Free Tax Invoice Template Download

Creating accurate and professional billing documents is crucial for any business or freelance professional. These documents serve not only as a record of transactions but also as a reflection of your business’s credibility and attention to detail. With the right tools, generating these important records becomes a simple and efficient task.

Using pre-designed documents can save time and ensure that all necessary information is included. Customizable formats allow you to adjust the details to suit your specific needs, whether you’re issuing a one-time charge or setting up a recurring billing cycle. With easy access to these resources, you can ensure that your financial communications remain clear and error-free.

In this section, we will explore the various resources available to streamline the process of creating such documents. Whether you’re looking for a basic structure or a more advanced design, there are options to suit every requirement.

Tax Invoice Template Free Download

Having access to pre-made document structures can greatly enhance your efficiency when creating important financial records. By using customizable files, you ensure consistency and professionalism in all of your transactions. These ready-to-use formats help simplify the process, enabling you to focus on other critical aspects of your business.

Why Choose Pre-designed Formats?

Pre-designed documents offer numerous advantages, including easy customization, time-saving features, and the ability to follow industry standards. With the right structure, you can ensure that your records contain all the necessary details, such as client information, services rendered, and payment terms, while maintaining a clean and organized layout.

How to Access and Use Customizable Files

Many resources are available online to obtain these useful structures. You can find a variety of formats in different styles, allowing you to pick one that suits your business needs. Once obtained, these files can be tailored to match the specifics of your transactions, ensuring accuracy and efficiency with each record you create.

Why Use a Tax Invoice Template

Using pre-structured forms for billing is essential for ensuring both accuracy and professionalism in financial transactions. With the right document in place, businesses and individuals can maintain consistency in the way they present financial details, minimizing errors and improving overall workflow.

By relying on these organized formats, you can streamline your billing process, save valuable time, and avoid the hassle of manually creating new records from scratch each time. This approach helps in maintaining a high level of professionalism and ensures that all necessary information is consistently included.

| Advantages | Details |

|---|---|

| Consistency | Ensures that each document follows a standardized format with all required information. |

| Efficiency | Saves time by eliminating the need to design each record from scratch. |

| Professionalism | Helps present a polished, consistent image to clients and partners. |

| Accuracy | Reduces the chance of missing critical details or making mistakes. |

By adopting these ready-made structures, you can focus on providing quality services without worrying about the technicalities of record creation. These resources provide an efficient way to manage all financial communications with clients and partners.

How to Customize Your Tax Invoice

Personalizing your financial records ensures that they meet the specific needs of your business or client base. Customization allows you to include all relevant details, modify the layout for clarity, and tailor the document’s appearance to reflect your brand identity. With a few simple adjustments, you can create a document that looks professional and serves its purpose efficiently.

Steps to Personalize Your Financial Document

- Update Your Branding – Add your company logo, business name, and contact information to make the document easily identifiable.

- Adjust Layout and Structure – Organize sections based on the type of service or goods provided, ensuring clarity and easy reference.

- Include Payment Terms – Specify due dates, late fees, and payment methods to set clear expectations for your clients.

- Customize Currency and Tax Rates – If applicable, adjust the currency type and tax rates according to the location or service provided.

Additional Features to Consider

- Client Information – Ensure that each document includes the correct client’s name, address, and contact details.

- Unique Reference Numbers – Create unique codes for each transaction to avoid confusion and ensure proper record-keeping.

- Notes or Additional Information – Include a section for special instructions or terms that may be relevant to the client.

Once customized, these documents will serve as a clear and professional means of communication with your clients, ensuring that all essential information is presented accurately and consistently.

Top Benefits of Using Templates

Utilizing pre-designed documents for your business transactions can greatly simplify the billing process. These ready-made structures provide a consistent format that saves time, ensures accuracy, and promotes a professional image. The key advantage of using these resources is the efficiency they bring, allowing you to focus on other important aspects of your work while maintaining high-quality records.

Here are some of the top benefits of adopting structured formats for your financial communications:

- Time Savings – Ready-to-use designs eliminate the need to start from scratch, enabling you to generate documents quickly and efficiently.

- Consistency – These formats ensure that all your records follow the same layout, reducing the chances of missing important information.

- Professional Appearance – Pre-designed files offer a polished look, reflecting your attention to detail and enhancing your business image.

- Reduced Errors – With a set format, you minimize the risk of forgetting key elements or making mistakes, improving accuracy in your records.

- Customization Options – Despite their ready-made structure, these resources are flexible enough to be adjusted to meet your specific needs.

By integrating these tools into your workflow, you can streamline the billing process and ensure that your financial documents are both clear and professional.

Where to Find Free Templates

Accessing ready-made documents for your business transactions has become easier than ever. There are numerous online platforms that offer customizable files designed to meet your specific needs. Whether you’re looking for simple layouts or more advanced structures, these resources provide a variety of options to suit every requirement.

Here are some of the best places to find these ready-made resources:

- Online Document Repositories – Websites like Google Docs and Microsoft Office offer a wide range of customizable files that can be easily edited and saved.

- Business Resource Websites – Many business-focused platforms provide access to downloadable files specifically designed for financial documentation, offering a variety of formats for different industries.

- Freelance Platforms – Freelance marketplaces often have templates available for download, created by professionals who understand the needs of business owners and contractors.

- Government and Legal Websites – Some official websites offer free resources, including files tailored to meet legal and business standards.

- Design Tools – Online design tools such as Canva or Adobe Spark provide customizable document layouts, allowing you to create professional-looking records easily.

These resources give you the flexibility to find exactly what you need, ensuring that you can generate high-quality, organized documents without much effort.

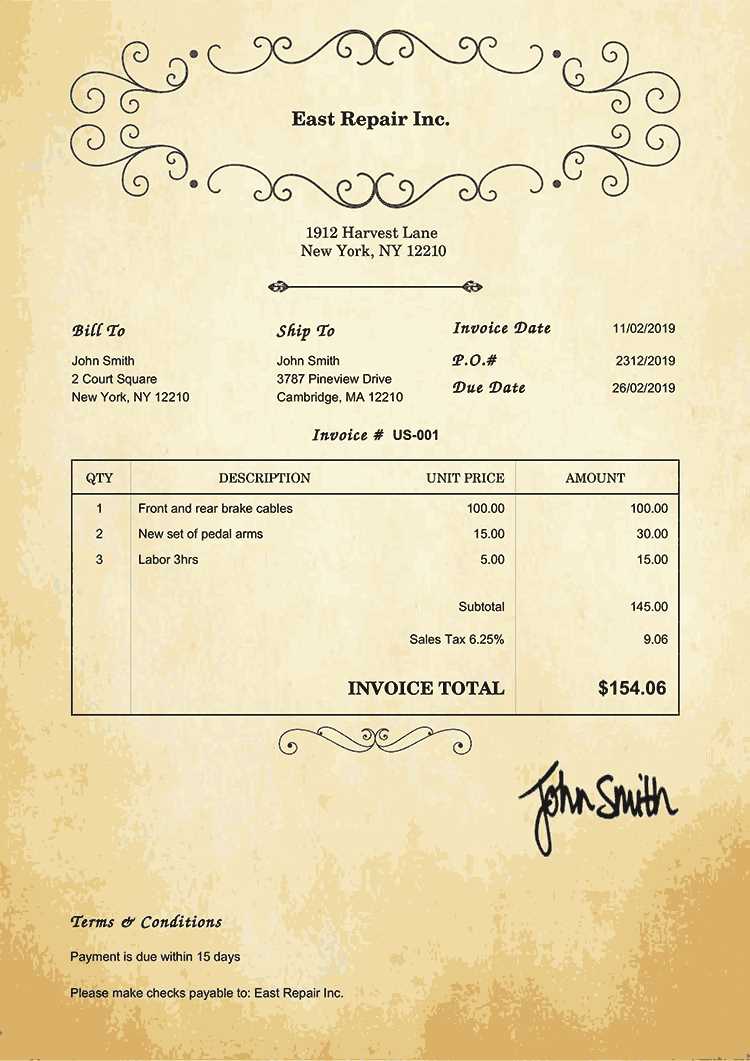

How to Create a Tax Invoice

Creating a professional billing document involves more than just entering basic information. It’s important to structure the details clearly, ensuring that all necessary components are included to avoid confusion and ensure smooth transactions. By following a few simple steps, you can create a comprehensive document that meets both your needs and those of your clients.

Step-by-Step Guide

- Header Information – Include your business name, logo, and contact details at the top of the document for easy identification.

