How to Use Invoice Template PDF on Mac for Efficient Billing

Managing payments and keeping track of financial transactions is essential for any business, whether small or large. Having an efficient system in place to generate and send professional documents that outline charges is crucial. These documents serve as a formal request for payment, ensuring clarity and helping maintain a smooth workflow.

For those who use Apple computers, there are powerful tools available that simplify this process. With a variety of software options, it’s possible to create clear and customized billing forms that are both easy to use and reliable. Whether you are a freelancer, a small business owner, or part of a larger organization, these resources can save you time and reduce errors when preparing payment requests.

In this guide, we’ll explore different ways to create and manage professional billing forms on your Apple device. By utilizing the right resources, you can ensure that your financial documents look polished and are delivered to your clients in a timely manner. From creating documents to editing and sharing them, these solutions provide everything you need for an efficient billing system.

Invoice Template PDF for Mac Users

Creating professional payment requests is a crucial aspect of managing any business. For users of Apple devices, there are various resources available to easily design and manage these documents, ensuring accuracy and a polished appearance. These tools provide a seamless experience, allowing you to generate custom forms tailored to your specific needs while maintaining consistency across all client communications.

Why Choose These Tools on Apple Devices

Apple’s operating system offers several built-in features and third-party applications that simplify the creation of well-structured financial documents. The ability to customize these forms ensures that your business’s branding is reflected clearly, while offering flexibility in terms of layout and content. These options also support seamless exporting and sharing, making it easy to send completed forms directly to clients or partners.

Key Features for Efficient Billing Forms

Among the most notable features available are pre-made formats, which help to quickly populate essential details such as contact information, transaction summaries, and payment terms. Many of these tools also support easy editing, allowing users to adjust and modify content as needed. Additionally, by choosing the right platform, you can automate the process, saving time and reducing the risk of manual errors.

Why Use PDF Invoice Templates on Mac

For any business or freelance professional, managing financial documents effectively is key to maintaining a smooth workflow. Using a reliable format to create and store billing records not only ensures clarity but also offers a professional touch to client communications. When working on an Apple device, there are numerous reasons why certain formats are particularly beneficial for these purposes.

Consistency and Professionalism

One of the primary advantages of choosing a standardized format is the consistency it brings. By using pre-designed forms, you ensure that each document sent to clients maintains the same professional look and structure. This helps build trust and creates a positive impression with your customers, as well as making it easier for them to understand the details at a glance.

Security and Compatibility

Another significant benefit of using this type of format is its security features. Documents saved in this format are less prone to accidental editing, which helps protect sensitive financial information. Additionally, these files are universally compatible, making them easily accessible across different devices and operating systems without the risk of formatting issues.

Top Benefits of PDF Invoices for Businesses

For any business, efficient billing practices are essential to maintain a steady cash flow and keep operations running smoothly. The use of well-structured financial documents offers numerous advantages, not only in terms of organization but also in enhancing client relationships. By using a widely accepted format, businesses can enjoy streamlined processes and greater accuracy when handling financial transactions.

Improved Accuracy and Reduced Errors

When dealing with financial records, accuracy is critical. By utilizing a consistent, standardized format, the chances of errors are minimized. These documents help ensure that all relevant information is included, which reduces the risk of missing key details that could lead to misunderstandings or delayed payments.

Faster Processing and Payments

Sending well-organized and clear financial documents speeds up the entire payment process. Clients can easily understand the charges, payment terms, and deadlines, leading to faster approvals and payments. This efficiency also reduces the time your team spends on follow-ups, freeing them up for more important tasks.

| Benefit | Description |

|---|---|

| Consistency | Standardized formats ensure a professional and uniform presentation across all documents. |

| Security | These files are secure, preventing unauthorized changes and protecting sensitive data. |

| Convenience | Easy to send via email and accessible on multiple devices, ensuring clients have quick access. |

| Environmental Impact | Digital documents reduce the need for paper, promoting eco-friendly business practices. |

How to Create Invoices on Mac

Creating accurate and professional billing documents on your Apple device can be a straightforward task with the right tools. Whether you’re a freelancer or a small business owner, having the ability to quickly generate payment requests helps streamline financial operations and improves client communication. In this section, we’ll walk you through the essential steps to efficiently prepare and manage your payment documents using various applications available on Apple’s operating system.

Using Built-in Tools for Document Creation

Apple’s native apps like Pages and Numbers provide easy-to-use features for creating professional billing forms. These tools offer pre-designed layouts that can be customized with your business details. You can adjust the design, add your logo, and include all necessary payment information. After designing the form, you can save it in a compatible format for sharing with clients or storing for future reference.

Third-Party Apps for More Advanced Features

If you need additional features, such as automated calculations or enhanced customization, third-party software can help. Applications like Excel, QuickBooks, or other billing software provide advanced options for creating and managing financial records. These apps also support integrations with payment systems, allowing for a more seamless experience when issuing and tracking payments.

