How to Create a Business Invoice Template

Having an organized way to request payments is crucial for smooth financial transactions. A well-structured document can streamline the process and ensure clarity between you and your clients. By following a few key steps, you can establish an efficient approach that suits your needs and meets professional standards.

Designing this important tool involves understanding the essential components that make it clear and easy to follow. It’s not just about numbers; attention to detail ensures that all necessary information is included, preventing any confusion. A properly set-up document can make managing finances easier while maintaining professionalism.

Customization plays a significant role, allowing you to reflect your brand’s identity while keeping everything functional. Whether you’re working with a template or building from scratch, the goal is to ensure accuracy and consistency across all your records.

How to Create a Business Invoice Template

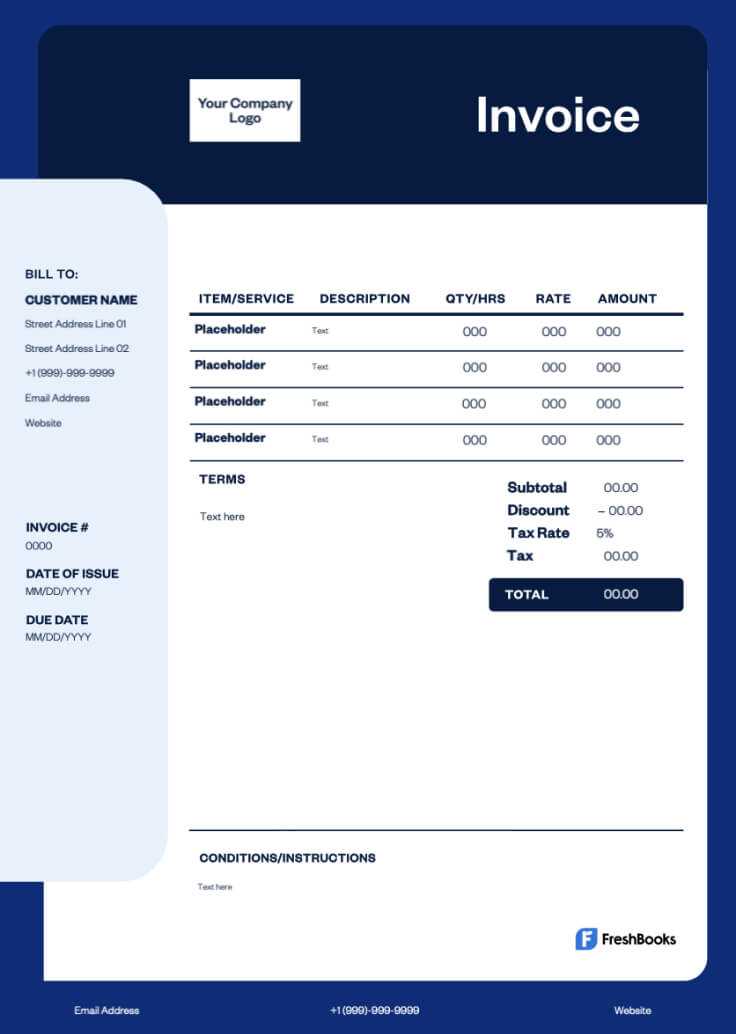

Designing an effective document for billing requires focusing on both structure and clarity. By assembling key details in a logical format, you can ensure clients easily understand the requested amount and payment terms. This section will guide you through the essential elements to include in such a document to make it both functional and professional.

The first step is to organize the content into clear sections. Here’s a breakdown of the most important components:

- Header Section: Include your company name, address, and contact details.

- Client Information: Make sure to list the client’s name, address, and any relevant identification or account number.

- Unique Reference Number: Assign each document a unique reference to ensure easy tracking and organization.

- Detailed List of Services or Products: Clearly describe what was provided, with corresponding costs.

- Amount Due and Payment Terms: Specify the total amount, taxes, discounts (if any), and the due date.

- Additional Information: This could include payment methods or any legal disclaimers related to payment procedures.

Once you’ve outlined these details, focus on making the document visually appealing yet straightforward. Choose a clear, legible font and maintain consistency throughout the layout. Use grids or tables to display numerical information neatly, which helps prevent confusion.

Finally, save and manage these documents in a way that ensures easy access and reference for future use. Using software tools or online services can simplify this process and save time. By following these steps, you’ll be able to streamline billing and maintain a professional approach to client transactions.

Understanding the Importance of Invoices

Documents used for requesting payments play a crucial role in ensuring smooth financial transactions between service providers and clients. These records not only outline the details of the work or goods provided, but also establish clear expectations regarding payment. Their primary function is to serve as a formal agreement and a reminder for clients about what is owed and when it is due.

These records offer more than just a means to collect funds. They help businesses maintain accurate financial records, which are essential for both short-term operations and long-term planning. Properly managed documents can improve cash flow and prevent misunderstandings with clients.

Here are some key reasons why such documents are essential:

- Legal Protection: They act as an official record of the transaction, protecting both parties in case of disputes.

- Financial Tracking: Proper documentation ensures you can track payments, monitor outstanding debts, and organize your accounts effectively.

- Professionalism: Sending a clear and professional document enhances the perception of your services or products, fostering trust with clients.

- Tax Compliance: These records are often necessary for filing taxes, as they provide a detailed account of earnings and business expenses.

- Payment Clarity: A well-structured document prevents confusion by clearly listing the amounts due, payment methods, and deadlines.

In conclusion, having a clear and well-organized document helps businesses maintain a professional image, ensures proper tracking of financial transactions, and ultimately contributes to the success of both parties involved.

Key Elements of an Invoice

When preparing a document to request payment, it is essential to include specific information that ensures clarity and completeness. These key components not only help in processing the payment but also protect both parties by making the terms and conditions transparent. By organizing these elements effectively, you can avoid confusion and maintain professionalism in your transactions.

The following table outlines the most critical details to include in such a document:

| Element | Description |

|---|---|

| Contact Information | Include your name or company name, address, phone number, and email, as well as the client’s contact details. |

| Document Reference Number | A unique number to identify and track the transaction for future reference and record-keeping. |

| Date of Issue | The date when the payment request is issued. This helps establish the timeline for payment. |

| Itemized List of Goods/Services | Provide a clear breakdown of what was provided, with each item or service listed along with its corresponding price. |

| Total Amount Due | The total sum to be paid, including any taxes or additional fees, clearly outlined at the bottom of the list. |

| Payment Terms | Specify the payment due date, as well as acceptable payment methods and any late fees or discounts. |

| Notes or Special Instructions | Provide any additional information that may be relevant to the transaction, such as tax identification numbers or payment instructions. |

Including these key components ensures that the document serves its intended purpose and helps both parties stay organized and informed throughout the payment process. It also helps to build trust and professionalism in your dealings with clients.

