Vendor Invoice Template Word for Effortless Billing

Managing financial transactions effectively is essential for any business. One of the most important aspects is ensuring that payment requests are clear, organized, and easy to process. Having a well-structured document for billing purposes can save time, reduce errors, and improve communication with clients.

By using customizable tools, businesses can design professional-looking documents tailored to their needs. These documents can include all necessary details, such as payment terms, due dates, and itemized lists of services or products. Whether you’re a freelancer or part of a larger organization, using a standardized format for these records can make the billing process smoother and more efficient.

Why Use a Billing Document Format

Utilizing a standardized structure for requesting payments can significantly enhance the efficiency and accuracy of financial operations. A well-structured format ensures all critical information is clearly presented, reducing the chances of errors or misunderstandings between businesses and their clients.

Benefits of Standardizing Payment Requests

- Time-saving: Predefined formats eliminate the need to start from scratch with each transaction.

- Consistency: A uniform design helps maintain a professional appearance across all communications.

- Accuracy: Essential details like amounts, due dates, and itemized lists are systematically included.

- Legal Compliance: Using an established structure ensures that required information is always included, helping to meet legal and tax obligations.

Improving Communication with Clients

Clear and organized documents help build trust with clients. By providing all necessary details in an easy-to-read format, businesses make it simpler for clients to process payments promptly. This reduces confusion and can lead to faster transactions, contributing to smoother business operations.

Benefits of Customizing Your Billing Document

Customizing your payment request format allows you to tailor the design and content to meet specific business needs. A personalized document not only reflects your brand but also ensures that all relevant information is easily accessible and organized according to your preferences.

- Brand Identity: Adding your company logo and colors enhances brand recognition and professionalism.

- Flexibility: Customization allows you to adjust the structure based on different client requirements or project types.

- Clarity: By prioritizing the most important details, you can ensure that clients understand the terms of the transaction clearly.

- Efficiency: Tailored documents reduce the time spent adjusting the format for every new request, streamlining your processes.

- Client-Specific Adjustments: You can include specific terms, discounts, or notes that are relevant only to certain clients, making each request more personalized.

How to Create a Billing Document

Creating a clear and professional payment request document requires attention to detail and a systematic approach. By including the necessary elements and organizing the information effectively, you can ensure that clients understand the terms of the transaction and make payments promptly.

Steps to Create a Billing Document

- Include Business Information: Ensure your company name, contact details, and logo are clearly visible at the top.

- Client Details: Add the client’s name, address, and contact information to make the document personal and specific.

- Transaction Date: Include the date the payment request was generated to avoid confusion over deadlines.

- List of Services or Products: Detail the products or services provided, including quantities, descriptions, and individual prices.

- Payment Terms: Specify payment deadlines, any late fees, and accepted payment methods.

- Total Amount Due: Clearly display the total amount due, including taxes or discounts if applicable.

- Additional Notes: If necessary, include any other relevant information, such as references or special instructions.

Finalizing and Sending the Document

Once all information is included, review the document for accuracy before sending it to your client. Ensure that the layout is professional and easy to understand, making it simple for clients to process and pay their bills promptly.

Key Elements in Billing Documents

To ensure clarity and avoid misunderstandings, it is crucial to include specific details when creating a payment request. Each component plays an important role in helping both parties track and manage financial transactions effectively. These elements ensure that all necessary information is presented in a consistent and easily understandable manner.

Essential Information for Clarity

- Business Details: Include the name, address, and contact information of the business issuing the request.

- Client Information: The recipient’s name, address, and contact information should be clearly mentioned to personalize the document.

- Unique Reference Number: Assign a reference or identification number for easy tracking and record-keeping.

- Payment Terms: Define the agreed-upon terms, such as due dates and accepted payment methods, to avoid confusion later.

Itemizing Charges and Totals

- Product or Service Descriptions: Provide a detailed list of goods or services with quantities and individual pricing.

- Subtotal and Taxes: Clearly show the subtotal before taxes, followed by any applicable tax amounts or discounts.

- Total Amount: Ensure the total amount due is prominently displayed, including taxes and any adjustments.

