Free Professional Services Invoice Template for Easy Billing

Managing payments and keeping track of your work can be a time-consuming task, especially for independent workers and small businesses. Having a well-organized system to request compensation for your efforts is crucial to maintaining a professional image and ensuring timely payments. Simplifying this process with an efficient structure can help reduce stress and improve cash flow.

With the right resources, anyone can create clear, concise documents that outline the services rendered and the amount due. There are a variety of options available to simplify this task, whether you are just starting out or looking to update your current method. Using a ready-made framework can save valuable time while ensuring that all necessary information is included.

Efficiency and accuracy are key when dealing with financial transactions. By choosing the right tool, you can avoid common mistakes and ensure that all details are correct. This guide will help you find the ideal solution to make billing more straightforward and professional, giving you more time to focus on your business.

Why Use a Professional Invoice Template

Having a consistent and organized approach to requesting payment is essential for any business. A well-designed structure helps ensure that all key details are included, making the process clearer for both you and your clients. Without a reliable system, it’s easy to overlook important information, which could lead to confusion or delays in payment.

Using a structured document helps you maintain a polished image and demonstrates attention to detail. This can enhance trust with clients, making them more likely to pay on time. A clean, easy-to-read format can also minimize the chances of errors, such as incorrect amounts or missing information, which can complicate the payment process.

Time efficiency is another reason to opt for an organized billing method. Rather than starting from scratch each time, having a ready-made structure allows you to fill in the details quickly, saving valuable time. The more streamlined your system, the less you need to worry about administrative tasks, leaving you with more time to focus on your core business activities.

Furthermore, using a structured approach can assist with record-keeping and tax preparation. A standardized format ensures that every document follows the same guidelines, making it easier to track payments, monitor outstanding balances, and organize financial records for future reference.

Benefits of Free Invoice Templates

Using ready-made documents for requesting payment offers a range of advantages, especially for small businesses and freelancers. These resources provide a simple, efficient way to keep track of transactions without having to invest in expensive software or hire outside help. With just a few clicks, you can access a well-structured format that ensures your billing process is clear and professional.

Cost-Effective Solution

One of the main advantages of using these resources is the cost savings. Many tools are available at no charge, offering a high-quality option for those who may not have the budget for premium solutions. This allows businesses, especially startups or freelancers, to avoid additional expenses while still maintaining an organized billing system.

Ease of Use and Customization

Another key benefit is ease of use. These documents are often simple to fill out, requiring minimal technical skill. You can quickly customize the fields to reflect your specific business needs, adding details like your logo, payment terms, and contact information. This flexibility ensures that each transaction looks professional and suits your branding.

