Free Transportation Invoice Template for Easy Billing

Managing payments and ensuring accurate financial records is essential for any business. Having the right tools to create clear and professional documents is a key part of maintaining smooth operations. A well-organized document can help businesses streamline their financial processes, reduce errors, and save valuable time.

Many professionals and companies turn to pre-designed solutions to simplify their billing systems. These solutions allow for quick customization, making it easier to match documents to specific needs and business standards. Whether you’re dealing with logistics, delivery services, or any other field, having a solid document structure ensures both efficiency and accuracy.

Adopting digital tools for generating these documents brings additional benefits, such as reducing the chances of manual errors and speeding up the payment cycle. With customizable formats, businesses can easily adapt to changing requirements without the need for extensive document redesigns or the use of expensive software.

Utilizing pre-designed solutions offers a simple yet effective way to meet legal and organizational standards while maintaining a professional image in all client communications.

Why Use a Free Billing Document Format

Efficient financial documentation is crucial for maintaining smooth operations and clear communication with clients. Having a ready-made structure for creating payment requests can save both time and effort, ensuring that businesses can focus on their core activities. The use of an accessible, pre-designed format offers numerous advantages for companies of all sizes.

One of the primary reasons to choose an easily accessible billing document structure is cost-effectiveness. Instead of investing in expensive software or spending time creating custom forms, businesses can quickly implement a solution that meets their needs. This allows small businesses and freelancers, in particular, to reduce overhead costs without sacrificing professionalism.

Customizable features of these formats enable businesses to tailor the documents to their specific requirements. This flexibility allows for the inclusion of key details such as payment terms, contact information, and service descriptions, making each document unique and suited to the business’s branding and client expectations.

Additionally, using a structured format ensures consistency across all client communications, improving accuracy and reducing the risk of errors. This not only helps streamline the billing process but also reinforces a professional image that builds trust with clients.

Benefits of Customizing Your Billing Document

Customizing your billing format provides a range of advantages that help ensure your documents meet both legal requirements and your unique business needs. By adapting the structure, you can ensure that every detail is tailored to your brand and client expectations, making each payment request both professional and clear.

One significant benefit of personalizing your document is the ability to reinforce your brand identity. By adding your company logo, adjusting the color scheme, and including your contact details, you present a cohesive, branded experience to your clients, which can improve trust and recognition.

Flexibility in customization allows you to prioritize the most important information for your business. Whether it’s special payment terms, itemized service lists, or tax details, you can structure the document to highlight what matters most, ensuring clarity and reducing potential confusion on the client’s end.

Moreover, the ability to modify the document for different types of services or client relationships can streamline your process. This adaptability means that each request can be aligned with specific projects or agreements, ensuring that both you and your clients are on the same page every time.

