Free Daycare Invoice Template for Easy Billing

Managing payments in the childcare business can be challenging, especially when it comes to keeping track of each client’s details and ensuring timely collections. Using organized billing documents is essential to make this process smoother and more efficient. A well-designed form allows service providers to present accurate charges while maintaining a professional image.

Customizable billing forms are an excellent solution for simplifying the payment process. They provide a clear structure, making it easier for both the service provider and the client to understand the costs involved. With the right format, you can reduce errors, save time, and focus more on delivering quality care.

In this article, we’ll explore various options for easily accessible documents that can be tailored to meet your specific needs. These resources help ensure that your financial transactions are smooth, organized, and hassle-free.

Free Daycare Invoice Templates for Your Business

When managing payments for childcare services, having an organized method to document and track financial transactions is essential. Utilizing accessible documents designed specifically for this purpose can simplify your accounting and improve communication with clients. With the right structure, these forms help ensure that every service is accurately billed and that no detail is overlooked.

There are many resources available that provide downloadable forms, which can be tailored to suit the unique needs of your business. These resources help streamline your billing process and can be used with minimal effort. Below are some key benefits of using such ready-made documents for your operations:

Key Benefits of Using Billing Forms

- Time-saving: Ready-made documents save you time by eliminating the need to create a billing structure from scratch.

- Professionalism: Pre-designed forms give your business a polished, professional appearance, building trust with clients.

- Accuracy: These forms ensure you capture all relevant details for each service, reducing the risk of errors.

- Customization: Many documents are customizable, allowing you to tailor them to your specific pricing structure and services.

Where to Find Accessible Documents

There are numerous platforms offering downloadable options that can be adapted to your unique needs. Some popular sources for obtaining these documents include:

- Online business resources and accounting websites

- Childcare-focused blogs or community forums

- Template-sharing platforms like Google Docs or Microsoft Office

With these easily accessible options, you can choose the document that fits your needs best, saving you time and effort in the long run while keeping your financial records organized and clear.

Why Use a Daycare Invoice Template?

For any business, maintaining clear and accurate financial records is essential. Using a structured document to record charges, payments, and services rendered makes it easier to stay organized, ensure accurate billing, and minimize confusion. By adopting a pre-designed format, you streamline your operations, enhance professionalism, and reduce administrative workload.

Here are some compelling reasons why using a pre-made billing format can benefit your business:

| Benefit | Description |

|---|---|

| Efficiency | Pre-formatted documents save time by providing a ready-to-use structure, eliminating the need for creating forms from scratch each time. |

| Accuracy | These forms ensure that all necessary fields are included, reducing the risk of missing vital information, such as service dates or fees. |

| Consistency | Using a consistent format ensures that each client receives a clear, standardized record of charges, which helps in maintaining transparency and trust. |

| Professional Appearance | Well-structured documents reflect positively on your business, showing clients that you are organized and reliable. |

| Customization | Most formats allow for easy customization, meaning you can adjust them to fit your specific pricing model and services offered. |

By using these pre-built forms, your administrative tasks become much more manageable, allowing you to focus on providing quality care to your clients while maintaining smooth financial operations.

Benefits of Customizable Invoice Formats

Using flexible billing documents that can be adapted to your specific needs offers numerous advantages. These customizable formats allow you to adjust fields, include relevant details, and match your pricing structure. This level of personalization helps ensure that each transaction is accurately recorded and reflects the unique nature of the services you provide.

Enhanced Flexibility and Control

One of the primary benefits of customizable documents is the flexibility they offer. You can modify the layout and content to suit the requirements of different clients or services. For example, if your pricing varies based on the number of children or hours of care, you can easily adjust the charges to reflect that. This control helps avoid confusion and ensures all clients are billed according to their specific needs.

Professional Image and Brand Consistency

With customizable formats, you can incorporate your branding, such as your business logo, color scheme, and contact information. This creates a cohesive and professional look that reinforces your business identity and adds credibility. Consistent branding across all client documents helps build trust and makes your service appear more reliable and established.

