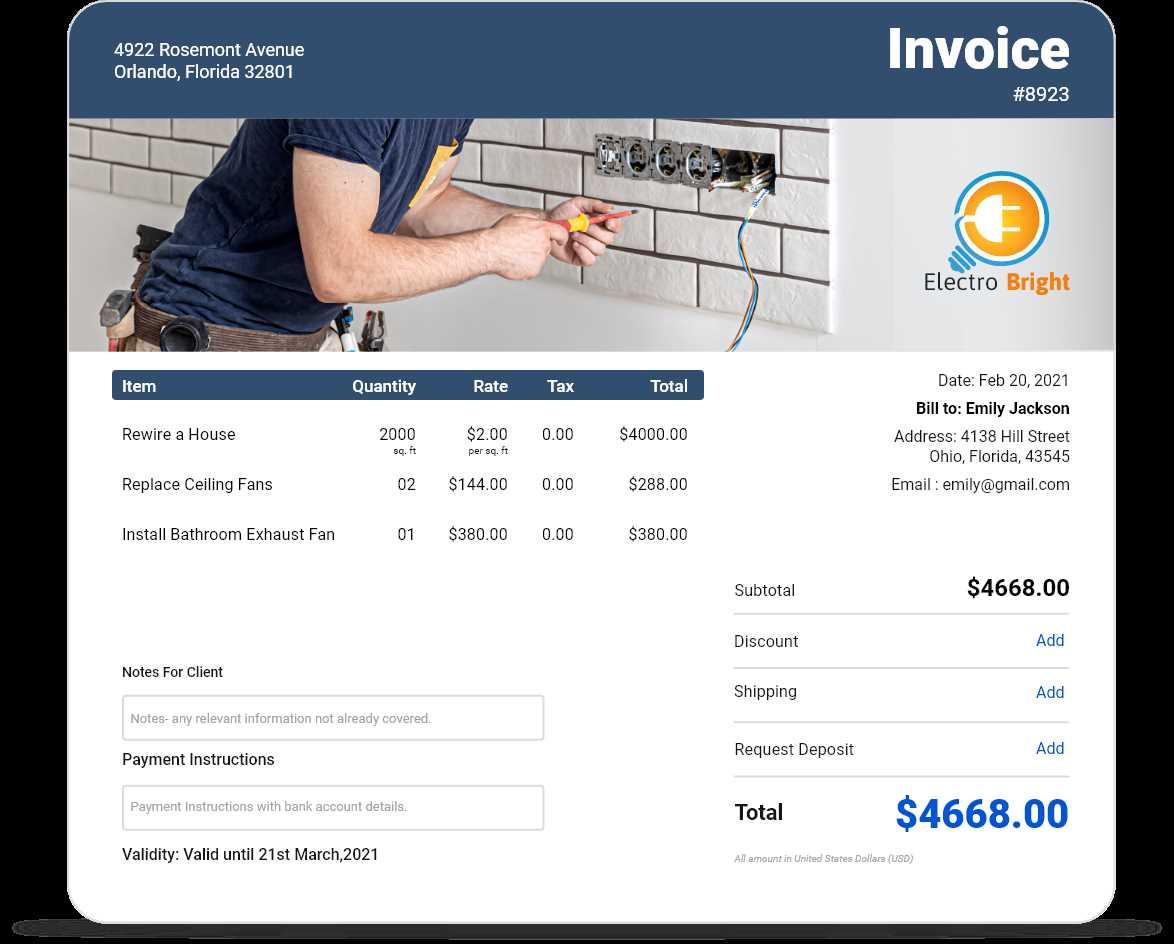

Basic Work Invoice Template for Easy and Effective Billing

Efficiently managing payments and ensuring clarity in transactions is crucial for any business. A well-structured billing document serves as the primary tool for communicating the amount due for services rendered. By using a customizable format, individuals and companies can streamline the payment process, making it easier for both parties to stay organized.

Designing a clear, professional-looking document can help avoid confusion and prevent potential disputes. Whether you’re freelancing or running a small business, a reliable format ensures consistency and reduces the time spent on administrative tasks. With a few key sections, you can create an effective tool that supports a seamless exchange of services for compensation.

Understanding the components of such a document is essential for anyone looking to improve their financial transactions. From client details to payment deadlines, knowing what to include helps establish trust and professionalism, setting a solid foundation for future business relationships.

