Free T Shirt Invoice Template for Easy Customization and Billing

For any business involved in creating and selling custom clothing, maintaining clear and organized financial records is crucial. Whether you’re running a small local shop or a larger online store, an efficient way to manage client payments and orders can save time and prevent costly errors. By using well-structured billing documents, you can ensure smooth transactions and build trust with your customers.

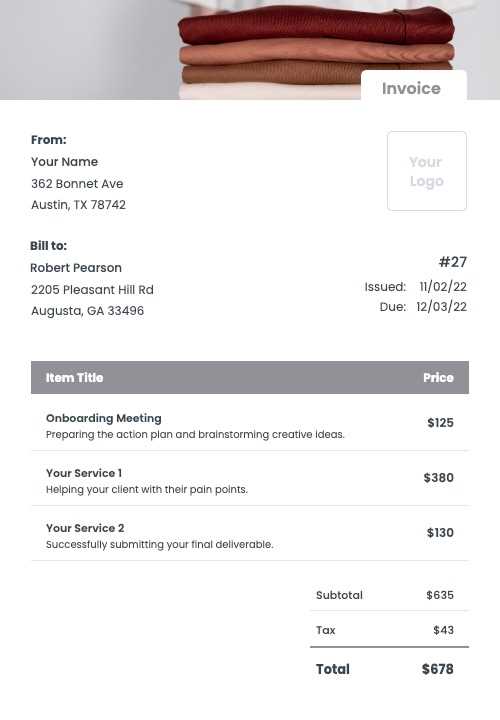

Customizable documents are a great tool for simplifying this process. These documents can be easily modified to suit your specific needs, whether you are dealing with one-time clients or repeat orders. With the right structure, you can capture all necessary details, including design specifics, prices, and payment terms, all in a professional format.

In this article, we will explore how you can create or find a ready-made solution for managing orders and payments effectively. From understanding the components to customizing your documents, you’ll gain insight into how to stay organized and maintain professionalism throughout your business operations.

Understanding T Shirt Invoice Templates

When running a business that involves personalized clothing, it’s essential to have a streamlined system for recording sales and managing transactions. A well-organized document can serve as the foundation for efficient communication between you and your customers, detailing everything from the design order to the payment terms. These essential tools help maintain professionalism and transparency in every business interaction.

