Download Purchase Invoice Template Excel for Easy Billing

Efficiently managing business transactions is crucial for maintaining smooth operations. One of the key components of this process is having a well-organized system to document financial exchanges. A well-structured record not only simplifies tracking but also ensures accuracy and consistency in every business deal.

Using digital tools to generate and track financial documents offers a significant advantage over manual methods. By relying on spreadsheet software, you can create customized documents tailored to your specific needs. These tools allow for quick edits, easy data management, and a professional format that enhances both readability and clarity.

Automating key aspects of your billing workflow can save time, reduce errors, and help you stay on top of important tasks. With the right digital framework, keeping track of costs, payments, and client details becomes seamless. Whether you’re working with large volumes or small-scale transactions, the ability to streamline processes with a simple tool makes all the difference.

Take advantage of modern spreadsheet capabilities to optimize your financial documentation and create a reliable system that will serve your business for years to come.

What is a Purchase Invoice Template

In business transactions, documenting sales or services rendered is essential for keeping track of financial exchanges. A properly structured document can provide both the seller and the buyer with clear and detailed information, helping to ensure that all parties are on the same page regarding the amount owed, due dates, and other terms of the deal.

A standardized form for this purpose allows users to create consistent records without having to start from scratch each time. These forms typically include fields for essential data, making the process faster, more efficient, and less prone to errors. With the right structure, all necessary details can be captured in an organized manner, which simplifies both financial tracking and reporting.

Key Features of This Type of Document

- Seller Information: Includes company name, address, and contact details.

- Buyer Details: Information about the client or purchaser, including contact info.

- Transaction Description: A list of products or services provided, along with quantities and pricing.

- Total Amount Due: The final amount to be paid, including taxes, discounts, or any additional charges.

- Due Date: The agreed-upon date by which payment should be made.

Why Use a Structured Document

- Consistency: Ensures every transaction follows the same format, making them easy to review and compare.

- Professionalism: Provides a polished and organized representation of the transaction.

- Efficiency: Saves time by eliminating the need to create a new document from scratch each time.

Benefits of Using Excel for Invoices

Utilizing spreadsheet software for creating and managing financial documents offers a range of advantages. Its flexible structure and powerful features allow users to easily customize forms, automate calculations, and keep detailed records in a streamlined, efficient manner. This approach is particularly useful for businesses of all sizes, from small startups to large enterprises, simplifying the process of generating accurate and professional documents.

One of the key benefits of using such software is the ability to automate repetitive tasks. With built-in formulas, you can instantly calculate totals, taxes, and discounts, minimizing human error and saving valuable time. This automation also ensures that calculations are always accurate, which helps maintain financial integrity.

Customization is another major advantage. Unlike pre-made solutions, spreadsheets offer complete control over the document’s layout, allowing you to tailor it to your specific business needs. You can add or remove fields, adjust column widths, and modify fonts to create a design that reflects your brand’s identity.

Moreover, using a digital tool ensures that documents are easy to store, retrieve, and share. You can quickly access past records, track payment histories, and share the documents with clients or partners via email or cloud services. This makes the whole process faster and more convenient compared to traditional paper-based methods.

Finally, security features allow you to protect sensitive data. Password protection and encryption options can be applied to your documents, ensuring that only authorized individuals have access to important financial information. This added layer of security helps mitigate the risks associated with data breaches or unauthorized access.

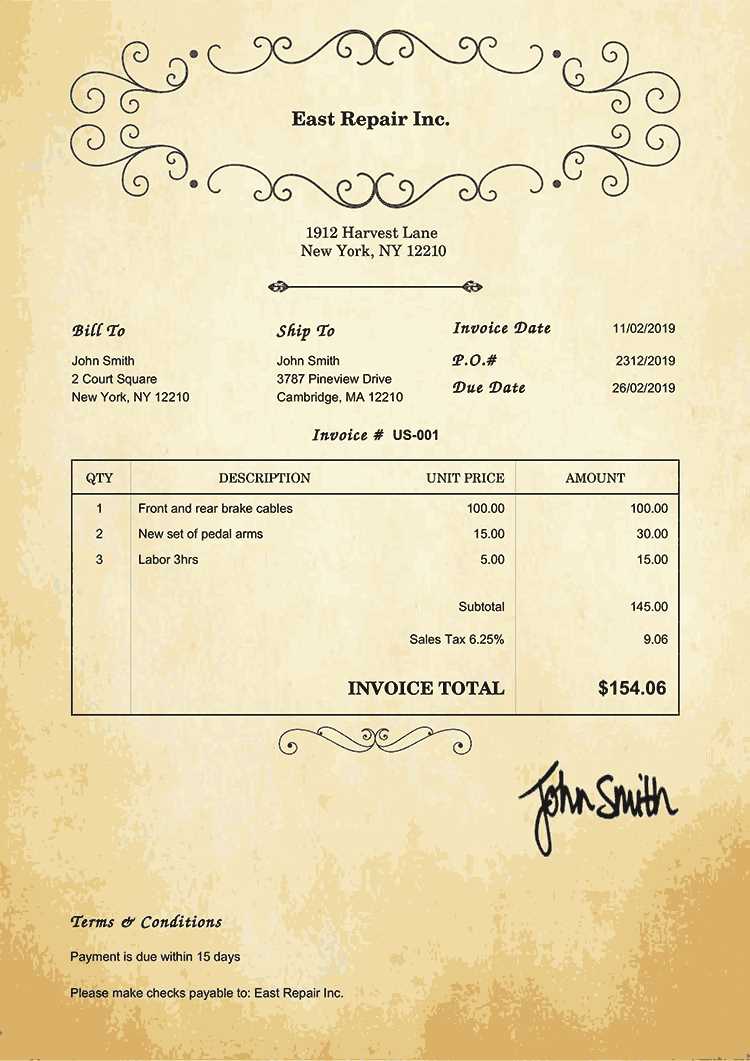

How to Create a Purchase Invoice

Creating a professional document for transactions involves organizing important details clearly and concisely. By following a few simple steps, you can generate a well-structured record that covers all necessary information, ensuring transparency and accuracy for both parties involved. The process can be done quickly using digital tools, which allow for easy customization and adjustment as needed.

Start by including the header information, such as the name and contact details of both the seller and the buyer. This ensures that the document is immediately recognizable and that all parties are properly identified. Additionally, include a unique reference number to easily track the transaction in your system.

Next, provide a detailed list of the goods or services involved. For each item, include a brief description, the quantity purchased, and the price per unit. Make sure to calculate the total cost for each item and then sum these amounts to determine the final amount due. You can also apply any applicable discounts, taxes, or other charges at this stage to ensure accuracy.

