How to Use a Manual Invoice Template for Easy and Professional Billing

Managing payments and maintaining professional records are essential for any business. One of the most effective ways to handle transactions is through well-organized and personalized billing documents. These documents help both businesses and clients keep track of services rendered, payments due, and overall financial transparency.

Having the right structure for your billing paperwork ensures clarity and prevents confusion. With a carefully crafted format, you can easily outline the necessary details such as dates, amounts, and descriptions of work completed. This approach also allows you to reflect your brand’s identity while maintaining professionalism.

Crafting your own billing forms offers flexibility in how you present important financial information. Whether you’re managing a small freelance project or running a larger company, customizing these documents can meet your specific needs while staying efficient and easy to understand for your clients.

Whether you’re new to this process or looking to refine your approach, understanding how to design these forms is a critical step in ensuring smooth transactions and fostering trust between businesses and clients.

Manual Invoice Template Overview

Creating personalized billing documents is a crucial step in any business transaction. These forms provide a structured way to present payment requests, offering a clear record of services rendered, amounts owed, and other relevant details. Having a well-designed layout is not just about formality–it helps avoid misunderstandings and ensures that both parties are on the same page regarding payment terms.

Understanding the Purpose of Billing Documents

At their core, these forms are used to formalize the financial exchange between a business and its clients. Whether you’re a freelancer, contractor, or running a larger operation, having a consistent method for outlining charges helps maintain organization. Customizing these forms to fit the needs of your business allows for greater flexibility in how information is presented, ensuring that all critical elements are included while reflecting your brand’s identity.

Why Customization Matters

One of the primary advantages of using a customized format is that it can be tailored to specific industries, client needs, or transaction types. You can adjust the layout, font, and structure to suit your business style, while ensuring that all essential information, like payment due dates and descriptions of services, is easy to read and understand. Customizing the look and feel of your documents not only streamlines your billing process but also improves the overall client experience.

What Is a Manual Invoice Template

A personalized billing form is a document designed to request payment for services or goods provided. It outlines key information, such as the amount due, the work completed, and payment terms. Unlike automated systems, this method is typically filled out by hand or with a custom-built file, offering greater control over the document’s appearance and content.

These forms are often used by freelancers, small business owners, or anyone who prefers a non-digital way of managing financial transactions. The process involves creating or using a pre-structured layout that can be manually edited for each specific client and project.

Key Features of These Billing Documents

- Clear Breakdown of Charges: Itemizes each service or product, making it easy for clients to understand what they are paying for.

- Payment Terms: Specifies when payment is due, whether it’s immediately, within a certain number of days, or on a specific date.

- Contact Information: Includes the sender’s details and those of the recipient to avoid any confusion.

- Customization Options: Allows for specific fields to be added or removed based on the type of work or services provided.

Why Use a Customized Billing Document

Customizing these forms offers a range of benefits. For one, it allows you to maintain a professional appearance, reflecting your brand’s identity. Additionally, having a personalized document can streamline your administrative process, ensuring that all the necessary details are included and presented in a way that suits your business needs.

Benefits of Using Manual Invoices

Opting for a personalized approach to billing offers several advantages, especially for small businesses, freelancers, and contractors. By creating custom payment requests, businesses can maintain a higher level of control over their financial documentation. This not only ensures accuracy but also allows for greater flexibility in how information is presented to clients.

Improved Accuracy and Clarity

One of the main benefits of creating custom billing forms is the ability to clearly outline the charges and services provided. This transparency helps reduce the chances of errors and misunderstandings between the business and the client. Additionally, manual forms can be tailored to meet the specific needs of each transaction, ensuring all necessary details are included.

Cost-Effective and Flexible

Customizing your own payment request form can be a budget-friendly alternative to expensive accounting software. It allows businesses to create simple, functional documents without needing to invest in complex systems or subscriptions. Moreover, this approach provides the flexibility to adapt the layout, content, and style to fit different industries or project types.

| Benefit | Description |

|---|---|

| Control over Content | Fully customizable, allowing businesses to add or remove sections based on needs. |

| Personalized Branding | Forms can reflect a company’s identity, helping reinforce professionalism. |

| Ease of Use | Simple to create and modify, even without advanced software knowledge. |

| Reduced Costs | No need for expensive invoicing tools or subscriptions, making it a cost-effective solution. |

When to Choose a Manual Invoice

Deciding when to use a custom-built billing document depends on the nature of your business and the complexity of your transactions. While automated systems work well for high-volume businesses, there are specific situations where creating a personalized form is more advantageous. This approach is particularly useful for small businesses, freelancers, and those who manage one-off projects or occasional clients.

When Simplicity Is Key

If you’re working on a small scale or only occasionally issuing requests for payment, a custom document can be the simplest and most cost-effective solution. You don’t need to invest in software, and the layout can be as simple or detailed as required. For businesses that don’t require frequent updates or complicated financial tracking, manually creating these documents offers a streamlined approach.

Customizing for Specific Client Needs

Another reason to opt for a personalized document is the need to tailor the content to each client. Manual forms allow for flexibility, enabling you to add specific terms or payment conditions that suit a particular project or agreement. This is especially helpful when dealing with irregular billing scenarios or when you wish to present your services in a personalized, client-focused way.

- Low Volume of Transactions: When your business handles only a few transactions, creating personalized forms is a simple and effective method.

- One-Time Projects: For short-term or one-off contracts, using a custom layout allows you to include the exact details of each job.

- Cost Efficiency: If you are trying to minimize overhead costs, creating these documents manually can save money by eliminating the need for expensive software.

- Personal Touch: Some clients may appreciate receiving a more tailored approach, which can reflect your professionalism and attention to detail.

Key Elements of a Manual Invoice

When creating a custom billing document, it’s essential to include all the necessary information to ensure clarity and transparency. A well-structured form helps both the sender and the recipient understand the terms of the transaction and facilitates smooth payment processing. Certain components should always be present to ensure the document serves its purpose effectively.

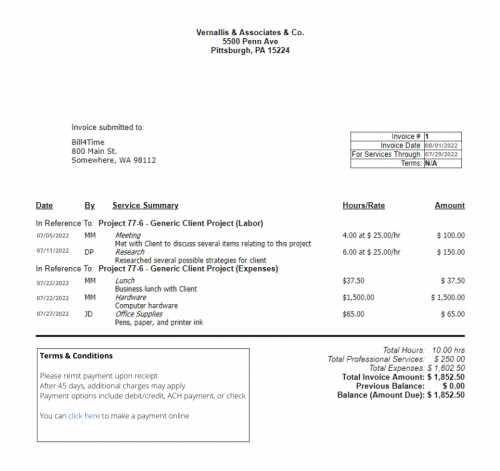

Essential Components

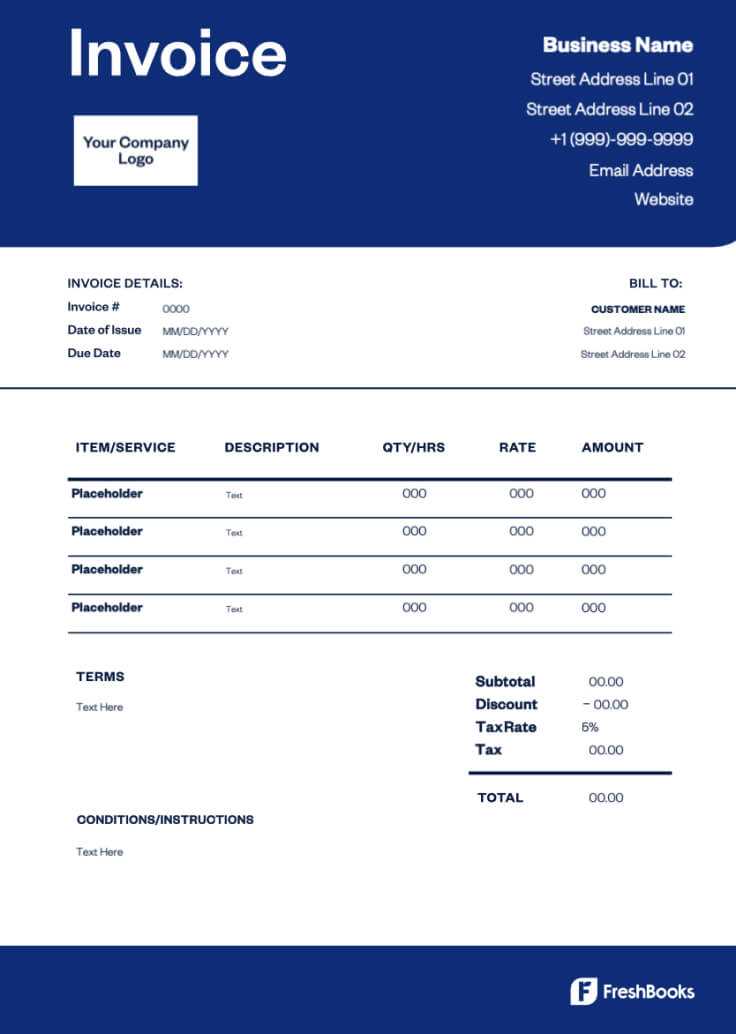

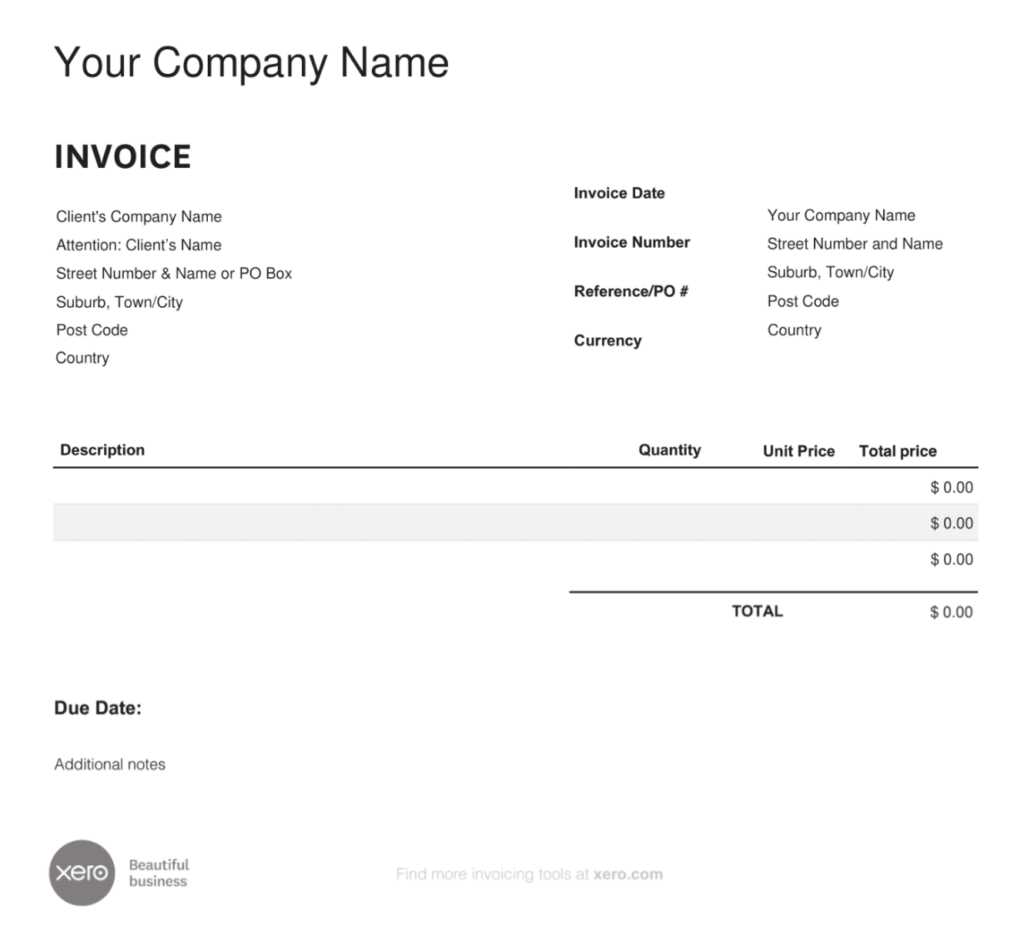

- Business Information: This includes the name, address, contact details, and logo of the business issuing the document. It’s important for establishing the sender’s identity and maintaining professionalism.

- Client Information: Clearly list the recipient’s name, address, and contact details. This ensures the document is correctly directed and avoids confusion.

- Description of Services or Goods: Provide a detailed breakdown of what is being billed for, including the quantity, unit price, and a brief description of each item or service.

- Amount Due: Clearly state the total amount owed, specifying the currency and any applicable taxes or discounts.

- Payment Terms: Indicate when payment is due, whether it’s immediate, within a set number of days, or based on specific milestones. Payment methods should also be specified (e.g., bank transfer, credit card, cash).

- Invoice Number: Assign a unique number to each document for reference. This helps with organization and tracking.

- Dates: Include the issue date and, if applicable, the due date for payment. This ensures both parties know the timeline for the transaction.

- Additional Notes: Any extra information, such as late fees, terms of service, or specific conditions, can be added here for clarity.

Why These Elements Matter

Including these key components ensures that the document is not only functional but also professional. Each element serves a distinct purpose: they provide the necessary details for both the payer and the payee to process the payment without confusion. Moreover, having a consistent structure makes it easier to track transactions and maintain records for future reference.

