Free Production Invoice Template for Easy Billing

Managing payments efficiently is essential for any business. Having a reliable and clear system for documenting transactions can save you time and prevent errors. Utilizing pre-designed documents ensures that each payment request follows a consistent structure, making it easier to track and manage. This method simplifies your workflow and keeps all necessary information organized in one place.

By choosing to use these pre-made billing forms, you can eliminate the need for manual creation each time you issue a request. The ready-made formats are designed to meet industry standards, helping you avoid costly mistakes and reduce administrative work. Whether you’re handling one-time clients or ongoing projects, having access to these well-structured documents offers significant advantages in terms of efficiency and professionalism.

With the availability of such resources at no cost, it’s possible for any business–small or large–to streamline their billing procedures without additional expenses. These tools are not only cost-effective but also highly customizable, allowing you to tailor them to your specific needs. In the following sections, we’ll explore how to make the most of these forms and how they can improve your day-to-day operations.

Free Production Invoice Template Overview

Having a standardized form to manage billing and payment requests is crucial for maintaining organization and professionalism in any business. A ready-to-use document can simplify the process by providing a clear structure for recording transaction details, ensuring consistency across all client interactions. These pre-designed forms help eliminate confusion and streamline your workflow, saving both time and effort.

These ready-made solutions are designed to meet industry standards while being customizable to suit specific business needs. By using such forms, businesses can ensure that every essential piece of information–such as service descriptions, payment terms, and contact details–is included, reducing the chances of errors and omissions. It also provides a clear record that both parties can refer to, enhancing transparency and trust in business relationships.

Advantages of Using Pre-Made Billing Documents

One of the key benefits of utilizing pre-built forms is the reduction in manual entry, which cuts down on administrative overhead. Instead of spending time designing a document from scratch, businesses can quickly generate a request by simply filling in the relevant details. This not only speeds up the process but also minimizes the chances of making mistakes in formatting or content. Additionally, having access to a uniform format makes it easier for both the sender and the recipient to understand and process the document.

Customization and Flexibility

While these ready-made forms offer a solid foundation, they also allow room for customization. Companies can modify certain sections to reflect their unique services, branding, or specific client needs. The flexibility to adjust the format makes these documents adaptable to various industries, whether you are a freelancer, a small business owner, or part of a larger enterprise. With a few simple changes, you can ensure that the document accurately represents your brand and meets your business requirements.

Why Use a Free Template for Invoices

Using a ready-made document to handle financial transactions brings significant advantages to any business, especially when time and accuracy are critical. These pre-designed forms provide an efficient solution by offering a consistent structure, ensuring all the necessary details are included without requiring manual setup. This can lead to quicker processing and fewer mistakes, helping you maintain smooth operations.

Another important benefit is cost-effectiveness. By utilizing no-cost resources, businesses avoid spending on expensive software or design services. This is particularly valuable for small companies or freelancers who need a professional solution but have limited budgets. These accessible tools ensure that everyone, regardless of their financial situation, can maintain a high level of professionalism in their business transactions.

Furthermore, using pre-structured forms saves valuable time. Rather than drafting documents from scratch or worrying about missing important sections, you can focus on other areas of your business. The simplicity and ease of filling out these forms allow you to quickly move through administrative tasks, reducing the overall workload and giving you more time to dedicate to your core business activities.

Benefits of a Professional Invoice Format

Using a polished and well-organized document for billing purposes provides several advantages for both businesses and clients. A professional design ensures that all relevant information is clearly presented, reducing confusion and improving communication. It demonstrates attention to detail and a commitment to quality, which can help build trust and credibility with your clients.

One of the key benefits of a structured format is its ability to make transactions more transparent. With clearly defined sections for payment terms, amounts, and deadlines, both parties have a clear understanding of the financial agreement. This transparency reduces the likelihood of disputes or misunderstandings and makes the payment process more straightforward.

Additionally, a professional layout helps businesses stand out in a competitive market. A clean, modern appearance reflects a level of professionalism that can positively influence client perceptions. When clients receive a well-organized document, they are more likely to view the business as reliable and trustworthy, which can encourage repeat business and referrals.