Be sure to specify the payment terms, including the due date and any late fees that may apply. This helps set clear expectations for the buyer regarding when the payment is expected. Additionally, it’s important to include your preferred payment methods, such as bank transfer or online payment options.

Once all the details are filled in, review the document for any errors or missing information. A final check ensures that everything is accurate and properly formatted. If everything looks good, save the document and send it to the relevant party. With digital tools, you can easily make changes in the future and keep a record of all previous transactions.

Essential Features of Invoice Templates

Creating effective documents for financial transactions requires including key details that ensure clarity and accuracy. These features help structure the information in a way that makes the document professional and easy to understand for both the seller and the buyer. A well-designed document can streamline the process, reduce errors, and improve communication.

One of the most important components is the header information. This includes the business name, contact details, and a unique identifier for the transaction. Both the seller’s and the buyer’s details should be clearly outlined to avoid any confusion. A reference number or code is essential for easy tracking and future reference.

Itemized list of goods or services is another key feature. Each entry should include a brief description, quantity, unit price, and total cost for clarity. This section provides transparency, allowing both parties to see exactly what is being charged and why. Additionally, the ability to calculate totals automatically within the document helps prevent any mistakes during the process.

Payment terms are also critical. Clearly outlining the due date, accepted payment methods, and any applicable late fees ensures that there is no ambiguity about the terms of the transaction. This section helps set expectations and encourages timely payments, which is essential for maintaining a healthy cash flow.

Lastly, having a professional design makes the document more credible. Clean fonts, well-organized sections, and a logical flow contribute to its readability and overall appearance. A polished document not only boosts your professional image but also ensures the transaction details are easy to find and understand.

Customizing Excel Invoice Templates

Personalizing your financial documents allows you to create a more tailored experience for both your business and your clients. Customization ensures that the layout, design, and content reflect your company’s identity and meet your specific needs. With the right tools, it’s easy to modify existing documents to better align with your brand and improve usability.

One of the simplest ways to customize a document is by adjusting the layout. You can change the column widths, add or remove rows, and rearrange sections based on what information you need to prioritize. For example, if your business requires detailed descriptions for each item, you can expand the relevant section to ensure clarity.

To make your document more professional, consider adding your company logo and choosing a color scheme that matches your brand. You can use your company’s colors for headings, borders, or background shading, making your document visually appealing and instantly recognizable.

You can also customize formulas to match your pricing structure. For example, if you offer volume discounts or need to apply varying tax rates depending on the location, adjusting the formulas ensures that the calculations are automatically updated when new data is entered.

