Free Tree Service Invoice Template for Easy Professional Billing

Managing client transactions and keeping track of payments can be time-consuming, especially for professionals in industries like landscaping and maintenance. To simplify this process, using pre-made documents can save valuable time and ensure accuracy in financial record-keeping. By utilizing a well-structured document for client charges, you can provide clear and professional statements that help both you and your customers stay organized.

Creating these financial documents from scratch can be tedious, but with the right resources, it becomes effortless. A ready-to-use form offers a straightforward layout for entering relevant details, such as labor costs, materials, and payment terms. This not only improves workflow efficiency but also presents your business in a polished, reliable light.

Whether you’re just starting or looking to improve your current method, adopting a professional approach to invoicing will positively impact your business relationships and overall productivity. Investing in a quality solution will ensure that all transactions are handled smoothly and that you maintain a high level of professionalism throughout every job.

Free Tree Service Invoice Template Benefits

Using a pre-designed billing document offers numerous advantages for businesses handling client payments. It saves time, ensures consistency, and minimizes errors, all of which are crucial for maintaining professional standards. By relying on structured layouts, you can streamline the entire financial process, making it quicker and more efficient for both you and your customers.

Key Advantages of Pre-made Billing Forms

- Time Efficiency: Ready-to-use documents allow you to focus more on your work and less on administrative tasks.

- Professional Appearance: A standardized layout ensures that all client communications are polished and reflect the quality of your business.

- Consistency: Templates offer uniformity, making it easier to manage multiple transactions and keeping your records organized.

- Reduced Errors: Structured formats minimize the chance of missing important details or making mistakes during the documentation process.

How a Pre-made Billing Document Enhances Your Workflow

- Faster Turnaround: With fields already defined, you only need to input specific data, making the process faster and more accurate.

- Improved Client Relationships: Providing clear and detailed documents builds trust and credibility with your clients, helping to foster long-term partnerships.

- Easy Customization: You can adjust the document as needed, adding specific details relevant to each job while keeping the overall structure intact.

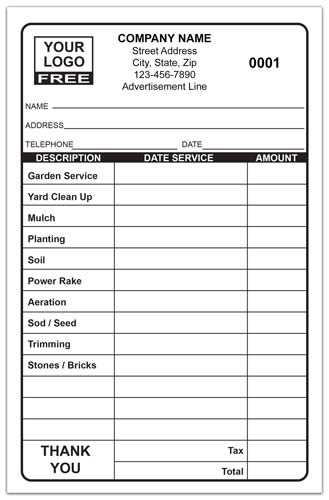

How to Use an Invoice Template

Using a pre-formatted document for billing is an excellent way to streamline your business transactions and ensure accuracy. These forms are designed to make the process of creating financial statements quick and simple. By following a few straightforward steps, you can generate professional, detailed documents that reflect your business’s services and help maintain clear communication with your clients.

Steps to Fill Out a Billing Form

- Step 1: Open the document and ensure it’s in an editable format, such as a Word file or PDF.

- Step 2: Enter your business details, including the name, contact information, and logo, if available.

- Step 3: Fill in the client’s information, including their name, address, and contact details.

- Step 4: Specify the services provided, listing them clearly with a description, quantity, and price.

- Step 5: Indicate payment terms, such as the due date and accepted methods of payment.

- Step 6: Review the document for accuracy before sending it to the client.

Customization Tips

- Adjust Fields: Add or remove sections based on the specifics of each transaction, such as discounts, taxes, or additional fees.

- Personalize Your Brand: Incorporate your business colors, logo, and branding to make the document reflect your company’s image.

- Update Regularly: Ensure that payment details, such as account numbers or policies, are up to date.

Why Choose a Free Template

Opting for a pre-designed document for your billing needs offers several compelling reasons, especially when you are just starting or looking for an affordable solution. These resources allow businesses to maintain professional standards without the added cost of specialized software or services. With a well-structured layout, it becomes easier to manage financial records and create detailed statements that build trust with clients.

