Comprehensive Guide to Using the FBDI Template for AR Invoices

Efficiently managing accounts receivable is essential for a business’s financial health. Modern systems provide automated solutions that simplify the process of uploading and processing transactional data, which significantly enhances the speed and accuracy of financial reporting. Using structured import tools allows companies to handle large volumes of data with ease, minimizing the risk of human error and ensuring compliance with established accounting standards.

This approach relies on predefined data structures to ensure that information is correctly mapped and validated before processing. By preparing data according to specific guidelines, companies can seamlessly upload essential information, reducing manual entry time and accelerating workflow. These imports support a range of configurations, making them adaptable to various business requirements.

In this guide, you will learn how to use structured import methods effectively in your accounts receivable processes. We will cover essential setup steps, tips on

Understanding Data Import Tools in Oracle Fusion

Managing large volumes of financial data can be challenging, but Oracle Fusion provides structured import methods that simplify and streamline this process. By following standardized formats, businesses can quickly integrate essential financial information into the system. This approach not only improves the speed of processing but also ensures greater consistency and reliability of the data being managed.

Core Components of the Import Structure

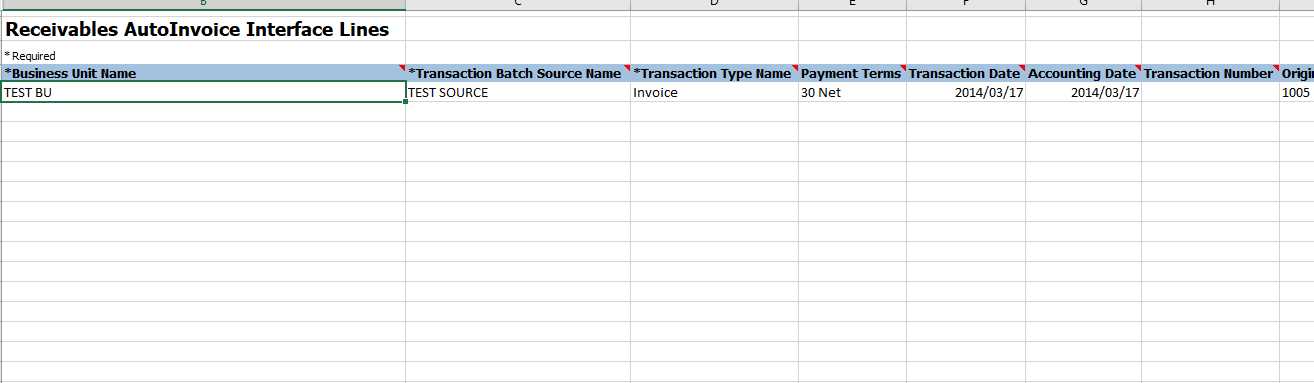

The data import tool uses a specific structure to map financial information accurately. Each element plays a vital role in ensuring data is imported correctly, minimizing potential errors. Key elements include:

- Data Fields: Each column in the format corresponds to a distinct field in the financial system, from client details to transaction amounts.

- Validation Rules: To ensure data accuracy, specific rules check for inconsistencies or missing details during upload, safeguarding the q

Benefits of Automating AR Invoicing

Implementing automation in accounts receivable brings transformative advantages to financial operations, enabling faster, more accurate processing of transactions. By reducing the need for manual data entry and validation, businesses can streamline their invoicing workflows, leading to improved cash flow and greater financial transparency.

Increased Efficiency and Reduced Errors

Automation allows repetitive tasks to be handled quickly and accurately, which minimizes the potential for human error. This results in fewer discrepancies and a faster invoicing cycle. Key advantages include:

- Time Savings: Automated systems handle tasks such as data entry, validation, and report generation, significantly reducing the time required for each invoice.

- Error Reduction: Automated checks and validations ensure that data conforms to set standards, reducing the risk of costly mistakes

Key Components of the Data Import Structure

The organized layout of data import files is essential for smooth integration with financial systems. Each element within the structure ensures that financial information is correctly mapped, validated, and ready for processing. By aligning data with the necessary fields and formats, businesses can minimize errors and ensure consistency across transactions.

Essential Fields and Mapping

Each section within the file structure serves a specific purpose, from identifying customer details to defining transaction values. This segmentation allows for detailed and accurate mapping of information. Important fields include:

- Header Information: Contains core details about the transaction, such as customer identification, document dates, and transaction types.

