Free Musician Invoice Template for Easy Billing

For those working in the creative industry, keeping track of payments and ensuring smooth transactions is crucial. Whether you’re a solo artist or part of a group, having a well-organized method for documenting and requesting payment can make all the difference. A well-structured document helps maintain professionalism and ensures you get paid on time.

Streamlining your payment process is essential for managing finances effectively. A structured form can save time, reduce errors, and provide clarity for both you and your clients. By using customizable options, you can ensure that each billing document meets the specific needs of your work, whether it’s for performances, sessions, or other creative services.

Organizing your finances doesn’t need to be complicated. With the right tool, you can simplify the process while maintaining a professional appearance. Explore how a carefully designed document can make managing your creative career more efficient and stress-free.

Why Artists Need a Billing Document

For any creative professional, having a reliable system for documenting payments is essential. Without a formal method to outline services and costs, it becomes difficult to track earnings, manage client expectations, and maintain a clear record for tax purposes. A well-structured document provides transparency, ensures clarity, and fosters professionalism in business dealings.

Here are some reasons why an organized billing form is crucial for creative professionals:

- Clear Communication: A detailed document eliminates confusion about the terms of payment, project scope, and delivery timelines.

- Time-Saving: Using a pre-designed structure allows for faster creation of payment requests, saving time and effort.

- Record Keeping: Properly formatted documents help track payments and ensure no money is left unaccounted for.

- Professionalism: Presenting a structured payment request shows that you are serious and organized, which can improve your business reputation.

- Legal Protection: A clear outline of services, fees, and payment terms helps avoid misunderstandings and potential disputes.

Whether you’re working on a freelance basis or collaborating with others, using a formal payment request system can simplify your financial management and boost your credibility. With such a tool, you’re better equipped to handle various payment situations and ensure a smoother transaction process.

Benefits of Using a Billing Document Format

Adopting a structured approach to payment requests offers several advantages for those working in creative fields. Instead of creating a new document from scratch each time, having a ready-to-use, customizable format can save time, ensure consistency, and reduce the likelihood of mistakes. This method helps to streamline the entire process, making transactions more efficient and professional.

Time Efficiency

One of the most significant benefits of using a pre-designed format is the time saved. Rather than spending time manually organizing details for each client, you can simply input the necessary information into a structured layout, which significantly speeds up the process. This allows you to focus on your craft rather than administrative tasks.

Consistency and Professionalism

Consistency is key when managing multiple projects and clients. By using a structured format, you ensure that all documents are uniform, which can increase your professionalism. A consistent approach to documenting services helps clients easily understand your terms, fostering trust and reliability.

| Benefit | Description |

|---|---|

| Time-Saving | Quickly generate documents without starting from scratch every time. |

| Consistency | Maintain uniformity in how you present payment requests to clients. |

| Professional Appearance | Present a polished and organized request that boosts your business image. |

| Flexibility | Customize the format to suit different client needs and project types. |

By using a structured approach, you not only simplify the process of creating payment requests but also present a more professional image to clients, which can ultimately lead to more successful business relationships.

How to Create a Professional Payment Request

Creating a formal payment request requires attention to detail and clarity. A well-constructed document not only helps you get paid on time but also ensures both you and your client are on the same page regarding services and terms. The key is to include all relevant information in a clear, easy-to-understand format that promotes transparency and professionalism.

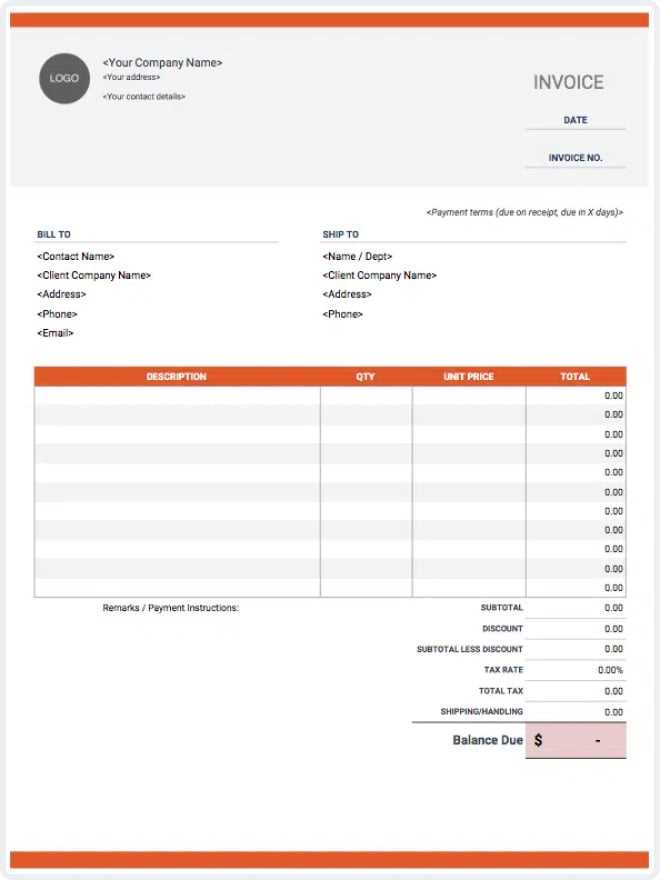

Key Elements to Include

To ensure your payment request is both clear and professional, make sure to include the following:

- Your contact information: Include your full name, address, email, and phone number for easy communication.

- Client’s contact information: Always include your client’s details, such as their name, company, and contact info.

- Detailed description of services: Provide a clear breakdown of the services you provided, including any dates and specific deliverables.

- Payment terms: Clearly outline when the payment is due, accepted payment methods, and any penalties for late payments.

- Payment amount: List the agreed-upon amount for your services, including taxes or additional charges if applicable.

- Invoice number: Assign a unique identifier to each document for tracking purposes.

Designing the Layout

The layout of your payment request is just as important as the content. A clean, simple design helps the client focus on the important information. Use clear headings, organized sections, and adequate spacing between items. This makes the document easy to read and professional in appearance. If you don’t have design experience, many online tools offer simple formats that are easy to customize without needing graphic design skills.

By following these steps and paying attention to the details, you can create a professional payment request that reflects your business standards and ensures smooth financial transactions.

Essential Information for Payment Requests

When creating a formal request for payment, it’s important to include all the necessary details to ensure transparency and avoid any misunderstandings. A well-organized document not only outlines the services provided but also clearly communicates the agreed-upon terms, making it easier for both you and your client to track the transaction.

Here are the key components that should be included in any payment request:

- Your details: Always include your full name or business name, address, and contact information, so the client knows who the payment is for.

- Client’s details: Include the client’s name or company, address, and contact information to ensure clarity on who the payment is from.

- Clear description of services: List the work or services you have provided, including dates, hours worked, and any specific deliverables.

- Amount due: Specify the total payment expected, including any taxes or additional charges if applicable.

- Payment terms: Include the due date, accepted payment methods, and any late fees if the payment is delayed.

- Unique reference number: Assign a specific reference number to each document for tracking and organization purposes.

Including these essential elements in your payment request ensures a smooth and professional financial transaction. It helps both parties stay informed and avoids any potential confusion about payment details.

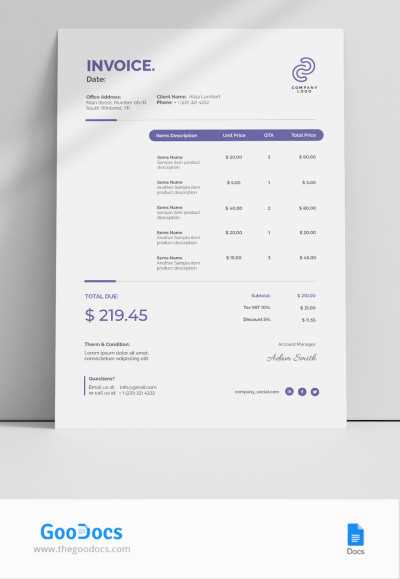

Customizing Your Payment Request Format

Personalizing your billing document is an essential step in making it fit your unique business needs. While pre-designed formats provide a useful starting point, customization allows you to tailor the document to reflect your specific services, branding, and client relationships. By adjusting the layout and content, you can create a more professional and streamlined payment process.

Here are some ways to customize your payment request:

- Adjust the design: Customize the colors, fonts, and logos to match your brand or personal style. A consistent design helps reinforce your professional identity.

- Service descriptions: Adapt the wording and breakdown of services to accurately reflect the work you’ve done for each client. Include relevant details like session times, project milestones, or special requests.

- Payment terms: Customize the payment schedule to fit your business model. For example, offer different rates for rush orders or include options for installment payments if needed.

- Additional fees: If you have specific charges (e.g., travel expenses or material costs), create sections to list them separately. This will keep everything clear for your client.

- Client-specific notes: Include personalized notes or terms that may be relevant to each client. This could include gratitude for working together, reminders about future bookings, or any custom agreements you have.

By taking the time to personalize your billing document, you make it a more effective and professional tool. It helps ensure that each transaction runs smoothly, and clients receive clear, tailored information about what they are paying for.

Free Payment Request Formats vs Paid Options

When it comes to creating payment request documents, there are two main options available: using a free pre-designed format or investing in a paid solution. Both approaches have their own set of advantages and drawbacks, depending on your specific needs, business size, and how much customization you require. Understanding the differences between these options can help you make a more informed decision.

Advantages of Free Options

Free formats are often a great starting point for individuals or small businesses who need a simple and quick way to create payment requests. Here are some key benefits:

- Cost-effective: The obvious advantage is that they don’t cost anything, making them ideal for those just starting out or working on a limited budget.

- Quick Setup: Many free formats are easy to use and require little effort to get started. You can usually find a basic structure that fits your needs without much customization.

- Basic Features: For simple needs, these documents provide all the essential elements, such as service descriptions, payment terms, and client information.

Benefits of Paid Solutions

While free formats are useful for basic billing, paid options typically offer more flexibility and advanced features. Here’s what you can expect from investing in a paid solution:

- Customization: Paid options often come with a wide range of customization features, allowing you to tailor every aspect of the document, from layout to specific clauses.

- Professional Design: Many premium solutions include more polished and visually appealing designs, helping you present a more professional image to clients.

- Advanced Functionality: Paid options may offer additional features such as automated calculations, integration with accounting software, and client tracking tools that make managing finances easier.

Ultimately, whether you choose a free or paid option depends on your business needs. If you’re looking for simplicity and are working with a tight budget, a free format may suffice. However, if you require advanced features, a professional design, or greater flexibility, a paid solution may be worth the investment.

What to Include in Your Payment Request

Creating a clear and detailed payment request is essential for both you and your client. A well-structured document helps ensure that the terms of the agreement are transparent and that there is no confusion about the services rendered or the amount due. By including the right details, you can streamline the payment process and maintain a professional image.

Essential Information

Make sure to include these key components to ensure the request is comprehensive:

- Your Contact Information: Include your full name or business name, address, phone number, and email so the client can easily reach you if needed.

- Client’s Contact Information: It’s important to list the client’s details as well, including their name, address, and contact information to avoid any confusion regarding the recipient of the payment.

- Description of Services: Provide a clear and concise breakdown of the work or services you’ve completed, including relevant dates, hours worked, or milestones achieved.

- Payment Amount: Clearly state the total amount due, including any applicable taxes, fees, or extra charges, so the client knows exactly what to pay.

- Payment Terms: Define the due date, acceptable payment methods, and any penalties or interest for overdue payments.

- Unique Reference Number: This helps you and the client track the transaction easily, especially if you have multiple clients or projects.

Optional Additions

While the essential information above is necessary, you may also want to include additional details that further clarify your services and help avoid misunderstandings:

- Special Instructions: If you have specific instructions for payment, such as preferred payment methods or deadlines, make sure to highlight them.

- Notes or Remarks: Adding a personal note or a thank-you message can go a long way in building a positive relationship with your clients.

By incorporating these details, your payment request will be both professional and informative, helping ensure smooth transactions with your clients.

Common Mistakes to Avoid in Payment Requests

When creating a payment request, it’s easy to overlook important details or make small mistakes that can lead to confusion or delays. Whether you’re new to generating these documents or just need a refresher, avoiding common pitfalls is essential for maintaining professionalism and ensuring timely payments. Below, we’ll discuss some of the most frequent errors and how to prevent them.

Incorrect or Missing Information

One of the most critical mistakes is failing to include accurate and complete details. Omitting important information can lead to misunderstandings or delays in processing payments. Some key areas to watch out for include:

- Client details: Double-check that the client’s name, address, and contact information are correct.

- Service descriptions: Ensure that the services provided are clearly outlined with all relevant details, such as dates or specific tasks completed.

- Payment amount: Verify that the total due is accurate, including any additional charges, such as taxes or late fees.

Poor Formatting and Layout

Another common issue is poor formatting, which can make your document harder to read and less professional. To avoid this, focus on the following:

- Consistency: Use uniform fonts, colors, and spacing throughout the document to keep everything neat and easy to follow.

- Clear structure: Make sure that all sections are logically ordered, and key details such as payment due date and service breakdown are easy to find.

- Professional appearance: Choose a clean, professional design that reflects your brand. A cluttered or overly complex layout can leave a negative impression.

By addressing these common mistakes, you can create a more effective and professional payment request that not only ensures you get paid promptly but also reinforces your credibility and attention to detail.

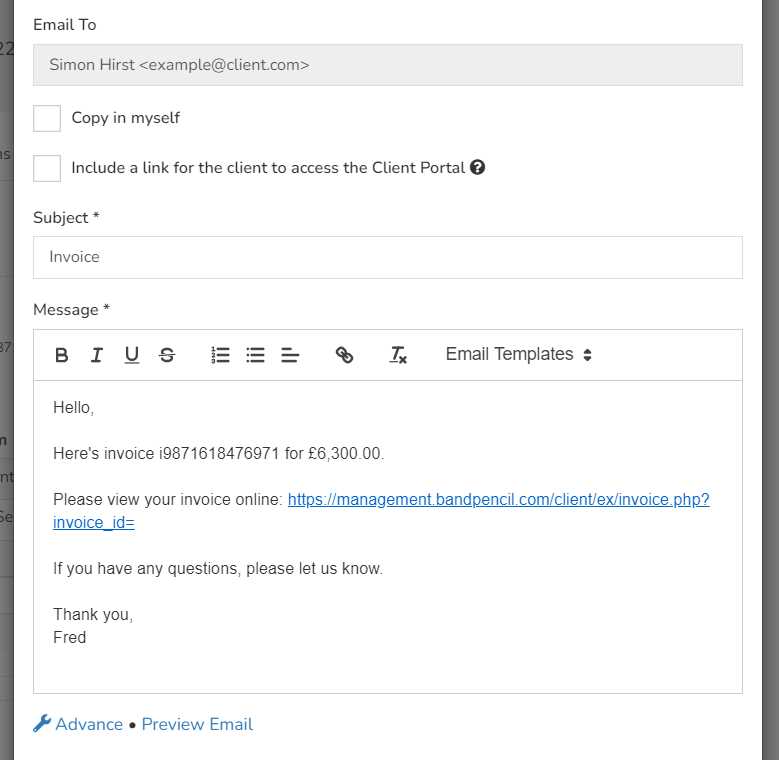

Understanding Payment Request Numbers

Assigning unique reference numbers to your payment documents is an essential practice for maintaining organization and ensuring smooth tracking of financial transactions. These numbers serve as a way to identify each request and differentiate between multiple transactions, helping both you and your clients stay on top of records. In this section, we’ll explore the importance of payment request numbers and how to use them effectively.

Why Payment Request Numbers Matter

Having a structured system for numbering your documents ensures that each transaction can be easily referenced, helping to avoid confusion or errors when dealing with multiple requests. Some reasons to use numbered references include:

- Better organization: It helps you keep track of all financial records and payments made, making your accounting process more efficient.

- Clear communication: A unique number makes it easier for both you and your client to refer to specific transactions, reducing misunderstandings.

- Professionalism: Using a numbering system demonstrates attention to detail and establishes a level of professionalism in your business dealings.

How to Structure Payment Request Numbers

There are many ways to structure your numbering system, depending on your preferences or business needs. Here are some tips on creating an effective system:

- Sequential numbering: One of the simplest ways to number requests is sequentially, starting from 001, 002, 003, and so on. This method is easy to follow and helps you quickly spot any missing documents.

- Include the year: For added organization, consider including the year in the number. For example, “2024-001” or “001-2024” can help you easily track payment requests by year.

- Use client identifiers: If you work with multiple clients, adding a client-specific code to the number can help further organize the documents, such as “CLT-001” for the first client’s request.

By understanding and utilizing a numbering system, you ensure that your financial documents are well-organized, easy to reference, and professional in appearance. This practice streamlines the tracking and management of payments, making your workflow more efficient and your communication clearer with clients.

How to Calculate Fees on Your Payment Request

Calculating the fees associated with a service or project is an essential step in ensuring that both you and your client are clear on the total amount due. Whether you charge by the hour, a flat rate, or based on a custom structure, having a clear understanding of how to calculate your fees is crucial for transparency and professionalism. In this section, we’ll explore various methods for calculating fees and the factors to consider when determining your final amount.

Hourly Rate Calculation

If you charge by the hour, the first step is to determine your hourly rate and the number of hours worked. Here’s how to calculate:

- Determine your hourly rate: Set a rate based on your skill level, industry standards, and the nature of the work.

- Track your hours: Keep accurate records of how much time you spend on each task or project.

- Multiply: Multiply the total number of hours worked by your hourly rate to get the total amount due.

For example, if your hourly rate is $50 and you worked 10 hours, your fee would be $500.

Flat Rate Calculation

For projects that have a fixed scope or deliverables, you may prefer to charge a flat rate. This is often simpler and can provide clarity to your client upfront. Here’s how to calculate:

- Define the scope: Outline the specific services you are providing and agree on a set price before starting the work.

- Factor in additional costs: If there are any extra expenses (travel, materials, etc.), include these in your flat rate.

- Set your price: Once you’ve accounted for time, expenses, and the value of your work, set a fixed fee that reflects the total value of the project.

Flat rates can be beneficial for both you and your client as they provide a clear expectation of the total cost upfront.

Whether you choose to calculate fees based on hourly work or a

Legal Considerations for Payment Requests

When creating payment documents, it’s essential to be aware of legal aspects to ensure that both parties are protected. These documents not only outline the agreed-upon terms but also serve as proof of the transaction in case of disputes or legal issues. Understanding your rights and obligations can help you avoid legal pitfalls and maintain professional relationships with your clients. In this section, we’ll highlight key legal considerations when preparing payment documents.

Required Information for Legal Compliance

To ensure that your payment requests meet legal standards, it’s crucial to include the right information. Here are some key elements to consider:

- Legal name and business information: Always include your full legal name or business name and your contact details, including your address and phone number.

- Client details: Clearly list the client’s full name or company name along with their address and contact details.

- Tax identification numbers: Depending on your location, you may be required to include your tax identification number (TIN) and the client’s TIN for tax reporting purposes.

- Payment terms: Be explicit about the payment due date, any late fees, and payment methods accepted (bank transfer, credit card, etc.).

Tax Obligations and Compliance

Many regions require businesses or individuals to collect and report taxes on services rendered. It’s important to be clear about your tax obligations when preparing payment requests. Here are some steps to ensure compliance:

- Sales tax or VAT: Determine whether you are required to charge sales tax or VAT on the services you provide and include this in your total amount.

- Invoicing for international clients: If you’re working with international clients, make sure you are aware of any import taxes or duties that may apply, and include the relevant details in your request.

- Record keeping: Keep a record of all transactions and taxes collected for accurate reporting when filing your taxes.

Dispute Resolution and Legal Protection

To avoid complications in case of a dispute, consider including clear terms about how conflicts will be resolved. This can help protect you and your client from unnecessary legal issues. You may want to include the following:

- Payment dispute process: Outline the steps for resolving disputes, including how both parties will communicate and the timeline for resolution.

- Legal jurisdiction: Specify the legal jurisdiction (location) where any legal matters related to the payment request will be resolved.

- Contract agreements: Whenever possible, have a signed contract or agreement outlining terms before creating a payment request. This can provide additional legal protection.

By understanding the legal aspects of preparing payment do

Tracking Payments with Your Payment Request

Effectively monitoring payments is crucial to ensure that all transactions are completed in a timely manner. By keeping track of payments, you can quickly identify any overdue amounts, avoid potential disputes, and maintain a healthy cash flow. This section discusses methods for tracking payments through your payment requests and how to stay organized throughout the process.

Key Information to Track

In order to manage and track payments efficiently, it’s important to include specific details in your request. These details can help you easily monitor when payments are made and which transactions are still pending:

- Payment due date: Make sure the due date is clearly stated to set clear expectations for when the payment should be completed.

- Payment amount: Ensure the amount due is easy to identify, including any taxes, fees, or discounts that apply.

- Payment method: Record the method of payment (e.g., bank transfer, credit card, check) for easy reference and reconciliation.

- Transaction date: Include the date when the payment is made to help you keep track of when the funds are received.

- Reference number: If applicable, include any payment reference or transaction number for easier identification on your end.

Tracking and Managing Payment Status

Once the payment request is sent, keeping track of the payment status can help you stay organized and reduce the risk of missed payments. Here are some ways to track the status of payments:

- Mark the payment status: Use your payment records to track whether the payment is “Paid,” “Pending,” or “Overdue.” This simple step allows you to quickly assess the status of each payment.

- Send reminders for overdue payments: If a payment becomes overdue, set up automated or manual reminders to notify clients about their outstanding balances.

- Use accounting software: Many accounting platforms provide tools to track and manage payments. These tools often include automatic payment reminders, reports, and dashboards that can help you stay on top of transactions.

Maintaining a Payment Log

To ensure you have a complete record of all your transactions, keep a log of each payment made. This log can be digital or paper-based, depending on your preference. Key details to include in your log:

- Payment date: The date when the payment was received.

- Amount received: The exact amount paid by the client.Using Payment Request Formats for International Payments

When dealing with international transactions, it’s essential to ensure that your payment documents are clear, professional, and comply with different countries’ regulations. This section explores how to effectively use customizable formats for global payments, helping you avoid common issues such as currency confusion or missing information.

Key Considerations for International Transactions

International payments require more detailed information to prevent misunderstandings. The following factors are important when preparing payment requests for overseas clients:

- Currency: Clearly state the currency being used for the payment. Ensure that both parties understand the exchange rate and any applicable conversion fees.

- Tax and VAT: Different countries have varying tax regulations. Indicate whether taxes are included or excluded, and provide the necessary tax identification numbers if required.

- Payment Methods: Offer multiple payment options such as bank transfers, PayPal, or international credit card payments to accommodate clients from different regions.

- Bank Details: For bank transfers, include your full international bank account information, such as SWIFT/BIC code and IBAN number.

- Shipping and Handling: If applicable, outline any shipping fees or handling charges associated with the transaction.

Making Sure Your Documents Are Clear and Legible

In international business, clarity is crucial. Providing an easily understandable payment document will not only ensure smooth transactions but also foster trust with your clients. Here’s how to keep your payment documents clear:

- Use a professional format: Choose a consistent layout that includes all necessary fields and is easy to read across different platforms and devices.

- Provide clear instructions: Include specific instructions about how payments should be made, especially if the client is unfamiliar with your payment methods.

- Offer multilingual support: If possible, provide the option for your payment request to be available in your client’s preferred language. This will ensure there are no misunderstandings regarding the terms of payment.

Using the right format for international payments ensures that both parties understand the transaction terms, reduces potential errors, and facilitates smooth financial exchanges across borders.

Free Formats for Different Music Genres

When creating professional payment documents, it’s essential to tailor the format to the specific needs of the music genre you work in. Each genre has unique aspects that can affect the structure of your financial documents, such as the type of services provided, payment terms, and even the audience you’re working with. Here’s how to adapt your payment requests based on different music styles.

Classical Music

For classical performances, the agreements often involve orchestras, concert halls, and long-term engagements. The payment structure may include fixed fees for concerts, rehearsals, and potentially royalties. The format for these transactions should be clear and formal, with detailed breakdowns of each performance and associated costs.

- Detailed breakdown of services: Include specific fees for rehearsals, performances, and post-concert obligations.

- Fixed and variable rates: List standard fees for performances along with any additional charges, such as overtime or special requests.

- Royalty considerations: If applicable, indicate how royalties or revenue sharing will be handled.

Pop and Rock

Pop and rock performances often involve more flexible payment terms, as these genres may include a combination of live shows, studio recordings, and promotional work. These formats should allow for adjustments based on the scope of the project or the artist’s popularity.

- Flexibility in pricing: Include adjustable pricing for various activities, such as concerts, recording sessions, and media appearances.

- Split payments: If working with multiple band members or collaborators, split payments may need to be clearly outlined in the document.

- Promotion fees: Consider fees for promotional activities like interviews, photoshoots, or social media engagement.

Jazz

Jazz performances tend to have a more fluid structure, often based on improvisation and smaller, more intimate venues. The financial agreements in this genre should focus on hourly or per-performance rates rather than long-term contracts.

- Hourly rates: Jazz performances often charge based on the time spent performing, so be sure to outline hourly rates for gigs.

- Collaboration costs: If working with multiple musicians, ensure that each member’s compensation is clearly defined.

- Travel and accommodation: Include additional expenses for travel and accommodations, especially if performing at events far from the home base.

Electronic and DJ

For electronic music artists or DJs, payment documents can vary based on event size and location. These formats should cover everything from DJ gigs at clubs to high-profile festival performances.

- Event-based pricing: Clearly state fees based on the size of the event, location, and the artist’s profile.

- Technical requirements: Include any technical equipment or special equipment rental fees that may b

How to Download and Use Formats Easily

Accessing and using ready-made financial document structures is a simple and efficient way to handle transactions. Whether you’re looking to streamline your payment requests or ensure accuracy in your records, downloading these formats can save you time. Here’s how to easily find, download, and use these documents for your professional needs.

Steps to Download Your Preferred Format

Downloading a payment document format is typically a straightforward process. Follow these steps to get the format that suits your needs:

- Visit a reliable source: Look for websites that offer well-designed, customizable structures for different types of work.

- Select the right style: Choose a document that fits your specific requirements, whether it’s for short-term gigs, ongoing projects, or large events.

- Download the file: Most sites allow you to download the document in formats like PDF, Word, or Excel. Pick the one that works best for your workflow.

- Check for customizations: Some platforms may offer built-in fields for personalization, such as adding logos or adjusting payment terms.

Using the Document for Your Transactions

Once downloaded, the next step is to easily integrate the document into your routine. Here’s how you can make the most of it:

- Fill in your details: Add all necessary information such as the name of the client, payment terms, and specific charges related to the services provided.

- Customize the format: Modify the sections to reflect the specifics of your project or agreement, such as including travel expenses, overtime, or special terms.

- Track your payments: