you can find and use these resources effectively. From choosing the right design to ensuring all key elements are present, you’ll be ready to create documents that support your business operations with ease.

Free Blank Invoice Template Printable

Having an easily accessible and customizable document for billing purposes is essential for streamlining financial transactions. When you need to request payment or outline the details of a sale, having a ready-made structure can make the process smoother and more efficient. With the right format, you can ensure clarity, consistency, and professionalism in all your business dealings.

Advantages of Using Ready-Made Formats

Ready-to-use documents allow you to focus on your work without worrying about formatting or layout. These pre-designed forms are typically structured to include all necessary fields, such as contact information, payment terms, and services or products rendered. Customization options are available, so you can easily personalize the document to reflect your brand’s identity and specific details for each transaction.

How to Get Started with Customizable Documents

Accessing and utilizing these ready-made formats is straightforward. Many websites offer downloadable versions that can be tailored to your needs. Once you download the document, you can adjust fields for client names, pricing, and service descriptions, ensuring each transaction is unique and accurate. Whether you’re managing a small business or freelancing, having a simple yet effective method for creating these documents is invaluable for maintaining professional standards and clear communication with your clients.

Why Use a Printable Invoice Template

Having a standardized document for billing can simplify your administrative tasks and ensure accuracy in financial records. Using a structured format to request payments helps prevent mistakes and ensures that all relevant information is clearly presented to clients. With a reliable method in place, you can save time and avoid confusion in transactions.

Here are some key reasons to consider using a pre-designed billing document:

- Efficiency: Ready-made formats streamline the process, allowing you to quickly generate billing requests without starting from scratch each time.

- Consistency: Using the same layout for all your requests helps maintain a uniform appearance, reinforcing professionalism in your communications.

- Customization: You can easily modify sections of the document to include specific details like product descriptions, pricing, and terms.

- Accuracy: Pre-designed documents are typically structured to include all necessary fields, minimizing the risk of missing important details.

- Time-saving: A ready-to-use structure reduces the time spent on document creation, enabling you to focus more on your work or business operations.

Whether you are managing your own small business or working as a freelancer, having an effective method for creating financial documents ensures that you can focus on growing your business while handling payments smoothly.

How to Customize Your Invoice Template

Personalizing your billing documents allows you to align them with your business’s branding and unique requirements. By adjusting key fields and elements, you ensure that each request for payment is accurate, professional, and reflects your specific service or product offering. Customization helps clients easily understand the details of the transaction and ensures that nothing important is overlooked.

