Best Practices for Crafting an Invoice Sending Email Template

When it comes to managing finances and ensuring prompt payments, a well-crafted message plays a crucial role in maintaining professional relationships and clear communication. Setting the right tone and structuring the information effectively can lead to faster responses and smoother transactions with clients.

A thoughtful, organized message conveys professionalism and respect for the recipient’s time. Key details should be highlighted, leaving no room for confusion or missed information. From concise summaries to friendly reminders, every part of your message serves a purpose in guiding the recipient through the payment process efficiently.

Understanding the elements of a structured message is essential for encouraging prompt action. With the right approach, you can make sure your requests are not only informative but also engaging, helping to foster trust and streamline the entire transaction process.

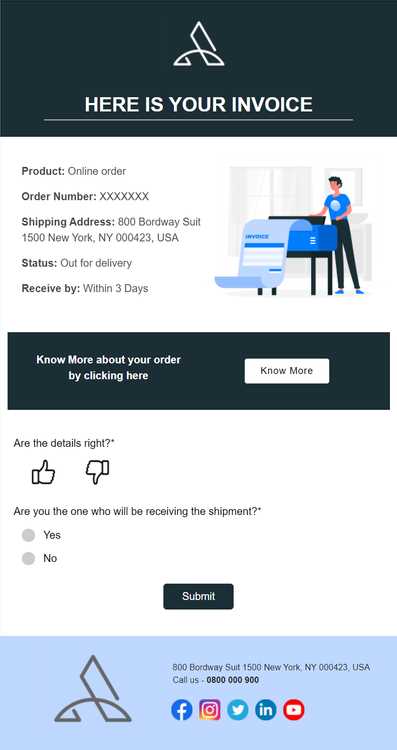

Creating an Invoice Email Template

Designing an effective message for payment requests requires a balance of clarity and professionalism. An organized structure ensures that all essential details are easy to find, guiding the recipient toward completing the transaction without unnecessary delays.

To create a well-rounded message layout, consider the following components:

- Clear Subject Line: Begin with a brief, straightforward subject line that accurately reflects the purpose of the message. This helps the recipient immediately understand the context.

- Personalized Greeting: Address the recipient by name to create a respectful and professional tone from the start.

- Concise Message Body: Keep the body text concise yet informative, covering essential information like the amount due, due date, and relevant

Key Elements of a Billing Email

When preparing a structured message for payment requests, it’s essential to include specific elements that convey clarity, accuracy, and professionalism. A well-organized layout not only ensures that all details are easy to understand but also encourages a prompt response from the recipient.

Essential Information to Include

The message should cover several critical points to eliminate any uncertainties:

- Recipient’s Information: Ensure the client’s name and company details are accurate, which helps create a personal and professional touch.

- Clear Amount Due: State the exact amount to be paid, so there is no ambiguity about the financial expectations.

- Due Date: Mention the payment deadline clearly to highlight the urgency and importance of timely processing.

How to Personalize Invoice Emails

Customizing your payment request messages can significantly impact client relationships, showing attention to detail and fostering a sense of trust. Personal touches demonstrate that each message is tailored to the recipient, which can improve responsiveness and client satisfaction.

To add a personal approach, consider these effective strategies:

- Use the Client’s Name: Addressing the recipient by name rather than using a generic greeting creates a more direct, respectful tone.

- Reference Previous Interactions: Mentioning past projects or transactions can help the recipient connect the message to real, meaningful exchanges, making it more memorable.

- Express Gratitude for Partnership: Acknowledging the ongoing business relationship shows appreciation and reinforces positive rapport.

Additional methods to refine the message for each recipient include

Writing a Clear Payment Request

Creating a straightforward and transparent message for payment requests is essential to avoid misunderstandings and ensure smooth transactions. By organizing information clearly and directly, you make it easier for recipients to understand the necessary steps, which can help reduce delays and promote prompt responses.

