China Invoice Template for Easy and Accurate Billing

Managing financial transactions smoothly is crucial for any business. One of the most essential tasks for maintaining proper documentation is creating accurate and professional documents that clearly list services or products provided. Whether you are dealing with domestic clients or international transactions, ensuring that all the necessary details are captured in a consistent format is key to avoiding confusion and errors.

Professional templates can make this process easier by providing a structured framework for creating detailed records of each sale. These tools allow businesses to save time while ensuring compliance with local standards and practices. With the right format, you can enhance the appearance of your documents and streamline your accounting processes.

Choosing the right layout is just the beginning. A well-organized document should contain all the important information, from product descriptions to payment terms, and should reflect the professional image of your business. Customizing your document according to specific needs ensures that you remain efficient and precise in your financial operations.

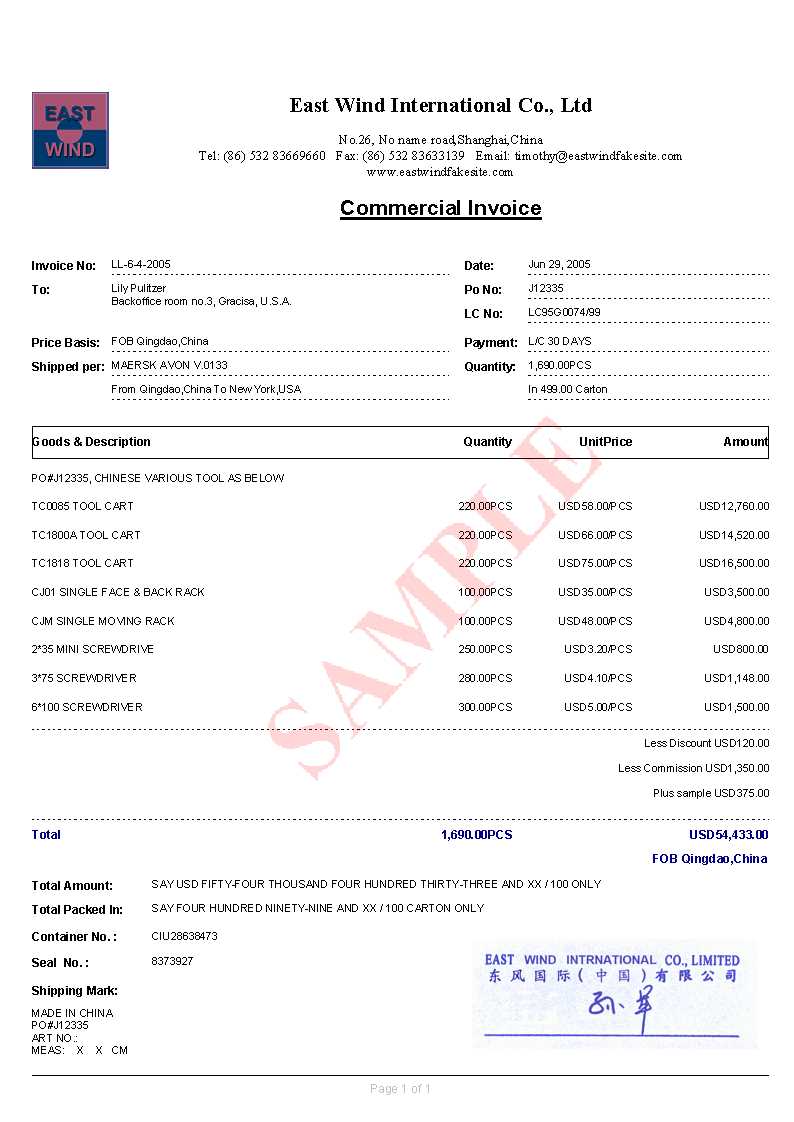

Understanding Invoice Documents for International Transactions

When conducting business across borders, it’s essential to use a structured format that clearly outlines the terms of a transaction. These records not only serve as proof of an agreement but also help maintain clarity between parties involved in financial exchanges. A well-organized document ensures that both the seller and buyer are on the same page regarding prices, delivery, and payment schedules.

To ensure that the document meets international standards, certain elements are universally included. These core components make up the foundation of a functional and legally recognized record:

- Seller and buyer details: Names, addresses, and contact information of both parties.

- Product or service description: Clear and detailed list of items or services provided, including quantities and prices.

- Payment terms: This section outlines the expected date of payment and any terms related to deposits or late fees.

- Currency and tax details: Specifies the currency used for the transaction and any applicable taxes or fees.

- Delivery information: Date and method of delivery or service completion.

By following this standard structure, businesses can avoid misunderstandings and ensure that both parties are aware of their responsibilities. Customizing these formats allows for flexibility, while still adhering to the necessary legal and professional requirements.

Why Use a Structured Billing Format

Maintaining consistency and accuracy in business transactions is essential for building trust and ensuring smooth financial operations. One of the most effective ways to achieve this is by using a predefined structure for documenting sales. A well-constructed framework reduces the risk of errors, ensures that key details are never overlooked, and saves valuable time when processing multiple transactions.