- Line Details: Specifies individual items or services, including descriptions, quantities, and associated prices.

- Tax and Charges: Includes applicable taxes, discounts

How to Prepare Data for Import

Preparing data for import into a financial system involves careful formatting and organization to ensure seamless integration. Proper preparation minimizes errors and ensures that each data entry aligns with the system’s requirements, making the upload process faster and more efficient. By following a few essential steps, businesses can ensure that data is ready for processing with minimal issues.

Organizing Data Fields

To prepare data accurately, it’s essential to ensure that each field corresponds to a required category in the import structure. Important points include:

- Consistent Column Headers: Make sure that each header matches the expected format and naming conventions of the target system.

- Data Segmentation: Group data logically, separating general information, line details, and transaction specifics.

- Standardized Formats: Follow any required number formats, date formats, or

Common Issues with FBDI Files

Working with data import files can present challenges that disrupt smooth data integration and processing. Common errors arise from formatting mismatches, missing information, or inconsistencies that prevent successful uploads. Identifying these issues early can save time and reduce errors, ensuring a more efficient import experience.

Formatting Errors

One of the most frequent problems occurs when file formatting does not align with system requirements. Even minor inconsistencies, such as incorrect date formats or number entries, can cause the file to be rejected. Key issues include:

- Date Mismatches: Incorrectly formatted dates, such as using slashes instead of dashes, can lead to failed uploads.

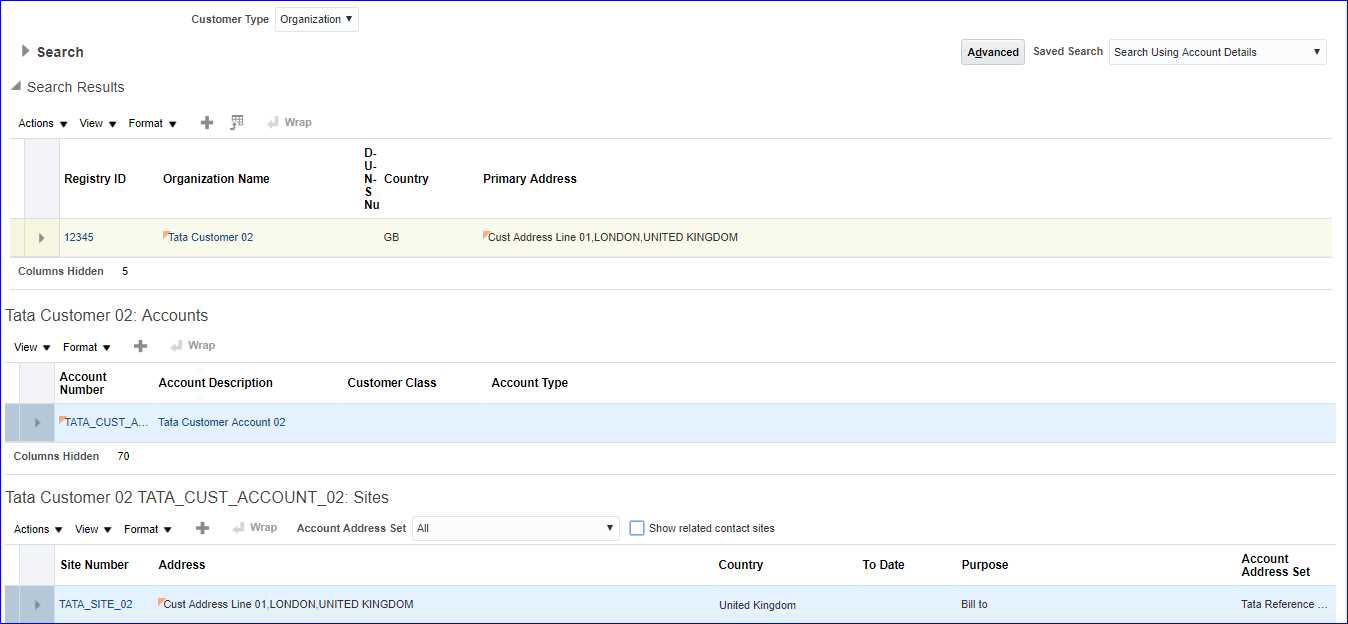

- Customer Information: Verify the correct billing address, contact details, and account number.

- Transaction Details: Include a breakdown of purchased items or services, quantities, and unit prices.

- Payment Terms: Specify payment due dates, discounts, and any applicable interest or penalties for late payments.

Steps to Generate an AR Invoice

Creating a financial document for receivables requires a series of steps that ensure accuracy and compliance with accounting standards. These steps guide users through gathering the necessary data, formatting it correctly, and submitting the document for processing. Following a structured approach can significantly streamline the process and reduce the chances of errors.

Gathering Required Information

The first step in generating a financial document for accounts receivable is collecting the necessary data. This includes customer details, transaction amounts, payment terms, and any applicable taxes or fees. Ensure that all information is accurate and up-to-date. Key items include:

Formatting and Submission

Once the data is gathered, it must be formatted according to the system’s requirements. This ensures that it aligns with the expected structure for processing. The steps include:

- Data Validation: Verify all data is correct and that there are no missing or incorrect entries.

- File Formatting: Arrange the data in the required order, following the correct structure for submission.

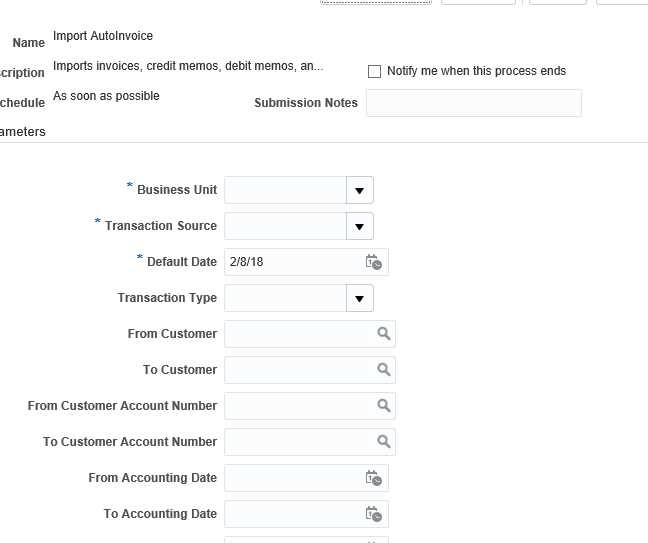

- Submitting the Document: Once everything is in place, submit the file through the appropriate system interface for processing.

By carefully following these steps, businesses can efficiently create and process receivable records, ensuring timely and accurate accounting of all transactions.

Formatting Requirements for Successful Upload

To ensure a smooth process when submitting data for system integration, it is essential to follow specific formatting rules. Adhering to these standards minimizes errors and guarantees the data is correctly interpreted by the receiving platform. A properly formatted file is critical to avoid rejection or delays in processing.

File Structure and Organization

One of the most important aspects of preparing a file is ensuring that its structure aligns with system specifications. Key points to consider include:

- Column Order: Ensure that the columns follow the required sequence, as per the system’s guidelines. Misordering fields can result in processing errors.

- Mandatory Fields: Verify that all necessary fields are present. Missing data can lead to file rejection or incomplete processing.

- Consistent Data Types: Each column must contain the appropriate type of data, such as text, numbers, or dates, without any irregularities.

Handling Special Characters and Formats

Special characters or formatting inconsistencies can cause significant issues. Pay attention to the following:

- Avoiding Extra Spaces: Ensure there are no unnecessary spaces before or after data entries, especially in numeric or text fields.

- Date and Time Formats: Ensure consistency in date and time formats, using the standard format required by the system (e.g., YYYY-MM-DD).

- Consistent Decimal Points: Use periods as decimal separators, and avoid mixing commas and periods in numbers.

By carefully reviewing and adjusting the file’s format, users can prevent common issues and ensure a smooth upload experience.

Mapping Data Fields in AR Templates

Mapping data fields correctly is crucial for ensuring that information is transferred accurately from one system to another. Properly matching each data element with its corresponding field ensures seamless integration and minimizes the risk of errors. This step involves aligning the data sources with the required structure for processing and storage.