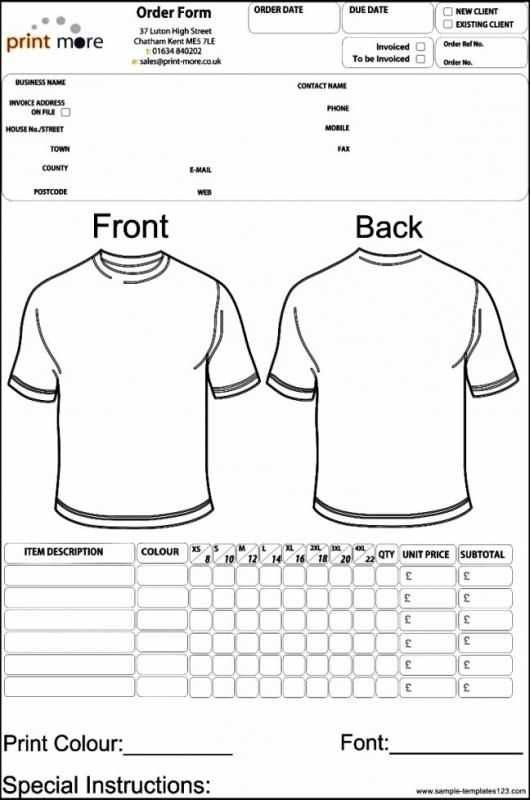

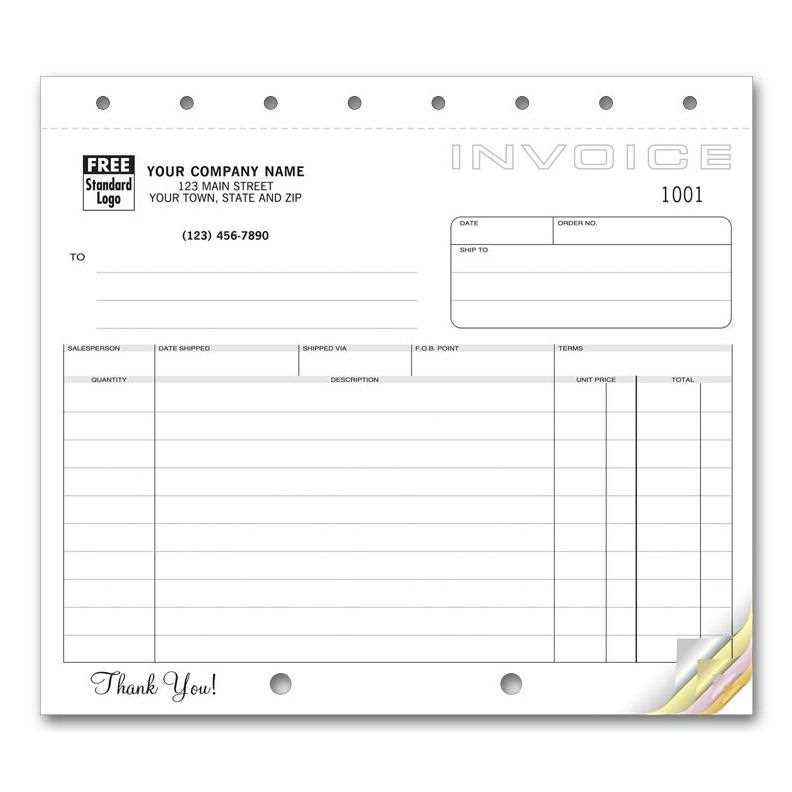

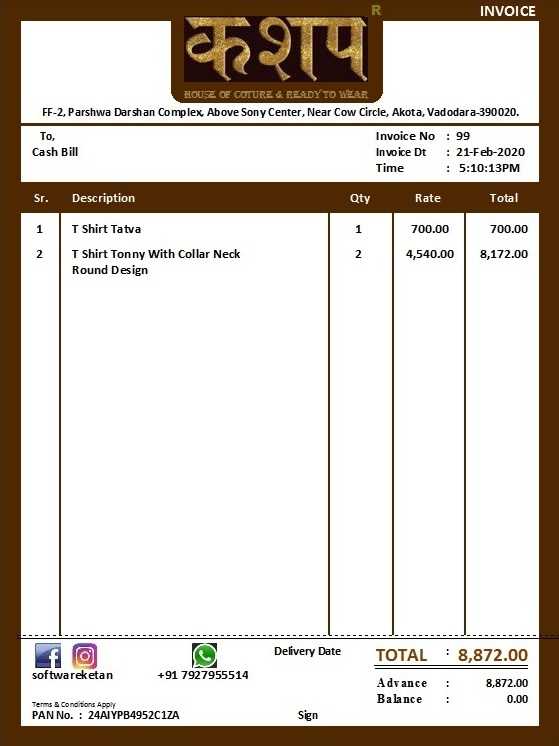

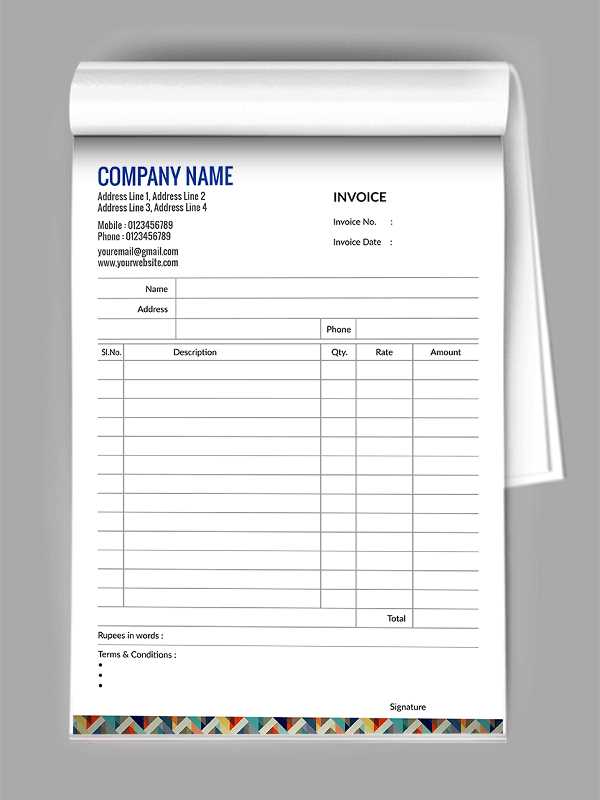

These documents typically include key information such as client details, item descriptions, quantities, pricing, and payment terms. They also often feature a section for any additional notes or customizations that clients might request. By having a standard format for these records, you ensure that nothing important is overlooked during the transaction process.

