Invoice Template for Sole Trader Simple and Professional

Running a small business or working independently can be highly rewarding, but it comes with its own set of challenges. One of the most crucial aspects of managing finances is ensuring that payments are clearly requested and tracked. This is where an effective billing system becomes essential. Having a well-organized document that outlines the services provided and the amounts due not only ensures smooth transactions but also reflects a professional image.

Efficient billing can save you time and help you avoid confusion with clients. Whether you are providing services or selling goods, a properly formatted record is vital for keeping everything in order. By using a carefully designed structure, you can create clear, concise, and legally compliant records that will help your business grow.

In this article, we’ll explore how to craft a professional billing document that works for your specific needs. We’ll cover tips on design, necessary components, and how to customize your documents to make sure you always stay on top of your financial transactions.

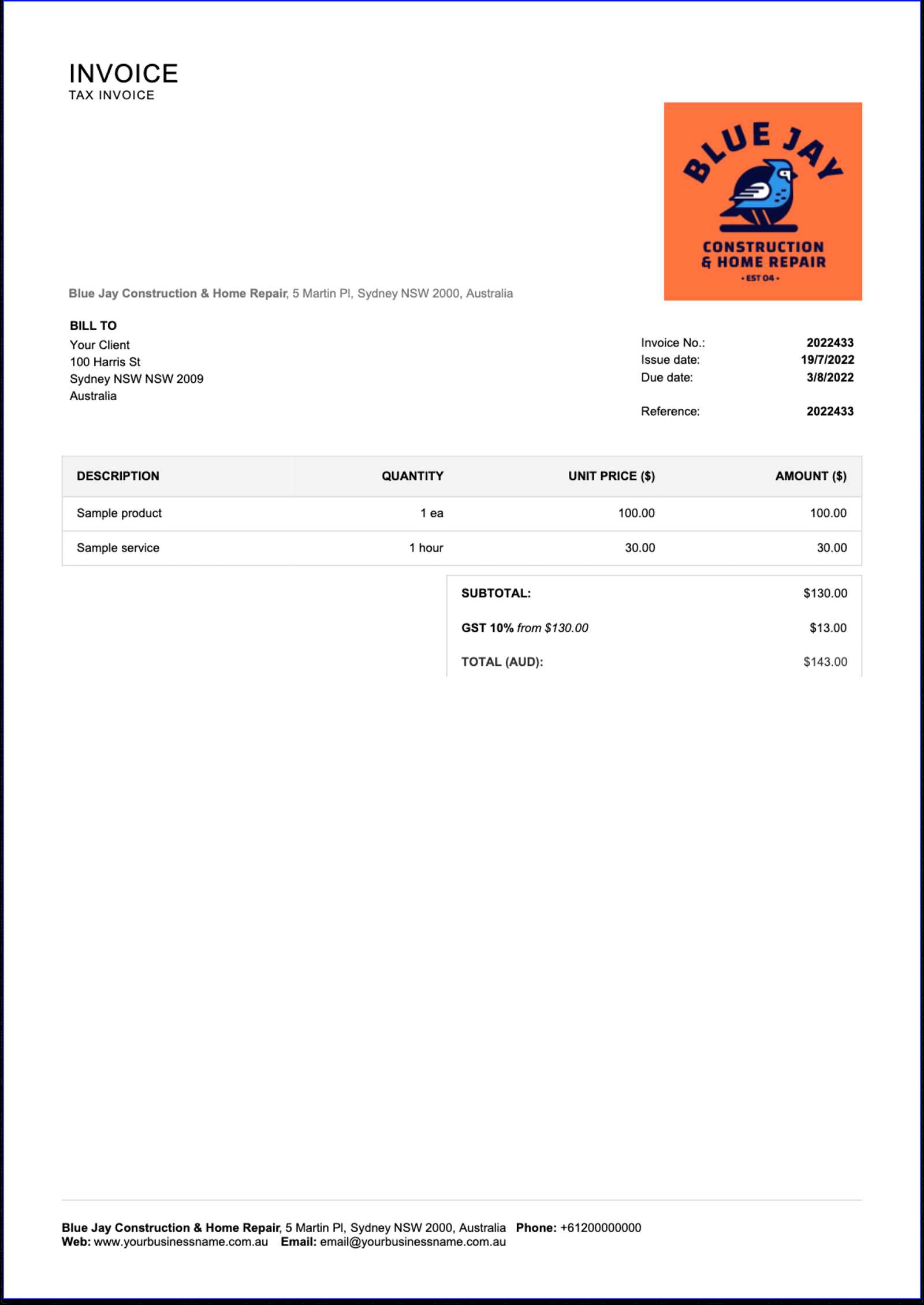

Invoice Template for Sole Trader

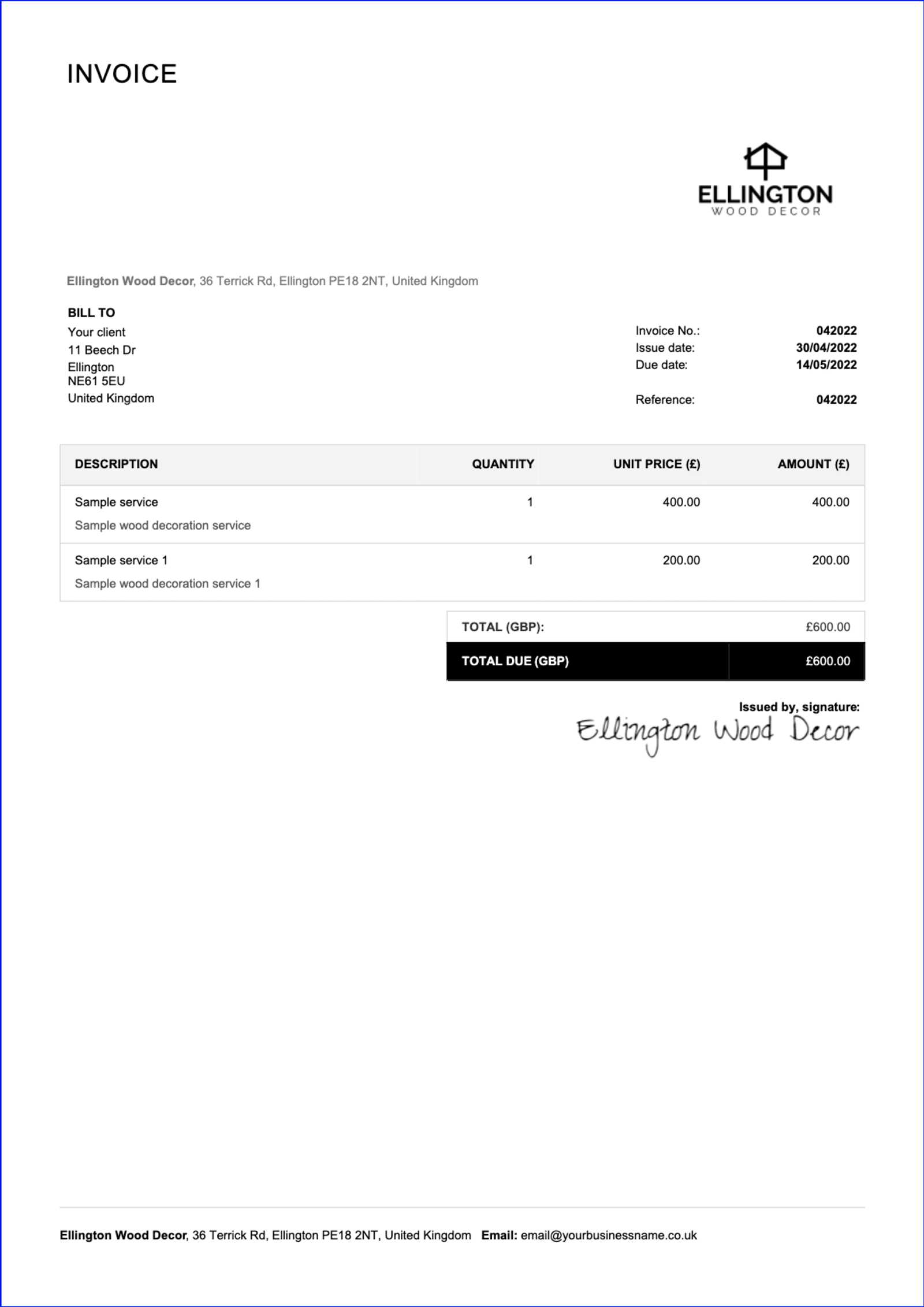

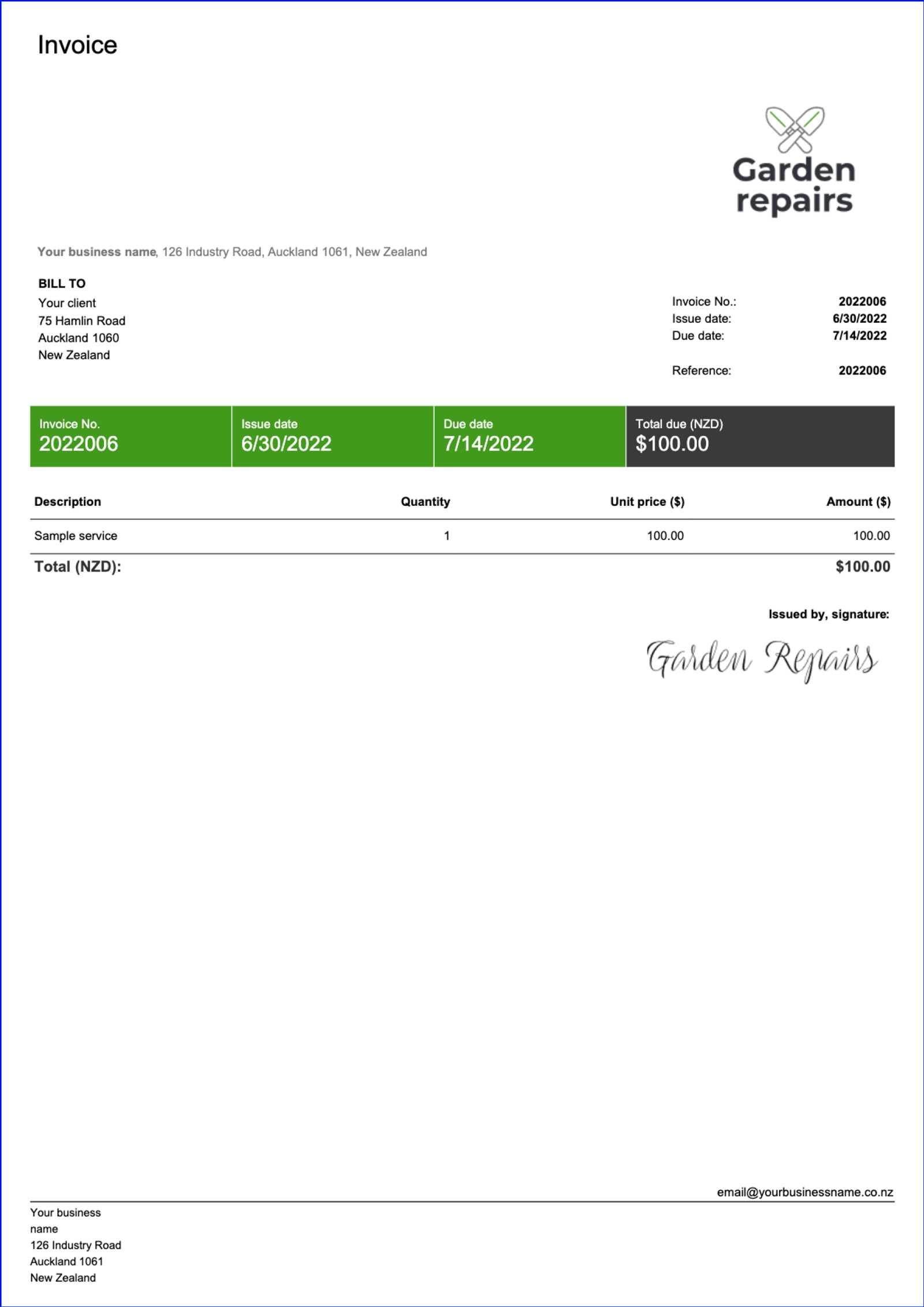

When running a small business or offering freelance services, it’s essential to maintain a clear and professional method for requesting payments. A well-structured document is key to ensuring your clients understand the charges and the services provided. This document should include all necessary details, such as the amount due, payment terms, and contact information, while also maintaining a simple yet professional layout.