Understanding Data Field Matching

The data fields must be mapped to specific categories to facilitate proper handling by the receiving system. Below is an example of how data fields might be mapped:

Source Field Mapped Field Description Customer Name Account Holder The name of the client or company responsible for the payment. Transaction Amount Amount Due The total sum to be paid for the goods or services provided. Due Date Payment Deadline The date by which the payment is expected to be completed. Ensuring Accurate Mapping

When mapping the data fields, it is important to ensure accuracy in each conversion. Key practices include:

- Double-checking field names: Make sure the fields correspond exactly to the ones required by the destination system.

- Validating data formats: Ensure that date, numeric, and text formats match the expected format in the new system.

- Testing the mapping: Perform tests to confirm that the mapping process works as expected and that data is transferred correctly.

Accurate field mapping helps avoid potential errors and ensures a smooth data migration process.

Best Practices for Data Validation

Ensuring the accuracy and integrity of data is critical when transferring information between systems. Effective validation processes help identify and resolve potential errors before they affect operations. By following best practices, businesses can enhance data reliability and streamline workflows.

To maintain data quality, it is essential to implement systematic checks and balances. Below are some key practices to ensure successful data validation:

Best Practice Details Consistency Checks Verify that data values are consistent with predefined rules, such as ensuring that numeric fields only contain numbers or dates are in the correct format. Completeness Verification Ensure that all necessary fields are populated and no critical information is missing. Range Validation Check that numerical values fall within an acceptable range to avoid out-of-bound errors. Cross-Referencing Cross-check data across different sources or systems to ensure consistency and accuracy. By incorporating these validation techniques, organizations can significantly reduce the risk of processing errors and improve the overall quality of their data.

Setting Up Error-Free Data Loads

Ensuring smooth and accurate data transfers is crucial for any business operation. By establishing a well-defined process for loading data, organizations can minimize the risk of errors and ensure that all information is correctly uploaded into the system. A strategic approach is essential for preventing issues such as incomplete entries or mismatched values that can disrupt workflows.

To achieve error-free data loads, several key steps should be followed:

- Pre-Load Validation: Conduct thorough checks to ensure the data meets all necessary criteria before initiating the transfer process. This can include verifying the format, completeness, and correctness of values.

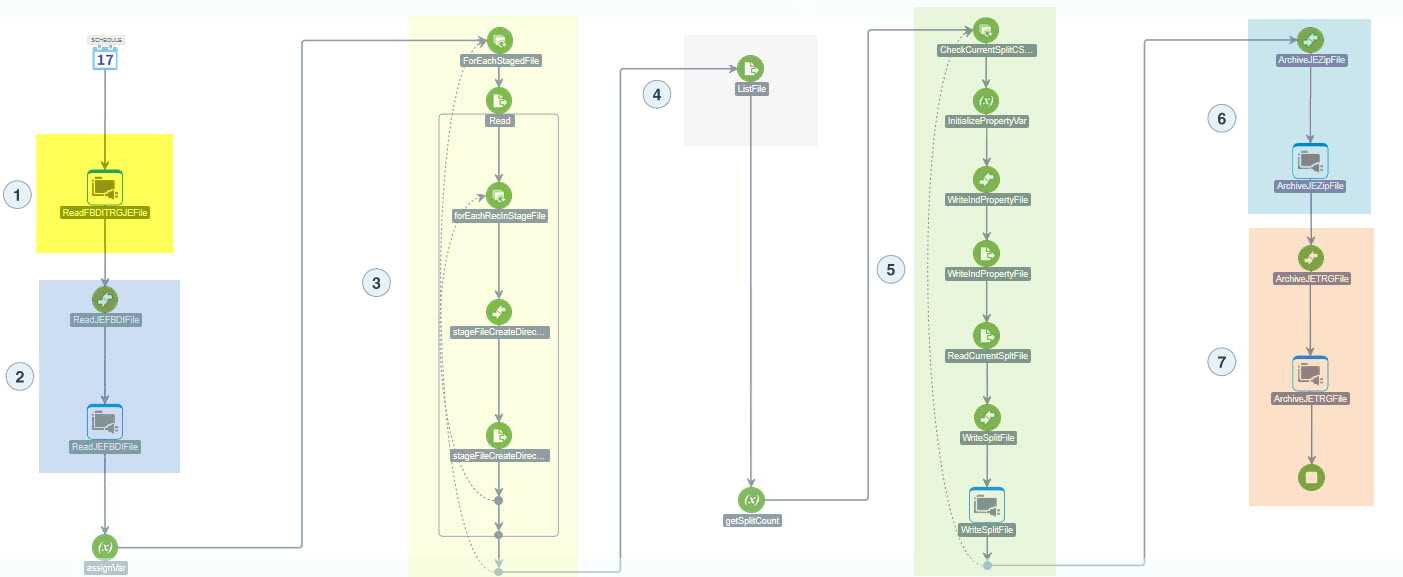

- Automation Tools: Utilize automation tools to handle repetitive tasks and reduce the possibility of human error. These tools can also ensure that data is loaded according to the predefined rules.

