Simple and Customizable Invoice Salary Template for Easy Payroll Management

Managing employee compensation can become complex without a clear, structured system in place. Proper documentation not only ensures accuracy but also promotes transparency in business operations. Having an organized method to communicate payment details is essential for both employers and workers alike.

Creating a clear document that outlines the amounts owed, deductions, and final payments can simplify payroll management. It serves as both a record of financial transactions and a way to track payments over time. When designed correctly, this system helps avoid misunderstandings and fosters trust between businesses and their staff.

Utilizing a ready-made solution can save valuable time and reduce errors. A well-organized document helps to clarify the terms of payment and ensures that all calculations are accurate. Whether you’re a small business owner or part of a larger company, having a reliable way to handle payment records is crucial for smooth financial operations.

Understanding Payment Documentation Formats

Proper documentation for employee payments is essential for any business. A well-structured record helps ensure clarity and transparency in compensation processes, while also reducing the risk of errors. The idea is to have a standardized way of presenting the details of each employee’s earnings, deductions, and final amounts due. This clarity benefits both employers and employees, fostering trust and ensuring smooth financial operations.

Such documents are not just for record-keeping but also play a role in financial management. They help business owners track expenses, maintain compliance with tax regulations, and provide employees with clear and understandable payment statements. By utilizing an organized format, companies can save time and effort in calculating and verifying compensation.

Employers can create their own structure or use pre-designed formats to streamline the process. The key is to ensure that all important details, such as gross pay, deductions, bonuses, and taxes, are clearly presented. A well-designed system can automate parts of this process, allowing businesses to focus on growth while keeping financial records accurate and up to date.

