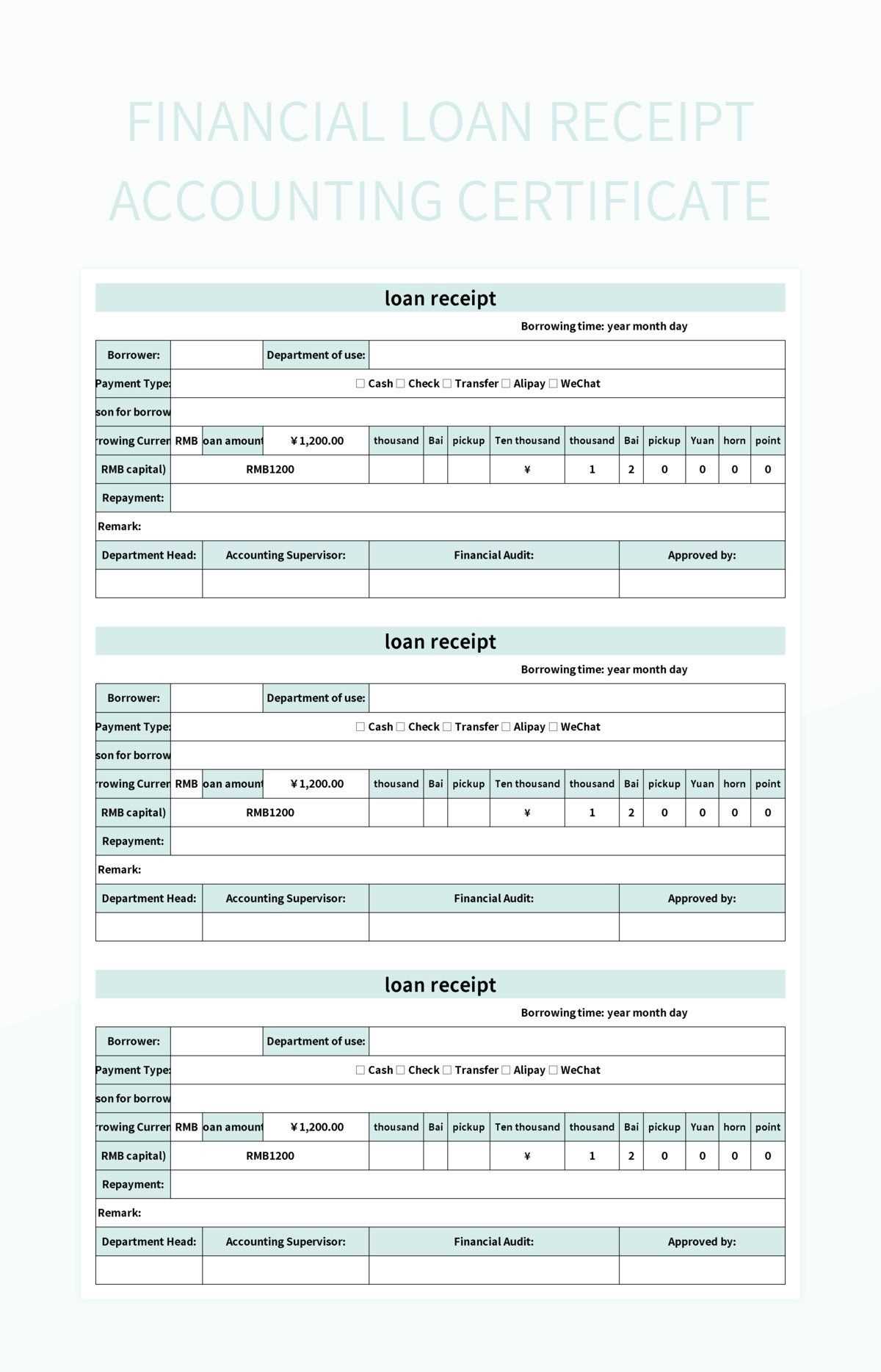

Customizable Loan Invoice Template for Easy Use

When it comes to managing financial transactions, having a clear and organized way to document amounts due is crucial. A properly structured payment record can help ensure that both parties are on the same page, avoid misunderstandings, and streamline the process of collecting and tracking payments. Whether for personal or business purposes, this type of document serves as a formal request for repayment while providing all necessary details for reference.

Efficiency and accuracy are key when preparing such a document. It should be easy to customize and adaptable to different scenarios, allowing users to fill in the relevant details like amounts, dates, and other terms. Additionally, a well-designed document helps keep a clear record for both parties, assisting in accounting and future reference. By using a clear and professional format, you can create a trustworthy and transparent record that will support any necessary follow-up actions.

Adapting this document to your specific needs is a simple process that can provide significant benefits. Whether you’re working with a small-scale agreement or a larger transaction, customizing the structure to suit the situation will help keep everything in order. With the right approach, managing financial agreements can be smooth and hassle-free.

Loan Payment Record Guide

Creating an organized document to request repayment or record a financial arrangement is essential for maintaining clarity in any transaction. A well-structured document serves as a formal reminder and ensures all the necessary details are included. Whether you’re managing a personal agreement or a business transaction, having a standardized format makes the process smoother and more professional.

Key Elements to Include

When preparing a financial record, there are a few essential pieces of information that should always be present to avoid confusion:

- Amount Due: Clearly state the amount that is being requested for payment.

- Due Date: Specify when the payment is expected to be made.

- Interest or Fees: If applicable, mention any additional charges or interest rates on the amount owed.

- Payment Instructions: Include details on how the payment should be made (e.g., bank transfer, check, etc.).

- Personal or Business Information: Provide contact details for both parties involved in the transaction.

Customizing Your Document

Once you have the basic structure, it’s important to adapt the content to the specific terms of your agreement. You can include personalized fields for the recipient’s name, the amount owed, and any special conditions related to the transaction. A flexible approach to the layout will ensure that the document remains relevant for different types of financial agreements.