Steps for Customizing Your Document

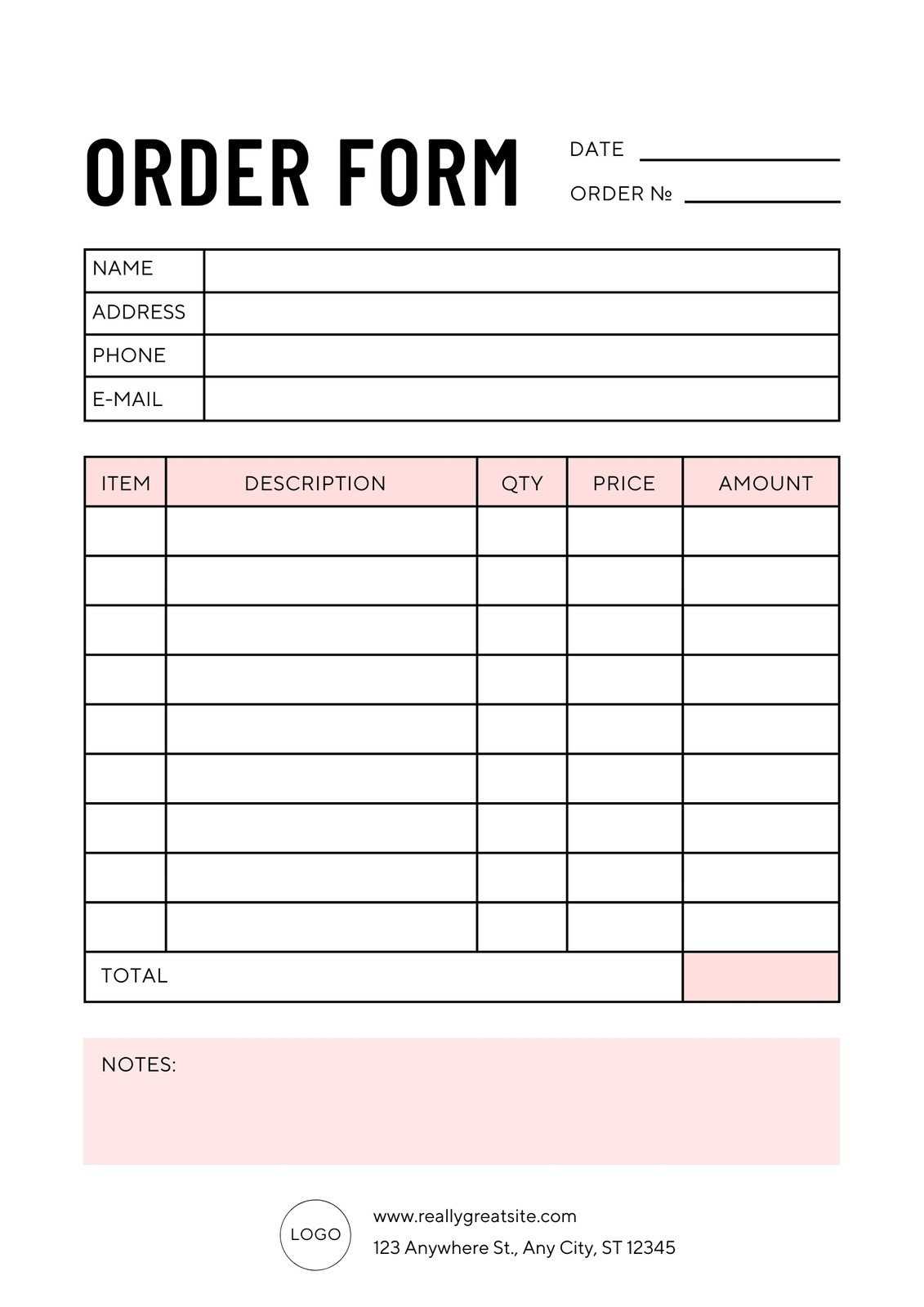

Customizing your form involves making changes to several key areas to ensure it suits your needs. Here are the main steps to follow:

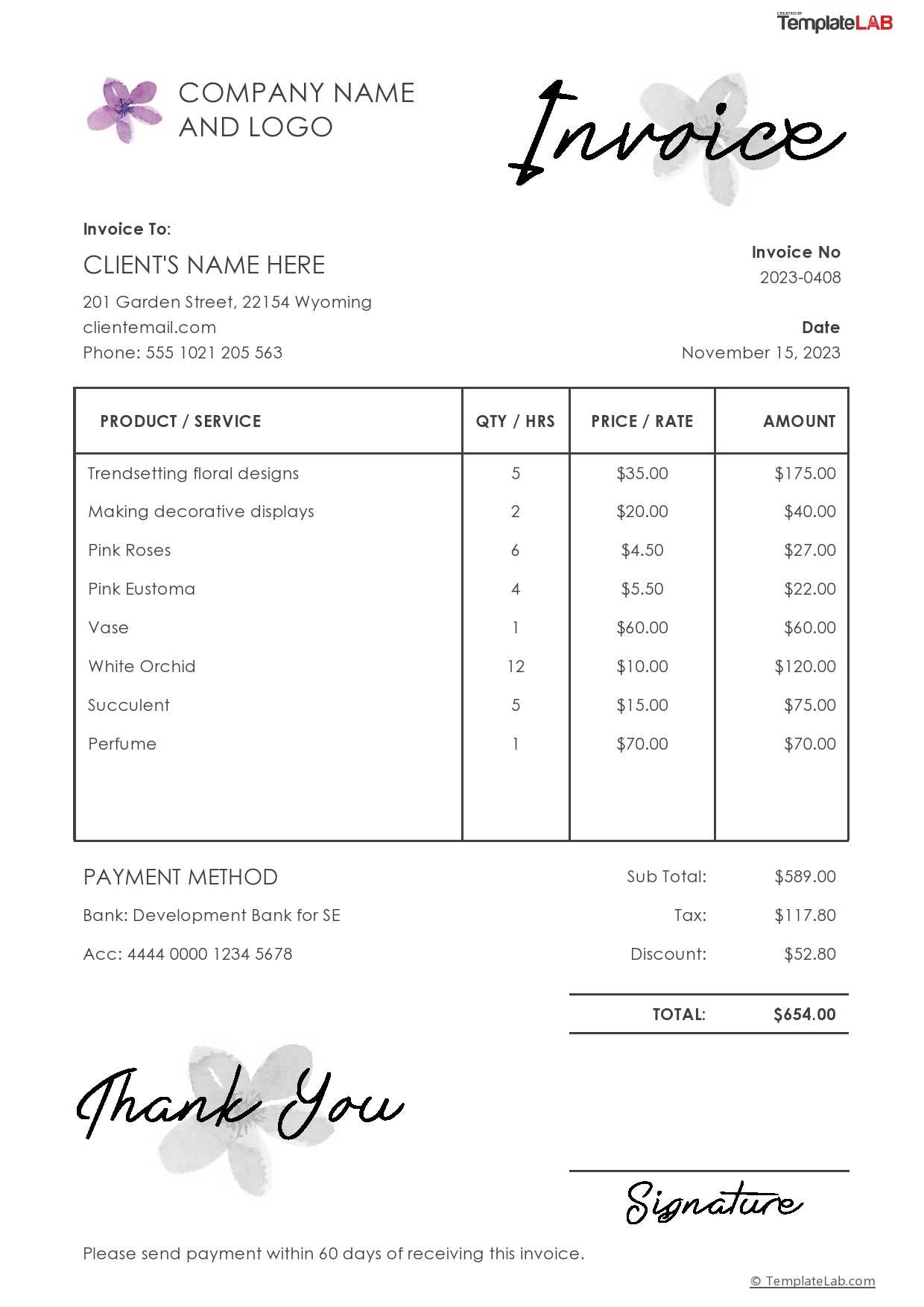

- Company Information: Include your business name, logo, and contact details at the top of the document to ensure it looks professional and is easy for clients to reach you.