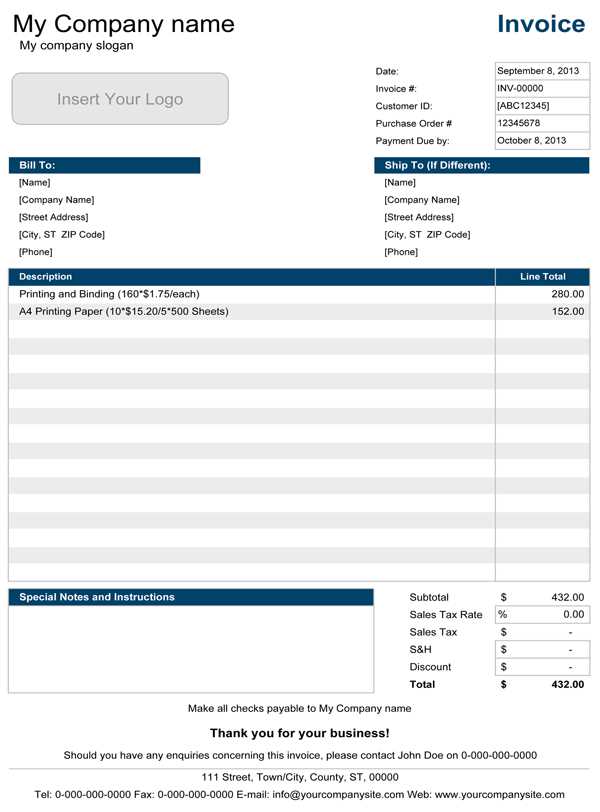

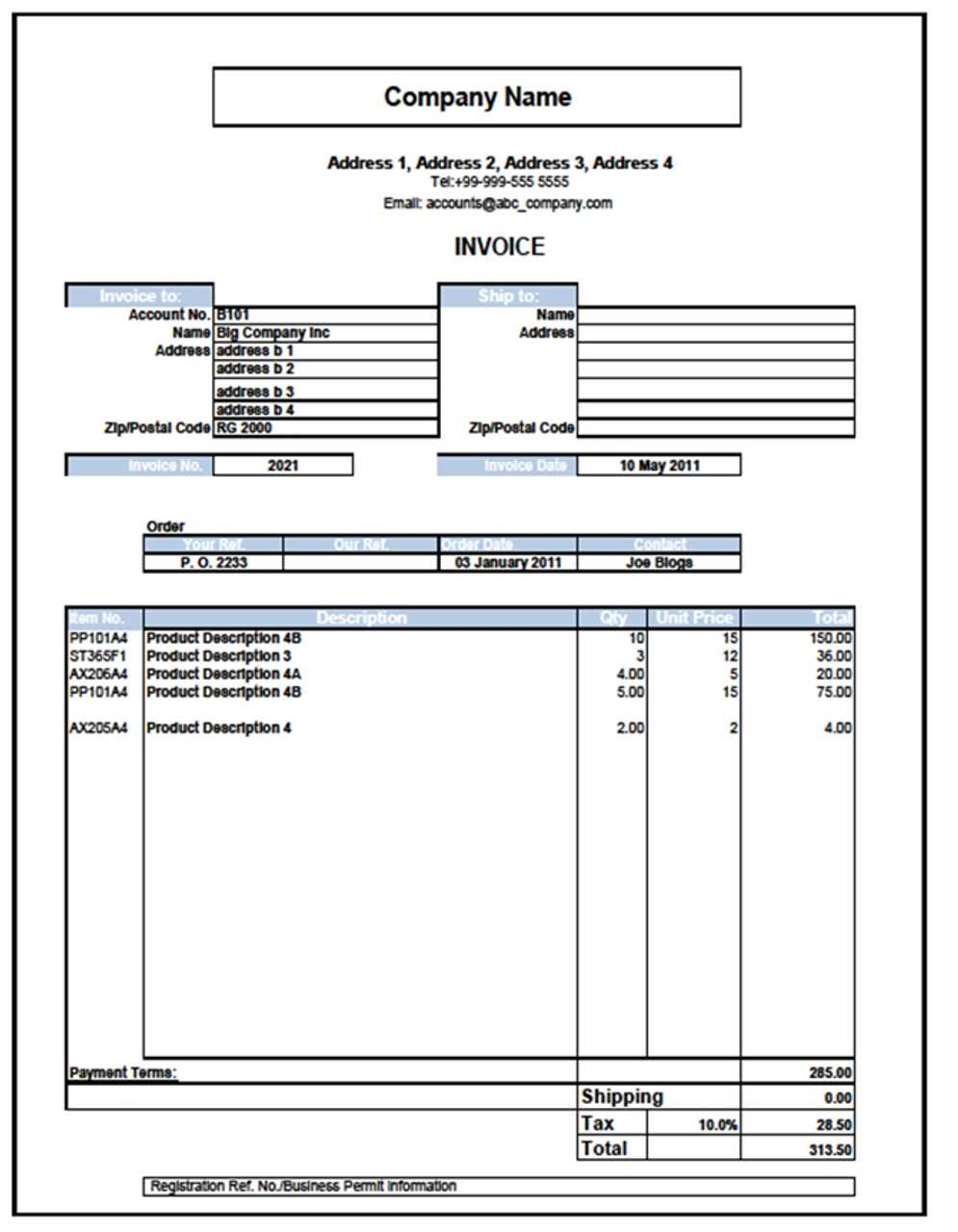

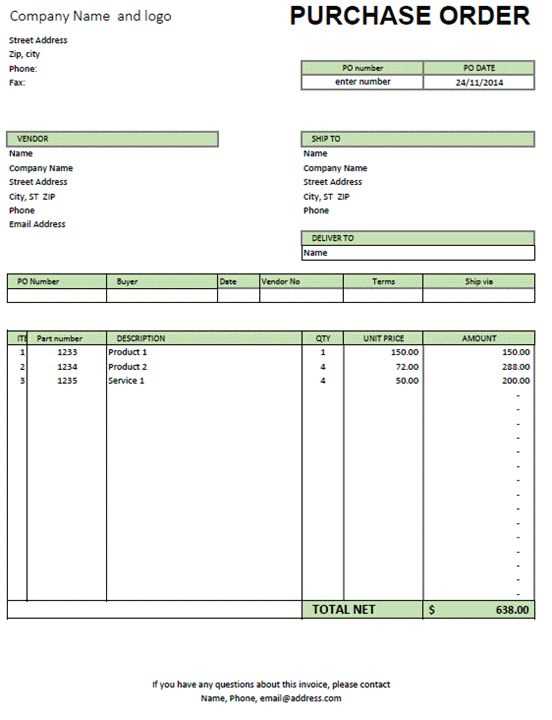

Here is an example of a customized table layout for a financial document:

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Product A | 5 | $10.00 | $50.00 |

| Product B | 3 | $15.00 | $45.00 |

| Total | $95.00 | ||

By customizing these aspects, you can ensure your documents are aligned with your business needs and enhance the overall efficiency of your transactions.

Best Practices for Invoice Design

Creating professional and effective documents for financial transactions requires thoughtful design. A well-designed form not only improves readability but also enhances the overall user experience. The key to successful document creation lies in balancing functionality and aesthetics to ensure that the document is both easy to understand and visually appealing.

One of the most important aspects of good design is clarity. Ensure that the document is structured logically with clear headings and organized sections. The information should flow in a natural sequence, making it easy for the recipient to find important details like item descriptions, totals, and payment terms. Consistent spacing between sections and proper alignment of text helps avoid confusion.

Legibility is another crucial factor. Use readable fonts and avoid cluttering the document with excessive text or unnecessary graphics. Stick to a clean, professional font such as Arial or Times New Roman, and ensure that font sizes are large enough to be easily read. Use bold or italics to highlight key sections, such as totals or due dates, but avoid overusing them to maintain a clean design.

Color choices also play a significant role in document design. Opt for a simple color scheme that aligns with your brand identity. Too many colors can be distracting, so it’s best to keep it minimal. Consider using contrasting colors for headings and totals to make important information stand out while maintaining a professional look.

Another best practice is to include clear payment instructions and relevant terms. Specify how the recipient can make the payment, the due date, and any penalties for late payments. This ensures that there are no misunderstandings and that both parties are on the same page regarding expectations.

Finally, keep it simple. A cluttered or overly complex design can lead to confusion and frustration. Stick to essential information and organize it in a straightforward manner. A minimalist approach is often the most effective, ensuring that the recipient can easily understand all the necessary details without feeling overwhelmed.

Why Choose Excel Over Other Software

When it comes to creating and managing financial records, there are various tools available, but using a spreadsheet program offers unique advantages. Its flexibility, ease of use, and wide accessibility make it an ideal solution for businesses of all sizes. Whether you’re a small startup or a large corporation, spreadsheet software allows you to efficiently organize data, automate calculations, and customize documents without the need for specialized training or expensive software packages.

Cost-Effectiveness and Accessibility

One of the biggest reasons businesses choose spreadsheets over other software is cost-effectiveness. Most spreadsheet applications come at little to no additional cost if you already use office suites, making them an affordable solution for companies with limited budgets. Additionally, these tools are widely available and compatible with most operating systems, ensuring you can work from virtually any device or location.

Flexibility and Customization

Another advantage of using a spreadsheet is its flexibility in customization. Unlike pre-built software that might be rigid in its structure or require you to follow set templates, spreadsheets give you complete control over the layout and design of your documents. You can adjust columns, rows, formulas, and formatting to match your specific needs. This adaptability makes it easy to create tailored documents that perfectly suit your business model.

Furthermore, spreadsheet software allows you to use formulas to automate calculations, such as tax rates, totals, and discounts, reducing the risk of errors and saving time. Whether you need to track expenses or generate recurring bills, the ability to quickly input data and have the program do the math for you adds efficiency to your workflow.

By choosing spreadsheet software, businesses gain the ability to combine simplicity, customization, and automation in one versatile tool, making it a top choice over more specialized or costly alternatives.

How to Save and Share Invoice Files

Once you’ve created a financial record, it’s important to save and share it in a way that ensures both accessibility and security. The process of saving these documents should prioritize organization and ease of retrieval, while sharing them with clients or colleagues should be done in a secure and efficient manner. This can be done using various file formats and sharing platforms, depending on your specific needs.

Saving Your Document for Future Use

When saving your file, it’s crucial to choose the right format for the document’s intended use. The most common and accessible format is PDF, as it preserves the layout and formatting across different devices. This ensures that when the recipient opens the file, it appears exactly as intended. Alternatively, you may choose to save the document in a spreadsheet format (e.g., .xls or .xlsx) if you need to edit or update the data later.