How to Customize a Production Invoice

Personalizing your billing documents allows you to create a more tailored and professional experience for your clients. Customization ensures that all relevant information reflects your brand and specific service offerings, making each financial request distinct and easily recognizable. Adjusting the format can help highlight important details, such as payment terms, due dates, and itemized services or products.

Adjusting Key Details

The first step in customizing your billing document is to modify key sections to align with your business needs. You can include your business logo, contact information, and any specific terms that apply to your transactions. Ensuring that all these elements are clear and accurate will make your document more professional and help clients easily identify your brand.

Using Tables to Organize Information

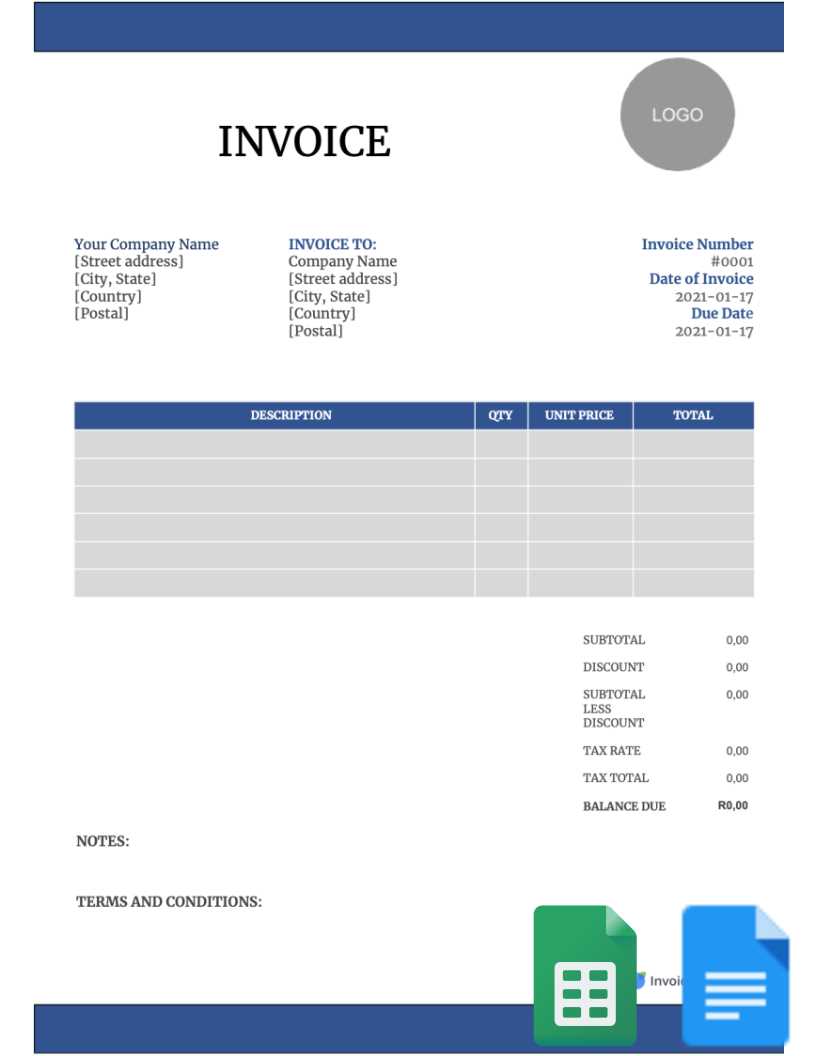

Using tables within the document is an effective way to organize itemized details such as products, quantities, prices, and total costs. This not only helps you keep track of each component but also makes it easier for your clients to understand what they are being charged for. Below is an example of how to structure the information in a table:

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Item 1 | 2 | $50 | $100 |

| Item 2 | 1 | $150 | $150 |

| Total | $250 |

By including such tables, you can create clear, itemized statements that help clients review and understand their charges quickly. Adjusting the format to meet your specific needs and providing clear information will increase the professionalism of your business.