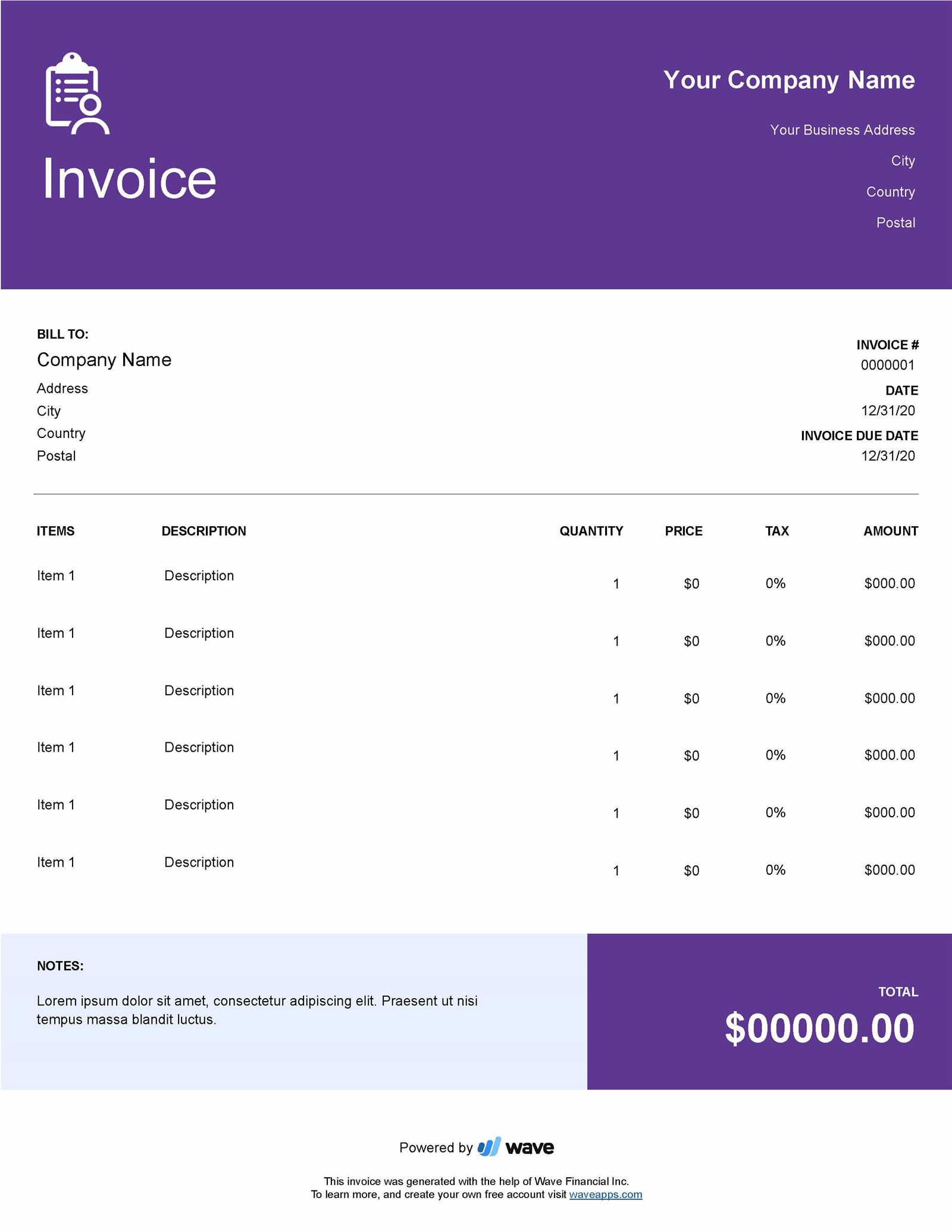

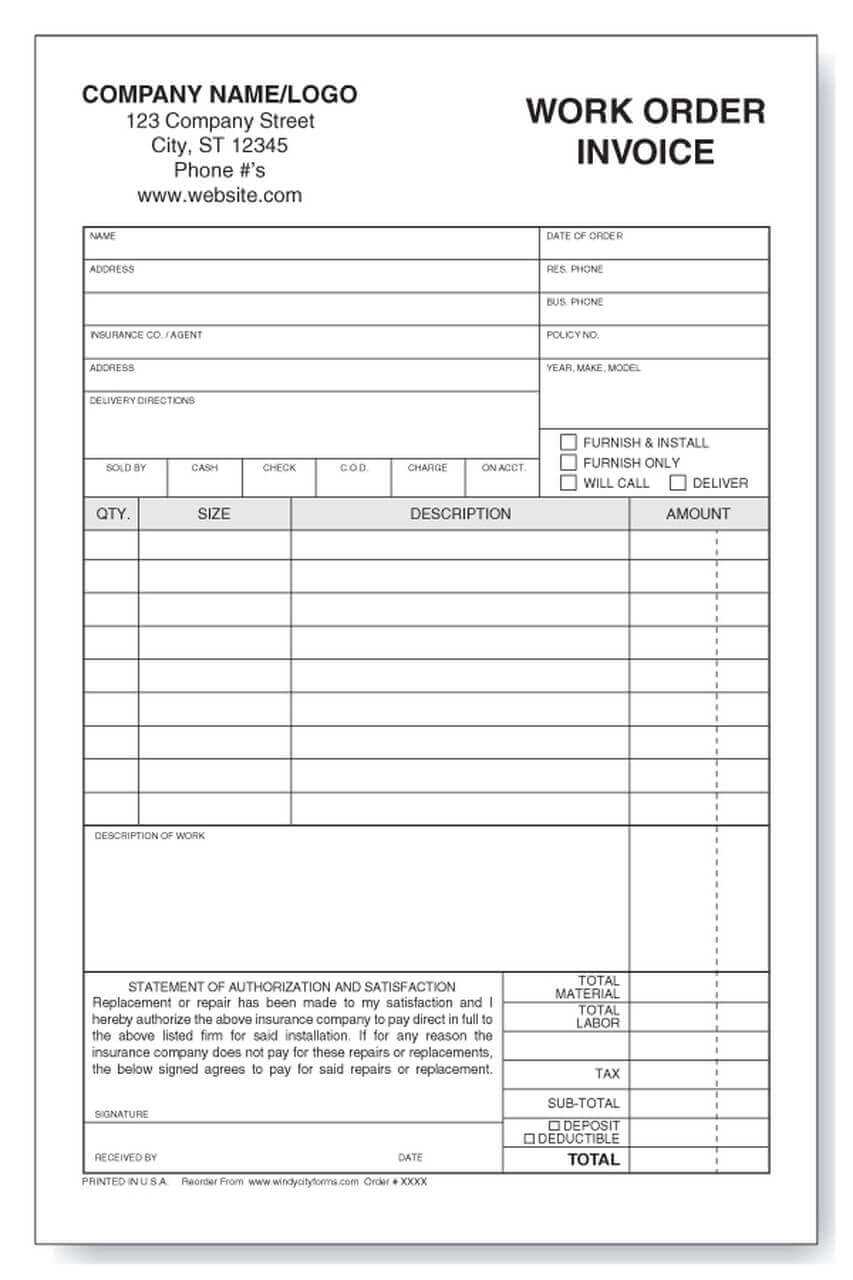

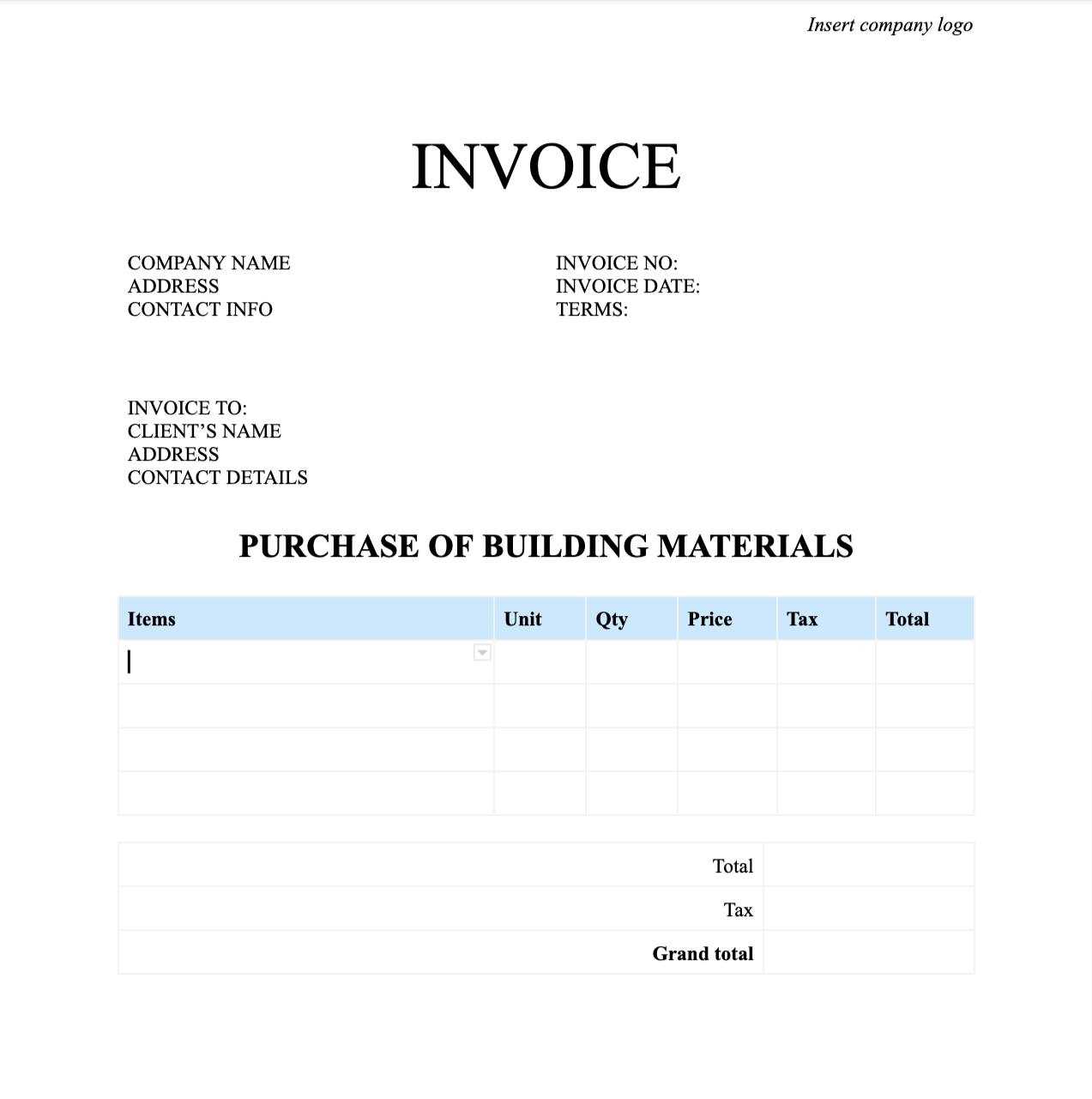

Simple Billing Document Format

Having a well-organized document to outline services provided and payments due is essential for maintaining clear financial records. A structured form allows for easy tracking of transactions and helps ensure that all necessary details are communicated efficiently. This format can be adapted to suit various types of services and businesses, offering flexibility while maintaining professionalism.

Key elements of a good document include sections for service descriptions, client information, and agreed-upon fees. By incorporating these components into a clear and concise layout, you can create a tool that helps facilitate smooth transactions. The document should also account for important dates such as payment due dates and terms for late fees, ensuring both parties are on the same page.

Personalizing this format allows for a more tailored approach to each project or service. Whether you’re providing consulting, freelance services, or any other professional offerings, adapting the document to fit your business needs will ensure you have a consistent and reliable method of tracking payments.