Tips for Accurate Document Creation

Ensuring precision when creating a payment request is essential to avoid errors and disputes. By following a structured approach and paying attention to detail, you can guarantee that all information is correctly presented and easy to understand, making the process smoother for both parties involved.

Best Practices for Accuracy

| Tip | Description |

|---|---|

| Double-Check Details | Before finalizing any document, review all information for accuracy, including the amounts, client details, and dates. |

| Use a Clear Layout | A well-organized format allows for easy reading and ensures that no crucial information is overlooked. |

| Keep Records | Maintain a copy of every payment request for your records to help track payments and follow up if needed. |

| Provide Clear Instructions | Include any necessary payment instructions, such as bank account details or links to online payment portals. |

| Verify Calculations | Ensure that all numbers, including subtotals, taxes, and totals, are calculated correctly to avoid confusion. |

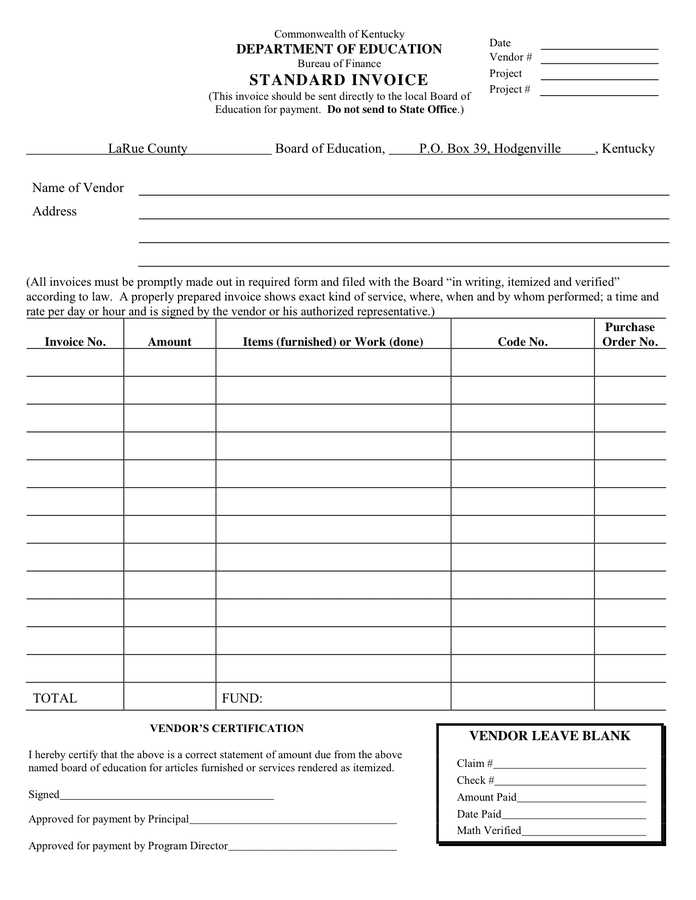

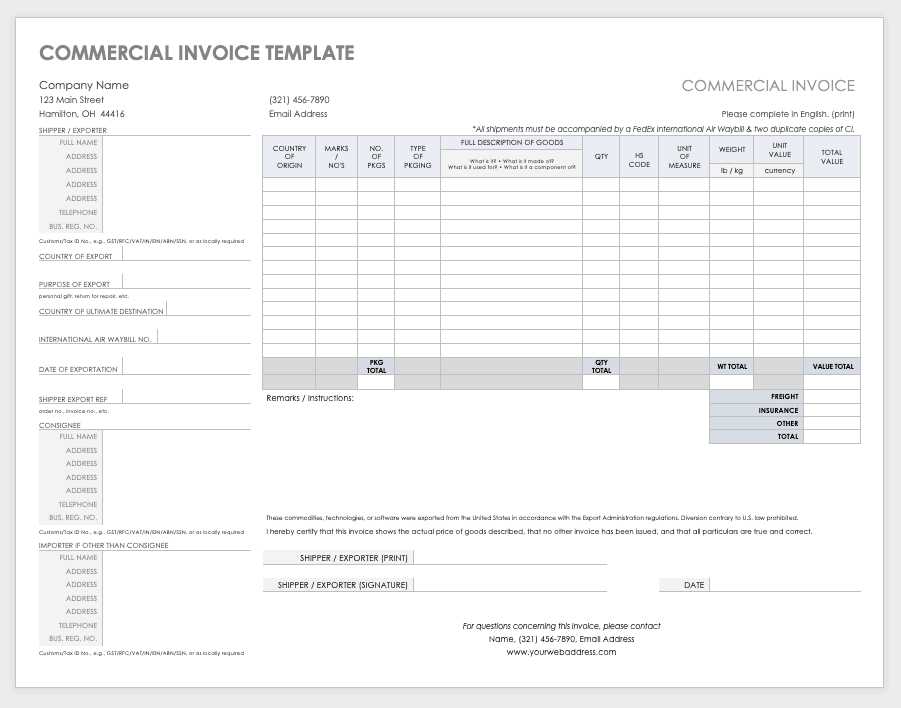

Free Billing Document Templates Available

There are many free resources available that offer customizable payment request formats to simplify the billing process. These ready-to-use formats can save time and ensure that all essential details are included in an organized manner, helping you create professional and accurate documents with minimal effort.

Benefits of Using Free Templates:

- Time-Saving: Pre-designed documents allow for quicker creation and reduce the need to start from scratch.

