PC Repair Invoice Template for Efficient Billing and Easy Customization

When managing a computer repair business or offering tech support, maintaining clear and professional records is essential. Proper documentation not only helps keep track of work completed but also ensures transparency in financial transactions. A well-organized billing system is crucial for both clients and service providers, as it avoids confusion and sets clear expectations.

Creating effective billing documents requires including relevant details such as services performed, costs, and payment terms. Having a standardized format that you can easily customize for each job allows for faster processing and greater efficiency. With the right structure, you can enhance customer trust and simplify your administrative workload.

Using a customizable format for your service statements can improve your workflow by providing a consistent approach to documenting work. This makes it easier to track previous jobs, manage finances, and ensure clients receive accurate summaries of the services rendered. Whether you’re a freelancer or part of a larger team, investing time in developing the right billing documents is key to smooth operations and client satisfaction.

Why You Need a PC Service Billing Document

For any business offering computer-related services, having a structured way to document transactions is essential. Clear, well-organized financial records not only ensure you are compensated fairly but also provide a professional approach that builds trust with clients. Without proper documentation, there is a higher risk of misunderstandings or missed payments.

Providing clear breakdowns of the work performed and associated costs helps both you and your clients stay on the same page. It reduces the likelihood of disputes and helps maintain transparency in all financial dealings. This kind of documentation also serves as a reminder for customers about the value of the services they received.

Tracking past jobs becomes much simpler when you use a standardized document. You can quickly reference previous transactions, monitor payment histories, and keep a record for tax purposes or future service needs. A well-crafted billing statement is not just a tool for payment collection; it’s a valuable business asset for managing your workflow and maintaining a professional reputation.