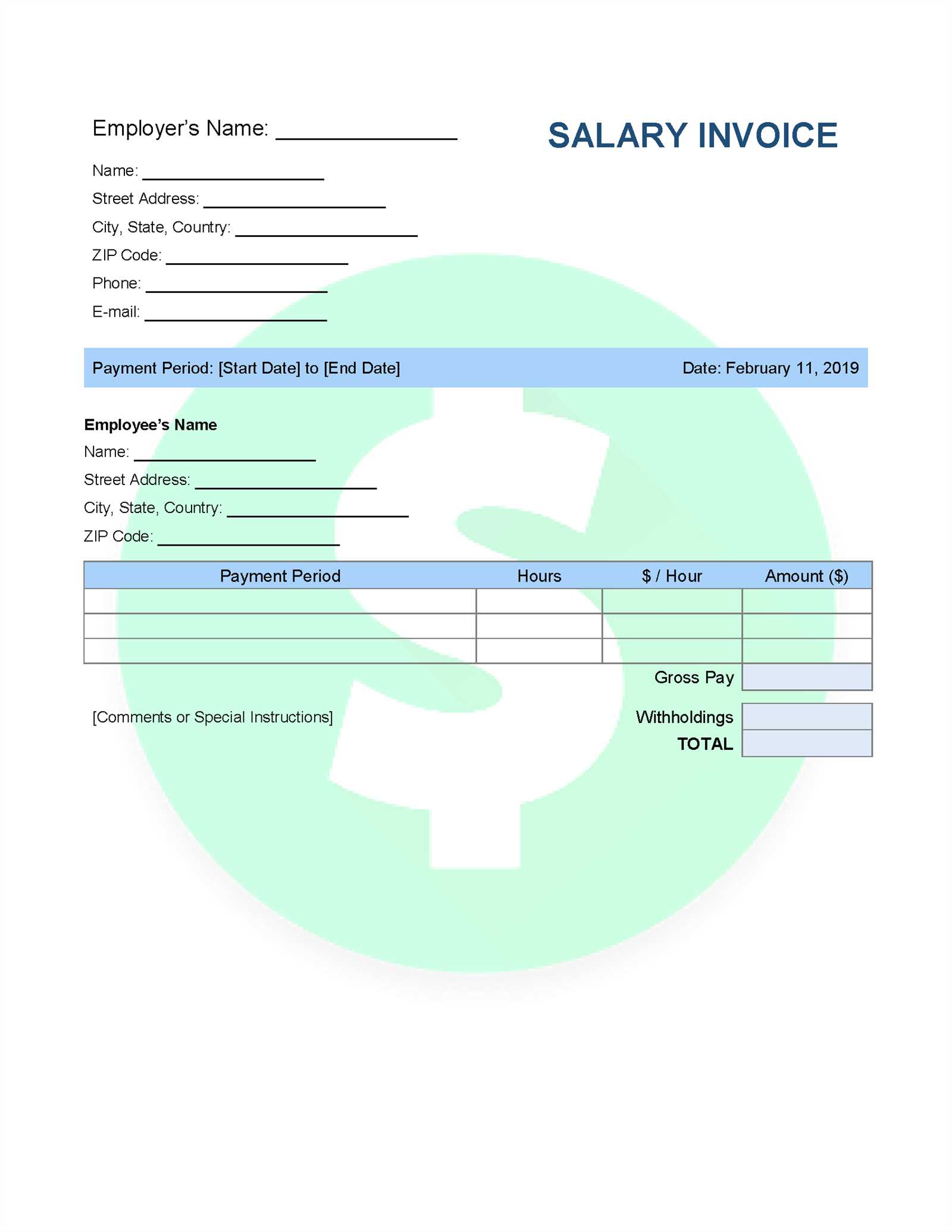

How to Create a Payment Statement for Employees

Creating a clear and accurate document that outlines employee compensation is essential for any business. This record should include the details of the payment, including earnings, deductions, and net amounts owed. By following a structured approach, employers can ensure that employees receive clear communication about their payments and reduce the risk of errors.

To create this document, start by including key information such as the employee’s name, pay period, and total hours worked. Then, list all components of their compensation, including base pay, overtime, and any bonuses or allowances. Be sure to also account for necessary deductions, such as taxes and insurance contributions. Finally, clearly display the total amount due after deductions.

| Item | Amount |

|---|---|

| Base Pay | $2,000 |

| Overtime | $300 |

| Bonus | $150 |

| Tax Deduction | -$500 |

| Net Payment | $1,950 |

Once the details are included, double-check the numbers for accuracy and ensure that all necessary deductions are accounted for. By providing a comprehensive and easy-to-read payment statement, both employer and employee can confidently track payments and financial records.

Benefits of Using Payment Documentation Formats

Using a standardized format for documenting employee compensation offers a range of advantages for businesses. This approach streamlines the payroll process, reduces errors, and ensures that all parties are on the same page regarding payments. Whether you’re a small business owner or managing a large team, having a reliable system in place can save time and minimize administrative work.

One of the key benefits is consistency. By utilizing a pre-designed structure, employers can ensure that all necessary information is included in every document, which helps maintain uniformity across all records. This not only makes it easier to track payments but also ensures that employees receive clear and understandable statements.

| Benefit | Description |

|---|---|

| Time Savings | Pre-designed formats reduce the need for manual calculations and formatting, speeding up the process. |

| Accuracy | Using a set structure reduces the risk of missing important details or making calculation mistakes. |

| Clarity | A standardized format makes it easier for employees to understand their compensation details. |

| Professionalism | Consistent, well-organized documents enhance the professional image of the business. |

Moreover, using a structured system helps businesses stay compliant with tax regulations and simplifies the auditing process. With everything clearly documented, it’s easier to generate reports or provide necessary paperwork when required by authorities. Ultimately, these formats help businesses maintain efficiency and accuracy while ensuring transparency for both employers and employees.

Essential Components of a Payment Record

When creating a document that outlines employee compensation, it is crucial to include all relevant details to ensure clarity and transparency. A well-structured record not only helps avoid misunderstandings but also provides both the employer and employee with a comprehensive overview of the payment. Certain components are essential for accuracy, and each one plays a critical role in ensuring that the document is complete and informative.

Key Information to Include

- Employee Details: Name, position, and identification number or employee code.

- Payment Period: The start and end dates of the pay period for which compensation is being provided.

- Hours Worked: The total number of hours worked during the pay period, including regular and overtime hours.

- Earnings Breakdown: A clear listing of base pay, overtime, bonuses, or commissions.

- Deductions: A detailed list of all applicable deductions, such as taxes, insurance, and retirement contributions.

- Net Amount: The final amount due after all deductions have been made.

Additional Helpful Details

- Payment Method: How the payment is being made (e.g., bank transfer, check, cash).

- Employer Information: The name and contact details of the business or employer issuing the payment.

- Unique Reference Number: A reference code or number for easy tracking and record-keeping.

- Notes or Comments: Any additional information or clarification, such as performance bonuses or special instructions.

Including these key components ensures that the document is comprehensive, reducing the likelihood of confusion and providing a transparent record for both the employer and the employee. This level of detail not only fosters trust but also simplifies the process of auditing or reviewing payments in the future.