- Customization: Many free resources allow for personalization, making it easy to adjust for different clients and services.

- Professionalism: Ready-made formats are often designed to be clean and professional, giving your business a polished image.

- Easy Accessibility: These templates are available for download or direct use online, making them accessible to anyone at any time.

By using free formats, you can ensure that your requests are clear, accurate, and well-organized, providing a smoother experience for both you and your clients.

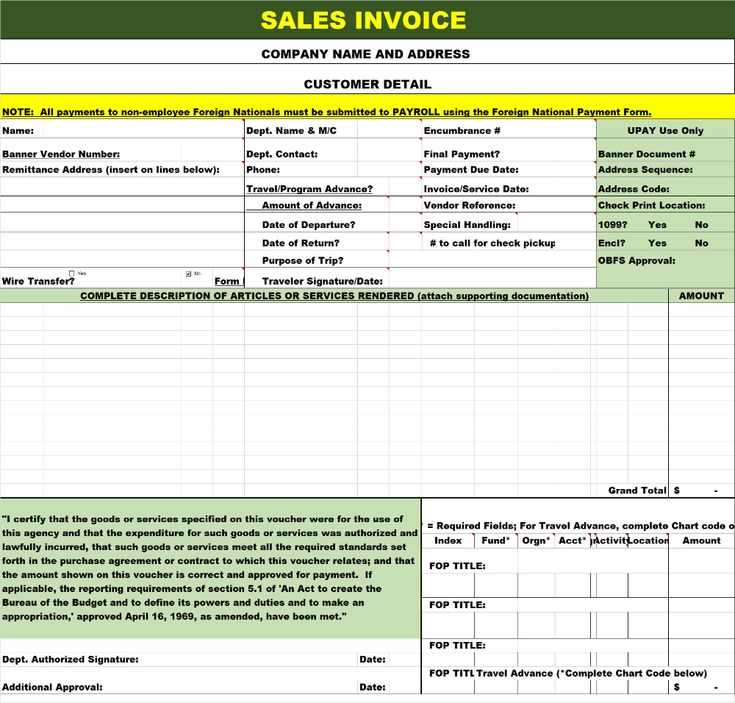

Billing Document Format for Small Businesses

For small businesses, having a clear and concise payment request format is essential to ensure proper tracking and smooth financial transactions. A well-structured document helps maintain professionalism, making it easier for clients to understand the details and make timely payments. Tailoring this format to fit the specific needs of a small business is crucial for efficient operations.

Key Elements to Include

- Business Information: Include the name, address, and contact details of your business to ensure that clients can easily reach you if needed.

- Client Information: Provide the recipient’s name, business address, and other relevant contact information to personalize the document.

- Clear Itemization: List the products or services provided, along with quantities and prices, to avoid any confusion.

- Payment Terms: Clearly state the payment due date, accepted methods of payment, and any late fees or discounts offered.