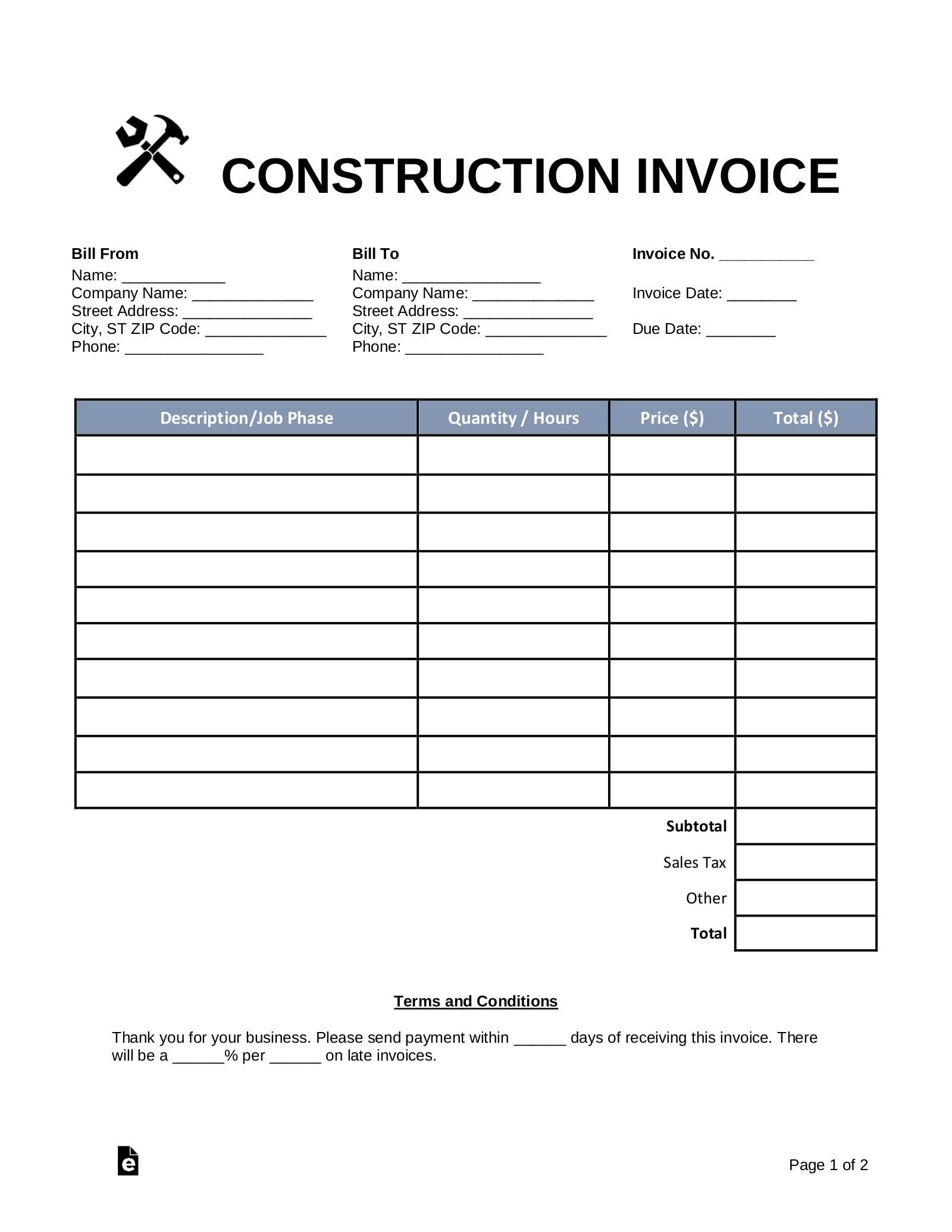

Choosing the Right Template Format

When designing a document for requesting payment, selecting the appropriate format is essential to ensure that it is both functional and easy to use. The layout should allow you to clearly communicate the necessary details, while also fitting the needs of your business operations. A good format ensures that information is presented logically and consistently, making it easier to manage transactions and maintain a professional appearance.

Consider Your Business Needs

The first step in choosing the right format is understanding your specific requirements. If your business involves simple transactions, a minimalistic approach may work best. For more complex operations, you may need a more detailed structure that includes sections for taxes, discounts, or multiple items. Select a design that accommodates all the key information without overwhelming the recipient.

Format Options to Explore

There are several options to consider when it comes to the structure of the document. Here are some popular formats:

- Basic Layout: A simple, clean format that focuses on essential information such as dates, amounts, and client details.

- Detailed Breakdown: A more structured layout that includes itemized lists, descriptions, and pricing for each product or service.

- Automated System: Software solutions that generate documents based on templates, ensuring consistency and ease of use.

Ultimately, choose a layout that suits your workflow and provides clear, organized information for both you and your clients. Whether you prefer a more traditional, manual approach or a digital tool, the goal is to make the process as efficient and straightforward as possible.

Customizing Your Invoice Design

Personalizing the appearance of a payment request document is crucial for making it stand out while maintaining a professional and consistent look. Customization allows you to reflect your company’s branding and values, ensuring that the document aligns with the overall identity of your services. A well-designed document can make a significant impact, fostering trust and improving client relationships.

Focus on Key Design Elements that enhance readability and visual appeal. These include selecting appropriate fonts, colors, and layouts. Keep in mind that the goal is to present the necessary information clearly without overcrowding the page. A balanced design ensures that essential details are easy to find and understand.

Branding is another important aspect to consider when designing your document. Incorporating your company’s logo, color scheme, and contact information not only adds a personal touch but also helps clients immediately recognize your brand. This consistency across all communication materials builds a professional image and strengthens your brand’s presence.

Incorporate the necessary sections for details such as client information, transaction summaries, and payment terms in a way that flows logically. Use tables or grids to neatly present itemized costs and amounts due. Simple touches like borders, spacing, and alignment can make a significant difference in how your document is perceived.

Setting Up Invoice Numbers

Assigning unique identifiers to payment requests is an essential practice for tracking transactions and ensuring smooth financial management. These reference numbers help both you and your clients to easily identify and reference each document, preventing confusion or duplication. A well-organized numbering system is a key element in maintaining accurate records and efficient workflow.