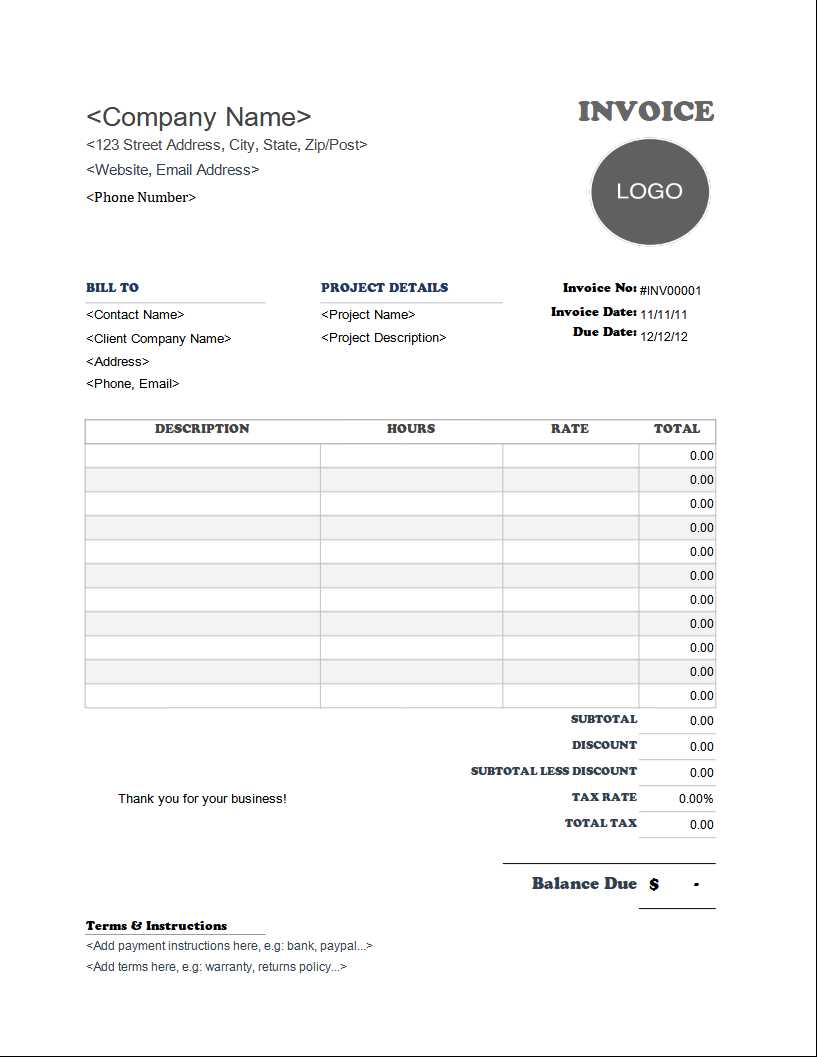

How to Customize Your Invoice Template

Customizing your billing document allows you to tailor it to your specific needs, ensuring that it reflects your brand and includes all relevant details. By adjusting the format and content, you can make your payment requests more professional and aligned with your business style. Below are some steps to help you personalize your document efficiently.

Start by editing the basic details such as your company name, contact information, and logo. Make sure that the format matches your branding guidelines, using the right colors and fonts to keep everything consistent. You can also customize the payment terms, such as due dates and late fees, to suit your preferences.