- Unique Reference Number: Include a unique identifier to help track the transaction for future reference.

Benefits for Small Businesses

- Professional Appearance: A well-organized format enhances your business image and builds trust with clients.

- Consistency: Using a standard format for all payment requests ensures consistency across your operations.

- Improved Cash Flow: Clear, accurate documents can help prevent delays in payments and improve cash flow.

How to Add Tax Information

Including tax information in payment documents is essential to ensure compliance with local laws and provide transparency for both your business and your clients. Properly detailing tax charges helps prevent confusion and ensures that all necessary payments are accurately calculated.

Steps to Include Tax Details

- Identify Applicable Taxes: Determine which taxes apply to the transaction, such as sales tax or VAT, based on your location and the type of product or service provided.

- Calculate the Tax Amount: Multiply the taxable amount by the applicable tax rate to get the total tax due. Be sure to calculate taxes for each item separately if different rates apply.

- Include Tax Breakdown: Clearly itemize the tax charges on the document. This can include separate lines for each type of tax and the applicable rates.

- Show Total Tax: Include a section where the total tax amount is calculated and added to the subtotal to show the final amount due.

Best Practices for Tax Information

- Be Clear and Precise: Ensure the tax information is clearly visible and easy to understand to avoid any misunderstandings.

- Stay Compliant: Regularly review tax laws to ensure your calculations and rates are up-to-date with the current regulations.

- Keep Records: Retain a copy of the documents with tax details for accounting and auditing purposes.

How to Track Payment Transactions

Effectively tracking payment transactions is essential for maintaining smooth business operations and ensuring that all amounts owed are received on time. By keeping accurate records, businesses can stay on top of their finances, prevent overdue accounts, and improve cash flow management.

Methods for Tracking Payments

- Create a Payment Record: Record each payment as soon as it is received. Include details such as the payment method, amount, and the date it was processed.

- Use Accounting Software: Leverage accounting tools or software to automate the tracking process. This allows for real-time updates and minimizes human errors.

- Manual Record-Keeping: If you prefer traditional methods, use spreadsheets or ledgers to track payments. Keep a separate column for payment status (paid, pending, overdue) and date received.

- Issue Receipts: Always issue receipts for payments to maintain transparency and provide proof of payment for both your records and the client’s.

Best Practices for Payment Tracking

- Set Up Payment Reminders: Use reminders or automated alerts to follow up on overdue payments, ensuring you don’t miss any critical dates.

- Reconcile Payments Regularly: Frequently review and reconcile your records to ensure that all transactions are accounted for and match your bank statements.

- Organize by Client: Keep payment records organized by client or account for easy reference in case of disputes or clarifications.

Common Mistakes in Billing Statements

When preparing billing documents, businesses often overlook certain key details that can lead to confusion, delays, or errors in the payment process. Recognizing and avoiding common mistakes can help ensure smoother transactions and better relationships with clients.

Typical Errors in Billing Documents

- Incorrect Contact Information: Failing to include or correctly list the recipient’s name, address, or contact details can cause delays in payment processing.

- Missing or Incorrect Dates: Not including the correct date of issuance or due date can lead to misunderstandings about the payment timeline.

- Failure to Include Tax Information: Omitting necessary tax details such as sales tax or VAT can complicate the payment process and cause legal issues.

- Unclear Item Descriptions: Vague or insufficiently detailed descriptions of goods or services provided can result in disputes over charges.

- Mathematical Errors: Simple calculation mistakes, such as incorrect totals or tax amounts, can undermine the document’s reliability and cause confusion.

How to Avoid These Mistakes

- Double-Check Information: Always review the details before finalizing the document. Ensure that all information is accurate and up-to-date.

- Use Billing Software: Leverage software that automatically calculates totals and generates standardized forms to minimize human error.

- Clearly List Terms: Make payment terms clear, including late fees and payment methods, to avoid future misunderstandings.

Legal Requirements for Billing Statements

When preparing official billing statements, it’s crucial to adhere to legal guidelines to ensure compliance with tax regulations and avoid potential disputes. These documents must contain specific information that complies with local laws, which vary depending on the jurisdiction. Failing to meet these requirements can result in penalties or issues with tax authorities.