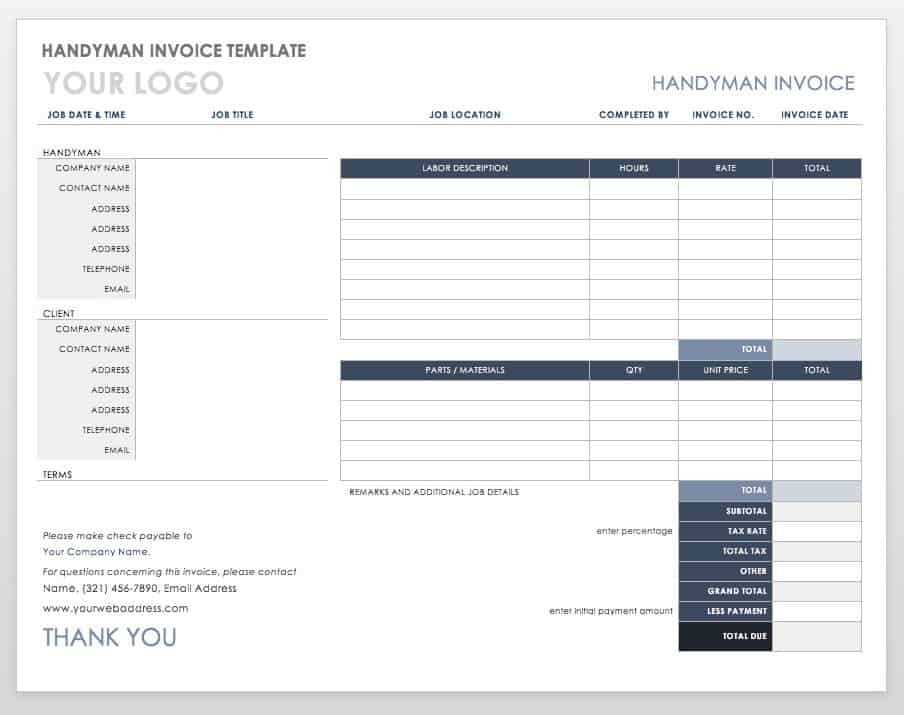

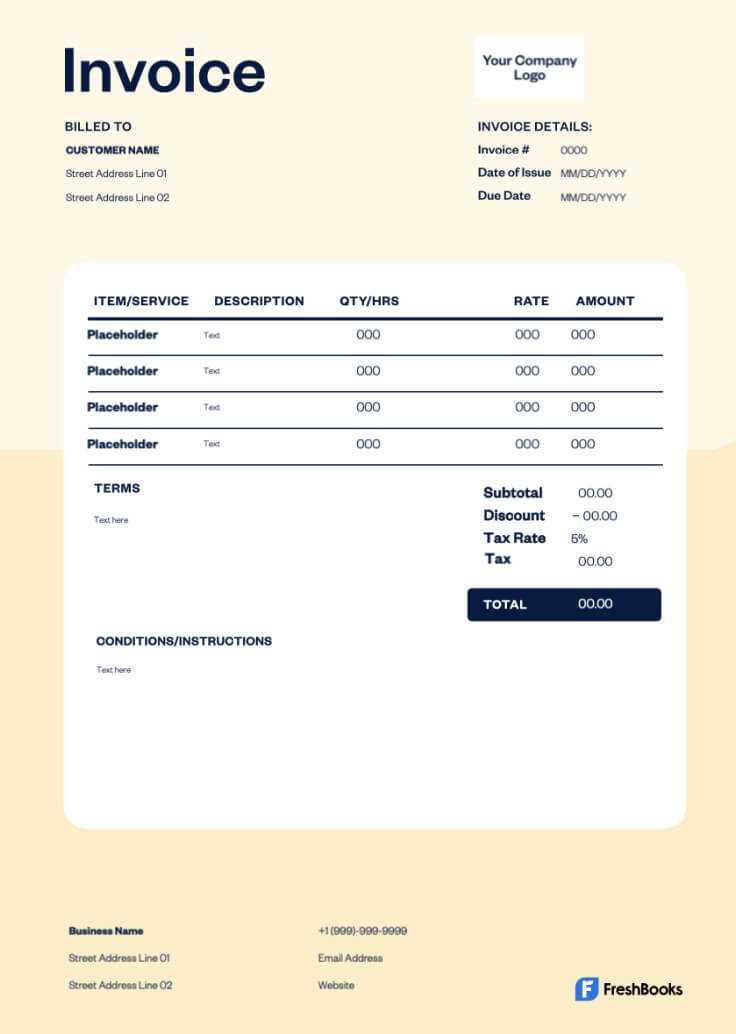

Free Templates for Payroll Invoicing

Finding ready-to-use, customizable documents for employee payment records can greatly simplify payroll management. With pre-designed formats, businesses can quickly generate accurate and professional compensation summaries without spending time on formatting or calculations. These resources can be especially helpful for small businesses or startups looking to streamline their financial processes without investing in expensive software.