By following a clear structure and ensuring that all details are provided, this document can serve as an effective tool for keeping both parties informed and accountable throughout the repayment process.

Why Use a Payment Request Document

Having a standardized document for requesting repayment is an essential tool for anyone managing financial agreements. It ensures that all critical information is communicated clearly and professionally, reducing the chances of misunderstanding between the parties involved. By using a consistent format, both the lender and borrower can stay organized and maintain a formal record of their agreement.

Efficiency and accuracy are the main advantages of using such a document. It allows you to quickly fill in the necessary details, such as the amount due, the payment terms, and contact information, without the need for complex calculations or guesswork. This makes the entire process smoother, especially when dealing with multiple transactions or clients.

Time-saving and consistency are key benefits as well. By relying on a pre-designed structure, you can save time on creating a new document from scratch each time you need to request payment. Consistency in your approach also ensures that all transactions are documented in the same manner, making it easier to track and manage your financial records over time.

How to Customize a Payment Request Document

Personalizing a document for requesting repayment is a straightforward process that ensures it meets the specific needs of each transaction. Customization allows you to modify the layout, adjust terms, and add specific details that are relevant to the agreement. This flexibility is essential for making sure the document accurately reflects the conditions of the deal.

Adjusting key fields such as the amount, due date, and recipient information is the first step in tailoring your document. By simply entering the relevant data into pre-defined sections, you can quickly create a professional record. Furthermore, including personalized payment instructions or any special terms will make the document more applicable to your unique situation.

Changing the design is another way to enhance the document’s relevance. You can modify the layout by adjusting fonts, colors, and the overall structure to better align with your brand or personal preferences. This will help ensure that the document is not only functional but also aesthetically pleasing and easy to read.

Key Elements of a Payment Request Document

For any financial request, it’s essential to include certain elements to ensure the document is clear, complete, and easy to understand. These key components help avoid confusion and ensure that both parties are aligned on the terms of the transaction. A well-organized document not only outlines the payment details but also serves as a formal reference for future communication.

Critical information that should always be present includes the total amount due, the due date, and any payment methods or instructions. These details ensure that the person receiving the request knows exactly what is expected of them and how to proceed. Including additional terms such as late fees or interest rates can further clarify the conditions of the agreement.

- Amount Due: Clearly state the total amount owed.

- Due Date: Specify the exact date by which payment should be made.

- Payment Instructions: Include how the payment should be made (e.g., bank transfer, check).

- Personal Details: Include the name and contact information of both parties involved.

- Transaction Reference: Add any relevant reference numbers or identifiers to track the agreement.

By including these key elements, you can ensure that the document is both professional and functional, providing all necessary details for a smooth transaction process.

Benefits of Using a Payment Request Document

Using a structured document for repayment requests provides numerous advantages for both the lender and the borrower. It helps ensure transparency, reduces the risk of confusion, and makes the entire process more efficient. Whether for personal or business transactions, having a formalized request in writing is a crucial step in maintaining clear financial records.

Clarity and professionalism are some of the primary benefits. A well-designed document communicates expectations clearly, outlining the amount due, payment methods, and terms. This reduces the likelihood of misunderstandings and creates a more professional appearance, especially when dealing with clients or business partners.

Tracking and record-keeping are also improved by using such a document. It serves as an official record for both parties, making it easier to track payments, monitor deadlines, and ensure that all terms are met. This organized approach can be especially valuable when managing multiple transactions or agreements over time.

Common Mistakes to Avoid in Payment Request Documents

When preparing a document for repayment, it’s essential to ensure that all information is accurate and clear. Even small errors can cause confusion or lead to delayed payments. Avoiding common mistakes can help make the entire process smoother and more efficient for both parties involved.

Common Errors in Document Preparation

Here are some typical mistakes people make when creating repayment requests and how to avoid them:

- Incorrect Amount: Double-check the amount being requested to ensure it matches the agreed-upon sum. An error in the total can cause significant confusion.

- Missing Due Date: Always specify the exact date by which payment is due. Leaving this out can lead to misunderstandings regarding when the payment is expected.

- Unclear Payment Instructions: Make sure payment methods and instructions are clearly stated. Whether it’s a bank transfer, check, or other method, it should be easy for the recipient to understand how to pay.

- Lack of Contact Information: Include the correct contact details for both parties to make communication easier in case any issues arise.

- Unprofessional Design: A cluttered or poorly designed document can look unprofessional. Make sure the layout is clean, easy to read, and well-organized.

Other Important Considerations

To further avoid errors, ensure that all terms are clearly stated and that there are no ambiguities. Including reference numbers or other identifying information can also prevent confusion, especially in the case of multiple transactions or agreements.

How to Track Payments with Payment Request Documents

Keeping track of payments is a critical part of managing financial agreements. Using a well-organized document to record each transaction helps ensure that both parties are aware of the status of their payments. By updating and referencing this document regularly, you can easily monitor progress and address any discrepancies or issues that arise.

Here are some key steps to effectively track payments:

- Record Payment Dates: Each time a payment is made, note the exact date. This will allow you to track whether payments are made on time and help you identify any overdue amounts.

- Update the Remaining Balance: After each payment, update the balance to reflect the remaining amount due. This keeps both parties informed of the current status.

- Include Payment Methods: Specify the payment method used for each transaction (e.g., bank transfer, check, online payment). This provides additional clarity in case of any future disputes or questions.

- Keep Detailed Records: If there are multiple payments or installments, maintain a clear history of all transactions in the document. This makes it easier to review the entire payment schedule and ensures that no details are overlooked.

- Set Reminders for Future Payments: If the agreement includes ongoing payments, set up reminders based on the agreed-upon schedule. This helps both parties stay on track and avoid missed deadlines.