When drafting a payment request, focus on providing all essential details without overloading the recipient with excessive information. A table can be an effective way to break down specific charges and provide clarity. Here’s an example of how to structure key details:

Description Amount Due Date Payment Method Service or Product Name $Amount MM/DD/YYYY Bank Transfer, Credit Card Tips for Crafting a Polite Reminder

When reaching out with a follow-up on a pending payment, it’s important to maintain a respectful tone that encourages action without causing discomfort. A courteous reminder can be both effective and considerate, helping to strengthen professional relationships while gently prompting timely responses.

Here are some helpful tips for composing a polite and effective follow-up:

- Use a Friendly Greeting: Begin with a warm greeting to set a positive tone and reinforce the amicable nature of the reminder.

- Acknowledge the Client’s Time: Show appreciation for their time, especially if they have a busy schedule, to convey understanding and respect.

- Gently Refer to the Original Request: Mention the initial message in a subtle manner, focusing on providing clarity rather than emphasizing delay.

- Express Willingness to Assist: Offer help if they need any clarification or additional details, making it easy for them to respond if they had overlooked the initial note.

Ensuring Professional Tone in Emails Maintaining a polished and respectful tone in written communications is vital for fostering positive relationships and conveying credibility. The way messages are crafted reflects not only on the sender but also on the organization they represent, making professionalism essential in all interactions.

Key Elements of a Professional Tone

To ensure your correspondence is received positively, consider the following aspects:

- Clear and Concise Language: Use straightforward language to convey your message effectively, avoiding jargon or overly complex terms that may confuse the recipient.

- Respectful Address: Always use appropriate titles and names, addressing recipients formally unless you are certain a more casual approach is acceptable.

- Polite Expressions: Incorporate phrases that reflect courtesy, such as “please” and “thank you,” to create a welcoming atmosphere.

- Neutral Tone: Avoid emotional language or strong opinions to maintain an objective and calm approach in your communications.

Techniques to Enhance Professionalism

Implementing these techniques can elevate the quality of your written interactions:

- Proofread Before Sending: Review your messages for spelling and grammatical errors, ensuring clarity and professionalism in your writing.

- Be Mindful of Formatting: Use proper formatting techniques such as bullet points or numbered lists to make information easily digestible.

- Stay on Topic: Keep your message focused on the subject matter at hand to avoid overwhelming the recipient with irrelevant information.

By adhering to these principles and techniques, you can cultivate a professional tone that enhances communication effectiveness and reinforces trust with your recipients.

Benefits of Using Templates

Utilizing pre-designed formats for communications can significantly enhance efficiency and consistency in correspondence. By adopting structured approaches, individuals and organizations can streamline their processes, reduce errors, and ensure professionalism in their messaging.

Key Advantages

Here are some of the primary benefits of employing structured formats for your communications:

Advantage Description Time-Saving Pre-defined structures allow for quicker creation of messages, reducing the time spent on drafting. Consistency Standardized formats ensure uniformity across communications, reinforcing brand identity and professionalism. Reduced Errors Using established formats minimizes the risk of forgetting essential details or making mistakes in wording. Professional Appearance Structured messages convey a sense of organization and attention to detail, enhancing the sender’s image. Improving Communication Quality

In addition to the aforementioned advantages, structured formats can also improve overall communication quality:

- Easy Customization: While templates provide a base, they can be easily modified to suit specific needs without starting from scratch.

- Enhanced Clarity: Well-organized layouts facilitate clearer presentation of information, making it easier for recipients to understand key points.

- Scalability: As organizations grow, having pre-defined formats helps maintain communication standards across various teams and departments.

Incorporating structured approaches into your communication strategy not only boosts efficiency but also contributes to a more professional and organized image in all interactions.

Best Practices for Invoice Layout

Creating an effective structure for billing documents is essential for clear communication and ensuring that recipients understand their obligations. A well-organized design not only enhances readability but also contributes to a professional appearance that reflects positively on the sender.

To optimize the layout of your billing documents, consider the following best practices:

- Clear Branding: Include your business logo and contact information prominently at the top to establish identity and credibility.

- Consistent Formatting: Use uniform fonts, sizes, and colors throughout the document to create a cohesive look that is easy to follow.

- Logical Sections: Organize the content into distinct sections such as billing details, services rendered, payment terms, and due dates to facilitate quick reference.

- Itemized Listings: Provide a detailed breakdown of charges to enhance transparency and help recipients understand what they are paying for.

- Readable Layout: Ensure that the text is legible with appropriate spacing, bullet points, and headers to improve the overall flow of information.

- Highlight Important Information: Use bold or larger fonts to draw attention to critical details like total amounts due and payment deadlines.

By implementing these best practices, you can create billing documents that are not only visually appealing but also effectively convey necessary information, thereby enhancing the overall customer experience.

Common Mistakes to Avoid

In the process of creating and sending financial documents, certain pitfalls can lead to confusion and dissatisfaction among recipients. Recognizing and avoiding these errors is crucial for maintaining professionalism and ensuring clarity in communication.

Frequent Errors

Below are some common mistakes that should be avoided when drafting billing communications:

- Incorrect Information: Always double-check details such as amounts, dates, and recipient information to prevent misunderstandings.

- Lack of Clarity: Avoid using jargon or overly complex language; strive for straightforward communication to ensure recipients fully grasp the content.

- Omitting Payment Instructions: Clearly outline how payments should be made, including accepted methods and any relevant account information.

- Ignoring Follow-Up: Failing to follow up on outstanding payments can lead to delays; always remind clients in a polite manner.

- Unprofessional Appearance: Neglecting formatting can make documents hard to read; ensure a polished and organized layout.

Additional Tips

Avoiding these pitfalls can significantly enhance the effectiveness of your billing communications:

- Neglecting Deadlines: Always highlight due dates to encourage timely payments.

- Forgetting to Personalize: Tailor messages to address recipients by name and acknowledge past interactions to build rapport.

- Using Generic Language: Ensure that your messaging feels specific to the recipient rather than a one-size-fits-all approach.

By steering clear of these common mistakes, you can foster better relationships with clients and ensure smoother transactions.

Streamlining Follow-Up Emails

Efficiently managing reminders and follow-ups is essential for maintaining clear communication and ensuring timely responses. Implementing a systematic approach can help enhance the effectiveness of these messages, making them more likely to achieve the desired outcome.

Consistent Scheduling: Establish a routine for sending follow-up reminders. Setting specific intervals, such as a week after the initial communication, can help create a predictable pattern that recipients will recognize.

Clear Subject Lines: Use straightforward and informative subject lines to grab attention. Including key details, such as the reference number or date, can help recipients quickly understand the context of your message.

Personalized Content: Tailor your follow-ups to address recipients by name and refer to previous interactions. This personal touch can foster a sense of connection and encourage prompt responses.

Concise Messaging: Keep your messages brief and to the point. Highlight essential information such as outstanding amounts and deadlines while avoiding unnecessary details that may overwhelm the recipient.

Call to Action: Clearly state what you need from the recipient. Whether it’s confirmation of receipt, payment processing, or additional information, a direct request can prompt quicker responses.

Tracking Responses: Maintain a log of your follow-up communications to monitor responses. This practice can help you identify patterns and adjust your approach as needed to improve engagement.

By streamlining your reminder process, you can enhance communication effectiveness and encourage timely responses, ultimately leading to more efficient financial transactions.

Adding Payment Terms to Emails

Incorporating clear and concise payment conditions in communications is crucial for ensuring mutual understanding between parties. These stipulations not only outline the expectations regarding financial transactions but also help to foster professional relationships.

Importance of Clarity

Transparency: Clearly defining the payment conditions helps eliminate any ambiguity regarding when and how payments should be made. This transparency is vital for maintaining trust and ensuring that both parties are on the same page.

Key Elements to Include

Due Dates: Specify the exact date by which payment is expected. This sets clear expectations and helps avoid delays.

Payment Methods: Outline the accepted forms of payment, whether it be bank transfer, credit card, or another method. Providing this information upfront simplifies the process for recipients.

Late Fees: If applicable, mention any penalties for late payments. This can serve as an incentive for prompt payment and inform recipients of potential consequences.