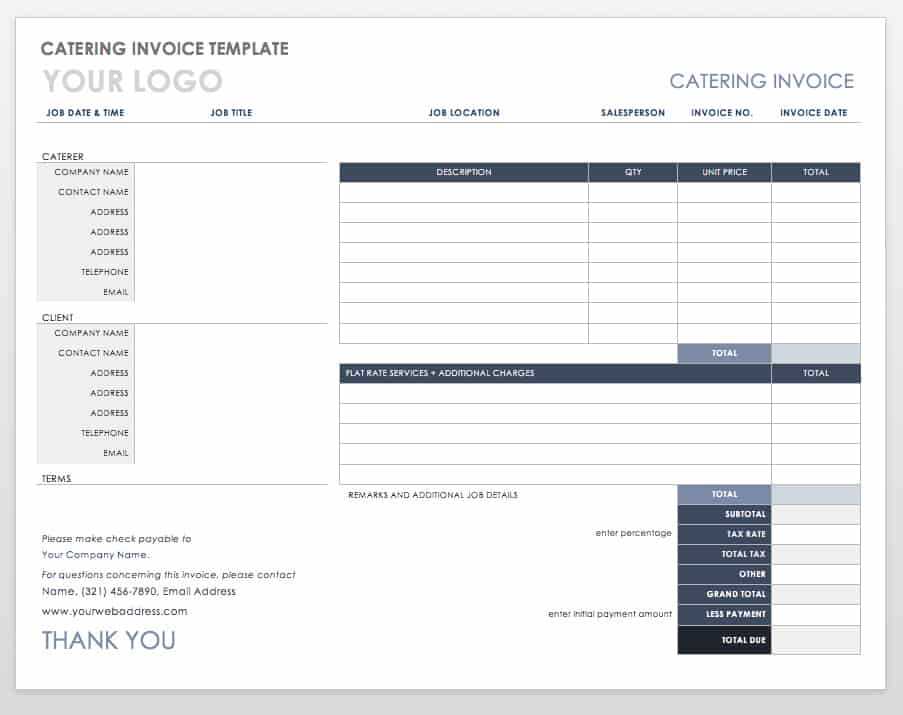

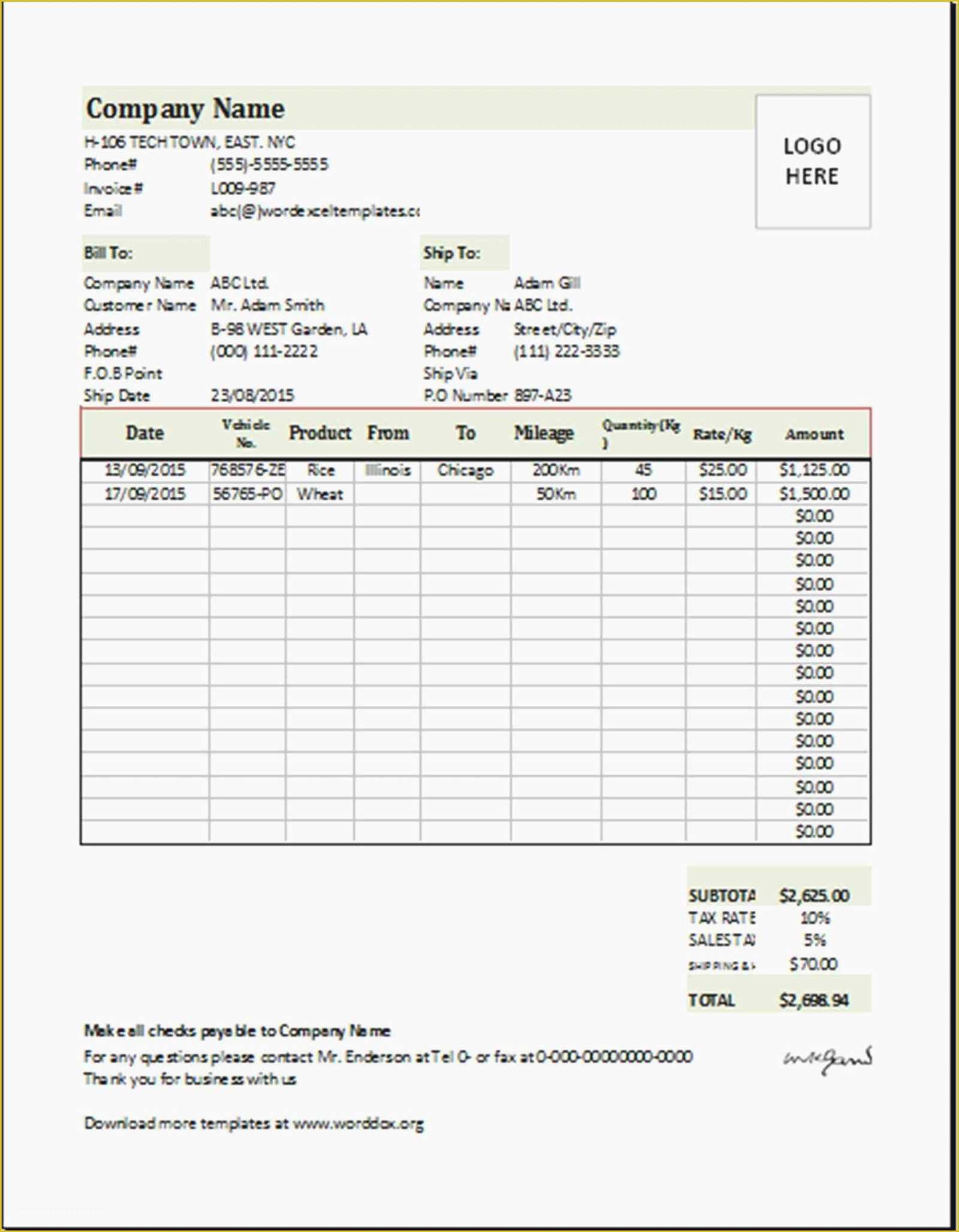

Key Features of a Good Billing Document

To ensure smooth transactions and maintain a professional image, it is crucial that your payment requests are clear, accurate, and well-organized. A high-quality billing document should contain specific elements that both you and your clients can easily understand and rely on. These features help create consistency and minimize the risk of errors, ensuring that payments are processed efficiently.

- Contact Information: The document should clearly display your business name, address, phone number, and email to make it easy for clients to reach out if needed.

- Client Details: Including the recipient’s name, address, and contact info ensures that the document is properly addressed and avoids confusion.

- Unique Reference Number: A distinct number for each request helps with tracking and accounting, providing both you and the client with an easy way to identify the transaction.

- Detailed Breakdown: A clear list of services or products provided, along with their corresponding costs, ensures transparency and allows clients to see exactly what they are being charged for.

- Payment Terms: Clearly outlining payment due dates, accepted methods, and any late fees promotes timely payments and avoids misunderstandings.

- Tax Information: Properly listing applicable taxes ensures legal compliance and provides clients with an accurate total cost.

- Professional Layout: An organized, easy-to-read design helps make the document visually appealing and reduces the chances of overlooking critical details.

Incorporating these key elements into your billing documents will not only make your processes more efficient but will also help build trust with your clients by demonstrating professionalism and attention to detail.

How to Download a Free Billing Document Format

If you’re looking to simplify your billing process, downloading a ready-made document structure is a quick and efficient way to get started. Many platforms offer downloadable versions of these files, which can be customized to suit your business needs. Here’s a step-by-step guide on how to access and download the right format for your company.