- Incremental Loads: Instead of loading large volumes of data at once, use incremental loads to process smaller batches. This reduces the chance of overwhelming the system and makes it easier to identify and fix issues.

- Continuous Monitoring: Implement monitoring mechanisms that track the load process in real-time. This helps to detect any errors early and allows for quick troubleshooting.

By following these steps, businesses can ensure that their data loading processes run smoothly, without introducing costly mistakes or delays into their operations.

Reviewing Processing Logs

Analyzing processing logs is an essential part of troubleshooting and ensuring the smooth operation of data uploads. Logs provide detailed insights into the steps taken during the data load process, helping to identify any issues or failures that may have occurred. By carefully reviewing these logs, teams can pinpoint specific errors, understand their causes, and take corrective actions to avoid future problems.

Here are some key considerations when reviewing processing logs:

- Error Messages: Look for any error messages or warnings that indicate problems during data processing. These messages often provide specific details about what went wrong and can help guide the troubleshooting process.

- Success Indicators: Confirm that the logs show signs of successful operations. This includes verifying that records were properly loaded, and there are no indications of incomplete or skipped entries.

- Timestamp Analysis: Review the timestamps to understand the time taken for each process. This can highlight performance issues, such as delays or bottlenecks in the data transfer process.

- Log Consistency: Ensure that the logs align with the expected output. Any discrepancies should be addressed and investigated further.

By consistently reviewing the processing logs, teams can improve the accuracy of data loads, reduce the occurrence of errors, and optimize system performance.

Optimizing Performance of AR Uploads

Improving the performance of data uploads is crucial to ensure quick and efficient processing. Slow uploads can lead to delays, errors, and a decrease in overall productivity. By implementing several best practices, the speed and reliability of these operations can be enhanced significantly. Below are key strategies for optimizing performance:

- Data Validation: Ensure that the data being uploaded is clean and accurate. Pre-validating records before uploading reduces the chances of errors and minimizes the time spent on corrections.

- Batch Processing: Breaking large datasets into smaller batches can help reduce system load. Uploading data in smaller chunks allows for quicker processing and easier error identification.

- Indexing: Proper indexing of databases can improve the performance of data queries and data insertion processes. Ensure that the relevant fields are indexed to speed up lookups and reduce processing time.

- Network Optimizations: Ensure that the network infrastructure is optimized to handle large data transfers. Consider improving bandwidth and reducing latency to speed up the upload process.

- Automated Scheduling: Schedule uploads during off-peak hours to minimize system resource contention. Automation also reduces human errors and ensures consistent processing.

By following these strategies, organizations can enhance the efficiency of their data uploads, ensuring that operations run smoothly and deadlines are met.

Integrating FBDI with External Systems

Connecting internal processes with external systems is essential for improving automation, data accuracy, and overall efficiency. Integrating with third-party tools or platforms allows for seamless data flow between systems, reducing manual intervention and errors. To achieve smooth integration, several key considerations should be taken into account.

- Data Mapping: Ensure that fields from external systems match the data structure of the internal system. This requires mapping data accurately to prevent mismatches and errors during transfer.

- APIs and Web Services: Utilize APIs or web services to facilitate the exchange of data. These technologies ensure that data can be transferred in real time, reducing delays and maintaining data consistency across platforms.

- Error Handling: Implement robust error handling mechanisms to catch and resolve issues during integration. This can include logging errors, sending alerts, and automatically retrying failed operations.

- Security Protocols: Data security should always be a top priority. Ensure that all data exchanges are encrypted and access controls are in place to protect sensitive information during transmission.

- Automation: Automating the data transfer process between systems helps reduce human error and ensures that updates occur in real-time, streamlining workflow and improving operational efficiency.

By focusing on these strategies, businesses can integrate their internal systems with external tools smoothly, achieving faster and more reliable operations, as well as better data accuracy.