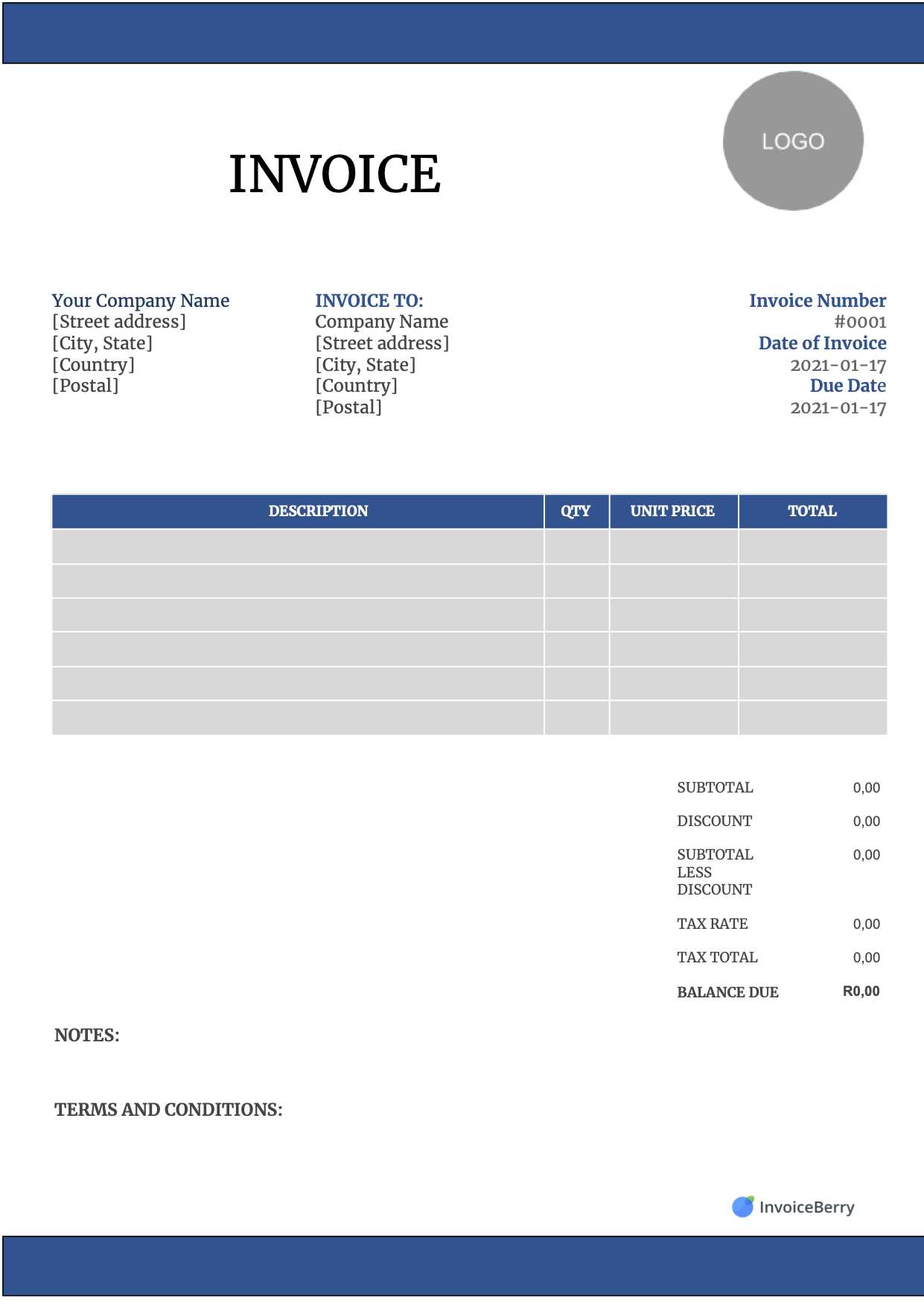

How to Customize a Manual Invoice

Customizing a billing document allows you to tailor it to your business’s specific needs while ensuring it meets the requirements of your clients. Whether you’re handling a small project or managing a large contract, personalizing these forms helps convey professionalism and improves the client experience. There are several key areas where customization can make a significant difference.

Steps to Personalize Your Billing Form

- Adjust the Layout: You can choose the format that best suits your business. For example, you may want to include a logo at the top, bold headings, or sections that are visually separated to enhance readability.

- Add Specific Information: Depending on your industry, you might need to include special fields. For example, if you’re a consultant, you may want to add a “project milestones” section or if you sell products, a “SKU number” field.

- Change the Terminology: Customize the language used in the document to match your business style. For instance, instead of “Amount Due,” you might use “Total Balance” or “Payment Requested” depending on how you communicate with clients.

- Branding Elements: Include your company logo, color scheme, and fonts to create a cohesive brand identity. This makes the document look polished and reinforces your brand’s image.

- Include Payment Options: Tailor the payment methods to what you accept–whether that’s bank transfer, PayPal, credit card, or other forms. You can also include specific instructions for clients on how to make payments, including account details or links to payment portals.

- Set Payment Terms: Define payment terms clearly, such as due dates, late fees, or discounts for early payment. Customizing these details helps clients understand your expectations and ensures timely payments.

Why Customization is Important

Customizing your billing form not only makes it more functional but also ensures that it reflects your unique business operations. A tailored document can be more efficient, accurate, and client-friendly. Additionally, presenting a polished and consistent document reinforces trust and professionalism, making it easier to maintain long-term client relationships.

Common Mistakes in Manual Invoices

Even when creating custom payment documents, it’s easy to overlook certain details that can lead to confusion or payment delays. Making mistakes in these forms can result in misunderstandings between you and your clients, causing unnecessary back-and-forth communication. Recognizing common errors in the process can help you avoid these pitfalls and ensure smoother transactions.

| Mistake | Explanation | Consequence |

|---|---|---|

| Missing Contact Information | Leaving out your business or client’s contact details makes it difficult to reach the right person for follow-ups. | Delays in payment processing or confusion about the recipient. |

| Incorrect or Incomplete Service Descriptions | Not providing enough detail about the work completed or product delivered leads to ambiguity. | Clients may question charges, leading to delays or disputes. |

| Not Including Payment Terms | Failure to specify when and how payment is due can cause misunderstandings about timelines. | Late payments or confusion about payment deadlines. |

| Omitting Unique Invoice Number | Not assigning a unique reference number makes tracking and organizing documents more difficult. | Problems with record-keeping and difficulty referencing the document in the future. |

| Not Double-Checking Totals | Forgetting to double-check the final amounts or taxes can lead to incorrect charges. | Overcharging or undercharging clients, leading to frustration or financial discrepancies. |

By carefully reviewing each section of your custom payment request, you can ensure that no critical information is left out and that every detail is accurate. This helps maintain professionalism, improves client satisfaction, and ensures timely payments.

Creating Professional Invoices by Hand

While digital systems are widely used for billing, creating a custom payment request by hand can still be an effective and professional approach, especially for small businesses or independent contractors. Handwritten or manually created documents allow for full control over the presentation and content. With careful attention to detail and structure, these forms can appear polished and trustworthy, reflecting positively on your business.

Steps to Craft a Professional Document

To create a professional-looking form, focus on both the content and the layout. Start by clearly stating the purpose of the document and organizing the information in a logical manner. Consistent formatting and readable fonts contribute to a clean and organized appearance.

- Choose a Clean Layout: Start with a simple, easy-to-read format. Use sections for client details, service descriptions, amounts, and payment terms to break up the content into digestible chunks.

- Include All Relevant Information: Ensure that all key components are included, such as your business name, client information, a detailed list of services provided, amounts, and clear payment instructions.

- Use Professional Language: Even in a manually created document, use formal and polite language. This maintains a professional tone and shows respect for your clients.

- Stay Consistent with Branding: Incorporate your logo, business name, and any colors or fonts that reflect your brand identity to make the document feel cohesive with the rest of your materials.