Discounts for Early Payment: Consider including incentives for early payments, which can encourage faster transactions and improve cash flow.

By effectively integrating payment conditions into your communications, you can streamline financial interactions and promote timely payments, benefiting both your organization and your clients.

Improving Client Communication

Establishing effective dialogue with clients is essential for fostering strong relationships and ensuring smooth transactions. Enhanced communication not only helps in addressing queries promptly but also builds trust and loyalty, leading to long-term partnerships.

Active Listening: Pay close attention to client needs and concerns. By demonstrating that you value their input, you create an environment where clients feel heard and appreciated, leading to more productive interactions.

Clear and Concise Messaging: Use straightforward language when conveying information. Avoid jargon and ensure that your messages are easily understandable. This clarity helps prevent misunderstandings and keeps all parties aligned.

Regular Updates: Keep clients informed about project progress or changes in policies. Regular updates show commitment and keep clients in the loop, minimizing uncertainty and enhancing their overall experience.

Personalization: Tailor your communication style to fit each client’s preferences. Whether it’s a more formal approach or a casual tone, adjusting your style can make clients feel more connected and valued.

By focusing on these aspects, you can significantly enhance your interactions, ensuring that clients feel respected and engaged throughout the process.

Using Email Automation for Invoicing

Leveraging automation tools can greatly enhance the efficiency of the billing process. By automating repetitive tasks, businesses can save time, reduce errors, and ensure timely communication with clients regarding their financial obligations.

Benefits of Automation

Implementing automated systems offers several advantages:

- Time Efficiency: Automating notifications and follow-ups allows teams to focus on more strategic tasks, improving overall productivity.

- Consistency: Automated messages maintain a uniform tone and structure, ensuring that all clients receive clear and professional communications.

- Accuracy: Reducing manual entry minimizes the risk of human error, leading to fewer discrepancies and enhanced reliability in client interactions.

Implementing Automation Tools

To effectively integrate automation into your billing process, consider the following steps:

- Identify tasks suitable for automation, such as reminders and confirmations.

- Select appropriate software that fits your business needs and integrates well with existing systems.

- Customize automated messages to align with your brand voice and ensure they include essential details for clarity.

- Monitor the effectiveness of your automated communications, making adjustments as necessary to improve engagement and response rates.

By utilizing automation, businesses can streamline their financial interactions, resulting in improved client satisfaction and enhanced operational efficiency.

Ensuring Accuracy in Billing Details

Maintaining precision in financial communications is crucial for building trust and ensuring smooth transactions. Correct details not only reflect professionalism but also prevent misunderstandings that can lead to delays and disputes. Implementing effective strategies for verifying information can significantly enhance the quality of client interactions.

Strategies for Accuracy

To guarantee that all financial particulars are correct, consider the following methods:

- Double-Check Entries: Always review information before dispatching it. This includes verifying amounts, client details, and payment terms.

- Utilize Software Tools: Employ accounting software or management systems designed to minimize human error through automated checks and balances.

- Standardize Formats: Create a consistent layout for your financial documents, ensuring that all relevant details are easily identifiable and comprehensible.

Implementing Verification Processes

Incorporating systematic verification procedures can further enhance accuracy:

- Regular Audits: Conduct periodic reviews of your billing processes to identify and correct recurring mistakes.

- Client Confirmation: Encourage clients to confirm their details periodically, fostering transparency and reducing the likelihood of errors.

- Staff Training: Ensure that all team members involved in the billing process are well-trained in the importance of accuracy and the systems in use.

By prioritizing accuracy in financial communications, businesses can foster stronger relationships with clients and streamline their operations.

Structuring Emails for Fast Payments

Creating well-organized communications is essential for encouraging timely transactions. A clear and concise structure not only helps convey necessary information but also guides the recipient toward prompt action. When clients can quickly grasp the details and respond accordingly, the likelihood of swift payments increases.

Key Components for Effective Structure

To enhance the chances of receiving payments promptly, incorporate the following elements into your communications:

- Clear Subject Line: Use a straightforward subject line that indicates the purpose, such as “Payment Due Reminder” or “Payment Request.” This sets the expectation from the outset.