There are several key elements that must be included in every billing document to ensure that it meets the necessary legal standards. Below is an overview of the essential details required by law:

| Requirement | Description |

|---|---|

| Company Information | Legal name, address, and contact details of both parties involved in the transaction (the seller and the buyer). |

| Transaction Date | The date the billing statement is issued and the date the goods/services were provided. |

| Tax Identification Number | A unique identifier for the business or service provider for tax purposes (e.g., VAT number or business registration number). |

| Amount Charged | The total cost, broken down by items/services, including any taxes or fees, clearly listed. |

| Payment Terms | Details regarding the payment due date, late fees, and available payment methods. |

Ensuring that these elements are present helps businesses stay compliant with local tax laws and provides a clear record for both parties. It’s important to research and understand the specific requirements for your region to avoid legal complications.

Payment Terms Explained

Understanding payment terms is essential for both businesses and clients to ensure smooth transactions and avoid confusion. These terms define the timeframe, conditions, and method by which payments are expected to be made following a service or product delivery. Clear payment terms help set expectations and maintain professional relationships.

Here are the common types of payment terms you may encounter:

- Net 30 – Payment is due within 30 days from the issue date of the billing statement.

- Net 60 – Payment is due within 60 days from the date the bill is issued. This term is often used for larger transactions or ongoing business relationships.

- Due on Receipt – Payment is expected immediately upon receiving the bill.

- Cash on Delivery (COD) – Payment must be made when the goods or services are delivered to the customer.

- Installments – Payments are made in multiple smaller amounts over a period of time, as agreed upon by both parties.

- Prepayment – Payment is made in full before any goods or services are delivered.

These payment terms are often negotiable depending on the agreement between the buyer and the seller. It’s important to specify the payment schedule and method in the terms to avoid any misunderstandings. Additionally, clear communication about any late fees or penalties for overdue payments can further protect both parties.

How to Save Time with Templates

Using pre-designed documents can significantly streamline processes, especially when dealing with repetitive tasks. By creating or utilizing ready-made formats, you can avoid starting from scratch every time you need to prepare essential paperwork. This method allows you to focus on the unique details rather than reinventing the structure each time.

Consistent Structure

One of the main advantages of using pre-set formats is the consistency they offer. With a set structure, you ensure that every document follows the same layout, ensuring that all required fields are included and nothing is overlooked. This consistency is particularly important when it comes to professionalism and meeting industry standards.

Faster Execution

By reducing the time spent on formatting and organizing the content, you can dedicate more time to other critical business tasks. Simply filling in the details, such as dates, amounts, and other specifics, speeds up the process. This is especially helpful when managing multiple documents within a short timeframe.

Incorporating pre-structured files into your workflow saves time and reduces the likelihood of mistakes. Additionally, having easy access to reusable templates helps to improve overall efficiency and organization in business operations.