There are different methods you can use to structure the numbering system, and it’s important to choose one that fits your needs. Below is an example of how to structure these identifiers for easy tracking:

| Numbering Style | Description |

|---|---|

| Sequential Numbers | A simple system that assigns a number in order, starting from 001 and increasing with each new request. |

| Date-Based Numbers | Include the date in the number (e.g., 2024-001), which helps in identifying when the request was issued. |

| Custom Prefixes | Use custom prefixes (e.g., CLT-001 for client transactions) to categorize documents by project or customer type. |

| Automatic Numbering | Many software tools offer automatic numbering systems that generate sequential numbers without manual input. |

Regardless of the system you choose, consistency is key. A well-defined numbering strategy helps avoid mistakes and ensures that each document is easily traceable, both for you and your clients. It also supports better organization when referencing past transactions for audits, disputes, or record-keeping purposes.

Including Business Contact Information

Providing clear and accurate contact details on payment request documents is crucial for maintaining professional communication. Including the right information ensures that clients can easily reach out for inquiries, clarifications, or further correspondence. This section outlines the key details to include to make it simple for clients to contact you when needed.

Key Information to Include

When listing your contact details, ensure you include the following essential elements:

- Company Name: Clearly state your full business name, which helps clients identify you easily.

- Address: Include your physical or mailing address to maintain transparency and enable clients to send documents or payments.

- Email Address: Provide a dedicated email address for inquiries or issues related to payments and transactions.

- Phone Number: Add a contact number where clients can reach you during business hours for immediate assistance.

- Website: If applicable, include your website URL for clients to learn more about your services or products.

Why It Matters

Having comprehensive contact details available ensures clients feel supported and have multiple ways to reach you. This level of accessibility helps build trust and fosters a positive client relationship. Additionally, accurate contact information is important for resolving any potential issues with payments, deliveries, or other aspects of the transaction process.

Adding Payment Terms and Conditions

Clearly defining the rules and expectations for payments is essential in any transaction. Including the terms and conditions helps set clear guidelines for both parties, preventing misunderstandings or disputes. A well-articulated section on payment policies not only provides transparency but also establishes a professional framework for the exchange of goods or services.

Key Components to Include

When outlining payment terms, make sure to include the following elements to ensure everything is covered:

- Due Date: Specify the exact date by which payment should be made, avoiding ambiguity.

- Accepted Payment Methods: List all the methods available for payment, such as bank transfer, credit card, or online platforms.

- Late Payment Penalties: Clarify any fees that may be applied for overdue payments, including interest rates or fixed penalties.

- Early Payment Discounts: If applicable, offer discounts for payments made before the due date.

- Currency: Ensure the currency of the transaction is clearly stated to avoid confusion.

Why It’s Important

Including payment terms and conditions helps establish a clear framework for the transaction, making both parties aware of their obligations. This section can serve as a reference point in case of delays or disputes, providing legal and operational clarity. It also contributes to smoother financial operations, allowing both parties to understand the process, deadlines, and consequences involved.

How to List Products or Services

Presenting the items or offerings you are charging for in a clear, organized manner is essential for transparency and ease of understanding. A detailed list allows your client to easily identify what they are paying for, which helps avoid confusion or disputes. This section should be laid out in a straightforward way, showing the necessary details for each item or service.

Be Specific when describing each item or service. Include detailed descriptions, quantities, unit prices, and any other relevant information that will clarify what the charge covers. This not only ensures clarity but also helps prevent any misunderstandings down the line.

Group Related Items into categories if there are multiple products or services. For example, if you offer both physical products and consultations, separating these into distinct sections will make the document easier to read and navigate.

Here’s an example of how to structure the list:

| Item/Service | Description | Quantity | Unit Price | Total |

|---|---|---|---|---|

| Consultation | Hourly professional consulting | 3 hours | $100 | $300 |

| Product A | High-quality leather wallet | 2 | $50 | $100 |

Ensure that each entry is clear and concise. Including all relevant details, such as product specifications, service duration, or materials used, will foster trust and professionalism in the eyes of your client.

Calculating Total Amount and Taxes

Accurately calculating the final cost for a client requires adding up the value of each item or service provided and then applying any necessary tax rates. This process ensures that the amount due is clear, transparent, and consistent with the agreed-upon terms. It also avoids misunderstandings by clearly detailing both the subtotal and applicable taxes before arriving at the total amount.

To calculate the final amount, begin by adding the price of each product or service. Then, apply any applicable tax rates based on local regulations or the specifics of the transaction. Be sure to clearly indicate the tax amount, and specify whether it is included in the price or added separately.

