Top Company Invoice Templates for Streamlined Billing

Accurate and organized documentation is essential for any professional exchange, ensuring clear communication and precise record-keeping. Businesses need a structured way to outline payment details, services, and client information. This practice not only simplifies internal processes but also enhances the trustworthiness of transactions.

Modern solutions allow businesses to automate and streamline this documentation, leading to a faster workflow and a reduction in administrative tasks. Digital formats enable personalization, ensuring that the style and details match the specific needs of any organization. With these tools, enterprises can maintain professionalism while saving valuable time.

In this guide, we’ll explore essential aspects of crafting clear and consistent documentation, highlight customization options, and provide tips for implementing these solutions seamlessly into any business model. From basic layouts to advanced software, each approach supports both accuracy and efficiency, empowering organizations to focus on their core operations.

Comprehensive Guide to Business Billing Documents

For any organization, well-structured billing documents are key to managing transactions smoothly and effectively. These formats act as essential tools for presenting service details, pricing, and payment terms in a clear, organized manner. Whether tailored for small businesses or large corporations, these standardized forms help facilitate efficient financial interactions and reduce potential misunderstandings.

Understanding Key Elements of Effective Billing Documents

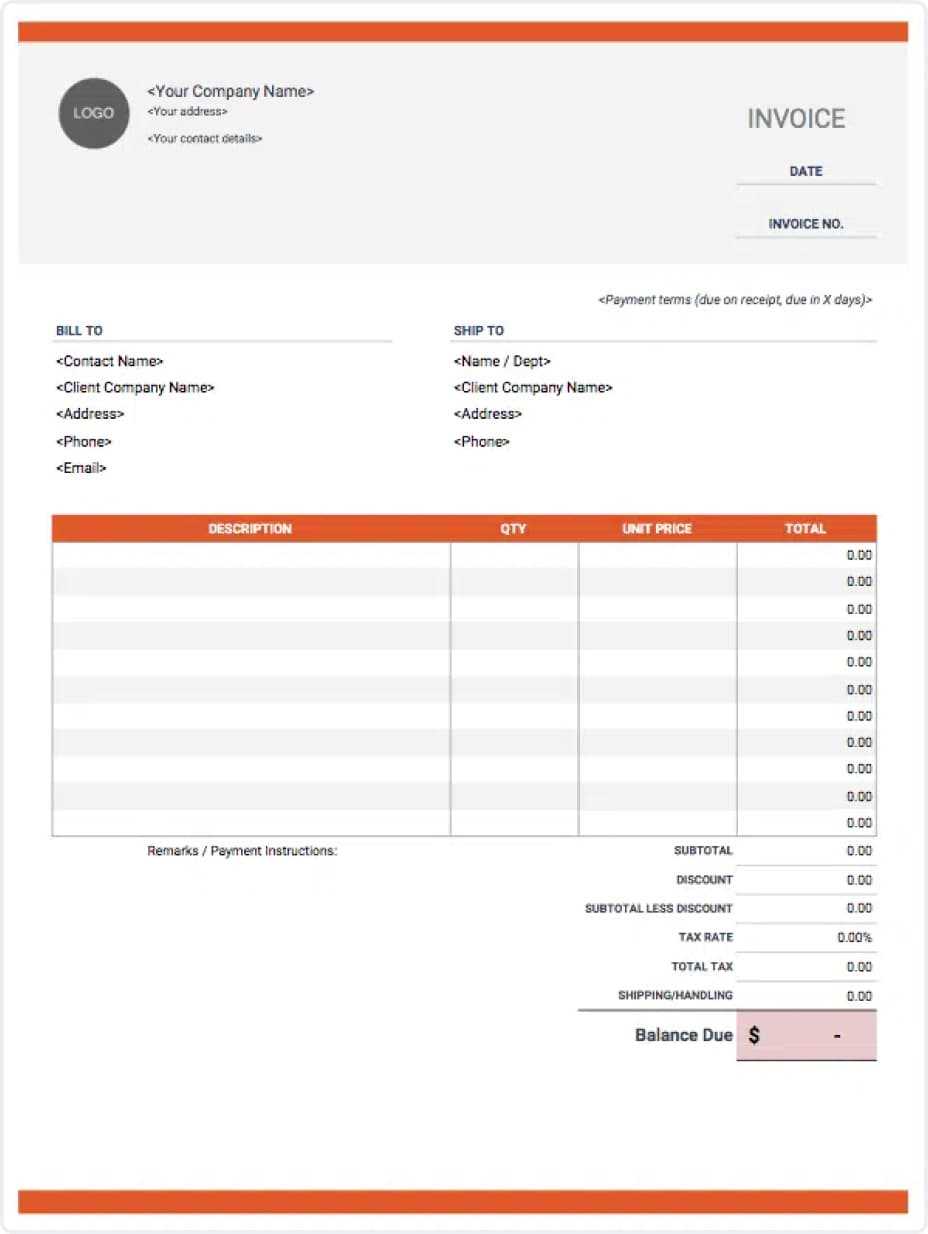

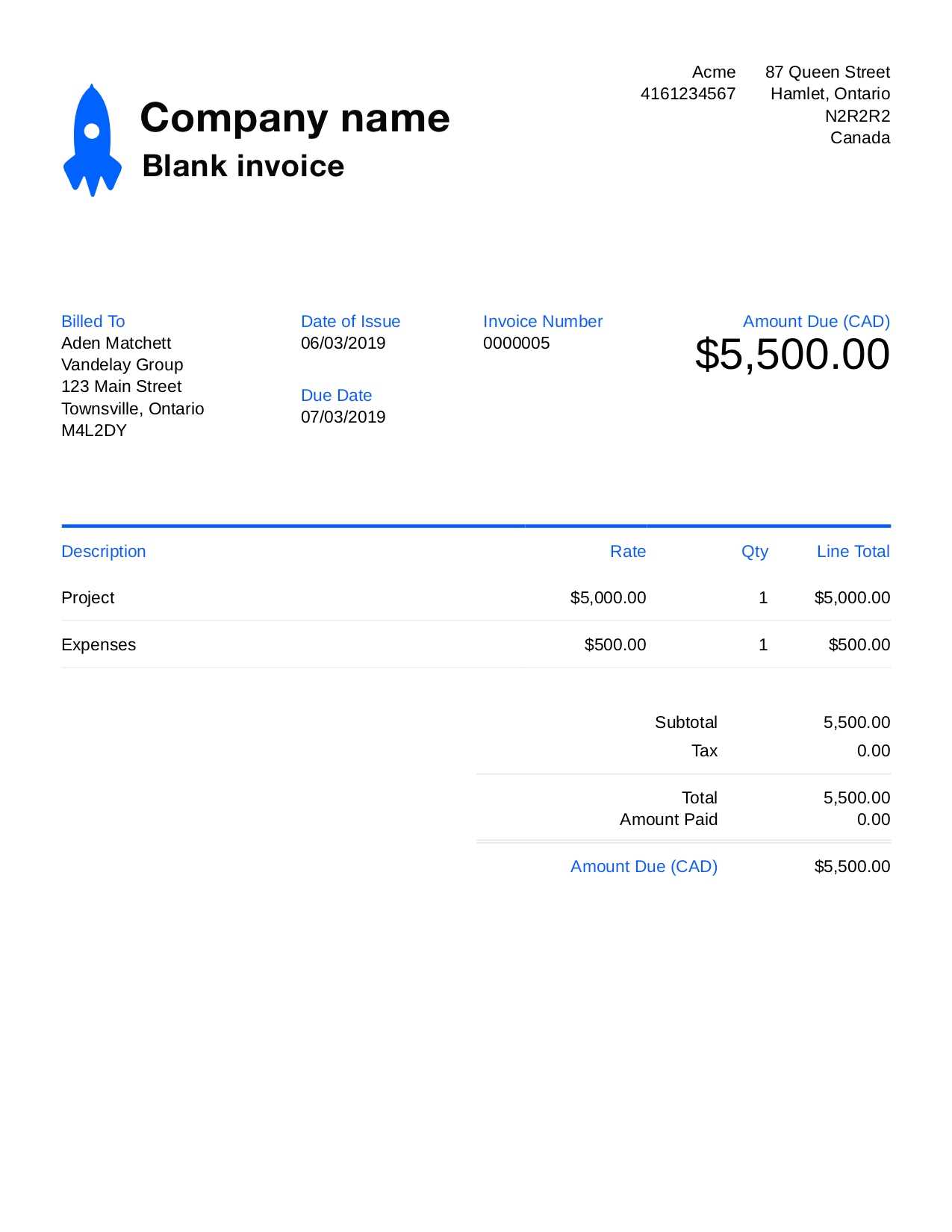

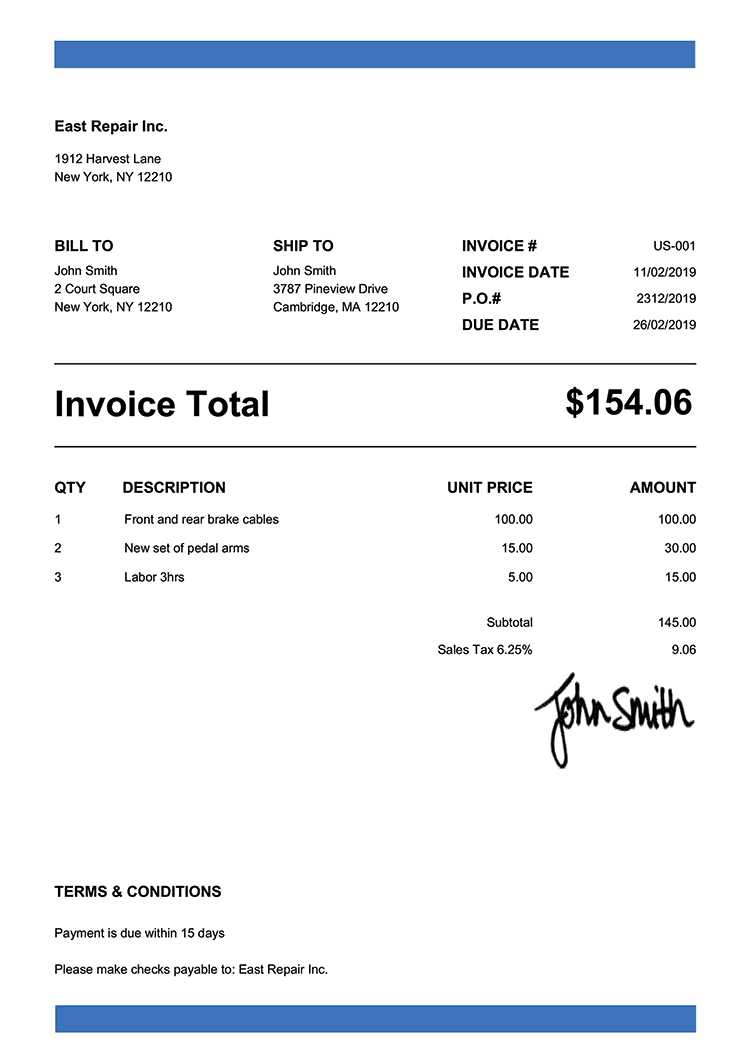

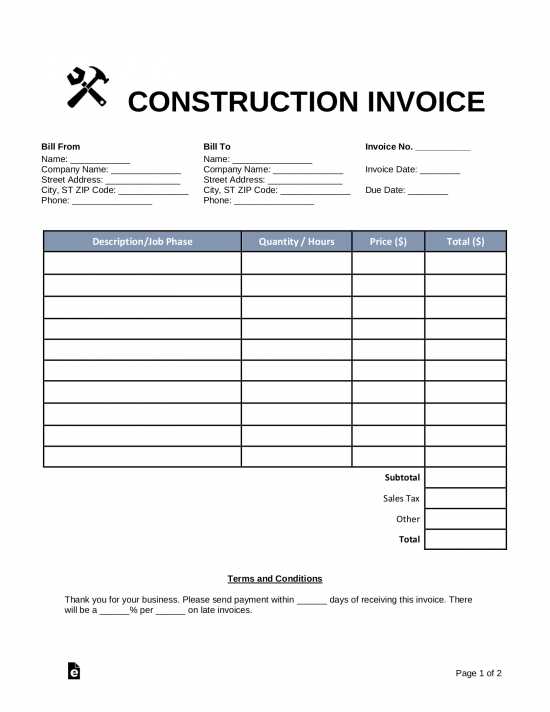

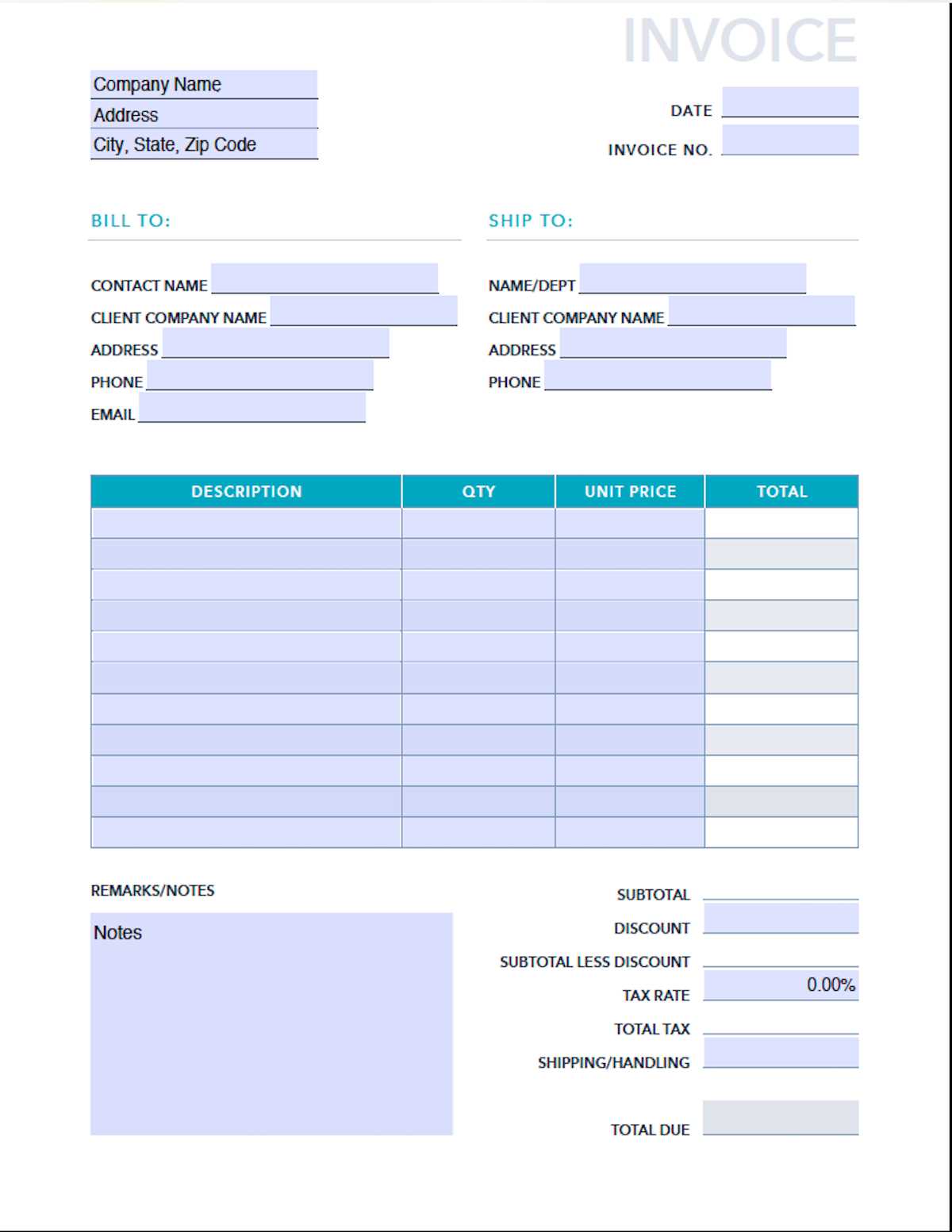

A complete billing form typically includes several crucial elements that ensure clarity for both parties involved. Core details often comprise descriptions of products or services provided, pricing breakdowns, dates, and payment instructions. Standardizing these elements allows for a consistent presentation, fostering trust and transparency with clients.

Adapting Documentation to Suit Unique Business Needs

Customization is often essential, as no two businesses operate exactly alike. By adjusting layouts, adding branding elements, and modifying fields, org

Understanding the Purpose of Billing Document Templates

In today’s business environment, clear and systematic financial documentation plays a crucial role in ensuring seamless transactions. These structured formats provide a straightforward way to organize essential details, from services rendered to payment terms, enabling efficient communication between service providers and clients. By following a standardized layout, businesses can save time while maintaining professionalism in their financial dealings.