By carefully tracking payments in this way, you can ensure a transparent and organized process. Regularly updating the document and monitoring payments helps prevent misunderstandings and ensures that both parties fulfill their obligations as agreed.

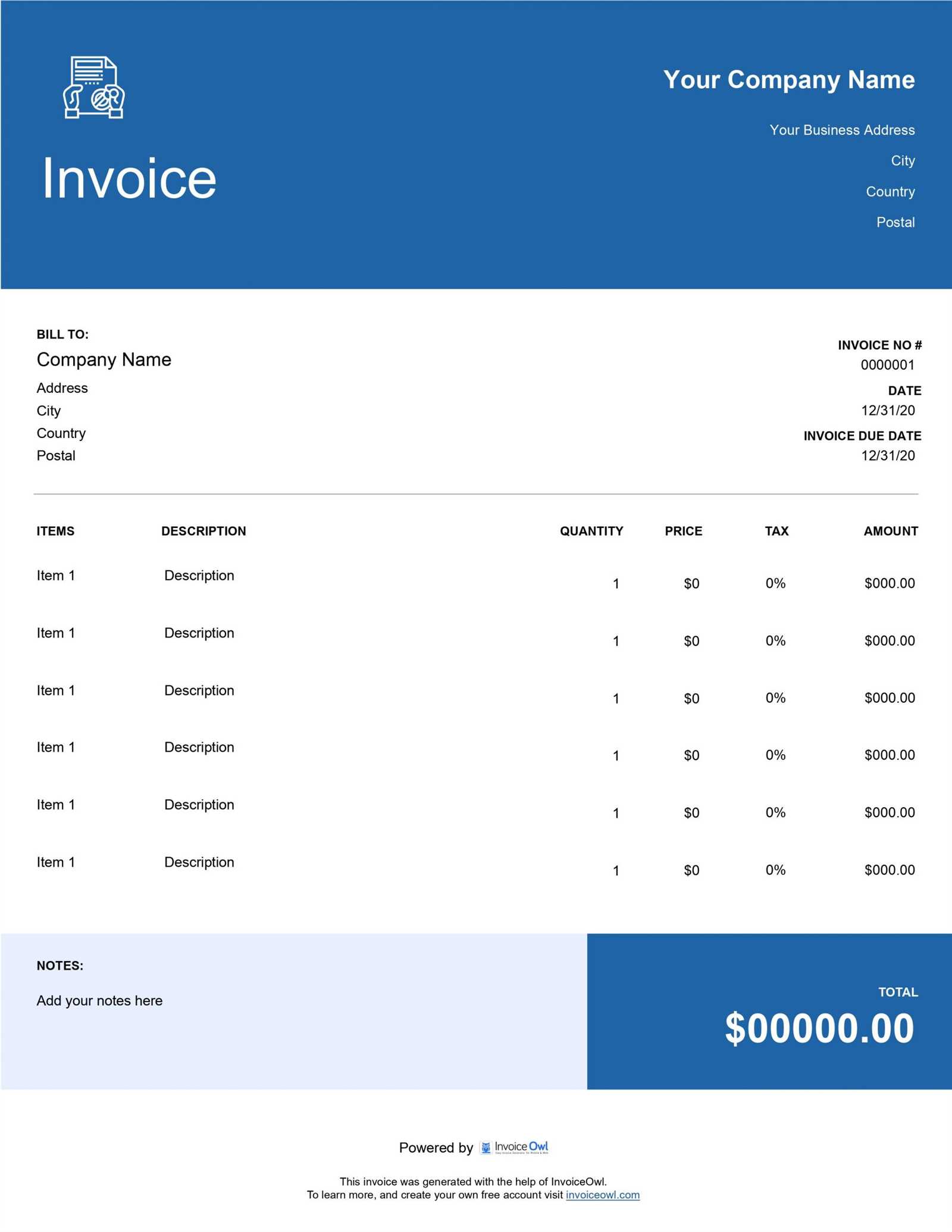

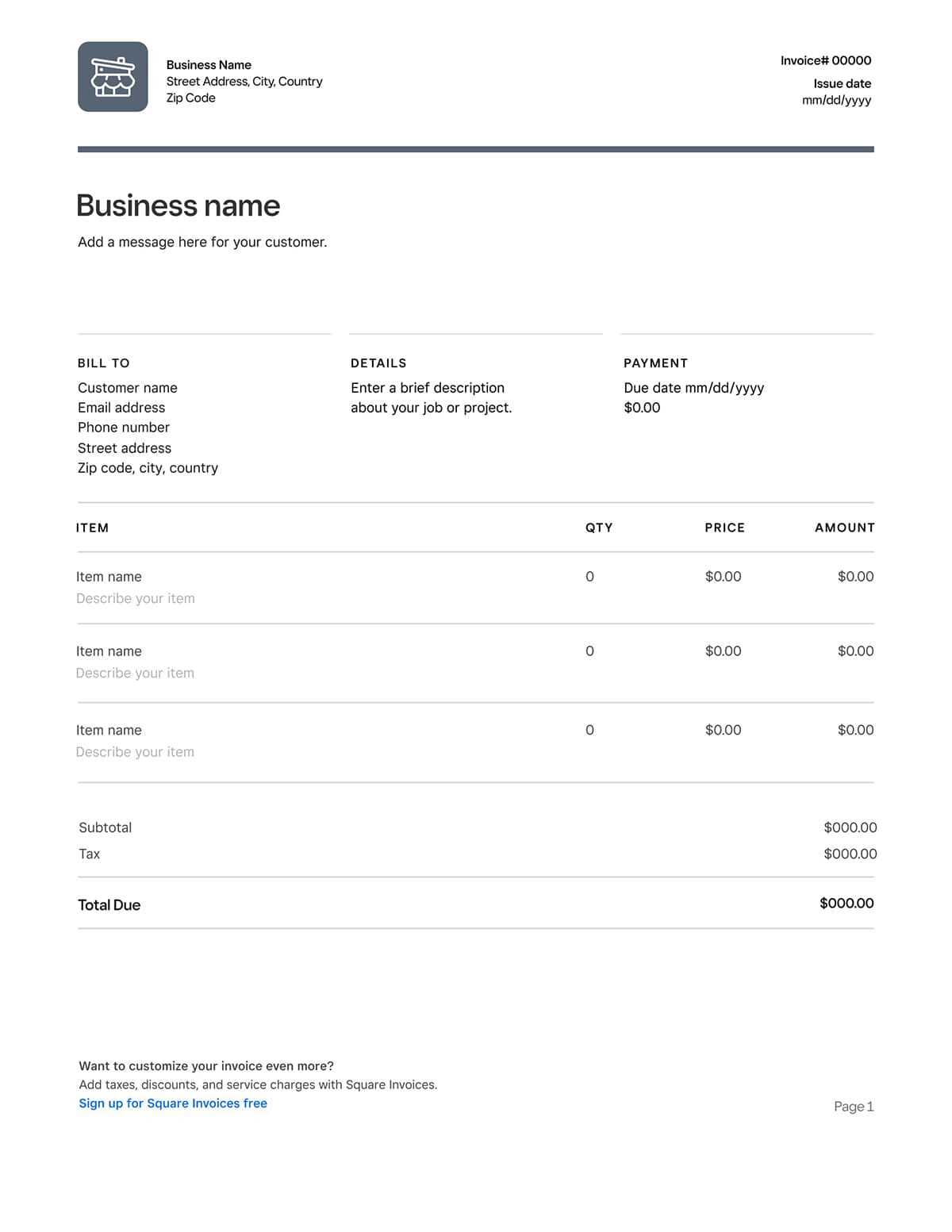

Designing a Professional Payment Request Document

Creating a well-organized and professional document for requesting repayment is crucial for maintaining a clear and effective financial relationship. A well-designed document not only ensures all necessary details are included but also conveys a sense of professionalism and reliability. Proper formatting and design can make a significant difference in how the document is perceived and help prevent confusion or misunderstandings.

Here are some essential tips for designing a professional document:

- Clear and Consistent Layout: Ensure that the document is easy to read by using a clean, organized layout. Avoid clutter by using clear headings and enough white space to separate sections.

- Branding and Personalization: If you’re a business, include your logo and business information at the top of the document. Personalize the content with the recipient’s name and other relevant details to make the document more formal and specific.