Managing Security in AR Template Processing

Ensuring the security of sensitive financial and customer data is critical during the processing of records in any automated system. With increasing digitalization, it becomes essential to implement stringent security measures at every stage to protect data integrity, confidentiality, and prevent unauthorized access. By applying robust security practices, organizations can safeguard critical information while maintaining smooth operational workflows.

- Access Control: Limit access to the system by implementing role-based access control (RBAC). Only authorized users should have permission to process, view, or modify sensitive data.

- Data Encryption: Always use encryption to protect data during both storage and transmission. This ensures that even if data is intercepted, it remains unreadable to unauthorized individuals.

- Audit Trails: Implement logging mechanisms that track all user activities. Audit logs help detect and investigate any unauthorized access or actions taken within the system.

- Authentication and Authorization: Utilize multi-factor authentication (MFA) to enhance user verification and ensure only legitimate users can access the system. Additionally, regularly review user roles and permissions.

- Regular Security Updates: Ensure that all systems and software involved are regularly updated with the latest security patches to protect against vulnerabilities and potential exploits.

- Data Masking: Apply data masking techniques to obfuscate sensitive data such as payment details or personal information during processing, ensuring it’s only fully visible to authorized users when necessary.

By following these practices, organizations can build a secure environment for handling sensitive records, minimizing the risk of data breaches and maintaining trust with customers and stakeholders.

Streamlining Financial Close with FBDI

Efficient financial closing is crucial for organizations to maintain accurate financial reporting and ensure timely decision-making. By automating and optimizing the processes associated with closing, businesses can save time, reduce errors, and achieve a smoother transition between periods. Utilizing automated data integration tools can significantly improve the efficiency and accuracy of financial operations during this critical phase.

Benefits of Automating the Financial Close Process

- Reduced Processing Time: Automating data transfers and report generation reduces the manual effort involved, leading to faster financial closure.

- Improved Accuracy: Automated processes help minimize human errors that may occur during data entry or reconciliation tasks, ensuring more reliable financial results.

- Enhanced Compliance: By standardizing the closing process, organizations can better adhere to regulatory requirements and ensure consistent reporting.

- Better Visibility: Automated systems offer real-time insights into financial performance, allowing managers to track the progress of the close and quickly identify any discrepancies.

Key Steps to Streamline the Close Process

- Automated Data Collection: Set up integrations to gather financial data from multiple sources, ensuring the timely import of transaction and accounting information.

- Reconciliation and Validation: Use automated tools to reconcile accounts and validate the accuracy of data, reducing the need for manual checks.

- Reporting and Analysis: Implement automated reporting solutions to quickly generate financial statements and supporting documents, making it easier to assess the financial position.

- System Integration: Ensure that all financial systems are connected and share data seamlessly to facilitate a smooth closing process.

By embracing automation and streamlining the financial close process, organizations can improve operational efficiency, enhance financial transparency, and reduce the risk of errors, enabling them to close books more swiftly and with greater confidence.

Advanc

Efficient management of financial processes plays a pivotal role in ensuring smooth business operations. Advances in technology have significantly transformed how organizations handle various financial tasks, from data processing to reporting. Automation and integration of systems are key factors in enhancing accuracy, saving time, and optimizing resource utilization. This section explores the advancements in financial management systems, focusing on tools that streamline operations and improve overall effectiveness.

Key Advancements in Financial Management

- Automation of Data Entry: Reducing manual effort by implementing tools that automatically capture and input data from various sources.

- Improved Integration: Seamless connection between different financial systems for faster data sharing and improved coordination.

- Real-time Reporting: Generating real-time financial reports for quicker decision-making and enhanced accuracy.

- Enhanced Security: Leveraging modern encryption techniques to ensure data integrity and protect sensitive information.

Impact of Technological Advancements on Financial Closures

The advancements in automation and system integration have revolutionized the way financial closings are handled. By reducing manual tasks, companies can accelerate the closing process, mitigate errors, and improve data quality. These improvements have a direct impact on the efficiency of financial operations and help businesses maintain timely and accurate financial reporting.

Advancement Benefit Impact on Process Automation Reduces manual entry errors Speeds up data processing System Integration Improves data flow between systems Enhances coordination and reduces delays Real-time Reporting Provides up-to-date insights Facilitates faster decision-making