Step 1: Choose a Reliable Source

The first step in finding a useful document is selecting a trustworthy website. Look for platforms that provide professional-quality documents and allow for easy customization. Trusted websites often offer different options based on industry, making it easier to find one tailored to your needs.

Step 2: Download and Save the Document

Once you’ve found the right source, follow these steps:

- Navigate to the download section of the website.

- Choose the document format that works best for your business (e.g., Word, Excel, PDF).

- Click the download button and save the file to your computer or cloud storage for easy access.

Ensure that you are downloading the document from a secure and reputable site to avoid any potential issues, such as malware or compatibility problems.

Step 3: Customize the Document

After downloading the document, you can open it in the appropriate software and begin editing. Modify sections such as your business information, client details, services rendered, payment terms, and any other relevant content to fit your specific needs. Most platforms allow for easy editing, making it simple to personalize each document.

By following these steps, you’ll be able to quickly access a high-quality, customizable format that will streamline your billing process and help you maintain professionalism in all client communications.

Common Mistakes in Billing Documents

While creating payment requests, it’s easy to overlook key details or make errors that can lead to confusion and delays. Simple mistakes in these documents can create misunderstandings with clients, delay payments, or even result in legal issues. Avoiding these common errors is crucial for maintaining professionalism and ensuring smooth transactions.

Incorrect or Missing Information

One of the most common mistakes is failing to include or misplacing important details such as the client’s contact information, the date of the service, or the business’s own details. This can cause confusion about who the request is for or when the services were rendered. Additionally, failing to include a unique reference number or identification can make it difficult to track or reconcile payments later on.

- Missing client contact details: Always ensure that the client’s name, address, and email or phone number are clearly included.

- Incorrect date: Double-check that the date of service or delivery is accurate, as this can impact payment schedules.

- Missing or incorrect reference number: Every document should have a unique identifier to ensure it can be easily tracked and referenced.

Ambiguous Payment Terms

Unclear payment terms can lead to delays or disputes. If the deadlines, accepted payment methods, or any penalties for late payments are not clearly stated, clients may be unsure of when and how to pay. It’s essential to outline these terms in a straightforward manner to ensure mutual understanding.

- Unclear due date: Always specify the exact payment deadline, whether it’s 30 days, net 15, or another agreed-upon timeframe.

- Unspecified late fees: If there are any penalties for late payments, be sure to include these to avoid confusion.

- Payment methods not listed: Clearly mention the accepted methods (bank transfer, credit card, etc.) to prevent delays caused by payment method issues.

By being mindful of these common mistakes, you can ensure that your billing documents are clear, professional, and effective in securing timely payments.

Free Billing Formats vs Paid Versions

When selecting a document structure for your business, you may face the decision between using a no-cost option or investing in a premium version. Both options have their merits and drawbacks, depending on the scale of your operations and your specific needs. Understanding the differences can help you make an informed choice that aligns with your goals.

Free options are often an attractive choice for small businesses and startups. These resources typically offer basic features that meet the fundamental requirements for creating professional documents. However, they may lack advanced customization features or additional support that could be useful as your business grows.

Paid versions, on the other hand, come with additional benefits. They often include enhanced features such as advanced customization, the ability to integrate with accounting software, or additional professional designs. For businesses with more complex needs or those that require more frequent, high-quality documents, investing in a premium solution might be worthwhile.

- Customization: Free formats may offer limited options for personalization, while paid versions allow for more flexible designs and the inclusion of branding elements.

- Support: Paid options often come with customer support, which can be invaluable if you encounter issues or need assistance with specific features.

- Integration: Premium formats may offer integration with other business tools (e.g., accounting software), which can save time and reduce errors in your financial processes.

- Design Options: Free versions may have basic designs, while paid versions often feature more polished, professional templates that enhance the overall appearance of your documents.

Ultimately, the choice between free and paid billing formats depends on your business’s size, requirements, and available resources. If you’re just starting out and only need basic functionality, free options may suffice. However, for businesses that require more robust features and long-term scalability, investing in a premium version may offer greater value.