- Brief Introduction: Begin with a polite greeting and a concise introduction to remind the recipient of the context without unnecessary elaboration.

- Itemized Details: Present the relevant financial information in a clear format, including amounts due, payment methods, and deadlines. An itemized list can enhance clarity.

Creating a Call to Action

Encouraging a swift response is crucial for expediting transactions. Ensure to:

- Include Payment Instructions: Clearly outline how the recipient can make the payment, providing links or details for different payment options.

- Set a Deadline: Specify a due date for payment to create a sense of urgency, making it clear when the payment is expected.

- Offer Support: Indicate your willingness to assist with any questions or concerns, inviting the recipient to reach out if needed.

By structuring communications effectively, you create an environment that fosters timely financial transactions, leading to improved cash flow and strengthened client relationships.

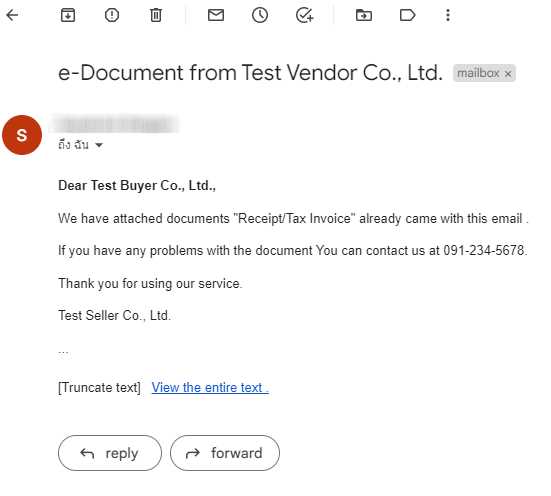

Tracking Invoices with Confirmation Messages

Monitoring financial requests is essential for maintaining clarity in transactions and ensuring timely responses. Confirmation messages serve as an effective tool to acknowledge receipt and provide reassurance to both parties. This practice not only enhances communication but also contributes to a smoother workflow and fosters trust.

Importance of Confirmation Messages

Implementing confirmation notifications offers several benefits, including:

- Acknowledgment: A confirmation message verifies that the financial request has been received, reducing uncertainty for the recipient.

- Clarity: It clarifies the details of the transaction, ensuring both parties are on the same page regarding expectations and deadlines.

- Record Keeping: These messages provide a written record of communications, which can be helpful for future reference or dispute resolution.

Best Practices for Sending Confirmation Messages

To effectively utilize confirmation messages, consider the following guidelines:

- Timeliness: Send the confirmation shortly after the initial communication to reinforce promptness.

- Clear Content: Include essential details such as the amount requested, payment terms, and any relevant deadlines.

- Contact Information: Provide your contact details, encouraging the recipient to reach out with any questions or concerns.

By incorporating confirmation messages into your tracking process, you enhance communication, promote accountability, and improve the overall efficiency of financial transactions.

Securing Payment Information in Emails

Protecting financial details during communication is critical for maintaining trust and safeguarding sensitive data. Ensuring that payment information remains secure requires careful attention to how it is shared and what measures are implemented to prevent unauthorized access. By adopting best practices, individuals and businesses can significantly reduce the risk of data breaches and enhance the overall security of their financial transactions.

Best Practices for Safeguarding Payment Details

Implement the following strategies to protect sensitive information effectively:

- Encryption: Utilize encryption methods to secure data during transmission, making it inaccessible to unauthorized users.

- Secure Connections: Always use secure protocols, such as HTTPS, to ensure that communications are transmitted over encrypted channels.

- Limit Information: Only share essential payment details. Avoid including unnecessary sensitive information that could be exploited.

Training and Awareness

Educating employees and clients about security protocols is vital for minimizing risks. Conduct regular training sessions to raise awareness of potential threats, phishing attempts, and safe practices when handling financial information.

By prioritizing the security of payment information, individuals and organizations can foster a safer environment for conducting transactions and strengthen their relationships with clients.