Customization plays a major role in tailoring the document to suit your unique business needs. From adding your business logo to adjusting the format based on the services you offer, customizing your billing paperwork helps present your brand in the best light. The flexibility of the design allows you to keep things simple for smaller transactions or create more detailed statements for larger projects.

Having the right structure in place helps streamline your accounting process. By using a predefined format, you eliminate confusion and ensure that every payment request follows a standard approach. This also makes it easier to track past transactions, monitor cash flow, and maintain organized records for tax purposes.

Why Use an Invoice Template

Maintaining consistency and professionalism in your billing process is crucial for any independent business. A structured document helps streamline transactions by clearly outlining the amounts due and the services provided. This minimizes misunderstandings with clients and ensures that all essential details are presented in an easy-to-understand format.

Time-saving is another key benefit. Instead of starting from scratch each time you need to request payment, having a ready-made structure allows you to focus on the specifics, such as adjusting prices or updating dates. This not only speeds up your workflow but also reduces the chances of making mistakes in your financial records.

Using a pre-designed format also promotes professionalism. Clients are more likely to trust and respect your business when they receive clear, well-organized documentation. It reflects that you value your work and take your financial responsibilities seriously, which in turn can lead to faster payments and stronger client relationships.

Key Features of a Good Invoice

A well-designed billing document should clearly communicate essential details in a way that leaves no room for confusion. The most important feature is clarity – every element should be easy to read and understand, ensuring that both parties are on the same page. A well-organized structure, with all necessary information in the right places, helps to avoid misunderstandings and improves the overall professionalism of your business.

Here are the key features that make up an effective billing document:

| Feature | Description |

|---|---|

| Contact Information | Include both your details and those of the client for easy communication. |

| Unique Identifier | Each document should have a unique number or code for easy reference. |

| Clear Breakdown | Provide a detailed list of the products or services provided, including quantities and rates. |

| Payment Terms | State the due date and any late fees to avoid delays. |

| Total Amount | Clearly show the final amount due, including taxes or any other adjustments. |

| Payment Methods | Specify the acceptable payment methods, such as bank transfer or online payment systems. |

Including these key features ensures that the document serves its purpose effectively, making the transaction smoother and more efficient for both you and your clients.