Best Tools for PDF Invoices on Mac

Creating and managing professional financial documents on an Apple device can be made easy with the right set of tools. Whether you are a freelancer, a small business owner, or part of a larger company, using the best applications ensures that your records are organized, accurate, and easy to share. In this section, we will explore the most efficient tools available for generating and managing billing documents on your Apple device.

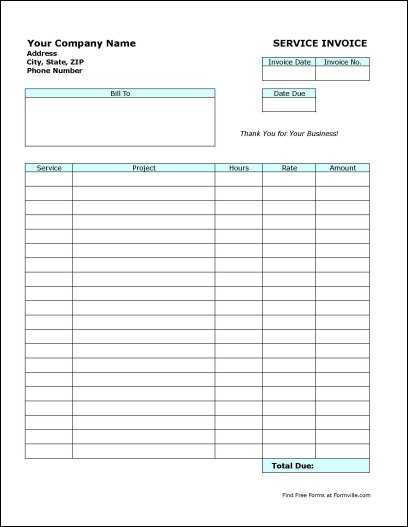

Top Software for Simple and Customizable Forms

Several programs are available that offer simplicity and flexibility when creating financial records. These applications allow you to design forms from scratch or choose from pre-built layouts, offering a range of customization options. You can add your logo, adjust formatting, and insert specific business details to make the document uniquely yours. Many of these apps also support easy exporting, so you can send your forms instantly to clients.

Advanced Applications for Professional Users

If you need more features such as automation, calculations, and integration with payment systems, there are advanced tools designed specifically for professional use. These apps provide deeper customization, streamline your workflow, and ensure that your billing process is as efficient as possible. Many even offer cloud storage integration, allowing for easy access and organization across multiple devices.

| Tool | Key Features | Best For |

|---|---|---|

| Apple Pages | Customizable templates, easy-to-use interface | Small businesses and freelancers |

| QuickBooks | Automated calculations, expense tracking | Larger businesses with advanced needs |

| Excel | Powerful formula support, custom templates | Users needing more control over layouts and formulas |

| FreshBooks | Cloud-based, invoicing automation, time tracking | Freelancers and small businesses seeking automation |

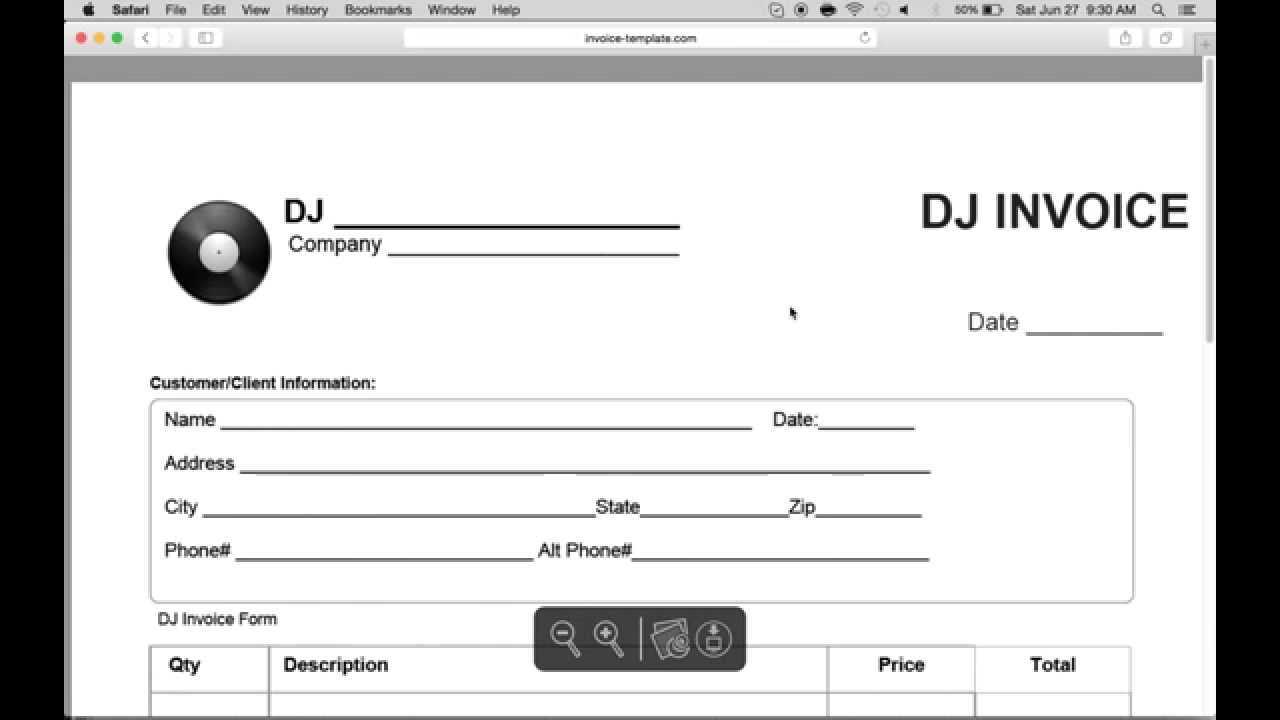

Customizing Your Invoice Template on Mac

Customizing billing documents allows businesses to present a professional and consistent image to clients. With the right tools available on Apple devices, you can easily modify the look and content of your payment requests to match your branding and meet specific client needs. Personalizing these forms not only helps improve communication but also ensures that all necessary information is clearly presented.