Using pre-made formats or creating your own can significantly improve your workflow. A flexible document allows you to quickly input the necessary data and make modifications based on the specific order. This approach not only saves time but also ensures consistency across all your transactions.

What is a T Shirt Invoice Template?

A professional document designed for tracking orders and payments is an essential part of any custom apparel business. It serves as an official record that details the products sold, the prices agreed upon, and the payment status. This type of record helps ensure clarity between the seller and the customer, reducing the risk of misunderstandings.

Such documents usually follow a set structure that can be easily adapted to different transactions. The key benefit of using a pre-designed format is the ability to quickly and consistently record all necessary details without the need to create a new layout from scratch each time.

Key Features of a Billing Document

- Customer Information: Includes the buyer’s name, contact details, and shipping address.

- Order Details: Lists the products, quantities, and any customizations requested by the customer.

- Pricing Information: Clearly shows the price per item, any discounts applied, and the total amount due.

- Payment Terms: Outlines the due date, payment methods accepted, and any late fees or conditions.

- Company Information: Displays the seller’s business name, contact information, and sometimes a logo for branding.

Why Use a Pre-Designed Format?

Having a structured format for these records offers several advantages. It saves time by eliminating the need to create a new document from scratch for each order. It also ensures consistency across your transactions, which helps maintain a professional appearance and prevents important details from being missed.

Benefits of Using an Invoice Template

Utilizing a pre-designed document to manage transactions and payments offers numerous advantages for businesses, particularly in the custom apparel industry. By adopting a consistent and organized format, you can streamline your workflow, minimize errors, and enhance communication with customers. This simple yet effective tool saves time and helps maintain a professional image.

One of the primary benefits is efficiency. With a ready-made structure, you no longer need to start from scratch with each order. Instead, you can quickly input the necessary details, which speeds up the process and allows for more orders to be handled in less time. Additionally, it reduces the risk of missing crucial information, ensuring accuracy in every transaction.

Another advantage is consistency. Using the same layout for all your records ensures that every document looks polished and professional. This consistent approach helps build trust with clients, as they will appreciate the clear and organized presentation of their orders. It also makes it easier to compare and track past transactions, which can be useful for accounting and reporting purposes.

Furthermore, customizable formats allow you to tailor each document to your business’s specific needs. Whether it’s including unique product details or adjusting payment terms, having a flexible solution means you can adapt to different types of orders or customer requirements without creating a new document each time.

How to Create a T Shirt Invoice

Creating a detailed and professional document to manage customer orders and payments is essential for any custom apparel business. By following a clear structure and including all necessary information, you can ensure that transactions are recorded accurately and efficiently. Here is a simple step-by-step guide to help you craft your own order record.

Step 1: Collect Required Information

Before you start filling out your document, gather the following details:

- Customer Details: Name, contact information, and shipping address.

- Order Information: Descriptions of the products, quantities, and any custom requests.

- Pricing: Price per item, discounts, and the total cost.

- Payment Terms: Payment methods, due date, and any late fees or conditions.

- Your Business Information: Company name, address, phone number, and email.

Step 2: Format Your Document

Once you have all the details, begin organizing them into a professional format. You can either create a new document in a word processor or use an online service that provides a customizable structure. Make sure to include the following sections:

- Header: Your business name, logo (if applicable), and contact details.

- Client Information: Include the customer’s name, address, and contact details.

- Order Summary: List all items purchased, including quantities and custom details, if any.

- Pricing Breakdown: Show individual prices, any applicable discounts, and the total amount due.

- Payment Instructions: Provide payment methods, due date, and any late fee terms.

- Footer: Include any additional notes, your company’s terms and conditions, and legal disclaimers if necessary.

By following these steps, you can create a clear and professional record for each order, making it easier to manage your transactions and ensuring that both you and your customers are on the same page.

Essential Information for T Shirt Invoices

When creating a document to track transactions and payments for custom apparel, it’s crucial to include all the necessary details to ensure clarity and prevent confusion. A well-structured record helps both you and your customer understand the terms of the sale, making it easier to resolve any potential issues. Below are the key elements that must be included in any transaction document.

Key Details to Include

- Business Information: Your company name, address, phone number, and email should always be included. This makes it easy for clients to contact you if needed.

- Client Information: Always include the customer’s name, contact details, and shipping address, ensuring that the order can be delivered to the correct location.