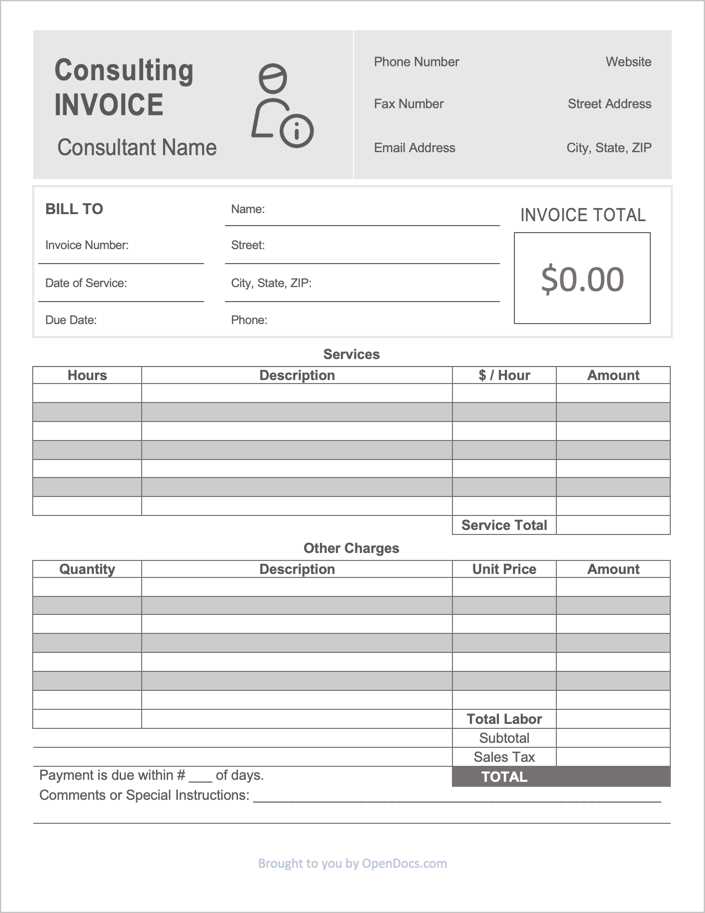

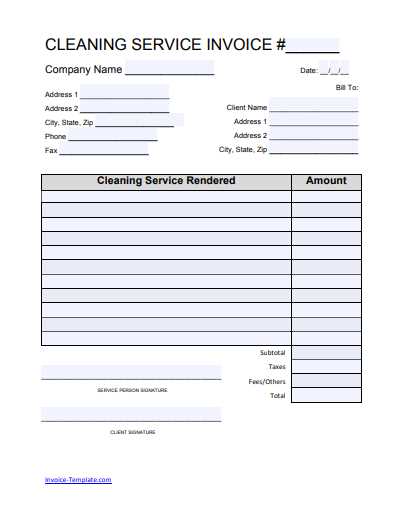

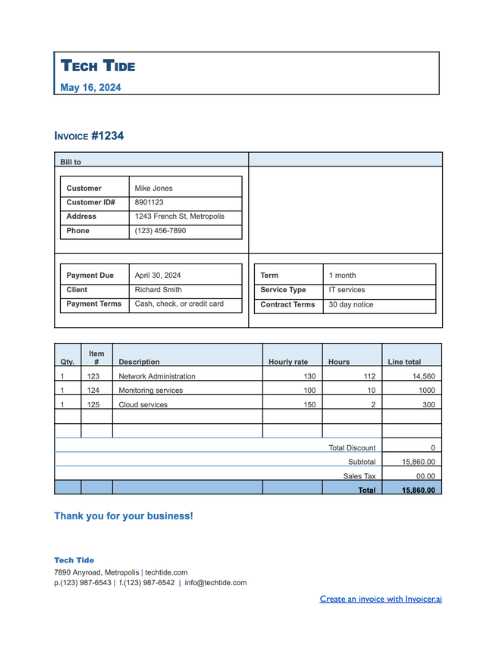

| Element | Customizable Options |

|---|---|

| Header Section | Company logo, name, and address |

| Client Details | Client name, address, contact info |

| Itemized List | Description, quantity, price, total |

| Payment Terms | Due date, late fees, discounts |

| Footer Section | Additional notes, payment methods |

By adjusting these sections, you can create a document that is both functional and visually appealing, helping ensure timely payments and maintaining a strong relationship with your clients.