Additionally, be sure to use a clear and consistent naming convention for your files. Including important information, such as the date, client name, or transaction reference number in the file name, makes it easier to locate specific records later. For example, a file name could look like: “Invoice_JohnDoe_2024-11-07”. This helps maintain organization and saves time when searching for specific documents.

Sharing Your Documents Securely

When sharing your financial records, it’s essential to prioritize security and privacy. The most common methods for sharing documents include email, cloud storage, or secure file-sharing services. If you choose to send a file via email, ensure that it is password-protected, especially if it contains sensitive financial data. Many software programs allow you to set a password for PDF files before sending them.

If you need to share files with multiple people or collaborate with a team, cloud storage services like Google Drive or Dropbox are excellent options. These platforms allow you to upload and share documents with specific people, while also providing the ability to track changes or manage permissions. For added security, ensure that your cloud storage account is protected with two-factor authentication and limit access to authorized individuals only.

By properly saving and securely sharing your files, you can ensure that your documents are easily accessible, well-organized, and protected from unauthorized access.

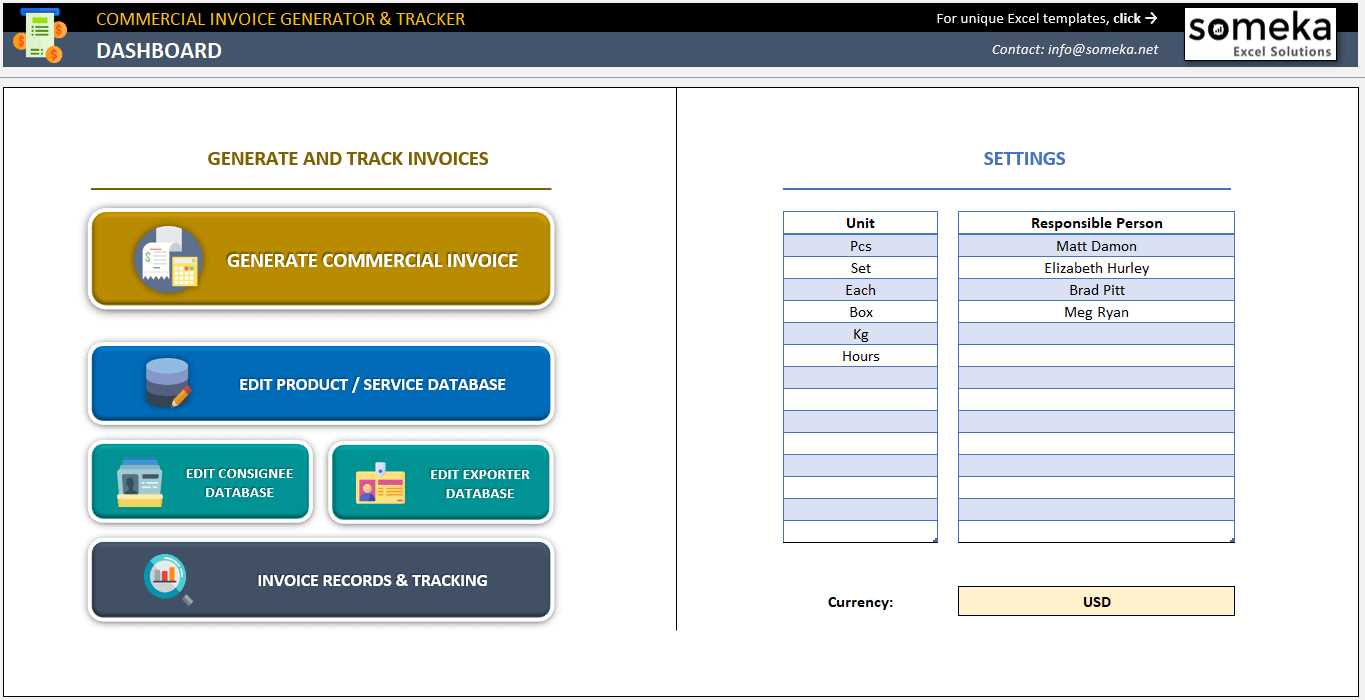

Automating Invoice Generation in Excel

Automating the creation of financial documents can significantly streamline business processes, saving time and reducing the risk of human error. By utilizing built-in tools and features, you can set up a system that generates new documents quickly and accurately, without having to manually input data every time. Automation not only improves efficiency but also ensures consistency in the documents you produce.

Using Formulas to Streamline Calculations

One of the most powerful automation features in spreadsheet software is the ability to use formulas to perform calculations automatically. For instance, you can set up formulas to calculate total costs, taxes, discounts, or any other variables relevant to the document. By linking different sections of the file with formulas, you eliminate the need to manually update each field whenever the details change.

For example, a simple formula like =A2*B2 can multiply the quantity of an item (A2) by its unit price (B2) to automatically calculate the total cost for that item. More advanced formulas can be used to calculate subtotal amounts, apply taxes, or calculate totals with various discounts based on predefined rules.

Creating Dropdown Lists for Quick Data Entry

To make the process even faster and more accurate, you can use dropdown lists for selecting predefined options, such as product names, payment terms, or tax rates. This reduces the chances of making typographical errors and ensures consistency across all documents. You can create these dropdown lists using data validation features in your spreadsheet software, which allows users to select from a list of options rather than typing the information manually.

For example, if you frequently sell the same products or services, a dropdown list can be created for item names and their corresponding prices, so you don’t have to input this data each time. This speeds up document generation and ensures that the pricing remains accurate.

By combining formulas, dropdown lists, and other built-in features, you can automate many of the repetitive tasks involved in document creation, making your financial processes faster, more accurate, and easier to manage.

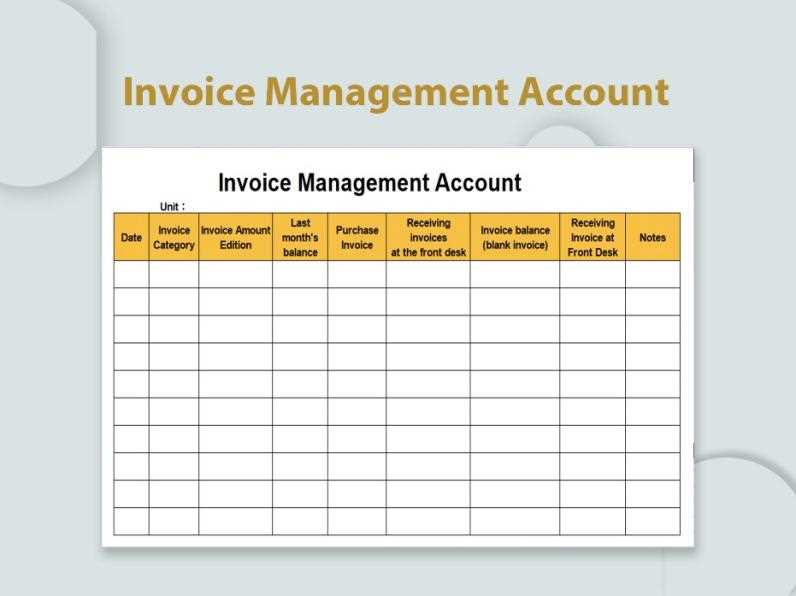

Tracking Payments with Excel Templates

Keeping track of payments is a crucial part of maintaining healthy cash flow in any business. Using digital tools to record and monitor these transactions helps ensure that no payments are missed, and it allows for easy follow-ups on outstanding amounts. A well-structured system for payment tracking can simplify the entire process, reduce errors, and save time.