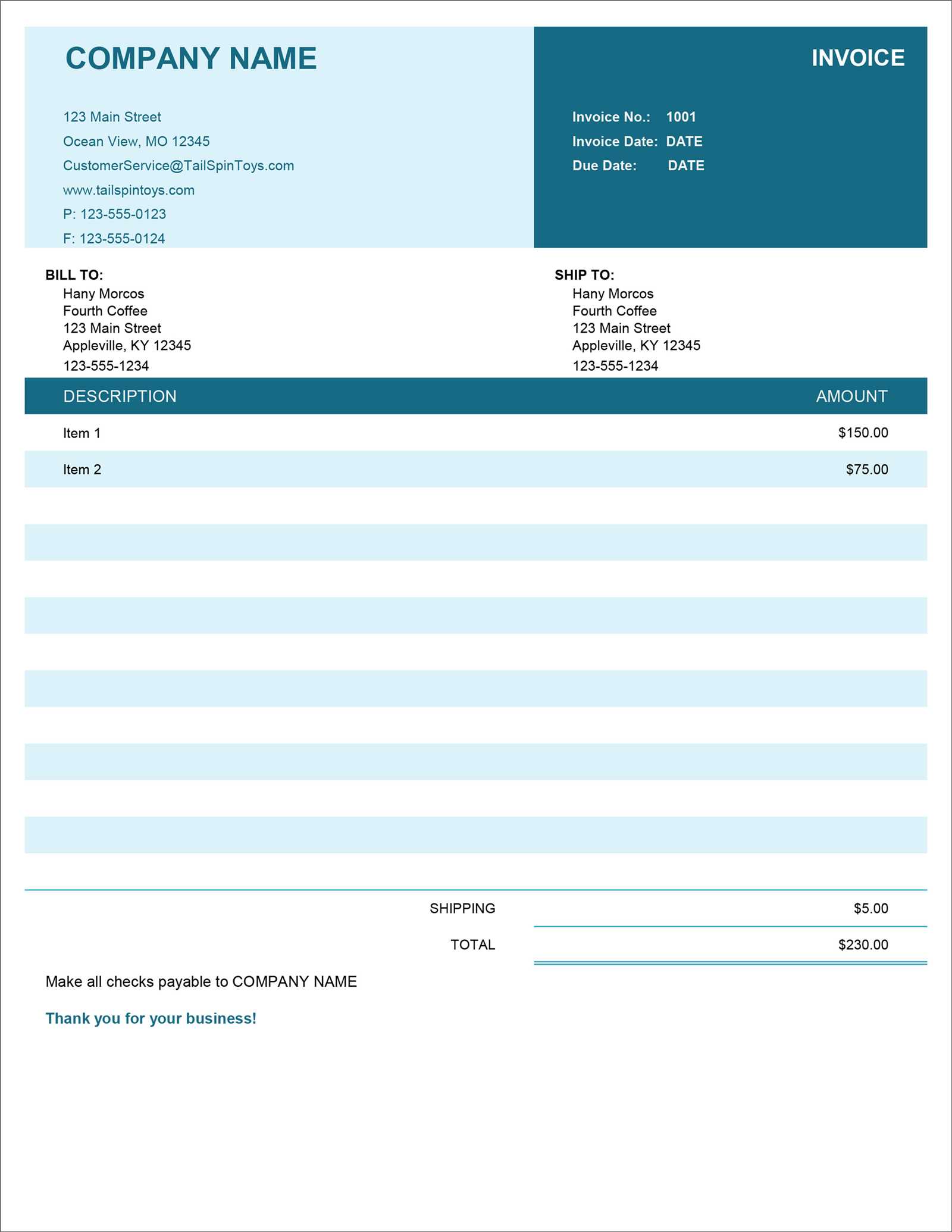

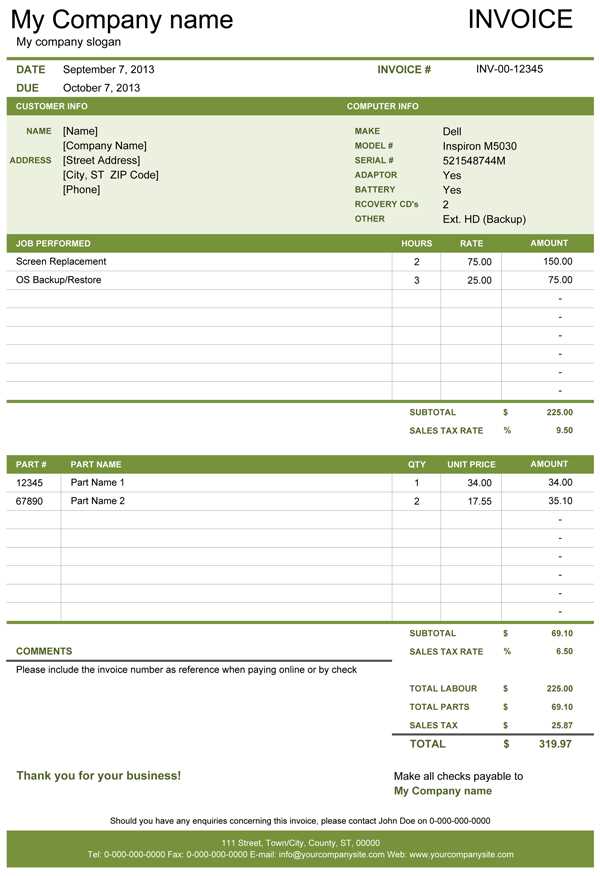

Key Elements of a PC Service Billing Document

When creating a document to summarize the services provided, it is important to include specific details that help both the service provider and the client understand the scope and cost of the work. A clear structure ensures that all the necessary information is included and easily accessible, reducing the chance of confusion or errors.

Customer and service provider information should always be prominently displayed. This includes names, contact details, and business addresses. Including these details establishes a formal relationship and ensures both parties can be easily contacted if needed.

Detailed descriptions of the services performed are crucial for transparency. It’s important to list the tasks completed in a clear and concise manner, with any relevant specifications or issues addressed. Additionally, outlining costs and taxes is necessary for clarity. Providing a breakdown of charges allows the client to see exactly what they are paying for, including labor, parts, and any applicable fees.

Lastly, payment terms and deadlines are essential to avoid misunderstandings. Make sure to specify when payments are due, and any late fees or penalties that might apply. This helps ensure timely payments and sets clear expectations for both parties.

How to Create a PC Service Billing Document

Creating an effective billing document requires attention to detail and a clear structure. The goal is to provide both the service provider and the client with a comprehensive summary of the work done, along with the associated costs. By following a systematic approach, you can ensure that every aspect of the transaction is properly documented and easy to understand.

Step 1: Include Basic Information

Start by adding essential contact details for both parties. This includes the names, addresses, phone numbers, and email addresses of the customer and service provider. This information helps establish a formal relationship and provides a point of reference for future communication.

Step 2: List Services and Costs

Next, provide a detailed breakdown of the tasks completed. Be specific about what was done, and include any relevant details that may help the client understand the work performed. After listing the services, include the associated costs for each one, ensuring that all charges are clearly outlined. Don’t forget to add applicable taxes or additional fees to provide a complete picture of the total amount due.

Finalizing the document involves specifying the payment terms. This includes the due date, payment methods, and any late fees or penalties for overdue payments. Clear payment instructions help avoid confusion and ensure that both parties are aligned on the financial expectations.