- Client Details: Make sure to add the recipient’s name, address, and any other necessary contact information for clarity.

- Itemized List: Provide a clear breakdown of the products or services rendered, along with quantities, unit prices, and total amounts.

- Payment Terms: Clearly state your payment terms, including the due date, any late fees, and acceptable methods of payment.

- Additional Notes: If necessary, add any specific instructions or disclaimers related to the transaction.

Using a Structured Layout for Clarity

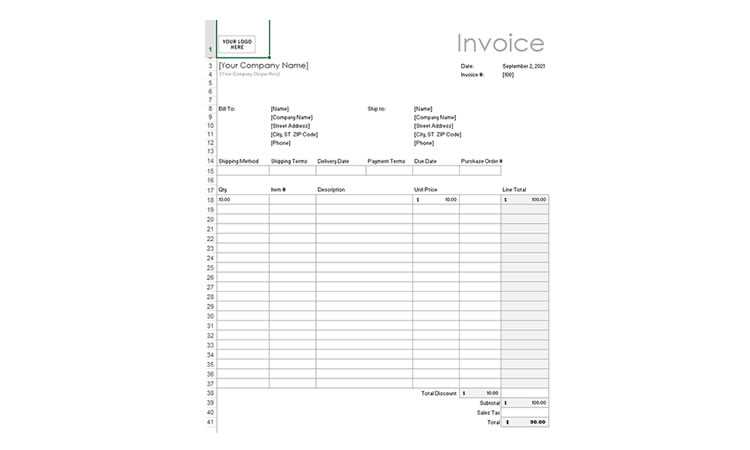

A well-organized structure is essential for readability and professionalism. Consider using a table format to clearly display the details of the transaction. Here’s an example of how you can set up your layout:

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Web Design Services | 1 | $500 | $500 |

| Hosting Fee | 1 | $100 | $100 |

| Total Amount | $600 |

This layout ensures that each element of the billing process is transparent and easy to follow. Customization not only makes your document professional but also enhances client trust by providing clear and comprehensive details.

Benefits of Using Free Invoice Templates

Utilizing pre-designed formats for requesting payments can significantly enhance your business’s efficiency and professionalism. These ready-to-use documents are designed to make the billing process quick, easy, and error-free. By relying on an established structure, you save time and reduce the likelihood of overlooking important details, while also ensuring consistency across all your transactions.

Here are the main advantages of using a ready-made document format:

- Time-saving: Instead of starting from scratch, you can quickly generate a well-structured billing document, allowing you to focus on other aspects of your business.

- Professional appearance: Using a polished, organized layout reflects well on your business and helps build credibility with clients.

- Easy customization: These formats are easily adaptable, enabling you to modify details such as company name, client information, service descriptions, and pricing with just a few clicks.

- Accuracy: Pre-designed documents typically include all necessary fields and sections, minimizing the chances of omitting important details like payment terms or itemized lists.

- Cost-effective: Many resources are available at no charge, making them an ideal solution for small businesses and freelancers who want to keep costs low while maintaining professionalism.

- Consistency: By using the same format for every billing request, you create a consistent experience for your clients and establish clear expectations.

Overall, relying on structured formats helps simplify the billing process, ensuring that both you and your clients stay on the same page, reducing administrative effort and potential errors.

Types of Invoice Templates Available

When it comes to creating billing documents, there are various formats designed to suit different business needs. Depending on your industry, client type, and services or products offered, you can choose from a variety of structures that best match your requirements. Each format is created with specific elements and layouts to make the billing process smoother and more efficient.

Here are some common types of documents available for use:

- Basic Billing Format: This simple design includes key details such as service descriptions, prices, and payment terms. It’s ideal for straightforward transactions without complicated terms or additional fields.

- Itemized List Format: For businesses offering multiple products or services, this format breaks down each item separately, showing quantities, individual costs, and total amounts clearly for transparency.

- Hourly Rate Format: This format is perfect for freelancers or contractors charging by the hour. It includes fields for the number of hours worked, hourly rate, and a total for each service provided.

- Recurring Billing Format: Used for subscription-based businesses, this version includes fields for regular payments, billing cycle dates, and the total amount due over a specified period.

- Proforma Invoice: Often used for quotes or pre-billing purposes, this format outlines the expected costs and details of a service or product before the final payment request is made.

- Credit Note Format: This format is used when issuing a refund or adjusting an earlier payment, showing the amounts being credited or refunded to a customer.

By choosing the right structure, you can ensure that all necessary information is clearly presented and tailored to meet the expectations of both your business and your clients. Whether you need something simple or more complex, there is a format that suits every scenario.

Choosing the Right Template for Your Business

Selecting the appropriate format for billing is crucial to ensure clarity, professionalism, and accuracy in your financial communications. Different industries and business models have varying needs when it comes to requesting payments, and the right structure can help streamline this process. The key is to find a design that complements your services, caters to your client base, and includes all necessary details in a straightforward manner.

To choose the best format for your business, consider the following factors:

- Industry Requirements: Certain fields or sections may be more important depending on the nature of your work. For example, freelancers may need to emphasize hourly rates, while product-based businesses should focus on item descriptions and quantities.

- Transaction Complexity: If your billing is straightforward, a simple layout may suffice. However, if your services involve multiple stages or products, an itemized list will provide greater clarity for your clients.