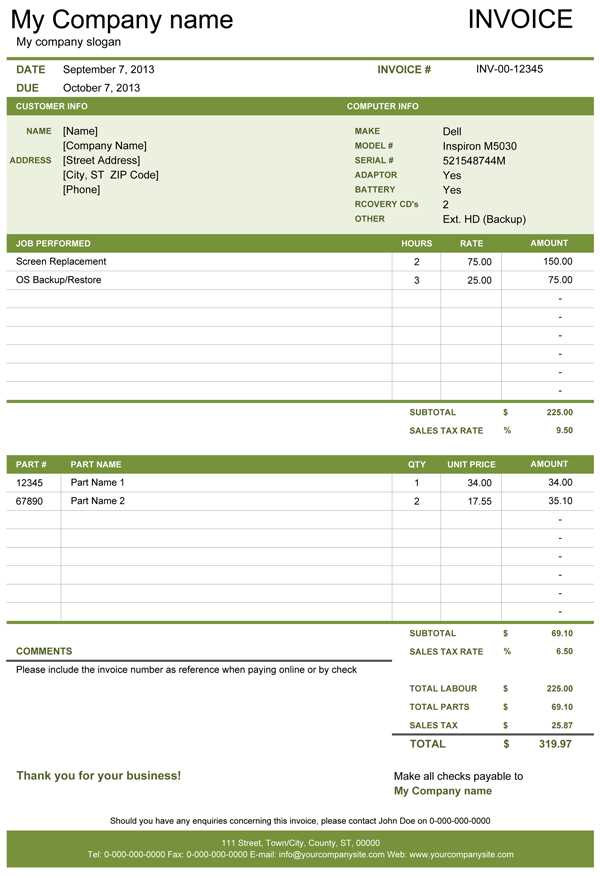

How to Create a Billing Document

Designing a reliable document for detailing services rendered and amounts due can significantly improve your business operations. A well-crafted form ensures that both you and your client have a clear understanding of the terms, payment amount, and deadlines. By following a few simple steps, you can create a document that is both professional and functional, making the billing process smoother for all parties involved.

The following table outlines the key sections to include when creating a comprehensive billing document:

| Section | Description |

|---|---|

| Client Information | Include the name, address, and contact details of the client. |

| Service Details | Describe the services provided, including quantities, rates, and any relevant project descriptions. |

| Payment Terms | Clearly state the payment due date and any applicable late fees. |

| Total Amount | Sum up the cost of the services, taxes, and any additional fees. |

| Invoice Number | Assign a unique reference number to help track the document for future reference. |

By including these components, you ensure that your document serves its purpose efficiently. Once the sections are laid out, you can adjust the format to fit your specific needs, adding any additional information that may be required for your industry or type of service provided.

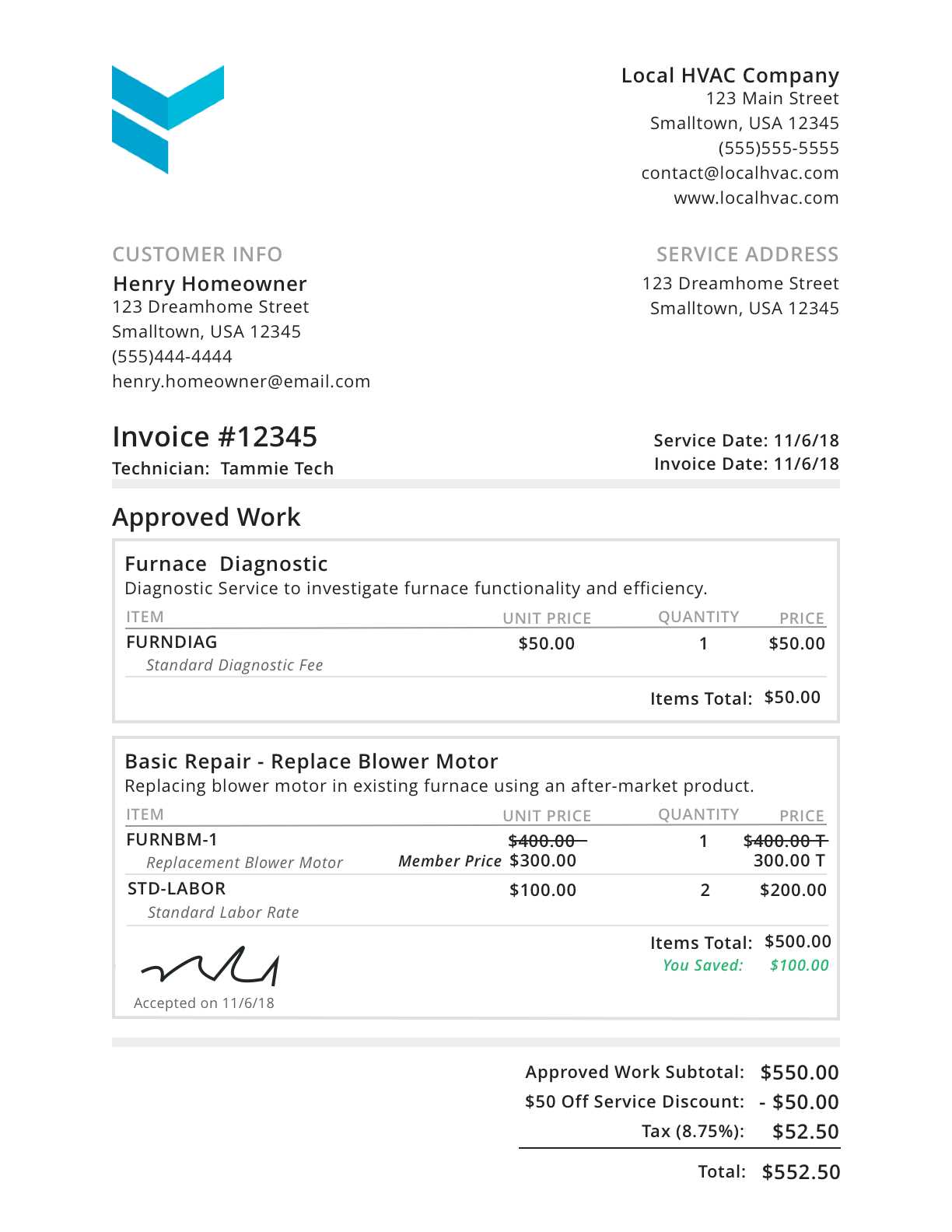

Key Elements of a Billing Document

To ensure that your financial transactions are clear and well-documented, certain key details should always be included in your billing document. These components serve not only to communicate the amount due but also to maintain transparency between you and your client. By including these essential sections, you can prevent misunderstandings and ensure a smooth payment process.