Additional Customization Options can include adding discounts, taxes, or even personalized notes to specific clients, ensuring the document suits each situation. Custom formats are a powerful tool for managing billing efficiently and professionally.

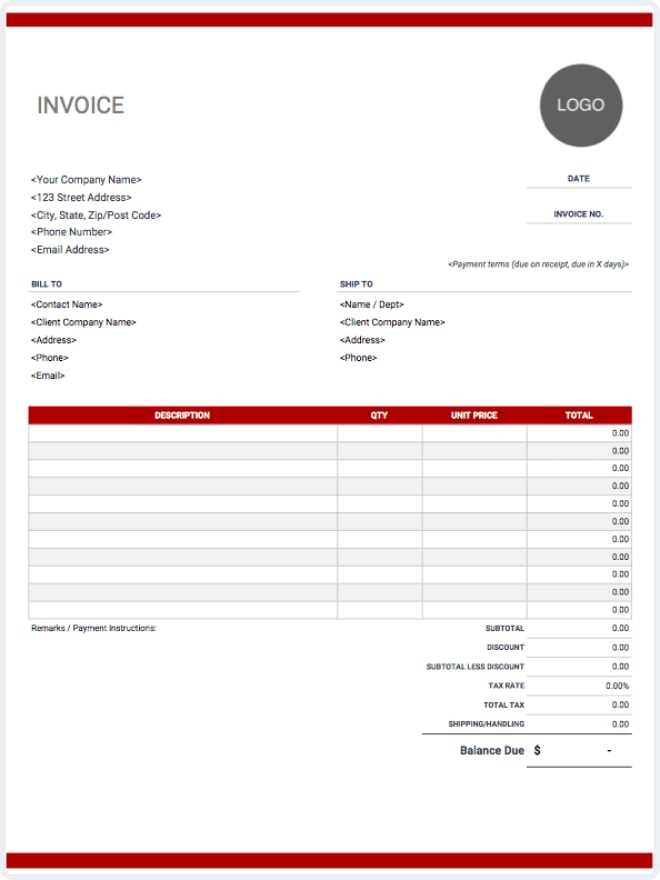

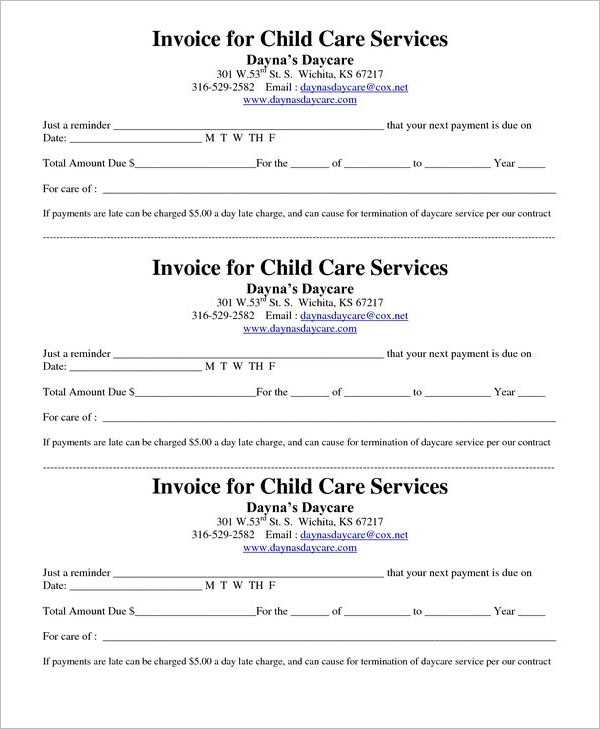

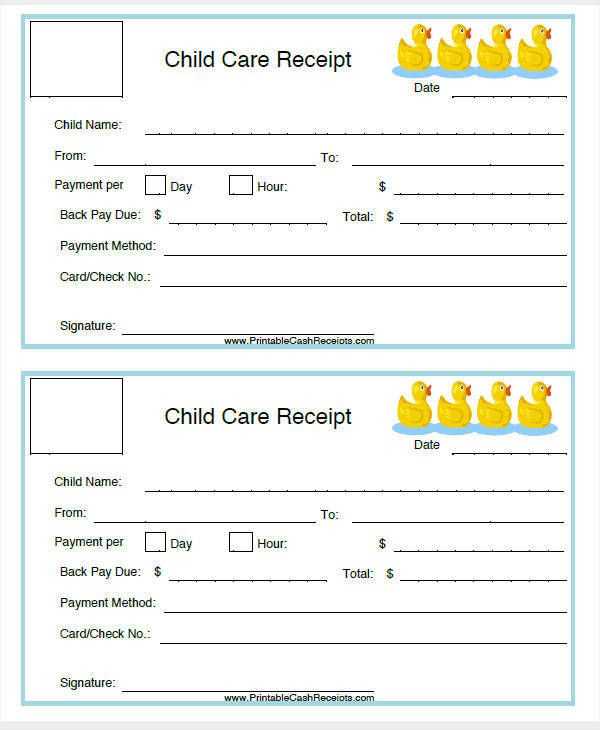

How to Create a Professional Billing Document

Designing a professional billing document is essential for maintaining clarity and building trust with clients. A well-structured form provides all necessary information, ensuring both parties are clear about charges and payment terms. Creating this document is straightforward, especially when you know the key elements to include, which will guarantee a smooth transaction process.

Essential Elements to Include

When creating a billing document, it is important to capture all the relevant details that both the client and service provider need. Below are the key components of an effective form:

| Element | Description |

|---|---|

| Business Information | Include your business name, logo, address, phone number, and email address for easy contact. |

| Client Information | List the client’s name, address, and contact details to ensure the document is specific to them. |

| Service Details | Clearly state the services provided, along with the duration or frequency (e.g., number of hours or days). |

| Charges | Break down the charges clearly, including any taxes, discounts, or special fees. |

| Payment Terms | Specify the due date, payment methods accepted, and any late fees or penalties for overdue payments. |

Tips for a Polished Appearance

For a professional finish, make sure the design is neat and easy to read. Use clear fonts, organize the sections logically, and keep the layout consistent. Adding your logo and company colors can enhance the document’s branding and make it stand out to clients.

Once you’ve added all the necessary details and formatted the document, it will not only look professional but also provide both you and your clients with a reliable reference for all transactions.