- Order Description: List the items ordered with clear descriptions, including quantities and any customizations or special requests made by the customer.

- Pricing Breakdown: Provide detailed pricing for each item, including unit costs, any discounts applied, and the total cost before and after tax.

- Payment Terms: Specify when the payment is due, accepted payment methods, and any late fees or penalties that might apply if the payment is delayed.

Additional Considerations

- Order Number: Assign a unique order number for easy reference and record-keeping.

- Dates: Include both the date of order and the due date for payment to avoid any confusion about deadlines.

- Legal Disclaimers: Depending on your business, you might need to include terms and conditions, warranty information, or return policies to ensure both parties are aware of their rights and obligations.

By including these essential components, you can create a clear, professional, and organized document for each transaction, which will ultimately improve customer satisfaction and help keep your records in order.

Customizing Your Invoice Template

Personalizing your transaction records is a great way to make your business stand out and ensure that each document meets your unique needs. Customization allows you to reflect your brand’s identity while providing all necessary details in a clear and professional manner. Whether you’re designing a new layout or modifying an existing one, tailoring your documents can help streamline your workflow and enhance the customer experience.

Branding and Design Elements

One of the first steps in customization is incorporating your brand’s logo, colors, and fonts. These elements not only make your documents look more professional but also reinforce brand recognition. By using a consistent design, you help create a cohesive customer experience across all communication channels.

- Logo: Place your company logo at the top to ensure it’s the first thing customers see.

- Colors: Use brand colors in headings, borders, or accents to create a unified look.

- Font: Choose a clear, readable font that matches your brand’s style while maintaining professionalism.

Personalizing Content

Customization isn’t just about design. You can also adjust the content based on your business model and customer needs. Whether you sell single items or handle bulk orders, your document should be flexible enough to accommodate various types of transactions.

- Custom Fields: Add fields for special instructions, product customization, or additional charges such as shipping.

- Payment Terms: Adjust payment terms to reflect your business practices, such as deposits, discounts for early payments, or specific due dates.

- Notes or Terms: Include sections for return policies, warranties, or any other important information that ensures clarity for both parties.

By taking the time to personalize your documents, you enhance the professional image of your business while also making it easier to manage orders and payments.

Choosing the Right Invoice Format

Selecting the correct structure for your transaction records is essential for streamlining your business operations. The right format not only ensures that all the necessary details are included but also impacts the overall clarity and professionalism of your communications with customers. Whether you’re handling individual orders or large-scale sales, choosing the right format will help you maintain consistency and efficiency.

Considerations When Choosing a Format

Different types of businesses have different needs, and your record format should reflect that. Below are some key factors to consider when selecting the structure for your documents:

- Business Size: A smaller operation may require a simpler, more basic structure, while larger businesses may need more detailed layouts with additional sections for tracking bulk orders, taxes, and payment schedules.

- Customization Needs: If your business regularly works with custom orders, a format that allows for flexibility in terms of product descriptions and special requests is essential.

- Client Type: The needs of individual customers may differ from corporate clients, so you may need a more complex layout for business-to-business transactions, incorporating purchase orders and terms of service.

- Payment Methods: Your chosen format should clearly outline accepted payment methods, whether it’s through credit cards, bank transfers, or digital platforms. Make sure there’s room for payment instructions and relevant details.

Types of Formats to Consider

There are several types of record structures to choose from, each catering to different business needs. Here are some common options:

- Basic Format: Ideal for small businesses with simple orders. Includes essential details such as item description, pricing, and payment terms.

- Detailed Format: Best for businesses dealing with large or complex transactions. Includes sections for product details, taxes, shipping, and customer-specific terms.

- Automated Format: For businesses looking to save time. This format integrates with accounting software and can generate records automatically, reducing the need for manual entry.

Choosing the appropriate format ensures that your business remains organized and your customers have a clear understanding of the transaction details. Whether you opt for a simple or detailed structure, it’s important that the format aligns with both your business operations and your clients’ expectations.

Free T Shirt Invoice Templates Online

Finding customizable, free resources to manage orders and payments can significantly reduce the time spent on administrative tasks. Many online platforms offer downloadable formats that you can easily modify to suit your business needs. These resources are particularly valuable for entrepreneurs and small businesses looking to streamline their operations without investing in expensive software or hiring additional staff.

By using online resources, you gain access to professionally designed documents that help you maintain a clear, consistent, and organized billing system. Most of these documents are easy to edit, allowing you to personalize the content with your branding, product details, and specific payment terms.