Here’s a simple breakdown of the calculation:

| Description | Amount |

|---|---|

| Subtotal | $400 |

| Tax (8%) | $32 |

| Total Amount Due | $432 |

Ensure that all calculations are clear and easy to follow. This not only helps your client understand how the final amount is reached but also ensures that all legal and financial requirements are met regarding tax compliance.

Incorporating a Due Date on Invoices

Including a clear payment deadline is essential for establishing expectations and ensuring timely payments. A specified due date provides both parties with a concrete timeline, preventing delays and promoting efficient financial management. This helps maintain healthy cash flow and prevents any misunderstandings related to payment timing.

When setting a due date, it is important to keep a few key considerations in mind:

- Clarity: Ensure the due date is clearly visible and easy to find on the document. It should stand out to avoid confusion.

- Reasonable Timeframe: Allow enough time for payment based on your agreement, whether it’s a week, 30 days, or a different period.

- Consistency: Make sure you apply consistent terms to all clients or contracts to maintain fairness and professionalism.

- Grace Period: Consider offering a small grace period for payments made just after the due date, depending on your policies.

Here’s an example of how to present the due date:

| Description | Amount |

|---|---|

| Subtotal | $400 |

| Due Date | October 15, 2024 |

By including a precise due date, you help your clients know when the payment is expected, reducing the chances of delays and improving the efficiency of your financial operations.

Choosing Invoice Software or Tools

Selecting the right software or tools for managing payment requests is crucial for streamlining your financial operations. With the right solution, you can automate many aspects of the process, from generating documents to tracking payments, reducing the chance for human error and saving valuable time. The key is to choose an option that aligns with your business needs and offers the features that matter most to you.

When evaluating different options, consider the following factors:

- Ease of Use: Look for software with an intuitive interface that allows you to create and manage documents quickly without a steep learning curve.

- Customization: Ensure the tool allows you to tailor payment requests to your preferences, such as adding branding elements or adjusting layouts.

- Integrations: Consider whether the software can integrate with other platforms you use, such as accounting systems or payment gateways.

- Automation: Automated features, like recurring billing and reminders, can save time and reduce manual effort.

- Security: Ensure the tool has adequate security features, like data encryption, to protect sensitive financial information.

Some popular options include:

- QuickBooks: Known for its comprehensive accounting features and invoicing capabilities.

- FreshBooks: An easy-to-use solution ideal for freelancers and small businesses.

- Zoho Invoice: A cloud-based tool offering customization and automation features.

Take the time to explore different software options, read user reviews, and even take advantage of free trials to find the best fit for your needs.

Best Practices for Invoice Formatting

When designing a document for requesting payment, presentation plays a key role in ensuring clarity and professionalism. A well-organized and easy-to-read structure not only helps your client understand the details but also speeds up the payment process. Following certain formatting guidelines can make the document more effective and reduce the chances of confusion or errors.

Ensure Clarity and Consistency

Maintaining a clear and consistent layout is crucial. Organize the content logically, using headers, tables, and bullet points to break down the information. This makes it easier for the recipient to follow and reduces the risk of missing key details.

- Font Choice: Use simple, professional fonts such as Arial or Times New Roman for easy readability.

- Spacing: Proper spacing between sections and entries helps the recipient quickly distinguish between different types of information.

- Align Numbers: Align monetary amounts to the right to create a clean, organized appearance.

Highlight Important Information

It’s important to emphasize the most critical details, such as the total amount due and the payment deadline. This helps ensure that these elements stand out and are not overlooked.

- Bold Key Figures: Make totals and due dates bold so they are easily identifiable.

- Use Color Sparingly: Adding color can help highlight important details but should be used sparingly to maintain professionalism.

By adhering to these formatting best practices, you ensure that your payment request is both professional and easy to navigate, which can positively impact the overall payment experience for both you and your client.

Maintaining Consistent Branding

Ensuring that your communication materials reflect your company’s identity is essential for building trust and recognition. The way you present payment requests plays a significant role in how clients perceive your professionalism and attention to detail. By incorporating consistent branding elements, you reinforce your company’s image with every interaction.

Key Elements to Include

When designing documents for financial transactions, include the following branding elements to maintain consistency across all your materials:

- Logo: Place your logo prominently at the top to ensure it is easily recognizable. This helps strengthen brand recall.

- Color Scheme: Use the same color palette as your website and marketing materials to create a cohesive look and feel.

- Fonts: Stick to the fonts used in your branding to ensure a uniform visual style across all communications.

