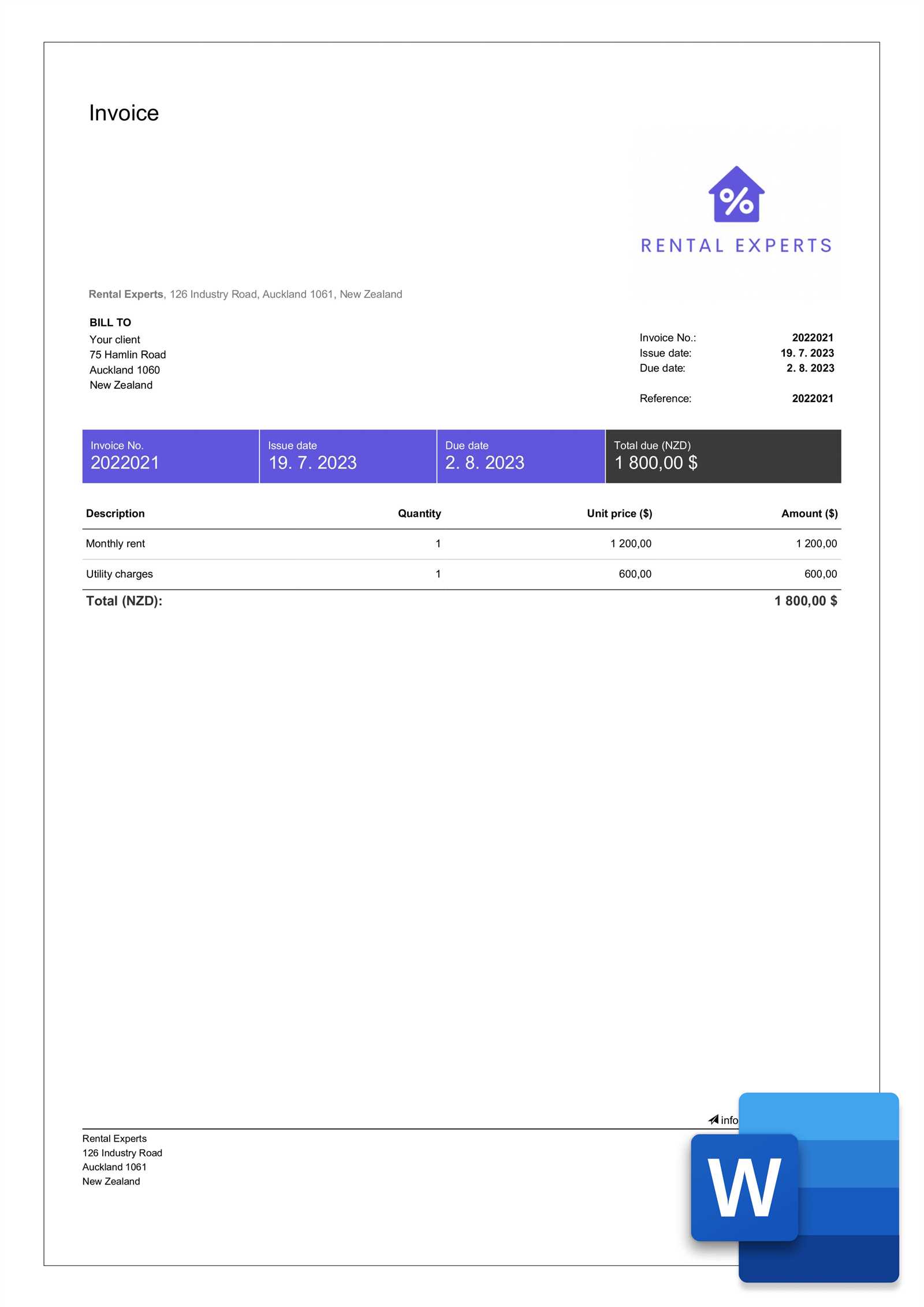

Free Rental Invoice Template in Word Format

Managing the billing process can often be time-consuming, especially when it involves custom calculations and formatting. Many businesses, especially those offering leasing or property services, need to create detailed documents that reflect payments, terms, and other important data for clients. Ensuring accuracy while saving time is crucial for maintaining professionalism and efficiency.

One of the most effective ways to simplify this task is by using a pre-designed document that can be tailored to meet specific needs. With just a few adjustments, you can generate professional records that suit your particular business style, all while ensuring clarity and correctness in every transaction. Utilizing the right kind of structure enhances both convenience and consistency, reducing errors and delays.

Whether you’re just starting or are looking to improve your current workflow, having a ready-made document structure can be an invaluable tool. It not only saves you time but also helps you maintain a high standard of communication with clients, ensuring transparency in your financial dealings.

Free Rental Invoice Template in Word

Having access to a customizable document that simplifies financial transactions can greatly improve business efficiency. With the right structure, you can easily record the necessary details for payments and agreements, ensuring both clarity and professionalism. These ready-to-use documents are designed to streamline the process, making it easy to add specific terms, amounts, and client information in just a few simple steps.

One of the primary advantages of using a pre-made document is the ability to save time while ensuring consistency across all your transactions. The format is structured to include all essential elements, such as payment due dates, descriptions, and totals, while allowing space for customization based on individual client needs. This flexibility makes it easy to adapt the document to your business practices and the nature of your services.

Moreover, choosing a format compatible with common software ensures accessibility and ease of use. By leveraging a simple, customizable layout, businesses can maintain professionalism and reduce the risk of errors, helping to build trust with clients and ensuring smooth financial operations.

Why Use a Rental Invoice Template

Using a pre-designed document to handle financial records can significantly streamline your workflow and ensure consistency. It allows businesses to quickly generate accurate billing statements that include all necessary details, such as payment amounts, due dates, and client information, without the need to manually format each entry. This simple process can save valuable time and reduce the likelihood of errors.

One of the key advantages of employing such a structure is its ability to maintain professionalism. A standardized layout not only presents information clearly but also conveys reliability to clients, fostering trust in your business practices. Customizing these documents to suit individual transactions ensures that all the required elements are included while keeping your communications uniform and organized.

Furthermore, by adopting this approach, you can easily keep track of payments and financial obligations, helping to stay on top of accounts and manage your cash flow more efficiently. With the ability to make quick adjustments, businesses can adapt to changing needs and continue offering exceptional service to their clients without unnecessary delays or complications.

Benefits of Word Format Templates

Using a document format that is widely accessible and easy to modify brings a range of advantages to businesses looking to simplify their financial processes. When creating professional records, it is important to have a format that is both customizable and compatible with common software programs. The ability to quickly adjust details while maintaining consistency can greatly improve the overall efficiency of your workflow.

Some of the main benefits of choosing this format include:

- Ease of Customization: With simple tools, you can modify fields such as payment details, client names, and amounts, ensuring the document fits your specific needs.

- Wide Accessibility: This format is compatible with most devices and operating systems, making it easy for anyone in your business to use and share.

- Consistency: Using a predefined structure helps maintain uniformity across all your documents, ensuring a professional appearance every time.

- Time Efficiency: Pre-designed layouts eliminate the need to create a new document from scratch, allowing you to quickly generate important records with minimal effort.

- Flexibility: Easily adjust the document to fit a variety of business needs, whether it’s for different clients, services, or payment types.

By choosing a universally accepted format, businesses can streamline their operations and ensure that important transactions are recorded accurately and professionally. This approach saves time, reduces errors, and fosters trust with clients and partners.

How to Customize Your Invoice

Customizing your billing document allows you to tailor it to the specific needs of your business and clients. By modifying certain sections, you can ensure that all relevant information is included and that the document reflects your company’s branding and style. Adjusting the layout and content makes the document more personalized and easier to understand for your clients.

Step 1: Adjusting the Layout

The first step in customization is deciding on the layout. Depending on your business, you may want to highlight specific information such as the payment due date, client details, or service description. Ensure that the most important elements are prominently displayed for easy reference. You can also change fonts, colors, and sections to match your branding, giving your documents a professional appearance.

Step 2: Adding Specific Details

Next, include all necessary information such as service descriptions, payment terms, and totals. Be sure to add fields for any discounts, taxes, or other charges that may apply. Customize these sections based on your services, ensuring that each document is as informative and transparent as possible. Clear itemization of charges will help clients understand the costs and terms involved in the transaction.

Customizing your records is an important step to maintaining consistency and professionalism in your business communications. By carefully adjusting the layout and content, you can create a document that works efficiently for your business needs while keeping the process simple for your clients.

Simple Steps for Template Download

Downloading a ready-made document for your financial needs is a straightforward process that can save you time and effort. By following a few simple steps, you can quickly access a structured document that can be customized for your business. This process ensures you can start using the document right away with minimal adjustments.

Step 1: Find a Reliable Source

The first step is to locate a trusted website or service that offers downloadable documents. Ensure that the source provides secure and high-quality files, so your information remains safe. Look for platforms with a reputation for offering professional-grade documents that meet your specific needs.

Step 2: Choose Your Desired Document

Once you have found a reliable source, browse through the available options and select the one that suits your business needs. Many sites offer different versions or formats based on industry or service, so pick the one that best matches your requirements.

| Step | Action |

|---|---|

| 1 | Search for a trusted source with downloadable files |

| 2 | Select the document that fits your business |

| 3 | Click the download link and save the file |

Following these easy steps will ensure that you can quickly get the document you need and start using it for your business. With just a few clicks, you can streamline your workflow and focus more on delivering great services to your clients.

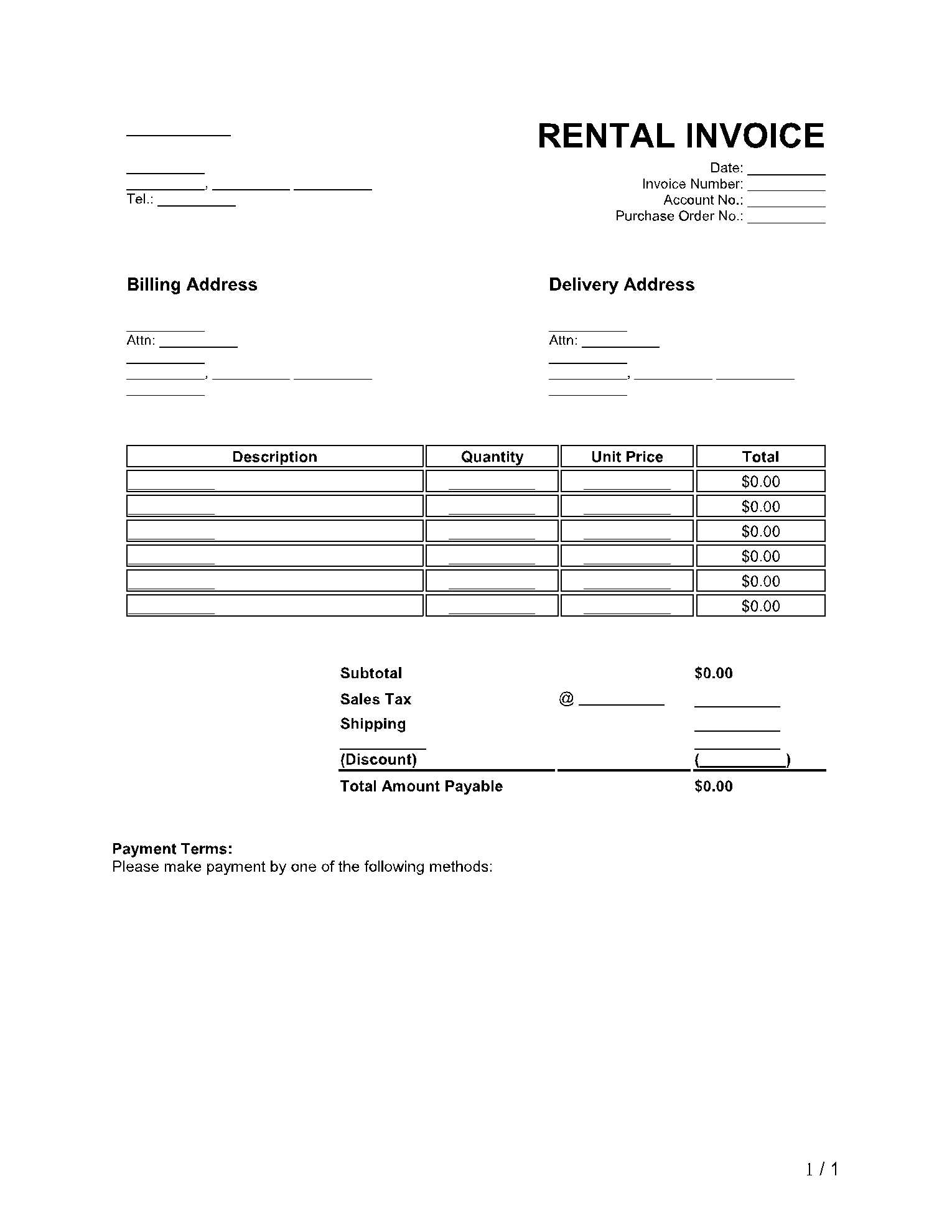

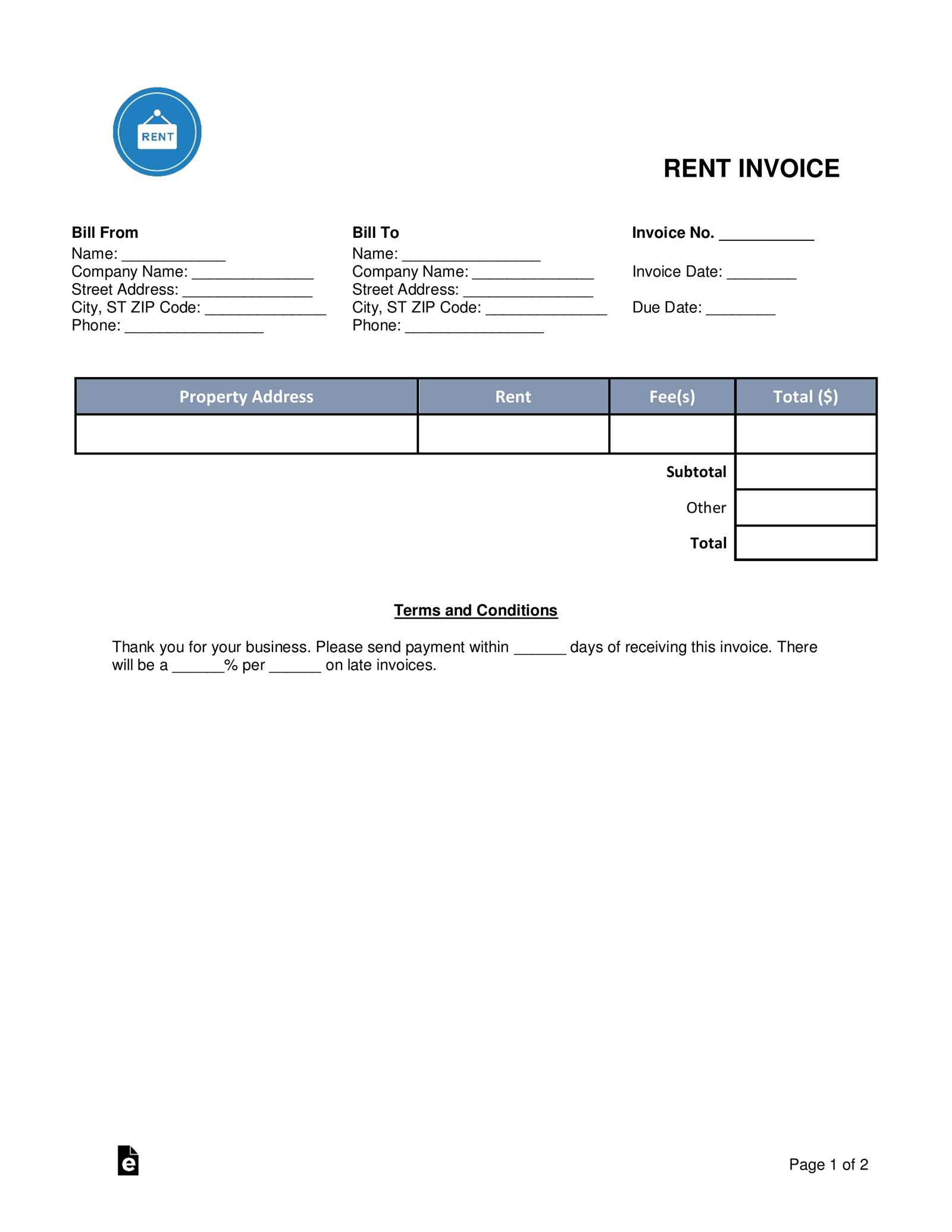

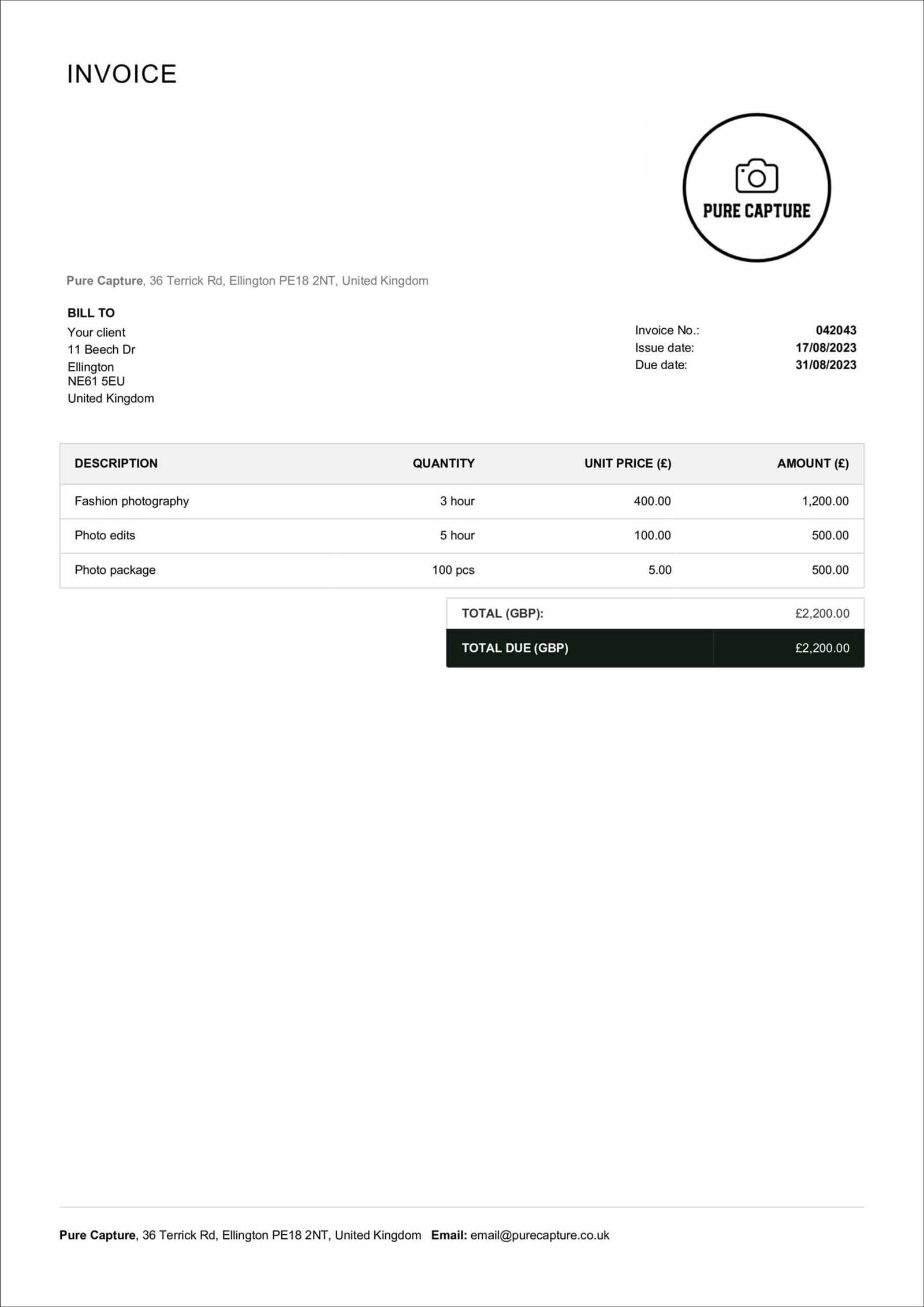

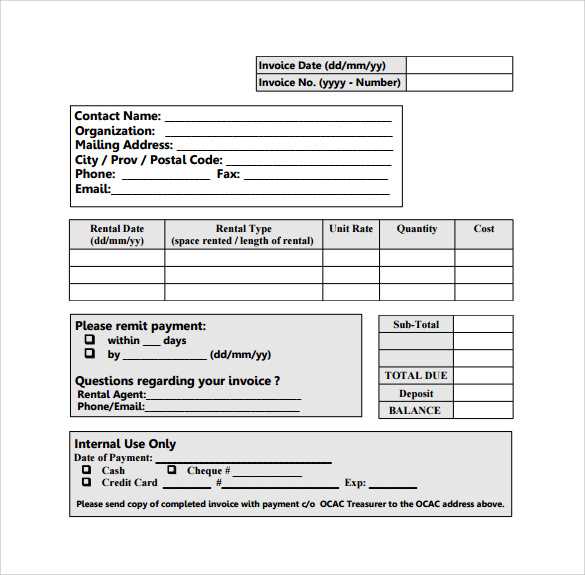

Key Elements of a Rental Invoice

When creating a billing document for services provided, it’s essential to include specific components that ensure clarity and professionalism. These elements help ensure that both the business and the client understand the details of the transaction. A well-structured document should be clear, concise, and contain all necessary information to avoid confusion and streamline the payment process.

The essential components of such a document typically include:

- Business Information: Include your company name, address, contact details, and logo to help clients identify the source of the document.

- Client Information: Clearly list the client’s name, address, and contact information to avoid any misunderstandings.

- Document Number: A unique identifier for each document to help you track and reference past transactions.

- Date of Issue: The date when the document is created, which helps define the payment timeline.

- Service Description: Provide a detailed breakdown of the services provided, including quantities, prices, and relevant terms.

- Amount Due: Clearly state the total amount owed, including any taxes, fees, or discounts applied.

- Payment Terms: Include clear instructions on how and when the payment should be made, as well as any late fees or penalties if applicable.

By including these components in your documents, you ensure transparency and avoid potential disputes. Having a detailed, organized record not only improves your business’s credibility but also facilitates prompt and accurate payments from your clients.

Common Mistakes to Avoid in Invoices

Creating a well-structured billing document is crucial for maintaining professionalism and ensuring prompt payments. However, there are common errors that many businesses make, which can lead to confusion or delays. By avoiding these mistakes, you can ensure a smoother transaction process and a better experience for both you and your clients.

Missing or Incorrect Details

One of the most frequent mistakes is failing to include complete or accurate information. If any essential details, such as client names, addresses, or payment terms, are missing or incorrect, it can cause delays in payment or confusion. Always double-check that the document contains correct data and that all fields are filled out properly.

Unclear Payment Terms

Another common issue is providing unclear payment instructions. Whether it’s a vague due date, missing payment methods, or lack of information on late fees, unclear terms can result in misunderstandings. Always specify the exact payment due date, accepted payment methods, and any penalties for late payments.

By being mindful of these mistakes and ensuring that all details are accurate and clear, you can create a more efficient billing process that enhances your professionalism and reduces errors.

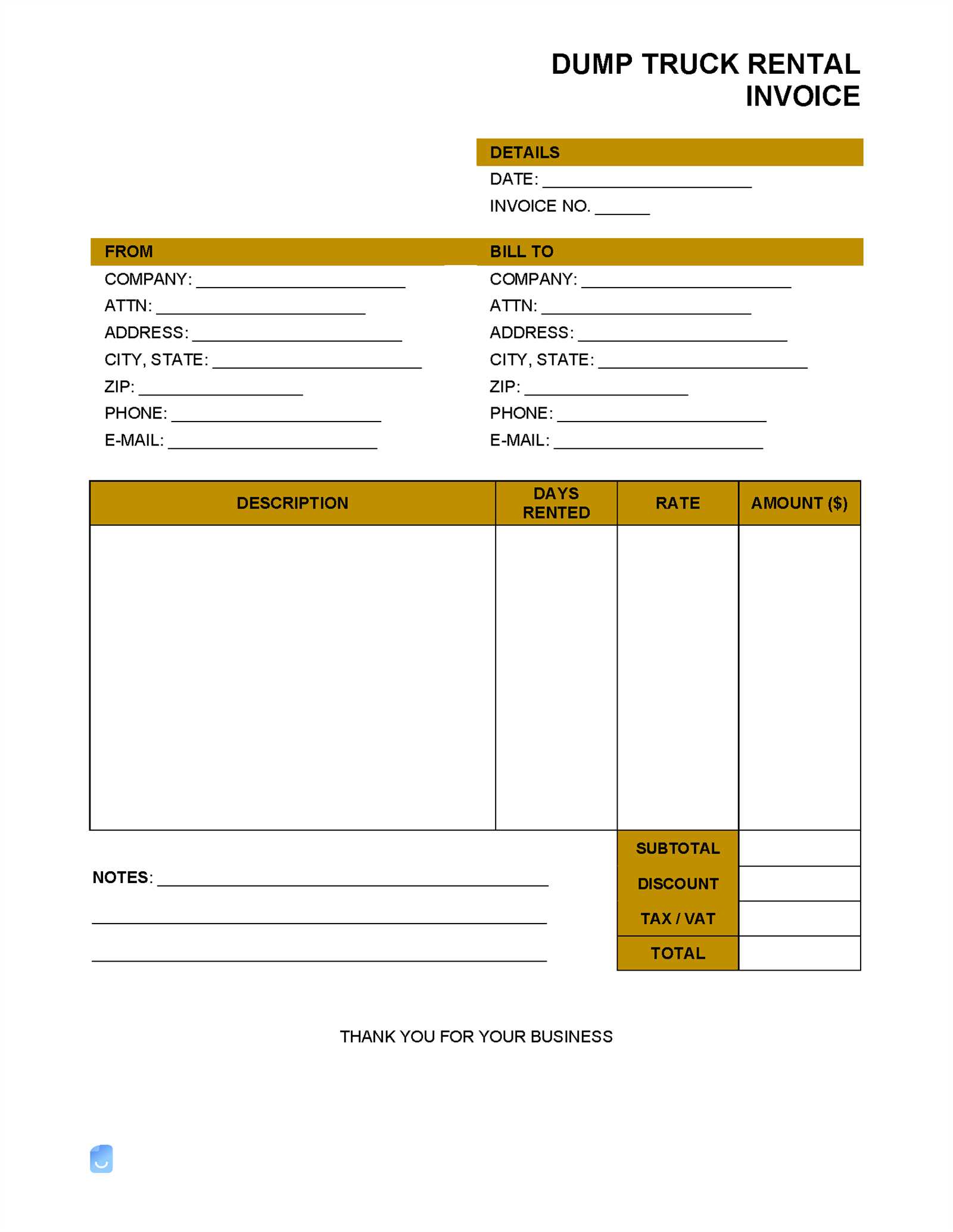

How to Add Payment Terms to Invoices

Clearly outlining payment expectations is essential for any transaction, as it ensures both parties understand when and how the payment should be made. Including clear payment terms in your billing documents helps establish a professional tone and reduces confusion. By specifying deadlines, payment methods, and any additional charges, you can set clear expectations and avoid potential disputes.

To effectively add payment terms, include the following key elements:

- Due Date: Specify the exact date by which the payment should be completed. This helps your client understand the time frame for payment.

- Accepted Payment Methods: Clearly list the methods of payment you accept, whether it’s credit card, bank transfer, checks, or online payment platforms.

- Late Fees: If applicable, outline any penalties for late payments, including the amount or percentage of the fee and when it will be applied.

- Discounts for Early Payment: You may also offer an incentive for early payment, such as a small discount for clients who pay ahead of the due date.

By providing these details clearly, you not only foster trust but also encourage timely payments, which helps maintain cash flow and strengthens your business relationships.

Understanding Rental Invoice Legal Requirements

When creating any billing document, it is essential to be aware of the legal obligations that may apply. Different jurisdictions have various rules regarding what information must be included to ensure that the document is both valid and enforceable. Understanding these legal requirements helps businesses avoid disputes and maintain compliance with local laws.

Here are the key legal components that should be included:

- Identifying Information: Both the issuer and recipient should be clearly identified. This includes full names, addresses, and relevant contact information.

- Itemized List: A breakdown of the items or services provided must be included. It is important to specify what is being billed, the quantity, and the price for each item or service.

- Total Amount: The total amount due must be clearly indicated, including applicable taxes and any additional charges or discounts.

- Payment Terms: Legal terms regarding payment should be outlined. This includes the due date, acceptable methods of payment, and penalties for late payments.

- Tax Information: In many regions, the inclusion of applicable tax rates and registration numbers is required to comply with tax laws.

Additional Considerations

In some locations, you may also need to include other details such as the payment schedule, cancellation policies, or terms of service. Be sure to research your specific legal obligations based on your location or consult with a legal professional to ensure complete compliance.

By ensuring that your billing documents meet these legal requirements, you protect both your business and your customers, ensuring transparency and minimizing potential legal issues.

How to Save Time with Templates

Using pre-designed documents can significantly streamline the process of creating necessary paperwork, allowing you to save time and focus on other important tasks. Instead of starting from scratch each time, you can simply customize existing files, making the entire process faster and more efficient.

Here are a few ways to save time by utilizing pre-made documents:

- Consistency in Design: Pre-structured documents ensure that all relevant information is consistently organized. This eliminates the need for constant formatting adjustments, saving you valuable time.

- Faster Editing: With ready-made fields, you only need to fill in specific details rather than redesign the layout. This reduces the time spent on editing and ensures all necessary components are included.

- Reduced Error Rate: Since the document is already structured, there are fewer chances of omitting crucial information, minimizing the risk of mistakes that could require time-consuming revisions.

Benefits of Customization

Though pre-built documents are a great time-saver, they still allow for flexibility. You can adjust sections to meet your unique needs, such as changing payment terms or adding a personalized logo, without needing to create an entirely new file each time.

By adopting ready-made documents, you can significantly cut down on the time spent preparing paperwork, improve accuracy, and ensure that every document is ready quickly and efficiently.

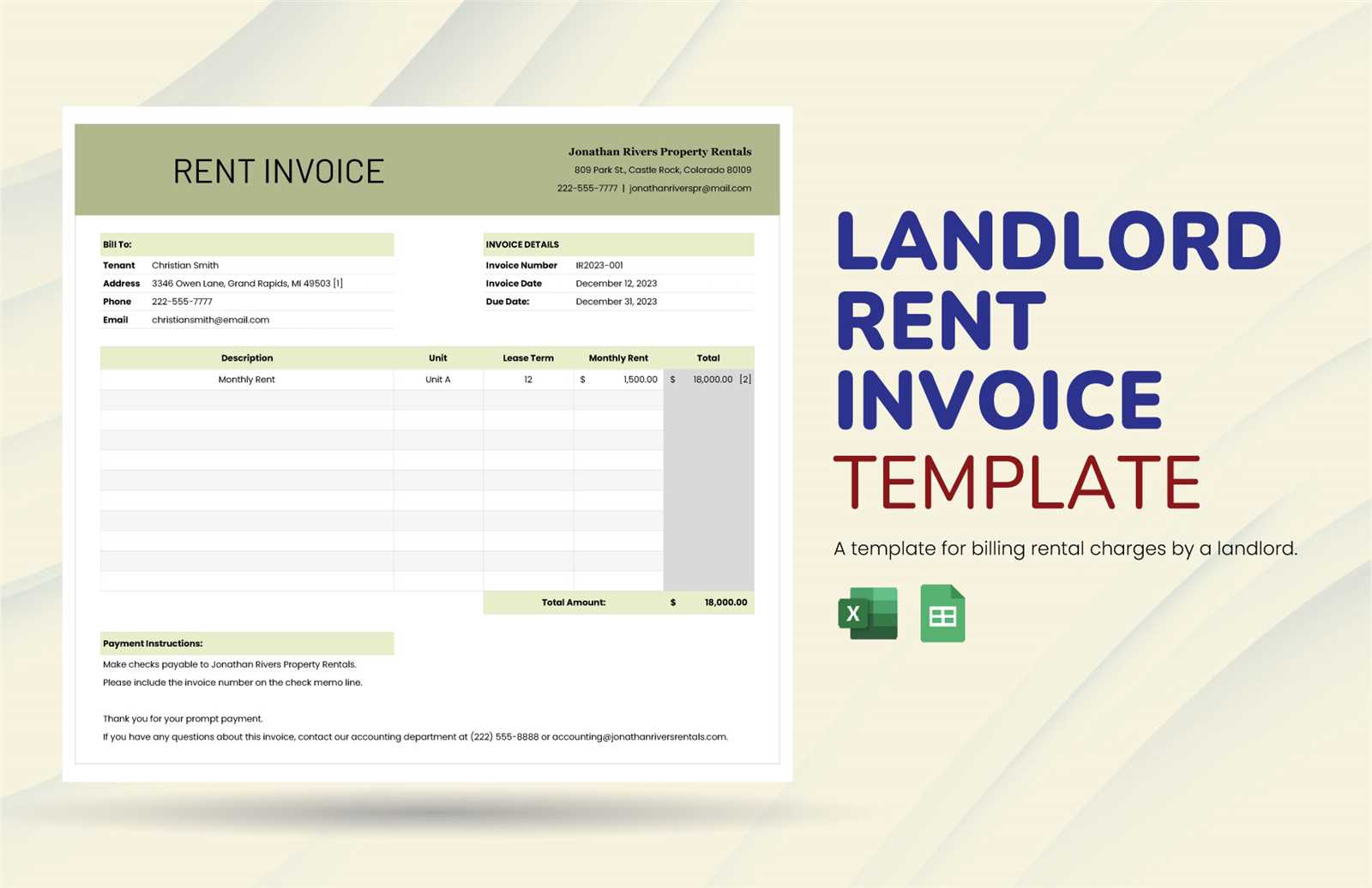

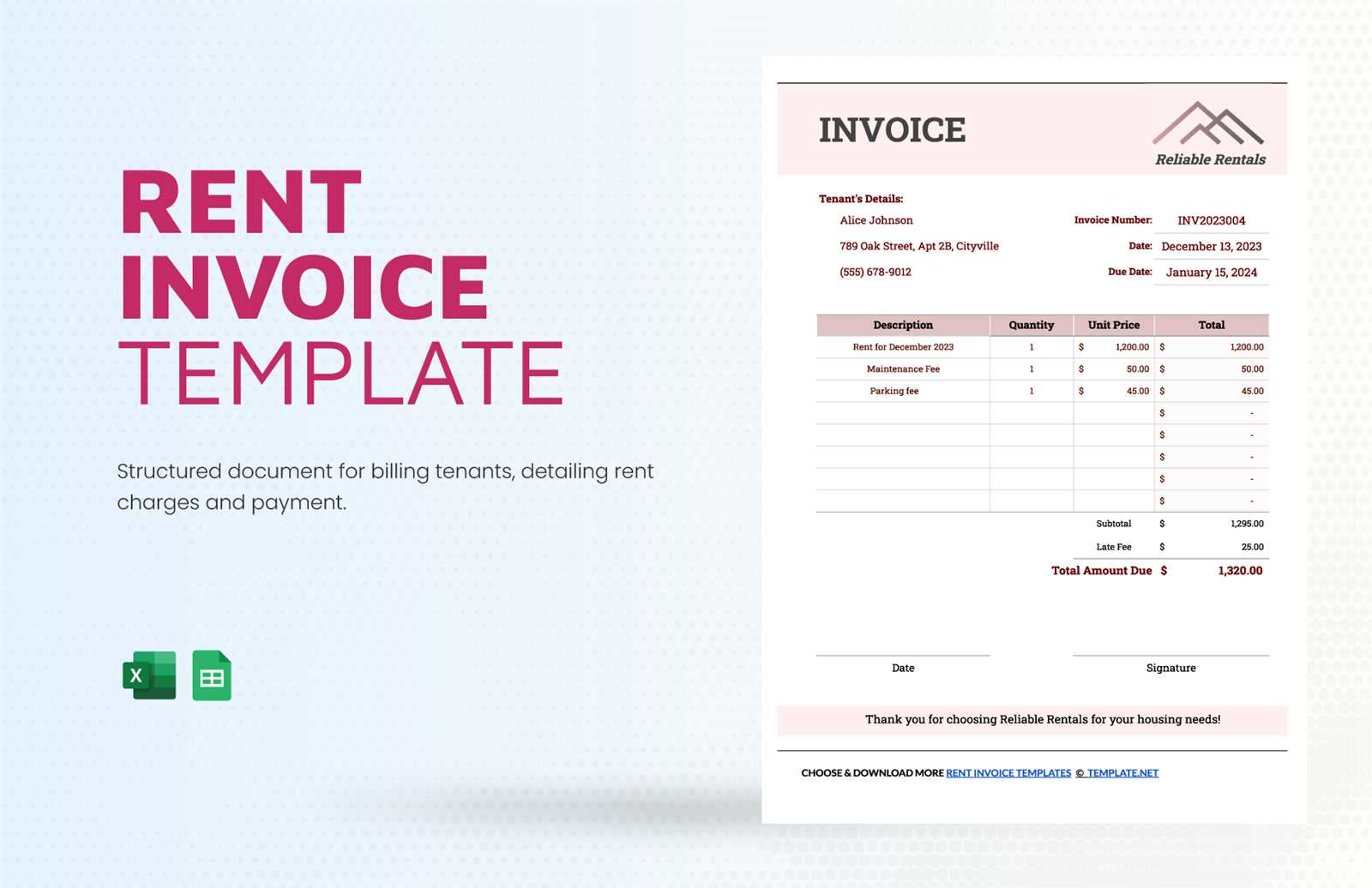

Tracking Rental Payments Using Templates

Monitoring payments for services or property leasing can be made much easier with the right structure in place. Using pre-made documents to log each transaction ensures that all necessary details are captured in an organized manner, providing both clarity and accountability.

Here’s how using structured documents helps you track payments more effectively:

- Clear Payment Records: A pre-designed structure makes it easy to record each payment made, including the amount, date, and method of payment. This reduces confusion and allows for a quick review of past transactions.

- Easy Updates: Once a payment is made, it can be easily recorded and updated in the document. This ensures that your records stay current, reducing the chances of overlooking any outstanding payments.

- Automated Calculations: Some documents include fields for automatic calculations, such as remaining balances or late fees, which saves you from manually calculating each amount and ensures accuracy.

Benefits of Organized Payment Tracking

When payments are systematically tracked, you can easily identify patterns, manage due dates, and address any payment delays promptly. This not only improves financial management but also helps you stay organized throughout the lease period.

By implementing a structured approach, you can maintain a clear financial overview, which simplifies the entire payment tracking process.

Top Features to Look for in Templates

When choosing a pre-designed document for tracking financial transactions, certain features are crucial to ensure ease of use and accuracy. Selecting the right structure will help streamline your process, making it more efficient and effective in the long run.

Here are the essential features to consider:

- Customization Options: The ability to adjust details such as payment amounts, dates, and service descriptions is vital. A flexible format ensures that the document can be tailored to suit specific needs without hassle.

- Clarity and Readability: Choose a layout that is clear and easy to follow. A well-organized document reduces confusion, ensuring that every section is straightforward and understandable for both parties involved.

- Calculation Functions: Automatic calculation fields, such as totals or outstanding balances, save time and minimize human error. These features streamline the process, especially for complex transactions.

- Professional Appearance: A clean and polished design reflects well on your business. A structured and professional-looking document conveys trustworthiness and attention to detail.

- Multi-Format Compatibility: Ensure that the design can be used across different platforms or devices, such as desktop computers or mobile phones. This makes it more versatile and accessible for various users.

With these key features, you can improve your efficiency in managing transactions while maintaining a high level of professionalism in your documentation process.

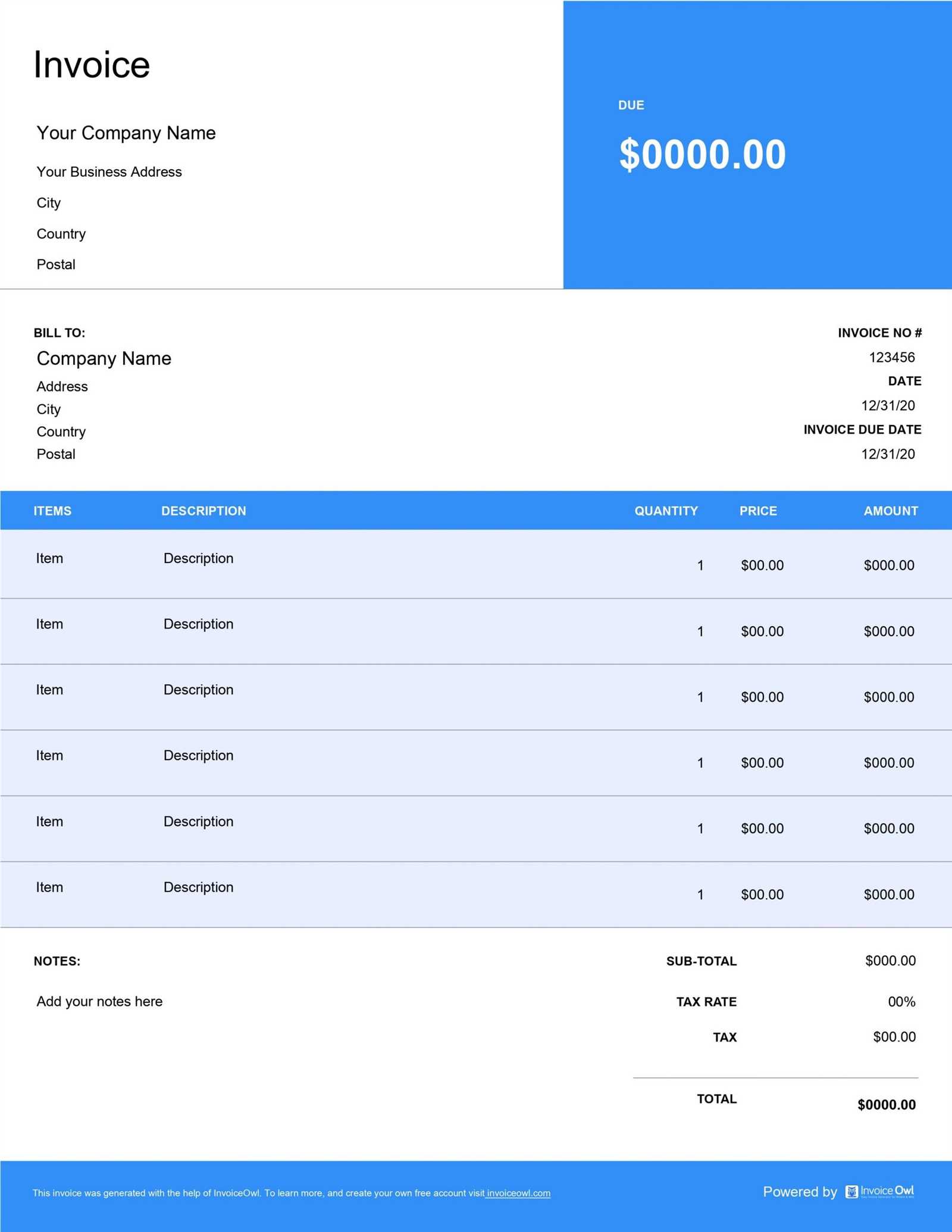

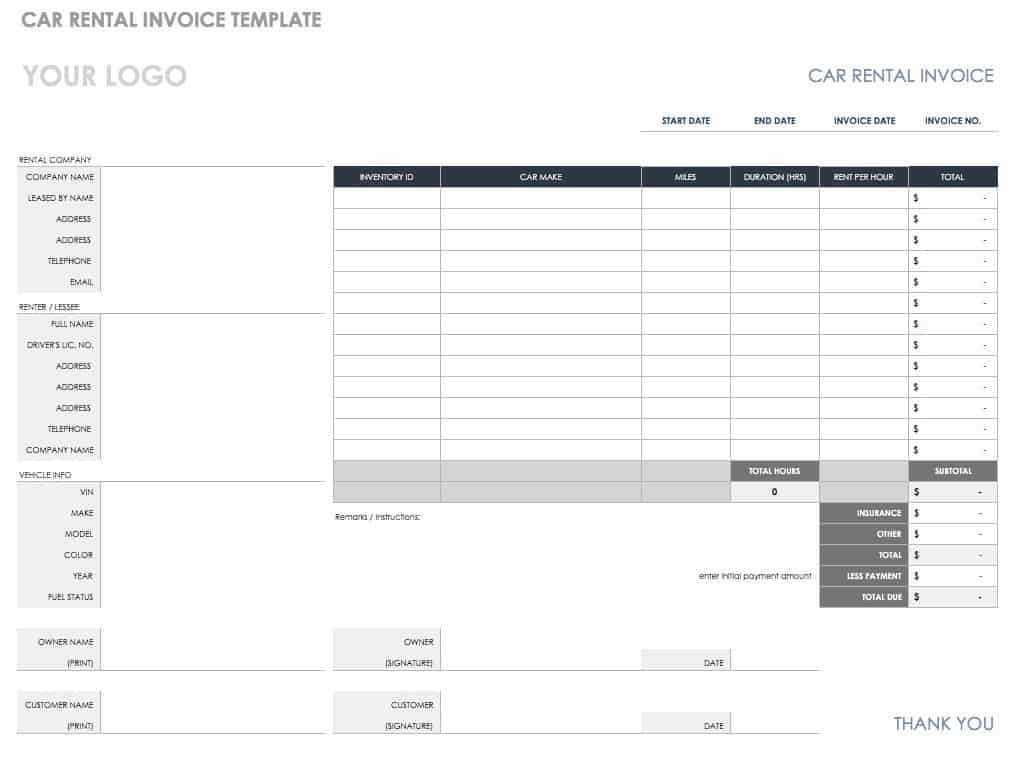

Why Choose Word Over Other Formats

When it comes to creating professional documents for financial records or transactions, the choice of format plays a crucial role in both usability and compatibility. While there are various options available, some formats offer unique advantages that make them stand out for creating structured documents.

The flexibility and accessibility of certain file types, especially when it comes to creating or editing documents, offer significant benefits that ensure users can easily make adjustments and share them across different platforms.

| Feature | Benefits of Word Format | Other Formats |

|---|---|---|

| Customization | Easily editable, allowing for quick updates and changes to text, layout, and design elements. | Less flexible, often requiring specialized software or limited editing options. |

| Compatibility | Works seamlessly across most devices and platforms, including both Windows and Mac systems. | May not be universally compatible or could require additional software to open and edit. |

| Formatting Options | Offers extensive formatting tools for text, tables, and images to create a polished document. | Limited formatting capabilities or complex interface for customization. |

| Ease of Use | Widely familiar interface that most users find intuitive for document creation. | May require additional training or have a steeper learning curve for new users. |

Choosing the right format for your documents can make a significant impact on your workflow. The convenience, versatility, and user-friendly nature of certain formats make them ideal for efficiently handling everyday business needs.

Free vs Paid Rental Invoice Templates

When it comes to creating professional documents for billing or transactions, there are numerous options available to choose from. Users often find themselves deciding between no-cost and paid solutions. Both choices come with their own set of advantages and limitations, which can influence how well they meet specific needs.

While no-cost options can be appealing due to their accessibility, paid alternatives often provide additional features and support that may be crucial for more complex or professional use. Understanding these differences can help you determine which solution best fits your requirements.

Benefits of No-Cost Options

- Accessibility: Easy to find and use without any upfront costs.

- Simple Design: Often sufficient for basic needs or occasional use.

- Quick Start: Ready to use without requiring subscriptions or complex setups.

Advantages of Paid Solutions

- Customization: Offers more advanced design options and customization features to meet specific business needs.

- Professional Support: Access to customer support or technical assistance for troubleshooting.

- Advanced Features: Often includes integrations with accounting software or enhanced formatting capabilities.

While no-cost options may be suitable for occasional or simple uses, businesses that require more specialized features or long-term use may benefit more from investing in a paid solution. Choosing the right option depends on your specific needs and how much you value customization, support, and added functionality.

How to Share Your Rental Invoice

Once you have created your billing document, sharing it with clients or tenants is an essential step in the process. Whether it’s for clarity or record-keeping, ensuring that the document reaches the right person in a timely and professional manner is key to maintaining smooth transactions. There are several methods available to send your document securely and efficiently.

For quick delivery and convenience, digital methods such as email or cloud-based services are the most common and effective. You can attach the file directly to an email or share a link to a cloud storage location where it can be accessed by the recipient. For those who prefer physical copies, printing and mailing the document is still a viable option.

- Email: Attach the document as a PDF or other file format and send it to the recipient’s email address.

- Cloud Storage: Upload the document to a secure cloud service and share a link for easy access.

- Physical Copy: Print the document and send it through traditional mail for clients who prefer hard copies.

When sharing your document, always ensure that the file is properly labeled and formatted for easy identification by the recipient. It is also important to confirm receipt, especially for important or time-sensitive payments.

Updating and Maintaining Your Invoice Template

Keeping your billing document up-to-date is crucial for ensuring that all details remain accurate and professional. Over time, your business or financial requirements may change, and it’s important to reflect those adjustments in the format you use. Regularly reviewing and updating your template helps prevent mistakes, ensures compliance, and enhances the overall professionalism of your communication.

Start by regularly checking for any changes in regulations or industry standards that might require updates to your document. For instance, tax rates, payment terms, or contact information may change over time. It’s also a good practice to review the layout periodically to ensure that it remains clear, readable, and aligned with your brand’s identity.

- Stay Current with Legal Changes: Ensure that your document includes any new legal requirements or tax rates that may apply.

- Review Branding Elements: Update the design, logo, or colors to align with your current brand identity.

- Consistency is Key: Check that all fields, such as payment terms, addresses, and services, are consistent across all documents.

By maintaining an organized and updated billing structure, you can streamline your business processes and avoid unnecessary complications. Regular updates not only ensure accuracy but also improve the professionalism of your interactions with clients or customers.

Best Practices for Rental Invoicing

Effective billing is essential for maintaining clear financial communication and ensuring timely payments. By following best practices, you can avoid common errors and improve the overall efficiency of your accounting processes. This section outlines strategies to help you create clear, accurate, and professional documents for your financial transactions.

Key Tips for Accurate and Professional Billing

- Include All Necessary Information: Always make sure that your document includes complete details, such as names, addresses, payment amounts, due dates, and service descriptions. Missing information can lead to confusion and delays.

- Be Clear and Concise: Ensure that the content is easy to read and free from ambiguity. Use simple language and clear formatting to avoid misunderstandings.

- Establish Consistent Payment Terms: Clearly state payment terms such as the due date, any applicable late fees, and accepted payment methods to set expectations for both parties.

Streamlining Your Process

- Automate When Possible: Utilize tools and software that can streamline the creation and tracking of your billing documents. This helps save time and reduce errors.

- Send Documents Promptly: Issue your document as soon as services are rendered or goods are delivered. Early submission encourages timely payment.

- Follow Up on Overdue Payments: Implement a follow-up system to ensure that payments are made on time. Friendly reminders can help maintain good relationships with clients.

By adhering to these best practices, you can ensure smooth and efficient financial transactions while fostering professionalism and trust with your clients. Consistent, clear, and timely billing is essential for maintaining healthy business operations and relationships.