Key Elements to Customize

When customizing financial documents, there are several key elements you should focus on to ensure that the form is clear and aligned with your business requirements:

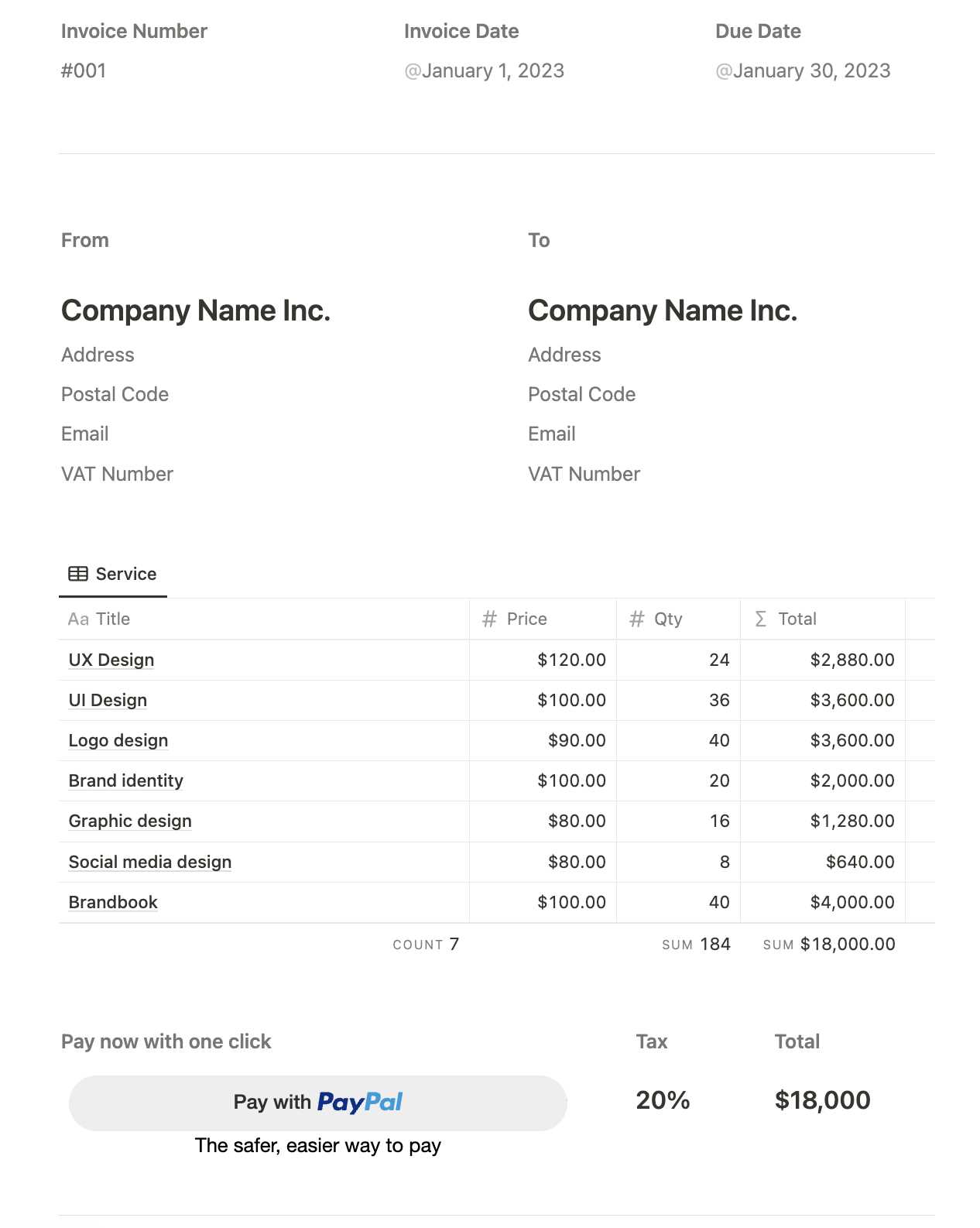

- Business Information: Add your company name, address, contact details, and logo to make the document look professional and easy to identify.

- Payment Terms: Specify your payment policies, including due dates, late fees, and accepted payment methods.

- Itemized List: Include a detailed breakdown of the services or products provided, with clear descriptions and pricing.

- Branding: Customize the fonts, colors, and layout to match your company’s branding guidelines, giving the document a consistent visual identity.

- Additional Notes: Leave space for any custom messages, such as thank-you notes or additional instructions for the client.

Steps to Personalize Your Billing Forms

Here’s how you can efficiently customize your forms on an Apple device:

- Open your preferred document creation tool, such as Pages or Excel.

- Select a pre-built layout or start from scratch to create a new document.

- Insert your business name, logo, and contact details in the designated fields.

- Adjust the design elements such as colors and fonts to match your branding.

- Enter all relevant transaction details, including the list of products or services, quantities, and prices.

