Professional Invoice Template for Photographers to Simplify Your Billing

Managing finances is an essential part of any creative business, but it can often be time-consuming and complex. Having a structured method to request payment not only ensures timely compensation but also enhances your professionalism. With the right tools, this process becomes more efficient, leaving more room for focusing on your craft.

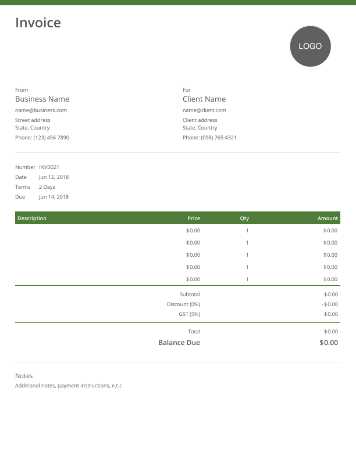

Customizable documents designed to match the specific needs of service-based industries can make a world of difference. These documents can be tailored to reflect personal branding while maintaining a formal approach to financial transactions. This is especially useful for those who regularly collaborate with clients or manage multiple projects.

By using specialized tools, you can streamline your workflow, improve your accounting practices, and maintain clear communication with clients. A well-structured billing system sets the foundation for a professional relationship, ensuring transparency and minimizing misunderstandings. The following guide will explore how such solutions can work to your advantage, offering both practicality and efficiency for your business operations.

Why Creative Professionals Need Structured Billing Documents

Managing payments efficiently is crucial for anyone running a service-based business. Without a clear system in place, it becomes easy to miss payments, confuse clients, or even encounter legal issues. Having a ready-made solution to generate consistent, professional billing can help maintain organization and smooth financial transactions.

For those in visual arts, where client projects can range from single sessions to long-term contracts, accurate documentation is key. Structured records not only reflect professionalism but also protect both the creator and the client in case of disputes or future reference.

Benefits of Organized Billing

- Time-saving: Automated systems reduce the time spent manually creating each document.

- Consistency: Using pre-designed formats ensures every transaction follows the same structure.

- Professionalism: A well-organized record boosts credibility and reflects your attention to detail.

- Legal Protection: Properly formatted documentation can serve as proof of agreement in case of legal issues.

Key Features of Effective Billing Solutions

- Clear Terms: Well-defined payment terms, such as due dates and penalties, minimize confusion.

- Personalization: Customizable options allow you to add your logo and other branding elements, creating a cohesive client experience.

- Easy Tracking: Built-in tracking tools help monitor outstanding payments and set reminders.

Benefits of Using Ready-Made Templates

Utilizing pre-designed documents can greatly simplify many tasks, especially for those in the creative industries. Instead of starting from scratch, having access to customizable, professionally structured formats saves both time and effort. These solutions offer a straightforward approach to creating polished, consistent records without the need for extensive technical skills or design knowledge.

By using a ready-made structure, you can focus on what truly matters–delivering your creative services. The following table highlights some of the key advantages of choosing a pre-made option for managing financial documentation:

| Benefit | Description |

|---|---|

| Time Efficiency | Pre-designed documents are ready to use, reducing the time spent on formatting and structuring. |

| Consistency | Each record follows a uniform layout, ensuring a professional appearance with every transaction. |

| Ease of Customization | Many pre-made solutions allow easy adjustments, such as adding your logo, changing colors, or updating terms. |

| Professional Quality | Designed by experts, these formats often include essential elements that might otherwise be overlooked. |

| Reduced Risk of Error | With an already established structure, there is less chance of missing critical information or making formatting mistakes. |