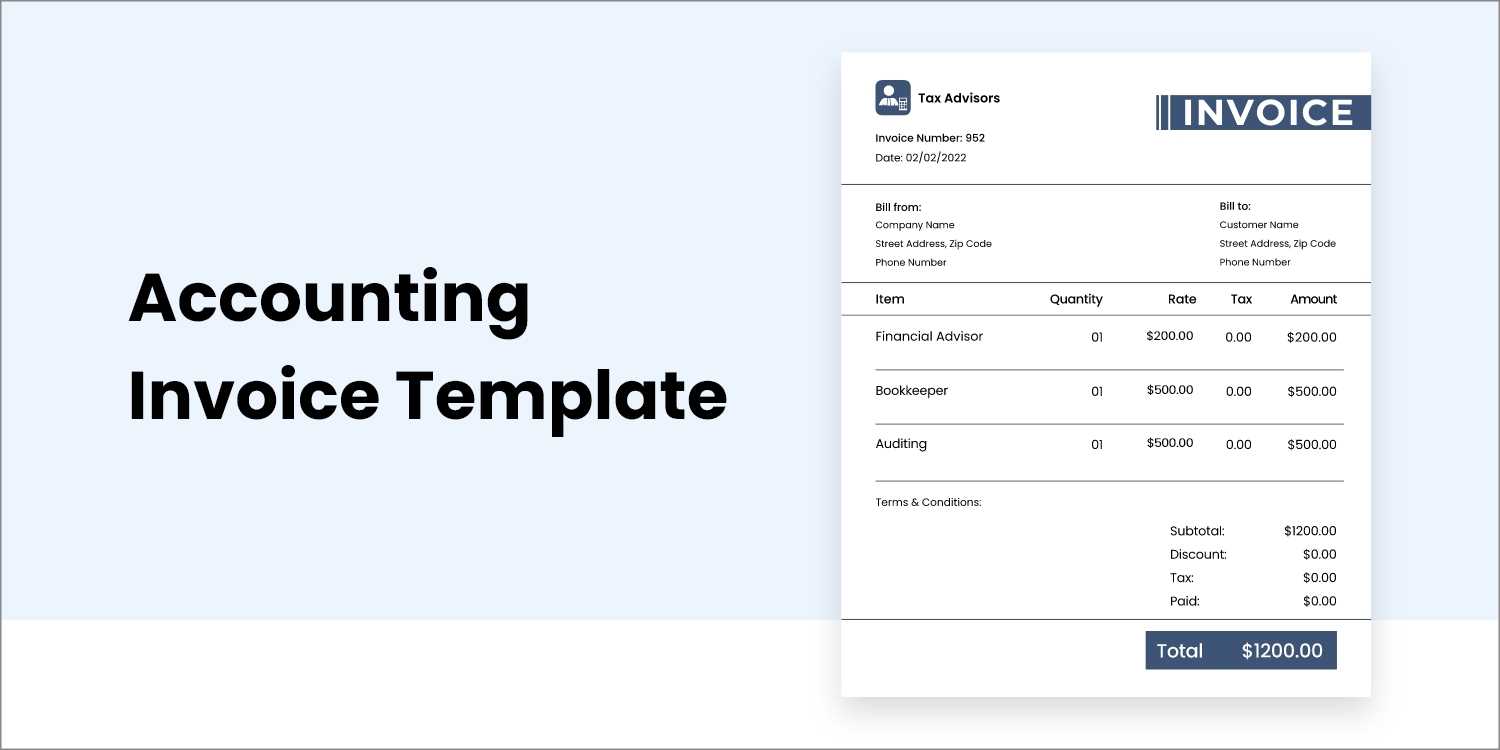

Essential Elements of a Professional Invoice

To create an effective document for requesting payment, it is crucial to include all necessary components that ensure clarity and accuracy. A well-structured payment request should not only look professional but also provide clients with the information they need to process payments promptly. Below are the essential elements to include in your document.

- Header Information: This should include your business name, logo, and contact details (address, phone number, email).

- Client Details: Include the client’s name, address, and contact information to avoid confusion.

- Document Number: Assign a unique reference number to each document for easier tracking and record-keeping.

- Itemized List of Charges: Clearly outline the work done, the quantity, and the price for each item or task.

- Total Amount Due: Calculate the total, including any applicable taxes, fees, or discounts.

- Payment Terms: Specify the payment due date, accepted payment methods, and any late fees or discounts.

- Footer: Include any additional notes, such as thank-you messages, terms, or refund policies.

These components form the foundation of a well-organized payment request, helping to build trust and ensure smooth transactions with clients.

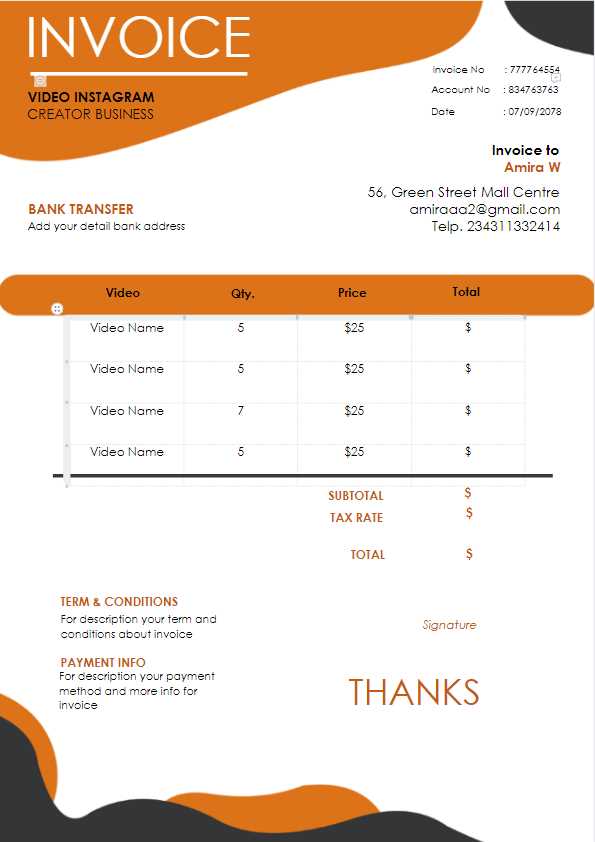

Where to Find Free Invoice Templates

For those looking to streamline their payment requests, there are numerous resources available online that offer high-quality, no-cost options. These documents are designed to be user-friendly and easily customizable, allowing you to create professional billing statements quickly. Whether you prefer to use pre-designed files or online tools, there are many places to find the right solution for your needs.

One of the most common sources is business websites that specialize in providing tools for small business owners and freelancers. Many of these platforms offer a wide variety of pre-made formats that can be downloaded instantly and edited to suit your specific requirements. Additionally, popular office software programs, such as Word or Excel, often provide built-in options or downloadable files that make creating documents a breeze.

If you are looking for even more flexibility, several online platforms allow you to generate and customize your documents directly within your browser. Websites like Google Docs, for example, offer free templates that you can personalize and save in your own account for easy access. Other platforms offer cloud-based solutions that not only provide customizable layouts but also allow for automatic saving and sharing.