Why Handwritten Requests Can Still Work

Despite the rise of digital alternatives, creating a custom billing form by hand can still carry significant benefits. For smaller businesses and freelance operatio

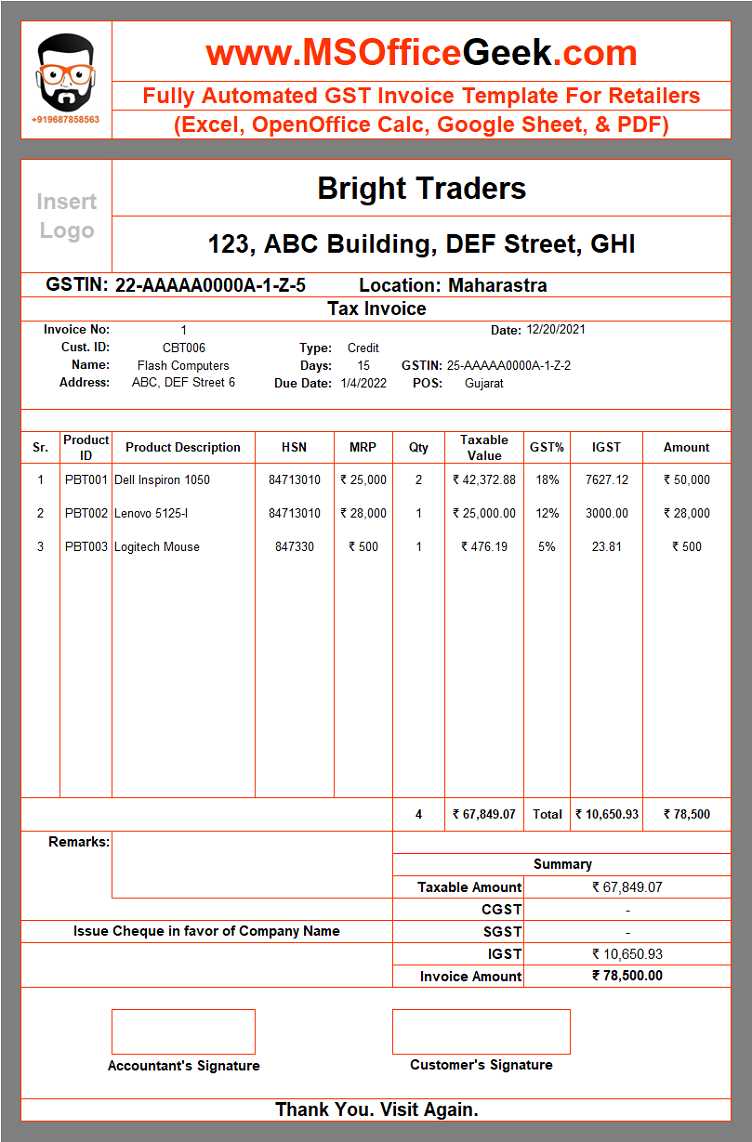

Legal Requirements for Manual Invoices

When creating custom billing documents, it’s essential to ensure that they comply with relevant legal standards. Different countries and regions have specific rules regarding what information must be included, how records should be maintained, and how taxes should be handled. Failure to meet these requirements can result in financial penalties or issues with tax authorities, so it’s crucial to stay informed and ensure your documents adhere to the law.

| Requirement | Explanation | Consequence of Non-Compliance |

|---|---|---|

| Business Identification | Your business name, address, and contact details must be clearly displayed on the document. | Failure to provide this information may result in difficulty processing payments and legal disputes. |

| Unique Document Number | Each form should have a unique identification number to facilitate tracking and record-keeping. | Lack of a unique number can lead to issues with bookkeeping and tax reporting. |

| Tax Information | If applicable, include the relevant tax identification number and specify the tax rates for products or services. | Failure to comply with tax regulations can result in fines or audits from tax authorities. |

| Clear Payment Terms | State the payment due date, available methods, and any late fees or penalties for delayed payments. | Unclear payment terms can lead to delayed payments or disputes over charges. |

| Itemized Breakdown | Provide a detailed list of goods or services provided, including quantities, unit prices, and total amounts. | Failure to itemize charges can lead to confusion and legal challenges over the correctness of charges. |

To avoid potential issues, always ensure that your billing documents comply with the relevant regulations in your country or region. Including all required information will not only help you stay legal but also present your business as professional and trustworthy to clients.

Tracking Payments with Manual Invoices

Accurately tracking payments is crucial for maintaining the financial health of any business. When creating custom billing documents, it’s important to have a system in place that helps you monitor which payments have been received, which are still pending, and which may be overdue. Without a reliable method for tracking, businesses risk losing track of outstanding payments, leading to cash flow problems and client disputes.

To efficiently manage payments, it’s helpful to include specific fields on your billing forms that make tracking easier. These can include columns for the date of payment, the method of payment, and the payment status (paid, pending, overdue). By recording this information directly on the document or in a separate tracking system, you can keep a clear record of all transactions and follow up with clients as needed.

Additionally, using a spreadsheet or simple accounting software to track these payments can complement your manual records. This helps you create a clear overview of all financial transactions, ensuring nothing slips through the cracks.

By taking these steps, you can streamline your payment tracking process, reduce the risk of missed payments, and maintain good relationships with your clients.

How to Format Your Manual Invoice

Proper formatting is essential when creating a custom billing document, as it ensures clarity, professionalism, and ease of understanding for both you and your clients. A well-organized structure helps avoid confusion and allows for quick identification of important details, such as payment terms, amounts due, and services rendered. A consistent layout also reflects your business’s professionalism and attention to detail.

Key Elements to Include

To create an effective document, focus on the following key components that should be clearly formatted:

- Header: Start with your business name, logo, and contact information at the top. This should be easy to find and professional-looking.

- Client Information: Below the header, list your client’s name, address, and contact details. This ensures the correct recipient receives the document.