- Client Information – Clearly list the name, address, and contact information of the recipient of the document.

- Unique Reference Number – Assign a unique code or number to each document for future reference and tracking.

- Services or Goods Provided – Describe in detail the items or services provided, including quantity, unit price, and total amount.

- Payment Terms – Outline the payment method, due date, and any applicable late fees or discounts.

- Legal and Regulatory Information – Include any necessary legal statements or compliance information that may be required in your region or industry.

Formatting and Organization

Maintaining a clean and organized layout is crucial for clarity. Group related information together and ensure that all sections are easy to locate. Use bold headings and clear section breaks to guide the reader through the document efficiently. An organized structure helps avoid confusion and ensures that all relevant details are included in the right place.

Essential Elements of a Tax Invoice

When creating a professional document to outline charges for goods or services, there are several critical components that must be included. These essential elements ensure clarity, prevent misunderstandings, and maintain legal compliance. Each piece of information serves a specific purpose, from identifying the sender and recipient to providing a clear breakdown of charges.

Key Information to Include

- Header Details – Your company name, logo, and contact information should be clearly displayed at the top of the document, making it easy for recipients to identify who is issuing the document.

- Recipient Information – Include the name, address, and contact details of the recipient to ensure that the document reaches the correct party and is properly referenced.

- Unique Reference Number – Assign a specific reference number to each document for tracking and future reference, making it easier to manage records and follow up if necessary.

- Description of Goods or Services – Provide a clear, itemized list of the goods or services provided, including quantity, unit price, and total cost for each item or service.

- Payment Terms – Outline the payment terms, including the due date, accepted payment methods, and any applicable late fees or discounts.

Additional Considerations

- Legal Information – Some regions may require additional legal or regulatory details, such as tax identification numbers or specific terms mandated by local laws.

- Total Amount Due – Clearly state the total amount due, including any applicable taxes, fees, or discounts, to ensure that both parties are on the same page regarding the financial transaction.

Including these essential elements ensures that your documents are comprehensive, professional, and easy to understand, which helps build trust with clients and facilitates smoother business transactions.

Common Mistakes in Tax Invoices

When creating a document to record transactions, certain mistakes can easily occur that could lead to confusion or even legal issues. It’s important to be aware of these common errors to ensure that your records are both accurate and professional. Addressing these mistakes proactively can save time and prevent unnecessary disputes with clients.

Frequent Errors to Avoid

- Missing Contact Details – Failing to include accurate business and client contact information can lead to communication problems and delays in payment.

- Incorrect or Missing Amounts – Not calculating the total amount correctly or omitting line items can result in overcharging or undercharging, which may cause client dissatisfaction.

- Omitting Payment Terms – Not specifying due dates, accepted payment methods, or penalties for late payments can create confusion and hinder the collection process.

- Not Including a Unique Reference Number – Skipping the inclusion of a reference number can make it difficult to track transactions, leading to potential issues with accounting and record-keeping.

- Failure to Add Legal Requirements – Neglecting to include necessary legal or regulatory information, such as business registration numbers or tax rates, can make the document non-compliant with local laws.

How to Prevent These Mistakes

- Double-Check Calculations – Always verify the amounts, taxes, and totals before finalizing the document to avoid errors in the financial details.

- Use a Checklist – Create a checklist of required information to ensure that all necessary components are included in the document.

- Seek Professional Advice – If unsure about legal or tax requirements, consult with an accountant or legal professional to ensure compliance.

By being mindful of these common mistakes and taking steps to prevent them, you can create accurate, clear, and professional documents that will strengthen your business relationships and streamline financial processes.

How to Save Time with Templates

Using pre-designed documents can significantly speed up the process of creating and managing business records. These ready-made structures allow you to avoid repetitive tasks, reduce the chance of errors, and focus on other important aspects of your business. By customizing and reusing these resources, you can streamline your workflow and enhance productivity.

Steps to Save Time

- Reuse Existing Formats – Once you’ve created a well-structured document, you can reuse the same layout for future transactions, saving time on formatting and setup.

- Automate Data Entry – Many digital tools allow you to input data automatically into pre-existing fields, reducing the time spent on manual entry.

- Standardize Information – By using a consistent structure, you ensure that all necessary information is included every time, eliminating the need to double-check for missing components.

- Reduce Customization Time – Pre-built files require minimal adjustments, allowing you to focus only on updating specific details like amounts, dates, and client names.