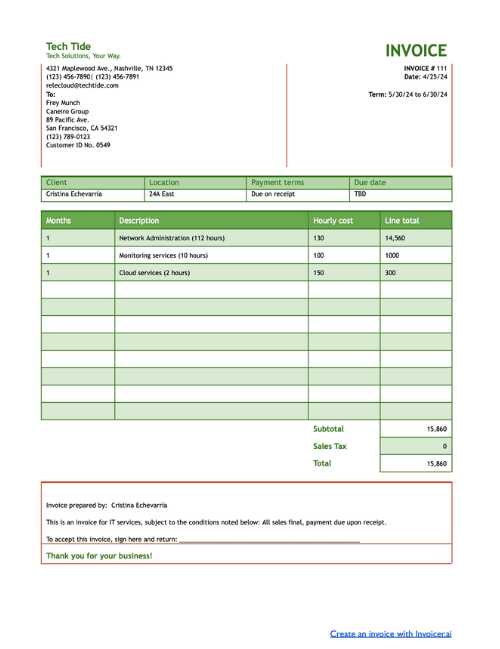

Creating Invoices for Freelancers and Contractors

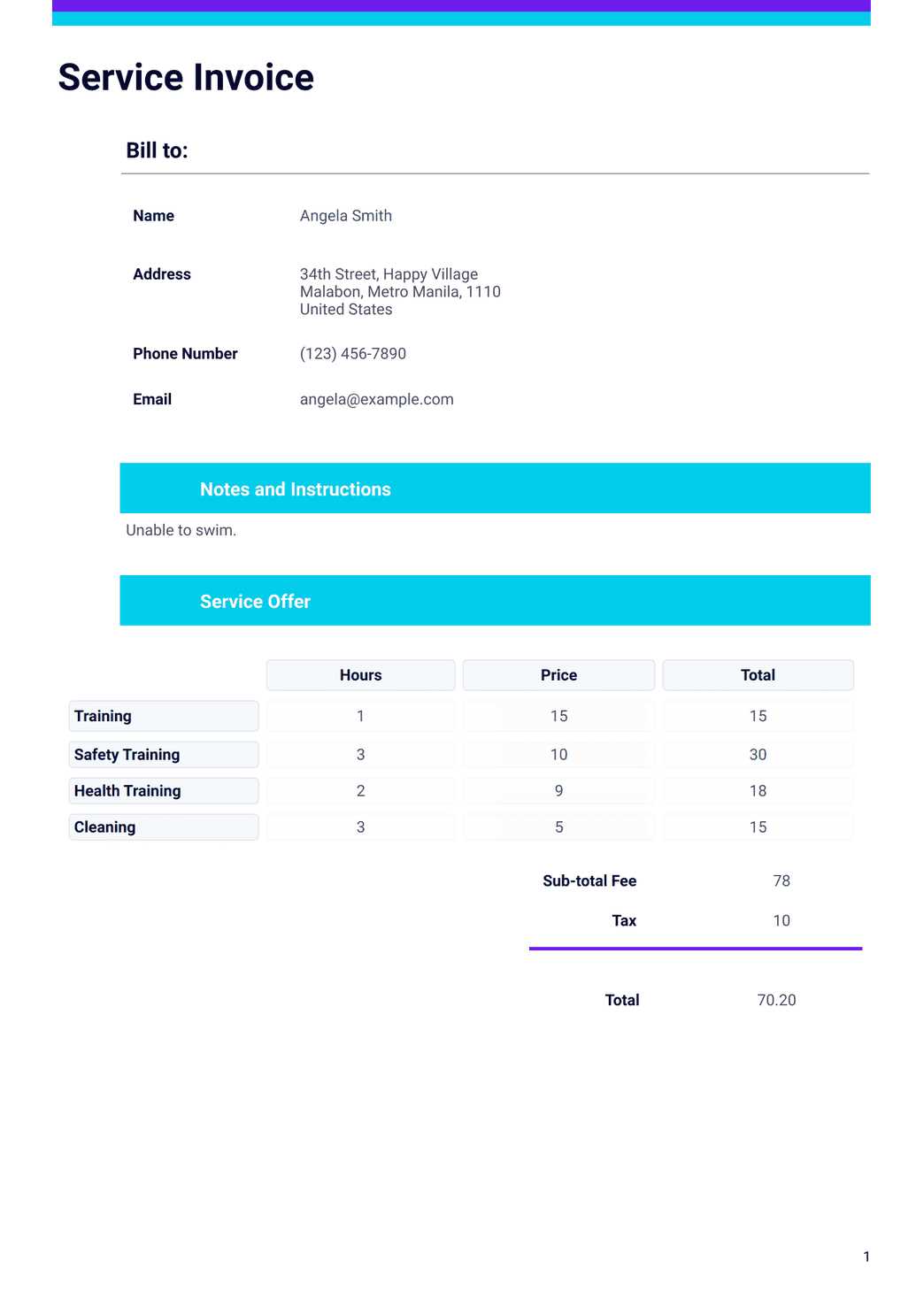

For freelancers and independent contractors, having a clear and organized method of requesting payment is essential to maintaining smooth financial operations. A well-crafted billing document not only ensures that clients understand the costs associated with the work but also helps establish a professional relationship that encourages timely payments. When creating these documents, there are a few important steps to follow.

First, it’s important to clearly list the details of the work completed. This includes a description of each task or project, the time spent, and the agreed-upon rate. Providing transparency around what was done and how the final amount was calculated can prevent misunderstandings and build trust with your clients.

Second, make sure to include essential details such as your name or business name, contact information, and the client’s information. This ensures that both parties are on the same page and makes it easier to refer back to the document later. Additionally, always specify the due date for payment, as well as any applicable late fees or discounts for early payments.

Lastly, keeping your documents organized and easy to read will streamline your billing process. Using a consistent layout for all your payment requests not only saves time but also reinforces your professionalism.

How Free Templates Save Time and Money

Using pre-designed documents for billing can significantly reduce the time and costs involved in creating payment requests from scratch. These ready-made resources are designed to be easily customizable, allowing you to focus on the content rather than formatting or layout. By leveraging these tools, you can streamline your entire billing process while keeping expenses low.

- Time Savings: Instead of designing a document every time you need to bill a client, you can simply fill in the relevant details. This eliminates the need for repetitive tasks and allows you to send out bills faster.

- Cost Efficiency: Many of these resources are available at no cost, meaning you don’t need to purchase expensive software or hire a designer to create customized documents. This is particularly beneficial for small businesses and freelancers operating on a budget.

- Consistency: Using a standardized document helps you maintain a consistent format, making it easier to track past payments and organize your financial records.

- Reduced Errors: With predefined sections and calculations, you minimize the risk of making mistakes, such as missing key details or incorrectly calculating totals.