Client Information is one of the most important sections. This includes the client’s name, address, and contact details. Having this information readily available ensures that the document is personalized and can be easily tracked for future reference.

Service Descriptions should clearly outline what is being billed. This section includes the type of service provided, the quantity, and the agreed-upon rate. Detailing the services ensures both parties understand what is being paid for, avoiding any potential confusion.

Payment Terms specify when the payment is due and any penalties for late payment. These terms set expectations and provide clarity regarding deadlines, making it easier to manage cash flow and ensure timely payments.

Total Amount sums up the cost of services, including any taxes, additional fees, or discounts. This final figure should be clear and easy to understand, showing exactly what the client owes.

By incorporating these key elements into your document, you ensure that both you and your client have a clear understanding of the transaction, helping to foster trust and professionalism in your business relationships.

Customizing Your Billing Document for Projects

When working on various projects, it’s important to adjust your billing form to match the specific needs of each job. Tailoring the document ensures that both you and your client have a clear understanding of the scope of work, payment structure, and terms. A customizable format allows for flexibility while maintaining a professional appearance.

Essential Adjustments for Different Projects

Depending on the type of project, you may need to modify certain sections of your document. Below are a few key adjustments to consider:

- Service Breakdown: Provide a detailed list of the tasks completed or services rendered, along with the time spent on each task or any applicable rates.

- Payment Milestones: For larger projects, consider adding milestones where payments are due upon completion of specific phases or deliverables.

- Project-Specific Terms: Include any unique terms specific to the project, such as special deadlines or conditions that apply to the service provided.

- Additional Costs: If there are extra costs related to the project, such as materials or travel expenses, these should be listed separately.

Ensuring Clarity and Flexibility

Customization allows you to ensure that all project-specific details are covered, but it also helps maintain clarity for your client. A flexible format makes it easier to adjust for each unique job, ensuring that both parties are aligned on expectations and payment terms.

By adjusting your billing document to fit the specifics of each project, you increase transparency, reduce misunderstandings, and create a more efficient payment process. This tailored approach also reflects professionalism and attention to detail, strengthening your business relationships.

Why Use a Billing Document Format

Using a structured document to outline services and payment terms offers numerous advantages for both businesses and clients. A standardized format helps ensure clarity, consistency, and professionalism, making financial transactions smoother and reducing the risk of misunderstandings. With the right format, you can create a seamless process for managing payments and maintaining clear records.

- Consistency: A well-defined structure helps maintain uniformity in all transactions, ensuring that every detail is covered in each document.

- Time-Saving: By having a ready-to-use format, you eliminate the need to create a new document from scratch every time, speeding up the billing process.

- Professional Appearance: A clean and organized format reflects professionalism, which can enhance your business image and build trust with clients.

- Clarity and Accuracy: Clear sections make it easier to include all necessary details, reducing errors and ensuring that both parties understand the terms and amounts involved.

- Flexibility: A customizable format allows you to adapt the document to suit different projects or client needs, making it versatile for various types of services.

Adopting a standard format not only simplifies the billing process but also helps foster positive relationships with clients. By clearly laying out expectations, payment amounts, and deadlines, you create an efficient and professional experience for all parties involved.

Common Mistakes to Avoid in Billing Documents

Creating a clear and accurate document for services rendered is essential for smooth business operations. However, several common mistakes can cause confusion, delays, or even disputes between you and your clients. Avoiding these errors ensures that the document serves its purpose effectively, keeping your financial transactions professional and efficient.

Incorrect or Missing Information

One of the most frequent errors is providing incomplete or inaccurate details. Missing contact information, incorrect dates, or missing service descriptions can lead to misunderstandings. To avoid this:

- Double-check client details: Ensure that the name, address, and contact information are correct.

- Verify service descriptions: Make sure that the work done is clearly outlined, with no ambiguity about the charges.

- Review dates: Ensure that the date of service and payment due date are accurate and easy to follow.

Failure to Specify Payment Terms

Another common mistake is neglecting to clearly state payment terms. This can lead to delays or confusion about when and how payments should be made. Always include:

- Due dates: Clearly specify when the payment is expected.

- Late fees: If applicable, mention any penalties for overdue payments.

- Accepted payment methods: Indicate whether you accept bank transfers, checks, or online payments, and provide relevant details.

By addressing these issues and avoiding common mistakes, you can streamline the billing process, reduce confusion, and maintain a professional relationship with your clients. A well-structured and accurate document is an essential tool for smooth transactions and successful business dealings.

Essential Information to Include in Billing Documents

To ensure that financial transactions are smooth and transparent, it’s crucial to include all necessary details in your billing documents. Each section of the document plays an important role in communicating expectations, amounts due, and terms. Missing even a small detail can lead to confusion or delayed payments, so it’s essential to include key elements to maintain clarity and professionalism.