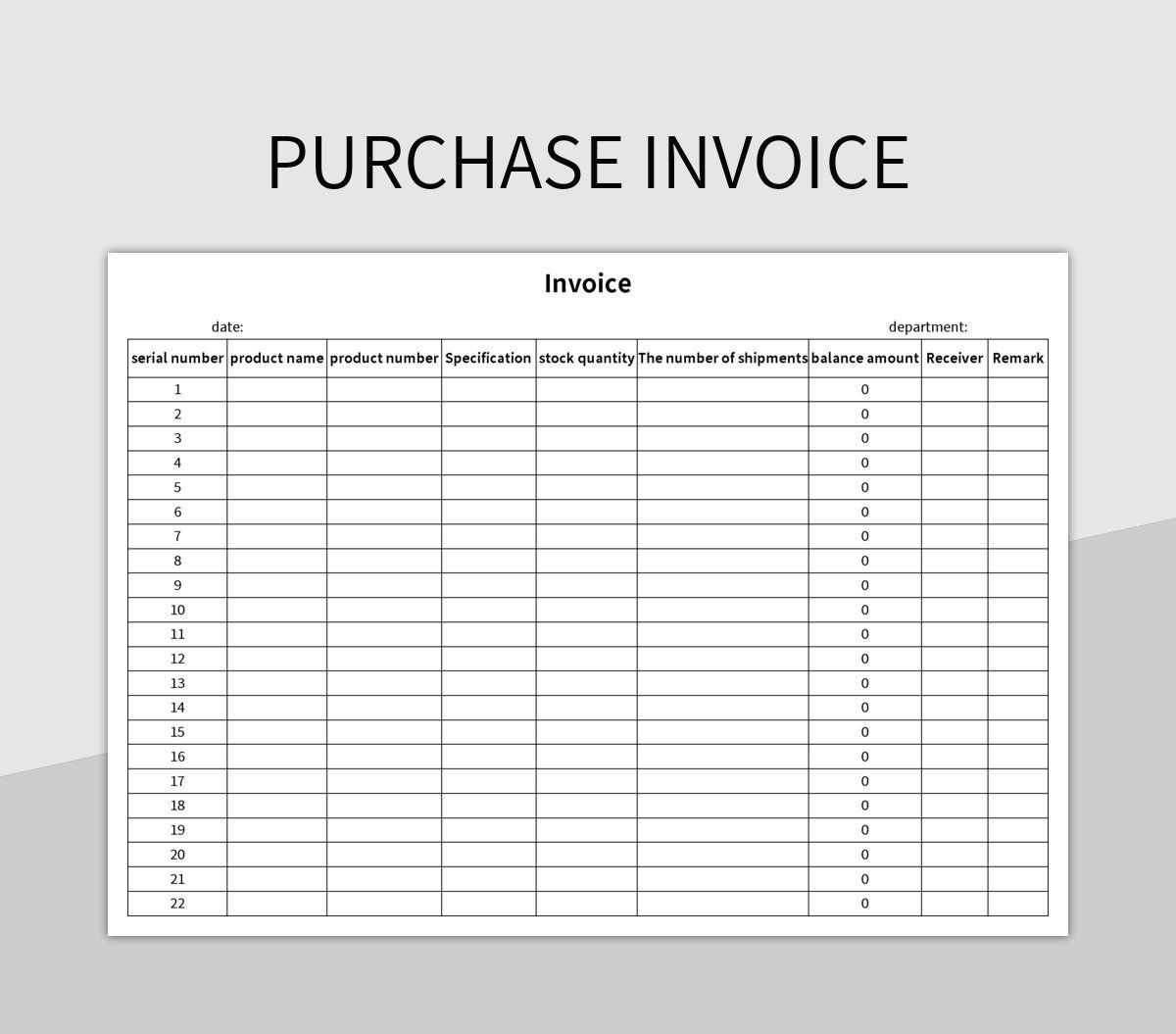

By organizing data in a structured format, you can easily monitor the status of each transaction and ensure that payments are processed in a timely manner. A good approach is to create a table that includes all essential payment details, such as the amount owed, the payment due date, and the payment status. This allows you to have a quick overview of all your pending and completed transactions.

Essential Fields for Tracking Payments

- Transaction ID: A unique reference number for each transaction to help you easily identify it in your records.

- Amount Due: The total amount that the customer is expected to pay for the goods or services provided.

- Due Date: The date by which the payment is expected to be made.

- Amount Paid: The amount that has been paid by the customer, which should be updated as payments are received.

- Payment Status: A column to indicate whether the payment is pending, completed, or overdue.

- Payment Method: The method used for payment, such as bank transfer, credit card, or cash.

- Balance: The remaining amount owed, which can be automatically calculated based on the amount due and paid.

Creating a Payment Tracking System

To streamline your payment tracking, you can set up a spreadsheet with columns for each of these fields. As payments are received, simply update the “Amount Paid” and “Payment Status” columns. You can also use conditional formatting to visually highlight overdue payments, making it easier to follow up with clients who have not paid on time.

By automating calculations for outstanding balances and payment status, you e

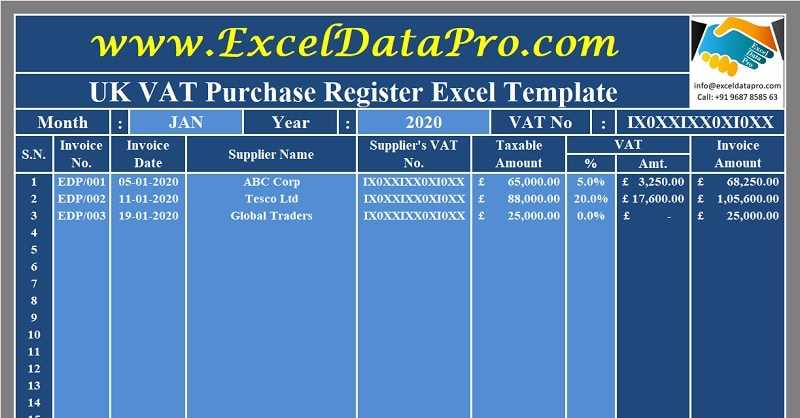

Common Errors in Purchase Invoices

When creating financial documents for transactions, errors can occur that lead to confusion, delays in payment, or even disputes between parties. Identifying and correcting common mistakes is crucial for maintaining accuracy and professionalism. Understanding the most frequent issues that arise can help you avoid them and ensure that your records are clear and reliable.