In addition to saving you valuable time and money, these tools also improve the professionalism of your billing, making it easier to establish trust with clients and ensure timely payments.

Choosing the Right Template for Your Business

Selecting the right document for requesting payment is crucial for maintaining professionalism and efficiency in your business. It’s important to choose a layout that aligns with your industry, the size of your business, and the types of transactions you typically handle. A well-chosen layout not only simplifies the billing process but also strengthens your brand image and fosters trust with clients.

Consider Your Business Type

The first factor to consider is the nature of your business. For example, if you’re a freelancer or a contractor, you might need a simpler format that lists only the tasks performed, the time spent, and the amount due. On the other hand, if you run a larger operation or provide multiple products, you might need a more complex structure that includes detailed itemization, taxes, and discounts.

Customization and Flexibility

Customization is another important aspect. Choose a document that allows you to add your company logo, adjust the color scheme, and modify fields to fit your particular needs. Having flexibility in terms of layout and content ensures that the document accurately reflects your branding and offers a clear breakdown of costs to your clients.

By carefully selecting the right structure, you ensure a smoother and more professional payment process that can help you build better client relationships and manage your finances more effectively.

Invoice Template Features You Should Know

When selecting a document for billing clients, it’s important to be aware of the key features that make the format efficient and professional. A well-designed layout should not only capture essential details but also ensure clarity and accuracy in the payment process. Here are the essential elements to look for when choosing a document structure for your business.

Key Elements to Include

- Client and Business Information: Clearly list both your details and the client’s, including contact info, business name, and addresses.

- Itemized Charges: Break down the work or products provided, including individual prices for each task or item, quantities, and totals.

- Payment Terms: Clearly state the payment due date, accepted methods, and any applicable late fees or discounts for early payments.

- Unique Reference Number: Each document should have a distinct number for tracking and organizational purposes.

- Tax Information: If applicable, ensure tax rates, amounts, and calculations are clearly listed.