Key Sections to Include

- Client Details: Include the client’s full name, address, and contact information to ensure that the document is properly attributed.

- Your Business Information: Make sure to include your business name, address, and contact details so the client can reach you if necessary.

- Service Description: Provide a clear and concise breakdown of the services or products provided, including quantities, rates, and any other relevant details.

- Total Amount Due: Clearly state the total cost, including taxes, additional charges, and any discounts applied.

- Payment Terms: Specify the due date for payment and any penalties or late fees for overdue amounts.

Additional Information to Consider

- Invoice Number: A unique reference number helps track the document for future reference.

- Payment Methods: Clearly indicate the acceptable payment methods (bank transfer, check, online payment, etc.).

- Due Date: Make sure to specify the exact date by which the payment should be completed.

By including these key details, you not only ensure that the billing process is straightforward but also foster a sense of professionalism and trust with your clients. A well-organized document reflects your business’s attention to detail and commitment to clarity in financial transactions.

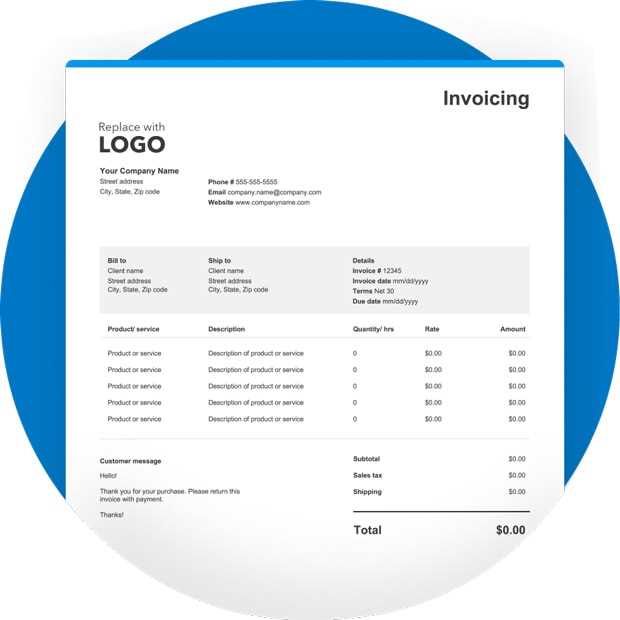

Choosing the Right Billing Document Format

Selecting the appropriate structure for your financial documents is crucial for ensuring that all information is presented clearly and professionally. The format you choose should align with the needs of your business and the preferences of your clients. Whether you’re managing a small project or handling multiple clients, finding the right layout can make a significant difference in how quickly and easily payments are processed.

Standard vs. Custom Formats are two common approaches when deciding on the layout of your document. A standard format provides a reliable and consistent way to present your details, while a custom format offers flexibility to include project-specific information or branding elements.

Electronic or Paper Documents is another decision to make. While digital formats are convenient and easily shareable, some clients may prefer paper versions. Deciding which format to use depends on client preferences, ease of use, and how you manage your records.

Ultimately, the best format is one that ensures accuracy, simplicity, and a professional appearance. It should make the process of issuing and paying bills straightforward while reflecting your business’s attention to detail and customer service.

Free Formats for Billing Documents

Accessing free resources to streamline the creation of billing documents can save both time and money. Many websites and platforms offer downloadable options that allow you to quickly generate professional-looking financial records without the need for custom design. These free formats can be used for various types of transactions, making it easier to manage your business dealings and ensure accuracy.

- Pre-made Templates: Various online platforms offer ready-made formats that include all the essential sections such as client details, service descriptions, and payment terms. These formats are often customizable to suit your specific needs.

- Spreadsheet Formats: Some people prefer using spreadsheets like Excel or Google Sheets. These formats are flexible and allow you to make quick adjustments while automatically calculating totals or taxes.

- Word Processing Documents: For those who prefer a more traditional approach, many websites offer free word processing formats like Microsoft Word or Google Docs. These are easy to customize with your own branding or project details.

- Online Tools: Some services offer free online tools where you can fill out a form and generate a document instantly. These tools often provide a simple, user-friendly interface and are perfect for one-off billing needs.

Using free formats for your financial documents can help ensure that your paperwork is always professional, accurate, and aligned with standard practices. With so many options available, it’s easy to find a format that works for your business and clients, saving you time and reducing errors in the process.

How to Organize Your Billing Documents

Efficient organization of your financial records is key to running a smooth business operation. Keeping track of payments, due dates, and completed projects helps maintain accurate records and improves cash flow management. A well-organized system reduces the risk of errors and ensures that all transactions are easily accessible when needed.

Digital vs. Physical Organization

When deciding how to organize your records, consider whether you prefer to maintain physical copies or digital files. Each method has its benefits, and the right choice depends on your business needs and personal preferences:

- Digital Records: Using cloud storage or dedicated accounting software makes it easy to store, search, and retrieve documents. It also allows for secure backup and reduces the need for physical storage space.

- Physical Records: For those who prefer hard copies, create a filing system with clearly labeled folders by month, client, or project. This can be particularly helpful for businesses that deal with clients who prefer paper documentation.

Organizing by Categories

Regardless of whether you use physical or digital storage, organizing your documents by category can make it easier to find specific records. Consider organizing by:

- Client: Keep all documents for each client in separate folders or digital files to easily track the history of transactions.

- Payment Status: Organize documents into “Paid,” “Pending,” and “Overdue” folders to help prioritize follow-ups and manage cash flow.

- Service Type: Grouping documents by service or project type can help you quickly access the details of similar jobs for comparison or reference.