- Client Expectations: Think about the level of detail your clients might expect. Some may prefer a more formal, detailed document, while others might be comfortable with a simplified version.

- Branding: The format you choose should reflect your brand’s identity, incorporating your logo, colors, and overall style to present a cohesive image.

- Payment Terms: Make sure the chosen format includes clear sections for payment due dates, methods, and any other relevant terms specific to your business.

Choosing the right structure helps ensure that your billing process is efficient and that your clients receive all the necessary information to make prompt payments. By evaluating your needs and tailoring the format accordingly, you can maintain professionalism and improve the overall client experience.

How to Download a Blank Invoice Template

Accessing a ready-made document for requesting payments is a simple and efficient process. There are numerous online resources where you can find customizable formats tailored to various business needs. Downloading these documents allows you to quickly start issuing professional billing requests without having to design the layout from scratch.

Steps to Download the Right Format

Follow these easy steps to download a document for your business:

- Search for a Reliable Source: Start by finding trustworthy websites that offer downloadable options. Many platforms provide a variety of styles and formats, so ensure you select one from a reputable provider.

- Choose Your Preferred Format: Once you’ve found a source, browse through the available designs and select the one that suits your business needs best. Whether you need something simple or more detailed, there’s an option for every requirement.

- Download the Document: After selecting the desired format, click the download link. Most platforms allow you to download the document in multiple formats, such as PDF, Word, or Excel.

- Save to Your Device: Store the downloaded document on your computer or cloud storage, making it easily accessible whenever you need to create a new request for payment.

Customizing After Download

Once you’ve downloaded the document, you can customize it to suit your needs. Most formats allow you to edit the text fields, add or remove sections, and update any information like payment terms, pricing, and services offered. This ensures each document is specific to the current transaction.

Here’s an example of a downloaded structure:

| Service Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Consulting Services | 5 hours | $100 | $500 |

| Website Design | 1 | $1500 | $1500 |

| Total Amount Due | $2000 |

By following these steps, you’ll have an efficient and professional document ready for use in no time, helping you stay organized and on top of your billing tasks.

Top Websites for Free Invoice Templates

There are numerous online platforms where you can find well-structured documents for requesting payments. These resources offer a variety of formats that can be customized to suit your specific needs. Many of these websites provide high-quality, downloadable documents that make it easy to start managing your billing process quickly and professionally.

Popular Platforms to Explore

Here are some of the top websites where you can find reliable, ready-made formats for your billing needs:

- Microsoft Office Templates: A trusted platform offering a wide range of documents for businesses of all sizes. You can easily find customizable options that work with Word or Excel, providing flexibility for various industries.

- Template.net: This site offers numerous pre-designed documents tailored to different sectors. Whether you’re looking for simple or detailed formats, it has a comprehensive selection, often available in multiple file types.

- Canva: Known for its easy-to-use design tools, Canva offers customizable document layouts that allow you to add personal branding, logos, and other elements to your forms.

- Zoho Invoice: This platform offers a selection of professional layouts, specifically designed for businesses. Zoho’s billing solutions come with easy-to-fill fields and customizable options for a variety of billing scenarios.

- FreshBooks: FreshBooks offers templates that are ideal for freelancers and small businesses. They focus on ease of use and functionality, ensuring all the necessary sections are included for a clear, concise request for payment.

- Invoice Generator: This simple tool lets you create and download a document in just a few clicks. You can quickly customize your document and generate a PDF for immediate use.

How to Choose the Best Website for Your Needs

When selecting a website, consider the following factors to ensure it aligns with your requirements:

- Ease of Use: Choose a platform that allows you to easily edit and customize documents without needing advanced design skills.

- Variety: Look for a website that offers multiple formats or layouts, so you can pick the one that best fits your specific business style.

- Customization Options: Make sure the site allows you to personalize fields such as pricing, payment terms, and service descriptions.

- File Compatibility: Choose a platform that provides downloadable formats compatible with the tools you alread

How to Fill Out an Invoice Template

Filling out a billing document correctly is essential for ensuring that both you and your client are on the same page regarding payment details. Whether you’re a freelancer, small business owner, or service provider, completing these forms with accuracy can prevent misunderstandings and streamline the payment process. By following a few simple steps, you can ensure that all necessary information is included and easy to understand.

Here’s a guide to help you fill out your billing document effectively:

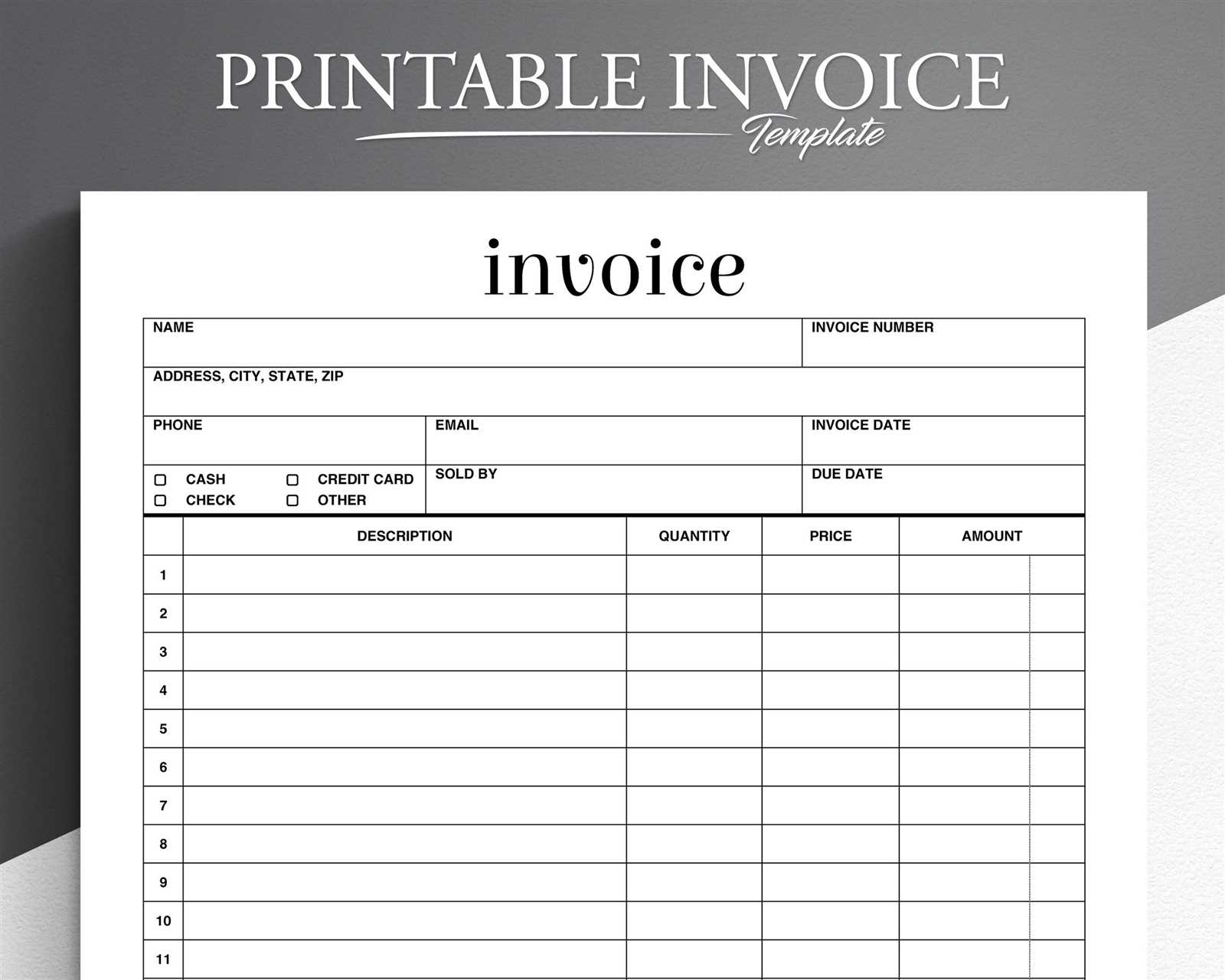

- Include Your Business Information: At the top of the document, provide your business name, logo, address, phone number, and email address. This ensures your client knows how to contact you and gives the document a professional appearance.

- Add Client Details: Include your client’s name, address, and contact information. This helps avoid confusion, especially if you’re working with multiple clients.

- List the Products or Services: Include a detailed description of the items or services provided. Be specific about each product or service, including quantities, unit prices, and total amounts. This provides transparency and clarity.

- Specify Payment Terms: Clearly outline your payment expectations. Include the due date, accepted payment methods, and any applicable late fees or discounts for early payment.

- Calculate the Total Amount: Add up all costs and provide a final total. Make sure the numbers are correct, and include any taxes or additional charges if necessary.

- Include Additional Notes or Instructions: If there are any special instructions or terms you want the client to know about, add them at the bottom of the document.

Once you have completed these steps, review the document for accuracy before sending it to your client. By providing clear and comprehensive billing information, you ensure a smoother transaction process and maintain professionalism in your business operations.

Invoice Template for Freelancers and Contractors

For freelancers and contractors, having a clear and professional document to request payment is essential. Unlike businesses with set billing departments, independent workers often handle billing directly, which means they need a reliable structure to ensure that all services rendered are accurately documented and paid for on time. A well-organized request for payment helps clarify expectations and reduces the likelihood of disputes.

Key Elements for Freelance Billing

When creating a payment request for your freelance or contracting work, it’s important to include the following key elements:

- Your Information: Include your name or business name, contact information, and any other details your client may need to reach you.

- Client’s Details: Always list the client’s full name, company (if applicable), and contact information to ensure there’s no confusion about who is receiving the bill.

- Service or Project Description: Provide a detailed list of the services provided or work completed. This can include hourly rates or fixed project fees, depending on how you charge.

- Payment Terms: Include clear instructions regarding payment methods, the due date, and any late fees or discounts for early payments.

- Hourly Rates or Project-Based Fees: Specify the rates charged per hour or the total agreed-upon fee for the entire project. Include the number of hours worked or milestones completed.

- Total Amount Due: Calculate the total amount the client owes, including any taxes or extra charges, and ensure it is clearly highlighted at the bottom of the document.