- Use of Fonts and Colors: Choose professional fonts that are easy to read, and limit the use of colors. Stick to a simple color scheme that reflects your style, but avoid bright or distracting colors.

- Logical Structure: Organize the document with a logical flow, beginning with the total amount owed, followed by payment methods, and closing with the contact details. This order ensures that the key information is easily accessible.

- Incorporate Payment Details: Clearly present the amount due, payment methods, due dates, and any additional fees or terms. Having these details highlighted in a section will make them easy to spot for the recipient.

By following these design principles, you can create a document that not only looks professional but also effectively communicates the necessary information, making it easier for both parties to manage the financial agreement.

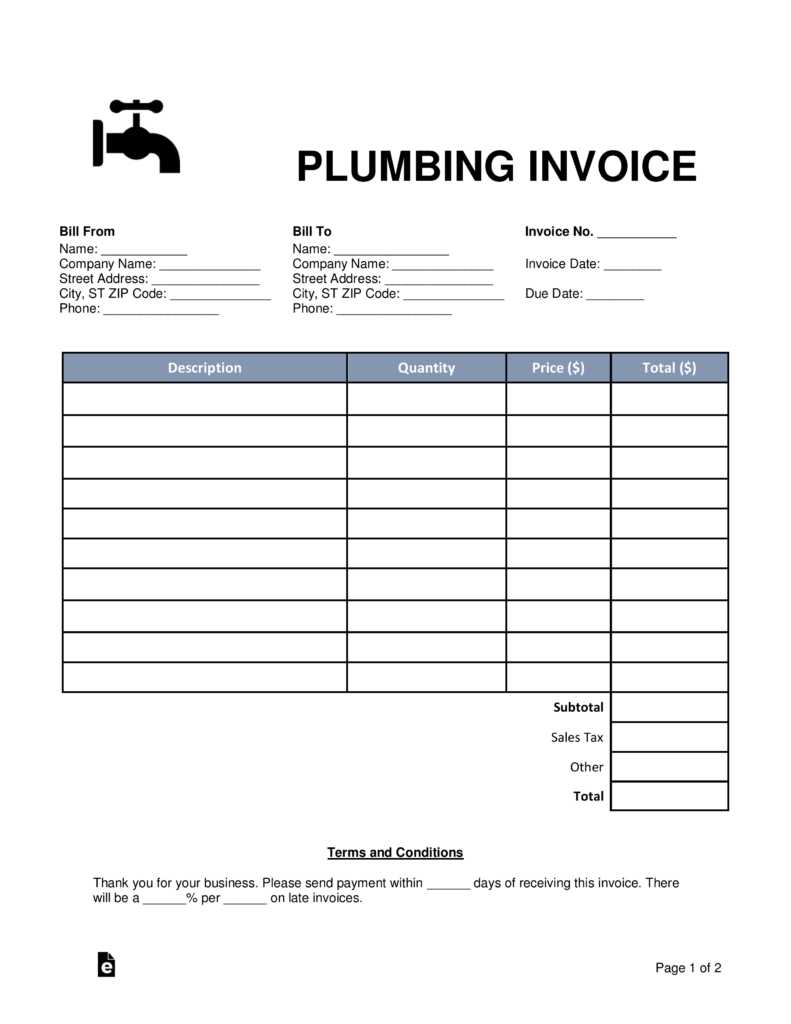

Payment Request Document for Small Businesses

For small businesses, managing financial agreements and keeping track of outstanding payments is crucial for maintaining healthy cash flow. A well-crafted document for requesting repayment can help businesses formalize the process and ensure that they receive payments on time. This document not only serves as a reminder but also acts as a professional reference for both the business and the client.