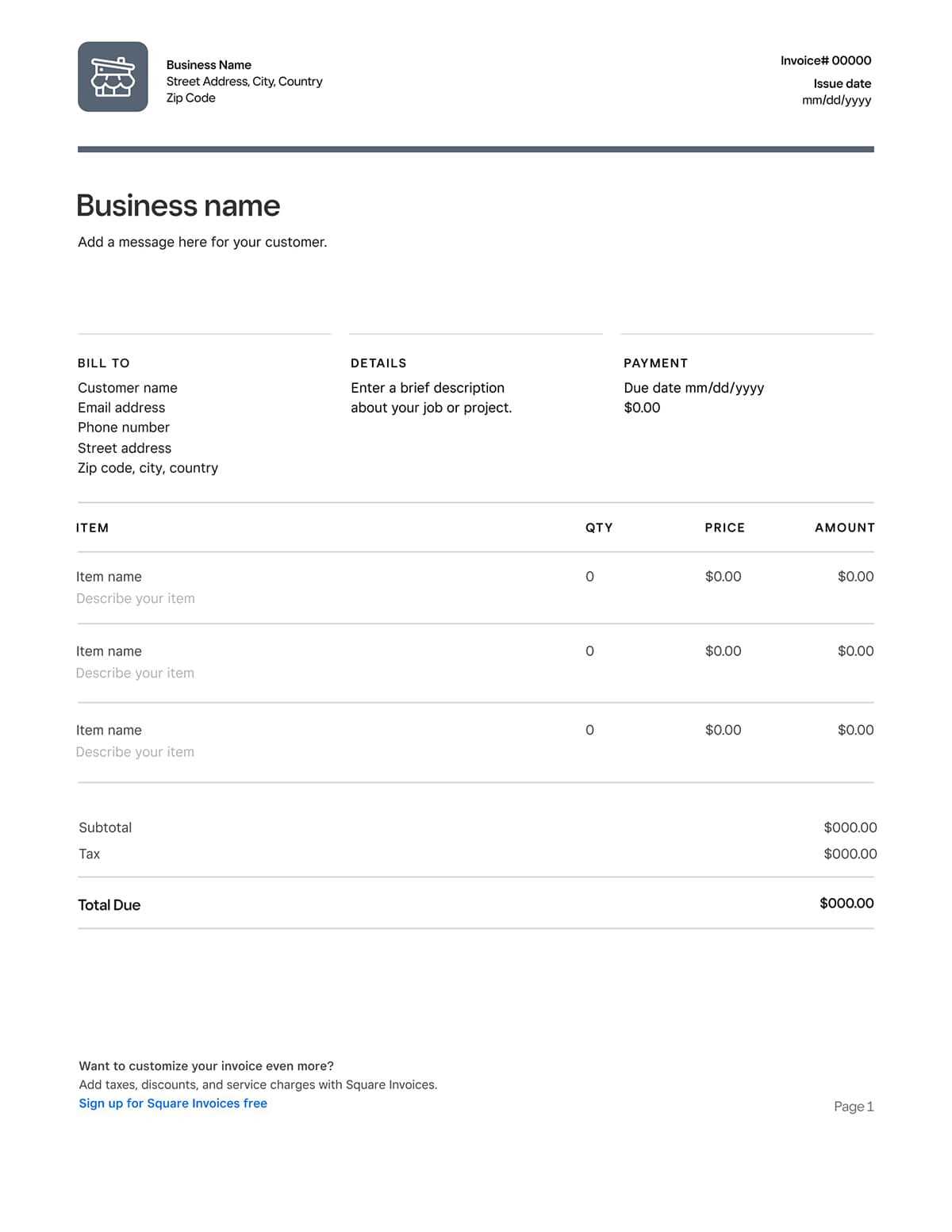

Steps to Personalize Your Billing Document Format

Customizing your billing format ensures that it reflects your business’s identity while meeting your specific needs. Personalization can make your documents look more professional and align them with your brand. Whether you’re adapting an existing structure or starting from scratch, the process of customization is simple and can be done in just a few steps.

Step 1: Add Your Business Information

The first step in personalizing your document is to include essential details about your business. These elements make it clear who the document is coming from and provide your client with the necessary contact information. Make sure to include:

| Business Detail | Example |

|---|---|

| Business Name | ABC Logistics |

| Address | 123 Main Street, City, Country |

| Phone Number | (123) 456-7890 |

| Email Address | [email protected] |

Step 2: Customize the Layout and Design

Next, adjust the layout to match your branding. This can include selecting a color scheme that complements your company logo, or choosing a specific font style. A clean, professional design not only makes your documents easier to read but also enhances your brand image.

Consider the following design aspects to customize:

- Header and footer design, including your logo

- Font style and size for better readability

- Use of colors that match your branding

- Alignment of key information, ensuring clarity

Step 3: Include Payment Terms and Other Specific Details

Ensure that your document includes specific details relevant to the service provided, such as payment deadlines, accepted payment methods, and any applicable taxes. This helps avoid confusion and ensures timely payment.

| Detail | Example |

|---|---|

| Payment Due Date | 30 days from the date of service |

| Late Fee | 5% after 30 days |

| Accepted Payment Methods | Bank transfer, credit card |

By following these simple steps, you can create a personalized and professional document that meets your needs and