Common Mistakes to Avoid

- Incorrect Calculations: One of the most common errors is miscalculating totals, taxes, or discounts. Failing to double-check the arithmetic can result in discrepancies between the amount due and the amount actually charged. It’s essential to use automated calculations whenever possible to minimize human error.

- Missing or Incorrect Details: Another frequent issue is leaving out essential information, such as the buyer’s or seller’s name, contact details, or transaction date. Incomplete records can cause delays or confusion. Always ensure that all fields are filled in correctly before sending the document.

- Incorrect Payment Terms: It’s important to clearly state payment terms, including due dates, late fees, and payment methods. Ambiguity in this section can lead to misunderstandings about when and how payment should be made. Always be clear and precise about your expectations.

- Inconsistent Item Descriptions: If the description of products or services is vague or inconsistent, it can lead to disputes over what was purchased. Be specific and use consistent terminology to avoid confusion.

- Failure to Include a Unique Reference Number: Each document should have a unique reference number for tracking purposes. Missing or duplicating reference numbers can cause difficulties in managing and organizing financial records.

- Incorrect Currency or Tax Rates: Using the wrong currency or applying incorrect tax rates is another common mistake. This can be particularly problematic for international transactions, where exchange rates and tax laws may vary. Always verify the current rates before finalizing the document.

- Unclear Payment Status: It’s vital to clearly indicate whether a payment has been received or is still pending. Failure to update the payment status can create confusion and complicate financial tracking.

How to Avoid These Mistakes

To avoid these errors, consider using automated tools that handle calculations and ensure consistency across all documents. Double-check all details before sending, and implement a checklist to ensure that each field is correctly filled out. Establish clear guidelines for your team regarding how documents should be formatted and reviewed.

By being mindful of these common errors, you can significantly improve the accuracy and professi

Tips for Accurate Invoice Calculation

Ensuring precise calculations in financial documents is essential for maintaining clear and trustworthy business transactions. Mistakes in pricing, taxes, or totals can lead to confusion, payment delays, or even disputes. By following best practices and utilizing the right tools, you can eliminate errors and ensure that your documents are always accurate and professional.

Double-Check Your Rates and Amounts

One of the first steps to ensuring accuracy is to verify all rates, including unit prices, discounts, taxes, and shipping fees. Even small discrepancies can accumulate over multiple transactions, leading to significant errors. Before finalizing any document, confirm that the prices and rates are up to date and accurately reflect the terms agreed upon with the client.

If your business deals with multiple products or services, consider using a standardized pricing list that’s easily accessible to avoid mistakes in calculating individual prices. This will help you avoid errors when inputting details into your records.

Leverage Automation and Formulas

Manual calculations are more prone to errors than automated ones. Take advantage of automated formulas within your spreadsheet software to ensure all calculations are accurate. By setting up formulas to automatically calculate totals, taxes, and discounts, you can minimize the risk of human error. For example, you can use formulas to multiply quantity by unit price or apply tax rates, automatically updating your document as new data is entered.

For added accuracy, consider using a rounding function to ensure that values like taxes are calculated to the correct decimal places. This eliminates rounding discrepancies that can occur when manually adding or subtracting amounts.

Account for All Costs

Sometimes, overlooked costs can result in incomplete calculations. Ensure that all additional charges, such as delivery fees or handling costs, are included in the final total. By tracking and adding any extra charges, you can avoid surprises for both you and the recipient, ensuring a clear breakdown of all fees.

By following these tips and taking extra care with each document, you can ensure that your financial records are accurate, transparent, and free of mistakes, fostering better relationships with clients and improving your overall business operations.

How to Format an Invoice in Excel

Creating a professional and well-organized document is essential for ensuring clarity and efficiency when handling business transactions. Properly formatting a financial record not only makes it easier to read but also helps maintain consistency across all documents. In this guide, we’ll walk you through the steps to format a clean, clear, and easily understandable record in a spreadsheet program.

Step-by-Step Guide to Formatting Your Document

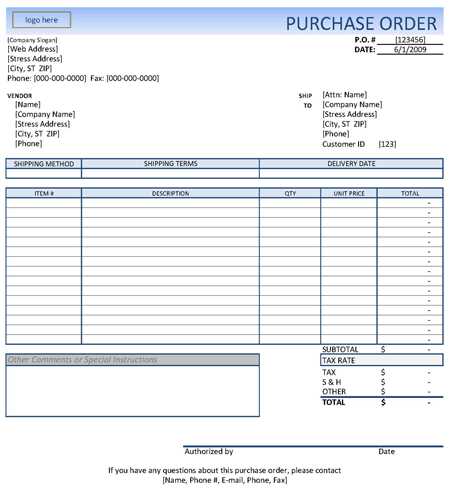

- Set Up Your Header: At the top of the document, include essential details such as your company’s name, logo, contact information, and the title of the document. Make sure that this section is clearly separated from the rest of the content, as it helps identify your business and the purpose of the record.

- Include Client Information: Beneath your company’s details, add the recipient’s name, company (if applicable), and contact information. Be sure to include the date and a unique reference number to help track the transaction.

- Organize the Itemized List: Use columns to create an itemized list of products or services. The typical columns should include:

- Item Description: A clear and concise description of what was provided.

- Quantity: The number of items or the amount of services rendered.

- Unit Price: The price per individual item or service.

- Total Price: The total for each item, calculated as quantity multiplied by unit price.

- Calculate Totals: Below the itemized list, create a section for calculating totals. This should include the subtotal, applicable taxes, discounts (if any), and the final amount due. Ensure that each calculation is clearly labeled and easy to follow.

- Define Payment Terms: At the bottom of the document, include your payment terms. Specify the due date, payment methods, and any late fees or discounts for early payments. This information is essential for setting expectations and helping your clients understand their obligations.

Tips for Clear and Professional Formatting

- Use Borders and Shading: Use borders around key sections (such as the itemized list and totals) to make the document easier to navigate. A subtle background shading can also be helpful to distinguish between different sections, such as the header and body.