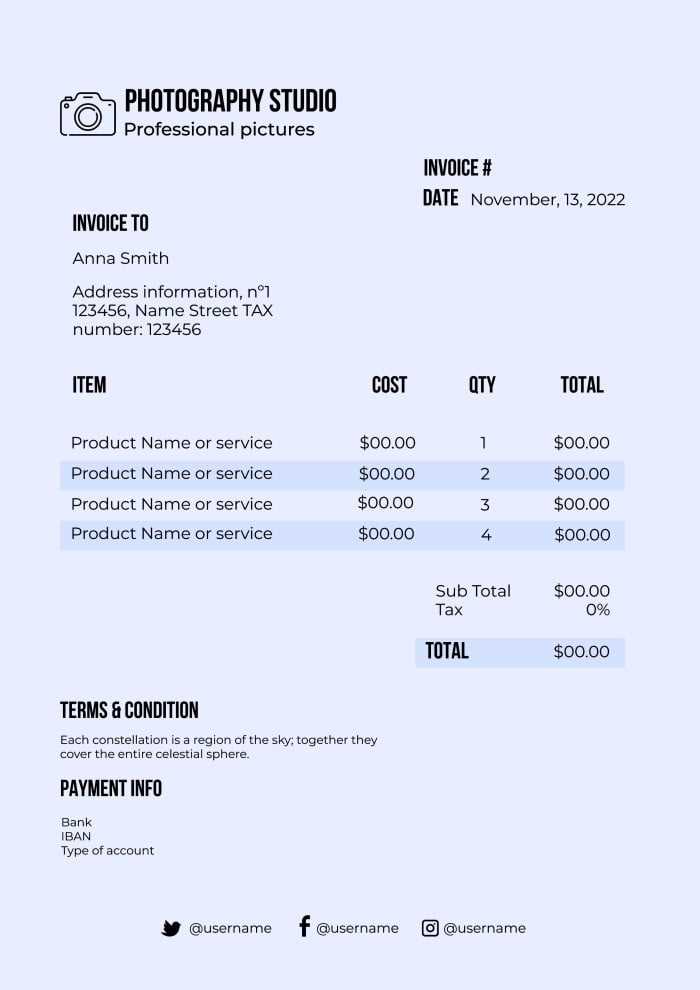

How to Customize Your Photography Invoice

Creating personalized billing documents that reflect your unique style and brand identity is a powerful way to build trust and professionalism with clients. Customizing your records allows you to include the specific details that matter most, while still maintaining a structured and easy-to-understand format. The ability to modify these documents ensures they meet your business needs and enhance your client’s experience.

Essential Elements to Personalize

When adapting your billing documents, there are several key components to focus on in order to make them more suited to your specific business:

- Branding: Include your logo, business name, and contact details to give the document a professional look.

- Client Information: Ensure that client names, addresses, and contact details are clearly stated for easy reference.

- Services Provided: List the services you’ve completed or the products sold, specifying quantities and prices.

- Payment Terms: Define your payment terms, including due dates, accepted payment methods, and any late fees.

Design and Layout Tips

While the content is crucial, the appearance of your billing records is just as important. A clean, organized layout makes it easier for clients to navigate and understand. Here are some simple tips:

- Consistent Fonts: Use professional, easy-to-read fonts and avoid overcrowding the document with too much text.

- Clear Sections: Use headings and bold text to highlight important sections like “Total Amount Due” or “Payment Information.”

- Color Scheme: Match your document’s colors to your brand palette for a cohesive and polished look.

By taking these steps, you can craft a personalized and professional financial record that will impress your clients and help you maintain a well-organized business.

Top Features of a Good Invoice

A well-designed billing document is more than just a request for payment; it’s a reflection of your professionalism and attention to detail. The best records not only make it easier for clients to understand the charges but also ensure all essential information is included, reducing the chances of disputes or confusion. Here are the key features that contribute to a strong, effective record.

Key Components

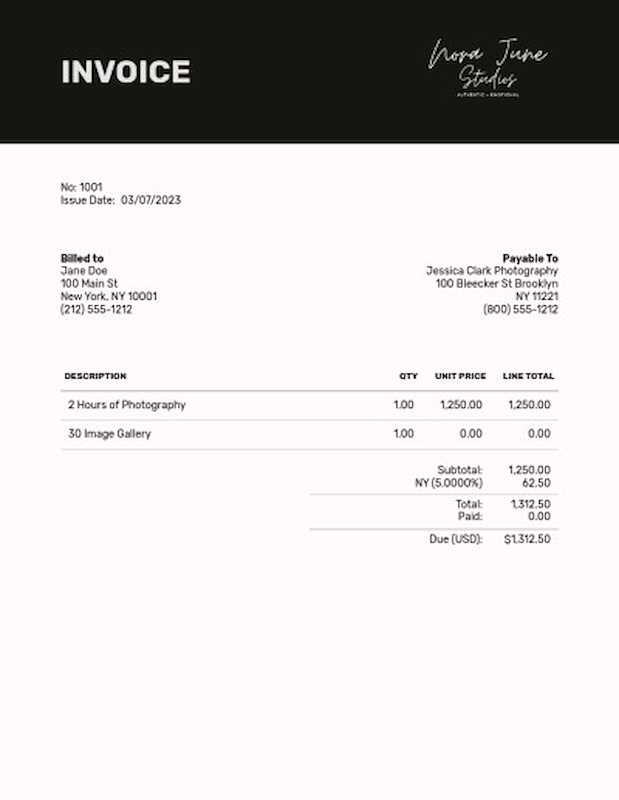

- Clear Identification: Your name, business name, and contact details should be prominently displayed, making it easy for clients to reach out if needed.

- Client Information: The recipient’s full name and contact details should be listed to ensure accuracy and prevent mistakes.

- Unique Reference Number: Each document should include a unique identifier for easy tracking and reference, especially if you handle multiple transactions.

- Detailed Breakdown: Itemized lists of services or products with clear descriptions and corresponding prices help avoid confusion and provide transparency.

- Payment Terms: Clearly defined payment terms, including due date and acceptable methods of payment, set the expectations and help ensure timely transactions.

Additional Useful Features

- Subtotal and Total Amount: Displaying a clear subtotal, taxes (if applicable), and total amount due makes it easier for clients to see the final cost.

- Late Fees or Discounts: If you have penalties for late payments or offer early payment discounts, make sure these terms are easy to locate.

- Branding: Adding your logo and using your business’s color scheme creates a professional, cohesive look and reinforces your brand identity.

- Payment Instructions: Providing clear instructions on how clients can pay (e.g., bank details, PayPal link, or credit card instructions) simplifies the process and ensures smooth transactions.

When all of these features are combined, the document not only serves as a financial record but also as a tool for building trust and fostering a positive client relationship.

Choosing the Right Format for Billing Documents

When it comes to managing your financial records, selecting the right format is crucial. The ideal format should not only be easy to use but also adaptable to the unique needs of your business. Whether you’re dealing with one-time clients or long-term contracts, the right structure can simplify your workflow and improve communication. It’s important to consider factors such as layout, customization options, and how easily it integrates with your accounting practices.

There are various formats available, each offering different advantages. Understanding your specific needs can help you decide on the best solution, whether it’s a simple, straightforward design or a more detailed layout with additional sections. Below is a comparison table of different formats to help you make an informed choice:

| Format Type | Best For | Key Advantages |

|---|---|---|

| Simple Layout | One-time projects, small jobs | Quick to create, easy to read, minimal design |

| Itemized Breakdown | Package deals, multiple services | Clear explanation of charges, transparency with clients |

| Customizable Format | Ongoing clients, brand-specific needs | Allows for branding, personalization, flexible for various services |

| Recurring Billing | Long-term contracts, subscription services | Automated, saves time, ideal for regular payments |

Choosing the right structure can greatly improve your billing process. By selecting a format that fits your specific needs, you ensure that your documents are both effective and professional, enhancing client trust and streamlining financial management.

How Billing Solutions Save Time

Time is one of the most valuable resources when running a business. The more time you can save on administrative tasks, the more you can focus on what matters–serving your clients and growing your brand. Ready-to-use billing documents offer a straightforward way to streamline your financial processes, allowing you to complete tasks quickly and efficiently without sacrificing professionalism or accuracy.

Key Ways to Save Time

- Quick Setup: Pre-designed formats eliminate the need to start from scratch. You simply fill in the necessary details and the rest is already formatted.

- Reduced Editing: The basic structure is already in place, so there’s no need to adjust fonts, spacing, or other formatting elements every time you create a new document.

- Automatic Calculations: Many systems automatically calculate totals, taxes, and discounts, reducing the chances of errors and cutting down on manual math.

- Consistency Across Documents: Using the same structure every time ensures that your records are uniform, saving you time spent on formatting and organizing different designs.

Time-Saving Benefits for Your Workflow

- Streamlined Client Communication: Consistent, professional documents reduce the back-and-forth with clients, as everything they need is clearly laid out.

- Faster Payment Processing: Clear, easy-to-understand documents lead to fewer client questions and faster payment times.

- Easy Tracking: Having a standardized format makes it easier to keep track of your records and manage outstanding payments, saving time spent on follow-ups.

By adopting a standardized approach to your financial documentation, you save valuable hours that can be redirected toward more creative or business-building activities.

Key Information Every Photography Billing Document Should Include

When creating financial records for completed work, it’s essential to include all the necessary details to ensure clarity and avoid confusion. A well-structured document should provide clients with a clear breakdown of services provided, payment terms, and other important details that protect both parties. By ensuring that each document contains the right information, you can maintain a professional relationship and avoid unnecessary disputes.

Essential Details to Include

- Contact Information: Include your business name, address, phone number, and email address. Also, make sure to list the client’s contact information for easy reference.

- Unique Reference Number: Assign a unique number to each document to help keep track of transactions and make future references easier.

- Date of Issue: Specify the date when the document is issued. This helps both you and your clients track payment timelines.

- Payment Due Date: Clearly indicate the deadline for payment, reducing the chance of late payments and misunderstandings.

- Detailed List of Services: Include a clear breakdown of all services provided or products sold, with specific descriptions and quantities where applicable.

- Total Amount Due: Sum up the cost of all services, including any taxes, discounts, or additional fees.

Additional Helpful Information

- Payment Methods: Clearly specify the acceptable payment methods, such as bank transfer, credit card, or online payment platforms like PayPal.

- Late Payment Terms: Include information on any penalties for late payments to help avoid delays in receiving funds.

- Thank You Note: A brief thank you message adds a personal touch and fosters positive client relations.

Incorporating these key details ensures that both you and your clients are on the same page, promoting transparency and reducing the likelihood of issues during the payment process.

Best Billing Software for Creative Professionals

Managing finances can be one of the most time-consuming aspects of running a creative business. Fortunately, there are a variety of software solutions designed to simplify the process of creating, sending, and tracking financial documents. The right tool can automate tasks, improve accuracy, and help you stay organized–allowing you to focus more on your creative work and less on administrative duties. Here are some of the best billing tools available for visual artists and creatives.

Top Features to Look For

- Customization: The ability to personalize your documents with logos, colors, and brand elements helps create a professional look.

- Ease of Use: Choose software that has an intuitive interface and doesn’t require a steep learning curve.

- Payment Integration: Look for solutions that allow you to integrate payment systems, such as credit cards, PayPal, or bank transfers, directly into your records.

- Recurring Billing: If you offer ongoing services or retainers, software that can automate recurring payments will save you time.

- Reporting Tools: Built-in reporting features can help track payments, overdue accounts, and generate financial summaries.

Best Software Options

- FreshBooks: Known for its user-friendly design, FreshBooks allows easy customization of billing documents, automatic reminders for clients, and seamless payment integration.

- Wave: A free tool that provides a simple interface, Wave is ideal for small businesses or freelancers looking to streamline financial management with no monthly fee.

- Zoho Books: Zoho offers robust features for billing, including automated workflows, client management, and integration with various payment gateways.

- QuickBooks: This is a comprehensive solution for both small and large businesses, offering a range of financial tools from invoicing to tax reporting.

- PayPal Invoicing: For those who use PayPal for payments, PayPal’s built-in invoicing tool allows easy creation and tracking of professional financial records.

By selecting the right billing software, you can automate many aspects of your financial management, allowing you to focus on delivering quality work and building your business.

Free vs Paid Billing Documents for Creative Professionals

When choosing a solution for generating financial records, one of the key decisions you’ll face is whether to go with free or paid options. Both have their advantages and drawbacks, depending on your business needs, the volume of work, and the level of customization you require. Understanding the differences can help you make an informed choice that balances functionality and budget.

Benefits of Free Solutions

- No Cost: Free options are a great starting point if you’re just getting started or if you have a limited budget.

- Basic Features: These are often simple to use and provide essential functions, such as entering client information and listing services.

- Quick Setup: Free tools are typically ready to use with little to no setup required, ideal for those needing fast and simple solutions.

- Accessibility: Many free solutions are web-based, meaning you can access them from any device with an internet connection.

Benefits of Paid Solutions

- Advanced Customization: Paid options often allow for deeper customization, such as adding your branding, adjusting layouts, and including complex tax calculations.

- Automated Features: Features like automatic payment reminders, recurring billing, and integration with payment gateways are common in paid software.

- Comprehensive Support: Paid solutions typically offer better customer service, including live chat, phone support, and dedicated help resources.

- Scalability: As your business grows, paid options tend to scale with you, offering more advanced reporting, multi-user access, and integration with other business tools.

Which One Is Right for You?

- Choose Free: If you’re just starting out or have a low volume of work and need basic functionality without the need for complex features.