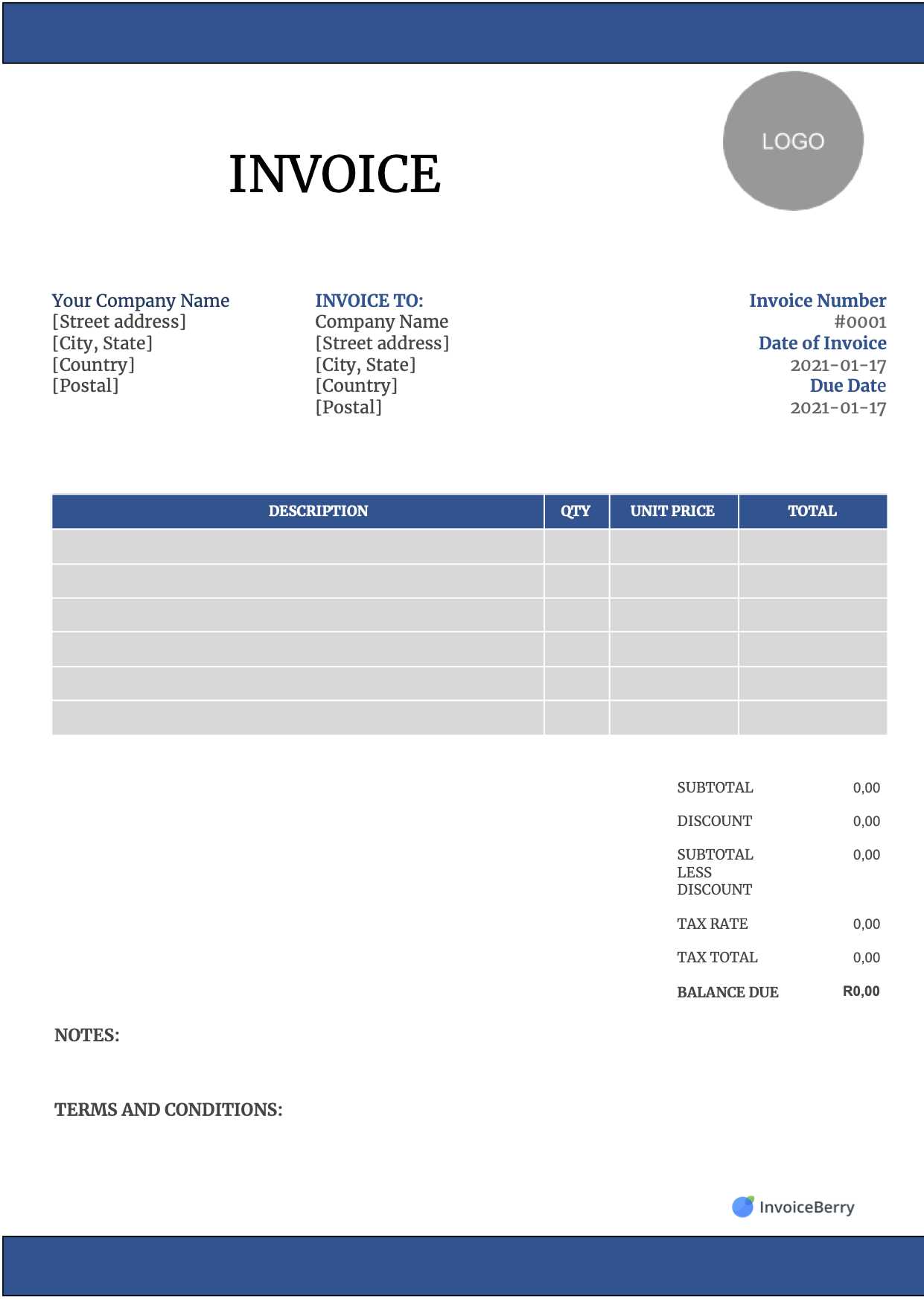

Essential Features for a Service Billing Document

When creating a document to summarize the work completed, there are several key components that ensure the document is both professional and functional. These elements not only improve the clarity of the transaction but also help streamline the payment process, making it easier for both the provider and the client to understand the charges and terms.

First and foremost, clear identification of both parties is crucial. This includes full names, addresses, and contact details for both the service provider and the customer. Having this information visible ensures that the document is formal and traceable.

Another essential feature is a detailed description of services provided. Clearly outlining the tasks or issues addressed helps justify the charges and provides transparency. Each service should be listed separately, allowing the client to see what they are paying for and why those services were necessary.

Pricing breakdown is equally important. Ensure that every cost is listed individually, including labor, parts, and any additional fees. This helps the customer understand how the total amount was calculated and prevents any confusion when the bill is reviewed.

Finally, having payment terms and conditions is vital. Specify when the payment is due, what methods are accepted, and any late fees that may apply. Clear payment terms help both parties stay on the same page and avoid potential payment issues down the line.

Customizing Your PC Service Billing Document

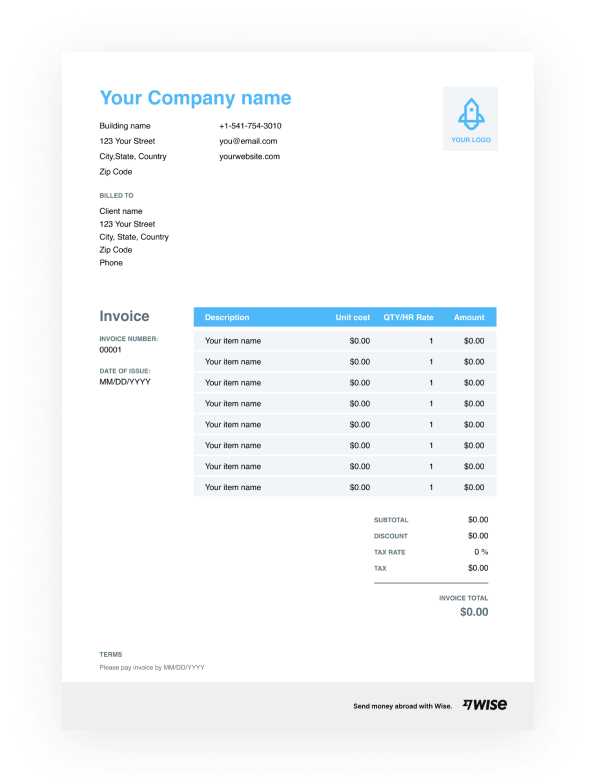

Tailoring your billing document to match the specific needs of your business and your clients is essential for creating a professional and efficient system. Customization allows you to adapt the structure and details to fit your particular services, making the document not only functional but also aligned with your brand identity. A personalized approach enhances clarity and helps build trust with customers.

Step 1: Include Your Branding

One of the first elements you should customize is the branding. Adding your company logo, contact information, and a consistent color scheme helps reinforce your brand and makes the document look polished. Including your website or social media links can also offer additional ways for clients to stay connected or find more information about your services.

Step 2: Tailor the Service Descriptions

Next, modify the section where you describe the work done. Each service may require unique details or specific terminology that best reflects what was accomplished. Whether it’s computer diagnostics, software installation, or hardware troubleshooting, clear and concise descriptions make it easy for clients to understand the work performed. Customizing this part ensures that it matches the exact nature of your services and avoids any ambiguity.

Setting payment terms and conditions to your preference is another important step. You may want to adjust due dates, specify payment methods, or offer discounts for early payment, all of which can be tailored to your business model. By customizing payment instructions, you can set expectations clearly and professionally, making the transaction smoother for both parties.

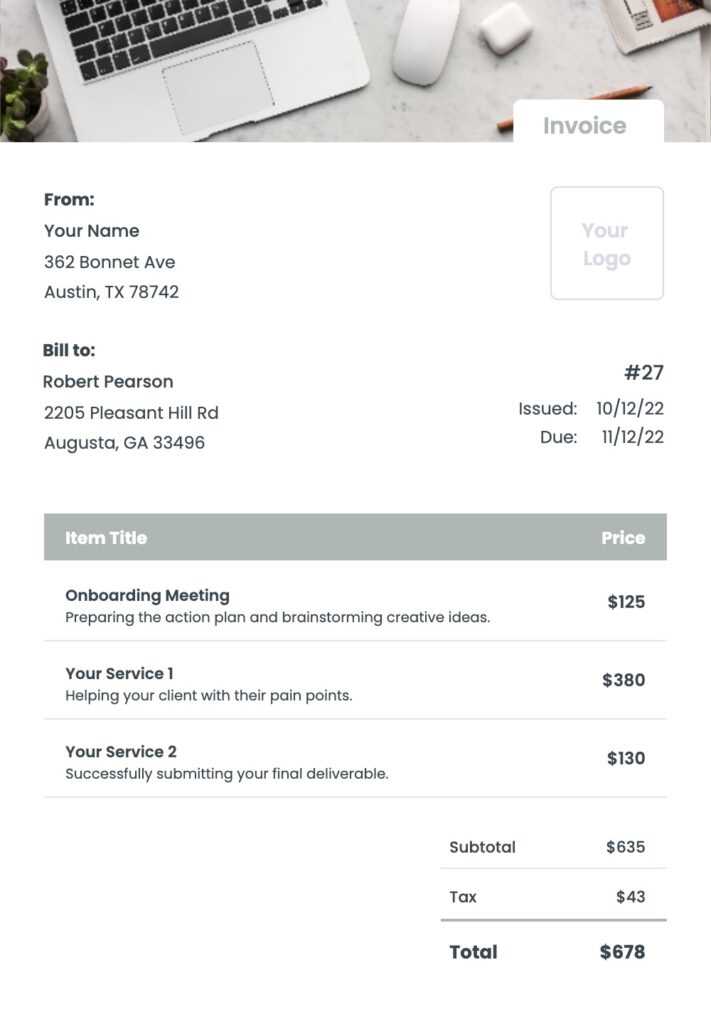

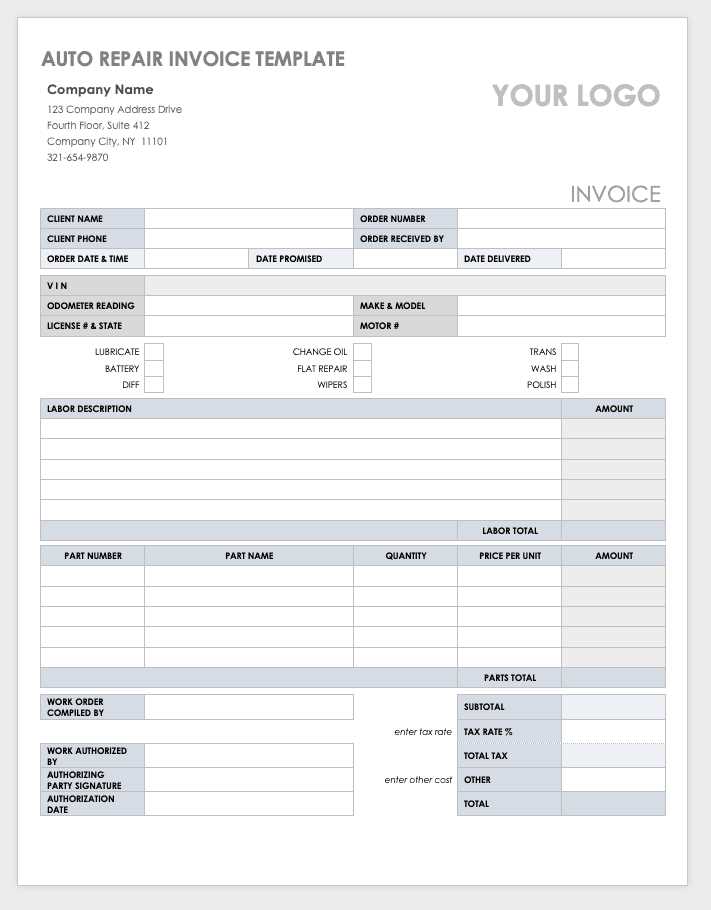

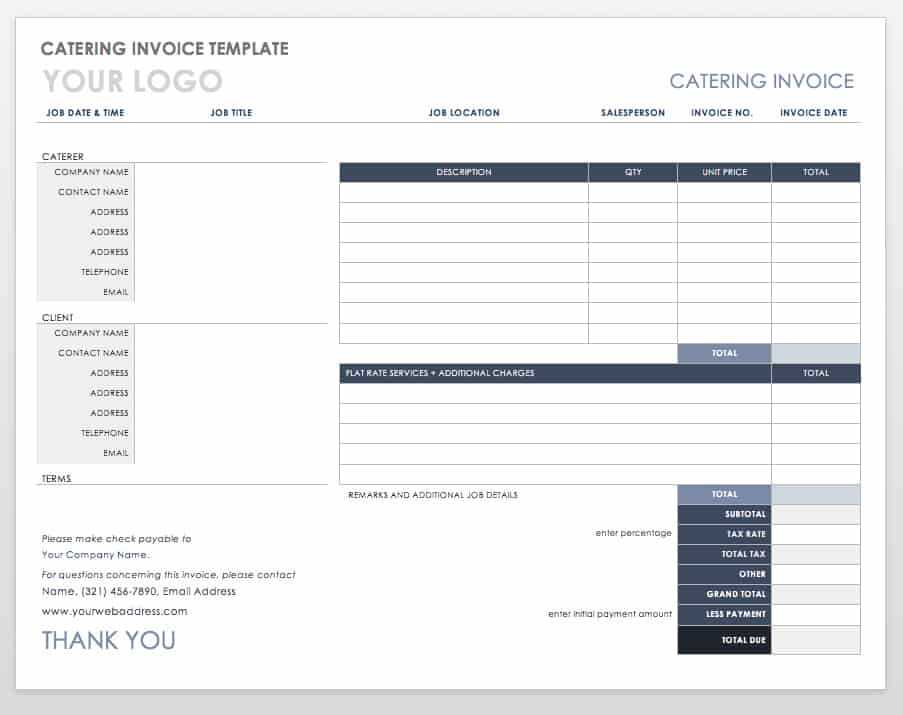

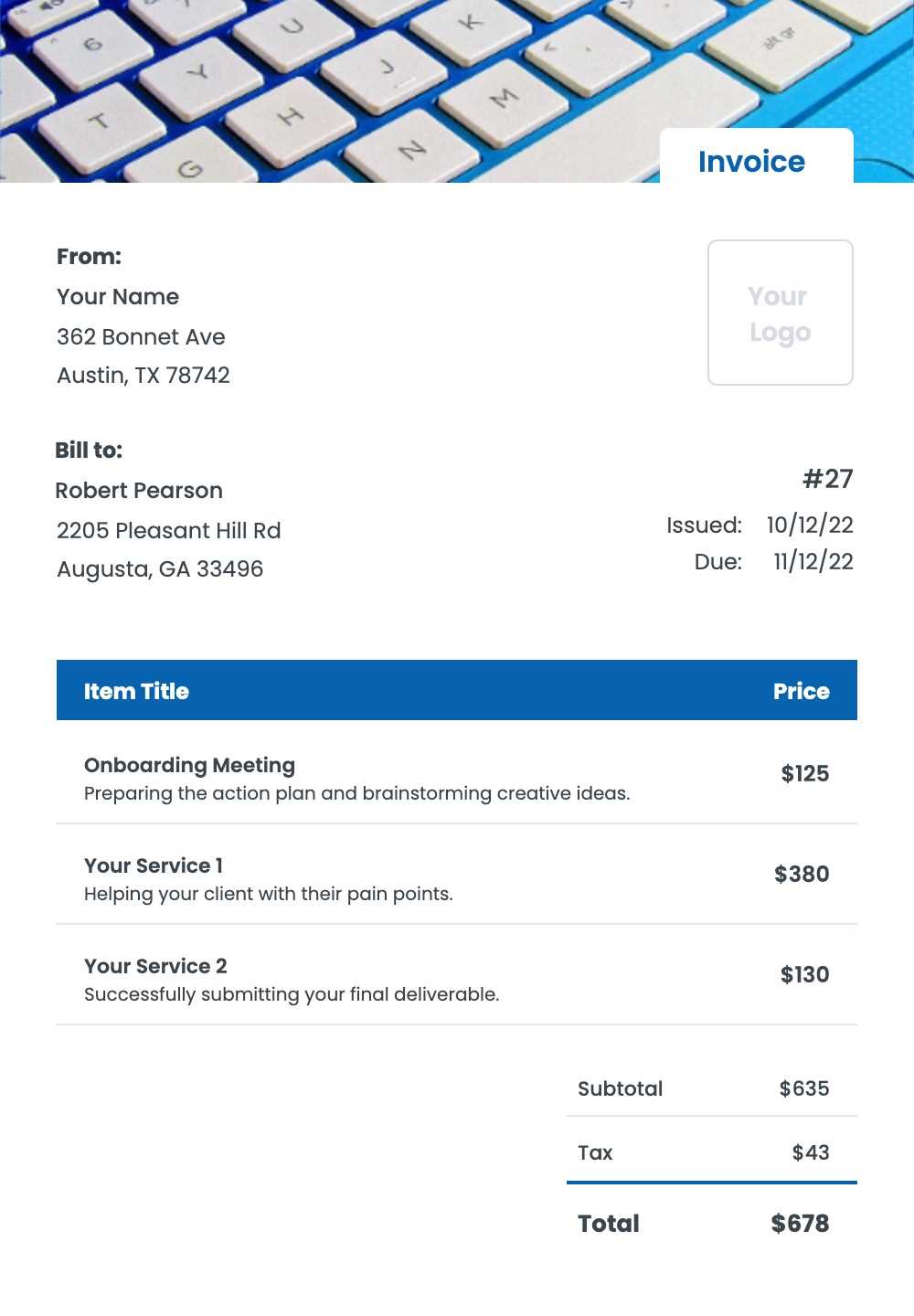

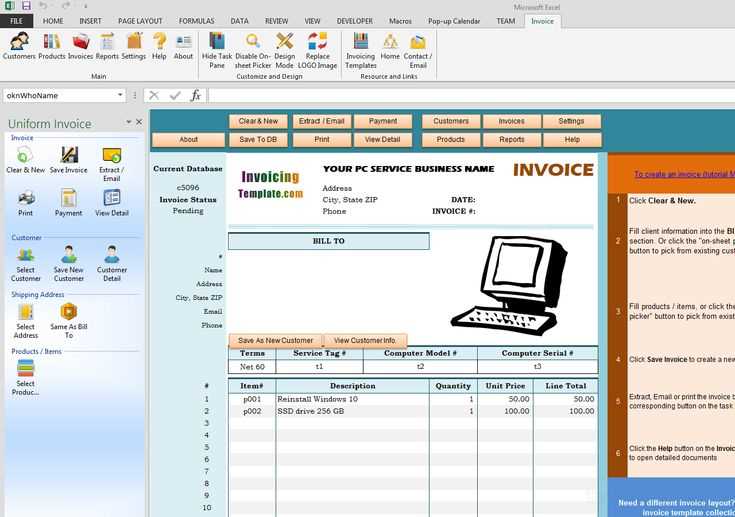

Free PC Service Billing Documents to Use

If you’re looking for a quick and effective way to manage your billing process, using pre-made documents can save time and effort. Many free resources are available online that offer customizable formats, designed specifically for those offering computer-related services. These ready-made solutions allow you to easily input your own details, adjust for specific needs, and ensure that your financial records are organized and professional.

Online Platforms with Free Resources

Several websites offer a wide range of free templates that can be downloaded and customized to suit your business. These resources often include editable fields for customer information, service descriptions, and pricing breakdowns, making it easy to create a professional document in just a few steps. Websites like Template.net and Invoice Generator are great starting points for finding high-quality documents that meet your needs.

Customizable Formats for Different Needs

Another great feature of free service documents is their flexibility. Most platforms allow you to modify fields according to the nature of the work, adding or removing sections as necessary. You can tailor the design, adjust the layout, and even choose between different file formats such as PDF, Word, or Excel for easy editing and sharing. This ensures that whether you’re a freelancer or running a larger operation, you can find a format that fits your workflow.

Using free resources not only saves money but also helps you stay organized and maintain a professional image. With the right tools, managing your service documentation becomes much easier, helping you focus on what matters most–providing excellent service to your clients.

Best Software for Creating Service Billing Documents

When it comes to generating professional and accurate billing records, using the right software can make a significant difference in efficiency and accuracy. Many software options are designed to simplify the process, providing customizable templates, automated calculations, and easy tracking of payments. Choosing the best tool depends on your business size, the features you need, and your personal preferences for ease of use.

Top Options for Small to Medium Businesses

For small businesses or independent contractors, the following software options offer a great balance of features and simplicity:

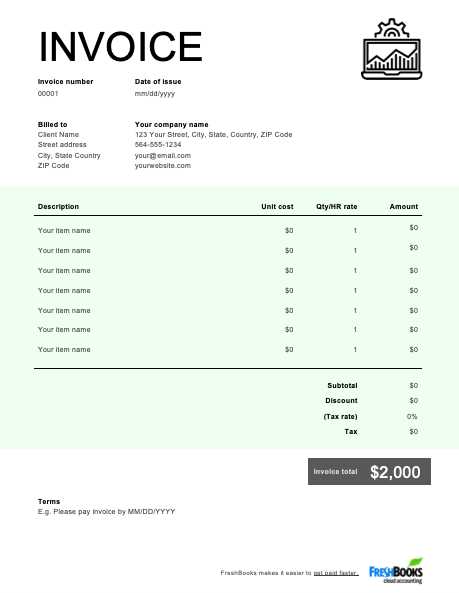

- QuickBooks – A widely used accounting software that allows you to create professional documents, track payments, and manage finances all in one place.

- FreshBooks – Known for its user-friendly interface, FreshBooks allows you to create custom billing statements, track time and expenses, and automate client communications.

- Wave – A free accounting software offering customizable billing documents, expense tracking, and even invoice reminders, making it ideal for small business owners.

For Larger Operations or Advanced Features

If you run a larger business or require more advanced features, these tools offer robust solutions for managing complex workflows:

- Zoho Books – A comprehensive accounting solution with advanced billing features, project management tools, and integration with other business software.

- Xero – Known for its real-time collaboration and cloud-based features, Xero makes it easy for teams to manage financial records and generate detailed service documents.

- Microsoft Excel – Though not a dedicated billing tool, Excel offers flexibility and control over document design, allowing you to build custom records from scratch or use a pre-designed spreadsheet.

Choosing the right software can save time and help you maintain organized and professional records, streamlining the billing process and reducing errors. Whether you’re just starting out or managing a larger team, these tools can help you create polished documents and focus more on growing your business.

How to Add Tax and Discounts

Incorporating taxes and discounts into your service billing is crucial for ensuring accurate and transparent financial records. Whether you need to apply sales tax based on local regulations or offer a discount to a loyal customer, these adjustments should be clearly presented to avoid confusion. Knowing how to properly include these factors will ensure that your clients are aware of the final amount due and that your business remains compliant with tax laws.

Step 1: Adding Tax to Your Billing Document

To apply tax, you first need to know the applicable tax rate for your region. The rate can vary depending on where the service is provided and what type of service is being delivered. Once you know the correct percentage, calculate the tax based on the total cost of the services rendered.

- Calculate tax amount: Multiply the subtotal of services by the tax rate (e.g., subtotal × tax rate = tax amount).

- Apply tax to the total: Add the calculated tax amount to the subtotal to arrive at the final total due.

It’s important to clearly show the tax on the document by listing it separately from the other charges. This ensures transparency and makes it easy for the customer to understand the breakdown of their payment.

Step 2: Including Discounts

Offering discounts can be an excellent way to reward loyal customers or incentivize early payments. When applying a discount, it’s important to specify the percentage or amount being deducted from the total cost. Discounts should be clearly visible, and their conditions (e.g., “10% off for early payment”) should be stated.

- Calculate the discount: If offering a percentage discount, multiply the subtotal by the discount rate (e.g., subtotal × discount rate = discount amount).

- Apply the discount: Subtract the discount from the subtotal to calculate the adjusted amount.

Ensure that both the discount and the final price are clearly stated in the document so that your client understands the value they’re receiving. Offering clear and professional details helps build trust and encourages prompt payment.

Including Service Details in Billing Documents

When creating a billing record for services rendered, providing clear and detailed descriptions of the tasks performed is essential. These details not only justify the charges but also help clients understand the work completed. Properly documenting the services makes the transaction more transparent and minimizes the chances of misunderstandings or disputes.

Step 1: Be Specific About the Services

Each task or issue addressed should be described in clear and concise terms. Avoid vague language, and instead, focus on the exact work performed. Whether it’s troubleshooting a system issue, installing software, or upgrading hardware, include enough detail to show the value of the work done. This will help clients understand what they’re paying for and appreciate the expertise involved.

- Example: Instead of simply stating “system maintenance,” specify “diagnosed and resolved slow boot issue, updated operating system, and removed malware.”

- Additional details: If the service required special equipment or parts, mention this as well, especially if it impacts the cost.

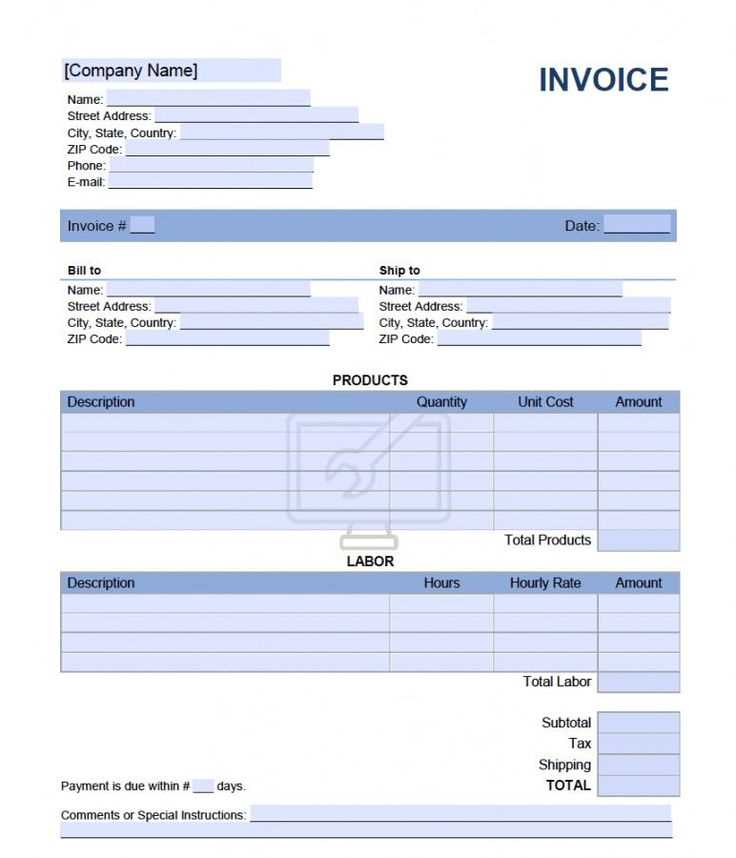

Step 2: Include Time Spent and Materials Used

For services that involve time-based billing, clearly note the hours worked and the corresponding rate. This provides a clear breakdown of the costs, which can be particularly important for hourly services. Additionally, if any materials or parts were used, make sure to list them along with their cost, providing an itemized list if applicable.

- Time-based charges: List the total time spent on each task and multiply by the hourly rate.

- Materials used: Itemize any materials, parts, or equipment purchased for the service, including the cost for each item.

By including detailed service descriptions, you not only provide transparency but also demonstrate professionalism, which can build trust and help maintain strong client relationships. A well-documented billing record reflects the quality of your work and ensures that all aspects of the job are accounted for clearly and accurately.

Billing Document for Multiple Services

When providing several services in a single job, it is essential to organize the details in a clear and structured way. A well-designed billing document should reflect the variety of tasks completed, making it easy for both the service provider and the client to understand the breakdown of costs. A template that accommodates multiple services allows you to itemize each task individually while providing a total amount for the entire job.

Step 1: List Each Service Separately

For each task performed, include a brief yet detailed description. This ensures that the client knows exactly what was done and can see how the charges were calculated. Whether it’s software troubleshooting, hardware installation, or data backup, each service should be clearly outlined with its associated cost. This approach avoids confusion and shows that you’ve accounted for all aspects of the job.

- Example: “Installed new graphics card – $150” or “Replaced faulty power supply unit – $100”

- Tip: If the services are related, group them together under relevant headings (e.g., “Hardware Services” or “Software Services”).

Step 2: Apply Discounts or Group Pricing

For multiple services, you might offer a discount or package pricing for clients who request several tasks at once. This helps incentivize clients to bundle services and can lead to more business in the future. If offering a discount, make sure to clearly specify the percentage or fixed amount deducted from the subtotal. Additionally, if there are any group pricing options available, list them and show how the total was adjusted accordingly.

- Example: “10% discount for bundling three services together – Applied to subtotal”

- Group pricing: “Comprehensive system check-up and upgrade package – $250 (including hardware and software upgrades).”

Including clear itemization and special offers not only makes your billing documents more professional but also helps clients appreciate the value they’re receiving. By organizing multiple services effectively, you provide both transparency and clarity, enhancing client satisfaction and trust.

How to Include Client Information

Including accurate and complete client information in your billing document is essential for maintaining clear communication and a professional appearance. This information ensures that both parties know exactly who is responsible for the payment and provides a way to reach the client if needed. Properly documenting client details also helps keep your records organized and can be useful for future reference or follow-up.

Step 1: Include Basic Client Details

Start by listing the client’s full name, business name (if applicable), and contact information. This should include the client’s phone number, email address, and physical address. Providing these details makes it easier to contact the client for any clarifications or follow-up regarding the payment.

- Client Name: Full name or business name (if applicable).

- Contact Information: Phone number, email address, and physical address.

Step 2: Provide Relevant Account or Job Details

In addition to basic contact information, including any relevant job-specific details can help keep the record organized. For instance, if you assign an account number or job ID to each project, make sure to include that in the document. This allows both you and the client to easily reference the service and the specific job or project in the future.

- Account Number or Job ID: This helps uniquely identify the transaction.

- Project Description: Briefly mention the project or service provided, making it clear what the client is being billed for.

Clearly presenting client details not only ensures your documents are organized and professional but also provides a smooth experience for the client when it’s time to review or pay the bill. Including all necessary information upfront minimizes confusion and helps foster positive business relationships.

Tracking Payments with Billing Documents

Effectively tracking payments is essential for maintaining the financial health of your business. By organizing payment details in your billing records, you ensure that both you and your client have a clear understanding of what has been paid and what remains outstanding. This system not only simplifies accounting but also helps to prevent missed payments or confusion regarding amounts due.

Step 1: Add Payment Terms and Due Dates

One of the most important elements to include in your billing records is clear payment terms. This includes specifying the due date, the acceptable methods of payment, and any penalties for late payments. By establishing these terms upfront, you help set expectations for your clients, making the payment process smoother for both sides.

- Due Date: Clearly state when payment is expected (e.g., “Due within 30 days of receipt”).

- Accepted Payment Methods: List the types of payments you accept, such as bank transfers, credit cards, or checks.

- Late Fees: Include any penalties for late payments, such as a percentage charge for overdue amounts.

Step 2: Track Paid and Outstanding Amounts

To track payments effectively, include a section in your billing document to record the payment status. This could be a simple “Paid” or “Outstanding” label, or you may choose to include the amount paid and the remaining balance. When payments are made, update the document with the relevant payment details, such as the date and method of payment. This ensures that you have an accurate and up-to-date record of all transactions.

- Payment Status: Mark the document as “Paid” once payment is received, or leave it as “Outstanding” until the full amount is settled.

- Partial Payments: If a client pays in installments, note each payment made and adjust the remaining balance accordingly.

Keeping a clear record of payments not only helps you maintain financial accuracy but also improves transparency with your clients, reducing the risk of misunderstandings and helping to ensure that payments are received promptly.

How to Handle Late Payments on Billing Documents

Late payments can disrupt the cash flow of any business, so it is important to have a clear plan for managing them when they arise. Establishing clear payment terms upfront and communicating expectations effectively can reduce the risk of overdue balances. However, when late payments do occur, it’s crucial to handle them professionally and assertively to ensure timely resolution and maintain positive client relationships.

Step 1: Establish Late Payment Terms

The best way to handle late payments is to prevent them in the first place by setting clear payment terms. These should include the payment due date, any applicable late fees, and the process for handling overdue accounts. Make sure that clients understand these terms at the time of the agreement, and include them in the billing document as a reminder.

| Payment Term | Details |

|---|---|

| Due Date | Specify the date by which payment is expected, e.g., “Due within 30 days of receipt.” |

| Late Fee | State any late fee charges, such as a fixed amount or percentage (e.g., 2% per month). |

| Grace Period | Allow a brief grace period (e.g., 5 days) before charging late fees. |

Step 2: Follow Up Professionally

If a payment is not received on time, it’s important to follow up promptly but professionally. Start with a gentle reminder, as sometimes clients simply forget or are delayed. If the payment remains unpaid, a more formal reminder or phone call may be necessary. Maintaining professionalism during these interactions is key to preserving good client relations while ensuring payment is made.

Using reminders effectively can help clients stay on track with their payments without feeling pressured. Clearly outline any fees for late payment and emphasize the importance of settling the balance as soon as possible to avoid further charges or service interruptions.

Legal Considerations for Billing Documents

When creating billing documents for services provided, it’s crucial to ensure that they comply with legal requirements. Proper documentation not only protects your business but also ensures transparency and fairness for your clients. Being aware of the necessary legal elements to include, such as payment terms, business registration details, and tax information, will help avoid disputes and maintain a professional standing in the eyes of the law.

Step 1: Ensure Accurate Business Information

Every billing document should clearly display your business’s legal details. This includes your business name, address, and contact information, as well as any relevant registration or licensing numbers. Depending on your location, you may also need to include your tax identification number (TIN) or employer identification number (EIN). Providing this information helps establish legitimacy and allows clients to confirm that they are dealing with a registered business.

- Business Name and Address: Make sure your official business name and address are clearly listed.

- Tax Information: Include your TIN, VAT number, or other relevant tax details, depending on local requirements.

- Licensing and Certifications: If applicable, include your business license number or any certifications related to your services.

Step 2: Comply with Local Tax Laws

When charging for services, it’s essential to follow local tax laws regarding sales tax, service tax, or VAT. This means including the correct tax rate on your billing documents and providing a breakdown of the taxes applied. Failing to charge the correct amount or to provide necessary tax information could result in legal issues or fines. Be sure to consult with an accountant or legal advisor to ensure compliance with tax laws in your jurisdiction.

- Sales Tax: Include the applicable tax rate and total amount charged for taxes on the document.

- Tax Exemptions: If any of your services are tax-exempt, be sure to clearly state that and include the relevant exemption details.

- Legal Disclaimers: Consider adding any legal disclaimers required for your industry, such as warranty disclaimers or limitations of liability.

By including necessary legal information in your billing records, you reduce the risk of disputes and ensure that both parties are aware of their rights and responsibilities. This practice will help foster a trustworthy and compliant business environment, giving your clients confidence in their transactions with you.

Benefits of Professional Billing Documents for Technicians

For technicians providing technical services, using professional billing documents brings numerous advantages. These documents not only serve as a record of services rendered but also enhance the credibility of the technician and the business. Clear, well-organized records help improve communication with clients, streamline payment processes, and ensure that both parties have a clear understanding of the financial aspects of the service provided.

Step 1: Establishing Trust and Professionalism

When a technician uses a polished and detailed billing record, it creates an impression of professionalism and reliability. Clients are more likely to trust a technician who provides clear and formal documentation, as it demonstrates that the technician is organized and values transparency. This level of professionalism can set you apart from competitors and encourage repeat business from clients.

- Client Confidence: A professional document gives the client confidence that they are dealing with a legitimate, reliable service provider.

- Clear Communication: A structured record reduces confusion by clearly outlining services performed and associated costs.

Step 2: Simplifying Financial Tracking and Management

Using professional billing records helps technicians keep track of payments and outstanding balances in an organized way. It allows technicians to easily monitor the financial health of their business, identify overdue payments, and follow up with clients as needed. This streamlined financial management reduces the risk of missed payments and simplifies accounting and tax preparation.

- Payment Clarity: Detailed documents help both the technician and client clearly see amounts owed and paid, making the payment process more transparent.

- Efficient Record Keeping: Having a consistent, professional approach to billing makes it easier to maintain accurate records for taxes or audits.

Using professional billing documents not only ensures smoother business operations but also helps build lasting relationships with clients through clear, transparent, and efficient communication. By establishing a solid foundation for financial transactions, technicians can focus more on their work and less on potential payment issues.

Best Practices for Sending Billing Documents

Sending well-prepared billing documents is essential for maintaining professionalism and ensuring prompt payment. How and when you send these documents can impact how quickly you get paid and how your business is perceived by clients. Following best practices not only streamlines the process but also minimizes the risk of misunderstandings or delayed payments.

One of the first steps in sending billing records is ensuring that they are accurate and complete. This includes verifying that all services, costs, and taxes are correctly listed. A detailed and clear document will prevent clients from needing to ask for clarifications, which can delay payment. It’s also important to send the document promptly after the service is completed to avoid any confusion and ensure timely payment.

Another important factor is choosing the right method for sending the document. While traditional paper copies can still be used, digital documents have become the preferred choice for many businesses due to their convenience and speed. Sending a digital version ensures that your client receives the document quickly and can make the payment right away, especially if you include links to online payment options.

Follow these best practices for sending billing records:

- Ensure Accuracy: Double-check all details before sending, including services rendered, costs, and any applicable taxes.

- Send Promptly: Dispatch the document as soon as the service is completed, ideally within 24-48 hours.

- Use Digital Methods: Send documents via email or a professional online platform to speed up the process and provide easy access for the client.

- Provide Clear Payment Instructions: Include clear instructions on how to pay, including any accepted methods or links to online payment platforms.

By following these best practices, you will create a more efficient process for both you and your clients, resulting in faster payments and a smoother workflow. Keeping things professional and clear can lead to better client relationships and greater financial stability for your business.