Where to Find Free Payroll Documents

There are many websites and platforms offering free downloadable formats for employee payment documentation. These resources are often available in popular file formats such as Excel, Word, or PDF, making them easy to use and edit. By choosing the right format, businesses can quickly tailor the document to fit their specific needs. Some reliable sources include:

- Online Payroll Platforms: Many payroll software providers offer free downloadable records as part of their services, allowing you to manage both employee compensation and taxes.

- Business Websites: Numerous business-focused websites share free templates that can be customized for a variety of industries and company sizes.

- Document Sharing Platforms: Websites like Google Docs and Microsoft Office offer free templates created by other users that can be used and modified to fit your needs.

Advantages of Using Free Formats

Using pre-designed documents for payment records offers several advantages, including:

- Cost-Effective: No need to purchase expensive software or hire a designer–free resources are available to anyone.

- Time-Saving: Ready-to-use documents allow businesses to quickly input payment data without starting from scratch.

- Customization: Most free formats are editable, enabling you to add or remove fields depending on your specific payroll requirements.

These free resources are a great starting point for businesses looking to maintain accurate and professional compensation records without unnecessary costs or complexities.

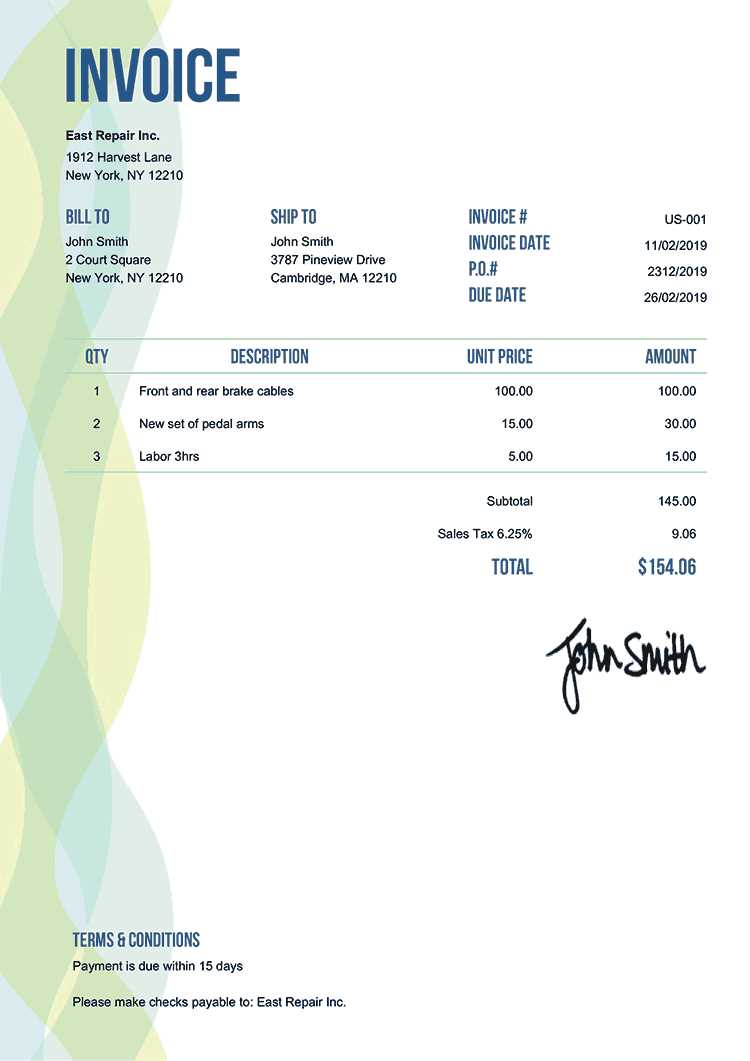

How to Customize Your Payment Record

Personalizing your payment documentation can make it more relevant to your business needs and ensure all necessary details are included. Customization allows you to tailor the format to reflect your company’s branding, streamline the information for easier understanding, and accommodate any specific requirements unique to your workforce or industry.

Key Steps to Personalize Your Payment Record

- Add Company Branding: Include your business logo, name, address, and contact information at the top of the document to make it official and professional.

- Modify Payment Breakdown: Adjust the sections to reflect the types of compensation specific to your organization, such as performance bonuses, commissions, or allowances.

- Include Relevant Tax Information: Depending on your location and tax requirements, you might need to add tax rates, deductions, or social security contributions.

- Personalize for Employee Information: Ensure each document includes the employee’s name, position, and any additional identifiers that help track their payments more effectively.

- Customize Payment Frequency: If your employees are paid weekly, bi-weekly, or monthly, be sure to adjust the record to reflect the correct frequency of payments.