Key Benefits of Structured Billing Forms

Standardized financial forms help establish consistency and reliability, which are vital for both small enterprises and larger corporations. By using predefined layouts, businesses can quickly prepare documents, reducing errors and improving the accuracy of records. These advantages contribute to building trust with clients and promoting smoother financial operations.

| Benefit | Description | ||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Time Efficiency | Predefined layouts allow for faster creat

How to Choose the Right Document FormatSelecting an effective layout for billing documents is essential for creating a clear and professional look that aligns with your business needs. With various formats available, it’s important to consider factors such as functionality, customization options, and ease of use. The right design can simplify record-keeping and make a positive impression on clients. Key Factors to ConsiderTo find the ideal document format for your business, assess the following aspects:

Essential Elements of a Billing Document Format

|

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Consulting Services | 5 hours | $100 | $500 |

| Project Management | 3 hours | $120 | $360 |

| Subtotal | $860 | ||

| Tax (10%) | $86 | ||

| Total Due | $946 |

By having clear categories and calculations, such formats eliminate confusion, helping both the service provider and client understand the transaction in detail, and minimizing the risk of mistakes.

Benefits of Digital Billing Formats

Using digital formats for managing financial documents offers significant advantages, especially in terms of efficiency, accessibility, and accuracy. These electronic resources simplify the creation, storage, and sharing of records, helping businesses streamline their processes while reducing manual effort.

Key Advantages of Digital Billing Formats

Here are some of the top benefits of adopting digital solutions for managing payment records:

- Increased Efficiency: Automated fields and customizable layouts reduce the time spent creating and modifying records, leading to faster billing cycles.

- Accessibility: Digital documents can be stored in cloud services or on local devices, making them accessible from anywhere at any time.

- Environmental Benefits: By eliminating the need for paper, businesses contribute to sustainability efforts and reduce paper waste.

- Easy Sharing: Digital formats can be emailed or shared online, making the process of sending financial records quicker and more reliable.

Why Digital Formats Are More Accurate

With built-in features such as automated calculations and error-checking, digital resources help reduce the risk of mistakes that can arise in manual processes. This accuracy ensures that all details, such as prices, taxes, and totals, are correct every time, minimizing disputes and improving client satisfaction.

How Templates Streamline Payment Collection

Using standardized documents for payment requests can significantly enhance the efficiency of collecting payments. By automating essential details and maintaining consistency across all transactions, businesses can reduce the complexity involved in tracking and following up on payments.

Improved Efficiency: When businesses use pre-designed structures, they can quickly generate and send payment requests with all necessary details pre-filled, saving time and effort. This allows for faster processing and quicker turnarounds for payments.

Clear Communication: A well-structured document ensures that all required information, such as amounts, due dates, and payment methods, are clearly outlined, minimizing confusion for both parties and reducing the risk of missed or delayed payments.

Faster Follow-Ups: The consistency and clarity provided by these resources help businesses easily track outstanding payments. Automated reminders and easy-to-update formats enable timely follow-ups, improving cash flow and reducing administrative work.

Creating Professional-Looking Payment Requests Easily

Designing polished and professional payment requests is crucial for maintaining a positive image with clients. With the right tools, it becomes easier to produce visually appealing and accurate documents without the need for advanced design skills or complex software.

Key Features to Include

To create professional documents, ensure the inclusion of essential elements like your business details, a clear breakdown of charges, and easy-to-read formatting. These features not only promote clarity but also present your business as organized and trustworthy.

Using Pre-Formatted Structures

Leveraging pre-designed structures is an efficient way to generate high-quality documents quickly. These structures typically have the necessary fields and layout already set up, allowing you to focus on adding specific details, such as amounts or payment terms, without worrying about formatting issues.

Tracking Payments with Invoice Templates

Effectively managing payments requires keeping accurate records of all transactions. By using structured documents for payment requests, businesses can easily track the status of each payment, ensuring timely follow-ups and proper financial management.

Key Benefits of Tracking Payments

- Clear Overview: A well-organized document allows you to quickly see which payments have been made and which are still pending.

- Reduced Errors: Consistent formatting and automation minimize human errors in tracking amounts and due dates.

- Faster Payment Reminders: Easily identify overdue payments and send reminders efficiently to ensure timely collection.

How to Set Up Tracking Features

- Ensure each payment request includes a unique reference number for easy identification.

- Mark payment statuses clearly, such as “Paid,” “Pending,” or “Overdue.”