Benefits of Free Resources

- Cost-Effective: Accessing free templates means you don’t have to invest in expensive software or hire a designer to create a custom document.

- Easy to Customize: Most free resources are designed to be user-friendly, allowing you to quickly modify fields such as client names, product descriptions, prices, and terms of payment.

- Time-Saving: With pre-made formats, you can save time by simply filling in the details rather than creating a new document from scratch for each transaction.

- Professional Appearance: These templates often have clean, professional designs that enhance your brand image and ensure that your records look organized and legitimate.

Where to Find Free Resources

There are numerous websites offering free, customizable formats for managing customer orders. Here are a few places to consider:

- Template Websites: Sites like Canva, Microsoft Office, and Google Docs provide free, editable options that can be customized to suit your business needs.

- Accounting Platforms: Some online accounting tools, such as Wave or FreshBooks, offer free billing document templates as part of their service.

- Online Communities: Platforms like Etsy or independent bloggers often offer free resources as part of business guides or marketing materials.

By using these free, readily available formats, you can efficiently manage orders and payments while maintaining a professional approach in your business dealings.

How to Add Design Details to Invoices

Incorporating design elements into your order records not only makes them visually appealing but also reinforces your brand identity. Customizing the design ensures that your documents stand out while providing all the necessary information in a clear and professional manner. Adding design details like logos, colors, and fonts can make your business appear more polished and cohesive.

Using Visual Elements to Enhance Your Documents

To create a document that reflects your brand and catches your customer’s eye, consider integrating the following visual elements:

- Logo: Position your logo prominently at the top of the page to ensure it’s visible. This helps with brand recognition and gives your documents a professional look.

- Brand Colors: Incorporating your company’s colors into headings, borders, or backgrounds will add personality and a cohesive feel to your business materials.

- Fonts: Choose readable fonts that align with your brand’s style. Use a consistent typeface for headings and body text to ensure readability and professionalism.

- Imagery or Icons: Adding relevant images, such as product icons or design elements, can break up the text and make your document more engaging.

Practical Tips for Customization

When adding design details to your documents, keep functionality in mind. The goal is to balance visual appeal with clarity and ease of use. Here are a few practical tips:

- Keep it Simple: Avoid overloading the document with too many design elements. Focus on a clean, easy-to-read layout with enough white space to make the content stand out.

- Align with Your Branding: Ensure that the design choices you make reflect your business’s personality and style, from color schemes to the tone of any written content.

- Consistency: Use the same design elements across all business documents to establish a recognizable and professional brand identity.

By carefully integrating design elements, you can create a memorable and professional experience for your customers while maintaining clear and organized records for your business.

Tracking Orders with Invoice Templates

Managing customer orders and tracking payments efficiently is essential for any business, particularly in industries that involve custom products. A well-organized order record helps you stay on top of each transaction, ensuring that no details are overlooked and that every step of the process is clearly documented. By using a structured format, you can easily track the progress of each sale, from initial order placement to final payment.

Benefits of Tracking with Structured Records

Using a detailed, pre-designed structure for managing orders provides several key advantages:

- Order Organization: Each transaction is clearly recorded, making it easy to reference specific details like customer information, products ordered, and payment status.

- Payment Monitoring: You can track which payments have been received and which are still pending, ensuring that you follow up with customers if necessary.

- Inventory Management: By maintaining an organized record, it’s easier to track product quantities and ensure you don’t run out of stock or over-commit to customers.

- Time Efficiency: Using a pre-made structure saves time, allowing you to focus on fulfilling orders and managing your business rather than recreating records for each new transaction.

How to Use a Structured Format for Tracking

Here’s how to effectively track orders with a structured format:

- Assign Unique Order Numbers: Each transaction should have a unique identifier for easy reference. This makes it simple to track and locate specific orders when needed.

- Update Payment Status: As payments are received, be sure to update the record accordingly. This helps you keep an accurate record of income and ensures you don’t overlook unpaid orders.

- Include Delivery Information: Record the shipment details, including shipping address, courier, and tracking number, to easily track the status of each order during fulfillment.

By maintaining an organized and consistent record for each transaction, you’ll be able to efficiently track orders and ensure smooth, reliable customer service. This streamlined approach not only helps you stay organized but also improves communication and builds trust with your clients.