Tools for Customizing Your Payment Record

There are various tools you can use to easily customize your payment documents:

- Spreadsheet Software: Programs like Microsoft Excel or Google Sheets offer flexibility in creating and modifying records, with options for calculations, formatting, and saving in multiple file types.

- Document Editing Software: Word processors such as Microsoft Word or Google Docs allow for quick customization, especially for text-heavy records.

- Payroll Software: Many payroll platforms allow you to create and personalize records, ensuring they are consistent with your internal systems.

Customizing your payment records ensures that all the necessary information is clearly displayed, enhancing communication with your employees and making the entire payroll process more efficient.

Top Software for Generating Payment Records

Choosing the right software to generate employee payment documentation can greatly simplify the payroll process. Reliable software not only automates calculations but also ensures that records are accurate, consistent, and professional. The right tool can save time, reduce errors, and help businesses stay organized when handling employee compensation details.

Best Software for Payroll Records Management

Here are some of the top tools available for generating employee payment documents:

- QuickBooks: A well-known accounting software that includes features for generating detailed employee payment records. It allows businesses to automate tax calculations and create professional payment statements.

- Gusto: A popular payroll management platform that simplifies employee compensation, offering easy-to-use templates and customizable reports for every pay period.

- FreshBooks: An invoicing and accounting software that offers simple ways to generate payment statements, track hours worked, and calculate deductions for employees.

- Zoho Books: A comprehensive accounting solution that enables users to create customizable payment records while also tracking expenses, taxes, and employee hours.

- Wave: A free accounting and payroll software that provides easy-to-use tools for creating payment summaries and processing direct deposits for employees.

Why Use Payroll Software?

Using dedicated payroll software offers numerous advantages:

- Automation: Payroll tools can automatically calculate taxes, deductions, and overtime, reducing the chance of human error.

- Compliance

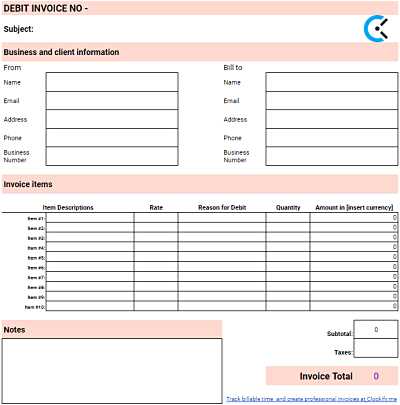

Common Mistakes to Avoid in Payment Records

When creating documents that detail employee compensation, accuracy is crucial. Even small errors can lead to confusion, mistrust, and potential legal issues. Many businesses fall into common pitfalls when managing their payment records, which can affect both employees and the company’s operations. It’s important to be aware of these mistakes and take steps to avoid them in order to maintain transparency and ensure smooth financial processes.

Common Errors to Watch Out For

- Incorrect Calculations: One of the most common mistakes is failing to accurately calculate total earnings, deductions, or taxes. Double-check all numbers, including overtime, bonuses, and taxes, to ensure they align with the employee’s actual compensation.

- Missing Information: Failing to include important details like the payment period, employee ID, or the breakdown of deductions can lead to confusion. Always ensure the document includes all necessary fields, such as payment date, total hours worked, and specific deductions.

- Not Updating Information: If employee rates or tax regulations change, it’s essential to update the record formats. Outdated information can result in incorrect calculations or compliance issues.

- Inconsistent Formats: Using different styles or structures for each employee’s record can cause confusion. Maintain a consistent format across all documents to ensure clarity and professionalism.

- Failure to Track Changes: When adjustments need to be made (e.g., retroactive pay, corrections to hours worked), it’s crucial to clearly document those changes. Not doing so can lead to discrepancies and future misunderstandings.

How to Prevent These Mistakes

To avoid common errors in payment documentation, consider implementing these best practices:

- Automate Calculations: Use accounting software or payroll tools to automate calculations and minimize human error.

- Double-Check Entries: Always review payment records before sending them to ensure all information is accurate and complete.

- Maintain Consistent Formatting: Use the same layout and structure for all records to avoid confusion and ensure a professional appearance.

- Stay Updated: Regularly update your records to reflect changes in tax laws, employee pay rates, or business policies.

By being mindful of these common mistakes, businesses can ensure that their payment documentation is accurate, professional, and easy to understand, ultimately fostering trust and reducing the risk of errors in financial operations.

How to Calculate Compensation on a Payment Record

Accurately calculating employee compensation is a critical aspect of financial management. The calculation should account for various factors, including base pay, overtime, deductions, and any bonuses or commissions. Understanding how to properly compute these amounts ensures that both the employer and the employee are clear about the total compensation due. By following a step-by-step process, businesses can avoid errors and maintain transparency in their financial records.