How to Customize Your Invoice Template

Personalizing your billing document is a great way to make your business stand out while ensuring all necessary information is included in a clear and professional format. Customization allows you to adapt the structure to your specific needs, whether you’re offering a service, selling a product, or managing multiple projects. By adjusting various elements, you can make the document more functional and aligned with your brand.

Branding is one of the first elements to consider when personalizing your document. Incorporating your business logo, colors, and fonts not only creates a cohesive appearance across all your materials but also reinforces your professional identity. Make sure that your business name and contact details are prominently displayed so clients can easily reach you.

Another important aspect is layout. Depending on the complexity of the transaction, you can modify the layout to suit the type of services or goods you’re providing. For example, if you offer hourly services, include a section for hours worked and rate per hour. For product-based businesses, adjust the table to show item descriptions, quantities, and individual prices clearly.

Finally, make sure that the payment details and due dates are easily noticeable. You can highlight these sections with bold text or a different color to ensure they stand out and help avoid any confusion when the time comes to settle the bill.

Free vs Paid Invoice Templates

When it comes to creating a billing document, there are two primary options available: free and paid solutions. Both have their advantages and drawbacks, and the right choice depends on your specific business needs and how much customization you require. Understanding the differences between these options can help you decide which one best suits your operations.

Free options are often a great choice for small businesses or freelancers just starting out. They offer a simple way to get your billing system up and running without any upfront costs. Many free solutions come with basic features, such as space for contact details, service descriptions, and payment terms. However, they may lack advanced customization options and can sometimes look generic, which may not align with your brand image.

On the other hand, paid solutions provide greater flexibility and often come with more sophisticated features. With a paid service, you can expect enhanced design options, advanced payment tracking, integration with accounting software, and better customer support. These features can save you time and help you streamline your financial processes, but they come at a cost, which may not be justified for smaller businesses or those with limited budgets.

Ultimately, the choice between free and paid options depends on how complex your billing needs are and whether the extra features are worth the investment for your business growth.

Creating a Professional Invoice for Your Business

Designing a professional billing document is an essential part of maintaining a reliable and credible business. It serves as a formal request for payment, providing your clients with a clear record of what they owe and why. A well-crafted document not only ensures smooth transactions but also reinforces your business’s reputation for professionalism and attention to detail.

To create a professional billing document, start by including all necessary information such as your business name, contact details, and the client’s information. The layout should be clean, with sufficient space between sections to make the document easy to read. Use bold text or a different color to highlight important elements like payment terms and the total amount due, making it easier for your client to understand the key details.

Incorporating your brand’s logo and color scheme is also important. This adds a personal touch and aligns your document with your overall business image. When listing the services or goods provided, be sure to include clear descriptions and individual prices. Always double-check that the totals are accurate and that payment methods are easily accessible to avoid delays.

Finally, ensure that your payment terms are clearly stated, including the due date and any late fees if applicable. A well-crafted and professional billing document can help build trust with your clients, ensure timely payments, and contribute to the overall success of your business.

Common Mistakes in Invoice Design

Creating a billing document may seem simple, but there are several common pitfalls that can lead to confusion or missed payments. Poor design choices and missing information can affect how your clients view your professionalism and how easily they can process the payment. Avoiding these mistakes will ensure that your documents are clear, easy to understand, and legally sound.

Overcomplicating the Layout

One of the most frequent errors is making the design too complex. While it may be tempting to use elaborate fonts, colors, or graphics, a cluttered appearance can detract from the core message: the amount due. A clean, organized layout with adequate white space is essential for readability. Make sure the most important details–like the amount owed and payment terms–are immediately noticeable.

Leaving Out Key Details

Another common mistake is failing to include crucial information, which can lead to delays or confusion. Missing contact details, payment instructions, or service descriptions can make it difficult for your clients to process the request. Always ensure that each document includes your name, address, and contact information, along with a unique reference number, the payment due date, and a clear breakdown of services or products.

Inaccurate Totals are also a major issue. Double-check that all amounts add up correctly before sending the document. Mistakes in calculation can damage your credibility and cause unnecessary delays in payment.

By paying attention to these common mistakes, you can create a more effective, professional, and efficient way of managing your billing process.