Cost-Effective: One of the most obvious benefits is that these resources are available at no cost, allowing small businesses or freelancers to stay within budget. Instead of investing in expensive software, you can access everything you need to create accurate billing forms without the financial burden.

Ease of Use: Many of these pre-designed forms are user-friendly and require minimal time to fill out. The structure is already in place, so you only need to input specific details like service descriptions and client information. This saves you from having to spend hours designing documents from scratch.

Customization Options: While these forms are ready to use, they can often be easily customized to suit the unique needs of your business. You can add or remove sections, change fonts, and even include your branding elements like logos or colors. This ensures that every document you send out matches your company’s identity.

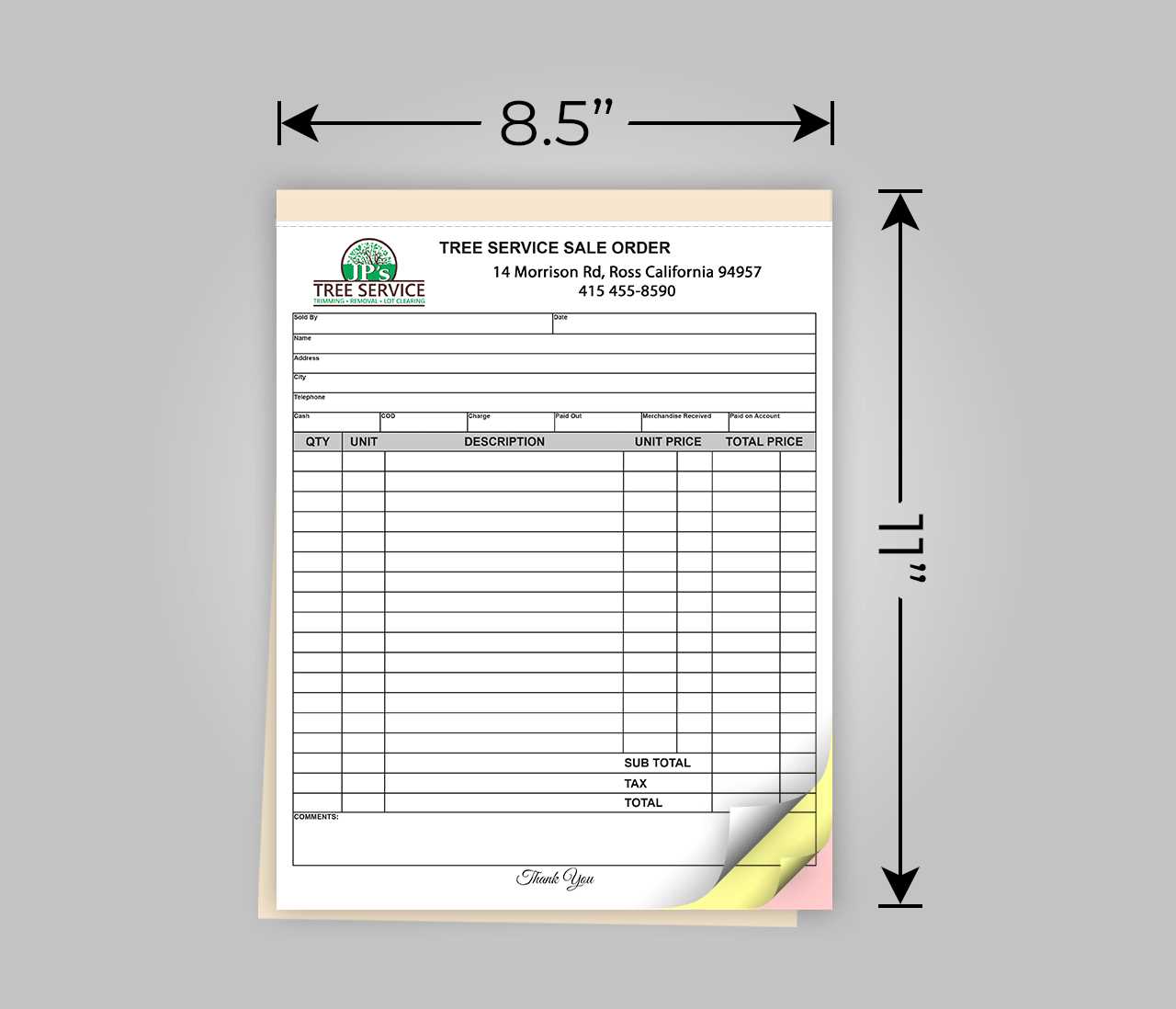

Essential Information for Tree Service Invoices

When creating a financial document for a completed job, it’s important to include all necessary details to ensure clarity and avoid misunderstandings. Properly formatted statements not only help keep track of payments but also reflect the professionalism of your business. A well-crafted document should cover key information to make the transaction process as smooth as possible for both you and your clients.

Key Elements to Include

Every billing form should include several essential sections to ensure that both the service provider and the client are on the same page regarding the work performed and payment terms. These elements are crucial for transparency and effective communication.

| Section | Description |

|---|---|

| Business Information | Your company’s name, address, phone number, and email address should be clearly listed at the top of the document. |

| Client Information | Include the client’s full name, address, and contact details to ensure there are no errors in communication. |

| Job Description | Provide a clear, detailed description of the services rendered, including materials used and any labor performed. |

| Dates | Include the date the work was completed, as well as the date the payment is due. |

| Pricing | List the cost of each service or item, followed by the total amount due for the entire project. |

| Payment Terms | Clearly state the due date for payment, accepted methods (e.g., credit card, check), and any penalties for late payments. |

Additional Details to Consider

- Tax Information: If applicable, include the relevant tax rates and total tax amount.

- Discounts or Adjustments: If you offer discounts or special pricing, be sure to list them and show the final adjusted price.

- Notes: Add any additional terms or conditions that may apply to the job or payment, such as warranties or guarantees.