The basic process for calculating compensation typically involves adding up regular earnings, calculating any overtime, and then subtracting applicable deductions such as taxes and insurance premiums. The final amount should reflect the net payment that is due to the employee.

Component Amount Base Pay (40 hours @ $20/hr) $800 Overtime (5 hours @ $30/hr) $150 Bonus $100 Tax Deduction -$200 Health Insurance -$50 Net Payment $800 In this example, the employee worked 40 regular hours at $20 per hour, plus 5 hours of overtime at a higher rate. After adding the bonus and deducting taxes and insurance, the final amount due to the employee is $800. By following this straightforward method, you can ensure accuracy in calculating compensation and avoid any discrepancies.

Remember, it’s important to factor in any additional payments, such as commissions, allowances, or special bonuses, depending on your company’s compensation structure. Always verify calculations before issuing any payments to ensure compliance and maintain good relationships with your employees.

When to Use Payment Records in Business

In any business, accurately documenting employee compensation is crucial for maintaining transparency and ensuring smooth financial operations. While many companies may already have internal systems in place for payroll processing, there are specific situations where generating formal records of payments becomes necessary. Understanding when to use these documents helps businesses stay compliant with regulations, build trust with employees, and manage financial reporting effectively.

When You Need a Formal Payment Record

There are several scenarios where creating formal payment documentation is essential:

- Regular Payroll Processing: Whether employees are paid weekly, bi-weekly, or monthly, generating records for each pay period ensures clarity and accuracy in tracking compensation over time.

- Tax Reporting and Compliance: For businesses that need to comply with tax laws, providing detailed records of employee compensation is essential during tax season or when preparing for audits.

- Employee Requests: Employees may request payment records for various reasons, such as securing loans, applying for visas, or verifying their income for other personal financial matters.

- Bonuses and Commissions: When special bonuses, commissions, or performance-based rewards are issued, formal documentation ensures transparency and clear communication regarding how these amounts are calculated.

Benefits of Providing Payment Records

Providing formal records for employee payments benefits both the employer and the employees:

- Transparency: Clear documentation of earnings and deductions helps avoid misunderstandings and ensures that employees know exactly what they are being paid for.

- Tax Compliance: Payment records are often required for tax purposes, ensuring that businesses are properly reporting employee income and adhering to local and national tax laws.

- Financial Tracking: Keeping accurate payment records allows businesses to track labor costs, monitor budget allocation, and assess overall payroll expenses.

- Employee Satisfaction: Providing clear and consistent payment records fosters trust between the employer and employee, reducing potential disputes and improving job satisfaction.

Using payment documentation regularly in your business helps keep things organized, ensures compliance with legal requirements, and promotes a professional relationship between employers and employees.

Legal Considerations for Payment Records

When it comes to generating formal compensation documents, businesses must be aware of the legal obligations that govern how these records are created, maintained, and shared. Proper documentation not only ensures compliance with labor laws but also protects both the employer and the employee in the event of disputes or audits. There are several key legal factors to consider when preparing employee compensation summaries.

Key Legal Factors to Keep in Mind

- Compliance with Labor Laws: Different jurisdictions have specific regulations governing employee wages, hours worked, and required deductions. It is essential to ensure that the information on compensation records is accurate and adheres to these laws.

- Minimum Wage Requirements: Employers must ensure that employees are paid at least the minimum wage required by law for their position and location. Failure to meet this requirement can result in penalties and legal consequences.

- Tax Reporting: Accurate reporting of employee income is necessary for tax purposes. Employers must deduct the correct amount of income tax, social security contributions, and other statutory deductions. These records may be required for tax filings or audits.

- Overtime Regulations: In many regions, overtime pay must be calculated at a higher rate (usually 1.5 times the regular hourly rate). It is important to accurately calculate overtime hours and document them appropriately.

- Record Retention: Employers are required to keep compensation records for a specified period, usually several years, in case of future audits or legal inquiries. Failing to retain these records can lead to legal challenges or penalties.

Best Practices for Legal Compliance

To ensure that your compensation documents are legally compliant, consider the following best practices:

- Verify Tax Rates: Regularly check local and federal tax rates to ensure proper deductions are being made for each employee.

- Use Clear and Accurate Language: Ensure that all terms used in compensation records are clear, such as specifying “regular pay” versus “overtime” or “bonus.” This helps prevent any confusion or misunderstandings.

- Update Records Promptly: Whenever there are changes to an employee’s compensation, role, or deductions (e.g., tax changes, new benefits), update the records immediately to reflect those changes.