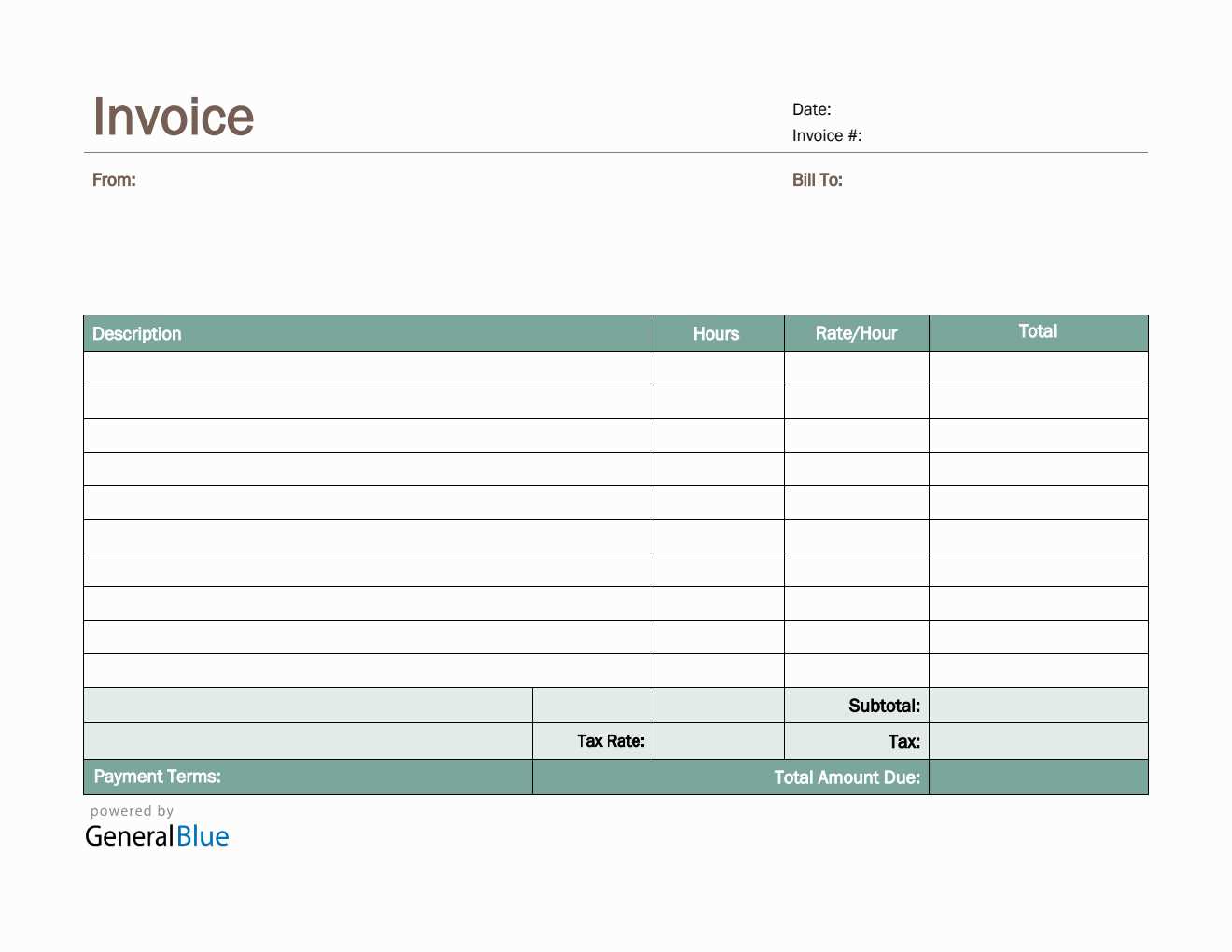

- List of Services or Products: Clearly itemize each service or product provided, with descriptions, quantities, unit prices, and total amounts.

- Payment Details: Include the total amount due, along with the payment methods you accept, payment due date, and any other relevant terms.

- Footer: Finish with any additional information, such as terms of service, tax information, or late payment penalties, if applicable.

Formatting Tips for Clarity

To enhance readability, make sure to use clear headings, bold text for key information, and enough spacing between sections. Use a clean, easy-to-read font, and avoid cluttering the page with unnecessary details. If possible, align your text to the left for consistency and legibility, and ensure the amounts are properly aligned for easy comparison. Properly formatted documents will be easier to process, and they will help establish a professional reputation with your clients.

Manual vs Digital Invoice Templates

When it comes to creating billing documents, businesses often face the decision of whether to use traditional handwritten forms or modern digital solutions. Both methods have their advantages and drawbacks, and the right choice largely depends on the nature of the business, the volume of transactions, and the resources available. Understanding the differences between these two options can help you choose the best approach for your operations.

Manual Billing Documents

Creating a custom payment request by hand offers simplicity and flexibility. It is often chosen by small businesses, freelancers, and individuals who handle a limited number of transactions. Manual documents can be personalized, allowing for a more intimate, custom approach, especially for one-time projects or clients. However, there are limitations in terms of organization and scalability.

- Low Initial Cost: No software or digital tools are required, which makes this approach cost-effective for small-scale operations.

- Personal Touch: Handwritten documents can feel more personal, which may help build stronger client relationships.

- Time-Consuming: Each document needs to be filled out manually, which can be slow and inefficient for businesses with multiple transactions.

- Risk of Errors: Manual processes are more prone to mistakes, such as calculation errors or missing information.