Additional Tips

- Organize Your Documents – Store commonly used files in an easily accessible place to quickly retrieve and edit them when needed.

- Choose Flexible Solutions – Opt for customizable structures that allow you to adapt them to different situations, ensuring they meet your specific needs without wasting time on major changes.

By leveraging the power of pre-designed formats, you can save valuable time and improve efficiency in your business operations. The key is to establish a system that works for you and allows for quick, consistent, and accurate document creation.

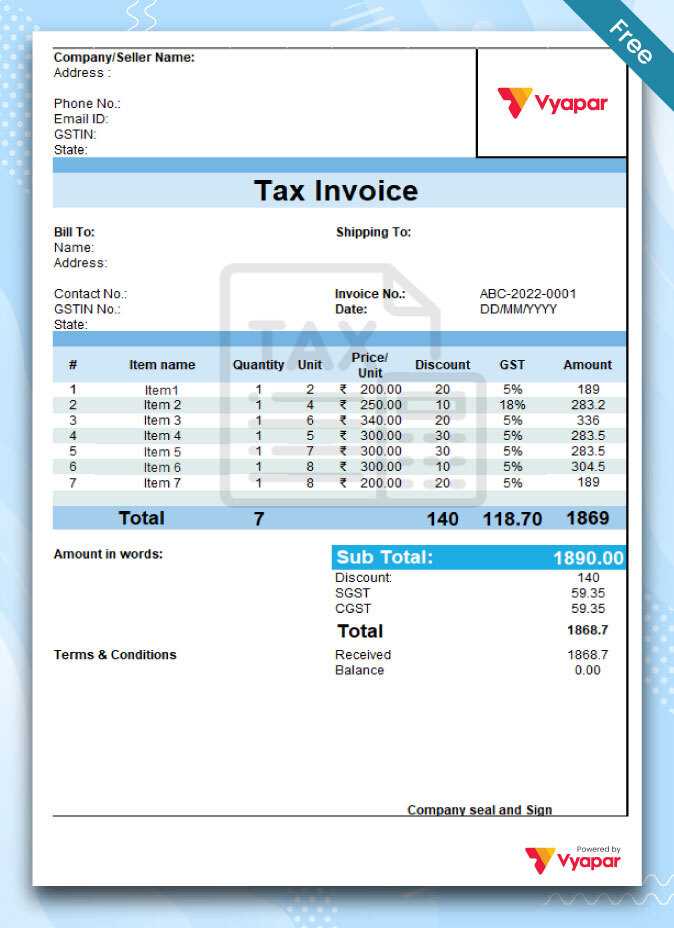

Free Tax Invoice Templates for Businesses

Businesses often need a quick and efficient way to create professional documents to record payments for services or products. By using ready-made structures, companies can save time, reduce errors, and maintain consistency across all transactions. These pre-designed formats are especially helpful for small businesses or startups looking for an easy way to streamline their billing process.

Various online resources offer these preformatted files, allowing you to customize them according to your specific business needs. These documents typically include all the necessary sections, such as details of goods or services provided, payment terms, and client information, helping you maintain clarity and accuracy in every transaction.

Using such structures can also help ensure compliance with legal requirements by including all required information in the proper format. Whether you need to issue one or multiple documents, having a standardized approach simplifies the process and keeps your operations running smoothly.