By implementing an organized approach, you can easily manage your financial records, stay on top of payments, and avoid unnecessary stress when it’s time to review or send out documents. Whether you choose a physical or digital method, the key is consistency and organization to keep things running smoothly.

Benefits of Digital Billing Formats

Switching to digital formats for your financial documents offers numerous advantages, especially in today’s fast-paced, technology-driven world. Digital records are not only more efficient but also provide greater flexibility and accuracy compared to traditional paper-based methods. By adopting electronic systems, businesses can streamline their operations, save time, and enhance customer experiences.

Key Advantages of Using Digital Formats

- Efficiency: Digital documents are quicker to create and send. You can instantly generate and send records via email or through online payment platforms, saving valuable time.

- Cost Savings: By eliminating the need for paper, ink, and physical storage space, businesses can cut down on operational costs. Digital systems also reduce the costs associated with lost or damaged physical documents.

- Accuracy: Automated calculations reduce human error. Many digital platforms include features that auto-fill common details and perform calculations, ensuring that your records are accurate every time.

- Environmentally Friendly: Going digital is a step toward reducing paper waste, contributing to more sustainable business practices.

- Easy Access and Storage: Digital documents are easier to store, organize, and retrieve. With cloud storage, your records are safely backed up and accessible from any device, at any time.

Enhanced Professionalism and Customization

- Branding Opportunities: Digital formats allow you to easily customize your documents with your company’s logo, colors, and design, which adds a professional touch and reinforces your brand identity.

- Client Convenience: Clients can receive and view documents on their smartphones, tablets, or computers, making it easier for them to review and process payments promptly.

In conclusion, adopting digital formats for your billing records not only makes your processes more efficient and eco-friendly but also enhances accuracy, reduces costs, and provides more opportunities for customization. These benefits contribute to better overall business management and improved client relations.

Understanding Payment Terms in Billing Documents

Payment terms play a crucial role in the financial aspect of any transaction. These terms outline when and how payment should be made, helping both businesses and clients clearly understand expectations. Clear payment terms not only ensure that there are no misunderstandings but also help in maintaining a smooth cash flow for the business.

Payment terms can vary depending on the type of service provided, the client relationship, and the industry. Common payment terms include net payment schedules, discounts for early payment, and penalties for late payment. Defining these terms in advance helps both parties manage their finances better and reduces the risk of delayed payments or disputes.

It’s essential to specify due dates, payment methods, and any potential penalties or incentives directly on billing documents. By doing so, you establish transparency and avoid unnecessary confusion, ensuring that the entire process is efficient and professional.

Legal Requirements for Billing Documents

Every business must adhere to certain legal standards when issuing payment requests to clients. These regulations ensure transparency, protect both parties, and create a clear record of the transaction. Understanding and complying with these legal requirements is essential for avoiding disputes and ensuring that your documents are legally enforceable.

Depending on the country and industry, different legal obligations may apply. However, most jurisdictions require businesses to include specific information on their billing documents, such as:

- Unique Identification Number: Each document must have a unique reference number for tracking purposes.

- Business Information: The name, address, and tax identification number of the business issuing the document are required for official purposes.

- Client Information: Full details of the client receiving the bill, including their address and any relevant contact information.

- Clear Description of Services or Goods: A detailed breakdown of the products or services provided, along with the associated costs.

- Tax Information: If applicable, the appropriate tax rates and amounts must be specified to ensure compliance with tax laws.

- Payment Due Date: A clear deadline for when payment is expected, which helps avoid confusion and delays.

Failure to include these mandatory details can lead to legal complications or non-compliance with tax authorities. Therefore, it’s important to ensure that all necessary information is included in each document and that it complies with relevant laws to protect your business and maintain smooth operations.

How to Send and Track Billing Documents

Sending and managing payment requests efficiently is key to maintaining cash flow and building strong client relationships. Properly dispatching financial records and monitoring their status ensures that payments are made on time, minimizing delays and avoiding misunderstandings. This process is enhanced when businesses use reliable systems to track sent documents and manage follow-ups.

Sending Payment Requests Effectively

When sending billing records, it’s crucial to choose a delivery method that suits both you and your client. You can send documents through email, postal mail, or via an online payment platform, depending on your preferences and the client’s needs. Here are a few tips for efficient sending:

- Clear Subject Lines: Ensure that the subject line of your email clearly indicates that the document is a billing request.

- Personalized Message: Accompany the document with a brief and polite message to remind the client of the due payment and the terms.

- Multiple Formats: Offer the document in multiple formats (PDF, DOC, etc.) to ensure it is accessible to your client.

- Include Instructions: Provide clear instructions on how the payment should be made, including preferred payment methods and due dates.

Tracking the Status of Sent Documents

Tracking sent billing records is essential for staying organized and following up when necessary. Many businesses use automated software to track whether a document has been viewed or paid. Below is an example of key fields to track:

| Document ID | Client Name | Date Sent | Payment Due Date | Status | Follow-up Actions |

|---|---|---|---|---|---|

| #12345 | Client A | 2024-11-01 | 2024-11-15 | Sent | Email Reminder |

| #12346 | Client B | 2024-11-03 | 2024-11-17 | Paid | None |

By keeping track of the status of each document, you can stay ahead of potential issues and ensure that payments are processed on time. In case of delays, automated follow-up reminders or manual contact can be sent to encourage timely settlement.

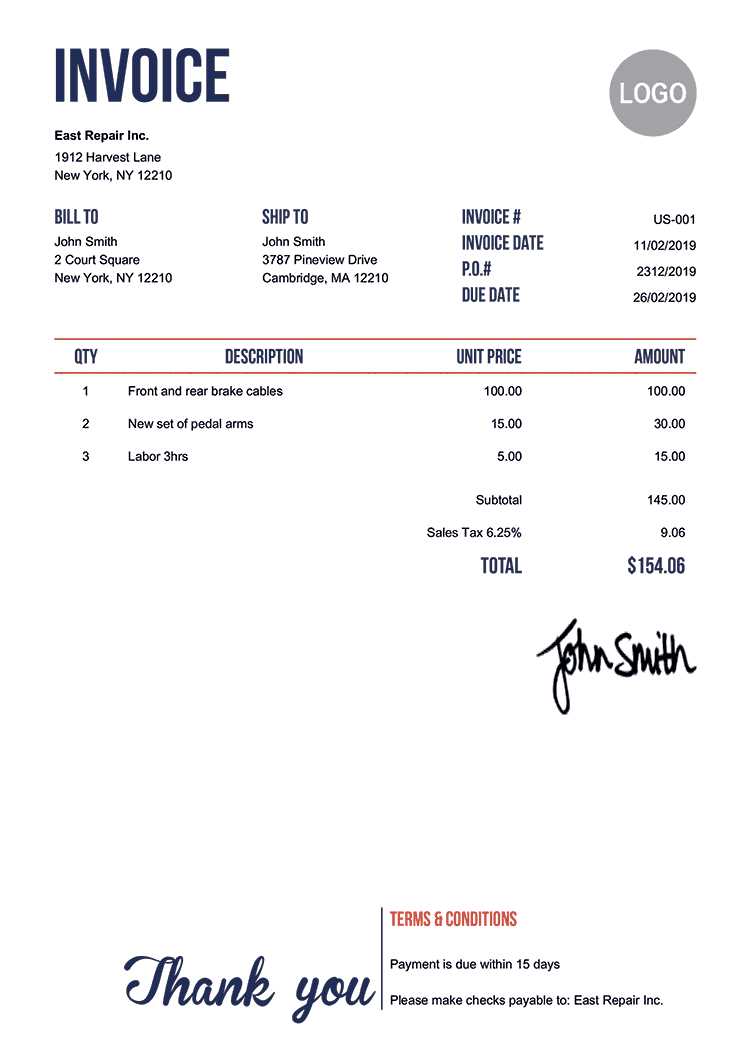

Best Practices for Document Design

Creating visually appealing and functional billing documents is essential for ensuring clarity and professionalism in business transactions. A well-designed record not only provides essential details but also enhances the client’s overall experience. By following best practices for document layout, you can make sure your payment requests are both easy to understand and effective in collecting payments on time.

Key Elements of Effective Design

When designing a payment document, simplicity and clarity are key. Here are some important elements to include for a professional and efficient layout:

- Clean Layout: Ensure the document is organized with ample white space to make the information easy to read.

- Branding: Include your business logo, contact information, and brand colors to create a cohesive and professional look.

- Clear Sections: Organize the document into distinct sections, such as client information, services provided, pricing, and payment terms, to avoid confusion.

- Readable Fonts: Use legible fonts, keeping the text size large enough for easy reading, especially for key details like amounts and dates.

- Consistent Style: Maintain a consistent design throughout, using the same color scheme, font styles, and layout for each document.

Optimizing for User Experience

The goal of your design should be to make the payment process as straightforward as possible. Keep these points in mind for an optimal user experience:

- Simple Navigation: Ensure that the document is easy to scan by using headings, bullet points, and concise language.

- Highlight Key Information: Make important details stand out, such as the total amount due, due date, and payment methods. Bold or highlight these elements to draw attention.

- Include Payment Instructions: Clearly explain how payments can be made, providing any necessary links or account details to facilitate smooth transactions.

By following these design best practices, you ensure that your documents are not only professional but also encourage timely payment and positive client relationships. The right design can help eliminate misunderstandings and streamline your payment processes effectively.

Improving Payment Speed with Billing Documents

In any business, ensuring timely payment is crucial for maintaining cash flow and sustaining operations. One effective way to accelerate payments is by streamlining how you present billing requests to clients. By optimizing the design, structure, and delivery of your payment documents, you can make it easier for clients to process payments quickly and efficiently.

Clear and Accurate Details are the foundation of any payment request. Clients are more likely to pay promptly when all the necessary information is easy to find and understand. Ensure that the following details are included:

- Client Information: Ensure that the client’s name, address, and contact details are correctly listed.

- Breakdown of Charges: Provide a detailed list of services or goods delivered, including quantities, unit prices, and totals.

- Due Dates and Terms: Clearly state the due date, along with any applicable payment terms (e.g., early payment discounts or late fees).

Simple Payment Methods can also encourage faster payments. Offer multiple payment options such as bank transfers, credit card payments, or online platforms like PayPal, which can expedite the transaction process. Make sure that payment instructions are easily accessible and clearly stated within the document.

Prompt Delivery of payment documents is another important factor. Sending documents immediately after the completion of a service or delivery of goods helps clients to process payments without unnecessary delays. If possible, consider sending digital versions, which clients can view and pay instantly, reducing any delays caused by mail delivery.

Incentives for Early Payment are also a good way to encourage faster transactions. Offering a small discount for early settlement can motivate clients to pay ahead of schedule, improving your cash flow and helping to maintain strong client relationships.

By focusing on these areas and ensuring your billing documents are clear, easily accessible, and well-structured, you can significantly improve the speed at which clients make payments, benefiting both your business and your customer satisfaction levels.