Key Elements of a Production Invoice

In order to create a clear and effective document for business transactions, it is essential to include certain vital components. These elements ensure that the details are organized, understood, and legally binding for both parties involved. Proper structuring can help avoid confusion and ensure prompt payments or processing of goods and services.

Basic Information

The first part of any business document involves basic identification details. This includes the names, addresses, and contact information of both the sender and the recipient. These must be clearly listed to avoid any mix-ups, especially in cases where items or services are shipped or delivered. Including the date of issue is also crucial for tracking the timeline of the transaction.

Details of Items or Services

Another critical aspect is a clear breakdown of what is being exchanged. For goods, this may include descriptions, quantities, unit prices, and total amounts. For services, it could involve detailed descriptions of the work completed along with the rates applied. Accurate and specific information helps both parties understand the scope of the agreement and aids in verification when needed. A summary of charges and any applicable discounts or taxes should be noted as well.

Where to Find Free Invoice Templates

Finding the right document for business transactions doesn’t have to be expensive. There are many resources available online where you can access customizable documents to suit your specific needs. Whether you’re looking for simple formats or more detailed ones, numerous platforms offer easy access to these resources at no cost.

Online Platforms

Several websites provide a wide range of editable documents. These platforms often have user-friendly interfaces, allowing you to download and personalize the content quickly. Some sites even allow users to create and save documents directly within their accounts, offering the flexibility to access them anytime.

Office Software Suites

If you already use productivity software such as Microsoft Office or Google Workspace, you can find document structures within their built-in libraries. These programs typically offer a variety of options that can be downloaded or created on the spot, which you can then modify to fit your specific transaction details.

Choosing the Right Invoice Template for Your Business

Selecting the right document format for your business transactions is essential for maintaining professionalism and clarity. The structure you choose should reflect the nature of your operations and help ensure smooth communication with your clients. It’s important to consider several factors when picking the appropriate layout to meet both functional and aesthetic needs.

Factors to Consider

- Business Type: Choose a layout that aligns with your industry. For example, service-based businesses may require more detailed descriptions, while product-based businesses might focus more on item quantities and pricing.

- Complexity: Decide whether you need a simple or more detailed format. A straightforward document may suffice for smaller transactions, while larger or more complex sales could benefit from a layout that includes sections for terms, discounts, or taxes.

- Branding: The design should reflect your brand identity. Consider using colors, fonts, and logos that match your business style to maintain consistency with other customer-facing materials.

- Customization: Look for a structure that is easy to personalize with your company’s details, client information, and transaction specifics.

Where to Find the Best Options

- Online Platforms: Many websites offer customizable options suitable for different industries, allowing you to download and tailor the design to your needs.

- Office Suites: Productivity software often includes pre-designed options that can be modified for your business purposes.

- Accounting Software: If you use accounting software, many provide built-in features that automatically generate and customize these documents for you.

How to Edit a Production Invoice Template

Customizing a document for business transactions is a simple yet essential process. Adjusting the details allows you to tailor the format to match your company’s specific requirements. Whether you’re adding new information or modifying existing content, making changes is straightforward and helps ensure the document meets your needs.

Step 1: Choose the Right Software

To start, select an appropriate tool for editing. You can use word processing software such as Microsoft Word, Google Docs, or even spreadsheet applications like Microsoft Excel or Google Sheets. These programs provide all the necessary features to adjust text, layout, and design with ease.

Step 2: Personalize the Content

Once you’ve chosen your editing software, begin by entering your company’s details, such as name, address, and contact information. After that, input the relevant client details, including their name, address, and the agreed-upon terms. Pay attention to these key sections:

- Item or Service Descriptions: Provide accurate descriptions of the items or services being exchanged.

- Pricing Information: Include the cost for each item or service, as well as any discounts, taxes, or additional charges.

- Payment Terms: Clearly specify the payment deadlines and any late fees or penalties that may apply.

Step 3: Format for Clarity

Ensure that the layout is easy to follow. Use clear headings and sections to separate the different elements of the document. You can also adjust fonts, colors, and borders to improve readability, but be sure not to overwhelm the reader with too much detail. Keep it clean and professional.