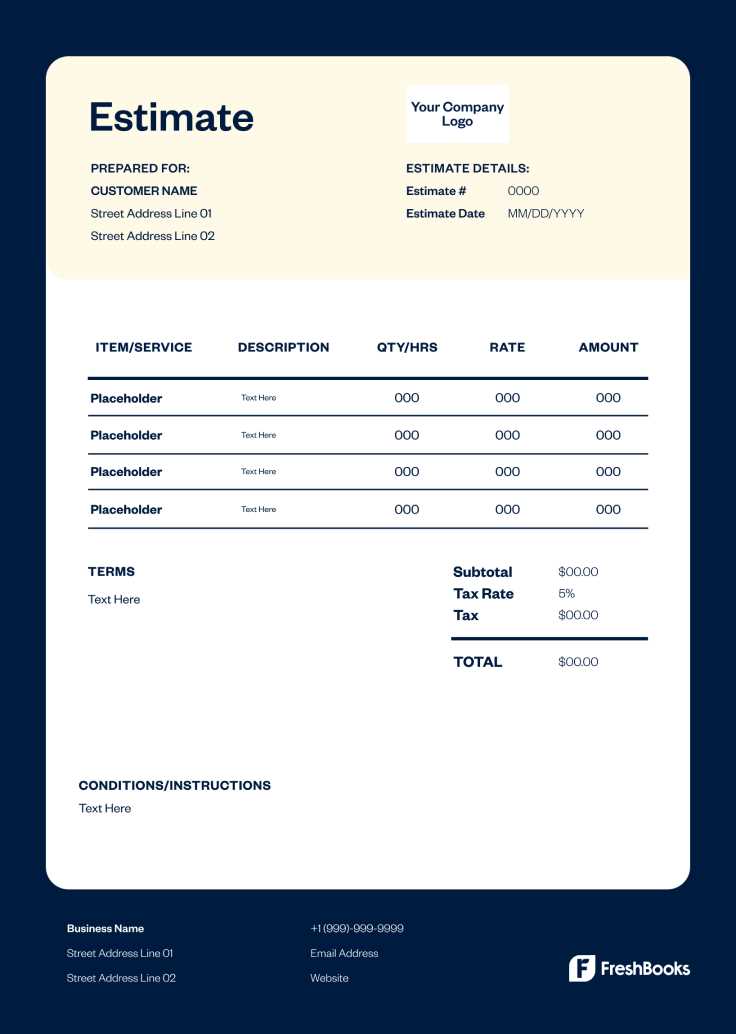

Customizing Your Billing Document

Tailoring a financial document to meet the specific needs of your business can greatly enhance its effectiveness. Customization allows you to adjust the layout, content, and even the design to reflect your brand, highlight important details, and ensure that it accurately represents the work completed. Personalizing these documents not only improves your professionalism but also ensures that clients receive clear, concise, and relevant information every time.

Personalizing the Design

Customizing the appearance of your document can help strengthen your brand identity and make your documents instantly recognizable. Here are a few ways to personalize the design:

- Logo and Branding: Add your company logo and choose colors that match your business’s branding to create a cohesive, professional look.

- Font Selection: Pick easy-to-read fonts that reflect the tone of your business. Opt for clean, modern fonts for a professional appearance.

- Header and Footer: Customize the header with your business name and contact details, and add a footer with any legal disclaimers or payment instructions.

Adjusting the Content

While the basic structure of the document is essential, it’s equally important to adjust the content to reflect the unique aspects of your business and each specific job.

- Service Details: Be sure to describe each task or product in detail. Include quantities, unit costs, and any materials used.

- Payment Instructions: Clearly outline accepted payment methods, late fees, and any deposit requirements to avoid confusion.

- Discounts or Promotions: If you offer special pricing or discounts, incorporate those into the document to provide clarity to the client.

Free Templates vs. Paid Alternatives

When deciding between using a no-cost document or opting for a premium solution, it’s important to consider the specific needs of your business and the resources available. Both options offer distinct advantages, but they also come with certain limitations. Understanding the differences can help you choose the best option based on factors like budget, customization, and long-term use.

Comparison of Key Features

| Feature | No-Cost Option | Premium Option |

|---|---|---|

| Cost | Completely free, no initial investment required. | Requires a one-time or subscription-based payment. |

| Customization | Basic customization options, limited design changes. | Highly customizable with advanced features and design flexibility. |

| Ease of Use | Simple, easy to use, but may lack advanced functionality. | Can include more intuitive tools for managing billing and clients. |

| Support | Minimal or no customer support available. | Full customer service and technical support for troubleshooting and assistance. |

| Long-Term Use | Great for one-time or occasional use but may lack long-term scalability. | Ideal for businesses with recurring needs or complex billing requirements. |

Which Option is Right for You?

Choosing the right option ultimately depends on the size and complexity of your business. A no-cost document can be sufficient for small operations or occasional use, offering simplicity and functionality without extra expenses. However, if you require more advanced features, support, or are managing a large client base, a premium solution may be the better choice. Consider your business needs, future growth, and available resources to make an informed decision.

How to Create Professional Invoices Quickly

Generating polished financial documents quickly and efficiently is crucial for maintaining a smooth workflow, especially in a busy business environment. Whether you are a freelancer or a small business owner, having a streamlined process for creating billing forms can save you time and reduce errors. With the right approach, you can create accurate and professional statements in just a few simple steps.

Steps to Create an Efficient Billing Form

- Choose a Structured Format: Start with a pre-made form that includes all the necessary sections, such as your business information, client details, and service descriptions.

- Fill in the Key Information: Input the most important details like job descriptions, costs, and dates. Make sure to be clear and specific about each item to avoid any confusion.

- Review and Adjust: Before finalizing the document, check for any errors, such as incorrect pricing or missing details. Ensure the format looks clean and easy to read.

- Save and Send: Save the document in a format that’s easy to send (like PDF) and promptly share it with your client through email or another preferred method.

Time-Saving Tips

- Use Pre-Filled Information: Save commonly used details (like your business address and payment terms) so you don’t have to re-enter them each time.

- Leverage Automation Tools: Many software solutions and online platforms offer tools that automatically generate financial documents based on your input, saving you even more time.

- Keep Templates Updated: Regularly review your forms and make any necessary adjustments, ensuring they are always ready for use when needed.

Improving Billing Efficiency with Templates

Using pre-designed documents for your business transactions can drastically improve the efficiency of your billing process. By eliminating the need to manually create a new document each time, these tools streamline the workflow, reduce errors, and save valuable time. This efficiency allows you to focus more on the core activities of your business while ensuring that all financial details are properly documented.

With ready-made forms, you can quickly input specific job information and payment details, keeping your records organized and reducing the chance of mistakes. The consistent format helps maintain professionalism while simplifying the overall administrative burden. Below are a few key ways templates can enhance your efficiency:

| Benefit | How it Improves Efficiency |

|---|---|

| Consistency | Using a standardized structure ensures that all essential information is included in every document, minimizing errors and omissions. |

| Speed | Filling out a pre-structured form is quicker than creating a new one from scratch, allowing you to generate documents in minutes. |

| Organization | Having a uniform format helps you keep track of multiple transactions and makes it easier to reference past documents when needed. |

| Accuracy | By reducing manual input and following a clear layout, the chance of mistakes is reduced, improving the accuracy of your records. |

| Customization | Many pre-designed forms allow for easy customization, so you can adjust them to fit your specific needs while maintaining a fast turnaround. |

Key Features of a Good Invoice

A well-crafted financial document is not only a record of a transaction but also an important communication tool between a business and its clients. To ensure that these documents are effective and professional, certain features must be included. A good form should be clear, detailed, and easy to understand, with all the necessary information to facilitate payment processing.

Essential Elements of a Quality Document

To create a document that works well for both your business and your clients, certain key elements should always be included. These features help ensure that there are no misunderstandings and that all terms are clearly communicated.

- Contact Information: The document should list both your business and the client’s contact details, including addresses, phone numbers, and email addresses.

- Unique Identifier: Assign a unique reference number to each document for easy tracking and reference.

- Itemized List of Services: Include a detailed breakdown of the work done, including labor and materials, with individual pricing for each service provided.

- Clear Payment Terms: State the total amount due, the due date, and any penalties for late payments. Clearly list acceptable payment methods.

- Tax Information: If applicable, include tax rates and totals to avoid confusion for your client and ensure compliance with local regulations.

Design and Layout Considerations

In addition to the content, the layout and design of the document play a crucial role in making the information easy to read and professional-looking. Here are some important design considerations:

- Clean and Organized: Keep the layout simple, with clearly defined sections for each type of information. Use headings and bullet points to make it easier to navigate.

- Readable Fonts: Choose clear, legible fonts and make sure the text is well-spaced and aligned.

- Branding: Incorporate your company’s logo and colors to personalize the document and make it instantly recognizable.

Common Mistakes to Avoid in Invoices

While creating billing documents, it’s easy to overlook certain details that can lead to confusion or delays in payment. Small errors can undermine the professionalism of your business and make it harder to maintain clear communication with clients. Avoiding these common mistakes ensures that your financial statements are accurate, transparent, and effective in prompting timely payments.

Here are some of the most frequent errors to watch out for when preparing your billing statements:

- Missing or Incorrect Contact Information: Ensure that both your business and the client’s details are up-to-date and accurate. This includes names, addresses, phone numbers, and email addresses. Incorrect or missing information can delay communication and payment.

- Unclear Payment Terms: Always specify the total amount due, the due date, and any applicable late fees. Failing to include this information can lead to confusion and delays in receiving payment.

- Omitting a Unique Reference Number: Each document should have a unique reference or invoice number. This makes it easier for both you and the client to track payments and address any issues that may arise.

- Incomplete Service Descriptions: Be as detailed as possible when describing the work or products provided. Ambiguous or vague descriptions can lead to disputes or misunderstandings about what was charged.

- Not Including Tax Information: If applicable, make sure to include relevant tax rates and totals. Failing to do so can result in confusion, and in some cases, tax liabilities for your business.

- Incorrect Pricing: Double-check all amounts and calculations. Overcharging or undercharging, even by a small amount, can lead to issues and may harm client trust.

- Poor Formatting: A cluttered or poorly formatted document can make it difficult for your clients to understand the charges. Use clean, organized layouts and consistent fonts to make your document easy to read.

Free Billing Forms for Small Businesses

For small business owners, managing financial documents efficiently is crucial to maintaining a steady cash flow and ensuring that clients pay on time. Using pre-designed documents is a cost-effective way to handle billing without sacrificing professionalism. These ready-made forms can help streamline the process, reduce the time spent on paperwork, and ensure that every transaction is properly documented.

Why Small Businesses Benefit from Ready-Made Documents

Ready-to-use forms are particularly useful for small business owners who may not have the resources to invest in expensive accounting software or hire a dedicated administrator. With these tools, you can quickly create polished, accurate financial statements that reflect your brand’s professionalism. Additionally, many free options are customizable, allowing you to tailor them to your specific needs while keeping costs down.

Advantages of Using Pre-Designed Forms:

- Cost Savings: There’s no need to pay for expensive software or hire professionals to create these forms from scratch.

- Time Efficiency: With a structured layout, you can fill in the necessary details quickly, saving time on administrative tasks.

- Consistency: Using a consistent format for all your transactions ensures your documents are easily recognizable and professional.

- Customizable: Many free options allow you to add your company’s logo, change colors, or modify sections to suit your business model.

Where to Find These Documents:

Many online platforms offer free, customizable billing forms. You can find them in a variety of formats, from simple PDF files to editable Word documents and Excel sheets. These resources are perfect for business owners looking to simplify their billing process while maintaining a professional image.

Legal Requirements for Billing in the Industry

When managing financial transactions for your business, it’s essential to be aware of the legal requirements that apply to creating and issuing billing documents. These legal standards ensure that both parties – the business and the client – are protected, and that all necessary information is disclosed in a clear and compliant manner. Understanding these obligations helps prevent disputes, ensures timely payments, and keeps your business in good legal standing.

Here are the key legal aspects to consider when preparing your billing documents:

- Clear Payment Terms: Clearly state the total amount due, the payment deadline, and any penalties for late payments. It’s important that clients understand when payments are expected and what happens if deadlines are missed.

- Itemized Charges: All billed items, including labor, materials, and other charges, should be broken down with as much detail as necessary. This transparency helps avoid misunderstandings and legal disputes.

- Tax Information: Depending on the jurisdiction, you may be required to include applicable sales tax or other taxes on the billing document. Be sure to check local tax laws to ensure compliance.

- Legal Disclaimers: Include any legally required disclaimers or clauses, such as warranty information, terms of service, or limitations of liability. This protects your business in case of future claims or disputes.

- Accurate Dates: Make sure the billing document reflects the correct date of issue and the date the services were provided or completed. These dates help establish a clear timeline for payment expectations and can be critical in case of disputes.

- Client Information: Always include the correct name, address, and contact details of the client. This information ensures that the right party is being billed and helps avoid confusion during payment processing.

- Business Information: Ensure your business’s legal name, address, and contact details are included. Some regions may also require your business registration number or tax identification number.

By following these legal guidelines, you ensure that your financial documents are both clear and legally compliant, protecting your business from unnecessary disputes or complications.

How to Track Payments Using Templates

Tracking payments efficiently is essential for maintaining cash flow and ensuring that all transactions are recorded accurately. By utilizing pre-designed documents, you can streamline the process of monitoring outstanding balances and incoming payments. These forms allow you to track which payments have been received, which are overdue, and which are still pending, making financial management much easier and more organized.

Here are some ways you can use these documents to effectively track payments:

- Include a Payment Status Field: Add a section to the form that indicates whether the payment is “Pending,” “Paid,” or “Overdue.” This makes it easy to track the status of each transaction at a glance.

- Record Payment Dates: Always record the date when each payment is received. This will help you stay organized and ensure you’re keeping track of deadlines and due dates.

- Maintain a Running Total: Keep a column showing the remaining balance due after each payment. This helps both you and your clients see exactly how much is left to pay and when the balance is cleared.

- Set Up Payment Reminders: If your document includes payment due dates, set up a reminder system, such as automatic email alerts, to notify clients of upcoming payments or overdue amounts.

- Track Multiple Installments: For clients who pay in installments, track each payment separately and adjust the total balance accordingly. This ensures there is no confusion regarding partial payments.

By utilizing these strategies, you can ensure that all financial transactions are clearly recorded, making it easier to follow up on overdue payments, avoid mistakes, and maintain a healthy cash flow for your business.

Why Invoicing Software Might Not Be Necessary

Many small business owners and freelancers find invoicing software appealing for its ability to automate and streamline the billing process. However, depending on the size and nature of your business, such software may not always be necessary. For some businesses, manual processes or using simple, customizable documents might provide enough efficiency and functionality without the need for expensive or complex software solutions.

Here are a few reasons why you might not need invoicing software:

Cost-Effective Solutions

For small businesses with a limited number of transactions, purchasing software may not be a cost-effective option. Instead, using pre-designed documents or basic spreadsheets can provide the necessary functionality without the recurring subscription fees or upfront costs associated with invoicing platforms. This allows you to maintain simplicity and control over your financial records.

Simple Billing Needs

If your billing process is straightforward, with only a few services or products being offered to clients, there might be no need for specialized software. A well-structured document can capture all the necessary details, such as pricing, payment terms, and client information, without requiring any complex setup or integration. You can create, update, and send your statements manually, which may be more than enough to meet your needs.

Flexibility and Customization

Many free and customizable documents allow for greater flexibility in how you present your billing information. Unlike some software, which might have rigid templates and layouts, using simple forms or spreadsheets can let you tailor the document to your preferences and brand identity. You can easily adjust the format to match specific client requirements or the nature of the work done, ensuring clarity and professionalism without relying on software limitations.

In some cases, opting for simpler solutions can save both time and money while still allowing you to maintain an efficient and effective billing system. If your business doesn’t require the complexity of invoicing software, it might be more practical to use free or low-cost alternatives that still meet your needs.

Free Templates and Time Management

Efficient time management is crucial for small business owners and freelancers, especially when juggling multiple tasks. One of the best ways to save time and streamline administrative work is by using pre-designed forms. These tools can simplify repetitive processes like creating financial statements, allowing you to focus more on your core activities rather than spending valuable time on paperwork.

By utilizing pre-made forms, you can significantly reduce the amount of time spent on routine administrative tasks. These forms are often easy to customize, quick to fill out, and can be reused for multiple clients, minimizing the effort needed for each new transaction.

How Pre-Designed Forms Help Save Time

Using pre-designed forms offers several time-saving benefits that can help you stay organized and efficient:

- Consistency: Using the same format for all billing and transaction records ensures consistency, reducing the chances of errors or omissions. This consistency leads to faster processing times as you become familiar with the layout and details.

- Quick Customization: Many forms are highly customizable, allowing you to adjust client-specific details in just a few minutes, without needing to create a new document from scratch.

- Faster Record-Keeping: Once you’ve filled in the necessary information, these forms can be saved, reused, and tracked easily, helping you stay organized with minimal effort.

- Reduced Paperwork: By organizing billing records digitally, you can avoid the need for excessive physical paperwork, reducing the time spent on filing and searching for documents.

Practical Tips for Efficient Use

To make the most of pre-designed documents, consider these tips for maximizing your time management:

- Set Up Templates for Common Services: If your business offers recurring services, create or use forms designed specifically for those tasks. This way, you can quickly fill in the details each time without starting from scratch.

- Automate Reminders: Many pre-designed forms allow you to integrate payment reminders, helping you manage overdue payments without additional effort.

- Use Digital Tools: Leverage digital tools like cloud storage or document management systems to store and track all your records in one place, making access and updates faster.

Incorporating pre-made documents into your workflow is a simple yet effective way to save time and improve overall productivity. By reducing the time spent on administrative tasks, you can focus more on growing your business and meeting your clients’ needs.