Digital Billing Solutions

On the other hand, digital billing systems offer a more streamlined approach, especially for businesses with a larger client base or more frequent transactions. Digital tools allow for automation, which can save time and reduce errors. These systems also make it easier to track payments and manage records.

- Efficiency and Speed: Digital tools allow for quick generation of billing documents and can even automate recurring billing.

- Easy Record-Keeping: Payments, transactions, and invoices can be easily stored, sorted, and searched through digital systems.

- Customization Options: Many digital platforms offer built-in templates that can be customized with a few clicks, saving time on formatting.

- Initial Setup Cost: Some digital solutions may require an upfront investment in software or subscriptions.

Choosing between a traditional, handwritten approach and a modern, digital solution depends on the scale of your operations and the need for efficiency. Smaller businesses with fewer transactions may find handwritten forms sufficient, while larger operations may benefit from the automation and ease of digital systems.

Using Manual Invoices for Small Business

For small businesses, creating custom billing documents by hand can be an effective and low-cost solution, especially in the early stages of operation. Whether you’re a freelancer or running a small shop, manually prepared payment requests offer a simple way to track transactions without the need for expensive software or complicated systems. While digital tools offer efficiency, handwritten documents can still serve as a personal and straightforward method for managing client payments.

Advantages of Manual Billing for Small Businesses

There are several reasons why small businesses might choose handwritten or custom-created payment documents over digital alternatives:

- Low Cost: Without the need for subscription fees or software, manually created forms are a budget-friendly choice for businesses with limited resources.

- Personal Touch: Creating a custom document by hand can foster a more personal relationship with clients, which can be beneficial for small businesses looking to build strong, trust-based connections.

- Flexibility: You have complete control over the design and content, enabling you to adapt the document as needed for each unique transaction or client request.

Considerations for Manual Billing

While manual billing can be an ideal solution for smaller-scale operations, it does have its limitations, particularly as the business grows. The main challenges include:

- Time-Consuming: Manually creating each document can be a slow process, especially when managing multiple transactions at once.

- Risk of Errors: Handwritten documents are more prone to mistakes, whether in calculations, missing details, or incorrect dates.

- Tracking Challenges: Keeping track of payments and invoices can become difficult, especially without a proper filing system or digital backup.

For small businesses, using handwritten or custom-created billing documents can work well as long as there are systems in place to manage time and accuracy. If your business is growing or you handle many transactions, you may eventually find it beneficial to switch to more automated solutions to maintain efficiency.

Top Tips for Clear Invoicing

Clear and effective billing documents are essential for ensuring timely payments and maintaining positive client relationships. Whether you’re preparing a payment request by hand or using a digital tool, the clarity of the document plays a significant role in reducing misunderstandings and disputes. To streamline the payment process and avoid confusion, it’s important to follow a few best practices when creating your billing forms.

Here are some top tips to make your billing documents clear and professional:

- Use Simple Language: Avoid jargon and complex terms. Use clear, straightforward language to explain the services or products provided and any associated costs.

- Be Detailed: Include a thorough breakdown of the goods or services delivered. Ensure that each item has a description, quantity, unit price, and total amount, making it easy for clients to understand what they’re being charged for.

- Clearly State Payment Terms: Specify the payment due date, accepted payment methods, and any late fees or penalties for overdue payments. This helps set expectations and encourages timely settlement of the balance.

- Ensure Legible Formatting: Use a clean, easy-to-read font and appropriate spacing. Keep the layout simple and organized so clients can quickly find essential information like the total amount due and the payment due date.

- Include Contact Information: Always provide clear contact details, including your business name, address, phone number, and email address. This helps clients reach out with any questions or concerns, fostering transparency and trust.

By following these tips, you can create billing documents that are not only clear but also reflect professionalism and attention to detail. A well-structured document reduces the likelihood of payment delays, minimizes disputes, and promotes a smooth transaction process for both you and your clients.

Software to Enhance Manual Invoicing

While creating custom billing documents by hand can be effective for smaller businesses, there are software solutions that can significantly streamline and enhance the process. These tools help automate certain aspects of the task, reducing human error, improving efficiency, and making it easier to keep track of payments and client details. Using the right software can bring the flexibility of manual billing together with the convenience and organization of digital systems.

Here are some software options that can enhance your billing process:

- Accounting Software: Tools like QuickBooks or Xero can simplify the creation of custom payment requests while automatically calculating totals, taxes, and discounts. These platforms also allow you to store client information and track payment history, making it easier to manage your finances.