Example of a Simple Payment Request

Here’s a simple breakdown of how a payment request could look for freelance or contract work:

Service Description Hours Worked Hourly Rate Total Graphic Design for Website 20 $50 $1000 Consulting (Marketing Strategy) 10 $75 $750 Total Amount Due $1750 This format clearly shows the services provided, how much time was spent on each, and the total cost. Such clarity helps both you and your client stay organized, ensuring that payment is processed without delay.

Printable Invoice Templates for Small Businesses

For small business owners, having a professional way to request payments is essential to maintaining smooth operations and good client relations. A well-organized billing document not only makes it easier for clients to understand the charges but also helps ensure that payments are made on time. With a simple, customizable format, you can tailor each request to your specific needs, whether you’re offering services or selling products.

These formats are ideal for small businesses because they streamline the billing process and reduce the time spent on administrative tasks. By using pre-made structures, you can focus on delivering quality services or managing your inventory, while still keeping track of all financial transactions.

Here’s why small businesses should consider using pre-structured documents for payment requests:

- Efficiency: Time is valuable for small businesses. Ready-to-use formats allow you to quickly input necessary details like client names, service descriptions, and amounts due, without wasting time on design or layout.

- Professionalism: A polished, consistent request for payment presents your business as reliable and trustworthy, which is important for maintaining good client relationships.

- Customization: These formats are flexible. You can easily edit them to reflect your business’s unique offerings, whether you bill by the hour, by project, or by product sale.

- Record Keeping: A well-organized document allows you to track payments, outstanding balances, and payment histories for future reference, helping you manage your finances with ease.

For a small business, simplicity and clarity are key when it comes to billing. Using these pre-designed structures allows you to focus on what matters most: growing your business while keeping your finances organized.

How to Save Time with Invoice Templates

Managing finances can be one of the most time-consuming tasks for small business owners and freelancers. However, by using a pre-structured billing document, you can drastically reduce the time spent on generating payment requests. These ready-to-use formats simplify the process, allowing you to quickly input the necessary information and focus on more important aspects of your business.

Why Time Management is Crucial for Small Business Owners

For business owners, every minute spent on administrative tasks is time taken away from serving clients, expanding the business, or developing new projects. The quicker and more efficiently you can handle routine tasks, the more time you have to focus on growing your business. Using a pre-built structure can make your billing process much faster and more efficient.

Steps to Speed Up the Billing Process

- Reuse Existing Formats: Once you’ve created or downloaded a billing document, you can save it and reuse it for each new payment request. Simply update the client’s details, services, and costs, and the document is ready to go.

- Pre-Fill Common Information: Many of the details, such as your business information and payment terms, will remain the same for every request. Having these sections pre-filled saves you time on each new document.

- Automate Calculations: For businesses that bill hourly or by unit, having a format that automatically calculates totals based on quantities and rates can save significant time compared to manually adding up each charge.

- Easy Customization: With a pre-made structure, you can quickly adapt the document to fit any new service or pricing model, ensuring flexibility without sacrificing efficiency.

Here’s an example of a time-saving payment request:

Service Description Hours Worked Hourly Rate Total Consulting Services 10 $50 $500 Website Development Legal Considerations for Invoices When creating a document to request payment, it’s important to ensure that all necessary legal details are included. These details not only help ensure that both you and your client are clear on the terms of the transaction, but they also protect your rights as a business owner. Proper documentation is crucial in case of disputes, audits, or legal actions, as it can serve as evidence of agreed-upon terms and transactions.

Essential Legal Elements to Include

When preparing a billing document, there are several legal requirements and recommendations that should be included to ensure compliance with laws and regulations:

- Clear Payment Terms: It’s essential to specify the payment due date, any late fees, and acceptable payment methods. This helps avoid confusion and protects you in case a payment is delayed.

- Business Identification Information: Include your business’s name, address, and tax identification number. Depending on your location, you may also need to provide a VAT or sales tax number.

- Client Information: Always include the client’s full name or business name, as well as their contact information. This ensures that there’s no confusion about who is responsible for the payment.

- Service Description: Clearly describe the products or services provided, including the scope of work, quantities, and agreed rates. This transparency helps avoid misunderstandings about what was delivered.

- Tax Information: If applicable, be sure to include any taxes owed on the transaction. This can vary based on location, and ensuring the tax is properly applied can help you avoid legal complications down the line.

Why Accurate Documentation Matters

Accurate documentation of transactions is essential for several reasons:

- Dispute Resolution: In the event of a dispute, a well-documented payment request serves as evidence of the agreed-upon terms, protecting both parties in case of a legal issue.

- Tax Compliance: Properly documenting all payments and transactions ensures that you meet tax reporting requirements and avoid issues during audits.

- Professional Reputation: Including all necessary legal elements demonstrates professionalism and can help build trust with clients, showing that you operate with transparency and in compliance with regulations.

By incorporating these legal considerations into your payment requests, you ensure not only smoother business operations but also a layer of protection for your company in any potential legal situation.

How to Edit and Print Your Invoice

Once you have your payment request document ready, the next step is to make any necessary adjustments before sending it to your client. Editing and customizing these forms is a crucial part of ensuring that the information is accurate and aligned with the specific transaction. After making the necessary updates, you’ll be able to easily print or send the document electronically to facilitate quick payment.

Steps to Edit Your Payment Request Document

Editing your payment request document is a simple process that involves updating key information to reflect the specific details of the transaction. Here’s how to do it:

- Open the Document: Begin by opening your payment request document in your preferred editing software or application.