Free Resources for Downloading Invoice Templates

Finding reliable resources to access downloadable documents for billing can save both time and effort. Numerous platforms provide ready-to-use files that can be easily customized for your specific needs. These sources offer a range of options, allowing you to choose the format that best fits your business structure and workflow.

Many websites provide a variety of customizable forms that are easy to download and integrate into your accounting system. These documents are designed to meet different business requirements, from simple forms to more detailed ones with additional features. Whether you are looking for basic structures or advanced designs, these resources offer something for every need.

Here are a few places where you can find such resources:

- Microsoft Office Templates: A vast collection of forms available through Word and Excel that can be customized according to your specifications.

- Google Docs: Offers a variety of editable documents that can be accessed and used directly from your Google Drive.

- Template Websites: Platforms like Template.net or Invoice Simple provide pre-made forms that are quick to download and easy to personalize.

- Business Blogs: Many business-focused blogs offer downloadable files as part of their resources section, catering to a wide range of industries.

By exploring these resources, you can quickly access and start using professional billing documents, allowing you to focus more on providing services rather than creating paperwork from scratch.

Essential Information for Your Billing Documents

To ensure clear communication and avoid confusion, it’s crucial that every billing document contains the necessary details. An organized and complete record of services, charges, and client information helps streamline the payment process and ensures that both you and your clients are on the same page. Including the right elements makes your billing more efficient and professional.