- Maintain Consistency: Ensure that font styles and sizes are consistent throughout the document. Use bold for headings and important details (e.g., total amounts), but avoid overusing formatting that may make the document look cluttered.

- Align Text Properly: Align text and numbers properly within their respective columns for a clean, professional appearance. Typically, text is aligned to the lef

Improving Efficiency with Invoice Templates

Streamlining business processes is essential for increasing productivity and minimizing errors. By using pre-designed structures for creating financial records, you can save valuable time and reduce the chances of mistakes. Standardizing your documents with a consistent layout ensures that every transaction is processed quickly and accurately, allowing your team to focus on more strategic tasks.

One of the best ways to improve efficiency is by utilizing structured frameworks that allow for rapid data entry and automatic calculations. This helps you avoid manually formatting each document from scratch, and reduces the time spent on repetitive tasks. A well-organized system also ensures that all necessary information is included and easily accessible.

Key Benefits of Using Pre-Formatted Documents

- Faster Document Creation: Predefined structures allow you to quickly fill in the details of each transaction, eliminating the need to start from scratch every time.

- Consistency Across Records: Using a standard layout ensures that all records are uniform, making them easier to read and reducing the chance of important details being omitted.

- Minimized Errors: Automated fields and built-in formulas reduce the risk of human error, ensuring calculations like totals and taxes are always accurate.

- Easy Tracking and Management: A consistent structure makes it easier to keep track of completed and pending transactions, improving overall organization and reducing the time spent searching for specific records.

How a Structured Framework Enhances Workflow

A structured framework not only helps with document creation but also enhances the overall workflow of your business. With a clear and standardized format, team members can quickly review and approve records, ensuring that no details are overlooked. Additionally, any data required for reporting or analysis can be automatically compiled from the organized information.

Section Benefit Header Section Quickly identifies the company, recipient, and purpose of the record. Itemized List Organizes products or services into clear categories, making data entry fast and accurate. Subtotal and Total Calculations Automated formulas ensure calculations are accurate, reducing errors in final amounts. Payment Terms Ensures that all payment details are clearly defined, preventing confusion with clients. By using structured frameworks, businesses can create high-quality financial records more quickly and efficiently, helping to optimize day-to-day operations and maintain a professional image with clients.