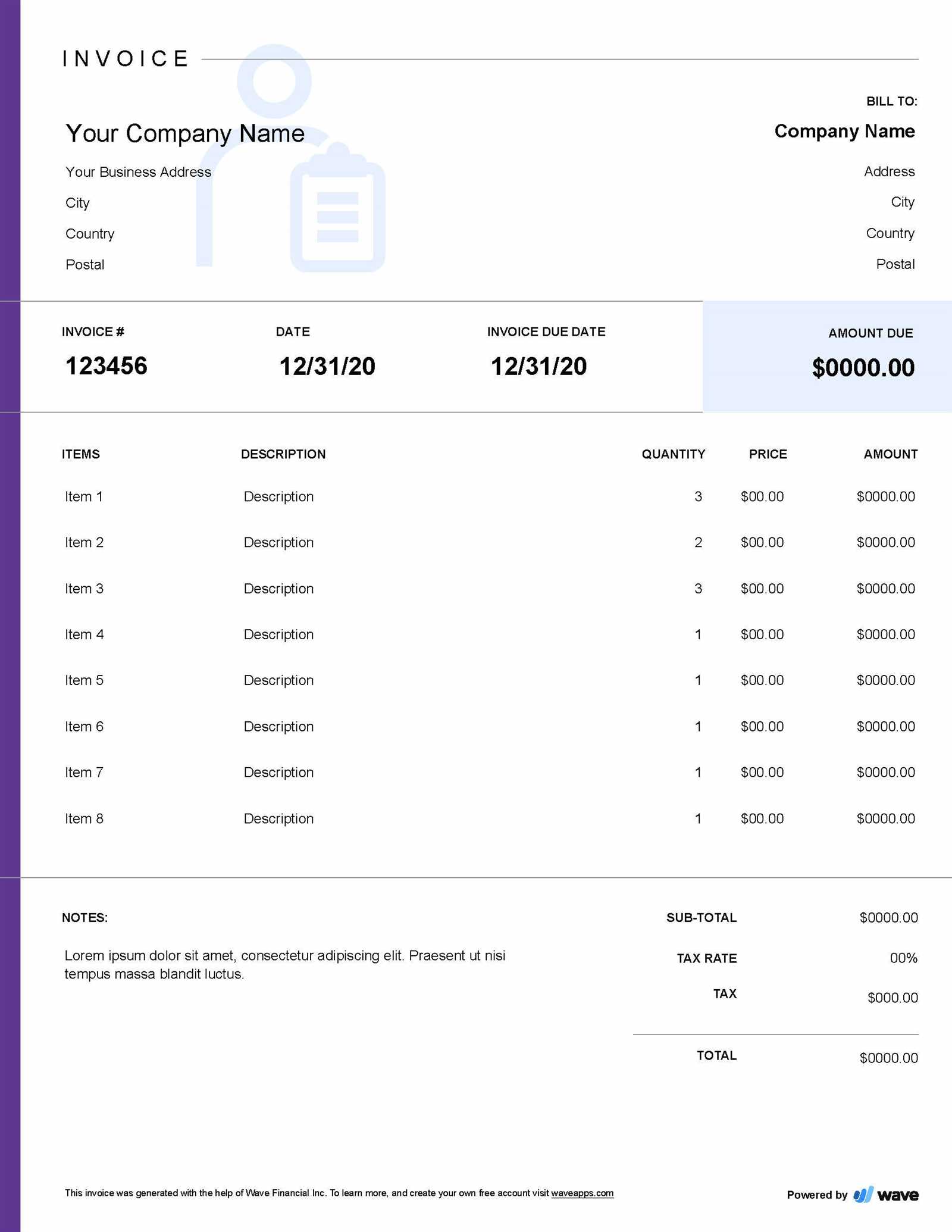

Choosing the Right Invoice Format

Selecting the correct format for your billing documents is crucial to ensuring clarity, ease of use, and professionalism. The structure of the document can influence how quickly clients process payments and how smoothly your business runs. It’s important to choose a format that suits both the type of services or products you offer and your clients’ needs.

Simple vs Detailed Formats

A simple format may be ideal if your business involves straightforward transactions with few variables. This format typically includes just the essential information: your contact details, the client’s information, a brief description of services, and the amount due. If your services or products are more complex, a more detailed structure may be needed, with space for additional breakdowns, such as hours worked, itemized product lists, or tiered pricing.

Digital vs Paper Formats

Another important decision is whether to use a digital or paper format. Digital formats are becoming the preferred choice for many businesses due to their speed, ease of use, and ability to integrate with accounting software. They also offer the advantage of being easily stored and retrieved for future reference. On the other hand, paper formats can still be useful in certain industries or for clients who prefer physical records. Consider your audience and workflow when making this choice.

Choosing the right format ensures that your documents meet your business requirements while being easy to understand and process for your clients. Whether you opt for a basic layout or a more complex design, always aim for clarity and professionalism.

Invoice Templates for Different Services

Different types of businesses and services require distinct structures when creating a billing document. The needs of a freelancer offering writing services are quite different from those of a contractor or a product-based business. Customizing your document to suit the specific nature of your work will ensure that your clients understand exactly what they are paying for and make the process smoother for both parties.

Here are some examples of how to tailor your billing documents based on the type of services you offer:

- Hourly Services: Include fields for hours worked, hourly rate, and a clear breakdown of the total charge. It’s essential to list each task or project phase to avoid confusion.

- Project-based Work: If you charge a fixed price for a project, detail the milestones or deliverables. A description of each phase of the project and its corresponding cost will help your client understand the value they are receiving.