- Regularly update the document to reflect the latest payment status for accurate tracking.

Optimizing Templates for Quick Data Entry

Efficient data entry is crucial for maintaining productivity and minimizing errors. By designing structured forms for billing and payment processes, businesses can streamline the process, ensuring that all necessary information is captured swiftly and accurately.

Key Strategies for Faster Data Input

- Pre-filled Fields: Include default values or pre-filled options for recurring information, such as company details or payment terms, to save time.

- Drop-Down Menus: Use drop-down menus for common selections, like payment methods or invoice categories, to reduce manual typing.

- Auto-formatting: Implement automatic formatting for dates, amounts, and other numerical values to avoid errors and ensure consistency.

These optimizations make it easier for employees to enter data quickly, improving efficiency and reducing the likelihood of mistakes. By utilizing streamlined designs and functionality, businesses can handle financial documentation with greater ease and speed.

Tips for Organizing Invoice Records

Efficient management of billing records is essential for smooth financial operations. Proper organization not only helps in maintaining accuracy but also ensures quick retrieval and easy tracking of transactions over time.

Best Practices for Organizing Billing Information

- Use Clear Naming Conventions: Label each document consistently, including dates and reference numbers to easily identify and sort them.

- Maintain Digital and Physical Copies: Keep both digital and hard copies of important documents, ensuring redundancy in case of system failures or other issues.

- Group Documents by Period: Organize records into monthly, quarterly, or annual folders to streamline access and reduce clutter.

Leveraging Technology for Better Organization

- Automated Categorization: Utilize software that can automatically categorize and store records based on predefined criteria, reducing manual effort.

- Cloud Storage: Store records in the cloud for easier access, secure backups, and the ability to retrieve them from any location.

By implementing these strategies, businesses can ensure a more efficient and reliable way of managing their billing documentation, which ultimately saves time and enhances accuracy.

Ensuring Compliance with Invoice Templates

Maintaining legal and financial compliance is a critical aspect of managing business transactions. Proper documentation ensures that all requirements are met, helping to avoid potential legal issues and penalties. Understanding and implementing the right structure in your billing documents is essential for staying compliant with regulations and tax laws.

Key Considerations for Legal Compliance

- Include Required Information: Ensure that essential details such as payment terms, seller and buyer information, and transaction specifics are clearly stated to meet legal standards.

- Adhere to Local Tax Laws: Properly list applicable taxes, including VAT or sales tax, according to the regulations of the specific region where the transaction occurs.

- Maintain Accurate Records: Keep detailed and organized records to facilitate auditing processes and ensure all transactions are well documented.

Tools for Streamlining Compliance

- Use Digital Solutions: Leverage software that incorporates compliance checks and prompts, ensuring that all required fields are filled and that documents meet regulatory requirements.

- Stay Updated with Changes: Regularly review local and international regulatory changes, adjusting your billing documents to reflect any new requirements.

By adhering to these practices, businesses can streamline their operations and reduce the risk of non-compliance, ensuring that all transactions are properly documented and legally sound.

Securing Digital Invoices

As businesses increasingly shift to electronic documentation, safeguarding digital records has become more crucial than ever. With sensitive financial data being exchanged, ensuring that these documents are protected from unauthorized access, fraud, or tampering is essential. Implementing robust security measures can help protect both the business and its clients.

Best Practices for Protecting Digital Records

- Encryption: Encrypt all digital files to ensure that data is unreadable to anyone without the correct decryption key.

- Password Protection: Use strong, unique passwords for accessing and sharing files to prevent unauthorized individuals from viewing or editing documents.

- Secure File Storage: Store electronic documents in secure cloud systems or on encrypted servers that provide protection against hacking attempts and data breaches.

- Regular Backups: Maintain regular backups of important documents to ensure data recovery in case of system failure or malicious attacks.

Tools for Enhanced Security

| Security Measure | Description |

|---|---|

| Digital Signatures | Use electronic signatures to verify authenticity and integrity, ensuring that documents have not been altered. |

| Two-Factor Authentication | Implement two-factor authentication for accessing files to provide an extra layer of security. |

| Secure Email Services | Send sensitive documents via encrypted email services to prevent interception during transmission. |

By adopting these security measures, businesses can ensure the integrity and safety of their digital documents, protecting both their financial data and their reputation.