Here are the key pieces of information to include in your billing documents:

- Business Information: Your business name, address, contact details, and logo help personalize the document and make it easily identifiable.

- Client Information: Ensure you include the client’s full name, address, and contact details for clarity and to prevent mistakes.

- Service Description: A detailed list of the services rendered, including dates, hours, or specific activities performed, ensures transparency and helps the client understand the charges.

- Pricing Breakdown: Clearly itemize all fees, taxes, and additional charges to avoid confusion. Providing a breakdown helps clients see exactly what they are paying for.

- Payment Terms: Include the due date, accepted payment methods, and any late fee policies to clarify expectations for timely payment.

- Unique Identifier: Each document should have a reference number or unique identifier to easily track the transaction for future reference.

By ensuring that each billing record includes these key details, you create a professional and organized approach that benefits both you and your clients.

Common Billing Mistakes to Avoid

Billing errors can lead to confusion, disputes, and delayed payments, which is why it’s important to avoid common mistakes that can disrupt your business. Ensuring your payment records are accurate, clear, and professional is essential for maintaining a smooth relationship with your clients. Below are some common pitfalls to be aware of when creating and sending payment documents.

1. Incomplete or Missing Information

Omitting key details, such as client contact information, service dates, or payment terms, can lead to misunderstandings. Ensure all fields are filled out thoroughly to provide a complete record of the transaction. This helps clients know exactly what they are paying for and when the payment is due.

2. Lack of Clear Payment Terms

Unclear payment terms can cause delays in receiving payments. Always specify the due date, acceptable payment methods, and any penalties for late payments. Providing this information upfront helps set expectations and reduces confusion for your clients.

By avoiding these common mistakes and paying close attention to detail, you can ensure that your billing process is smooth, professional, and efficient.

Tips for Streamlining Your Billing Process

Efficiently managing your payment records is crucial for maintaining smooth financial operations. A streamlined process reduces time spent on administrative tasks, minimizes errors, and ensures that payments are collected on time. Below are some tips that can help simplify your billing routine, allowing you to focus more on your core services.

1. Automate Where Possible

Consider using accounting software or digital tools that allow you to generate and send payment documents automatically. Automation helps reduce manual entry, ensures consistency, and saves you valuable time.

2. Set Clear Payment Deadlines

Specify payment due dates upfront and stick to them. Setting clear terms helps avoid confusion and encourages timely payments from clients.

3. Keep a Consistent Format

Using a uniform format for all billing records ensures that both you and your clients are familiar with the structure. Consistency makes it easier to track transactions and reduces the likelihood of mistakes.

4. Offer Multiple Payment Methods

By providing several payment options (e.g., bank transfer, online payments, checks), you make it easier for clients to settle their bills on time. More payment options can lead to faster and more reliable collections.

5. Review Records Regularly

Regularly reviewing your financial documents helps identify any discrepancies early on and ensures that no payments are overlooked. Establishing a routine for reviewing records can save time and effort in the long run.

By implementing these practices, you can simplify the entire payment process, making it more efficient, transparent, and hassle-free for both you and your clients.

How to Personalize Your Billing Document

Personalizing your billing document helps create a stronger connection with your clients and reinforces your brand identity. By adding specific details and adjusting the format to suit your business, you can make the document not only functional but also reflective of the services you offer. Customization also allows you to cater to the unique needs of each client, making the payment process smoother and more professional.

Here are several ways to personalize your billing document:

- Add Your Business Branding: Include your logo, brand colors, and business name at the top of the document to create a professional and cohesive look that reflects your business identity.

- Customize the Service Description: Tailor the service descriptions to reflect the specific care or services provided, ensuring clarity and helping the client understand what they are being charged for.

- Include Personalized Messages: Adding a thank-you note or specific instructions about payment terms helps foster a positive relationship with your clients and encourages timely payments.

- Adjust the Layout: Modify the layout to suit your needs, such as adding additional fields for discounts, taxes, or special rates that apply to particular clients.