Step 4: Save and Use the Document

Once your document is edited and formatted to your liking, save it in a suitable file format, such as PDF, to ensure it maintains its structure when shared. This also guarantees that no accidental edits will occur once the document is sent to the recipient.

Common Mistakes to Avoid in Invoices

When preparing documents for transactions, accuracy and clarity are key. Small errors can lead to confusion, delayed payments, or even legal issues. It’s important to avoid certain common mistakes that can affect the effectiveness of these records and your professional reputation.

Incorrect or Missing Details

- Incomplete Contact Information: Always ensure that both your and your client’s contact details are accurate and complete. Missing phone numbers, emails, or addresses can cause delays or misunderstandings.

- Missing Date and Number: Never forget to include the date of issue and a unique reference number. These are essential for tracking and organizing records.

- Incorrect Payment Terms: Clearly state the due date and any payment terms. Failure to specify these can lead to confusion over when payment is expected.

Calculation Errors

- Math Mistakes: Double-check all figures, including unit prices, totals, and taxes. Even a small mistake can lead to a financial discrepancy that may cause disputes.

- Omitting Discounts or Charges: If applicable, ensure any discounts or extra charges are clearly stated and correctly calculated. Missing these can result in the recipient underpaying.

Design and Layout Issues

- Poor Readability: Avoid cluttered designs. Make sure the document is easy to read by using clear fonts, adequate spacing, and logical organization.

- Unprofessional Appearance: Choose a simple, professional design that reflects your business image. Overly elaborate or unorganized layouts can undermine your professionalism.

How to Save Time with Templates

Using pre-designed formats for business documents can significantly reduce the time spent on routine tasks. By eliminating the need to start from scratch each time, you can streamline your workflow and focus on more important aspects of your work. With customizable structures, you can quickly adjust the details for each transaction without compromising accuracy or professionalism.

One of the biggest advantages of using pre-made structures is consistency. You can maintain the same format for all your records, ensuring that each document looks professional and is easy to read. This consistency also helps avoid mistakes, as the layout and fields are already set up, reducing the chances of missing important information.

Another time-saving benefit is the ability to quickly update and reuse your documents. Once you have a basic structure, you can simply replace the specific details (such as client information or transaction data) and save it as a new file. This eliminates the need to manually design each document from scratch, saving you valuable time in the long run.

Best Practices for Creating Accurate Invoices

Ensuring accuracy in your business documents is crucial for maintaining professionalism and avoiding misunderstandings. By following best practices, you can create clear, detailed, and error-free records that reflect the terms of the transaction and help ensure timely payment. A well-structured document not only improves communication but also enhances your business’s reputation.

Key Elements to Include

When preparing your document, it’s essential to include certain elements that will make it both complete and easy to understand. Here’s a quick guide to the key components:

| Element | Description |

|---|---|

| Contact Information | Always include accurate details for both your business and the recipient, including names, addresses, and phone numbers. |

| Date and Reference Number | Assign a unique reference number and include the date of the document for easy tracking and future reference. |

| Itemized List | Provide a clear description of the items or services provided, with quantities, unit prices, and totals for each line. |

| Payment Terms | Clearly state the due date, payment methods, and any applicable terms such as discounts or late fees. |

| Total Amount | Ensure that the total amount due is clearly marked and includes all taxes, discounts, and additional fees. |

Tips for Accuracy

- Double-Check All Calculations: Always review your figures to ensure that all totals and subtotals are correct.

- Use Consistent Formatting: Consistency in layout, fonts, and spacing ensures that the document is easy to read and professional.

- Proofread: Always proofread your document before sending it to catch any typos or missing information.

- Set Clear Payment Instructions: Provide clear and concise instructions on how the recipient should make the payment to avoid delays.

Why Templates Improve Invoice Accuracy

Utilizing a pre-structured format for business documents significantly enhances their precision. By using a consistent layout, you reduce the risk of making errors that can occur when creating these records from scratch. Templates provide a solid foundation, ensuring that no critical details are missed and that everything is organized in a clear and logical manner.

How Pre-Designed Structures Help

- Consistency: Templates ensure uniformity across all documents, so every detail is presented in the same format, reducing the chance of forgetting key information.