Creating a Professional Appearance

A well-branded payment request not only stands out but also adds to the professionalism of your company. By following these simple practices, you ensure that every document you send reflects the quality of your work and your commitment to your brand.

- Header and Footer Design: Include your contact information and website URL in the footer, ensuring it aligns with your branding style.

- Consistent Layout: Keep the design layout consistent with other materials, so it feels familiar to clients.

By integrating your brand’s visual identity into every document, you establish a strong, recognizable presence that reinforces your company’s credibility and professionalism.

Sending and Managing Invoices

Effectively delivering and tracking payment requests is crucial for maintaining smooth financial operations. The way you send and manage these documents directly impacts your cash flow and your client relationships. By implementing organized systems for distribution and follow-up, you can ensure that payments are processed promptly and that any issues are handled efficiently.

Best Practices for Sending Payment Requests

Timeliness and clarity are key when sending a request for payment. Here are some tips to improve the process:

- Choose the Right Method: Decide whether to send through email, postal mail, or a payment platform, depending on client preferences.

- Include Clear Instructions: Make sure payment terms, amounts, and deadlines are easily visible and understood.

- Use Digital Formats: PDF files are widely accepted and help preserve formatting, making the document easy to open and read on any device.

Tracking and Managing Payment Requests

Once the documents are sent, tracking their status is vital for ensuring timely payment. Consider using these strategies to stay on top of your payments:

- Organize by Date: Keep a record of all payment requests with their due dates to prioritize follow-ups.

- Use Accounting Software: Automated tools can help you monitor the status of payments and send reminders when due dates approach.

- Follow Up Professionally: If payment is overdue, send a polite reminder and give clients enough time to make the payment.

By setting up a reliable system for sending and tracking payment requests, you can reduce delays, improve cash flow, and foster better business relationships.

Tracking Payments and Overdue Invoices

Effectively monitoring payments and managing overdue requests is essential for maintaining a healthy cash flow. By establishing a clear system to track outstanding balances and payment dates, you can stay on top of finances and reduce the likelihood of delayed or missed payments.

Tracking Payments

Accurate tracking ensures that you are aware of paid and unpaid amounts, allowing you to follow up with clients when necessary. Here are a few methods to improve payment tracking:

- Record Payment Dates: Log each payment received, along with the date it was processed.

- Use Accounting Tools: Utilize software or spreadsheets to automatically update payment statuses and keep records organized.

- Confirm Payments: Send clients a receipt or confirmation once a payment has been received, ensuring both parties are aware of the status.

Managing Overdue Payments

When payments become overdue, having a clear strategy for follow-ups can help you recover the funds. Implementing these methods can streamline the collection process:

- Set Up Reminders: Automated reminder emails or notifications can prompt clients to pay before the due date arrives.

- Send Professional Follow-Ups: When overdue, send polite reminders and be transparent about any late fees or consequences.

- Offer Payment Plans: In cases where clients are unable to pay the full amount upfront, consider offering flexible payment terms or installment options.

By tracking payments carefully and addressing overdue accounts promptly, you can reduce financial stress and keep your operations running smoothly.

Improving Your Invoice Workflow

Streamlining the process of managing financial documents can save time, reduce errors, and improve the efficiency of your operations. Establishing an optimized workflow for handling payments and documentation is essential for maintaining smooth business activities. A well-structured approach can ensure that invoices are generated, sent, and tracked in a timely manner, resulting in faster payments and fewer complications.

Automating Key Steps

By automating repetitive tasks in your workflow, you can free up time for more valuable work. Here are some key areas where automation can help:

- Invoice Generation: Use software to automatically generate invoices with predefined fields and consistent formats.

- Payment Reminders: Set up automatic reminders to notify clients of upcoming due dates or overdue balances.

- Data Entry: Integrate payment systems and accounting software to reduce manual data input and prevent errors.

Organizing Your Workflow

Organization is crucial to ensuring that financial tasks are handled efficiently. Consider implementing these strategies to maintain a structured process:

- Track Each Stage: Clearly define stages in your process–such as generating, sending, and following up on payments–and assign tasks to appropriate team members.

- Centralized Storage: Store all documents in a centralized location for easy access and tracking, whether it’s through cloud storage or a dedicated document management system.

- Review Regularly: Regularly audit your workflow to identify inefficiencies and improve areas that may be slowing down the process.

With these improvements, you’ll be able to manage financial documents more effectively, reduce mistakes, and ensure timely payments from clients, ultimately contributing to better cash flow and overall business performance.