Customization and Ease of Use

- Flexibility: The ability to adjust fields, add logos, or customize fonts helps align the layout with your business branding.

- Readable Format: The design should be clean and organized, making it easy for clients to understand the charges and terms.

- Pre-set Calculations: Automatic calculations for totals, taxes, and discounts save you time and prevent errors.

By choosing a document that includes these features, you ensure a smooth, clear, and professional transaction process, strengthening your business’s financial operations.

How to Edit and Format Invoice Templates

Editing and formatting your billing documents is an essential step to ensure they meet both your business needs and client expectations. With the right adjustments, you can make the document clearer, more professional, and in line with your company’s branding. Below are the key steps to follow when editing and formatting your billing layouts.

Editing the Content

The first step in customizing your billing document is to update the essential fields with your information. This includes adding your business name, logo, and contact details, as well as the client’s name, address, and relevant information. Additionally, make sure to fill in the itemized list of charges, including specific tasks, rates, quantities, and total amounts.

Formatting for Clarity and Professionalism

Once the content is in place, it’s important to format the document for readability. Here are a few tips:

- Use a clean and simple layout, with clear section headings.

- Ensure there’s enough spacing between sections t

Common Mistakes When Using Invoice Templates

While ready-made documents can save time and streamline the billing process, there are common mistakes that can undermine their effectiveness. These errors can lead to confusion, delayed payments, or even a loss of professionalism. It’s important to be aware of these pitfalls to ensure that your billing documents are accurate and properly structured.

Common Errors to Avoid

- Missing Client Details: Forgetting to include the client’s name, address, or contact information can cause confusion and delay payments.

- Incorrect Calculations: Failing to double-check totals or tax calculations can result in incorrect amounts being requested, leading to trust issues with clients.

- Not Specifying Payment Terms: If payment due dates or accepted methods aren’t clearly stated, it can lead to misunderstandings and late payments.

- Overcomplicating the Layout: A cluttered or overly complex format can make the document hard to read and cause clients to overlook important information.

How to Prevent These Mistakes

By following these guidelines, you can ensure that your billing documents are clear, correct, and professional:

Common Mistake How to Avoid It Missing Client Details Always double-check that all client information is included and up to date. Incorrect Calculations Use built-in formulas or review the math before sending out the document. Not Specifying Payment Terms Clearly list payment deadlines, methods, and penalties for late payments. Overcomplicating the Layout Keep the format simple and easy to follow, with clear sections and appropriate spacing. By taking extra care with these details, you can avoid common mistakes and ensure that your billing process remains smooth and professional.

How to Include Taxes in Your Invoice

Including taxes in your billing documents is an important aspect of maintaining legal compliance and ensuring accurate payments. It’s essential to clearly indicate any applicable taxes, so clients are aware of the total amount they owe, including tax charges. Here’s how to properly include taxes in your payment requests without causing confusion.

First, you need to determine the tax rate that applies to your products or services. This will vary depending on the location and type of business you’re operating. Once you know the correct rate, calculate the tax amount based on the subtotal of your charges. Be sure to display this calculation clearly, showing both the pre-tax amount and the total tax value. This will allow clients to see how the tax was applied to their bill.

Section What to Include Subtotal List the total amount for all items or services before taxes. Tax Rate Clearly state the tax rate applied (e.g., 10%, 15%) and the applicable jurisdiction. Tax Amount Display the amount of tax calculated based on the subtotal and tax rate. Total Amount Due Include the subtotal plus the calculated tax to show the final amount owed by the client. By following these steps and ensuring clarity in your documents, you can avoid confusion and create a transparent, professional billing experience for your clients.

Why Accurate Invoices Are Important

Creating precise billing documents is crucial for maintaining a healthy cash flow and a professional relationship with your clients. Accuracy ensures that both parties understand the terms of the transaction, reducing the risk of misunderstandings or delays in payment. Clear and error-free documents not only help you get paid on time but also contribute to building trust and credibility with your clients.

Avoiding Payment Delays

One of the main reasons for late payments is discrepancies or errors in the payment request. If clients find mistakes in the charges, tax calculations, or totals, they may hesitate to make the payment until they receive a corrected version. This back-and-forth can delay cash flow and strain client relationships. Ensuring your documents are accurate from the start minimizes these delays.

Legal and Financial Protection

Accurate billing documents also protect both you and your clients legally. If there’s ever a dispute regarding payment terms, the details outlined in your documents can serve as evidence in clarifying the terms of the agreement. Clear records help ensure that both parties meet their obligations, reducing the chance of legal issues or conflicts.