Managing Payments with Invoice Templates

Effectively managing payments is crucial for maintaining cash flow and ensuring that your business operates smoothly. By using a clear and structured format for documenting transactions, you can easily track what has been paid, what is due, and any outstanding balances. A well-organized record allows you to stay on top of your finances and helps you quickly address any payment-related issues with customers.

Tracking Payment Status

One of the most important aspects of managing payments is keeping accurate records of what has been paid and what remains outstanding. This allows you to monitor your business’s cash flow and follow up with customers as needed. Here’s how you can efficiently track payments:

- Clear Payment Terms: Clearly outline payment terms, including due dates and accepted payment methods, in your order records. This helps avoid confusion and sets expectations from the start.

- Payment Tracking: Record when payments are received, including the amount paid and the payment method used. This ensures you have an accurate record of incoming funds.

- Outstanding Balances: Keep track of any unpaid amounts and follow up with customers before the due date to ensure timely payment.

Managing Partial Payments and Discounts

For businesses that offer flexible payment plans or discounts, it’s important to track these variations accurately. A structured record can easily accommodate adjustments such as deposits, installment payments, or discounts, ensuring you maintain clarity in your financial management.

- Deposits and Installments: Record any initial deposits or installment payments separately from the final balance to avoid confusion.

- Discounts: If you offer discounts for early payments or bulk orders, clearly list them in your records to make sure both you and your customer have a clear understanding of the terms.

By using a consistent and organized approach to managing payments, you ensure that your financial records are accurate and that your customers are satisfied with the billing process. Clear tracking helps you avoid missed payments and disputes, improving the overall efficiency of your business operations.

Common Mistakes in T Shirt Invoices

Creating transaction records may seem straightforward, but there are several common mistakes that can lead to confusion, delays in payments, or even disputes with customers. Avoiding these errors is essential for maintaining professionalism and ensuring that your billing process runs smoothly. Whether it’s a missed detail, an unclear term, or an overlooked fee, each mistake can impact your relationship with clients and affect your business’s financial health.

Frequent Errors to Avoid

Here are some of the most common mistakes when creating transaction documents:

- Missing or Incorrect Contact Information: Failing to include correct contact details, such as your business address, phone number, or email, can cause confusion and make it difficult for clients to reach you if they have questions or concerns.

- Unclear Payment Terms: Not specifying payment due dates, late fees, or accepted methods of payment can lead to delays in payment or misunderstandings about when the payment is due.

- Omitting Shipping Information: When shipping is involved, it’s crucial to clearly outline shipping costs, delivery times, and tracking numbers. Missing this information can frustrate customers and delay order fulfillment.

- Incorrect or Missing Product Descriptions: Failure to provide clear descriptions of items, including quantities and customizations, can cause confusion and lead to disputes over what was ordered versus what was delivered.

- Inconsistent Pricing: Be sure to double-check that the prices listed for each item are accurate and consistent. Errors in pricing can lead to client dissatisfaction and potential loss of business.

- Failure to Include Taxes: Leaving out applicable sales tax or other fees can cause issues with local regulations and create confusion for the customer regarding the total amount due.

How to Avoid These Mistakes

To prevent these common errors, ensure that your transaction records include all necessary information and are reviewed thoroughly before sending them to clients. Here are some steps to avoid mistakes:

- Double-Check Details: Always review your customer’s contact information, order details, and pricing before finalizing the document.

- Clarify Payment Terms: Clearly outline payment deadlines, late fees, and available payment methods to ensure transparency.

- Update Records Regularly: Keep your pricing and tax rates up to date, especially if changes occur in your business or local regulations.

- Use Professional Software: Consider using accounting or billing software to help automate the process and reduce the risk of human error.

By being mindful of these common mistakes and taking steps to avoid them, you can ensure that your transaction records are accurate, professional, and clear, creating a positive experience for both you and your customers.

Improving Professionalism with Custom Invoices

Customizing your transaction records can significantly enhance your business’s professional image. Tailored documents reflect the unique identity of your brand and can help build trust with clients. By adding personalized design elements, clear branding, and organized details, you can improve both the visual appeal and functionality of your documents. This level of professionalism helps set your business apart and strengthens customer relationships.

Benefits of Customizing Your Transaction Records

Here are several reasons why creating personalized documents can improve the professionalism of your business:

- Brand Identity: Custom documents with your business logo, colors, and fonts create a cohesive brand experience for your clients, making your business look more established and reliable.

- Clear Communication: A tailored design allows you to present all necessary information in a structured and easily understandable way. This reduces confusion and ensures clients understand payment terms, product details, and due dates.