- Seek Legal Advice: If you’re uncertain about any legal requirements regarding employee pay records, it’s always best to consult a legal expert or labor attorney to ensure full compliance with local laws and regulations.

By following these guidelines and staying up-to-date with legal requirements, businesses can avoid potential legal issues, maintain compliance, and ensure fair and transparent compensation practices.

How to Track Payments with Payment Records

Keeping an accurate record of employee compensation is crucial for financial tracking and overall business organization. Whether you’re handling weekly wages, monthly payments, or special bonuses, it’s important to track each transaction carefully. By using detailed payment documents, businesses can monitor disbursements, maintain transparency, and ensure proper financial management. Tracking payments accurately also allows for efficient reconciliation and simplifies tax reporting.

Steps to Effectively Track Payments

- Document Each Payment: For every pay cycle, generate a formal record of the total compensation issued to each employee. This should include their earnings, deductions, and net pay.

- Record Payment Dates: Always include the specific payment date on each record. This helps you track when payments were made and verify that disbursements align with your payroll schedule.

- Include Detailed Payment Breakdowns: Include separate sections for regular hours, overtime, bonuses, commissions, and deductions. This allows for easy tracking and ensures clarity for both the employee and the employer.

- Track Outstanding Payments: In case there are discrepancies or delayed payments, maintain a log of any outstanding amounts due to employees. This helps prevent errors and ensures that all payments are made in a timely manner.

Tools for Tracking Payments

To streamline payment tracking, businesses can use several tools and software programs:

- Accounting Software: Platforms like QuickBooks, FreshBooks, or Xero offer payment tracking features that allow you to monitor every disbursement, categorize transactions, and generate payment reports.

- Payroll Management Systems: Specialized payroll software like Gusto or ADP provides features to track payments, calculate taxes, and store all compensation records securely in one place.

- Spreadsheets: For smaller businesses or manual record-keeping, a well-organized spreadsheet can be an effective tool for tracking payments. You can create columns for each payment cycle, record earnings, deductions, and final amounts paid.

By adopting a methodical approach to tracking payments and utilizing the right tools, businesses can ensure accurate records, reduce the risk of errors, and maintain a well-organized financial system.

Payment Records for Remote Workers

With the rise of remote work, businesses are increasingly faced with the need to manage compensation for employees who work outside traditional office environments. This requires a more flexible and efficient approach to documenting and processing payments. For remote workers, it’s essential to ensure that payment records are clear, accurate, and reflect the unique nature of remote work arrangements, such as varying time zones, flexible hours, or project-based work.

When managing compensation for remote employees, businesses must adapt their payment documentation practices to include all the relevant details, such as hours worked, location-based rates, and any adjustments for travel, equipment, or home office stipends. Ensuring that remote workers receive timely and accurate payment records not only keeps operations running smoothly but also helps to build trust and maintain strong employer-employee relationships.

Clear, well-organized payment records can help remote workers keep track of their earnings, understand how their pay is calculated, and easily reference past payments for tax or personal financial planning. These records also help employers ensure that they remain compliant with local labor laws, even when employees are located in different regions or countries.

Using Payment Records for Tax Reporting

Accurate and detailed payment documentation is not only essential for managing employee compensation but also plays a critical role in tax reporting and compliance. For businesses, maintaining organized records of each employee’s earnings, deductions, and benefits ensures that tax filings are correct and timely. These records serve as the foundation for calculating payroll taxes, withholding amounts, and reporting earnings to tax authorities.

How Payment Records Support Tax Compliance

Properly formatted payment records provide key data that is necessary for tax reporting. This includes details such as gross earnings, tax deductions, and contributions to social security, retirement funds, and insurance premiums. These records help businesses to:

- Ensure Accurate Tax Withholding: By documenting all necessary deductions, businesses can ensure that the correct amount of tax is withheld from employees’ paychecks.

- Report Correctly to Tax Authorities: Clear records allow businesses to report accurate figures to federal, state, and local tax authorities, ensuring compliance with tax regulations.

- Prepare for Audits: If a business is audited, having a well-organized set of payment records provides a transparent and easy-to-follow trail of payments, deductions, and other tax-related details.

Key Information to Include for Tax Purposes

When preparing records for tax purposes, make sure the following elements are clearly documented:

- Gross Earnings: The total amount earned before any deductions or taxes are applied.

- Tax Deductions: Include federal, state, and local taxes that are withheld from an employee’s pay.

- Employee Benefits: Document benefits such as healthcare, retirement contributions, and bonuses, as these may be subject to different tax treatments.

- Employer Contributions: If the employer is contributing to taxes, insurance, or retirement funds, these amounts should also be recorded.