- Product Sales: For businesses selling physical or digital products, make sure to list each item sold, its price, quantity, and the total amount. You may also want to include details like SKU numbers or product codes for better tracking.

- Retainer Agreements: If you work on a retainer basis, make sure to clearly outline the services included in the retainer, as well as the duration and any additional charges for work outside the scope of the agreement.

Customizing your billing document for each type of service you provide not only ensures clarity but also helps to build trust with your clients, showing that you take your work and their needs seriously.

Benefits of Using Digital Invoices

In today’s fast-paced business world, digital billing solutions are becoming increasingly popular due to their efficiency and convenience. Unlike traditional paper-based records, digital documents offer a range of benefits that can streamline the payment process, reduce errors, and improve overall organization. By adopting digital methods, businesses can save time, reduce costs, and offer a more professional experience to their clients.

Speed and Efficiency are among the most significant advantages of using digital formats. Sending a billing document electronically is nearly instantaneous, eliminating the need for postal delays or manual paperwork. Clients can receive the document, review it, and process payment much faster than with physical copies.

Another key benefit is easy access and storage. Digital records are much easier to organize and store than paper documents. You can save them in secure online systems, making it easy to retrieve past transactions when needed. This also reduces the risk of losing important documents or dealing with cluttered filing systems.

Automation is also a major advantage of digital billing. Many software options allow for automatic calculations, reducing the chances of errors in totals or tax rates. Additionally, these systems can be integrated with payment gateways, enabling quicker payment processing and real-time tracking of outstanding invoices.

Lastly, using digital formats is better for the environment and more cost-effective. There is no need for paper, ink, or postage, reducing your business’s environmental footprint and operational costs.

Essential Information to Include on Your Invoice

When creating a billing document, it’s crucial to ensure that all necessary details are included to avoid confusion and ensure smooth payment processing. A clear and complete document helps both you and your client understand the terms of the transaction and makes it easier to track payments. Missing or unclear information can lead to delays, misunderstandings, or disputes.

Here are the essential elements that should always be included in your billing request:

- Your Business Details: Always include your full business name, address, and contact information such as email or phone number. This makes it easy for your client to reach out if they have questions.

- Client Information: Include your client’s name, company (if applicable), and contact details. This ensures there is no confusion about who the billing is addressed to.

- Unique Reference Number: Assign a unique number or code to each document to help track payments and avoid confusion when managing multiple transactions.

- Description of Services or Products: Clearly list what has been provided, including dates of service, product descriptions, quantities, and individual prices. Be as specific as possible to avoid any misunderstandings.

- Amount Due: Ensure the total amount due is clearly stated, including taxes or discounts. Break down the total if necessary, showing subtotals for different sections.

- Payment Terms: Include the payment due date and any late fees, if applicable. This will help clarify expectations and avoid unnecessary delays.

- Payment Methods: Clearly list the methods of payment you accept, whether it’s bank transfer, online payment systems, or credit card, to make the process convenient for your client.

By ensuring these details are included, you make the billing process transparent and professional, which can help improve cash flow and client satisfaction.

How to Track Payments with Invoices

Effectively tracking payments is a key aspect of managing your finances as an independent business owner. By maintaining accurate records of all transactions, you can stay on top of your cash flow, identify overdue payments, and ensure your business remains profitable. A well-organized system for tracking payments helps prevent errors, reduces the risk of missed payments, and improves financial planning.

To track payments efficiently, start by assigning a unique reference number to each document you issue. This makes it easier to cross-reference and track specific payments. Include the due date on the document, and when a payment is made, record the payment date and amount received. You can use accounting software or a simple spreadsheet to keep track of these details, marking each document as paid once the payment is received.

Another helpful practice is to maintain a status column or section where you can mark the payment status of each document, such as “Paid,” “Pending,” or “Overdue.” This allows you to quickly see the status of outstanding balances and follow up with clients who have not yet paid. Additionally, regularly review your payment records to ensure everything is accounted for and that no payment has been overlooked.

By keeping a systematic record of payments, you can improve your ability to manage finances, reduce the chances of errors, and ensure that you receive timely compensation for your work or products.