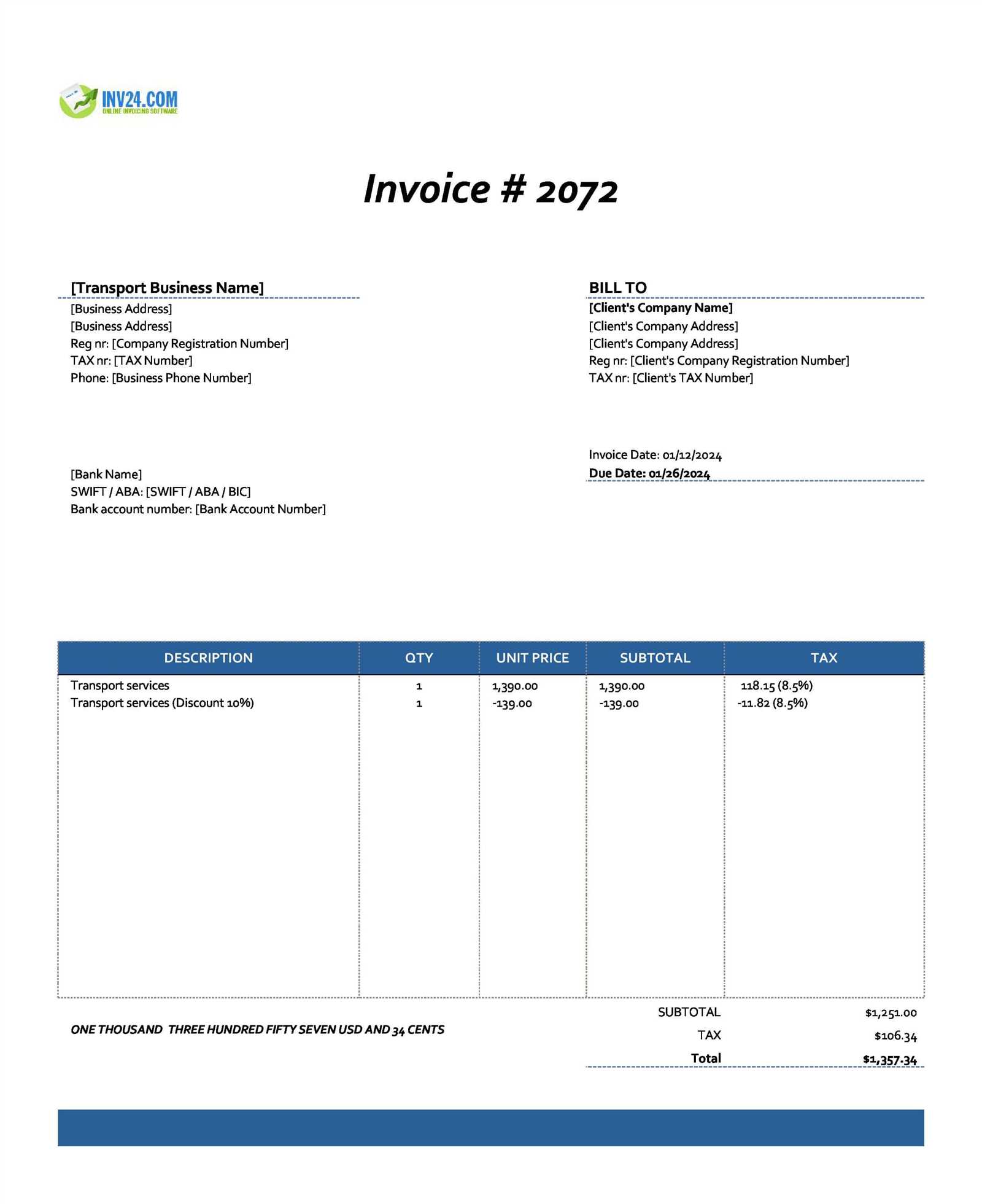

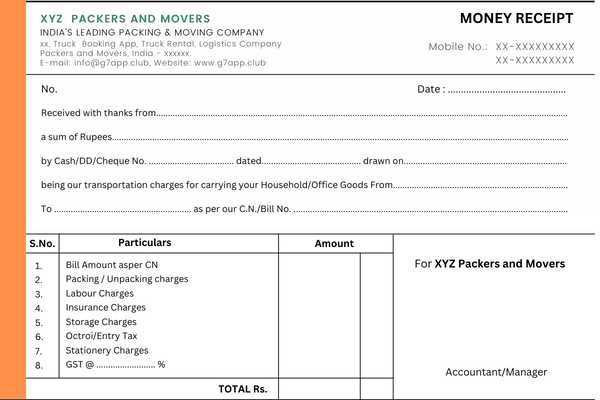

How to Include Tax Information on Billing Documents

Properly including tax details on your billing documents is essential for both legal compliance and transparency with your clients. Whether you’re dealing with sales tax, VAT, or other applicable taxes, ensuring these figures are accurately represented helps avoid misunderstandings and keeps your financial records in order. This section outlines the key steps to properly incorporate tax information into your payment requests.

Step 1: Identify the Applicable Tax Rate

The first step in including tax information is determining which tax rates apply to your services or goods. Tax rates can vary depending on your location, the type of service, or even the specific client. Ensure you are using the correct rate based on current laws and regulations in your jurisdiction.

For example:

- If you’re providing services within a specific state or country, use the local sales tax rate.

- For international clients, you may need to apply VAT or other relevant taxes depending on their location.

Step 2: Clearly Display Tax Amounts

Once you’ve identified the correct tax rate, you must clearly indicate the tax amount on the document. It’s important to make the tax calculation transparent to your clients. This can be done by listing the tax as a separate line item or including it as part of the total cost breakdown. Either way, the tax should be clearly labeled to avoid confusion.

Example:

| Description | Amount |

|---|---|

| Service Fee | $500.00 |

| Sales Tax (8%) | $40.00 |

| Total | $540.00 |

Step 3: Include Tax Identification Number (TIN) or VAT ID

Depending on your country’s tax regulations, you may be required to include a tax identification number (TIN) or VAT registration number on your billing documents. This is important for businesses that are registered for tax purposes, as it helps with recordkeeping and ensures your clients can claim tax deductions if applicable.