- Increased Trust: When customers receive a professionally formatted record, it gives the impression that you are organized and serious about your business, which fosters confidence in your services.

- Better Client Experience: Customizing transaction documents for your customers makes the process feel more personal and less generic, which enhances customer satisfaction.

How to Customize Your Transaction Records

To make your documents stand out and reflect your business’s professionalism, consider the following tips for customization:

- Add Your Logo: Include your logo at the top of the document to reinforce your brand identity and ensure it’s the first thing clients see.

- Use Brand Colors: Incorporate your company’s color scheme into headings, borders, and other design elements. This helps maintain a consistent visual identity across all communications.

- Include Clear Payment Instructions: Ensure that payment terms, deadlines, and methods are easy to find. Clearly state due dates, accepted payment methods, and any late fees.

- Organize Information: Use a clean, well-structured layout that separates key sections like client details, order items, and payment instructions. This makes it easy for clients to understand the document at a glance.

- Personalize for the Client: Adding a personal touch, such as addressing the client by name or referencing previous transactions, makes the document feel more tailored to the individual customer.

Customizing your transaction documents can go a long way in improving your business’s image. When clients receive a document that reflects your attention to detail and professional standards, they’re more likely to trust your business and feel confident in their purchase.

Why Templates Save Time and Effort

Using pre-designed documents for billing and order tracking can save significant time and effort in your daily operations. Rather than creating a new document from scratch each time, a ready-made structure allows you to quickly input relevant information and move on to the next task. This efficiency is crucial for small businesses or those with a high volume of orders, as it minimizes administrative workload and streamlines the billing process.

Key Reasons Templates Improve Efficiency

Here are several ways in which pre-made structures help businesses save both time and effort:

- Consistency: By using a standard format, you ensure that all of your records look professional and follow a consistent structure, making it easier for clients to understand the information.

- Quick Setup: Templates allow you to skip the repetitive task of designing a new document each time. With all the essential elements in place, you only need to fill in the specific details for each transaction.

- Reduced Errors: Using a predefined layout minimizes the chances of missing important details like customer information, payment terms, or item descriptions, as everything is already organized and ready for completion.

- Improved Productivity: The time saved by not having to create a document from scratch allows you to focus on other aspects of your business, such as product development or customer service.

- Customization Flexibility: Even though you’re using a pre-designed structure, templates can still be easily customized to fit your unique needs, ensuring they reflect your business’s branding and specific terms.

How Templates Save Time in Practice

In practice, here’s how templates help streamline your workflow:

- Automatic Calculations: Many templates include features like auto-calculation for totals, taxes, and discounts, which eliminates the need for manual math and reduces the risk of errors.

- Easy Updates: If you need to make changes to your pricing or terms, updating the template ensures consistency across all your records without having to modify each one individually.

- Ready-to-Use Design: Most templates come with a professional design that doesn’t require you to spend time on formatting or layout decisions, making the document ready to go as soon as you input the details.

By incorporating pre-designed documents into your workflow, you can not only save time but also ensure that your business operates more efficiently. This leaves you with more resources to focus on growth, customer engagement, and other vital areas of your business.

Best Practices for Sending Invoices

Sending clear and professional transaction records is essential for maintaining good relationships with your clients and ensuring timely payments. Following best practices for sending these documents helps avoid confusion, reduces the risk of errors, and sets clear expectations for both parties. By adhering to a few simple guidelines, you can streamline your billing process and enhance customer satisfaction.

Key Tips for Sending Transaction Documents

Here are some best practices to consider when sending out your billing records:

- Send Promptly: Always send your transaction records as soon as possible after the completion of the order or service. This helps clients stay organized and ensures that they have all necessary details to make timely payments.

- Use Professional Communication: When sending a billing document, accompany it with a clear and polite message. This reinforces your professionalism and provides clients with a context for the document, especially if it’s the first time you’re working with them.

- Verify Accuracy: Before sending the document, double-check that all details are correct, including customer information, products or services provided, and amounts owed. Sending an inaccurate document can cause delays and confusion.

- Choose the Right Delivery Method: Opt for a reliable and secure method of sending the document, whether it’s through email, a secure payment platform, or physical mail. Email is often the most convenient and immediate option, but always ensure that your documents are well-organized and professional-looking in any format.

- Set Clear Payment Terms: Ensure that payment terms–such as the due date, payment methods, and any late fees–are clearly outlined in the document. Ambiguity can lead to delays in payment and unnecessary follow-ups.