- Save and export the document in your desired format for easy sharing and distribution.

How to Save and Export PDF Invoices

After creating and customizing your billing documents, it’s crucial to save them properly for future reference and easy sharing with clients. Exporting these forms into a widely used format ensures they can be opened and reviewed on various devices without losing the layout or content. In this section, we’ll explore how to save your completed records and export them for seamless delivery.

Saving Your Billing Documents

Saving your financial records in a secure and accessible location is the first step to ensure you can quickly retrieve them when needed. Here are a few tips to consider when saving your documents:

- Choose a Clear File Name: Use descriptive names such as “Client_Name_Transaction_Date” to easily locate the file later.

- Organize in Folders: Create specific folders for each client or project to keep your files organized.

- Use Cloud Storage: Save your files in cloud-based services like iCloud or Google Drive for easy access from multiple devices.

- Local Backup: Keep a copy on an external drive for an additional layer of security.

Exporting for Client Distribution

Once your document is saved, you may want to send it to your client. Exporting it to a common format ensures compatibility and smooth sharing. Here’s how to export:

- After finishing your document, go to the “File” menu in your document creation tool.

- Select the “Export” or “Save As” option from the dropdown list.

- Choose the format you want to export to (typically a .doc, .xls, or .txt format depending on your needs).

- Select the destination folder where the file will be saved.

- Ensure the file is named properly and click “Save” or “Export” to finalize the process.

After export, your document is ready to be sent via email, uploaded to your client portal, or printed for physical delivery. This simple process ensures your documents are stored securely and can be easily accessed and shared with others when needed.

Free Invoice Templates for Mac Users

For business owners and freelancers, finding a cost-effective way to create professional billing documents is essential. Fortunately, there are many free resources available that allow users of Apple devices to generate custom forms without spending extra money. These free solutions provide all the necessary tools to produce clean and functional records, saving time and effort in the process.

Where to Find Free Resources

Various platforms offer free templates that can be easily accessed and customized. Some are built into the software available on your Apple device, while others can be downloaded from trusted online sources. These resources are designed to suit a variety of business types, from freelancers to larger organizations, and they can be easily adapted to your specific needs.

Popular Free Solutions for Professional Documents

Here are a few popular free tools and platforms for creating clean and professional billing documents:

| Resource | Features | Best For |

|---|---|---|

| Apple Pages | Free pre-built layouts, customization options | Small businesses and freelancers |

| Google Docs | Easy-to-use, cloud-based, real-time collaboration | Freelancers and remote teams |

| Canva | Professionally designed layouts, drag-and-drop editor | Creative professionals and startups |

| Invoice Ninja | Cloud-based, invoice tracking, recurring billing | Freelancers and small businesses |

Each of these tools offers a variety of customization options to fit your needs. Whether you’re a freelancer who needs something simple or a business that requires more detailed features, these free resources can help you generate and manage your financial documents with ease.

How to Edit PDF Invoices on Mac

Once your billing document is created and saved, there may be times when you need to make adjustments or updates before sharing it with your clients. Whether it’s correcting a typo, updating payment terms, or modifying a price, being able to quickly edit your financial records is essential. Fortunately, on an Apple device, there are several tools available that allow for efficient and easy modifications to existing documents.

Tools for Editing Billing Documents

There are multiple software options for making changes to your saved financial documents. Some tools are built into your device, while others are available as third-party applications, offering additional features. Here are some popular tools you can use:

- Preview: Apple’s built-in Preview app allows you to make basic edits such as adding text, annotations, or highlights. It’s a great tool for simple edits and quick changes.

- Adobe Acrobat Reader: With its free version, you can view, comment, and annotate, while the paid version provides more advanced editing tools like text modifications and form field editing.

- PDF Expert: This app offers comprehensive features, allowing you to edit text, images, and even rearrange pages. It’s a paid solution with advanced options for professionals.

- Smallpdf: An online tool that provides a user-friendly interface to edit and modify documents directly from your browser without needing to install anything.

Steps to Edit Documents on Your Apple Device

Follow these simple steps to edit your financial records on an Apple device:

- Open your document in the chosen editing tool, such as Preview or Adobe Acrobat.

- Select the “Edit” option from the toolbar or menu.

- Make the necessary changes, such as updating client details, correcting figures, or adding notes.

- Review the changes for accuracy and formatting.

- Save the modified document by clicking “Save As” to avoid overwriting the original.

- Export the updated document if needed, and share it with your client or store it in your preferred location.

These steps ensure that you can quickly make changes to your billing records, keeping them accurate and up-to-date for your clients without hassle.

Streamlining Billing with PDF Templates

Efficient billing processes are essential for businesses of all sizes. Using well-designed forms that can be easily customized, saved, and shared not only reduces administrative workload but also improves consistency and accuracy. By leveraging simple yet powerful tools, businesses can simplify the billing process, saving valuable time while ensuring clients receive clear and professional documents.