For example, if you’re registered for VAT in your country, include your VAT ID number on all billing documents to help clients process their own tax filings.

By following these steps, you ensure that all necessary tax information is included in your billing documents, which keeps you compliant and helps your clients better understand their charges.

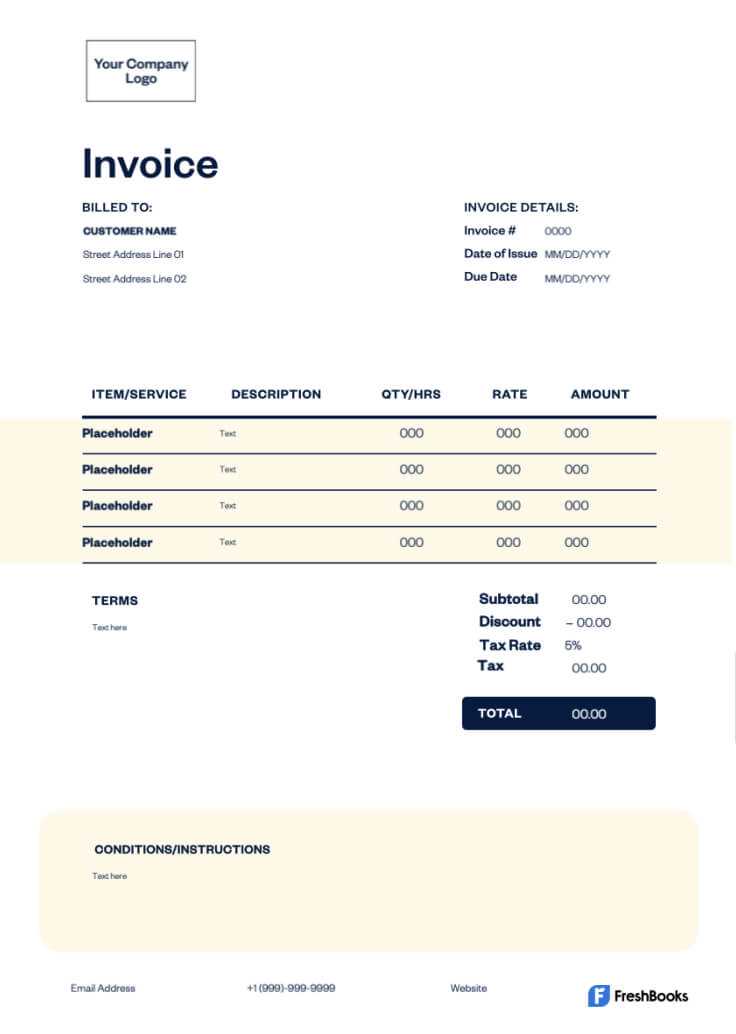

Best Software for Editing Billing Documents

When it comes to customizing your financial documents, having the right software can make all the difference. The best programs not only allow you to easily modify existing documents but also provide the tools necessary to ensure they are professional, accurate, and tailored to your specific needs. Whether you’re looking for a simple tool to update details or an advanced platform for comprehensive document management, there are several excellent options available.

Top Software for Customizing Billing Files

Here are some of the best programs for editing and personalizing your billing documents:

- Microsoft Word – A well-known word processor that offers basic editing tools, easy customization options, and pre-built templates for quick document creation.

- Excel – Ideal for users who prefer working with spreadsheets. It allows for simple calculations (such as tax and totals) and offers flexibility in layout and design.

- Google Docs – A free cloud-based solution that allows you to create, edit, and share documents with ease. It’s great for businesses looking to collaborate and access documents from anywhere.

- Canva – A user-friendly design tool perfect for those who want to add visual appeal to their documents. Canva offers customizable templates and design elements to create professional-looking documents.

- Zoho Invoice – A more specialized option for creating and managing billing files. Zoho provides pre-designed formats, automatic calculations, and integrates with accounting tools.

- FreshBooks – A complete invoicing and accounting solution that allows for easy document creation, tracking, and client management in one platform.

Why Choose Paid Software Over Free Options?

While there are free programs available, paid software often offers additional features such as advanced customization, customer support, and integration with accounting systems. For businesses that need professional-grade features or require frequent document generation, investing in paid software can save time and reduce the risk of errors.

Choosing the right tool depends on your business needs, whether you prioritize simplicity, collaboration, or advanced functionality. The software you choose will play a key role in streamlining your billing process and enhancing your professional image.

Creating Clear Payment Terms for Clients

Establishing clear and concise payment terms is essential for maintaining healthy business relationships and ensuring timely payments. When clients know exactly when and how to pay, it reduces the risk of delays and misunderstandings. Clear payment terms also help avoid disputes and ensure that both parties are aligned on the expectations surrounding financial transactions.