Using a structured payment request provides several benefits to small businesses. It helps streamline the repayment process by clearly stating the amount due, due dates, and the payment methods accepted. This can prevent confusion or disputes about terms, making it easier for both the business and its clients to stay on the same page.

Customization is key when creating these documents for small businesses. You can tailor the content to suit your business’s needs, adding specific terms, contact information, and any additional details relevant to your particular agreements. This ensures the document not only serves its financial purpose but also aligns with your branding and professional standards.

- Clear Contact Information: Include your business name, address, and contact details for easy communication.

- Specific Payment Terms: Outline the payment methods, due dates, and any late fees or penalties to prevent delays.

- Professional Appearance: Ensure that the design is clean and easy to read, representing your business well.

- Detailed Breakdown: List individual charges or services provided to give transparency on the total amount due.

By using this structured approach, small businesses can keep their financial transactions organized, maintain professionalism, and ensure timely payments, contributing to better financial management overall.

Understanding Payment Terms on Repayment Documents

When dealing with financial agreements, understanding the terms of repayment is essential for both parties involved. Clearly defined terms help avoid confusion, set clear expectations, and ensure that payments are made on time. The payment terms included in a document outlining the repayment schedule serve as the framework for how and when payments should be made.

Payment terms are typically a set of guidelines that specify the conditions under which a repayment should occur. These terms outline the total amount due, the payment schedule, and the accepted payment methods. They may also include additional clauses such as late fees or penalties for missed payments. Having these terms clearly stated helps both parties understand their obligations and protects them from potential misunderstandings or disputes.

Common elements of payment terms include:

- Due Date: The specific date by which the payment is expected. This helps prevent delays and ensures both parties know when the payment must be completed.

- Payment Methods: A description of acceptable payment methods, whether through bank transfer, checks, or other means.

- Late Fees: Terms specifying any additional charges if payments are not made by the due date.

- Installment Plans: If the total amount is to be paid in installments, the document will specify the schedule for these payments.

- Early Payment Incentives: In some cases, payment documents may offer discounts or other incentives for early repayment.

Understanding and clearly outlining these terms ensures that all parties are aware of their responsibilities and helps maintain transparency throughout the financial arrangement.