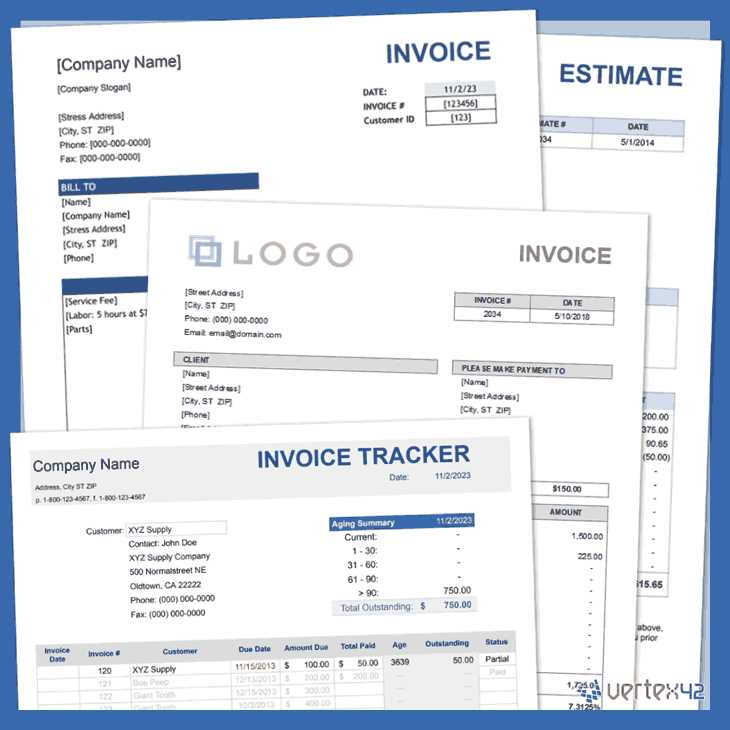

- Spreadsheet Programs: Programs like Microsoft Excel or Google Sheets provide a flexible platform for creating custom billing documents. With templates and formulae, you can quickly calculate totals and track payments, while still having full control over the design and layout.

- Online Billing Platforms: Services like FreshBooks or Zoho Invoice offer online platforms where you can create, send, and track payment requests. These platforms often provide pre-designed templates that you can customize, as well as features like automatic reminders and integrated payment processing.

- Invoice Management Tools: Software like Bill.com or Wave helps you generate, send, and track all your payment requests in one place. These tools can also automate follow-up reminders and integrate with your accounting system to ensure that your records are up to date.

By integrating these software tools with your existing workflow, you can save time, reduce errors, and ensure that your custom billing documents remain clear, professional, and accurate. Whether you prefer to maintain a hands-on approach or want to automate certain tasks, these solutions offer a range of options to suit your needs.

How to Store Manual Invoices Securely

When handling custom billing documents, it is essential to have a secure system for storing them. These records contain sensitive financial information that needs to be protected from unauthorized access, loss, or damage. Whether you choose to keep physical copies or prefer digital storage, ensuring the safety and confidentiality of these documents is a critical part of your business operations.

Physical Storage Options

If you maintain hard copies of your billing documents, there are several methods to ensure they are stored safely:

- Use Locked Storage: Keep all paper records in a locked filing cabinet or safe. This will help prevent unauthorized access and keep sensitive information secure.

- Organize with Folders: Organize your documents into clearly labeled folders or binders, categorized by client or date. This makes it easier to locate specific records when needed while keeping them protected.

- Limit Access: Only authorized personnel should have access to your physical records. Ensure that staff members are trained on the importance of data security and confidentiality.

Digital Storage Solutions

If you prefer to store your records electronically, digital solutions can provide enhanced security and easier access. Here are some strategies for safely storing your digital billing documents:

- Use Cloud Storage: Services like Google Drive, Dropbox, or OneDrive offer secure cloud-based storage, with features such as password protection and encryption, making it easy to back up and access your records from anywhere.

- Implement Encryption: Encrypt your files to ensure that they are unreadable to anyone without the proper authorization. Most cloud storage solutions and file management systems offer built-in encryption features.

- Regular Backups: Make regular backups of your digital records to ensure that you have a copy in case of data loss. Use both cloud backups and external hard drives for added protection.

- Access Control: Limit access to your digital records by setting permissions for who can view, edit, or delete documents. This can help prevent accidental or intentional data breaches.

Whether you choose physical or digital storage, the key to securing your custom billing documents lies in organization, restricted access, and using appropriate tools to protect the data. By implementing these strategies, you can ensure that your records are safe, easily accessible, and compliant with relevant regulations.

Designing an Attractive Invoice Layout

Creating a well-designed payment request is crucial for maintaining a professional image and ensuring that clients can easily understand the details of the transaction. The layout of your billing document should be visually appealing yet functional, allowing recipients to quickly find important information such as the total amount due, payment terms, and your business contact details. A clean and organized design enhances readability and encourages timely payments.

Key Elements of an Effective Layout

When designing a payment request, focus on clarity and ease of navigation. Here are some essential elements to include:

- Business Information: Include your business name, logo, address, and contact information at the top of the document. This makes it easy for clients to identify the source and contact you if needed.

- Client Details: Clearly display the recipient’s name, address, and contact information. This helps avoid any confusion about who the payment request is intended for.

- Itemized List: Break down the goods or services provided with descriptions, quantities, unit prices, and total amounts. A well-organized list makes it easier for clients to understand the charges and verify the accuracy of the request.

- Total Amount Due: Make the total amount due prominent, so it’s easy for the client to identify how much they owe. Consider using a larger or bold font for this section.

Visual Design Tips for a Professional Look

The visual design of your payment document can greatly impact how it’s perceived. A professional, clean layout can help reinforce your brand’s identity and make your business look more established.

- Use Consistent Branding: Incorporate your company’s colors, fonts, and logo throughout the document. Consistency in design reflects professionalism and helps with brand recognition.

- Whitespace is Important: Don’t overcrowd the document with too much information or too many elements. Leave adequate whitespace around text and sections to enhance readability and make the layout feel more organized.

- Align Items Properly: Use grid lines or alignments to ensure that text and numbers are well-structured. This makes it easier for the recipient to quickly scan and understand the information.

- Choose Readable Fonts: Stick to clean, easy-to-read fonts. Avoid overly decorative fonts that might hinder readability, especially for important sections like totals and due dates.

By focusing on these design elements, you can create a payment request that is not only functional but also visually appealing. A well-designed document can leave a lasting impression on your clients, making them more likely to process payments promptly and view your business as professional and organized.