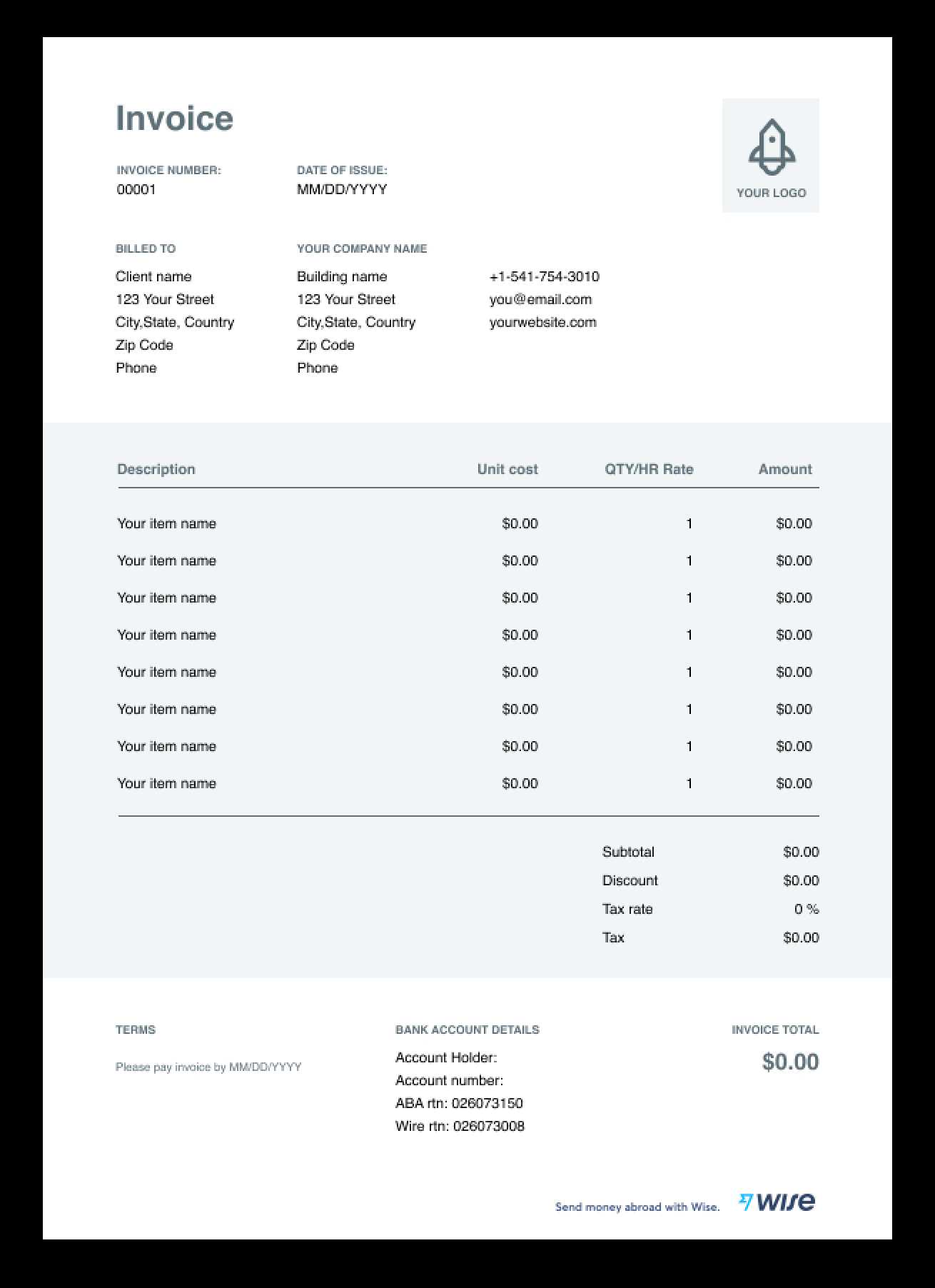

Designing Professional Vendor Invoices

Creating a polished and professional document for business transactions is crucial for establishing credibility and fostering trust with clients. A well-designed form reflects attention to detail and helps ensure clarity and accuracy in all aspects of the exchange. The design of these forms should balance functionality with aesthetics to facilitate smooth and efficient processing.

Consistency and Clarity are key when designing professional documents. Use a clean, simple layout that avoids clutter while ensuring all necessary information is easy to read. This includes contact details, payment terms, and transaction breakdowns. The font should be legible, and the structure should logically guide the reader through the necessary sections.

Branding Elements should also be incorporated to reinforce the identity of your business. Including your company logo, consistent colors, and specific fonts can make your form visually aligned with your brand, helping to create a sense of professionalism and consistency across all client communications.

Essential Design Features

- Contact Information: Ensure both your business and the client’s details are easily accessible.

- Clear Breakdown of Services or Products: Present a detailed description of the provided services or goods.

- Payment Terms: State clearly the payment due date and any other important terms.

Investing time into the design process pays off, as it not only improves the overall presentation but also contributes to smoother, error-free transactions.

Vendor Invoice Template for Freelancers

For independent contractors, creating a clear and organized document for each project is essential for maintaining professionalism and ensuring timely payments. A well-structured form makes the billing process smooth and efficient, allowing freelancers to keep track of their work and manage finances effectively. Such a document typically includes essential elements like service descriptions, payment terms, and contact information, which help both parties avoid misunderstandings.