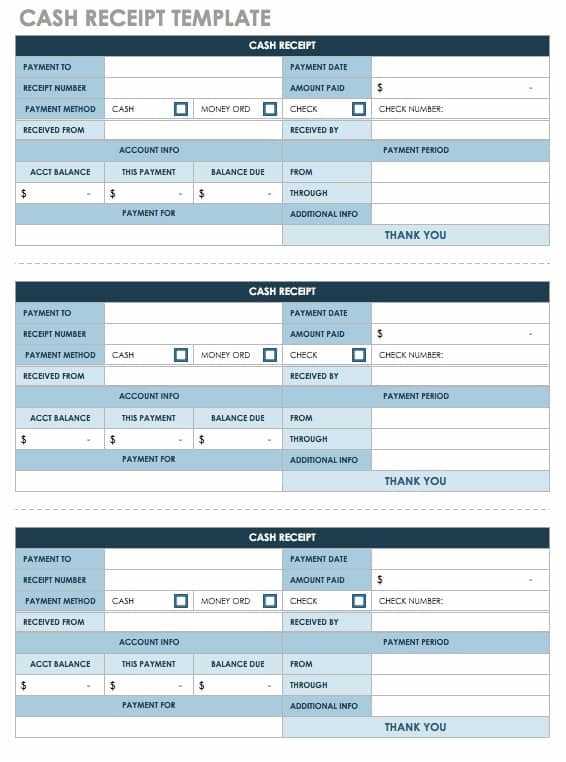

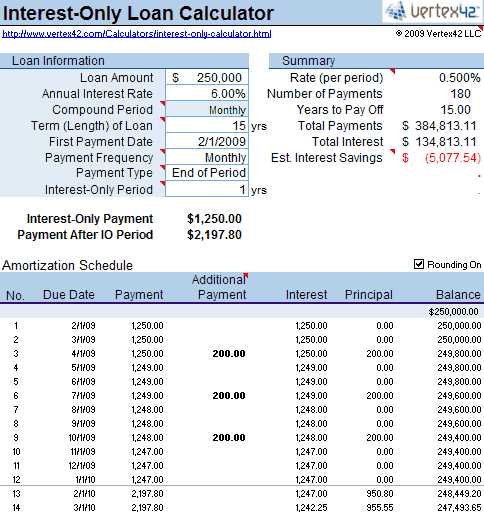

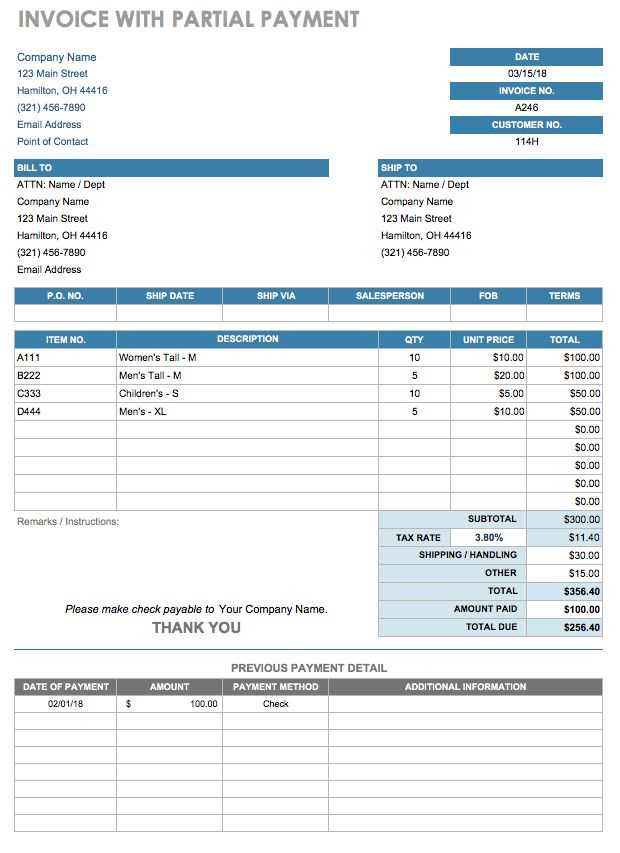

How to Create a Payment Request Document in Excel

Creating a structured payment request document in Excel is an efficient way to manage financial agreements and ensure clear communication between parties. Excel provides a versatile platform to customize and track repayment schedules, making it easier to maintain organized records and monitor payment statuses. With the right layout and formulas, you can generate a professional and practical document for your business or personal needs.

Steps to Create a Payment Request Document

Follow these simple steps to create an effective payment request document using Excel:

- Open a New Excel Workbook: Start by creating a new document to work from. Excel allows you to customize the layout according to your needs, giving you complete control over the design.

- Set Up Your Header: At the top of the document, include the necessary details such as your business name, logo, contact information, and the recipient’s details. Make this section clear and professional to set the tone for the document.

- Create Column Headings: Set up columns for the necessary information, including the item or service description, amount due, payment terms, due date, and payment method. These columns should be easy to read and organized in a logical order.

- Insert Formulas for Calculations: Use Excel’s built-in formulas to calculate totals, taxes, or discounts. For example, you can use SUM to calculate the total amount due after including any fees or adjustments.

- Include Payment Terms: In a separate section, outline the payment due date, installment plan (if applicable), and any penalties for late payments. This helps keep the repayment process clear and ensures both parties are on the same page.

Finalizing Your Document

Once you’ve added all the necessary details, format the document to make it visually appealing. Adjust font sizes, add borders to sections, and use bold text for headings to increase readability. You can also include a “Thank You” note or payment instructions at the bottom of the document.

Excel’s customizable features allow you to quickly create a detailed, professional payment request document that can be tailored to suit various financial agreements. Once completed, you can easily save, print, or email the document to your recipient.

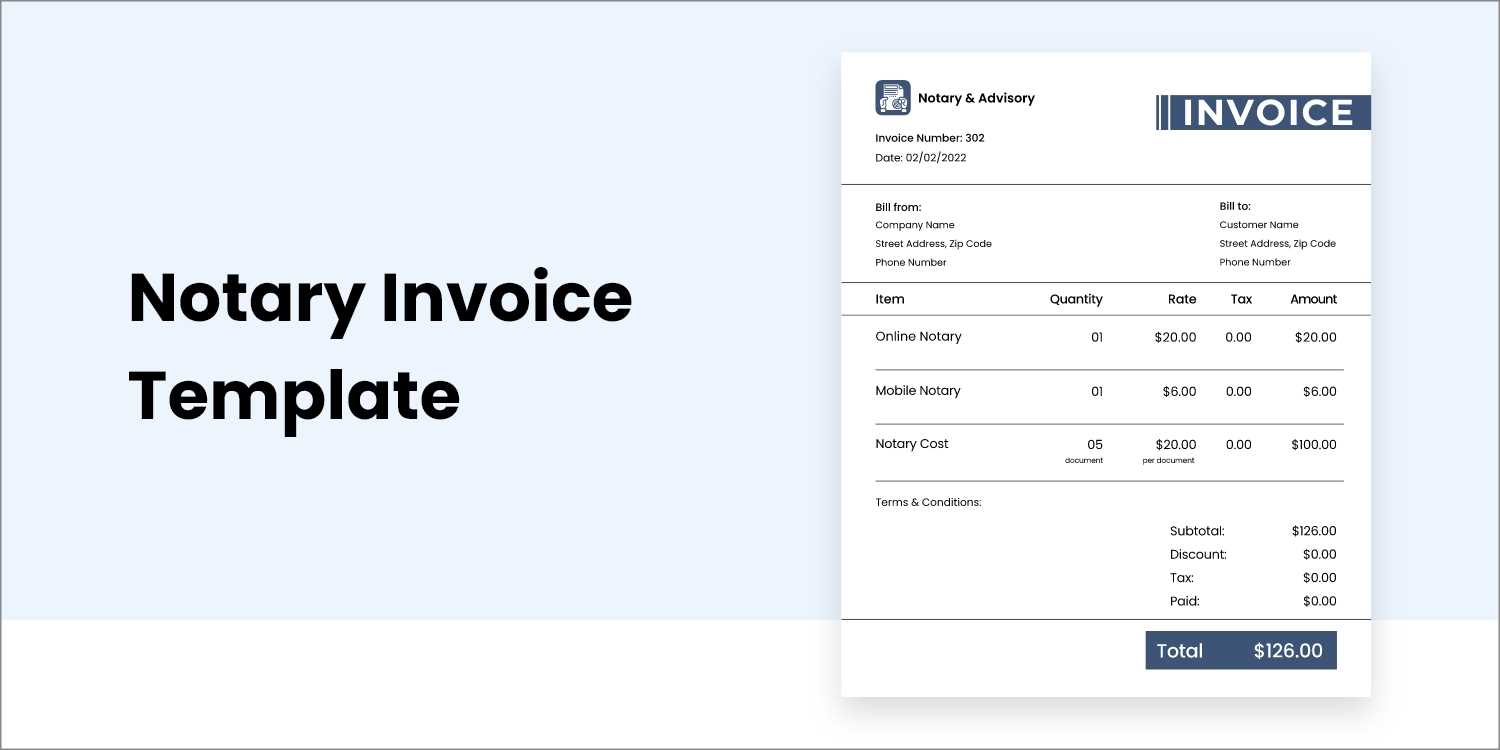

Essential Information for Payment Request Documents

When creating a document for requesting repayment, it’s crucial to include all the necessary details to ensure clarity and avoid misunderstandings. This information not only helps both parties track the transaction but also establishes the terms under which the repayment is expected. Including the right details in your document provides transparency, reduces confusion, and ensures smooth financial transactions.