Advantages of Automated Billing Forms

Using standardized billing formats offers numerous benefits, especially when managing multiple clients or transactions. Automation eliminates the need for manually creating each document from scratch, reducing human error and ensuring consistent formatting. Below are some key advantages:

- Time Savings: Once set up, forms can be reused, allowing you to quickly create new records without repetitive data entry.

- Consistency: Using the same structure for all records ensures a professional, uniform appearance across your business.

- Accuracy: Automated calculations and pre-set fields ensure that all details are accurate, minimizing mistakes.

- Customization: Forms can be customized with your branding, making each document uniquely suited to your business identity.

How Automated Billing Tools Simplify Operations

Many billing software tools and applications allow you to automate key aspects of your financial records. These tools often come with built-in features like itemized lists, automatic price calculation, and customizable fields, streamlining the entire process. Below is a comparison of some popular tools:

| Tool | Key Features | Best For |

|---|---|---|

| QuickBooks | Automated calculations, expense tracking, recurring billing | Small businesses and freelancers |

| Zoho Invoice | Customizable designs, recurring invoicing, multi-currency support | Global businesses and freelancers |

| Wave | Free, cloud-based, automatic payment reminders | Freelancers and startups |

| FreshBooks | Cloud-based, expense tracking, time tracking | Freelancers and small service-based businesses |

Using these tools, businesses can not only automate the creation of financial records but also streamline the distribution process, making it easier and faster to get paid and maintain financial organization.

Setting Up Invoice Details on Mac

When creating billing records, it’s essential to include all the necessary information to ensure clarity and professionalism. By properly organizing and structuring the content, you can create a document that’s both informative and easy for clients to understand. On Apple devices, there are several ways to set up these details, allowing you to customize each form to suit your business and client needs.