To create effective payment terms, it’s important to cover key details such as due dates, accepted payment methods, and any late fees or discounts. Here’s a breakdown of what should be included:

| Payment Term | Details |

|---|---|

| Due Date | Clearly specify the exact date the payment is due (e.g., 30 days from the date of service). |

| Payment Methods | List all acceptable payment methods (bank transfer, credit card, online payment gateways, etc.). |

| Late Payment Fees | State the penalty for late payments (e.g., 5% per month after the due date). |

| Discounts for Early Payment | Offer an incentive, such as a 2% discount, if the client pays before a specific date. |

| Partial Payments | If applicable, explain whether partial payments are allowed and how they will be applied to the total balance. |

By being transparent and explicit about these key terms, you ensure that clients understand what is expected and help prevent potential issues. Furthermore, these clear guidelines can enhance trust and foster a positive business environment, ultimately improving cash flow and reducing payment delays.

Essential Elements of a Billing Document

To ensure a smooth and professional transaction, certain key details must be included in your financial documents. These elements not only help clarify the charges for your clients but also provide a clear record of the service provided. Having a comprehensive and accurate payment request is critical for both business organization and legal compliance.

Key Information for Clarity

Each document should contain the following basic details to be considered complete:

- Business Information: Include your company’s name, address, phone number, and email address for easy communication.

- Client Information: Clearly list your client’s full name, company name (if applicable), address, and contact details.

- Service Description: Provide a clear breakdown of the services rendered, including dates of service, delivery information, and any specific details of the work performed.

- Amount Due: State the total cost for the services provided, along with any applicable taxes, fees, or discounts.

- Payment Terms: Include the due date, acceptable payment methods, and any late payment penalties.

Optional but Recommended Details

While not required by law, these additional elements can enhance the professionalism and utility of your document:

- Unique Reference Number: Assign a unique number to each document for easy tracking and reference.

- Purchase Order (PO) Number: If applicable, include the client’s PO number to facilitate internal processes.

- Payment Instructions: Provide clear details about how to submit payment (bank transfer, credit card, etc.).

- Notes or Terms and Conditions: If necessary, add any specific terms, conditions, or disclaimers relevant to the service or payment process.

By incorporating these essential and optional elements, your financial documents will not only look professional but also function effectively in ensuring smooth payments and clear communication with your clients.

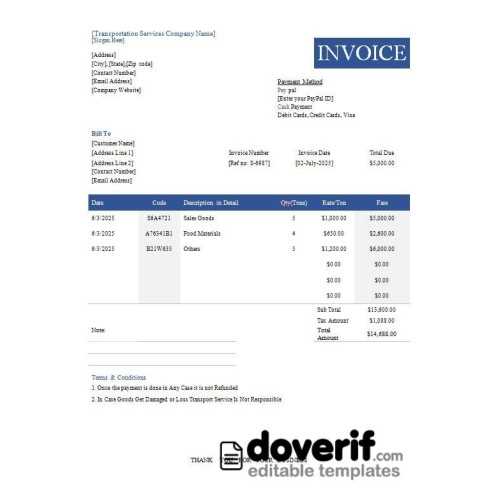

How to Format Your Billing Document Professionally

Proper formatting is crucial for creating professional financial documents that are easy to read, clear, and effective. A well-structured document not only makes a positive impression but also ensures that all necessary details are presented in an organized way. Properly formatted documents help avoid confusion and streamline the payment process for both you and your client.

Key Formatting Guidelines

Here are some essential tips for formatting your financial documents professionally:

- Use a Clean Layout: Make sure your document has a clear and simple layout with distinct sections for key information (e.g., business details, client details, payment breakdown). Avoid cluttering the document with unnecessary elements.

- Consistent Fonts: Choose easy-to-read fonts such as Arial or Times New Roman. Use a consistent font style and size throughout the document for a uniform appearance.

- Organize Sections Clearly: Divide the document into well-labeled sections, such as “Services Provided,” “Total Amount Due,” “Payment Terms,” and “Client Information.” Each section should be easy to find and distinct from the others.

- Highlight Important Information: Make sure the total amount due, payment due date, and any late fee information are easily noticeable. You can bold or use a larger font size for these critical details.

- Use Tables for Financial Breakdown: A table format is ideal for showing itemized costs and calculations. This ensures that both you and your client can easily review the details of the charges.

Additional Design Considerations

Beyond the functional aspects of formatting, design plays a key role in the professionalism of your document. Here are a few additional tips:

- Include Your Logo: If applicable, add your business logo at the top of the document to enhance your brand identity.

- Maintain Proper Alignment: Align text and numbers neatly, especially when listing amounts or due dates. Misaligned text can make your document look unorganized and unprofessional.

- Leave Enough White Space: Ensure that there is enough space between sections so that the document doesn’t appear cramped. This makes it easier for the recipient to read and understand.

By following these formatting guidelines, your billing documents will not only look professional but also provide clarity and organization, leading to better communication and more efficient payments.

How to Add Your Branding to Billing Documents

Incorporating your branding into financial documents not only enhances your professional appearance but also reinforces your company’s identity in every transaction. By customizing these documents with your logo, colors, and other brand elements, you create a consistent experience for your clients. This section covers the steps to seamlessly integrate your brand into your billing paperwork.

Key Elements to Include for Branding

To make your documents reflect your brand, consider the following elements:

- Logo: Place your company logo prominently at the top of the document. This makes it immediately recognizable to your clients.