Here are some key elements that should be included in any payment request document:

| Information Type | Description |

|---|---|

| Business or Lender Information | Include the name, address, and contact details of the party requesting repayment. |

| Borrower Information | Provide the name, address, and contact details of the party owing the payment. |

| Amount Due | The total amount that needs to be paid, clearly listed and broken down if necessary. |

| Payment Due Date | The specific date by which the payment should be made to avoid any penalties. |

| Payment Terms | Details about payment methods, late fees, and installment options (if applicable). |

| Description of Services or Goods | A brief overview of the services or goods provided, which the repayment covers. |

| Late Fees or Penalties | Information on any additional charges for late payments, and when these fees apply. |

| Payment Instructions | Details on how the payment can be made (bank transfer, check, online payment, etc.). |

Including these elements in your document ensures that both parties are fully aware of the payment terms and obligations. Whether you are creating a document for personal use or for a business transaction, having these key details in place will lead to a smoother and more professional process.

Digital vs. Paper Payment Request Documents

When it comes to managing financial transactions, the method of delivering payment requests plays a crucial role in ensuring smooth communication and tracking. Both digital and paper formats have their benefits, but the choice depends on factors such as convenience, accessibility, and security. Understanding the advantages and drawbacks of each approach can help you make an informed decision based on your specific needs.

Advantages of Digital Payment Request Documents

Digital payment request documents offer several benefits that make them a popular choice for businesses and individuals alike. These include:

- Convenience: Digital documents can be created, shared, and stored with ease, eliminating the need for physical storage space and reducing the time spent on handling paperwork.

- Speed: Sending a digital document via email or an online platform is instantaneous, ensuring quick delivery and faster responses.

- Cost-Effective: Digital documents eliminate the costs associated with printing, paper, postage, and physical storage, making them a more affordable option.

- Accessibility: Both the sender and receiver can access digital documents from any device, at any time, and from anywhere, enhancing convenience and flexibility.

Advantages of Paper Payment Request Documents

While digital methods have gained significant popularity, paper documents are still preferred in certain situations. Some key advantages of paper documents include:

- Physical Record: A paper copy provides a tangible record that some people find more reliable or legally binding in certain situations.

- Personal Touch: A printed document can feel more formal or personal, which may be preferred in high-value transactions or when a more professional impression is desired.

- Security: Paper documents are less vulnerable to cyber threats such as hacking, making them a safer option for those concerned about digital security risks.

Ultimately, the choice between digital and paper payment requests depends on your preferences and the specific requirements of your transaction. Each method has its place, and understanding their respective advantages can help you decide which one best suits your needs.