- Choose Paid: If you’re looking for greater flexibility, need to handle more clients, or want features like payment tracking, automatic reminders, and robust reporting tools.

Ultimately, the decision between free and paid solutions comes down to your business’s current needs and future plans. If your business is growing, investing in a paid option might offer more value in the long run.

How to Organize Your Billing Documents Efficiently

Keeping your financial records well-organized is essential for maintaining a smooth workflow and staying on top of payments. Proper organization helps reduce the risk of losing important information, makes it easier to find past transactions, and ensures you can quickly respond to client inquiries or tax season requirements. By adopting a systematic approach, you can save time, avoid errors, and manage your business finances with ease.

Key Strategies for Effective Organization

- Use a Consistent Naming System: Develop a uniform way of naming your records (e.g., ClientName_ServiceType_Date) to make them easily identifiable and searchable.

- Create Digital Folders: Organize your financial documents into clearly labeled folders by year, client, or project. Digital files are easier to access and less likely to be lost than paper records.

- Track Due Dates: Keep a calendar or spreadsheet to monitor payment due dates, helping you follow up with clients on time and stay ahead of any overdue accounts.

- Regular Backups: Back up your financial records regularly to prevent loss of data due to technical issues or accidents. Cloud storage services are a reliable and secure option.

Utilizing Software for Better Organization

- Automate Record Creation: Use software that allows you to quickly generate and save billing records, reducing manual effort and the chance of mistakes.

- Link to Accounting Tools: Many tools offer direct integration with accounting software, allowing for easy syncing of financial data and improved record-keeping.

- Set Up Automatic Reminders: Use tools that send automatic reminders to clients about upcoming or overdue payments, keeping you from needing to send them manually.

By adopting a few simple organization techniques and leveraging the right tools, you can ensure that your financial documentation stays accurate, accessible, and manageable. This not only boosts your productivity but also enhances your professionalism when dealing with clients.

Legal Considerations for Photography Billing Documents

When creating financial records for services provided, it’s important to ensure that the document complies with relevant laws and regulations. A well-constructed record not only serves as proof of payment but also protects both you and your clients in case of legal disputes. By understanding the legal requirements surrounding financial documentation, you can minimize risks and ensure that all necessary information is included in your documents.

Essential Legal Elements

- Clear Terms and Conditions: Always include your payment terms, such as due dates, late fees, and accepted payment methods. This helps set expectations and avoid disputes later.

- Accurate Client Information: Ensure that both your and your client’s names, addresses, and contact details are correct and up to date to avoid any legal issues with miscommunication.

- Copyright Information: If you’re providing creative work such as photos, it’s important to specify whether the client is purchasing full rights to the images or if you retain copyright. This helps avoid legal confusion later on regarding the usage of the images.

- Taxes: Always include any applicable taxes based on your local tax laws, such as sales tax or VAT. Ensure that you’re calculating these correctly and reflecting them clearly on the document.

Important Considerations

| Consideration | Description |

|---|---|

| Payment Methods | Specify accepted payment methods (e.g., credit card, bank transfer, PayPal) to avoid ambiguity or disputes. |

| Late Fees | If you charge late fees, be sure to clearly state this in your terms and conditions to avoid legal challenges regarding overdue payments. |

| Refund Policies | If applicable, include a section outlining your refund policy to protect both parties in case of cancellations or disputes. |

By taking these legal factors into account, you can ensure that your billing documents meet legal requirements and protect both your rights and your client’s. Proper documentation will not only ensure smooth transactions but also contribute to maintaining a positive, professional relationship with clients.

How to Create Professional Billing Documents

Creating professional financial documents is essential for maintaining a credible business image and ensuring smooth transactions with clients. A well-designed document not only helps convey your professionalism but also ensures clarity in terms of services rendered and payment expectations. Crafting such documents involves more than just filling in numbers–it’s about presenting clear, organized information in a way that builds trust and encourages prompt payment.

Steps to Crafting a Professional Document

- Use a Clear and Clean Layout: Avoid clutter and unnecessary details. The layout should be easy to navigate, with distinct sections for client details, services, payment information, and totals.

- Include Essential Details: Always include your business name, contact information, a unique reference number, the date of issue, and payment terms. These are vital for record-keeping and legal purposes.

- Professional Branding: Incorporate your business logo, color scheme, and fonts to give the document a polished, branded look that matches your business identity.

- Be Specific and Transparent: List all services or products provided with clear descriptions, quantities, and pricing. Avoid ambiguity to prevent misunderstandings.

- Highlight Payment Terms: Clearly state the payment due date and accepted methods. If you charge any late fees, include this information as well to ensure clients are aware of the conditions.

Additional Tips for Refining Your Billing Process

- Use Numbering Systems: Assign a unique number to each document for better tracking and reference. This will help you keep your records organized and make future communication with clients easier.

- Stay Consistent: Use the same format for all your financial documents. Consistency not only looks professional but also makes it easier to track payments and manage records over time.

- Proofread: Double-check for errors in spelling, calculations, or client details. Mistakes can reduce professionalism and cause confusion with clients.

By following these steps, you can create polished, professional financial documents that reflect the quality of your work and facilitate smooth payment processes. A well-crafted document not only ensures clarity but also strengthens your reputation as a trustworthy business professional.

Integrating Payment Methods in Your Billing Document

Including clear and convenient payment options in your financial records is essential for ensuring smooth transactions. Providing multiple payment methods can make it easier for clients to pay promptly and reduce delays. By offering flexibility, you demonstrate professionalism and make it more likely that clients will follow through with payments on time. Whether you’re using online platforms, credit cards, or bank transfers, clearly listing your accepted payment methods helps maintain transparency and streamline the process.

Types of Payment Methods to Include

| Payment Method | Description |

|---|---|

| Bank Transfer | Provide your bank account details, including the account number and sort code, for clients who prefer direct transfers. |

| Credit/Debit Cards | Integrate payment processing platforms like Stripe or Square to allow clients to pay directly via credit or debit cards. |

| PayPal | Include your PayPal details or generate a PayPal payment link for clients who prefer this popular and secure online payment service. |

| Online Payment Gateways | For broader payment flexibility, include links to other online platforms like Venmo, Google Pay, or Apple Pay for easy mobile payments. |

| Checks | For clients who prefer traditional methods, include details for mailing checks, such as your business address. |

Best Practices for Including Payment Information

- Be Clear and Specific: Ensure that the payment method, terms, and instructions are easy to find and understand. Ambiguity can lead to delays or confusion.

- State Payment Due Dates: Clearly mention the due date alongside payment options to avoid misunderstandings and late payments.

- Consider Fees: If certain payment methods incur fees (e.g., credit card processing fees), mention them upfront to avoid surprises.

- Offer Multiple Options: The more choices you offer, the easier it will be for clients to pay in a way that suits them best. Flexibility

Common Mistakes to Avoid in Billing Documents

When creating financial records, it’s easy to overlook certain details that can lead to misunderstandings, delays, or even disputes with clients. Common errors in these documents can cause confusion about payment terms, amounts, or due dates, and may reflect poorly on your professionalism. By being aware of these frequent mistakes and taking steps to avoid them, you can ensure smoother transactions and maintain a positive relationship with your clients.

Frequent Errors to Watch Out For

Mistake Consequence How to Avoid Missing or Incorrect Client Information Leads to confusion or issues with payment tracking and can delay transactions. Double-check all client details, including names, addresses, and contact information. Unclear Payment Terms Clients may not understand when payment is due or which methods they can use, causing delays. State payment terms clearly, including due dates and acceptable payment methods, in an easy-to-read format. Omitting Taxes or Fees Can result in undercharging or clients refusing to pay additional fees unexpectedly. Ensure all applicable taxes or service fees are clearly listed and calculated correctly. Not Including Unique Reference Numbers Makes it difficult to track payments or reference specific transactions, especially for large client bases. Assign a unique number to each financial record for easy tracking and reference. Incorrect or Missing Dates Creates confusion regarding payment deadlines and may complicate accounting processes. Always include the date the document was issued and specify the payment due date. Failing to Include a Clear Breakdown of Services Leaves clients unclear about what they are paying for, leading to potential disputes. Provide a detailed list of services, including quantities, descriptions, and individual prices. Best Practices for Error-Free Billing

- Double-Check All Information: Review your document before sending it to ensure accuracy in every section, from client details to service descriptions.

- Use Consistent Formatting: Stick to a clear, easy-to-read layout to minimize confusion and ensure all key information stands out.