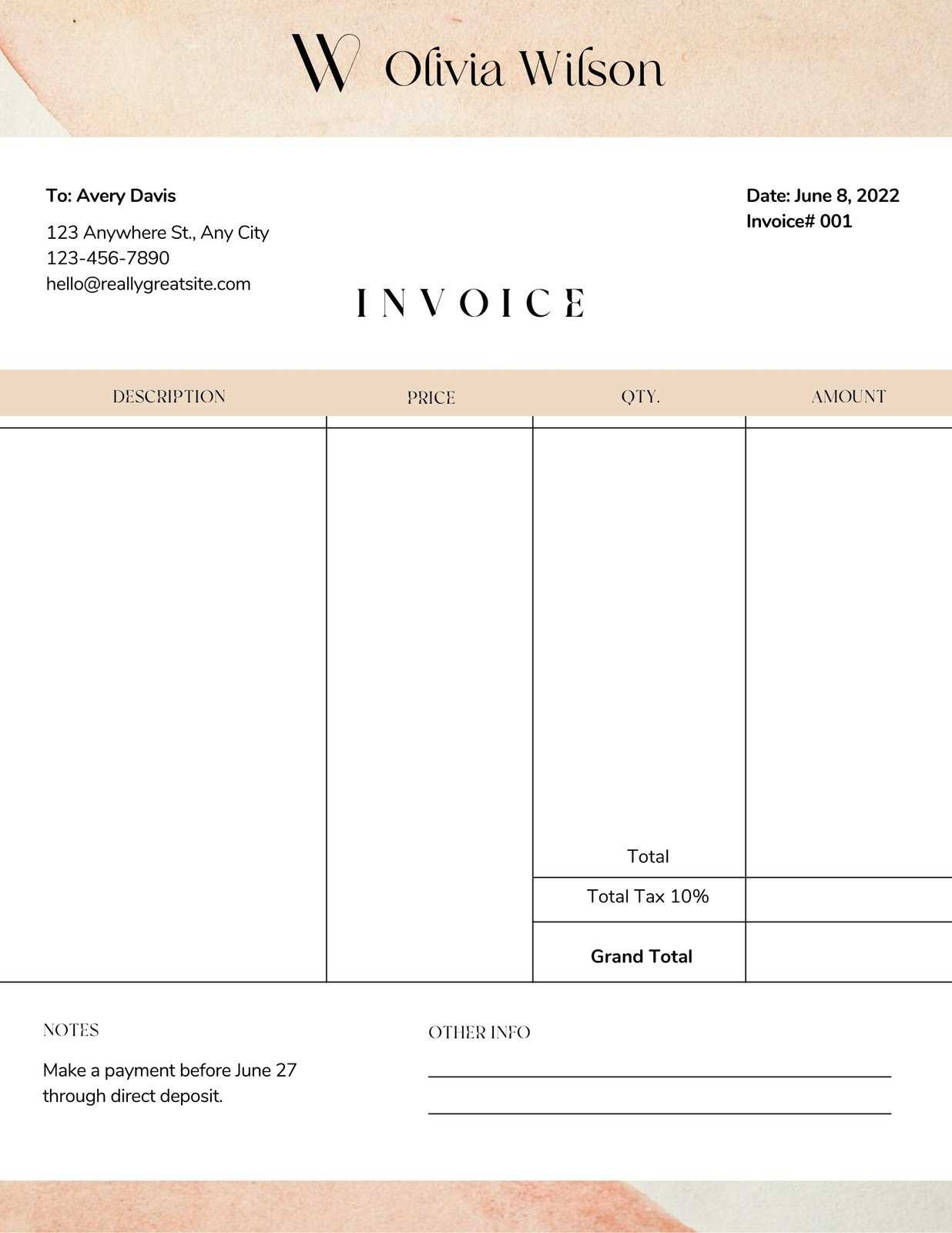

Tax Invoice Template for Freelancers

Freelancers often need to issue documents to clients that clearly outline the work performed, the agreed-upon rates, and payment details. Having a structured document to provide these details helps to maintain professionalism and clarity, ensuring that both the freelancer and the client are on the same page. It also helps in organizing financial records for future reference or tax purposes.

For freelancers, using a standardized format can save time and effort. Whether you are billing for one-time projects or ongoing services, a pre-designed document can help you create consistent and accurate records each time. Here’s a basic structure to consider for your billing needs:

| Section | Description |

|---|---|

| Contact Information | Include your name, business name (if applicable), and contact details along with the client’s information. |

| Service Details | List the services rendered, including a brief description, quantity, rate, and total cost for each item. |

| Payment Terms | Specify the due date, acceptable payment methods, and any late payment penalties or discounts for early payment. |

| Subtotal and Total | Clearly show the subtotal, taxes (if applicable), and the total amount due. |

By using this kind of structured approach, freelancers can efficiently create documents that look professional and are easy for clients to understand. Whether you are just starting out or have years of experience, using a structured document can help you manage your billing process and improve your client relationships.

Formatting Your Invoice for Clarity

Effective document formatting plays a crucial role in ensuring that your clients understand the charges, terms, and details related to a transaction. Clear, organized presentation not only enhances professionalism but also prevents confusion and minimizes the chances of disputes. The goal is to make it as easy as possible for your clients to read, comprehend, and process the information.