- Brand Colors: Use your brand’s color scheme throughout the document, especially for headings, borders, and important figures, such as the total amount due.

- Fonts: Select fonts that match your brand’s style. Whether you prefer a modern, minimalist look or something more traditional, consistency in font choice across all your materials is key.

- Tagline or Slogan: If applicable, include your tagline or slogan somewhere on the document. This adds an extra layer of brand identity and helps reinforce your message.

Where to Position Branding Elements

When customizing your document layout, make sure the branding elements are strategically placed so they’re visible but don’t overwhelm the content. Here’s how to position key elements:

| Branding Element | Recommended Position |

|---|---|

| Logo | Top left or top center of the page, ensuring it’s large enough to be clearly visible. |

| Brand Colors | Use for section headings, borders around key information, and totals, but avoid overusing them. |

| Tagline or Slogan | Consider placing it in the footer or near the signature line, subtly reinforcing your brand message. |

By including these branding elements, you make your financial documents more aligned with your business identity, helping clients recognize your brand more easily and strengthening your professional reputation.

Automating Billing Document Creation for Efficiency

Automating the creation of your financial documents can save time, reduce errors, and streamline your workflow. By using software or tools that automatically generate these documents, you eliminate the need for manual data entry, ensuring faster processing and more accurate results. This approach is particularly valuable for businesses that handle a high volume of transactions and need to ensure consistency across all documents.

Why Automation Matters

Manual creation of billing documents can be time-consuming, especially when each document requires entering similar information repeatedly. With automation, you can set up templates and workflows that fill in repetitive details–such as client names, dates, and amounts–saving you hours of work. Furthermore, automation helps reduce human error, ensuring that all figures and data are consistent and accurate.

How to Set Up Automated Billing

Setting up an automated system is easier than it sounds. Here are some steps to get started:

- Choose the Right Software: Look for software that offers automation features, such as automatic data entry, calculation of totals, and customizable templates.

- Integrate with Your Accounting System: If your business uses accounting software, ensure that the system can be integrated with your billing tool. This way, you can pull client details, payment history, and service information directly from your accounts without needing to input them manually.

- Set Up Recurring Billing: For clients who have regular payments, set up recurring billing schedules that automatically generate and send documents on a set date (weekly, monthly, etc.).

- Customize Your Documents: Customize the document layout to include your branding, payment terms, and any specific items that need to be detailed for each transaction.

Benefits of Automation

By automating the document creation process, you can enjoy several key advantages:

- Time Savings: Automatically generated documents are created in seconds, reducing the manual effort required.

- Consistency: Automation ensures that all your documents follow the same format and contain the same key information, reducing the risk of discrepancies.

- Improved Cash Flow: Faster and more efficient document generation helps ensure timely payments from clients, improving your cash flow.

- Better Record-Keeping: Most automated tools store all documents digitally, making it easier to track past transactions and manage your financial records.

Overall, automating your billing process is an excellent way to increase productivity, enhance accuracy, and ensure your business operates smoothly. Once you’ve set up an automated system, you’ll be able to focus on growing your business rather than on tedious paperwork.

Legal Considerations When Using Billing Documents

When creating and issuing financial documents, it’s essential to be aware of the legal requirements that govern these transactions. Properly formatted and legally compliant documents not only ensure smooth business operations but also protect both parties in case of disputes. Understanding the key legal elements involved helps avoid potential legal issues and ensures that your business transactions are valid and enforceable.

Key Legal Considerations

Below are several important legal factors to keep in mind when using financial documents:

- Accuracy of Information: Ensure that all details in the document, including client information, payment terms, and amounts, are correct. Incorrect information can lead to misunderstandings or legal disputes.

- Compliance with Local Laws: Different regions have specific laws regarding taxes, payment deadlines, and what needs to be included in billing documents. Always research and comply with the legal requirements in your jurisdiction.

- Tax Information: If applicable, it’s important to include proper tax identification numbers, tax rates, and VAT (Value Added Tax) details. Failure to do so can result in legal complications with tax authorities.

- Clear Payment Terms: Be explicit about payment deadlines, acceptable payment methods, and any late fees or interest charges for overdue payments. This helps prevent disputes and ensures enforceability in case of non-payment.

- Record Keeping Requirements: Many regions require businesses to keep copies of all financial documents for a specific period (e.g., 5-7 years). Ensure your documents are stored properly for future reference or audits.

Common Legal Pitfalls to Avoid

To ensure that your documents are legally sound, here are some common pitfalls to avoid:

- Lack of Signature or Approval: In some cases, not obtaining proper authorization from the client can invalidate the agreement. Make sure that documents are signed or electronically approved when required.

- Failure to Include Required Terms: Missing critical information like payment due dates or itemized service details can make the document unenforceable in a legal dispute.

- Non-Compliance with Consumer Protection Laws: Many jurisdictions have specific consumer protection laws that require you to include certain terms in financial documents. Always check that your documents meet these standards.

Enforcing Payment

If a client does not pay as agreed, having legally binding terms in place makes it easier to pursue payment through legal channels, such as collections or small claims court. Always consult with a legal professional if you are unsure about the enforceability of your terms or if yo