- Offer Payment Options: Personalize the payment section by offering your clients various payment methods that work best for them, whether it’s online payment, bank transfer, or other convenient methods.

By tailoring your billing document to reflect your business values and your clients’ specific needs, you ensure a professional yet personalized experience that can lead to stronger client relationships and smoother financial transactions.

Best Software for Billing Documents

Choosing the right software to manage your billing documents can significantly improve efficiency, accuracy, and organization. With a variety of tools available, selecting one that suits your specific needs can streamline your financial processes and save valuable time. The best software options offer customizable features, ease of use, and integration with other systems, ensuring that your payment management is seamless and professional.

Top Features to Look for in Billing Software

When evaluating software, consider the following features to ensure that it meets your business needs:

- Customization: The ability to adjust document layouts and fields to match your specific services and pricing model.

- Automation: Features that allow for automatic generation and sending of payment documents based on predefined schedules.

- Payment Tracking: Tools that track payments, send reminders, and keep a record of transactions.

- Ease of Use: User-friendly interfaces that require minimal training and make document creation fast and easy.

- Security: Secure storage and data protection to ensure that client information is kept private and safe.

Recommended Software Options

The following software tools are highly recommended for managing billing documents in a smooth and organized manner:

| Software | Key Features | ||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| QuickBooks | Comprehensive accounting software with customizable billing options, payment tracking, and integration with other financial tools. | ||||||||||||||||||||||||||||

| FreshBooks | Easy-to-use invoicing software with automated reminders, online payment options, and reporting features. | ||||||||||||||||||||||||||||

| Zoho Books | Offers automated billing, customizable templates, and an intuitive dashboard for managing finances. | ||||||||||||||||||||||||||||

Wave

Tracking Payments with a Billing DocumentTracking payments effectively is key to maintaining financial clarity and ensuring timely collections. Using a structured form that records payment status, due dates, and amounts allows you to stay organized and minimize the risk of missed or delayed payments. With the right approach, managing your payments becomes much more efficient, and you can easily monitor outstanding balances or completed transactions. How to Track Payments EfficientlyTo effectively track payments, include specific sections in your documents that allow you to monitor the payment status for each transaction. Here are some tips on what to include:

Tools for Monitoring PaymentsMany software tools offer features that help track payments efficiently, often allowing you to generate reports that show the payment status for all outstanding balances. Incorporating these digital tools into your billing process can reduce manual tracking and make it easier to monitor payments in real-time. By carefully tracking payments through a well-organized system, you can ensure that your financial records remain accurate and that payment processes are smooth for both you and your clients. When to Send Your Billing DocumentsKnowing when to send payment records is crucial to maintaining a steady cash flow and ensuring that clients make timely payments. The timing of your billing can have a significant impact on your business’s financial health. By establishing clear guidelines for when to issue your payment requests, you can avoid confusion, reduce the likelihood of late payments, and keep your operations running smoothly. Factors to Consider When Setting Billing DatesSeveral factors play a role in determining the best time to send your payment documents. Here are some key considerations to help you decide:

Recommended Billing Schedules

While the exact timing may vary based on your service type and client preferences, here are some common schedules for issuing payment documents:

By establishing a clear billing schedule and understanding the best times to issue payment requests, you can streamline your business’s financial operations and maintain a positive relationship with your clients. How to Handle Late Payments EffectivelyLate payments are a common challenge for businesses, but managing them effectively can help maintain cash flow and ensure that your operations continue smoothly. Having a clear strategy for dealing with overdue payments not only helps you recover funds but also maintains positive relationships with clients. A professional and consistent approach is key to resolving payment delays without damaging your reputation. Key Steps for Managing Late PaymentsWhen faced with overdue payments, following a structured approach can help resolve the situation quickly and professionally. Here are some steps to consider:

Late Payment Handling TableThe following table shows an example of how you can track and manage late payments effectively:

|