Time Efficiency and Consistency

By relying on a ready-made structure, businesses can avoid reinventing the wheel each time a new transaction occurs. Instead of starting from scratch, a consistent approach allows for faster document creation and ensures uniformity across all records. This can be especially helpful when managing a high volume of sales, as it reduces the time spent on administrative tasks.

Professionalism and Accuracy

Using a structured format not only enhances efficiency but also promotes a more professional image. It ensures that all necessary details–such as payment terms, product descriptions, and buyer information–are clearly presented. This level of accuracy builds confidence in clients and partners, as they can easily verify the transaction terms without any confusion.

Customized options allow businesses to tailor documents to their specific needs while still maintaining a high standard of professionalism. By organizing financial records in a clear, consistent format, businesses can avoid costly mistakes and streamline their accounting processes.

Key Features of International Billing Formats

When creating formal financial records for business transactions, it is crucial to include certain elements that are universally recognized and ensure clarity for both parties. A well-designed document format not only provides essential details but also helps establish a professional and transparent relationship between the seller and buyer. The following features are commonly found in structured billing formats to meet legal and business requirements.

Essential Components of a Standard Format

A comprehensive format includes several key sections that should be included in every transaction document. These components ensure that both the seller and buyer have a clear understanding of the terms and conditions:

- Transaction Identification: Each document should have a unique number for tracking purposes.

- Seller and Buyer Information: Full contact details, including names, addresses, and registration numbers, to clearly identify both parties.

- Product/Service Description: Clear and accurate descriptions of items sold or services rendered, including quantities and unit prices.

- Payment Terms: Specifies payment deadlines, methods, and any discounts or penalties for late payments.

- Tax and Currency Information: The applicable tax rates and the currency used for the transaction should be clearly stated.

- Delivery or Service Details: Information regarding the delivery method, timeline, and any applicable shipping costs.

Customization Options for Specific Needs

While the basic components are essential, many businesses also offer customization options that can tailor the format to specific industry requirements or preferences. For example, adding additional notes or instructions, including terms of warranty, or incorporating a company logo can help personalize the record while still adhering to professional standards.

By ensuring that all of these key elements are included in your financial documents, you not only comply with legal requirements but also establish trust and transparency with your clients and partners.