Here are some key tips for formatting your document for maximum clarity:

- Use Clear Headers – Start with easy-to-read headers for each section of the document, such as “Service Details”, “Payment Terms”, and “Amount Due”. This helps the reader navigate the document with ease.

- Organize Information in Tables – Group similar information together in tables. For example, list services, quantities, rates, and totals in separate columns. This makes the information more digestible.

- Be Consistent with Fonts and Sizes – Use uniform font styles and sizes throughout the document. This gives the document a clean, organized appearance and avoids distractions.

- Highlight Key Information – Use bold or underlined text to emphasize crucial details such as the total amount due, payment terms, and due date. This ensures they stand out at a glance.

- Avoid Overcrowding – Don’t try to fit too much information on a single page. Use white space effectively to avoid a cluttered look and allow for easier readability.

By following these formatting tips, you can create a document that is not only clear and easy to understand but also presents your business in a professional light. Clarity in documentation can improve client satisfaction and expedite the payment process.

Legal Requirements for Tax Invoices

When creating business documents for transactions, it’s essential to comply with legal regulations to ensure that all required information is included and properly formatted. Different countries have specific guidelines that dictate the necessary elements for such documents, particularly when it comes to record-keeping and compliance with financial laws.

Here are the key legal requirements to consider when preparing such documents:

- Identification Details – The document must clearly identify the seller’s and buyer’s information, including business names, addresses, and contact details. This helps establish the legitimacy of the transaction.

- Unique Document Number – Each document should have a unique number for easy identification and tracking in case of future reference or audits.

- Date of Issue – The date when the document is issued must be included to establish the timeline for payment and any applicable deadlines.

- Description of Goods or Services – A detailed description of the goods or services provided is necessary. This ensures that the client knows exactly what is being billed for.

- Payment Terms – Clearly state the payment due date, terms, and any penalties or discounts for early or late payment.

- Tax Information – If applicable, the document must indicate the tax rate and the total amount of tax charged. This is crucial for both the business and the client’s accounting records.

- Amount Due – The total amount that needs to be paid, including the cost of goods/services and any applicable taxes, should be clearly displayed.

Adhering to these legal requirements not only helps maintain transparency in business dealings but also ensures that your documents will be accepted in case of audits or legal reviews. It’s crucial to familiarize yourself with local laws to avoid fines or complications later on.

Choosing the Right Template for Your Needs

When preparing professional documents for your business transactions, selecting the right structure is crucial to ensuring clarity and compliance with requirements. The correct design helps both you and your clients easily understand the details, including the services provided, pricing, and terms of payment. There are various styles and formats available, each offering different features to cater to specific business needs.

Here are some factors to consider when choosing the most suitable structure for your purposes:

Consider Your Business Type

- Freelancers – If you work as a freelancer, a simple and clean layout with essential fields such as service description, hours worked, and hourly rate may be all you need.

- Small Businesses – A more comprehensive layout may be required if you offer a range of products or services. This would include detailed descriptions, quantities, and pricing.

- Large Enterprises – Larger companies may need more sophisticated formats, with sections for multiple services, payments, terms, and even references to contracts or purchase orders.

Match with Your Branding

- Professional Appearance – Choose a design that aligns with your company’s image. A clean, polished structure reflects well on your business and reinforces your professionalism.

- Customization – Look for a structure that allows customization of colors, fonts, and logos to match your brand identity.

By selecting the right structure, you can streamline your workflow, ensure that all necessary information is clearly presented, and maintain a professional standard that leaves a positive impression on your clients.

How to Edit Templates in Word

Editing pre-designed documents in Word is a straightforward process, allowing you to customize the content to fit your specific needs. Whether you’re adjusting the layout, updating information, or personalizing the look, Word provides a range of tools that can help you modify these documents efficiently. The flexibility of Word’s editing features ensures that you can create a professional result with minimal effort.

Here’s how you can quickly make changes to an existing document in Word:

- Open the Document – Begin by opening the file you want to edit. You can do this by double-clicking the document in your file explorer or selecting it from within Word’s “Open” menu.

- Enable Editing – If the document is in “Read-Only” mode, click the “Enable Editing” button at the top of the page to make changes.

- Update the Content – Click on the text or section you wish to modify. Delete or type over the existing text to update the details, such as names, dates, or amounts.