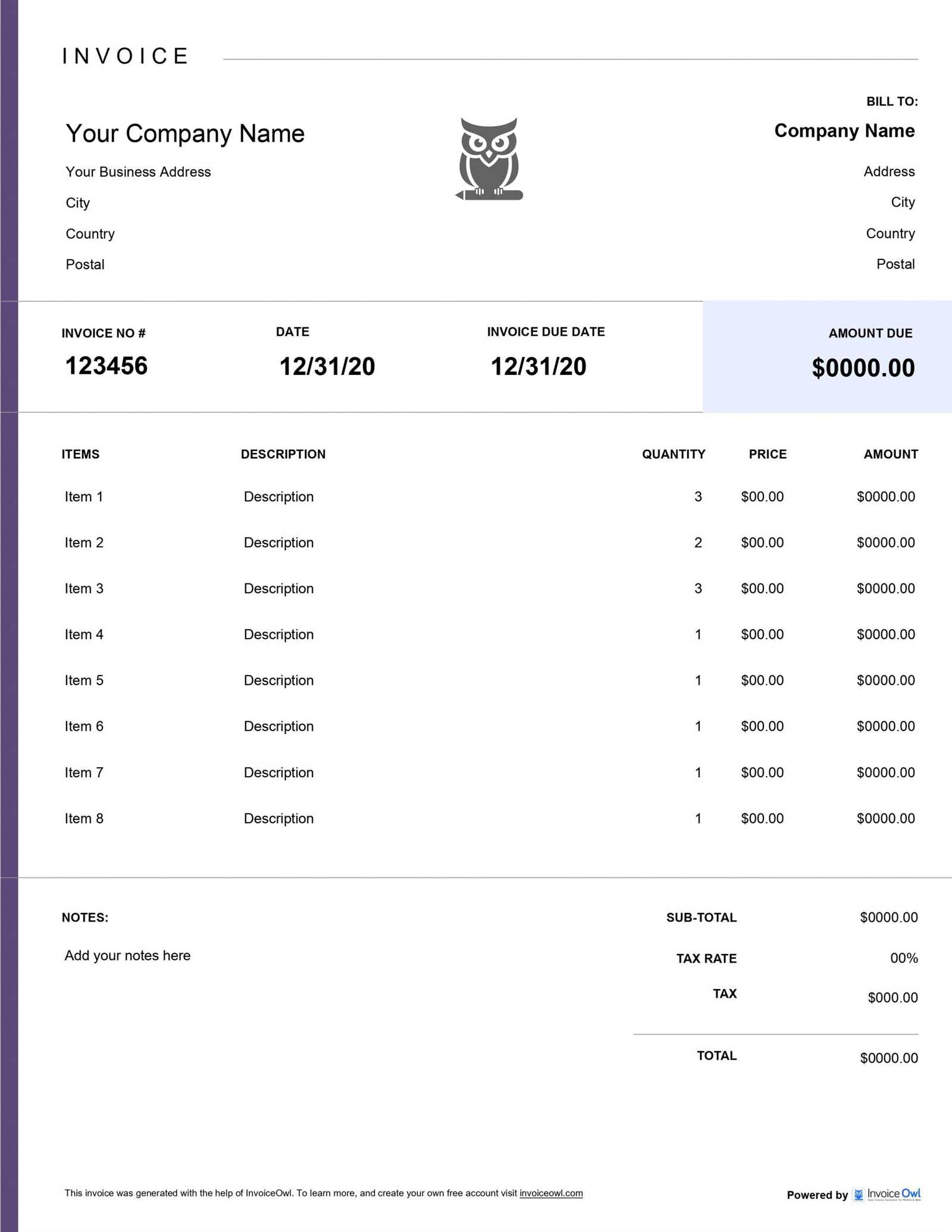

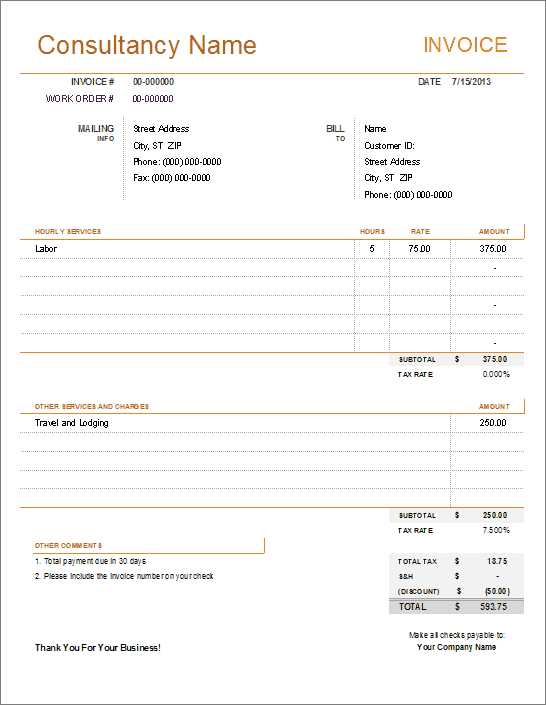

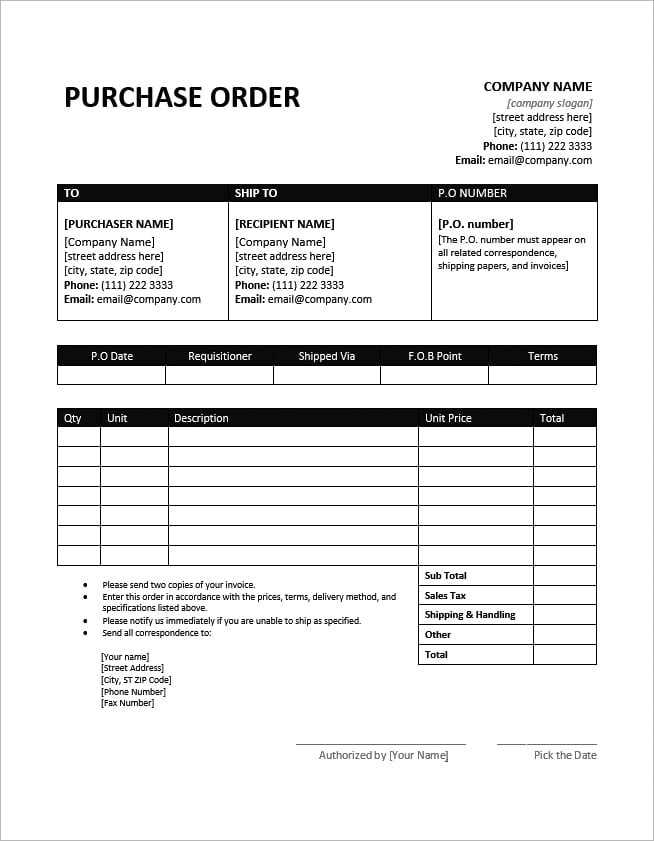

Free Purchase Invoice Templates Online

For businesses and freelancers looking to create professional financial records without spending a lot of time on design or formatting, there are plenty of free resources available online. These ready-made structures provide an easy solution for generating clean, well-organized documents that can be customized to fit specific needs. By using these free options, you can save time and focus more on running your business, while still ensuring that your records are accurate and polished.

Online platforms offer a variety of customizable templates that can be easily downloaded and edited to match your company’s branding and specific requirements. These documents typically include all the essential sections, such as itemized lists, totals, and payment terms, which helps reduce the chances of leaving out important information.

Whether you are creating a document for a one-time transaction or setting up a reusable structure for recurring billing, free online options allow you to get started quickly. Most importantly, they ensure consistency across all your records, which is essential for both internal management and client relationships.

Integrating Templates with Accounting Tools

Efficient financial management often requires integrating various tools to streamline workflows and maintain accurate records. By connecting your structured documents with accounting software, you can automate many tasks such as expense tracking, tax calculations, and financial reporting. This integration helps reduce manual entry errors and ensures that all your financial data is synchronized in real-time, making business operations more efficient and error-free.

Benefits of Integration

- Automated Data Entry: Linking your documents with accounting tools allows for automatic population of financial data, reducing the need to enter information manually, which saves time and minimizes mistakes.

- Real-Time Updates: Any updates made in the accounting software will automatically reflect in your financial records, ensuring accuracy and up-to-date information at all times.

- Improved Organization: Integration ensures that all your financial records are stored in one place, making it easier to track, manage, and retrieve past transactions for reporting and auditing purposes.

- Streamlined Reporting: With your data in sync, generating comprehensive reports on your financial health becomes simpler and more accurate. You can easily analyze income, expenses, and profitability without needing to manually compile the data.

How to Integrate Documents with Accounting Tools

- Choose Compatible Tools: Ensure that the software you’re using to manage your financial records can integrate with your preferred accounting tool. Many modern accounting platforms support file imports, data syncing, and API connections.

- Set Up Data Sync: Once your tools are linked, set up automatic synchronization. This will ensure that each transaction recorded in your document is transferred to your accounting software seamlessly.

- Use Consistent Formatting: Make sure the layout and data fields in your financial documents align with the format used by your accounting tools to avoid errors during the transfer process.

- Test the Integration: Before relying on automated transfers, test the integration to ensure everything works smoothly. Check if data is being imported correctly, and make adjustments if necessary.

By integrating your financial documents with accounting tools, you streamline your workflow, improve data accuracy, and gain better control over your financial operations. This integration reduces the administrative burden, allowing you to focus on growing your business with confidence.

Securing Your Invoice Data in Excel

When handling sensitive financial information, ensuring the security of your data is critical. From personal details to business transactions, any breach or data loss can have significant consequences. By taking the necessary precautions to safeguard your records, you can maintain both confidentiality and integrity in your financial processes. In this section, we will explore several strategies to protect your documents from unauthorized access and potential threats.

Best Practices for Data Security

- Password Protection: The simplest and most effective way to secure your documents is by applying strong passwords. This ensures that only authorized personnel can access or modify the content. Choose complex passwords and update them regularly.

- File Encryption: Encrypting your files adds an extra layer of protection. Even if someone gains unauthorized access to your file, they will not be able to view or alter the contents without the decryption key.

- Use of Secure Cloud Storage: Storing your files in secure cloud services with strong encryption and multi-factor authentication (MFA) reduces the risk of data loss due to hardware failure or theft. Ensure your cloud provider meets industry-standard security practices.

- Limit Access Rights: Restrict editing and viewing rights based on user roles. This ensures that only those who need to interact with financial records can access the information, minimizing the chances of accidental changes or unauthorized use.

Data Protection Features in Spreadsheet Software

Feature Benefit File Passwords Prevents unauthorized access by requiring a password to open or edit the file. Sheet Protection Allows users to lock specific cells or sheets to prevent unwanted changes while enabling read-only access. Audit Trails Tracks changes made to the document, allowing you to see who made edits and when, enhancing accountability. Data Validation Prevents incorrect or malicious data from being entered by restricting the type or format of information that can be input.