By taking the time to ensure accuracy in your billing documents, you contribute to smoother business operations, enhanced client satisfaction, and better financial management.

Tips for Efficient Invoice Management

Managing payment requests efficiently is key to ensuring that your business operations run smoothly and that you receive timely compensation. A well-organized approach to billing not only saves time but also reduces the chances of errors and late payments. Here are some tips to help you streamline the process and stay on top of your financial tasks.

- Automate Where Possible: Use software or tools that automate calculations, send reminders, and track outstanding payments. This will save you from having to manually handle repetitive tasks.

- Set Clear Payment Terms: Always include payment deadlines, acceptable payment methods, and any late fees upfront. This helps prevent confusion and sets clear expectations for clients.

- Organize Your Records: Keep detailed and organized records of all billing documents. Use folders, spreadsheets, or digital accounting software to track each document’s status–whether paid, pending, or overdue.

- Follow Up on Overdue Payments: Don’t wait too long to follow up on unpaid requests. Sending polite reminders within a few days of the due date can help keep your cash flow steady.

- Standardize Your Documents: Use a consistent layout and structure for all your payment requests. This makes it easier to spot errors and speeds up the process of creating new documents.

By incorporating these practices into your routine, you can reduce stress, avoid mistakes, and ensure a more efficient and effective billing process for your business.

How to Track Payments Using Templates

Tracking payments effectively is crucial for maintaining financial stability and ensuring you are paid on time. By using structured billing documents, you can easily monitor the status of each payment and keep a clear record of outstanding balances. Here’s how you can use these documents to track and manage payments efficiently.

Key Steps to Track Payments

- Assign Unique Reference Numbers: For each transaction, ensure that every billing document has a unique reference number. This makes it easier to match payments to specific requests and reduces the risk of confusion.

- Include Payment Status Fields: Add a section where you can mark whether a payment has been made, is pending, or is overdue. This allows you to quickly identify outstanding payments.

- Set Clear Due Dates: Always include payment due dates. This helps you monitor when payments are due and ensures timely follow-ups for overdue payments.

- Record Payment Details: Make a habit of documenting any partial or full payments. Include the amount paid, the payment method, and the date of payment directly on the billing document for easy reference.

- Use Payment Tracking Software: Combine manual tracking with digital tools or software that allows you to track payments automatically. Many software options allow you to input payment details and track overdue amounts in real-time.

Using Templates to Simplify Tracking

By utilizing organized documents that incorporate these features, you can reduce errors and avoid missing payments. The structure of these documents helps keep payment details transparent, enabling you to stay on top of your financials and maintain good client relationships.

Legal Considerations for Professional Invoices

When creating billing documents, it’s important to understand the legal requirements that ensure your records are both compliant and enforceable. Certain elements need to be included to make your documents valid, and failure to meet these legal standards could result in disputes, delayed payments, or even legal action. Below are key considerations to keep in mind when preparing your payment requests.

Key Legal Elements to Include

- Accurate Business Information: Always include your business name, address, and contact information. Depending on your country or region, you may also need to list your tax identification number (TIN) or business registration details.

- Client Information: Make sure the recipient’s full name or business name, address, and contact details are listed. This ensures that the document is legally directed to the correct party.

- Clear Payment Terms: Specify the terms of payment, including the due date and any late fees or penalties for overdue payments. This establishes clear expectations and protects you legally in case of delays.

- Tax Compliance: If applicable, include the tax rate and amount that is being charged. This helps you comply with local tax laws and provides clear details for your clients, reducing the risk of disputes.

- Unique Reference Number: Assign a unique identifier to each document. This is essential for tracking and ensuring that all parties can reference the document properly in case of a dispute.

Important Considerations for International Transactions

If you are working with clients in other countries, you may need to account for specific international laws, such as:

- Currency: Clearly state the currency in which the payment should be made, especially for international transactions.

- Cross-Border Taxes: Make sure to factor in any cross-border tax obligations, such as VAT or GST, depending on your location and that of your client.

- Language and Legal Jurisdiction: Specify the language of the document and the legal jurisdiction that will govern any disputes. This is particularly important for international agreements.

By adhering to these legal considerations, you ensure that your documents not only serve as a professional and transparent request for payment but also protect your rights and minimize potential legal issues.