- Update Client Details: Ensure the client’s name, address, and contact information are correct. This will ensure there are no issues with the delivery of the request.

- Review Service or Product Information: Double-check that the description of services or products is accurate. Include any specific details such as quantities, rates, and total costs.

- Adjust Dates and Payment Terms: Confirm that the due date for payment is clearly noted. You may also want to review any agreed-upon payment methods or late fees, making sure they align with your agreement with the client.

- Verify Tax Details: If taxes are applicable, ensure they are calculated correctly and included in the total amount. Different locations may have different tax requirements.

How to Print or Send Your Document

After editing, you can either print the document for physical delivery or send it electronically to your client. Here’s how to proceed:

- Print the Document: If you prefer to mail a physical copy, simply select the “Print” option in your document editor. Be sure to use high-quality paper and include any additional notes if needed.

- Save as a PDF: For electronic delivery, saving the document as a PDF file ensures that the layout and formatting are preserved when the client opens it.

- Send via Email: Attach the PDF to an email and send it to your client. Make sure to include a brief, professional message explaining the request for payment.

- Use Online Platforms: Some businesses prefer using online invoicing platforms, which allow you to send the request directly through the platform and track its status.

Editing and sending your payment request document doesn’t have to be a complicated task. By following these simple steps, you ensure that all information is accurate, clear, and easily accessible to your client, speeding up the payment process and keeping everything organized.

Common Mistakes to Avoid with Invoices

When creating a document to request payment, accuracy and attention to detail are key to maintaining professional relationships and ensuring timely payments. Even minor mistakes can lead to confusion, delayed payments, or even disputes. It’s important to avoid common errors that could harm your business operations or client relationships.

Common Errors in Payment Requests

Here are some of the most frequent mistakes that people make when preparing payment requests, along with tips on how to avoid them:

- Missing Contact Information: Failing to include either your own or your client’s correct contact details can cause issues in communication and payment processing. Always double-check that names, addresses, and phone numbers are accurate.

- Incorrect Payment Terms: Not specifying the correct payment due date or payment methods can lead to confusion. Ensure that your terms are clearly stated, including whether payment should be made by bank transfer, credit card, or other methods.

- Vague Service Descriptions: Providing insufficient detail about the services or products provided can create misunderstandings. Always include a clear description of the work done or items delivered, along with any relevant quantities or specifications.

- Omitting Taxes: If applicable, be sure to include taxes and make it clear whether they are part of the total or extra. Neglecting this can cause accounting issues down the line.

- Not Tracking Payment History: If you’re issuing multiple payment requests over time, it’s crucial to keep track of what has been paid and what remains outstanding. Failing to do so could result in missed payments or double billing.

How to Correctly Present the Information

In order to avoid mistakes, ensure that your payment requests are clear, concise, and well-organized. A sample structure is shown below:

Service Description Quantity Unit Price Total Web Design Services 1 $500 $500 Consulting Hours 10 $50 $500 Total Amount Due $1000 By avoiding these common mistakes and presenting the information in a clear and organized manner, you help ensure that your payment requests are processed without delay, keeping both you and your clients happy.

How to Use Invoice Templates for Tax Purposes

Accurate financial documentation is essential for complying with tax regulations. Using a standardized billing document can help ensure that all necessary details are included for tax reporting. These documents not only make it easier to track income and expenses but also help you organize the information needed to file taxes correctly and avoid errors that could lead to penalties.

Key Elements to Include for Tax Purposes

When preparing your payment request documents with tax reporting in mind, there are several important elements to include to ensure that your records are complete and accurate:

- Business Identification: Always include your business name, address, and tax identification number (TIN) or employer identification number (EIN). This helps confirm your business status and provides the necessary details for tax filings.

- Client Details: Include your client’s full name, address, and, where applicable, their tax ID number. This is crucial for keeping track of whom you have billed and reporting to tax authorities.

- Transaction Dates: Record the date when the work was completed or the product was delivered. This is important for reporting income in the correct tax year.

- Tax Amounts: Be sure to include applicable taxes on each item or service provided. This can include VAT, sales tax, or other regional taxes. Clearly label the tax amount and its rate on the document.

- Total Amount Due: The total amount should reflect the cost of the service or product, plus taxes, fees, and discounts. This will help ensure accurate income reporting.

How to Keep Your Records Organized for Tax Time

Using consistent and organized financial documentation can save you time and reduce stress during tax season. Here are some best practices for keeping your records in order:

- Save Digital Copies: Keep a digital record of each document, including the original and any updates. This ensures that you have a backup in case you need to reference or send documents later.

- Record Payments Received: Mark each payment as received and track whether it was paid on time or if there were delays. This helps with cash flow reporting and shows income flow for tax purposes.

- Track All Deductions: If applicable, make note of any deductions related to business expenses, including software, office supplies, or other items necessary for your work. These deductions can help reduce your taxable income.

- Classify Income by Category: If you offer multiple services, separate income from each category t

Printable Invoices for Different Industries

Different industries often have unique requirements when it comes to creating and managing billing documents. Depending on the type of services or products offered, the structure of these records can vary to accommodate specific needs such as compliance, itemization, or tax requirements. Customizing your documents to fit the needs of your industry not only streamlines your accounting process but also ensures clarity and professionalism when dealing with clients.