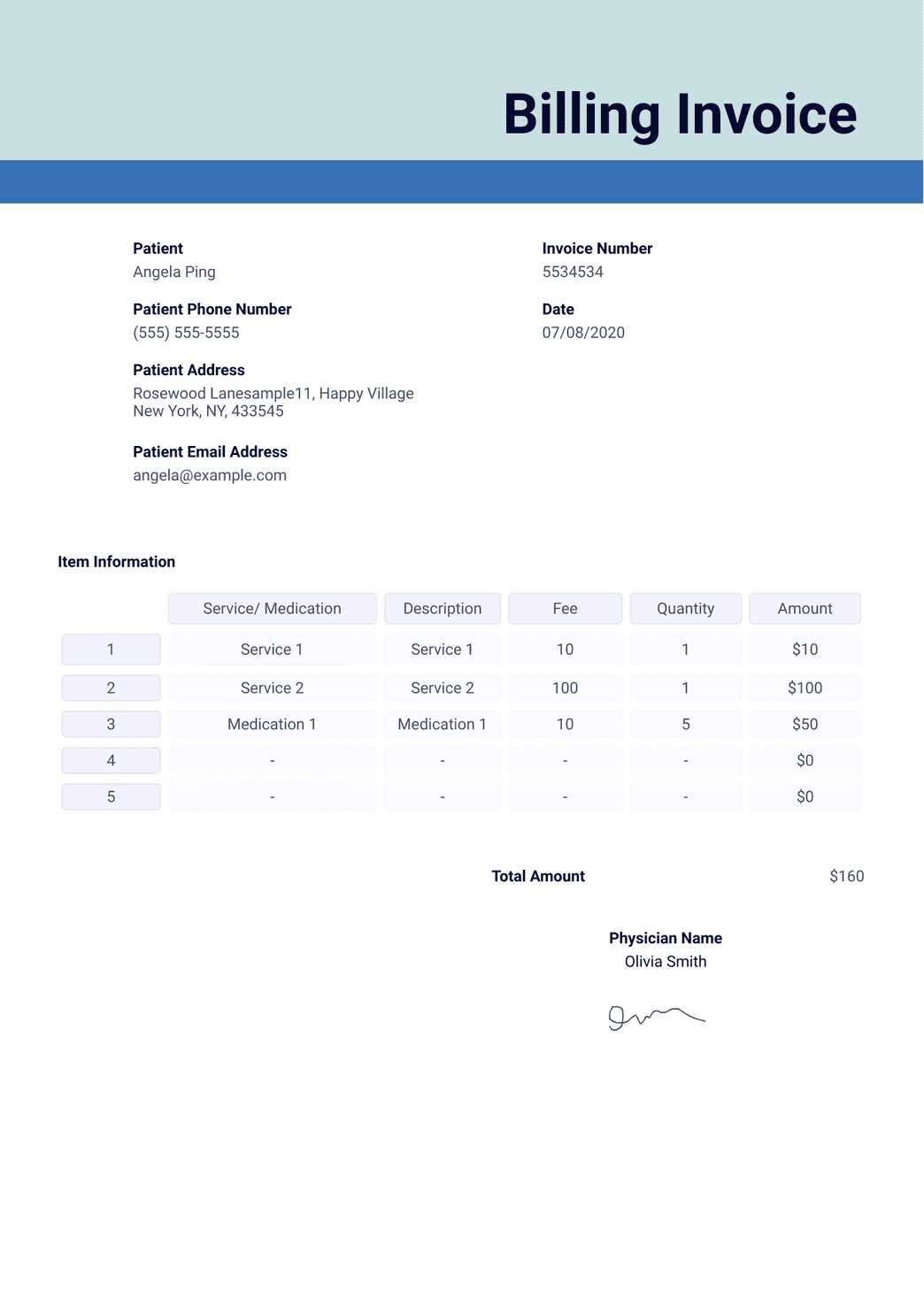

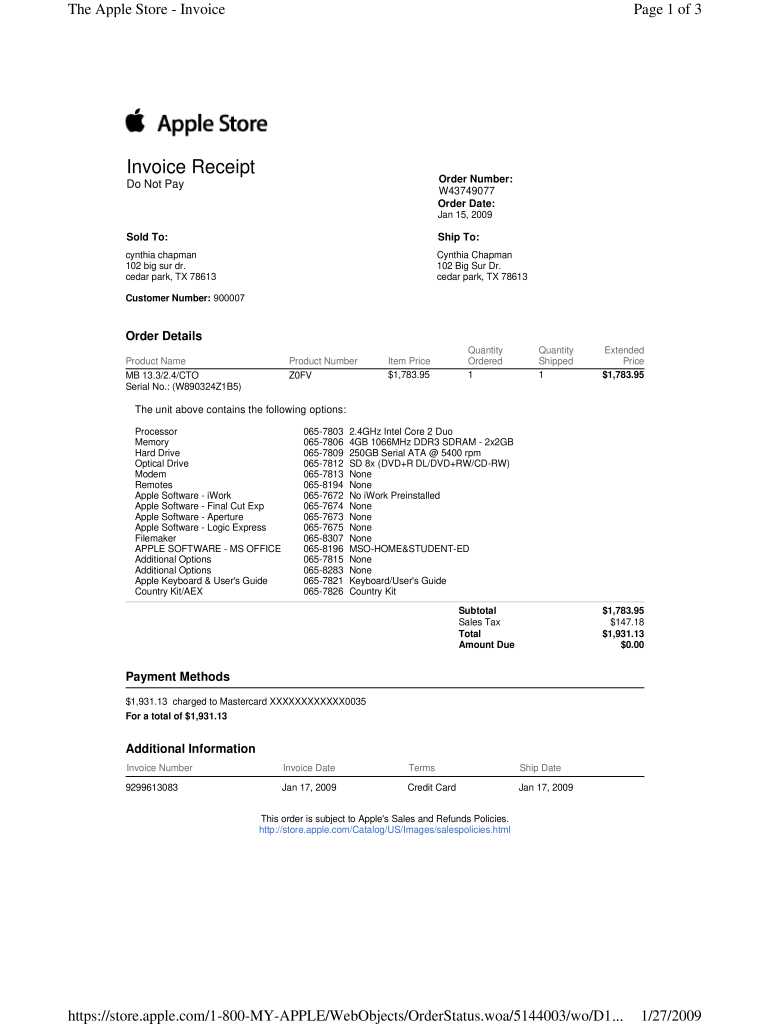

Essential Information to Include

To ensure your billing documents are complete and contain all the necessary details, it’s important to include the following key elements:

- Business Information: Your company name, address, phone number, and email should be prominently displayed at the top of the document. This makes it easy for clients to contact you if necessary.

- Client Information: Include the name, address, and contact details of the client or company receiving the payment request.

- Itemized List: A clear breakdown of the products or services provided, including quantities, descriptions, and prices for each item.

- Payment Terms: Specify your payment conditions, such as due dates, late fees, or discounts for early payments.

- Unique Reference Number: Assign a unique number to each record for easy tracking and reference.

- Notes and Messages: Include any additional instructions or personalized messages, such as “Thank you for your business” or “Please make payments via bank transfer.”

Steps to Set Up Billing Details on Your Apple Device

Follow these simple steps to set up and structure your billing document:

- Open your preferred document creation app on your Apple device (e.g., Pages, Numbers, or Excel).

- Choose a blank document or a pre-designed layout that suits your needs.

- Enter your business and client details at the top of the form, making sure the information is clearly organized.

- For each service or product, provide a brief description, quantity, and price in an organized list format.

- Add your payment terms, including due dates and accepted payment methods, at the bottom or in a separate section of the form.

- Double-check all details for accuracy before saving the document or exporting it for sharing.

By carefully setting up your document with all the necessary information, you’ll ensure that your clients have a clear understanding of the payment request and can easily follow the terms and conditions you’ve outlined.

How to Automate Invoice Creation on Mac

For businesses with a high volume of transactions, manually creating financial records for each sale or service can be time-consuming and prone to errors. Automating this process can save significant time, improve accuracy, and streamline your workflow. By setting up automated systems, you can ensure that each document is generated consistently, leaving you with more time to focus on other tasks.

Tools for Automating Billing Documents

There are several applications and services available for automating the creation of financial records on Apple devices. These tools integrate with your business management system and generate the required documents with just a few clicks. Here are some popular tools for automating billing on Apple devices:

- QuickBooks: An all-in-one accounting solution that allows you to automate the creation of detailed financial records, track payments, and manage recurring billing.