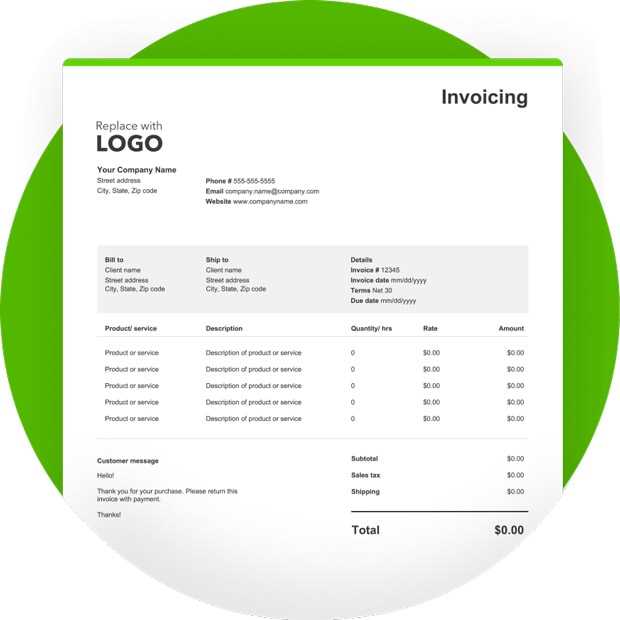

Invoice Templates for Small Businesses

Small businesses often face unique challenges when it comes to managing financial transactions. One of the key components of maintaining healthy cash flow is ensuring that clients receive clear, professional billing statements. Having the right structure for your documents can streamline this process, reduce confusion, and help you get paid on time. Whether you offer services, sell products, or operate on a subscription basis, a well-organized billing structure is essential for keeping things running smoothly.

Choosing the Right Structure

The structure of your billing document should align with your business type and client needs. Here are a few options that can work well for different types of small businesses:

- Service-Based Businesses: If you offer services, your document should include detailed descriptions of the work performed, hours worked (if applicable), and rates charged. Clear breakdowns are essential for clients to understand what they are paying for.

- Product-Based Businesses: For those who sell physical or digital products, ensure each item is listed with quantity, unit price, and total cost. Adding product codes or SKUs can help clients identify items easily.

- Subscription or Recurring Billing: For businesses with regular, recurring charges, it’s important to include the billing cycle (e.g., monthly or quarterly) and any adjustments (such as discounts or credits).

Key Features for Small Business Billing Documents

Regardless of the type of small business, your billing document should include the following essential information:

- Clear Contact Information: Your business name, address, and contact details should be easy to find.

- Client Information: Including the client’s name, address, and other contact information ensures the document is personalized and accurate.

- Payment Terms: State the due date and any late payment penalties to avoid delays in payment.

- Payment Methods: Clearly outline how the client can pay, whether through bank transfer, credit card, or online payment services.

By using a clear and professional billing structure, small businesses can simplify their financial processes, improve communication with clients, and maintain a more organized record of transactions.