By keeping thorough and up-to-date payment records, businesses can ensure they meet all tax obligations and avoid costly errors or penalties. Accurate documentation not only simplifies tax season but also fosters a transparent and trustworthy relationship with employees and tax authorities alike.

How to Protect Payment Record Data

When handling employee compensation details, safeguarding sensitive information is crucial for both legal compliance and organizational integrity. Payment records contain personal and financial data that, if compromised, could lead to identity theft, fraud, or legal disputes. Implementing strong data protection measures ensures that this information remains secure, confidential, and accessible only to authorized individuals within the organization.

There are several best practices that businesses should follow to protect payment data, ranging from encryption to access control. By using the right tools and strategies, businesses can minimize the risks associated with unauthorized access or data breaches.

Key Steps to Safeguard Payment Information

- Encryption: Encrypting payment records both in transit and at rest is one of the most effective ways to prevent unauthorized access. Use strong encryption protocols to protect sensitive data when it is stored on servers or sent over the internet.

- Access Control: Limit access to payment records to only those employees or stakeholders who absolutely need it. Use role-based access control (RBAC) systems to ensure that each user has access only to the information relevant to their job functions.

- Regular Backups: Regularly back up payment records to secure storage systems. In case of a system failure or data breach, having a backup ensures that important information is not lost.

- Audit Trails: Maintain detailed logs of who accessed or modified payment records. This allows you to track any unusual activity and helps to ensure accountability in case of security breaches.

- Secure File Sharing: When sharing payment records electronically, use secure file-sharing platforms that offer password protection, encryption, and other security features. Avoid using unprotected email or shared drives to transmit sensitive data.

Data Protection Best Practices

Beyond technical measures, businesses should also educate their staff about the importance of data protection. This includes:

- Training Employees: Regularly educate employees about the risks associated with handling sensitive financial data and provide them with best practices for safeguarding information.

- Regular Security Audits: Conduct regular security audits to identify vulnerabilities in your systems and ensure that all protections are up-to-date and effective.

- Compliance with Regulations: Ensure that your data protection practices comply with local and international regulations, such as GDPR or CCPA, to avoid legal complications.

By following these steps, businesses can effectively protect payment records from unauthorized access, minimize the risk of data breaches, and comply with privacy laws. Secure handling of compensation information not only protects your business but also builds trust with employees, showing that their personal data is valued and respected.

Integrating Payment Records with Accounting Systems

Efficient integration of compensation records with accounting systems is essential for streamlining business operations and ensuring accurate financial reporting. By automating the flow of compensation data directly into your accounting software, businesses can save time, reduce errors, and maintain up-to-date financial records. This integration helps align payroll processing with overall financial management, enabling businesses to track expenses, calculate taxes, and prepare for audits with ease.

Automating the transfer of payment information not only reduces manual input but also enhances consistency and accuracy across both payroll and accounting functions. For businesses, this means fewer discrepancies, better budget planning, and more reliable financial reporting.

Benefits of Integrating Payment Data with Accounting Software

- Improved Accuracy: Integration ensures that data is transferred without human error, reducing the likelihood of mistakes in both payment calculations and accounting records.

- Time Efficiency: Automating the data transfer process saves time that would otherwise be spent manually entering payment details into accounting systems.

- Streamlined Reporting: With accurate, up-to-date payment data, businesses can quickly generate financial reports, including payroll expenses, profit and loss statements, and tax filings.

- Better Financial Visibility: Integrating payment records gives businesses a clear view of their overall financial picture, making it easier to track labor costs, plan budgets, and forecast cash flow.

- Compliance and Auditing: Integrated systems allow businesses to maintain consistent records that meet legal requirements and are ready for audit at any time.

How to Integrate Payment Records with Accounting Tools

- Select Compatible Software: Ensure that your payroll system and accounting software are compatible and can easily exchange data. Popular tools like QuickBooks, Xero, and Sage offer seamless integration with various payroll platforms.

- Use Automation Tools: Many accounting platforms offer automation features that automatically import payment records from payroll systems. These tools can help you sync data in real time, ensuring accuracy and timeliness.

- Set Up Data Syncing: Configure your software to automatically update accounting records with every payroll cycle. This eliminates the need for manual entry and reduces the risk of discrepancies between the payroll and financial departments.

- Ensure Proper Categorization: When integrating data, ensure that payment records are categorized correctly in your accounting system. This includes classifying expenses by type (e.g., wages, bonuses, taxes) for easier financial tracking and reporting.

By integrating payment records with accounting systems, businesses can improve their financial operations, enhance data accuracy, and create a more efficient workflow. This integration not only simplifies payroll management but also strengthens overall financial reporting and compliance practices.