- Customize the Layout – If needed, adjust the layout by selecting the text and using Word’s formatting tools. Change fonts, colors, or paragraph alignment to match your preferences or branding.

- Insert Tables or Graphics – You can also insert tables, logos, or other visuals to enhance the document’s appearance. Select “Insert” from the top menu, then choose the appropriate option for tables, pictures, or shapes.

- Save the Document – Once you’ve made the necessary edits, save the document. You can either overwrite the original file or save it as a new version by selecting “Save As” from the “File” menu.

Here’s an example of a basic structure you might be editing in Word:

| Field | Content |

|---|---|

| Date | [Insert Date] |

| Sender Name | [Your Name/Business Name] |

| Receiver Name | [Client’s Name] |

| Amount Due | [Insert Amount] |

| Terms | [Insert Payment Terms] |

With these steps, you can easily tailor a document in Word to your exact specifications, ensuring that it meets your business needs and maintains a professional appearance.

Using Excel for Tax Invoices

Excel is a powerful tool that can be used for creating and managing professional documents for business transactions. With its robust features, you can easily organize and customize essential details such as itemized lists, prices, and payment terms. By using Excel, you streamline the process of creating detailed and consistent records for each transaction, ensuring efficiency and accuracy in your documentation.

Here are the key benefits of using Excel to manage your business documentation:

- Customizable Structure: Excel allows you to create documents that match your specific business needs. You can set up rows and columns for different data points, like item descriptions, quantities, unit prices, and totals, making the document highly adaptable.

- Automatic Calculations: Using formulas in Excel, you can automate calculations such as totals and taxes. This reduces the risk of errors and saves you time when processing multiple transactions.

- Easy Updates: Excel’s spreadsheet format makes it easy to make changes to your data. You can quickly update quantities, prices, and terms without having to manually edit each part of the document.

- Data Management: You can store and manage all transaction records in one file, enabling easy tracking and searching for past records. With Excel’s filtering and sorting capabilities, you can quickly locate any transaction you need to reference.

- Professional Appearance: With Excel, you can format your documents to look clean and organized, which gives your business a polished, professional appearance.

To get started with Excel, follow these basic steps:

- Set up the Structure: Create a new workbook and set up columns for the necessary fields, such as Item Name, Quantity, Price, and Total. You can adjust the column width to ensure the data fits neatly.

- Input Data: Enter the details for each item or service provided. Be sure to include accurate descriptions, amounts, and applicable terms.

- Apply Formulas: Use Excel formulas to automatically calculate totals, taxes, and discounts. For example, use the SUM function to add up prices or calculate the final amount after applying tax.

- Format for Readability: Use bold headings, borders, and shading to highlight important information and make the document easy to read.

- Save and Share: Once your document is complete, save it as a file that can be easily shared with clients or stored for future reference. Excel also allows you to save files as PDF for easy printing and sharing.

Excel provides a flexible and reliable way to manage business transactions, ensuring that your records are accurate and easily accessible when needed.

How to Download and Use Templates

In today’s fast-paced business environment, having a ready-made document format can save valuable time and ensure consistency in your records. Many online resources offer pre-designed layouts that can be easily accessed, customized, and used for various purposes, including managing client transactions. These ready-to-use formats can be quickly downloaded, allowing you to focus more on the content rather than the structure.

Here are the steps to efficiently access and use such ready-made documents:

- Find a Reliable Source: Start by searching for reputable websites that offer document formats tailored to your needs. Many platforms provide these resources at no cost, with options for different industries and business types.

- Choose the Right Format: Once you’ve identified a source, browse through the available options and choose a format that best suits your business. Make sure it includes all the necessary sections for your specific requirements, such as dates, item details, and total amounts.

- Download the Document: After selecting the appropriate format, click the download link. Most platforms will allow you to download the document in a common file format, such as Microsoft Word, Excel, or PDF, depending on your preference and software compatibility.

- Open and Customize: After downloading, open the document in the appropriate software (e.g., Microsoft Word or Excel). You can now customize the content by adding your business details, adjusting fields as needed, and ensuring the information is correct before using it for transactions.

- Save and Use: Once the format is personalized, save the file for future use. Depending on the software you used, you may also save it in different formats, such as PDF, to easily share with clients or store for record-keeping.

By following these simple steps, you can easily access and use pre-designed layouts to streamline your workflow and ensure your business transactions are handled efficiently and professionally.