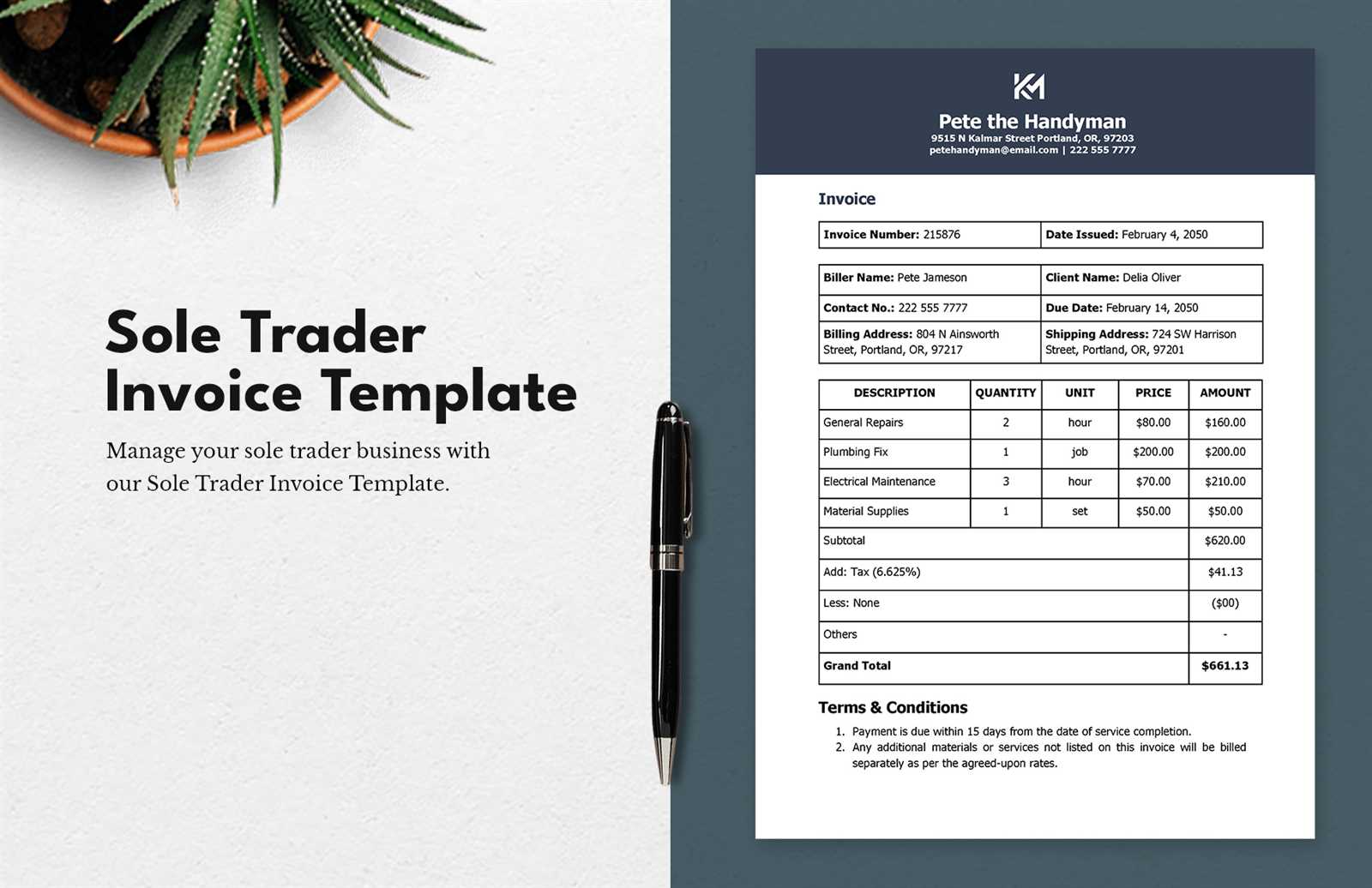

Managing Taxes with Invoice Templates

As a small business owner, effectively managing taxes is an essential part of staying compliant with local regulations and ensuring smooth financial operations. One of the key tools in managing your taxes is creating detailed billing documents that accurately track income, taxes collected, and other relevant financial details. By using the right structure, you can easily calculate and report your tax obligations, simplifying the process of tax filing at the end of the year.

Including Tax Information

When creating your billing documents, it’s important to include specific tax-related details, especially if you are required to collect sales tax or VAT on your goods or services. Make sure that the tax rate is clearly stated and calculated correctly for each item or service you provide. This will help both you and your clients understand how much of the total amount is attributable to taxes.

| Description | Amount | Tax Rate | Tax Amount | Total |

|---|---|---|---|---|

| Consulting Services | $500.00 | 10% | $50.00 | $550.00 |

| Product Sale | $200.00 | 8% | $16.00 | $216.00 |

Tax Tracking and Reporting

It’s also important to regularly track your tax collected and ensure you’re reporting it accurately. Many businesses use accounting software that integrates with their billing system to automate the calculation and tracking of taxes. However, even if you use manual methods, make sure to maintain a record of all the tax amounts you’ve collected over the course of the year. This will help you when it’s time to file your taxes and will ensure that you don’t miss any important deductions or obligations.

By carefully managing tax information within your billing documents, you can keep track of your tax responsibilities, reduce errors, and make the process of filing taxes more efficient and less stressful.

How to Send Invoices Effectively

Sending billing documents in an organized and timely manner is crucial for maintaining a healthy cash flow in your business. How and when you send them can significantly impact whether payments are made on time. Clear communication, professionalism, and convenience are key factors to consider when delivering these important records. Adopting an efficient approach to sending your billing documents can save time, reduce delays, and create a positive experience for your clients.

Choose the Right Delivery Method

The method by which you send your billing document can affect how quickly your client receives and processes it. Here are some popular delivery options:

- Email: Sending a digital copy through email is one of the fastest and most efficient methods. Attach your document as a PDF to ensure it looks professional and is easily accessible to your client.

- Online Payment Platforms: If you’re using online invoicing software, many platforms allow you to send documents directly to clients through their systems. These platforms also often enable clients to pay immediately upon receiving the document, speeding up the process.

- Physical Mail: In certain cases, sending a printed copy via mail may still be necessary, especially if your client requests it. However, this method tends to take longer and incurs additional postage costs.

Best Practices for Sending Billing Documents

To ensure your client receives and processes your billing document promptly, consider the following tips:

- Timely Delivery: Send your document as soon as the work is completed or goods are delivered. Ensure that your client has enough time to review and make payments before the due date.

- Clear Communication: In your message, provide a brief but clear explanation of the document, including the total amount due and the due date. This sets expectations and reduces confusion.

- Follow-Up: If payment has not been made by the due date, send a polite reminder. A well-timed follow-up can help prompt clients to settle their balances without damaging the relationship.

By choosing the right delivery method and following these best practices, you can ensure your billing documents are sent effectively, helping to streamline the payment process and keep your business running smoothly.

Legal Considerations When Using Invoices

When creating and sending billing documents, it is essential to be aware of the legal requirements that ensure your transactions are compliant with relevant laws and regulations. Properly formatted records not only help you maintain financial order but also protect your business and client relationships in case of disputes. Understanding what needs to be included in your documents, how to handle payment terms, and what laws govern your industry is key to avoiding legal issues.

Accurate Information is a critical aspect of compliance. All billing documents should include accurate and up-to-date details about the transaction, including the full name and address of both parties, a clear description of goods or services provided, and any relevant tax information. Failure to include required information, such as tax identification numbers or VAT registration details (if applicable), could result in fines or legal complications.

Payment Terms are another important legal consideration. It’s essential to clearly state the terms under which payment is due, including the payment deadline and any penalties for late payments. If your payment terms are not clearly outlined, clients may not be obligated to pay within a certain timeframe, leading to