- FreshBooks: A user-friendly cloud-based tool that automates billing, tracks expenses, and sends reminders for unpaid balances.

- Zoho Books: A powerful platform that offers automation for recurring transactions, client management, and custom document generation.

- Wave: A free tool that automates the creation of financial documents, integrates with bank accounts, and sends payment reminders.

- Invoicely: A simple solution for automating billing and creating professional records, including multi-currency support and automated reminders.

Steps to Set Up Automation for Your Billing System

Follow these steps to automate your document creation process:

- Choose an automation tool that fits your business needs (e.g., QuickBooks, FreshBooks, or Zoho Books).

- Sign up for an account and integrate the tool with your payment system, bank account, or other financial platforms.

- Set up recurring billing for regular clients or services to automatically generate records at specified intervals.

- Customize the document layout and fields to match your business branding and client needs.

- Enable automated reminders for overdue payments to ensure prompt follow-up with clients.

- Review generated documents periodically for accuracy and update any information as necessary.

With the right tools and setup, automating the creation of your financial records can significantly reduce the time spent on administrative tasks and help you maintain consistency in your billing process.

Best Practices for Professional Invoices

Creating clear and professional billing records is essential for maintaining strong relationships with clients and ensuring timely payments. By following best practices, businesses can ensure that their documents are not only functional but also presentable and easy for clients to understand. Whether you’re running a small business or a large enterprise, these practices can help improve the effectiveness and professionalism of your financial documentation.

Key Elements for Professional Billing Documents

To ensure your documents are both effective and professional, it’s important to include the following elements:

- Clear Contact Information: Include your business name, address, phone number, and email at the top of the document to make it easy for clients to reach you if needed.

- Client Details: Always include the client’s full name, company name (if applicable), and contact information to avoid confusion.

- Unique Identification Number: Assign a unique reference number to each document for tracking and organizational purposes.

- Detailed List of Services or Products: Clearly describe the goods or services provided, along with their individual costs and quantities. This ensures transparency and helps avoid disputes.

- Payment Terms: Clearly state the due date, accepted payment methods, and any late fees or discounts for early payment.

- Thank You Note or Professional Message: A simple thank you or message of appreciation can go a long way in strengthening client relationships.

Tips for Making Your Documents Stand Out

Aside from the basic information, you can apply the following tips to enhance the visual appeal and professionalism of your financial records:

- Keep the Design Clean and Simple: Use a consistent font and layout that’s easy to read. Avoid clutter and make sure the key information stands out.

- Use Your Branding: Incorporate your business logo and colors to ensure your document reflects your brand identity.

- Ensure Proper Alignment: Align text and numbers neatly to create a professional, organized appearance. This makes the document easy to follow and visually appealing.

- Include Itemized Charges: Break down each service or product, including quantity and price, to prevent any confusion for the client.

- Proofread and Double-Check Details: Always review your document for accuracy, ensuring all numbers, names, and dates are correct before sending.

By following these best practices, you can create billing records that not only reflect your professionalism but also ensure smoother transactions and a positive experience for your clients.

How to Include Taxes in Billing Documents

When creating billing records, it’s important to accurately account for taxes to ensure legal compliance and avoid confusion with clients. Including taxes in your documents not only helps you stay transparent but also ensures that clients are aware of their total payment obligations. Calculating and adding taxes correctly is a crucial step in generating accurate and professional financial statements.

Understanding Tax Calculations

Before including taxes in your financial documents, you need to calculate the tax amount based on the applicable rate. The tax rate may vary depending on the location of your business, the client, or the nature of the goods or services provided. Here’s a simple method to include taxes:

- Determine the Tax Rate: Verify the applicable tax rate based on your location or the client’s location, as tax rates can vary by region or country.

- Calculate the Tax Amount: Multiply the total price of the goods or services by the tax rate. For example, if your total is $100 and the tax rate is 8%, you will calculate $100 * 0.08 = $8 in taxes.

- Add Tax to the Total: Once the tax amount is calculated, add it to the subtotal to get the final total that the client owes.

Steps to Include Taxes in Your Financial Documents

Once you’ve calculated the tax amount, follow these steps to include it in your billing document:

- Include a Tax Section: Add a dedicated section to the document for taxes, typically under the list of items or services. Label it clearly (e.g., “Sales Tax” or “VAT”) and provide the tax amount calculated above.

- Show Tax Rate: Display the applicable tax rate alongside the tax amount so that the client can see exactly how the tax was calculated.

- Display Total Amount: After including the tax, clearly indicate the final amount owed by the client at the bottom of the document.

- Password Protection: Always apply password protection to your documents before sharing or sending them. This ensures that only authorized recipients can access the information.

- Encryption: Encrypt your documents using secure algorithms to protect them from unauthorized access. Encryption turns the content of the document into unreadable data for anyone without the correct decryption key.

- Watermarking: Adding a watermark can discourage unauthorized use of your documents. Watermarks can indicate ownership and help prevent the document from being altered or shared without permission.