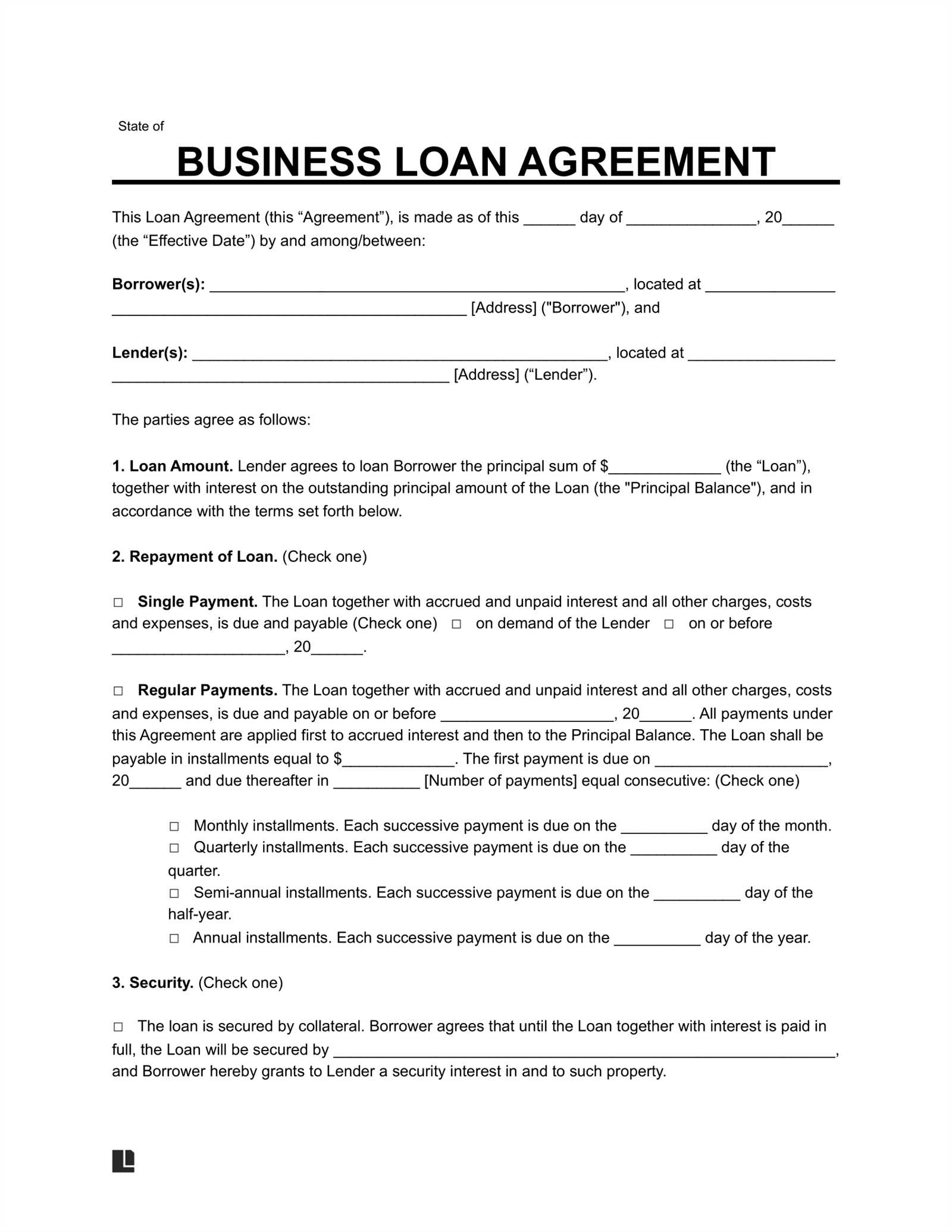

Payment Request Document for Personal Borrowing

When creating a financial agreement between individuals, it is essential to have a clear and organized document to track repayment terms and details. Whether you’re lending money to a friend or family member, a well-structured request document ensures transparency and helps prevent misunderstandings. This document typically outlines the amount borrowed, repayment schedule, and any other conditions of the transaction.

Key Information to Include

A personal borrowing document should include several important elements to ensure both parties are aware of their obligations. These key details help formalize the agreement and ensure clarity for the borrower and lender.

| Element | Description |

|---|---|

| Lender’s Information | The name, address, and contact details of the person providing the funds. |

| Borrower’s Information | The name, address, and contact details of the person receiving the funds. |

| Amount Borrowed | Specify the total amount of money being lent to the borrower. |

| Repayment Schedule | Details of the repayment structure, including the due dates and amounts for each installment. |

| Interest Rate | If applicable, the interest rate agreed upon between the parties for the borrowed sum. |

| Late Payment Fees | Specify any fees or penalties that will be charged in case of missed or delayed payments. |

| Payment Method | The agreed method for how payments will be made (e.g., bank transfer, cash, check). |

| Signatures | Both parties should sign the document to acknowledge their agreement to the terms. |

Why It’s Important

Having a written agreement in place for personal loans ensures that both the lender and borrower understand their responsibilities. It helps create a more formal structure around what is often an informal transaction, giving both parties peace of mind. Whether the loan is for personal needs or family support, clarity in the document helps avoid confusion and ensures that the loan is repaid according to the agreed terms.

Managing Interest Rates in Financial Agreements

When lending money, it is essential to clearly define the terms of repayment, especially when interest is involved. Managing the interest rate correctly can impact both the lender’s and borrower’s expectations and responsibilities. By outlining this component in a financial document, both parties are better informed about how the amount borrowed will grow over time. Proper management of interest ensures fairness and transparency, preventing future misunderstandings or disputes.

Understanding Interest Rate Calculation

Interest rates can be calculated in different ways, each affecting the overall repayment structure. Two of the most common methods are simple interest and compound interest. It is crucial to specify the type of interest in the agreement to avoid confusion about how payments will accumulate.

- Simple Interest: This method calculates interest only on the principal amount. It’s straightforward and predictable, with interest being charged at a fixed rate over the term of the loan.

- Compound Interest: Compound interest is calculated on both the principal and any accumulated interest from previous periods. This can lead to higher overall payments, as interest builds on both the original loan amount and any previous interest.

Setting Fair and Clear Terms

When determining the interest rate, consider the following factors to ensure fairness:

- Market Rates: It’s important to research current market conditions and set a rate that is competitive yet reasonable for both parties.

- Loan Amount and Duration: Larger loans or longer repayment terms may warrant different rates, as they involve higher risk and longer commitment.

- Legal Regulations: Depending on your location, there may be legal limits on how high an interest rate can be. Always ensure compliance with local laws and regulations when determining rates.

Clear documentation of interest rates in any financial agreement ensures that both the lender and borrower have mutual understanding and that the financial terms are transparent from the start.

How to Issue Financial Documents Correctly

Issuing financial documents in a clear and professional manner is key to ensuring smooth transactions between lenders and borrowers. These documents outline the amount owed, payment schedules, and any associated fees or interest rates. By following the correct process and including all necessary details, you can avoid misunderstandings and ensure that both parties are on the same page regarding their financial responsibilities.

Essential Steps for Issuing Financial Documents

When issuing such documents, it’s important to follow a structured approach. This not only helps in keeping track of payments but also ensures transparency and accountability. Here are the basic steps to follow:

- Step 1: Include borrower and lender details: Always start by stating the full name, address, and contact information for both parties.

- Step 2: Specify the amount: Clearly indicate the amount owed, as well as the principal and any additional costs.

- Step 3: Outline the payment terms: Define when payments are due, the amount for each installment, and any relevant dates such as due dates or grace periods.

- Step 4: Include interest rates or fees: Be transparent about any interest charges or administrative fees that apply to the agreement.

- Step 5: Signature lines: Both parties should sign to confirm they agree to the terms. This adds a layer of legal validity to the document.

Important Information to Include

In addition to the basic details, make sure to include the following information to ensure clarity:

| Item | Description |

|---|---|

| Principal Amount | The initial amount borrowed, excluding interest or fees. |

| Interest Rate | State whether it’s a fixed or variable rate, and specify the percentage applied. |

| Repayment Schedule | Provide a breakdown of when payments are due, including the frequency (e.g., weekly, monthly). |

| Late Fees | Clarify any additional charges for late payments or missed deadlines. |