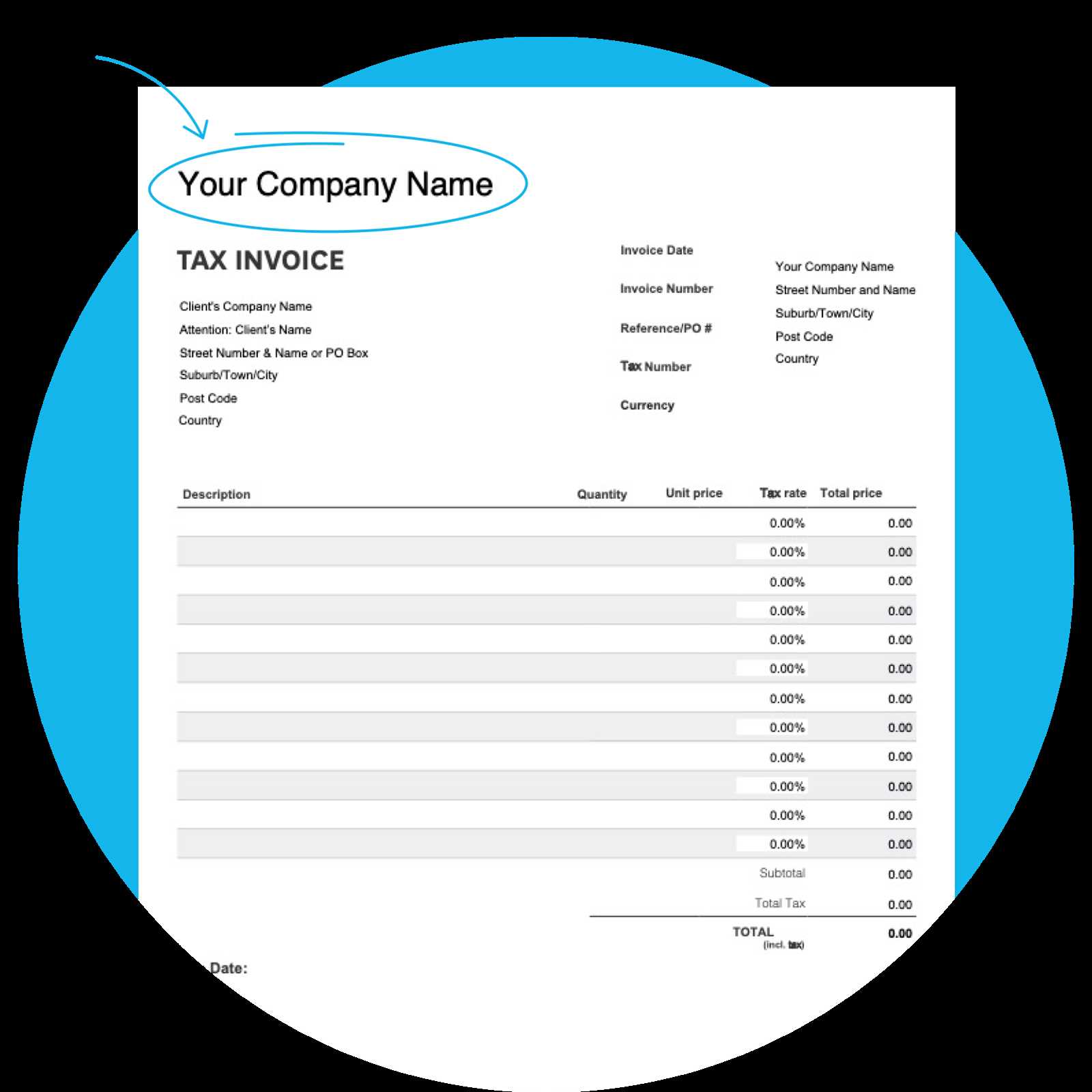

How to Customize Your Billing Format

Adapting a standard document format to better fit the unique needs of your business is an important step in streamlining your financial processes. Customization not only allows you to reflect your company’s branding but also ensures that all relevant information is included and presented clearly. By modifying certain sections and adding specific details, you can create a personalized record that meets your requirements while maintaining professionalism.

Steps for Customization

To tailor the document effectively, there are several key elements you can modify:

- Company Branding: Add your company logo, colors, and fonts to make the document align with your brand identity.

- Header Information: Include details such as your business registration number, tax ID, and contact information at the top for easy reference.

- Terms and Conditions: Customize the payment terms, delivery instructions, and return policies to match your business practices.

- Itemized Lists: Modify the layout of the item or service description to include additional columns, such as SKU numbers, product codes, or detailed descriptions.

- Notes and Special Instructions: Provide space for additional comments, such as discounts, promotional offers, or instructions for the client.

Ensuring Clarity and Professionalism

While customization is essential, it’s important to maintain clarity and professionalism. Avoid overcomplicating the format with unnecessary details that might confuse the reader. Keep the structure simple and organized, ensuring all essential information is easy to find. A clean and straightforward layout enhances the overall appearance and readability, reflecting well on your business.

By following these guidelines, you can ensure that your billing documents are not only customized to your needs but also convey professionalism and transparency to your clients.

Top Benefits of Using Predefined Formats

Utilizing structured formats for documenting transactions offers numerous advantages for businesses. Instead of reinventing the process with each new document, predefined frameworks allow you to focus on essential details while maintaining consistency and accuracy. This approach not only saves time but also ensures that every document meets professional standards.

Efficiency and Time Savings

One of the primary benefits of using a predefined format is the time it saves. Rather than starting from scratch with each new transaction, you can quickly fill in the required information and generate a complete document in minutes. This is particularly valuable for businesses with a high volume of transactions, allowing staff to work more efficiently and focus on other important tasks.

Consistency and Professionalism

Using a set structure ensures that every document follows the same format, promoting consistency across your records. This not only helps maintain professionalism but also makes it easier to review past transactions and compare terms. Whether you are dealing with clients locally or internationally, presenting a uniform, clean document increases the trust your clients have in your business.

Additional Benefits

| Benefit | Description |

|---|---|

| Accuracy | Predefined formats reduce the chance of missing essential information, ensuring that all key details are included. |

| Customization | These formats are often customizable, allowing businesses to tailor them to their specific needs while maintaining structure. |

| Legal Compliance | Standardized formats ensure that your records comply with local regulations, avoiding potential legal issues. |

By incorporating these predefined frameworks into your business processes, you streamline administrative tasks, improve accuracy, and present a more professional image to your clients.

Common Mistakes to Avoid in Billing Documents

When creating financial records, even small mistakes can lead to confusion, delayed payments, and strained client relationships. Ensuring accuracy and completeness in every document is crucial to maintaining professionalism and keeping your operations running smoothly. Here are some common errors that businesses should avoid when preparing transaction documents.

Key Mistakes to Watch Out For

- Missing Contact Information: Failing to include essential details such as the seller’s and buyer’s names, addresses, and contact numbers can create difficulties in communication and verification.

- Incorrect Payment Terms: Not specifying the due date or payment methods clearly can result in misunderstandings about when and how payments are expected.

- Omitting Product/Service Details: Providing incomplete descriptions of products or services can lead to confusion and disputes. Be sure to list quantities, unit prices, and any relevant identifiers.

- Wrong Tax Calculation: Inaccurate tax calculations can cause compliance issues and result in penalties. Always verify the correct tax rate and apply it appropriately.

- Failing to Include a Unique Identifier: Not including a transaction number or reference code makes it difficult to track and match payments to specific transactions.

- Confusing Formatting: A cluttered or difficult-to-read layout can cause confusion and may discourage clients from reviewing the document thoroughly.

How to Prevent These Mistakes

To avoid these errors, it’s important to follow a consistent structure and double-check the document before sending it. Consider using a reliable system for creating and tracking records, which can help ensure that all information is accurate and up-to-date. A careful review process will help maintain professional standards and reduce the chances of costly mistakes.

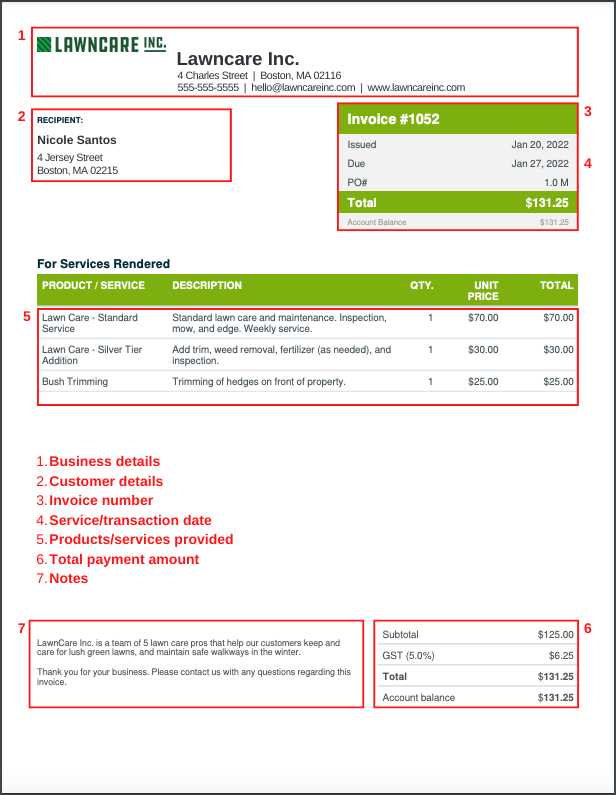

Essential Information in Business Billing Documents

To ensure smooth transactions and clear communication, it’s crucial to include all the necessary details in financial records. These documents act as formal agreements, outlining the terms and conditions of the sale. Missing or incomplete information can lead to misunderstandings, delayed payments, or even legal issues. Below are the key pieces of information that should always be included in your business transaction documents.

Critical Elements to Include

A well-structured document should contain the following details to maintain accuracy and professionalism:

| Information Type | Importance |

|---|---|

| Seller and Buyer Details | Accurate names, addresses, and contact information of both parties are essential for identification and communication. |

| Transaction Date | The date of the sale or service completion is crucial for tracking payment deadlines and agreement terms. |

| Product or Service Description | Clear and specific descriptions of items or services provided, including quantities and unit prices, help avoid confusion. |

| Payment Terms | Specifying due dates, payment methods, and any applicable penalties for late payments ensures clarity in expectations. |

| Tax and Currency Information | Clear tax rates and the currency in which the transaction was made prevent misunderstandings about the total cost. |

| Unique Document Number | A unique reference number helps track and organize documents for future reference and auditing purposes. |

Why This Information Matters

Incorporating these critical elements ensures that both the seller and buyer have a clear understanding of the terms and obligations of the transaction. Having accurate and complete details also helps in case of disputes or legal requirements. By maintaining a consistent structure and including all necessary information, you promote trust and transparency in your business dealings.

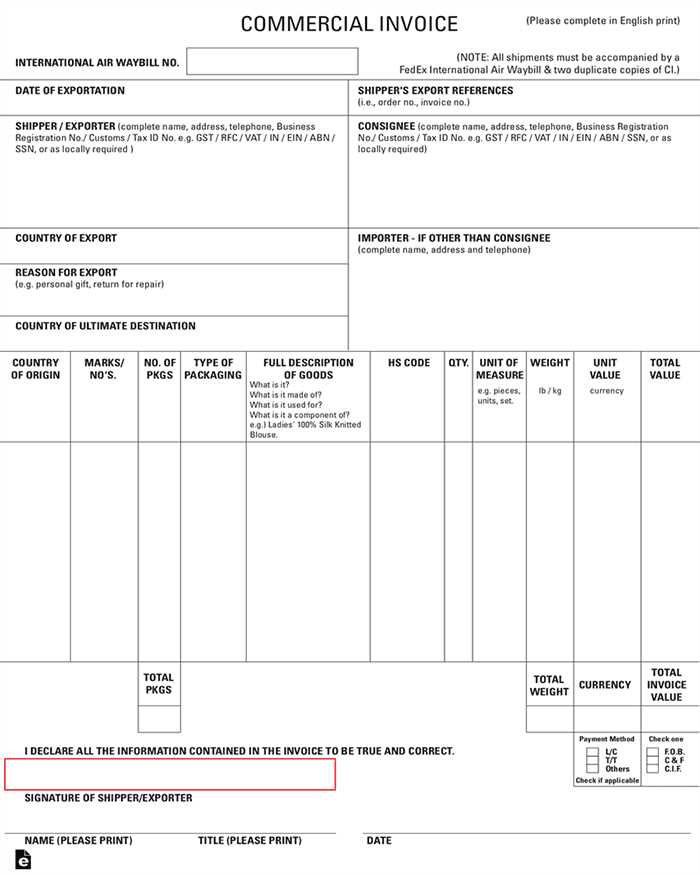

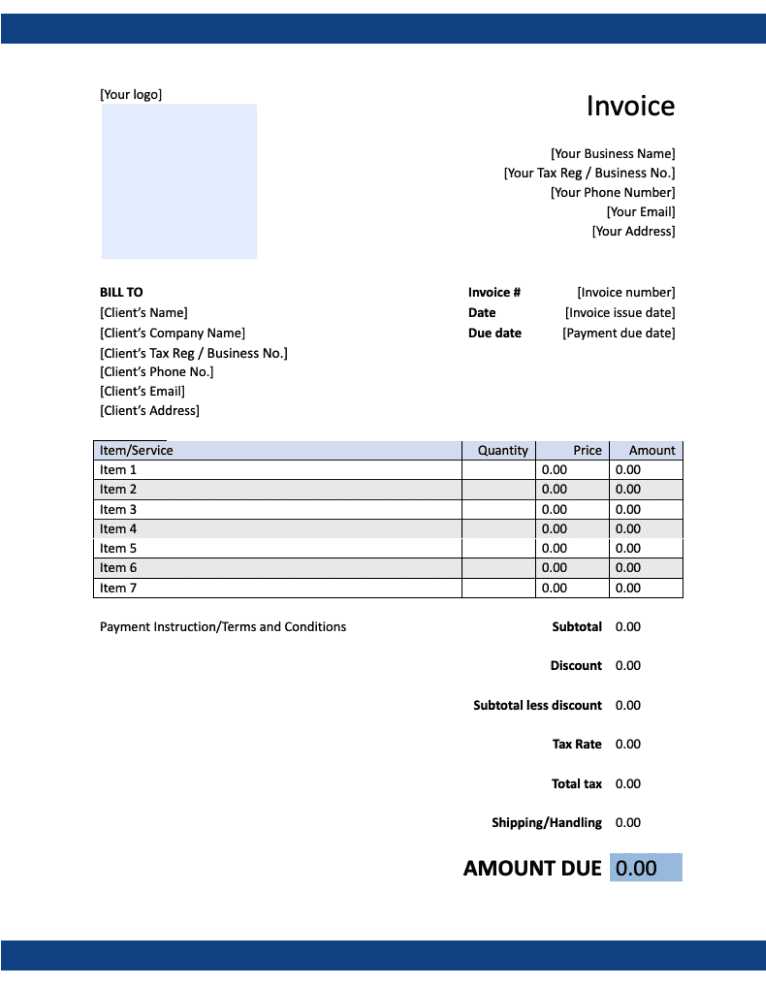

How to Properly Format Your Billing Document

Creating a clear and professional document for recording transactions is essential for maintaining smooth financial operations. Proper formatting ensures that all necessary details are easy to locate and read, reducing confusion for both parties involved. A well-organized record not only reflects well on your business but also helps streamline payment processing and future reference. Below are key steps to properly format your billing document for optimal clarity and professionalism.

Key Formatting Guidelines

When structuring your financial document, consider the following formatting elements:

- Use a Clean Layout: A simple, uncluttered design is essential for readability. Make sure your document is well-spaced, with sections clearly separated.

- Header Section: Place your business name, contact details, and logo at the top of the document for easy identification. Also, include your customer’s information, including their name and contact details.

- Transaction Details: Clearly outline the list of products or services provided, with each item’s description, quantity, unit price, and total cost. Ensure this section is easy to navigate with a table layout if necessary.

- Highlight Total Amount: The total due should be easily distinguishable, typically placed at the bottom of the document with bold text and underlined if necessary.

- Clear Payment Terms: Include payment instructions, deadlines, and accepted payment methods in a distinct section to avoid confusion.

Improving Document Legibility

Formatting is not just about making a document look neat; it’s also about ensuring its information is legible and easy to find. Use a legible font size, and avoid overly complicated or small fonts. Consistent use of headings, bullet points, and section breaks will guide the reader through the document. Also, make sure to leave enough space between different sections to prevent overcrowding.

By adhering to these guidelines, you can create a document that is both professional and easy to process, ensuring smoother transactions and better relationships with your clients.

Creating Professional Billing Documents for Clients

When working with clients, presenting a well-organized and professional document is essential for establishing trust and ensuring smooth transactions. A polished document not only reflects the quality of your business but also serves as a formal record of the terms of your agreement. Properly formatted documents help reduce misunderstandings and encourage timely payments, promoting positive long-term business relationships.

To create a professional document for your clients, it’s important to include all the relevant details, ensure clarity, and use a consistent format every time. Here are a few guidelines to ensure your documents stand out and meet professional standards.

- Include Accurate and Complete Information: Always include your company’s name, address, and contact details at the top, as well as the client’s information. Be sure to specify the products or services provided, the agreed prices, and any taxes or fees.

- Clearly Define Payment Terms: State your payment expectations, including the payment methods accepted, the due date, and any late fees if applicable. This clarity ensures there are no surprises for your client.

- Professional Formatting: Use a clean and organized layout. Ensure that the document is easy to read, with a logical flow from one section to the next. Consistent fonts and spacing will make your document appear more professional.

- Make It Easy to Understand: Use simple language and avoid jargon that may confuse the client. Make sure your client can easily understand the breakdown of costs and what they are being billed for.

- Include a Unique Reference Number: This makes it easier to track the document and helps with organizational purposes, especially if multiple transactions are involved.

By following these best practices, you can create a document that not only looks professional but also ensures your clients feel confident in their dealings with your business.

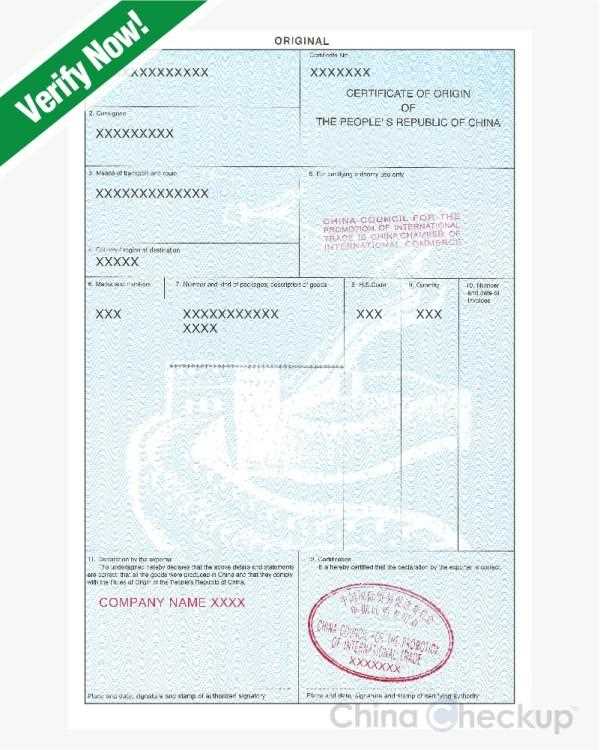

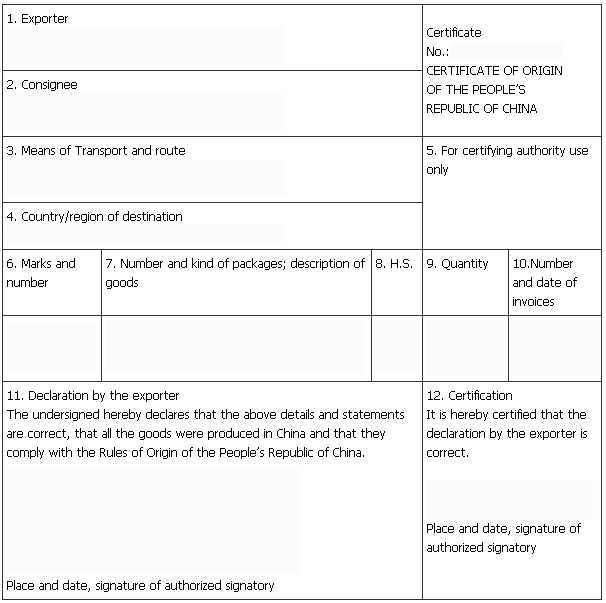

Legal Requirements for Chinese Billing Documents

In any business transaction, compliance with local laws and regulations is crucial. For businesses operating in specific regions, there are particular legal guidelines that must be followed when creating financial records. These regulations help ensure transparency, prevent tax evasion, and safeguard both the business and the client. Understanding the legal requirements for business records is important to avoid potential legal and financial issues.

Key Legal Considerations

In the context of financial documents, there are several important legal aspects that must be taken into account:

- Mandatory Information: Every document should include essential details, such as the names and addresses of both the buyer and seller, transaction dates, product or service descriptions, and a clear breakdown of amounts owed.

- Tax Compliance: It is necessary to include the applicable tax rate and properly calculate the tax amount on the total sum. Accurate tax documentation is essential for tax filing and avoiding penalties.

- Official Stamp or Seal: In some regions, a valid stamp or official seal is required for the document to be legally recognized, particularly in transactions with government agencies or large companies.

- Unique Identification Number: Each document should have a unique reference number to track the transaction. This helps in organizing records and facilitates audits and legal inquiries.

Importance of Compliance

Failure to adhere to these legal requirements can result in complications, including delays in payments, fines, or even legal disputes. By ensuring that all required information is included and correctly formatted, businesses not only avoid legal issues but also demonstrate professionalism and reliability to clients. It’s advisable to stay informed about local regulations and regularly update billing practices to maintain compliance.

Best Software for Generating Billing Documents

Generating accurate and professional billing documents can be time-consuming, but using the right software can simplify the process. There are numerous tools available that allow businesses to create customized records quickly and efficiently. These tools not only save time but also help ensure that all necessary information is included, reducing errors and improving overall financial management. Below is a list of some of the best software options for generating billing documents.

| Software | Features | Best For |

|---|---|---|

| QuickBooks | Automatic calculations, tax management, invoice tracking | Small businesses and freelancers |

| FreshBooks | Customizable templates, client management, recurring billing | Service-based businesses and consultants |

| Zoho Invoice | Multi-currency support, project tracking, time tracking | Global businesses and project-based companies |

| Wave | Free to use, accounting and invoicing in one platform | Small businesses and startups |

| Invoice Ninja | Custom branding, mobile-friendly, payment gateway integration | Freelancers and entrepreneurs |

These software options cater to different business needs, from simple solutions for small businesses to more advanced features for large-scale operations. The right choice depends on your specific requirements, such as the volume of transactions, integration with other tools, and budget. By using one of these tools, businesses can streamline their billing processes and ensure consistent, professional financial records.

How to Save Time with Document Templates

When it comes to creating professional documents, consistency and efficiency are key. Using pre-designed formats for recurring tasks can significantly reduce the time spent on creating new records. Instead of manually formatting and organizing each document from scratch, templates allow you to focus on the essential details and quickly customize them as needed. This streamlined process not only saves time but also ensures that all necessary information is consistently included, reducing the risk of errors.

Benefits of Using Pre-Designed Formats

Here are some of the main ways in which pre-designed formats can help save time in your daily operations:

- Quick Customization: Pre-built structures allow you to enter essential information without worrying about formatting. Simply update the specific details like client names, products, and amounts.

- Consistency: By using the same structure every time, you ensure consistency in your records, which is important for both internal organization and external professional communication.

- Reduced Errors: With fewer steps involved in creating a document, the chances of making mistakes decrease, leading to more accurate and reliable records.

- Time Efficiency: Templates eliminate repetitive tasks, allowing you to generate documents in minutes rather than hours. This increased efficiency lets you focus on other important aspects of your business.

How to Maximize Efficiency with Templates

To get the most out of pre-designed formats, here are a few tips:

- Use Automated Features: Many tools allow you to set up auto-filling options for common fields such as dates, addresses, and contact information.

- Organize Templates by Type: Keep different formats for different purposes (e.g., sales, services, and contracts) to quickly find the one you need.

- Keep It Simple: Avoid overloading templates with unnecessary fields. A streamlined design ensures you don’t waste time navigating through irrelevant sections.

Incorporating pre-designed formats into your workflow not only saves valuable time but also enhances productivity and professionalism in your business operations.

Currency and Tax Considerations in China

When managing financial documents for international transactions, understanding the local currency and tax regulations is essential. These factors directly influence the way business transactions are recorded and processed, especially when dealing with global markets. Correctly handling currency conversion and complying with local tax laws can prevent costly errors and ensure that financial operations remain transparent and in line with regulatory requirements.

Currency Considerations: The primary currency used in the region is the renminbi (RMB), also known as the yuan. Businesses dealing with transactions in this currency need to be aware of fluctuating exchange rates and how they affect pricing, invoicing, and accounting. In cases of international business dealings, companies often need to convert prices from their local currency to RMB. Using automated conversion tools and regularly checking exchange rates can help maintain accurate pricing structures.

Tax Implications: Understanding local tax laws is crucial when preparing financial documents. The tax system in this region involves various levies, including value-added tax (VAT), corporate income tax, and individual income tax. Each type of tax has specific rates and guidelines that must be followed, depending on the nature of the goods or services provided. Businesses should ensure that they are applying the correct tax rates and documenting them accurately in their financial records.

Key Considerations for Compliance: To ensure full compliance with local financial regulations, consider the following:

- Tax Registration: Companies must be registered with the local tax authorities and obtain a tax identification number (TIN).

- Correct Tax Rates: Businesses should apply the correct tax rate based on the product or service provided. Inaccurate tax calculation can lead to fines or other penalties.

- Exchange Rate Adjustments: For international transactions, keeping track of exchange rate fluctuations can help prevent discrepancies in pricing and payments.

- Detailed Documentation: Accurate record-keeping is essential to ensure compliance. Every transaction should clearly list tax rates, amounts in local currency, and the final totals after conversion.

By understanding these local factors and integrating them into financial practices, businesses can ensure smooth operations and avoid legal complications when conducting transactions in this market.

How to Send Invoices in China

Sending financial documents efficiently and correctly is crucial for maintaining smooth transactions, especially in international settings. Understanding the preferred methods for transmitting business records, and ensuring they meet local standards, is key to avoiding delays or misunderstandings. Different regions may have varying preferences when it comes to the delivery and format of such documents, which is why it’s essential to know how to handle this process properly when engaging with businesses in the region.

Methods of Sending Financial Documents

In this region, there are several ways to send formal business records to clients or partners. The choice of method often depends on the preferences of the recipient, the type of transaction, and the nature of the business relationship. Here are some common ways to send these documents:

- Electronic Submission: Sending records via email or a secure online platform is becoming increasingly common. Many businesses prefer digital copies for faster processing and record-keeping.

- Postal Mail: For formal transactions or when required by law, hard copies can be sent through local or international postal services. This method is usually more time-consuming.

- Courier Services: For businesses that require signed or certified documents, using a courier service ensures secure and timely delivery of hard copies.

- Government Platforms: Some regions have specific digital portals where businesses must upload and submit records for tax or legal purposes. Make sure to check for compliance with these regulations.

Key Considerations When Sending Documents

There are several things to consider when sending business records to ensure they are received and processed without issues:

- Clarity of Content: Ensure that all required details are clear and complete. Missing or incorrect information can delay payment or lead to misunderstandings.

- Delivery Confirmation: Always request confirmation of receipt, whether via email or postal service, to ensure the document has been successfully received by the recipient.

- Secure Transmission: Use secure methods for sending sensitive financial data. Avoid sending important documents through unsecured email or public platforms.

- Compliance with Local Regulations: Different regions may have specific rules regarding how documents should be formatted or sent. Ensure that you adhere to these to avoid delays or legal issues.

By understanding the most common methods for sending business documents and following best practices, you can ensure that your transactions remain efficient and compliant with local standards.

Ensuring Accuracy in Your Invoices

Accuracy is essential when preparing formal documents for financial transactions. Ensuring that all information is correct and consistent helps to prevent delays in payments, disputes, and potential legal complications. Errors in business records can damage your reputation, cause confusion, and lead to costly mistakes. Here’s how to maintain precision in your financial documents.

Key Steps to Achieve Accuracy

There are several practices you can adopt to make sure your records are accurate and reliable:

- Double-Check All Information: Always review every detail before sending. Check the client’s name, address, the description of the products or services provided, quantities, and pricing. Any missing or incorrect data can lead to confusion.

- Use Standardized Formats: Consistency is key. Using a standardized format helps prevent errors. It ensures that all necessary details are included and presented in a clear, understandable manner.

- Verify Calculations: Ensure that all numbers are correctly calculated. This includes totals, taxes, discounts, and any additional fees. Small calculation mistakes can lead to significant discrepancies.

- Ensure Legal Compliance: Check that your document includes all the required legal information, such as tax IDs or registration numbers. Failing to comply with local regulations can lead to rejection or legal issues.

- Include Clear Payment Instructions: Clearly state the payment method, due date, and any other relevant payment terms. Ambiguities in payment details can cause delays.

Tools and Tips for Accuracy

Several tools and methods can help improve the accuracy of your business records:

- Automated Software: Using automated accounting or invoicing software can help reduce human error and speed up the process. These tools typically come with built-in checks for accuracy.

- Templates with Pre-Set Fields: Using pre-designed document structures ensures that all the required fields are present and correctly formatted. It minimizes the chances of omitting important information.

- Use of Checklists: Before finalizing any document, use a checklist to ensure all necessary steps have been completed and verified.

By following these best practices, you can ensure that your business records are clear, accurate, and professional, leading to smoother transactions and stronger relationships with clients and partners.

Tips for International Invoicing with China

When engaging in cross-border transactions, it is essential to ensure that your financial documents meet the standards and expectations of both parties involved. Each country may have specific requirements, and understanding those will help streamline the process, avoid misunderstandings, and ensure smooth payment processing. Below are some tips for managing international transactions effectively when working with partners abroad.

Understand Local Regulations and Customs

One of the most important aspects of international trade is ensuring compliance with local laws. Each country has its own legal framework regarding business documentation, taxes, and customs procedures. To avoid delays or legal issues, make sure you:

- Familiarize Yourself with Tax Regulations: Understand the tax rules that apply to your transactions, such as value-added tax (VAT) or other duties, to ensure accurate documentation and payments.

- Know the Legal Requirements: Some regions require specific information to be included in your business records, such as business registration numbers or additional contact details.

- Incorporate Multilingual Elements: Depending on your business relationship, using the local language or providing bilingual documents may improve clarity and reduce confusion.

Choose the Right Currency and Payment Methods

When dealing with international clients or suppliers, choosing the correct currency and payment method is crucial. This can affect the ease of payment and the overall cost of the transaction. To optimize international invoicing, consider the following:

- Use a Stable Currency: For international transactions, choose a widely accepted and stable currency, such as USD or EUR, to avoid fluctuations in exchange rates that could impact the payment amount.

- Provide Clear Payment Terms: Specify the preferred payment methods (bank transfer, PayPal, credit card, etc.), the time frame for payments, and any additional fees associated with currency conversion or transaction costs.

- State the Currency Clearly: Always indicate the currency in which the transaction is being conducted to prevent misunderstandings.

By following these tips and staying informed about international trade practices, you can ensure smooth transactions and foster trust with your overseas partners.