Industry-Specific Adjustments and Considerations

Here’s how various industries customize their payment requests to meet their specific needs:

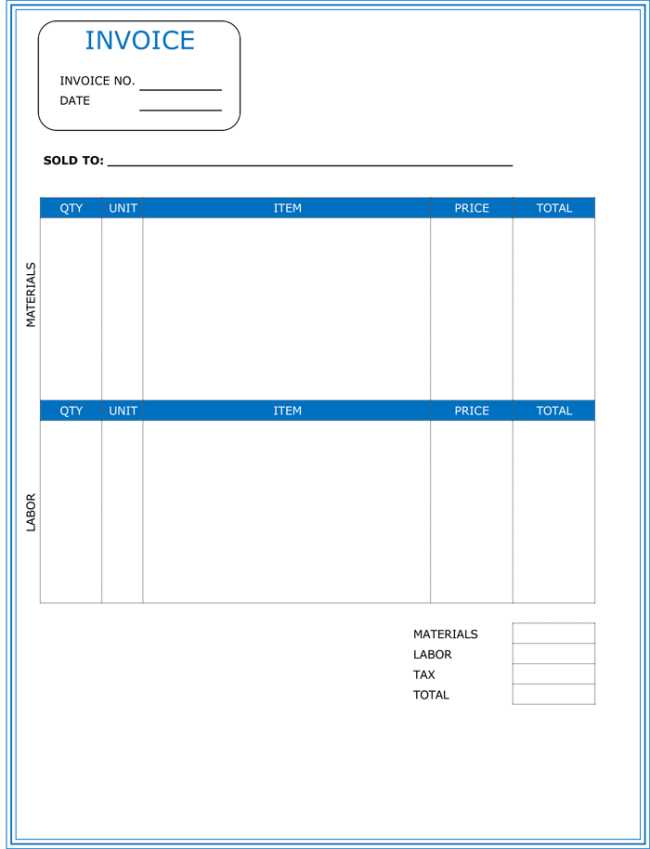

- Construction & Contracting: Businesses in construction often require detailed breakdowns of labor, materials, and additional costs like permits or inspection fees. These documents typically include more specific job descriptions, hourly rates for workers, and material costs.

- Retail & Wholesale: For retail and wholesale businesses, payment requests often involve large volumes of goods, so itemized lists with descriptions, quantities, and unit prices are essential. This helps ensure transparency for both parties, especially in case of bulk transactions.

- Creative Services: Freelancers and agencies in the creative industry typically require detailed descriptions of services provided, such as hours worked, design concepts delivered, or marketing services completed. Many times, these documents also include intellectual property or licensing details for digital assets delivered to the client.

- Healthcare & Medical Services: Professionals in the healthcare industry may need to include coding information, such as ICD-10 codes for treatments or procedures, along with patient details. These records also often contain insurance or billing information for claims.

- Consulting & Professional Services: Consultants and other professional service providers often use time-based billing, meaning payment requests need to reflect the time spent on a particular project or task, along with any additional costs related to travel, accommodations, or equipment rental.

Sample Industry-Specific Payment Request Layouts

Below is an example of how a payment request might be structured for a consulting business:

Service Description Hours Worked Hourly Rate Total Consulting: Business Strategy 10 $150 $1500 Research & Analysis 5 $120 $600 Total Amount Due $2100 Each industry has its own unique

Best Practices for Invoice Design and Layout

The design and layout of your billing documents are crucial not only for clarity but also for ensuring a professional appearance. A well-organized document makes it easier for clients to understand the charges and details, which can lead to faster payments and fewer disputes. By following best practices for structure and design, you create a positive impression and ensure that your documents serve their purpose effectively.

Key Design Elements for Effective Billing Documents

Here are the main design elements to focus on to make your payment requests clear and professional:

- Clean and Simple Layout: Avoid cluttering your document with unnecessary details. Use a simple, well-structured layout with clear headings and sections. This allows clients to quickly find the information they need.

- Consistent Font and Colors: Choose easy-to-read fonts and use them consistently throughout your document. Stick to a professional color scheme that matches your brand identity, avoiding overly bright or distracting colors.

- Clear Itemization: Break down services, products, or hours worked in a clear, itemized format. This makes it easier for clients to see exactly what they are being charged for, which can prevent misunderstandings.

- Prominent Payment Details: Ensure that the total amount due is clearly highlighted and easy to find. It should stand out on the page to avoid any confusion about the payment amount.

- Use of Branding: Including your business logo and contact details makes the document look more professional and reinforces your brand identity.

Layout Considerations for Different Needs

Depending on the complexity of the work or the services provided, the layout might require additional elements. For example:

- Hourly Work or Projects: If billing by time, include a detailed table with hours worked, hourly rate, and total cost. This helps clients understand how the final amount was calculated.

- Product Sales: For product-based businesses, provide a detailed list of items with unit prices, quantities, and total costs. This makes it easy for clients to cross-check what they received against the billed amount.

- Discounts and Adjustments: If there are any discounts, refunds, or adjustments, clearly highlight these on the document to ensure that clients understand how they affect the final total.

By following these best practices for design and layout, you create billing documents that are not only functional but also reinforce your professionalism and brand image. Clear, well-structured documents help build trust with your clients and make the paym