- Reduced Risk of Omission: With predefined sections for all necessary information, it becomes less likely that important details, like tax rates or payment terms, will be overlooked.

- Faster Processing: Since the format is already established, creating new documents becomes a quicker task, allowing you to focus more on accuracy than on formatting.

Benefits of Structured Layouts

- Clarity: A well-organized format makes it easier for both parties to understand the document, leading to fewer misunderstandings or disputes.

- Fewer Calculation Errors: Pre-designed sections for totals, taxes, and discounts help ensure that all numbers are calculated and displayed correctly, reducing the likelihood of mistakes.

- Professionalism: A clean, consistent layout not only boosts accuracy but also projects a professional image to clients, fostering trust and confidence in your business.

How to Keep Track of Your Invoices

Effective management of your business documents is essential for maintaining financial clarity and ensuring timely payments. By keeping accurate records of all transactions, you can quickly reference past exchanges, track due payments, and avoid confusion. Staying organized with your documentation helps reduce administrative errors and enhances overall workflow.

Methods for Tracking Transactions

- Use a Spreadsheet: Organize your records in a spreadsheet application, such as Microsoft Excel or Google Sheets. Include columns for client names, transaction amounts, due dates, and payment status. This allows you to monitor the status of all transactions in one place.

- Utilize Accounting Software: Many accounting tools come with built-in features that automatically track and categorize each transaction. This software can also generate reports, helping you stay on top of outstanding payments and tax liabilities.

- Create a Filing System: If you prefer physical documentation, create a filing system that organizes records by client, date, or status. Make sure each file is easily accessible and well-labeled for quick retrieval.

Tips for Maintaining Accurate Records

- Label Everything: Use unique reference numbers or codes for each document to make searching and sorting easier. This helps avoid confusion if multiple documents are issued for the same client.

- Set Regular Reminders: Schedule reminders for payment due dates to ensure you follow up promptly on overdue transactions.

- Keep Copies of All Documents: Whether digital or physical, always keep a backup copy of each document. This serves as a safety net in case of disputes or data loss.

Tips for Organizing Your Production Invoices

Proper organization of business documents is crucial for efficiency and financial transparency. When you keep your records well-structured, it’s easier to track payments, manage taxes, and maintain a professional image. Implementing a solid system ensures you never lose track of a transaction and helps streamline your overall workflow.

Effective Ways to Categorize Documents

- Group by Client: Organize your records based on clients or customers. This allows you to easily retrieve all documents related to a particular party, making follow-ups and audits much simpler.

- Sort by Date: Arrange documents chronologically to track when transactions were made. This helps with managing deadlines and ensuring timely payments.

- Use Project-Based Filing: For businesses with multiple ongoing projects, categorize your records according to specific projects. This helps keep everything related to a particular initiative in one place.

Tips for Digital Organization

- Cloud Storage: Store your records on a cloud service for easy access and backup. This ensures that your files are protected from data loss and can be accessed from any device.

- Label and Tag Files: Use clear, consistent file names and tagging systems to make searching for specific documents quicker. Include the client name, date, or transaction number in the file name for better organization.

- Regular Backups: Schedule regular backups of your digital records to avoid data loss due to system failures or other technical issues.

Using Templates for Consistent Billing

Maintaining a consistent approach in your business documents is essential for professionalism and efficiency. By using pre-designed formats, you ensure that every transaction is handled in the same structured way, minimizing errors and streamlining your administrative processes. This consistency also enhances your credibility and helps in building strong, trustworthy relationships with your clients.

Why Consistency Matters

- Professional Appearance: Consistency in design and structure helps create a polished and organized look, which reflects well on your business.

- Reduced Errors: Using a standard format ensures that no key information is left out, making your records more accurate and less prone to mistakes.

- Faster Processing: When every document follows the same layout, you can complete them quickly without needing to make adjustments every time.

Essential Components of a Consistent Format

To ensure your documents are both clear and professional, make sure to include the following key elements in a consistent format:

| Component | Description |

|---|---|

| Header | Include your company name, logo, and contact details at the top for easy identification. |

| Unique Reference Number | Ensure each document has a unique reference number for tracking purposes. |

| Client Information | Provide the recipient’s name, address, and contact details for clear communication. |

| Itemized List | Break down the products or services provided with clear descriptions, quantities, and pricing. |

| Total Amount | Always display the total amount due, including taxes, discounts, and any additional charges. |

How Free Templates Help Save Money

Utilizing pre-designed structures for business documents can significantly reduce operational costs. By eliminating the need for custom designs or hiring external professionals, you can focus your resources on other aspects of your business. These ready-to-use formats offer a cost-effective solution for maintaining accuracy and consistency in your records, without compromising on quality.

Ways Ready-Made Formats Reduce Expenses

- Eliminate Design Costs: Using an existing structure removes the need to pay for professional design services, saving both time and money.

- Minimize Errors: Pre-designed layouts ensure all necessary fields are included, reducing the risk of missing information, which could otherwise result in costly mistakes or follow-ups.

- Increase Efficiency: With a standardized format, you can quickly create documents, saving time on formatting and administrative tasks. This leads to increased productivity without the need for additional staff or resources.

Benefits for Small Businesses

- Affordable Solution: Ready-made documents are usually available at no cost, making them an ideal choice for small businesses looking to minimize overhead expenses.

- Scalability: As your business grows, using these formats allows you to easily scale operations without needing to invest in expensive software or custom-built systems.

- Consistency Across All Documents: Maintaining a uniform approach to all your business records helps reinforce professionalism, which can attract more clients without additional costs.

How to Integrate Invoice Templates with Software

Integrating pre-designed business document formats with software solutions can streamline your workflow, reduce manual tasks, and enhance overall efficiency. By automating the generation of these records, you save time and reduce the risk of errors, while ensuring consistency and accuracy across all transactions.

Steps for Successful Integration

- Choose Compatible Software: Ensure the software you’re using supports the import or customization of existing document layouts. Popular accounting or business management tools often offer built-in integrations for document customization.

- Import Your Document Layout: Many software solutions allow you to upload your pre-designed structure. Follow the software’s instructions to import your file, whether it’s a .docx, .xlsx, or PDF format.

- Customize Fields: Tailor the document fields in the software to match your business needs. This could include adjusting the layout, adding business-specific details, or integrating automated calculations for totals, taxes, and discounts.

Benefits of Integration

- Efficiency Boost: Once integrated, the software can automatically populate the document with client information and transaction details, reducing the need for manual input and speeding up the process.

- Consistency: The integration ensures that each document follows the same layout, improving accuracy and maintaining a professional appearance across all records.

- Seamless Record Keeping: With integration, your documents are stored digitally within the software, making it easy to retrieve, track, and manage transactions over time.

Understanding Legal Requirements for Invoices

Every business needs to ensure that its financial documents comply with local laws and industry regulations. Proper documentation is essential for maintaining transparency, avoiding legal disputes, and ensuring tax compliance. There are specific details that must be included in each record to meet legal standards and avoid issues during audits or financial reviews.

Essential Information to Include

- Unique Identification Number: Every document should have a unique number for tracking purposes, ensuring that each transaction can be individually identified and referenced.

- Business Information: It is crucial to include your company name, address, contact details, and tax identification number to meet legal reporting standards.

- Recipient Information: The recipient’s name, address, and contact details must be listed clearly, as this identifies the party responsible for payment.

- Clear Breakdown of Products or Services: A detailed list of the products or services provided, along with quantities, prices, and any applicable discounts or taxes, is required for tax and legal purposes.

- Total Amount Due: The final amount owed, including taxes, discounts, and any additional charges, must be clearly stated to avoid confusion and ensure the amount is accurate.

- Date of Transaction: The date on which the goods or services were provided, as well as the date the document was issued, is necessary for legal tracking.

Tax and Legal Compliance

In addition to the basic information, certain tax laws and local regulations may require additional details on your documents, such as tax rates or exemption numbers. It’s essential to research the specific requirements in your jurisdiction and ensure that your records meet these standards to avoid potential fines or penalties.