- Include a Call to Action: Encourage prompt payment by including a clear call to action, such as “Please pay by [due date]” or “Click here to pay online.” This makes it easy for the client to take the next step.

Following Up on Unpaid Records

Sometimes clients may forget to make a payment, or delays can occur. Having a system in place for following up is crucial:

- Set Up Reminders: Send gentle reminders a few days before the due date and a follow-up message if the payment is not received on time. Be polite and professional in your communication.

- Offer Multiple Payment Options: Make it easy for your clients to pay by offering various payment methods (credit card, bank transfer, digital wallets, etc.). The easier you make it for clients to pay, the more likely they will do so promptly.

- Maintain Pro

How to Automate Invoice Generation

Automating the creation of transaction records can save significant time and reduce human error in your billing process. By using software tools or integrated systems, you can streamline your workflow, ensuring that every order is tracked efficiently and that clients receive accurate records without the need for manual input. This not only saves time but also enhances professionalism, as it guarantees consistency across all your documents.

Steps to Automate Document Creation

Here are the key steps to setting up an automated system for generating your transaction documents:

- Choose the Right Software: Select a tool or platform that aligns with your business needs. Many accounting software options, such as QuickBooks, FreshBooks, and Zoho, offer built-in automation features for creating and sending transaction documents.

- Set Up Client Profiles: For automation to work smoothly, ensure that your client profiles are up-to-date with accurate contact details, payment preferences, and billing information. This allows the system to populate the document with relevant data without manual input.

- Integrate with Sales Systems: Connect your automated billing system to your sales or e-commerce platform. This integration allows transaction details, such as products, prices, and taxes, to automatically flow into your document creation system as soon as a sale is made.

- Create Custom Templates: Customize the structure and design of your transaction documents to reflect your brand. Most automation tools allow you to create templates that can be reused for every transaction, ensuring a consistent look and feel across all records.

- Set Payment Terms and Reminders: Program the system to automatically apply your standard payment terms, such as due dates, late fees, and available payment methods. You can also set up automated reminders to notify clients of upcoming or overdue payments.

Benefits of Automating Document Creation

Automating your transaction document generation offers numerous advantages:

- Time Savings: Automation eliminates the need for manually creating documents for each transaction, freeing up your time for other important business tasks.

- Accuracy: With automated data entry, you reduce the risk of errors such as incorrect pricing, missing information, or calculation mistakes.

- Consistency: Automated systems ensure that every document follows the same format, making it easy for clients to recognize and understand the information presented.

- Faster Payments: With accurate and timely documents, clients are more likely to pay promptly, reducing the time spent following up on ov

Legal Considerations in T Shirt Invoices

When issuing transaction documents, it’s important to understand the legal requirements and considerations that apply to your business. These records serve as formal agreements between you and your clients, and any errors or omissions could lead to disputes or legal issues. Knowing the key legal elements to include ensures your documents are compliant with tax laws, regulations, and industry standards, helping to protect your business and avoid costly mistakes.

Key Legal Elements to Include in Your Documents

To ensure that your billing documents are legally sound, certain information should always be included. The following table outlines the most important legal details to include in your records:

Element Importance Legal Requirement Business Information Provides legitimacy and identification of your business. Required by law in most jurisdictions to include business name, address, and contact details. Customer Details Ensures proper identification and avoids errors in delivery or payment. Necessary for accurate record-keeping and taxation purposes. Transaction Date Determines the timeline for payment terms and record-keeping. Essential for setting due dates and compliance with tax reporting periods. Product or Service Description Clarifies the terms of the transaction to avoid misunderstandings. Required for taxation and to provide an accurate breakdown of products or services sold. Total Amount and Payment Terms Defines the financial agreement and provides clarity on payment obligations. Legally required for contracts and financial reporting purposes. Tax Information Ensures proper compliance with sales tax and other applicable levies. Mandatory for businesses in regions with sales tax laws, and necessary for tax reporting. Compliance with Local Tax Laws

Different regions and countries have varying tax laws that impact the way you must structure your documents. For example, some areas may require the inclusion of specific tax rates, while others may need additional documentation for international transactions. Always ensure that your transaction documents comply with local tax regulations to avoid penalties.

Understanding the legal aspects of transaction records not only helps you stay compliant but also builds trust with your clients. A legally sound document reduces the risk of disputes and helps establish your business as a professional and reliable entity.