- Use Secure Platforms for Sharing: When sending documents, use encrypted email services or secure cloud storage platforms that offer end-to-end encryption to keep your files safe during transmission.

- Limit Access: Restrict access to the document to only those who need it. For example, set permissions for who can view, edit, or share the document, especially when storing it on shared platforms.

- Backup Regularly: Always keep secure backups of important documents, either on an encrypted external drive or a trusted cloud service. This ensures that your files are safe in case of hardware failure or accidental deletion.

- Use Version Control: For documents that go through multiple updates or revisions, use version control systems to track changes and prevent unauthorized edits.

- Implement Access Controls: In a team environment, set up role-based access controls to ensure that only authorized personnel can access, edit, or share sensitive files.

- Email: Sending documents via email is one of the simplest methods. Attach your financial document directly to an email and include any relevant message. Ensure that your email platform supports encryption for added security when sending sensitive information.

- Cloud Storage: Cloud storage services like Google Drive, Dropbox, or iCloud allow you to upload your financial records and share a link with your recipients. This method provides easy access, especially for larger documents, and allows you to control permissions, like restricting editing or downloading.

- File Transfer Apps: Using apps like AirDrop, you can securely send documents between Apple devices. AirDrop uses encryption and does not require an internet connection, making it a fast and secure option for sharing files locally.

- Messaging Apps: For faster or less formal communication, consider using messaging apps like Slack, WhatsApp, or iMessage. However, make sure that the app you use supports file encryption and is a secure platform for sharing business-related documents.

- Secure File Sharing Services: For highly sensitive documents, consider using services like DocuSign or Hightail. These platforms offer secure file sharing and allow you to set permissions, request digital signatures, and track document receipt and viewing status.

- Use Password Protection: If sharing via email or cloud storage, consider adding password protection to your document. This ensures that only the intended recipient can open the file, adding an extra layer of security.

- Verify the Recipient’s Contact Information: Double-check that you are sending your documents

Common Mistakes to Avoid When Invoicing

Creating financial documents can be straightforward, but there are several common pitfalls that businesses often fall into. These mistakes can lead to confusion, delays in payment, or even damage to client relationships. To ensure smooth transactions and maintain professionalism, it’s important to be aware of these errors and take steps to avoid them. Below are some of the most frequent mistakes and tips on how to prevent them.

Common Mistakes and How to Avoid Them

Here are several common errors that businesses make when creating financial records and how to avoid them:

- Missing or Incorrect Contact Information: Failing to include accurate business and client details can lead to confusion and missed payments. Double-check all names, addresses, and contact information before sending any document.

- Omitting a Unique Reference Number: Without a reference number, tracking and organizing records becomes difficult. Always assign a unique identifier to each document for easy reference and to avoid payment discrepancies.

- Not Including Payment Terms: Be clear about payment deadlines, accepted payment methods, and any late fees. Ambiguity in payment terms can lead to delayed payments and misunderstandings with clients.

- Overlooking Taxes: Failing to properly calculate or include taxes can cause issues with tax compliance and may upset clients. Always ensure that you calculate taxes correctly and display them clearly on the document.

- Providing Vague Descriptions of Services or Products: Lack of clarity about what was provided can lead to disputes or confusion. Make sure you provide detailed descriptions of the goods or services rendered, including quantities and prices.

- Forgetting to Proofread: Spelling or arithmetic mistakes in your document can create a negative impression and lead to complications. Always proofread your document before sending it to ensure all information is accurate and professional.

- Sending Documents Without Security: Sharing financial records without securing them can expose sensitive information to unauthorized access. Consider using password protection, encryption, or secure file-sharing platforms to protect client data.

How to Avoid These Mistakes

By taking the following steps, you can ensure that your billing documents are error-free and professional:

- Double-Check All Information: Always verify your contact details, dates, amounts, and other crucial information before sending any document.

- Use Templates or Software: Using i

Ensuring Security for Billing Documents

When dealing with financial records, ensuring the security of your documents is essential. Sensitive information such as payment details, client information, and transaction history must be protected from unauthorized access and potential misuse. Implementing security measures will help prevent data breaches and maintain client trust. There are various methods to secure your documents and ensure that they are shared and stored safely.

Methods to Secure Your Documents

To protect your billing records, consider the following security strategies:

Best Practices for Storing Secure Documents

In addition to securing the document itself, it’s equally important to store it in a secure environment. Here are some best practices for keeping your documents safe:

By applying these security measures, you can safeguard your financial documents and protect both your business and your clients from potential threats. Taking these steps will help build a secure workflow for handli

How to Share Your Billing Documents on Mac

Sharing financial records securely and efficiently is crucial for smooth business operations. Whether you’re sending receipts, payment requests, or transaction summaries, it’s essential to choose the right method to ensure your documents are received by the client without compromising privacy. On Apple devices, there are several ways to share these records, each offering different benefits in terms of security and convenience.

Methods for Sharing Your Financial Records

There are several methods available to send your documents to clients or colleagues. Below are the most common and effective ways to share your records:

Best Practices for Sharing Billing Records

To ensure that your financial documents are shared securely and professionally, follow these best practices: