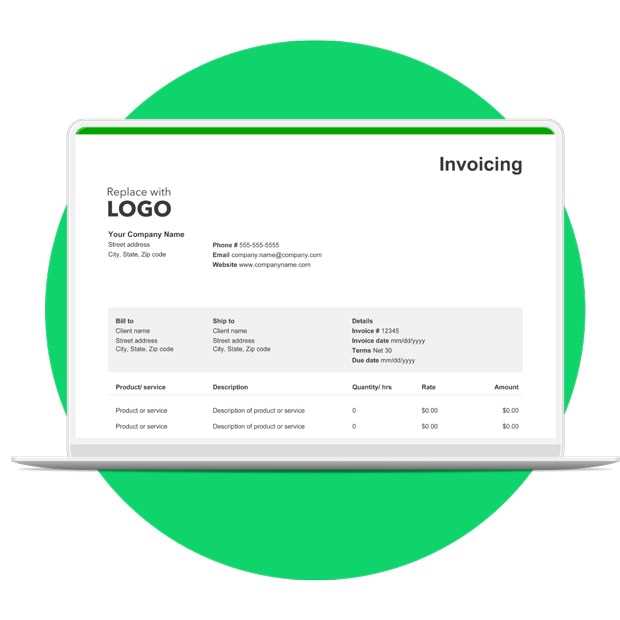

Customizable Business Invoice Template for Easy and Professional Billing

Managing payments and keeping track of transactions is an essential aspect of running any professional venture. A well-organized system not only ensures timely payments but also contributes to a smooth financial workflow. One of the most effective ways to simplify this process is by utilizing ready-made documents that help you stay consistent and accurate in your transactions.

These documents are designed to make the task easier by providing a clear structure, allowing you to focus on the content rather than worrying about formatting. By using a structured format, you can ensure that every necessary detail is included, reducing the chances of errors or confusion.

Customization is key to making these forms reflect your unique needs. Tailoring them to your specific requirements can enhance professionalism and align the document with your brand’s image. Whether you are dealing with local clients or international partners, having a standardized system helps build trust and ensures clarity in all dealings.

With the right approach, organizing financial transactions becomes not only easier but also more efficient. Implementing these helpful tools can lead to greater consistency, improved cash flow, and a smoother overall experience for both you and your clients.

Template for Business Invoice

When it comes to handling financial transactions, having a clear and structured document to track payments is crucial. This document helps both parties involved stay organized, ensures all necessary details are included, and facilitates easy record-keeping. The right format not only helps convey professionalism but also reduces the likelihood of confusion or errors.

Essential Elements of a Payment Document

Every well-organized form should contain specific components to ensure clarity and transparency. These typically include the name and contact details of the service provider, the recipient’s information, a list of goods or services provided, the amount due, and the payment terms. Below is a breakdown of common fields included in such documents:

| Field | Description |

|---|---|

| Provider Details | Includes name, address, phone, and email of the company or individual issuing the document. |

| Recipient Details | Includes the name and contact information of the client or customer. |

| List of Goods/Services | Describes the products or services provided, including quantities, unit prices, and total amounts. |

| Total Amount | Sum of all charges, including taxes and any discounts applied. |

| Payment Terms | Specifies the due date and accepted payment methods. |

Benefits of Using a Standardized Format

Using a set layout brings many advantages. It enhances consistency, making it easier to spot any discrepancies between transactions. Additionally, it creates a streamlined process that saves time and effort in tracking payments. Adopting a standardized approach also strengthens the professional image of the service provider, reassuring clients about the credibility of the transaction process.

Why You Need an Invoice Template

Having a standardized document to request payment and detail transactions is essential for maintaining order and clarity in financial dealings. Without a structured approach, managing payments can become disorganized, leading to confusion, missed details, and even delayed transactions. A reliable format ensures both you and your clients are on the same page, streamlining communication and reducing errors.

Ensuring Accuracy and Consistency

One of the primary reasons to use a predefined format is to avoid mistakes. By following a consistent structure every time, you ensure that each element–such as the amount owed, payment terms, and descriptions–is accounted for. This consistency reduces the likelihood of overlooked details and ensures accuracy in the final payment request, helping both parties avoid misunderstandings.

Enhancing Professionalism and Trust

Sending a well-organized, clear document not only facilitates a smooth transaction but also reflects professionalism. Clients are more likely to trust a provider who demonstrates attention to detail and consistency. A polished, well-crafted document can also serve as a reminder of your brand and reputation, fostering a sense of reliability.

Incorporating a clear format into your payment processes can ultimately improve your cash flow and prevent unnecessary delays. A streamlined approach helps you stay on top of financial records and maintain strong relationships with clients, which is essential for the growth of any venture.

Key Elements of a Business Invoice

To ensure a smooth transaction and avoid confusion, it’s important that a payment request document includes specific details that both parties can easily refer to. A well-structured form provides clarity about what is being charged, when payment is due, and how it should be made. These essential components not only prevent misunderstandings but also help maintain a professional image.

Crucial Information to Include

The following elements are necessary for a complete and accurate request for payment:

- Provider’s Details: The full name, address, phone number, and email of the service provider or company.

- Recipient’s Details: Information about the client, including their name and contact details.

- List of Goods or Services: A detailed breakdown of the products or services provided, including quantities, unit prices, and total amounts for each item.

- Total Amount Due: The overall cost of the services or goods, including taxes, discounts, or additional charges.

- Payment Terms: Information on when payment is due, accepted methods of payment, and any late fees if applicable.

Why These Elements Matter

Each section of the document plays a crucial role in ensuring both parties understand the terms of the transaction. By clearly listing services, costs, and due dates, you avoid confusion and ensure payment is made promptly. A professional presentation of these details not only ensures clarity but also strengthens the credibility of the service provider.

Maintaining this level of detail helps build trust and transparency, which are vital for long-term business relationships.

How to Choose the Right Template

Selecting the appropriate document format to request payment is a critical decision for any professional. The right structure can save time, prevent errors, and improve the overall efficiency of your financial operations. It’s important to consider the complexity of your transactions, the style of your brand, and the specific needs of your clients when choosing the ideal format.

Factors to Consider When Choosing a Format

There are several key aspects to keep in mind when selecting a layout:

- Clarity: The format should be easy to read and understand, ensuring all key details are visible and accessible.

- Customization: A good format should be flexible enough to allow you to adjust it for different types of transactions or clients.

- Professional Appearance: Choose a layout that aligns with your brand and conveys a sense of credibility and trustworthiness.

- Compatibility: Make sure the format can be easily shared and accessed by your clients, whether digitally or in print.

Comparison of Common Format Options

The table below compares some of the most popular options to help you decide which one fits your needs best:

| Option | Features | Best For |

|---|---|---|

| Simple Text-Based | Basic, minimal design with essential details | Small businesses, freelancers, or one-off transactions |

| Customizable Digital | Easy to edit with branding options, can be saved in multiple formats | Growing companies, service-based professionals |

| Pre-Designed with Branding | Fully designed with company logo, colors, and fonts | Established businesses that want to maintain a consistent brand identity |

Ultimately, the best choice depends on the scale of your operations and the level of professionalism you wish to convey. By understanding your specific needs and evaluating different options, you can select the most effective format to streamline your financial processes and enhance your client relationships.

Free vs Paid Invoice Templates

Choosing between no-cost and premium invoice solutions depends on specific needs, budget, and desired customization options. Each option has its strengths and trade-offs, making it essential to understand their primary differences before deciding on the right approach.

Advantages of Free Solutions

Free options are popular among freelancers and small companies, providing an easy way to create professional-looking bills without financial commitment. These solutions often feature standard layouts and essential elements.

- No cost, making them accessible to everyone

Free vs Paid Invoice Templates

Choosing between free and paid designs for billing documents can be challenging. Each option has unique advantages, catering to various professional needs and budgets. Understanding the differences helps in making a choice that enhances your workflow and fits your specific requirements.

Advantages of Free Versions

- Cost-effective: Free options provide a straightforward solution without any financial investment, ideal for startups and small projects.

- Easy Access: Many free options are readily available online and often require minimal setup, making them convenient for immediate use.

- Basic Functionality: These designs cover essential needs, ensuring all necessary elements are included while keeping things simple.

Benefits of Paid Options

- Customization: Paid choices often offer advanced customization options, allowing a more tailored and professional look.

- Enhanced Features: Many paid designs include additional features like branding elements, color schemes, and automation tools, helping to streamline the process.

- Customer Support: Access to support is typically included, making it easier to resolve any issues or to modify elements as business needs evolve.

Ultimately, the decision comes down to balancing costs with specific professional needs, ensuring the right balance of quality and functionality for smooth and effective billing processes.

Top Features of an Invoice Template

Effective billing documents should include specific features that improve clarity, organization, and ease of use. These elements ensure that the document is both professional and functional, meeting the needs of both sender and recipient.

Essential Components

- Contact Information: Clearly display the names, addresses, and contact details of both parties, ensuring easy communication and accurate record-keeping.

- Unique Identifier: A distinctive reference number for each document, simplifying tracking and reducing errors in record management.

- Clear Itemization: A list of provided goods or services, with detailed descriptions, quantities, and individual prices, offering full transparency.

Additional Helpful Elements

- Tax Details: Sections for applicable taxes ensure compliance and accurate financial reporting for both parties.

- Digital vs Printable Invoice Templates

When preparing billing documents, deciding between digital and printed formats is essential. Each option has specific benefits, suited to different professional scenarios and preferences, impacting both workflow and client interactions.

Advantages of Digital Formats

- Instant Delivery: Digital versions allow for immediate sending via email, ensuring faster communication and prompt responses.

- Environmentally Friendly: Reducing paper usage helps minimize waste, making digital documents a more eco-conscious choice.

- Easy Archiving: Digital copies can be stored electronically, providing an organized, searchable record system for easy access.

Benefits of Printed Versions

- Tangible Record: Physical documents provide a concrete reference, ideal

How to Add Branding to Your Invoice

Incorporating branding into billing documents enhances your company’s identity and creates a lasting impression on clients. Strategic use of brand elements can make these documents more recognizable and professional, reinforcing your business’s visual style.

Key Branding Elements to Include

Branding Element Description Logo Position your logo prominently at the top to immediately identify your company and make the document stand out. Color Scheme Use your brand colors to accentuate headers, lines, or background sections, creating a cohesive look that matches your other materials. Font Choice Select fonts that align with your brand style for a consistent appearance, ensuring readabi Best Tools for Creating Invoice Templates

Selecting the right software to design billing documents can make the process efficient and professional. Numerous tools offer customizable features that help streamline the creation process, allowing you to add brand elements, organize information, and adjust layouts to fit your needs.

Top Software Options

- Microsoft Excel: Known for its flexibility and accessibility, Excel offers customizable spreadsheets where you can create organized layouts and include formulas for automatic calculations.

- Google Docs: Google Docs provides easy-to-use templates and allows real-time collaboration, making it ideal for teams working together on a shared billing system.

- Canva: With a range of design templates and customization options, Canva is perfect for those seeking visually appealing, branded designs that stand out.

- QuickBooks: A comprehensive accounting tool, QuickBooks allows users to generate professional documents integrated directly into bookkeeping processes,

How to Organize Your Invoice Records

Keeping billing documents organized is crucial for efficient record-keeping and smooth financial management. A structured system helps track payments, manage client information, and ensure accurate reporting, simplifying administrative tasks.

1. Use a Consistent Naming System

Establish a clear naming convention for files, incorporating details like date, client name, and unique identification number. This approach ensures that each document is easy to locate and distinguish, preventing confusion.

2. Create Folders by Year and Month

Organize files into folders based on year and month, allowing quick access to recent records and an easy way to archive older documents. This structure also aids in tracking payment timelines and generating monthly or annual reports.

3. Leverage Digital Tools

Consider using dedicated software that automates

Legal Considerations for Invoices

When creating billing documents, it is essential to comply with legal requirements to ensure accuracy and protect both parties involved. Specific elements must be included to meet legal standards, safeguard transactions, and provide clear records in case of disputes.

Required Information

To comply with regulations, include the following information:

- Company Details: Clearly state the registered name, address, and contact details of your organization to validate the source of the document.

- Client Information: Include the recipient’s full name or company name and contact information to specify the intended party.

- Unique Identification Number: Assign a unique identification number to each document to facilitate tracking and reference in future communications.

- Payment Terms: Specify the payment terms, including the due date, to establish clear expectations for timely settlement.

Legal Compliance Tips

Incorporate the following practices to enhance compliance and security:

- Tax Identification: If applicable, include tax ID

Tracking Payments with Your Invoice

Efficient payment tracking is essential to maintain smooth cash flow and ensure that all transactions are accounted for. Implementing an organized system helps you monitor outstanding amounts, identify paid accounts, and follow up on pending payments as needed.

Key Steps to Track Payments

- Assign Unique Identifiers: Use distinct identification numbers for each document to make it easier to reference individual transactions in your records.

- Include Payment Status: Indicate whether the payment is “Paid,” “Unpaid,” or “Partially Paid” on each record. Update this status once transactions are completed to keep accurate records.

- Set Due Dates: Clearly define due dates and make them easily visible to encourage timely payments. This also helps you organize follow-ups with clients if deadlines are missed.

Using Software to Simplify Tracking

How to Avoid Common Invoice Mistakes

Avoiding errors in billing documents is essential to maintain professionalism and ensure timely payments. Even small mistakes can lead to delays or misunderstandings, so attention to detail is crucial when preparing records.