- Provide Contact Information: Include your phone number or email addr

Tracking Payments with Billing Documents

Efficiently tracking payments is essential to maintaining a healthy cash flow and staying organized in your business operations. By ensuring that each transaction is properly recorded and monitored, you can avoid missed payments, prevent financial discrepancies, and ensure that clients follow through with their obligations. Well-structured financial documents not only help you communicate the details of the transaction but also serve as tools for tracking and managing incoming payments.

Key Steps to Track Payments Effectively

- Assign Unique Reference Numbers: Including a unique number for each document helps you keep track of payments and simplifies communication with clients. It also makes searching for past records easier.

- Set Payment Deadlines: Clearly state payment due dates to ensure that clients know when they are expected to pay. This helps you track whether payments are received on time or are overdue.

- Monitor Payment Status: Keep a record of each transaction’s status–whether it’s paid, pending, or overdue. This allows you to follow up promptly with clients who have yet to settle their balances.

- Use Payment Methods Effectively: Offer multiple payment options and track which methods are used most frequently. Knowing how clients prefer to pay helps streamline the collection process and ensures you don’t miss any payments.

Tools and Methods for Tracking Payments

- Accounting Software: Use digital tools like QuickBooks, FreshBooks, or Xero to track payments automatically. These platforms can generate reports, track overdue payments, and send reminders to clients.

- Manual Logs: If you prefer a more hands-on approach, maintain a spreadsheet or a physical logbook. Be sure to regularly update the status of each payment and note any necessary follow-up actions.

- Automated Reminders: Setting up automated reminders in your billing system helps you stay on top of overdue payments without having to manually follow up.

Best Practices for Effective Payment Tracking

- Maintain Consistency: Use the same process to track every transaction to avoid confusion and ensure that no payments slip through the cracks.

- Regularly Review Your Records: Periodically review your payment records to identify any outstanding balances and address them promptly.

- Stay Transparent with Clients: Keep your clients informed about payment statuses and offer them an easy way to contact you if they encounter issues with payment.

By implementing these strategies, you’ll be able to keep a clear overview of your transactions, minimize the risk of missed payments, and ensure that your financial records remain organized and accurate. Effective tracking not only improves your cash flow but also strengthens client relationships by showing that you’re attentive and professional in managing your business finances.

How to Use Billing Documents for Tax Purposes

Accurate record-keeping is crucial when managing taxes, especially for small business owners and independent contractors. By properly documenting all transactions, you ensure that you have the necessary evidence to back up your income and expenses during tax season. Well-organized financial records can simplify the filing process, reduce the risk of errors, and help you comply with tax regulations. The key is to use your billing documents effectively as part of your overall tax management strategy.

Why Proper Documentation Matters

Tax authorities require proof of income, expenses, and business transactions, and these documents are essential to substantiate your earnings and deductions. Failure to keep accurate records may lead to issues during an audit or tax review. Whether you’re a freelancer, a small business owner, or a sole proprietor, maintaining clear and detailed transaction records will protect you from potential legal and financial consequences.

How to Utilize Billing Documents for Tax Reporting

- Track Your Income: Each document you issue represents a transaction and should be recorded as income. Keep a record of all transactions, including the amount paid, client details, and the date the payment was made.

- Record Business Expenses: Some expenses, such as supplies or travel, can be deducted from your taxable income. Ensure these expenses are documented accurately and match any related payments in your financial records.

- Document Sales Tax: If applicable, ensure that any sales tax collected from clients is clearly indicated in your billing documents. This information will help you calculate the taxes you need to remit to the government.

- Use Unique Reference Numbers: Each financial document should have a unique number that helps you organize and track your records. This makes it easier to reference specific transactions when filing taxes.

- Include Payment Terms and Dates: Knowing when payments were made and whether they were completed within the appropriate tax year is vital for accurate reporting. Record due dates, payment dates, and any partial payments clearly.

Organizing Your Records for Tax Filing

- Use Accounting Software: Digital tools like QuickBooks or Xero can automate the tracking of income and expenses. These platforms often allow you to generate tax reports, which can save you time during tax preparation.

- Maintain Physical or Digital Copies: Keep all records, whether in digital format or printed, organized by year or tax period. Be sure to back up digital files to avoid losing important information.

- Consult a Tax Professional: When in doubt, it’s always helpful to consult a tax advisor. They can help ensure that your records are compliant with current tax laws and help you maximize any available deductions.

By leveraging your financial documents correctly, you can not only streamline your tax preparation but also reduce th