Freelancers should prioritize a simple yet thorough structure. Below is an example of how to organize a professional document for freelance work:

| Section | Details |

|---|---|

| Freelancer’s Information | Name, business name, address, email, phone number |

| Client Information | Name, company name, address, contact details |

| Description of Services | A brief overview of the work done, including project details |

| Total Amount Due | Cost for services rendered and applicable taxes, if any |

| Payment Terms | Due date, accepted payment methods, late fees (if applicable) |

This structure ensures that all important details are accounted for, making it easier to manage and track freelance projects. By maintaining consistency and clarity, freelancers can enhance their business image and streamline their financial processes.

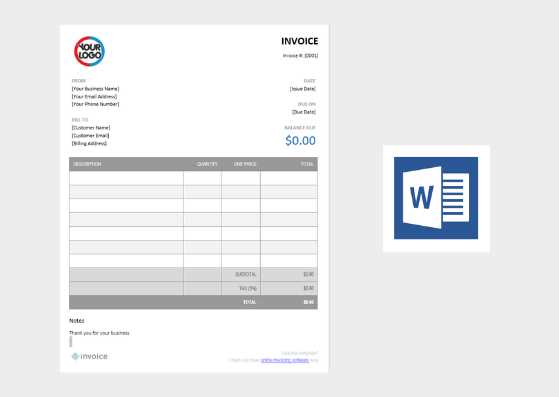

How to Use Word for Invoices

Using a word processor for creating billing documents is an effective way to maintain a professional appearance while ensuring that important details are easily accessible. By leveraging the features of a word processing application, users can quickly generate accurate documents without the need for advanced software. This approach helps streamline the process, especially for those who work with clients regularly and require a consistent layout.

Steps to Create a Billing Document

To efficiently create a clear and organized document for billing, follow these simple steps:

- Open the Application: Start by opening your word processor of choice and selecting a blank document.

- Include Header Information: At the top, include the essential details, such as your name, business name, and contact information.

- Client Details: Beneath the header, list the client’s name, address, and contact details.

- Describe the Services: Clearly describe the services provided, including any relevant dates or milestones for clarity.

- Add Total Amount: Include the total amount owed, broken down if necessary, to show how the final sum is calculated.

- Specify Payment Terms: Define when payment is due, preferred payment methods, and any late fees if applicable.

Formatting Tips

To enhance the readability and professionalism of your document:

- Use Clear Headings: Organize information under headings for easy reference.

- Choose Readable Fonts: Stick to professional fonts like Arial or Times New Roman.

- Keep It Simple: Avoid clutter by maintaining a clean layout with enough spacing between sections.

By following these guidelines, you’ll be able to create efficient and professional billing documents that help maintain smooth business operations.

Updating Your Vendor Invoice Template

Keeping your billing documents up to date is essential to maintain accuracy and professionalism. As your business evolves, so should the structure and information included in your documents. Regularly reviewing and modifying these documents ensures they meet current legal requirements, reflect changes in your pricing, and align with your brand identity. Here are key steps to consider when revising your document.

Essential Updates to Make

There are several areas that may need modification to keep your billing process smooth and consistent:

- Contact Information: Update any changes to your business’s name, address, phone number, or email to ensure clients can reach you without difficulty.

- Payment Terms: Review and modify payment deadlines, late fees, or accepted payment methods to reflect current business policies.

- Service Descriptions: If your services have changed or expanded, make sure these are clearly detailed in the document.

- Branding: Consider adding or adjusting logos, color schemes, and fonts to match your latest brand identity.

- Legal Compliance: Ensure that all legal information, such as tax rates or business identification numbers, are correctly stated and reflect any recent legislative changes.

How to Make Updates Efficiently

To ensure your updates are both effective and efficient, follow these tips:

- Utilize Software Features: Take advantage of built-in tools, like automatic date insertion or templates that help streamline changes.

- Review for Consistency: Double-check your updates for consistency across all documents to avoid confusion for your clients.

- Save Versions: Keep a backup of older versions so that you can refer to them if necessary, especially for legal or tax purposes.

By regularly updating your billing documents, you ensure they remain professional, accurate, and aligned with your business needs.