1. Double-Check All Contact Information

Ensure that the recipient’s name, address, and email are correct. Incorrect details can result in lost documents or delayed responses, impacting payment timelines.

2. Use Clear Descriptions of Services or Products

Provide a concise but detailed explanation of each item or service being billed. Avoid vague terms, as they can cause confusion and lead to unnecessary questions from the client.

3. Confirm Pricing and Tax Details

Double-check all pricing, discounts, and taxes applied. Miscalculations or missed discounts can cause disputes and delay the payment process. Accuracy here ensures smooth transactions

Using Templates for International Billing

Handling transactions across borders involves additional details to ensure accuracy and compliance with different regional standards. By structuring documents carefully, you can streamline international transactions and avoid misunderstandings.

- Include Currency Specifications: Always state the currency type clearly to prevent confusion regarding payment amounts. Using standardized currency codes, like USD or EUR, helps ensure clarity.

- Account for Regional Tax Regulations: Different countries apply various taxes, such as VAT or GST. Be sure to research and include any applicable taxes to maintain compliance with local requirements.

- Adapt Language as Needed: Consider including translations or relevant terms if working with clients in non-English-speaking countries. This can help ensure mutual understanding and improve client relationships.

- Provide Clear Payment

Automating Your Invoicing Process

Streamlining the creation and delivery of billing documents can save valuable time and reduce the risk of errors. Automation helps maintain consistency, increases efficiency, and ensures timely payments.

Benefit Description Time Efficiency By automating repetitive tasks like document creation and sending reminders, you free up resources to focus on other areas of your work. Accuracy Automation ensures consistent formatting and reduces human errors in calculations, such as tax or discounts. Improved Cash Flow Automated reminders and payment tracking help ensure that clients make timely payments, which improves cash flow and reduces overdue accounts. Customizable Features Automation tools often allow customization for specific needs, such as adding company branding or adjusting payment terms according to client agreements. By integrating invoicing automation into your workflow, you can improve overall productivity and financial management, creating a more efficient and professional operation.

Best Practices for Professional Invoices

Creating clear and precise billing documents helps establish trust and ensures smooth financial transactions. Adopting a few simple yet effective practices can significantly improve the professionalism and efficiency of your documents.

- Include Clear Contact Information: Always provide full contact details, including your name, address, phone number, and email, along with your client’s contact information for easy reference.

- Itemize Services or Products: Break down each item or service, including quantities, rates, and any applicable discounts, so that your client understands the charges clearly.

- Provide a Unique Reference Number: Assign a unique number to each document to avoid confusion and make it easier to track payments or disputes.

- State Clear Payment Terms: Clearly mention the payment due date, available payment methods, and any late fees or penalties to set expectations from the start.

- Be Transparent with Taxes: If applicable, display tax amounts separately so your client can easily identify them, adhering to local tax laws.

- Maintain Professional Formatting: Use a clean, easy-to-read layout with consistent fonts and sufficient white space. This adds to the clarity and overall professional look.

By following these practices, you ensure that your billing documents are not only professional but also reduce the chances of delays or misunderstandings in payments.

How to Send and Manage Invoices

Effectively distributing and overseeing your billing documents is essential for maintaining smooth financial operations. Whether you prefer digital or physical copies, establishing a systematic approach will ensure timely payments and organized records.

Sending Billing Documents

- Choose the Right Delivery Method: Depending on your client’s preference, opt for either email or physical mail. Digital delivery is faster and more eco-friendly, while traditional mail may be necessary for certain clients.

- Ensure Proper Formatting: Before sending, double-check that all details are correct, including amounts, dates, and contact information. Use a PDF format for email delivery to ensure the document appears as intended.

- Set a Clear Subject Line: Use a subject that clearly indicates the purpose of the email, such as “Payment Request” or “Amount Due for [Your Service/Product].”

- Follow Up on Outstanding Payments: If payment is overdue, send a polite reminder email or letter, including all necessary details to facilitate payment.

Managing Billing Records

- Track All Sent Documents: Keep a log of all sent documents, including dates and amounts, to monitor outstanding payments. This can be done manually or using a software tool.

- Organize by Due Date: Sort documents by their due dates to prioritize follow-ups and avoid missing any payments.

- Store Documents Securely: Save copies of all billing records in a safe and easily accessible location, whether digital or physical. Using cloud storage or specialized software can help keep things organized.

- Review Payment Status Regularly: Check the status of payments periodically to stay on top of collections and ensure prompt payment processing.

By following these steps, you can streamline the sending and management of your billing documents, ensuring timely payments and efficient financial management.